Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Cooper-Standard Holdings Inc. | a8-kredeutschebankautoconf.htm |

1 Deutsche Bank Global Auto Industry Conference January 13, 2015

2 2 Forward-Looking Statements There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in this presentation. Important factors that could cause our actual results to differ materially from the forward-looking statements we make herein include, but are not limited to: prolonged or material contractions in automotive sales and production volumes, our liquidity, the viability of our supply base and the financial conditions of our customers; loss of large customers or significant platforms; our ability to obtain financing in the future; ability to generate sufficient cash to service all of our indebtedness; operating and financial restrictions imposed on us by the term loan and credit agreement; underfunding of pension plans; availability and increasing volatility in costs of manufactured components and raw materials; escalating pricing pressures; our ability to meet significant increases in demand; our ability to successfully compete in the automotive parts industry; risks associated with our non-U.S. operations; foreign currency exchange rate fluctuations; ability to control the operations of our joint ventures for our sole benefit; effectiveness of continuous improvement programs and other cost savings plans; product liability, warranty and recall claims that may be brought against us; work stoppages or other labor conditions; natural disasters; ability to meet our customers’ needs for new and improved products on a timely or cost-effective basis; the possibility that our acquisition strategy may not be successful; the ability of our intellectual property portfolio to withstand legal challenges; a disruption in or the inability to successfully implement upgrades to our information technology systems; environmental, health and safety laws and other laws and regulations; the possible volatility of our annual effective tax rate; significant changes in discount rates and the actual return on pension assets and other factors; the possibility of future impairment charges to our goodwill and long-lived assets; the concentration of stock ownership may allow a few owners to exert significant control over us; stock volatility; and dependence on our subsidiaries for cash to satisfy the obligations of the holding company.

Jeff Edwards Chairman and Chief Executive Officer Cooper Standard Overview

4 4 Cooper Standard (NYSE: CPS) 2014 Revenue: ≈ $3.2+ billion1 (52% NA, 35% Europe, 8% Asia, 5% SA) $400+ million nonconsolidated JV Automotive Supplier Rank2: 67 Globally 41 North America 49 Europe Global Footprint: 94 facilities 10 technical centers 20 countries Employees: 27,000 + employees 1 Estimate 2 Automotive News – 2013 Sealing Systems Fuel & Brake Delivery Systems Fluid Transfer Systems Anti-Vibration Systems Product Lines

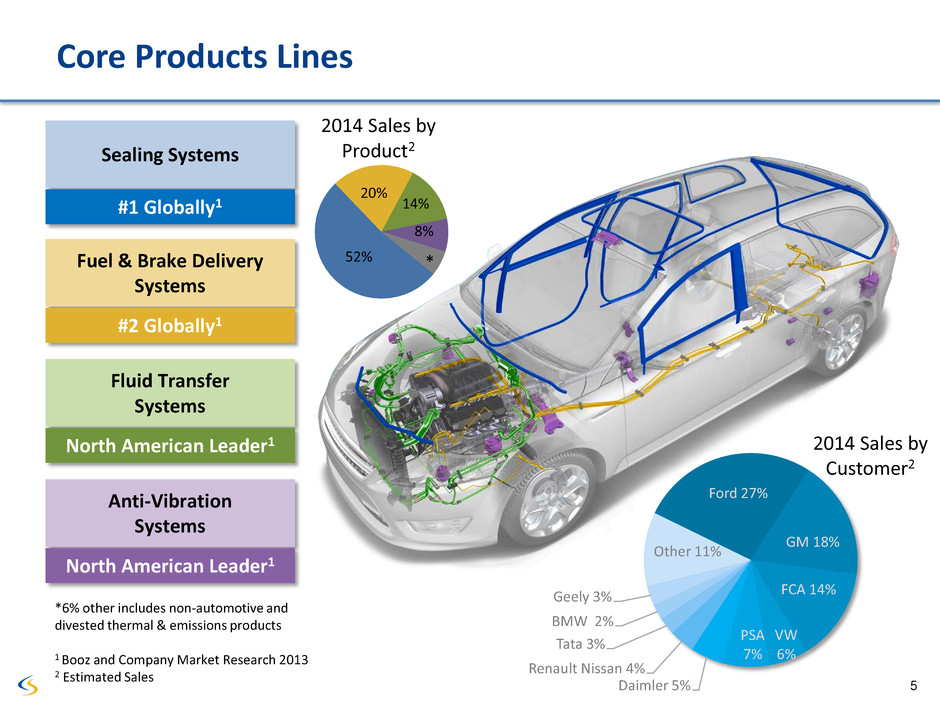

5 5 Core Products Lines Fuel & Brake Delivery Systems #2 Globally1 Fluid Transfer Systems North American Leader1 Anti-Vibration Systems North American Leader1 52% 20% 14% 8% 2014 Sales by Product2 *6% other includes non-automotive and divested thermal & emissions products 1 Booz and Company Market Research 2013 2 Estimated Sales * Ford 27% GM 18% FCA 14% VW 6% PSA 7% Daimler 5% Renault Nissan 4% Tata 3% BMW 2% Geely 3% Other 11% 2014 Sales by Customer2 Sealing Systems #1 Globally1

Relentless Focus on the Customer Superior Products and Innovation Advantaged Global Footprint & World-Class Operations High Performing Engaged Workforce Drive for Profitable Growth

7 7 Drive for Profitable Growth

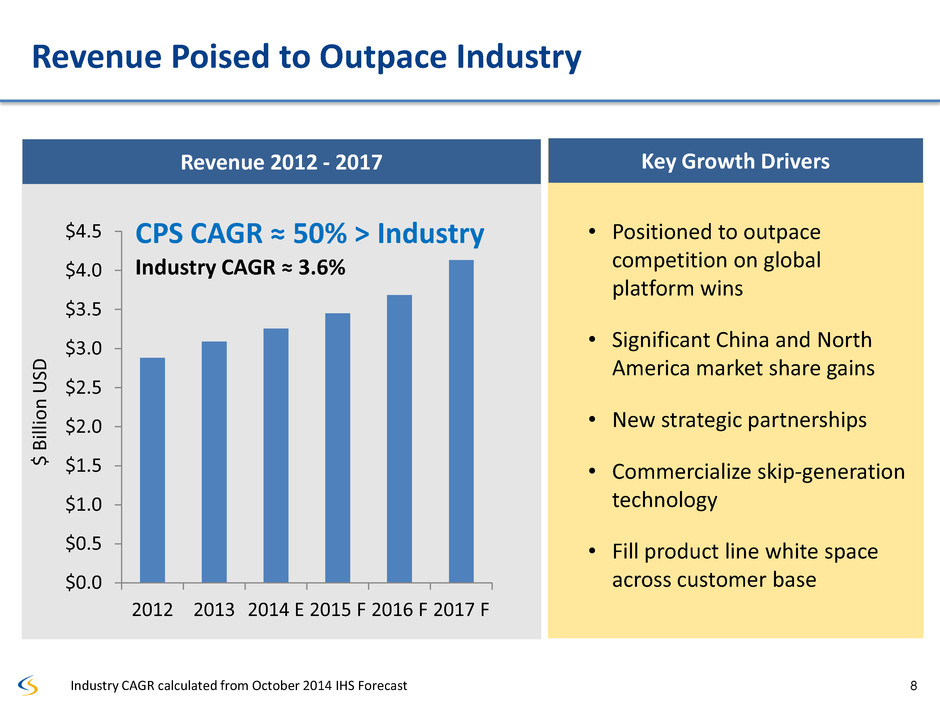

8 8 Revenue 2012 - 2017 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 $4.5 2012 2013 2014 E 2015 F 2016 F 2017 F Revenue Poised to Outpace Industry Key Growth Drivers • Positioned to outpace competition on global platform wins • Significant China and North America market share gains • New strategic partnerships • Commercialize skip-generation technology • Fill product line white space across customer base Industry CAGR ≈ 3.6% CPS CAGR ≈ 50% > Industry Industry CAGR calculated from October 2014 IHS Forecast $ Bi lli on U SD

9 9 Products Well Represented on Key Platforms Denotes Global Platform Cooper Standard Products are Consistently on the Top Selling Global Platforms 1 Sales adjusted for cross platform products 2 This particular Volvo model is not global but the platform was designed as part of Ford’s global platform Vehicle Sealing Fuel & Brake Delivery Fluid Transfer Systems Anti-Vibration Systems Ford F-150 GM Silverado / Sierra/ Tahoe / Yukon / Escalade Ford Focus / Escape 1 Ford Fiesta / B Max / Ecosport 1 Ford Mondeo / S-Max; Volvo S60 / V70; Tata Range Rover 2 Ford Explorer / Taurus 1 GM LaCrosse / Malibu PSA 308 / 408 / C4 Picasso/ Partner / Berlingo FCA Dodge Ram PSA Picasso / C3 FCA Giulietta / Dart / 200 GM Cruze / Volt / Astra GM Aveo / Cobalt / Encore / Mokka / Onix Ford Fusion / Mondeo / MKZ 1 FCA 300 / Charger / Challenger / Ghibli / Quattroporte FCA Mid - Size CUV / Journey FCA Siena / Palio / Strada / Doblo FCA Town & Country / Caravan Ford F-Series Super Duty VW Beetle/Golf/Jetta/Passat/Sagitar/Scirocco/Tiguan/TT North America 2015 Car/Truck of the Year

10 10 Content Per Vehicle on Top Five Platforms 1 Sales adjusted for cross platform products 2 This particular Volvo model is not global but the platform was designed as part of Ford’s global platform 3 Approximate Vehicle Content Per Vehicle3 Sealing F&B FTS AVS Ford F-150 ≈ $440 GM Silverado / Sierra/ Tahoe / Yukon / Escalade ≈ $170 Ford Focus / Escape 1 ≈ $95 Ford Fiesta / B Max / Ecosport 1 ≈ $130 Ford Mondeo / S-Max; Volvo S60 / V70; Tata Range Rover 2 ≈ $160

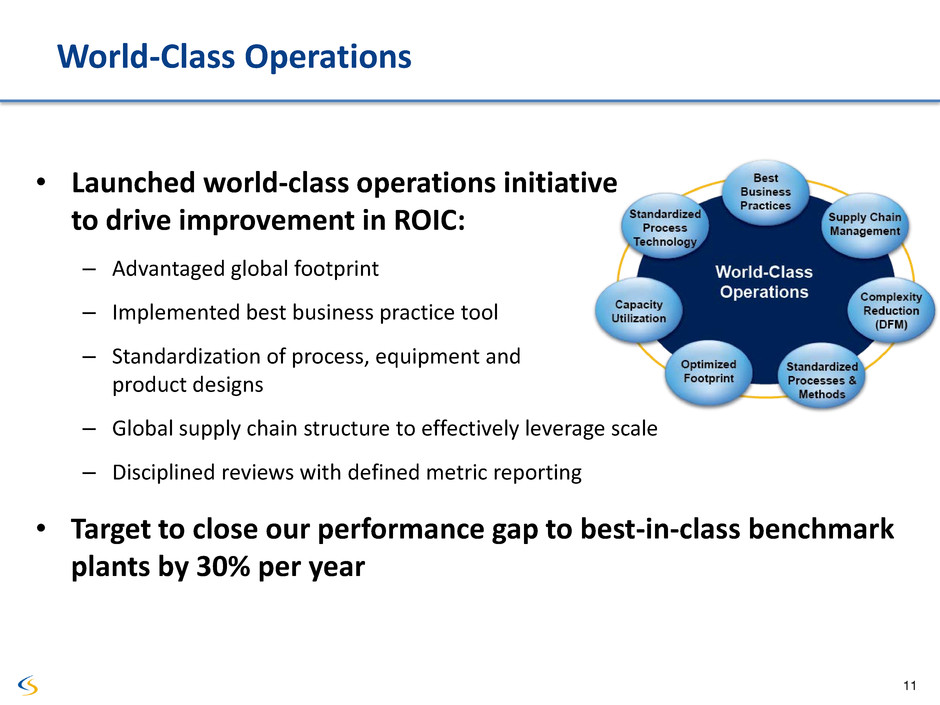

11 11 World-Class Operations • Launched world-class operations initiative to drive improvement in ROIC: – Advantaged global footprint – Implemented best business practice tool – Standardization of process, equipment and product designs – Global supply chain structure to effectively leverage scale – Disciplined reviews with defined metric reporting • Target to close our performance gap to best-in-class benchmark plants by 30% per year

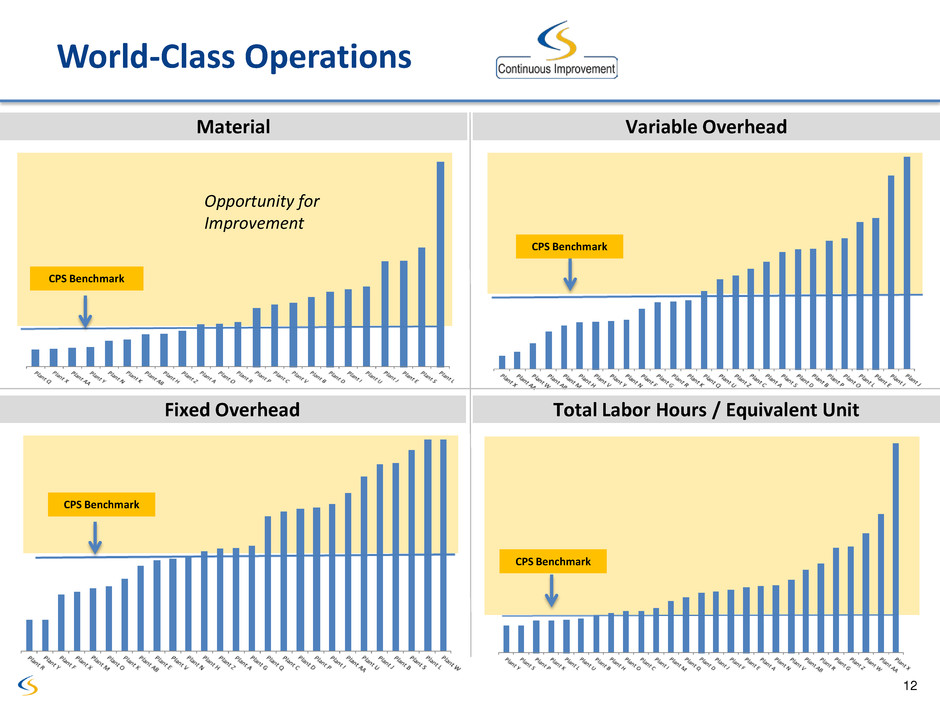

12 12 CPS Benchmark World-Class Operations Material Variable Overhead Fixed Overhead Total Labor Hours / Equivalent Unit CPS Benchmark Opportunity for Improvement CPS Benchmark CPS Benchmark

13 2 2 Restoring Competitive Advantage in Europe • New regional management in place to accelerate performance • Vertical integration • Addressing commercial gaps • Footprint optimization • Revised restructuring plan • Acquired 100 percent interest in Cooper Standard France JV • Re-entered Spain market to support growth • Serbia ramping up

14 14 Changchun Chongqing Huai-an Jingzhou Kunshan Shanghai Wuhu Guangzhou Shenyang Fengxian Accelerating Growth in China Huayu-Cooper Standard JV* Cooper Standard / INOAC JV* • Majority-owned JV in Asia to accelerate fluid transfer systems growth • Provides additional growth opportunities with Japanese OEMs • Supports global platforms • Cooper Standard to become majority (95%) owner of largest Chinese automotive sealing supplier • Accelerates company’s sealing growth • Provides additional growth opportunities with domestic Chinese automakers for all products lines • Supports global platforms Qingpu * Subject to Chinese regulatory and other approvals

15 15 Accelerating Growth in India Bawal Chennai Sahibabad Manesar Mumbai Pune 2 Sanand • Strengthened regional management team • Launching new sealing and fuel & brake facilities to expand market leading positions for both product lines • Expanding technical capabilities in Pune • Expanded relationship with Sujan Group with new fluid transfer systems JV • Becoming 100% owner of existing sealing JV

16 16 Technology Benefits Status Ultra Galfan Coating Increases product life for fuel and brake lines In production Quick Connect with Sensor Improves connections with sensor capability Booked orders ArmorHose™ Eliminates requirement for protective sleeves Booked orders Fortrex™ Material revolutionizing sealing and hose technology Offering to customers in 1st half of 2015 Bringing Innovations to Market

Cooper Standard Overview Allen Campbell Executive Vice President and Chief Financial Officer

18 18 2014 In Review Operational Improvements • Green on major platform launches in North America • Continuing margin improvement in Europe • Improving sealing profitability Headwinds • Foreign exchange volatility • Soft production volume in Europe • Challenging economic environment in Brazil • New technology introduction in sealing Infrastructure Investments • Improvement of Global Technology Process Off-shore CAD capabilities Product Lifecycle Management SAP/Program Management/AutoQuote

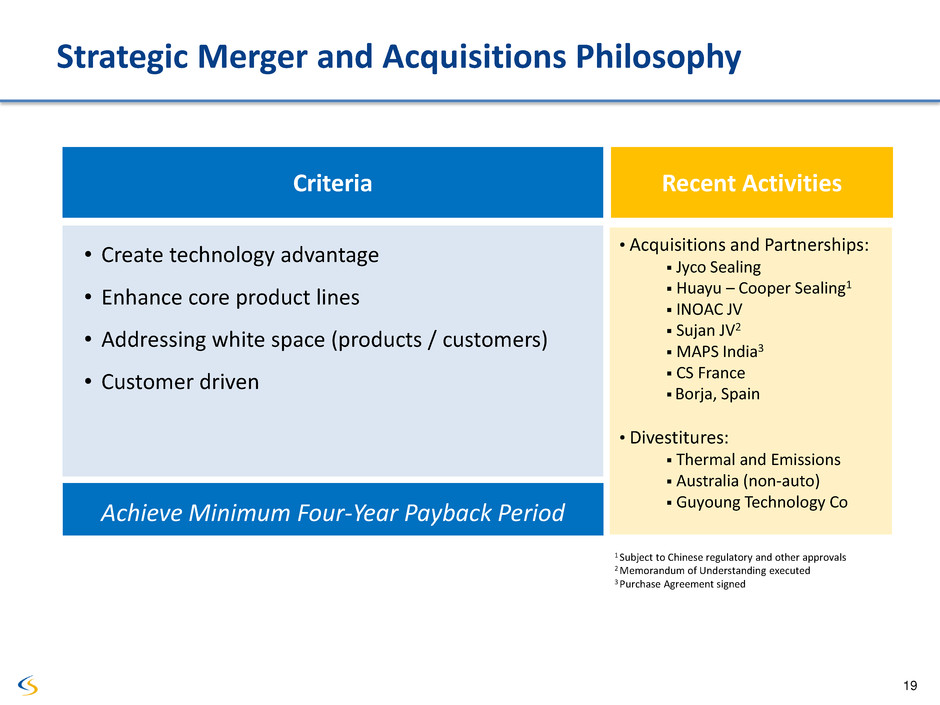

19 19 Strategic Merger and Acquisitions Philosophy Criteria Recent Activities • Create technology advantage • Enhance core product lines • Addressing white space (products / customers) • Customer driven • Acquisitions and Partnerships: Jyco Sealing Huayu – Cooper Sealing1 INOAC JV Sujan JV2 MAPS India3 CS France Borja, Spain • Divestitures: Thermal and Emissions Australia (non-auto) Guyoung Technology Co 1 Subject to Chinese regulatory and other approvals 2 Memorandum of Understanding executed 3 Purchase Agreement signed Achieve Minimum Four-Year Payback Period

20 20 Key Joint Ventures Joint Venture Ownership Structure Huayu- Cooper Sealing MAPS India Sujan JV CS INOAC JV CS France Nishikawa Product Country Sealing Sealing AVS FTS FTS Sealing, AVS, FTS Sealing Agreed to acquire 95% interest1 Agreed to acquire 100% interest2 50% ownership, no change Agreed to acquire 35% interest4 51% ownership1 Acquired 100% interest 40% ownership, no change 2014 E Revenue ($million) China India India Various Asian countries France, Poland US, Thailand $ 180 $ 38 $ 103 N/A $ 295 $ 2503 Financial Reporting To be consolidated To be consolidated Non-consolidated3 Consolidated Consolidated Non-consolidated 1 Subject to Chinese regulatory and other approvals 2 Purchase Agreement signed 3 Represents total JV interest 4 MOU executed

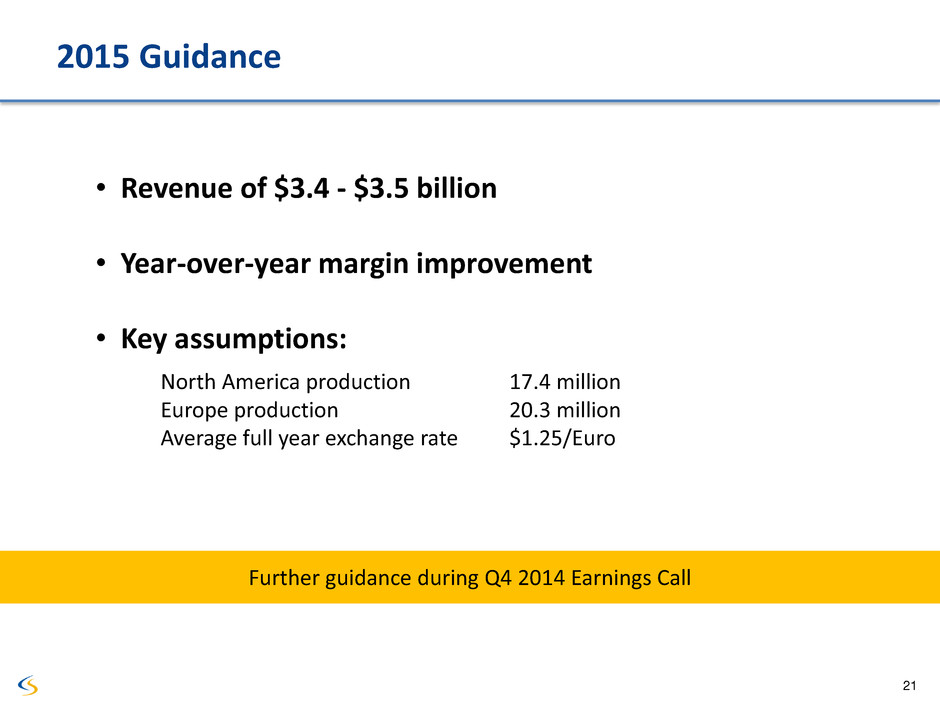

21 21 2015 Guidance • Revenue of $3.4 - $3.5 billion • Year-over-year margin improvement • Key assumptions: North America production 17.4 million Europe production 20.3 million Average full year exchange rate $1.25/Euro Further guidance during Q4 2014 Earnings Call

22 22 Q & A CPS Profitable Growth Drivers

23 23 Non-GAAP Financial Measures EBITDA and adjusted EBITDA are measures not recognized under Generally Accepted Accounting Principles (GAAP) which exclude certain non-cash and non-recurring items. When analyzing the company’s operating performance, investors should use EBITDA and adjusted EBITDA in addition to, and not as alternatives for, net income (loss), operating income, or any other performance measure derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of the company’s performance. EBITDA and adjusted EBITDA have limitations as analytical tools and should not be considered in isolation or as substitutes for analysis of the company’s results of operations as reported under GAAP. Other companies may report EBITDA and adjusted EBITDA differently and therefore Cooper Standard’s results may not be comparable to other similarly titled measures of other companies.