Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - MEDICAL PROPERTIES TRUST INC | d846891dex991.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 7, 2015

Medical Properties Trust, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Maryland | 001-32559 | 20-0191742 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

1000 Urban Center Drive, Suite 501, Birmingham, AL 35242

(Address of principal executive offices) (Zip code)

(205) 969-3755

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01. | Regulation FD Disclosure. |

On January 7, 2015, Medical Properties Trust, Inc. (the “Company”) commenced a public offering of shares of its common stock (the “Offering”). The preliminary prospectus, dated January 7, 2015, by which the common stock is being offered includes the following information under the heading “Recent Developments”:

Acquisition of Median Kliniken Portfolio

On October 15, 2014, we entered into definitive agreements pursuant to which subsidiaries of our operating partnership will acquire substantially all the real estate assets of Median Kliniken S.à r.l. (“Median”), a German provider of post-acute and acute rehabilitation services, for an aggregate purchase price that is expected to be approximately €705 million ($881 million). The Median portfolio includes 38 rehabilitation hospitals and two acute care hospitals located across 11 states in the Federal Republic of Germany.

The table below sets forth information with respect to the facilities to be acquired:

| Property |

Type of Property |

Location | Number of Licensed Beds |

Total Square Feet |

||||||||||

| Heiligendamm |

Rehab | Heiligendamm | 255 | 162,643 | ||||||||||

| Wismar |

Rehab | Wismar | 203 | 139,242 | ||||||||||

| Bad Sulze |

Rehab | Bad Sulze | 230 | 180,489 | ||||||||||

| Hoppegarten |

Rehab | Hoppegarten | 244 | 218,701 | ||||||||||

| Grunheide |

Rehab | Grunheide | 240 | 215,030 | ||||||||||

| Berlin-Kladow |

Rehab | Berlin | 220 | 180,489 | ||||||||||

| NRZ Magdeburg |

Rehab | Magdeburg | 210 | 229,732 | ||||||||||

| Kalbe |

Rehab | Kalbe | 220 | 178,865 | ||||||||||

| Flechtingen I |

Rehab | Flechtingen | 195 | 131,976 | ||||||||||

| Flechtingen II |

Rehab | Flechtingen | 225 | 180,489 | ||||||||||

| Bad Tennstedt |

Rehab | Bad Tennstedt | 251 | 179,197 | ||||||||||

| Ilmtal |

Rehab | Bad Berka | 217 | * | 141,590 | |||||||||

| Quellbrunn |

Rehab | Bad Berka | 217 | * | 86,564 | |||||||||

| Adelsberg Klinik |

Rehab | Bad Berka | 237 | 167,368 | ||||||||||

| Bad Lobenstein |

Rehab | Bad Lobenstein | 228 | 168,815 | ||||||||||

| Bad Lausick |

Rehab | Bad Lausick | 199 | 131,976 | ||||||||||

| Berggiesshubel |

Rehab | Berggiesshubel | 195 | 131,976 | ||||||||||

| Bad Gottleuba |

Rehab | Bad Gottleuba | 545 | 260,486 | ||||||||||

| Weserklinik |

Rehab | Bad Oeynhausen | 210 | 137,286 | ||||||||||

| Flachsheide |

Rehab | Flachsheide | 235 | 195,666 | ||||||||||

| Klinik am Burggraben |

Rehab | Bad Salzuflen | 747 | 433,086 | ||||||||||

| Reha-Zentrum Gyhum |

Rehab | Gyhum | 333 | 162,643 | ||||||||||

| Braunfels |

Acute | Braunfels | 160 | 135,216 | ||||||||||

| Schlangenbad |

Rehab | Schlangenbad | 115 | 227,538 | ||||||||||

| Aukammtal |

Rehab | Wiesbaden | 236 | 177,464 | ||||||||||

| Hohenfeld |

Rehab | Bad Camberg | 373 | 209,127 | ||||||||||

| Klinik am Sudpark |

Rehab | Bad Nauheim | 265 | 96,875 | ||||||||||

| Kaiserberg Klinik |

Rehab | Bad Nauheim | 245 | 124,861 | ||||||||||

| Kinzigtal Klinik |

Rehab | Bad Soden-Salmünster | 189 | 108,005 | ||||||||||

| Burg Landshut |

Rehab | Bernkastel-Kues | 250 | 181,673 | ||||||||||

| Moselschleife |

Rehab | Bernkastel-Kues | 203 | 147,465 | ||||||||||

| Bernkastel |

Rehab | Bernkastel-Kues | 215 | 85,110 | ||||||||||

| Moselhohe |

Rehab | Bernkastel-Kues | 230 | 103,516 | ||||||||||

| Gunzenbachhof |

Rehab | Baden-Baden | 68 | 66,736 | ||||||||||

| Achertal Klinik |

Rehab | Ottenhöfen im Schwarzwald | 69 | 77,253 | ||||||||||

| Franz-Alexander Klinik |

Rehab | Nordrach | 34 | 39,557 | ||||||||||

| St. Georg Nordrach |

Rehab | Nordrach | 97 | 54,325 | ||||||||||

| St. Georg Bad Krozingen |

Rehab | Bad Krozingen | 138 | 64,196 | ||||||||||

| St. Georg Bad Durrheim |

Rehab | Bad Durrheim | 116 | 205,375 | ||||||||||

| ATOS – Heidelberg |

Acute | Heidelberg | 73 | 117,327 | ||||||||||

|

|

|

|

|

|||||||||||

| Total |

8,715 | 6,235,928 | ||||||||||||

|

|

|

|

|

|||||||||||

| * | Licensed beds for Ilmtal and Quellbrunn shown together. |

2

The initial acquisition of Median was completed on December 15, 2014 when an affiliate of Waterland Private Equity Fund V C.V. (“Waterland V”) acquired 94.9% of the outstanding equity interests in Median and we indirectly acquired the remaining 5.1% of the outstanding equity interests in Median. In connection with the closing, we provided interim acquisition loans to Waterland V and Median in aggregate amounts of approximately €425 million ($531 million). In this prospectus supplement, we refer to the December 15, 2014 acquisition of Median and related financing transactions as the “Initial Median Closing.”

In a series of transactions we expect will be completed during the first quarter of 2015, we will acquire substantially all of Median’s real estate assets in sale-leaseback transactions between us and Median. We will lease the assets back to Median under a 27 year master lease, with annual escalators at the greater of one percent or 70% of the German consumer price index. The initial GAAP yield is 9.3%, which includes the straight line revenue associated with the minimum annual rent escalator. The interim loans that we provided in connection with the Initial Median Closing bear interest at a rate similar to the initial lease rate we will receive under the sale and leaseback transactions. In this prospectus supplement, we refer to the sale and leaseback transactions as the “Median Real Estate Acquisitions.”

Upon closing of the Median Real Estate Acquisitions, the interim loans that we provided in connection with the Initial Median Closing will be converted and offset against the real estate purchase price payable by us. The purchase price, which will not exceed €705 million ($881 million) in the aggregate, will be further reduced and offset against amounts of debt that we elect to assume or provide cash to repay in connection with closing. The Median Real Estate Acquisitions are subject to customary real estate, regulatory and other closing conditions, including waiver of any statutory pre-emption rights by local municipalities. To the extent we are unable to acquire the entire Median real estate portfolio as contemplated by the Median Real Estate Acquisitions, we will have a right of first refusal with regard to any new real estate properties owned or acquired by Median, until we have acquired real estate properties from Median for an aggregate purchase price of at least €705 million ($881 million).

In this prospectus supplement, we refer to the Initial Median Closing and the Median Real Estate Acquisitions, along with the related financing transactions described above, collectively as the “Median Transactions.”

Waterland V is an affiliate of Waterland Private Equity Fund IV C.V. (“Waterland IV”), which controls RHM Klinik-und Altenheimbetriebe GmbH & Co. KG (“RHM”), the operator and lessee of 14 German facilities that we currently own. On December 18, 2014, Waterland Private Equity Investments, the parent company of Waterland V and Waterland IV, announced its intent to merge Median and RHM during the course of 2015. Pro forma for the merger, and after giving effect to the Median Transactions and certain fourth quarter transactions described below (assuming full funding of our remaining development commitments), the combined Median-RHM portfolio will represent approximately 27% of our portfolio by investment amount.

Financing

We borrowed $533 million under our revolving credit facility, along with cash on hand, to fund the amounts payable by us in connection with the Initial Median Closing, in addition to related costs, fees and expenses. We intend to use all of the net proceeds from this offering of shares of our common stock to repay a portion of the amounts borrowed under our revolving credit facility.

During the first quarter of 2015, we expect to acquire substantially all of Median’s real estate assets in the Median Real Estate Acquisitions described above for an aggregate purchase price of approximately €705 million ($881 million), plus an estimated €60.3 million ($75.3 million) in related transaction costs, fees and expenses. The interim loans of approximately €425 million ($531 million) that we provided in connection with

3

the Initial Median Closing will be converted and offset against the real estate purchase price under the Median Real Estate Acquisitions. We intend to finance the remaining approximately €280 million ($350 million) of the purchase price (plus the related costs, fees and expenses) with borrowings under our revolving credit facility, the assumption of existing Median debt and/or with funds from additional financing arrangements, which may include borrowings or net proceeds from senior debt facilities or issuances, assumption of existing or placement of new secured loans on the Median real estate, or a combination thereof. The sources of financing actually used will depend upon a variety of factors, including then-current market conditions.

Credit Facility Amendment and Upsize

On October 17, 2014, we entered into an amendment to our revolving credit and term loan agreement to increase the current aggregate committed size of the facility to $1.15 billion and increase the incremental term loan and/or revolving loan capacity by up to an additional $400 million, for total aggregate capacity of $1.55 billion. The amendment also increases the alternative currency sublimit under the facility to €500 million and amends certain covenants in order to permit us to consummate and finance the Median Transactions. To the extent necessary, we also have commitments from a syndicate of lenders for a senior unsecured interim loan facility with current availability of up to $215 million.

Other Acquisitions / Transactions

On October 31, 2014, we acquired a 237-bed acute care hospital and associated medical office buildings and a behavioral health facility in Sherman, Texas for $32.5 million. Alecto Healthcare Services is the tenant and operator pursuant to a 15-year lease agreement with three five-year extension options. In addition we agreed to fund a working capital loan up to $7.5 million, all of which was funded during the fourth quarter of 2014.

During the fourth quarter of 2014, we acquired three RHM rehabilitation facilities in Germany for an aggregate purchase price of €63.6 million (approximately $79.5 million), including real estate transfer taxes. These facilities include: Bad Liebenstein (271 beds), Bad Tolz (248 beds) and Bad Mergentheim (211 beds). All three properties are included under our existing master lease agreement with RHM.

On December 31, 2014, we completed the restructuring of our investment in Monroe Hospital, located in Bloomington, Indiana, by entering into a lease with an affiliate of Prime Healthcare Services (“Prime”) for the operation of the facility. The lease was included under our existing master lease with Prime, which has more than seven years remaining on the fixed term and contains two renewal options of five years each. The lease rate for the Monroe facility is based on a $30 million investment value and escalates annually at the greater of the consumer price index increase or 2%. We paid $5.0 million for capital improvements in connection with entering into the lease with Prime and Prime has the option to acquire the facility for $30 million at any time upon 90 days written notice.

In this prospectus supplement we refer to the acquisitions in Sherman, Texas, the acquisition of the three German RHM rehabilitation facilities and the lease with Prime of Monroe Hospital as the “Fourth Quarter Transactions.”

4

Benefits of Median and Fourth Quarter Transactions

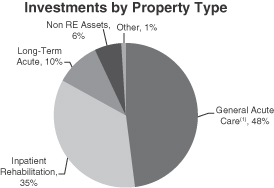

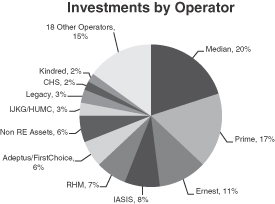

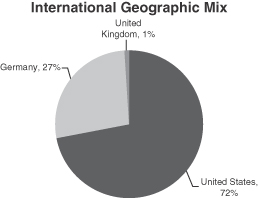

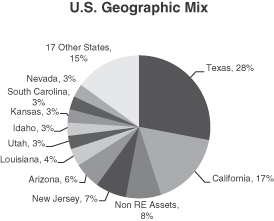

Enhances Size, Quality and Diversity of our Portfolio. As described in more detail below, we believe that the Median Transactions and the Fourth Quarter Transactions will enhance the size and quality of our healthcare portfolio and add diversity by property type, operator and geographic location:

|

|

(1) Includes freestanding emergency rooms.

|

|

Note: Percentages in all charts are based on our total gross assets, assuming development commitments are fully funded.

Accretive Transactions. The Median Transactions and the Fourth Quarter Transactions are expected to be immediately accretive to cash available for distribution to our stockholders, resulting in an improved payout ratio and stronger sustainability of our dividends.

Expands Our Size and Scale. The Median Transactions, when consummated, and the Fourth Quarter Transactions will significantly expand our total gross assets by approximately 35% to $4.5 billion (assuming development commitments are fully funded), increase the total number of properties in our portfolio by approximately 40% to 172, and increase our total number of beds by approximately 95% to nearly 20,000.

Increases Our Total Revenues. For the nine months ended September 30, 2014, our total revenues were $230.4 million under GAAP. Assuming consummation on January 1, 2014 of the Median Transactions and the Fourth Quarter Transactions, as well as the other acquisition transactions previously completed during 2014, our pro forma total revenues for the nine months ended September 30, 2014 would have been approximately $310.6 million (excluding additional revenues received from our development properties that began operations during 2014).

5

Extends Our Lease Maturity Schedule. The Median Transactions and the Fourth Quarter Transactions will have the effect of extending our overall weighted average lease expiration from 12.9 years to 16.5 years, pro forma as of September 30, 2014. Pro forma for the Median Transactions and Fourth Quarter Transactions as of September 30, 2014, approximately 72.4% of the total annualized rent of our portfolio of healthcare properties will have lease expirations beyond 2025, with average annual lease maturities of less than 1.3% per annum through 2021.

Further Increases Our Exposure to Favorable Market Trends in Western Europe. As one of the strongest global economies, with low unemployment rates and universal healthcare coverage and payment policies, we believe Germany remains a favorable market in which to invest. The public and private sectors are making considerable investments in the healthcare industry in Germany, and we expect to realize significant value and long-term stability through our increased investments in the region. After giving effect to the Median Transactions and Fourth Quarter Transactions and assuming development commitments are fully funded, approximately 28% of our portfolio by investment amount, or a total of 55 facilities, will be located in Western Europe.

In addition, on January 7, 2015, the Company issued a press release announcing that it had commenced the Offering, a copy of which is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

The information contained in this Item 7.01 is being “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise. The information in this Item 7.01 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act or into any filing or other document pursuant to the Securities Exchange Act of 1934, as amended, except as otherwise expressly stated in any such filing.

This Current Report on Form 8-K does not constitute an offer to sell, or a solicitation of an offer to buy, any of the Company’s securities, including, without limitation, those securities proposed to be offered and sold pursuant to the preliminary prospectus and registration statement described above.

| Item 9.01. | Financial Statements and Exhibits. |

| (d) | Exhibits |

| Exhibit |

Description | |

| 99.1 | Press Release dated January 7, 2015 | |

6

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| MEDICAL PROPERTIES TRUST, INC. | ||

| By: | /s/ R. Steven Hamner | |

| Name: | R. Steven Hamner | |

| Title: | Executive Vice President and Chief Financial Officer | |

Date: January 7, 2015

7