Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AVEO PHARMACEUTICALS, INC. | d850777d8k.htm |

JP

Morgan 2015 Global Healthcare Conference

JANUARY 15, 2015

Exhibit 99.1 |

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. All statements, other than

statements of historical facts, contained in this presentation

are

forward-looking

statements.

The

words

“anticipate,”

“believe,”

“estimate,”

“expect,”

“intend,”

“may,”

“plan,”

“predict,”

“project,”

“target,”

“potential,”

“will,”

“would,”

“could,”

“should,”

“continue,”

“contemplate,”

or

the

negative

of

these

terms

or

other

similar

expressions

are

intended

to

identify

forward-looking statements, although not all forward-looking statements

contain these identifying words. These forward-looking statements

include, among others, statements about: AVEO’s estimates for its 2014

year-end cash balance; AVEO’s goals and business strategy and its ability to optimize its

resources; the timing and results of preclinical and clinical trials; AVEO’s

approach to treat cachexia; and AVEO’s

plans

to

leverage

biomarkers

and

pursue

strategic

partnerships

for

certain

of

its

assets.

Actual

results

or

events

could

differ

materially

from

the

plans,

intentions

and

expectations

disclosed

in

the

forward-looking statements AVEO makes due to a number of important factors,

including substantial risks and uncertainties relating to: AVEO’s

ability to successfully implement its restructuring and strategic

plans;

AVEO’s

ability

to

successfully

develop,

test

and

gain

regulatory

approval

of

its

product

candidates;

AVEO’s ability to obtain necessary financing; AVEO’s ability to establish

and maintain new strategic partnerships; AVEO’s ability to obtain,

maintain and enforce intellectual property rights; competition; AVEO’s

dependence on its strategic partners and other third parties; adverse economic conditions; and

those

risk

factors

discussed

in

the

“Risk

Factors”

and

elsewhere

in

AVEO’s

Quarterly

Report

on

Form

10-

Q

for

the

quarter

ended

September

30,

2014,

and

other

periodic

filings

AVEO

makes

with

the

SEC.

All

forward-looking statements contained in this presentation speak only as of the

date of this presentation, and AVEO undertakes no obligation to update any

of these statements, except as required by law. 2

|

AVEO

Path Forward: Goals and Milestones January 12, 2015

3

AVEO Has a Robust Pipeline and Streamlined

Organization

Tivozanib

VEGFR 1,2,3 TKI

Evaluate potential development strategies for registration

-

EU MAA (RCC)

-

CRC biomarker-driven studies

-

RCC studies

Present biomarker data

Ficlatuzumab

HGF MAb

Enroll Biodesix-funded Phase 2 FOCAL study in NSCLC

Target Phase 3 readiness by 2017

AV-203

ERBB3 MAb

Leverage strong biomarker data to secure a partnership

AV-380

GDF-15 MAb

Leverage preclinical proof of concept data to determine optimal go-

forward strategy, including partnership or internal development

|

AVEO

Go Forward Strategy Optimally Leveraging Biomarker

Insights and Partnership Resources

to Advance Our Portfolio of

Development-Stage Assets

January 12, 2015

4 |

AVEO

is Leveraging Biomarkers and Partnerships to Advance its Robust Pipeline of

Assets 5

Substantial Ownership of all Programs

Program

Pathway

Development

Candidate

Preclinical

Phase 1

Phase 2

Phase 3

Rights

Tivozanib

VEGFR 123 TKI

Own ex-Asian

rights

Ficlatuzumab

HGF MAb

AV-203

ERBB3 MAb

Wholly Owned

AV-380

GDF15 MAb

Wholly Owned

Most advanced stage of development

Streamlined Organization to Focus on

Clinical and Business Development Operations

GDF-15 Biomarker Cachexia

Potential EU File RCC

NRG-1 Biomarker Solid Tumors

Serum Proteomic Biomarker NSCLC

Angiogenesis Biomarkers CRC

Ocular Diseases |

Tivozanib

A

POTENT

,

SELECTIVE

,

LONG HALF

-LIFE INHIBITOR OF

VASCULAR ENDOTHELIAL

GROWTH FACTOR

(VEGF) 1, 2, AND 3 RECEPTORS 6 |

Tivozanib –

VEGFR 1, 2 & 3 Tyrosine Kinase Inhibitor

•

Potent, selective inhibitor of VEGFRs 1, 2, and 3

with a long half-life that is designed to optimize

blockade while minimizing off-target toxicities

1,2

•

Patent term: 2022 (composition of matter) with

potential extension to 2027

•

Orphan drug designation in Europe for RCC

1. Nakamura K et al. Cancer Res 2006;66:9134–9142.

2. Eskens FA et al. Clin Cancer Res 2011;17:7156–7163.

7

1.

Reacquired worldwide rights (Aug 2014)

2.

Ophthotech option agreement to evaluate in ocular indications (Nov 2014)

3.

Received confirmation of eligibility for MAA from the EMA for RCC (Jan 2015)

4.

Ongoing evaluation of novel angiogenesis biomarkers from BATON studies

to explore advancing tivozanib clinical development |

Ophthotech Research and Option Agreement: Nov. 2014

January 12, 2015

8

8

Agreement

Research and Exclusive Option Agreement for

Non-Oncology Disease of the Eye

Territory

Worldwide ex-Asia

Upfront

$500,000

Option Term Milestones

$2M at IND filing and $6M based upon the

achievement of specified R&D, business goals

Option Payment*

$2M

Clinical and Regulatory Milestones

$50M

Sales-based Milestones

$45M

Royalties

Tiered, double digit royalties, up to the mid-

teens, on net sales

Agreement monetizes tivozanib while retaining oncology indications and

providing significant potential downstream value for AVEO

All payments received by AVEO subject to sublicense revenue obligation to Kyowa

Hakko Kirin * Assumes execution of option by Ophthotech

|

Tivozanib Preclinical Activity in Ocular Models

January 12, 2015

9

Compared to the vehicle-treatment, tivozanib

suppressed

the

development

of

CNV

lesions

and

led

to

a

significant

regression

of

established

CNV

reducing the affected areas by 80.7% and 67.7% respectively |

|

Evaluating Potential for MAA Filing for RCC

January 12, 2015

•

Met primary PFS endpoint

of superiority vs sorafenib

•

First H2H RCC pivotal trial

to show superiority over

another VEGF TKI

•

Demonstrated

differentiated safety profile

•

OS confounded by

crossover

•

Median OS similar to

historical TKI agents,

despite lack of subsequent

therapy |

January 12, 2015

•

Interim results (ESMO 2014) suggest that tivozanib+mFOLFOX6 is comparable to

bevacizumab+mFOLFOX6 in the ITT population, with an acceptable safety profile.

•

PFS: 9.4 (Tivo) vs 10.7 (Bev) months; HR=1.091, p=0.706

•

ORR: 45% (Tivo) vs. 43% (Bev), p=0.718

•

Final pre-specified biomarker analysis to be presented at upcoming scientific

meeting •

Biomarker IP to be filed in January

* Interim ITT PFS analysis (after full enrollment) indicated futility for

superiority of Tivo vs. Bev Tivozanib Biomarker Study

tivozanib

+

mFOLFOX6

bevacizumab

+

mFOLFOX6

N = 265

•

1

st

line Stage IV mCRC

•

No fluorouracil adj tx

<6 months

•

ECOG PS 0 or 1

•

1

O

: PFS*

•

2

O

: OS, ORR, DoR,

TTF, HRQol, Safety

and tolerability for

ITT & Pre-Specified

Biomarkers

|

Ficlatuzumab

13 |

•

A Favorable Profile to In-Class Antibodies

–

High affinity (pM) and slow off-rate for HGF

–

High potency (nM) inhibiting all biological activities of

HGF, including autocrine/paracrine activation loops

–

In vivo preclinical efficacy superior to in-class

antibodies

Ficlatuzumab –

Humanized IgG1k MAb Inhibitor of HGF

14

Data on file

* January 2028 expiry in US and June 2027 expiry in Europe and Japan

1.

Identified potential serum proteomic biomarker: Biodesix VeriStrat

®

2.

Finalized Biodesix partnership to fund confirmatory phase 2 study (April

2014) 3.

Presented Phase 2 Biodesix VeriStrat

®

analysis (ESMO 2014)

4.

Confirmatory phase 2 NSCLC study open

•

Patent Term: 2027-28 (composition of matter) with

potential extension to 2032-2033* |

Biodesix Partnership: April 2014

AVEO and Biodesix Partner to Co-Develop and Commercialize

Ficlatuzumab with a Companion Diagnostic

–

Unique collaboration where the diagnostic company provides funding for

POC clinical development in NSCLC

•

Biodesix will fund up to $15 million of the cost of the confirmatory phase 2

study in NSCLC and all companion diagnostic development costs

•

50/50 sharing of ficlatuzumab development and commercialization

expenses beyond confirmatory phase 2

•

50/50 sharing of potential profits from ficlatuzumab

•

Biodesix retains revenue from companion diagnostic

•

AVEO to lead worldwide commercialization of ficlatuzumab

–

Agreement advances ficlatuzumab with external funding while retaining

significant downstream value for AVEO

January 12, 2015

15 |

Ficlatuzumab Randomized Phase 2 Study (P06162):

Exploratory Analysis Results*

VeriStrat

may

be

a

predictive

biomarker

for

the

combination

of

ficlatuzumab

EGFR

TKI

over

EGFR

TKI

alone

Observation to be confirmed in the Phase 2 FOCAL study, initiated in 2014

16

* Mok et al ESMO 2014

VeriStrat Poor (VSP)

ficlatuzumab + gefitinib

n=18

gefitinib alone

n=17

OS

Median

23.9 months

5.8 months

Hazard Ratio

0.41

p-value

0.032

PFS

Median

7.4 months

2.3 months

Hazard Ratio

0.41

p-value

0.014

VSP & EGFRm

ficlatuzumab + gefitinib

n=5

gefitinib alone

n=6

OS

Median

17.8 months

10.4 months

Hazard Ratio

0.3

p-value

0.09

PFS

Median

11.1 months

2.3 months

Hazard Ratio

<0.01

p-value

<0.01

+

® |

FOCAL

Study – Confirmatory Phase 2

January 12, 2015

17

A Phase 2, Multicenter, Randomized, Double-blind Study of

Ficlatuzumab Plus Erlotinib Versus Placebo Plus Erlotinib in Subjects Who

Have Previously Untreated Metastatic, EGFR-mutated Non-small Cell Lung

Cancer (NSCLC) and BDX004 Positive Label

1

st

Line

Stage

IV

NSCLC

EGFR Mutation+

BX004 Positive

ECOG PS 0 or 1

N

= 86

ficlatuzumab

+

erlotinib

placebo

+

erlotinib

1

O

: PFS

2

O

: OS, ORR, Disease

Control, PK, Safety

and tolerability |

AV-203

18 |

AV-203:

Superhumanized

IgG1k

MAb

Inhibitor

of

ERBB3

•

Potent high affinity NRG-1/HRG binding

inhibition

–

Exclusively blocks ERBB3 signaling

–

Potential for inducing ADCC

–

Prevents NRG-1/HRG induced proliferation

–

Opportunity to explore combinations with HER2

and EGFR Targeted Therapies

•

Patent Term: 2031 (composition of matter) and

2032 (NRG-1 biomarker) with potential for

extensions

January 12, 2015

19

1.

Reacquired worldwide rights from Biogen Idec (March 2014)

2.

Presented Phase 1 monotherapy data showing encouraging early

support for NRG-1/HRG biomarker hypothesis (ASCO 2014)

TM |

Biogen Idec Agreement: March 2014

January 12, 2015

20

•

Actively pursuing partnership to advance development

•

AVEO reacquired AV-203 worldwide rights from Biogen Idec

–

NRG-1/HRG positive tumors

–

Combinations with EGFR and HER2 targeted inhibitors

–

Combination with chemotherapy in chemotherapy resistant/refractory tumors

•

Multiple, attractive opportunities for clinical development leveraging

NRG- 1/HRG Biomarker

–

AVEO owes a percentage of milestones from a future partnership and low single

digit royalties on net sales up to a fixed cap of $50M

Biogen Idec agreement allows for AVEO to find a worldwide partner to

fund further development for AV-203 |

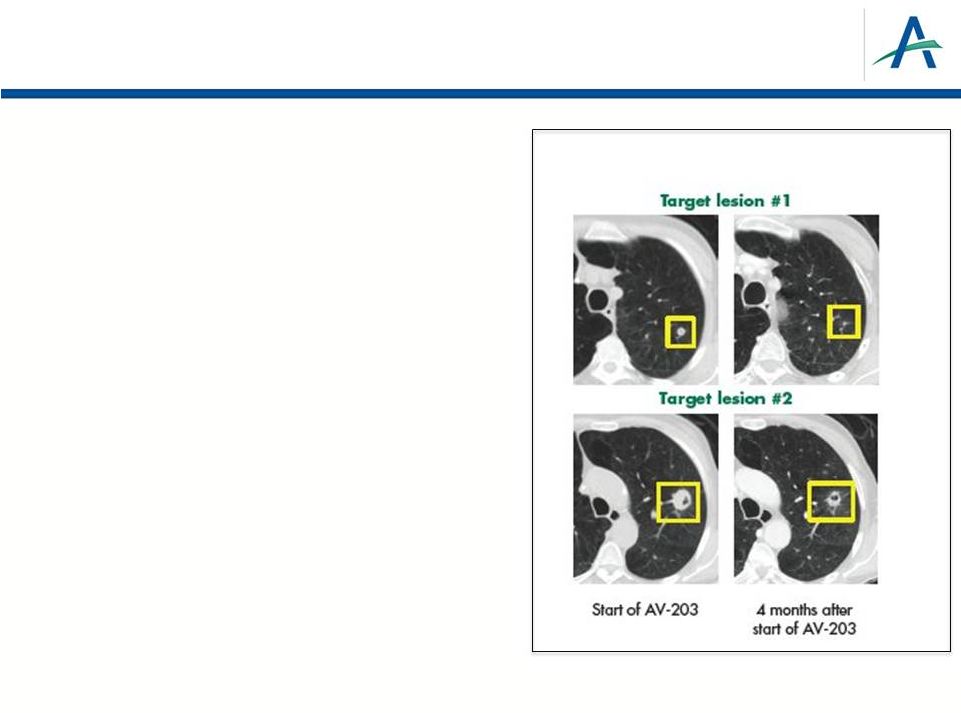

Phase

1 AV-203 Dose-Escalation, Monotherapy Study Completed*

•

22 subjects enrolled

–

Tumor types: 4 NSCLC (3 sq, 1 adeno); 4 CRC;

2 sq cell skin; one each ovarian, peritoneal,

SCLC, endometrioid, osteosarcoma, HCC,

pancreatic, neuroendocrine, bladder,

mesothelioma, SCCHN, cervical

•

Recommended P2 dose is 20mg/kg every

2 weeks (maximum dose tested)

–

Most common treatment-related AEs were

diarrhea (59%), dry skin and decreased appetite

(32% each); 1 DLT observed

•

Encouraging early efficacy and

support for NRG-1/HRG biomarker

hypothesis

–

Of 22 patients, 8 SD and 1 PR

–

1 of 2 NRG-1/HRG+ patients experienced a PR

January 12, 2015

* Sarantopoulos, ASCO 2014. Abs#11113.

NSCLC with partial response (9 mg/kg)

(NRG-1/HRG Positive)

21 |

22

AV-380 |

23

associated with several underlying chronic

illnesses and characterized by loss of

muscle mass and strength, loss of whole

body fat, inflammation, anemia, etc.

~400,000 pts

In US

~960,000 pts

In US

~150,000 pts

In US

~3,200,000 pts

In US

Morley

et

al;

Am

J

Clin

Nutr

2006;83:735–

43

Cachexia Represents a Significant Unmet Medical Need

Cancer

Congestive

Heart

Failure

Chronic

Kidney

Disease

Chronic

Obstructive

Pulmonary Disease

Cachexia

(Wasting Syndrome)

Cachexia

Complex

metabolic

syndrome

: |

GDF15

– Driver of Cachexia (Wasting Syndrome)

24

Proof-of-Concept:

•

Elevated in cachectic

models and patients

(vs. non-cachectic)

•

Administration of

GDF15 induces

cachexia

•

Inhibition of GDF15

reverses cachexia

24 |

GDF15

– Driver of Cachexia (Wasting Syndrome)

25

Proof-of-Concept:

25

GDF15 Levels –

Patient Samples

GDF15 Levels –

Murine Models

Inhibition of GDF15

reverses cachexia

Administration of

GDF15 induces

cachexia

Elevated in cachectic

models and patients

(vs. non-cachectic) |

GDF15

– Driver of Cachexia (Wasting Syndrome)

26

Proof-of-Concept:

Elevated in cachectic

models and patients

(vs. non-cachectic)

Administration of

GDF15 induces

cachexia

Inhibition of GDF15

reverses cachexia

26

*** |

GDF15

– Driver of Cachexia (Wasting Syndrome)

27

Proof-of-Concept:

Elevated in cachectic

models and patients

(vs. non-cachectic)

Administration of

GDF15 induces

cachexia

Inhibition of GDF15

reverses cachexia

27 |

GDF15

– Driver of Cachexia (Wasting Syndrome)

28

Proof-of-Concept:

28

Inhibition of GDF15

reverses cachexia

Administration of

GDF15 induces

cachexia

Elevated in cachectic

models and patients

(vs. non-cachectic) |

First-in-Class, Differentiated Approach to Cachexia

•

AV-380: Potent humanized GDF15 inhibitory MAb

–

Unique mechanism of action

•

Increase

calorie/food intake

•

Reverse

body weight loss

•

Restore

normal body composition

•

Mechanism of action different from:

–

Hormonal/Metabolic agents (i.e. ghrelin, SARMs)

•

Focus on stimulation of appetite or muscle protein synthesis

–

Muscle regulation-directed agents (i.e. myostatin, activin)

•

Address the muscle wasting aspect of the diseases

–

Early

cytokine

inhibitors

(i.e.TNF

,IL-6,

IL-8)

•

Mechanistic link to the disease not well established

•

Strong Intellectual Property Position

–

Composition of matter patent (filed)

–

Method of use patent (granted in US and EU)

29 |

Financials and Summary

January 12, 2015

30 |

Financials Highlights

•

Streamlined operations

–

Exited long term facilities lease

–

Eliminated research function to focus on clinical and BD functions

•

Headcount reduction from 60 to 20

•

Expected to reduce annual compensation expenses by ~$6 million

•

Will reduce AVEO’s facilities requirements by up to 80% of its current

space, including the elimination of lab and vivarium needs

•

Estimated 4Q14 cash and securities of ~$52M*

•

Shares outstanding: ~52M

31

* Unaudited 4Q financial results as of 12/31/14 |

AVEO

is Poised to Unlock the Potential of its Robust Pipeline of Assets by Leveraging

Biomarkers and Partnerships 32

Substantial Ownership of all Programs

Program

Pathway

Development

Candidate

Preclinical

Phase 1

Phase 2

Phase 3

Rights

Tivozanib

VEGFR 123 TKI

Own ex-Asian

rights

Ficlatuzumab

HGF MAb

AV-203

ERBB3 MAb

Wholly Owned

AV-380

GDF15 MAb

Wholly Owned

Most advanced stage of development

Streamlined Organization to Focus on

Clinical and Business Development Operations

GDF-15 Biomarker Cachexia

Potential EU File RCC

NRG-1 Biomarker Solid Tumors

Serum Proteomic Biomarker NSCLC

Angiogenesis Biomarkers CRC

Ocular Diseases |

33

JP Morgan 2015 Global

Healthcare Conference

JANUARY 15, 2014 |