Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - AtriCure, Inc. | d847142dex991.htm |

| 8-K - CURRENT REPORT - AtriCure, Inc. | d847142d8k.htm |

Investor Presentation

January 2015

Exhibit 99.2 |

| 2

Forward Looking Statements/Non-GAAP Measures

This

presentation

contains

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Forward-

looking

statements

include

statements

that

address

activities,

events

or

developments

that

AtriCure

expects,

believes

or

anticipates

will

or

may

occur

in

the

future,

such

as

earnings

estimates

(including

projections

and

guidance),

other

predictions

of

financial

performance,

launches

by

AtriCure

of

new

products

and

market

acceptance

of

AtriCure’s

products.

Forward-looking

statements

are

based

on

AtriCure’s

experience

and

perception

of

current

conditions,

trends,

expected

future

developments

and

other

factors

it

believes

are

appropriate

under

the

circumstances

and

are

subject

to

numerous

risks

and

uncertainties,

many

of

which

are

beyond

AtriCure’s

control.

These

risks

and

uncertainties

include

the

rate

and

degree

of

market

acceptance

of

AtriCure’s

products,

AtriCure’s

ability

to

develop

and

market

new

and

enhanced

products,

AtriCure’s

ability

to

retain

and

attract

key

employees,

the

timing

of

and

ability

to

obtain

and

maintain

regulatory

clearances

and

approvals

for

its

products,

the

timing

of

and

ability

to

obtain

reimbursement

of

procedures

utilizing

AtriCure’s

products,

AtriCure’s

ability

to

continue

to

be

in

compliance

with

applicable

U.S.

federal

and

state

and

foreign

government

laws

and

regulations,

AtriCure’s

ability

to

consummate

acquisitions

or,

if

consummated,

to

successfully

integrate

acquired

businesses

into

AtriCure’s

operations,

AtriCure’s

ability

to

recognize

the

benefits

of

acquisitions,

including

potential

synergies

and

cost

savings,

failure

of

an

acquisition

or

acquired

company

to

achieve

its

plans

and

objectives

generally,

risk

that

proposed

or

consummated

acquisitions

may

disrupt

operations

or

pose

difficulties

in

employee

retention

or

otherwise

affect

financial

or

operating

results,

competition

from

existing

and

new

products

and

procedures,

including

the

development

of

drug

or

catheter-based

technologies,

or

AtriCure’s

ability

to

effectively

react

to

other

risks

and

uncertainties

described

from

time

to

time

in

AtriCure’s

SEC

filings,

such

as

fluctuation

of

quarterly

financial

results,

fluctuations

in

exchange

rates

for

future

sales

denominated

in

foreign

currency,

which

represent

a

majority

of

AtriCure’s

sales

outside

of

the

United

States,

reliance

on

third

party

manufacturers

and

suppliers,

litigation

or

other

proceedings,

government

regulation

and

stock

price

volatility.

AtriCure

does

not

guarantee

any

forward-looking

statement,

and

actual

results

may

differ

materially

from

those

projected.

AtriCure

undertakes

no

obligation

to

publicly

update

any

forward-looking

statement,

whether

as

a

result

of

new

information,

future

events

or

otherwise.

A

further

list

and

description

of

risks,

uncertainties

and

other

matters

can

be

found

in

our

Annual Reports on

Form 10-K and Quarterly Reports on Form 10-Q..

This

presentation

includes

the

use

of

non-GAAP

measures.

Reference

AtriCure’s

Form

8-K

filings

which

include

the

furnishing

of

our

earnings releases

for a reconciliation to the related GAAP measures. |

3

Vision

AtriCure seeks to develop solutions

for and become a leader in the

treatment of Atrial Fibrillation (Afib)

and left atrial appendage (LAA)

management for stroke reduction |

4

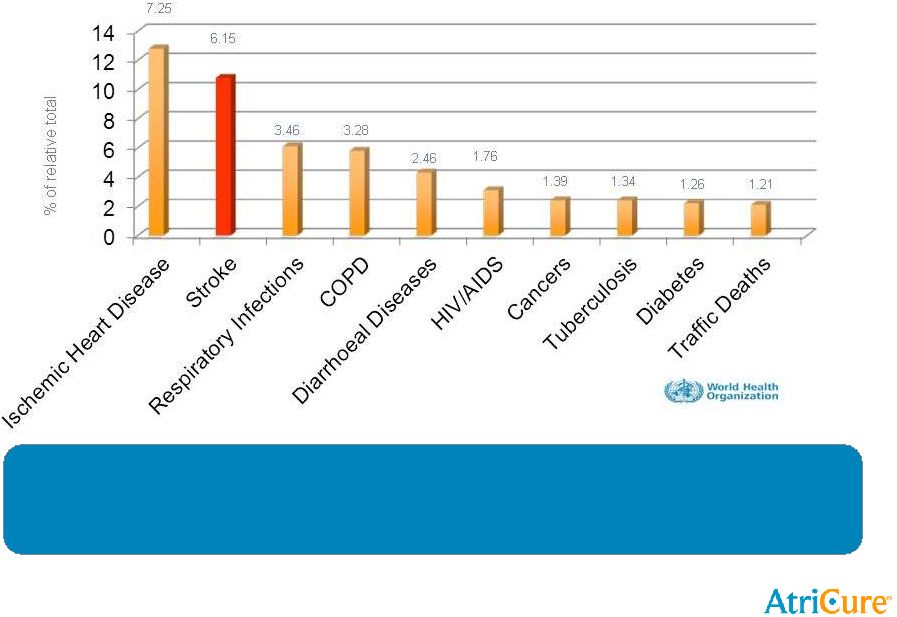

Top 10 disease related deaths worldwide

Afib is the second leading cause of stroke! |

| 5

Key Takeaway Messages

•

Atrial Fibrillation is a health problem of epidemic proportions

•

Only 27% of all surgical patients with AF are treated leaving a big opportunity for

treatment

1

•

Many current therapies such as anti-arrhythmic medications are

ineffective •

The Cox-Maze IV procedure is very effective at treating Afib

•

Patients

with

Afib

on

average

4-6

times

more

likely

to

have

a

stroke

2

•

Large,

under-penetrated

market

(10M+

people

globally

–

conservative

estimate)

•

$26 Billion annual health economic burden from Afib in the U.S. alone

AND ATRICURE IS POISED FOR SUCCESS …

1

Circulation:

Cardiovascular

Quality

and

Outcomes.

Estimation

of

Total

Incremental

Health

Care

Costs

in

Patients

With

Atrial

Fibrillation

in

the

United

States.

Michael

H.

Kim

et

al.

2

.http://www.ninds.nih.gov/disorders/atrial_fibrillation_and_strok

e/atrial_fibrillation_and_stroke.htm |

6

•

The leading global player in the surgical Afib market

Only FDA-approved device for surgical treatment of Afib

Broad and deep product portfolio with deepest IP in the field

World-class training

•

Strong and Consistent Revenue Growth and Gross Margins

17% growth in 2014

31% growth in 2014; organic growth of close to 20%

Expect 14-16% growth in 2015

-

weakening

Euro

impacting

business

–

guidance

would

have

been

higher

with

a

flat

exchange

rate from 2014

Gross Margins 70% in 2014 and on path to 75% over five years

•

Growth

Short

Term

=

Open

Ablation

+

Clip

+

International

Education,

Awareness, Training

Long

Term

=

MIS

+

MIS

Clip

+

New

Products

Trials

Upside = MIS and International

AtriCure Is Poised For Growth |

7

How Are We Doing?

A look at the last ten quarters:

2014

31% growth

Q3 2012

6% growth

Q4 2012

9% growth

Q1 2013

11% growth

Q2 2013

12% growth

Q3 2013

25% growth

Q4 2013

19% growth

Q1 2014

28% growth

Q2 2014

30% growth

Q3 2014

32% growth

Q4 2014

35% growth

Includes revenue from

12/31/13 Estech

acquisition

–

organic

revenue above 17% |

8

Be the recognized leader in Afib and

appendage management

Have improved the lives of more than

250,000 Afib patients and treated over

150,000 with Clips

By The End Of The Decade We Will… |

9

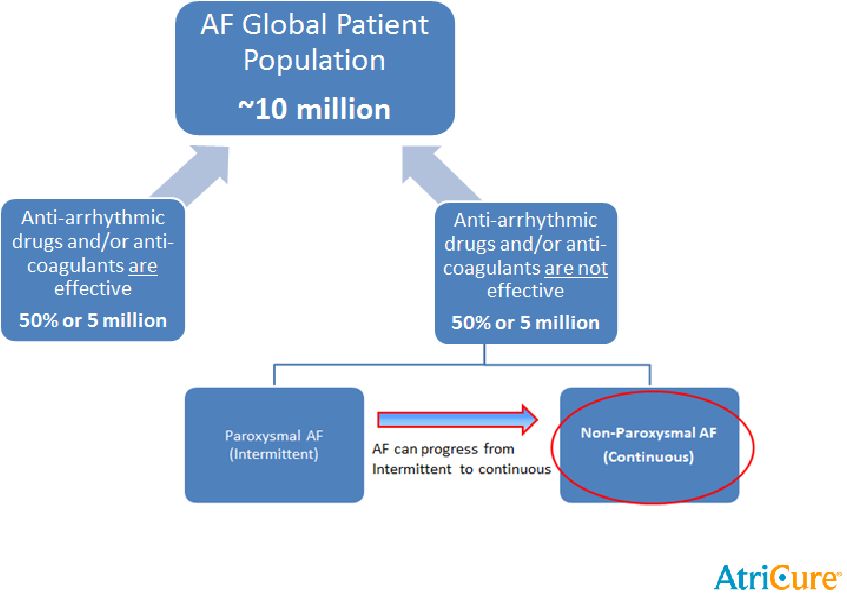

AF Clinical Hierarchy |

10

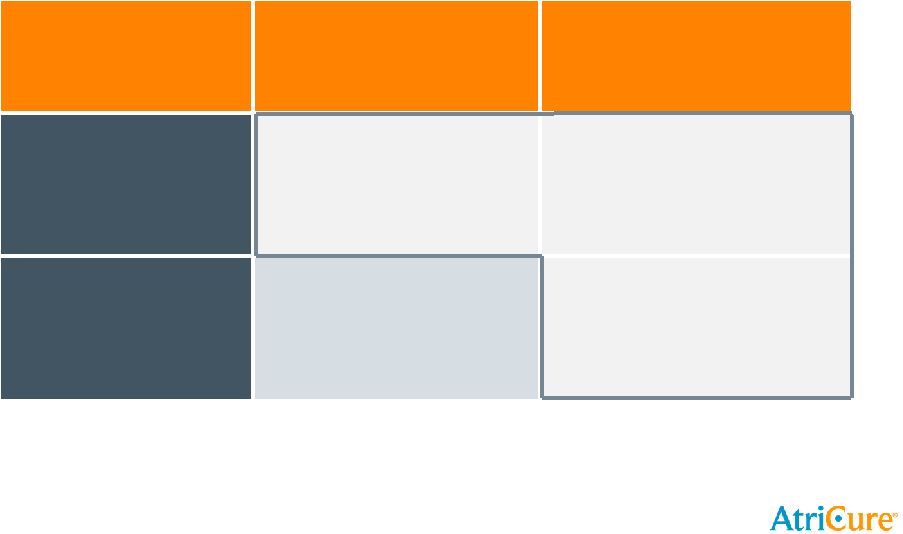

Emerging Clinical Paradigm

PAROXYSMAL

(INTERMITTENT)

NON-PAROXYSMAL

(CONTINUOUS)

OPEN

(CONCOMITANT)

PULMONARY VEIN

ISOLATION

(CLAMP or FUSION)

COMPLETE MAZE

STAND-ALONE

PULMONARY VEIN

ISOLATION

(CATHETER)

HYBRID

(SURGERY + EP PROCEDURE) |

11

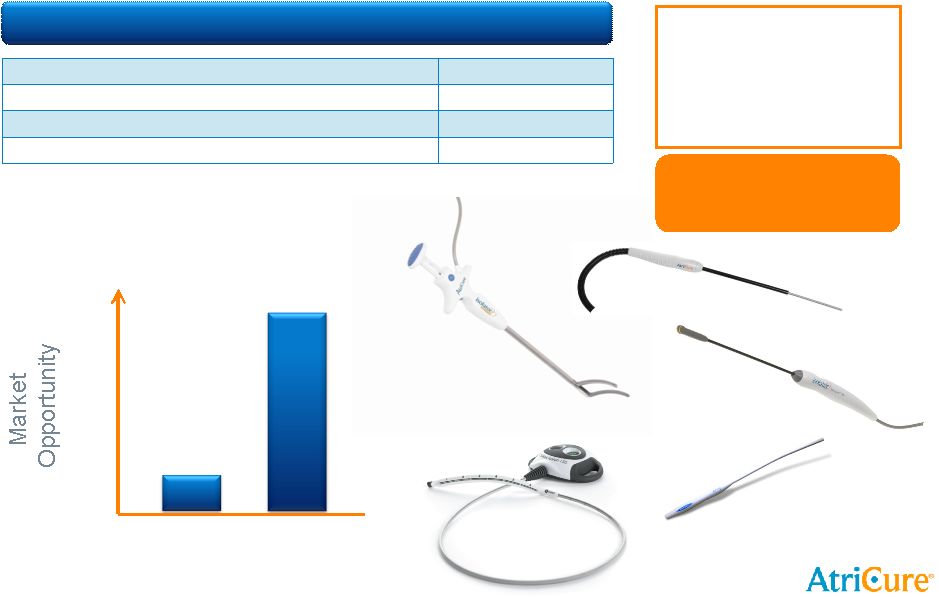

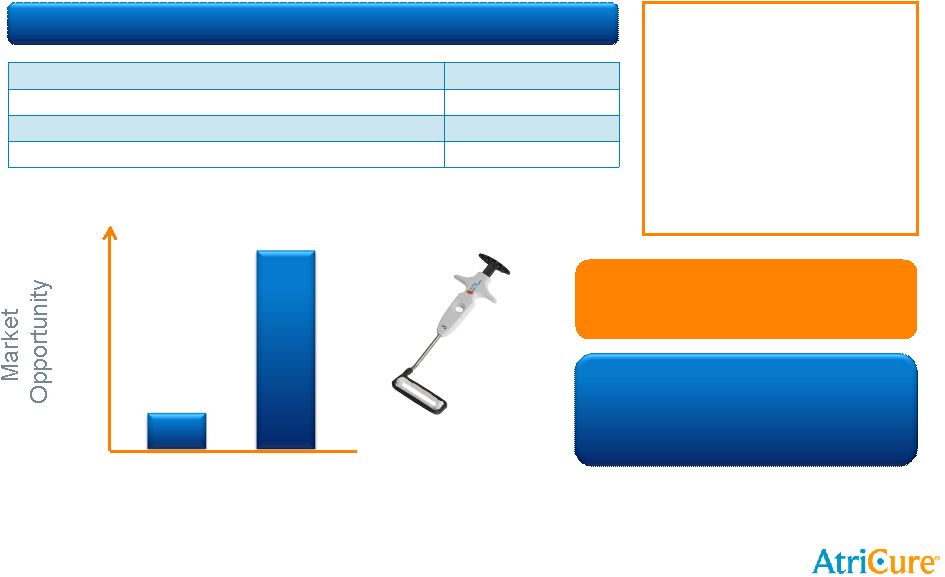

Ablation Global Market Opportunity –

Open

•

Labeling advantage in U.S.*

•

Best products

•

High gross margins

•

Education is key

•

Competition is large device

AtriCure has the only

on-label products for the

surgical treatment of Afib*

Open Ablation

$600M

$120M

Current

Market

Potential

Market

Estimated open heart surgeries per year

750,000

Estimated % that have Afib

33%

Estimated Afib patients undergoing surgery

250,000

Estimated

Market

Opportunity

–

Annual

$600,000,000

Source: AtriCure estimates

* PMA approved products include our OLL2 and OSL2

clamps., along with the ASU RF generator and ASB

switchbox; see AtriCure website for full indication language

|

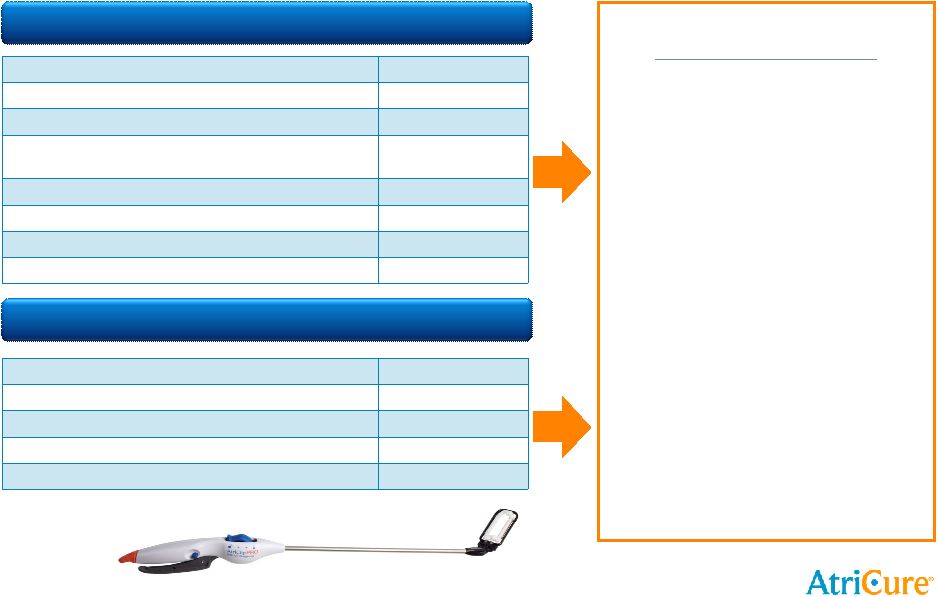

12

Ablation Global Market Opportunity –

Stand-alone

•

High reimbursement

•

High gross margins

•

Growing internationally

•

Development needed

•

Competition is start-ups

Developing Market

Trial Key to FDA

Approval for Afib

treatment

MIS / Stand Alone Ablation

Estimated

Afib

patients

–

E.U.

and

U.S.

Only

8,000,000

Estimated % drug refractory and symptomatic

50%

Subtotal

4,000,000

Estimated Persistent and Longstanding Persistent subset

50%

Subtotal -

Patients

2,000,000

Estimated

Market

Opportunity

–

Total

$20,000,000,000

Estimated % treated annually

5%

Estimated

Market

Opportunity

–

Annual

$1,000,000,000

$1B

$40M

Current

Market

Potential

Market

Source: AtriCure estimates |

13

LAA Global Market Opportunity –

Open

•

Best in class LAA management

•

Superior

safety

-

No

adverse

events

•

Mechanical & Electrical Solution

•

Competition includes Tiger Paw,

staple, suture, ligature (endo loop)

•

2014

Revenue

-

$8.7M

•

2014

Revenue

-

$12.4M

(+44%)

4+ years of clinical experience

Over

43,000

clips

implanted

–

well

ahead of competitive products

Estimated Open heart surgeries per year

750,000

Estimated % that have Afib

33%

Estimated Afib patients undergoing surgery

250,000

Estimated

Market

Opportunity

–

Annual

$250,000,000

$250M

$10M

Current

Market

Potential

Market

UPSIDE:

Prophylactic treatment could more than

double this market

Open Clip

Source: AtriCure estimates |

14

LAA Global Market Opportunity –

MIS (AtriClip

®

Pro)

One Product, Two Markets

Concomitant with MIS Ablation

•

Today’s market …will draft MIS growth

•

Virtually ALL revenue from MIS Clip is

for concomitant treatment along with

MIS ablation –

90% attach rate

Attractive sole therapy market

•

NEW market for us…

•

Today only a couple cases have been

done with OUR products “sole

therapy”…

a lot done percutaneous

•

Competition includes implants and EP

closure (without FDA approval)

•

Stroke trial key to success

Estimate of treatment resistant Afib patients

1,000,000

Estimated global revenue per device (all modes)

$5,000

Estimated

Market

Opportunity

–

Total

$5,000,000,000

Estimated % treated annually

10%

Estimated

Market

Opportunity

–

Annual

$500,000,000

Estimated

Afib

patients

–

E.U.

and

U.S.

Only

8,000,000

Estimated % drug refractory and symptomatic

50%

Subtotal

4,000,000

Estimated Persistent and Longstanding Persistent

subset

50%

Subtotal -

Patients

2,000,000

Estimated

Market

Opportunity

–

Total

$5,000,000,000

Estimated % treated annually

5%

Estimated

Market

Opportunity

–

Annual

$250,000,000

MIS Clip With Ablation

MIS Clip

Source: AtriCure estimates |

15

Summary High-Level Plan

Market

Open is growth in short term

LAA Market is here now

Clinical data key to MIS growth

Short-Term (3-year)

Focus on commercial execution

Education, Education, Education

Cryo enhancements

Clip innovation

Long-Term (5-year)

Stroke trial success

DEEP trial success

LoLA on beating heart

SubX Clip

Financial

15%+ growth target

(17% in 2014 / 31% in 2014)

75% Gross Margin Target

(70% 2014)

Strategic Focus |

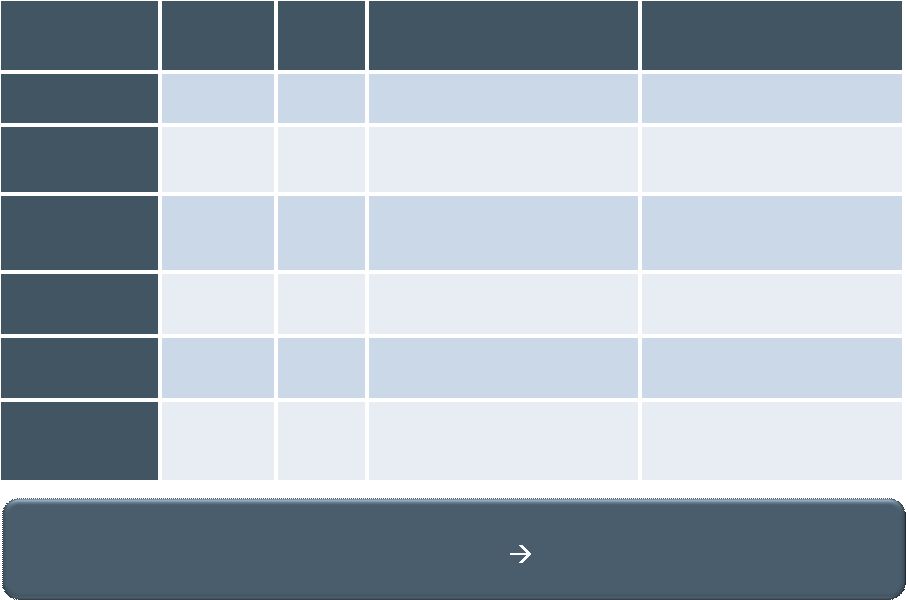

16

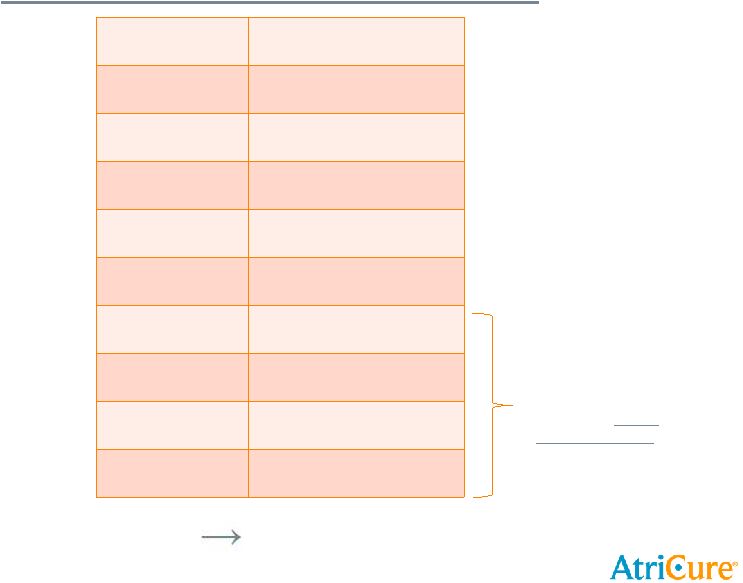

Business Overview -

Diversified and Growing Portfolio

Focus Areas

Preliminary

2014 Growth

Global

Market

Size

Keys to Success

Current Trials

Open Ablation

(Concomitant)

$44.7M U.S.

+18%

$600M

Annually

•

Education and awareness

•

Conversions and add-on sales

PMA Post Approval Study

(350 Patients; Five Years)

Open Clip

$16.7M

U.S.

+54%

$250M

Annually

•

Education and awareness

•

Tie to ablation growth

Sponsored Investigator Study Design

Underway

MIS Ablation

$16.0M U.S.

+18%

$20B total

$1B+

Annually

•

Trial

•

Collaborative care

•

Integration of Estech

IDE Staged DEEP (Hybrid)

Pivotal Approved

220 Patients; 25 sites

1, 2 and 3 year follow-up

MIS Clip

Included

In Open Clip

line above

$5B total

$500M+

Annually

•

Awareness

•

Trial

Stroke Safety Feasibility Study

Approved

30 patients, 7 sites

International

$27.3M

+39%

Included

above

•

Market expansion

•

Reimbursement

•

Coverage

Involvement Above and Several E.U.

Studies in Process

Overall

$107.5M

+31%

$1B+

Annually

$20B+

Total

2015 Revenue Guidance:

$122.5 -

$124.5 million

14-16% growth

(Reflects estimated $1.6 million adverse currency impact due to weakening Euro)

|

17

Growth Strategy: Overview

Expand Open Heart Sales

Penetrate LAA Opportunity

Build MIS Platform

International Expansion

•

Leverage Afib indication

•

Increased training and education

•

Capitalize on sales force

•

Afib Program Development

•

Capitalize on investments in sales team

•

Geographic expansion and new products

•

Increase support for distributors

•

Penetrate concomitant ablations

•

Validate stroke prevention with trial

•

Support existing MIS surgeons

•

Support Staged DEEP AF trial

•

Integrate Estech Acquisition

AtriCure

is

the

only

company

with

FDA

approval

to

surgically

treat

the

Afib

disease

state

and

is

a

leader

in

the emerging market of LAA exclusion |

18

•

Highly experienced sales and marketing team

•

45 U.S. sales territories; additional clinical team of 25

–

Up from 35 and 12 two years ago respectively

–

Adding 5+ territories in 2015

•

E.U. subsidiary and 30 countries (generate ~25% of revenue)

–

Direct presence in Germany, France, BENELUX

over 10 people

–

Estech brings strong presence in E.U.

–

Well-established international network of independent distributors

–

Japan, China, Eastern Europe, UK, Italy, Russia

Robust Commercial Infrastructure

AtriCure

has

established

a

strong

commercial

infrastructure

which

will

drive

superior

growth

going

forward |

19

Other Key Investments For Long-term Growth

Innovation

Education

Clinical Science

AtriCure

is a leading Afib

solutions partner,

passionately

focused on reducing

the global Afib

epidemic and

healing the lives of

those affected. |

20

Education and Training Focus

•

Robust training program

•

Course designed by Dr. James Cox

•

Leading KOL Education Steering Committee

•

700+ unique accounts and more than 1500

surgeons trained on the MAZE IV™

procedure

•

Over 400 courses completed

•

International Expansion Underway |

21

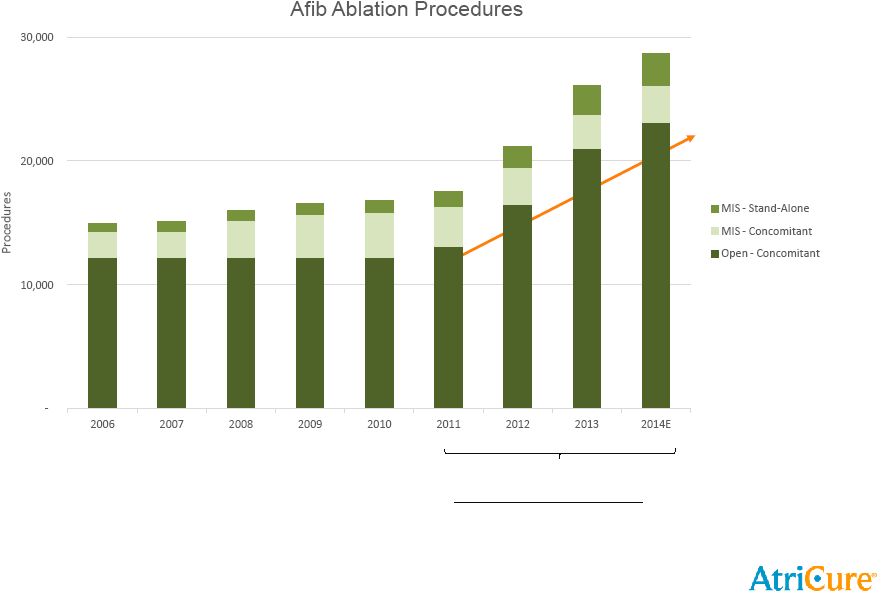

Impact of Label and Educational Programs

Growth of Open Ablation due to

ATRC Educational Programs

•

FDA

Approval

of

Synergy™

System

in

December

2011

for

the

treatment

of

persistent

Afib

•

Have trained ~62% of cardiac surgeons in the U.S.; 38% more to go!

Sources: STS Adult Cardiac

Surgery

Database

-

2006-

2014;

Ad

2014

-

Ann

Thor

Surg

Vol

96

-

763-769;

company estimates |

22

Evidence-Based Benefits of AtriCure Technology

•

$15M+ annual R&D expense –

includes clinical trial expense

•

Over 100 peer-reviewed publications to date

•

Post Approval Study –

350 patients; 50 sites; 5 years with 3 year follow-up

•

EXCLUDE Trial demonstrating safety and efficacy of AtriClip System

•

Staged DEEP Protocol –

FDA-approved hybrid trial

•

Stroke trial design underway

•

International trials –

reimbursement focus

•

Combined with Estech, 185 issued and nearly 50 patents pending

•

Compelling animal and early clinical data with Estech Fusion System

Commitment to Clinical Science |

23

Financial Snapshot

•

Approximately

$68.5

million

in

cash

and

investments

at

12/31/2014

•

No debt outstanding

•

Approximately 27.5 million shares outstanding

Revenue and Gross Margin

Balance Sheet and Share Statistics

•

2014 Total Revenue Growth: 31%

•

2014 US Growth: 29%

•

2014 OUS Growth: 39%

•

Four Year CAGR of 16%

•

Gross Margins 70-73%, with expansion

opportunity |

24

Positioned for Success

•

Strong and growing revenue base

•

2014 Revenue: $81.9 million (17% growth)

•

2014 Revenue (expected): $107.5 million (31% growth; ~ 20% organic growth)

•

2015

Revenue

(guidance):

$122.5

-

$124.5

million

(14%

to

16%

growth,

even

with

a

weak

Euro)

•

Accelerating revenue growth

•

Open

only

device

FDA-approved

for

surgical

treatment

of

Afib

•

Minimally

Invasive

Solutions

(MIS)

trial,

Estech

acquisition,

education

and

clinical

data

key

•

Left

Atrial

Appendage

(LAA)

open

and

future

trial

•

International

Expansion

improve

share

and

enter

new

markets

•

Opportunity

for

expanding

gross

margins

path

to

75%+ |

|

26

Atrial Fibrillation Overview

Condition Overview

Continuum of Care

•

Abnormal electrical impulses cause the upper

chambers of the heart to quiver at rapid rates of 400

to 600 BPM

•

Frequently associated with cardiovascular disease,

in particular hypertension, congestive heart failure,

coronary artery disease, etc.

Effects

•

Causes blood in the atria to become static,

increasing the risk of blood clot formation, stroke,

and other serious complications

•

Symptoms include heart palpitations, dizziness,

fatigue and shortness of breath, and these

symptoms can be debilitating / life threatening

Types

•

Paroxysmal: rapid heart rate begins and stops

suddenly

lasting

24

hours

–

1

week

•

Persistent: abnormal heart rate continuing for more

than a week

•

Permanent: normal heart rhythm can't be restored;

often the result of paroxysmal and persistent Afib

becoming more frequent

•

Initial treatments include electrical cardioversion

(shock to return heart to normal rhythm) and

anticoagulant medicines such as warfarin

•

If persistent, anticoagulants are augmented by rate-

control medicines such as beta blockers

•

When drugs fail, MIS catheter ablation and open-

procedure surgical ablation are used to disrupt the

electric impulses that cause Afib |

27

Afib Population: Large, Growing & Undertreated

(1)Miyasaka Y, et al. Circulation. 2006;114(2):119-125

(2)Lloyd-Jones D, et al. [published online ahead of print December 17, 2009].

Circulation. doi:10.1161/CIRCULATIONAHA.109.192667.

(3)Lloyd-Jones DM, et al. Circulation. 2004;110(9):1042-1046.

(4) Fuster V, et al. J Am Coll Cardiol. 2001;38(4):1231-12665

(5)

Benjamin EJ, et al. Circulation. 1998;98(10):946-952.

(6)

Kim M, et al. Circ Cardiovasc Qual Outcomes. 2011; 4:313-320

Afib affects over 5 million

in the U.S.

(1)

Significant costs to

healthcare system

•

U.S. prevalence projected to grow to 12-15 million by 2050

•

International prevalence is comparable to the U.S.

•

Most

common

sustained

cardiac

arrhythmia

(2)

•

Lifetime

risk

of

Afib:

~1

in

4

for

adults

40

years

of

age

(3)

Afib increases 5-fold the

risk of stroke

(4,5)

•

Afib

is

leading

cause

of

stroke

–

over

15%

in

U.S.

linked

to

Afib

(5)

•

Afib

results

in

early

mortality

and

cause

of

stroke

in

elderly

(4)

•

Afib-related

strokes

are

more

severe

(5)

Issues with non-surgical

treatment of Afib

•

Warfarin drug therapy has complications

•

Anti-arrhythmic drugs often not well-tolerated and ineffective

•

<3% of Afib patients are treated with catheter or surgical ablation

•

Direct

medical

costs

are

~73%

higher

in

Afib

patients

(6)

•

Net

incremental

cost

of

$8,705

per

patient

per

annum

(6)

•

U.S.

annual

incremental

cost

of

Afib

is

~$26.0

billion

(6) |

28

Ablation Procedure Comparison

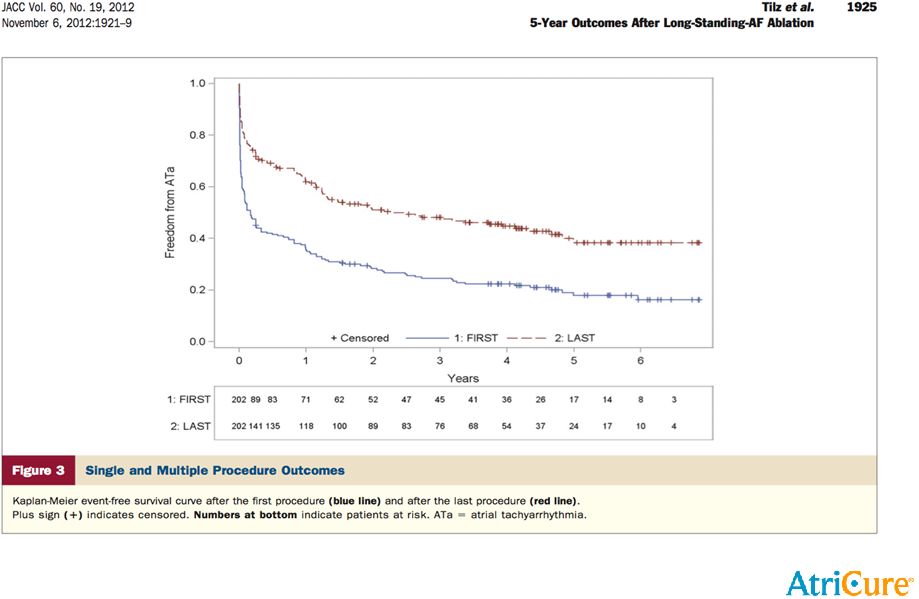

J Thorac Cardiovasc Surg 2012;-:1-6; J Am Coll Cardiol 2012;60:1921–9

|

29

20% 1 procedure

45% 2.44 procedures

Catheter Ablation of Long-Standing Persistent Atrial Fibrillation

5-Year Outcomes of the Hamburg Sequential Ablation Strategy

|

30

Maze IV |

31

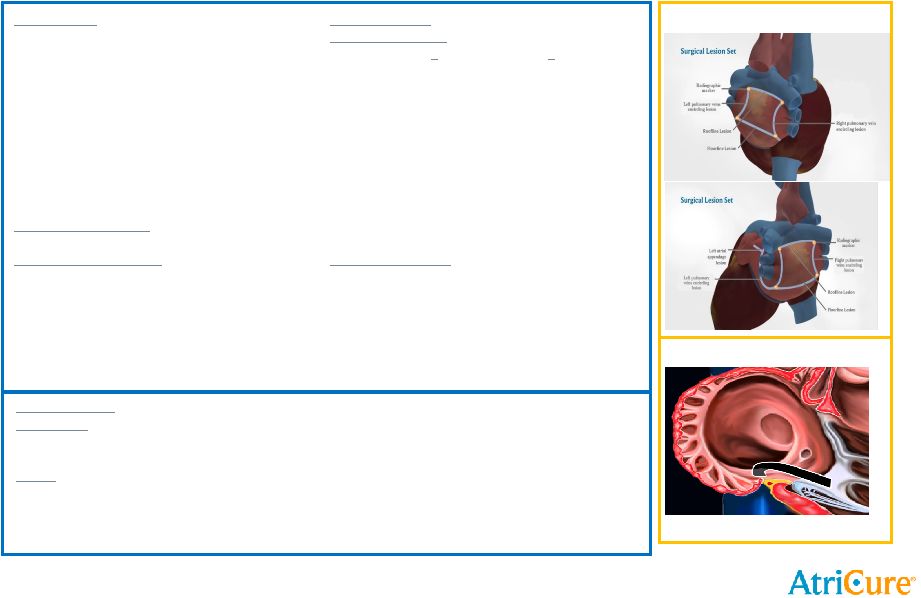

DEEP Pivotal Study (CP2014-1) Surgical Lesion Set

Endocardial Lesion Set

Cavo-tricuspid isthmus line

Study

Objective:

Establish

the

safety

and

effectiveness

of

a

dual

epicardial

and

endocardial

ablation

procedure

for

patients

presenting

with

Persistent

or

Longstanding

Persistent

Atrial

Fibrillation

utilizing

the

AtriCure

Bipolar

System

and

AtriClip

®

PRO

LAA

Exclusion

System

in

an

endoscopic

or

open

ablation

procedure,

followed

by

an

endocardial

mapping

and

ablation

procedure

utilizing

commercially

available

RF

based,

irrigated,

power

controlled,

ablation

catheters

for

endocardial

lesions.

The

endocardial

procedure

will

be

staged

to

occur

after

90

days

post

epicardial

surgical procedure.

Number of Subjects/Sites: 220 Subjects, 23 US/2 OUS

study locations

Lead Principal Investigators:

Kenneth Ellenbogen, MD, VCU

Vigneshwar Kasirajan, MD, VCU

Ali Khoynezhad, MD, Cedars Sinai

Paul J. Wang, MD, Stanford

Primary Endpoints:

Effectiveness:

Freedom

from

any

documented

AF,

atrial

flutter,

or

atrial

tachycardia

lasting

>30

seconds

in

duration

through

the

12

month

follow-up

visit

in

the

absence

of

Class

I

or

III

AADs

(with

the

exception

of

previously

failed

AADs

at

doses

not

exceeding

those

previously

failed).

Safety:

Composite

endpoint

consisting

of

predefined

Adverse

Events

that

are

adjudicated

by

the

CEC

to

be

serious

adverse

events

(SAEs)

and

related

to

the

AtriCure

Bipolar

System,

the

AtriClip

Pro

LAA

Exclusion

System,

within

30

days

of

the

epicardial

surgical

ablation

procedure,

or

within

7

days

of

the

index

endocardial

procedure,

or

within

7

days

after

a

repeat

endocardial

procedure

within

the

blanking

period.

Subject Population:

Key Inclusion Criteria:

•

Patient is >18 years of age and <

75 years

of age at time of consent.

•

Patient has symptomatic (e.g. palpitations,

shortness of breath, fatigue) Persistent Atrial

Fibrillation or Longstanding Persistent Atrial

Fibrillation refractory to a minimum of one Class I

or Class III AADs.

•

Patient may have had up to two (2) previously

failed catheter ablations to treat atrial fibrillation

using catheter ablation are eligible, if they

present with symptomatic Persistent or

Longstanding Persistent AF.

Key Exclusion Criteria:

•

Patient has a documented history of AF >10

years.

•

Patient has had an EP catheter ablation

procedure to treat atrial fibrillation within 6

months prior to signing consent. |