Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SANFILIPPO JOHN B & SON INC | d848590d8k.htm |

Sidoti &

Company, LLC Emerging Growth Institutional Investor Forum

January 12, 2015

NASDAQ: JBSS

Exhibit 99.1 |

Forward-Looking Statements

Some of the statements in this presentation constitute “forward-looking

statements” about John B. Sanfilippo & Son, Inc. Such statements

include, in particular, statements

about our plans, strategies, business prospects, changes and trends in our business

and the markets in which we operate. In some cases, you can identify

forward-looking statements by the use of words such as

“may,” “will,”

“could,”

“would,”

“should,”

“expect,”

“plan,”

“anticipate,”

“intend,”

“believe,”

“estimate,”

“forecast,”

“predict,”

“propose,”

“potential”

or “continue”

or the negative of those terms or other comparable

terminology. These statements represent our present expectations

or beliefs

concerning future events and are not guarantees. Such statements

speak only as of

the date they are made, and we do not undertake any obligation to update any

forward-looking statement.

We caution that forward-looking statements are qualified by important factors,

risks and uncertainties that could cause actual results to differ materially

from those in the forward-

looking statements. Our periodic reports filed with the Securities and

Exchange Commission, including our Forms 10-K and 10-Q and any amendments

thereto, describe some of these factors, risks and uncertainties.

2

* |

Mission

To be the global leader of quality driven,

innovative nut solutions that enhance

the customer and consumer

experience and achieve consistent,

profitable growth for our

stockholders.

We will accomplish this

through our commitment to a

dynamic infrastructure that

maximizes the potential of our

brands, people and processes.

Core Values

Integrity

People

Investment

Customer Driven

Quality

Innovation

Execution

Continuous Improvement

Safety

Resource Conservation

3

*

*

*

* |

Who

is JBSS? •

One of the largest nut processors in the world with fiscal 2014 annual sales in

excess of $778 million

•

State-of-the-art nut processing capabilities, including what we believe

is the single largest nut processing facility in the world

•

A North American market leader in every major selling channel –

from consumer and

commercial ingredient customers to contract packaging and export

customers

•

Dual consumer strategy of branded nut and dried fruit programs (Fisher, Orchard

Valley Harvest)

as well as private brands to major retailers

•

Commodity procurement expertise with buyers averaging over 20+ years

experience •

A category leader in packaging and product innovation

•

Vertically integrated nut processing operation for pecans, peanuts and

walnuts 4

*

* |

“The success

of any company is contingent upon having a strong team to manage and grow the

business. We have that here at JBSS.” Gustine, CA

130 Employees

Garysburg, NC

38 Employees

Bainbridge, GA

102 Employees

Selma, TX

167 Employees

Elgin, IL

857 Employees

*

5 |

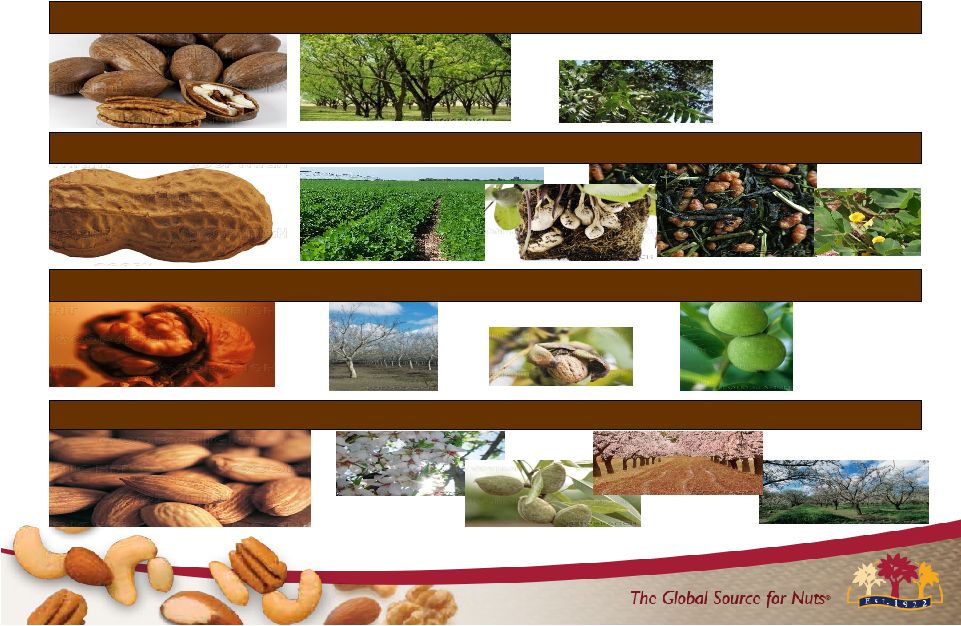

We Are Experts

In Every Nut Type We Are Experts In Every Nut Type

6

•

Full portfolio of nuts

•

Broad variety of value-

added products

•

Wide assortment of other

snack products

•

Versatile and customized

formulas

•

Benefits

Appeals to major

customers

Adapts to changing

consumer needs

Reduces product

concentration risks

% of total gross sales

*

other consists of trail and snack mixes which include nut products

* |

We Are Experts

In Procurement We Are Experts In Procurement

7

Pecans

Peanuts

Almonds

Walnuts

* |

JBSS

SALES CHANNEL UPDATES

8

*

*

*

*

*

*

*

* |

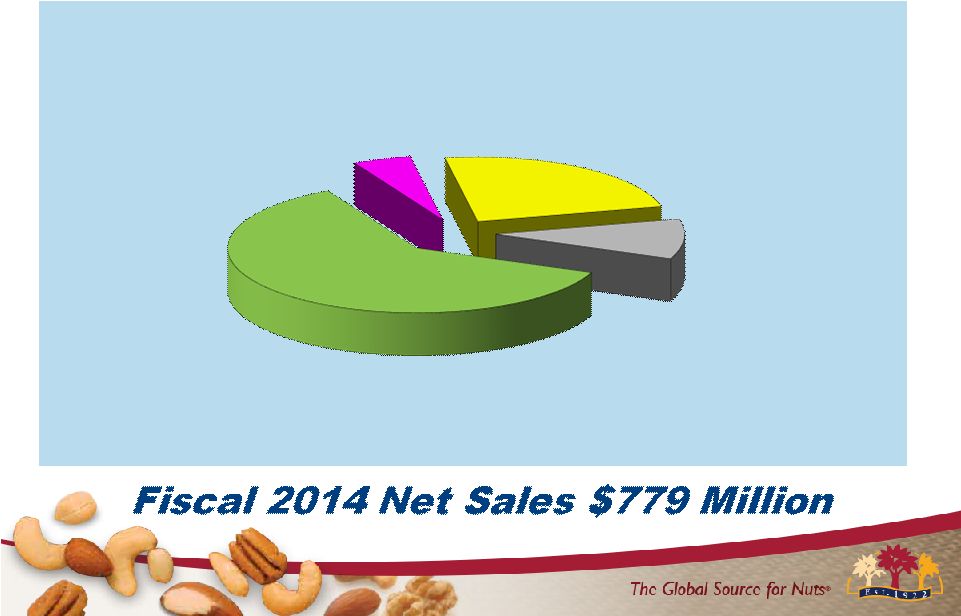

Commercial

Ingredients

25%

Contract Pkg.

13%

Consumer

58%

Export

4%

$193

$98

$454

Business Channel Diversification

(Millions of $)

* Approximately 31% of the Consumer channel sales were Fisher brand sales

$34

9

*

* |

4.1% 10

Consumer

58%

vs. FY ‘13

FY 2014 Consumer Channel

* |

Commercial

Ingredients

25%

8.4%

11

vs. FY ‘13

FY 2014 Commercial Ingredients Channel

* |

Export

4%

0%

Vs. FY ‘13

FY 2014 Export Channel

12

* |

14.0%

13

Contract

Packaging

13%

Vs. FY ‘13

FY 2014 Contract Packaging Channel

* |

FY 2014

Financial Milestones 14 |

Diluted EPS Improvement of 49%

Net Sales increased by 11% to a record $778.6 million

Time to Celebrate Successful Results

over the last three years

680,000,000

700,000,000

720,000,000

740,000,000

760,000,000

780,000,000

800,000,000

FY12

FY13

FY14

Net Sales FY 12-FY 14

$778,622,000

15

0

0.5

1

1.5

2

2.5

3

FY12

FY13

FY14

EPS FY 12-FY 14

* |

Creating

Shareholder Value Outperformed the Russell 2000 Index by over 87%!

16

Stock Price

$23.59

1/7/2014

Stock Price

$42.75

1/7/2015

* |

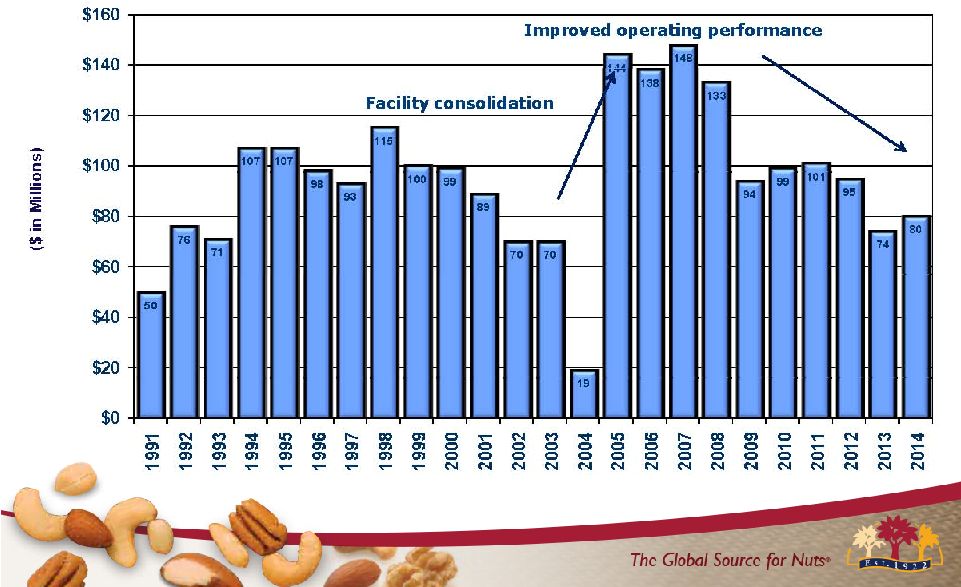

JBSS

Stockholders’ Equity FYs 1991-

2014

17

*

* |

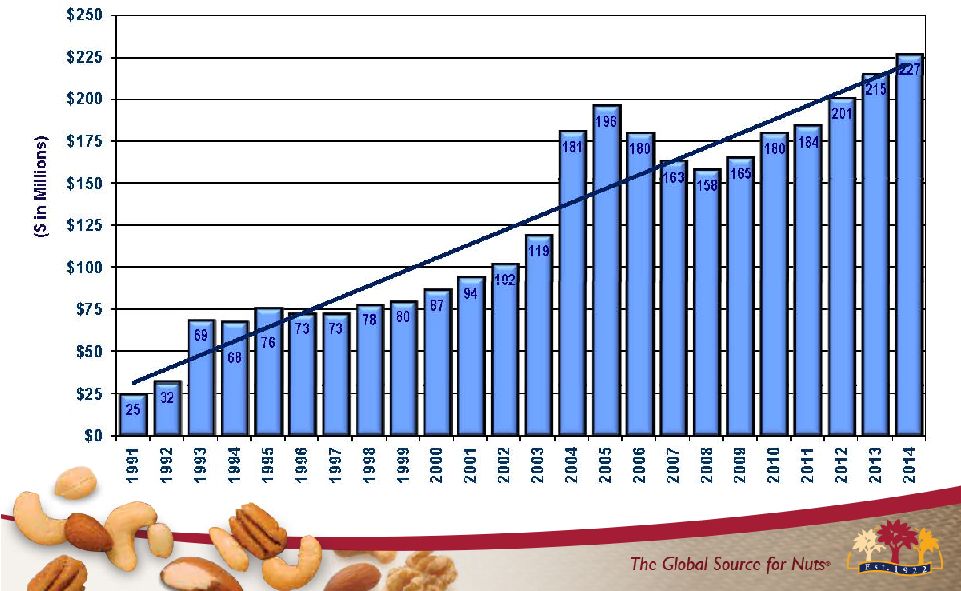

JBSS Net

Sales FYs 1991- 2014

18

* |

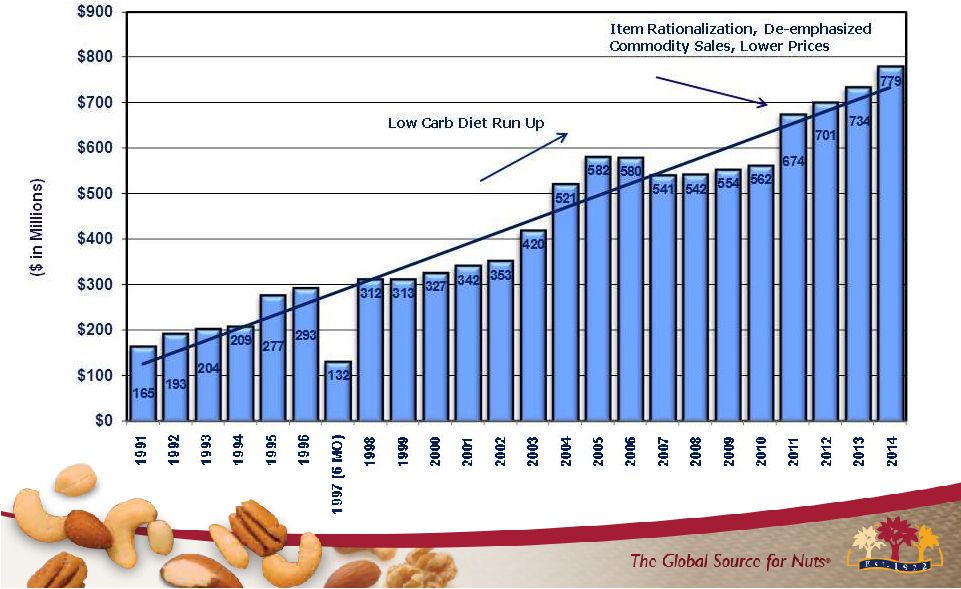

JBSS Total

Outstanding Debt FYs 1991- 2014

19

*

* |

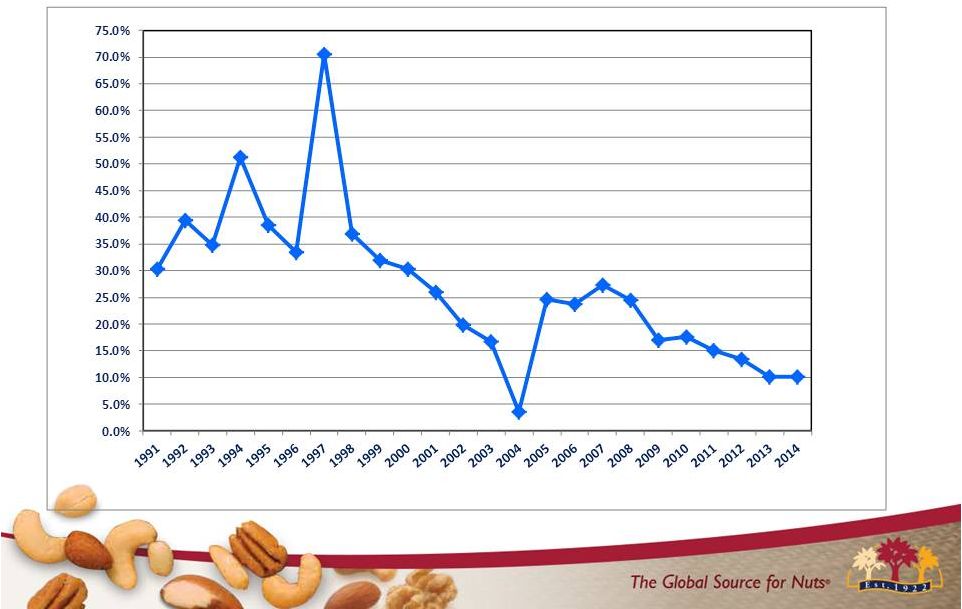

JBSS

Total Outstanding Debt As % of Net Sales FYs 1991 –

2014

Note: FY 1997 reflects stub year

20

* |

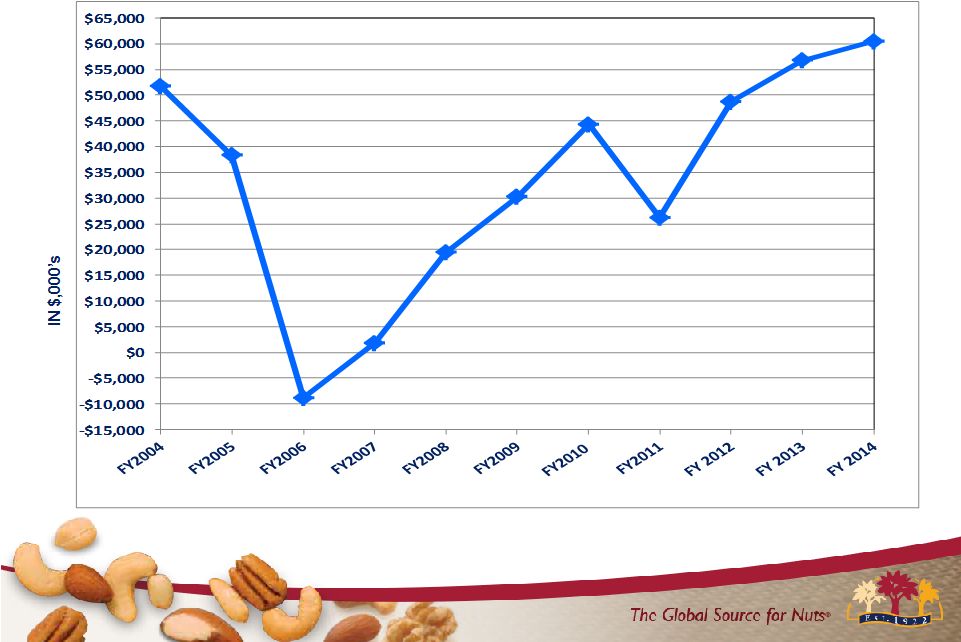

EBITDA

consists

of

earnings

before

interest,

taxes,

depreciation,

amortization

and

noncontrolling

interest.

EBITDA

is

not

a

measurement

of

financial

performance

under

accounting

principles

generally

accepted

in

the

United

States

of

America

("GAAP"),

and

does

not

represent

cash

flow

from

operations.

EBITDA

is

presented

solely

as

a

supplemental

disclosure

because

management

believes

that

it

is

important

in

evaluating

JBSS's

financial

performance

and

market

valuation.

In

conformity

with

Regulation

G,

a

reconciliation

of

EBITDA

to

the

most

directly

comparable

financial

measures

calculated

and

presented

in

accordance

with

GAAP

is

presented

in

the

following

slide.

EBITDA

21

*

*

* |

Reconciliation of Net Income (Loss) to EBITDA

(In $,000's)

FY2004

FY2005

FY2006

FY2007

FY2008

FY2009

FY2010

FY2011

FY2012

FY2013

FY2014

NET INCOME (LOSS)

22,630

14,499

(16,721)

(13,577)

(5,957)

6,917

14,425

2,835

17,122

21,760

26,287

INTEREST EXPENSE

3,434

3,998

6,516

9,347

10,502

7,646

5,653

6,444

5,364

4,754

4,354

INCOME TAX

(BENEFIT) EXPENSE

14,468

9,269

(8,689)

(7,520)

(897)

(259)

8,447

(49)

9,099

13,536

13,545

DEPRECIATION &

AMORTIZATION

11,190

10,501

10,000

13,584

15,742

15,922

15,825

16,968

17,117

16,717

16,278

EBITDA

51,722

38,267

(8,894)

1,834

19,390

30,226

44,350

26,198

48,702

56,767

60,464

NET SALES

520,811

581,729

579,564

540,858

541,771

553,846

561,633

674,212

700,575

734,334

778,622

EBITDA MARGIN

(% OF NET SALES)

9.9%

6.6%

-1.5%

0.3%

3.6%

5.5%

7.9%

3.9%

7.0%

7.7%

7.8%

POUNDS SOLD

284,576

278,741

248,137

246,142

221,958

217,465

224,302

232,746

212,553

221,762

240,417

EBITDA PER

POUND SOLD

0.182

0.137

(0.036)

0.007

0.087

0.139

0.198

0.113

0.229

0.256

0.252

22

*

* |

EBITDA*

*

EBITDA

is

a

non-GAAP

measure.

See

slide

entitled

“Reconciliation

of

Net

(Loss)

Income

to

EBITDA”

for

reconciliation

to

GAAP

measure

23

* |

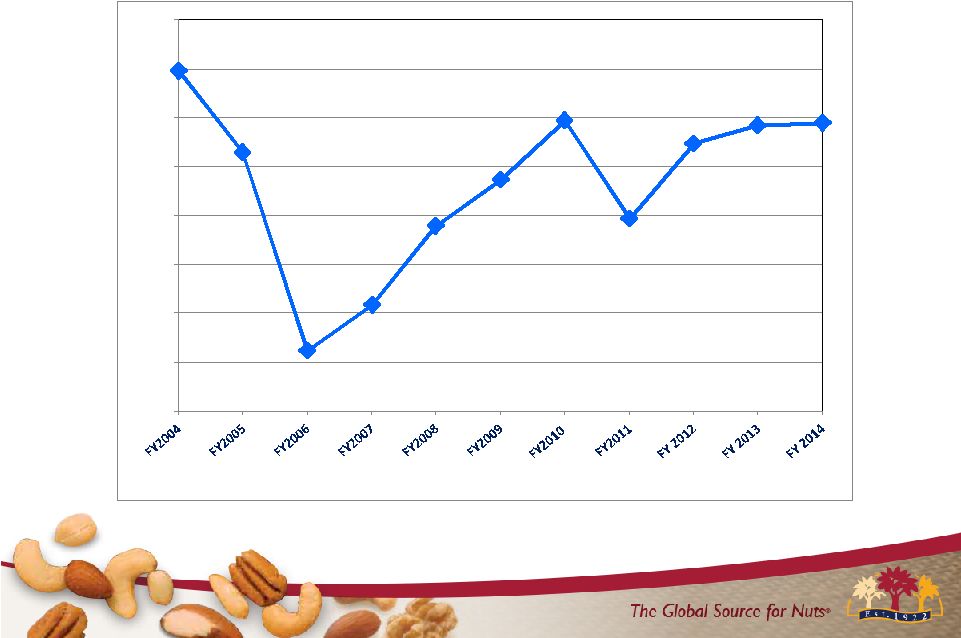

EBITDA*

Margin (% of Net Sales) *

EBITDA

is

a

non-GAAP

measure.

See

slide

entitled

“Reconciliation

of

Net

(Loss)

Income

to

EBITDA”

for

reconciliation

to

GAAP

measure

24

-4.0%

-2.0%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

* |

PEANUT AND

TREE NUT SPOT MARKET PRICES VS. JBSS ROLLING 4 QTR. GROSS MARGIN %

Source: Spot market prices from survey of JBSS vendors and brokers

25 |

Highlights: Q1 2015 vs. Q1 2014

(in 000’s except EPS)

26

$ Change

% Change

Net

Sales $

28,340

16.0%

Sales Volume (lbs.

sold) 4,055

7.1%

Gross

Profit $

1,315

4.5%

Net Income

*

($860)

(12.7%) Earnings Per

Share

($0.08)

(13.1%) Operating Cash

Flows $ 20,455 276.3%

Total

Debt

($11,385)

(16.4%)

*

Adversely impacted by $0.9 million after-tax increase in maintenance

expenses for the exterior of our office building.

* |

27

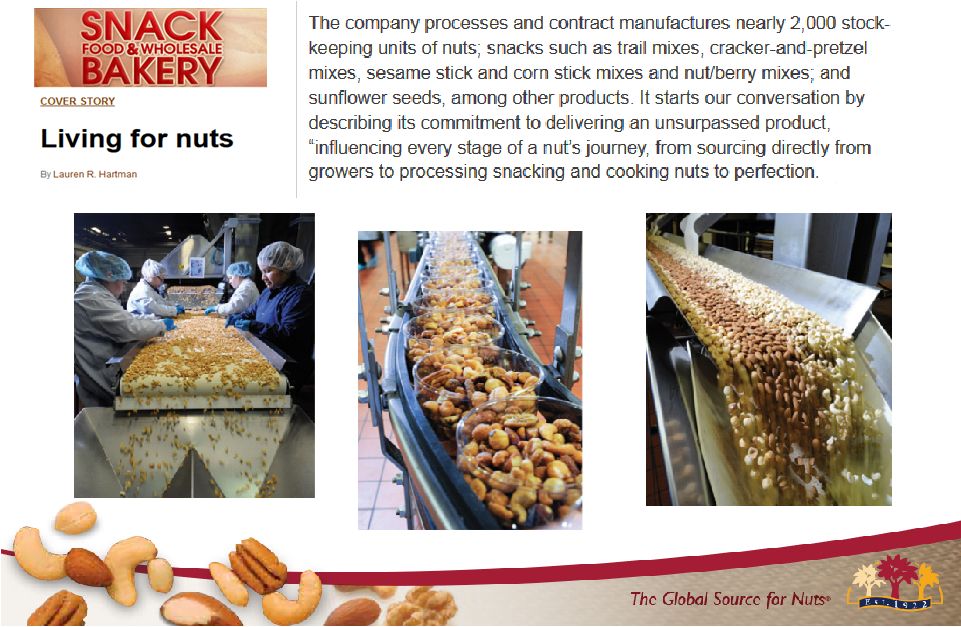

John B. Sanfilippo & Son, Inc.: Transformed Consumer Products

Company …

Reproduced with permission of Snack Food & Wholesale Bakery magazine

* |

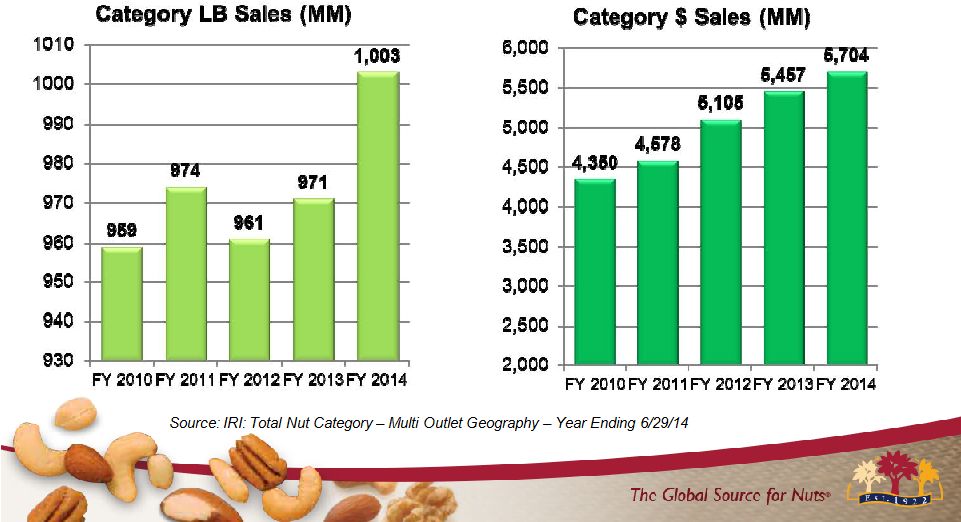

Nut

Category Trends 28

*

*

*

*

*

*

*

* |

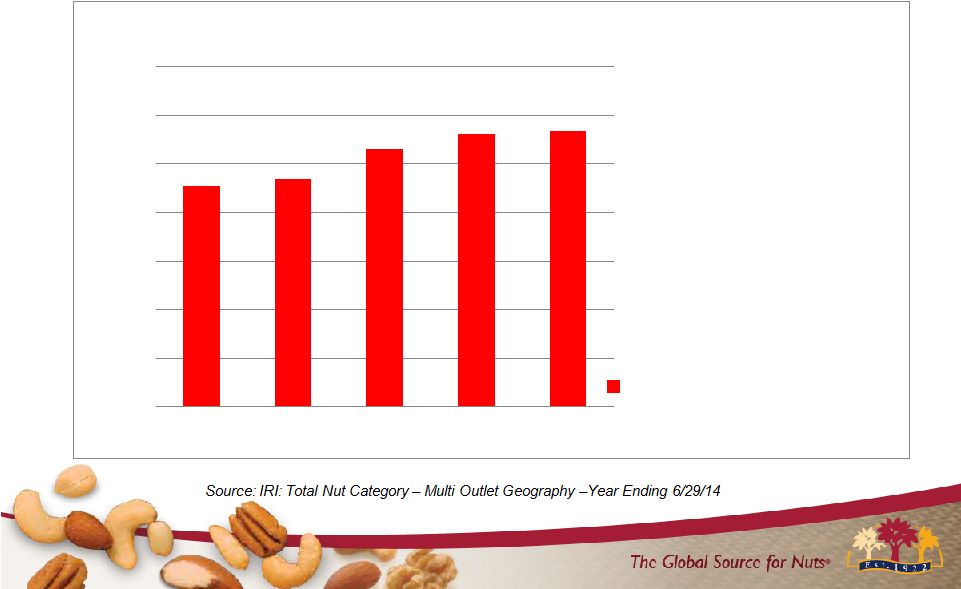

$4.53

$4.70

$5.31

$5.62

$5.68

$0.00

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

$7.00

FY 2010

FY 2011

FY 2012

FY 2013

FY 2014

Price Per Pound

Price Per Pound Category

Retail Prices Higher Over the

Last 5 Years

29

* |

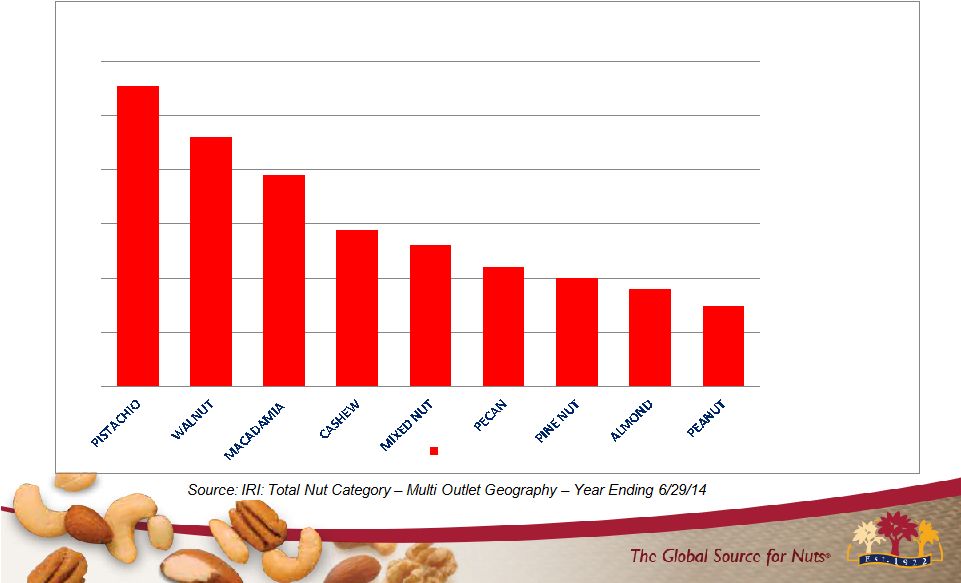

0%

10%

20%

30%

40%

50%

60%

Price Per Pound –

Percent Change Over Last 5 Years

Change vs. FY 2010

30

Retail Prices Up Across All Nut

Types over the Last 5 Years

+56%

+46%

+20%

+18%

+15%

+29%

+39%

+26%

+22%

* |

31

Nut Category has had strong

Sales Growth

* |

CORPORATE STRATEGIES

32

*

*

*

*

*

*

*

* |

33 |

•

Fisher Recipe Nuts market share

leadership excluding club size items

•

Fisher Snack Nuts market share

growth in high franchise Midwest

•

Orchard Valley Harvest expanded

distribution and increased velocity

resulting in double-digit revenue

growth

•

Award-winning marketing programs

FY 2014 Accomplishments

34

* |

•

Established a Foreign Invested

Commercial Enterprise (FICE) in

China

•

Expanded Fisher Snacks in Asia and

the Middle East

•

Continued to leverage key retail

partnerships for a record year with

private brands

FY 2014 Accomplishments

35

* |

•

Received Contract Manufacturing

supplier quality award

•

Optimized Food Service and Industrial

Ingredient customer and product

portfolios

•

Expanded Continuous Improvement

efforts throughout our organization

FY 2014 Accomplishments

36

* |

FY 2014

Sales & Marketing Update

37 |

Grow

Brands Recipe Nuts

Snack Nuts

38

*

* |

Fisher is

a Growing Brand Sales Pounds

+7%

Net Sales

+6%

Sales Pounds

+1%

Net Sales

+8%

Fiscal 2014 Actual vs. Prior Year

3 Year CAGR

39

* |

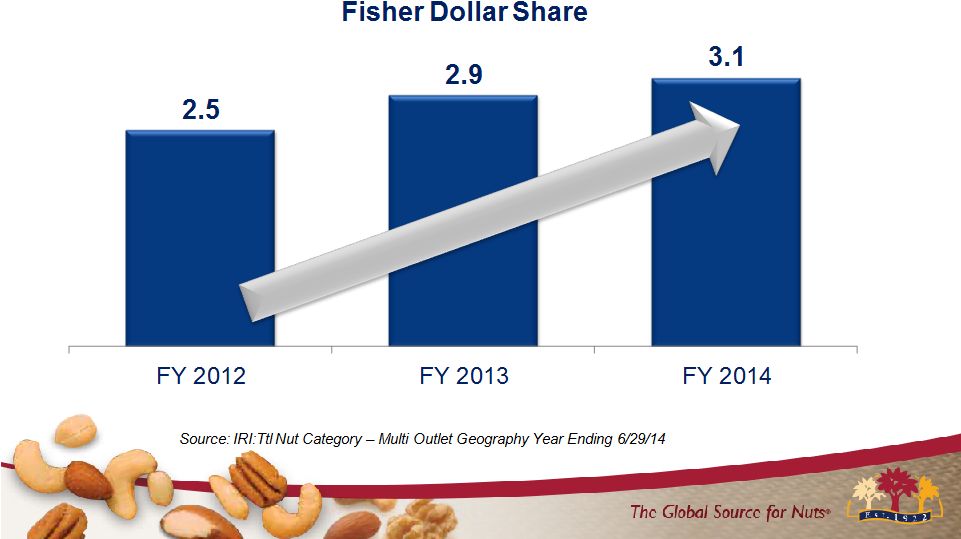

40

Total Fisher Brand has Grown

Dollar Share over the last 3 Years

* |

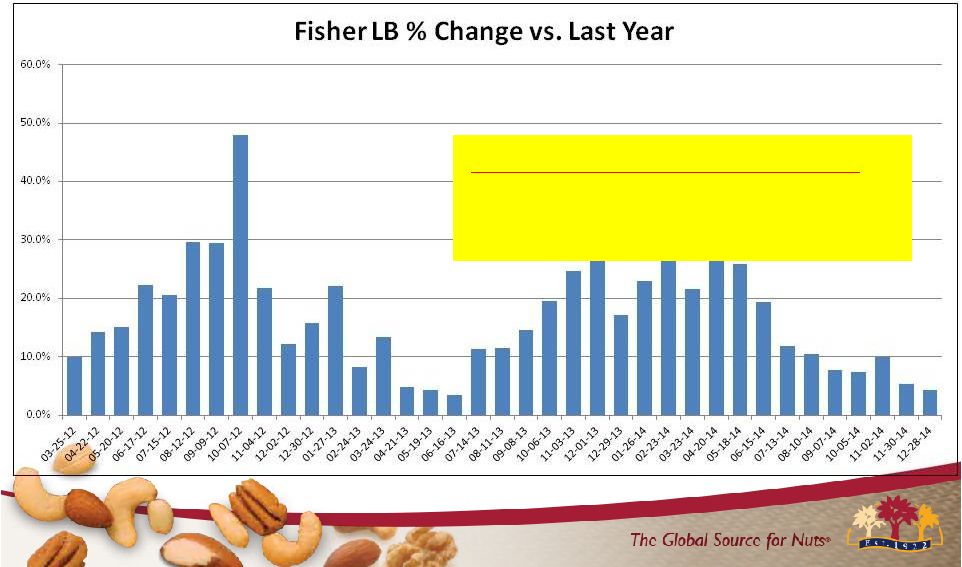

Strong and

Sustained Growth on Fisher Recipe Nuts

37 Consecutive Quad–Weeks of

Increased IRI measured

Consumption!

Source : IRI: Total Recipe Nut Category –

Multi Outlet Geography –

Latest 37 Quad Weeks Ending 12-28-14

41 |

Differentiating versus competition

with “No Preservatives”

Message

Print

42

* |

Recipes

Food Network

Vignettes

Digital and Mobile

Recipe Contest

Food Network

Magazine

Social Media and PR

Social Media and PR

Building Fisher Brand Equity with

Food Network Sponsorship

43

* |

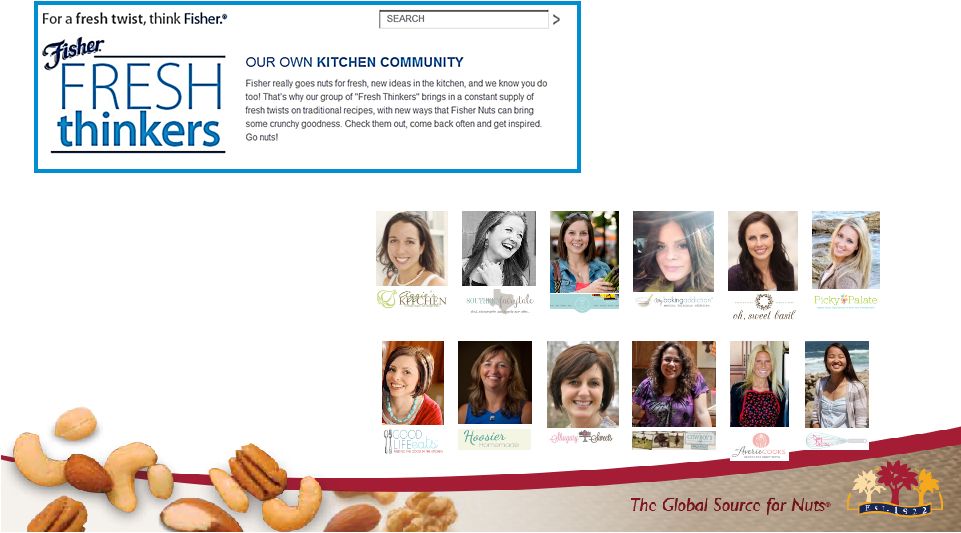

Expanding

Social Media Presence with “Fisher Fresh Thinkers”

44

* |

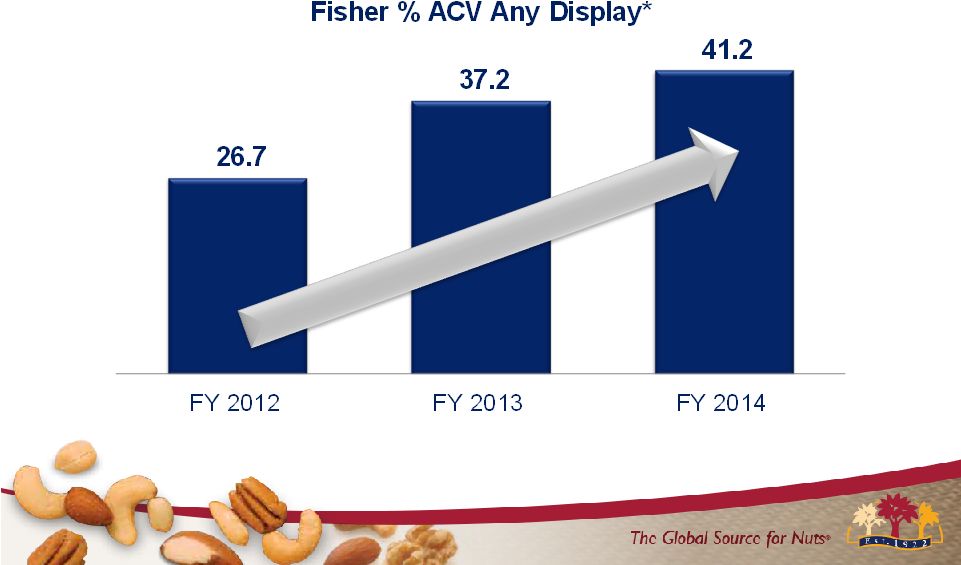

Winning

the year is about Pounds-on-the-floor

45

Source:

IRI:

Ttl

Recipe

Nut

Category

–

Multi

Outlet

Geography

–Year

Ending

6/29/14

*Note:

ACV

refers

to

“All

Commodity

Volume”

as

measured

by

IRI

* |

46

* |

Fisher

snack nut Strategy Focused on Midwest High Franchise Markets

47

* |

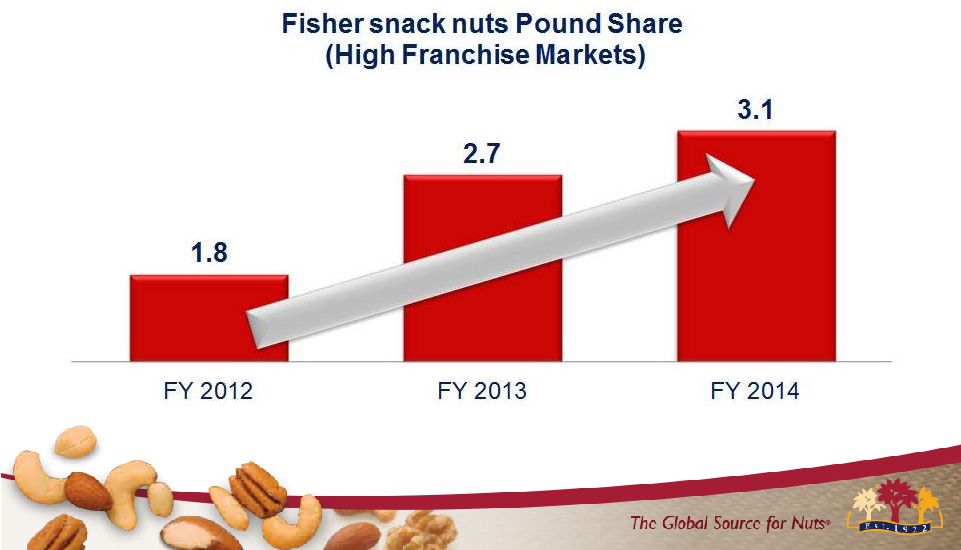

48

Fisher snack nuts Growing Pound

Share in High Franchise Markets

Source:

IRI:

Ttl

Snack

Nut

Category

–

Fisher

High

Franchise

Geography

–Years

Ending

6/29/14

* |

Source: Blue Chip Worldwide SPARQ concept research, December 2013

Driving Results on Core Dry

Roast Peanut Business

•

“Oven Roasted, Never

Fried”

communication

drives purchase interest

•

Elevates taste and healthy

snack perceptions

•

Supported through FSIs,

In-Store and via Digital

49

* |

Velocity

(Pound Sales per Distribution Point)

Source: IRI

Growing Fisher Almond line

•

Converted Almond line to

5.5 oz Stand Up Re-sealable bags

•

Consumer Value Proposition:

Better per package price;

Re-closeable to seal-in freshness

•

Result: Increased movement per point

of distribution

50

January

February

March

April

May

June

2014 SUB Data

2013 Can Average

Source: IRI Quad Week Data Ending 6/29/14 Multi-Outlet Geography

Note: Velocity refers to pounds per point of distribution as measured by

IRI * |

We are

fast adapting to key retailers’ rules on displays…

winning again!

51

* |

Pure and Simple Goodness

52 |

Orchard Valley

Harvest Brand Equity Pure & Simple Goodness

Support a healthy lifestyle

Close to the earth

53 |

Orchard Valley

Harvest Delivers 54 |

Sales Pounds

+ 9%

+ 9%

Net Sales

+16

+16%

%

Orchard Valley Harvest

is a Growing Brand

55

Fiscal 2014 Actual vs. Prior Year |

Source:

The Hartman Group : Eating Occasions, Compass 2012

The Hartman Group: Reimagining Health and Wellness, 2013

Mini’s and Multi-Packs Tap into “On the

Go”

Snacking

•

Snacking accounts for over

53% of all eating occasions

in the US

•

38% of consumers snack

several times per day

56

Grab ‘n Go Mini’s

Multi-Packs |

FY15 OVH

Marketing Support Ibotta

Website

PR

In-Store

Merchandising

New

Packaging

57

Bloggers |

Driving

Increased Distribution 58

FY13

Driver:

FY14

Driver:

Source:

IRI:

Ttl

Produce

Nut

Category

–

Total

US

Food

Geography–Year

Ending

6/29/14

*Note:

%

ACV

refers

to

%

“All

Commodity

Volume”

as

measured

by

IRI

* |

THANK

YOU 59 |