Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIVE BELOW, INC | jan122015_fivebelow8k.htm |

1 ©2014 Five Below, Inc. – Confidential©2014 Five Below, Inc. 1 Investor Presentation January 2015

2 ©2014 Five Below, Inc. – Confidential©2014 Five Below, Inc. 2 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which reflect management's current views and estimates regarding our industry, business strategy, goals and expectations concerning our market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources and other financial and operating information. Investors can identify these statements by the fact that they use words such as "anticipate," "assume," "believe," "continue," "could," "estimate," "expect," "intend," "may," "plan," "potential," "predict," "project," "future" and similar terms and phrases. We cannot assure investors that future developments affecting the Company will be those that we have anticipated. Actual results may differ materially from these expectations due to risks relating to our strategy and expansion plans, the availability of suitable new store locations, risks that consumer spending may decline and that U.S. and global macroeconomic conditions may worsen, increased competition from other retailers and the presence of online retailers, and other factors that are set forth in our SEC filings, including risk factors contained in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and current reports on Form 8-K, filed with or furnished to the Securities and Exchange Commission and available at www.sec.gov. If one or more of these risks or uncertainties materialize, or if any of our assumptions prove incorrect, our actual results may vary in material respects from those projected in these forward-looking statements. Any forward-looking statement we make in this presentation speaks only as of the date of this presentation. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for the Company to predict all of them. We undertake no obligation to publicly update or revise our forward-looking statements, whether as a result of new information, future developments or otherwise, except as may be required by applicable securities laws. Non-GAAP Financial Measures - Certain financial measures included in these presentation materials, and which may be referred to in management’s discussion of the Company’s results and outlook, have not been calculated in accordance with generally accepted accounting principles (“GAAP”), and therefore are referred to as non-GAAP financial measures. Non-GAAP financial measures should not be considered in isolation or as an alternative to such measures determined in accordance with GAAP. Please refer to the “Non-GAAP Financial Measures” and “Notes to Non-GAAP Financial Measures” at the end of these materials for a reconciliation and more information regarding limitations. Forward Looking Statements

3 ©2014 Five Below, Inc. – Confidential©2014 Five Below, Inc. 3 Introduction Company Overview and Differentiation Growth Opportunities Business and Financial Performance Agenda Presenters Joel Anderson President and CEO Ken Bull CFO Today's Agenda and Presenters

4 ©2014 Five Below, Inc. – Confidential©2014 Five Below, Inc. 4 ► Strong, diverse retail background ► Fully engaged in all aspects of the business ► Ongoing transition with Tom Vellios, Executive Chairman Priorities Joel Anderson, President and CEO ► Continue to grow our store base in new and existing markets ► Thrive as a merchandise driven company ► Win with a best in class store experience that drives customer engagement ► Build digital presence and bolster brand awareness ► Leverage infrastructure to drive margins and support scaling of the business ► Win with talent – implement programs to train and further develop talent internally Joel Anderson’s and Tom Vellios’ titles effective 1-Feb-2015. Notes:

5 ©2014 Five Below, Inc. – Confidential©2014 Five Below, Inc. 5 Name Retail Experience (1) Tenure at Five Below (1) Background Tom Vellios Executive Chairman (2) 34 13 ► President and CEO at Five Below, President, CEO and Director of Zany Brainy and Senior Vice President of Merchandising at Caldor Joel Anderson President and CEO (2) 23 < 1 ► President and CEO of Walmart.com, President at Lenox Group and various executive roles at Toys “R” Us Ken Bull Chief Financial Officer 22 9 ► Finance Director and Treasurer at Urban Outfitters and Vice President, Finance at Eagle’s Eye Eric Specter Chief Administrative Officer 31 < 1 ► EVP and CIO at Ascena Retail Group, President at Catherine’s and EVP and CFO at Charming Shoppes Michael Romanko Executive Vice President, Merchandising 30 < 1 ► Chief Design Officer at Patriarch Partners, Vice President Merchandising at Fortunoff and senior merchandising and product development positions at Linens n Things, Toys R Us and Macys Michael Pannullo Senior Vice President, Product and Business Development 19 2 ► President, U.S. Division at JM Manufacturing and senior merchandising positions at Michaels and Caldor Gene Rosadino Senior Vice President, Supply Chain 30 7 ► Vice President, Supply Chain at Blue Tulip, COO at 4R Systems and Executive Vice President, Inventory Management at Zany Brainy Larry Lombardi Senior Vice President, Stores 33 8 ► Vice President, Director of Stores at Fashion Bug David Makuen Senior Vice President, Marketing 17 3 ► Vice President, Marketing at Eddie Bauer and Vice President, Direct Marketing at Ann Taylor and LOFT Bill Clark Senior Vice President, Human Resources 15 < 1 ► Vice President, Human Resources at Dollar General and Vice President, Human Resources at Sam’s Club (1) Represents number of years. (2) Titles effective 1-Feb-2015. Strength and Depth of Management

6 ©2014 Five Below, Inc. – Confidential©2014 Five Below, Inc. 6 Our Achievements Since IPO... Financial Targets vs. Actual Performance ► 150+ new stores in existing markets and 4 new markets ► Positive comparable stores sales growth in every quarter ► Continued margin expansion despite merchandise and infrastructure investments Five-Year Target (at IPO) Avg. Annual Performance to Date Unit Growth ~20% Comp Store Sales Growth (Annual) ~4% Operating Margin ~12% Net Income CAGR 25% – 30%

7 ©2014 Five Below, Inc. – Confidential©2014 Five Below, Inc. 7 ...Support Our Long-Term Plan What We Have Learned ► Our core teen and pre-teen customers appreciate value ► Our unique store model is exportable across geographies at same or better paybacks ► Our increased scale is improving merchandising and strengthening our value proposition ► No other company has been able to replicate our model and success Where We Are Going ► Long runway for continued unit growth ► Delivering trend-right products in a differentiated store environment ► Disciplined operational investments to deliver value to our customers ► Digital presence and enhanced brand awareness ► Talent development to drive growth

8 ©2014 Five Below, Inc. – Confidential©2014 Five Below, Inc. 8 ► Post-Black Friday softness continued into early December ► Sales accelerated closer to Christmas and into post-holiday period ► Continued strong new store performance ► Well positioned to deliver on 2015 growth plans Holiday Update Holiday update based on press release dated January 8, 2015. Notes:

9 ©2014 Five Below, Inc. – Confidential©2014 Five Below, Inc. 9 Company Overview and Differentiation

10 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 10 Our Mission: The Five Below Promise

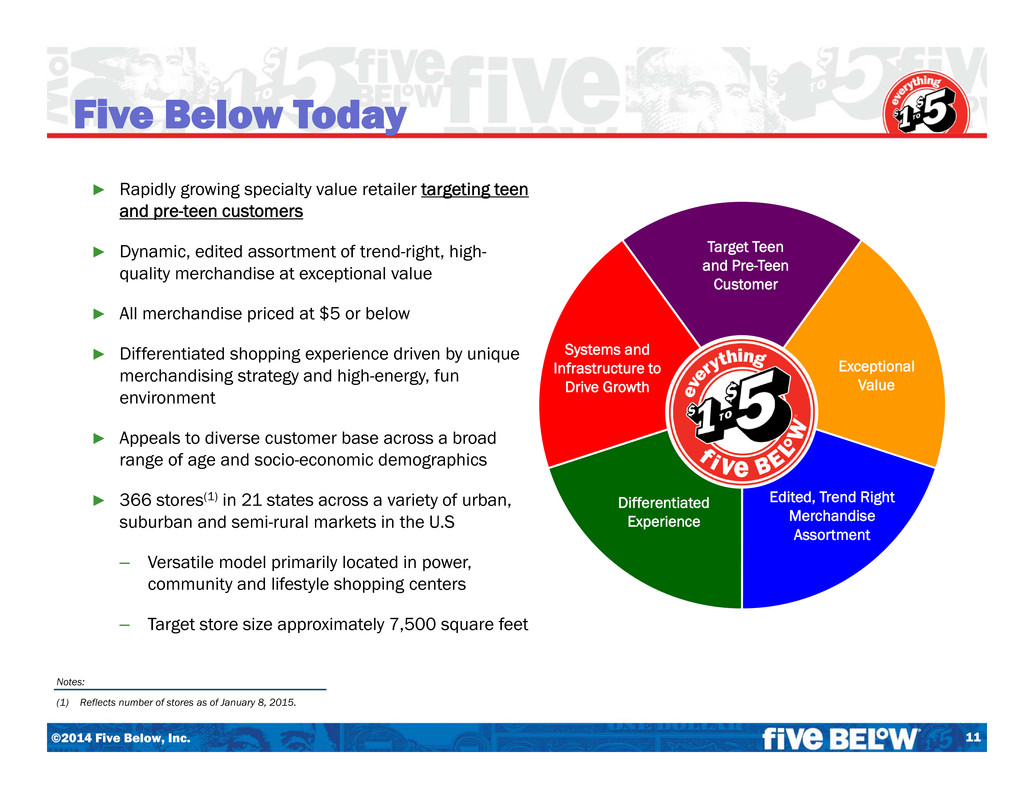

11 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 11 ► Rapidly growing specialty value retailer targeting teen and pre-teen customers ► Dynamic, edited assortment of trend-right, high- quality merchandise at exceptional value ► All merchandise priced at $5 or below ► Differentiated shopping experience driven by unique merchandising strategy and high-energy, fun environment ► Appeals to diverse customer base across a broad range of age and socio-economic demographics ► 366 stores(1) in 21 states across a variety of urban, suburban and semi-rural markets in the U.S – Versatile model primarily located in power, community and lifestyle shopping centers – Target store size approximately 7,500 square feet (1) Reflects number of stores as of January 8, 2015. Systems and Infrastructure to Drive Growth Edited, Trend Right Merchandise Assortment Differentiated Experience Exceptional Value Target Teen and Pre-Teen Customer Notes: Five Below Today

12 ©2014 Five Below, Inc. – Confidential© 014 Five B low, Inc. 12 (1) Source: U.S. Census; reflects total population between ages 5 and 19. ► Teens and pre-teens represent an attractive customer segment – Sizeable population of 62 million(1) as of 2013 ► Teens and pre-teens are underserved by value retail U.S. concepts Why Teens and Pre-Teens? ► Edited, dynamic assortment of trend-right, high- quality merchandise ► Merchandising approach and in-store environment that targets teens and pre-teens ► All products priced at $5 or below ► Our price points and merchandising approach allow teens and pre-teens to: – Shop independently – Exercise self expression ► Unique retail concept that focuses on teens and pre-teens combining the breadth of our product offering with exceptional value Our Unique Approach Focus on the Teen and Pre-Teen Customer Notes:

13 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 13 Exceptional Value with $1 to $5 Model Investment in broad, deep merchandising team Strong sourcing capabilities Focus on high velocity, high margin products Benefits of economies of scale Low-cost operating philosophy How We Deliver Value

14 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 14 Edited Assortment of Trend-Right Merchandise

15 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 15 Major Brands and Licenses to Support Trends

16 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 16 (1) Source: Third Party Research (Oct-2014); sample size of 1,444 customers (2) Represents annual income Representative Customer Demographics (1) 0 % 20 % 40 % 60 % 80 % 100 % By Gender By Age By Income (2) Male Female Adults w/ Kids 12 & Under 18-24 <$25,000 $50,001 - $75,000 $75,001 - $100,000 $100,001+ No Answer $25,000 - $50,000 Adults w/ Kids 13-17 Teens 13-17 Adults 25+ w/o Kids Broad Appeal Across Demographics Notes: Adults w/ Kids 12 & Under + 13-17

17 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 17 ► Unique and engaging in-store atmosphere ► Stores are fun and dynamic ► Consistent floor layout with easy to navigate sightlines across entire store ► Novel merchandise display techniques Differentiated Shopping Experience

18 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 18 Growth Opportunities

19 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 19 Continue to Grow Our Store Base Thrive as a Merchandise Driven Company Leverage Infrastructure to Drive Margins Build Digital Presence and Bolster Brand Awareness 1 2 3 4 Summary Growth Opportunities

20 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 20 Significant Store Growth Opportunity Ample White Space Disciplined Real Estate Strategy 67 215 366 2007 Store Count At IPO (2) Current Store Count (3) Potential (1) 2,000+► 2,000+ store potential(1) in the U.S. ► Experienced and proven real estate team with national broker network ► Impressive track record of opening new stores in new and existing markets ► Opened 50, 52, 60 and 62 net new stores in 2011, 2012, 2013 and 2014 respectively ► Plans to open ~70 new stores in 2015 (1) Based on management estimates. (2) Reflects number of stores as of IPO (July-2012). (3) Reflects number of stores as of January 8, 2015. 1 Notes: Continue to Grow Our Store Base New 2015 markets

21 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 21 ► Deep merchandising team includes two General Merchandise Managers, Head of Product Development and a new Head of Merchandising ► Leverage base of over 800 vendors ► Expanded overseas sourcing with 25% penetration in 2014 ► Increased purchasing scale and sourcing capabilities creates more "wow" and newness for the customer Thrive as a Merchandise Driven Company2

22 ©2014 Five Below, Inc. – Confidential© 014 Five B low, Inc. 22 Leverage Infrastructure to Drive Margins3 ► Our core competency ► Improved capabilities including response times ► Product development team in place Merchandising ► Distribution center in Olive Branch, Mississippi — 605,000 sq. feet — Fully operational as of 2013 ► New distribution center in New Jersey — 1,045,000 sq. feet — Expected to be fully operational in 2015 — Supports continued growth and expansion on the East Coast Supply Chain / Distribution Michael Romanko EVP, Merchandising Michael Pannullo SVP, Product and Business Development Wayne Stockton General Merchandise Manager Karen Pinney General Merchandise Manager Systems (2015+) ► Merchandise Planning System ► New ERP System

23 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 23 ► Build brand awareness with engaging digital and TV media ► Growth in social media channels with teen-centric content ► Drive traffic with large email database ► Develop ecommerce capabilities ► Current brand awareness level presents large opportunity to attract new customers to the brand Build Digital Presence and Bolster Brand Awareness4 21 % 45 % 48 % 54 % < 2 years 2 - 4 years 4 - 6 years > 6 years Five Below Avg. Brand Awareness(1) (1) Customers within 30 mile radius. Notes: Tenure in Market

24 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 24 Video

25 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 25 Business and Financial Performance

26 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 26 ► Success spans both new & existing markets ► Consistent results across vintages ► EBITDA margin > 20% ► Low capital investment and strong EBITDA yields a payback of less than one year Year 1 New Store Sales & EBITDA Dollars in thousands 2014 class average sales and EBITDA include projected data Average EBITDA Margin 24% 25% 25% 25% Compelling New Store Performance Notes: $1,869 $1,928 $1,885 $1,950 $455 $474 $473 $480 2011 2012 2013 2014E Sales EBITDA

27 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 27 27 FY 2013 AUV by State (1) (1) Represents fiscal 2013 AUV for "large stores". Includes class of 2013 AUV projections. States with fewer than 3 stores (WV) have been combined with adjacent states. For 2013 class, results include, on average, 6 months of 2014 results. Consistent Results Across States $2,068 $2,503 $1,704 $1,741 $1,961 $1,880 $1,991 $1,803 $1,823 $1,827 $1,964 $2,047 $2,179 $1,836 $1,954 $1,940 $1,917 $1,733 CT DE GA IL IN MA MD MI MO NC NH NJ NY OH PA RI TX VA/WV Stores 7 3 13 22 5 10 21 27 6 9 3 20 24 18 43 3 17 20

28 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 28 Annual 7.9% 7.1% 4.0% ~3% Positive Comps in Varied Economic Environments 7.6 % 0.7 % 7.6 % 12.1 % 10.4 % 8.6 % 8.8 % 4.4 % 4.2 % 6.6 % 9.0 % 0.3 % 6.2 % 3.2 % 1.5 % ~3 % Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4E 2011 2012 2013 2014E 35 Consecutive Quarters of Positive Comparable Store Sales Growth (Since Q2 2006)

29 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 29 Number of Stores Comparable Store Sales Net Sales Adjusted Operating Income CAGR 32 % 33 % 24 % Dollars in millions. 2014 estimated. Financial Performance Notes: 192 244 304 366 2011 2012 2013 2014E 7.9 % 7.1 % 4.0 % ~3 % 2011 2012 2013 2014E $ 297 $ 419 $ 535 $ 680 2011 2012 2013 2014E $ 33 $ 50 $ 61 $ 78 2011 2012 2013 2014E

30 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 30 30 Dollars in thousands. (1) Year one economics include results for first full 12 months (2) Excludes distribution, buying and pre-opening costs (3) Includes store build out (net of tenant allowances), inventory (net of payables) and cash pre-opening expenses Year One New Store Metrics(1) Projected New Store Model Average Store EBITDA(2) ~$350 Average Net Investment(3) ~$300 Average Return on Investment ~110% Payback Period <1 Year New Store Economics Notes: Disciplined Real Estate Strategy ► 90% of our new stores payback the investment in less than one year

31 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 31 Dollars in millions. 2014 estimated 2011 ► Business Intelligence System ► Warehouse Management System 2012 ► Human Resources Information System (phase 1) ► New Corporate Offices 2013 ► 2nd Distribution Center ► Mobile Store Systems ► Human Resources Information System (phase 2) ► Merchandise Allocation System ► IT Infrastructure Upgrades 2014 ► New and Existing Distribution Centers ► Corporate Office Expansion ► Mobile Systems Enhancements ► E-Learning / Training Program Capital Investments Over Time Notes: $ 1 $ 2 $ 3 $ 3 $ 2 $ 4 $ 3 $ 7 $ 16 $ 17 $ 20 $ 23 $ 19 $ 23 $ 26 $ 33 2011 2012 2013 2014E Corporate/IT Distribution Stores Key Implementations

32 ©2014 Five Below, Inc. – Confidential© 014 Five B low, Inc. 32 Dollars in millions. (1) Calculated as Operating Cash Flow less Capital Expenditure (2) LTM represents last twelve months ended November 1, 2014. ► Ample liquidity ► Strong free cash flow generation ► Self-funded growth ► Currently debt free Solid Balance Sheet Notes: Operating Cash Flow Free Cash Flow (1) $30 $31 $45 2012 2013 LTM² $7 $5 $16 2012 2013 LTM²

33 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 33 Unique Approach to Targeting the Teen and Pre-Teen Customer Edited Assortment of Trend-Right, High-Quality Merchandise Drives Universal Appeal Exceptional Value Proposition for Customers with $1 to $5 Model Differentiated Shopping Experience Long Runway for Store Growth with Compelling and Consistent Store Economics Experienced and Passionate Senior Management Team with Proven Track Record Summary

34 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 34 Financial Appendix

35 ©2014 Five Below, Inc. – Confidential©2014 Five B low, Inc. 35 Non-GAAP Reconciliation FY 2011 FY 2012 FY 2013 FY 2014E Net Income $ 16.1 $ 20.0 $ 32.1 $ 47.7 Interest / Other Expense (Income)(1) (0.0) 3.6 1.8 0.4 Income Tax Expense 10.2 14.1 19.8 28.9 Operating Income $ 26.2 $ 37.7 $ 53.7 $ 77.0 Expenses Related to Advent Transaction: Founders’ Option / Stock Grant(2) 6.8 10.8 6.1 0.9 Secondary Public Offering Fees 0.0 1.0 1.0 0.0 Total Adjustments $ 6.8 $ 11.8 $ 7.1 $ 0.9 Adjusted Operating Income $ 33.0 $ 49.5 $ 60.8 $ 77.8 Dollars in millions. Components may not add up to total due to rounding. (1) Includes loss or gain on debt extinguishment. (2) Reflects expenses related to stock option grant to founders (as part of Advent transaction) and the conversion of the options into restricted stock in Q1 2012 ahead of IPO. Notes: