Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CHUY'S HOLDINGS, INC. | a8-kxjanuary2015announceme.htm |

| EX-99.2 - PRESS RELEASE DATED JANUARY 12, 2015 - CHUY'S HOLDINGS, INC. | exhibit992-pressreleasejan.htm |

Company Presentation ICR XChange 2015

2 Cautionary Statements Forward‐Looking Statements This presentation may include forward‐looking statements. These statements reflect the current views of the Company’s senior management with respect to future events and financial performance. These statements include forward‐looking statements with respect to the Company’s business and industry in general. Statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “forecast,” “estimate,” “may,” “should,” “anticipate” and similar statements of a future or forward‐looking nature identify forward‐ looking statements for purposes of the federal securities laws or otherwise. Forward‐looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause the Company’s actual results to differ materially from those indicated in these statements. The statements made herein speak only as of the date of this presentation. Non‐GAAP Financial Measures This presentation contains certain non‐GAAP financial measures. A “non‐GAAP financial measure” is defined as a numerical measure of a company’s financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with GAAP in the statements of income, balance sheets or statements of cash flow of the company. The Company has provided a reconciliation of non‐GAAP financial measures to the most directly comparable financial measure in the Appendix to this presentation. The non‐GAAP financial measures used within this presentation are Adjusted EBITDA and Restaurant‐Level EBITDA. These measures are presented because management uses this information to monitor and evaluate financial results and trends and believes this information to also be useful for investors. For additional information about our non‐GAAP financial measures, see our earnings releases and filings with the Securities and Exchange Commission.

3 Senior Management Presenters Steve Hislop President and Chief Executive Officer Jon Howie Vice President and Chief Financial Officer

4 “If you’ve seen one Chuy’s, you’ve seen one Chuy’s!” Leave the cookie cutters to the other guys. Each Chuy’s has genuine character: a noisy, sprawling Tex Mex hacienda full of feel‐good drinks and home‐cooked foods. Chuy’s is Tex Mex Unchained!

5 Chuy’s Highlights Considerable Dining Value with Broad Customer Appeal Flexible Business Model with Industry Leading Unit Economics Deep Rooted and Inspiring Company Culture Upbeat Atmosphere Coupled with Irreverent Brand Helps Differentiate Concept Highly Experienced Management Team Fresh, Authentic Mexican and Tex Mex Inspired Cuisine

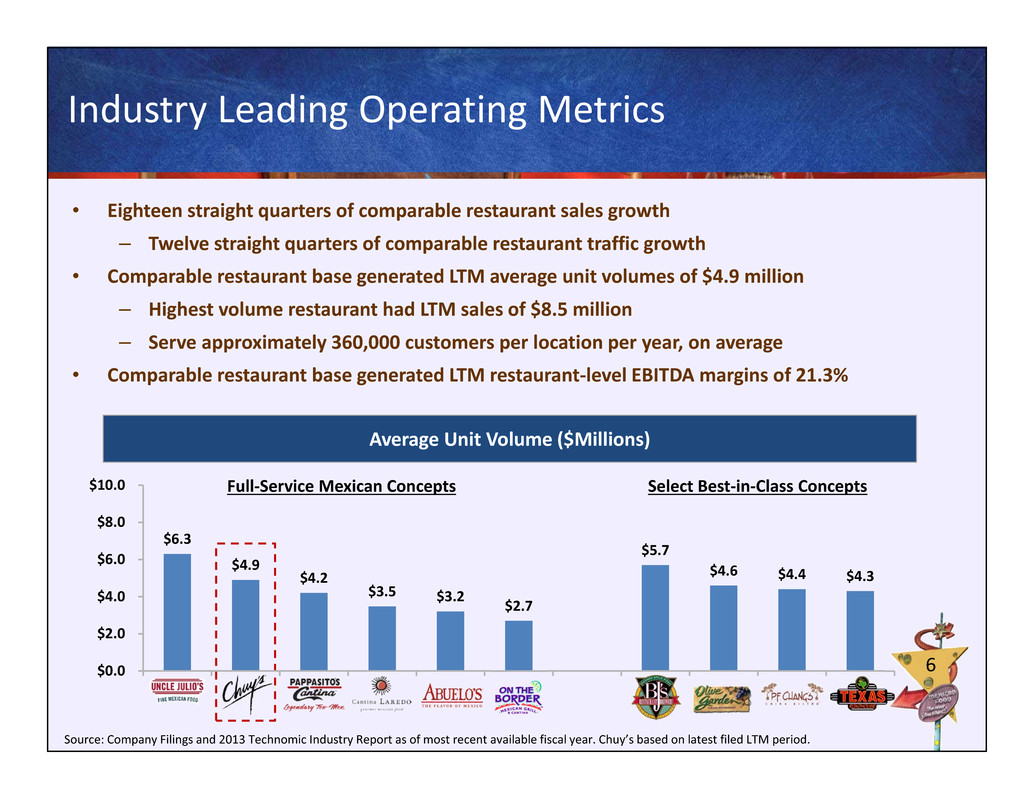

6 Industry Leading Operating Metrics • Eighteen straight quarters of comparable restaurant sales growth – Twelve straight quarters of comparable restaurant traffic growth • Comparable restaurant base generated LTM average unit volumes of $4.9 million – Highest volume restaurant had LTM sales of $8.5 million – Serve approximately 360,000 customers per location per year, on average • Comparable restaurant base generated LTM restaurant‐level EBITDA margins of 21.3% Source: Company Filings and 2013 Technomic Industry Report as of most recent available fiscal year. Chuy’s based on latest filed LTM period. Average Unit Volume ($Millions) $6.3 $4.9 $4.2 $3.5 $3.2 $2.7 $5.7 $4.6 $4.4 $4.3 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 Full‐Service Mexican Concepts Select Best‐in‐Class Concepts

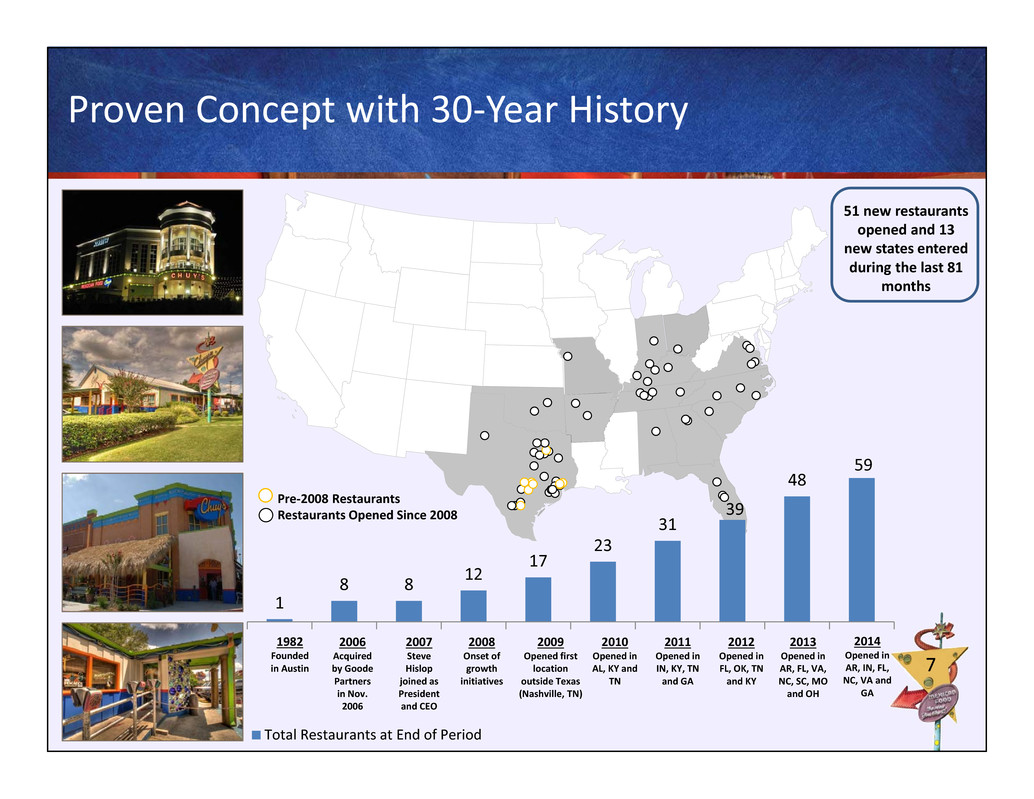

7 Proven Concept with 30‐Year History 51 new restaurants opened and 13 new states entered during the last 81 months Pre‐2008 Restaurants Restaurants Opened Since 2008 1982 Founded in Austin 2006 Acquired by Goode Partners in Nov. 2006 2008 Onset of growth initiatives 2009 Opened first location outside Texas (Nashville, TN) 2010 Opened in AL, KY and TN 2011 Opened in IN, KY, TN and GA 2007 Steve Hislop joined as President and CEO 2013 Opened in AR, FL, VA, NC, SC, MO and OH 2012 Opened in FL, OK, TN and KY 1 8 8 12 17 23 31 39 48 Total Restaurants at End of Period 59 2014 Opened in AR, IN, FL, NC, VA and GA

8 Fresh, Authentic Mexican Cuisine • Offer authentic Mexican food using only the freshest ingredients • Recipes and cooking techniques originated from friends and family of our founders, who are from Mexico, New Mexico and Texas • Commitment to made‐from‐scratch, freshly prepared cooking • Generous portions support value priced offering • Customizable food offering is core to the Chuy’s concept

9 We Take One Thing Seriously: Our Food! Homemade Sauces Tex Mex Ranchero Hatch Green Chile Green Chile Tomatillo Deluxe Tomatillo Creamy Jalapeno “Big As Yo’ Face” Burritos • A homemade, 12” flour tortilla stuffed with refried beans, cheese and choice of beef or chicken. Served with choice of sauce & choice of Mexican or green chile rice • Price: $8.29 ‐ $9.99 Chicka‐Chicka Boom‐Boom • Freshly‐roasted, hand‐pulled chicken & cheese with Boom‐ Boom sauce, made with cheese, roasted New Mexican green chiles, tomatillos, green onions, cilantro and lime juice. Served with choice of Mexican or green chile rice & refried or charro beans • Price: $10.29 Texas Martini • Served “shaken, not stirred,” this south‐of‐the‐border martini features tequila, Patrón Citrónge, fresh lime juice and a jalapeño‐stuffed olive • Three drinks for the price of one • Price: $8.50 Note: Prices above represent menu prices in Texas and Oklahoma as of December 28 2014, which may vary from prices in other states.

10 Exceptional Dining Value $12.44 $13.64 $14.00 $15.80 $16.50 $19.70 $20.32 $20.50 $24.39 $24.87 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 Source: Company filings as of most recent available fiscal year end and equity research. Chuy’s based on latest filed LTM period. (1) Applies to our tier 1 menu as of December 28, 2014 which is in place at 30 of our 59 restaurants as of that date. Average Check • Significant value proposition to customers • Only 5 out of 49 menu items priced over $10.00(1) • Average check of $13.64

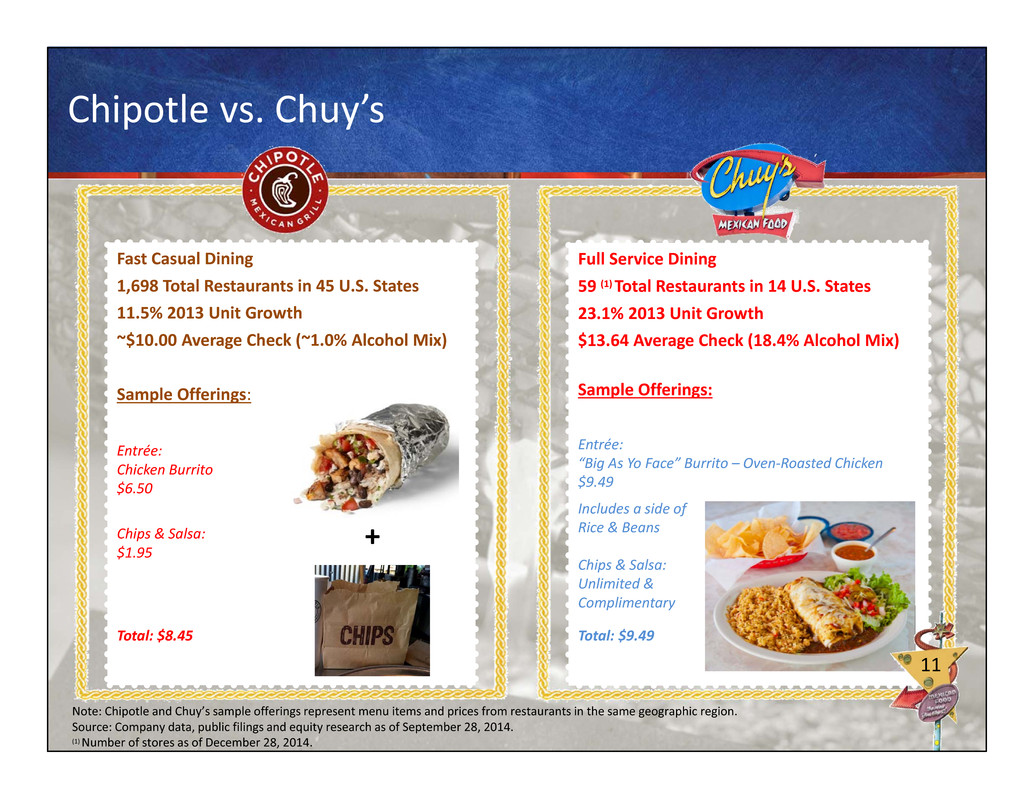

11 Full Service Dining 59 (1) Total Restaurants in 14 U.S. States 23.1% 2013 Unit Growth $13.64 Average Check (18.4% Alcohol Mix) Sample Offerings: Entrée: “Big As Yo Face” Burrito – Oven‐Roasted Chicken $9.49 Includes a side of Rice & Beans Chips & Salsa: Unlimited & Complimentary Total: $9.49 Chipotle vs. Chuy’s Fast Casual Dining 1,698 Total Restaurants in 45 U.S. States 11.5% 2013 Unit Growth ~$10.00 Average Check (~1.0% Alcohol Mix) Sample Offerings: Entrée: Chicken Burrito $6.50 Chips & Salsa: $1.95 Total: $8.45 + Note: Chipotle and Chuy’s sample offerings represent menu items and prices from restaurants in the same geographic region. Source: Company data, public filings and equity research as of September 28, 2014. (1) Number of stores as of December 28, 2014.

12 Upbeat Atmosphere and Appealing, Irreverent Brand

13 Growth Opportunities

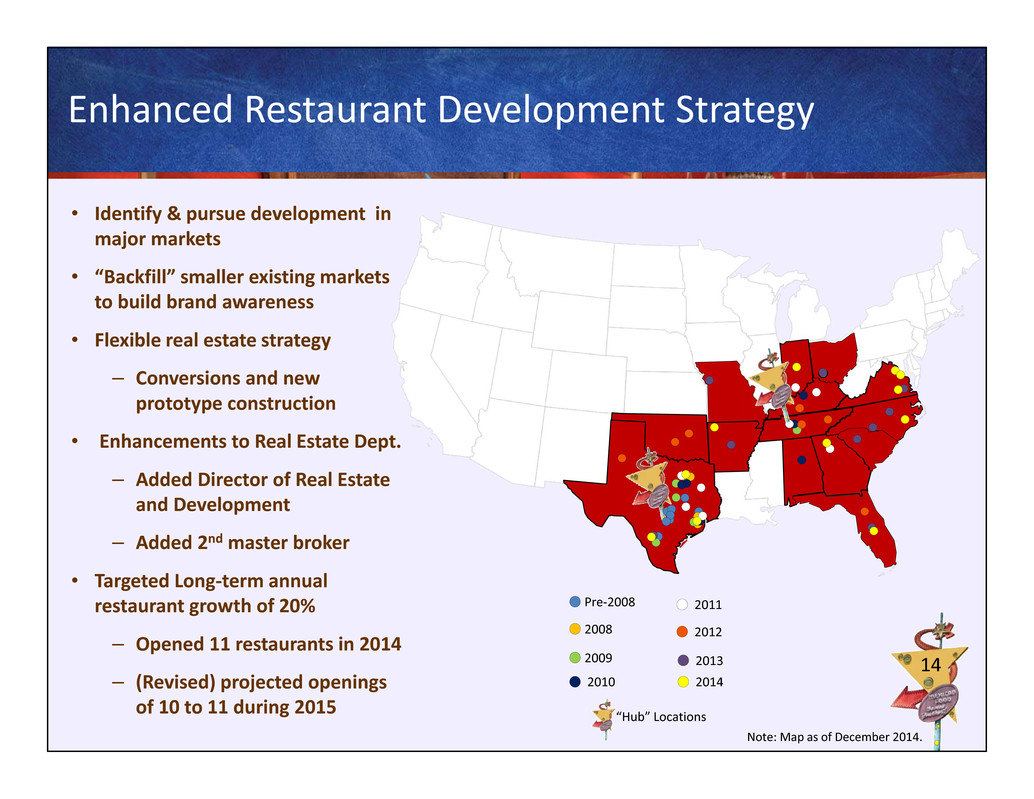

14 Enhanced Restaurant Development Strategy “Hub” Locations • Identify & pursue development in major markets • “Backfill” smaller existing markets to build brand awareness • Flexible real estate strategy – Conversions and new prototype construction • Enhancements to Real Estate Dept. – Added Director of Real Estate and Development – Added 2nd master broker • Targeted Long‐term annual restaurant growth of 20% – Opened 11 restaurants in 2014 – (Revised) projected openings of 10 to 11 during 2015 Pre‐2008 2008 2009 2010 2011 2012 2013 Note: Map as of December 2014. 2014

15 Initiatives to Build Margins Sales Growth Local Store Marketing (LSM) – New menu covers – Media – T.V. Demo’s – Events/ Program events Cost of Goods Sold – Seven day production sheets – Rolling ordering guides Labor Efficiencies – Base Productivity Standardization – Labor scheduling best practices – Number of manager rationalization based upon volumes Execution

16 Industry Leading New Unit Economics • Targeted cash‐on‐cash return beginning in the third operating year of ~30.0% and a sales to investment ratio of 1.9x. Source: Public filings and equity research estimates. Note: Cash‐on‐Cash Return defined as Restaurant‐Level EBITDA divided by Net Cash Investment excluding Pre‐Opening Expense. (1) Represents targeted Year 1 Average Unit Volume. (2) Represents Average cash investment based on historical new restaurant openings less land lord allowances and excludes preopening expenses. (3) Estimated as Average Unit Volume divided by FY 2013 Average Check. (4) Represents targeted Year 1 Sales: Investment Ratio. (5) Represents targeted Year 3 Cash‐on‐Cash Return. (6) Represents targeted cash investment less land lord allowance s and excludes preopening expenses. (7) Based on actual data per most recent filing. New Unit Economics ($000s) LTM Comparable Restaurants Blended Target Actual(7) Target Actual(7) Target Target Target Target Average Unit Volume $4,896 $3,750(1) $4,194 $6,000 $3,000 $1,800 $1,300 $1,500 $2,200 Restaurant‐Level EBITDA 1,043 746 1,170 600 526 225 225 413 % Margin 21.3% 15.0% ‐ 16.5% 17.8% 19.5% 20.0% 18.9% 17.3% 15.0% 18.8% Average Cash Investment $1,800(2) $2,000(6) 2,495 $4,500 $2,200 $1,400 $750 $750 $1,650 Customers Served Per Year(3) ~360,000 ‐‐ ‐‐ ‐‐ ‐‐ ‐‐ ‐‐ ‐‐ Sales to Investment Ratio 1.9x(4) 1.7x 1.3x 1.4x 1.3x 1.7x 2.0x 1.3x Cash‐on‐Cash Return ~30%(5) 29.9% ~27.5% 27.3% 25.0%+ 30.0%+ 30.0%+ 25.0%+ Casual Dining Fast Casual

17 Financial Summary

18 Eighteen Straight Quarters of Comparable Restaurant Sales Growth 0.1% 2.0% 1.4% 2.0% 2.0% 0.6% 1.1% 0.8% 0.3% 1.3% 0.0% 1.0% 2.0% 3.0% 2010 2011 2012 2013 2014 Traffic Check Number of Comparable Restaurants 18 2413 Chuy’s SSS 0.7% 3.1% 2.2% (1) 32 41 2.3% 3.3% KNAPP‐TRACK SSS (0.6%) 1.5% 0.6% (1.4%) Note: KNAPP‐TRACK is a monthly sales and guest count tracking service for the full service restaurant market in the United States. Source: KNAPP‐TRACK and Company data. (1) Adjusted to remove impact of the 53rd week and extra 1.5 operating days in fiscal 2012. (2) Based on preliminary KNAPP‐TRACK monthly data (0.2%) Comparable Sales Growth (2)

19 Demonstrated Revenue and Unit Growth $69.4 $94.9 $130.6 $172.6 $204.4 $245.1 $0.0 $40.0 $80.0 $120.0 $160.0 $200.0 $240.0 2009 2010 2011 2012 2013 2014 17 23 31 39 48 59 0 10 20 30 40 50 60 2009 2010 2011 2012 2013 2014 Revenue ($Millions) Total Restaurants

20 27.8% 26.2% 27.0% 27.7% 26.9% 27.4% 27.4% 28.2% 20.0% 22.5% 25.0% 27.5% 30.0% 2008 2009 2010 2011 2012 2013 YTD Q3 2013 YTD Q3 2014 Consistent Cost of Sales Management Cost of Sales (% of Revenue) 25.3% 14.7% 14.5% 14.9% 11.8% 18.7% Groceries Produce Beef Dairy Chicken Bar & Other Commodity Basket %’s

21 $10.9 $14.7 $18.3 $25.0 $34.8 $39.1 $30.1 $32.9 20.9% 21.2% 19.3% 19.2% 20.2% 19.1% 19.6% 17.9% 0.0% 15.0% 30.0% 45.0% 60.0% 75.0% $0.0 $10.0 $20.0 $30.0 $40.0 2008 2009 2010 2011 2012 2013 YTD Q3 2013 YTD Q3 2014 Restaurant‐Level EBITDA % Margin $7.3 $10.3 $13.4 $18.9 $25.5 $29.1 $22.4 $24.2 $0.0 $10.0 $20.0 $30.0 2008 2009 2010 2011 2012 2013 YTD Q3 2013 YTD Q3 2014 Increasing Restaurant‐Level and Adjusted EBITDA Restaurant‐Level EBITDA ($Millions) Adjusted EBITDA ($Millions) Total Restaurants: 12 Note: Restaurant‐Level EBITDA represents net income plus the sum of general and administrative expenses, the advisory agreement termination fee, the settlement with our former director, offering costs, restaurant pre‐ opening costs, depreciation and amortization, interest and taxes. Note: Adjusted EBITDA represents net income before interest, taxes, depreciation and amortization plus the sum of restaurant pre‐opening costs, deferred compensation, the advisory agreement termination fee, the settlement with our former director, offering costs, management fees and expenses and special one‐time bonus payment. 17 23 31 39 48 46 58

22 Appendix

23 Adjusted EBITDA Reconciliation Adjusted EBITDA Reconciliation FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 YTD Q3 2013 YTD Q3 2014 LTM Q3 2014 Net Income 0.2$ 2.7$ 3.3$ 3.5$ 5.5$ 11.1$ 8.6$ 9.2$ 11.7$ Income Tax provision (benefit) (0.1) 1.1 1.4 1.6 2.2 4.2 3.4 3.7 4.5 Interest Expense 2.8 3.1 3.6 4.4 5.6 0.1 0.1 0.1 0.1 Depreciation and Amortization 0.8 1.5 2.7 4.4 6.5 8.9 6.4 7.4 9.9 EBITDA 3.6$ 8.4$ 11.0$ 13.9$ 19.8$ 24.3$ 18.5$ 20.4$ 26.2$ Deferred Compensation 2.4 (0.1) ‐ ‐ ‐ ‐ ‐ ‐ ‐ Management Fees & Expenses 0.4 0.4 0.4 0.4 0.1 ‐ ‐ ‐ ‐ Advisory Agreement Termination ‐ ‐ ‐ ‐ 2.0 ‐ ‐ ‐ ‐ Offering Costs ‐ ‐ ‐ ‐ 0.2 0.9 0.9 ‐ ‐ Settlement with Former Director ‐ ‐ ‐ 0.2 ‐ ‐ ‐ ‐ ‐ Restaurant Pre‐opening 0.9 1.7 2.0 3.4 3.4 3.9 3.0 3.8 4.7 Special one‐time bonus payment ‐ ‐ ‐ 1.0 ‐ ‐ ‐ ‐ ‐ Adjusted EBITDA 7.3$ 10.3$ 13.4$ 18.9$ 25.5$ 29.1$ 22.4$ 24.2$ 30.9$

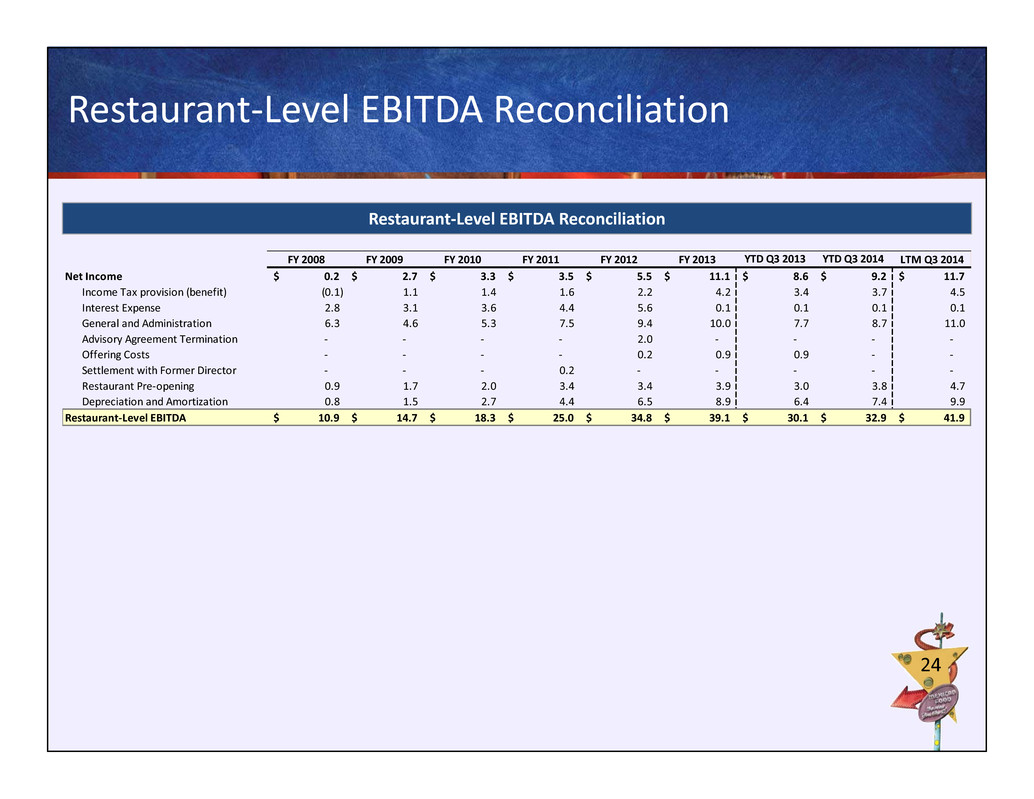

24 Restaurant‐Level EBITDA Reconciliation Restaurant‐Level EBITDA Reconciliation FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 YTD Q3 2013 YTD Q3 2014 LTM Q3 2014 Net Income 0.2$ 2.7$ 3.3$ 3.5$ 5.5$ 11.1$ 8.6$ 9.2$ 11.7$ Income Tax provision (benefit) (0.1) 1.1 1.4 1.6 2.2 4.2 3.4 3.7 4.5 Interest Expense 2.8 3.1 3.6 4.4 5.6 0.1 0.1 0.1 0.1 General and Administration 6.3 4.6 5.3 7.5 9.4 10.0 7.7 8.7 11.0 Advisory Agreement Termination ‐ ‐ ‐ ‐ 2.0 ‐ ‐ ‐ ‐ Offering Costs ‐ ‐ ‐ ‐ 0.2 0.9 0.9 ‐ ‐ Settlement with Former Director ‐ ‐ ‐ 0.2 ‐ ‐ ‐ ‐ ‐ Restaurant Pre‐opening 0.9 1.7 2.0 3.4 3.4 3.9 3.0 3.8 4.7 Depreciation and Amortization 0.8 1.5 2.7 4.4 6.5 8.9 6.4 7.4 9.9 Restaurant‐Level EBITDA 10.9$ 14.7$ 18.3$ 25.0$ 34.8$ 39.1$ 30.1$ 32.9$ 41.9$