Attached files

| file | filename |

|---|---|

| 8-K - BIOTIME, INC 8-K 1-12-2015 - Lineage Cell Therapeutics, Inc. | form8k.htm |

EXHIBIT 99.1

Regenerative Medicine Through PluripotencyNYSE MKT: BTX January, 2015

Safe Harbor Statement 2 The matters discussed in this presentation include forward looking statements which are subject to various risks, uncertainties, and other factors that could cause actual results to differ materially from the results anticipated. Such risks and uncertainties include but are not limited to the success of BioTime in developing new stem cell products and technologies; results of clinical trials of BioTime products; the ability of BioTime and its licensees to obtain additional FDA and foreign regulatory approval to market BioTime products; competition from products manufactured and sold or being developed by other companies; the price of and demand for BioTime products; and the ability of BioTime to raise the capital needed to finance its current and planned operations. Any statements that are not historical fact (including, but not limited to statements that contain words such as "will," "believes," "plans," "anticipates," "expects," "estimates") should also be considered to be forward-looking statements. Forward-looking statements involve risks and uncertainties, including, without limitation, risks inherent in the development and/or commercialization of potential products, uncertainty in the results of clinical trials or regulatory approvals, need and ability to obtain future capital, and maintenance of intellectual property rights. As actual results may differ materially from the results anticipated in these forward-looking statements they should be evaluated together with the many uncertainties that affect the business of BioTime and its subsidiaries, particularly those mentioned in the cautionary statements found in BioTime's Securities and Exchange Commission filings. BioTime disclaims any intent or obligation to update these forward-looking statements.

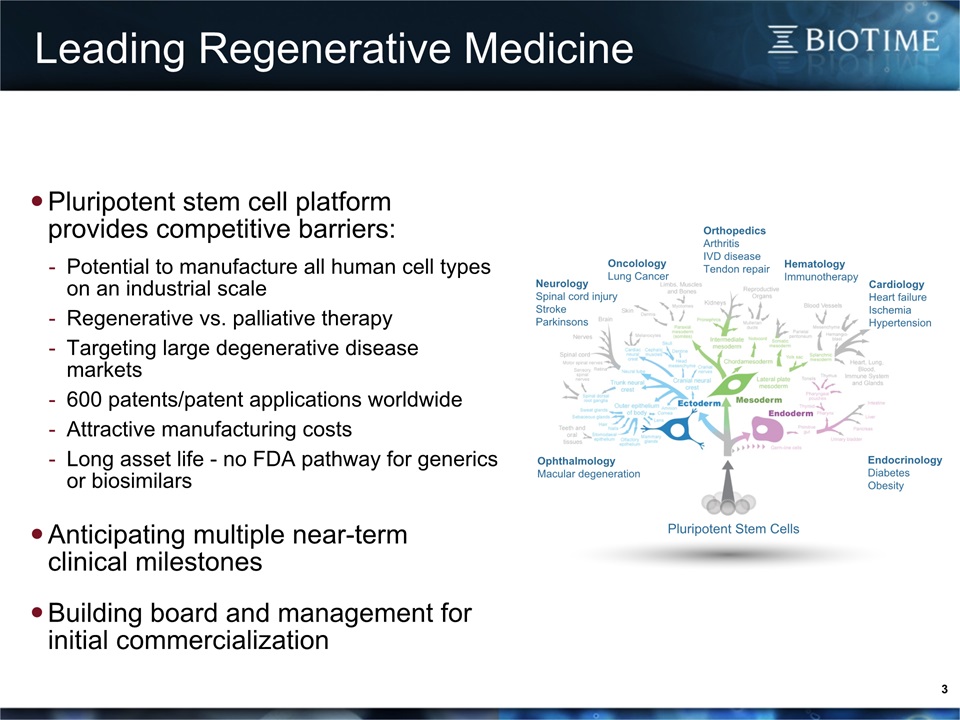

3 Pluripotent stem cell platform provides competitive barriers:Potential to manufacture all human cell types on an industrial scaleRegenerative vs. palliative therapyTargeting large degenerative disease markets 600 patents/patent applications worldwideAttractive manufacturing costsLong asset life - no FDA pathway for generics or biosimilars Anticipating multiple near-termclinical milestonesBuilding board and management for initial commercialization Pluripotent Stem Cells OrthopedicsArthritisIVD diseaseTendon repair EndocrinologyDiabetesObesity NeurologySpinal cord injuryStrokeParkinsons CardiologyHeart failureIschemiaHypertension OphthalmologyMacular degeneration HematologyImmunotherapy OncolologyLung Cancer Leading Regenerative Medicine

4 Over the next 12 months, BioTime and its subsidiaries arepositioned to increase shareholder value by… Announcing results from six clinical studiesCommercializing cancer screening diagnosticsCompleting Renevia pivotal clinical trial Implementing clinical and financial de-risking strategiesUnlocking subsidiary company value for BioTime shareholdersBuilding management & Board for commercial phase Near-Term Value Creation

Clinical Milestones in 1H 2015 5 Publication and presentation at major scientific meetings on results of clinical studies of the PanC-Dx family of diagnostics addressing lung, bladder and breast cancerInterim data from the pivotal trial of Renevia, a therapeutic product addressing a large market opportunity in lipoatrophyCompletion of enrollment of first cohorts in two Phase 1/2a clinical trials (OpRegen and OPC1) each addressing multi-billion dollar market opportunities

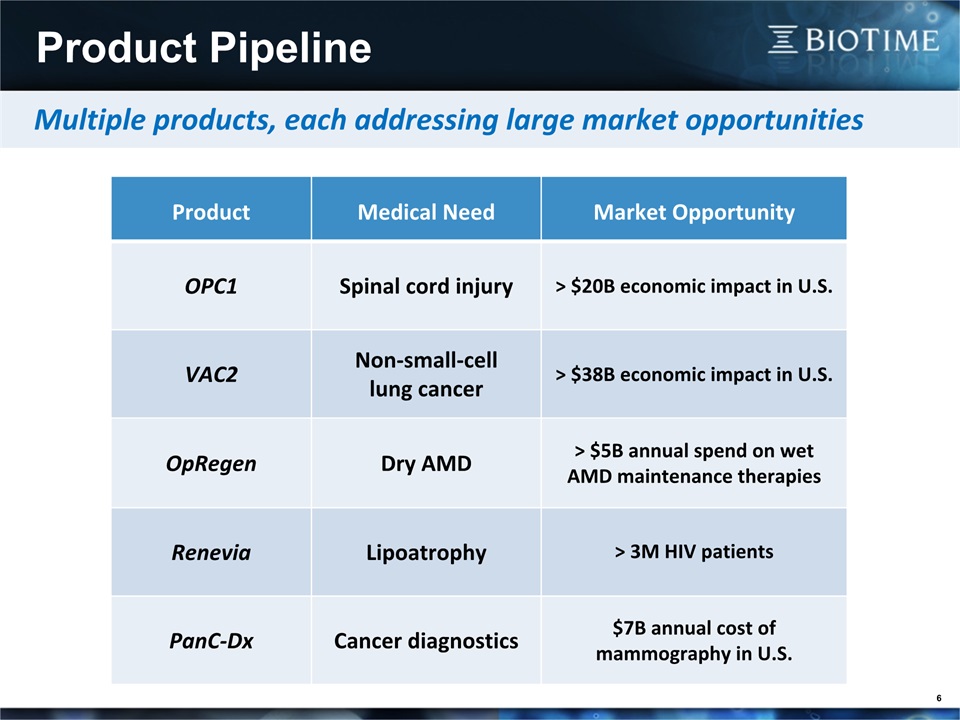

6 Multiple products, each addressing large market opportunities Product Medical Need Market Opportunity OPC1 Spinal cord injury > $20B economic impact in U.S. VAC2 Non-small-celllung cancer > $38B economic impact in U.S. OpRegen Dry AMD > $5B annual spend on wet AMD maintenance therapies Renevia Lipoatrophy > 3M HIV patients PanC-Dx Cancer diagnostics $7B annual cost of mammography in U.S. Product Pipeline

7 Maximizing shareholder value in a broad platform company Increases financial flexibility at both the corporate and subsidiary levelLimits direct dilution to existing shareholders of BTXAttracts talented executives with focus on diverse fields of medicineAllows investors to focus on opportunities that most interest themEnables development of more products using our broad technology platformsLimits downside risk by spreading investments among multiple opportunitiesMaintains upside potential as subsidiaries address large market opportunities Subsidiary Strategy

Major Therapeutics 8 OPC1 Potential patients in U.S. Research Preclinical Phase 1 Phase 2 Spinal cord injury 12,000/year Multiple sclerosis 180,000 prevalence Stroke 800,000/year VAC1 Prostate cancer 240,000/year AML 12,000/year VAC2 Lung cancer OpRegen Dry AMD 7.3 million prevalence

OPC1 & VAC2 9 Developing Breakthrough Technologies for Regenerative Medicine(NYSE MKT: AST)Pedro Lichtinger, CEOFormer CEO Optimer Pharmaceuticals, and President of Pfizer’s Global Primary Care Unit 9

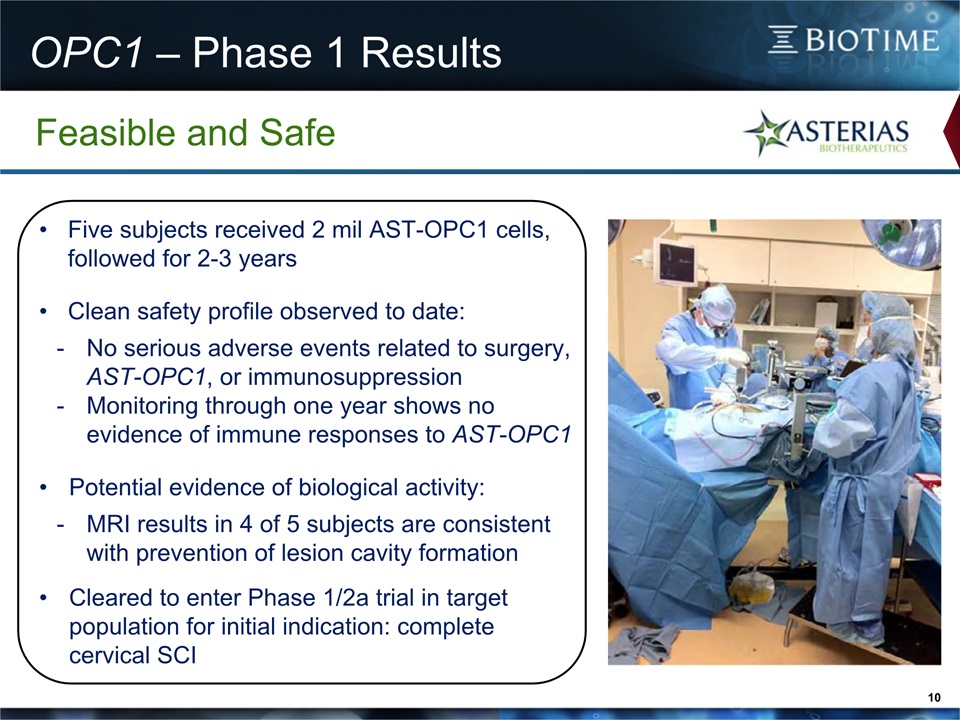

OPC1 – Phase 1 Results 10 Feasible and Safe Five subjects received 2 mil AST-OPC1 cells, followed for 2-3 years Clean safety profile observed to date:No serious adverse events related to surgery, AST-OPC1, or immunosuppressionMonitoring through one year shows no evidence of immune responses to AST-OPC1Potential evidence of biological activity:MRI results in 4 of 5 subjects are consistent with prevention of lesion cavity formationCleared to enter Phase 1/2a trial in target population for initial indication: complete cervical SCI

OPC1 – Phase 1/2a Trial 11

12 OPC1 Opportunity: SC Injury

VAC2 - Proof of Concept Telomerase is expressed in ~95% of cancer typesVAC1 was safe and stimulated anti-telomerase immune responses in two clinical trials with improved or stabilized biomarkers 13 Phase 1: prostate cancerDukeJ. Immunol 2005, 174:3798 Phase 2: acute myelogenous leukemia Multi-centerKhoury ASH 2010 Patients treated 20 21 Tolerability Excellent Excellent Patients immunized against telomerase 95% 55% Laboratory & clinical impact Highly significant increase in PSA doubling timesClearance of circulating immune complexes Significant increase in 12-month DFS in high-risk group (N=11) compared to published historical controls

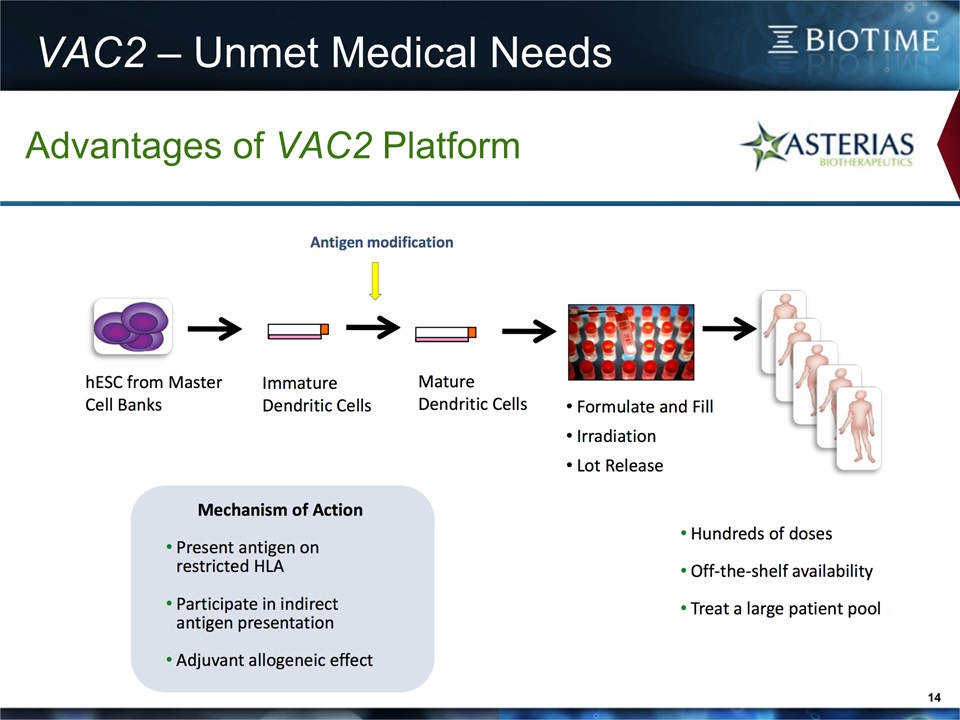

VAC2 – Unmet Medical Needs 14 Advantages of VAC2 Platform

15 AST-VAC2 – Trial Design

16 1 Source: Cancer Research Technologies2 Source: National Institutes of Health3 Source: Decision Resources VAC2 Opportunity: NSC lung cancer

OpRegen 17 Advancing Medicine Through Stem Cell TherapiesCharles Irving, Ph.D., CEO 17

AMD and Loss of RPE Cells OpRegen Photoreceptors depend on RPE cells for nourishment, recycling of visual pigment and waste disposal When RPE cells die, the photoreceptors also die and central vision is lost Geographic Atrophy (RPE)

OpRegen®: Cell replacement therapy for the dry form of age–related macular degeneration (dry-AMD) utilizing a suspension of animal product-free RPE cells produced from human embryonic stem cells. Indication: Geographic atrophy (the severe dry-form AMD)Formulation: Cell suspension in BSS Plus; ready for injection Delivery Route: Subretinal administrationMechanism of Action: Integration into subretinal spaceand replacement of missing or diseased RPE cellsPlanned Clinical Trial: Phase I/IIa trial inprogressive dry-form AMD with GAStudy Site: Hadassah Univ Medical Center, JerusalemStage of Development: FDA & Israel Ministry of Health of Health authorization received Therapy for Dry-AMD OpRegen

Trial Design OpRegen Phase I/IIa Dose Escalation Safety and Efficacy Study of OpRegen® Transplanted Subretinally in Patients with Advanced Dry-Form AMD (Geographic Atrophy)Open label, non-randomized, sequential, single center trialStudy Site: Hadassah University Medical Center, Jerusalem, IsraelDose and Administration: Single injection of 50,000-500,000 viable cells in saline delivered via a cannula through a small retinotomy into the subretinal space. Part 1Cohort 1: 3 Patients, BCVA 20/200 or less, 50,000 OpRegen® cellsCohort 2: 3 Patients, BCVA 20/200 or less, 200,000 OpRegen® cellsCohort 3: 3 Patients, BCVA 20/200 or less, 500,000 OpRegen® cellsPart 2Cohort 4: 6 Patients, BCVA 20/100, 500,000 OpRegen® cells

Device & Diagnostic Pipeline 21 Partner Platform Pre-Clinical Design control /IND enabling Clinical development Regulatory Pathway Safety Efficacy Pivotal HyStem®Renevia CE Mark as a medical device HyStem®ReGlyde N/A N/A N/A 510 (k) device HyStem®Premvia Cleared Class II device August 2014 Indication Research Development Clinical Validation Commercialization Breast Clinical Studies in Progress 2015 Bladder Clinical Studies in Progress 2015 Lung Clinical Studies in Progress 2015 Injectable for the treatment of lipoatrophies Wound Management Protection following surgery Screening/Recurrence Setting Screening/Recurrence Setting High Risk Screening Pivotal

HyStem - Unmet Medical Needs 22 Polymerizes safely in vivo Stays as liquid for ~ 20 minutes Supports cells including adipocytes in 3-D Cast Hydrogel Cells in Sponge Injectable Multiple Formulations Durable Films 3-D Lattices Heparin-mediated Slow Release

ReneviaTM Pivotal Trial 23 Renevia™ is an injectable matrix designed to safely produce 3-D tissue in vivo, keeping cells where the surgeon places them. It is expected to have numerous applications in multiple tissue typesBioTime initially is seeking a CE mark for use in HIV-associated lipoatrophy in combination with autologous fat cells.An estimated 33M people worldwide have HIV. Number on HIV treatment has tripled in five years – now ~10M, target of 15M by the end of 2015. An estimated 35-50% of patients on ARV therapy have lipoatrophy.A greater number of people in the US have lipoatrophy due to wounds and age. Age-Related Lipoatrophy

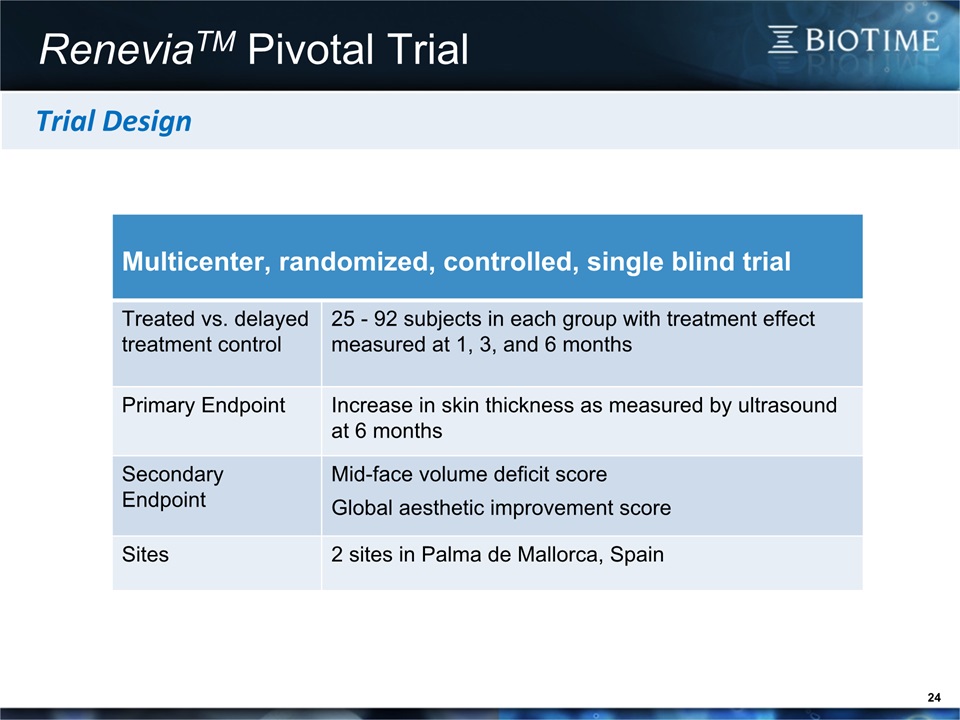

24 ReneviaTM Pivotal Trial Multicenter, randomized, controlled, single blind trial Treated vs. delayed treatment control 25 - 92 subjects in each group with treatment effect measured at 1, 3, and 6 months Primary Endpoint Increase in skin thickness as measured by ultrasound at 6 months Secondary Endpoint Mid-face volume deficit score Global aesthetic improvement score Sites 2 sites in Palma de Mallorca, Spain Trial Design

25 Advanced Noninvasive Cancer DiagnosticsJoseph Wagner, Ph.D., CEO 25 PanC-Dx

PanC-Dx – Cancer Diagnostics 26 PanC-DX™ Potential market size Status Results Announced Breast cancer $2.5 billion Clinical study underway 1H 2015 Bladder cancer $500 million Clinical study underway 1H 2015 Lung cancer $525 million Clinical study underway 1H 2015 Novel products for the diagnosis and treatment of cancer in order to improve both the quality and length of cancer patients’ livesInternally developed cancer gene discovery platformPlatform based on extensive microarray datasetMarket discovery principle based on similarity between embryonic development and cancerScores of potential targets identifiedMultiple product opportunitiesDevelop and market low-cost molecular diagnostic tests for major types of cancer

Balance of Near-Term Products PanC-Dx™ Breast Cancer Diagnostic: Blood-based screening diagnostic Panel of protein markers$25M initial market opportunity, $2.5B expanded opportunityPanC-Dx™ Bladder Cancer Diagnostic:Urine-based screening diagnostic for recurrence Panel of RNA markers$15M initial market opportunity, $500M expanded opportunityPanC-Dx™ Lung Cancer Diagnostic:Blood-based screening diagnostic Panel of RNA markers$25M initial market opportunity, $525M expanded opportunity 27 Three Diagnostic Products to be Commercialized within 12 Months

Clinical De-Risking Strategies OPC1: Initiative to accelerate current timelines for clinical program by about six months to obtain safety and efficacy readouts more rapidlyOPC1: Accelerated trial by six months and announced intent to strengthen robustness of proof of concept by seeking FDA permission to expand the number of patients from 13 to 40PanC-Dx™ and Renevia are judged by the company to be relatively low-risk products 28

AST-OPC1 AST-VAC2 $14.3 Million Grant Includes funding for:Execution of Phase 1/2a studyProcess and assay development activities to prepare for pivotal trials and commercializationFacilities and indirect costsPotential follow-on grants to expand and accelerate trial Clinical Development Partnership Asterias performs scale-up and tech-transfer of AST-VAC2 manufacturing processCRUK provides personnel and funding for cGMP manufacturing, regulatory filing, Phase 1/2a trialAsterias has first option to reacquire program on preset, reasonable terms; majority revenue share on partner’s development if does not choose to reacquire Estimated ~$40 Million of Total Non-dilutive Funding 29 Financial De-Risking

Unlocking Subsidiary Value 30 Asterias Biotherapeutics is the first of BioTime’s subsidiaries to be publicly traded Timeline 1 Created subsidiary to acquire Geron stem cell assets 2 Closed acquisition of assets 3 Hired a seasoned management team 4 Appointed Pedro Lichtinger as CEO, a leader with significant commercialization expertise 5 Executed clinical and financial de-risking strategies 6 Executed spin-off to public company 7 Listed on NYSE MKT under symbol “AST” BTX owns 72% of ~$120M AST Market CapBTX has 7 other subsidiaries whose value could be unlockedGoal: Unlock value of one additional subsidiary in 2015

Building Commercialization Team 31 Appointed Pedro Lichtinger as President and Chief Executive Officer of Asterias, a former Pfizer senior executive with successful drug development and commercialization experienceAdi Mohanty, former Shire executive, appointed COO of BioTimeMichael H. Mulroy and Stephen L. Cartt joined BioTime’s Board of Directors. Mr. Mulroy and Mr. Cartt both had successful careers in senior management at Questcor Pharmaceuticals, Inc.Angus C. Russell, former Chief Executive Officer of Shire plc, appointed to BioTime's Board of Directors Focused on adding biopharmaceutical industry executives with expertise in clinical development and commercialization

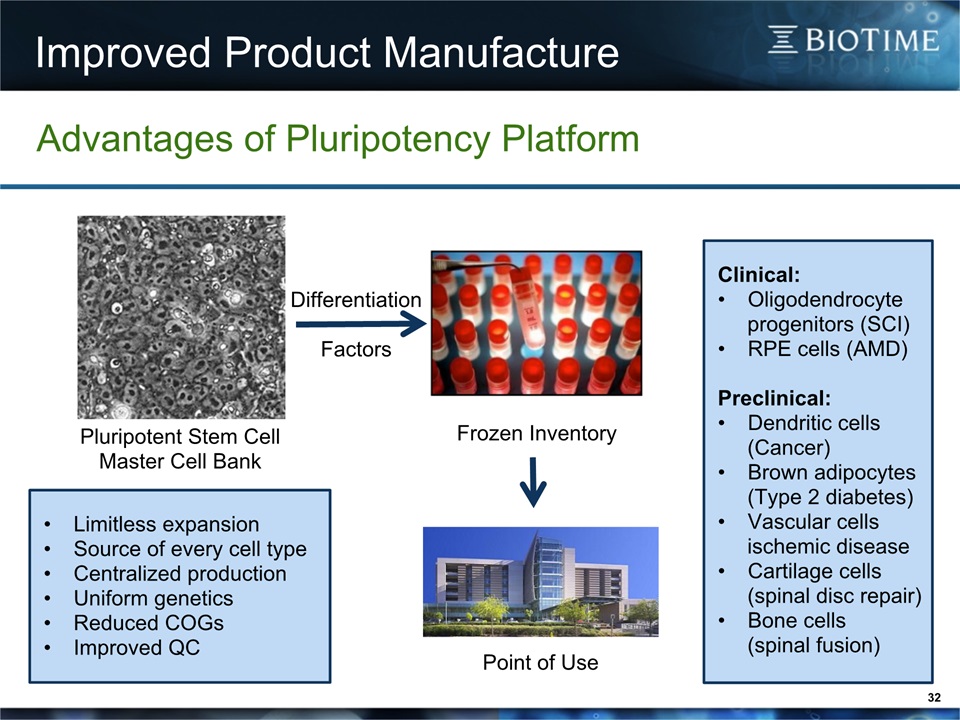

Improved Product Manufacture 32 Advantages of Pluripotency Platform Pluripotent Stem CellMaster Cell Bank Limitless expansionSource of every cell typeCentralized productionUniform geneticsReduced COGsImproved QC DifferentiationFactors Frozen Inventory Point of Use Clinical:Oligodendrocyte progenitors (SCI)RPE cells (AMD)Preclinical:Dendritic cells (Cancer)Brown adipocytes (Type 2 diabetes)Vascular cells ischemic diseaseCartilage cells (spinal disc repair)Bone cells (spinal fusion)

Value of the Pluripotent Platform 33 Cell therapy: the next wave – with a potentially long lifespan due to lack of regulatory pathway for generics or biosimilars Recombinant ProteinsTechnology in maturity phase Small MoleculesTechnology in decline Unique and proprietary Pluripotent Stem Cells Extensively characterized to Strict Regulatory Requirements. hESC MasterCell Bank Product Monoclonal AntibodiesTechnology in growth phase Cell TherapyTechnology in clinical trials phase

BioTime (NYSE Market: BTX) 34 $156M liquid assets: ~$36M in cash, $3M in registered BTX shares held by subsidiaries, & $117M AST shares held by BTX (as of October 16, 2014) BTX market cap approx. $290M, owns approx. 70% of AST (market cap approx. $130M (as of January 9, 2015)No debt Long-term investors hold approx. 45% of BTX stock Strong Board, Management, and Financial Structure Key Statistics: