Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AERIE PHARMACEUTICALS INC | d850110d8k.htm |

| EX-99.1 - EX-99.1 - AERIE PHARMACEUTICALS INC | d850110dex991.htm |

Aerie Pharmaceuticals, Inc.

Company Overview

January 12 -

15, 2015

Building a Major

Ophthalmic

Pharmaceutical

Company

Exhibit 99.2 |

2

Important Information

Any discussion of the potential use or expected success of our product candidates

is subject to our product candidates being approved by regulatory

authorities. In addition, any discussion of clinical data results for our

Rhopressa ™

and Roclatan

™

product candidates relate to the results in our Phase 2 clinical

trials.

The information in this presentation is current only as of its date and may have

changed or may change in the future. We undertake no obligation to update

this information in light of new information, future events or otherwise. We

are not making any representation or warranty that the information in this

presentation is accurate or complete.

Certain

statements

in

this

presentation

are

“forward-looking

statements”

within

the

meaning

of

the

federal

securities laws, including beliefs, expectations, estimates, projections and

statements relating to our business plans, prospects and objectives, and the

assumptions upon which those statements are based. Words such as

“may,” “will,”

“should,”

“would,”

“could,”

“believe,”

“expects,”

“anticipates,”

“plans,”

“intends,”

“estimates,”

“targets,”

“projects”

or similar expressions are intended to identify these forward-

looking statements. These statements are based on the Company’s current plans

and expectations. Known and unknown risks, uncertainties and other factors

could cause actual results to differ materially from those contemplated by

the statements. In evaluating these statements, you should specifically

consider various factors that may cause our actual results to differ materially

from any forward-looking statements. These risks and uncertainties are

described more fully in the quarterly and annual reports that

we

file

with

the

SEC,

particularly

in

the

sections

titled

“Risk

Factors”

and

“Management’s

Discussion

and

Analysis

of

Financial

Condition

and

Results

of

Operation.”

Such

forward-looking

statements

only

speak as of the date they are made. We undertake no obligation to publicly update

or revise any forward- looking statements, whether because of new

information, future events or otherwise, except as otherwise required by

law. |

3

Rhopressa

TM

Triple Action

All Products Fully

Owned by Aerie

Roclatan

TM

Quadruple Action

•

Fixed

combination

of

Rhopressa

TM

and

latanoprost

•

P2b achieved all clinical endpoints, P3 start mid-2015

•

Potentially most efficacious IOP-lowering therapy

•

Inhibits ROCK and NET, targets diseased tissue

•

Consistent

IOP

lowering,

lowers

Episcleral

Venous

Pressure

•

Expect P3 efficacy data mid-Q2 2015, NDA filing mid-2016

Large Market

Opportunity

•

$4.5B US/EU/JP Market with significant unmet needs -

growing to more than $8B

by 2023

•

Multiple MOAs, once daily, high efficacy and safety

•

Late-stage/potential blockbuster revenue opportunity

•

Full patent protection through at least 2030

•

Plan to commercialize products ourselves in North America

(and potentially Europe) while partnering in Japan

•

Grow

pipeline

via

R&D

efforts,

in-license

and/or

acquisition

Aerie –

Building a Major Ophthalmic

Pharmaceutical Company |

4

Largest Rx market in ophthalmology: $4.5B US/EU/JP*

•

US

Glaucoma

patients:

2.7M

growing

to

4.3M

by

2030

1

•

Patients on more than one drug to control disease: 50%

No commonly prescribed drugs:

•

target the diseased tissue

•

relax the main fluid drain and lower EVP

•

show consistent efficacy across a broad range of pressures

*

IMS 2013

1

National Eye Institute

Glaucoma Market

Unmet Needs

Expanding Market |

5

FY 2013 U.S. Glaucoma Market = $2.0B; 31.5M TRx

Market Share in TRx

Current Product Dashboard

PGA: Prostaglandin Analogue; BB: Beta Blocker; AA: Alpha Agonist; CAI: Carbonic

Anhydrase Inhibitor Once Daily

2-3 Times Daily

Bimatoprost

Travoprost

Latanoprost

BB

BB Fixed Combo

AA

CAI

15%

8%

10%

10%

10%

31%

14%

PGA Market

Non-PGA Market |

6

New MOAs

Rhopressa

TM

(Aerie

AR-13324)

ROCK/NET inhibitor (qd)

Phase 3

Roclatan

TM

(Aerie PG324)

ROCK/NET inhibitor + PGA (qd)

Phase 3

K-115 (Kowa)

ROCK inhibitor (bid)

Approved in Japan*

Adjunctive Therapy

AMA0076 (Amakem)

ROCK inhibitor (bid)

Phase 2a

INO-8875 (Inotek)

Adenosine-A1 agonist (bid)

Phase 2

OPA-6566 (Acucela)

Adenosine-A2a agonist (bid)

Phase 1/2

SYL040012 (Sylentis)

RNAi beta blocker (qd)

Phase 2

New PGAs: not usable as add-on to current PGAs

Rhopressa

TM

and Roclatan

TM

: advanced triple and quadruple MOAs

New PGAs

BOL-303259 (B+L)

NO donating latanoprost (qd)

Phase 3

DE-117 (Santen)

EP2 agonist (qd)

Phase 2a

ONO-9054 (Ono)

FP/EP3 agonist (qd)

Phase 1

Glaucoma Competitors in Pipeline

* Approved in Japan 9/29/2014 |

7

2023 U.S. Glaucoma Market

and Market Share Projections*

Projected Market Share in TRx

PGA: Prostaglandin Analogue; BB: Beta Blocker; AA: Alpha Agonist; CAI: Carbonic

Anhydrase Inhibitor Data Source: IMS 2013 FY TRX. Internal projection

*Projected market shares compiled by an independent market research company

U.S. Glaucoma Market = $4.9B; 41.7 M TRx

TRx Growth 2013-2023 = 2.3%

Roclatan™

+ Rhopressa™

May Capture Over 40% Market Share

Based on 200 U.S. Physician Responses to Survey

PGA’s

BB

BB Fixed Combo

AA

CAI

Rhopressa

™

Roclatan™

25%

6%

9%

5%

5%

31%

18% |

8

Managed Care Market Research Summary

* Respondents ranked products on a scale of 1-7

** After pricing was disclosed and discussed

Payers

were

impressed

by

Roclatan

TM

’s unprecedented lowering of IOP

Payers’

score

on

the

overall

utility

of

Rhopressa

TM

was

4.7*

(Market research firm states that scores above 4 are high)

Payers’

score

on

the

overall

utility

of

Roclatan

TM

was 5.2*

(Market research firm states that scores above 5 are rare)

100%

of

respondents

placed

Rhopressa

TM

and

Roclatan

TM

in

Tier 2 or Tier 3 of Commercial and Medicare Part D

formularies.**

There were no “Not Covered”

recommendations.

Interviews with 12 decision makers whose companies cover over 42

million Commercial, Medicare and Medicaid lives

Payers

were

receptive

to

Rhopressa

TM

’s new MOAs and efficacy at any baseline IOP |

9

increase

Decreases Fluid

Inflow/Production

(Ciliary Processes)

Increases Fluid Outflow:

Secondary Drain

(Uveoscleral Pathway)

Increases Fluid Outflow:

Primary

Drain-

Lowers EVP -

(Episcleral Venous Pressure)

Rhopressa

™

Roclatan

™

AA, BB, CAI

PGAs

Aerie Products Cover the IOP-lowering Spectrum

Trabecular Meshwork (TM); |

Aerie

Product Market Positioning* * Confirmed by Market Research

Triple-Action Rhopressa™

Triple-Action Rhopressa™

Quadruple-Action Roclatan™

Quadruple-Action Roclatan™

Also for PGA users as add-on

therapy

Also for PGA non-responders and

those with tolerability concerns

Also for patients with low-tension

glaucoma

For patients with IOPs above

26 mmHg

Also for patients at any IOP with

significant disease progression

10

Efficacy potentially greater than all

currently marketed drugs

Future product of choice for

patients requiring maximal IOP

lowering

Future drug of choice for the 80%

of patients with IOP of 26 mmHg

or less |

11

Rhopressa

™

NET

RKI

NET

RKI

Trabecular

Meshwork

Triple-Action Rhopressa™

Episcleral

Veins

Schlemm’s

Canal

Ciliary Processes

Uveoscleral

Outflow

ROCK inhibition relaxes TM, increases outflow

NET inhibition reduces fluid production

ROCK inhibition lowers Episcleral Venous

Pressure (EVP)

IOP-Lowering Mechanisms

RKI

Cornea |

12

Rhopressa™: Powerful Compound for Physiological

Lowering of IOP –

Phase 2b Results

Once-daily

PM

dosing

of

0.02%

Rhopressa™

is

highly

effective

IOP -5.7 and -6.2 mmHg on D28 and D14

Rhopressa™

efficacy results within ~1 mmHg of latanoprost

Favorable tolerability profile with no systemic side effects

Mean

Mean

Diurnal

Diurnal

IOP

IOP

–

–

Entry

Entry

IOP

IOP

22-36

22-36

mmHg

mmHg

(n=221)

(n=221)

25.6

19.5

20.0

25.5

18.4

18.7

13

18

23

28

Baseline

Day 14

Day 28

Rhopressa™

0.02% (n=71)

Latanoprost (n=76) |

13

Rhopressa

™

Differentiated Efficacy Profile

Phase 2b baseline IOP entry requirements: 24,

22, 22 mmHg (8 AM, 10 AM, 4 PM)

Rhopressa

™

and latanoprost clinically

and statistically equivalent in patients

with moderately elevated IOPs of 22-26

mmHg

Latanoprost loses ~1 mmHg efficacy @

baselines of 22-26 mmHg

Rhopressa

™

maintains consistent

efficacy

Rhopressa

™; 1

st

product to treat the

diseased tissue (trabecular meshwork)

with a once-daily (QD) dose

Baseline: 22 –

36 mmHg (n=221)

Baseline: 22 –

26 mmHg (n=106)

-5.7

-6.8

-8

-6

-4

-2

0

0.02% Rhopressa™

Latanoprost

-5.8

-5.9

-8

-6

-4

-2

0

0.02% Rhopressa™

Latanoprost |

14

Sustained Effect of Rhopressa™

vs. Latanoprost

* 36 hours post dose

0.02% Rhopressa

™

Roclatan

™

Phase 2b

0.02% Rhopressa

™

Rhopressa

™

Phase 2b

0.005% latanoprost

Rhopressa

™

Phase 2b

(n = 78)

(n = 71)

(n = 76)

Baseline

26.6

27.2

26.8

Day 8

20.0

21.1

20.0

Day 29

20.3

21.2

19.2

Day 30*

21.0

22.2

22.4

8 AM Mean IOP (mmHg) by Treatment Group

Rhopressa

™

Duration is Superior to Latanoprost

36 Hours After Last Dose |

15

Rhopressa™

EVP-Lowering Breakthrough

Phase 2b data provided first sign of EVP-lowering:

Phase 1 study in low baseline IOP subjects:

Preclinical in vivo study:

Note: Timolol and latanoprost reported to have no effect or to increase

EVP in animal models

Consistent Efficacy Across Baseline IOPs

Lowered Average IOP by Over 30%

From 16 Down to 11 mmHg

Lowered EVP by 35% |

16

Baseline IOP*

~80% of U.S. Glaucoma Patients Have IOPs that

are

26 mmHg at Time of Diagnosis

The Baltimore Eye Survey

*

Sommer A, Tielsch JM, Katz J et al. Relationship between intraocular pressure and

primary open angle glaucoma among white and black Americans:

The

Baltimore

eye

survey.

Arch

Ophthalmol

1991;109:1090-1095

**

IWASE et al Tajimi study group. Japan Glaucoma Society. Ophthalmology, 2004 Sep, 111 (9): 1641-8.

21 mmHg

(Normal Tension Glaucoma)

>21

-

26

mmHg

>26 -

<35 mmHg

10,444 Individuals Were Screened for the Prevalence of Primary Open-Angle

Glaucoma (POAG) and the IOP at Time of Diagnosis

92%

of

Japanese

Patients

with

POAG,

IOPs

Were

21

mmHg**

20%

60%

20% |

17

Latanoprost and Timolol Show Reduced Efficacy

at Lower Baseline IOPs

Pooled data from three latanoprost registration studies. Hedman and Alm;

European Journal Ophthalmology; 2000 Latanoprost and timolol

lose efficacy as baseline

IOPs decline

Timolol at least 1 mmHg less

effective than latanoprost

across all published baselines

Rhopressa™

equivalent/

non-inferior

to

latanoprost

at

baselines 22–26 mmHg

Timolol is the standard

comparator for glaucoma

Phase 3 trials

-16

-14

-12

-10

-8

-6

-4

-2

0

16

18

20

22

24

26

28

30

32

34

36

38

Untreated Diurnal IOP (mmHg)

Timolol (n=369)

Latanoprost (n=460) |

18

Rhopressa™

Registration Trial Overview

Primary efficacy endpoint: IOP at nine time points through Day 90

Phase 3 entry IOP is >20 mmHg and <27 mmHg

Non-inferiority design vs. timolol

95% CI within 1.5 mmHg at all time points, within 1.0 mmHg at a majority

of time points

Combined trials to include approximately 1,300 total patients

100 patients with 12 months of safety data needed for NDA filing

Should meet efficacy requirements for EMA filing

300

patients

with

6

months

safety

data

needed

for

EMA

filing

and

100

with

12 months |

19

Rhopressa™

Registration Trial Design

*

PGAs have been shown to be less effective when dosed BID

“Rocket 1”

90-Day Efficacy

Registration Trial

Rhopressa™

0.02% QD

~200 patients

Timolol BID

~200 patients

“Rocket 2”

One Year Safety

(3 Mo. Interim

Efficacy)

Registration Trial

“Rocket 3”

One Year Safety

Registration Trial

Canada

Rhopressa™

0.02% QD

~230 patients

Rhopressa™

0.02% BID

*

~230 patients

Timolol BID

~230 patients

Rhopressa™

0.02% QD

~90 patients

Rhopressa™

0.02% BID

~90 patients

Timolol BID

~60 patients |

20

Latanoprost

Rhopressa

™

Quadruple-Action Roclatan™

Fixed

Combination

of

Rhopressa™

with

Latanoprost

IOP-Lowering Mechanisms

ROCK inhibition relaxes TM, increases outflow

NET inhibition reduces fluid production

ROCK inhibition lowers EVP

PGA receptor activation

increases uveoscleral outflow

Ciliary Processes

Cornea

Uveoscleral

Outflow

NET

RKI

NET

Trabecular

Meshwork

Episcleral

Veins

Schlemm’s

Canal

RKI

PGA |

21

Roclatan™

Phase 2b Clinical Trial Design

Phase 2b Protocol

Roclatan™

0.01%

vs.

Roclatan™

0.02%

vs.

Rhopressa™

0.02%

vs.

Latanoprost

All Dosed QD PM

~300 Patients

28 Days

Primary efficacy endpoint:

Mean diurnal IOP on Day 29

Two concentrations of

Roclatan™

vs. Rhopressa™

0.02% and latanoprost

Trial design follows FDA

requirement for fixed-dose

combination

Statistically significant difference

at measured time points

Higher combo efficacy vs.

components of at least 1–3

mmHg, as previously accepted

by FDA for product approval |

22

Roclatan™

Phase 2b Clinical Trial Performance

Achieved primary efficacy measure

Superiority over each of the components on day 29

Achieved statistical superiority over the individual components at all

time points

More efficacious than latanoprost by 1.6 –

3.2 mmHg

More efficacious than Rhopressa™

by 1.7 –

3.4 mmHg

Main adverse event was hyperemia (eye redness):

Reported in 40 percent of patients

Mild for the large majority of patients

No systemic drug-related adverse events |

23

Mean IOP at Each Time Point

Primary Efficacy Measure

0.02% Roclatan™

Achieved Statistical Superiority Over

Individual Components at All Time Points (p<0.001)

Roclatan™

Phase 2b, Intent to Treat

14

15

16

17

19

20

21

22

23

24

25

26

27

28

29

Pre

-

8AM

8AM

10AM

4PM

8AM

10AM

4PM

8AM

10AM

4PM

8AM

10AM

4PM

8AM

Study

Qual 1

Baseline

Day 8

Day 15

Day 29

Day 30

0.02% Rhopressa™

(n=78)

0.005% Latanoprost (n=73)

0.02% Roclatan™

(n=72)

18 |

24

Roclatan™

Phase 2b, ITT

Mean IOP (mmHg)

*

Difference

between

0.02%

Roclatan™

and

latanoprost

or

Rhopressa™

Roclatan:

Produced lowest IOP

drop in any trial

Was superior to

latanoprost by 1.6–3.2

mmHg (p<0.001)

Was superior to

Rhopressa™

by 1.7–3.4

mmHg (p<0.001)

Impressive Rhopressa™

performance

0.02%

0.02%

Roclatan

Roclatan

™

™

(n = 72)

(n = 72)

0.005%

0.005%

latanoprost

latanoprost

(n = 73)

(n = 73)

0.02%

0.02%

Rhopressa

Rhopressa

™

™

(n = 78)

(n = 78)

Mean

Mean

Mean

Mean

Difference*

Difference*

Mean

Mean

Difference*

Difference*

Day 8

8 AM

17.0

19.6

-2.6

20.0

-3.1

10 AM

15.6

18.3

-2.7

18.0

-2.4

4 PM

15.6

18.6

-3.1

17.9

-2.3

Day 15

8 AM

16.5

19.6

-3.2

19.6

-3.1

10 AM

15.8

18.3

-2.4

18.7

-2.8

4 PM

15.7

18.3

-2.6

18.4

-2.7

Day 29

8 AM

16.9

19.2

-2.4

20.3

-3.4

10 AM

15.9

17.7

-1.8

18.6

-2.7

4 PM

16.8

18.4

-1.6

18.5

-1.7 |

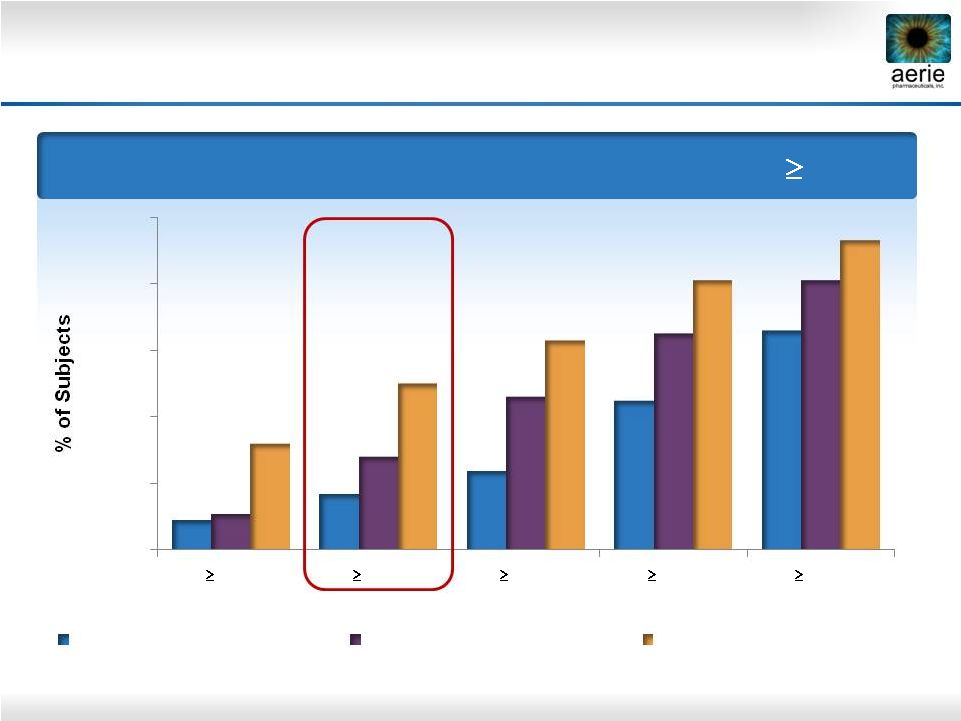

Day

29 – % of Patients with IOP Reductions of

20%

Roclatan™

Phase 2b Responder Analysis:

Goal is to Achieve Lowest IOP Possible

9%

17%

24%

45%

66%

11%

28%

46%

65%

81%

32%

50%

63%

81%

93%

0%

20%

40%

60%

80%

100%

40%

35%

30%

25%

20%

Reduction

0.02% Rhopressa™

(n=78)

0.005% Latanoprost (n=73)

0.02% Roclatan™

(n=72)

25 |

26

Roclatan™

Phase 2b Responder Analysis:

Goal is to Achieve Lowest IOP Possible

Day 29 –

% of Subjects with IOP Reduced to <

18 mmHg

10%

21%

25%

40%

8%

18%

29%

47%

38%

46%

57%

69%

0%

20%

40%

60%

80%

100%

15 mmHg

16 mmHg

17 mmHg

18 mmHg

Reduction

0.02% Rhopressa™

(n=78)

0.005% Latanoprost (n=73)

0.02% Roclatan™

(n=72) |

27

Diurnal

IOP in Subset Of High Responders 16 mmHg

Roclatan™

Phase 2b High Responders:

Consistent IOP Drop by Rhopressa™

and Roclatan™

-9.6

-7.2

-9.9

-9.4

-8.2

-10.6

-9.5

-9.5

-10.2

-12

-11

-10

-9

-8

-7

-6

-5

-4

-3

-2

-1

0

0.02% Rhopressa™

(n=16)

0.005% Latanoprost

(n=13)

0.02% Roclatan™

(n=31)

Day 8

Day 15

Day 29 |

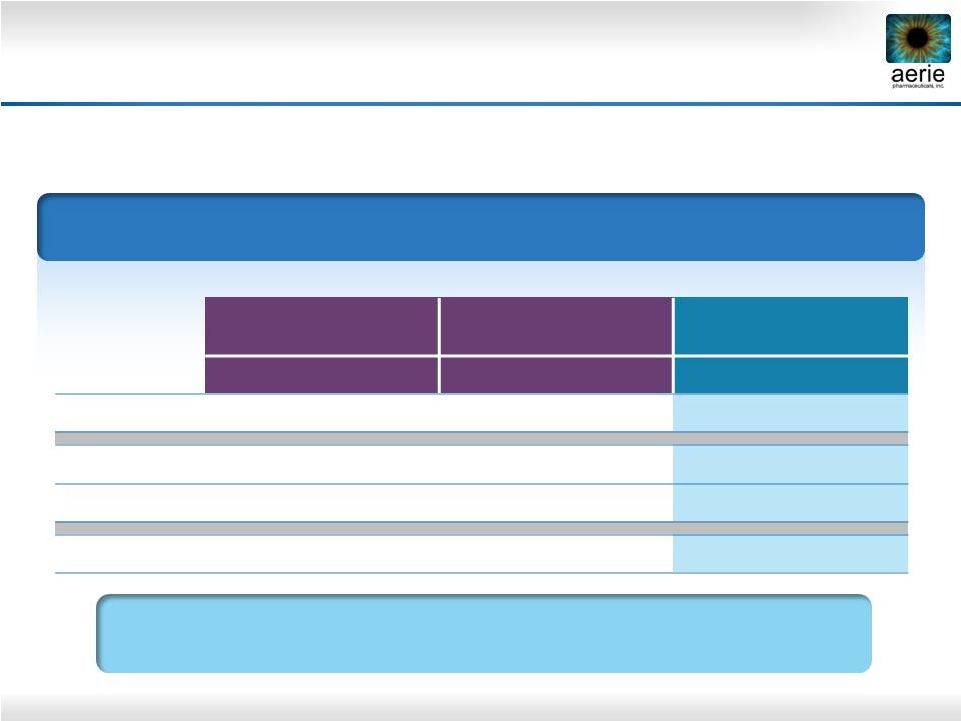

28

2014

2015

2016

2017

2018

Key Future Milestones

June

2014:

Roclatan™

Phase 2b clinical trial completed

Mid-2015:

Roclatan

™

Phase 3 initiated

Mid-2016:

Roclatan

™

Efficacy

results from Phase 3 expected

Mid-2017:

Roclatan

™

NDA filing expected

2H

2018:

Roclatan

™

Launch expected

3Q

2014:

Rhopressa

™

Phase 3 initiated

Mid-Q2

2015:

Rhopressa

™

Efficacy results from Phase 3

expected

Mid-2016:

Rhopressa

™

NDA filing expected

2H 2017: Rhopressa™

Launch expected |

29

Financing the Future

Sufficient Capital to Fund:

$190+ Million Raised From IPO (10/13) and Follow-on Financing (9/14)

FDA

approval

and

launch

of

Rhopressa™

and

Roclatan™

Building of Aerie’s pipeline via internal discovery, licensing and M&A

|

Building a Major

Ophthalmic

Pharmaceutical

Company |