Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Rebel Group, Inc. | Financial_Report.xls |

| EX-32.1 - CERTIFICATION - Rebel Group, Inc. | f10k2014ex32i_rebelgroup.htm |

| EX-4.1 - SPECIMEN STOCK CERTIFICATE - Rebel Group, Inc. | f10k2014ex4i_rebelgroup.htm |

| EX-21.1 - LIST OF SUBSIDIARIES - Rebel Group, Inc. | f10k2014ex21i_rebelgroup.htm |

| EX-31.1 - CERTIFICATION - Rebel Group, Inc. | f10k2014ex31i_rebelgroup.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

| ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2014

|

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________ |

Commission File No. 333-177786

| ||

| REBEL GROUP, INC. | ||

| (Exact Name of Registrant as Specified in its Charter) | ||

| Florida | 45-3360079 | |

| (State

or Other Jurisdiction of Incorporation or Organization) |

(I.R.S.

Employer Identification No.) |

Unit No. 304, New East Ocean Centre, No 9 Science Museum Road, T.S.T., Kowloon, Hong Kong |

(852) 2723-8638 | |

| (Address

of Principal Executive Offices and Zip Code) |

(Registrant’s

Telephone Number, Including Area Code) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act: None

Securities registered pursuant to Section 12(g) of the Securities Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☒ No ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐ No ☒

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐

Non-accelerated filer ☐ Smaller reporting company ☒

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☒ No ☐

The aggregate market value of the voting common equity held by non-affiliates based upon the price at which Common Stock was last sold as of March 31, 2014, the last business day of the registrant’s most recently completed second fiscal quarter was approximately $48,300,000.

As of January 8, 2015, the number of shares of the registrant’s common stock outstanding was 2,300,118.

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2014

TABLE OF CONTENTS

Cautionary Note Regarding Forward-Looking Statements

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

| ● | The availability and adequacy of our cash flow to meet our requirements; |

| ● | Economic, competitive, demographic, business and other conditions in our local and regional markets; |

| ● | Changes or developments in laws, regulations or taxes in our industry; |

| ● | Actions taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities; |

| ● | Competition in our industry; |

| ● | The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; |

| ● | Changes in our business strategy, capital improvements or development plans; |

| ● | The availability of additional capital to support capital improvements and development; and |

| ● | Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC. |

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Defined Terms

Except as otherwise indicated by the context, references in this Report to:

●

|

The “Company,” “we,” “us,” or “our,” are references to the combined business of the Rebel Group, Inc., a Florida corporation (“REBL”) and Moxian Intellectual Property Limited, a company formed under the laws of Samoa (“Moxian Samoa”). |

| |

●

|

“Moxian BVI” refers to Moxian Group Limited, a company incorporated under the laws of British Virgin Islands. |

●

|

“Moxian HK” refers to Moxian (Hong Kong) Limited, a company incorporated under the laws of Hong Kong, a wholly-owned subsidiary of Moxian BVI. |

●

|

“Moxian Shenzhen” refers to Moxian Technologies (Shenzhen) Co., Ltd., a company incorporated under the laws of the People’s Republic of China, a wholly-owned subsidiary of Moxian HK. |

● |

“Moxian Malaysia” refers to Moxian Malaysia SDN BHD, a wholly-owned subsidiary of Moxian HK. |

● |

“Common Stock” refers to the common stock, par value $.0001, of the Company; |

| ● | “HK” refers to the Hong Kong; |

● |

“U.S. dollar,” “$” and “US$” refer to the legal currency of the United States; |

● |

“Securities Act” refers to the Securities Act of 1933, as amended; and |

● |

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

Unless otherwise noted, all currency figures in this filing are in U.S. dollars. References to "yuan" or "RMB" are to the Chinese yuan (also known as the renminbi). According to the currency exchange website www.xe.com, as of January 8, 2015, US$1.00 =6.21314 yuan; 1 yuan= US$0.160959.

| 3 |

Introduction

Rebel Group, Inc. (“Rebel,” the “Company,” “we,” “our,” or “us”), formerly Inception Technology Group, Inc., Moxian Group Holdings, Inc., and First Social Networx Corp., was incorporated under the laws of the State of Florida on September 13, 2011. On April 16, 2013, the Company changed its name from “First Social Networx Corp.” to “Moxian Group Holdings, Inc.” with its trading symbol being “MOXG.” Also effective on April 16, 2013, the Company increased the number of shares that it is authorized to issue to a total of 600,000,000 shares, including 500,000,000 shares of Common Stock and 100,000,000 shares of preferred stock, par value $.0001 per share. In addition, the Company effected a 20-for-1 forward stock split of the Common Stock, without changing the par value or the number of authorized shares of the Common Stock (the “Forward Split”).

On April 25, 2013, pursuant to a Share Exchange Agreement, the Company completed a reverse acquisition of Moxian BVI and its wholly-owned subsidiaries, including Moxian HK, Moxian Shenzhen and Moxian Malaysia (the “Share Exchange Transaction”). The Company acquired the operating business of Moxian BVI and its subsidiaries and the Company ceased being a shell company as such term is defined under Rule 12b-2 under the Exchange Act. Since the incorporation of the business of Moxian BVI, the Company changed its business to licensing and commercializing the intellectual property of a social network platform that integrates social media and business into one single platform.

On February 17, 2014, the Company incorporated a new wholly-owned subsidiary, Moxian Intellectual Property Limited, under the laws of Samoa (“Moxian Samoa”). On February 19, 2014, Moxian HK and Moxian Shenzhen entered into an Assignment and Assumption Agreement with Moxian Samoa, where Moxian HK and Moxian Shenzhen assigned and transferred all of the intellectual property rights that they respectively owned in connection with the Moxian business (the “IP Rights”) to Moxian Samoa in consideration of $1,000,000. As a result, the Company owns and controls such IP Rights through Moxian Samoa.

On February 19, 2014, the shareholders holding a majority of the outstanding shares of the Company approved and authorized the Company to enter into a License and Acquisition Agreement (the “License and Acquisition Agreement”) with Moxian China, Inc. (“MOXC”), pursuant to which the Company sold 100% of the equity interests of Moxian BVI together with its subsidiaries to Moxian CN Group Limited, a wholly-owned subsidiary of MOXC (“Moxian CN Samoa”) for $1,000,000. The License and Acquisition Agreement closed on February 21, 2014. As a result, Moxian BVI, together with its subsidiaries, Moxian HK, Moxian Shenzhen, and Moxian Malaysia, became the subsidiaries of MOXC.

| 4 |

Under the License and Acquisition Agreement, the Company also agreed to grant MOXC the exclusive right to use our IP Rights in Mainland China, Hong Kong, Taiwan, Malaysia, and other countries and regions where the Company conduct business (the “Licensed Territory”) as well as the exclusive right to solicit, promote, distribute and sell products and services in the Licensed Territory for five years (the “License”). In exchange for such License, MOXC agreed to pay to the Company: (i) $1,000,000 as license maintenance royalty each year commencing on the first anniversary of the date of the License and Acquisition Agreement; and (ii) 3% of the gross profit resulting from distribution and sale of our products and services on behalf of the Company as an earned royalty. In addition, MOXC has the right to acquire the new IP Rights that are developed by the Company and sub-license such rights to a third party. MOXC is also under the obligation to develop the social media market of our products and services in the Licensed Territory.

The Company sought to acquire a new business in the technology area and as a result, on July 23, 2014, the Company changed its name from “Moxian Group Holdings, Inc.” to “Inception Technology Group, Inc.” Also effective on July 23, 2014, the Company effected a 1-for-5 reverse split of its issued and outstanding Common Stock. However, no acquisition of a technology business was closed or consummated.

Recent Development

Currently, the Company is seeking to acquire a new business in the field of promoting mixed martial art events and developing combat sports in Asia. Thus, effective on December 5, 2014, the Company changed its name from “Inception Technology Group, Inc.” to “Rebel Group, Inc.” with its trading symbol changed to “REBL.” Also effective on December 5, 2014, the Company effected a 1-for-20 reverse stock split (the “Reverse Split”) of its Common Stock, without changing the par value or the number of authorized shares of the Common Stock.

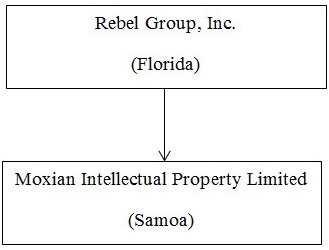

The following diagram sets forth the structure of the Company as of the date of this Report:

Information contained on our web site is not part of this Annual Report on Form 10-K or our other filings with the Securities and Exchange Commission (“SEC”).

| 5 |

Plan of Operation

The Company was a social network that integrated social media and business into one single platform (the “Moxian Platform”) and utilized a website and social media to promote business of its clients and assist them to find consumers online and bring them into real-world stores. After consummation of the transactions under the Assignment and Assumption Agreement and License and Acquisition Agreement, we changed our business to developing and commercializing our intellectual property rights that are related to the social media business based on the Moxian Platform (the “Moxian Business”).

After the filing of this Report, the Company plans to divest the Moxian Business by selling the equity interests in Moxian Samoa to MOXC and acquire a new business. Once the proceeds from the sale of Moxian Samoa(“Samoa Sales Proceeds”) are received, we plan to distribute the Samoa Proceeds as well as the unpaid proceeds in the amount of $1 million pursuant to the License and Acquisition Agreement (“License and Acquisition Unpaid Proceeds”) to the Company’s shareholders on a pro rata basis. The Company is also in the process of negotiating the acquisition of the business of Rebel Holdings Limited, which operates under the trade name “Rebel Fighting Championship” (“Rebel FC”), a company incorporated under the laws of British Virgin Islands. Rebel FC hosts mixed martial arts events and records and broadcasts TV programs featuring MMA fighting in Asian countries.

The Company is currently reviewing Rebel FC due diligence documents and files and there can be no assurance that the Company will successfully make an acquisition or that such acquisition will be successful for the Company and its shareholders. The completion of acquisition is contingent on the following factors:

| ● | Satisfaction of our due diligence investigation on Rebel FC, |

| ● | Rebel FC providing U.S. GAAP audited financial statements for the past two fiscal years and the subsequent interim period, and |

| ● | Rebel FC entering into binding acquisition agreements that are satisfactory to the Company. |

Form of Acquisition

The Company plans to acquire the business of Rebel FC through a securities exchange which will make it become a wholly owned subsidiary of the Company. In addition, the present stockholders of the Company most likely will not have control of a majority of the voting stock of the Company following a transaction with Rebel FC. As part of such a transaction, the Company's existing directors may resign and new directors may be appointed without any vote by stockholders.

Rebel FC Business

Rebel Holdings Limited (“Rebel FC”), a BVI corporation founded on October 28, 2014 is a combat sports entertainment company that produces dynamic mixed martial arts (“MMA”) fighting events featuring top level athletic talent. Rebel FC also broadcasts live events and distributes videos of MMA fighting through internet, TV channels, and other social media. Prior to incorporation of Rebel FC, business was mainly conducted through its current operating subsidiary, Pure Heart Entertainment Pte. Ltd., which was incorporated in Singapore in 2000.

MMA is a full-contact combat sports that allows the use of both striking and grappling techniques, both standing and on the ground, from a variety of other combat sports and martial arts. The styles of martial arts can range from Brazilian Jiu-Jitsu, Judo, Karate, Boxing, Muay Thai, Wrestling, Jeet Kune Do, Taekwondo, Sanshou and various other forms of martial arts. One of the goals of Rebel FC is to promote MMA in Asian countries through hosting the events that attract the top talented fighters from all over the world.

| 6 |

We believe that Rebel FC is different from other MMA businesses because it integrates the introduction of the background information and stories of the athletes into the live broadcasting of fighting events. Rebel FC events are broadcast through television, internet and through other means of social media, and there are also pre-event live shows for MMA fans and media which are free-of-charge for participants. In 2014, Rebel FC successfully hosted two large scale events in Singapore. Rebel FC’s first big event, Into the Lion’s Den, was hosted on December 21, 2013 at the Singapore Indoor Stadium and 4,000 people attended the event. The second large-scale event, Battle Royale, was held on August 1, 2014 at the Suntec Singapore Convention and Exhibition Centre and approximately 5,000 audiences were present. While Rebel FC is dedicated to producing high quality shows throughout Singapore, Rebel FC plans to bring live MMA events to both China and Australia in 2015. Rebel FC plans to broadcast their MMA events through top sporting entertainment stations in each country, while also focusing on utilizing online platforms for internet streaming in order to reach audience in other countries. Rebel FC is currently in negotiation with several internet streaming providers, such as Go Fight Live. Rebel FC plans to broadcast and show its MMA events via TV channels in 2015 and 2016. Rebel FC is currently expanding its business to China. It plans to broadcast its MMA events in China in 2015. From 2015, Rebel FC plans to invest in developing a Pay Per View (“PPV”), which is a type of pay television service by which a subscriber of a television service provider can purchase events to view via private telecast.

By 2016, Rebel FC’s believes its PPV model can be deployed in China, Singapore, and Australia with support from selected service providers to enable paid online streaming of Rebel FC’s MMA events.

Moxian Business

The Company is currently engaged in the business of developing and commercializing intellectual property rights that are related to the social media businesses supported by the Moxian Platform.

License Agreement

On February 19, 2014, the Company entered into a License and Acquisition Agreement with Moxian China, Inc. (“MOXC”), pursuant to which the Company agreed to grant MOXC the exclusive right to use our IP Rights in Mainland China, Hong Kong, Taiwan, Malaysia, and other countries and regions where we conduct business, and the exclusive right to solicit, promote, distribute and sell products and services in the Licensed Territory for five years. In exchange for such License, MOXC agreed to pay to the Company: (i) $1,000,000 as license maintenance royalty each year commencing on the first anniversary of the date of the License and Acquisition Agreement; and (ii) 3% of the gross profit of distribution and sale of our products and services on behalf of the Company as an earned royalty. In addition, MOXC has the right to acquire the new IP Rights that are developed by the Company and sub-license such rights to a third party. MOXC is also under the obligation to develop the social media market in the Licensed Territory for our products and services.

Intellectual Property

The following are the intellectual property rights that the Company owns through Moxian Samoa, the details of which are set forth in the following table:

Trademarks

| Type | Marks | Application No. | Country | Status |

| Trademark |  |

85931344 | United States of America | Pending |

| Trademark |  |

302534274 | Hong Kong | Approved |

| Trademark |  |

13460714 | China | Pending |

| Trademark |  |

13460852 | China | Pending |

| Trademark |  |

10624504 | China | Approved |

| Trademark | 魔线 | 13461178 | China | Pending |

| Trademark |  |

10624435 | China | Approved |

| 7 |

Patent

The application to patent the marketing and promotional methods utilized by the Moxian Platform (Patent Application No. 201310734492.2) has been submitted. The marketing method to be patented is that online users (such as merchants) may use the statistics and data collected from consumers to promote and market their businesses on the Internet. The primary feature of such marketing method is that it can locate merchants that match consumers’ needs and provide a series of interactive tools for merchants to promote their sales, including, granting rewards points, granting reward prizes, providing online games for consumers to earn rewards points, etc.

Copyright

The copyright application of Moxian’s mascot “Moya” has been submitted by Moxian Shenzhen on December 2, 2013 (Application No. 201330592230.8). Moya is a mascot representing Moxian Platform. Below are some pictures of Moya with different expressions:

Regulations

As we engage in the business of licensing and commercializing our intellectual property rights in China, we should comply with the Chinese Regulations on Administration of Import and Export of Technology as well as rules and regulations of trademark licensing pursuant to the Trademark Law of China.

Employees

As of September 30, 2014, the Company had 3 employees working in administration.

Available Information

The Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are filed with the U.S. Securities and Exchange Commission (the “SEC”). The Company is subject to the informational requirements of the Exchange Act and files or furnishes reports, proxy statements, and other information with the SEC. Such reports and other information filed by the Company with the SEC are available on the SEC’s website. The public may read and copy any materials filed by the Company with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The contents of these websites are not incorporated into this filing. Further, the Company’s references to the URLs for these websites are intended to be inactive textual references only.

| 8 |

Principal Executive Offices

Our principal executive office is located at Unit No. 304, New East Ocean Centre, No 9 Science Museum Road, T.S.T., Kowloon, Hong Kong. Our principal telephone number at such location is (852) 2723-8638.

Disclosure in response to this item is not required of a smaller reporting company.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Disclosure in response to this item is not required of a smaller reporting company.

The Company currently does not own any properties. For our headquarter, we are renting the office from our corporate secretary, H.K.I.C Consultants Limited for an annual rent of HKD$10,000 (or approximately $1,290). The Company believes that the aforementioned office space will be sufficient for its current needs.

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. There are currently no legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is currently trading on the OTC Market Group’s OTCQB. Our common stock was traded under the symbol “FSCN” until April 16, 2013 and later changed to “MOXG” until July 23, 2014. The symbol for our common stock was subsequently changed to “ITGU.” Since January 6, 2015, our common stock is trading under the symbol “REBL.” Our common stock did not trade prior to June 18, 2013. Trading in stocks quoted on the OTCQB is often thin and is characterized by wide fluctuations in trading prices due to many factors that may have little to do with a company’s operations or business prospects. We cannot assure you that there will be a market for our common stock in the future.

OTCQB securities are not listed or traded on the floor of an organized national or regional stock exchange. Instead, OTCQB securities transactions are conducted through a telephone and computer network connecting dealers in stocks.

| 9 |

For the periods indicated, the following table sets forth the high and low bid prices per share of common stock. The following quotations reflect the high and low bids for our shares of common stock based on inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions. The following prices reflect a 1-for-5 reverse split of its common stock on July 23, 2014.

| High | Low | |||||||

| Fiscal Year 2013* | Bid | Bid | ||||||

| First Quarter* | $ | - | $ | - | ||||

| Second Quarter* | $ | - | $ | - | ||||

| Third Quarter* | $ | - | $ | - | ||||

| Fourth Quarter | $ | 0.8 | $ | 0.28 | ||||

| High | Low | |||||||

| Fiscal Year 2014 | Bid | Bid | ||||||

| First Quarter | $ | 0.34 | $ | 0.19 | ||||

| Second Quarter | $ | 0.38 | $ | 0.21 | ||||

| Third Quarter | $ | 0.21 | $ | 0.18 | ||||

| Fourth Quarter | $ | 1.10 | $ | 0.85 | ||||

* The Company’s Common Stock did not trade until June 2013.

As of January 8, 2015, the last sale price reported on the OTCQB for the Company’s Common Stock was approximately $1.01 per share.

Holders

As of the date of this Annual Report, we had 2,300,118 shares of our Common Stock par value, $.0001 issued and outstanding. There were approximately 571 beneficial owners of our common stock.

Transfer Agent and Registrar

The Transfer Agent for our capital stock is Island Stock Transfer, located at 15500 Roosevelt Boulevard, Suite 301.

Penny Stock Regulations

The Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share. Our Common Stock, when and if a trading market develops, may fall within the definition of penny stock and be subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 individually, or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser’s prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the Securities and Exchange Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell our Common Stock and may affect the ability of investors to sell their Common Stock in the secondary market.

| 10 |

In addition to the "penny stock" rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit the investors’ ability to buy and sell our stock.

Dividend Policy

Any future determination as to the declaration and payment of dividends on shares of our Common Stock will be made at the discretion of our board of directors out of funds legally available for such purpose. We are under no contractual obligations or restrictions to declare or pay dividends on our shares of Common Stock. In addition, we currently have no plans to pay such dividends. Our board of directors currently intends to retain all earnings for use in the business for the foreseeable future.

Equity Compensation Plan Information

Currently, there is no equity compensation plan in place.

Unregistered Sales of Equity Securities

None.

Purchases of Equity Securities by the Registrant and Affiliated Purchasers

We have not repurchased any shares of our common stock during the fiscal year ended September 30, 2014.

ITEM 6. SELECTED FINANCIAL DATA

Disclosure in response to this item is not required of a smaller reporting company.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Introduction

The following discussion of our financial condition and results of operations should be read in conjunction with our unaudited condensed consolidated financial statements and the notes to those financial statements appearing elsewhere in this Report.

Certain statements in this Report constitute forward-looking statements. These forward-looking statements include statements, which involve risks and uncertainties, regarding, among other things, (a) our projected sales, profitability, and cash flows, (b) our growth strategy, (c) anticipated trends in our industry, (d) our future financing plans, and (e) our anticipated needs for, and use of, working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plan,” “potential,” “project,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend,” or the negative of these words or other variations on these words or comparable terminology. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

| 11 |

The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

The "Company", "we," "us," and "our," refer to (i) Rebel Group, Inc. (formerly, Inception Technology Group, Inc.), a Florida corporation, and (ii) Moxian Intellectual Property Limited, a Samoa company.

Overview

The Company was a social network that integrated social media and business into the Moxian Platform and utilized a website and social media to promote business of its clients and assist them to find consumers online and bring them into real-world stores. After consummation of the transactions under the Assignment and Assumption Agreement and License and Acquisition Agreement, we changed our business to licensing and commercializing our intellectual property rights that are related to the social media business based on the Moxian Platform (the “Moxian Business”).

After the filing of this Report, the Company plans to divest the Moxian Business by selling the equity interests in Moxian Samoa to MOXC and acquire a new business. Once the proceeds from the sale of Moxian Samoa are received, we plan to distribute the Samoa Proceeds as well as the License and Acquisition Unpaid Proceeds to the Company’s shareholders on a pro rata basis. The Company is also in the process of negotiating the acquisition of the business of Rebel Holdings Limited, which operates under the trade name “Rebel Fighting Championship” (“Rebel FC”), a company incorporated under the laws of British Virgin Islands. Rebel FC hosts mixed martial arts events and records and broadcasts TV programs featuring MMA fighting in Asian countries.

The Company is currently reviewing Rebel FC due diligence documents and files and there can be no assurance that the Company will successfully make an acquisition or that such acquisition will be successful for the Company and its shareholders. The completion of acquisition is contingent on the following factors:

● Satisfaction of our due diligence investigation on Rebel FC,

● Rebel FC providing U.S. GAAP audited financial statements for the past two fiscal years and the subsequent interim period, and

● Rebel FC entering into acquisition documents that are satisfactory to the Company.

As of September 30, 2013 and September 30, 2014, our accumulated deficits were $945,153 and ($790,279), respectively. Our stockholders’ equity (deficiency) was $991,653 and ($735,279) respectively. We have so far generated nil in revenue. Our losses have principally been attributed to operating expenses, administrative and other operating expenses.

Results of Operations

For the year ended September 30, 2014 compared with the year ended September 30, 2013

Gross Revenues

The Company received sales revenues of $0 in the year ended September 30, 2014 compared to $0 being generated in the year ended September 30, 2013.

Operating Expenses

Operating expenses for the years ended September 30, 2014 and September 30, 2013, were $8,347 and nil, respectively. The expenses consisted of filing fees, professional fees, payroll and benefits and other general expenses.

We expect that our general and administrative expenses will continue to increase as we incur additional costs to support the growth of our business.

| 12 |

Net Loss

Net income (loss) for the years ended September 30, 2014 and September 30, 2013, were $1,735,496 and ($759,181), respectively. Basic and diluted net profit (loss) per share amounted to $0.01 and ($0.00) respectively for the years ended September 30, 2014 and September 30, 2013.

The increase in net profit was mainly due to the gain from on disposal of subsidiaries in February 2014.

Liquidity and Capital Resources

At September 30, 2014 we had working capital of $991,653 with cash on hand of $0 as compared to working capital of $1,000,072 with our cash of $753,098 as of September 30, 2013.

Net cash used in operating activities for the year ended September 30, 2014 was $1,207,446 as compared to $766,887 for the year ended September 30, 2013. The cash used in operating activities are mainly for filing fees, professional fees, payroll and benefits and general expenses.

Currently, we have limited operating capital. We expect that our current capital and our other existing resources will be sufficient only to provide a limited amount of working capital, and the revenues, if any, generated from our business operations alone may not be sufficient to fund our operations or planned growth.

We will likely require additional capital to continue to operate our business, and to further expand our business. Sources of additional capital through various financing transactions or arrangements with third parties may include equity or debt financing, bank loans or revolving credit facilities. We may not be successful in locating suitable financing transactions in the time period required or at all, and we may not obtain the capital we require by other means. Our inability to raise additional funds when required may have a negative impact on our operations, business development and financial results

Critical Accounting Policies and Estimates

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent liabilities at dates of the financial statements and the reported amounts of revenue and expenses during the periods. Actual results could differ from these estimates. Our significant estimates and assumptions include depreciation and the fair value of our stock, stock-based compensation, debt discount and the valuation allowance relating to the Company’s deferred tax assets.

Recently Issued Accounting Pronouncements

Reference is made to the “Recent Accounting Pronouncements” in Note 2 to the Financial Statements included in this Report for information related to new accounting pronouncement, none of which had a material impact on our consolidated financial statements, and the future adoption of recently issued accounting pronouncements, which we do not expect will have a material impact on our consolidated financial statements.

Going Concern

We have not attained profitable operations and are dependent upon obtaining financing to pursue any extensive activities and business development. For these reasons, our auditors stated in their report on our audited financial statements that they have substantial doubt that we will be able to continue as a going concern without further financing.

Off-Balance Sheet Arrangements

As of September 30, 2014, we did not have any off-balance sheet arrangements.

| 13 |

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Disclosure in response to this item is not required of a smaller reporting company.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The Company's consolidated financial statements, together with the report of the independent registered public accounting firm thereon and the notes thereto, are presented beginning at page F-1.The Company’s balance sheets as of September 30, 2014 and 2013 and the related statements of operations, changes in stockholders’ deficit and cash flows for the years then ended have been audited by Dominic K.F. Chan & Co. Dominic K.F. Chan & Co is an independent registered public accounting firm. These financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America and pursuant to Regulation S-K as promulgated by the Securities and Exchange Commission and are included herein pursuant to Part II, Item 8 of this Form 10-K. The financial statements have been prepared assuming the Company will continue as a going concern.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

Disclosures Control and Procedures

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is defined in Rule 13a-15(f) or 15d-15(f) promulgated under the Exchange Act as a process designed by, or under the supervision of, the company’s principal executive and principal financial officers and effected by the company’s board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America and includes those policies and procedures that:

| ● | Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the company; |

| ● | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States of America and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and |

| ● | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the company’s assets that could have a material effect on the financial statements. |

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. All internal control systems, no matter how well designed, have inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Because of the inherent limitations of internal control, there is a risk that material misstatements may not be prevented or detected on a timely basis by internal control over financial reporting. However, these inherent limitations are known features of the financial reporting process. Therefore, it is possible to design into the process safeguards to reduce, though not eliminate, this risk.

| 14 |

As of September 30, 2014, management assessed the effectiveness of our internal control over financial reporting based on the criteria for effective internal control over financial reporting established in Internal Control--Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) and SEC guidance on conducting such assessments. Based on that evaluation, they concluded that, during the period covered by this Report, such internal controls and procedures were not effective to detect the inappropriate application of US GAAP rules as more fully described below. This was due to deficiencies that existed in the design or operation of our internal controls over financial reporting that adversely affected our internal controls and that may be considered to be material weaknesses.

The matters involving internal controls and procedures that our management considered to be material weaknesses under the standards of the Public Company Accounting Oversight Board were: (1) lack of a functioning audit committee due to a lack of a majority of independent members and a lack of a majority of outside directors on our board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; (2) inadequate segregation of duties consistent with control objectives; and (3) ineffective controls over period end financial disclosure and reporting processes. The aforementioned material weaknesses were identified by our Chief Executive Officer in connection with the review of our financial statements as of September 30, 2014.

Management believes that the material weaknesses set forth in items (2) and (3) above did not have an effect on our financial results. However, management believes that the lack of a functioning audit committee and the lack of a majority of outside directors on our board of directors results in ineffective oversight in the establishment and monitoring of required internal controls and procedures, which could result in a material misstatement in our financial statements in future periods.

Management’s Remediation Initiatives

In an effort to remediate the identified material weaknesses and other deficiencies and enhance our internal controls, we have initiated, or plan to initiate, the following series of measures:

We will create a position to segregate duties consistent with control objectives and will increase our personnel resources and technical accounting expertise within the accounting function when funds are available to us. And we plan to appoint one or more outside directors to our board of directors who shall be appointed to an audit committee resulting in a fully functioning audit committee who will undertake the oversight in the establishment and monitoring of required internal controls and procedures such as reviewing and approving estimates and assumptions made by management when funds are available to us.

Management believes that the appointment of one or more outside directors, who shall be appointed to a fully functioning audit committee, will remedy the lack of a functioning audit committee and a lack of a majority of outside directors on our Board.

We anticipate that these initiatives will be at least partially, if not fully, implemented by the end of fiscal year 2015. Additionally, we plan to test our updated controls and remediate our deficiencies in year 2015.

| 15 |

Changes in internal controls over financial reporting

Except the following, there was no change in our internal controls over financial reporting that occurred during the period covered by this Report, which has materially affected, or is reasonably likely to materially affect, our internal controls over financial reporting:

This annual report does not include an attestation report of the Company’s registered independent public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered independent public accounting firm pursuant to rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this Annual Report on Form 10-K.

None.

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The following table sets forth the name and position of our current executive officers and directors.

| Name | Age | Position | ||

| Liew Kwong Yeow | 59 | President, Chief Executive Officer and sole Director |

Mr. Liew Kwong Yeow, age 59, has more than 25 years of experience in several multi-national organizations, such as Matsushita Denki, General Motors, Intel as well as Urmet Telecoms Italy. He held senior positions and mainly responsible for quality, engineering and procurement of related products and services. In 2006, Mr. Liew was instrumental in setting up the first manufacturing plant of Urmet Telecommunications Torino Italy in China and fine-tuning its supply chains, and with Mr. Liew’s assistance, the entire operations of Urmet became significantly competitive in the China markets. Prior to that, Mr. Liew was the General Manager of Aztech Singapore’s plant in China from 2001 through 2005. During 1992 through 2001, he served as the head of QA Operations of the manufacturing facilities of Pheonix Mecano Switzerland in Singapore. Mr. Liew received his diploma in Electrical Engineering from Singapore Polytechnics University in 1974. He also completed the management study programs in: City and Guilds regarding Electrical and Electronics in 1974, Industrial Training Board at MOE Singapore in 1976, Matsushita DENKI Management Development Program in 1978, General Motors Institute in 1983 and Intel University in 1987. Mr. Liew is fluent in English and Chinese.

The Board of Director reached a conclusion that Mr. Liew should serve as a Director of the Company based on his extensive experience in management.

All directors hold office until the next annual meeting of shareholders and until their successors have been duly elected and qualified. Directors are elected at the annual meetings to serve for one-year terms. Any non-employee director of the Company or its subsidiaries is reimbursed for expenses incurred for attendance at meetings of the Board and any committee of the board of directors although no such committee has been established.

Each officer is appointed by the board of directors and holds his office at the pleasure and discretion of the board of directors or until his earlier resignation, removal or death.

There are no material proceedings to which any director, officer or affiliate of the Company, any owner of record or beneficially of more than five percent of any class of voting securities of the Company, or any associate of any such director, officer, affiliate of the Company or security holder is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

Director Independence

Our securities are not listed on a national securities exchange or in an inter-dealer quotation system which has requirements that directors be independent. We do not have majority of independent directors.

| 16 |

Committees of the Company’s Board of Directors

Because our board of directors currently consists of two members, we do not have a standing nominating, compensation or audit committee. Rather, our full board of directors performs the functions of these committees. Also, we do not have a “financial expert” on our board of directors as that term is defined by Item 401(e)(2) of Regulation S-K. We do not believe it is necessary for our board of directors to appoint such committees because the volume of matters that come before our board of directors for consideration permits the Board of Directors to give sufficient time and attention to such matters to be involved in all decision making. Additionally, because our Common Stock is not listed for trading or quotation on a national securities exchange, we are not required to have such committees. In considering candidates for membership on the Board of Directors, the Board of Directors will take into consideration the needs of the Board of Directors and the candidate's qualifications. The Board of Directors will request such information as:

| ● | The name and address of the proposed candidate; |

| ● | The proposed candidates resume or a listing of his or her qualifications to be a director of the Company; |

| ● | A description of any relationship that could affect such person's qualifying as an independent director, including identifying all other public company board and committee memberships; |

| ● | A confirmation of such person's willingness to serve as a director if selected by the Board of Directors; and |

| ● | Any information about the proposed candidate that would, under the federal proxy rules, be required to be included in the Company's proxy statement if such person were a nominee. |

Once a person has been identified by the Board of Directors as a potential candidate, the Board of Directors may collect and review publicly available information regarding the person to assess whether the person should be considered further. Generally, if the person expresses a willingness to be considered and to serve on the Board of Directors and the Board of Directors believes that the candidate has the potential to be a good candidate, the Board of Directors would seek to gather information from or about the candidate, including through one or more interviews as appropriate and review his or her accomplishments and qualifications generally, including in light of any other candidates that the Board of Directors may be considering. The Board of Director's evaluation process does not vary based on whether the candidate is recommended by a shareholder.

The Board of Directors will, from time to time, seek to identify potential candidates for director nominees and will consider potential candidates proposed by the Board of Directors and by management of the Company.

Meetings of the Board of Directors

During its fiscal year ended September 30, 2014, the Board of Directors did not meet on any occasion, but rather transacted business by unanimous written consent.

Board Leadership Structure and Role in Risk Oversight

Our Board recognizes that the leadership structure and combination or separation of the chief executive officer and chairman roles is driven by the needs of the Company at any point in time. Currently, Mr. Liew serves as the sole officer and director of the Company. We have no policy requiring the combination or separation of leadership roles and our governing documents do not mandate a particular structure. This has allowed, and will continue to allow, our Board the flexibility to establish the most appropriate structure for our company at any given time.

| 17 |

Code of Ethics

Our Board of Directors will adopt a new code of ethics that applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer. The new code will address, among other things, honesty and ethical conduct, conflicts of interest, compliance with laws, regulations and policies, including disclosure requirements under the federal securities laws, confidentiality, trading on inside information, and reporting of violations of the code.

Section 16(a) Beneficial Ownership Reporting Compliance

We do not yet have a class of equity securities registered under the Securities Exchange Act of 1934, as amended. Hence, compliance with Section 16(a) thereof by our officers and directors is not required.

ITEM 11. EXECUTIVE COMPENSATION

The following table sets forth all compensation earned or awarded by our Chief Executive Officer and Chief Financial Officer and other “named executive officers” for our last two completed fiscal years:

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pensions Value and Non-Qualified Compensation Earnings | All Other Compensation ($) | Total ($) | |||||||||||||||||||||||||||

| Liew Kwong Yeow(1) | 2014 | $ | – | – | – | – | – | – | – | – | ||||||||||||||||||||||||||

| President and CEO | 2013 | $ | – | – | – | – | – | – | – | – |

| (1) | Mr. Liew is serving as the Company’s President and CEO since February 27, 2013. |

The Company does not have an employment agreement with Mr. Liew and Mr. Liew has not received any compensation during the fiscal year of 2014. We do not provide any employee benefit programs to our employees other than a periodic grant of warrants.

Outstanding Equity Awards at Fiscal Year-End

No unexercised options or warrants were held by any of our named executive officers at September 30, 2014. No equity awards were made during the fiscal year ended September 30, 2014.

Director Compensation

The following table sets forth the compensation paid to our directors during the years ended September 30, 2014, and 2013.

| DIRECTOR COMPENSATION | ||||||||||||||||||||

| Name and Position | Year | Fees Earned or Paid in Cash ($) | Option Awards ($) | All Other Compensation ($) | Total ($) | |||||||||||||||

| Liew Kwong Yeow (1) | 2014 | 0 | 0 | 0 | 0 | |||||||||||||||

| 2013 | 0 | 0 | 0 | 0 | ||||||||||||||||

| Lin Kuan Liang Nicolas (2) | 2014 | 0 | 0 | 0 | 0 | |||||||||||||||

| 2013 | 0 | 0 | 0 | 0 | ||||||||||||||||

| (1) | Mr. Liew is serving as the Company’s director since February 27, 2013. | |

| (2) | Mr. Lin served as the Company’s director from February 27, 2013 to May 5, 2014. |

| 18 |

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth certain information regarding the beneficial ownership of the Company's Common Stock as of the date herein by (i) each stockholder known by the Company to be the beneficial owner of more than 5% of the Company's Common Stock and (ii) by the directors and executive officers of the Company. The person or company named in the table has sole voting and investment power with respect to the shares beneficially owned.

| Address of Beneficial Owner | Positions with the Company | Title of Class | Amount and Nature of Beneficial Ownership (1) | Percent of Class (1) | ||||||||

| Officers and Directors | ||||||||||||

| Liew

Kwong Yeow 407 Sinming Garden #09-209 Singapore 570407 | CEO and Director | Common Stock, $0.0001 par value | 0 | - | ||||||||

| All officers and directors as a group (1 person named above) | Common Stock, $0.0001 par value | 0 | - | |||||||||

| 5% Securities Holders | ||||||||||||

| Medicode

Group Limited Unit No 304, New East Ocean Centre, No 9 Science Museum Road, T.S.T., Kowloon, Hong Kong | Common Stock, $0.0001 par value | 1,050,000 | 45.65 | % | ||||||||

| Bright

Growth Capital Limited Unit No 304, New East Ocean Centre, No 9 Science Museum Road, T.S.T., Kowloon, Hong Kong | Common Stock, $0.0001 par value | 400,000 | 17.39 | % | ||||||||

| (1) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Beneficial ownership also includes shares of stock subject to options and warrants currently exercisable or exercisable within 60 days of the date of this table. In determining the percent of common stock owned by a person or entity as of the date of this Report, (a) the numerator is the number of shares of the class beneficially owned by such person or entity, including shares which may be acquired within 60 days on exercise of warrants or options and conversion of convertible securities, and (b) the denominator is the sum of (i) the total shares of common stock outstanding on as of the date of this Annual Report (2,300,118 shares), and (ii) the total number of shares that the beneficial owner may acquire upon exercise of the derivative securities. Unless otherwise stated, each beneficial owner has sole power to vote and dispose of its shares. The number of shares has reflected the result of the 1-for-5 reverse split of Common Stock effected on July 23, 2014 and the 1-for-20 reverse split of Common Stock effected on December 5, 2014. |

| 19 |

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, DIRECTOR INDEPENDENCE

Except as set forth below, we have not been a party to any transaction since October 1, 2012, in which the amount involved in the transaction exceeded or will exceed the lesser of $120,000 or one percent of the average of our total assets as at the year-end for the last two completed fiscal years and in which any of our directors, executive officers or beneficial holders of more than 5% of our capital stock, or any immediate family member of, or person sharing the household with, any of these individuals, had or will have a direct or indirect material interest.

Our policy is that a contract or transaction either between the Company and a director, or between a director and another company in which he is financially interested is not necessarily void or void-able if the relationship or interest is disclosed or known to the board of directors and the stockholders are entitled to vote on the issue, or if it is fair and reasonable to our company.

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

Audit Fees

The following table sets forth the aggregate fees billed to the Company by its independent registered public accounting firm, Dominic K.F. Chan & Co, for the fiscal years indicated.

| ACCOUNTING FEES AND SERVICES | 2014 | 2013 | ||||||

| Audit fees | $ | 17,500 | $ | 36,154 | ||||

| Audit-related fees | - | - | ||||||

| Tax fees | $ | - | $ | - | ||||

| All other fees | - | - | ||||||

| Total | $ | 17,500 | $ | 36,154 | ||||

The category of “Audit fees” includes fees for our annual audit, quarterly reviews and services rendered in connection with regulatory filings with the SEC, such as the issuance of comfort letters and consents.

The category of “Audit-related fees” includes employee benefit plan audits, internal control reviews and accounting consultation.

All above audit services and audit-related services were pre-approved by the Board of Directors, which concluded that the provision of such services by Dominic K.F. Chan & Co. was compatible with the maintenance of the firm’s independence in the conduct of its audits.

| 20 |

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

| (a) | Financial Statements |

The following are filed as part of this report:

| Financial Statements |

The following financial statements of Rebel Group, Inc. and Report of Independent Registered Public Accounting Firm are presented in the “F” pages of this Report:

| Page | |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | F – 2 |

| CONSOLIDATED FINANCIAL STATEMENTS | |

| Consolidated Balance Sheets as of September 30, 2014 and September 30, 2013 | F – 3 |

| Consolidated Statements of Operations for the years ended September 30, 2014 and September 30, 2013 and for the Period from September 13, 2011 (inception) to September 30, 2014 | F – 4 |

| Consolidated Statements of Changes in Stockholders’ Equity for the years ended September 30, 2014 and September 30, 2013 and for the Period from September 13, 2011 (inception) to September 30, 2014 | F – 5 |

| Consolidated Statements of Cash Flows for the year ended September 30, 2014 and September 30, 2013 and for the Period from September 13, 2011 (inception) to September 30, 2014 | F – 6 |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | F – 7 to F – 22 |

| 21 |

| (b) | Exhibits |

The following exhibits are filed or “furnished” herewith:

Exhibit Number |

Description | |

| 3.1 | Articles of Incorporation of the Company filed on September 13, 2011 (incorporated by reference herein to Exhibit 3.1 to the Company’s Registration Statement on Form S-1 filed with the SEC on November 7, 2011). | |

| 3.2 | Articles of Amendment to the Company’s Articles of Incorporation filed on March 12, 2013 (incorporated by reference herein to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed with the SEC on April 18, 2013). | |

| 3.3 | Articles of Amendment to the Company’s Articles of Incorporation filed on July 9, 2014 (incorporated by reference herein to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed with the SEC on July 24, 2014). | |

| 3.4 | Articles of Amendment to the Company’s Articles of Incorporation filed on December 1, 2013 (incorporated by reference herein to Exhibit 3.1 to the Company’s Current Report on Form 8-K filed with the SEC on December 9, 2014). | |

| 3.5 | Bylaws (incorporated by reference herein to Exhibit 3.2 to the Company’s Registration Statement on Form S-1 filed with the SEC on November 7, 2011). | |

| 4.1 | Specimen Stock Certificate of Common Stock of Rebel Group, Inc.* | |

| 10.1 | Assignment and Assumption Agreement, dated February 19, 2014, among Moxian HK, Moxian Shenzhen and Moxian Samoa. (incorporated by reference herein to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on February 25, 2014). | |

| 10.2 | License and Acquisition Agreement, dated February 21, 2014, among the Company, MOXC, Moxian BVI and Moxian CN Samoa. (incorporated by reference herein to Exhibit 10.2 to the Company’s Current Report on Form 8-K filed with the SEC on February 25, 2014). | |

| 21.1 | List of Subsidiaries. * | |

| 31.1 | Certification of Chief Executive Officer pursuant to Exchange Act Rule 13a-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002;* | |

| 32.1 | Certification of Chief Executive Officer and Chief Accounting Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.* | |

| 101.INS | XBRL Instance Document.** | |

| 101.SCH | XBRL Taxonomy Extension Schema Document.** | |

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase Document.** | |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase Document.** | |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase Document.** | |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase Document.** |

* Filed herewith.

| ** | Users of this data are advised pursuant to Rule 406T of Regulation S-X that this interactive data file is deemed not filed or part of a registration statement or prospectus for the purpose of section 11 or 12 of the Securities Act of 1933, as amended, is deemed not filed for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, and otherwise is not subject to liability under these sections. |

| 22 |

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 8, 2015 |

REBEL GROUP, INC. | |

| By: | /s/ Liew Kwong Yeow | |

Liew Kwong Yeow Chief Executive Officer | ||

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, this Report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| Date: January 8, 2015 | /s/ Liew Kwong Yeow |

| Liew Kwong Yeow | |

| Chief Executive Officer and Director |

| 23 |

REBEL GROUP, INC.

(Formerly known as Inception Technology Group, Inc.)

(A CORPORATION IN THE DEVELOPMENT STAGE)

CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED SEPTEMBER 30, 2014 AND 2013

(Stated in US Dollars)

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

REBEL GROUP, INC.

We have audited the accompanying consolidated balance sheets of Rebel Group, Inc. (the “Company”), a development stage company, as of September 30, 2014 and 2013 and the related consolidated statements of operations, shareholders’ equity and other comprehensive income, and cash flows, for the years ended September 30, 2014 and 2013. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, these financial statements present fairly, in all material respects, the financial position of the Company as of September 30, 2014 and 2013 and the results of its operations and their cash flows for the years ended September 30, 2014 and 2013 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company is in the development stage and has minimal operations. Its ability to continue as a going concern is dependent upon its ability to develop additional sources of capital, develop websites, generate advertising income, and ultimately, achieve profitable operations. These conditions raise substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Dominic K.F. Chan & Co

Certified Public Accountants

Hong Kong, January 8, 2015

| F-1 |

(A DEVELOPMENT STAGE COMPANY)

CONSOLIDATED BALANCE SHEETS

(Stated in US Dollars)

| As of | ||||||||

| Sept 30, 2014 | Sept 30, 2013 | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash and cash equivalents | $ | - | $ | 753,098 | ||||

| Accounts receivable | - | 1,032.00 | ||||||

| Prepayments, deposits and other receivables | 991,653 | 74,148.00 | ||||||

| Total current assets | 991,653 | 828,278 | ||||||

| Property and equipment, net (Note 3) | - | 171,794 | ||||||

| TOTAL ASSETS | $ | 991,653 | $ | 1,000,072 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accrued liabilities | $ | - | $ | 39,379 | ||||

| Unearned revenue | - | 4,782 | ||||||

| Loans from former shareholders (Note 4) | - | 1,691,190 | ||||||

| Total current liabilities | - | 1,735,351 | ||||||

| Total liabilities | $ | - | $ | 1,735,351 | ||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Capital stock (Note 5) | ||||||||

| Common stock: 500,000,000 authorized ; $0.0001 par value; 46,000,000 shares issued and outstanding* | $ | 4,600 | $ | 4,600 | ||||

| Additional paid-in capital | 41,900 | 41,900 | ||||||

| Surplus (deficit) accumulated during the development stage | 945,153 | (790,343 | ) | |||||

| Accumulated other comprehensive income | - | 8,564 | ||||||

| Total stockholders’ equity (deficit) | 991,653 | (735,279 | ) | |||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 991,653 | $ | 1,000,072 | ||||

*The number of shares of common stock has been retroactively restated to reflect the 20-for-1 forward stock split effected on April 16, 2013, and reflect the 1-for-5 reverse split of its issued and outstanding common stock effected on July 9, 2014.

See accompanying notes to consolidated financial statements

| F-2 |

(A DEVELOPMENT STAGE COMPANY)

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(Stated in US Dollars)

| For the period | ||||||||||||

| from Inception | ||||||||||||

| For the | For the | Sept 13, 2011 | ||||||||||

| year ended | year ended | to | ||||||||||

| Sept 30, 2014 | Sept 30, 2013 | Sept 30, 2014 | ||||||||||

| Revenues, net | $ | - | $ | - | $ | - | ||||||

| Cost and expenses | ||||||||||||

| Cost of sales | - | - | - | |||||||||

| Depreciation and amortization expenses | - | - | - | |||||||||

| Selling, general and administrative expenses | 8,347 | - | 39,095 | |||||||||

| Loss from operations | (8,347 | ) | - | (39,095 | ) | |||||||

| Other income | ||||||||||||

| Gain on disposal of subsidiaries | 2,551,298 | - | 2,551,298 | |||||||||

| Loss from continuing operations before income tax | 2,542,951 | - | 2,512,203 | |||||||||

| Income tax expenses | - | - | - | |||||||||

| Net profit (loss) from continuing operations | 2,542,951 | - | 2,512,203 | |||||||||

| Loss from discontinued operations, net of tax | (807,455 | ) | (759,181 | ) | (1,567,050 | ) | ||||||

| Net profit (loss) | 1,735,496 | (759,181 | ) | 945,153 | ||||||||

| Foreign currency translation adjustments | - | - | - | |||||||||

| Comprehensive income (loss) | $ | 1,735,496 | $ | (759,181 | ) | $ | 945,153 | |||||

| Earnings per share (note 6) | ||||||||||||

| Basic and diluted: | ||||||||||||

| Net profit (loss) | $ | 0.04 | $ | (0.02 | ) | |||||||

| Net profit (loss) from continuing operations | 0.06 | 0.00 | ||||||||||

| Net profit (loss) from discontinuing operations | $ | (0.02 | ) | $ | (0.02 | ) | ||||||

| Basic and diluted weighted average common shares outstanding* | 46,000,000 | 46,000,000 | ||||||||||

*The number of shares of common stock has been retroactively restated to reflect the 20-for-1 forward stock split effected on April 16, 2013, and reflect the 1-for-5 reverse split of its issued and outstanding common stock effected on July 9, 2014.

See accompanying notes to consolidated financial statements

| F-3 |

(A DEVELOPMENT STAGE COMPANY)

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Stated in US Dollars)

| Accumulated | ||||||||||||||||||||||||

| surplus | Accumulated | |||||||||||||||||||||||

| Additional | (deficit) | other | ||||||||||||||||||||||

| Common Stock* | paid in | development | comprehensive | |||||||||||||||||||||

| Shares | Amount | capital | stage | income | Total | |||||||||||||||||||

| Balance at Inception, September 13, 2011 | - | $ | - | $ | - | $ | - | $ | - | $ | - | |||||||||||||

| Common shares issued to Founder for cash at $.00025 per share (par value $.0001) on September 13, 2011 | 36,000,000 | 3,600 | 5,400 | - | - | 9,000 | ||||||||||||||||||

| Net loss | - | - | - | (2,100 | ) | - | (2,100 | ) | ||||||||||||||||

| Balance, September 30, 2011 | 36,000,000 | $ | 3,600 | $ | 5,400 | $ | (2,100 | ) | $ | - | $ | 6,900 | ||||||||||||

| Common shares issued to Investor for cash at $.00375 per share (par value $.0001) on March 14, 2012 | 10,000,000 | 1,000 | 36,500 | - | - | 37,500 | ||||||||||||||||||

| Net loss | - | - | - | (29,062 | ) | - | (29,062 | ) | ||||||||||||||||

| Balance, September 30, 2012 | 46,000,000 | $ | 4,600 | $ | 41,900 | $ | (31,162 | ) | $ | - | $ | 15,338 | ||||||||||||

| Cancelled of 105,000,000 shares by a shareholder on April 25, 2013 | (21,000,000 | ) | (2,100 | ) | - | - | - | (2,100 | ) | |||||||||||||||

| Issuance of 105,000,000 shares for a share exchange transaction on April 25, 2013 | 21,000,000 | 2,100 | - | - | - | 2,100 | ||||||||||||||||||

| Net loss | - | - | - | (759,181 | ) | - | (759,181 | ) | ||||||||||||||||

| Foreign currency adjustment | - | - | - | - | 8,564 | 8,564 | ||||||||||||||||||

| Balance, September 30, 2013 | 46,000,000 | $ | 4,600 | $ | 41,900 | $ | (790,343 | ) | $ | 8,564 | $ | (735,279 | ) | |||||||||||

| Net profit | - | - | - | 1,735,496 | - | 1,735,496 | ||||||||||||||||||

| Foreign currency adjustment | - | - | - | - | (8,564 | ) | (8,564 | ) | ||||||||||||||||

| Balance, September 30, 2014 | 46,000,000 | $ | 4,600 | $ | 41,900 | $ | 945,153 | $ | - | $ | 991,653 | |||||||||||||

*The number of shares of common stock has been retroactively restated to reflect the 20-for-1 forward stock split effected on April 16, 2013, and reflect the 1-for-5 reverse split of its issued and outstanding common stock effected on July 9, 2014.

See accompanying notes to consolidated financial statements

| F-4 |

(A DEVELOPMENT STAGE COMPANY)

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Stated in US Dollars)

| For the period | ||||||||||||

| For the | For the | from Inception | ||||||||||

| year | year | Sept 13, 2011 | ||||||||||

| ended | ended | to | ||||||||||

| Sept 30, 2014 | Sept 30, 2013 | Sept 30, 2014 | ||||||||||

| OPERATING ACTIVITIES | ||||||||||||

| Net profit (loss) | $ | 1,735,496 | $ | (759,181 | ) | $ | 945,153 | |||||

| Loss from discontinued operations | 807,455 | 759,181 | 1,567,050 | |||||||||

| Loss from continuing operations | 2,542,951 | - | 2,512,203 | |||||||||

| Gain on disposal of subsidiaries | (2,551,298 | ) | - | (2,551,298 | ) | |||||||

| Changes in operating assets and liabilities: | ||||||||||||

| Increase in deposits, prepayments and other receivables | (991,653 | ) | - | (991,653 | ) | |||||||

| Net cash used in operating activities - continuing operations | (1,000,000 | ) | - | (1,030,748 | ) | |||||||

| Net cash used in operating activities - discontinued operations | (207,446 | ) | (766,887 | ) | (964,183 | ) | ||||||

| Net cash used in operating activities | (1,207,446 | ) | (766,887 | ) | (1,994,931 | ) | ||||||

| INVESTING ACTIVITIES | ||||||||||||

| Net cash used in investing activities - continuing operations | - | - | - | |||||||||

| Net cash used in investing activities - discontinued operations | (2,680 | ) | (197,107 | ) | (199,787 | ) | ||||||

| Net cash used in investing activities | (2,680 | ) | (197,107 | ) | (199,787 | ) | ||||||

| FINANCING ACTIVITIES | ||||||||||||

| Capital stock issued for cash | - | - | 4,650 | |||||||||

| Paid In capital | - | - | 41,850 | |||||||||

| Net cash provided by financing activities - continuing operations | - | - | 46,500 | |||||||||

| Net cash provided by financing activities - discontinued operations | 457,028 | 1,691,190 | 2,148,218 | |||||||||

| Net cash provided by financing activities | 457,028 | 1,691,190 | 2,194,718 | |||||||||

| Effect of foreign currency translation | - | 8,564 | - | |||||||||

| Net (decrease) increase in cash and cash equivalents | (753,098 | ) | 727,196 | - | ||||||||

| Cash and cash equivalents, beginning of year | 753,098 | 17,338 | - | |||||||||

| Cash and cash equivalents, end of year | $ | - | $ | 753,098 | $ | - | ||||||

| Supplemental cash flow disclosures: | ||||||||||||

| Cash paid for interest expense | $ | - | $ | - | $ | - | ||||||