Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Addus HomeCare Corp | d850382d8k.htm |

Exhibit 99.1

|

|

Exhibit 99.1

Serving Families at Home Since 1979

The Pre-Acute Solution to the Post-Acute Problem.

JP Morgan Conference

January 12-15, 2015

Mark Heaney President and CEO Inna Berkovich Chief Information Officer

Darby Anderson Chief Business Development and Strategy Officer

|

|

Forward-Looking Statements

The following information contains, or may be deemed to contain, forward-looking statements. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. The future results of Addus may vary from the results expressed in, or implied by, the following forward-looking statements, possibly to a material degree, and historical results may not be an indication of future performance. For a discussion of some of the important factors that could cause Addus’ results to differ from those expressed in, or implied by, the following forward-looking statements, please refer to Addus’ most recent Annual Report on Form 10-K, and its Quarterly Reports on Form 10-Q, each of which is available at www.SEC.gov, particularly the Sections entitled “Risk Factors.” Addus undertakes no obligation to update or revise any forward-looking statements, except as may be required by law.

|

|

Mission

It is the primary mission of Addus HomeCare to improve the health and well being of our consumers through the provision of quality, cost-effective home and community based services.

We will accomplish our goals by fostering an environment in which our employees enthusiastically support and advance our mission.

Reward for accomplishing our mission includes pride in our organization, contribution to the community and a reasonable profit.

3

|

|

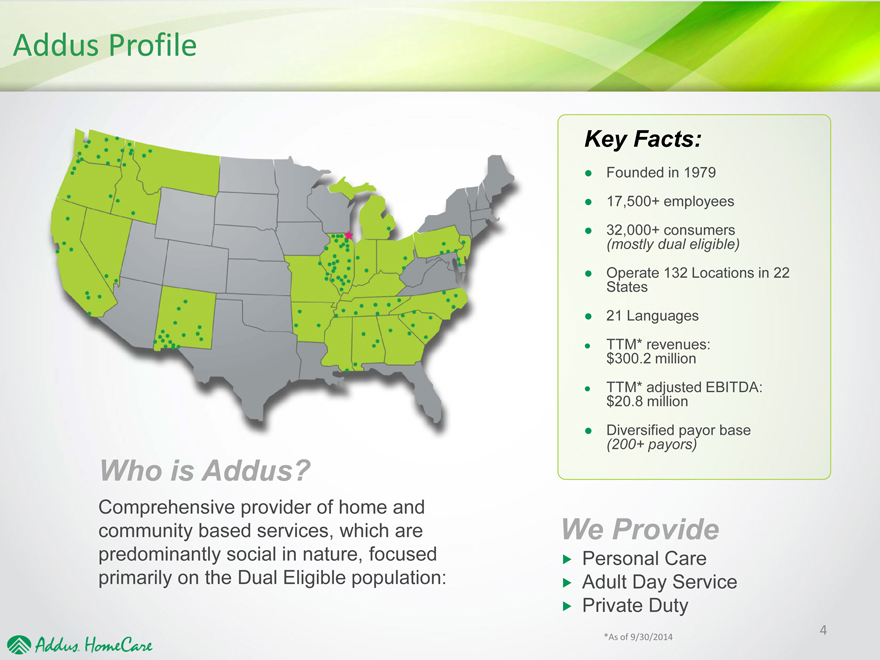

Addus Profile

Who is Addus?

Comprehensive provider of home and community based services, which are predominantly social in nature, focused primarily on the Dual Eligible population:

Key Facts:

• Founded in 1979

• 17,500+ employees

• 32,000+ consumers

(mostly dual eligible)

• Operate 132 Locations in 22

States

• 21 Languages

• TTM* revenues:

$300.2 million

• TTM* adjusted EBITDA:

$20.8 million

• Diversified payor base

(200+ payors)

We Provide

? Personal Care

? Adult Day Service

? Private Duty

*As of 9/30/2014 4

|

|

Who We Serve….

…The 5% who consume 50% of the Healthcare dollars

10,000 people a day turn 65 years old

Those baby boomers that live to 75 can expect to live at least 10 more years

In just 14 years, life expectancy has increased 2.4 years, meaning….…more elderly are living longer and, as they do, they become increasingly poor

5

Source: Pew Research Center, December 2010

|

|

Our Services

We serve high volume consumers of healthcare in their homes at the lowest

price point for hands-on care

We serve over 32,000 consumers—typically elderly, chronically ill or disabled, at risk of hospitalization or institutionalization

Our Homecare Aides assist with essential activities of daily living – without this help, consumers will go to a nursing home

Average duration of services is approximately 17 months per consumer

We see our consumers on average 45 hours per month

Addus average revenue per billable hour is $17.05

Substantial opportunity to integrate technology to leverage our low-cost care

6

|

|

Addus Dual AdvantageTM

The Very Front Line

No one knows more about the

member…

No one is in a better position to

positively affect health

outcomes…

Than the

Addus HomeCare

Aide.

7

|

|

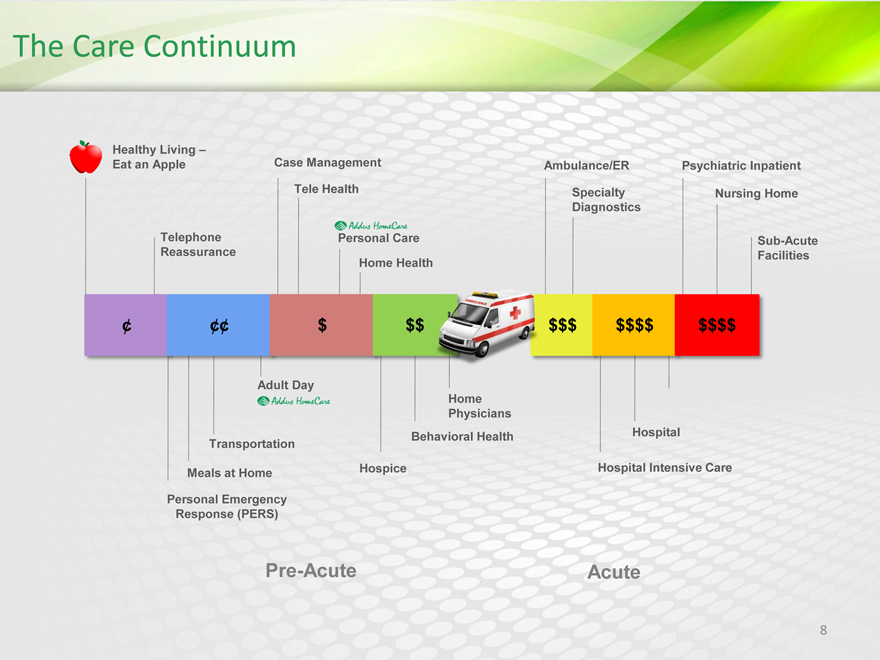

The Care Continuum

Healthy Living –

Eat an Apple Case Management Ambulance/ER Psychiatric Inpatient Tele Health Specialty Nursing Home Diagnostics

Telephone Personal Care Sub-Acute Reassurance Home Health Facilities

¢ ¢¢ $ $$ $$$ $$$$ $$$$

Adult Day

Home Physicians

Behavioral Health Hospital Transportation

Hospice Hospital Intensive Care

Meals at Home

Personal Emergency Response (PERS)

Pre-Acute Acute

8

|

|

The Leader in Large, Highly Fragmented Industry

Only public pure-play home care provider

Approximately 20,000 home care agencies

Personal care market in excess of $60 billion

Home care proven effective in enabling consumers to remain safely and healthfully at home for as long as possible

Public policy shift to consolidate Medicare and Medicaid programs for 9 million dual-eligibles driving expansion of MCOs

9

|

|

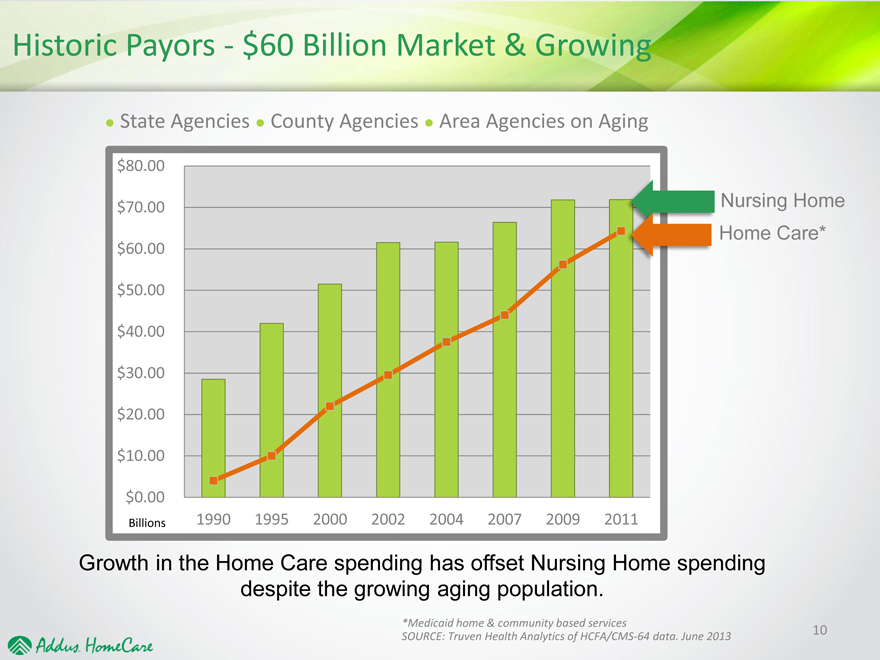

Historic Payors—$60 Billion Market & Growing

State Agencies County Agencies Area Agencies on Aging

$80.00

$70.00 Nursing Home

Home Care*

$60.00

$50.00

$40.00

$30.00

$20.00

$10.00

$0.00

Billions 1990 1995 2000 2002 2004 2007 2009 2011

Growth in the Home Care spending has offset Nursing Home spending

despite the growing aging population.

*Medicaid home & community based services

SOURCE: Truven Health Analytics of HCFA/CMS-64 data. June 2013 10

|

|

Strategies for Growth

Aging population Favor larger, more

Longer lifespan sophisticated,

Sales programs to increase providers

same store census • Require technology

De novo expansion int More

new markets comprehensive

Business development offerings

with traditional payors • Expect health

Adult Day expansion outcomes

Product diversification Risk based contracts

o Tele-monitoring

o Risk assessments

o Platform for small

providers

• 20,000 Mostly small agencies

• Changing market

• Mounting regulatory pressure

• Industry consolidation

11

|

|

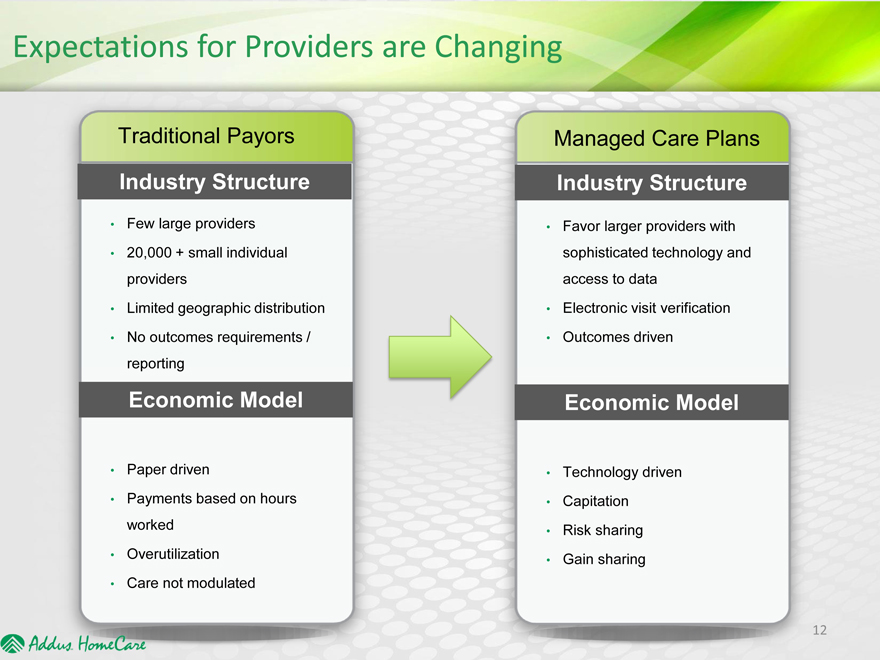

Expectations for Providers are Changing

Traditional Payors

Industry Structure

Few large providers

20,000 + small individual

providers

Limited geographic distribution

No outcomes requirements /

reporting

Economic Model

Paper driven

Payments based on hours

worked

Overutilization

Care not modulated

Managed Care Plans

Industry Structure

Favor larger providers with

sophisticated technology and

access to data

Electronic visit verification

Outcomes driven

Economic Model

Technology driven

Capitation

Risk sharing

Gain sharing

12

|

|

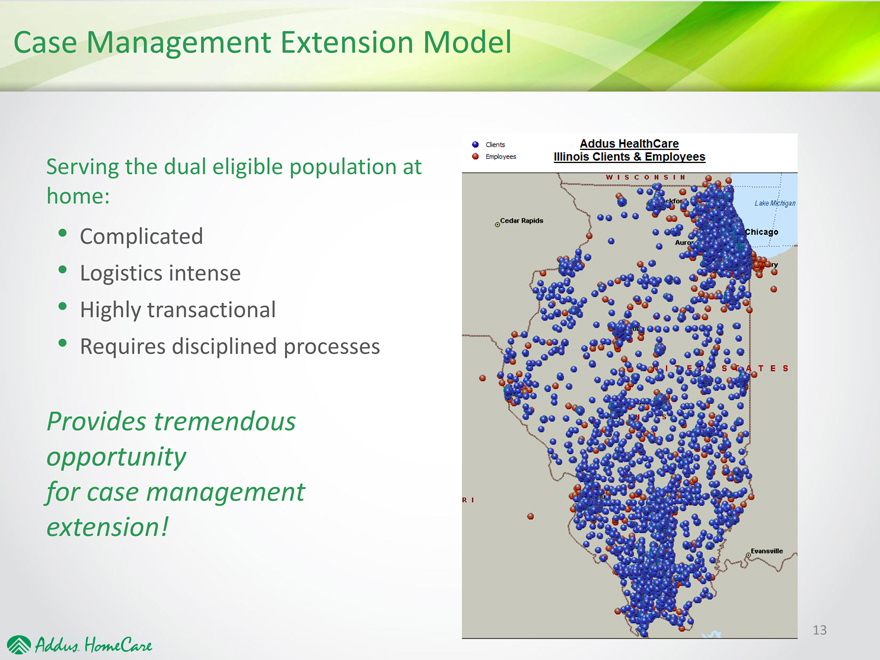

Case Management Extension Model

Serving the dual eligible population at

home:

Complicated

Logistics intense

Highly transactionvbal

Requires disciplined processes

Provides tremendous

opportunity

for case management

extension!

|

|

Addus Dual Advantage™ — The New Paradigm

The Addus Advantage coordinated care model

By Enabling members to live safely and healthfully at home as long as possible we add value for any provider/payer at financial risk

|

|

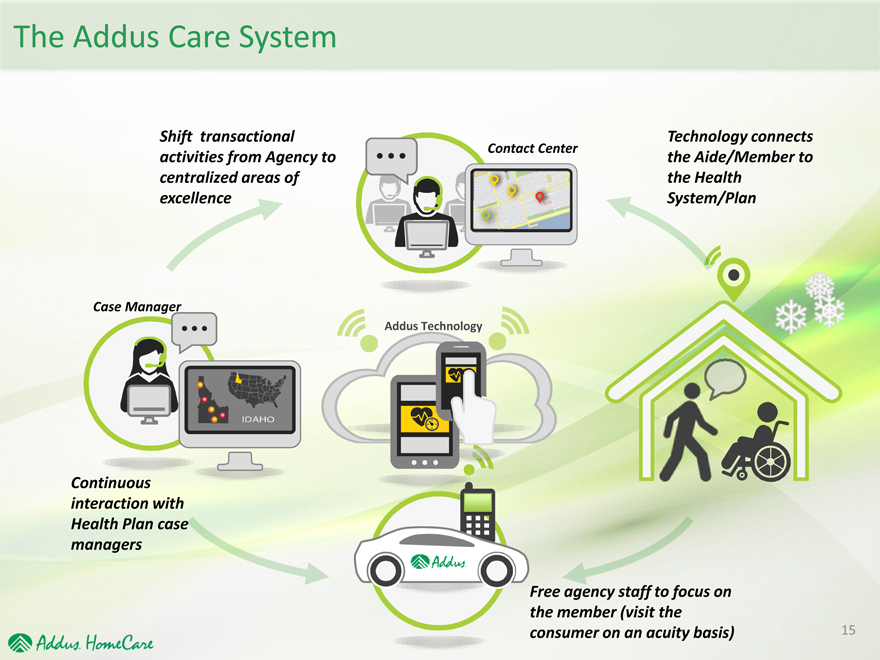

The Addus Care System

Shift transactional activities from Agency to centralized areas of excellence

Contact Center

Technology connects the Aide/Member to the Health System/Plan

Case Manager

Addus Technology

Continuous

interaction with

Health Plan case

managers

Free agency staff to focus on the member (visit the consumer on an acuity basis)

|

|

Driving Outcomes

Services We Provide

Activities of Daily Living Needs

Driving to

Doctor Visits

Personal Hygiene

Nutrition/Meal Prep

Errands/Shopping

Home Safety Assessment

Member Engagement

Because we’re always there

Observe & Report

Photo Documentation

Real-time Patient

Condition Monitoring

and Early Intervention

Outcomes

Early Intervention and Compliance

Weight Mgmt &

Medication Compliance

Nutrition

Stay At Home

Reduced

Hospitalizations/Nursing

Homes

Fall Prevention

16

|

|

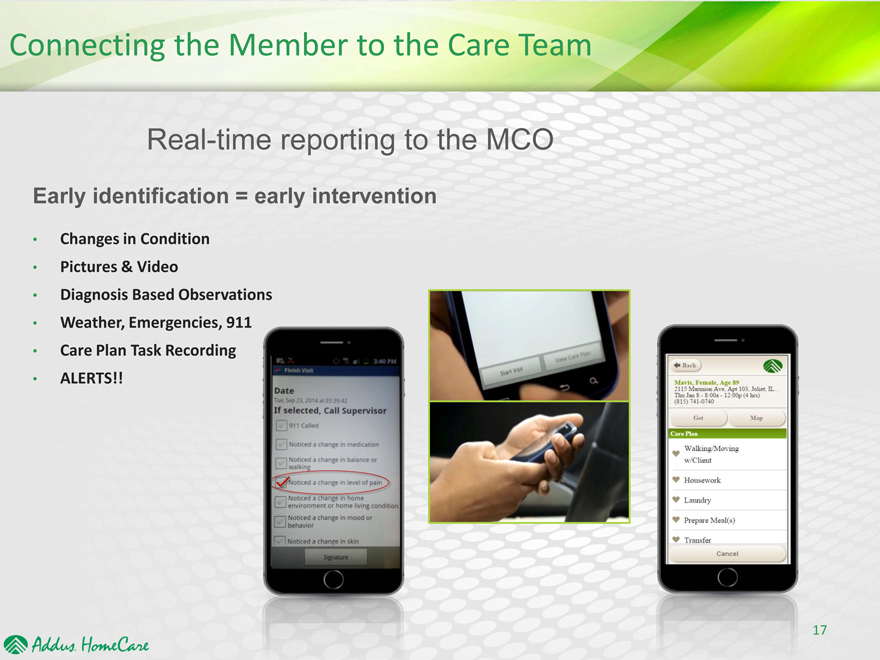

Connecting the Member to the Care Team

Real-time reporting to the MCO

Early identification = early intervention

Changes in Condition

Pictures & Video

Diagnosis Based Observations

Weather, Emergencies, 911

Care Plan Task Recording

ALERTS!!

|

|

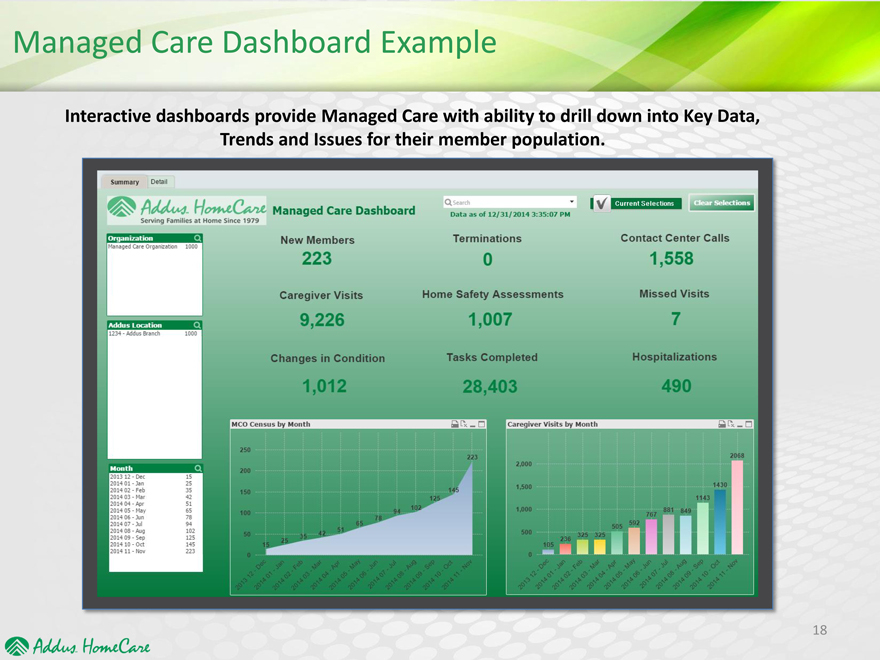

Managed Care Dashboard Example

Interactive dashboards provide Managed Care with ability to drill down into Key Data, Trends and Issues for their member population.

|

|

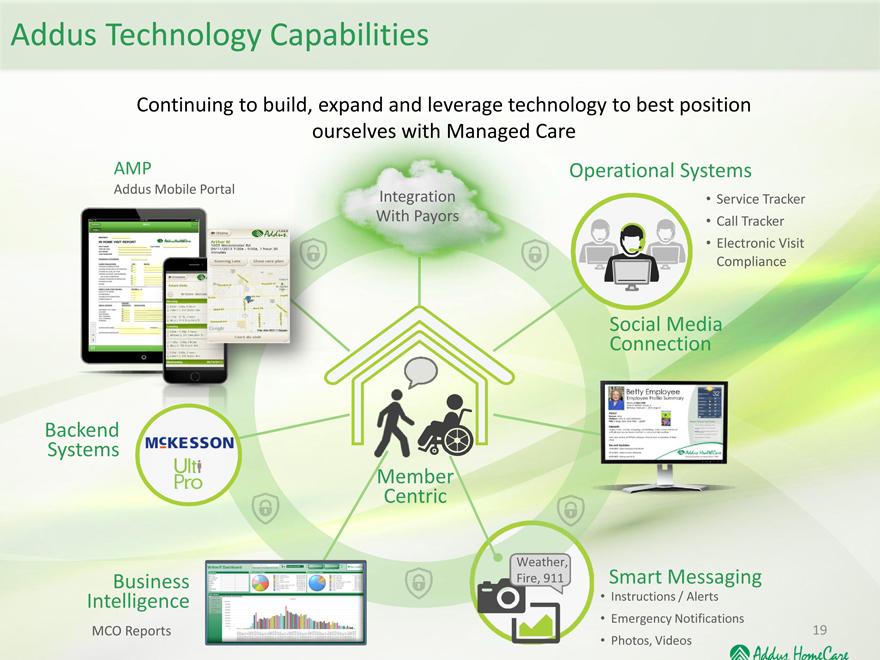

Addus Technology Capabilities

Continuing to build, expand and leverage technology to best position

ourselves with Managed Care

AMP Operational Systems

Addus Mobile Portal Integration • Service Tracker

With Payors • Call Tracker

• Electronic Visit

Compliance

Social Media

Connection

Backend

Systems

Member

Centric

Weather,

Business Fire, 911 Smart Messaging

Intelligence • Instructions / Alerts

• Emergency Notifications

MCO Reports

• Photos, Videos

19

|

|

Compelling Investment Considerations

Favorable demographic trends for growth

We serve a high utilization/high risk population (the 5% who use 50%)

Health care is moving to home based care away from acute based care

To manage this population we have to treat the consumer, at home, with people and

technology

Managed care is assuming management of this population and will favor larger, more

sophisticated, technology and outcome driven, risk taking organizations

Largest public, pure play, home care company with significant geographic footprint

Our model is easily replicable and scalable

We have made significant technology investments and are an operating laboratory for

future development

We have a solid record and reputation

20

|

|

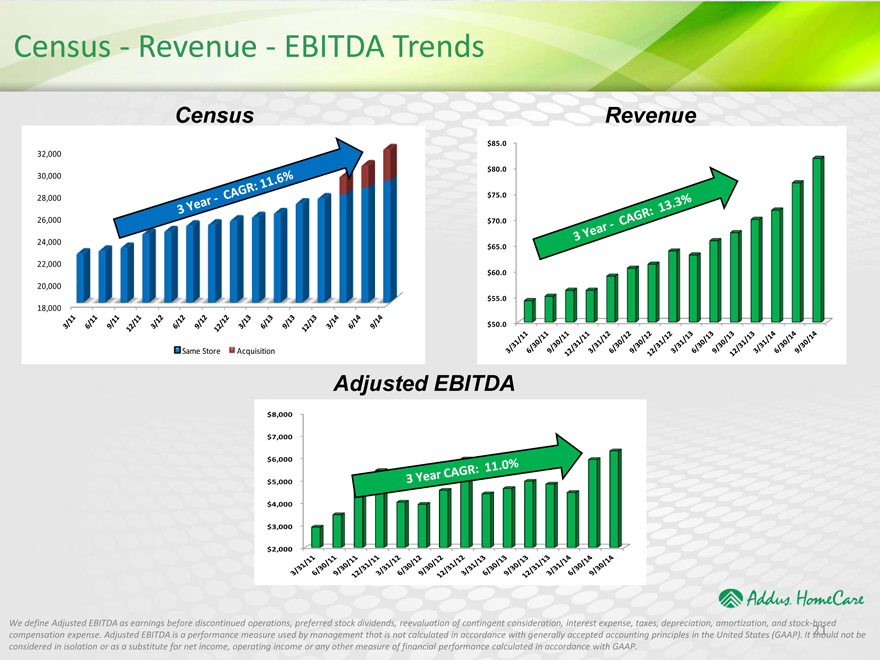

Census—Revenue—EBITDA Trends

Census

32,000

30,000

28,000

26,000

24,000

22,000

20,000

18,000

Same Store Acquisition

Revenue

$ 85.0

$ 80.0

$ 75.0

$ 70.0

$ 65.0

$ 60.0

$ 55.0

$ 50.0

Adjusted EBITDA

$ 8,000

$ 7,000

$ 6,000

$ 5,000

$ 4,000

$ 3,000

$ 2,000

We define Adjusted EBITDA as earnings before discontinued operations, preferred stock dividends, reevaluation of contingent consideration, interest expense, taxes, depreciation, amortization, and stock-based

compensation expense. Adjusted EBITDA is a performa

ce measure used by management that is not calculated in accordance with generally accepted accounting principles in the United States (GAAP). It should not be

considered in isolation or as a substitute for net income

operating income r any other measure of financial performance calculated in accordance with GAAP.

21

|

|

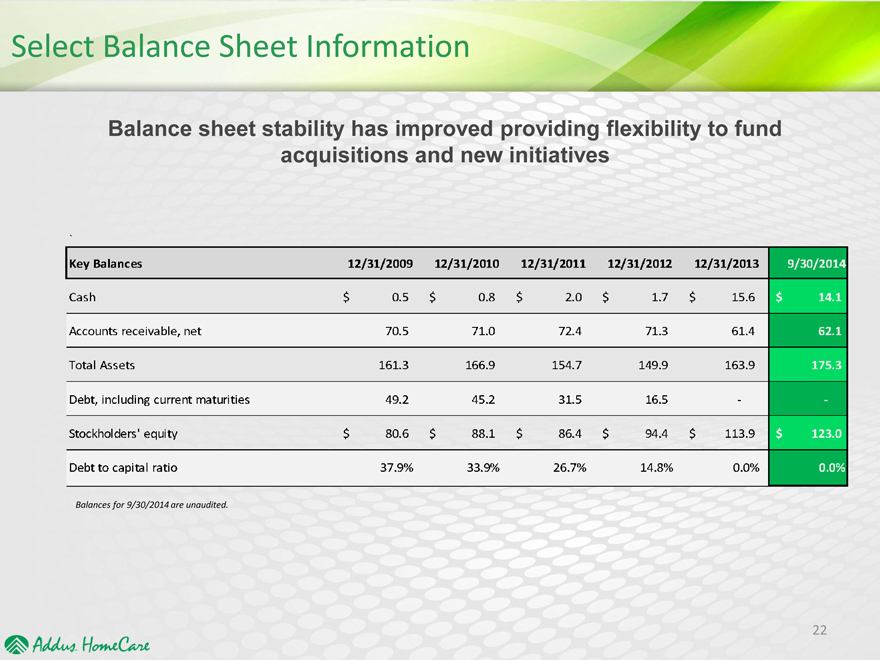

Select Balance Sheet Information

Balance sheet stability has improved providing flexibility to fund acquisitions and new initiatives