Attached files

| file | filename |

|---|---|

| EX-3.3 - BYLAWS - My Active Date | madbylaws.htm |

| EX-3.2 - ARTICLES OF AMENDMENT PAGE 1 - My Active Date | madaoiamend1.htm |

| EX-5.1 - OPINION OF COUNSEL - My Active Date | madopinoinofcounsel.htm |

| EX-3.1 - CERTIFICATE OF INCORPORATION - My Active Date | madaoi.htm |

| EX-23.2 - CONSENT - My Active Date | madconsentfinal1.htm |

| EX-3.2 - ARTICLES OF AMENDMENT PAGE 2 - My Active Date | madaoiamend2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

MY ACTIVE DATE, INC.

(Exact Name of Registrant As Specified In Its Charter)

| Wyoming | 5990 | 46-5220210 | ||

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

IRS I.D. |

|

2647 Gateway Rd. Suite 105-401 Carlsbad, California 92009 |

92009 | |

| (Address of principal executive offices) | (Zip Code) |

Mr. Blaine Nabors

Chief Executive Officer

2647 Gateway Rd. Suite 105-401

Carlsbad, California 92009

(713) 875-9200

(Name, address and telephone number of agent for service)

with copies to:

Adam S. Tracy, Esq.

Securities Compliance Group, Ltd.

520 W. Roosevelt Road, Suite 201

Wheaton, IL 60187

(888) 978-9901 x1

SEC File No. ________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company.

| Large accelerated filer | o | Accelerated Filer | o |

| Non-accelerated filer | o | Smaller reporting company | x |

1

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Amount to be registered | Proposed Max Offering price per share |

Proposed Max. Aggregate Offering Price |

Amount of Registration Fee (1) |

| Common Stock | 20,000,000 | $0.10 | $2,000,000 | $232.40 |

| (1) | Calculated under Section 6(b) of Securities Act of 1933 as $0.0001162 of aggregate offering price |

We hereby amend this registration statement on such date or dates as may be necessary to delay our effective date until we will file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a) may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the United States Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted under applicable law.

2

PROSPECTUS – SUBJECT TO COMPLETION DATED DECEMBER 30, 2014

MY ACTIVE DATE, INC.

Up to 20,000,000 Shares

This is the initial public offering of shares of our common stock. We are offering 20,000,000 shares of our common stock at $0.10 per share. Our common stock is not low listed on any national securities exchange or the NASDAQ stock market, and is not eligible to trade on the OTC Bulletin Board. While we intend to apply for the quotation of our common stock on the OTC Bulletin Board or OTCQB upon effectiveness of the registration statement of which this prospectus forms a part, there can be no assurance that we will meet the minimum requirements for such listing or that a market maker will agreed to file on our behalf the necessary documentation with the Financial Industry Regulatory Authority for such application for quotation to be approved.

The offering will commence on the effective date of this prospectus and will terminate on or before ____________

We will sell the common shares ourselves and do not plan to use underwriters or pay any commissions. We will be selling our common shares using our best efforts and no one has agreed to buy any of our common shares. There is no minimum amount of common shares we must sell so no money raised from the sale of such common shares will go into escrow, trust or another similar arrangement. We will bear the all of the costs associated with this offering.

Our auditors have indicated in their opinion on our financial statements as of and for the period from inception to September 30, 2014 that there exists substantial doubt as to our ability to continue as a going concern. Moreover, we are an early stage venture with limited operating history. As such, this offering is highly speculative and the common stock being offered for sale involves a high degree of risk and should be considered only be persons who can afford the loss of their entire investment. Readers are encouraged to reference “Risk Factors” beginning on page 9 herein for additional information regarding the risks associated with our company and common stock, which includes, but is not limited to:

- The industry in which we operate is highly competitive and there can be no assurance that our business model will allow us to generate sufficient revenue to obtain market share and continue to meet our obligations as they come due;

- The internet and related technologies and application continue to evolve and we may not be able to adapt to these changes leaving our application, services and proprietary technologies obsolete; and

| - | Our performance is subject to general economic conditions, which may adversely impact our ability to generate revenue and maintain profitability. |

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and, as such, may elect to comply with certain reduced public company reporting requirements for future filings.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. This prospectus is included in the registration statement that was filed by us with the Securities and Exchange Commission. We may not sell these securities until the registration statement becomes effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. We are offering to sell, and seeking offers to buy, shares of common stock only in those jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the common stock..

3

THE DATE OF THIS PROSPECTUS IS DECEMBER 30, 2014

4

TABLE OF CONTENTS

| Summary Information | 6 | |||

| The Offering | 7 | |||

| Risk Factors | 9 | |||

| Use of Proceeds | 16 | |||

| Determination of Offering Price | 17 | |||

| Dividend Policy | 17 | |||

| Dilution | 18 | |||

| Description of Securities | 21 | |||

| Business Operations | 22 | |||

| Directors, Officers & Control Persons | 27 | |||

| Security Ownership of Certain Beneficial Owners and Management | 28 | |||

| Certain Relationship and Related Transactions | 29 | |||

| Interests of Named Experts | 29 | |||

| Management's Discussion and Analysis of Financial Condition and Results of Operation | 25 | |||

| Market for Common Equity and Related Stockholder Matters | 30 | |||

| Financial Statements | 32 | |||

| Other Expenses of Issuance and Distribution | 52 | |||

| Indemnification of Officers and Directors | 52 | |||

| Recent Sales of Unregistered Securities | 52 | |||

| Exhibit Index | 53 | |||

| Undertakings | 54 | |||

| Signatures | 56 | |||

5

A CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These forward-looking statements include, without limitation, statements about our market opportunity, our strategies, competition, expected activities and expenditures as we pursue our business plan, and the adequacy of our available cash resources. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Actual results may differ materially from the predictions discussed in these forward-looking statements. The economic environment within which we operate could materially affect our actual results. Additional factors that could materially affect these forward-looking statements and/or predictions include, among other things: the volatility of real estate prices, the possibility that our marketing efforts will not be successful in identifying buyers of real estate, , the Company’s need for and ability to obtain additional financing, and, other factors over which we have little or no control.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

SUMMARY INFORMATION

As used in this prospectus, references to the “Company,” “we,” “our”, “us” or “My Active Date” refer to My Active Date, Inc., unless the context otherwise indicated.

You should carefully read all information in the prospectus, including the financial statements and their explanatory notes, under the Financial Statements prior to making an investment decision.

Our Company

| Organization: | The registrant was incorporated in the State of Wyoming on February 21, 2014. Our principal executive offices are located at 2647 Gateway Rd. Suite #105-401, Carlsbad, California. Our telephone number is (713) 875-9200. |

| Management: | Our Chief Executive Officer and Chief Financial Officer is Mr. Blaine Nabors. Ms. Kailynn Bowling and Mr. Tony Zandovskis are our Co-Presidents. |

| Plan of Operations: | The registrants will offer a mobile application that represents a unique approach to online dating that delivers a fresh innovative style for online dates. Unlike the traditional services like Match.com, My Active Date promotes an active lifestyle connecting people through activities that they enjoy. |

| Historical Operations: | In anticipation of launching our business, our Chief Executive Officer has been researching the so called pain points of the online dating industry in anticipation of the delivery of a fresh and friendly new product. The company believes that the users of such a product may benefit from our extensive research into the online dating industry, as well as our understanding of what people are looking for in online dating. To address such issues, we have developed a mobile application that introduces unique features seldom seen in any other mobile applications. |

| Current Operations: | Since inception, our Chief Executive Officer has overseen the development of the subscription based national internet dating app. Extensive market research has also been conducted to figure out who the target market is, what the current layout of the online dating industry is, and to establish the features and benefits that set My Active Date apart from its competition. |

| Going Concern: | Our independent auditor has expressed substantial doubt about our ability to continue as a going concern given our lack of operating history and the fact to date have had no significant revenues. Potential investors should be aware that there are difficulties associated with being a new venture, and the high rate of failure associated with this fact. We have incurred a cumulative deficit of ($196,466) and have not generated revenues to date. Our future is dependent upon our ability to obtain financing and upon future profitable operations from our operations. These factors raise substantial doubt that we will be able to continue as a going concern. |

The registrant has no present plans to be acquired or to merge with another company nor does the registrant, or any of its shareholders, have any plans to enter into a change of control or similar transaction.

6

THE OFFERING

| Type of Securities Offered: | Common Stock. |

| Common Shares Being Sold In this Offering: | Twenty million (20,000,000) |

| Offering Price: | The Company will offer its Common Stock at $0.10 per share |

| Common Shares Outstanding Before the Offering: | There exists 192,033,000 shares of the Company’s Common Stock issued and outstanding. |

| Preferred Stock Outstanding: | There exists 100,000,000 shares of Class A Preferred Stock issued and outstanding. Each share of the Preferred Stock is convertible into shares of the Company’s Common Stock at a 5 for 1 basis |

| Termination of the Offering: | The offering will commence of the effective date of this prospectus and will terminate on or before ________________ |

| Market for our Common Stock: | There is presently no public market for our common shares. We anticipate applying for quoting of our common shares on the OTC Bulletin Board or OTCQB upon the effectiveness of the registration statement of which this prospectus forms a part. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority, which operates the OTCBB and OTCQB, nor can there be any assurance that such application for quotation will be approved. |

| Common Stock Control: | Our Chief Executive Officer and Co-Presidents currently own, and will continue to own sufficient common shares to control the operations of the company after this offering, irrespective of its outcome. Our Chief Executive Officer owns 64,000,000 shares of our Common Stock and 10,000,000 shares of our Preferred Stock which is convertible into 50,000,000 shares of our Common Stock. Each of our Co-Presidents own 64,000,000 shares of our Common Stock and 45,000,000 shares of our Preferred Stock which is convertible into 225,000,000 shares of our Common Stock, respectively. Collectively, the Officers of the Company own 628,000,000 shares of Common Stock on an as-converted basis. |

| Penny Stock Regulation: | The liquidity of our common stock is restricted as the registrant’s common stock falls within the definition of a penny stock. These requirements may restrict the ability of broker/dealers to sell the registrant's common stock, and may affect the ability to resell the registrant's common stock. |

Emerging Growth Company

We are an emerging growth company under the JOBS Act. We shall continue to be deemed an emerging growth company until the earliest of:

| 1. | The last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more; |

·

| 2. | The last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective IPO registration statement; |

·

| 3. | The date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or |

·

| 4. | The date on which such issuer is deemed to be a ‘large accelerated filer’, as defined in section 240.12b-2 of title 46, Code of Federal Regulations, or any successor thereto. |

As an emerging growth company we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures. Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment and the effectiveness of the internal control structure and procedures for financial reporting.

7

As an emerging growth company we are also exempt from Section 14A (a) and (b) of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes. These exemptions are also available to us as a Smaller Reporting Company.

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the Jobs Act, that allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

Summary Financial Information

Because this is only a financial summary, it does not contain all the financial information that may be important to you. Therefore, you should carefully read all the information in this prospectus, including the financial statements and their explanatory notes before making an investment decision.

| MY ACTIVE DATE, INC. | |||||

| (A DEVELOPMENT STAGE COMPANY) | |||||

| STATEMENT OF OPERATIONS | |||||

| July 1, 2014 to September 30, 2014 | From Inception (February 21, 2014) to September 30, 2014 | ||||

| Revenues | $ | 0 | $ | 0 | |

| Operating Expenses | 2,350 | 196,466 | |||

| Net Income(Loss) from Operations | 2,350 | (196,466) | |||

| Other Income(Expenses) | |||||

| Interest Expense | 0 | 0 | |||

| Net Income(Loss) from Operations | |||||

| Before Income Taxes | 2,350 | (196,466) | |||

| Tax Expense | 0 | 0 | |||

| Net Income(Loss) | $ | 2,350 | $ | (196,466) | |

| Basic and Diluted Loss Per Share | 0.00 | (0.00) | |||

| Weighted average number | |||||

| of shares outstanding | 192,033,000 | 192,033,000 | |||

| "The accompanying notes are an integral part of these financial statements" | |||||

8

RISK FACTORS

In addition to the other information provided in this prospectus, you should carefully consider the following risk factors in evaluating our business before purchasing any of our common stock. All material risks are discussed in this section.

Risks Related to our Business

Our having generated no revenues from operations makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance.

As of September 30, 2014 , we have generated no revenues and incurred a loss of ($196,466). As a consequence, it is difficult, if not impossible, to forecast our future results based upon our historical data. Because of the related uncertainties, we may be hindered in our ability to anticipate and timely adapt to increases or decreases in sales, revenues or expenses. If we make poor budgetary decisions as a result of unreliable data, we may never become profitable or incur losses, which may result in a decline in our stock price.

Our auditor has indicated in its report that there is substantial doubt about our ability to continue as a going concern as a result of our lack of revenues and if we are unable to generate significant revenue or secure financing we may be required to cease or curtail our operations.

Our auditor has indicated in its report that our lack of revenues raise substantial doubt about our ability to continue as a going concern. The financial statements do not include adjustments that might result from the outcome of this uncertainty. If we are unable to generate significant revenue or secure financing we may be required to cease or curtail our operations.

After we attempt to increase operations, we will face increasing competition from domestic and foreign companies.

The mobile application industry in throughout the world is fragmented. Our ability to compete against other domestic and international enterprises will be, to a significant extent, dependent on our ability to distinguish our services from those of our competitors by differentiating our marketing approach and identifying attractive opportunities to market and sell. Some of our competitors have been in business longer than we have and are more established. Our competitors may provide services comparable or superior to those we provide or adapt more quickly than we do to evolving industry trends or changing market requirements. Increased competition may result in reduced margins and loss of market share, any of which could materially adversely affect our profit margins after we commence operations and generate revenues.

Our future sales and reputation may be affected by litigation or other liability claims.

We have not procured a general liability insurance policy for our business. To the extent that we suffer a loss of a type which would normally be covered by general liability, we would incur significant expenses in defending any action against us and in paying any claims that result from a settlement or judgment against us. Adverse publicity could result in a loss of consumer confidence in our products.

As we increase operations, our earnings may be sensitive to fluctuations in market prices and demand for our products.

In addition, after we commence operations, the demand for certain mobile applications could decline, whether because of supply or for any other reason, including other mobile applications considered to be superior by end users. A decrease in the profitability of certain advertising based revenues, or a decline in demand for online dating applications after we commence operations could have a material adverse effect on our business, results of operations and financial condition.

Our success depends upon the continued growth and acceptance of online advertising, particularly paid listings, as an effective alternative to traditional, offline advertising and the continued commercial use of the internet.

We continue to compete with traditional advertising media, including television, radio and print, in addition to a multitude of websites with high levels of traffic and online advertising networks, for a share of available advertising expenditures and expect to face continued competition as more emerging media and traditional offline media companies enter the online advertising market. We believe that the continued growth and acceptance of online advertising generally will depend, to a large extent, on its perceived effectiveness and the acceptance of related advertising models (particularly in the case of models that incorporate user targeting and/or utilize mobile devices), the continued growth in commercial use of the internet (particularly abroad), the extent to which web browsers, software programs and/or other applications that limit or prevent advertising from being displayed become commonplace and the extent to which the industry is able to effectively manage click fraud. Any lack of growth in the market for online advertising, particularly for paid listings, or any decrease in the effectiveness and value of online advertising (whether due to the passage of laws requiring additional disclosure, an industry-wide move to self regulatory principles that required additional disclosure and/or opt-in policies for advertising that incorporates user targeting or other developments) would have an adverse effect on our business, financial condition and results of operations.

9

We face intense competition within our industry, and our inability to compete effectively for any reason could adversely affect our business.

The mobile application market is highly competitive, and as such our services will face strong competition. We will compete primarily on the basis of unique features, positioning and ease of use. Many of our competitors are, or are affiliated with, large diversified companies that have substantially greater marketing or financial resources than we have. These resources give our competitors greater operating flexibility that, in certain cases, may permit them to respond better or more quickly to changes in the industry or to introduce new services more quickly and with greater marketing support. Increased competition could result in lower profit margins, substantial pricing pressure, reduced market share and lower operating cash flows. Price competition, together with other forms of competition, could have a material adverse effect on our business, financial position, results of operations and operating cash flows.

We depend heavily on key personnel, and turnover of key senior management could harm our business.

Our future business and results of operations depend in significant part upon the continued contributions of our Chief Executive Officer Blaine Nabors. If we lose his services or if he fails to perform in his current position, or if we are not able to attract and retain skilled employees as needed, our business could suffer. Significant turnover in our senior management could significantly deplete our institutional knowledge held by our existing senior management team. We depend on the skills and abilities of these key employees in managing the product acquisition, marketing and sales aspects of our business, any part of which could be harmed by turnover in the future.

We depend, in part, upon arrangements with third parties to drive traffic to our mobile application and distribute our products and services.

We engage in a variety of activities designed to attract traffic to our mobile application and convert visitors into repeat users and customers. How successful we are in these efforts depends, in part, upon our continued ability to enter into arrangements with third parties to drive traffic to our mobile application, as well as the continued introduction of new and enhanced products and services that resonate with users and customers generally. Even if we succeed in driving traffic to our properties, we may not be able to convert this traffic or otherwise retain users and customers unless we continue to provide quality products and services. In addition, we may not be able to adapt quickly and/or in cost-effective manner to frequent changes in user and customer preferences, which can be difficult to predict, or appropriately time the introduction of enhancements and/or new products or services to the market. Our inability to provide quality products and services would adversely affect user and customer experiences, which would result in decreases in users, customers and revenues and adversely affect our business, financial condition and results of operations.

The internet and related technologies and applications continue to evolve and we may not be able to adapt to these changes.

The development of new products and services in response to the evolving trends and technologies of the internet, as well as the identification of new business opportunities in this dynamic environment, requires significant time and resources. We may not be able to adapt quickly enough (and/or in a cost-effective manner) to these changes, appropriately time the introduction of new products and services to the market or identify new business opportunities in a timely manner. Also, these changes could require us to modify related infrastructures and our failure to do so could render our applications, services and proprietary technologies obsolete. Our failure to respond to any of these changes appropriately (and/or in a cost effective manner) could adversely affect our business, financial condition and results of operations.

Our success also depends, in part, on our ability to develop and monetize mobile versions of our products and services. While most of our users currently access our products and services through personal computers, users of (and usage volumes on) mobile devices, including tablets, continue to increase relative to those of personal computers. While we have developed mobile versions of certain of our products and services and intend to continue to do so in the future, we have limited experience with mobile applications, both in terms of development and monetization. Moreover, mobile versions of our products and services that we develop may not be compelling to users and/advertisers. Even if we are able to develop mobile applications that resonate with users and advertisers, the success of these applications is dependent on their interoperability with various mobile operating systems, technologies, networks and standards that we do not control and any changes in any of these things that compromise the quality or functionality of our products and services could adversely impact usage of our products and services on mobile devices and, in turn, our ability to attract advertisers. Lastly, as the adoption of mobile devices becomes more widespread, the usage of certain of our products and services may not translate to mobile devices, which shift could adversely affect our business, financial condition and results of operations if we are unable to replace the related revenues.

The processing, storage, use and disclosure of personal data could give rise to liabilities as a result of governmental regulation, conflicting legal requirements or differing views of personal privacy rights.

We receive, transmit and store a large volume of personal information and other user data (including credit card data) in connection with the processing of search queries, the provision of online products and services, transactions with users and customers and advertising on our mobile application. The sharing, use, disclosure and protection of this information are determined by the respective privacy and data security policies of our various businesses. These policies are, in turn, subject to federal, state and foreign laws and regulations, as well as evolving industry standards and practices, regarding privacy and the storing, sharing, use, disclosure and protection of personal information and user data (for

10

example, various state regulations concerning minimum data security standards, industry self-regulating principles that become standard practice and more stringent contractual protections regarding privacy and data security (and related compliance obligations).

In addition, if an online service provider fails to comply with its privacy policy, it could become subject to an investigation and proceeding for unfair or deceptive practices brought by the U.S. Federal Trade Commission under the Federal Trade Commission Act (and/or brought by a state attorney general pursuant to a similar state law), as well as a private lawsuit under various U.S. federal and state laws. In general, personal information is increasingly subject to legislation and regulation in numerous jurisdictions around the world, the intent of which is to protect the privacy of personal information that is collected, processed and transmitted in or from the governing jurisdiction.

U.S. legislators and regulators may enact new laws and regulations regarding privacy and data security. In February 2012, the White House released a proposed Consumer Privacy Bill of Rights, which is intended to serve as a framework for new privacy legislation. In March 2012, the U.S. Federal Trade Commission released a staff report making recommendations for businesses and policy makers in the area of consumer privacy. Similarly, new privacy laws and regulations at the state level, as well as new laws and directives abroad (particularly in Europe), are being proposed and implemented. For example, new legislation in the state of California that became effective on January 1, 2014 requires companies that collect personal information to disclose how they respond to web browser "Do Not Track" signals. In addition, existing privacy laws that were intended for brick-and-mortar businesses could be interpreted in a manner that would extend their reach to our businesses. New laws and regulations (or new interpretations of existing laws) in this area may make it more costly to operate our businesses and/or limit our ability to engage in certain types of activities, such as targeted advertising, which could adversely affect our business, financial condition and results of operations.

As privacy and data protection have become more sensitive issues, we may also become exposed to potential liabilities as a result of differing views on the privacy of consumer and other user data collected by our businesses. Also, we cannot guarantee that our security measures will prevent security breaches. In the case of security breaches involving personal credit card data, credit card companies could curtail our ability to transact payments and impose fines for failure to comply with Payment Card Industry (PCI) Data Security Standards. Moreover, any such breach could decrease consumer confidence in the case of the business that experienced the breach or our businesses generally, which would decrease traffic to (and in turn, usage and transactions on) the relevant website and/or our mobile application and which in turn, could adversely affect our business, financial condition and results of operations. The failure of any of our businesses, or their various third party vendors and service providers, to comply with applicable privacy policies, federal, state or foreign privacy laws and regulations or PCI standards and/or the unauthorized release of personal information or other user data for any reason could adversely affect our business, financial condition and results of operations.

Risks Related to Our Company

Our management has limited experience in managing the day to day operations of a public company and, as a result, we may incur additional expenses associated with the management of our company.

Our founder and Chief Executive Officer Blaine Nabors is responsible for the operations and reporting of our company. The requirements of operating as a small public company are new to our management. This may require us to obtain outside assistance from legal, accounting, investor relations, or other professionals that could be more costly than planned. We may also be required to hire additional staff to comply with additional SEC reporting requirements. We anticipate that the costs associated with SEC requirements associated with going and staying public are estimated to be approximately $25,000 in connection with this registration statement and thereafter $35,000 annually. If we lack cash resources to cover these costs in the future, our failure to comply with reporting requirements and other provisions of securities laws could negatively affect our stock price and adversely affect our potential results of operations, cash flow and financial condition after we commence operations.

Implications of Being an Emerging Growth Company.

As a company with less than $1.0 billion in revenue during its last fiscal year, we qualify as an "emerging growth company" as defined in the JOBS Act. For as long as a company is deemed to be an emerging growth company, it may take advantage of specified reduced reporting and other regulatory requirements that are generally unavailable to other public companies. These provisions include:

| - | a requirement to have only two years of audited financial statements and only two years of related Management's Discussion and Analysis included in an initial public offering registration statement; |

| - | an exemption to provide less than five years of selected financial data in an initial public offering registration statement; |

| - | an exemption from the auditor attestation requirement in the assessment of the emerging growth company's internal controls over financial reporting; |

| - | an exemption from the adoption of new or revised financial accounting standards until they would apply to private companies; |

| - | an exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor's report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; and reduced disclosure about the emerging growth company's executive compensation arrangements. |

11

An emerging growth company is also exempt from Section 404(b) of Sarbanes Oxley which requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting. Similarly, as a Smaller Reporting Company we are exempt from Section 404(b) of the Sarbanes-Oxley Act and our independent registered public accounting firm will not be required to formally attest to the effectiveness of our internal control over financial reporting until such time as we cease being a Smaller Reporting Company.

As an emerging growth company, we are exempt from Section 14A (a) and (b) of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We would cease to be an emerging growth company upon the earliest of:

- the first fiscal year following the fifth anniversary of this offering,

| - | the first fiscal year after our annual gross revenues are $1 billion or more, |

| - | the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt securities, or |

| - | as of the end of any fiscal year in which the market value of our common stock held by non-affiliates exceeded $700 million as of the end of the second quarter of that fiscal year. |

You may have limited access to information regarding our business because our obligations to file periodic reports with the SEC could be automatically suspended under certain circumstances.

As of effectiveness of our registration statement of which this prospectus is a part, we will be required to file periodic reports with the SEC which will be immediately available to the public for inspection and copying (see “Where You Can Find More Information” elsewhere in this prospectus). Except during the year that our registration statement becomes effective, these reporting obligations may (in our discretion) be automatically suspended under Section 15(d) of the Exchange Act if we have less than 300 shareholders and do not file a registration statement on Form 8A (which we have no current plans to file). If this occurs after the year in which our registration statement becomes effective, we will no longer be obligated to file periodic reports with the SEC and your access to our business information would then be even more restricted. After this registration statement on Form S-1 becomes effective, we will be required to deliver periodic reports to security holders. However, we will not be required to furnish proxy statements to security holders and our directors, officers and principal beneficial owners will not be required to report their beneficial ownership of securities to the SEC pursuant to Section 16 of the Exchange Act. Previously, a company with more than 500 shareholders of record and $10 million in assets had to register under the Exchange Act. However, the JOBS Act raises the minimum shareholder threshold from 500 to either 2,000 persons or 500 persons who are not "accredited investors" (or 2,000 persons in the case of banks and bank holding companies). The JOBS Act excludes securities received by employees pursuant to employee stock incentive plans for purposes of calculating the shareholder threshold. This means that access to information regarding our business and operations will be limited.

We have agreed to indemnification of officers and directors as is provided by Wyoming statute.

Wyoming Statutes provide for the indemnification of our directors, officers, employees, and agents, under certain circumstances, against attorney's fees and other expenses incurred by them in any litigation to which they become a party arising from their association with or activities our behalf. We will also bear the expenses of such litigation for any of our directors, officers, employees, or agents, upon such person's promise to repay us therefore if it is ultimately determined that any such person shall not have been entitled to indemnification. This indemnification policy could result in substantial expenditures by us that we will be unable to recoup.

Our directors’ liability to use and shareholders is limited.

Wyoming Revised Statutes exclude personal liability of our directors and our stockholders for monetary damages for breach of fiduciary duty except in certain specified circumstances. Accordingly, we will have a much more limited right of action against our directors that otherwise would be the case. This provision does not affect the liability of any director under federal or applicable state securities laws.

Because we do not have an audit or compensation committee, shareholders will have to rely on the entire board of directors, none of which are independent, to perform these functions.

We do not have an audit or compensation committee comprised of independent directors. Indeed, we do not have any audit or compensation committee. These functions are performed by the board of directors as a whole. No members of the board of directors are independent directors. Thus, there is a potential conflict in that board members who are also part of management will participate in discussions concerning management compensation and audit issues that may affect management decisions.

12

Risks Related to the Market for our Stock

Investors may have difficulty in reselling their shares due to the lack of market or state Blue Sky laws.

Our common stock is currently not quoted on any market. No market may ever develop for our common stock, or if developed, may not be sustained in the future.

The holders of our shares of common stock and persons who desire to purchase them in any trading market that might develop in the future should be aware that there may be significant state law restrictions upon the ability of investors to resell our shares. Accordingly, even if we are successful in having the Shares available for trading on the OTCBB, investors should consider any secondary market for the Company's securities to be a limited one. We intend to seek coverage and publication of information regarding the company in an accepted publication which permits a "manual exemption." This manual exemption permits a security to be distributed in a particular state without being registered if the company issuing the security has a listing for that security in a securities manual recognized by the state. However, it is not enough for the security to be listed in a recognized manual. The listing entry must contain (1) the names of issuers, officers, and directors, (2) an issuer's balance sheet, and (3) a profit and loss statement for either the fiscal year preceding the balance sheet or for the most recent fiscal year of operations. We may not be able to secure a listing containing all of this information. Furthermore, the manual exemption is a non issuer exemption restricted to secondary trading transactions, making it unavailable for issuers selling newly issued securities. Most of the accepted manuals are those published in Standard and Poor's, Moody's Investor Service, Fitch's Investment Service, and Best's Insurance Reports, and many states expressly recognize these manuals. A smaller number of states declare that they “recognize securities manuals” but do not specify the recognized manuals. The following states do not have any provisions and therefore do not expressly recognize the manual exemption: Alabama, California, Georgia, Illinois, Kentucky, Louisiana, Montana, South Dakota, Tennessee, Vermont and Wisconsin.

Accordingly, our shares should be considered totally illiquid, which inhibits investors’ ability to resell their shares.

We will be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock.

The SEC has adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. We anticipate that our common stock will become a “penny stock”, and we will become subject to Rule 15g-9 under the Exchange Act, or the “Penny Stock Rule”. This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers. For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in the secondary market.

For any transaction involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in a penny stock, of a disclosure schedule prepared by the SEC relating to the penny stock market. Disclosure is also required to be made about sales commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

We do not anticipate that our common stock will qualify for exemption from the Penny Stock Rule. In any event, even if our common stock were exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock, if the SEC finds that such a restriction would be in the public interest.

Sales of our common stock under Rule 144 could reduce the price of our stock.

There are 33,000 shares of our common stock held by non-affiliates, 192,000,000 shares held by affiliates and 100,000,000 shares of our preferred stock which is convertible into an additional 500,000,000 shares of common stock that Rule 144 of the Securities Act of 1933 defines as restricted securities.

20,000,000 newly issued shares are being registered in this offering, however all of the remaining shares will still be subject to the resale restrictions of Rule 144. In general, persons holding restricted securities, including affiliates, must hold their shares for a period of at least six months, may not sell more than one percent of the total issued and outstanding shares in any 90-day period, and must resell the shares in an unsolicited brokerage transaction at the market price. The availability for sale of substantial amounts of common stock under Rule 144 could reduce prevailing market prices for our securities.

Our Chief Executive Officer, Co-Presidents and Directors own a significant percentage of our outstanding voting securities which could reduce the ability of minority shareholders to effect certain corporate actions .

Our Chief Executive Officer, Co-Presidents and Directors own a majority of our outstanding voting securities. As a result, currently, and after the offering, they will possess a significant influence and can elect a majority of our board of directors and authorize or prevent proposed significant corporate transactions. Their ownership and control may also have the effect of delaying or preventing a future change in control, impeding a merger, consolidation, takeover or other business combination or discourage a potential acquirer from making a tender offer.

13

There may not be funds available for net income because our Officers and Directors maintain significant control and can determine their own salary and perquisites.

Our Officers and Directors own a majority of our outstanding voting securities. As a result, there may not be funds available for net income because they maintain significant control and can determine their own salary and perquisites.

Because our Officers and Directors hold a majority of our voting securities, it may not be possible to have adequate internal controls.

Section 404 of the Sarbanes-Oxley Act of 2002 ("Section 404") requires our management to report on the operating effectiveness of the Company's Internal Controls over financial reporting for the year ending December 31 following the year in which this registration statement is declared effective. We must establish an ongoing program to perform the system and process evaluation and testing necessary to comply with these requirements. However, because our Officers and Directors own a majority of our voting securities, and will continue to own the majority of our voting securities after the offering, it may not be possible to have adequate internal controls. We cannot predict what affect this will have on our stock price.

We may, in the future, issue additional shares of common stock and preferred stock, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation, as amended, authorize the issuance of 800,000,000 shares of common stock. As of the date of this prospectus the Company had 192,033,000 shares of common stock outstanding. Accordingly, we may issue up to an additional 607,967,000 shares of common stock. Similarly, our Articles of Incorporation, as amended, authorize the issuance of 100,000,000 shares of preferred stock. As of the date of this prospectus, the Company has 100,000,000 shares of preferred stock outstanding. Accordingly, the Company is not able to issue additional preferred stock without further amendment of the Articles of Incorporation. The future issuance of common stock or preferred stock may result in substantial dilution in the percentage of our voting securities held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock or preferred stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

We are subject to compliance with securities law, which exposes us to potential liabilities, including potential rescission rights.

We may offer to sell our common stock to investors pursuant to certain exemptions from the registration requirements of the Securities Act of 1933, as well as those of various state securities laws. The basis for relying on such exemptions is factual; that is, the applicability of such exemptions depends upon our conduct and that of those persons contacting prospective investors and making the offering. We may not seek any legal opinion to the effect that any such offering would be exempt from registration under any federal or state law. Instead, we may elect to rely upon the operative facts as the basis for such exemption, including information provided by investor themselves.

If any such offering did not qualify for such exemption, an investor would have the right to rescind its purchase of the securities if it so desired. It is possible that if an investor should seek rescission, such investor would succeed. A similar situation prevails under state law in those states where the securities may be offered without registration in reliance on the partial preemption from the registration or qualification provisions of such state statutes under the National Securities Markets Improvement Act of 1996. If investors were successful in seeking rescission, we would face severe financial demands that could adversely affect our business and operations. Additionally, if we did not in fact qualify for the exemptions upon which it has relied, we may become subject to significant fines and penalties imposed by the SEC and state securities agencies.

There is no current established trading market for our securities and if a trading market does not develop, purchasers of our securities may have difficulty selling their shares.

There is currently no established public trading market for our securities and an active trading market in our securities may not develop or, if developed, may not be sustained. While we intend to seek a quotation on the OTC Bulletin Board, there can be no assurance that any such trading market will develop, and purchasers of the shares may have difficulty selling their common stock should they desire to do so. No market makers have committed to becoming market makers for our common stock and none may do so.

Our common stock may be volatile, which substantially increases the risk that you may not be able to sell your shares at or above the price that you may pay for the shares.

Because of the limited trading market for our common stock and because of the possible price volatility, you may not be able to sell your shares of common stock when you desire to do so. The inability to sell your shares in a rapidly declining market may substantially increase your risk of loss because of such illiquidity and because the price for our Securities may suffer greater declines because of our price volatility.

14

The price of our common stock that will prevail in the market after this offering may be higher or lower than the price you may pay. Certain factors, some of which are beyond our control, that may cause our share price to fluctuate significantly include, but are not limited to the following:

| - | Variations in our quarterly operating results; |

| - | Loss of key relationship or failure to complete significant transactions; |

| - | Additions or departures of key personnel; and |

| - | Fluctuations in stock market price and volume |

Additionally, in recent years the stock market in general, and the over-the-counter markets in particular, have experienced extreme price and volume fluctuations. In some cases, these fluctuations are unrelated or disproportionate to the operating performance of the underlying company. These market and industry factors may materially and adversely affect our stock price, regardless of our operating performance. In the past, class action litigation often has been brought against companies following periods of volatility in the market price of those companies common stock. If we become involved in this type of litigation in the future, it could result in substantial costs and diversion of management attention and resources, which could have a further negative effect on your investment in our stock.

Because we do not intend to pay any cash dividends on our common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them. There is no assurance that stockholders will be able to sell shares when desired.

15

USE OF PROCEEDS

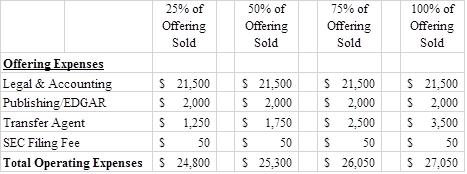

Our offering is being made on a self-underwritten basis: no minimum number of shares must be sold in order for the offering to proceed. The offering price per share is $0.10. The following table sets forth the uses of proceeds assuming the sale of 25%, 50%, 75% and 100%, respectively, of the securities offered for sale by the Company. There is no guarantee that we will receive any proceeds from the offering.

| 25% of Offering Sold | 50% of Offering Sold | 75% of Offering Sold | 100% of Offering Sold | ||||||

| Offering Proceeds | |||||||||

| Shares Sold | 5,000,000 | 10,000,000 | 15,000,000 | 20,000,000 | |||||

| Gross Proceeds | $ 500,000 | $ 1,000,000 | $ 1,500,000 | $ 2,000,000 | |||||

| Total Before Expenses | $ 500,000 | $ 1,000,000 | $ 1,500,000 | $ 2,000,000 | |||||

| Offering Expenses | |||||||||

| Legal & Accounting | $ 21,500 | $ 21,500 | $ 21,500 | $ 21,500 | |||||

| Publishing/EDGAR | $ 2,000 | $ 2,000 | $ 2,000 | $ 2,000 | |||||

| Transfer Agent | $ 1,250 | $ 1,750 | $ 2,500 | $ 3,500 | |||||

| SEC Filing Fee | $ 50 | $ 50 | $ 50 | $ 50 | |||||

| Total Operating Expenses | $ 24,800 | $ 25,300 | $ 26,050 | $ 27,050 | |||||

| Net Offering Proceeds | $ 475,200 | $ 974,700 | $ 1,473,950 | $ 1,972,950 | |||||

| Expenditures | |||||||||

| Legal & Accounting | $ 35,000 | $ 40,000 | $ 45,000 | $ 45,000 | |||||

| Office Lease & Equipment | $ 22,000 | $ 25,000 | $ 28,000 | $ 31,000 | |||||

| Software Development | $ 142,580 | $ 292,450 | $ 442,245 | $ 591,963 | |||||

| Marketing & Advertising | $ 205,359 | $ 433,442 | $ 680,759 | $ 932,950 | |||||

| Misc. Expenses | $ 18,960 | $ 38,890 | $ 58,800 | $ 78,700 | |||||

| Salaries & Commissions | $ 51,301 | $ 144,918 | $ 219,146 | $ 293,337 | |||||

| Total Expenditures | $ 475,200 | $ 974,700 | $ 1,473,950 | $ 1,972,950 | |||||

| Net Remaining Proceeds | $ - | $ - | $ - | $ - | |||||

The above figures represent only estimated costs. Currently, we do not have any commitments or prospective commitments for additional financing. Therefore, management believes that the Company will not be able to cover our general and/or administrative expenses if sufficient offering proceeds are not obtained. The expected use of net proceeds from this offering represents our intentions based upon our current plans and business conditions. The amounts and timing of our actual expenditures may vary significantly depending on numerous factors, including the status of and results from operations. As a result, our management will retain broad discretion over the allocation of the net proceeds from this offering. We may find it necessary or advisable to use the net proceeds from this offering for other purposes, and we will have broad discretion in the application of net proceeds from this offering. Furthermore, we anticipate that we will need to secure additional funding for the fully implement our business plan.

In the event we are not successful in selling all of the securities we would utilize any available funds raised in the following order of priority:

| - | for general and administrative expenses, including legal and accounting fees and administrative support expenses incurred in connection with our reporting obligations with the SEC |

| - | for costs related to the development of our mobile application |

| - | for marketing and sales |

16

DETERMINATION OF OFFERING PRICE

Our management has determined the offering price for the common shares being sold in this offering. The price of the shares we are offering was arbitrarily determined. The offering price bears no relationship whatsoever to our assets, earnings, book value or other criteria of value. The factors considered were:

| - | our lack of operating history |

| - | our cumulative loss of ($196,466) since inception; and |

| - | the degree of competition within our industry |

The offering price does not bear any relationship to our assets, results of operations, or book value, or to any other generally accepted criteria of valuation. Prior to this offering, there has been no market for our securities.

DIVIDEND POLICY

We have never paid or declared any cash dividends on our common stock, and we do not anticipate paying any cash dividends on our common stock in the foreseeable future. We intend to retain all available funds and any future earnings to fund the development and expansion of our business. Any future determination to pay dividends will be at the discretion of our board of directors and will depend upon a number of factors, including our results of operations, financial condition, future prospects, contractual restrictions, restrictions imposed by applicable law and other factors our board of directors deems relevant.

17

DILUTION

If you purchase any of the shares offered by this prospectus, your ownership interest will be diluted to the extent of the difference between the initial public offering price per share and the pro forma as adjusted net tangible book value per share of our common stock immediately after this offering. Dilution results from the fact that the initial public offering price per share is substantially in excess of the book value per share attributable to the existing stockholder for the presently outstanding stock. As of September 30, 2014, our net tangible book value was ($162,295) or ($0.0009) share of common stock. Net tangible book value per share represents the amount of our total tangible assets (excluding deferred offering costs) less total liabilities, divided by 192,033,000 number of shares of common stock outstanding at September 30, 2014.

The following table sets forth as of June 30, 2014 , the number of shares of common stock purchased from us and the total consideration paid by our existing stockholder and by new investors in this offering if new investors purchase 25%, 50%, 75% or 100% of the offering, after deduction of offering expenses, assuming a purchase price in this offering of $0.10 share of common stock.

| 25% of Offering Sold | 50% of Offering Sold | 75% of Offering Sold | 100% of Offering Sold | |||||

| Offering Price Per share | $ 0.10 | $ 0.10 | $ 0.10 | $ 0.10 | ||||

| Post Offering Net Tangible Book Value | $ 332,737 | $ 832,737 | $ 1,332,737 | $ 1,832,737 | ||||

| Post Offering Net Tangible Book Value Per Share | $ 0.0017 | $ 0.0041 | $ 0.0064 | $ 0.0086 | ||||

| Pre-Offering Net Tangible Book Value Per Share | $ (0.0009) | $ (0.0009) | $ (0.0009) | $ (0.0009) | ||||

| Increase (Decrease) Net Tangible Book Value Per Share After Offering for Original Shareholder | $ 0.0026 | $ 0.0050 | $ 0.0073 | $ 0.0095 | ||||

| Dilution Per Share for New Shareholders | $ 0.098 | $ 0.096 | $ 0.094 | $ 0.091 | ||||

| Percentage Dilution Per Share for New Shareholders | 98.31% | 95.88% | 93.56% | 91.36% | ||||

| Capital Contribution by Purchasers of Shares | $ 500,000 | $ 1,000,000 | $ 1,500,000 | $ 2,000,000 | ||||

| Capital Contribution by Existing Shares | $ 19,200 | $ 19,200 | $ 19,200 | $ 19,200 | ||||

| % Contribution by Purchasers of Shares | 96.30% | 98.12% | 98.74% | 99.05% | ||||

| % Contribution by Existing Shareholder | 3.70% | 1.88% | 1.26% | 0.95% | ||||

| # of Shares After Offering Held by Public Investors | 5,000,000 | 10,000,000 | 15,000,000 | 20,000,000 | ||||

| # of Shares After Offering Held by Existing Investors | 192,033,000 | 192,033,000 | 192,033,000 | 192,033,000 | ||||

| Total Shares Issued and Outstanding | 197,033,000 | 202,033,000 | 207,033,000 | 212,033,000 | ||||

| % of Shares - Purchasers After Offering | 2.54% | 4.95% | 7.25% | 9.43% | ||||

| % of Shares - Existing Shareholder After Offering | 97.46% | 95.05% | 92.75% | 90.57% |

18

PLAN OF DISTRIBUTION

This prospectus relates to the sale of 20,000,000 shares of our common stock.

We will sell the common shares ourselves and do not plan to use underwriters or pay any commissions. We will be selling our common shares using our best efforts and no one has agreed to buy any of our common shares. This prospectus permits our officers and directors to sell the common shares directly to the public, with no commission or other remuneration payable to them for any common shares they may sell. There is no plan or arrangement to enter into any contracts or agreements to sell the common shares with a broker or dealer. Our officers and directors will sell the common shares and intend to offer them to friends, family members and business acquaintances. There is no minimum amount of common shares we must sell so no money raised from the sale of our common shares will go into escrow, trust or another similar arrangement.

The common shares are being offered by Blaine Nabors, an officer and director of the registrant. Mr. Nabors will be relying on the safe harbor in Rule 3a4-1 of the Securities Exchange Act of 1934 to sell the common shares. No sales commission will be paid for common shares sold by Mr. Nabors. Mr. Nabors is not subject to a statutory disqualification and is not associated persons of a broker or dealer.

Additionally, Mr. Nabors primarily performs substantial duties on behalf of the registrant otherwise than in connection with transactions in securities. Mr. Nabors has not been a broker or dealer or an associated person of a broker or dealer within the preceding 12 months and they have not participated in selling an offering of securities for any issuer more than once every 12 months other than in reliance on paragraph (a)4(i) or (a)4(iii) of Rule 3a4-1 of the Securities Exchange Act of 1934.

The offering will commence on the effective date of this prospectus and will terminate on or before _______________

These are no finders.

Under the rules of the Securities and Exchange Commission, our common stock will come within the definition of a “penny stock” because the price of our common stock is below $5.00 per share. As a result, our common stock will be subject to the "penny stock" rules and regulations. Broker-dealers who sell penny stocks to certain types of investors are required to comply with the Commission’s regulations concerning the transfer of penny stock. These regulations require broker-dealers to:

- Make a suitability determination prior to selling penny stock to the purchaser;

- Receive the purchaser’s written consent to the transaction; and

- Provide certain written disclosures to the purchaser.

These requirements may restrict the ability of broker/dealers to sell our common stock, and may affect the ability to resell our common stock.

OTC Bulletin Board Considerations

To be quoted on the OTC Bulletin Board, a market maker must file an application on our behalf in order to make a market for our common stock. We anticipate that after this registration statement is declared effective, market makers will enter “piggyback” quotes and our securities will thereafter trade on the OTC Bulletin Board.

The OTC Bulletin Board is separate and distinct from the NASDAQ stock market. NASDAQ has no business relationship with issuers of securities quoted on the OTC Bulletin Board. The SEC’s order handling rules, which apply to NASDAQ-listed securities, do not apply to securities quoted on the OTC Bulletin Board.

Although the NASDAQ stock market has rigorous listing standards to ensure the high quality of its issuers, and can delist issuers for not meeting those standards, the OTC Bulletin Board has no listing standards. Rather, it is the market maker who chooses to quote a security on the system, files the application, and is obligated to comply with keeping information about the issuer in its files. FINRA cannot deny an application by a market maker to quote the stock of a company. The only requirement for inclusion in the bulletin board is that the issuer be current in its reporting requirements with the SEC.

Although we anticipate listing on the OTC Bulletin board will increase liquidity for our stock, investors may have greater difficulty in getting orders filled because it is anticipated that if our stock trades on a public market, it initially will trade on the OTC Bulletin Board rather than on NASDAQ. Investors’ orders may be filled at a price much different than expected when an order is placed. Trading activity in general is not conducted as efficiently and effectively as with NASDAQ-listed securities.

Investors must contact a broker-dealer to trade OTC Bulletin Board securities. Investors do not have direct access to the bulletin board service. For bulletin board securities, there only has to be one market maker.

19

Bulletin board transactions are conducted almost entirely manually. Because there are no automated systems for negotiating trades on the bulletin board, they are conducted via telephone. In times of heavy market volume, the limitations of this process may result in a significant increase in the time it takes to execute investor orders. Therefore, when investors place market orders - an order to buy or sell a specific number of shares at the current market price - it is possible for the price of a stock to go up or down significantly during the lapse of time between placing a market order and getting execution.

Because bulletin board stocks are usually not followed by analysts, there may be lower trading volume than for NASDAQ-listed securities.

There is no guarantee that our stock will ever be quoted on the OTC Bulletin Board.

Blue Sky Law Considerations

The holders of our shares of common stock and persons who desire to purchase them in any trading market that might develop in the future should be aware that there may be significant state law restrictions upon the ability of investors to resell our shares. Accordingly, even if we are successful in having the Shares available for trading on the OTCBB, investors should consider any secondary market for the Company's securities to be a limited one. There is no guarantee that our stock will ever be quoted on the OTC Bulletin Board. We intend to seek coverage and publication of information regarding the company in an accepted publication which permits a "manual exemption”. This manual exemption permits a security to be distributed in a particular state without being registered if the company issuing the security has a listing for that security in a securities manual recognized by the state. However, it is not enough for the security to be listed in a recognized manual. The listing entry must contain (1) the names of issuers, officers, and directors, (2) an issuer's balance sheet, and (3) a profit and loss statement for either the fiscal year preceding the balance sheet or for the most recent fiscal year of operations. We may not be able to secure a listing containing all of this information. Furthermore, the manual exemption is a non issuer exemption restricted to secondary trading transactions, making it unavailable for issuers selling newly issued securities. Most of the accepted manuals are those published in Standard and Poor's, Moody's Investor Service, Fitch's Investment Service, and Best's Insurance Reports, and many states expressly recognize these manuals. A smaller number of states declare that they “recognize securities manuals” but do not specify the recognized manuals. The following states do not have any provisions and therefore do not expressly recognize the manual exemption: Alabama, Georgia, Illinois, Kentucky, Louisiana, Montana, South Dakota, Tennessee, Vermont and Wisconsin.

We currently do not intend to and may not be able to qualify securities for resale in other states which require shares to be qualified before they can be resold by our shareholders.

Information you should get

In addition to this statement, your broker is required to give you a statement of your financial situation and investment goals explaining why his or her firm has determined that penny stocks are a suitable investment for you. In addition, your broker is required to obtain your agreement to the proposed penny stock transaction.

Before you buy penny stock, federal law requires your salesperson to tell you the “offer” and the “bid” on the stock, and the “compensation” the salesperson and the firm receive for the trade. The firm also must send a confirmation of these prices to you after the trade. You will need this price information to determine what profit or loss, if any, you will have when you sell your stock.

The offer price is the wholesale price at which the dealer is willing to sell stock to other dealers. The bid price is the wholesale price at which the dealer is willing to buy the stock from other dealers. In its trade with you, the dealer may add a retail charge to these wholesale prices as compensation (called a “markup” or “markdown”).

The difference between the bid and the offer price is the dealer’s “spread.” A spread that is large compared with the purchase price can make a resale of a stock very costly. To be profitable when you sell, the bid price of your stock must rise above the amount of this spread and the compensation charged by both your selling and purchasing dealers. Remember that if the dealer has no bid price, you may not be able to sell the stock after you buy it, and may lose your whole investment.

After you buy penny stock, your brokerage firm must send you a monthly account statement that gives an estimate of the value of each penny stock in your account, if there is enough information to make an estimate. If the firm has not bought or sold any penny stocks for your account for six months, it can provide these statements every three months.

Additional information about low-priced securities – including penny stocks – is available on the SEC’s Web site at http://www.sec.gov/investor/pubs/microcapstock.htm. In addition, your broker will send you a copy of this information upon request. The SEC encourages you to learn all you can before making this investment.

20

Brokers’ duties and customer’s rights and remedies.

Remember that your salesperson is not an impartial advisor – he or she is being paid to sell you stock. Do not rely only on the salesperson, but seek outside advice before you buy any stock. You can get the disciplinary history of a salesperson or firm from FINRA at 1-800-289-9999 or contact FINRA via the Internet at www.finra.org. You can also get additional information from your state securities official. The North American Securities Administrators Association, Inc. can give you contact information for your state. You can reach NASAA at (202) 737-0900 or via the Internet at www.nasaa.org.

If you have problems with a salesperson, contact the firm’s compliance officer. You can also contact the securities regulators listed above. Finally, if you are a victim of fraud, you may have rights and remedies under state and federal law. In addition to the regulators listed above, you also may contact the SEC with complaints at (800) SEC-0330 or via the Internet at help@sec.gov.

DESCRIPTION OF SECURITIES

The following description as a summary of the material terms of the provisions of our Articles of Incorporation and Bylaws. The Articles of Incorporation and Bylaws have been filed as exhibits to the registration statement of which this prospectus is a part.

Common Stock

We are authorized to issue 800,000,000 shares of common stock with $.0001 par value per share. As of the date of this registration

statement, there were 192,033,000 shares of common stock issued and outstanding.