Attached files

Table of Contents

As filed with the Securities and Exchange Commission on December 30, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Nexvet Biopharma public limited company

(Exact name of registrant as specified in its charter)

| Ireland | 2834 | 98-1205017 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

National Institute for Bioprocessing

Research and Training

Fosters Avenue, Mount Merrion

Blackrock, Co. Dublin, Ireland

+353 1 215 8100

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Marjorie Sybul Adams

DLA Piper LLP (US)

1251 Avenue of the Americas

New York, NY 10020

Tel: (212) 335-4500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Marjorie Sybul Adams Bruce Jenett Andrew Ledbetter DLA Piper LLP (US) 1251 Avenue of the Americas New York, NY 10020 Tel: (212) 335-4500 |

Mark B. Weeks John T. McKenna Andrew S. Williamson Cooley LLP 3175 Hanover Street Palo Alto, CA 94304 Tel: (650) 843-5000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price (1) |

Amount of Registration Fee (2) | ||

| Ordinary Shares, $0.125 nominal value per share |

$60,000,000 | $6,972 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. Includes the aggregate offering price of any additional ordinary shares the underwriters have the option to purchase to cover over-allotments, if any. |

| (2) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Subject to Completion. Dated December 30, 2014

Shares

Ordinary Shares

Nexvet Biopharma public limited company is offering ordinary shares. This is our initial public offering and no public market currently exists for our ordinary shares. We anticipate that the initial public offering price of our ordinary shares will be between $ and $ per share.

We have applied to list our ordinary shares on the Nasdaq Global Market under the symbol “NVET.”

We are an emerging growth company as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our ordinary shares involves a high degree of risk. Before buying any ordinary shares, you should read carefully the discussion of material risks of investing in our ordinary shares under the heading “Risk Factors” beginning on page 11 of this prospectus.

| Per Share |

Total |

|||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | See the section of this prospectus titled “Underwriting” for a description of the compensation payable to the underwriters. |

We have granted the underwriters an option to purchase up to an additional ordinary shares to cover over-allotments. The underwriters can exercise this option at any time within 30 days after the date of this prospectus.

Entities affiliated with Farallon Capital Management, L.L.C., which hold more than 5% of our ordinary shares and are affiliates of a director nominee, have indicated an interest in purchasing up to an aggregate of $ million of our ordinary shares in this offering at the initial public offering price. However, because these indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell more, less or no shares to these entities, and such entities could determine to purchase more, less or no shares in this offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the ordinary shares on or about , 2015.

| BofA Merrill Lynch | Cowen and Company |

| Piper Jaffray | JMP Securities |

The date of this prospectus is , 2015.

Table of Contents

|

Table of Contents

Prospectus

| 1 | ||||

| 11 | ||||

| 43 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 50 | ||||

| 53 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

55 | |||

| 70 | ||||

| 98 | ||||

| 107 | ||||

| 116 | ||||

| 119 | ||||

| 122 | ||||

| 154 | ||||

| 157 | ||||

| 169 | ||||

| 176 | ||||

| 176 | ||||

| 176 | ||||

| F-1 |

Neither we nor the underwriters have authorized anyone to provide you with information that is different from that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell ordinary shares and seeking offers to buy ordinary shares only in jurisdictions where such offers and sales are permitted. The information contained in this prospectus is accurate only as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus or any sale of ordinary shares. Our business, financial condition, results of operations and prospects may have changed since that date.

Through and including , 2015 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

For investors outside the United States: We have not, and the underwriters have not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the ordinary shares and the distribution of this prospectus outside the United States.

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our ordinary shares. You should read this entire prospectus carefully, especially the section of this prospectus titled “Risk Factors” and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision. In this prospectus, unless the context otherwise requires, references to “we,” “us,” “our,” “Nexvet,” “Nexvet Biopharma plc” or the “Company” refer to Nexvet Biopharma public limited company and its consolidated subsidiaries.

Overview

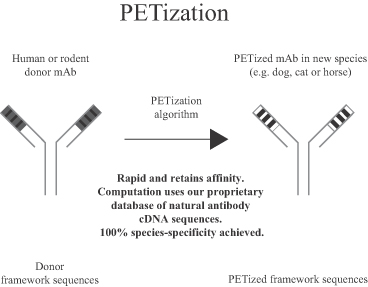

We are a clinical-stage biopharmaceutical company focused on transforming the therapeutic market for companion animals by developing and commercializing novel, species-specific biologics based on human biologics. Biologics are therapeutic proteins derived from biological sources. As a class, biologics have transformed human medicine in recent decades and represent some of the top-selling therapies on the market today. Our proprietary platform, which we refer to as “PETization,” is an algorithmic approach that enables us to rapidly create monoclonal antibodies that are designed to be recognized as “self” or “native” by an animal’s immune system, a property we refer to as “100% species-specificity.” PETization is also designed to build upon the safety and efficacy data from clinically tested human therapies to create new therapies for companion animals, thereby reducing clinical risk and development cost.

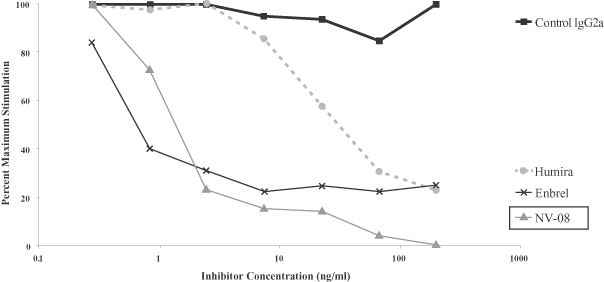

Biologics generally include monoclonal antibodies, or mAbs, which are targeted antibodies derived from identical, or clonal, cells, and fusion proteins, which are proteins created by joining two or more genes coded for separate proteins. Our first product candidate, NV-01, is a mAb that is a nerve growth factor, or NGF, inhibitor for the control of pain associated with osteoarthritis in dogs. NGF is a protein involved in growing and maintaining neural pathways and in neural signaling, including pain signals. NGF inhibitors seek to interrupt those signals to reduce pain. Our second product candidate, NV-02, is a mAb that is an NGF inhibitor for the control of pain associated with degenerative joint disease in cats. We expect data from our pivotal safety and efficacy studies for NV-01 by the end of 2015 and for NV-02 in 2016. Our third product candidate, NV-08, is a fusion protein that is a tumor necrosis factor, or TNF, inhibitor for the treatment of chronic inflammatory diseases, including atopic dermatitis, in dogs. TNF is a protein that causes inflammation, and TNF inhibitors suppress this inflammation. If our proof-of-concept safety and efficacy studies for NV-08 are successful, we will progress this product into formal development. In addition, using PETization, we are seeking to advance one new product candidate into development per year, commencing in the second half of 2015.

Veterinary care is one of the fastest growing industries in the overall U.S. companion animal market and is estimated to reach $15.3 billion in 2014. We are targeting the companion animal therapeutics segment of the veterinary care industry. We estimate that in 2013 consumers spent $2.3 billion on companion animal therapeutics. This segment is currently dominated by synthetic chemical drugs commonly referred to as “small molecule” drugs. The size and growth of the veterinary care industry reflects many factors, including higher rates of companion animal ownership, improved quality of veterinary care, and the increasingly important role of companion animals in our lives, who are often considered members of our families. We believe these factors, together with the introduction of our product candidates with their favorable safety and compliance profiles, will increase overall demand for companion animal therapeutics.

1

Table of Contents

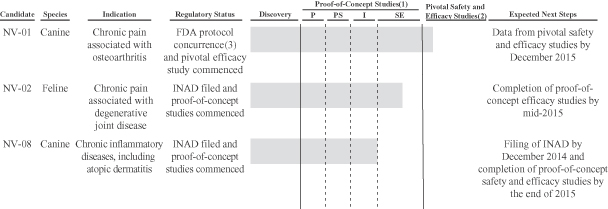

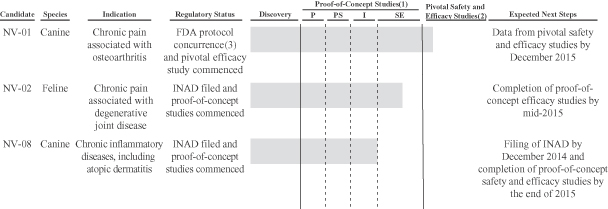

Product Pipeline

We have identified three lead product candidates, NV-01, NV-02 and NV-08. We submitted an investigational new animal drug application, or INAD, with the U.S. Food and Drug Administration, or the FDA, for NV-01 in 2012, for NV-02 in 2013 and for NV-08 in 2014.

| (1) | Our proof-of-concept studies include four sequential studies: pharmacokinetics (P), preliminary safety (PS), immunogenicity (I) and safety and efficacy (SE). |

| (2) | We have completed clonal cell manufacturing for NV-01, and we have accelerated and completed clonal cell manufacturing for NV-02 in order to rapidly advance its development. Material from manufactured clonal cells, from which biologics are created, is used in pivotal studies and is intended to be used later for commercial supply. The production of a high-yielding clonal cell line facilitates budgeting for commercial production. |

| (3) | FDA protocol concurrence means the Center for Veterinary Medicine within the FDA fundamentally agrees with the design, execution and analyses proposed in the protocol and there is a commitment that it will not later alter its perspective on these issues unless public or animal health concerns appear that were not recognized at the time of the protocol assessment. We have obtained protocol concurrences to commence our pivotal safety and efficacy studies for NV-01. |

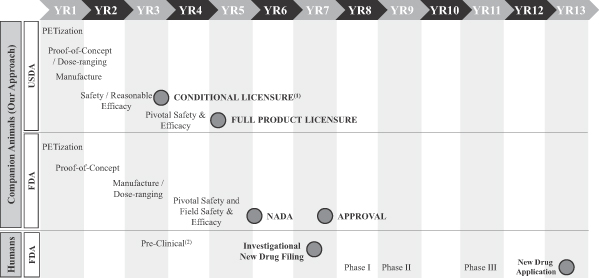

Development of companion animal therapeutics is typically faster and less expensive than human drug development. It requires fewer clinical trials, requires fewer subjects and pre-clinical work and can be conducted directly in the target species. According to Pharmaceutical Commerce, companion animal therapeutics can obtain U.S. regulatory approval in under six years. We expect the costs to complete the development and manufacturing scale-up of each of our three lead product candidates to be approximately $13.0 to $15.0 million per candidate. In contrast, receipt of regulatory approval for human therapeutics may take 12 to 13 years and development can cost hundreds of millions of dollars per drug.

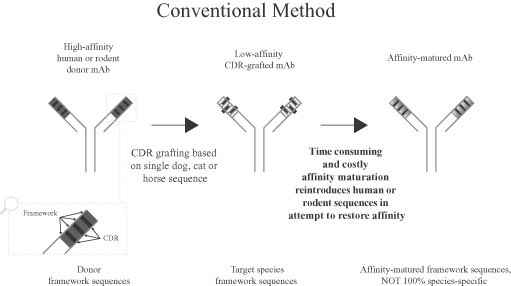

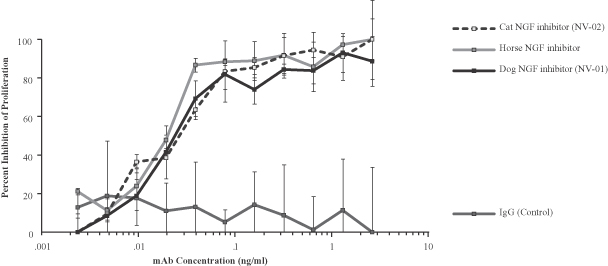

Our PETization Platform

Our PETization platform is a proprietary algorithmic approach that has demonstrated a reduction in the time and cost typically associated with the development of mAbs using conventional interspecies conversion methods. By applying our algorithms to analyze large data sets from our proprietary complementary deoxyribonucleic acid, or cDNA, library, PETization is designed to determine the minimal number of changes required in the mAb framework region to generate a 100% species-specific mAb that preserves the attraction between a biologic and its target, a property known as affinity. We have used PETization to successfully convert human and rodent mAbs into 100% species-specific canine, feline and equine mAbs, thereby leveraging their safety and efficacy profile for our companion animal therapies in development.

Using PETization, we are seeking to advance one new product candidate into development per year commencing in the second half of 2015. Our internal research team is studying mAbs that bind to canine, feline and equine targets relevant to pain, inflammation, cancer and other chronic conditions. We have also recently completed a survey of specialist veterinarians in the United States and the European Union, or the EU, to identify

2

Table of Contents

key areas of unmet medical need where mAbs could have a significant impact. The results of this survey are guiding our product development priorities.

We believe our PETization platform offers the following important advantages over other approaches to the design, discovery and development of mAbs in the veterinary care industry:

| • | Rapid creation of new products. PETization is designed to substantially reduce the time involved in the discovery process for new mAbs with high affinity, when compared to conventional discovery techniques. |

| • | Cost efficiencies in production. mAbs with higher affinity require less active pharmaceutical ingredient to achieve a therapeutic dose, leading to lower cost of goods. |

| • | Efficient development pathway. Harnessing existing donor mAb manufacturing, safety and clinical efficacy data can significantly reduce costs, time-to-market and regulatory and clinical risk. |

| • | Scalability across species. PETization enables us to rapidly identify new product candidates for many indications across multiple species. |

| • | Proprietary cDNA approach to mAb identification. Our proprietary cDNA library of mAb sequences allows us to use the natural variations found in mAbs to generate novel, species-specific mAbs. |

We believe that our PETization platform will create differentiated, high-value companion animal therapies with better health outcomes through the following characteristics:

| • | Efficacy. PETized mAbs are designed to retain the efficacy of the donor mAbs. |

| • | Safety. PETized mAbs match the structure of the target species more successfully than conventional approaches, thereby reducing the risk of immunogenicity. |

| • | Ease of compliance. PETized mAbs are designed to be injected every four to six weeks, as compared to small molecule treatments, which can require daily or more frequent injections or oral dosing. |

We believe that these product characteristics align favorably with veterinarian preferences and will contribute to the widespread market adoption of PETized mAbs.

We may also develop biologics outside of our PETization platform, such as NV-08. NV-08 is a proprietary fusion protein we have identified using internal research that has shown NV-08 to be a potent inhibitor of the inflammatory response.

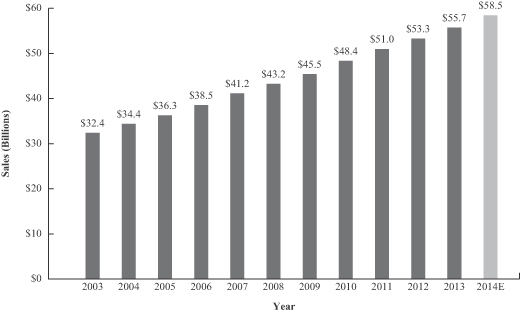

Companion Animal Therapeutic Market Overview

The U.S. companion animal market, which includes veterinary care, food, supplies and over-the-counter medications, live animal purchases and services such as grooming and boarding, is estimated to exceed $58.5 billion in sales in 2014. Veterinary care, which includes sales of companion animal therapeutics, parasiticides and vaccines and other medical expenses for veterinarian visits, is one of the fastest growing industries in the overall U.S. companion animal market. We are targeting the companion animal therapeutics segment of the veterinary care industry. We estimate that in 2013 consumers spent $2.3 billion on companion animal therapeutics. This segment is currently dominated by small molecule drugs. Although a few mAbs have received conditional licensure in the United States, there are currently no mAbs for companion animals approved for marketing in the United States or the EU. Biologics, including mAbs, have grown to be the largest class of therapeutics within the top ten best-selling drugs for humans. We believe that mAbs will drive a similar trend in the companion animal therapeutics market.

3

Table of Contents

Historically, most companion animal therapeutics have been in areas overlapping with livestock health, notably vaccines, parasiticides and anti-infectives. Similar to human therapeutics, and given the safety and efficacy profile of biologics, we see opportunities for biologic therapies for companion animals in the areas of pain, inflammation, oncology, dermatology, allergy and gastrointestinal disease. We expect the market for companion animal biologic therapies to increase primarily due to:

| • | Higher standards and better care. Because owners are increasingly regarding their companion animals as important members of their families, owners are demanding better care and treatment options for their companion animals. In a 2011 survey by Kelton Research, 81% of respondents considered their dogs to be true family members. According to the American Pet Products Association, approximately 78% of U.S. dog owners treated their dogs with medications in 2010, as compared to 50% in 1998. In a 2010 poll by Associated Press, 35% of companion animal owners indicated they were willing to spend $2,000 to treat their companion animal for a serious medical condition. |

| • | Aging companion animal population. Companion animals are living longer, leading to increased incidence of diseases commonly associated with aging, such as arthritis, diabetes, tumors and kidney disease. According to a 2013 report by Banfield Pet Hospital, the average lifespan of dogs increased from 10.5 years in 2002 to 11 years in 2012, and the average lifespan of cats increased from 11 years in 2002 to 12 years in 2012. |

We believe these favorable demographics create a significant opportunity for companion animal biologic therapies.

Limitations of Current Standard of Care and the Promise of Biologics

Despite the growing market for veterinary care and favorable market dynamics, there are few treatment options approved for use in companion animals relative to the diversity of available human therapeutics. Current approved therapeutics for the management of many conditions, including pain, inflammation and cancer, are predominantly small molecule drugs. In recent years, particularly in inflammation and cancer, human drug development has increasingly focused on biologics, such as mAbs, which generally offer safety and efficacy profiles that make them attractive alternatives to small molecule drugs for many indications. We believe this creates a significant opportunity for us to develop first-in-class therapeutics for the unmet medical needs of companion animals utilizing our proprietary PETization platform.

Our Strategy

We strive to be at the forefront of companion animal therapeutic innovation by developing and commercializing a portfolio of biologics for companion animals. To achieve this goal, we intend to:

| • | leverage our proprietary PETization platform and experience to develop multiple companion animal therapeutics; |

| • | focus on common conditions impacting the quality of life of companion animals to make a positive impact on their health; |

| • | commercialize our lead product candidates with a direct sales force and distributors in the United States and through strategic alliances in international markets; |

| • | educate veterinarians about the benefits of biologics compared to conventional treatments; and |

| • | collaborate with leaders in human and veterinary biologics to bring to market the next generation of companion animal therapeutics. |

4

Table of Contents

Risks Associated with Our Business

Our business is subject to the risks and uncertainties discussed more fully in the section of this prospectus titled “Risk Factors” immediately following this summary. In particular:

| • | We have a limited operating history, are not profitable and may never become profitable. |

| • | We will require substantial additional financing to achieve our goals, and if we fail to obtain necessary capital when needed on acceptable terms, or at all, we could be forced to delay, limit, reduce or terminate our product development, product portfolio expansion, other operations or commercialization efforts. |

| • | Our success depends largely upon our ability to advance our product candidates through the various stages of development, especially through pivotal safety and efficacy studies. If we are unable to successfully advance or develop our product candidates, our business will be harmed. |

| • | The discovery, development and manufacturing of biologics involves relatively novel technologies and an expensive and lengthy process with uncertain outcomes. |

| • | The results of our proof-of-concept studies for our product candidates may not be predictive of the results in any future pivotal safety and efficacy studies, and we may not be able to obtain any regulatory approvals. |

| • | We may be unable to obtain regulatory approval for our existing or future product candidates under applicable regulatory requirements. The denial or delay of any such approval would delay commercialization efforts and adversely impact our potential to generate revenue, our business and our results of operations. |

| • | If any of our product candidates are approved but do not gain meaningful market acceptance, we are not likely to generate significant revenue. |

| • | Our product candidates, if approved, will face competition, and our failure to effectively compete may prevent us from achieving significant market penetration. |

| • | Our commercial success will depend, in part, on obtaining and maintaining intellectual property protection for our product candidates. |

Implications of Being an Emerging Growth Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and therefore we intend to take advantage of reduced disclosure and regulatory requirements in contrast to those otherwise generally applicable to public companies, including presenting only two years of audited financial statements and related financial disclosure, not being required to have our internal control over financial reporting audited by our independent registered public accounting firm pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and any golden parachute payments. We may take advantage of these reduced disclosure and regulatory requirements until we are no longer an “emerging growth company.” In addition, the JOBS Act provides that an emerging growth company can delay adopting new or revised accounting standards until those standards apply to private companies. We have irrevocably elected not to avail ourselves of this delayed adoption of new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as public companies that are not emerging growth companies.

5

Table of Contents

Corporate Information

Nexvet Australia Pty Ltd, formerly known as Nexvet Biopharma Pty Ltd, or Nexvet Australia, was incorporated in Australia in February 2010. In September 2014, Nexvet Biopharma Limited, a newly-formed Irish private company, became the parent company of Nexvet Australia and its subsidiaries pursuant to a transaction in which all of the holders of ordinary shares, preference shares, restricted share units and options and warrants to purchase ordinary shares of Nexvet Australia exchanged their holdings for equivalent ordinary shares, preference shares, restricted share units or options or warrants to purchase ordinary shares, as applicable, of Nexvet Biopharma Limited. We refer to this transaction as the “Irish Exchange.” Nexvet Biopharma Limited then re-registered as an Irish public limited company in September 2014. We refer to this re-registration as the “Re-registration” and we refer to the Irish Exchange and the Re-registration collectively as the “Irish Reorganization.” Nexvet Biopharma plc became the parent company of Nexvet Australia pursuant to the Irish Reorganization, and for financial reporting purposes the historical consolidated financial statements of Nexvet Australia became the historical consolidated financial statements of Nexvet Biopharma plc and its subsidiaries as a continuation of the predecessor.

Unless otherwise indicated or the context otherwise requires, all dollar amounts presented in this prospectus are in U.S. dollars ($). This prospectus translates certain Australian dollar amounts into U.S. dollars at the exchange rates for A$ into US$. For assets and liabilities, the exchange rate at the balance sheet date is used. For revenue and expenses and gains and losses, a weighted-average exchange rate for the period is used to translate those elements. For transactions effected in Australian dollars, the exchange rate on the date of the transaction is used. Information not in U.S. dollars is identified by “€” for Euro-denominated amounts and “A$” for Australian dollar-denominated amounts.

Our principal executive offices are located at National Institute for Bioprocessing Research and Training, or NIBRT, Fosters Avenue, Mount Merrion, Blackrock, Co. Dublin, Ireland, and our telephone number is +353 1 215 8100. Our internet address is www.nexvet.com. Information contained on, or accessible through, our website is not a part of, and is not incorporated into, this prospectus and references to our website in this prospectus are inactive textual references only.

PETization, PETisation, Nexplora, Nexvet, our logo and our other registered or common law trademarks, trade names or service marks appearing in this prospectus are owned by us. Other trademarks, trade names or service marks appearing in this prospectus are the property of their respective owners. Solely for convenience, our trademarks and tradenames referred to in this prospectus appear without the ® or ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and tradenames.

6

Table of Contents

The Offering

| Ordinary shares we are offering |

ordinary shares |

| Ordinary shares to be outstanding immediately after this offering |

ordinary shares |

| Option to purchase additional ordinary shares |

ordinary shares |

| Use of proceeds |

We intend to use the net proceeds from this offering to complete the development and manufacturing scale-up of each of our three lead product candidates, to establish our sales force infrastructure in the United States for any approved products and for anticipated promotional and launch costs. We also intend to fund research to develop our pipeline of product candidates. We intend to use the remainder of the net proceeds from this offering for working capital and other general corporate purposes. See the section of this prospectus titled “Use of Proceeds.” |

| Proposed Nasdaq Global Market symbol |

“NVET” |

Entities affiliated with Farallon Capital Management, L.L.C., or Farallon, which hold more than 5% of our ordinary shares and are affiliates of a director nominee, have indicated an interest in purchasing up to an aggregate of $ million of our ordinary shares in this offering at the initial public offering price. However, because these indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell more, less or no shares to these entities, and such entities could determine to purchase more, less or no shares in this offering.

The number of ordinary shares to be outstanding immediately after the completion of this offering is based on 7,079,996 ordinary shares outstanding as of September 30, 2014 and excludes:

| • | 1,766,998 ordinary shares issuable upon the exercise of warrants to purchase ordinary shares outstanding as of September 30, 2014, with a weighted-average exercise price of $8.50 per ordinary share; |

| • | 358,553 ordinary shares issuable upon the exercise of options outstanding as of September 30, 2014, with a weighted-average exercise price of $2.64 per ordinary share, and 141,792 ordinary shares issuable upon the exercise of options issued after September 30, 2014, with an exercise price of the nominal value of $0.125 per ordinary share; |

| • | 50,454 ordinary shares issuable upon the conversion of restricted share units outstanding as of September 30, 2014 and 16,427 ordinary shares issuable upon the conversion of restricted share units issued after September 30, 2014, with a conversion price of the nominal value of $0.125 per ordinary share; |

| • | 32 ordinary shares, including 12 ordinary shares issuable upon the conversion of Series A investment preference shares and 10 ordinary shares issuable upon the conversion of Series B preference shares, outstanding following the November 2014 four-for-five share consolidation, which represent certain shares that would have become fractional shares in the consolidation and new issuances to prevent any fractional shares as a result of the consolidation, all of which shares are being held in trust pending their redemption or sale; |

7

Table of Contents

| • | 201,960 ordinary shares reserved for future issuance under our 2013 Long Term Incentive Plan as of September 30, 2014; and |

| • | 1,280,000 ordinary shares reserved for future issuance under our 2014 Equity Incentive Plan, to be effective upon the completion of this offering. |

Unless otherwise indicated or the context otherwise requires, all information in this prospectus reflects and assumes:

| • | the one-for-four share consolidation that occurred in August 2014 prior to the Irish Exchange, the completion of the Irish Reorganization in September 2014 and the four-for-five share consolidation that occurred in November 2014 following the completion of the Irish Reorganization; |

| • | the automatic conversion of all of our outstanding preference shares as of September 30, 2014 into 5,937,138 ordinary shares upon the completion of this offering; and |

| • | no exercise by the underwriters of their option to purchase up to an additional ordinary shares. |

8

Table of Contents

Summary Consolidated Financial Data

The following tables summarize our consolidated financial data. We derived the summary consolidated statements of operations data for the years ended June 30, 2013 and 2014 from our audited consolidated financial statements included elsewhere in this prospectus. We derived the summary consolidated statements of operations data for the three months ended September 30, 2013 and 2014 and the balance sheet data as of September 30, 2014 from our unaudited consolidated financial statements included elsewhere in this prospectus. We have prepared the unaudited consolidated financial statements on the same basis as the audited consolidated financial statements, and, in the opinion of management, the unaudited consolidated financial statements reflect all adjustments, consisting only of normal recurring adjustments, necessary for the fair statement of those financial statements. Our fiscal year ends on June 30, and references to any fiscal year are to our year ended June 30 in that year. You should read the following summary consolidated financial data in conjunction with the sections of this prospectus titled “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results to be expected in the future, and our interim results are not necessarily indicative of the results that should be expected for the full year or any other period.

Nexvet Biopharma plc became the parent company of Nexvet Australia pursuant to the Irish Reorganization, and for financial reporting purposes the historical consolidated financial statements of Nexvet Australia became the historical consolidated financial statements of Nexvet Biopharma plc and its subsidiaries as a continuation of the predecessor.

| Year Ended June 30, |

Three Months Ended September 30, |

|||||||||||||||

| 2013 | 2014 | 2013 | 2014 | |||||||||||||

| (unaudited) | ||||||||||||||||

| (in thousands, except share and per share amounts) |

||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||

| Revenue |

||||||||||||||||

| License and collaboration |

$ | 244 | $ | — | $ | — | $ | — | ||||||||

| Other |

85 | 13 | — | 25 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

329 | 13 | — | 25 | ||||||||||||

| Operating expenses |

||||||||||||||||

| Research and development |

2,722 | 5,617 | 1,240 | 2,539 | ||||||||||||

| General and administrative |

2,103 | 4,426 | 568 | 2,818 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

4,825 | 10,043 | 1,808 | 5,357 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(4,496 | ) | (10,030 | ) | (1,808 | ) | (5,332 | ) | ||||||||

| Other income (expense) |

||||||||||||||||

| Research and development incentive income |

1,135 | 2,337 | 503 | 741 | ||||||||||||

| Government grant income |

108 | 1,317 | 318 | 297 | ||||||||||||

| Exchange (loss) gain |

— | (375 | ) | (30 | ) | 1,984 | ||||||||||

| Interest income |

12 | 41 | 1 | 13 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (3,241 | ) | $ | (6,710 | ) | $ | (1,016 | ) | $ | (2,297 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per share attributable to ordinary shareholders, basic and diluted(1) |

$ | (3.62 | ) | $ | (6.70 | ) | $ | (1.02 | ) | $ | (2.13 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted-average ordinary shares outstanding, basic and diluted(1) |

894,794 | 1,000,872 | 1,000,000 | 1,078,166 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Pro forma net loss attributable to ordinary shareholders, basic and diluted(1) |

$ | (6,710 | ) | $ | (2,297 | ) | ||||||||||

|

|

|

|

|

|||||||||||||

| Pro forma net loss per share attributable to ordinary shareholders, basic and diluted(1) |

$ | (2.07 | ) | $ | (0.33 | ) | ||||||||||

|

|

|

|

|

|||||||||||||

| Pro forma weighted-average ordinary shares outstanding, basic and diluted(1) |

3,242,004 | 7,015,321 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| (1) | See Notes 2 and 11 to our consolidated financial statements included elsewhere in this prospectus for a description of the method used to compute basic and diluted net loss per share attributable to ordinary shareholders and pro forma net loss per share attributable to ordinary shareholders. |

9

Table of Contents

| September 30, 2014 | ||||||||||||

| Actual | Pro Forma(1) |

Pro Forma As Adjusted(2)(3) |

||||||||||

| (unaudited) | ||||||||||||

| (in thousands) | ||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash |

$ | 26,388 | $ | 26,388 | $ | |||||||

| Total assets |

28,740 | 28,740 | ||||||||||

| Total liabilities |

2,693 | 2,693 | ||||||||||

| Convertible preference shares |

33,826 | — | ||||||||||

| Total shareholders’ (deficit) equity |

26,047 | 26,047 | ||||||||||

| (1) | The pro forma column reflects the conversion of all outstanding preference shares into 5,937,138 ordinary shares upon the completion of this offering. |

| (2) | The pro forma as adjusted column further reflects the sale of ordinary shares in this offering at an assumed initial public offering price of $ per ordinary share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting the underwriting discount and estimated offering expenses payable by us. |

| (3) | Each $1.00 increase (decrease) in the assumed initial public offering price of $ per ordinary share, which is the midpoint of the price range set forth on the cover page of this prospectus, would increase (decrease) each of cash, total assets and total shareholders’ (deficit) equity on a pro forma as adjusted basis by approximately $ million, assuming that the number of ordinary shares offered by us, as set forth on the cover page of this prospectus, remains the same, after deducting the underwriting discount. Similarly, each increase (decrease) of 1,000,000 in the number of ordinary shares we are offering would increase (decrease) each of cash, total assets and total shareholders’ (deficit) equity on a pro forma as adjusted basis by approximately $ million, assuming that the assumed initial public offering price remains the same, and after deducting the underwriting discount. The pro forma as adjusted information discussed above is illustrative only and will be adjusted based on the actual initial public offering price and other terms of this offering determined at pricing. |

10

Table of Contents

Investing in our ordinary shares involves a high degree of risk. You should carefully consider the risks described below, as well as the other information in this prospectus, including our consolidated financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before deciding whether to invest in our ordinary shares. The occurrence of any of the events or developments described below could harm our business, financial condition, results of operations and growth prospects. In such an event, the market price of our ordinary shares could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may have similar adverse effects on us.

Risks Related To Our Business

We have a limited operating history, are not profitable and may never become profitable.

We are a clinical-stage biopharmaceutical company focused on the therapeutics segment of the companion animal market, with a limited operating history. Since our formation in February 2010, our operations have been limited to the identification of product candidates and to the research and development of our lead product candidates, which primarily target pain associated with osteoarthritis in dogs (NV-01), pain associated with degenerative joint disease in cats (NV-02) and chronic inflammatory diseases, including atopic dermatitis, in dogs (NV-08). As a result, we have limited historical operations upon which you can evaluate our business and prospects, and we have not yet demonstrated an ability to successfully overcome the risks and uncertainties frequently encountered by companies in new and rapidly evolving fields, particularly in companion animal therapeutics. We do not have any products approved for sale, have not generated any revenue from product sales since our inception and do not expect to generate any revenue from product sales in the near future. We have incurred significant net losses since our inception. We incurred net losses of $3.2 million, $6.7 million, $1.0 million and $2.3 million for fiscal years 2013 and 2014 and the three months ended September 30, 2013 and 2014, respectively, and as of September 30, 2014 we had an accumulated deficit of $14.1 million. This accumulated deficit has resulted principally from costs incurred in connection with research and development of our product candidates and general and administrative costs associated with our operations.

We expect to continue to incur net losses for the foreseeable future, and we expect these losses to increase as we continue our development of, and seek regulatory approvals for, our product candidates and begin commercialization activities in anticipation of regulatory approval. We will not be able to commercialize any product candidates until we successfully complete the required studies and they are approved by applicable regulatory authorities. In the United States, these authorities include the Center for Veterinary Medicine within the FDA and the Center for Veterinary Biologics within the Animal and Plant Health Inspection Service within the USDA. In Europe, these authorities include the European Medicines Agency, or the EMA. We refer to the FDA, the USDA and the EMA collectively as the “Regulatory Authorities.” Even if we succeed in developing and commercializing one or more product candidates, we expect to continue to incur net losses for the foreseeable future, and we may never become profitable. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. If we fail to achieve or maintain profitability, it would adversely affect the value of our ordinary shares.

We will require substantial additional financing to achieve our goals, and a failure to obtain this necessary capital when needed on acceptable terms, or at all, could force us to delay, limit, reduce or terminate our product development, product portfolio expansion, other operations or commercialization efforts.

Completing the development and obtaining regulatory approval of our product candidates will require substantial funds. We believe our cash balance of $26.4 million as of September 30, 2014, together with the net proceeds from this offering, will be sufficient to fund our anticipated level of operations for at least the next 24 months. Our operating plan may change as a result of many factors currently unknown to us, and we may seek additional funds sooner than planned through public or private equity or debt financings or other sources such as

11

Table of Contents

strategic collaborations. We have no current agreements or arrangements with respect to any such financings or collaborations, and any such financings or collaborations may result in dilution to our shareholders, the imposition of debt covenants and repayment obligations or other restrictions that may adversely affect our business or the value of our ordinary shares. Even if we believe we have sufficient funds on hand for our current or planned future business and operations, we may seek from time to time to raise additional capital based upon favorable market conditions or strategic considerations such as potential acquisitions.

Since our inception, nearly all of our resources have been dedicated to the research and development of our lead product candidates. We believe that we will continue to expend substantial resources for the foreseeable future for the development of our lead product candidates and any future product candidates we may choose to pursue. Because the outcome of our development activities is uncertain, we cannot reasonably estimate the actual amounts necessary to successfully complete the development of any of our current or future product candidates and, if approved, successfully commercialize them.

Our future capital requirements will depend on many factors, including:

| • | the scope, progress, results and costs of researching and developing our current or future product candidates, including conducting proof-of-concept and pivotal safety and efficacy studies; |

| • | the timing of, and the costs involved in, obtaining regulatory approvals for any of our current or future product candidates; |

| • | the number and characteristics of the product candidates we pursue; |

| • | whether we acquire or license any other companies, assets, intellectual property or technologies in the future; |

| • | the cost of commercialization activities, if any of our current or future product candidates are approved for sale, including marketing, sales and distribution costs; |

| • | the cost of manufacturing our current and future product candidates and any approved products we successfully commercialize; |

| • | our ability to establish and maintain strategic collaborations, licensing or other arrangements and the financial terms of such agreements; |

| • | the expenses needed to attract and retain skilled personnel; |

| • | the costs associated with being a public company; and |

| • | the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing patent claims, if any arise, including litigation costs and the outcome of such litigation. |

In addition, we may also have unanticipated costs. Additional funds may not be available when we need them on terms that are acceptable to us, or at all. If adequate funds are not available to us on a timely basis, we may be required to delay, limit, reduce or terminate one or more of our product development, product portfolio expansion, other operations or commercialization efforts.

Our success depends largely upon our ability to advance our product candidates through the various stages of development, especially through pivotal safety and efficacy studies. If we are unable to successfully advance or develop our product candidates, our business will be harmed.

We currently have no products approved for commercial distribution and are focused primarily on the development of our lead product candidates, NV-01, NV-02 and NV-08. None of our product candidates have completed pivotal safety and efficacy studies and their commercial viability will depend on the success of these

12

Table of Contents

studies, receipt of regulatory approvals and the viability of manufacturing processes. For our first lead product candidate, NV-01, we have completed proof-of-concept studies, and we have commenced our pivotal efficacy study and expect to commence our pivotal safety study in the first quarter of 2015, both of which we expect to be complete by December 2015. For our second and third lead product candidates, NV-02 and NV-08, we have completed proof-of-concept studies for pharmacokinetics, preliminary safety and immunogenicity, and we expect our final proof-of-concept study, for efficacy, to be completed by mid-2015 for NV-02 and our preliminary proof-of-concept studies for safety and efficacy to be completed by the end of 2015 for NV-08.

The success of our business ultimately depends upon our ability to advance the development of our product candidates from proof-of-concept studies through pivotal safety and efficacy studies in a manner that meets extensive regulatory requirements, establish facilities capable of consistently manufacturing them in accordance with strict specifications and regulations, obtain approval for their sale by the Regulatory Authorities, and ultimately have our product candidates successfully commercialized by us or a strategic partner or licensee. The results of our ongoing research and development activities, including pivotal safety and efficacy studies, may not support or justify the continued development of our product candidates, and we may not receive approval from the Regulatory Authorities to advance the development of our product candidates. Failure to advance the development of one or more of our product candidates may have an adverse effect on our business.

Our product candidates must satisfy regulatory standards of purity, safety, potency and efficacy, and standards related to manufacturing, before we can advance or complete their development or they can be approved for sale. To satisfy these standards, we must engage in expensive and sometimes lengthy proof-of-concept and pivotal safety and efficacy studies and develop acceptable and cost effective manufacturing processes. Despite these efforts, our product candidates may not:

| • | offer therapeutic or other medical benefits over existing drugs or other product candidates in development to treat the same animal population; |

| • | be proven to be safe and effective in pivotal safety and efficacy studies; |

| • | have the desired effects; |

| • | be free from undesirable or unexpected effects; |

| • | meet applicable regulatory standards (for example, be shown to be pure, safe, potent and effective); |

| • | be capable of being formulated and manufactured in commercially suitable quantities and at an acceptable cost; or |

| • | be successfully commercialized by us or by our collaborators. |

Even if we demonstrate favorable results in proof-of-concept studies for NV-01, NV-02 or NV-08, the results of pivotal safety and efficacy studies may not be sufficient to support the continued development of our product candidates. The development of companion animal therapeutics is subject to significant delays, setbacks and failures in all stages of development, including pivotal safety and efficacy studies, even after achieving promising results in proof-of-concept studies.

Accordingly, results from completed proof-of-concept studies of our product candidates may not be predictive of the results we may obtain in pivotal safety and efficacy studies. Furthermore, even if the data collected from proof-of-concept studies and pivotal safety and efficacy studies involving any of our product candidates demonstrate a satisfactory safety and efficacy profile, such results may not be sufficient to obtain regulatory approval from the Regulatory Authorities, which is required to market and sell a product.

13

Table of Contents

The discovery, development and manufacturing of biologics involves relatively novel technologies and an expensive and lengthy process with uncertain outcomes.

While many biologics have been approved for use in humans, apart from vaccines, relatively few recombinant proteins or antibodies have been approved for use in animals. There are unique risks and uncertainties associated with biologics, the discovery, development and manufacturing of which are subject to regulations that are complex and extensive. In addition, we develop biologics for companion animals using our proprietary PETization platform, which is a new platform that has not resulted in any commercialized products. Identification, optimization and manufacturing of biologics, including companion animal therapeutics, is a relatively new field in which unanticipated difficulties or challenges could arise. For example, there are no established practices or regulatory standards for pre-launch batch size manufacturing scale-up of a companion animal biological product candidate to commercial levels, which may cause our estimated manufacturing costs to materially increase due to unforeseen requirements from regulators or our third party manufacturer. Success in preliminary safety, proof-of-concept and prior target animal studies or pivotal studies, or success in studies of products similar to our product candidates but conducted in humans, does not ensure that our target animal studies or pivotal studies will be successful, and the results of development efforts by other parties may not be indicative of the results of our target animal studies, pivotal studies and other development efforts. We may be unable to identify biologics suitable for development or to achieve the potency and stability required for use in target animals. In particular, canine, feline and equine antibodies represent novel types of product candidates that may be difficult to identify through PETization or develop successfully.

Development of biologics, including companion animal therapeutics, is expensive and can take many years to complete, its outcome is inherently uncertain, and our development activities may not be successful. To gain approval to market an animal therapeutic for a particular species of animal, we must incur substantial expense for, and devote significant time to, pivotal safety and efficacy studies and provide the Regulatory Authorities with data that adequately demonstrate the safety and efficacy of that product in the target animal for the intended indication applied for in the new animal drug application, or NADA, product license or other regulatory filing. We rely on contract research organizations, or CROs, and other third parties to ensure the proper and timely conduct of our studies and development efforts, but we have limited influence over their actual performance. Pivotal safety and efficacy studies require adequate supplies of material and sufficient target animal enrollment. Delays in target animal enrollment can result in increased costs and longer development times that threaten the ability to complete the study. Pivotal safety and efficacy studies can be delayed or discontinued for a variety of reasons, including delays in or failure to:

| • | reach agreement on acceptable terms with study sites, which can be subject to extensive negotiation and may vary significantly among different sites; |

| • | complete pivotal safety and efficacy studies due to deviations from study protocol or the occurrence of adverse events; |

| • | address any safety concerns that arise during the course of testing; |

| • | address any conflicts with new or existing laws or regulations; |

| • | add new study sites; or |

| • | manufacture sufficient quantities of formulated biologics of adequate quality for use in studies. |

Even if we successfully complete pivotal safety and efficacy studies for our product candidates, we might not file the required regulatory submissions in a timely manner and may not receive regulatory approval for the product candidate. As a result, our product candidates may not successfully progress further through the drug development process or result in a commercially viable product.

14

Table of Contents

In addition, manufacturing biologics, especially in large quantities, is complex and may require the use of technologies that we may need to develop ourselves or in conjunction with third-party collaborators. Small changes in the manufacturing process can have a significant impact on product quality, consistency and yield. Such manufacturing requires facilities specifically designed and validated for this purpose and sophisticated quality assurance and quality control procedures. Biologics are also usually costly to manufacture. Manufacturing biologics may be more technically challenging, time-consuming and expensive than we anticipate or subject to other regulatory uncertainties. For example, human nerve growth factor inhibitor product candidates have been subject to classwide partial clinical holds imposed by the FDA in recent years due to the emergence of safety signals in humans, including rapidly progressive osteoarthritis, as a result of co-administration with non-steroidal, anti-inflammatory drugs. Classwide adverse effects may be seen in companion animals with the PETized product candidates we seek to manufacture and result in clinical holds or protocol revisions or otherwise cause delays or increased costs. We may be unable to manufacture biologics at full commercial scale and at an economical cost, if at all.

The results of our proof-of-concept studies for our product candidates may not be predictive of the results in any future pivotal safety and efficacy studies, and we may not be able to obtain any regulatory approvals.

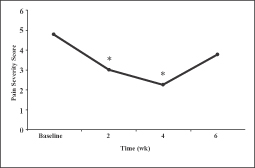

Our product pipeline includes species-specific formulations of our lead product candidates. The results of our proof-of-concept studies, other initial development activities and any previous studies in animals conducted by us or conducted in humans by third parties may not be predictive of future results of our pivotal safety and efficacy studies. Proof-of-concept studies involve relatively small numbers of animals compared to pivotal studies. For example, our proof-of-concept study completed for the efficacy of NV-01 involved 26 dogs, while our pivotal efficacy study being conducted for NV-01 will involve approximately 200 dogs. Similarly, some of our proof-of-concept studies for NV-02 and NV-08 have involved as few as four animals. Failure can occur at any time during the conduct of these studies and other development activities. Even if our species-specific pivotal safety and efficacy studies and other development activities are completed as planned, the results may not be sufficient to pursue a particular line extension for any of our product candidates. Further, even if we obtain promising results from these studies, we may not successfully commercialize any particular product candidate. Because our product candidates are developed for a particular species, our ability to leverage our experience from the development of our lead product candidates into product candidates for other species will be limited.

We may be unable to obtain regulatory approval for our existing or future product candidates under applicable regulatory requirements. The denial or delay of any such approval would delay commercialization efforts and adversely impact our potential to generate revenue, our business and our results of operations.

Our product candidates are in various stages of development, and our business currently depends entirely on their successful development, regulatory approval and commercialization. We currently have no products approved for sale, and we may never obtain regulatory approval to commercialize any of our current or future product candidates. The research, testing, manufacturing, labeling, approval, sale, marketing and distribution of animal therapeutic products are subject to extensive regulation by the FDA (which regulates the manufacturing and distribution of animal drugs and pharmaceuticals), the USDA (which regulates the manufacturing and distribution of veterinary biological products to prevent, diagnose, and treat animal diseases), the EMA and other regulatory authorities, and regulations differ for each Regulatory Authority and from country to country.

Any delay or failure in obtaining applicable regulatory approval from any Regulatory Authority for the intended indications of our product candidates would delay or prevent commercialization of such product candidates and would adversely impact our business and prospects. Even if an approved product reaches market, circumstances could result in the need to withdraw a product from the market.

In order to market any product outside of the United States, including in the European Economic Area, or EEA (which is composed of 27 of the 28 member states of the EU, plus Norway, Iceland and Liechtenstein), and many other foreign jurisdictions, separate regulatory approvals are required. For example, in the EEA, companion

15

Table of Contents

animal therapeutics can only be commercialized after obtaining a marketing authorization. Before granting a marketing authorization, the EMA or the competent national authorities of the member states of the EEA assess the risk-benefit balance of the product on the basis of scientific criteria concerning its quality, safety and efficacy.

The approval procedures vary among countries and can involve additional studies and testing, and the time required to obtain approval may differ from that required to obtain approval from the Regulatory Authorities. Animal studies conducted in one country may not be accepted by regulatory authorities in other countries. Approval by the FDA or the USDA does not ensure approval by regulatory authorities in other countries, and approval by one or more foreign regulatory authorities does not ensure approval by regulatory authorities in other foreign countries or in the United States. However, a failure or delay in obtaining regulatory approval in one country may have a negative effect on the regulatory process in others. The foreign regulatory approval process may include all of the risks associated with obtaining approval in the United States. We may not be able to file for regulatory approvals or to do so on a timely basis and, even if we do file them, we may not receive necessary approvals to commercialize our lead product candidates in any market.

If any of our product candidates are approved but do not gain meaningful market acceptance, we are not likely to generate significant revenue.

Even if we obtain approvals from the Regulatory Authorities, our current or future product candidates may not achieve market acceptance among veterinarians and animal owners, and may not be commercially successful. Market acceptance of any of our current or future product candidates for which we receive approval depends on a number of factors, including:

| • | the safety of our lead product candidates and the prevalence and severity of adverse side effects as demonstrated in our pivotal safety and efficacy studies; |

| • | the indications for which our lead product candidates are approved; |

| • | the acceptance by veterinarians and animal owners of the product as a safe and effective treatment; |

| • | the proper training regarding, and administration of, our lead product candidates by veterinarians; |

| • | the relative convenience and ease of administration of our lead product candidates; |

| • | the potential and perceived advantages of our product candidates over alternative treatments; |

| • | the cost of treatment in relation to alternative treatments and willingness to pay for our lead product candidates, if approved, on the part of veterinarians and animal owners; |

| • | the willingness of animal owners to pay for our lead product candidates, relative to other discretionary items, especially during economically challenging times; |

| • | the effectiveness of our sales and marketing efforts and those of our collaborators and distributors; and |

| • | the willingness of veterinarians to prescribe or administer our lead product candidates to the intended target animal population. |

The market for therapeutic veterinary biologics such as our product candidates is very limited at present and will require education and outreach efforts to establish a therapeutic biologics market among veterinarian practices. If our lead product candidates do not achieve meaningful market acceptance, or if the market for our lead product candidates proves to be smaller than anticipated, we may never generate significant revenue.

16

Table of Contents

The commercial potential of a product candidate in development is difficult to predict. The market for our product candidates is uncertain and may be smaller than we anticipate, which could significantly and negatively impact our revenue, results of operations and financial condition.

It is difficult to estimate the commercial potential of any of our product candidates because of the emerging nature of the companion animal therapeutics segment of the veterinary care industry. This segment continues to evolve, and it is difficult to predict the market potential for what we believe to be the unmet medical needs of companion animals. This market potential will depend on important factors such as safety and efficacy compared to other available treatments, changing standards of care, preferences of veterinarians, the willingness of animal owners to pay for such products, and the availability of competitive alternatives that may emerge either during the product development process or after commercial introduction. In addition, our efforts to influence veterinarian preferences by educating them about the benefits of biologics compared to currently available treatments may not be successful. If the demand for our product candidates is less than we anticipate due to one or more of these or other factors, it could negatively impact our business, financial condition and results of operations. Further, the willingness of animal owners to pay for our product candidates, if approved, may be less than we anticipate and may be negatively affected by overall economic conditions.

Our product candidates, if approved, will face competition, and our failure to effectively compete may prevent us from achieving significant market penetration.

The companion animal therapeutics segment of the veterinary care industry is highly competitive and characterized by rapid technological change. Key competitive factors in our segment include, among others, the ability to successfully advance the development of a product candidate through pivotal safety and efficacy studies, the timing and scope of regulatory approvals, if ever achieved, average selling price of competing products and animal therapeutic products in general, the availability of raw materials, contract manufacturing and manufacturing capacity, manufacturing costs, establishing and maintaining intellectual property and patent rights and their protection, and sales and marketing capabilities.

We believe our main competitors are animal health companies that are developing products for use in companion animals, such as Aratana Therapeutics, Inc., Kindred Biosciences, Inc. and Zoetis, Inc. In addition, there are a number of large biopharmaceutical companies with animal health divisions, such as Bayer AG; Boehringer Ingelheim GmbH; Eli Lilly and Company (Elanco division); Merck & Co., Inc.; Sanofi S.A. (Merial division); and Novartis AG. If approved, we expect NV-01 and NV-02 will face competition from Deramaxx, marketed by Novartis; Metacam, marketed by Boehringer Ingelheim; Previcox, marketed by Merial; and Rimadyl, marketed by Zoetis, as well as from generic Meloxicam and Carprofen and other pain-treating products. We believe that Aratana and Kindred are developing, and that other companies may develop, similar profile products as well. In addition, private-label products may compete with our lead product candidates. If companion animal therapeutics customers increase their use of new or existing private-label products, our operating results and financial condition could be adversely affected.

We are a clinical-stage biopharmaceutical company with a limited operating history and many of our competitors have substantially more resources than we do, including financial, technical and sales resources. In addition, many of our competitors have more experience than we have in the development, manufacture, regulation and worldwide commercialization of companion animal therapeutics. We are also competing with academic institutions, governmental agencies and private organizations that are conducting research in the field of companion animal therapeutics. Our competition will be determined in part by the potential indications for which our lead product candidates are developed and ultimately approved by the Regulatory Authorities. Additionally, the timing of market introduction of some of our future products or of competitors’ products may be an important competitive factor. Accordingly, we expect the speed with which we can develop our product candidates, complete pivotal safety and efficacy studies and approval processes, and supply commercial quantities to market to be important competitive factors.

17

Table of Contents

If we are unable to attract or retain key employees, advisors or consultants, we may be unable to successfully develop our product candidates in a timely manner, if at all, or otherwise manage our business effectively.

As of September 30, 2014, we had 21 full-time employees, and we anticipate the need to increase the size of our organization, which will require us to hire, train, retain, manage and motivate current and additional employees, consultants or advisors with experience in a number of disciplines, including research and development, sales, finance, and manufacturing. Our success depends in part on our ability to attract and retain highly qualified key management, personnel and directors to develop, implement and execute our business strategy and operations, and oversee the activities of our consultants and vendors, as well as academic and corporate advisors or consultants that assist us in this regard. We are currently highly dependent upon the efforts of our management team to accomplish this, specifically including Mark Heffernan, our co-founder and Chief Executive Officer, David Gearing, our co-founder and Chief Scientific Officer, and Damian Lismore, our Chief Financial Officer. We do not have any “key man” insurance.

Although we have successfully attracted and retained key personnel in the past, we may not be able to continue to do so in the future on acceptable terms, if at all. In addition, competition for qualified personnel in the companion animal therapeutics segment of the veterinary care industry is intense, because there are a limited number of individuals who are trained or experienced in the field. We may also face difficulty in expanding and enhancing our operational, financial and management systems as we grow. If we lose any key employees, or are unable to attract or retain qualified key personnel, directors, advisors or consultants, the development of our product candidates could be significantly delayed or discontinued.

We rely on a single third-party manufacturer for supplies of our lead product candidates, and we intend to rely on third-party manufacturers for commercial quantities of any of our product candidates that may be approved.

We currently have no internal capability to manufacture the formulated product candidates for use in our studies or commercial supplies of any of our product candidates that may be approved, and we are entirely dependent upon third-party manufacturers for such supplies. We currently have a relationship with only one contract manufacturer, Lonza Sales AG, or Lonza, for the manufacturing of our lead product candidates for clinical testing purposes. Lonza may terminate the agreements we have entered into with them by, among other ways, prior written notice if the services cannot be completed due to technical or scientific reasons, subject to certain conditions. If Lonza does not perform as agreed or terminates our agreements, we may be required to replace Lonza, and we may be unable to do so on a timely basis, on similar terms or at all.

We also expect to rely upon third parties to produce materials required for the commercial production of our product candidates if we succeed in obtaining the necessary regulatory approvals. We may be unable to identify and reach agreement with a third-party manufacturer for our product candidates in a timely manner on commercially reasonable terms, or at all. Any delay in our ability to identify and contract with these third-party manufacturers on commercially reasonable terms, or at all, would have an adverse impact upon our current product development activities and future commercialization efforts.

The facilities used by Lonza or other third-party manufacturers we engage to manufacture the active pharmaceutical ingredients and formulated biologics will be subject to inspections by the Regulatory Authorities that will be conducted after we submit our NADA to and obtain approval by the FDA, or during a potential USDA licensing process for future product candidates or the EMA approval process. Among other things, these inspections may consider whether Lonza or other third-party manufacturers are following strict procedures associated with pharmaceutical manufacturing operations. We also expect our third-party manufacturers to produce supplies in conformity to our specifications and regulatory requirements and to maintain quality control and quality assurance practices and not to employ disqualified personnel. If our third-party manufacturers’ facilities or quality control and quality assurance practices do not comply with regulatory requirements, we may need to find alternative manufacturing facilities, which would adversely impact our ability to develop, obtain regulatory approval for or market our product candidates, if approved. Minor deviations in our manufacturing processes, such as temperature excursions or improper package sealing, could result in delays, inventory

18

Table of Contents

shortages, unanticipated costs, product recalls, product liability or regulatory action. In addition, a number of factors could cause production interruptions, including:

| • | equipment malfunctions; |

| • | shortages of materials; |

| • | changes in manufacturing production sites and limits to manufacturing capacity due to regulatory requirements, changes in types of products produced, shipping distributions or physical limitations; |

| • | labor problems; |

| • | natural disasters or power outages; |

| • | terrorist activities; and |

| • | the outbreak of any highly contagious diseases near our production sites. |

These interruptions could result in launch delays, inventory shortages, recalls, unanticipated costs or otherwise adversely affect our operating results.

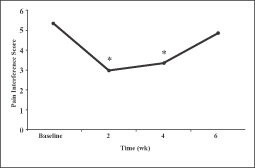

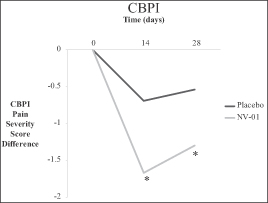

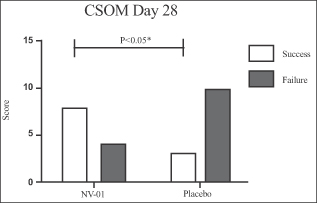

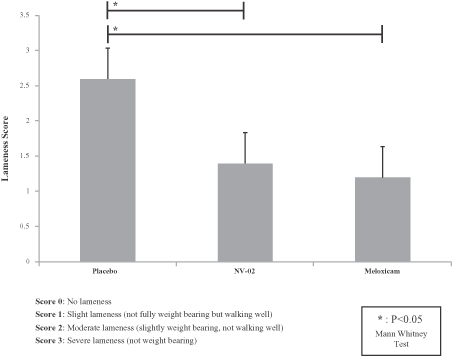

In accordance with good manufacturing practice, changing manufacturers may require the re-validation of manufacturing processes and procedures and may require further studies to show comparability between the materials produced by different manufacturers. Changing our current or future third-party manufacturers may be difficult, if possible for us, and could be extremely costly, which could result in our inability to manufacture our product candidates for an extended period of time and therefore a delay in the development or marketing of our product candidates. Further, in order to maintain our development timelines in the event of a change in our third-party manufacturer, we may incur significantly higher costs to manufacture our product candidates.