Attached files

| file | filename |

|---|---|

| 8-K - ABRAXAS PETROLEUM CORP | axas8k010515.htm |

Abraxas Petroleum Corporate Update December 2014 Exhibit 99.1

* The information presented herein may contain predictions, estimates and other forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Although the Company believes that its expectations are based on reasonable assumptions, it can give no assurance that its goals will be achieved. Important factors that could cause actual results to differ materially from those included in the forward-looking statements include the timing and extent of changes in commodity prices for oil and gas, availability of capital, the need to develop and replace reserves, environmental risks, competition, government regulation and the ability of the Company to meet its stated business goals. Forward-Looking Statements

* I. Abraxas Petroleum Overview

* Headquarters.......................... San Antonio Employees............................... 114 Shares outstanding(1)……......... 107.7 mm Market cap(3) …………………….... $358.6 mm Net debt(2)………………………….. $58.8 mm PV-10(7)……………………………….. $425.8 mm Fully diluted shares outstanding as of September 30, 2014. Total debt including RBL facility, rig loan and building mortgage less cash as of September 30, 2014. Share price as of November 30, 2014. Enterprise value includes working capital deficit (excluding current hedging assets and liabilities) as of September 30, 2014, but does not include building mortgage or rig loan. Includes RBL facility, rig loan and building mortgage less cash as of June 30, 2014. Average production for the quarter ended September 30, 2014. Calculation using average production for the quarter ended September 30, 2014 annualized and net proved reserves as of December 31, 2013. Proved reserves as of December 31, 2013. Uses SEC TTM average pricing of $97.33/bbl and $3.67/mcf. EV/BOE(2,3,4)………………………... $14.37 Proved Reserves(7).…………..... 31.0 mmboe % Oil………………………….. ~67% % Proved developed….. ~44% Production(5).……………………… 7,076 boepd R/P Ratio(6)…………………………. 12.0x 2015E CAPEX……………………. $200 mm NASDAQ: AXAS Corporate Profile

* Exposure to "core" acreage in Bakken, Eagle Ford and Permian Targeted acreage acquisitions in geologically controlled areas of core basins Premier Position Value + Growth Disciplined, ROR focused development model Visible/repeatable growth Significant Flexibility CAPEX can be swiftly reduced in matter of weeks in all areas if oil prices dictate Company owned rig in Bakken; Short term commitment in Eagle Ford Financially Sound Under 1.0x debt/ FTM EBITDA (1) High margin, crude oil weighted production base FTM debt calculation excludes building mortgage and rig loan which are secured by the building and rig, respectively. EBITDA definition per bank loan agreement (excludes Rig EBITDA). Management projection of forward EBITDA. Experienced Leadership Senior management with average 33 years of industry experience Abraxas Highlights

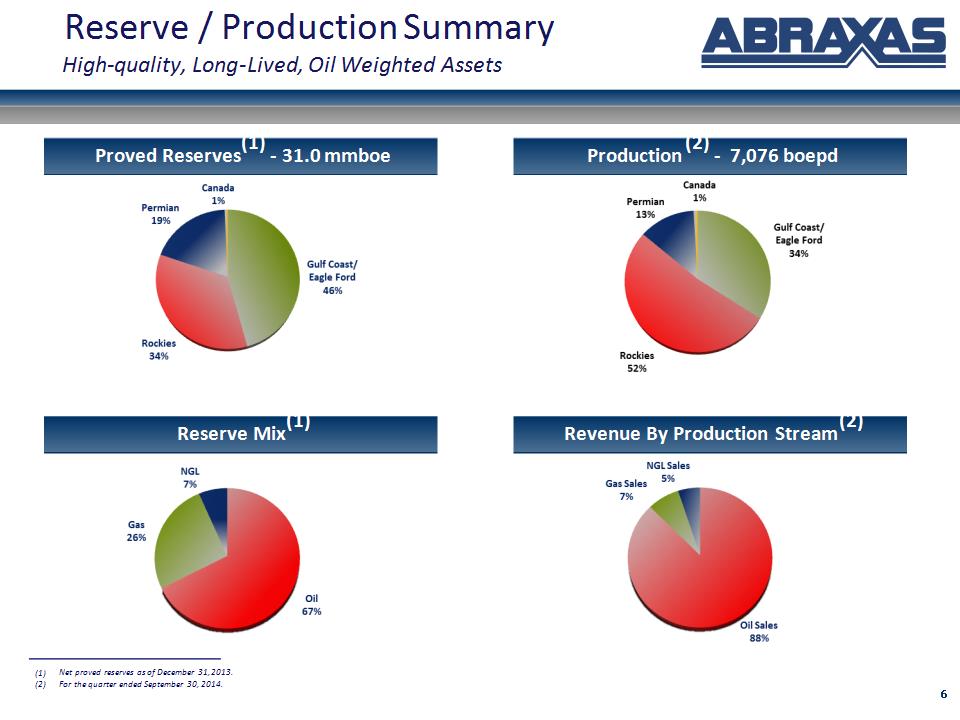

* Proved Reserves(1) – 31.0 mmboe Production(2) – 7,076 boepd Reserve Mix(1) Revenue By Production Stream(2) Reserve / Production Summary High-quality, Long-Lived, Oil Weighted Assets Net proved reserves as of December 31, 2013. For the quarter ended September 30, 2014.

* (Bopd) 9M14A Debt/EBITDA calculated using TTM 9M EBITDA. 2015 estimate assumes the midpoint of 2014 guidance of 8,900 – 9,200 boepd and 2014 guidance for an average 71% crude oil production percentage. Total Debt includes RBL facility, Rig Loan and Building Loan. TTM recurring EBITDA. Equivalent to Revenue – Realized Hedge Settlements – LOE – Production Taxes – Cash G&A – Other Expenses. Does not include EBITDA contribution from Raven Drilling or contributions from liquidated hedge settlements. Prudent Growth Growing Oil Volumes while Prudently Managing the Balance Sheet (Debt/TTM Recurring EBITDA) Daily Oil Production vs. Debt/TTM Recurring EBITDA (3)

* Williston: Bakken / Three Forks Powder River Basin: Turner Eastern Shelf: Conventional & Emerging Hz Oil Eagle Ford Shale Delaware Basin: Montoya/Devonian/Miss Gas, Shallow Oil, Emerging Hz Oil Proved Reserves (mmboe)(1): 31.0 Proved Developed(1): 44% Liquids(1): 74% Abraxas Petroleum Corporation Core Regions Net proved reserves as of December 31, 2013.

* II. Strategic Plan

* 2015 Capital Budget Flexibility

* No guarantee can be made as to management finding or transacting on acquisitions at acceptable terms. Based on internal management projections. FTM debt calculation excludes building mortgage and rig loan which are secured by the building and rig, respectively. EBITDA definition per bank loan agreement (excludes Rig EBITDA). Management projection of forward EBITDA. Strategic Plan – 2015+ Considering Potential 2015 Capital Plan Adjustments

* III. Abraxas Petroleum Financial Overview

* Current 2014/15 Operating and Financial Guidance(1) 4Q14E 4Q14E 2014E 2014E 2015E 2015E Production Low High Low High Low High Total (Boepd) 7,700 8,000 6,000 6,100 8,900 9,200 % Oil 70% 70% 68% 68% 71% 71% % NGL 9% 9% 9% 9% 7% 7% % Natural Gas 21% 21% 23% 23% 22% 22% Targeted Exit Rate (Boepd) 8,500 8,500 8,500 8,500 10,000 10,000 Operating Costs Low High Low High Low High LOE ($/BOE) $10.00 $12.00 $12.00 $13.00 $10.00 $12.00 Production Tax (% Revenue) 8.5% 9.0% 8.5% 9.0% 8.5% 9.0% Cash G&A ($mm) $5.0 $5.5 $11.5 $12.0 $11.5 $12.5 CAPEX (midpoint, $mm) $52.5 $52.5 $190.0 $190.0 $200.0 $200.0 Currently under review. Please see slides 10 and 11 for more detail.

* Strong Financial Performance OGJ150 Quarterly, September 2014. Includes companies whose accounting methods vary. Excludes companies whose results were inflated by identifiable extraordinary gains. Excludes royalty trusts. Other companies include: Mid-Con Energy Partners LP, Dorchester Minerals LP, Prime Energy Corp, Hess Corp, Continenal Resources, Humble Energy, Exxon Mobil Corp, Reserve Petroleum, Co, New Source Energy. Other companies include: Dorchester Minerals LP, Reserve Petroleum Co, Mid-Con Energy Partners LP, Spindletop Oil & Gas Co, Hess Corp, Quicksilver Resources Inc., Wexpro, New Source Energy Partners and Fidelity Exploration and Production Co. Other companies include: Dorchester Minerals LP, Gulfport Energy Corp, New Source Energy Partners, Mid-Con Energy Partners LP, Wexpro, Reserve Petroleum, EQT Production, Evolution Petroleum Corp, Fidelity Exploration and Production.. Debt adjusted shares calculated using total shares outstanding at the end of the period and debt divided by share price at the end of the period. 2015 share price uses share price as of September 30, 2014 Assumes the midpoint of 2015 guidance and oil percentage.

* IV. Asset Base Overview

* Abraxas’ Eagle Ford Properties ~10,611 Net Acres Jourdanton Area Atascosa County Black oil 7,352 net acres Cave Area McMullen County Black oil 411 net acres Dilworth East Area McMullen County Oil/condensate 940 net acres Yoakum Area (not shown) Dewitt and Lavaca County Dry gas 1,908 net acres Jourdanton Area Cave Area Dilworth East Area

* Eagle Ford Jourdanton Jourdanton 7,352 net acre lease block, 100% WI 90+ well Eagle Ford potential Austin Chalk and Buda also prospective North Fault Block Held by production Six wells drilled 37+ additional potential well locations Grass Farm 2H: waiting on completion Grass Farm 3H: postponed South Fault Block 48+ potential well locations First Well – Cat Eye 1H: completing Total 90+ potential well locations 7,433 net acres

* Eagle Ford Jourdanton Performance/Economics 300 gross MBoe curve 87% oil Initial rate: 11,500 bopm di: 97.00% dm: 7% b-factor: 1.3 CWC: $7.0 million (5,000 foot lateral) Jourdanton Area: Type Curve Assumptions Jourdanton Area: ROR vs CAPEX (1) Blue Eyes ESP Repair Uses strip pricing as of December 1, 2014.

* Eagle Ford Cave Cave 411 net acre lease block, 100% WI Additional locations (red) Two 9,000’ lateral locations Best month cumulative oil shown in green Offset operators : 8-10 mbo Abraxas Dutch 2H: 29 mbo Dutch 2H 30 day IP: 1,093 boepd (1) On production Dutch 1H 30 day IP: 786 boepd (1) On production Additional 2014 Activity Dutch 3H: producing Dutch 4H: producing The production rates for each well do not include the impact of natural gas liquids and shrinkage at the processing plant and include flared gas.

* Eagle Ford Cave Area Performance/Economics 584 MBoe gross type curve 83% oil Initial rate: 22,100 bopm di: 98.0% dm: 7.0% b-factor: 1.3 CWC: $11.0 million Cave Area: Type Curve Assumptions Cave Area: ROR vs CAPEX (1) Uses strip pricing as of December 1, 2014.

* Eagle Ford Dilworth East Dilworth East 940 acre lease block, 100% WI 9 additional locations (red) 5,000’+ lateral length R. Henry 2H 30 day IP: 780 boepd (1) On production Additional 2014 Activity R. Henry 1H: drilling Abraxas Type Curve 283 Mboe (44% oil) CWC: $7.5 million The production rates for each well do not include the impact of natural gas liquids and shrinkage at the processing plant and include flared gas.

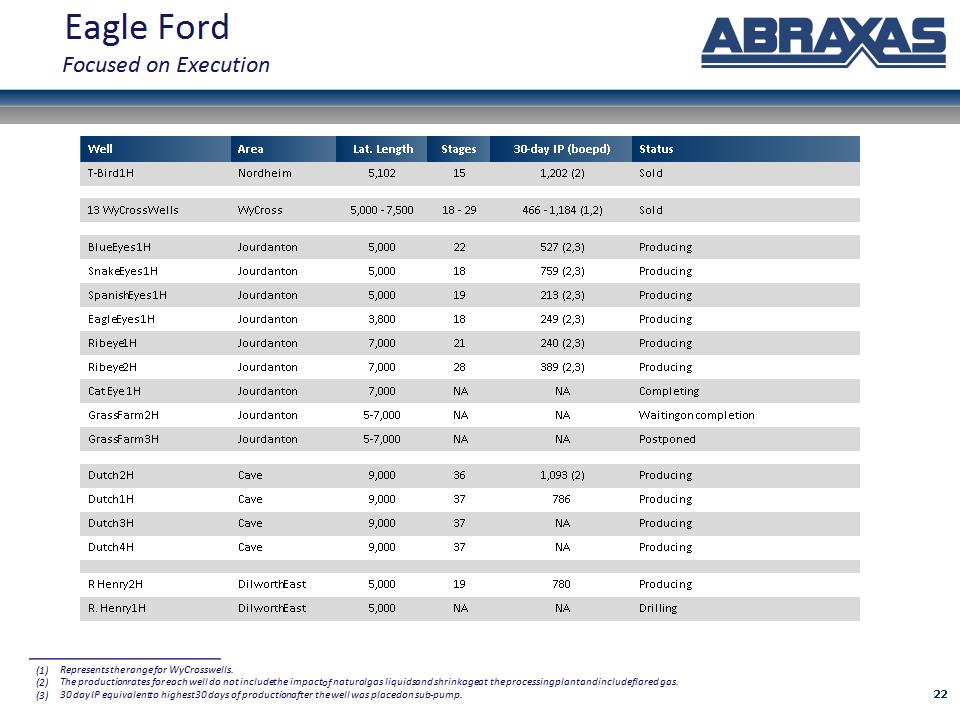

* Well Area Lat. Length Stages 30-day IP (boepd) Status T-Bird 1H Nordheim 5,102 15 1,202 (2) Sold 13 WyCross Wells WyCross 5,000 – 7,500 18 – 29 466 – 1,184 (1,2) Sold Blue Eyes 1H Jourdanton 5,000 22 527 (2,3) Producing Snake Eyes 1H Jourdanton 5,000 18 759 (2,3) Producing Spanish Eyes 1H Jourdanton 5,000 19 213 (2,3) Producing Eagle Eyes 1H Jourdanton 3,800 18 249 (2,3) Producing Ribeye 1H Jourdanton 7,000 21 240 (2,3) Producing Ribeye 2H Jourdanton 7,000 28 389 (2,3) Producing Cat Eye 1H Jourdanton 7,000 NA NA Completing Grass Farm 2H Jourdanton 5-7,000 NA NA Waiting on completion Grass Farm 3H Jourdanton 5-7,000 NA NA Postponed Dutch 2H Cave 9,000 36 1,093 (2) Producing Dutch 1H Cave 9,000 37 786 Producing Dutch 3H Cave 9,000 37 NA Producing Dutch 4H Cave 9,000 37 NA Producing R Henry 2H Dilworth East 5,000 19 780 Producing R. Henry 1H Dilworth East 5,000 NA NA Drilling Eagle Ford Focused on Execution Represents the range for WyCross wells. The production rates for each well do not include the impact of natural gas liquids and shrinkage at the processing plant and include flared gas. 30 day IP equivalent to highest 30 days of production after the well was placed on sub-pump.

* Bakken / Three Forks Positioned in Core Areas North Fork 4,457 Net Acres North Fork Area McKenzie County, ND Lillibridge Area McKenzie County, ND South Elm Coulee Area Richland County, MT Lillibridge South Elm Coulee

* North Fork 12 completed wells 3 wells completing Planned nine multi-well pads at 660 foot spacing 42 additional wells at 660 foot spacing Additional 2nd and 3rd Bench Three Forks potential Approved by NDIC Lillibridge 8 completed wells East & West pad: on production Planned two multi-well pads at 660 foot spacing Eight additional wells at 660 foot spacing Additional 2nd and 3rd Bench Three Forks potential Approved by NDIC Bakken / Three Forks North Fork/Lillibridge Potential

* Bakken / Three Forks North Fork/Lillibridge Performance/Economics Middle Bakken: ROR vs CAPEX (1) Uses Abraxas internal type curve and strip pricing as of December 1, 2014. D&M/Booked Assumptions 434 MBOE gross type curve 78% Oil Initial rate: 13,380 bopm di: 99.0% dm: 7.0% b-factor: 1.5 CWC: $8.5 million Middle Bakken: Type Curve Assumptions Abraxas Internal Assumptions 536 MBOE gross type curve 78% Oil Initial rate: 17,540 bopm di: 99.5% dm: 7.0% b-factor: 1.5 CWC: $8.5 million Abraxas Internal Type Curve D&M/Booked Type Curve

* Well Objective Lat. Length (1) Stages (1) 30-day IP (boepd) (2) Status Ravin 1H Three Forks 10,000 23 391 Producing Stenehjem 1H Middle Bakken 6,000 17 688 Producing Jore Federal 3H Three Forks 10,000 35 510 Producing Ravin 26-35 2H , 3H Middle Bakken 10,000 16 524 Producing Lillibridge 2H, 4H Three Forks 9,000 28 940 Producing Lillibridge 1H, 3H Middle Bakken 10,000 33 1,283 Producing Lillibridge 6H, 8H Three Forks 10,000 33 971 Producing Lillibridge 5H, 7H Middle Bakken 10,000 34 1,027 Producing Jore 1H Three Forks 10,000 33 1,037 Producing Jore 2H, 4H Middle Bakken 10,000 33 904 Producing Ravin 4H, 5H, 6H, 7H Middle Bakken 10,000 33 1,254 Producing, first downspacing test Stenehjem 2H Three Forks 10,000 33 NA Completing Stenehjem 3H Middle Bakken 10,000 33 NA Completing Stenehjem 4H Three Forks 10,000 33 NA Completing Jore 5H Middle Bakken 10,000 NA NA Surface cased Jore 6H Middle Bakken 10,000 NA NA Drilling intermediate Jore 7H Middle Bakken 10,000 NA NA Intermediate cased Jore 8H Middle Bakken 10,000 NA NA Intermediate cased Bakken / Three Forks Focused on Execution Represents the average lateral length and number of stages for each group of wells. The production rates for each well do not include the impact of natural gas liquids and shrinkage at the processing plant and include flared gas. Represents average per well performance over 27 average days of production.

* Sharon Ridge/Westbrook: Clearfork Trend 89 active wells San Andres, Glorietta, Clearfork Cooperative water flood on some leases 110 potential new-drills, recompletes or workovers 29 well development in 2015 11 recompletions 8 workovers 10 new drill wells Abraxas New Drill Type Curve 31 Mbo (100% oil) Gross/Net CWC: $0.75/$0.6 million Permian Basin Sharon Ridge - Westbrook: Clearfork Trend

* Ward County 2,592/2,196 gross/net prospective (1) acres 28 potential (1) gross Wolfcamp locations Potential (1) Wolfcamp locations shown in green Wolfcamp production shown in red Wolfcamp permits show in in blue Wells shown > 7,600’ Permian Basin Reeves/Ward County Bone Spring/Wolfcamp Potential Ward County 413/340 gross/net prospective (1) acres 3 potential (1) gross 2nd Bone Spring locations Potential (1) Bone Spring locations shown in green Bone Spring production shown in red Wells shown > 7,600’ Potential locations and prospective acres based on an internal geologic and technical evaluation of the area and offset activity. These locations have yet to be audited by our third party engineer D&M.

* Why Abraxas?

* Appendix

* Additional Assets Average net production for the month ending December 2013. As of 12/31/2013

* Edwards (South Texas) PDP: 8.3 bcfe (net)(3) Previous risked offsetting PUD locations: 27.9 bcfe (net) (4) 11 gross / 7 net locations dropped to PRUD (SEC 5 year rule) 7 gross / 5 net locations drilled / completed, yet to be frac’d: unbooked Edwards economics New drill: $7.0 million well / 4.0 bcfe EUR / F&D $1.73/mcfe (5) 20% ROR at $4.30/mcfe realized price (5) Refrac: $0.7 million well / 0.5 bcfe EUR / F&D $1.40/mcfe 20% ROR at $1.98/mcfe realized price (5) Montoya / Devonian (Delaware Basin, West Texas) PDP 17.1 bcfe (net) (3) Caprito 98 01U Devonian: 39.0 bcfe gross Howe GU 5 1 Devonian: 31.7 bcfe gross Previous risked offsetting PUD locations: 29.7 bcfe (net) (4) 12 gross/ 6 net locations dropped to PRUD (SEC 5 year rule) Montoya economics $5.0 million well / 6.6 bcfe EUR / F&D $.75/mcfe (5) 20% ROR at $3.16/mcfe realized price (5) Devonian economics $5.8 million well / 7.6 bcfe EUR / F&D $0.76/mcfe (5) 20% ROR at $2.51/mcfe realized price (5) Other Eagle Ford Shale, Yoakum: 1,908 net acres / ~24 net locations, unbooked PRB, Turner (~50% gas): 2 gross (1.7 net) PUD / 50 gross (13 net) PRUD locations, 40.6 bcfe (net) (3) Permian, Hudgins Ranch: 3 gross / 2.6 net PSUD locations, 9.1 bcfe (net) (5) Williston Basin, Red River: 1 gross / .8 net PRUD location, 2.1 bcfe (net) (5) Net of purchase price adjustments PV10 calculated using strip pricing as of 5/1/12 Based on December 31, 2013 reserves. Management estimate based on previously booked PUD reserves. Management estimate 2012 Ward County Acquisition Acquisition of Partners’ Interests in West Texas Purchase Price $6.7mm(1) PDP PV -15 $6.7mm(2) Production 1,440 mcfepd Reserves 7.613 bcfe Production $4,650/mcfe/day Reserves: $.88/mcfe Abraxas’ “Hidden” Gas Portfolio

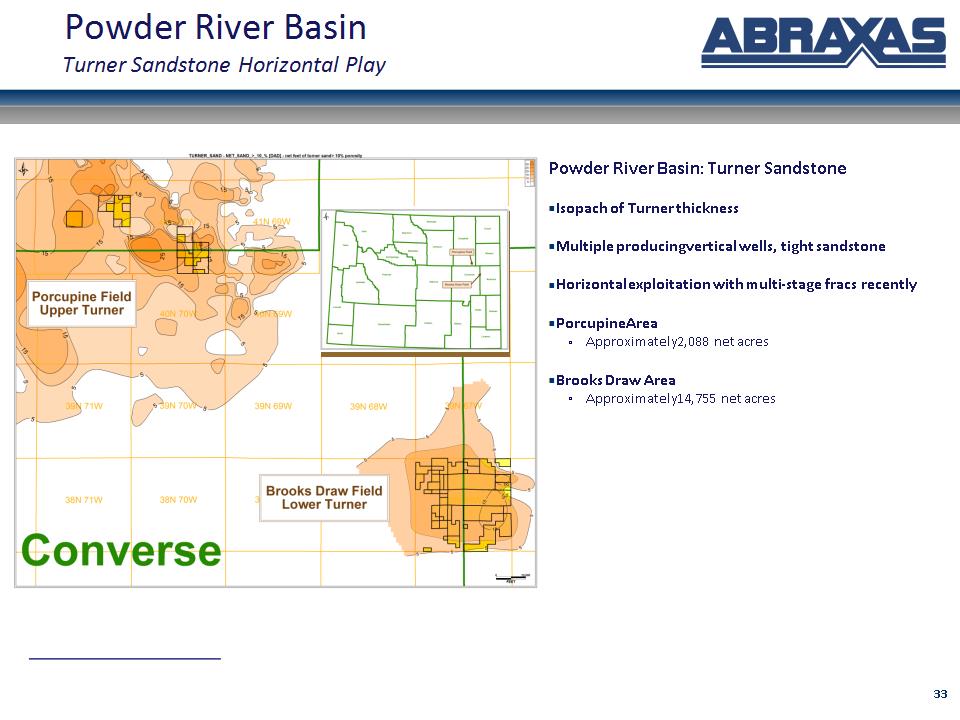

* Powder River Basin Turner Sandstone Horizontal Play Powder River Basin: Turner Sandstone Isopach of Turner thickness Multiple producing vertical wells, tight sandstone Horizontal exploitation with multi-stage fracs recently Porcupine Area Approximately 2,088 net acres Brooks Draw Area Approximately 14,755 net acres

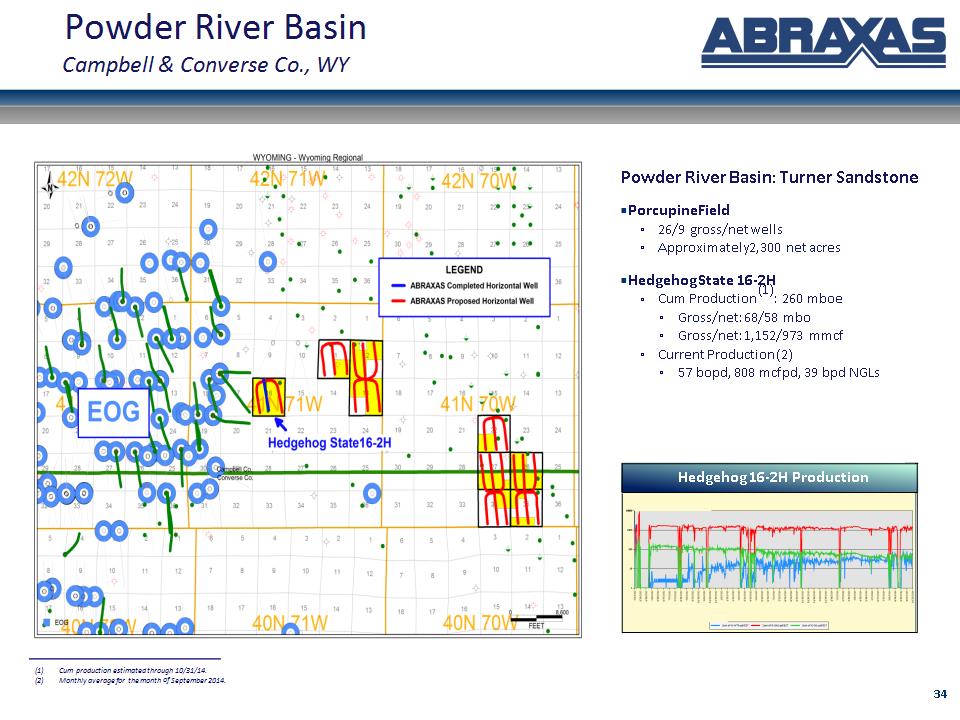

* Powder River Basin Campbell & Converse Co., WY Powder River Basin: Turner Sandstone Porcupine Field 26/9 gross/net wells Approximately 2,300 net acres Hedgehog State 16-2H Cum Production (1): 260 mboe Gross/net: 68/58 mbo Gross/net: 1,152/973 mmcf Current Production (2) 57 bopd, 808 mcfpd, 39 bpd NGLs Cum production estimated through 10/31/14. Monthly average for the month of September 2014. Hedgehog 16-2H Production

* Portilla Field San Patricio County, TX Portilla Field Annual CAPEX of ~$1 million to maintain flat decline rate Infill and work over opportunities 100% WI ownership Abraxas owns 1,769 surface acres Ideal CO2 candidate, 10% additional recovery = 8 mmbo Cum Production (1) ~80 mmbo + ~92 bcf Gross from Frio sands Current Production (2) 184 boepd Net 100% Surface Ownership Cum production estimated through 12/31/13. Monthly average for the month of December 2013.

* Abraxas Cherry Canyon Field: 30 Active Wells, three zones Waterflood potential 27 active wells Eight Proposed Injection Wells Horizontal potential Cum production (1) ~5 mmboe Gross Current production (2) 150 boepd Net Permian Basin Bell, Cherry and Brushy Canyon Production Cum production estimated through 11/30/13. Monthly average for the month of December 2013.

* Howe Deep: One active Montoya well Five active Devonian wells Horizontal Wolfcamp Potential Cum production (1) ~62 bcf Gross Current production (2) 1,325 mcfepd Net Permian Basin Howe Deep Cum production estimated through 12/31/13. Monthly average for the month of December 2013.

* R.O.C. Deep: Six active Montoya wells Four active Devonian wells One active Ellenburger well Cum production (1) ~138 bcf Gross Current production (2) 1,290 mcfepd Net Permian Basin R.O.C. Deep Cum production estimated through 12/31/13. Monthly average for the month of December 2013.

* Abraxas Hedging Profile PDP volumes per December 31, 2013 reserve report.

* NASDAQ: AXAS