Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COLUMBIA PROPERTY TRUST, INC. | cxp8-k2015januaryacquisiti.htm |

| EX-99.1 - EXHIBIT - COLUMBIA PROPERTY TRUST, INC. | ex991pressreleasejanuary82.htm |

1 Acquisition Update January 2015

2 Forward Looking Statements Certain statements contained in this presentation other than historical facts may be considered forward-looking statements. Such statements include, in particular, statements about our plans, strategies, and prospects, and are subject to certain risks and uncertainties, including known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as "may," "will," "expect," "intend," "anticipate," "estimate," "believe," "continue," or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements. We make no representations or warranties (express or implied) about the accuracy of any such forward-looking statements contained in this presentation, and we do not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Any such forward-looking statements are subject to risks, uncertainties, and other factors and are based on a number of assumptions involving judgments with respect to, among other things, future economic, competitive, and market conditions, all of which are difficult or impossible to predict accurately. To the extent that our assumptions differ from actual conditions, our ability to accurately anticipate results expressed in such forward-looking statements, including our ability to generate positive cash flow from operations, make distributions to stockholders, and maintain the value of our real estate properties, may be significantly hindered. See Item 1A in the Company's most recently filed Annual Report on Form 10-K for the year ended December 31, 2013, for a discussion of some of the risks and uncertainties that could cause actual results to differ materially from those presented in our forward-looking statements. The risk factors described in our Annual Report are not the only ones we face but do represent those risks and uncertainties that we believe are material to us. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also harm our business. For additional information, including reconciliations of any non-GAAP financial measures found herein, please reference the supplemental report furnished by the Company on a Current Report on Form 8-K filed on October 30, 2014. The names, logos and related product and service names, design marks, and slogans are the trademarks or service marks of their respective companies.

3 Transactions Overview Columbia expands its holdings in Manhattan and enters Boston’s urban core through two separate transactions totaling $588M. • Two property portfolio: − 315 Park Avenue South in Manhattan, NY − 1881 Campus Commons Drive in Reston, VA • Off-market transaction, closed January 7, 2015 • Near-term lease roll-up opportunity • Projected Year-One Net Operating Income: $17.0M Spear Street Capital Portfolio $436M • Located in Boston, MA • Purchased from Broadway Partners, closed January 8, 2015 • Near-term lease-up opportunity with in-place rents below market • Projected Year-One Net Operating Income: $5.5M 116 Huntington Avenue $152M • $148M of cash on hand primarily from 2014 disposition activity • $140M drawn from our fully available unsecured credit facility and a $300M bridge loan, both expected to be repaid with future disposition proceeds and other financing activity • No assumption of property level debt • Increases leverage to approximately 37% of gross real estate assets Financing

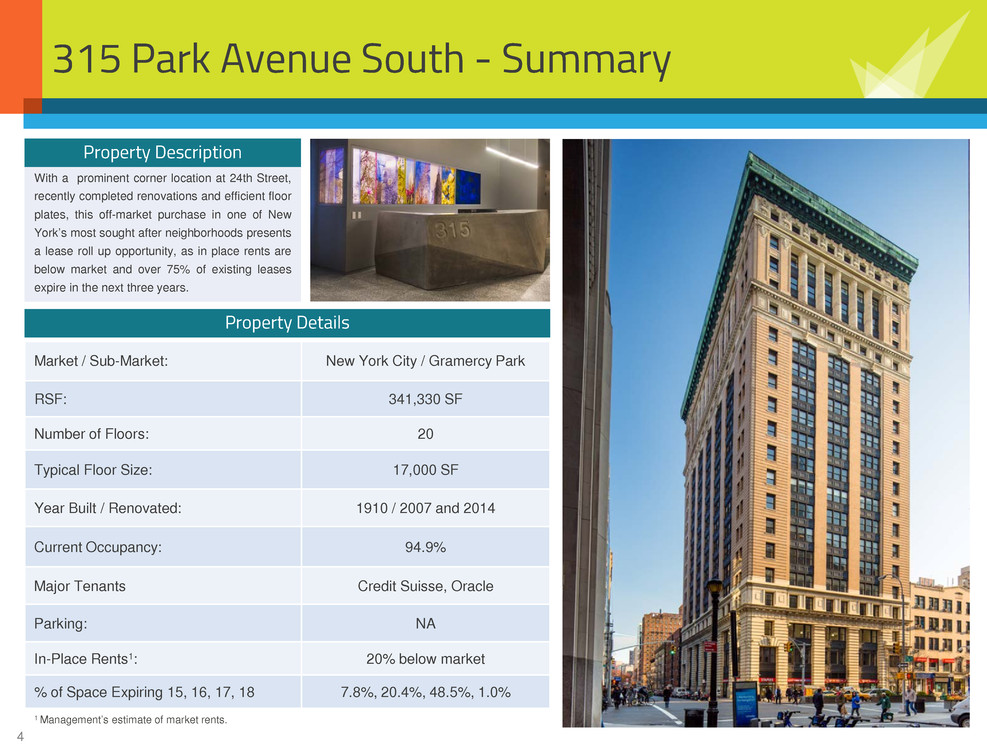

4 315 Park Avenue South - Summary Property Details Market / Sub-Market: New York City / Gramercy Park RSF: 341,330 SF Number of Floors: 20 Typical Floor Size: 17,000 SF Year Built / Renovated: 1910 / 2007 and 2014 Current Occupancy: 94.9% Major Tenants Credit Suisse, Oracle Parking: NA In-Place Rents1: 20% below market % of Space Expiring 15, 16, 17, 18 7.8%, 20.4%, 48.5%, 1.0% With a prominent corner location at 24th Street, recently completed renovations and efficient floor plates, this off-market purchase in one of New York’s most sought after neighborhoods presents a lease roll up opportunity, as in place rents are below market and over 75% of existing leases expire in the next three years. 1 Management’s estimate of market rents. Property Description

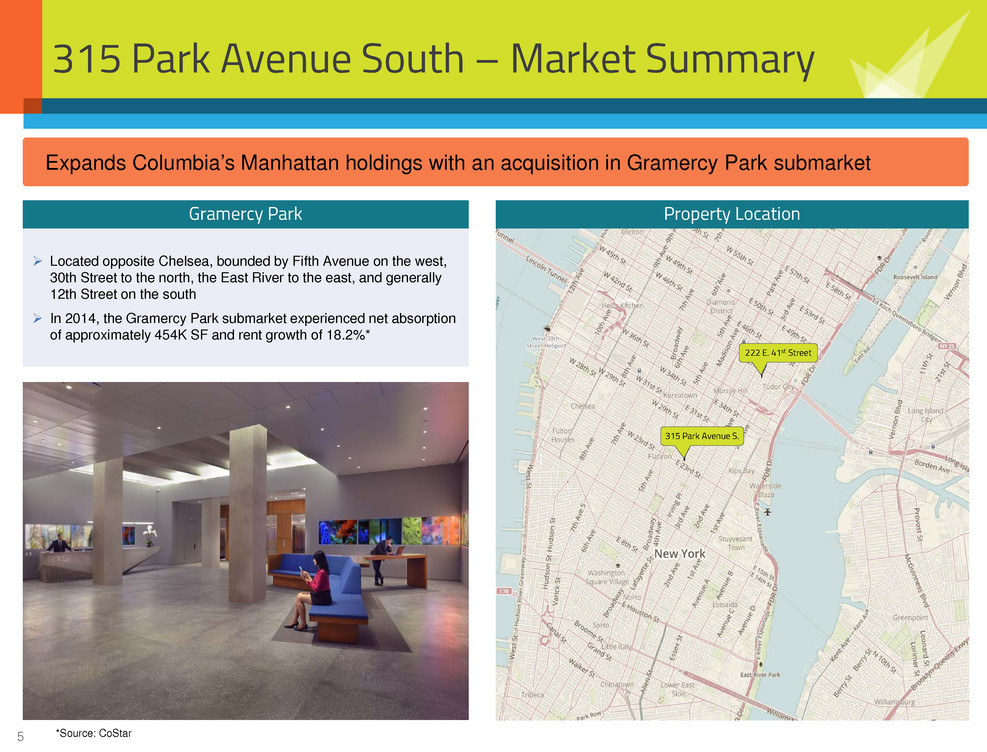

5 315 Park Avenue South – Market Summary Expands Columbia’s Manhattan holdings with an acquisition in Gramercy Park submarket Gramercy Park Property Location Located opposite Chelsea, bounded by Fifth Avenue on the west, 30th Street to the north, the East River to the east, and generally 12th Street on the south In 2014, the Gramercy Park submarket experienced net absorption of approximately 454K SF and rent growth of 18.2%* *Source: CoStar 222 E. 41st Street 315 Park Avenue S.

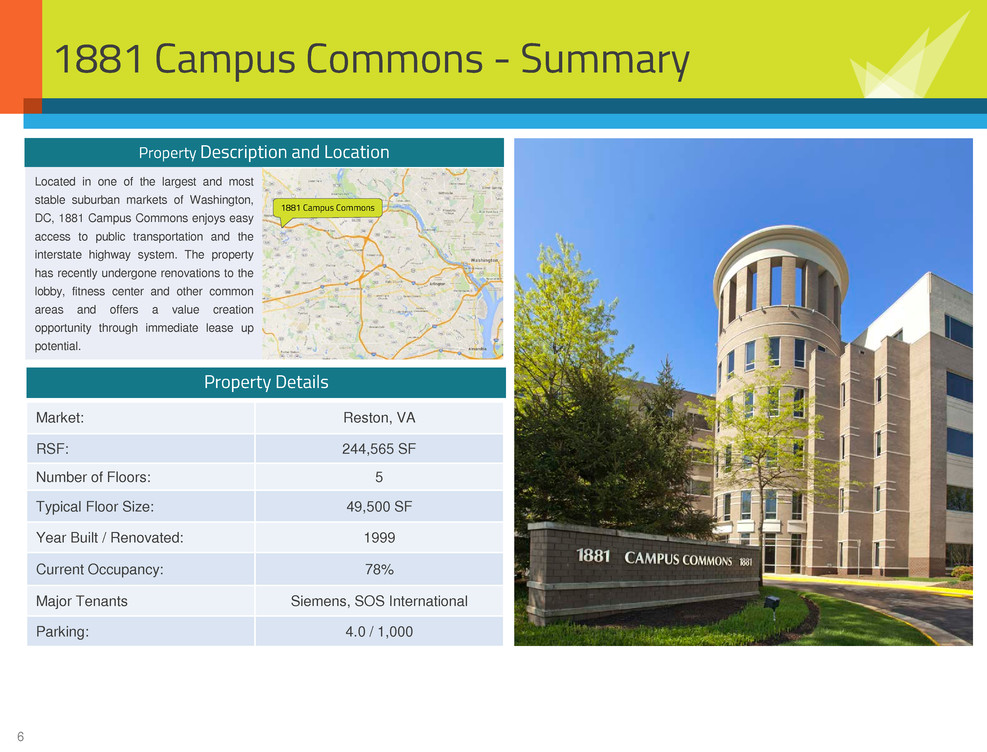

6 Located in one of the largest and most stable suburban markets of Washington, DC, 1881 Campus Commons enjoys easy access to public transportation and the interstate highway system. The property has recently undergone renovations to the lobby, fitness center and other common areas and offers a value creation opportunity through immediate lease up potential. 1881 Campus Commons - Summary Market: Reston, VA RSF: 244,565 SF Number of Floors: 5 Typical Floor Size: 49,500 SF Year Built / Renovated: 1999 Current Occupancy: 78% Major Tenants Siemens, SOS International Parking: 4.0 / 1,000 1881 Campus Commons Property Details Property Description and Location

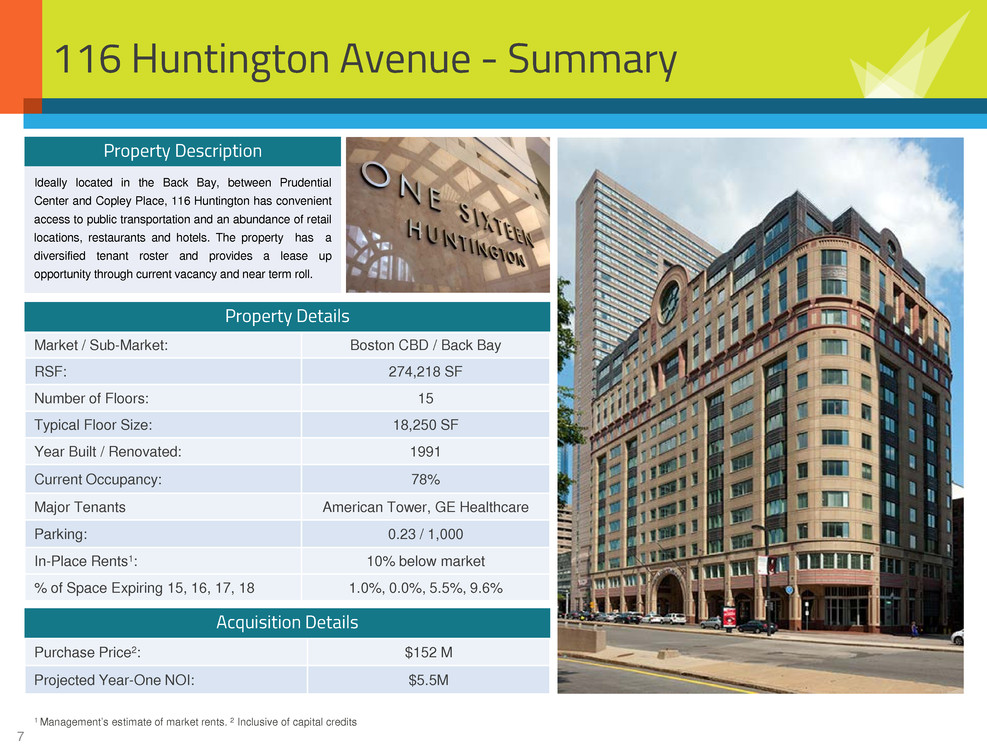

7 116 Huntington Avenue - Summary Market / Sub-Market: Boston CBD / Back Bay RSF: 274,218 SF Number of Floors: 15 Typical Floor Size: 18,250 SF Year Built / Renovated: 1991 Current Occupancy: 78% Major Tenants American Tower, GE Healthcare Parking: 0.23 / 1,000 In-Place Rents1: 10% below market % of Space Expiring 15, 16, 17, 18 1.0%, 0.0%, 5.5%, 9.6% 1 Management’s estimate of market rents. 2 Inclusive of capital credits Purchase Price2: $152 M Projected Year-One NOI: $5.5M Ideally located in the Back Bay, between Prudential Center and Copley Place, 116 Huntington has convenient access to public transportation and an abundance of retail locations, restaurants and hotels. The property has a diversified tenant roster and provides a lease up opportunity through current vacancy and near term roll. Property Description Property Details Acquisition Details

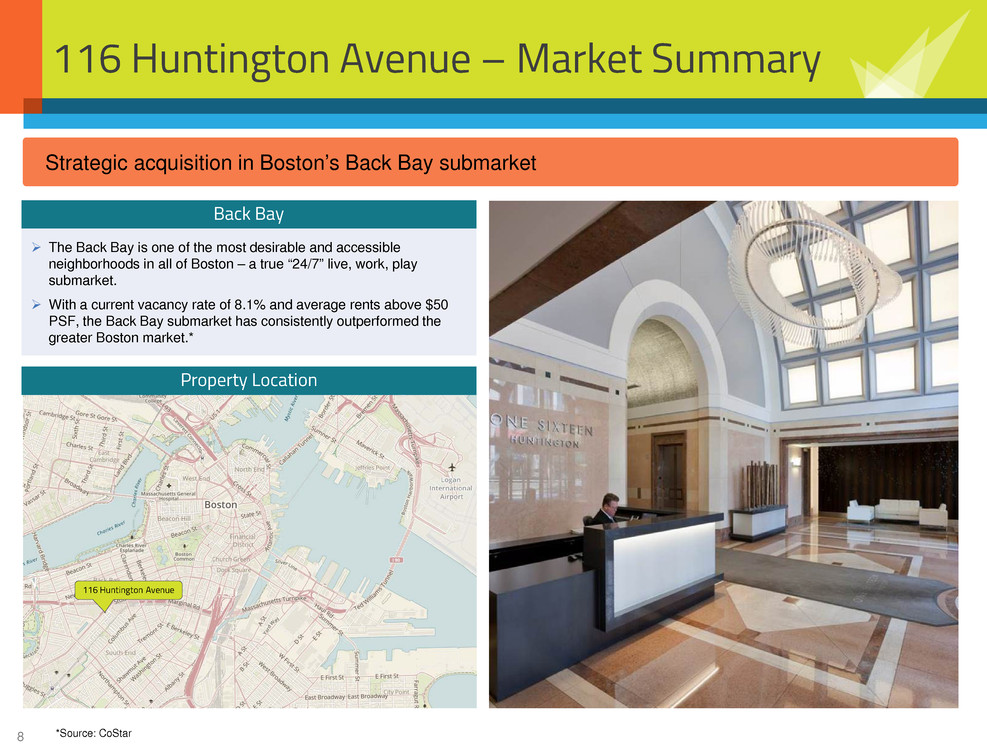

8 116 Huntington Avenue – Market Summary Strategic acquisition in Boston’s Back Bay submarket Back Bay Property Location The Back Bay is one of the most desirable and accessible neighborhoods in all of Boston – a true “24/7” live, work, play submarket. With a current vacancy rate of 8.1% and average rents above $50 PSF, the Back Bay submarket has consistently outperformed the greater Boston market.* *Source: CoStar 116 Huntington Avenue

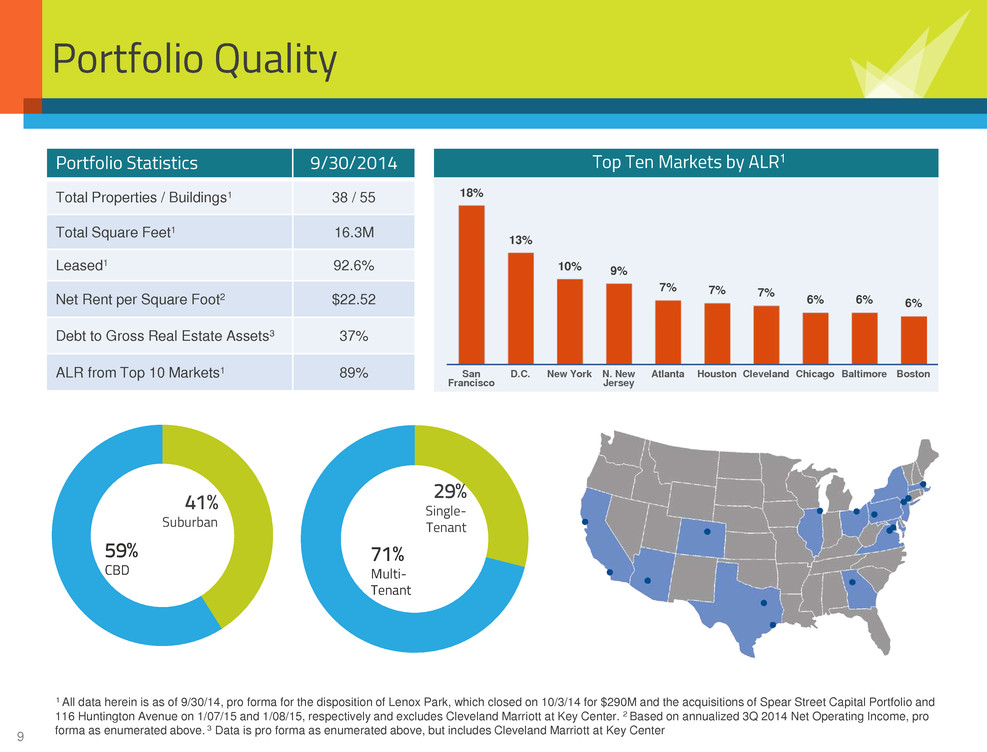

9 Portfolio Quality Portfolio Statistics 9/30/2014 Total Properties / Buildings1 38 / 55 Total Square Feet1 16.3M Leased1 92.6% Net Rent per Square Foot2 $22.52 Debt to Gross Real Estate Assets3 37% ALR from Top 10 Markets1 89% 1 All data herein is as of 9/30/14, pro forma for the disposition of Lenox Park, which closed on 10/3/14 for $290M and the acquisitions of Spear Street Capital Portfolio and 116 Huntington Avenue on 1/07/15 and 1/08/15, respectively and excludes Cleveland Marriott at Key Center. 2 Based on annualized 3Q 2014 Net Operating Income, pro forma as enumerated above. 3 Data is pro forma as enumerated above, but includes Cleveland Marriott at Key Center 41% Suburban 59% CBD 29% Single- Tenant 71% Multi- Tenant 18% 13% 10% 9% 7% 7% 7% 6% 6% 6% San Francisco D.C. New York N. New Jersey Atlanta Houston Cleveland Chicago Baltimore Boston Top Ten Markets by ALR1

10 For more information: Columbia Property Trust Investor Relations t 800.899.8411 e IR @ columbiapropertytrust.com 0009-CXPPRES1501 View of Back Bay from 116 Huntington Avenue Additional information about these transactions will be provided on our Q4 2014 conference call February 13, 2015 10:00 a.m. ET For call access information, please visit columbiapropertytrust.com