Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DUNKIN' BRANDS GROUP, INC. | a8kicr2015.htm |

| EX-99.1 - PRESS RELEASE - DUNKIN' BRANDS GROUP, INC. | janrelease.htm |

Investor Presentation Dunkin’ Brands Group, Inc. 1 ICR XChange Nigel Travis, Chairman & CEO January 12, 2015

Forward-Looking Statements • Certain information contained in this presentation, particularly information regarding future economic performance, finances, and expectations and objectives of management constitutes forward-looking statements. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and are generally contain words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates” or “anticipates” or similar expressions. Our forward-looking statements are subject to risks and uncertainties, which may cause actual results to differ materially from those projected or implied by the forward-looking statement. • Forward-looking statements are based on current expectations and assumptions and currently available data and are neither predictions nor guarantees of future events or performance. You should not place undue reliance on forward-looking statements, which speak only as of the date hereof. We do not undertake to update or revise any forward-looking statements after they are made, whether as a result of new information, future events, or otherwise, except as required by applicable law. For discussion of some of the important factors that could cause these variations, please consult the “Risk Factors” section of the Company’s most recent Annual Report on Form 10-K. Nothing in this presentation should be regarded as a representation by any person that these targets will be achieved and the Company undertakes no duty to update its targets. • Regulation G This presentation contains certain non-GAAP measures which are provided to assist in an understanding of the Dunkin’ Brands Group, Inc. business and its performance. These measure should always be considered in conjunction with the appropriate GAAP measure. Reconciliations of non-GAAP amounts to the relevant GAAP amount are available on www.investor.dunkinbrands.com. 2

3 YEARS OF BRAND HERITAGE SIGNIFICANT U.S. & GLOBAL GROWTH OPPORTUNITY ASSET-LIGHT, NEARLY 60+ 100% FRANCHISED BUSINESS Franchised business model generates strong free cash flow and provides platform for low capital growth

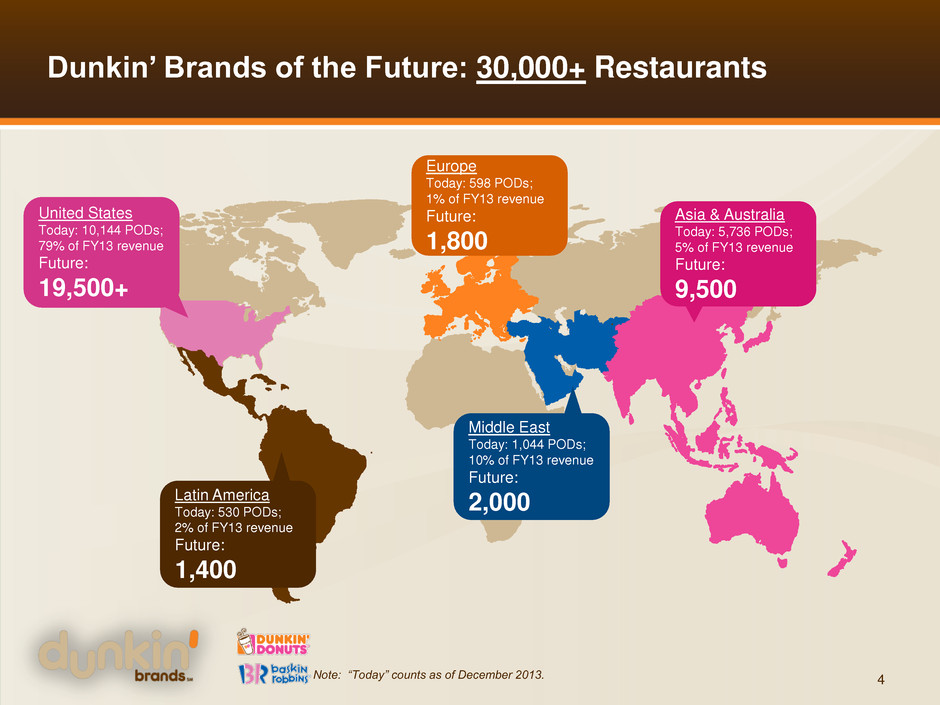

4 Dunkin’ Brands of the Future: 30,000+ Restaurants United States Today: 10,144 PODs; 79% of FY13 revenue Future: 19,500+ Latin America Today: 530 PODs; 2% of FY13 revenue Future: 1,400 Europe Today: 598 PODs; 1% of FY13 revenue Future: 1,800 Asia & Australia Today: 5,736 PODs; 5% of FY13 revenue Future: 9,500 Middle East Today: 1,044 PODs; 10% of FY13 revenue Future: 2,000 Note: “Today” counts as of December 2013.

Driving growth in 2015 and beyond Drive beverage category growth Expand global consumer engagement efforts in mobile, loyalty and social media 1 2 3 4 5 5 Enhance guest experience in all regions Intensify focus in high potential markets in U.S. and globally (California, Europe, Middle East, China) Continue to implement sustainability plan Franchisee economics is underlying priority

Focused growth strategies across each segment 6 INCREASE COMPARABLE STORE SALES AND PROFITABILITY IN DD U.S. INCREASE COMPARABLE STORE SALES AND DRIVE STORE GROWTH FOR BR U.S. CONTINUE DD U.S. CONTIGUOUS STORE EXPANSION DRIVE ACCELERATED INTERNATIONAL GROWTH ACROSS BOTH BRANDS

7 INCREASE COMPARABLE STORE SALES AND PROFITABILITY IN DD U.S.

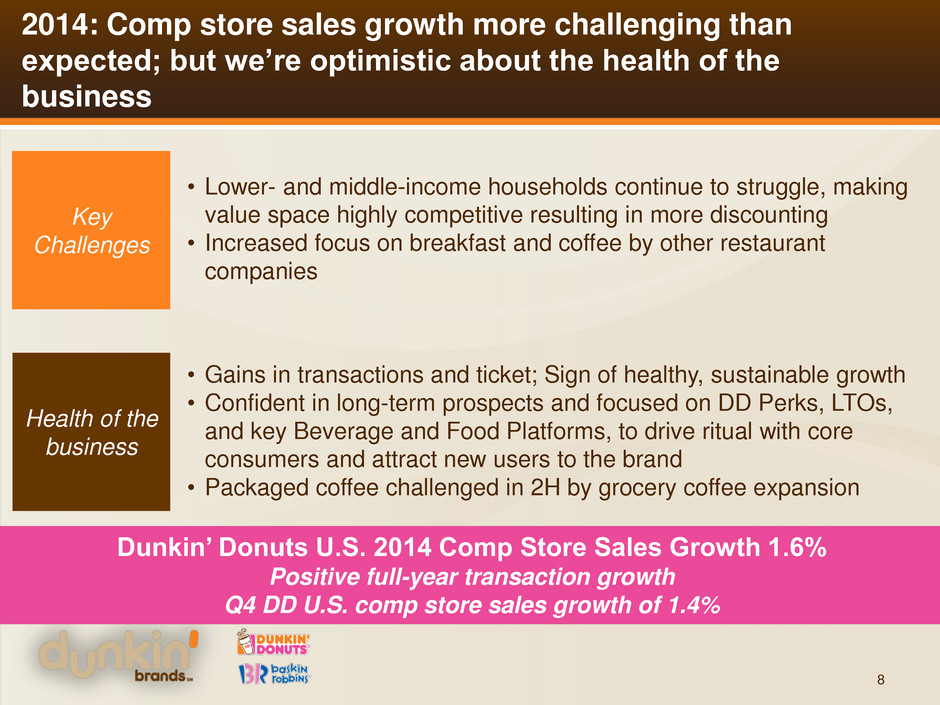

2014: Comp store sales growth more challenging than expected; but we’re optimistic about the health of the business • Lower- and middle-income households continue to struggle, making value space highly competitive resulting in more discounting • Increased focus on breakfast and coffee by other restaurant companies • Gains in transactions and ticket; Sign of healthy, sustainable growth • Confident in long-term prospects and focused on DD Perks, LTOs, and key Beverage and Food Platforms, to drive ritual with core consumers and attract new users to the brand • Packaged coffee challenged in 2H by grocery coffee expansion Key Challenges Health of the business 8 Dunkin’ Donuts U.S. 2014 Comp Store Sales Growth 1.6% Positive full-year transaction growth Q4 DD U.S. comp store sales growth of 1.4%

LTOs 2015 Product Strategy focused on Platforms and Limited Time Offers 9 Strengthen core menu with platform enhancements and bring regular news with LTOs Balance of Platforms and LTOs enables efficient and effective advertising and reduces menu complexity More robust coffee news; building on Iced Coffee leadership with exciting flavors nobody else can do; expanding frozen beverage line-up Platforms

Differentiated Product Innovation across categories Dunkin’ introduced 40+ products in 2014 10

Using Digital to Drive Our Comps Over 10 million app downloads including mobile payments Launched DD Perks Rewards Program nationally in 2014 – now more than 2M members 11 First steps in building comprehensive 1:1 marketing platform

12 CONTINUE DD U.S. CONTIGUOUS STORE EXPANSION

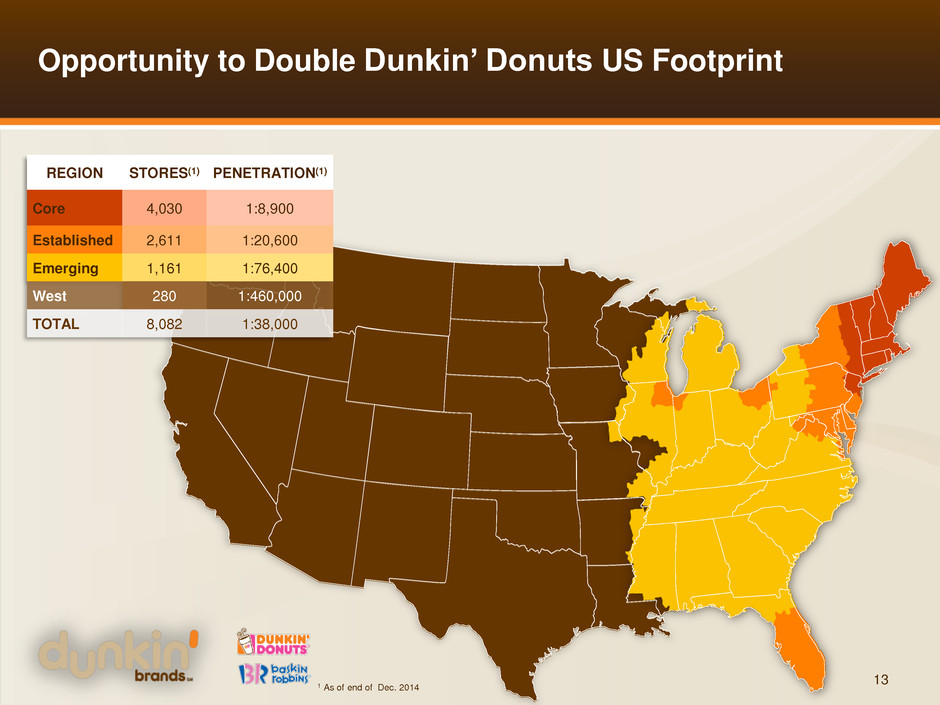

Opportunity to Double Dunkin’ Donuts US Footprint 13 REGION STORES(1) PENETRATION(1) Core 4,030 1:8,900 Established 2,611 1:20,600 Emerging 1,161 1:76,400 West 280 1:460,000 TOTAL 8,082 1:38,000 1 As of end of Dec. 2014

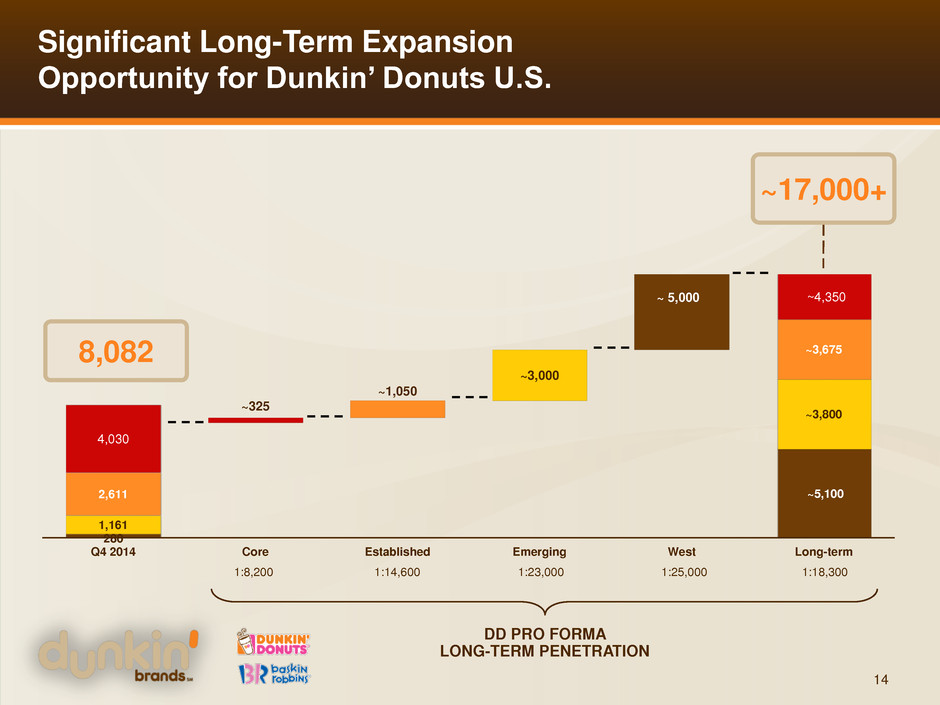

14 DD PRO FORMA LONG-TERM PENETRATION 280 ~5,100 1,161 ~3,800 2,611 ~3,675 4,030 ~4,350 ~325 ~1,050 ~3,000 ~ 5,000 Q4 2014 Core Established Emerging West Long-term 8,082 Significant Long-Term Expansion Opportunity for Dunkin’ Donuts U.S. ~17,000+ 1:8,200 1:14,600 1:23,000 1:25,000 1:18,300

Compelling unit economics driving accelerated growth 15 2013 COHORT STORE-LEVEL ECONOMICS – TRADITIONAL STORES AVERAGE UNIT VOLUMES $936,000 CASH-ON-CASH RETURNS 25%+ AVERAGE INITIAL CAPEX $450,000 As of 3/1/2014 Standalone, Traditional Dunkin Donuts Restaurants only 2013 data is projected based on partial year results

Successful debut in California 16 MODESTO SANTA MONICA CAMP PENDLETON EMBASSY SUITES SAN DIEGO BARSTOW STATION DOWNEY LONG BEACH WHITTIER Development ahead of schedule…5 traditional locations open; 4 with drive-thrus

Proven Track Record of Accelerating Growth 17 2009 2010 2011 2012 2013 2014 2015E 171 206 243 291 371 410 - 440 DUNKIN’ DONUTS U.S. NET DEVELOPMENT 405

18 DRIVE ACCELERATED INTERNATIONAL GROWTH ACROSS BOTH BRANDS

Targeting International Growth in Highest AWS/Profit Opportunity Markets 19 SIGNED LARGEST DEVELOPMENT AGREEMENT IN COMPANY HISTORY IN CHINA FOR 1,400 DUNKIN’ DONUTS RESTAURANTS SIGNED RESTAURANT DEVELOPMENT AGREEMENT WITH STRONG U.S. FRANCHISEE FOR 100 DUNKIN’ DONUTS RESTAURANTS IN MEXICO STRONG DUNKIN’ DONUTS EUROPE OPENINGS MIDDLE EAST IS A POWERHOUSE FOR BOTH BRANDS DUNKIN’ DONUTS SUPPLY CHAIN IMPROVEMENTS SUPPORTING FRNACHISEE ECONOMICS EXCELLENT NEW BR FRANCHISEES IN SOUTHEAST ASIA; RETOOLING ON TRACK IN AUSTRALIA Added 282 net new Dunkin’ Donuts and Baskin-Robbins internationally in 2014

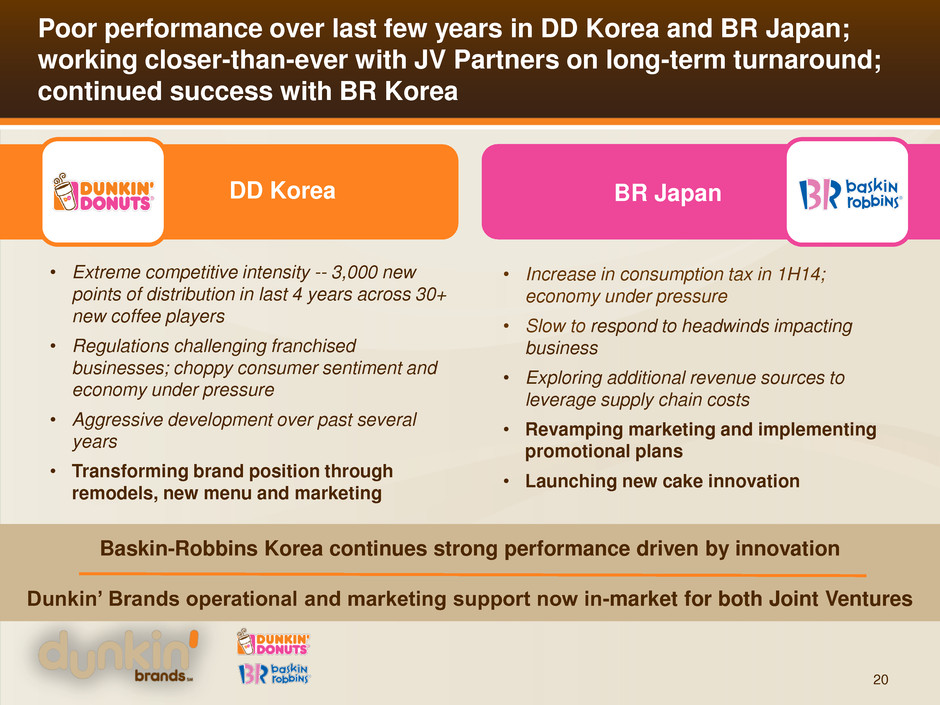

Poor performance over last few years in DD Korea and BR Japan; working closer-than-ever with JV Partners on long-term turnaround; continued success with BR Korea DD Korea BR Japan • Extreme competitive intensity -- 3,000 new points of distribution in last 4 years across 30+ new coffee players • Regulations challenging franchised businesses; choppy consumer sentiment and economy under pressure • Aggressive development over past several years • Transforming brand position through remodels, new menu and marketing • Increase in consumption tax in 1H14; economy under pressure • Slow to respond to headwinds impacting business • Exploring additional revenue sources to leverage supply chain costs • Revamping marketing and implementing promotional plans • Launching new cake innovation Baskin-Robbins Korea continues strong performance driven by innovation Dunkin’ Brands operational and marketing support now in-market for both Joint Ventures 20

21 INCREASE COMPARABLE STORE SALES AND DRIVE STORE GROWTH FOR BR U.S.

Returning Baskin-Robbins U.S. to Growth Restaurant base optimization complete Improving unit economics Attractive franchising offers 22 Opened 17 net new restaurants in 2014 Expecting 5 to 10 net new restaurants in 2015 Growing with top- performing franchisees Growing brand advertising fund Driving topline sales with technology Expecting 1–3% comp store sales growth in 2015 4.7% comp store sales growth in 2014 (Q4 comps 9.3%)

Franchisee-Model Enables Leveraged Capital Structure and Financial Flexibility 23 DELEVERAGE EBITDA growth & required amortization payments SHARE REPURCHASE Offset dilution from exercising of stock options & other opportunistic repurchases DIVIDENDS Raised quarterly dividend from $0.19 in 2013 to $0.23 in Q1 2014 4.9 4.6 4.4 4.2 4.1 5.2 5.2 4.9 5.0 4.8 4.5 4.6 4.6 4.5 UPSIZED TERM LOAN IN AUGUST 2012 $750M Returned to Shareholders since IPO RECENTLY ANNOUNCED INTENT TO SEEK REFINANCING OF EXISTING LONG-TERM DEBT THROUGH SECURITIZATION

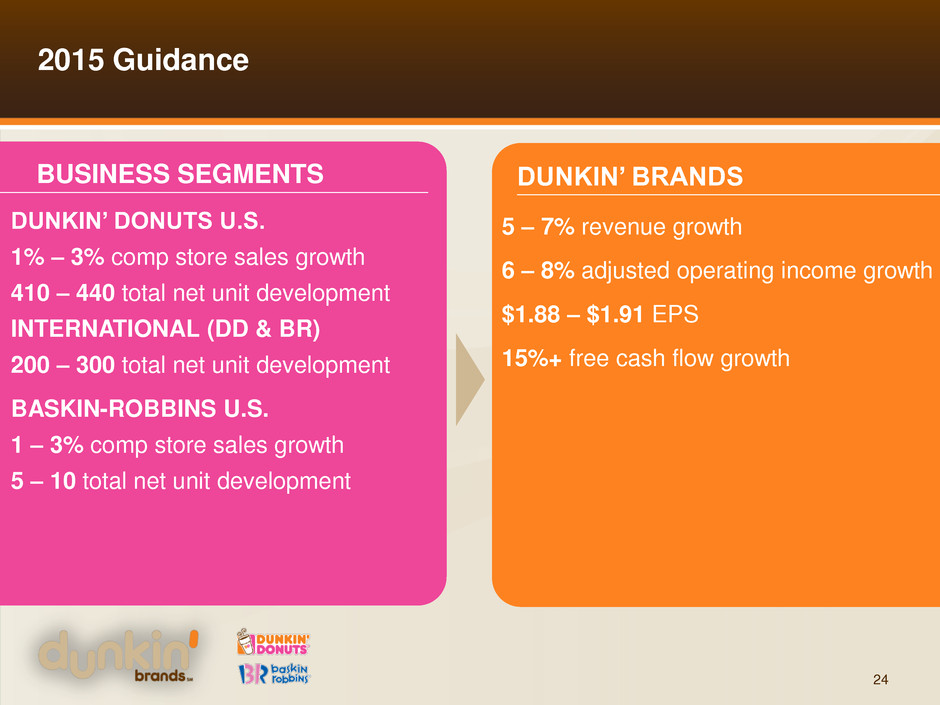

2015 Guidance 24 DUNKIN’ DONUTS U.S. 1% – 3% comp store sales growth 410 – 440 total net unit development INTERNATIONAL (DD & BR) 200 – 300 total net unit development BASKIN-ROBBINS U.S. 1 – 3% comp store sales growth 5 – 10 total net unit development BUSINESS SEGMENTS DUNKIN’ BRANDS 5 – 7% revenue growth 6 – 8% adjusted operating income growth $1.88 – $1.91 EPS 15%+ free cash flow growth

Summary • Disappointing Dunkin’ Donuts U.S. comp stores sales growth but building on lessons from 2014 • Intend to return to DD U.S. comps of 3 – 4% in coming years • Strong 2014 Dunkin’ Donuts U.S. restaurant growth; continued robust restaurant expansion in 2015 • Spectacular 2014 Baskin-Robbins performance – will continue to grow at modest pace • Continued intense focus on changing the trajectory of Baskin- Robbins Japan • International moving forward; growing with larger, more experienced partners • Looking to further de-risk business model with intent to seek fixed-rate debt through securitization 25

26