Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Wright Medical Group N.V. | d850054dex991.htm |

| 8-K - 8-K - Wright Medical Group N.V. | d850054d8k.htm |

Investor Presentation

4Q 2014

Exhibit 99.2 |

Forward Looking Statements

Forward-Looking Statements

Statements

contained

in

this

presentation

that

relate

to

future,

not

past,

events

are

forward-looking

statements

under

the

Private

Securities

Litigation

Reform

Act

of

1995.

Forward-looking

statements

are

based

on

current

expectations

of

future

events

and

often

can

be

identified

by

words

such

as

“expect,”

“anticipate,”

“project,”

“intend,”

“will,”

“may,”

“believe,”

“could,”

“continue,”

“estimate,”

“outlook,”

“plan,”

“guidance,”

“tomorrow”,

“desired

state,”

other

words

of

similar

meaning

or

the

use

of

future

dates.

Forward-looking

statements

by

their

nature

address

matters

that

are,

to

different

degrees,

uncertain.

Uncertainties

and

risks

may

cause

Tornier’s

actual

results

to

be

materially

different

than

those

expressed

in

or

implied

by

Tornier’s forward-

looking

statements.

For

Tornier,

such

uncertainties

and

risks

include,

among

others,

risks

relating

to

Tornier’s

proposed

merger

with

Wright

Medical

Group,

Inc.,

including

the

timing

of

the

transaction;

uncertainties

as

to

whether

Tornier

shareholders

and

Wright

shareholders

will

approve

the

transaction;

the

risk

that

competing

offers

will

be

made;

the

possibility

that

various

closing

conditions

for

the

transaction

may

not

be

satisfied

or

waived,

including

that

a

governmental

entity

may

prohibit,

delay

or

refuse

to

grant

approval

for

the

consummation

of

the

transaction,

or

the

terms

of

such

approval;

the

effects

of

disruption

from

the

transaction

making

it

more

difficult

to

maintain

relationships

with

employees,

customers,

vendors

and

other

business

partners;

the

risk

that

shareholder

litigation

in

connection

with

the

transaction

may

result

in

significant

costs

of

defense,

indemnification

and

liability;

other

business

effects,

including

the

effects

of

industry,

economic

or

political

conditions

outside

of

Wright’s

or

Tornier’s

control;

the

failure

to

realize

synergies

and

cost-savings

from

the

transaction

or

delay

in

realization

thereof;

the

businesses

of

Wright

and

Tornier

may

not

be

combined

successfully,

or

such

combination

may

take

longer,

be

more

difficult,

time-consuming

or

costly

to

accomplish

than

expected;

operating

costs

and

business

disruption

following

completion

of

the

transaction,

including

adverse

effects

on

employee

retention

and

on

Wright’s

and

Tornier’s

respective

business

relationships

with

third

parties;

transaction

costs;

actual

or

contingent

liabilities;

the

adequacy

of

the

combined

company’s

capital

resource;

and

other

risks

and

uncertainties,

including

Tornier’s

future

operating

results

and

financial

performance;

the

success

of

and

possible

disruption

from

Tornier’s

recently

completed

transition

to

dedicated

upper

and

lower

extremities

sales

forces;

fluctuations

in

foreign

currency

exchange

rates;

the

effect

of

global

economic

conditions;

the

timing

of

regulatory

approvals

and

introduction

of

new

products;

physician

acceptance,

endorsement,

and

use

of

new

products;

and

the

effect

of

regulatory

actions,

changes

in

and

adoption

of

reimbursement

rates,

product

recalls

and

competitor

activities.

More

detailed

information

on

these

and

other

factors

that

could

affect

Tornier’s

actual

results

are

described

in

Tornier’s

filings

with

the

U.S.

Securities

and

Exchange

Commission,

including

its

most

recent

annual

report

on

Form

10-K,

subsequent

quarterly

reports

on

Form

10-Q

and

registration

statement

on

Form

S-4

filed

in

connection

with

its

proposed

merger

with

Wright.

Tornier

undertakes

no

obligation

to

update

its

forward-looking

statements. |

Non-GAAP Financial Measures

Non-GAAP Financial Measures

Tornier

uses

certain

non-GAAP

financial

measures

in

this

presentation,

such

as

adjusted

EBITDA,

adjusted

gross

margin

and

constant

currency.

Tornier

uses

non-GAAP

financial

measures

as

supplemental

measures

of

performance

and

believes

these

measures

provide

useful

information

to

investors

in

evaluating

Tornier’s

operations,

period

over

period.

However,

non-GAAP

financial

measures

have

limitations

as

analytical

tools,

and

should

not

be

considered

in

isolation

or

as

a

substitute

for

Tornier’s

financial

results

prepared

in

accordance

with

GAAP.

In

addition,

investors

should

note

that

any non-

GAAP

financial

measure

Tornier

uses

may

not

be

the

same

non-GAAP

financial

measure,

and

may

not

be

calculated

in

the

same

manner,

as

that

of

other

companies.

A

reconciliation

of

the

non-GAAP

financial

measures

used

in

the

presentation

to

the

most

directly

comparable

GAAP

financial

measures

can

be

found

on

Tornier’s

website

www.tornier.com

under

the

“Non-GAAP

Measure

Reconciliation

Tables”

section

of

the

“Investor

Relations”

page.

Important

Additional

Information

and

Where

to

Find

It

In

connection

with

the

proposed

merger,

Tornier

has

filed

with

the

U.S.

Securities

and

Exchange

Commission

(SEC)

a

registration

statement

on

Form

S-4

that

includes

a

preliminary

joint

proxy

statement

of

Wright

and

Tornier

that

also

constitutes

a

preliminary

prospectus

of

Tornier.

The

registration

statement

is

not

complete

and

will

be

amended.

Once

finalized,

Wright

and

Tornier

will

make

the

final

joint

proxy

statement/prospectus

available

to

their

respective

shareholders.

Investors

are

urged

to

read

the

final

joint

proxy

statement/prospectus

when

it

becomes

available,

because

it

will

contain

important

information.

The

registration

statement,

definitive

joint

proxy

statement/prospectus

and

other

documents

filed

by

Tornier

and

Wright

with

the

SEC

will

be

available

free

of

charge

at

the

SEC’s

website

(www.sec.gov)

and

from

Tornier

and

Wright.

Requests

for

copies

of

the

joint

proxy

statement/prospectus

and

other

documents

filed

by

Wright

with

the

SEC

may

be

made

by

contacting

Julie

D.

Tracy,

Senior

Vice

President

and

Chief

Communications

Officer

by

phone

at

(901)

290-5817

or

by

email

at

julie.tracy@wmt.com,

and

request

for

copies

of

the

joint

proxy

statement/prospectus

and

other

documents

filed

by

Tornier

may

be

made

by

contacting

Shawn

McCormick,

Chief

Financial

Officer

by

phone

at

(952)

426-7646

or

by

email

at

shawn.mccormick@tornier.com. Wright,

Tornier,

their

respective

directors,

executive

officers

and

employees

may

be

deemed

to

be

participants

in

the

solicitation

of

proxies

from

Wright’s

and

Tornier’s

shareholders

in

connection

with

the

proposed

transaction.

Information

about

the

directors

and

executive

officers

of

Wright

and

their

ownership

of

Wright

stock

is

set

forth

in

Wright’s

annual

report

on

Form

10-K

for

the

fiscal

year

ended

December

31,

2013,

which

was

filed

with

the

SEC

on

February

27,

2014

and

its

proxy

statement

for

its

2014

annual

meeting

of

stockholders,

which

was

filed

with

the

SEC

on

March

31,

2014.

Information

regarding

Tornier’s

directors

and

executive

officers

is

contained

in

Tornier’s

annual

report

on

Form

10-K

for

the

fiscal

year

ended

December

29,

2013,

which

was

filed

with

the

SEC

on

February

21,

2014,

and

its

proxy

statement

for

its

2014

annual

general

meeting

of

shareholders,

which

was

filed

with

the

SEC

on

May

16,

2014.

These

documents

can

be

obtained

free

of

charge

from

the

sources

indicated

above.

Certain

directors,

executive

officers

and

employees

of

Wright

and

Tornier

may

have

direct

or

indirect

interest

in

the

transaction

due

to

securities

holdings,

vesting

of

equity

awards

and

rights

to

severance

payments.

Additional

information

regarding

the

participants

in

the

solicitation

of

Wright

and

Tornier

shareholders

will

be

included

in

the

joint

proxy

statement/prospectus. |

Tornier is…

A global medical device company,

focused on providing superior surgical solutions

treating orthopaedic extremities injuries & disorders.

|

Tornier is Well-Positioned for Long-Term Growth & Margin

Expansion Based upon management estimates

RESULTS DRIVEN TEAM |

Tornier is Well-Positioned for Long-Term Growth & Margin

Expansion Based upon management estimates

RESULTS DRIVEN TEAM |

LOWER

EXTREMITIES

Tornier is Well-balanced across Upper and Lower Extremities

UPPER

EXTREMITIES

Leveraging dedicated sales reps and a broad & innovative portfolio,

Tornier plans to drive above market growth in both upper and lower

extremities |

Extremities Market Growth driven by Demographics,

Clinical Practice Patterns, and Design Enhancement

•

Unmet need for Early-intervention

•

Revision of existing Shoulders & Ankles

•

Less-invasive and Revise-able Devices

•

Aging population –

Aging Workforce

•

Awareness to treatment options

•

“Quality of life”

expectations

Demographics

Volume Expansion

Practice Patterns

Mix Shift

•

Shift from Anatomic to Reversed Shoulder

•

Shift from Ankle Fusion to Arthroplasty

•

Increased Implant use in F&A Surgeries

Designs

Market Expansion

Simpliciti Ultra Short Stem –

Total Shoulder Platform |

Global Upper Extremity Market driven by US Shoulder Volumes and

Surgeon Practice Patterns

US will remain > 70% of Global Market Size through ’19

•

Additional Reversed Shoulder Arthroplasty adoption

•

Increased volumes through General Orthopaedic surgeons

•

Market expansion to early intervention and later-stage revision

INT’L Markets growing at 7 –

8% CAGR through ‘19

•

Geographic expansion into emerging markets

•

New technology introduction into more mature markets

Global Shoulder Arthroplasty Market

Geographic Split

Global Shoulder Arthroplasty Market

By Segment

Ultra Short Stem Segment expected to grow > 20% CAGR

•

More reproducible / revision-friendly solution for younger pts.

•

Increased glenoid access to perform a total shoulder

•

Next generations focused on avoiding glenoid replacement

Continued uptake of reversed shoulder with 12 –

14% CAGR

•

Proven treatment options for Torn Rotator Cuffs and severe OA

•

Increased

surgeon

users

-

US

Orthopaedic

generalist

training

•

Increased access (regulatory) to product in key OUS geographies

|

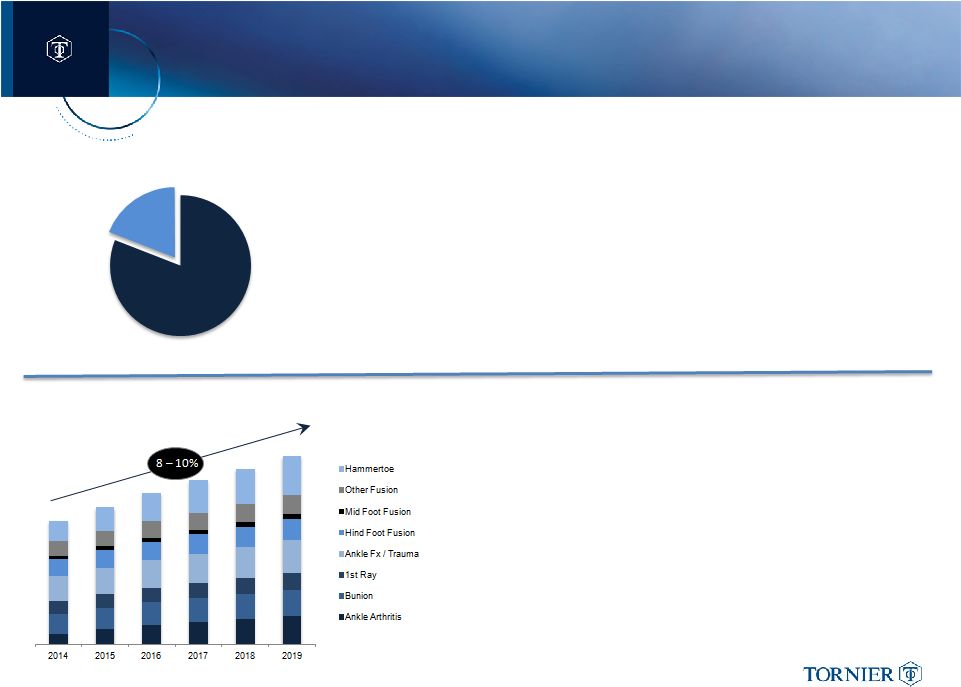

Global Lower Extremity Market Driven by US Foot & Ankle Volumes,

Indication Specific Designs and Shifts in Practice

Global Foot & Ankle Market

By Segment

Ankle Arthritis market expected to double within 4 –

5 yrs.

•

Shift in practice to TAA with ASP’s at 4x Fusion

•

Clinical data and Ease of Use driving increase adoption

Core Foot & Ankle Fusion Markets remain healthy

•

Steady volume increase expected in Hind/Mid-foot fusions

•

Increased indication specific solutions drive increased ASPs

•

“Add-on”

Biologics for fusions cases will increase market size

Hammertoe Correction Markets growing 12 –

14% CAGR

•

Steady volume increase expected

•

New Materials and designs driving higher ASPs

US represents ~80% of Global Foot and Ankle Market

•

Increasing case volumes for Orthopaedic Surgeon & Surgical

Podiatrist

•

Mix shift benefit from Ankle Fusion to Ankle Arthroplasty

•

Availability

of

“on-indication”

biologics

for

better

fusion

outcomes

INT’L Foot & Ankle Markets still early in growth curve

•

Geographic expansion into emerging markets

•

Mix shift from Ankle Fusion to Arthroplasty in more mature markets

Global Foot & Ankle Market

Geographic Split

US

INTL |

Tornier is Well-Positioned for Long-Term Growth & Margin

Expansion Based upon management estimates

RESULTS DRIVEN TEAM |

Tornier’s Comprehensive Portfolio Provides

Full-line Support to the Extremity Surgeon

PROCEDURES

Number of

Extremities

Products:

JOINT

REPLACEMENTS

BONE

REPAIR

BIOLOGICS

SOFT TISSUE

REPAIR

UPPER

Shoulder,

Elbow, Hand &

Wrist

LOWER

Foot & Ankle |

Ascend

Flex

Platform

–

TSA

/

RSA

-

Flex Convertible Stem

-

PerFORM

Glenoid

-

Reversed Threaded Post Baseplate

Phantom

Fiber

–

Soft

Tissue

Fixation

Salto

Talaris

v2.1

–

Ankle

Arthroplasty

Tornier’s Current Portfolio has Products to Drive Growth and

Innovative Designs to Fuel Market Expansion

Best-in-Class Products

Current Examples in Portfolio

Addressing Unmet Needs

Products in Development Pipeline

Simpliciti

Shoulder

Ultra Short Stem Total Shoulder Arthroplasty

Pyrolytic

Carbon

Aequalis

Humeral

Head

Improved

Articulating

Surface

Salto

Talaris

XT

Total

Ankle

Arthroplasty

Revision

System

•

Improve Clinical Outcomes

•

Improve Ease-of-use / Repeatability for

Extremities Procedures

•

Offer Value-differentiated Products

Portfolio Development

Strategic Levers

I. Drive Growth:

II. Expand Extremities Markets:

•

Provide Early Intervention Solutions

•

Create Improved Revision Solutions

•

Fill Product Gaps associated with geographic

specific requirements |

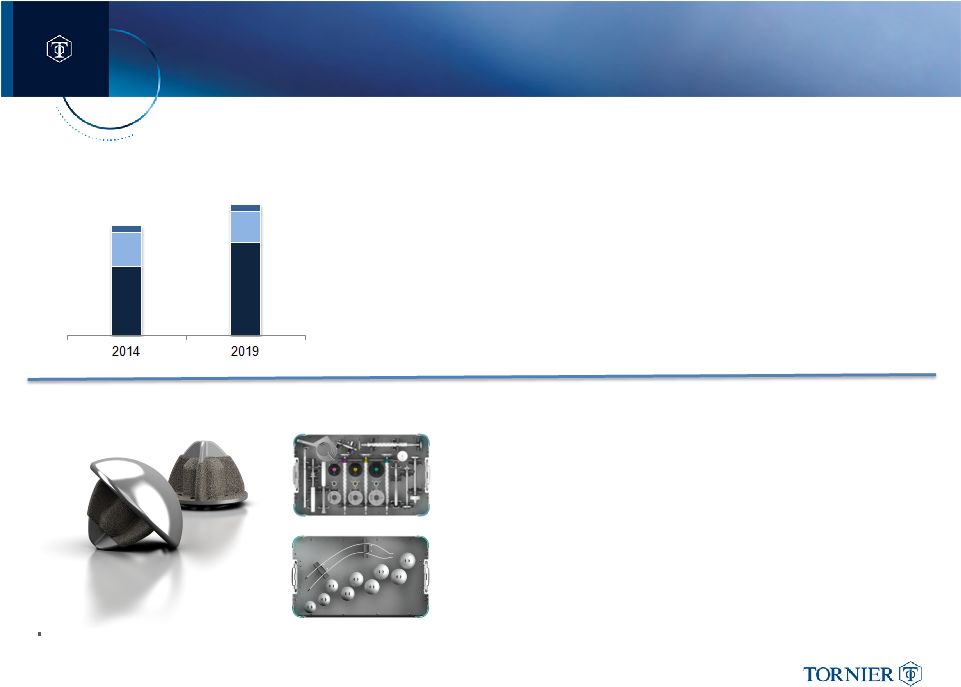

Tornier anticipates a Mid-2015 US Launch of Simpliciti,

Ultra Short Stem Total Shoulder

Ultra

Short

Stem

Estimated

Market

Opportunity:

$200m

-

$250m

•

TSA penetration of Ultra Short Stem expected to reach 25% by 2019

•

Ultra Short Stem will enable shift from Hemi-Shoulder to TSA

•

Ultra Short Stem offers TSA outcomes with less-invasive procedures

Tornier is 18 mos. ahead of Competitive US Market Entries

•

510k submission with IDE study data early 1Q 2015

•

Expected US Launch 2H15

•

2 Competitive IDEs in-progress, tracking toward 2017 FDA approvals

US Total Shoulder Arthroplasty Market

Conversion Candidates for Simpliciti

Total Shoulder Arthroplasty (TSA)

Hemi-Shoulder Arthroplasty

Resurfacing

More than 2700 cases performed OUS with excellent clinical feedback

Simpliciti Market Position

•

1

st

truly

bone

sparing

system

in

US

–

opens

new

market

category

•

Provides

Clinical

Benefits

–

simplifying

surgery

&

reducing

variables

•

Designed

for

simple

revision

/

removal

•

Expands

patient

pool

surgeons

willing

to

treat

Simpliciti Device provides economic benefits

•

Reduced

inventory

required

for

case

(40%

less

than

standard

TSA)

•

Hospital

enjoys

cost

benefits

of

less

blood

loss

and

shorter

OR

time

•

Capital

reduction

–

Instruments

approx.

50%

of

standard

TSA

sets

Simpliciti Ultra Short Stem TSA

Platform |

Tornier is Well-Positioned for Long-Term Growth & Margin

Expansion Based upon management estimates

RESULTS DRIVEN TEAM |

TODAY EXITING 2014

The US Sales Channel has been Restructured with

a Significant Portion now Direct Sales Territories

EXITING 2012

2014 US Revenue: ~ $200 Million

2014 US Growth Rate: 10%

US Revenues represent ~ 58% of Total Revenue |

While Work Remains, Tornier is Focused on

Transforming to a Competitively Superior Sales Force

Timing

2012

Desired State

Agreements

& Alignment

Rep Training

& Education

Performance &

Productivity

Distributor

Negotiation

US Sales Channel Transformation

Territory

Staffing

Sales Mgmt. &

Training Org.

Uncertainty, Limited

Accountability

Uncertainty, Limited

Accountability

Strong, Reliable & Above

Market Performance |

Tornier has a Strong International Footprint with

Direct Sales in most of the Major Geographies

Primarily direct sales

Primarily distributor

Mixed Model

Country Office

2014 OUS Revenue: ~145 Million

2014 OUS Growth Rate: ~13%

OUS Revenue represents ~ 42% of Total Revenue |

Our International Commercial Team plans to Leverage

Three Drivers to Sustain Above-market Extremities Growth

Selectively Invest in Emerging Markets

•

Establish

Emerging

Market

Presence

with

Select

Investments

–

Set-up

a

Brazil

Office

•

Evaluate

Expansion

Plans

in

other

Emerging

Geographies

–

Evaluating

India

Options

3

Introduce New Technologies in key geographies

2

•

Launch

New

Platform

Products

Globally

–

Deploy

additional

Ascend

Flex

&

Salto-Talaris

sets

•

Bring

Technologies

to

Underpenetrated

Markets

–

Continue

Japanese

Rev.

Shoulder

Introduction

•

Broaden

Product

Offering

in

Existing

Markets

–

Expand

PyC

Humeral

Head

in

EU

&

Australia

Increased Penetration in existing geographies

•

Strengthen

and

further

focus

our

OUS

Sales

Force

-

Adding

Direct

Reps

in

Key

Markets

•

Invest

in

Strategic

Development

Activities

–

European

Foot

&

Ankle

Markets

1 |

Tornier is Well-Positioned for Long-Term Growth & Margin

Expansion Based upon management estimates

RESULTS DRIVEN TEAM |

Tornier plans to Expand Gross Margin and

Leverage Expenses to Deliver >20% EBITDA by FY19

Gross Margin History & Expansion Plans

Improvement Levers

EBITDA History & Improvement Plans

Improvement Drivers (in addition to GM expansion)

•

Manufacturing Efficiencies

•

Product Process Improvements

•

Insourcing / Vendor Cost Reductions

-

Overhead reductions

-

Leverage higher production volumes

-

Innovative manufacturing processes

-

Scrap reductions and lower cost materials

-

Equipment / Inspection Automation

-

Insourcing F&A Plates & Screws

-

Increased

vendor

leverage

Higher

Volumes

•

Leverage G&A Expenses

•

Sales Force Productivity Improvements

•

Leverage Commercial Infrastructure Investments

-

Training Effectiveness and Sales Channel Maturity

-

Increased revenue per procedure on covered cases

-

Fixed Expenses for Sales Training & Education

-

Fixed Expenses for National Accounts and Pricing

-

Fixed Expenses for Sales Management

-

Fixed Expenses –

Public Company costs & Sr. Management

-

ERP System enables greater process efficiency/improvement

|

FY14

Financial Update (1)

Revenue

(2)

:

4Q:

~$96 million,

14.6% growth

FY:

~$345 million,

11.3% growth

Extremities revenue

(2)

:

4Q: ~$79 million,

16.0% growth

FY:

~$288 million,

11.7% growth

Full Year 2014 Financial and Key Metrics Update

(1) Preliminary and unaudited

(2) Constant currency, which is a non-GAAP financial measure

Key Metrics

(1) |

Wright and Tornier Agree to Merge Creating Premier

High-Growth Extremities-Biologics Company

Combination

Offers

Comprehensive

Upper

&

Lower

Extremity

Product

Portfolio

with

Broad

Global

Reach

Further

Accelerates

Growth

Opportunities

in

Three

of

the

Fastest

Growing

Areas

in

Orthopaedics

Adds

Significant

Scale

and

Scope

to

Provide

Accelerated

Path

to

Profitability

and

Stronger

Financial

Profile

Wright

Receives

Approvable

Letter

from

FDA

for

Augment®

Bone

Graft

+

Wright Medical and Tornier agree to merge…

Announced October 27, 2014 |

Tornier is Well-Positioned for Long-Term Growth & Margin

Expansion Based upon management estimates

RESULTS DRIVEN TEAM |

Thank You |