Attached files

Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS 2

As filed with the Securities and Exchange Commission on January 13, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BELLEROPHON THERAPEUTICS LLC

(to be converted into Bellerophon Therapeutics, Inc.)

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

2834 (Primary Standard Industrial Classification Code Number) |

36-4771642 (I.R.S. Employer Identification No.) |

53 Frontage Road, Suite 301

Hampton, New Jersey 08827

(908) 574-4770

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

Jonathan M. Peacock

Chief Executive Officer

Bellerophon Therapeutics LLC

53 Frontage Road, Suite 301

Hampton, New Jersey 08827

(908) 574-4770

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

Lia Der Marderosian, Esq. Steven D. Singer, Esq. Wilmer Cutler Pickering Hale and Dorr LLP 60 State Street Boston, Massachusetts 02109 Telephone: (617) 526-6000 |

Mitchell S. Bloom, Esq. Thomas S. Levato, Esq. Goodwin Procter LLP Exchange Place Boston, Massachusetts 02109 Telephone: (617) 570-1000 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities To Be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee(2) |

||

|---|---|---|---|---|

Common Stock, $0.01 par value per share |

$69,000,000 | $8,017.80 | ||

|

||||

- (1)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the

Securities Act of 1933, as amended.

- (2)

- Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Bellerophon Therapeutics LLC, the registrant whose name appears on the cover of this registration statement, is a Delaware limited liability company. Immediately prior to the effectiveness of this registration statement, Bellerophon Therapeutics LLC will be converted into a Delaware corporation, which we refer to as the Corporate Conversion, and renamed Bellerophon Therapeutics, Inc. Shares of the common stock, par value $0.01 per share, of Bellerophon Therapeutics, Inc. are being offered by the prospectus that forms a part of this registration statement. For convenience, except as context otherwise requires, all information included in the prospectus that forms a part of this registration statement is presented giving effect to the Corporate Conversion.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated January 13, 2015

PRELIMINARY PROSPECTUS

Shares

Common Stock

We are offering shares of our common stock. This is our initial public offering and no public market currently exists for our shares. We anticipate that the initial public offering price of our common stock will be between $ and $ per share.

We have applied to list our common stock on the NASDAQ Global Market under the symbol "BLPH."

We are an emerging growth company as that term is used in the Jumpstart Our Business Startups Act of 2012, and as such, are subject to reduced public company disclosure standards. See "Prospectus Summary—Implications of Being an Emerging Growth Company."

Investing in our common stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our common stock in "Risk Factors" beginning on page 13 of this prospectus.

| |

Per Share | Total | ||

|---|---|---|---|---|

Initial public offering price |

$ | $ | ||

Underwriting discount |

$ | $ | ||

Proceeds to us, before expenses |

$ | $ |

We have granted the underwriters an option to purchase up to additional shares of our common stock to cover over-allotments. The underwriters can exercise this option at any time within 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to investors on or about , 2015.

| Leerink Partners | Cowen and Company |

The date of this prospectus is , 2015.

Neither we nor any of the underwriters have authorized anyone to provide you with information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give to you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

No action is being taken in any jurisdiction outside the United States to permit a public offering of our common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions relating to this offering and the distribution of this prospectus applicable to that jurisdiction.

The trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the "Risk Factors" section and our financial statements and the related notes appearing at the end of this prospectus, before making an investment decision.

This prospectus relates to an offering of our common stock following certain transactions described herein that will occur prior to the effectiveness of the registration statement of which this prospectus forms a part, which we refer to as the Corporate Conversion. As used in this prospectus, unless the context otherwise requires, references to the "Company," "Bellerophon," "we," "us" and "our" refer to (i) following the date of the Corporate Conversion discussed under the heading "Corporate Conversion," Bellerophon Therapeutics, Inc. and its consolidated subsidiaries, or any one or more of them as the context may require, and (ii) prior to the date of the Corporate Conversion, Bellerophon Therapeutics LLC and its consolidated subsidiaries, or any one or more of them as the context may require.

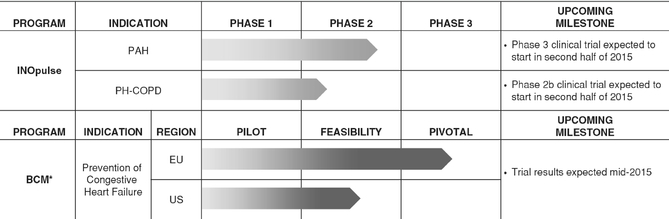

Company Overview

We are a clinical-stage therapeutics company focused on developing innovative products at the intersection of drugs and devices that address significant unmet medical needs in the treatment of cardiopulmonary and cardiac diseases. We have two programs in advanced clinical development. The first program, INOpulse, is based on our proprietary pulsatile nitric oxide delivery device. We are currently developing two product candidates under our INOpulse program: one for the treatment of pulmonary arterial hypertension, or PAH, for which we intend to commence Phase 3 clinical trials in the second half of 2015, and the other for the treatment of pulmonary hypertension associated with chronic obstructive pulmonary disease, or PH-COPD, which is in Phase 2 development. Our second program is bioabsorbable cardiac matrix, or BCM, which is currently in a placebo-controlled clinical trial designed to support CE mark registration in the European Union. We completed enrollment of this trial in December 2014, with 303 patients having completed the treatment procedure, and we expect to report top line results in mid-2015. Assuming positive results, we intend to conduct a pivotal pre-market approval trial of BCM beginning in the first half of 2016, which will be designed to support registration in the United States. We are developing BCM for the prevention of cardiac remodeling, which often leads to congestive heart failure following an ST-segment elevated myocardial infarction, or STEMI.

Our Product Candidates

The following table summarizes key information about our development programs and product candidates. We have worldwide commercialization rights to all of our product candidates.

- *

- We are currently conducting a single clinical trial for BCM that, assuming positive results, we plan to use as a CE mark registration trial in the European Union and following which we would conduct a second, larger clinical trial to support registration in the United States.

1

From the inception of our business through September 30, 2014, $184.3 million was invested in our development programs. To date, our sole source of funding has been investments in us by our former parent company, Ikaria.

INOpulse

Our INOpulse program is an extension of the technology used in hospitals to deliver continuous-flow inhaled nitric oxide. Use of inhaled nitric oxide is approved by the U.S. Food and Drug Administration, or the FDA, and certain other regulatory authorities to treat persistent pulmonary hypertension of the newborn. Ikaria, Inc., or Ikaria, has marketed continuous-flow inhaled nitric oxide as INOmax for hospital use in this indication since approval in 1999. In October 2013, Ikaria transferred to us exclusive worldwide rights to develop and commercialize pulsed nitric oxide in PAH, PH-COPD and pulmonary hypertension associated with idiopathic pulmonary fibrosis, or PH-IPF, with no royalty obligations. Our INOpulse program is built on scientific and technical expertise developed for the therapeutic delivery of inhaled nitric oxide. In 2010, Ikaria filed an investigational new drug application, or IND, for INOpulse for the treatment of patients with PAH, which is a form of pulmonary hypertension that is closely related to persistent pulmonary hypertension of the newborn. In 2012, Ikaria filed a second IND for INOpulse for the treatment of patients with PH-COPD. These INDs were included in the assets that were transferred to us by Ikaria.

Nitric oxide is naturally produced and released by the lining of the blood vessel and results in vascular smooth muscle relaxation, an important factor in regulating blood pressure. As the muscles of the blood vessels relax, this allows the heart to increase blood flow to tissues and organs of the body, including the lung. When administered through inhalation, nitric oxide acts to selectively reduce pulmonary arterial pressure in the lung with minimal effects on blood pressure outside of the lungs, an important safety consideration.

Inhaled nitric oxide is widely used in the hospital setting for the treatment of a variety of conditions and, as reported by Ikaria, over 450,000 patients have been treated with inhaled nitric oxide worldwide since its first such use. However, chronic outpatient use of this therapy has previously been limited by a lack of a safe and compact delivery system for outpatient use. We have designed our INOpulse device, which is the means by which inhaled nitric oxide is delivered to the patient, to be portable, which enables use by ambulatory patients on a daily basis inside or outside their homes. Our INOpulse device has a proprietary mechanism that delivers brief, targeted pulses of nitric oxide timed to occur at the beginning of a breath for delivery to the well-ventilated alveoli of the lungs, which minimizes the amount of drug required for treatment. We estimate this, and the higher concentration of nitric oxide we use, reduces the volume of drug delivered to approximately 5% of the volume required for equivalent alveolar absorption using standard continuous flow delivery systems, and also reduces the amount of nitric oxide, as well as its by-product nitrogen dioxide, that is exhaled and released into the patient's environment. INOpulse is designed to automatically adjust nitric oxide delivery based on a patient's breathing pattern to deliver a constant and appropriate dose of the inhaled nitric oxide over time, independent of the patient's activity level, thus ensuring more consistent dosing of the nitric oxide to the alveoli of the lungs.

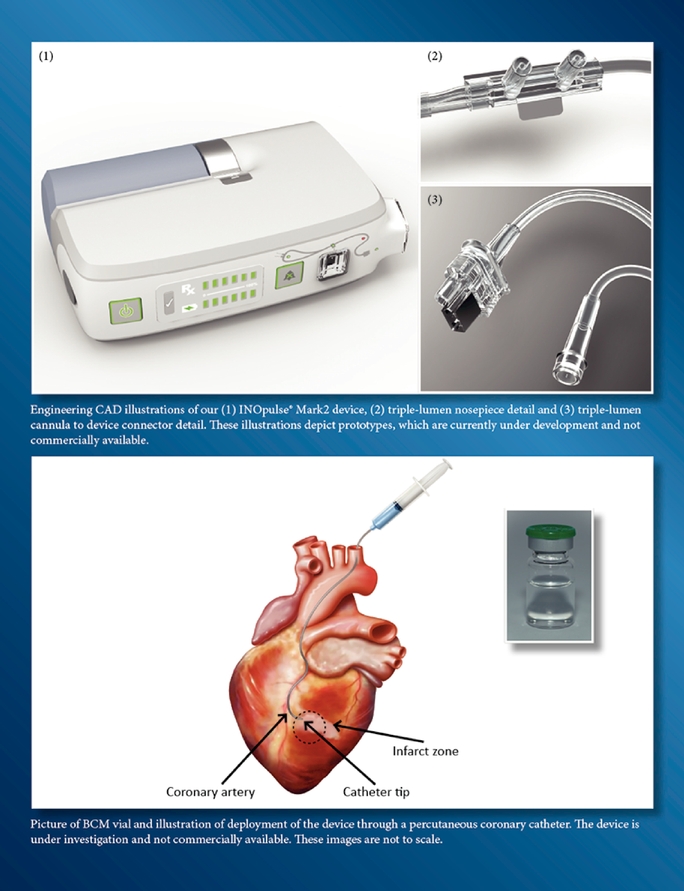

In our recently completed INOpulse clinical trials, we used the first generation INOpulse device, which we refer to as the INOpulse DS device. In future clinical trials, we intend to use our second generation device, which we refer to as the Mark2. The Mark2 has approximately the same dimensions as a paperback book and weighs approximately 2.5 pounds. The Mark2 has a simple and intuitive user interface and a battery life of approximately 24 hours when recharged, which takes approximately four hours and can be done while the patient sleeps. Based on the doses we have evaluated in our clinical trials, we expect that the cartridge will need to be replaced once a day. In addition, we have developed a triple-lumen nasal cannula, which forms part of the Mark2 and enables more accurate dosing of nitric oxide and minimizes infiltration of oxygen, which can react with nitric oxide to form nitrogen dioxide.

2

Our triple-lumen nasal cannula consists of a thin, plastic tube that is divided into three channels from end-to-end, including at the prongs that are placed in the patient's nostrils, with one channel delivering inhaled nitric oxide, a second for breath detection and a third available for oxygen delivery. INOpulse is designed to be compatible with many long-term oxygen therapy systems. In the usability research we conducted, all eight patients with experience with the INOpulse DS device responded positively to the Mark2, and several of these patients indicated that the ability to take the Mark2 outside the home would likely reduce concerns with maintaining compliance.

Our technology is based on patents we have exclusively licensed from Ikaria for the treatment of PAH, PH-COPD and PH-IPF. These include patents with respect to the pulsed delivery of nitric oxide to ensure a consistent dose over time, which expire as late as 2027 in the United States and as late as 2026 in certain other countries, as well as with respect to the special triple-lumen cannula that allows for safer and more accurate dosing of pulsed nitric oxide, which expires in 2033. We have also licensed several other patent applications from Ikaria for certain of the innovations included in the Mark2, and certain of the resulting patents, if issued, would expire as late as 2033.

INOpulse for PAH

We are developing INOpulse for the treatment of PAH to address a significant and unmet medical need in an orphan disease, which is a disease that affects fewer than 200,000 individuals in the United States. This program represents a potential first-in-class therapy for this indication. In October 2014, we completed a randomized, placebo-controlled, double-blind Phase 2 clinical trial of INOpulse for PAH. The data from this trial showed trends toward lower pulmonary vascular resistance in both active arms compared to placebo and a slight trend toward increased six-minute walk distance in the higher dose group. While neither result reached the threshold for statistical significance, additional exploratory analyses of patients who were compliant with therapy, assessed as being on therapy for greater than 12 hours per day, as well as a similar analysis of patients on long-term oxygen therapy, or LTOT, showed clinically meaningful and statistically significant improvements in both the primary endpoint of pulmonary vascular resistance and the key secondary endpoint of six-minute walk distance, relative to placebo, for patients on the higher dose. These two sub groups each comprised more than 50% of the total patients enrolled in the trial. Statistical significance for clinical trials means that, should the trial have a positive outcome, the results have a low probability of having occurred because of chance rather than from the efficacy of the product.

We believe the results of this trial provide sufficient indication of clinical benefit and safety to continue development of INOpulse for PAH in pivotal Phase 3 clinical trials. We had an End of Phase 2 meeting with the FDA on January 8, 2015. Based on feedback from the FDA at this meeting, we are moving forward with Phase 3 development and plan to conduct two adequate and well-controlled confirmatory Phase 3 clinical trials, either sequentially or in parallel. We intend to finalize the clinical trial design following additional discussions with the FDA as well as with other regulatory authorities, including with the EMA.

The FDA has granted orphan drug designation to our nitric oxide program for the treatment of PAH. If a product with an orphan drug designation is the first to receive FDA approval, the FDA will not approve another product for the same indication that uses the same active ingredient for seven years, unless the other product is shown to be clinically superior.

PAH is characterized by abnormal constriction of the arteries in the lung that increases the blood pressure in the lungs which, in turn, results in abnormal strain on the heart's right ventricle, eventually leading to heart failure. While prevalence data varies widely, we estimate there are a total of at least 35,000 patients currently diagnosed with and treated for PAH in the United States and European Union. Moreover, because PAH is rare and causes varied symptoms, we believe there is significant under-diagnosis of the condition at its early stages. There are several approved therapies for PAH, and

3

we estimate, based on public product sales data, that 2012 combined global sales for these therapies were over $4.0 billion. Most PAH patients are treated with multiple medications and many are on supportive therapy. We believe that approximately 20,000 patients have severe to very severe PAH and are treated with multiple therapies, including LTOT. Despite the availability of multiple therapies for this condition, PAH continues to be a life-threatening, progressive disorder. A French registry initiated in 2002 and a U.S. registry initiated in 2006 estimate that the median survival of patients with PAH is three and five years from initial diagnosis, respectively.

INOpulse for PH-COPD

We are also developing INOpulse for the treatment of PH-COPD. The data from an initial three-month, open-label chronic-use Phase 2 trial conducted by a third party, which we in-licensed, showed that pulsed inhaled nitric oxide significantly reduced pulmonary arterial pressures in PH-COPD patients on LTOT and did so without causing hypoxemia, or an abnormally low level of oxygen in the blood, which is a significant concern for these patients. In June 2012, Ikaria submitted the data from this trial to the FDA as part of the IND package for INOpulse for PH-COPD. Based on discussions with the FDA, we believe this trial is an adequate Phase 2 trial. The FDA asked us to confirm the dose range and the safety related to hypoxemia in PH-COPD patients using the INOpulse device, prior to proceeding to large scale trials. Following this guidance, we conducted a Phase 2 acute dose ranging trial with the INOpulse DS device. This trial, which we completed in July 2014, identified a dose range that showed similar reduction in pulmonary arterial pressure versus baseline when compared to the initial acute effects of pulsed inhaled nitric oxide in the original chronic-use trial. In addition, in our confirmatory trial, none of the INOpulse doses tested had an adverse effect on hypoxemia relative to placebo. While the reduction in pulmonary arterial pressure did not reach statistical significance versus placebo in this acute setting, which was the primary endpoint of the trial, we believe that the results have confirmed a dose range for this therapy that delivers a significant reduction in pulmonary arterial pressure versus baseline and does not cause hypoxemia in patients with PH-COPD. We are currently evaluating our trial design for chronic use in this population in a Phase 2b trial and plan to finalize the protocol following discussions with regulatory authorities in the United States and European Union.

COPD is a disease characterized by progressive and persistent airflow limitations. Patients with more severe COPD frequently have hypoxemia and may be treated with LTOT. Despite treatment with oxygen, hypoxemia can progress and contribute to pulmonary hypertension. In 2010, Datamonitor estimated that over 1.4 million COPD patients in the United States were being treated with LTOT. Based on academic studies, we estimate that 50% of COPD patients on LTOT have pulmonary hypertension. PH-COPD patients have a lower median life expectancy and a higher rate of hospitalization than COPD patients with similar respiratory disease but without pulmonary hypertension. Currently, there are no approved therapies for treating PH-COPD, and the only generally accepted treatments are LTOT, pulmonary rehabilitation and lung transplant.

BCM

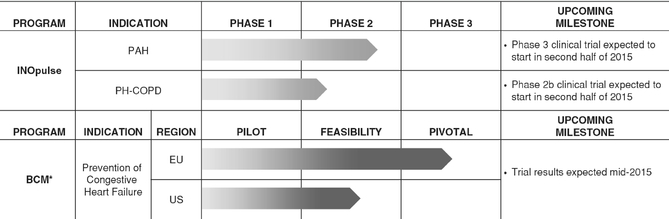

Our second program, BCM, is a medical device intended to prevent congestive heart failure following an ST-segment elevated myocardial infarction, or STEMI, which is a type of severe heart attack. Patients who suffer a STEMI are at an increased risk for congestive heart failure due to potential cardiac remodeling, which is a structural change in the size and shape of the heart that affects its ability to function normally.

BCM is delivered during a minimally invasive, commonly performed cardiac procedure called a percutaneous coronary intervention procedure. BCM is a formulated sterile solution of sodium alginate and calcium gluconate designed to be administered as a liquid through the coronary artery. When administered following a STEMI, BCM flows into damaged heart muscle where, in the presence of abnormally high extracellular calcium released by the damaged cells, it forms a protective hydrogel

4

meshwork within the wall of the heart's left ventricle. Based on pre-clinical animal studies, we believe that BCM has the potential to act as a flexible scaffold to provide physical support to the ventricle wall in the early stages of recovery following a STEMI and prevent further structural damage while the heart muscle heals. In addition, in our pre-clinical animal studies, as calcium levels in the damaged area returned to normal, BCM dissolved and was excreted through normal kidney function.

In a 27-patient pilot clinical trial conducted in 2009, BCM was safely administered within seven days following a STEMI. Patients showed no deterioration from baseline of important measures of left ventricular function at one, three and six month measurements. Follow-up safety data for these patients, which was obtained four years after the completion of the pilot clinical trial, showed one death from T-cell lymphoma—likely a preexisting condition—and one hospitalization from congestive heart failure. One patient was lost to follow-up in year four, but this patient had no device related adverse events through the three-year evaluation. These results were below the incidence of adverse events of approximately 25% to 30% we expected for patients following an acute myocardial infarction, or AMI, commonly known as a heart attack. This expectation was based on our review of publicly reported data from two long-term third-party studies of AMI patients.

We initiated a clinical trial of BCM in December 2011 and enrolled the first patient in April 2012. We completed enrollment of this trial in December 2014, with 303 patients having completed the treatment procedure at almost 90 clinical sites in Europe, Australia, North America and Israel. We expect to report top line results in mid-2015, following a six-month follow-up period for all patients. This trial is a CE mark registration trial in the European Union. If the results of this trial are positive, we expect it would form the basis for our application for CE marking in the European Union and we would expect to conduct a second, larger clinical trial to support approval in the United States through the premarket approval, or PMA, pathway.

In the United States, we are developing BCM under an investigational device exemption, or IDE. We sponsored an IDE application for our ongoing feasibility clinical trial of BCM to prevent ventricular remodeling and heart failure in patients who are at high risk for ventricular remodeling after an AMI and a successful percutaneous coronary intervention. The FDA has designated BCM as a Class III device. Class III devices are those which the FDA deems to pose the greatest risk, such as those that are life sustaining or life supporting. As a result, the FDA regulates Class III devices under the most rigorous device approval pathway, the PMA process. Device approval under the PMA pathway must be supported by extensive data, including from pre-clinical studies and clinical trials, that demonstrate the safety and efficacy of the device for its intended use. In August 2013, the FDA confirmed that no additional pre-clinical studies were required to support a PMA application. Assuming positive results from this trial, we intend to conduct a pivotal pre-market approval trial of BCM beginning in the first half of 2016, which will be designed to support registration in the United States.

We have an exclusive worldwide license to BCM from BioLineRx Ltd. and its subsidiary, or BioLine, including with respect to issued composition of matter patents on BCM that expire as late as 2029 in the United States, with a possible patent term extension to 2032 to 2034 depending on the timing of marketing approval and other factors, and 2024 in certain other countries. We licensed this product candidate in 2009, following completion of the 27-patient pilot clinical trial conducted by BioLineRx Ltd.

Data from the American Heart Association and the European Association for Percutaneous Cardiovascular Interventions suggests that a total of over 1,900,000 patients suffer a heart attack in the United States and European Union each year, with at least 750,000 of these patients having a STEMI. Following a STEMI, patients are at increased risk of developing cardiac remodeling and subsequent congestive heart failure, and data from long-term third-party studies suggest that the five-year post-AMI rate of congestive heart failure or death is approximately 35% to 40%.

5

Our Strategy

Our goal is to become a leader in developing and commercializing innovative products at the intersection of drugs and devices that address significant unmet medical needs in the treatment of cardiopulmonary and cardiac diseases. The key elements of our strategy to achieve this goal include:

- •

- Advance the clinical development of INOpulse. One of our lead product

candidates is INOpulse for PAH. Based on the results from our recently completed Phase 2 clinical trial in PAH, we intend to initiate a Phase 3 clinical trial for this indication in the

second half of 2015. In addition, we believe the results of the PH-COPD clinical trials support continued Phase 2 development and we plan to evaluate our options for further development,

including potentially through partnerships.

- •

- Advance the clinical development of BCM in the prevention of cardiac remodeling following a STEMI. One of our other lead product candidates is BCM.

Assuming positive results from our ongoing clinical trial, we expect to file for CE marking in the European Union in the second

half of 2015 and to initiate a pivotal trial in early 2016 to support a PMA submission seeking marketing approval in the United States.

- •

- Leverage our historical core competencies to expand our pipeline. We have

years of institutional experience in the use of inhaled nitric oxide in treating pulmonary hypertension and in the development of drug-device combination product candidates. If we successfully advance

INOpulse for the two product candidates we are currently developing, we expect to develop INOpulse for treatment of PH-IPF and, subject to obtaining additional license rights from Ikaria, potentially

other outpatient pulmonary hypertension indications. Our longer-term vision is to identify and opportunistically in-license innovative therapies that are at the intersection of drugs and devices and

to develop and commercialize these product candidates.

- •

- Build commercial infrastructure in select markets. As we near completion of the development of our product candidates, we expect to build a commercial infrastructure to enable us to market and sell certain of our product candidates with a specialized sales force and to retain co-promotion or similar rights, when feasible, in indications requiring a larger commercial infrastructure. While we may partner with third parties to commercialize our product candidates in certain countries, we may also choose to establish commercialization capabilities in select countries outside the United States.

The Spin-Out

In October 2013, Ikaria completed an internal reorganization of certain assets and subsidiaries, in which it transferred to us exclusive worldwide rights, with no royalty obligations, to develop and commercialize pulsed nitric oxide in PAH, PH-COPD and PH-IPF. Following the internal reorganization, in February 2014, Ikaria distributed all of our then outstanding units to its stockholders through the payment of a special dividend on a pro rata basis based on each stockholder's ownership of Ikaria capital stock. We refer to Ikaria's distribution of our then outstanding units to its stockholders as the Spin-Out. Shortly after the Spin-Out, Ikaria was acquired by entities affiliated with Madison Dearborn Partners, a private equity firm.

In connection with the Spin-Out, we entered into several agreements with Ikaria providing for, among other things, the provision of transition services, the cross license of certain intellectual property, commitments not to compete, the manufacture and supply of the INOpulse drug and device and certain employee matters.

As used in this prospectus, unless context otherwise requires, references to "Ikaria" refer to Ikaria, Inc. and its subsidiaries and any successor entity.

6

Risk Factors

Our business is subject to a number of risks of which you should be aware before making an investment decision. As a clinical-stage biotherapeutics company, we may face inherent risks in our business and our industry generally. These risks are discussed more fully in the "Risk Factors" section of this prospectus immediately following this prospectus summary. These risks include, among others:

- •

- We have incurred significant losses since inception. We expect to incur losses over the next several years and may never

achieve or maintain profitability.

- •

- Our very limited operating history as a stand-alone company may make it difficult for you to evaluate the success of our

business to date and to assess our future viability. We currently rely on Ikaria for transition services and may be unable to make the changes necessary to operate as a stand-alone company.

- •

- We will need substantial additional funding. Prior to the Spin-Out, we were funded by Ikaria. Going forward, if we are

unable to raise capital when needed, we could be forced to delay, reduce or eliminate our product development programs or commercialization efforts.

- •

- We are dependent on the success of our INOpulse and BCM product candidates and our ability to develop, obtain marketing

approval for and successfully commercialize these product candidates. If we are unable to develop, obtain marketing approval for or successfully commercialize our product candidates, either alone or

through a collaboration, or experience significant delays in doing so, our business could be materially harmed.

- •

- We rely on Ikaria for our supply of nitric oxide for the clinical trials of INOpulse. Ikaria is the sole supplier of

nitric oxide. Ikaria's inability to continue manufacturing adequate supplies of nitric oxide, or its refusal to supply us with commercial quantities of nitric oxide on commercially reasonable terms,

or at all, could result in a disruption in the supply of, or impair our ability to market, INOpulse.

- •

- Clinical trials involve a lengthy and expensive process with an uncertain outcome. We may incur additional costs or

experience delays in completing, or ultimately be unable to complete, the development and commercialization of our product candidates.

- •

- We exclusively license BCM from BioLine and INOpulse from Ikaria, and we may enter into additional agreements to

in-license technology from third parties. If we fail to comply with our obligations under any such license agreements, we could lose rights that are important to our business.

- •

- We may seek to enter into collaborations with third parties for the development and commercialization of our product

candidates. If we fail to enter into such collaborations, or such collaborations are not successful, we may not be able to capitalize on the market potential of our product candidates.

- •

- If we are unable to obtain and maintain patent protection for our technology and products or if the scope of the patent

protection obtained is not sufficiently broad, our competitors could develop and commercialize technology and products similar or identical to ours, and our ability to successfully commercialize our

technology and products may be impaired.

- •

- Our principal stockholders will continue to have substantial control over us after this offering, which could limit your ability to influence the outcome of key transactions, including any change of control.

7

Corporate Information

We were incorporated under the laws of the State of Delaware on October 17, 2013 under the name Ikaria Development LLC. We changed our name to Bellerophon Therapeutics LLC on January 27, 2014. We currently have three wholly-owned subsidiaries: Bellerophon BCM LLC, a Delaware limited liability company; Bellerophon Pulse Technologies LLC, a Delaware limited liability company; and Bellerophon Services, Inc., a Delaware corporation. Our website address is www.bellerophon.com. The information contained on, or that can be accessed through, our website does not constitute part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

Our executive offices are located at 53 Frontage Road, Suite 301, Hampton, New Jersey 08827, and our telephone number is (908) 574-4770.

Corporate Conversion

We are currently a Delaware limited liability company. Prior to the effectiveness of the registration statement of which this prospectus forms a part, we will complete transactions pursuant to which we will convert into a Delaware corporation and change our name to Bellerophon Therapeutics, Inc. In connection with the conversion, all of our outstanding voting units and non-voting units will convert into shares of voting common stock and non-voting common stock, respectively, and options to purchase our non-voting units will become options to purchase non-voting shares of our common stock. Pursuant to their terms, upon the consummation of this offering, the non-voting common stock will be converted into voting common stock and options to purchase non-voting common stock will become options to purchase voting common stock. Also, in connection with our conversion into a Delaware corporation, certain entities affiliated with certain of our principal stockholders will be merged with and into us. See "Corporate Conversion."

Implications of Being an Emerging Growth Company

We qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure and other requirements that are applicable to other public companies that are not emerging growth companies. These exemptions include:

- •

- being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim

financial statements, with correspondingly reduced "Management's Discussion and Analysis of Financial Condition and Results of Operations" disclosure;

- •

- not being required to comply with the auditor attestation requirements in the assessment of our internal control over

financial reporting;

- •

- not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board

regarding mandatory audit firm rotation or a supplement to the auditor's report providing additional information about the audit and the financial statements;

- •

- reduced disclosure obligations regarding executive compensation; and

- •

- exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenue, we have more than $700.0 million in market value of our stock held by non-affiliates or we issue more than $1.0 billion of non-convertible debt over a

8

three-year period. We may choose to take advantage of some or all of the available exemptions. We have taken advantage of certain reduced reporting burdens in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards, and therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

9

Common stock offered |

shares | |

Common stock to be outstanding after this offering |

shares |

|

Over-allotment option |

The underwriters have an option for a period of 30 days from the date of this prospectus to purchase up to additional shares of our common stock to cover over-allotments. |

|

Use of proceeds |

We estimate that the net proceeds from this offering, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, will be approximately $ million, or approximately $ million if the underwriters exercise their option to purchase additional shares from us in full, assuming an initial public offering price of $ , the midpoint of the estimated price range set forth on the cover page of this prospectus. We intend to use the net proceeds from this offering to fund to completion our ongoing clinical trial for BCM, to fund the first trial in our planned Phase 3 clinical program for INOpulse for PAH and for working capital and other general corporate purposes. |

|

|

See "Use of Proceeds" for more information. |

|

Risk factors |

You should read the "Risk Factors" section beginning on page 13 of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

|

Proposed NASDAQ Global Market symbol |

"BLPH" |

The number of shares of our common stock to be outstanding after this offering is based on 99,021,912 voting and non-voting shares of our common stock outstanding as of December 31, 2014 and excludes:

- •

- 13,607,098 shares of common stock issuable upon the exercise of stock options outstanding as of December 31, 2014

at a weighted average exercise price of $0.80 per share;

- •

- 633,282 additional shares of our common stock available as of December 31, 2014 for future issuance under our 2014

equity incentive plan; and

- •

- additional shares of our common stock that will be available for future issuance, as of the effective date of the registration statement for this offering, under our 2015 equity incentive plan.

Unless otherwise indicated, all information in this prospectus:

- •

- assumes no exercise of the outstanding options described above;

- •

- assumes no exercise of the underwriters' option to purchase additional shares;

- •

- gives effect to the Corporate Conversion as described under "Corporate Conversion";

- •

- assumes the conversion of all of the outstanding shares of our non-voting common stock into common stock upon the closing

of this offering; and

- •

- assumes the filing of our restated certificate of incorporation and the adoption of our amended and restated bylaws upon the closing of this offering.

10

The following summary financial information as of and for the years ended December 31, 2013 and 2012 has been derived from our audited financial statements as of and for the years ended December 31, 2013 and 2012 included elsewhere in this prospectus. The following summary financial information as of September 30, 2014 and for the nine months ended September 30, 2014 and 2013 has been derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. The summary financial information below should be read in conjunction with our historical financial statements and the related notes included elsewhere in this prospectus, as well as the "Selected Financial Information" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of this prospectus.

Our financial statements for periods prior to the Spin-Out, which occurred on February 12, 2014, include allocations of costs from certain shared functions provided to us by Ikaria, including general corporate and shared services expenses. These allocations were made based on either specific identification or the proportionate percentage of employee time or headcount to the respective total Ikaria employee time or headcount, as applicable, and have been included in our financial statements for periods prior to February 12, 2014.

The financial statements included in this prospectus may not necessarily reflect our financial position, results of operations and cash flows as if we had operated as a stand-alone company during all of the periods presented. Our historical results for any prior period are not necessarily indicative of results to be expected in any future period, and our interim period results are not necessarily indicative of results to be expected for a full fiscal year or any other interim period.

| |

Nine Months Ended September 30, | Year Ended December 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except per share data) | 2014 | 2013 | 2013 | 2012 | |||||||||

| |

(unaudited) |

|

|

||||||||||

Statement of Operations and Comprehensive Loss Information |

|||||||||||||

Operating expenses: |

|||||||||||||

Research and development |

$ | 36,368 | $ | 39,068 | $ | 52,985 | $ | 38,727 | |||||

General and administrative |

10,537 | 6,155 | 9,013 | 7,185 | |||||||||

Other operating expense |

— | — | — | 315 | |||||||||

| | | | | | | | | | | | | | |

Net loss and comprehensive loss |

$ | (46,905 | ) | $ | (45,223 | ) | $ | (61,998 | ) | $ | (46,227 | ) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Net loss per unit: |

|||||||||||||

Basic and diluted(1) |

$ | (0.47 | ) | ||||||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| |

|

|

|

As of September 30, 2014 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

As of December 31, | ||||||||||||||

| |

As of September 30, 2014 |

Pro Forma(2) | Pro Forma As Adjusted(3) |

|||||||||||||

| (in thousands) | 2013 | 2012 | ||||||||||||||

| |

(unaudited) |

|

|

(unaudited) |

||||||||||||

Balance Sheet Information |

||||||||||||||||

Cash and cash equivalents |

$ | 30,605 | — | — | ||||||||||||

Restricted cash(4) |

13,127 | — | — | |||||||||||||

Working capital (deficit) |

27,906 | (12,440 | ) | (10,892 | ) | |||||||||||

Total assets |

48,634 | 3,636 | 3,349 | |||||||||||||

Allocated portion of Ikaria special dividend bonus payable |

— | 4,273 | 2,865 | |||||||||||||

Other non-current liabilities |

— | 1,108 | 389 | |||||||||||||

Total long term liabilities |

— | 5,381 | 3,254 | |||||||||||||

Members'/stockholders' equity / invested (deficit) |

35,100 | (15,737 | ) | (11,116 | ) | |||||||||||

- (1)

- The weighted average units outstanding for basic and diluted net loss per unit for the nine months ended September 30, 2014 is 98,930,615. No net loss per unit information is presented for periods prior to the Spin-Out.

11

- (2)

- The

pro forma balance sheet information gives effect to the Corporate Conversion.

- (3)

- The

pro forma as adjusted balance sheet information gives further effect to (i) our issuance and sale of shares our of common stock

in this offering at an assumed initial public offering price of $ per share, which is the midpoint of the estimated price range set forth on the cover page of this prospectus,

after

deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, and (ii) the conversion of all of our outstanding shares of non-voting common stock

into shares of voting common stock.

- (4)

- Represents cash deposited into escrow to pay amounts owed under the transition services agreement with Ikaria.

A $1.00 increase (decrease) in the assumed initial public offering price of $ per share, which is the midpoint of the estimated price range set forth on the cover page of this prospectus, would increase (decrease) the pro forma as adjusted amount of each of cash and cash equivalents, working (deficit) capital, total assets and members' equity/invested (deficit) by $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions. Each increase (decrease) of 1.0 million shares in the number of shares of common stock offered by us at the assumed initial public offering price of $ per share, which is the midpoint of the estimated price range set forth on the cover page of this prospectus, would increase (decrease) the pro forma as adjusted amount of each of cash and cash equivalents, working (deficit) capital, total assets and members' equity/invested (deficit) by $ million, after deducting estimated underwriting discounts and commissions.

12

Investing in our common stock involves a high degree of risk. Before you decide to invest in our common stock, you should carefully consider the risks and uncertainties described below, together with the other information contained in this prospectus, including our financial statements and the related notes appearing at the end of this prospectus. If any of the following risks occur, our business, financial condition, results of operations and prospects could be materially and adversely affected. In these circumstances, the market price of our common stock could decline, and you might lose all or part of your investment.

Risks Related to Our Financial Position and Need for Additional Capital

We have incurred significant losses since inception. We expect to incur losses over the next several years and may never achieve or maintain profitability.

Since inception, we have incurred significant operating losses. Our net loss was approximately $46.2 million for the year ended December 31, 2012, $62.0 million for the year ended December 31, 2013 and $46.9 million for the nine months ended September 30, 2014. We do not know whether or when we will become profitable. We have not generated any revenues to date from product sales. We have not completed development of any product candidate and have devoted substantially all of our financial resources and efforts to research and development, including pre-clinical studies and clinical trials. We expect to continue to incur significant expenses and operating losses over the next several years. Our net losses may fluctuate significantly from quarter to quarter and year to year. Net losses and negative cash flows have had, and will continue to have, an adverse effect on our deficit and working capital. We anticipate that our expenses will increase substantially if and as we:

- •

- continue our research and clinical development of our inhaled nitric oxide program using our proprietary pulsatile

technology, which we refer to as our INOpulse program, for the treatment of pulmonary arterial hypertension, or PAH, and pulmonary hypertension associated with chronic obstructive pulmonary disease,

or PH-COPD, and of our program in respect of bioabsorbable cardiac matrix, or BCM, for the prevention of left ventricular remodeling following an ST-segment elevated myocardial infarction, or STEMI;

- •

- identify, develop and/or in-license additional product candidates;

- •

- seek regulatory approvals for any product candidates that successfully complete clinical trials;

- •

- in the future, establish a manufacturing, sales, marketing and distribution infrastructure;

- •

- maintain, expand and protect our intellectual property portfolio;

- •

- add equipment and physical infrastructure to support our research and development;

- •

- hire additional clinical, regulatory, quality control and scientific personnel;

and

- •

- add operational, financial and management information systems and personnel, including personnel to support our product development, any future commercialization efforts and our transition to a public company.

To become and remain profitable, we must succeed in developing and eventually commercializing products that generate significant revenue. We do not expect to generate significant revenue unless and until we are able to obtain marketing approval for, and successfully commercialize, one or more of our product candidates. This will require us to be successful in a range of challenging activities, including completing pre-clinical studies and clinical trials of our product candidates, discovering additional product candidates, obtaining regulatory approval for our product candidates, manufacturing, marketing and selling any products for which we may obtain regulatory approval, satisfying any post-marketing requirements and obtaining reimbursement for our products from private insurance or government payors. We are in the early stages of most of these activities and have not yet commenced other of

13

these activities. We may never succeed in these activities and, even if we do, may never generate revenues that are significant enough to achieve profitability.

Because of the numerous risks and uncertainties associated with pharmaceutical product development, we are unable to accurately predict the timing or amount of increased expenses or when, or if, we will be able to achieve profitability. If we are required by the U.S. Food and Drug Administration, or the FDA, or the European Medicines Agency, or the EMA, to perform trials in addition to those currently expected, or if there are any delays in completing our clinical trials or the development of any of our product candidates, our expenses could increase.

Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our failure to become and remain profitable would depress the value of our company and could impair our ability to raise capital, expand our business, maintain our research and development efforts, diversify our product offerings or even continue our operations. A decline in the value of our company could cause you to lose all or part of your investment.

In addition, our recurring losses from operations, accumulated deficit and our need to raise additional financing in order to continue to fund our operations, raise substantial doubt about our ability to continue as a going concern. If we are unable to obtain sufficient capital in this offering, our business, financial condition and results of operations will be materially and adversely affected and we will need to obtain alternative financing or significantly modify our operational plans to continue as a going concern. Further, even if we successfully complete and receive the net proceeds from this offering, given our planned expenditures for the next several years, including, without limitation, expenditures in connection with our clinical trials, our independent registered public accounting firm may conclude, in connection with the preparation of our financial statements for fiscal year 2014, or any other subsequent period, that there is substantial doubt regarding our ability to continue as a going concern.

Our very limited operating history as a stand-alone company may make it difficult for you to evaluate the success of our business to date and to assess our future viability.

We were formed as a wholly-owned subsidiary of Ikaria, Inc., or Ikaria, in October 2013 and became a stand-alone company in February 2014 following our spin-out from Ikaria, which we refer to as the Spin-Out, and, as such, have a very limited operating history as a stand-alone company. Prior to the Spin-Out, Ikaria assisted us by providing financing and certain corporate functions. Following the Spin-Out, Ikaria has no obligation to provide assistance to us other than on an interim basis as provided for in the agreements we entered into in connection with the Spin-Out. See "Certain Relationships and Related Person Transactions—Relationship with Ikaria."

Our operations to date have been limited to organizing and staffing our company, developing and securing our technology, and undertaking pre-clinical studies and clinical trials of our product candidates. We have not yet demonstrated the ability to successfully operate as a stand-alone company or to complete development of any product candidates, obtain marketing approvals, manufacture a commercial scale product, or arrange for a third party to do so on our behalf, or conduct sales and marketing activities necessary for successful product commercialization. Consequently, any predictions you make about our future success or viability may not be as accurate as they could be if we had a longer operating history or a history of successfully developing and commercializing products.

Assuming we obtain marketing approval for any of our product candidates, we will need to transition from a company with a research and development focus to a company capable of supporting commercial activities or we will need to enter into strategic partnerships. We may encounter unforeseen expenses, difficulties, complications and delays and may not be successful in such a transition.

14

We will need substantial additional funding. If we are unable to raise capital when needed, we could be forced to delay, reduce or eliminate our product development programs or commercialization efforts.

We expect our expenses to increase in connection with our ongoing activities, particularly as we initiate additional clinical trials of our INOpulse and BCM product candidates and continue research and development and seek regulatory approval for these and potentially other product candidates. In addition, if we obtain regulatory approval for any of our product candidates, we expect to incur significant commercialization expenses related to product manufacturing, marketing, sales and distribution. In particular, the costs that may be required for the manufacture of any product candidate that receives marketing approval may be substantial. Furthermore, upon the closing of this offering, we expect to incur additional costs associated with operating as a public company. As of September 30, 2014, we had cash and cash equivalents and restricted cash of $43.7 million. From the inception of our business through September 30, 2014, Ikaria made cumulative investments of $177.5 million in us and contributed an additional $80.0 million to us in connection with the Spin-Out. Now that we are a stand-alone company, any additional funding will need to come from another source. Accordingly, we will need to obtain substantial additional funding in connection with our continuing operations. If we are unable to raise capital when needed or on attractive terms, we could be forced to delay, reduce or eliminate our research and development programs or any future commercialization efforts.

We plan to use the net proceeds from this offering primarily to fund our ongoing research and development efforts. We will be required to expend significant funds in order to advance development of our INOpulse and BCM product candidates and any other potential product candidates. The net proceeds from this offering and our existing cash, cash equivalents and restricted cash will not be sufficient to fund all of the efforts that we plan to undertake, such as the further development of INOpulse for PH-COPD or BCM, or to fund completion of clinical development or commercialization of any of our product candidates. Accordingly, we will be required to obtain further funding through public or private equity offerings, debt financings, collaborations or licensing arrangements or other sources. Adequate additional funding may not be available to us on acceptable terms or at all. Our failure to raise capital as and when needed would have a negative impact on our financial condition and our ability to pursue our business strategy.

We believe that the net proceeds from this offering, together with our existing cash, cash equivalents and restricted cash as of September 30, 2014, will enable us to fund our operating expenses and capital expenditure requirements, as set forth below under "Use of Proceeds," for at least the next months. We have based this estimate on assumptions that may prove to be wrong, and we could use our capital resources sooner than we currently expect. Our future capital requirements will depend on many factors, including:

- •

- the progress and results of our current and planned clinical trials of our INOpulse and BCM product candidates;

- •

- the costs, timing and outcome of regulatory review of our product candidates;

- •

- the costs of operating as a stand-alone company;

- •

- the cost and timing of future commercialization activities, including product manufacturing, marketing, sales and

distribution, for any of our product candidates for which we receive marketing approval;

- •

- the revenue, if any, received from commercial sales of any product candidates for which we receive marketing approval;

- •

- our ability to establish and maintain strategic partnerships, licensing or other arrangements and the financial terms of such agreements;

15

- •

- the costs and timing of preparing, filing and prosecuting patent applications, maintaining and enforcing our intellectual

property rights and defending any intellectual property-related claims;

- •

- the scope, progress, results and costs of discovery, pre-clinical development and clinical trials for any other product

candidates;

- •

- the extent to which we acquire or in-license other product candidates and technologies;

- •

- our headcount growth and associated costs; and

- •

- the costs of operating as a public company.

Identifying potential product candidates and conducting pre-clinical studies and clinical trials is a time-consuming, expensive and uncertain process that takes years to complete, and we may never generate the necessary data or results required to obtain regulatory approval and achieve product sales. In addition, our product candidates, if approved, may not achieve commercial success. Our commercial revenues, if any, will be derived from sales of products that we do not expect to be commercially available for several years, if at all. Accordingly, we will need to continue to rely on additional financing to achieve our business objectives. Adequate additional financing may not be available to us on acceptable terms, or at all. In addition, we may seek additional capital due to favorable market conditions or strategic considerations, even if we believe we have sufficient funds for our current or future operating plans.

Raising additional capital may cause dilution to our stockholders, including purchasers of our common stock in this offering, restrict our operations or require us to relinquish rights to technologies or product candidates.

Until such time, if ever, as we can generate substantial product revenues, we expect to finance our cash needs through a combination of public or private equity offerings, debt financings and/or license and development agreements with collaboration partners. We do not have any committed external source of funds. To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest may be materially diluted, and the terms of such securities could include liquidation or other preferences that adversely affect your rights as a common stockholder. Debt financing and preferred equity financing, if available, may involve agreements that include restrictive covenants that limit our ability to take specified actions, such as incurring additional debt, making capital expenditures or declaring dividends.

If we are unable to raise additional funds through equity or debt financings when needed, we may be required to delay, limit, reduce or terminate our product development or future commercialization efforts or grant rights to develop and market product candidates that we would otherwise prefer to develop and market ourselves. If we raise funds through collaborations, strategic partnerships or marketing, distribution or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams, research programs or product candidates or grant licenses on terms that may not be favorable to us.

Risks Related to Our Business and Industry

We may be unable to make, on a timely or cost-effective basis, the changes necessary to operate as a stand-alone company, and we may experience increased or unexpected costs after the Spin-Out or as a result of the Spin-Out.

We have historically operated as part of Ikaria's broader corporate organization, and Ikaria has assisted us by providing certain corporate functions. However, following the Spin-Out, Ikaria is contractually obligated to provide to us only those services specified in the transition services agreement, or the TSA, and the other agreements we entered into with Ikaria to govern our relationship following the Spin-Out. See "Certain Relationships and Related Person Transactions—

16

Relationship with Ikaria" for a summary of these agreements. The TSA provides for certain services to be provided until February 2016. We may be unable to replace in a timely manner or on comparable terms the services or other benefits that Ikaria previously provided to us that are not specified in the TSA or the other agreements. Also, upon the termination of the services provided under the TSA or other agreements, such services will be provided internally or by unaffiliated third parties, and we expect that in some instances, we will incur higher costs to obtain such services than we incurred under the terms of such agreements. Ultimately, we may be unable to replace in a timely manner or on comparable terms the services specified in such agreements. In addition, during the transitional services period, we will rely, in part, on the same executive team at Ikaria that also will continue to manage the business of Ikaria during such time, and there may be conflicting demands on their time, which could result in an inadequate level of attention to the demands of our business. If Ikaria and its employees do not continue to perform effectively the transition services and the other services that are called for under the TSA and other agreements, we may not be able to operate our business effectively and our business and financial condition could be adversely affected.

Prior to the Spin-Out, we utilized the executive management team and administrative resources of Ikaria. Many daily functions were performed by Ikaria, including those related to the preparation of our financial statements and the engagement of auditors to audit our financial statements, which have become our responsibility following the Spin-Out. We may need to acquire assets and resources in addition to those provided to us by Ikaria, and we may face difficulty in integrating newly acquired assets into our business. Additionally, as a stand-alone company, we no longer have access to Ikaria's financial resources. Instead, our ability to fund our capital needs will depend on our ongoing ability to generate cash from operations, enter into partnering arrangements, obtain debt financing and access capital markets, which are subject to general economic, financial, competitive, regulatory and other factors that are beyond our control. Our business, financial condition and results of operations could be harmed, possibly materially, if we have difficulty operating as a stand-alone company, fail to acquire necessary capital or assets that prove to be important to our operations, or are unable to enter into partnering or other business development arrangements.

We also anticipate that we will incur additional incremental expenses associated with being a stand-alone company. We estimate that these incremental pretax expenses were between $3.0 million and $5.0 million for the year ended December 31, 2014.

Our historical and pro forma financial information is not necessarily representative of the results we would have achieved as a stand-alone company and may not be a reliable indicator of our future results.

The historical financial and pro forma financial information we have included in this prospectus may not reflect what our results of operations, financial position and cash flows would have been had we been a stand-alone company during the periods presented. This is primarily because:

- •

- our historical financial information reflects allocations for services historically provided to us by Ikaria, which

allocations may not reflect the costs we will incur for similar services in the future as a stand-alone company; and

- •

- our historical financial information does not reflect changes that we expect to incur in the future as a result of our separation from Ikaria and from reduced economies of scale, including changes in the cost structure, personnel needs, financing and operations of our business.

In addition, the pro forma financial information included in this prospectus is based on the best information available, which in part includes a number of estimates and assumptions. These estimates and assumptions may prove not to be accurate, and accordingly, our pro forma financial information should not be assumed to be indicative of what our financial condition or results of operations actually would have been as a stand-alone company, nor to be a reliable indicator of what our financial condition or results of operations actually may be in the future.

17

Following this offering, we also will be responsible for the additional costs associated with being a public company, including costs related to corporate governance and having listed and registered securities. Therefore, our financial statements may not be indicative of our future performance as a stand-alone public company.

For additional information about our past financial performance and the basis of presentation of our financial statements, please see "Summary Financial Information," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our financial statements and the notes thereto included elsewhere in this prospectus.

The ownership by certain of our executive officers and directors of equity of Ikaria, as well as the continued roles of certain of our directors with Ikaria, may create, or may create the appearance of, conflicts of interest.

Because of their current or former positions with Ikaria, our chief business officer, Manesh Naidu, our chief clinical development officer, Reinilde Heyrman, our chief scientific officer, Martin Meglasson, our treasurer, David Abrams, and one of our directors, Daniel Tassé, own equity in Ikaria. In addition, two of our directors, Matthew Holt and Adam B. Weinstein, may be deemed to beneficially own equity in Ikaria. Such equity ownership may create, or may create the appearance of, conflicts of interest. The individual holdings of equity of Ikaria may be significant for some of these persons compared to such person's total assets. Ownership by certain of our executive officers and directors of equity of Ikaria creates, or may create the appearance of, conflicts of interest when these officers or directors are faced with decisions that could have different implications for Ikaria than the decisions have for us. In addition, Matthew Holt and Daniel Tassé are currently serving on our board of directors as well as Ikaria's board of directors, and Mr. Tassé is currently serving as the chief executive officer of Ikaria. We expect that following the consummation of this offering these directors will remain in their roles at both companies. The continued service at both companies creates, or may create the appearance of, conflicts of interest when these directors are faced with decisions that could have different implications for Ikaria than the decisions have for us, such as the allocation of time and resources to the provision of transitional services to us by Ikaria pursuant to the TSA and other agreements.

We face substantial competition from other pharmaceutical, biotechnology and medical device companies and our operating results may suffer if we fail to compete effectively.

The pharmaceutical, biotechnology and medical device industries are highly competitive. There are many pharmaceutical, biotechnology and medical device companies, public and private universities and research organizations actively engaged in the research and development of products that may be similar to our product candidates. In addition, other companies are increasingly looking at the cardiopulmonary and cardiac disease market as a potential opportunity. Currently, there are 12 drugs approved for the treatment of PAH, within the following categories: prostacyclin and prostacyclin analogs (including Flolan® (epoprostenol), which is marketed by GlaxoSmithKline, Tyvaso® (treprostinil), Orenitram® (treprostinil) and Remodulin® (treprostinil), which are marketed by United Therapeutics Corporation, and Ventavis® (iloprost) and Veletri® (epoprostenol), which are marketed by Actelion Pharmaceuticals US, Inc., or Actelion), phosphodiesterase type-5 inhibitors (including Adcirca® (tadalafil), which is marketed by United Therapeutics Corporation, and Revatio® (sildenafil), which is marketed by Pfizer Inc.), endothelin receptor antagonists (including Letairis® (ambrisentan), which is marketed by Gilead Sciences, Inc., and Opsumit® (macitentan) and Tracleer® (bosentan), which are marketed by Actelion) and a soluble guanylate cyclase stimulator (Adempas® (riociguat), which is marketed by Bayer HealthCare Pharmaceuticals Inc.). Actelion recently submitted a new drug application, or NDA, to the FDA for selexipag, a selective prostacyclin receptor agonist. There are also other treatments in Phase 1 and Phase 2 clinical development, including other nitric oxide generation and delivery systems, including GeNOsyl™, which is being developed by GeNO LLC, and a nebulized formulation of nitrite, which is being developed by Mast Therapeutics.

18

Currently, there are no approved therapies for treating PH-COPD, and the only generally accepted treatments are long-term oxygen therapy, pulmonary rehabilitation and lung transplant, and we are not aware of any therapies for PH-COPD in advanced clinical development.

There are no generally accepted products approved for structural support to prevent cardiac remodeling following an AMI. Other product candidates that are currently in clinical development include stem cell therapies to restore heart muscle cells following an AMI, with large Phase 3 trials expected to be completed in 2018 or 2019. We do not expect BCM to compete with, or replace, current treatments for congestive heart failure following AMI, but instead believe it will become part of the treatment regimen used in conjunction with other therapies. In addition, because BCM can be delivered by a minimally invasive percutaneous coronary intervention procedure, we do not believe it will directly compete with devices that are used to treat congestive heart failure, which are designed for administration during open heart surgery or by intra-cardiac injection involving a thoracotomy procedure . These include mesh restraining devices, for example HeartNet™; injectable biopolymers, for example Algisyl LVR™; and implantable electro stimulation devices, for example, CardioFit™. In addition, volume reduction surgery or cardiac assist devices, or pumps, are sometimes used to treat patients with congestive heart failure.