Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Premier, Inc. | d849429dex992.htm |

| 8-K - 8-K - Premier, Inc. | d849429d8k.htm |

TRANSFORMING HEALTHCARE

33

rd

Annual

J.P.

Morgan

Healthcare

Conference

January 12, 2015

FROM THE INSIDE

Exhibit 99.1 |

Forward-looking statements and Non-GAAP financial measures

2

PREMIER, INC.

Forward-looking statements—Certain statements included in this presentation,

including, but not limited to, those related to our financial and business

outlook, strategy and growth drivers, member retention rates and revenue

visibility, cross and upsell opportunities, acquisition activities and

pipeline, revenue available under contract, and 2015 financial guidance

and

related

assumptions,

are

“forward-looking

statements”

within

the

meaning

of

the

federal

securities laws. Forward-looking statements may involve known and unknown risks,

uncertainties and other factors that may cause the actual results of Premier

to be materially different from historical results or from any future results

or projections expressed or implied by such forward- looking statements.

Accordingly, readers should not place undue reliance on any forward looking

statements. Readers are urged to consider statements in the conditional or future

tenses or that include

terms

such

as

“believes,”

“belief,”

“expects,”

“estimates,”

“intends,”

“anticipates”

or

“plans”

to be uncertain and forward-looking.

Forward-looking statements may include comments

as to Premier’s beliefs and expectations as to future events and trends

affecting its business and are

necessarily

subject

to

uncertainties,

many

of

which

are

outside

Premier’s

control.

More

information on potential risks and other factors that could affect Premier’s

financial results is included, and updated, from time to time, in

Premier’s periodic and current filings with the SEC, including

Premier’s

most

recent

Form

10-K

for

the

year

ended

June

30,

2014.

Forward-looking

statements speak only as of the date they are made. Premier undertakes no obligation

to publicly update or revise any forward-looking statements.

Non-GAAP financial measures—This presentation includes certain

“non-GAAP financial measures”

as

defined

in

Regulation

G

under

the

Securities

Exchange

Act

of

1934.

Schedules

are

attached that reconcile the non-GAAP financial measures included in the following

presentation to the most directly comparable financial measures calculated and

presented in accordance with Generally Accepted Accounting Principles in the

United States. Our Form 10-Q for the quarter ended September 30, 2014,

filed on November 12, 2014, provides further explanation and disclosure

regarding our use of non-GAAP financial measures and should be read in conjunction

with this presentation. |

Uniquely positioned to address industry challenges

“Data, data, everywhere...

…

and not a drop to drink!”

Premier is a uniquely-aligned healthcare performance

improvement company that provides integrated data-analytics

and business intelligence to comprehensively reduce costs,

improve quality, and drive better patient outcomes.

3

PREMIER, INC. |

Vision

and objectives OUR VISION

Through the collaborative power of the Premier

alliance, we will lead the transformation to

high-quality, cost-effective healthcare

PREMIER, INC.

4

»

Make healthcare supply chain efficient and

effective

»

Deliver continuous improvement in cost

and quality today and enable success in

new healthcare delivery / payment models

»

Integrate data and knowledge to create

meaningful business intelligence that drives

improvement |

Our

business at a glance Alliance

of

approximately

3,400

hospitals

–

68%

of

U.S.

community

hospitals

–

and

110,000

alternate

sites

of

care

74%

owned

by

health

systems

(1)

~$41

billion

in

group

purchasing

volume

Insights

into

~1

out

of

every

3

U.S.

health

system

discharges

Integrated clinical, financial and

operational data

Over

500

sales/field

and

advisory

services

employees

that

work

with

and

inside

our

member

hospitals

Data as of September 30, 2014.

(1)

Following October 31, 2014 exchange.

Premier’s unique customer alignment and data-driven intelligence

platform allow us to help our health systems manage current

challenges and build for the future…

all at the same time

PREMIER, INC.

5 |

Unique

business model drives innovation and growth PREMIER, INC.

6

INTEGRATED SALES/FIELD FORCE

& PLATFORM

Become the data analytics “backbone”

with wrap-around services for cost and

quality improvement over the short term

and population health management

solutions over the long term

Change the game in supply chain,

uncover unmatched savings and value,

and lead the disruption of the industry

Note: Consolidated revenue is presented on a non-GAAP pro forma basis for

Supply Chain Services. See reconciliation pages in the appendix.

Performance Services

»

SaaS-based informatics products

»

PremierConnect

®

Enterprise

»

Advisory services

»

Performance improvement

collaboratives

27% of FY’14 consolidated revenue

Supply Chain Services

73% of FY’14 consolidated revenue

»

Group purchasing

»

Direct sourcing

»

Specialty pharmacy

»

Capital planning |

Positioned to address industry needs

PREMIER, INC.

7

Helping health systems manage challenges, optimize the transition,

and build for the future . . . all at the same time |

Key

investment differentiators PREMIER, INC.

8 |

Unique customer

alignment

9 |

Partnership model drives innovation and growth

SCALE

»

Represent ~68% of U.S. community hospitals

»

Clinical, financial, operational data integrated on

PremierConnect

®

platform

»

Insights into

~1 out of

every 3 U.S. health system

discharges

»

Approximately $41 billion in supply chain spend

»

Manage ~1,900 contracts from ~1,100 suppliers

ALIGNMENT

»

Members own ~74% of equity

(1)

»

10 health system board members

»

Premier field force embedded in member hospitals

COMMITMENT

»

Member average tenure ~15 years (76% at 10+ years)

»

Members view Premier as strategic partner or

organizational extension

CO-INNOVATION

»

Co-develop solutions with members

»

Committees composed of ~165 member hospitals

»

~1,100 hospitals in performance improvement

collaboratives

»

Data Alliance Collaborative

Note: Data as of September 30, 2014.

(1)

Following October 31, 2014 exchange.

PREMIER, INC.

10 |

Data-driven,

technology enabled

11 |

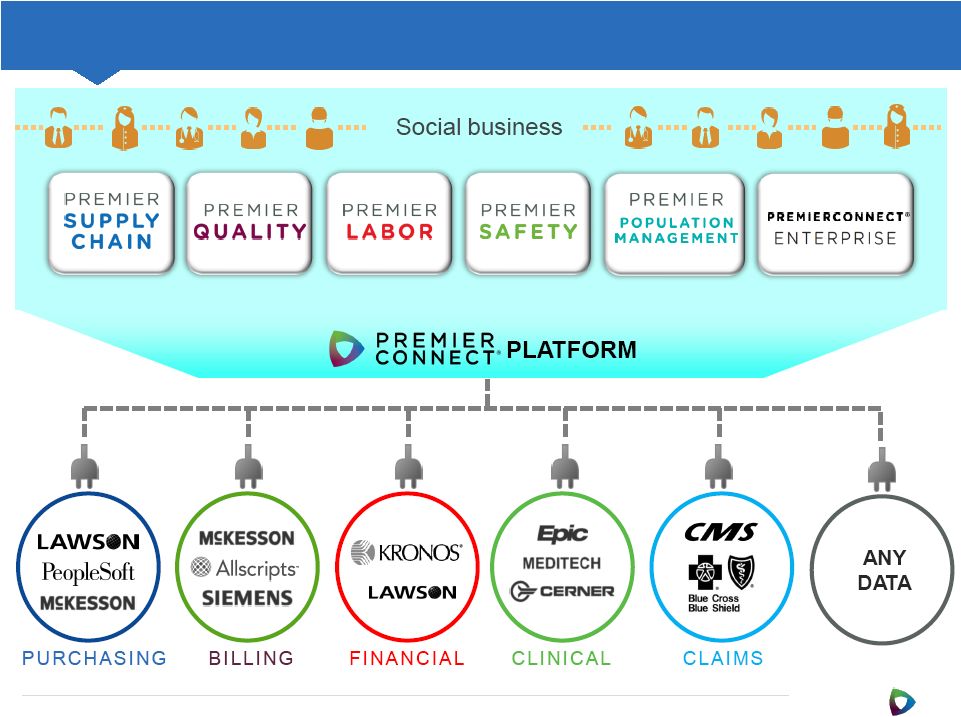

Connecting the data –

Enabling the information driven enterprise

12

PREMIER, INC. |

PremierConnect

®

Enterprise

&

Data

Alliance

Collaborative

»

Clinical utilization effectiveness

»

Harm reporting

»

Community health & equity reporting

»

Ambulatory quality measures

»

Claims analytics

»

Total cost of care

»

Operational reporting

»

Predictive model for readmissions

»

Population health analytics

»

ACO reporting

»

Referral analytics

»

H&V procedural analytics

»

Readmissions metrics & management

»

Population health

»

Throughput analytics

»

Operations & throughput modeling

»

Population stratification

»

Disease modeling

PREMIER, INC.

13

*PremierConnect

Enterprise

and

Data

Alliance

Collaborative

as

of

September

30,

2014. |

Measurable and scalable impact through collaboratives

PREMIER, INC.

14

~ 350

U.S. hospital members

~ 160,000

deaths avoided

~

$13.2

billion

saved

~ 55,800

readmissions prevented

~

21,700

instances

of

harm prevented

Approximately 1,100 U.S. hospital members participate in at least one

of our performance improvement collaboratives

Source: Premier QUEST participant performance data as of fiscal year end 6/30/2014

(Year 6, Q4 2013). Results are cumulative. Note: Deaths avoided and dollars

saved over the first 6 years of the program; instances of harm measured over

the past 4 years; readmissions prevented measured over the past 3

years. QUEST: Quality, Efficiency, Safety and Transparency. |

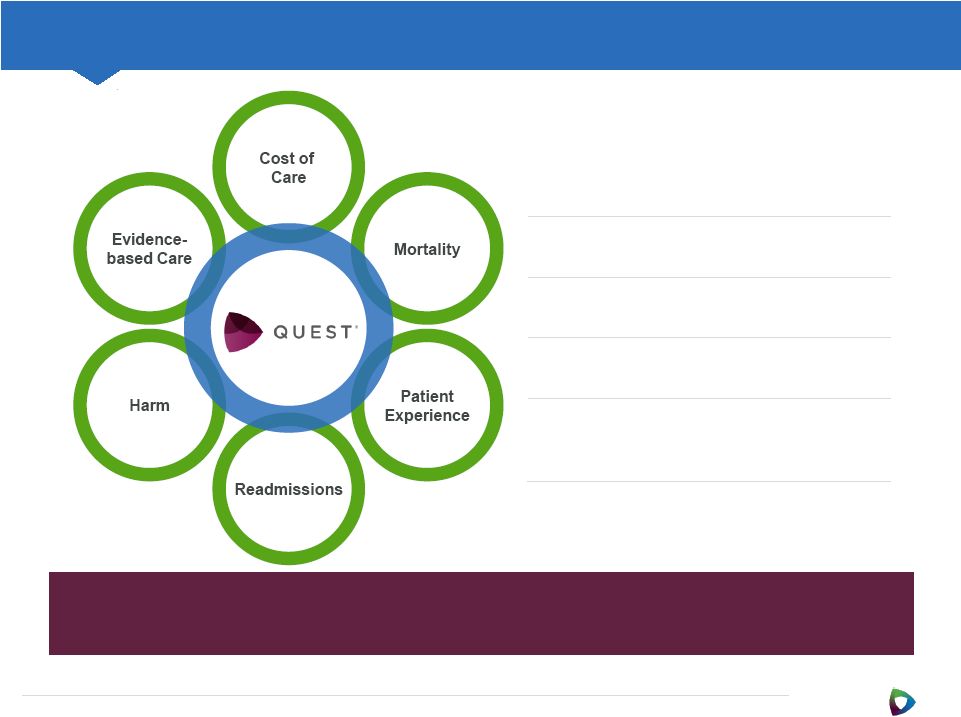

Evolving

QUEST

to

focus

on

integrated

population

health

management

PREMIER, INC.

15

Measures and focus areas

have two-fold purpose:

»

Continue to drive improvement on

inpatient metrics that align with

value-based purchasing and

payment reductions and penalties

»

Begin and enhance the improvement

on ambulatory and community

health-based metrics that will further

help Premier members move to new

models of care delivery

The latest generation of QUEST began January 1, 2014, with over 365

members focusing on ambulatory and population health based metrics in

addition to inpatient care |

Services

Integrated framework for delivering solutions

Collaboratives

Information

Technology

Solutions

QUALITY/SAFETY

IMPROVEMENT

•

Quality and safety

•

Physician performance

improvement

•

Regulatory compliance

•

Harm and readmissions

POPULATION

HEALTH

COST

MANAGEMENT

•

Group purchasing

•

Non-labor

•

Physician preference

•

Capital equipment

•

Labor

•

Total cost

•

Clinical variation

•

Resource utilization

•

Integrated pharmacy

PREMIER, INC.

16

INTEGRATED SALES/FIELD FORCE

&

PLATFORM

•

Physician network

management

•

Population analytics and

risk management

•

Population engagement |

Diversified growth

engine

17 |

Expanding

supply chain

solutions

Steady acute

GPO growth

“Other”

Upside

Performance Services

Supply Chain Services

Non-acute and

complementary

services

expansion

Top Priority Strategic Initiatives

Member

penetration

performance

services

New product

development

M&A and

growth

opportunities

Attributes

Top Priority Strategic Initiatives

PREMIER, INC.

18

Multiple opportunities to drive long-term sustainable growth

Expanded cost reduction

Non acute and pharmacy growth

Supply chain technology

Strong

distribution

channel

Desired

expertise/

capabilities

Clinical integration/ shared

services

Ambulatory data expansion

Population health capabilities |

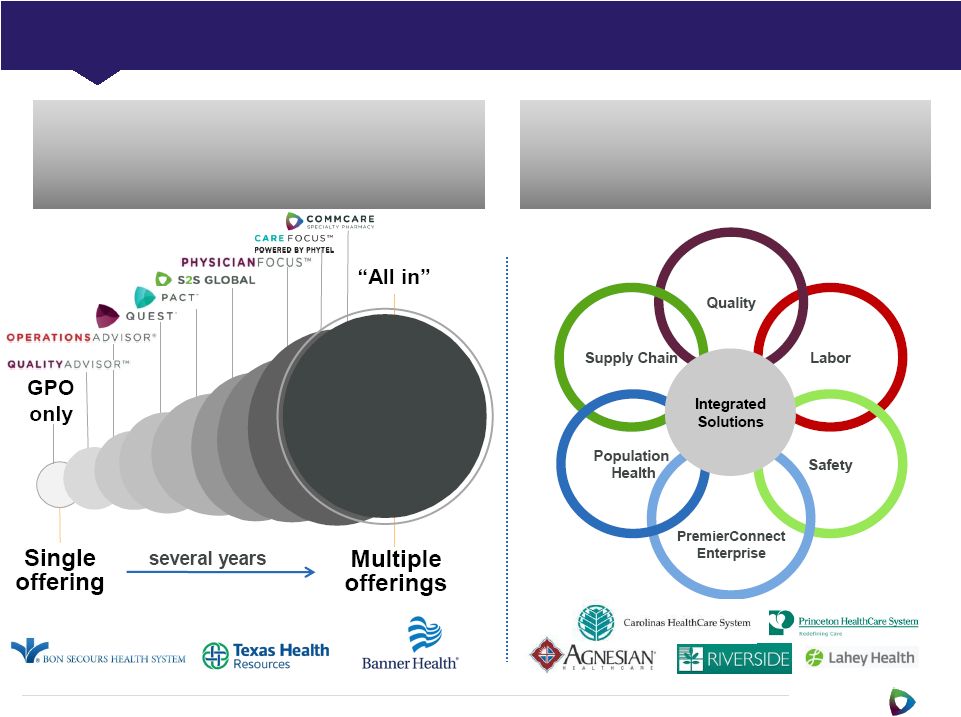

Growing from within our member channel

HISTORICAL BUSINESS GROWTH

PREMIER, INC.

19

CURRENT BUSINESS GROWTH

Note:

The

illustrations

above

are

representative

of

Premier’s

business

growth

and

do

not

necessarily

depict

the

specific

product

or

service

adoption

patterns

of

the

organizations

represented

here. |

Member-driven co-development engine

Organic

Acquisitions

Partnerships

Premier platform enables rapid deployment of new solutions

2006

2007

2010

2011

2013

2014

------------Post-IPO---------------------

2013

2014

2014

PREMIER, INC.

20 |

Strategic acquisitions address member needs

Clinical & physician

preference cost

reduction

Data acquisition from

multiple technologies

Health system capital

expenditure cost

reduction

Supply chain

technology

enablement

Quality & safety

improvement

Strategic Need

(Closed July 2013)

(Closed October 2013)

(Closed April 2014)

(Closed August 2014)

(Closed September 2014)

Company

PREMIER, INC.

21 |

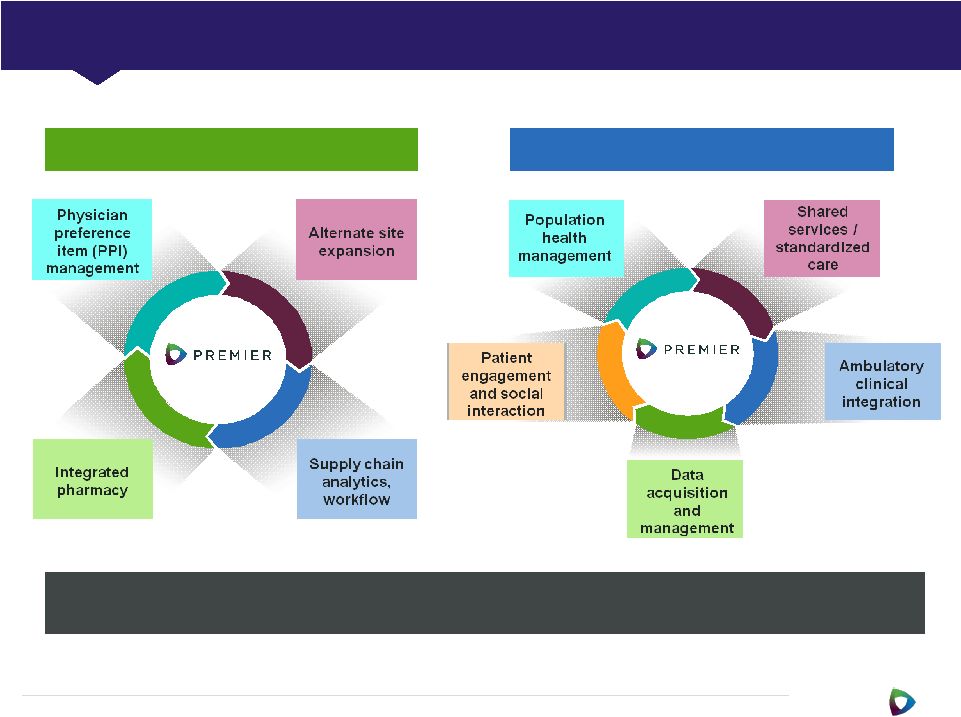

Attractive opportunities for further capital deployment

Performance Services

Supply Chain Services

Performance Services

Diverse and growing end markets to drive Premier’s growth

Supply Chain Services

PREMIER, INC.

22 |

Compelling financial

profile

23 |

MULTIPLE GROWTH

DRIVERS

•

Consolidated double-digit net revenue and adjusted

EBITDA

(1)

growth

•

Diversified revenue opportunities in Supply Chain Services

and Performance Services

•

Multiple emerging growth drivers

HIGH VISIBILITY

•

High retention rates in both business segments

•

5-7 year contracts in Supply Chain Services and 3-5 year

SaaS-based subscription contracts in Performance Services

•

Fiscal 2015 revenue visibility over 90%

ATTRACTIVE

ECONOMIC MODEL

•

Significant cross and upsell opportunities in existing

member base

•

High margins and low marginal cost to support new GPO

members and further penetration of existing GPO members

•

SaaS-based products generate high returns on new wins

EVOLVING

BUSINESS MIX

•

Investments in emerging growth initiatives will impact

adjusted

EBITDA

(1)

margins,

but

enhance

adjusted

EBITDA

(1)

growth

•

Capital investments increase D&A, impacting near-term net

income margins

DISCIPLINED CAPITAL

DEPLOYMENT TRACK

RECORD

•

Strong returns on acquired assets

•

Strategic, financial and execution framework in place for

capital deployment

Demonstrated financial model and performance

PREMIER, INC.

24

(1) See Adjusted EBITDA reconciliation to GAAP equivalent in Appendix.

|

Our

multiple

business

and

growth

drivers

(1)

GPO

Specialty

pharmacy

Direct

sourcing

SaaS-based

informatics

products

Performance

improvement

collaboratives

Advisory

services

Data

management/

warehousing

Business

Revenue Drivers

FY’14 Results

(1)

Net Revenue

14%

Segment Adjusted

EBITDA

9%

Net Revenue

13%

Segment Adjusted

EBITDA

31%

Net Revenue

14%

Adjusted EBITDA

12%

Adjusted fully

distributed EPS

9%

Consolidated

•

Administrative fees paid

by suppliers

•

Drug reimbursement

•

Fee for service

•

Product sales of contract

manufactured items

•

SaaS-based subscriptions

•

Fee-for-service

•

Fee-for-service

•

SaaS-based subscriptions

•

SaaS-based subscriptions

•

Significant stickiness

•

Strong visibility across

diverse revenue streams

(1)

Results are presented on a non-GAAP pro forma basis. See Adjusted EBITDA,

Segment Adjusted EBITDA and fully distributed net income

reconciliation to GAAP equivalent in the Appendix.

Net Revenue

11% -

14%

Adjusted EBITDA

8% -

11%

Adjusted fully

distributed EPS

7% -

11%

PREMIER, INC.

25 |

Net

revenue (1)

(millions)

(1)

See Net revenue, Segment Net Revenue, Adjusted EBITDA, Segment Adjusted EBITDA,

non-GAAP pro forma adjusted fully distributed net income, and non-

GAAP pro forma earnings per share on fully distributed net income reconciliations

to GAAP equivalents in Appendix; financial information for fiscal year 2014

and fiscal year 2013 have been adjusted on a non-GAAP pro forma basis to

reflect the impact of the company’s reorganization and initial public offering.

Adjusted EBITDA

(1)

(millions)

(2) Calculates income taxes at 40% on pre-tax income, assuming taxable C

corporate structure. (3) Calculates adjusted fully distributed

earnings per share, assuming total Class A and B common shares held by public

Double-digit

net

revenue

and

adjusted

EBITDA

growth

in

Fiscal

2014

(1)

Non-GAAP

pro

forma

adjusted

net

income

(2)

(millions)

Non-GAAP pro forma earnings per

share

on

fully

distributed

net

income

(3)

PREMIER, INC.

26 |

Fiscal

2015

first-quarter

update

1

Net revenue

(1)

(millions)

(1)

See Net Revenue, Segment Net Revenue, Adjusted EBITDA, Segment Adjusted EBITDA,

non-GAAP adjusted fully distributed net income, and non-GAAP

earnings per share on fully distributed net income reconciliations to GAAP

equivalents in Appendix; comparisons are between actual financial results for the

first quarter ended September 30, 2014, and non-GAAP pro forma results, which

have been adjusted to reflect the impact of the company’s reorganization and

initial public offering, for the first quarter ended September 30,

2013. Adjusted EBITDA

(1)

(millions)

(2) Calculates income taxes at 40% on pre-tax income, assuming taxable C

corporate structure. (3) Calculates adjusted fully distributed

earnings per share, assuming total Class A and B common shares held by public

Non-GAAP

pro

forma

adjusted

net

income

(2)

(millions)

Non-GAAP pro forma earnings per

share

on

fully

distributed

net

income

(3)

PREMIER, INC.

27 |

Cash

flow and capital flexibility at September 30, 2014 Cash, cash equivalents and

marketable securities of $398.2 million

No outstanding borrowings on $750 million

five-year unsecured revolving credit facility

Fiscal first-quarter cash flow from

operations of $45.9 million

CONSIDERABLE CASH AND

DEBT CAPACITY

AVAILABLE

AMPLE CAPITAL

FLEXIBILITY FOR FUTURE

ACQUISITIONS AND

GROWTH

PREMIER, INC.

28 |

Fiscal

2015

annual

guidance

(1)

(in millions, except per share data)

Pro Forma

FY 2015

YoY Change

Net Revenue:

Supply Chain Services

$688 -

$707

8% -

11%

Performance Services

$281 -

$288

21% -

24%

Total Net Revenue

$969 -

$995

11% -

14%

Non-GAAP adjusted EBITDA

$379 -

$390

8% -

11%

Non-GAAP adjusted fully distributed

EPS

$1.39 -

$1.44

7% -

11%

(1)

As of fiscal 2015 first-quarter conference call, 11/10/2014. For non-GAAP

measures, see reconciliations to GAAP equivalents in Appendix. Guidance

measures are “forward-looking statements.” For information

regarding the use and limitations of non-GAAP financial measures and

forward-looking

statements,

see

“Forward-looking

statements

and

Non-GAAP

financial

measures”

at

the

front

of

this

presentation.

Guidance

is

based on comparisons with prior-year non-GAAP pro forma results, which have

been adjusted to reflect the impact of the company’s reorganization and

IPO. Financial guidance for year ending June 30, 2015:

Supply Chain Services growth driven by:

Guidance Assumptions:

PREMIER, INC.

29

Performance Services growth driven by:

»

Low to mid-single-digit growth in net administrative

fee revenue

»

Continuation of high GPO retention rates

»

15% -

20% product growth

»

Continued demand for integrated offerings of SaaS-based

products, advisory services and collaboratives

»

TheraDoc and Aperek full revenue contributions in second,

third and fourth quarters

»

Continuation of high SaaS institutional renewal rates

|

Significant Fiscal 2015 revenue visibility: 90+%

PERFORMANCE METRICS

(1)

FY 2015

FY 2014

3 Year Average

Revenue available under contract

$898M

---

---

GPO retention rate

(2)

---

99%

97%

SaaS institutional renewal rate

(3)

---

94%

94%

(1)

As of fiscal year-end June 30, 2014

(2)

The retention rate is calculated based upon the aggregate purchasing volume among

all members participating in our GPO for such fiscal year less the annualized GPO purchasing

volume

for

departed

members

for

such

fiscal

year,

divided

by

the

aggregate

purchasing

volume

among

all

members

participating

in

our

GPO

for

such

fiscal

year.

(3)

The renewal rate is calculated based upon the total number of members that have

SaaS revenue in a given period that also have revenue in the corresponding prior year period

divided

by

the

total

number

of

members

that

have

SaaS

revenue

in

the

same

period

of

the

prior

year.

OVER 90%

FY 2015 REVENUE

GUIDANCE RANGE ALREADY

AVAILABLE UNDER

CONTRACT

PREMIER, INC.

30

HIGH GPO

RETENTION

AND SAAS

INSTITUTIONAL

RENEWAL RATES |

Summary –

Key investment differentiators

UNIQUE CUSTOMER ALIGNMENT

»

Interests and perspectives are aligned with our customers

»

Members own ~74% of equity

(1)

and view Premier as strategic partner

»

Embedded field force co-developing solutions with members

DATA-DRIVEN, TECHNOLOGY ENABLED

»

Integrated, payer-

and vendor-agnostic data platform

»

Insights from approximately 1 in 3 U.S. health system discharges

»

Emerging data warehousing capabilities

DIVERSIFIED GROWTH ENGINE

»

Multiple revenue levers

»

Attractive acquisition and partnership pipeline

COMPELLING FINANCIAL PROFILE

»

Double digit revenue and EBITDA

(2)

growth in fiscal 2014

»

Considerable cash and debt capacity for future growth

PREMIER, INC.

31

(1)

Following October 31, 2014 exchange.

(2)

See Net revenue and Adjusted EBITDA reconciliations to GAAP equivalents in

Appendix; financial information for fiscal year 2014 and fiscal year 2013

have been adjusted on a non-GAAP pro forma basis to reflect the impact of the company’s reorganization

and initial public offering. |

Thank you

32

FOR MORE INFORMATION CONTACT:

Jim Storey

Vice President, Investor Relations

Premier, Inc.

704-816-5958

jim_storey@premierinc.com |

Appendix

33 |

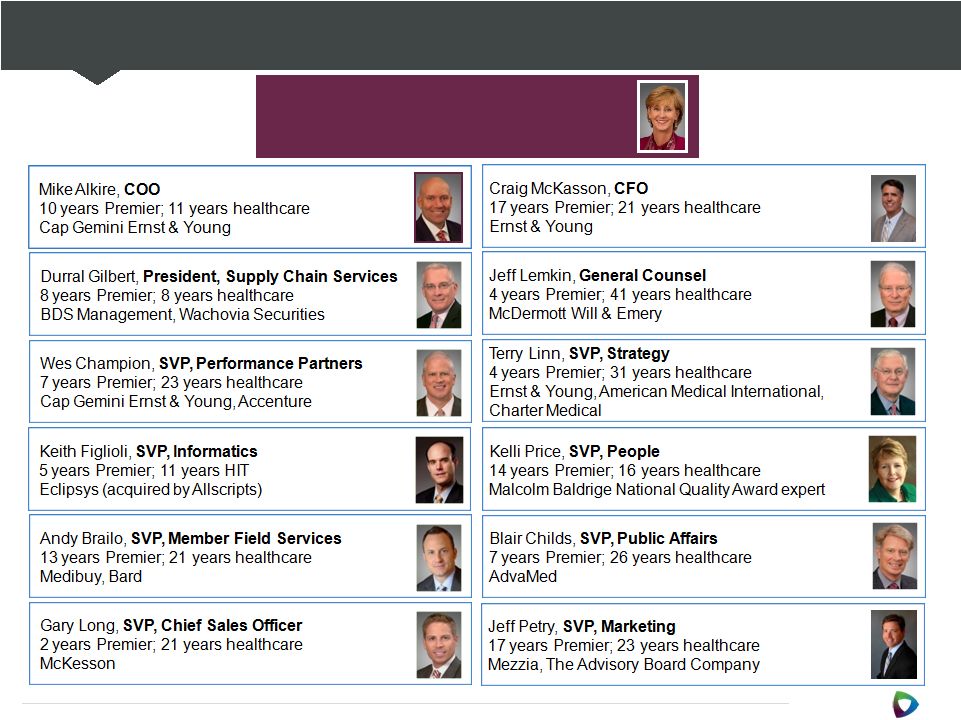

Our

leadership team Susan DeVore, President and CEO

11 years Premier; 26 years healthcare

Cap Gemini Ernst & Young

PREMIER, INC.

34 |

Structure

Structural implications of Premier, Inc.

Structured as “Up-C”

with Premier, Inc. (parent C-Corp above operating partnership and

subsidiaries)

Premier, Inc. formed with two classes of stock

•

Class A shares held by public investors

•

Class B shares allocated to member owners

22% of Limited Partner interests sold to public, 78% retained by

member owners as

Class B units

Class B units eligible to exchange 1/7th per year, over seven-year

period Exchange of Class B units for A-shares (on a 1-for-1

basis) as B-units become eligible for exchange subject to ROFR by

members owners and Premier, Inc. First exchange on October 31, 2014, and

subsequent company directed offering injected 3.9 million shares of

liquidity into the public market, resulting in public ownership of 26% and

member owner interest of 74% Given

Up-C

structure

and

differences

between

taxes

paid

by

our

Class

A

unit

holder

(Premier

GP)

vs.

distributions

to

our

Class

B

unit

holders

(members

owners),

we

calculate

Adjusted

Fully

Distributed

Net

Income

1

for

comparability

purposes

Reflects

taxes

and

net

income

as

if

the

Company

was

a

C-Corp

for

all

periods

presented

Class A and Class B shares will be used to calculate fully diluted EPS to

eliminate variability due to member exchanges over time

Impact of IPO and

Exchange Process

Adjusted fully

distributed net

income

Share count

PREMIER, INC.

35

(1)

See Adjusted EBITDA and Adjusted Fully Distributed Net Income reconciliations to

GAAP equivalents in Appendix |

Member owners allocated

income in operating

partnership based on

percentage ownership

Income tax expense equals

40% of income attributable

to Premier, Inc.

Member owners receive tax

distribution to cover any tax

liability on allocated income

Amount of retained

profitability in business

equal regardless of

ownership structure

Reflects 41% tax rate on

100% of pretax income

(assumes full C-Corp tax

treatment)

Amount paid for taxes equal

regardless of ownership

structure

Illustrative impact of ownership structure

PREMIER, INC.

36

1

For

illustrative

purposes

only.

Ownership

percentage

is

based

on

structure

at

the

time

of

the

October

2013

initial public offering and will change over time.

Ownership

(1)

22% Class A /

78% Class B

Ownership

100% Class A

Income Statement

Net Revenue

500,000

500,000

Cost of Revenue

200,000

200,000

Gross Profit

300,000

300,000

Operating Expenses

140,000

140,000

Operating Income

160,000

160,000

Net Income Attributable to NCI in Premier LP

(124,800)

-

Pre-Tax Income Attributable to Premier Inc.

35,200

160,000

Income Tax Expense

14,080

64,000

Net Income Attributable to Premier, Inc.

21,120

96,000

Income Retained in Business

Net Income Attributable to Premier, Inc.

21,120

96,000

Net Income Attributable to NCI in Premier LP

124,800

-

Tax Distribution to Premier LP Limited Partners

(49,920)

-

Net Income Retained in Business

96,000

96,000

Adjusted Fully Distributed Net Income

Net Income Attributable to Premier, Inc.

21,120

96,000

Add: Income Tax Expense

14,080

64,000

Add: Net Income Attributable to NCI in Premier

124,800

-

Fully Distributed Income Before Income Taxes

160,000

160,000

Adjusted for income tax expense on fully

distributed net income before income taxes

64,000

64,000

Adjusted Fully Distributed Net Income

96,000

96,000

Income Taxes/Tax Distributions

Income Tax Expense

14,080

64,000

Tax Distribution to Class B Limited Partners

49,920

-

Total Tax, including tax distribution to limited

partners

64,000

64,000 |

Fiscal 2014 and fiscal 2013 non-GAAP reconciliations

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

(Unaudited, in thousands)

Adjustments

Adjustments

Amount

% of Net

Revenue

Amount

Amount

% of Net

Revenue

Amount

% of Net

Revenue

Amount

Amount

% of Net

Revenue

Net revenue:

Net administrative fees

464,837

$

51%

(41,263)

$

423,574

$

49%

519,219

$

60%

(105,012)

$

414,207

$

54%

Other services and support

233,186

26%

-

233,186

27%

205,685

24%

-

205,685

27%

Services

698,023

77%

(41,263)

656,760

76%

724,904

84%

(105,012)

619,892

81%

Products

212,526

23%

-

212,526

24%

144,386

16%

-

144,386

19%

Net revenue

910,549

100%

(41,263)

869,286

100%

869,290

100%

(105,012)

764,278

100%

Cost of revenue:

Services

115,740

13%

-

115,740

13%

103,795

12%

-

103,795

14%

Products

191,885

21%

-

191,885

22%

133,618

15%

-

133,618

17%

Cost of revenue

307,625

34%

-

307,625

35%

237,413

27%

-

237,413

31%

Gross profit

602,924

66%

(41,263)

561,661

65%

631,877

73%

(105,012)

526,865

69%

Operating expenses:

Selling, general and administrative

294,421

33%

-

294,421

35%

248,301

29%

-

248,301

33%

Research and development

3,389

— %

-

3,389

— %

9,370

1%

-

9,370

1%

Amortization of purchased intangible assets

3,062

— %

-

3,062

— %

1,539

— %

-

1,539

— %

Total operating expenses

300,872

33%

-

300,872

35%

259,210

30%

-

259,210

34%

Operating income

302,052

33%

(41,263)

260,789

30%

372,667

43%

(105,012)

267,655

35%

Other income, net

58,274

6%

-

58,274

7%

12,145

1%

-

12,145

2%

Income before income taxes

360,326

40%

(41,263)

319,063

37%

384,812

44%

(105,012)

279,800

37%

Income tax expense

27,709

3%

(3,239)

24,470

3%

9,726

1%

22,813

32,539

4%

Net income

332,617

37%

(38,024)

294,593

34%

375,086

43%

(127,825)

247,261

33%

Net (income) loss attributable to noncontrolling interest

in S2S Global

(949)

— %

-

(949)

— %

1,479

— %

-

1,479

— %

Net income attributable to noncontrolling interest in

Premier LP

(303,336)

(33)%

57,690

(245,646)

(28)%

(369,189)

(42)%

150,726

(218,463)

(29)%

Net income attributable to noncontrolling interest

(304,285)

(33)%

57,690

(246,595)

(28)%

(367,710)

(42)%

150,726

(216,984)

(29)%

Net income attributable to shareholders

28,332

$

4%

19,666

$

47,998

$

6%

7,376

$

1%

22,901

$

30,277

$

4%

Adjustment of redeemable limited partners' capital to

redemption amount

(2,741,588)

$

nm

-

$

(2,741,588)

$

nm

-

$

nm

-

$

-

$

nm

Net income (loss) attributable to shareholders after

adjustment of redeemable partners' capital to

redemption amount

(2,713,256)

$

nm

19,666

$

(2,693,590)

$

nm

7,376

$

nm

22,901

$

30,277

$

nm

Adjusted EBITDA

392,288

$

43%

(41,263)

$

351,025

$

40%

419,025

$

48%

(105,012)

$

314,013

$

41%

Adjusted Fully Distributed Net Income

na

na

na

188,561

$

22%

na

na

na

172,793

$

23%

nm - Not meaningful

na - Not applicable

Actual

Actual

Non-GAAP Pro Forma

Year Ended June 30,

2014

2013

Non-GAAP Pro Forma

PREMIER, INC.

37 |

Fiscal 2014 and fiscal 2013 non-GAAP reconciliations

PREMIER, INC.

38

(Unaudited, in thousands)

Actual

Adjustments

Non-GAAP

Pro Forma

Actual

Adjustments

Non-GAAP

Pro Forma

Reconciliation of Non-GAAP Pro Forma Net Revenue to Net Revenue:

Supply Chain Services

678,141

$

(41,263)

$

636,878

$

664,076

$

(105,012)

$

559,064

$

Performance Services

232,408

-

232,408

205,214

-

205,214

Net Revenue

910,549

(41,263)

869,286

869,290

(105,012)

764,278

Reconciliation of Net Income to Adjusted EBITDA and Reconciliation of

Segment Adjusted EBITDA to Income Before Income Taxes:

Net income

332,617

$

(38,024)

$

294,593

$

375,086

$

(127,825)

$

247,261

$

Interest and investment income, net

(1,019)

-

(1,019)

(965)

-

(965)

Income tax expense

27,709

(3,239)

24,470

9,726

22,813

32,539

Depreciation and amortization

36,761

-

36,761

27,681

-

27,681

Amortization of purchased intangible assets

3,062

-

3,062

1,539

-

1,539

EBITDA

399,130

(41,263)

357,867

413,067

(105,012)

308,055

Stock-based compensation expense

19,476

-

19,476

-

-

-

Acquisition related expenses

2,014

-

2,014

-

-

-

Strategic and financial restructuring expenses

3,760

-

3,760

5,170

-

5,170

Gain on sale of investment

(38,372)

-

(38,372)

-

-

-

Adjustment to tax receivable agreement liability

6,215

-

6,215

-

-

-

Other (income) expense, net

65

-

65

788

-

788

Adjusted EBITDA

392,288

$

(41,263)

$

351,025

$

419,025

$

(105,012)

$

314,013

$

Segment Adjusted EBITDA:

Supply Chain Services

396,470

$

(41,263)

$

355,207

$

431,628

$

(105,012)

$

326,616

$

Performance Services

73,898

-

73,898

56,456

-

56,456

Corporate

(g)

(78,080)

-

(78,080)

(69,059)

-

(69,059)

Adjusted EBITDA

392,288

(41,263)

351,025

419,025

(105,012)

314,013

Depreciation and amortization

(36,761)

-

(36,761)

(27,681)

-

(27,681)

Amortization of purchased intangible assets

(3,062)

-

(3,062)

(1,539)

-

(1,539)

Stock-based compensation expense

(19,476)

-

(19,476)

-

-

-

Acquisition related expenses

(2,014)

-

(2,014)

-

-

-

Strategic and financial restructuring expenses

(3,760)

-

(3,760)

(5,170)

-

(5,170)

Adjustment to tax receivable agreement liability

(6,215)

-

(6,215)

-

-

-

Equity in net income of unconsolidated affiliates

(16,976)

-

(16,976)

(11,968)

-

(11,968)

Deferred compensation plan expense

(1,972)

-

(1,972)

-

-

-

Operating income

302,052

(41,263)

260,789

372,667

(105,012)

267,655

Equity in net income of unconsolidated affiliates

16,976

-

16,976

11,968

-

11,968

Interest and investment income, net

1,019

-

1,019

965

-

965

Gain on sale of investment

38,372

-

38,372

-

-

-

Other income (expense), net

1,907

-

1,907

(788)

-

(788)

Income before income taxes

360,326

$

(41,263)

$

319,063

$

384,812

$

(105,012)

$

279,800

$

Year Ended June 30,

2014

2013 |

Fiscal 2014 and fiscal 2013 non-GAAP reconciliations

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

(Unaudited, in thousands)

2014

2013

28,332

$

7,376

$

(41,263)

(105,012)

27,709

9,726

19,476

—

2,014

—

3,760

5,170

(38,372)

—

6,215

—

3,062

1,539

303,336

369,189

314,269

287,988

125,708

115,195

188,561

$

172,793

$

Non-GAAP Pro forma fully distributed income before income taxes

Income tax expense on fully distributed income before income taxes

Non-GAAP Pro Forma Adjusted Fully Distributed Net Income

Acquisition related expenses

Strategic and financial restructuring expenses

Gain on sale of investment

Adjustment to tax receivable agreement liability

Amortization of purchased intangible assets

Net income attributable to noncontrolling interest in Premier LP

Stock-based compensation expense

Year Ended June 30,

Net income attributable to shareholders

Pro forma adjustment for revenue share post-IPO

Income tax expense

PREMIER, INC.

39 |

Fiscal 2014 and fiscal 2013 non-GAAP reconciliations

PREMIER, INC.

40

2014

2013

Reconciliation of numerator for GAAP EPS to Non-GAAP EPS on Adjusted

Fully Distributed Net Income Net income (loss) attributable to

shareholders after adjustment of redeemable limited

partners' capital to redemption amount

(2,713,256)

$

7,376

$

Adjustment of redeemable limited partners' capital to redemption

amount

2,741,588

-

Net income (loss) attributable to shareholders

28,332

7,376

Pro forma adjustment for revenue share post-IPO

(41,263)

(105,012)

Income tax expense

27,709

9,726

Stock-based compensation

19,476

—

Gain on sale of investment

(38,372)

—

Acquisition related expenses

2,014

—

Strategic and financial restructuring expenses

3,760

5,170

Adjustment to tax receivable agreement liability

6,215

—

Amortization of purchased intangible assets

3,062

1,539

Net income attributable to noncontrolling interest in Premier LP

303,336

369,189

Non-GAAP pro forma adjusted fully distributed income before income

taxes 314,269

287,988

Income tax expense on fully distributed income before income

taxes 125,708

115,195

Non-GAAP pro forma adjusted fully distributed net income

188,561

$

172,793

$

Reconciliation of denominator for GAAP EPS to Non-GAAP to Adjusted

Fully Distributed Net Income Weighted Average:

Common shares used for basic and diluted earnings per share

25,633

5,858

Potentially dilutive shares

124

-

Class A common shares outstanding

6,742

26,517

Conversion of Class B common units

112,584

112,608

Weighted average fully distributed shares outstanding -

diluted

145,083

144,983

Reconciliation of GAAP EPS to Adjusted Fully Distributed EPS

GAAP income (loss) per share

$ (105.85)

$

1.26 Impact of adjustment of redeemable limited partners'

capital to redemption amount

$ 106.96

$

- Impact of additions:

Pro forma adjustment for revenue share post-IPO

$

(1.61) $

(17.93) Income tax expense

$

1.08

$

1.66 Stock-based compensation

$

0.76

$

- Gain on sale of

investment

$

(1.50)

$

- Acquisition related

expenses

$

0.08

$

- Strategic and financial

restructuring expenses

$

0.15

$

0.88 Adjustment to tax receivable agreement

liability

$

0.24

$

- Amortization of purchased

intangible assets

$

0.12

$

0.26 Net income attributable to noncontrolling interest in

Premier LP

$ 11.83

$

63.02 Impact of corporation taxes

$

(4.90) $

(19.66) Impact of increased share count

$

(6.06) $

(28.31) Non-GAAP earnings per share on adjusted fully

distributed net income -

diluted

$ 1.30

$

1.19

Supplemental Financial Information -

Reporting of Net Income and Earnings Per Share

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

(Unaudited)

(In thousands)

Year Ended

June 30, |

Fiscal 2015 and fiscal 2014 first-quarter non-GAAP reconciliations

(Unaudited, in thousands)

2014*

2013

Reconciliation of Non-GAAP Pro Forma Net Revenue to Net

Revenue: Non-GAAP Pro Forma Net Revenue

229,308

$

199,313

$

Non-GAAP pro forma

adjustment for revenue share post-IPO —

41,263

Net Revenue

229,308

$

240,576

$

Reconciliation of Supply Chain

Services Non-GAAP Pro Forma Net Revenue to Supply Chain Services Net Revenue:

Non-GAAP Pro Forma Supply Chain Services Net Revenue

170,302

$

146,195

$

Non-GAAP pro forma

adjustment for revenue share post-IPO —

41,263

Supply Chain Services Net Revenue

170,302

$

187,458

$

Net income

64,887

$

112,528

$

Non-GAAP pro forma

adjustment for revenue share post-IPO —

(41,263)

Interest and investment income, net

(191)

(220)

Income tax expense

5,811

764

Depreciation and amortization

10,308

8,356

Amortization of purchased intangible assets

903

601

EBITDA

81,718

80,766

Stock-based compensation

6,439

325

Acquisition related expenses

1,278

142

Strategic and financial restructuring expenses

96

1,842

Adjustment to tax receivable agreement liability

(1,073)

—

Acquisition related adjustment - deferred revenue

2,065

—

Other (income) expense, net

(5)

(4)

Adjusted EBITDA

90,518

$

83,071

$

Segment Adjusted

EBITDA: Supply Chain Services

91,268

$

125,480

$

Non-GAAP pro forma

adjustment for revenue share post-IPO —

(41,263)

Supply Chain Services

(including non-GAAP pro forma adjustment)

91,268

$

84,217

$

Performance

Services 18,362

16,329

Corporate

(19,112)

(17,475)

Adjusted EBITDA

90,518

$

83,071

$

Depreciation and

amortization (10,308)

(8,356)

Amortization of purchased intangible assets

(903)

(601)

Stock-based compensation

(6,439)

(325)

Acquisition related expenses

(1,278)

(142)

Strategic and financial restructuring expenses

(96)

(1,842)

Adjustment to tax receivable agreement liability

1,073

—

Acquisition related adjustment - deferred revenue

(2,065)

—

Equity in net income of unconsolidated affiliates

(4,866)

(4,114)

Deferred compensation plan expense

509

—

66,145

67,691

Non-GAAP pro forma adjustment for revenue share post-IPO

—

41,263

Operating income

66,145

$

108,954

$

Equity in net income of unconsolidated

affiliates 4,866

4,114

Interest and investment income, net

191

220

Other (expense) income, net

(504)

4

Income before income taxes

70,698

$

113,292

$

* Note that no pro forma adjustments were made

for the three months ended September 30, 2014; as such, actual results are presented for the three months ended September 30, 2014.

Three Months Ended

September 30,

Reporting of Non-GAAP Pro Forma Adjusted EBITDA and Non-GAAP

Adjusted Fully Distributed Net Income Reconciliation of Selected

Non-GAAP Measures to GAAP Measures Reconciliation of Net Income

to Adjusted EBITDA and Reconciliation of Segment Adjusted EBITDA to Income Before Income Taxes:

PREMIER, INC.

41 |

Fiscal 2015 and fiscal 2014 first-quarter non-GAAP reconciliations

(Unaudited, in thousands)

2014*

2013

Reconciliation of Non-GAAP Pro Forma Adjusted Fully Distributed Net

Income: Net income (loss) attributable to shareholders

9,273

$

(476)

$

Non-GAAP pro forma adjustment for revenue share post-IPO

—

(41,263)

Income tax expense

5,811

764

Stock-based compensation

6,439

325

Acquisition related expenses

1,278

142

Strategic and financial restructuring expenses

96

1,842

Adjustment to tax receivable agreement liability

(1,073)

—

Acquisition related adjustment - deferred revenue

2,065

—

Amortization of purchased intangible assets

903

601

Net income attributable to noncontrolling interest in Premier LP

54,816

113,214

Non-GAAP pro forma adjusted fully distributed income before income

taxes 79,608

75,149

Income tax expense on fully distributed income before income

taxes 31,843

30,060

Non-GAAP Pro Forma Adjusted Fully Distributed Net Income

47,765

$

45,089

$

Reporting of Non-GAAP Pro Forma

Adjusted EBITDA and Non-GAAP Adjusted Fully Distributed Net Income

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

Three Months Ended

September 30,

* Note that no pro forma adjustments were made for the three months

ended September 30, 2014; as such, actual results are presented for the three months ended

September 30, 2014.

PREMIER, INC.

42 |

Fiscal 2015 and fiscal 2014 first-quarter non-GAAP reconciliations

PREMIER, INC.

43

(Unaudited, in thousands, except per share data)

2014*

2013

Reconciliation of numerator for GAAP EPS to Non-GAAP EPS on Adjusted

Fully Distributed Net Income Net loss attributable to shareholders

after adjustment of redeemable limited partners' capital to redemption amount

(373,384)

$

(476)

$

Adjustment

of

redeemable

limited

partners'

capital

to

redemption

amount

382,657

—

Net income (loss) attributable to shareholders

9,273

(476)

Non-GAAP pro forma adjustment for revenue share post-IPO

—

(41,263)

Income tax expense

5,811

764

Stock-based compensation

6,439

325

Acquisition related expenses

1,278

142

Strategic and financial restructuring expenses

96

1,842

Adjustment to tax receivable agreement liability

(1,073)

—

Acquisition

related

adjustment

-

deferred

revenue

2,065

—

Amortization of purchased intangible assets

903

601

Net income attributable to noncontrolling interest in Premier LP

54,816

113,214

Non-GAAP pro forma adjusted fully distributed income before income

taxes 79,608

75,149

Income tax expense on fully distributed income before income taxes

31,843

30,060

Non-GAAP pro forma adjusted fully distributed net income

47,765

$

45,089

$

Reconciliation of denominator for GAAP EPS to Non-GAAP Adjusted Fully

Distributed Net Income Weighted Average:

Common shares used for basic and diluted earnings per share

32,376

5,627

Potentially dilutive shares

253

25

Class A common shares outstanding

-

26,749

Conversion of Class B common units

112,083

112,608

Weighted

average

fully

distributed

shares

outstanding

-

diluted

144,712

145,009

Reconciliation of GAAP EPS to Adjusted Fully Distributed EPS

GAAP loss per share

$ (11.53)

$

(0.08) Impact of adjustment of redeemable limited partners'

capital to redemption amount

$ 11.82

$

- Impact of additions:

Non-GAAP pro forma adjustment for revenue share post-IPO

$

-

$

(7.33) Income tax expense

$

0.18

$

0.14 Stock-based compensation

$

0.20

$

0.06 Acquisition related expenses

$

0.04

$

0.03 Strategic and financial restructuring expenses

$

0.00

$

0.33 Adjustment to tax receivable agreement liability

$

(0.03)

$

- Acquisition

related

adjustment

-

deferred

revenue

$

0.06

$

- Amortization of purchased

intangible assets

$

0.03

$

0.11 Net income attributable to noncontrolling interest in

Premier LP

$

1.69

$ 20.12

Impact of corporation taxes

$

(0.98)

$

(5.34) Impact of increased share count

$

(1.15)

$

(7.70) Non-GAAP

pro

forma

earnings

per

share

on

adjusted

fully

distributed

net

income

-

diluted

$ 0.33

$

0.31 * Note that no pro forma adjustments were made for the three

months ended September 30, 2014; as such, actual results are presented for the three months ended September 30, 2014.

Three Months Ended

September 30,

Reporting of Net Income and Earnings Per Share

Reconciliation of Selected Non-GAAP Measures to GAAP Measures

|