Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NAUTILUS, INC. | d850305d8k.htm |

Exhibit 99.1

NAUTILUS Inc.

ICR

XChangeConference

JANUARY 12, 2015

NAUTILUS

BOWFLEX

Universal

SCHWINN

Safe Harbor Statement

This presentation includes forward-looking statements (statements which are not historical facts) within the meaning of the Private Securities Litigation Reform

Act of 1995, including statements concerning the Company’s prospects, resources, capabilities, current or future financial trends or operating results, demand for the Company‘s products, future plans for introduction of new products and

the anticipated outcome of new business initiatives, estimates of market size and growth, planned capital expenditures and statements concerning our ability to finance growth plans with cash generated from our operations. Factors that could cause

Nautilus, Inc.’s actual results to differ materially from these forward-looking statements include our ability to acquire inventory from sole source foreign manufacturers at acceptable costs, within timely delivery schedules and that meet our

quality control standards, availability and price of media time consistent with our cost and audience profile parameters, a decline in consumer spending due to unfavorable economic conditions in one or more of our current or target markets, an

adverse change in the availability of credit for our customers who finance their purchases, our ability to pass along vendor raw material price increases and increased shipping costs, our ability to effectively develop, market and sell future

products, our ability to protect our intellectual property, and the introduction of competing products. Additional assumptions, risks and uncertainties are described in detail in our registration statements, reports and other filings with the

Securities and Exchange Commission, including the “Risk Factors” set forth in our Annual Report on Form 10-K, as supplemented by our quarterly reports on Form 10-Q. Such filings are available on our website or at www.sec.gov. You are

cautioned that such statements are not guarantees of future performance and that actual results or developments may differ materially from those set forth in the forward-looking statements. We undertake no obligation to publicly update or revise

forward-looking statements to reflect subsequent events or circumstances.

Unless otherwise indicated, all information regarding our operating results pertain to

continuing operations.

© Nautilus, Inc. 2015

NAUTILUS

BOWFLEX

Universal

SCHWINN

2

Who We Are

Leading

provider of consumer fitness equipment and related products

Strong portfolio of brands, including #1 in the fitness industry (Bowflex)*

Unique products recognized for quality and innovation

Multichannel growth strategy

Focused on profitable growth and increasing shareholder value

Our mission is to provide

products which allow consumers to achieve their health and fitness goals

* Based on 2012 National Consumer Research Study

NAUTILUS

BOWFLEX

Universal

SCHWINN

3

Strong Brands

BOWFLEX

#1 Fitness Brand* Innovation Quick, Proven Results

SCHWINN QUALITY ®

Quality and Value

High Awareness

NAUTILUS

Authentic Professional Grade Serious Fitness

Universal

American Heritage Strength

* Based on 2012 National Consumer Research Study

NAUTILUS

BOWFLEX

Universal

SCHWINN

4

Industry Leading Product Quality & Innovation

Continual Consumer Feedback

Fitness Results Validation

Rigorous Equipment Testing

Ground Up Design

In-depth Consumer Research

NAUTILUS

BOWFLEX

Universal

SCHWINN

5

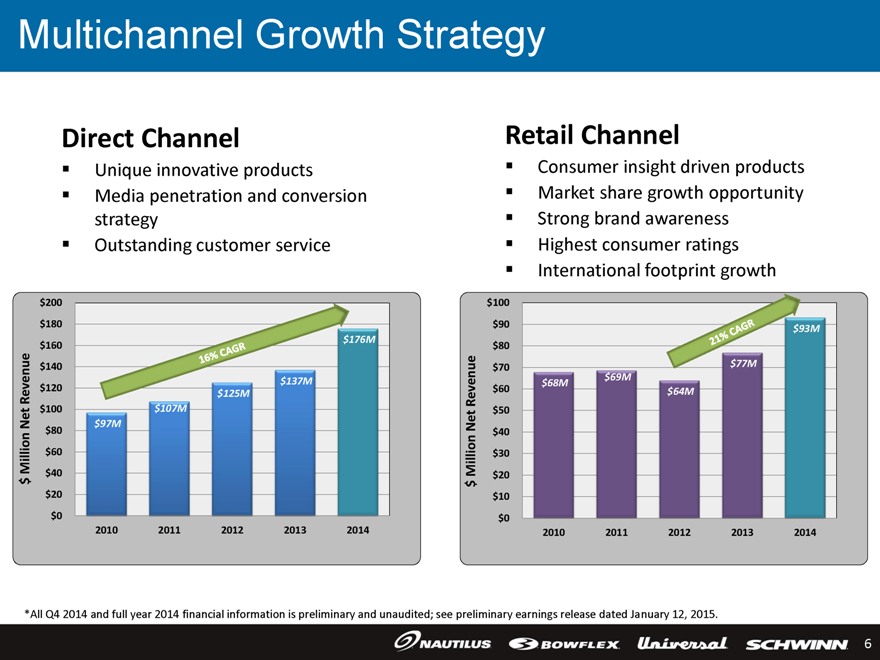

Multichannel Growth Strategy

Direct Channel

Unique innovative products

Media penetration and conversion strategy

Outstanding customer service

$ Million Net Revenue

$200 $180 $160 $140 $120 $100 $80 $60 $40 $20 $0

16% CAGR

$97M $107M $125M $137M $176M

2010 2011 2012 2013 2014

Retail Channel

Consumer insight driven products

Market share growth opportunity

Strong brand awareness

Highest consumer ratings

International footprint growth

$ Million Net Revenue

$100 $90 $80 $70 $60 $50 $40 $30 $20 $10 $0

21% CAGR

$68M $69M

$64M $77M

$93M

2010 2011 2012 2013 2014

*All Q4 2014 and full year 2014 financial information is preliminary and unaudited; see preliminary earnings release dated January 12, 2015.

NAUTILUS

BOWFLEX

Universal

SCHWINN

6

Strong Results Continued into Q4 2014

PRELIMINARY* UNAUDITED Q4 AND FULL YEAR 2014 RESULTS

(CONTINUING OPERATIONS)

Q4 Revenues grew 23% over Q4 last year

Direct business - 35% growth

Retail business - 8% growth

Full Year 2014 Revenues grew 25% over 2013

Direct business - 29% growth

Retail business - 21% growth

Q4 Pretax EPS is expected to be between $0.43 and $0.46 per share**

Versus $0.32 last year

Full year Pretax EPS is expected to be between $0.92 and $0.95 per share**

Versus $0.51 last year

Ending Cash and Investments of $72M and no debt

* All Q4 2014 and full year 2014 financial information is preliminary and unaudited; see preliminary earnings release dated January 12, 2015.

** Refer to preliminary earnings release dated January 12, 2015, available under “Investor Relations” at www.nautilusinc.com, for a reconciliation of Non-GAAP

financial information.

NAUTILUS

BOWFLEX

Universal

SCHWINN

7

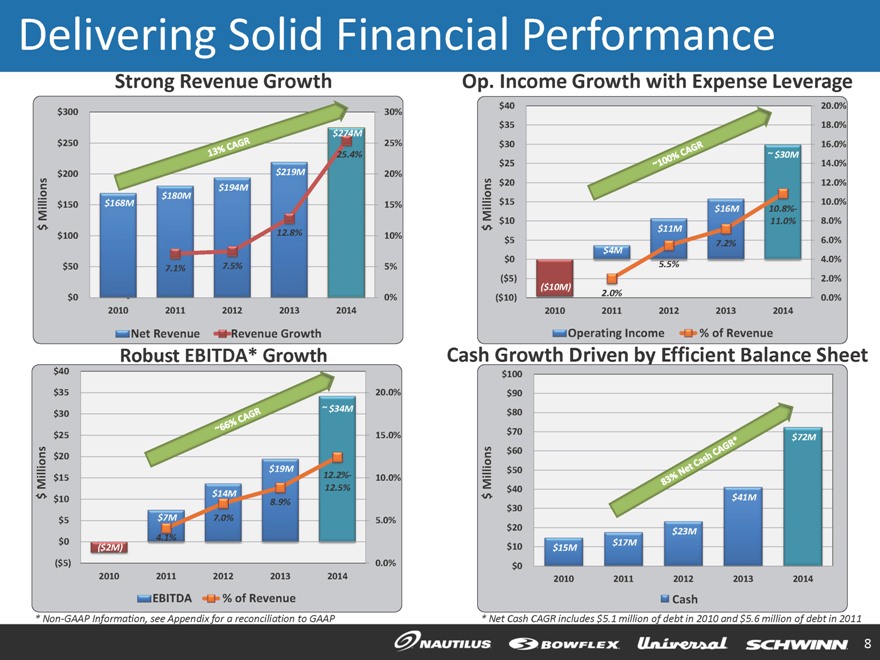

Delivering Solid Financial Performance Strong Revenue Growth $ Millions $300 $250 $200 $150 $100 $50 $0 13% CAGR $168M $194M $180M $219M $274M 7.1% 7.5% 12.8% 25.4% 30% 25% 20% 15% 10% 5% 0% 2010 2011 2012 2013 2014 Net Revenue Revenue Growth Robust EBITDA* Growth $ Millions $40 $35 $30 $25 $20 $15 $10 $5 $0 ($5) 67% CAGR ~66% CAGR ($2M) $7M $14M $19M ~ $34M 4.1% 7.0% 8.9% 12.2%-12.5% 20.0% 15.0% 10.0% 5.0% 0.0% 2010 2011 2012 2013 2014 EBITDA % of Revenue * Non-GAAP Information, see Appendix for a reconciliation to GAAP Op. Income Growth with Expense Leverage $ Millions $40 $35 $30 $25 $20 $15 $10 $5 $0 ($5) ($10) ~100% CAGR ($10M) $4M $11M $16M ~ $30M 2.0% 5.5% 7.2% 10.8%-11.0% 20.0% 18.0% 16.0% 14.0% 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% 2010 2011 2012 2013 2014 Operating Income % of Revenue Cash Growth Driven by Efficient Balance Sheet $ Millions $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 83% Net Cash CAGR* $15M $17M $23M $41M $72M 2010 2011 2012 2013 2014 Cash * Net Cash CAGR includes $5.1 million of debt in 2010 and $5.6 million of debt in 2011 NAUTILUS BOWFLEX Universal SCHWINN 8

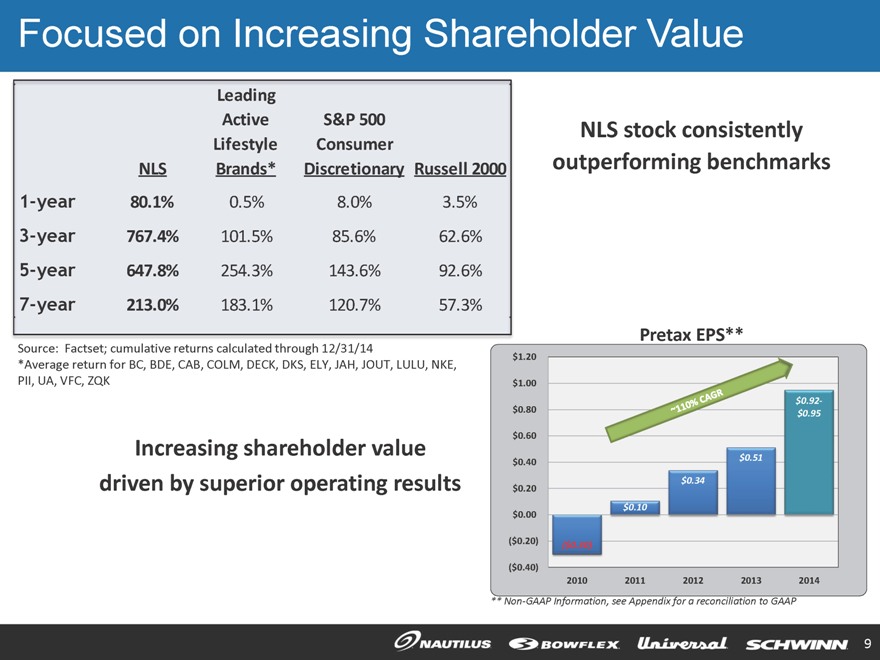

Focused on Increasing Shareholder Value NLS Leading Active Lifestyle Brands* S&P 500 Consumer Discretionary Russell 2000 1-year 80.1% 0.5% 8.0% 3.5% 3-year 767.4% 101.5% 85.6% 62.6% 5-year 647.8% 254.3% 143.6% 92.6% 7-year 213.0% 183.1% 120.7% 57.3% Source: Factset; cumulative returns calculated through 12/31/14 *Average return for BC, BDE, CAB, COLM, DECK, DKS, ELY, JAH, JOUT, LULU, NKE, PII, UA, VFC, ZQK Increasing shareholder value driven by superior operating results NLS stock consistently outperforming benchmarks Pretax EPS** $1.20 $1.00 $0.80 $0.60 $0.40 $0.20 $0.00 ($0.20) ($0.40) ~110% CAGR ($0.30) $0.10 $0.34 $0.51 $0.92-$0.95 2010 2011 2012 2013 2014 ** Non-GAAP Information, see Appendix for a reconciliation to GAAP NAUTILUS BOWFLEX Universal SCHWINN 9

NAUTILUS Inc.

Retail

Growth Drivers

10

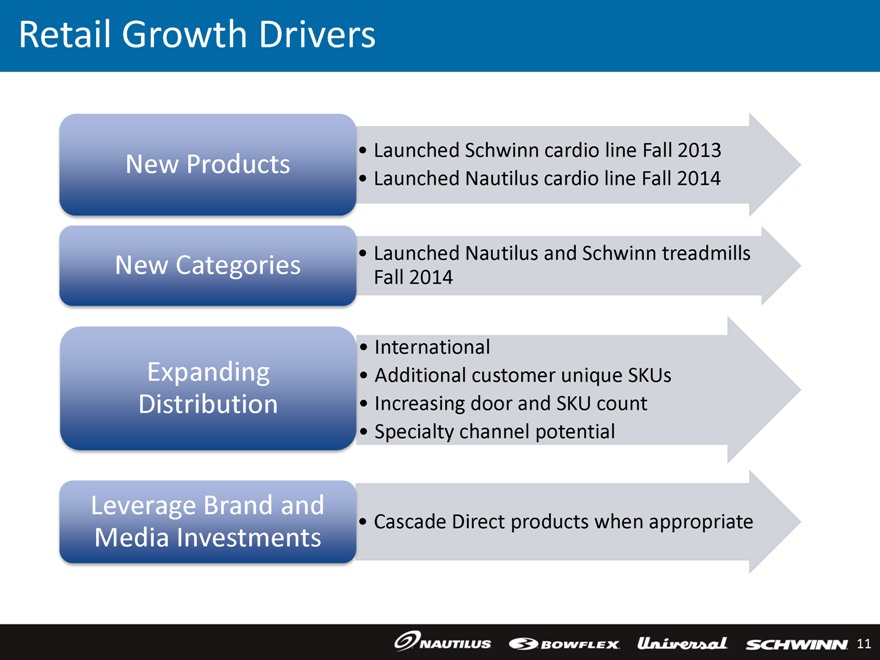

Retail Growth Drivers

New

Products

Launched Schwinn cardio line Fall 2013

Launched Nautilus cardio line

Fall 2014

New Categories

Launched Nautilus and Schwinn treadmills Fall 2014

Expanding Distribution

International

Additional customer unique SKUs

Increasing door and SKU count

Specialty channel potential

Leverage Brand and Media Investments

Cascade Direct products when appropriate

NAUTILUS

BOWFLEX

Universal

SCHWINN

11

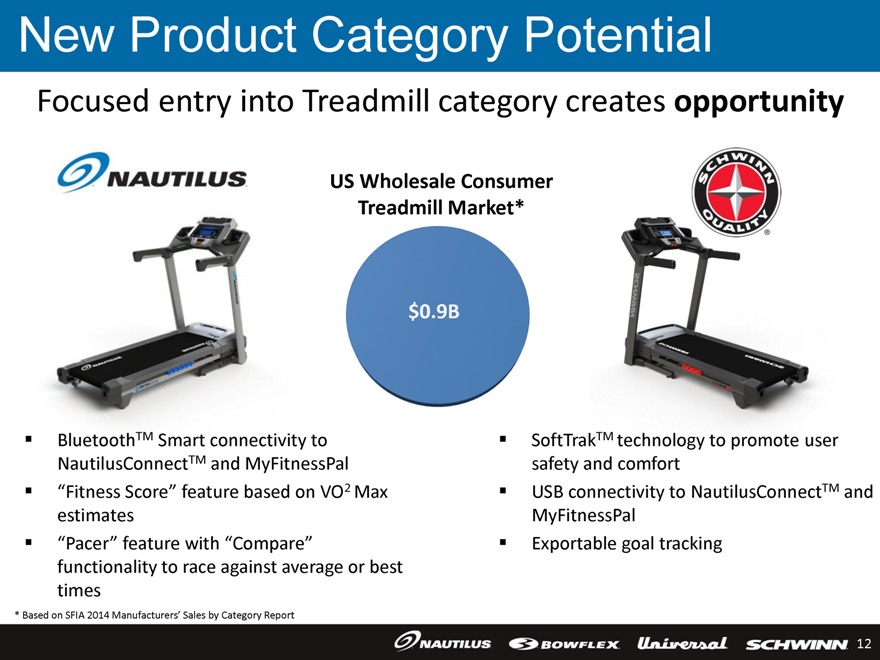

New Product Category Potential

Focused entry into Treadmill category creates opportunity

NAUTILUS

BluetoothTM Smart connectivity to NautilusConnectTM and MyFitnessPal

“Fitness Score”

feature based on VO2 Max estimates

“Pacer” feature with “Compare” functionality to race against average or best times

US Wholesale Consumer

Treadmill Market*

$0.9B

SCHWINN

QUALITY

SoftTrakTM technology to promote user safety and comfort

USB connectivity to NautilusConnectTM and MyFitnessPal

Exportable goal tracking

* Based on SFIA 2014 Manufacturers’ Sales by Category Report

NAUTILUS

BOWFLEX

Universal

SCHWINN

12

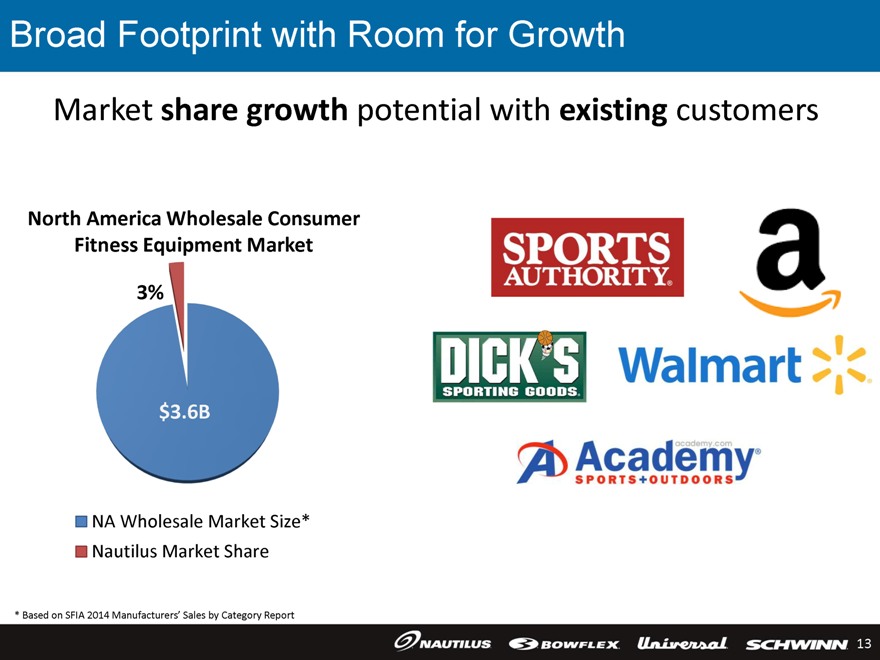

Broad Footprint with Room for Growth

Market share growth potential with existing customers

North America Wholesale Consumer Fitness

Equipment Market

3%

$3.6B

NA Wholesale Market Size*

Nautilus Market Share

* Based on SFIA 2014 Manufacturers’ Sales by Category Report

SPORTS AUTHORITY

DICKS

SPORTING GOODS

a

Walmart

A Academy academy.com

SPORTS+OUTDOORS

NAUTILUS

BOWFLEX

Universal

SCHWINN

13

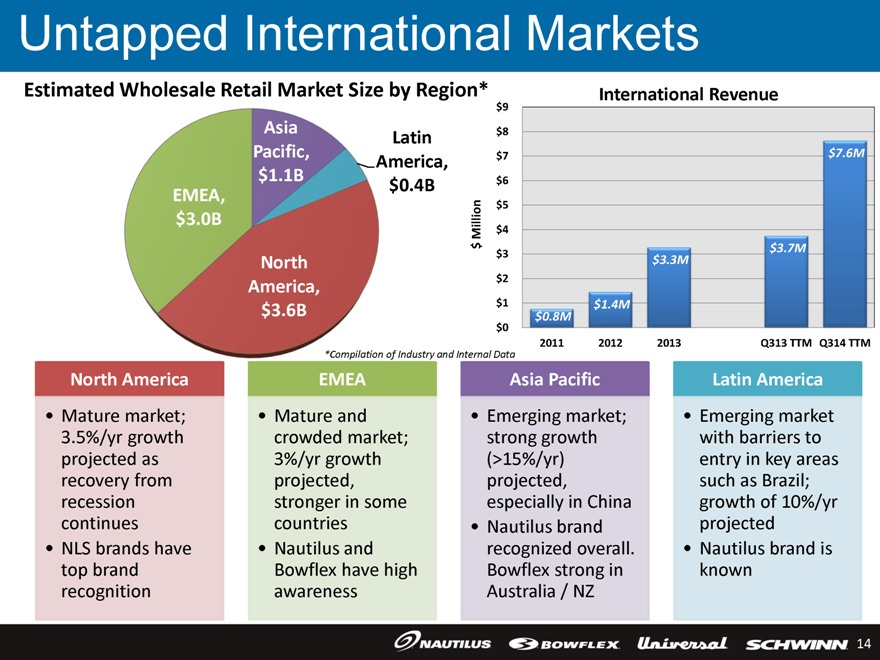

Untapped International Markets Estimated Wholesale Retail Market Size by Region* EMEA, $3.0B Asia Pacific, $1.1B North America, $3.6B Latin America, $0.4B *Compilation of Industry and Internal Data International Revenue $ Million $9 $8 $7 $6 $5 $4 $3 $2 $1 $0 $0.8M $1.4M $3.3M $3.7M $7.6M 2011 2012 2013 Q313 TTM Q314 TTM North America Mature market; 3.5%/yr growth projected as recovery from recession continues NLS brands have top brand recognition EMEA Mature and crowded market; 3%/yr growth projected, stronger in some countries Nautilus and Bowflex have high awareness Asia Pacific Emerging market; strong growth (>15%/yr) projected, especially in China Nautilus brand recognized overall. Bowflex strong in Australia / NZ Latin America Emerging market with barriers to entry in key areas such as Brazil; growth of 10%/yr projected Nautilus brand is known NAUTILUS BOWFLEX Universal SCHWINN 14

NAUTILUS Inc

Direct

Growth Drivers

15

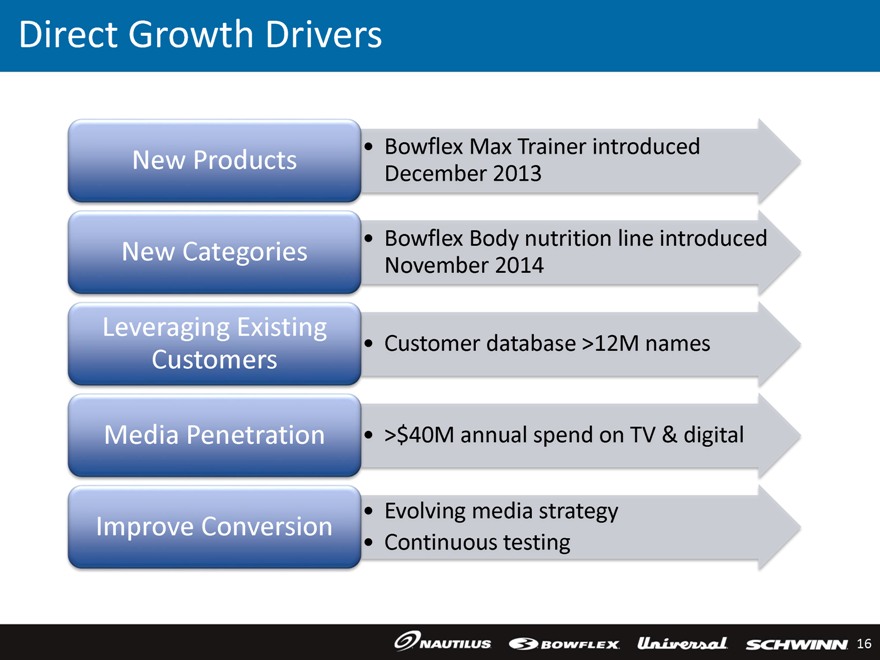

Direct Growth Drivers

New

Products

Bowflex Max Trainer introduced December 2013

New Categories

Bowflex Body nutrition line introduced November 2014

Leveraging Existing

Customers

Customer database >12M names

Media Penetration

>$40M annual spend on TV & digital

Improve Conversion

Evolving media strategy

Continuous testing

NAUTILUS

BOWFLEX

Universal

SCHWINN

16

Innovative New Products

BOWFLEX

Max Trainer targets the rapidly growing $1.2 Billion* elliptical and

stepper markets

BOWFLEX

BOWFLEX BODY

Antioxidant

BOWFLEX BODY

Fat Burner

BOWFLEX BODY

Fitness Shake

BOWFLEX BODY

Protein +

Bowflex Body provides simple but compelling nutrition solution in

>$20 Billion** adjacent market

* Based on SFIA 2014 Manufacturers’ Sales by Category

Report. Assumes 30% average retailer mark-up.

** Sources: Euromonitor, MarketData, Natural Products Insider, Packaged Facts

NAUTILUS

BOWFLEX

Universal

SCHWINN

17

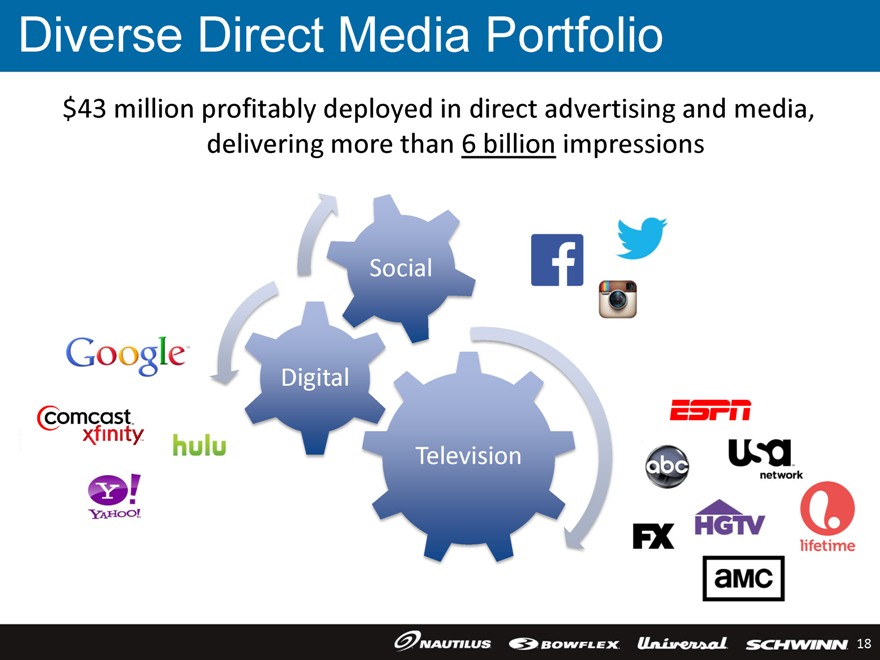

Diverse Direct Media Portfolio

$43 million profitably deployed in direct advertising and media, delivering more than 6 billion impressions

Social

Digital

Television

Google

comcast

xfinity

hulu

Y!

YAHOO!

ESPN

usa network

abc

FX

HGTV

lifetime

amc

NAUTILUS

BOWFLEX

Universal

SCHWINN

18

NAUTLUS Inc

Long-term

Goals

19

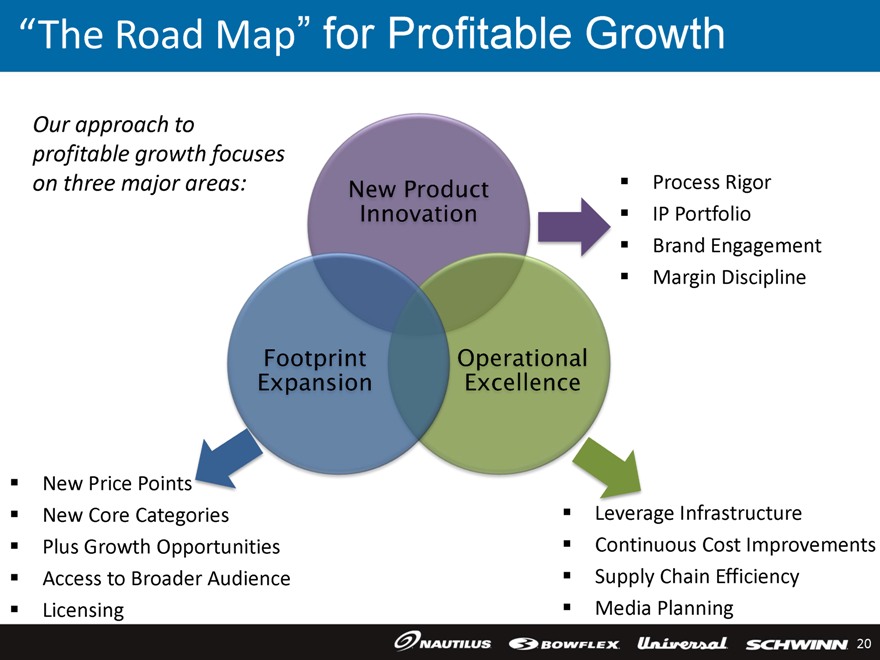

“The Road Map” for Profitable Growth

Our approach to profitable growth focuses on three major areas:

New Product Innovation

Process Rigor

IP Portfolio

Brand Engagement

Margin Discipline

Footprint Expansion

New Price Points

New Core Categories

Plus Growth Opportunities

Access to Broader Audience

Licensing

Operational Excellence

Leverage Infrastructure

Continuous Cost Improvements

Supply Chain Efficiency

Media Planning

NAUTILUS

BOWFLEX

Universal

SCHWINN

20

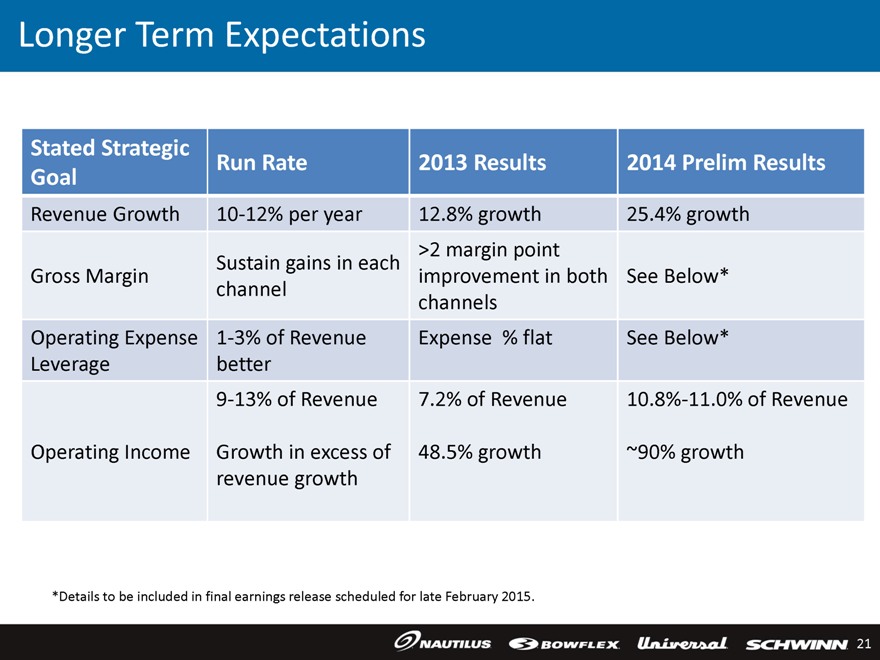

Longer Term Expectations

Stated Strategic Goal

Revenue Growth

Gross Margin

Operating Expense Leverage

Operating Income

Run Rate

10-12% per year

Sustain gains in each channel

1-3% of Revenue better 9-13% of Revenue

Growth in excess of revenue growth

2013 Results

12.8% growth >2 margin point improvement in both channels Expense % flat

7.2% of Revenue

48.5% growth

2014 Prelim Results

25.4% growth See Below* See Below*

10.8%-11.0% of Revenue

~90% growth

*Details to be included in final earnings release scheduled for late February 2015.

NAUTILUS

BOWFLEX

Universal

SCHWINN

21

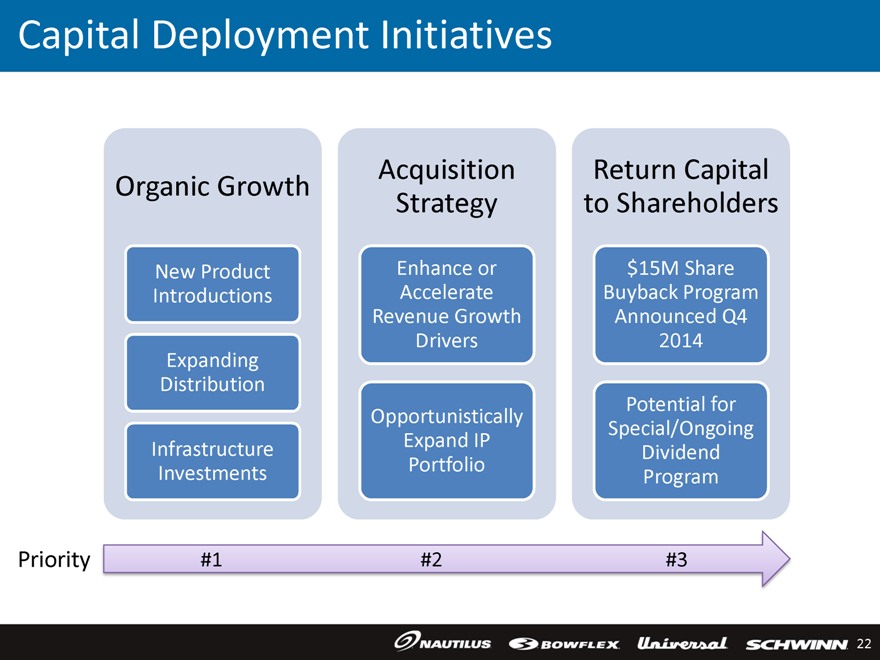

Capital Deployment Initiatives

Organic Growth

New Product Introductions

Expanding Distribution

Infrastructure Investments

Acquisition Strategy

Enhance or Accelerate Revenue Growth Drivers

Opportunistically Expand IP Portfolio

Return Capital to Shareholders

$15M Share Buyback Program Announced Q4 2014

Potential for Special/Ongoing Dividend Program

Priority #1 #2 #3

NAUTILUS

BOWFLEX

Universal

SCHWINN

22

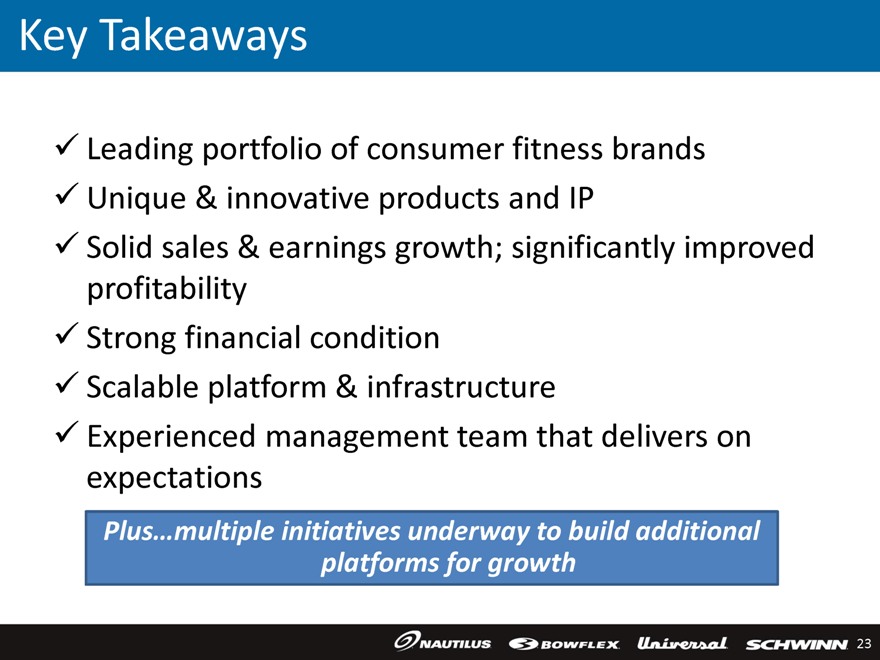

Key Takeaways

Leading

portfolio of consumer fitness brands

Unique & innovative products and IP

Solid sales & earnings growth; significantly improved profitability

Strong financial

condition

Scalable platform & infrastructure

Experienced management

team that delivers on expectations

Plus…multiple initiatives underway to build additional platforms for growth

NAUTILUS

BOWFLEX

Universal

SCHWINN

23

THANK YOU

24

NAUTILUS Inc

Appendix

25

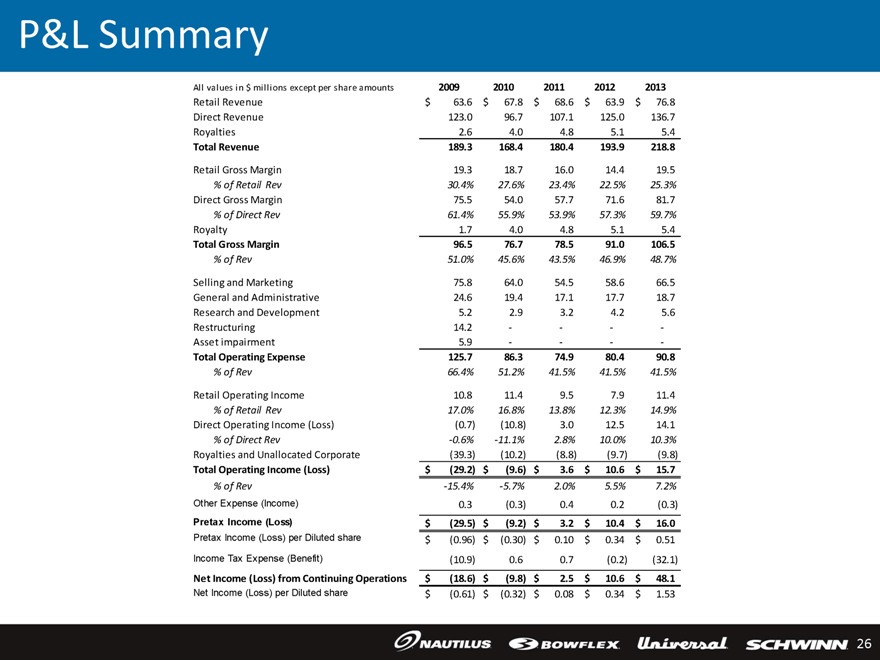

P&L Summary

All

values in $ millions except per share amounts 2009 2010 2011 2012 2013

Retail Revenue $63.6 $67.8 $68.6 $63.9 $76.8

Direct Revenue 123.0 96.7 107.1 125.0 136.7

Royalties 2.6 4.0 4.8 5.1 5.4

Total Revenue 189.3 168.4 180.4 193.9 218.8

Retail Gross Margin 19.3 18.7 16.0 14.4 19.5

% of Retail Rev 30.4% 27.6% 23.4% 22.5% 25.3%

Direct Gross Margin 75.5 54.0

57.7 71.6 81.7

% of Direct Rev 61.4% 55.9% 53.9% 57.3% 59.7%

Royalty 1.7 4.0

4.8 5.1 5.4

Total Gross Margin 96.5 76.7 78.5 91.0 106.5

% of Rev 51.0% 45.6%

43.5% 46.9% 48.7%

Selling and Marketing 75.8 64.0 54.5 58.6 66.5

General and

Administrative 24.6 19.4 17.1 17.7 18.7

Research and Development 5.2 2.9 3.2 4.2 5.6

Restructuring 14.2 - - - -

Asset impairment 5.9 - - - -

Total Operating Expense 125.7 86.3 74.9 80.4 90.8

% of Rev 66.4% 51.2% 41.5% 41.5% 41.5%

Retail Operating Income 10.8 11.4 9.5 7.9 11.4

% of Retail Rev 17.0% 16.8%

13.8% 12.3% 14.9%

Direct Operating Income (Loss) (0.7) (10.8) 3.0 12.5 14.1

%

of Direct Rev -0.6% -11.1% 2.8% 10.0% 10.3%

Royalties and Unallocated Corporate (39.3) (10.2) (8.8) (9.7) (9.8)

Total Operating Income (Loss) $(29.2) $(9.6) $3.6 $10.6 $15.7

% of Rev -15.4% -5.7% 2.0% 5.5%

7.2%

Other Expense (Income) 0.3 (0.3) 0.4 0.2 (0.3)

Pretax Income (Loss)

$(29.5) $(9.2) $3.2 $10.4 $16.0

Pretax Income (Loss) per Diluted share $(0.96) $(0.30) $0.10 $0.34 $0.51

Income Tax Expense (Benefit) (10.9) 0.6 0.7 (0.2) (32.1)

Net Income (Loss) from Continuing

Operations $(18.6) $(9.8) $2.5 $10.6 $48.1

Net Income (Loss) per Diluted share $(0.61) $(0.32) $0.08 $0.34 $1.53

NAUTILUS

BOWFLEX

Universal

SCHWINN

26

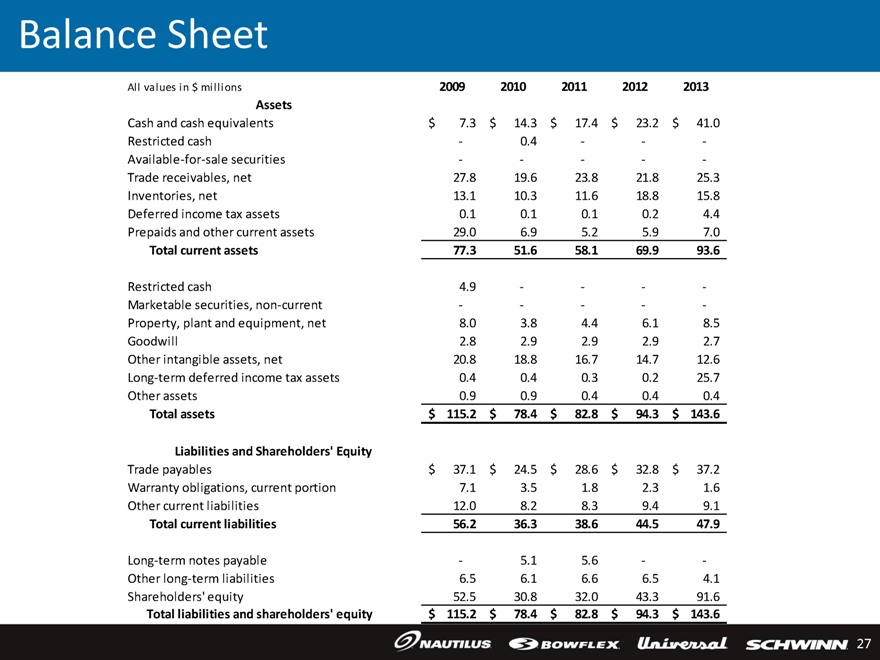

Balance Sheet

All values

in $ millions 2009 2010 2011 2012 2013

Assets

Cash and cash equivalents $7.3

$14.3 $17.4 $23.2 $41.0

Restricted cash - 0.4 - - -

Available-for-sale

securities - - - - -

Trade receivables, net 27.8 19.6 23.8 21.8 25.3

Inventories, net 13.1 10.3 11.6 18.8 15.8

Deferred income tax assets 0.1 0.1

0.1 0.2 4.4

Prepaids and other current assets 29.0 6.9 5.2 5.9 7.0

Total

current assets 77.3 51.6 58.1 69.9 93.6

Restricted cash 4.9 - - - -

Marketable securities, non-current - - - - -

Property, plant and equipment,

net 8.0 3.8 4.4 6.1 8.5

Goodwill 2.8 2.9 2.9 2.9 2.7

Other intangible assets,

net 20.8 18.8 16.7 14.7 12.6

Long-term deferred income tax assets 0.4 0.4 0.3 0.2 25.7

Other assets 0.9 0.9 0.4 0.4 0.4

Total assets $115.2 $78.4 $82.8 $94.3 $143.6

Liabilities and Shareholders’ Equity

Trade payables $37.1 $24.5 $28.6 $32.8 $37.2

Warranty obligations, current portion 7.1 3.5 1.8 2.3 1.6

Other current

liabilities 12.0 8.2 8.3 9.4 9.1

Total current liabilities 56.2 36.3 38.6 44.5 47.9

Long-term notes payable - 5.1 5.6 - -

Other long-term liabilities 6.5 6.1 6.6 6.5 4.1

Shareholders’ equity 52.5 30.8 32.0 43.3 91.6

Total liabilities and

shareholders’ equity $115.2 $78.4 $82.8 $94.3 $143.6

NAUTILUS

BOWFLEX

Universal

SCHWINN

27

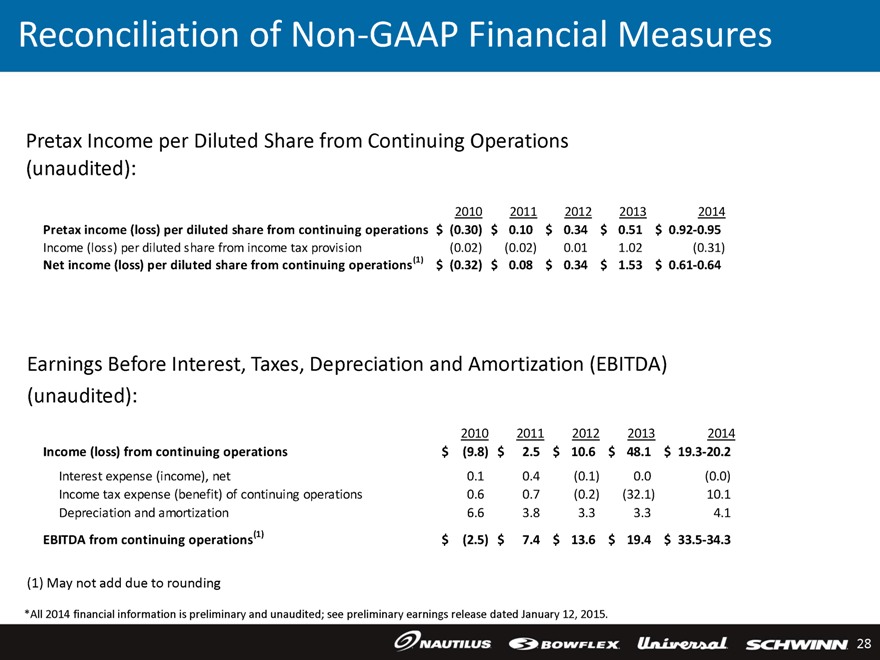

Reconciliation of Non-GAAP Financial Measures

Pretax Income per Diluted Share from Continuing Operations (unaudited):

2010 2011 2012 2013

2014

Pretax income (loss) per diluted share from continuing operations $(0.30) $0.10 $0.34 $0.51 $0.92-0.95

Income (loss) per diluted share from income tax provision (0.02) (0.02) 0.01 1.02 (0.31)

Net

income (loss) per diluted share from continuing operations(1) $(0.32) $0.08 $0.34 $1.53 $0.61-0.64

Earnings Before Interest, Taxes, Depreciation and Amortization

(EBITDA) (unaudited):

2010 2011 2012 2013 2014

Income (loss) from continuing

operations $(9.8) $2.5 $10.6 $48.1 $19.3-20.2

Interest expense (income), net 0.1 0.4 (0.1) 0.0 (0.0)

Income tax expense (benefit) of continuing operations 0.6 0.7 (0.2) (32.1) 10.1

Depreciation

and amortization 6.6 3.8 3.3 3.3 4.1

EBITDA from continuing operations(1) $(2.5) $7.4 $13.6 $19.4 $33.5-34.3

(1) May not add due to rounding

*All 2014 financial information is preliminary and unaudited;

see preliminary earnings release dated January 12, 2015.

NAUTILUS

BOWFLEX

Universal

SCHWINN

28