Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - First NBC Bank Holding Co | mdacoverpage.htm |

| EX-2.1 - EXHIBIT 2.1 - First NBC Bank Holding Co | mdamergeragreement3.htm |

| EX-99.1 - EXHIBIT 99.1 - First NBC Bank Holding Co | mdaexhibit991.htm |

Acquisition of State Investors Bancorp, Inc. (NASDAQ: SIBC) December 30, 2014 Investor Presentation Exhibit 99.2

2 General Information and Limitations Forward-Looking Statements Statements contained in this presentation that are not historical facts, including statements accompanied by words such as “will,” “believe,” “anticipate,” “expect,” “estimate,” “preliminary,” or similar words, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on management’s estimates, assumptions, and projections as of the date of the presentation and are not guarantees of future performance. Actual results may differ materially from the results expressed or implied by these forward-looking statements as the result of risks, uncertainties and other factors. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include risks and uncertainties relating to: (i) the ability to obtain the requisite shareholder approvals; (ii) the risk that First NBC Bank Holding Company (First NBC) may be unable to obtain governmental and regulatory approvals required to consummate the proposed transaction, or required governmental and regulatory approvals may delay the merger or result in the imposition of conditions that could cause the parties to abandon the merger; (iii) the risk that a condition to closing may not be satisfied; (iv) the timing to consummate the proposed merger; (v) the risk that the businesses will not be integrated successfully; (vi) the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; (vii) disruption from the transaction making it more difficult to maintain relationships with customers, employees or vendors; (viii) the diversion of management time on merger-related issues; and (ix) other factors which First NBC discusses or refers to in the “Risk Factors” section of its most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (SEC). Copies of the company’s SEC filings may be downloaded from the Internet at no charge from www.sec.gov or ir.firstnbcbank.com/sec.cfm. First NBC cautions you not to place undue reliance on the forward-looking statements contained in this presentation, which the company undertakes no obligation to update or revise to reflect future events, information or circumstances arising after the date of this presentation. Market data used in this presentation has been obtained from independent industry sources and publications as well as from research reports prepared for other purposes. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. The company has not independently verified the data obtained from these sources. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this presentation.

• In-market transaction with significant cost saving opportunities - 3 of the 4 SIBC branches are within 1-mile of a First NBC branch • Low-risk transaction as SIBC has maintained a strong credit / underwriting culture and top-tier asset quality profile • Adds approximately $158.0 million of total deposits within the New Orleans, LA MSA • Creates operating scale as SIBC adds approximately $268.9 million in total assets • Allows First NBC to effectively deploy capital while maintaining a well-capitalized position after transaction close • Financially attractive deal pricing and structure with conservative modeling assumptions - Transaction priced at $21.25 per share (approximately 118% of tangible book value) - “Well capitalized” pro forma company with strong capital ratios - Meaningful cost saving estimates (55%) achievable due to in-market transaction and significant branch overlap - Approximately 4.4% accretive to earnings per share (EPS) in first full year of integration (in 2016) - Tangible book value (TBV) earnback expected to be 3.0 years 3 Transaction Rationale

Pricing Multiples: Price per Share: Aggregate Transaction Value: $51.0 million 4 Transaction Overview $21.25 1.18x Price / TBV Shareholder approval for SIBC and customary regulatory approvals 2nd Quarter of 2015 Required Approvals: Targeted Closing: Consideration Mix: 100% cash consideration

(1) Year 1 defined as the remaining 2 quarters in 2015 after transaction close 5 Transaction Financial Impact Key Transaction Assumptions: • Assumed credit mark equal to SIBC’s loan loss reserves (net credit mark of zero) • Estimated cost savings of 55% of SIBC’s annual operating expenses • Transaction expenses of approximately $3.4 million after-tax Pro Forma Financial Impact: • Year 1 EPS accretion of 2.3%(1) • Year 2 EPS accretion of 4.4% • IRR greater than 17% • TBV earnback expected to be 3.0 years Estimated Pro Forma Capital Ratios at Closing: • Tangible Common Equity / Tangible Assets ratio of 10.3% • Leverage ratio of 11.3% • Tier 1 capital ratio of 12.5% • Total risk-based capital ratio of 13.7%

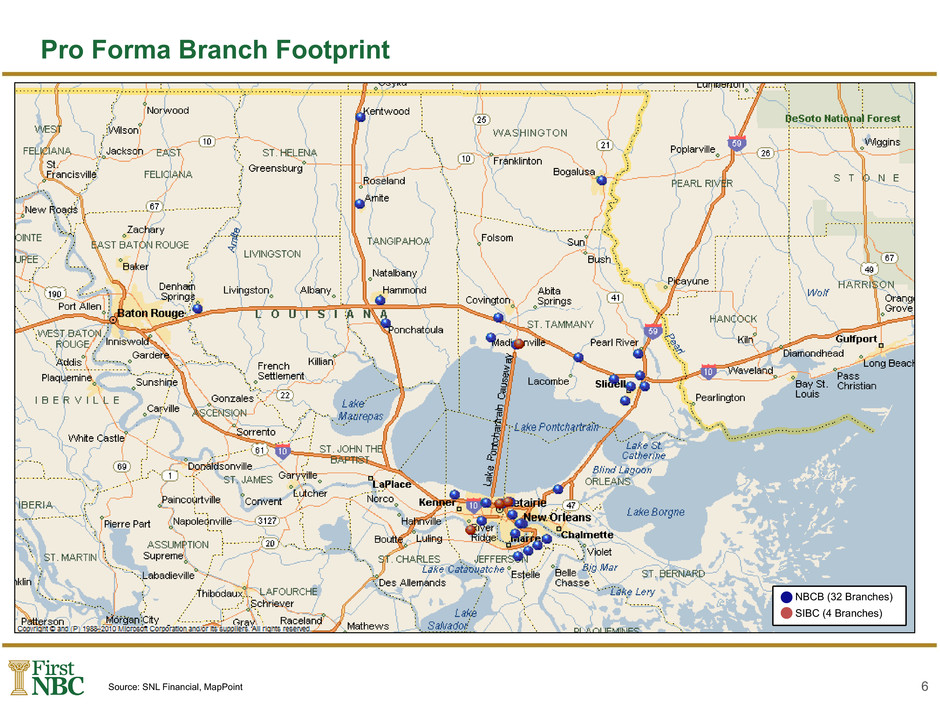

Source: SNL Financial, MapPoint 6 Pro Forma Branch Footprint NBCB (32 Branches) SIBC (4 Branches)

Source: SNL Financial, data for the last twelve months ended 9/30/2014 (1) Texas ratio equal to (NPAs + Loans 90 Days Past Due) / (Tangible Common Equity + Loan Loss Reserves) 7 Overview of State Investors Bancorp, Inc. (NASDAQ: SIBC) Overview Balance Sheet and Capital Adequacy Headquarters Metairie, LA Date Bank Established 9/14/1894 IPO Date 7/7/2011 Number of Branches 4 Assets ($000) $268,880 Gross Loans ($000) 214,527 Total Deposits ($000) 157,970 Total Equity ($000) 41,527 Loans / Deposits (%) 135.80 Tangible Common Equity / Tangible Assets (%) 15.44 Tier 1 Capital Ratio (%) 23.36 Total Risk-Based Capital Ratio (%) 24.19 Profitability Asset Quality ROAA (%) 0.39 ROAE (%) 2.45 Net Interest Margin (%) 3.42 Efficiency Ratio (%) 78.04 NPAs / Assets (%) 1.14 NPAs Excl. Restructured / Assets (%) 0.07 NPAs / Loans + OREO (%) 1.43 Reserves / Loans (%) 0.63 Reserves / NPAs (%) 43.92 NCOs / Avg. Loans (%) (0.02) Texas Ratio (%)(1) 8.99

Source: SNL Financial, data as of the most recent quarter ended 9/30/2014 Note: Regulatory financials used for comparative purposes. SIBC loan and deposit composition is at the bank level 8 Pro Forma Loan & Deposit Composition

9 Credit Due Diligence Diligence Scope Loan Portfolio Comments • Total loan portfolio of approximately $215 million • Portfolio is primarily composed of 1-4 family residential loans (68%), commercial real estate (30%), commercial loans (1%), and consumer loans (1%) • Performed review covering 90% of commercial loans and commercial real estate loans. • Majority of 1-4 family residential loans are well aged with good loan to value ratios and payment history • Asset quality statistics: - NPAs(1) / Assets: 1.14% - Nonaccruals / Total Loans: 0.02% - Past Dues / Total Loans: 1.97% - Other Real Estate: $0.2 million - Classified / Capital + Reserve: 16.8% (1) NPAs defined as nonaccrual loans, other real estate owned and TDRs.

• In-market acquisition builds operating scale and continues to position the pro forma company for additional future growth • Enhances competitive position within the New Orleans MSA • Attractive opportunity to acquire a 120 year old bank with deep community roots, a strong and proven credit history and a similar commitment toward customer service • Significant cost savings potential • Transaction is immediately accretive to earnings per share • Reasonable earnback period on tangible book value dilution 10 Transaction Summary