Attached files

| file | filename |

|---|---|

| EX-99 - Sierra Madre Mining | exhibit99.htm |

| EX-23 - Sierra Madre Mining | consentletterex23.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

Amendment No. 2

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SIERRA MADRE MINING, INCORPORATED

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

|

1040 |

|

47-1807657 |

|

(State or Other Jurisdiction of |

|

(Primary Standard Industrial |

|

(I.R.S. Employer |

Sierra Madre Mining, Inc.

18444 N 25th Ave. Suite #420–711

Phoenix, AZ 85023

Phone: 480-658-3822

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Michael Brown

Executive Chairman and Chief Executive Officer

Sierra Madre Mining, Inc.

18444 N 25th Ave. Suite #420–711

Phoenix, AZ 85023

Phone: 480-658-3822

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

Accelerated filer |

|

Non-accelerated filer (Do not check if a smaller reporting company) |

|

Smaller reporting company [X] |

CALCULATION OF REGISTRATION FEE

|

Securities to be |

Amount To Be |

Offering Price |

Aggregate |

Registration Fee | ||||

|

Registered |

Registered |

Per Share |

Offering Price |

[1] | ||||

|

Class B Stock: |

100,000,000 |

$ |

.25 |

$ |

25,000,000 |

$ |

3,200.00 | |

|

[1] |

Estimated solely for purposes of calculating the registration fee under Rule 457. | |||||||

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED 12/22/14

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

PROSPECTUS

SIERRA MADRE MINING, Inc.

OFFERED BY SIERRA MADRE MINING, INC.

Offering Made Without an Underwriter

Class B shares to be sold carry no voting rights

See the Section Offering-Plan of Distribution in the Prospectus

This offering is self-underwritten and conducted on a “Best Efforts No Minimum” basis and will end one year from the date that the registration statement is effective. No arrangement has been made to escrow funds received from the stock sales pending the completion of the offering. In that regard, proceeds from sales of the common stock will be delivered directly to the Company as sales occur. Directly funding the Company from the common stock sales exposes investors to significant risks as disclosed further in the section The Offering-Plan of Distribution. Because the offering has no set minimum and there is no plan to escrow the offering proceeds, the Company may fail to raise enough capital to fund its business plan and operations and it’s possible that investors may lose substantially all of their investment. No underwriter or person has been engaged to facilitate the sale of shares of common stock in this offering. There are no underwriting commissions involved in this offering. The Company does not intend to sell any specific minimum number or dollar amount of securities but will use its best efforts to sell the securities offered.

A Total of Up to 100,000,000 Shares of Class B Stock Par Value $ 0.000001 per Share

Offered at $.25 (a quarter) Per Share

OUR COMMON STOCK IS NOT TRADED ON ANY NATIONAL SECURITIES EXCHANGE AND IS NOT QUOTED ON ANY OVER-THE-COUNTER MARKET. THIS INVESTMENT INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE “RISK FACTORS” FOR A DISCUSSION OF RISKS APPLICABLE TO US AND AN INVESTMENT IN OUR COMMON STOCK.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TABLE OF CONTENTS

|

Page | |

|

Prospectus Summary |

3 |

|

Plan of Distribution; Terms of the Offering |

3 |

|

Summary of Financial Information |

4 |

|

JOBS Act Statement |

5 |

|

Risk Factors |

6 |

|

Use of Proceeds |

12 |

|

Determination of Offering Price |

13 |

|

Management’s Discussion and Analysis or Plan of Operation |

22 |

|

Directors, Executive Officers and Control Persons |

24 |

|

Security Ownership of Certain Beneficial Owners and Management |

25 |

|

Executive Compensation |

25 |

|

Transactions With Related Persons, Promoters, Control Persons |

26 |

|

Legal Proceedings |

26 |

|

Anti-Takeover Provisions Shares Eligible for Future Sale |

26 |

|

Code of Ethics |

27 |

|

Plan of Distribution |

27 |

|

Description of Securities |

29 |

|

Disclosure of Commission Position of Indemnification for Securities Act Liabilities |

30 |

|

Recent Sales of Securities |

30 |

|

Financial Statements |

30 |

|

Interests of Named Experts and Counsel |

38 |

|

Undertakings |

39 |

|

Signatures |

40 |

PROSPECTUS SUMMARY

THIS SUMMARY HIGHLIGHTS SELECTED INFORMATION AND DOES NOT CONTAIN ALL THE INFORMATION THAT MAY BE IMPORTANT TO YOU. YOU SHOULD CAREFULLY READ THIS PROSPECTUS, ANY RELATED PROSPECTUS SUPPLEMENT AND THE DOCUMENTS WE HAVE REFERRED YOU TO IN THE SECTION “WHERE YOU CAN FIND MORE INFORMATION” BEFORE MAKING AN INVESTMENT IN OUR COMMON STOCK, INCLUDING THE “RISK FACTORS” IN THIS PROSPECTUS, REFERENCES TO “THE COMPANY,” “SIERRA,” “WE,” “US,” “OUR,” REFER TO SIERRA MADRE MINING, INC. UNLESS OTHERWISE INDICATED OR THE CONTEXT OTHERWISE REQUIRES.

THE COMPANY

We incorporated in Delaware on November 6, 2013. We are an exploration stage mining company. Our office address is Sierra Madre Mining, Inc., 18444 N 25th Ave. Suite #420–711, Phoenix, AZ 85023. Our phone # is 480-658-3822. Our website is www.SierraMadreMining.com.

Business Overview

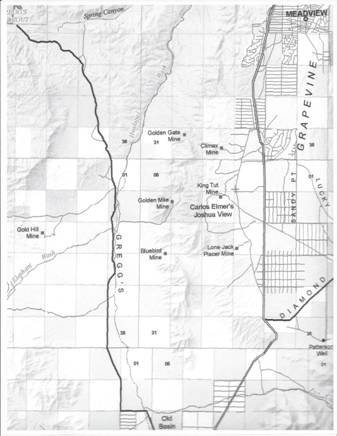

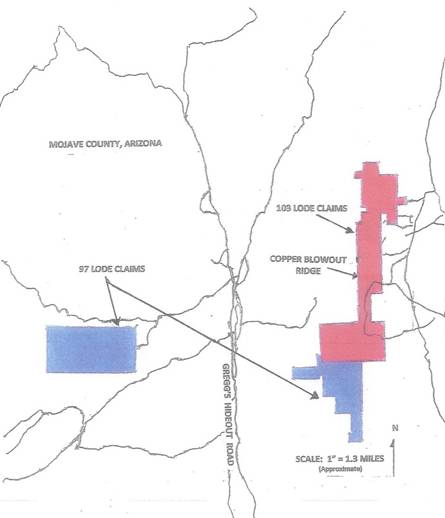

Sierra Madre Mining is a U.S.-based mining exploration company engaged in the acquisition and exploration of mineral properties. We own a 20% ownership interest in 200 lode claims located in two separate blocks of 97 claims and 103 claims, more or less contiguous, located in Mohave County, Arizona. We have a JV with the LLCs that own the remaining 80% ownership interest on these 200 lode claims. Sierra Madre has had no field operations or activity in 2013 or 2014. The company intends, with a successful offering, to use proceeds from sales of our securities to begin a drilling program on the mining claims, to determine what, if any, reserves are on the claims. We have named this particular JV the Copper Blowout Ridge JV. We also intend to be engaged in the acquisition, exploration and development of mining properties in the United States. 103 of our claims are located directly west of Meadview, Arizona, while the remaining claims are located another 10 miles further southwest from Meadview, AZ.

THE OFFERING-PLAN OF DISTRIBUTION

This prospectus refers to the sale of 100,000,000 shares of the Company's Class B stock. There is no minimum number of shares that must be sold by us for the offering to proceed, and we will retain the proceeds from the sale of any of the offered shares. The shares will be offered at a fixed price of $.25 per share for the duration of the offering, which will be for one year from the date of effectiveness of this prospectus.

This offering is a self-underwritten offering, which means that it does not involve the participation of an underwriter to market, distribute or sell the shares offered under this prospectus. We will sell shares on a continual basis. We reasonably expect the amount of securities registered pursuant to this offering to be offered and sold within one year from this initial effective date of this registration.

We are offering the shares on a "self-underwritten" best efforts basis directly through our CEO, Michael H. Brown. He is qualified pursuant to the safe harbor provision from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934. He will attempt to sell the shares. This Prospectus will permit Brown to use his best efforts to market and sell this common stock directly, with no commission or other remuneration payable to him for any shares he may sell. At this time, the Company has not made any arrangements to place the funds received in an escrow or trust account, thus, the Company and its executive officers will have immediate access to such funds. This offering will terminate upon the earliest to occur of (i) the first anniversary of the effective date of the registration statement, (ii) the date on which all 100,000,000 shares registered hereunder have been sold, or (iii) the date on which we terminate this offering.

In connection with his selling efforts in the offering, Mr. Brown will not register as a broker-dealer pursuant to Section 15 of the Exchange Act but rather will rely upon the "safe harbor" provisions of Rule 3a4-1 under the Exchange Act. Generally speaking, Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Exchange Act for persons associated with an issuer that participates in an offering of the issuer's securities. Mr. Brown is not subject to any statutory disqualification, as that term is defined in Section 3(a)(39) of the Exchange Act. Mr. Brown will not be compensated in connection with his participation in the offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in our securities. Mr. Brown is not and has not been within the past 12 months, a broker or dealer, and is not within the past 12 months, an associated person of a broker or dealer. At the end of the offering, Mr. Brown will continue to primarily perform substantial duties for us or on our behalf otherwise than in connection with transactions in securities. Mr. Brown has not participated in selling an offering of securities for any issuer more than once every 12 months other than in reliance on Exchange Act Rule 3a4-1(a)(4)(i) or (iii).

Any investment in the shares offered herein involves a high degree of risk. You should only purchase shares if you can afford a loss of your investment. Our independent registered public accountant has issued an audit opinion for our company, which includes a statement expressing substantial doubt as to our ability to continue as a going concern.

There currently is no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or on the over-the-counter market. There can be no assurance that our common stock will ever be quoted on a stock exchange or a quotation service or that any market for our stock will develop.

The following table shows the possible outcomes for computing the Company's outstanding stock given partial sales of the total offering given in percentage intervals. The Company has made no plans to place the proceeds of the offering in escrow or trust account. The proceeds are to be used when available. Immediate use of the proceeds when received in the Company’s accounts regardless of the total received at any time during the offering has the possibility of having a negative effect on investors. Because the offering has no set minimum and there is no plan to escrow the offering proceeds, the Company may fail to raise enough capital to fund its business plan and operations and it’s possible that investors may lose all or substantially all of their investment.

|

|

|

Offering Price Per Share |

|

Commissions |

|

Proceeds to Company Before Expenses if 10% of the shares are sold |

|

|

Proceeds to Company Before Expenses if 50% of the shares are sold |

|

|

Proceeds to Company Before Expenses if 100% of the shares are sold |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class B Common Stock |

|

$ |

.25 |

|

Not Applicable |

|

$ |

2,500,000 |

|

|

$ |

12,500,000 |

|

|

$ |

25,000,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals |

|

$ |

.25 |

|

Not Applicable |

|

$ |

2,500,000 |

|

|

$ |

12,500,000 |

|

|

$ |

25,000,000 |

|

Where You Can Find Us

Our office address is Sierra Madre Mining, Inc., 18444 N 25th Ave. Suite #420–711, Phoenix, AZ 85023. Our website is SierraMadreMining.com

SUMMARY FINANCIAL INFORMATION

We have prepared the following summary of our consolidated financial statements. The summary of our consolidated financial data set forth below should be read together with our separate audited financial statements and the notes thereto, as well as “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in this prospectus.

|

|

|

9/30/14 ($) |

| |

|

Financial Summary (Audited) |

|

|

|

|

|

Fixed Assets |

|

|

50,000 |

|

|

Total Assets |

|

|

50,000 |

|

|

Total Liabilities |

|

|

16,515 |

|

|

Total Stockholder’s Equity |

|

|

33,485 |

|

|

Common Stock, $.000001 par value, 300,000,000,000 shares authorized; 127,300,000 shares issued and outstanding all classes |

|

|

127 |

|

|

Additional Paid in Capital |

|

|

62,173 |

|

|

|

|

Accumulated from 11/6/13 (Inception) to 9/30/14 ($) |

| |

|

Consolidated Statements of Expenses and Comprehensive Loss |

|

|

| |

|

Total Operating Expenses |

|

|

28,815 |

|

|

Total Loss |

|

|

(28,815) |

|

EMERGING GROWTH COMPANY

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups Act.

We shall continue to be deemed an emerging growth company until the earliest of:

a. the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more;

b. the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under this title;

c. the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or

d. the date on which such issuer is deemed to be a `large accelerated filer', as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto.

As an emerging growth company we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures.

Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company we are exempt from Section 14A and B of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Act.

SMALLER REPORTING COMPANY

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY - THE JOBS ACT

We qualify as an emerging growth company as that term is used in the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

* A requirement to have only two years of audited financial statements and only two years of related MD&A ;

* Exemption from the auditor attestation requirement in the assessment of the emerging growth company's internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002;

* Reduced disclosure about the emerging growth company's executive compensation arrangements; and

* No non-binding advisory votes on executive compensation or golden parachute arrangements.

We may take advantage of the reduced reporting requirements applicable to smaller reporting companies even if we no longer qualify as an "emerging growth company."

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the "Securities Act") for complying with new or revised accounting standards. We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Act.

We could remain an emerging growth company for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a "large accelerated filer" as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal

quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

RISK FACTORS

An investment in our stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. Currently, shares of our common stock are not publicly traded. In the event that shares of our common stock become publicly traded, the trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. In the event our common stock fails to become publicly traded you may lose all or part of your investment.

We lack an Operating History

The Company has a very brief operating history. During its brief operating history, the Company has not recognized any revenue from its operations. The Company has used capital provided by shareholders to provide operations capital during its brief operating history. The Company may not immediately realize any revenue from its operations unless it obtains sufficient funding for its mining activities. The Company’s brief operating history and inability to yet realize any income from its efforts should be considered as a substantial risk to investors who purchase the securities of the Company.

Our operations are subject to permitting requirements which could require us to delay, suspend or terminate our operations on our mining property.

Our planned exploration activities on the Copper Blowout Ridge, and other properties we may acquire, require permits from the BLM, and several other governmental agencies. We may be unable to obtain these permits in a timely manner, on reasonable terms or at all. If we cannot obtain or maintain the necessary permits, or if there is a delay in receiving these permits, our timetable and business plan for exploration of the Copper Blowout Ridge will be adversely affected.

Our exploration activities may not be commercially successful, which could lead us to abandon our plans to develop the property we partially own, and lose the investments proceeds from it.

Our long-term success depends on our ability to identify mineral deposits on the Copper Blowout Ridge and other properties we may acquire, that we can then develop into commercially viable mining operations. Mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. These risks include unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment or labor. The success of exploration is determined in part by the following factors:

- the identification of potential copper, silver, and/or gold mineralization based on evaluation of the host rock, alteration, structure, geochemistry and proper sampling;

- availability of government-granted operation permits;

- the quality of our management and our geological and technical expertise; and

- the capital available for exploration.

Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. We may invest significant capital and resources in exploration activities and abandon such investments if we are unable to identify commercially exploitable mineral reserves. The decision to abandon a project may have an adverse effect on the market value of our securities and the ability to raise future financing. We cannot assure you that we will discover or acquire any mineralized material in sufficient quantities on any of our properties to justify commercial operations.

Actual capital costs, operating costs, production and economic returns may differ significantly from those we have anticipated and there are no assurances that our production activities will result in profitable mining operations.

Our estimated operating and capital costs for the Copper Blowout Ridge are based on information available to us and that we believe to be accurate. However, costs for labor, regulatory compliance, energy, mine and plant equipment and materials needed for production may significantly fluctuate. In light of these factors, actual costs related to our proposed budgeted production costs may exceed any estimates we may make. We do not have an operating history upon which we can base estimates of future operating costs related to Copper Blowout Ridge, and we intend to rely upon our future economic feasibility of the project and any estimates that may be contained therein. Studies derive estimates of cash operating costs based upon, among other things:

- anticipated tonnage, grades and metallurgical characteristics of the material to be mined and processed;

- anticipated recovery rates of gold and other metals from the material;

- cash operating costs of comparable facilities and equipment; and

- anticipated climatic conditions and availability of water.

Capital and operating costs, production and economic returns, and other estimates contained in feasibility studies may differ significantly from actual costs, and there can be no assurance that our actual capital and operating costs will not be higher than anticipated or disclosed.

A shortage of critical equipment, supplies, and resources could adversely affect our exploration activities.

We are dependent on certain equipment, supplies and resources to carry out our mining exploration activities, including input commodities, drilling equipment and skilled labor. A shortage in the market for any of these factors could cause unanticipated cost increases and delays in delivery times, which could in turn adversely impact production schedules and costs.

Historical production at the copper blowout ridge may not be indicative of the potential for future development.

The Copper Blowout Ridge is not in commercial production, and, since acquiring ownership, we have never recorded any revenues from commercial production at those mines. You should not rely on the fact that there were historical mining operations in the surrounding mining district as an indication that we will ever have future successful commercial operations at that specific mine. In order for us to develop new mining operations we will be required to incur substantial operating expenses and capital expenditures to refurbish and/or replace existing infrastructure.

We currently do not have sufficient funds to bring the Arizona into sustained commercial operation and we expect that we will require additional financing in the future.

We are an exploration stage company and do not currently have sufficient capital for sustained operations. We expect that the proceeds from this offering will be used to begin drilling and geological studies on the blowout ridge. Our future financing needs may be substantial if we encounter unexpected costs or delays at this early stage of developing the mine.

Failure to obtain sufficient financing through this offering may result in the delay or indefinite postponement of exploration, drilling, development or production at the Mines. Furthermore, even if we raise sufficient additional capital, there can be no assurance that we will achieve profitability or positive cash flow. In addition, any future equity offering will further dilute your equity interest in us and any future debt financing will require us to dedicate a portion of our cash flow to payments on indebtedness and will limit our flexibility in planning for or reacting to changes in our business.

If the development of one or more of our mineral projects is found to be economically feasible, we will be subject to all of the risks associated with establishing new mining operations.

If the development of one of our mineral projects is found to be economically feasible, such development will require obtaining permits and financing, and the construction and operation of mines, processing plants and related infrastructure. As a result, we will be subject to all of the risks associated with establishing new mining operations, including:

|

|

• |

|

the timing and cost, which can be considerable, of the construction of mining and processing facilities and related infrastructure; |

|

|

• |

|

the availability and cost of skilled labor, mining equipment and principal supplies needed for operations, including explosives, fuels, chemical reagents, water, power, equipment parts and lubricants; |

|

|

• |

|

the availability and cost of appropriate smelting and refining arrangements; |

|

|

• |

|

the need to obtain necessary environmental and other governmental approvals and permits and the timing of the receipt of those approvals and permits; |

|

|

• |

|

the availability of funds to finance construction and development activities; |

|

|

• |

|

industrial accidents; |

|

|

• |

|

mine failures, shaft failures or equipment failures; |

|

|

• |

|

natural phenomena such as inclement weather conditions, floods, droughts, rock slides and seismic activity; |

|

|

• |

|

unusual or unexpected geological and metallurgic conditions; |

|

|

• |

|

exchange rate and commodity price fluctuations; |

|

|

• |

|

high rates of inflation; |

|

|

• |

|

potential opposition from non-governmental organizations, environmental groups or local groups, which may delay or prevent development activities; and |

|

|

• |

|

restrictions or regulations imposed by governmental or regulatory authorities. |

The costs, timing and complexities of developing our projects may be greater than anticipated. Cost estimates may increase significantly as more detailed engineering work is completed on a project. It is common in mining operations to experience unexpected costs, problems and delays during construction, development and mine start-up. We cannot provide assurance that our activities will result in profitable mining operations at our mineral properties.

Our operations involve significant risks and hazards inherent to the mining industry.

Our exploration operations will involve the operation of large pieces of drilling and other heavy equipment. Hazards such as fire, explosion, floods, structural collapses, industrial accidents, unusual or unexpected geological conditions, ground control problems, cave-ins, flooding and mechanical equipment failure are inherent risks in our operations. Hazards inherent to the mining industry can cause injuries or death to employees, contractors or other persons at our mineral properties, severe damage to and destruction of our property, plant and equipment and mineral properties, and contamination of, or damage to, the environment, and can result in the suspension of our exploration activities and any future development and production activities. While the Company aims to maintain best safety practices as part of its culture, safety measures implemented by us may not be successful in preventing or mitigating future accidents.

In addition, from time to time we may be subject to governmental investigations and claims and litigation filed on behalf of persons who are harmed while at our properties or otherwise in connection with our operations. To the extent that we are subject to personal injury or other claims or lawsuits in the future, it may not be possible to predict the ultimate outcome of these claims and lawsuits due to the nature of personal injury litigation. Similarly, if we are subject to governmental investigations or proceedings, we may incur significant penalties and fines, and enforcement actions against us could result in the closing of certain of our mining operations. If claims and lawsuits or governmental investigations or proceedings are ultimately resolved against us, it could have a material adverse effect on our financial performance, financial position and results of operations. Also, if we mine on property without the appropriate licenses and approvals, we could incur liability or our operations could be suspended.

The mining industry is very competitive.

The mining industry is very competitive. Much of our competition is from larger, established mining companies with greater liquidity, greater access to credit and other financial resources, newer or more efficient equipment, lower cost structures, more effective risk management policies and procedures and/or a greater ability than us to withstand losses. Our competitors may be able to respond more quickly to new laws or regulations or emerging technologies, or devote greater resources to the expansion or efficiency of their operations than we can. In addition, current and potential competitors may make strategic acquisitions or establish cooperative relationships among themselves or with third parties. Accordingly, it is possible that new competitors or alliances among current and new competitors may emerge and gain significant market share to our detriment. We may not be able to compete successfully against current and future competitors, and any failure to do so could have a material adverse effect on our business, financial condition or results of operations.

The title to some of our mineral properties may be uncertain or defective, thus risking our investment in such properties.

The mineral properties we own, and acquire in the future, may be subject to prior recorded and unrecorded agreements, transfers or claims, and title may be affected by, among other things, undetected defects. A title defect on any of our mineral properties (or any portion thereof) could adversely affect our ability to mine the property and/or process the minerals that we mine.

Title insurance is generally not available for mineral properties and our ability to ensure that we have obtained secure claim to individual mineral properties or mining concessions may be severely constrained. We rely on title information and/or representations and warranties provided by our grantors. Any challenge to our title could result in litigation, insurance claims and potential losses, delay the exploration and development of a property and ultimately result in the loss of some or all of our interest in the property. In addition, if we mine on property without the appropriate title, we could incur liability for such activities.

If we obtain insurance, it may not provide adequate coverage.

Our business and operations are subject to a number of risks and hazards including, but not limited to, adverse environmental conditions, industrial accidents, labor disputes, unusual or unexpected geological conditions, ground control problems, cave-ins, changes in the regulatory environment, metallurgical and other processing problems, mechanical equipment failure, facility performance problems, fires and natural phenomena such as inclement weather conditions, floods and earthquakes. These risks could result in damage to, or destruction of, our mineral properties or production facilities, personal injury or death, environmental damage, delays in exploration, mining or processing, increased production costs, asset write downs, monetary losses and legal liability.

We do not currently have insurance, although we will obtain insurance if our public offering is successful. Our property and liability insurance may not provide sufficient coverage for losses related to these or other hazards. Insurance against certain risks, including those related to environmental matters or other hazards resulting from exploration and production, is generally not available to us or to other companies within the mining industry. In addition, we do not carry business interruption insurance relating to our properties. Accordingly, delays in returning to any future production could produce near-term severe impact to our business. Any losses from these events may cause us to incur significant costs that could have a material adverse effect on our financial performance, financial position and results of operations.

If we are unable to retain key members of management, our business might be harmed.

Our exploration activities and any future mining and processing activities depend to a significant extent on the venture agreement with have with AJA Mining, LLC & Gold Basin Mining, LLC, and our continued service and performance of our Chief Executive Officer. Departures by any of our Directors or management could have a negative impact on our business, as we may not be able to find suitable personnel to replace departing management on a timely basis. The loss of any member of our senior management team could impair our ability to execute our business plan and could therefore have a material adverse effect on our business, results of operations and financial condition. In addition, the international mining industry is very active and we are facing increased competition for personnel in all disciplines and areas of operation. There is no assurance that we will be able to attract and retain personnel to sufficiently staff our development and operating teams.

Changes in the market price of gold, silver and other metals, which in the past has fluctuated widely, will affect the profitability of our operations and financial condition.

Our profitability and long-term viability depend, in large part, upon the market price of gold, copper, silver and other metals and minerals produced from our mineral properties. The market price of gold and other metals is volatile and is impacted by numerous factors beyond our control, including:

- sales by central banks and other holders, speculators and producers of gold and other metals in response to any of the below factors.

- the relative strength of the U.S. dollar and certain other currencies;

- interest rates;

- global or regional political, financial, or economic conditions;

- supply and demand for jewelry and industrial products containing metals; and

- expectations with respect to the rate of inflation;

A material decrease in the market price of gold and other metals could affect the commercial viability of our properties and our anticipated development and production assumptions. Lower gold prices could also adversely affect our ability to finance future development at all of our mining properties, all of which would have a material adverse effect on our financial condition and results of operations. There can be no assurance that the market price of gold and other metals will remain at current levels or that such prices will improve.

We will be required to locate mineral reserves for our long-term success.

Because mines have limited lives based on proven and probable mineral reserves, we will have to continually replace and expand our mineral reserves, if any, when the Copper Blowout Ridge produces copper, gold and other base or precious metals. Our ability to maintain or increase the property’s annual production of copper or other base or precious metals will be dependent almost entirely on our ability to bring new mines into production.

Legislation, including the Sarbanes-Oxley Act of 2002, may make it difficult for us to retain or attract officers and directors.

We may be unable to attract and retain qualified officers, directors and members of board committees required to provide for our effective management as a result of rules and regulations which govern publicly-held companies. Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of directors and executive officers. We are a small company with a very limited operating history, which may influence the decisions of potential candidates we may recruit as directors or officers. The perceived increased personal risk associated with these recent changes may deter qualified individuals from accepting these roles.

We may fail to identify attractive acquisition candidates or joint ventures or may fail to successfully integrate acquired mineral properties or successfully manage joint ventures.

As part of our business strategy, we may acquire additional mineral properties or enter into joint ventures. However, there can be no assurance that we will be able to identify attractive acquisition or joint venture candidates in the future or that we will succeed at effectively managing their integration or operation. In particular, significant and increasing competition exists for mineral acquisition opportunities throughout the world. We face strong competition from other mining companies in connection with the acquisition of properties producing, or capable of producing, metals as well as in entering into joint ventures with other parties. If the expected synergies from such transactions do not materialize or if we fail to integrate them successfully into our existing business or operate them successfully with our joint venture partners, or if there are unexpected liabilities, our results of operations could be adversely affected.

In connection with any future acquisitions or joint ventures, we may incur indebtedness or issue equity securities, resulting in increased interest expense or dilution of the percentage ownership of existing stockholders. Unprofitable acquisitions or joint ventures, or additional indebtedness or issuances of securities in connection with such acquisitions or joint ventures, may adversely affect the price of our common stock and negatively affect our results of operations.

We may be subject to claims and legal proceedings that could materially adversely impact our financial position, financial performance and results of operations.

We may be subject to claims or legal proceedings covering a wide range of matters that arise in the ordinary course of business activities. These matters may result in litigation or unfavorable resolution which could materially adversely impact our financial performance, financial position and results of operations.

We are subject to environmental laws, regulations and permits that may subject us to material costs, liabilities and obligations.

We are subject to Federal and State environmental laws, regulations and permits in the jurisdiction in which we operate, including those relating to, among other things, the removal and extraction of natural resources, the emission and discharge of materials into the environment, including greenhouse gas emissions, plant and wildlife protection, remediation of soil and groundwater contamination, reclamation and closure of properties, including tailings and waste impoundments, groundwater quality and availability, and the handling, storage, transport and disposal of wastes and hazardous materials. Pursuant to such requirements we may be subject to inspections or reviews by governmental authorities. Failure to comply with these environmental requirements may expose us to litigation, fines or other sanctions, including the revocation of permits and suspension of operations. We expect to incur significant capital and other compliance costs related to such requirements. These laws, regulations and permits, and the enforcement and interpretation thereof, change frequently and generally have become more stringent over time.

Certain environmental laws impose joint and several strict liability for releases of hazardous substances at properties or sites, without regard to fault or the legality of the original conduct. Accordingly, we may be held responsible for more than our share of the contamination or other damages, up to and including the entire amount of such damages. In addition to potentially significant investigation and remediation costs, such matters can give rise to claims from governmental authorities and other third parties, including for orders, inspections, fines or penalties, natural resource damages, personal injury, property damage, toxic torts and other damages. Our costs, liabilities and obligations relating to environmental matters could have a material adverse effect on our financial performance, financial position and results of operations.

There is no existing market for our common stock and we do not know if one will develop. Even if a market does develop, the stock price in the market may not exceed the offering price.

Prior to this offering, there has not been a public market for our common stock. We cannot predict the extent to which investor interest in our Company will lead to the development of an active trading market on the OTCBB or otherwise, or how liquid that market may become. An active trading market for our common stock may not develop and even if it does develop, may not continue upon the completion of this offering and the market price of our common stock may decline below the initial public offering price. Consequently, you may not be able to sell shares of our common stock at prices equal to or greater than the price you pay in this offering.

The market price of our common stock may be volatile, which could result in substantial losses for you.

The initial public offering price may vary from the market price of our common stock after this offering. Some of the factors that may cause the market price of our common stock to fluctuate include:

|

|

• |

|

failure to identify mineral reserves at our properties; |

|

|

• |

|

failure to achieve production at our mineral properties; |

|

|

• |

|

actual or anticipated changes in the price of silver and base metal by-products; |

|

|

• |

|

fluctuations in our quarterly and annual financial results or the quarterly and annual financial results of companies perceived to be similar to us; |

|

|

• |

|

changes in market valuations of similar companies; |

|

|

• |

|

success or failure of competitor mining companies; |

|

|

• |

|

changes in our capital structure, such as future issuances of securities or the incurrence of debt; |

|

|

• |

|

sales of large blocks of our common stock; |

|

|

• |

|

announcements by us or our competitors of significant developments, contracts, acquisitions or strategic alliances; |

|

|

• |

|

changes in regulatory requirements and the political climate in the United States; |

|

|

• |

|

litigation involving our Company, our general industry or both; |

|

|

• |

|

additions or departures of key personnel; |

|

|

• |

|

investors’ general perception of us, including any perception of misuse of sensitive information; |

|

|

• |

|

changes in general economic, industry and market conditions; |

|

|

• |

|

accidents at mining properties, whether owned by us or otherwise; |

|

|

• |

|

natural disasters, terrorist attacks and acts of war; and |

|

|

• |

|

our ability to control our costs. |

In addition, if the market for stocks in our industry, or the stock market in general, experiences a loss of investor confidence, the trading price of our common stock could decline for reasons unrelated to our business, financial condition or results of operations. If any of the foregoing occurs, it could cause our stock price to fall and may expose us to lawsuits that, even if unsuccessful, could be both costly to defend against and a distraction to management.

Broker-dealers may be discouraged from effecting transactions in our common shares because they are considered a penny stock and are subject to the penny stock rules.

Rules 15g-1 through 15g-9 promulgated under the Exchange Act impose sales practice and disclosure requirements on certain brokers-dealers who engage in certain transactions involving a “penny stock.” Subject to certain exceptions, a penny stock generally includes any non-NASDAQ equity security that has a market price of less than $5.00 per share. Our common stock has traded below $5.00 per share throughout its trading history. The additional sales practice and disclosure requirements imposed upon broker-dealers may discourage broker-dealers from effecting transactions in our shares, which could severely limit the market liquidity of the shares and impede the sale of our shares in the secondary market.

A broker-dealer selling penny stock to anyone other than an established customer or “accredited investor,” generally, an individual with net worth in excess of $1,000,000 or an annual income exceeding $200,000, or $300,000 together with his or her spouse, must make a special suitability determination for the purchaser and must receive the purchaser’s written consent to the transaction prior to sale, unless the broker-dealer or the transaction is otherwise exempt. In addition, the penny stock regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the United States Securities and Exchange Commission relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to the broker-dealer and the registered representative and current quotations for the securities. Finally, a broker-dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer’s account and information with respect to the limited market in penny stocks.

Our current Director holds the only voting stock for the company. This will prevent any shareholders who purchase our nonvoting stock from having the ability to control any of our corporate actions. As a result, he can exercise substantial control over stockholder and corporate actions.

Our Director currently controls the only voting stock in the Company. This means that any corporate transactions can be completed only at his discretion. As a result of this substantial control of our voting stock, our CEO will have total control over the entire company. This concentration of ownership may also have the effect of delaying or preventing a change in control, which in turn could have a material adverse effect on the market price of the Company’s common stock or prevent stockholders from realizing a premium over the market price for their Shares. In addition, this ownership could discourage the acquisition of our common stock by potential investors and could have an anti-takeover effect, possibly depressing the trading price of our common stock. Our Director has the ability to control various corporate decisions, including our direction and policies, the election of directors, the content of our charter and bylaws and the outcome of any other matter requiring stockholder approval, including a merger, consolidation and sale of substantially all of our assets or other change of control transaction. The concurrence of our Class B stockholders will not be required for any of these decisions.

FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements,” which include information relating to future events, future financial performance, strategies, expectations, competitive environment, regulation and availability of resources. These forward-looking statements include, without limitation, statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operating results, and future economic performance; and statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. Words such as “may,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar expressions, as well as statements in future tense, identify forward-looking statements.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time those statements are made or management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

|

|

our ability to retain the continued service of our key professionals and to identify, hire and retain additional qualified professionals; | |

|

|

general economic conditions, nationally and globally, and their effect on the market for our services; | |

|

|

changes in laws, regulations, or policies; our ability to successfully manage our growth strategy; | |

|

|

other factors identified throughout this prospectus, including those discussed under the headings “Risk Factors |

Forward-looking statements speak only as of the date the statements are made. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions, or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

USE OF PROCEEDS

If we are able to sell all of the shares of our common stock we are offering through this prospectus, then we will raise gross proceeds of $25,000,000. There is no assurance we will be able to raise additional funds, and further, our officers and directors are under no contractual obligation to make additional investments or otherwise advance funds in support of the Company.

Our offering is being made on a self-underwritten basis. No minimum number of shares must be sold in order for the offering to proceed. The offering price per share is $.25. The following table sets forth the uses of proceeds assuming the sale of 25%, 50%, 75% and 100%, respectively, of the securities offered for sale by us.

|

USE OF PROCEEDS |

|

If 25% of the Shares are Sold |

|

If 50% of the Shares are Sold |

|

If 75% of the Shares are Sold |

|

If 100% of the Shares are Sold | ||||||||

|

|

|

|

|

|

|

|

|

| ||||||||

|

Gross Proceeds |

|

$ |

6,250,000 |

|

$ |

12,500,000 |

|

|

$ |

18,750,000 |

|

|

$ |

25,000,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

Operational Expenses (1)* |

|

|

250,000 |

|

|

500,000 |

|

|

|

1,000,000 |

|

|

|

1,500,000 |

| |

|

Drilling & Geology, Copper Blowout Ridge (4) |

|

|

2,000,000 |

|

|

4,000,000 |

|

|

|

5,250,000 |

|

|

|

7,500,000 |

| |

|

Mine Acquisition (3) |

|

|

2,000,000 |

|

|

4,000,000 |

|

|

|

7,000,000 |

|

|

|

9,000,000 |

| |

|

Site Improvement for Blowout Ridge (2) |

300,000 |

600,000 |

900,000 |

1,200,000 |

| |||||||||||

|

Working Capital/Cash Reserves |

|

|

1,500,000 |

|

|

|

3,000,000 |

|

|

|

4,000,000 |

|

|

|

5,000,000 |

|

|

Equipment & property purchase for Copper Blowout (5) |

200,000 |

400,000 |

600,000 |

800,000 |

| |||||||||||

|

TOTALS |

|

$ |

6,250,000 |

|

$ |

12,500,000 |

|

|

$ |

18,750,000 |

|

|

$ |

25,000,000 |

| |

(1) Includes: Executive salaries, general overhead, licensing and permitting fees.

* - Our general and administrative expenses consist of: professional fees, such as legal, audit and accounting, transfer agent and filing agent fees; office expenses; officers compensation; salaries and other miscellaneous expenses related to our general corporate activities and implementation of our business plan. Currently, we do not have any arrangements for additional financing. If we are not able to obtain needed financing and generate sufficient revenue from operations, we may have to cease operations. We intend to repay an open promissory note from proceeds out of the operational expenses. The total amount on the note is $13,015.

(2) Site improvement includes obtaining permits and equipment for road grading, fencing, locating and drilling water wells, and other improvements on the mining claims.

(3) Includes the cost of seeking, investigating, purchasing, and capital for bringing acquired mines into production.

(4) This includes costs for obtaining bonding, general liability insurance, permitting, contracting with a third-party company for core drilling for our JV on the copper blowout ridge, storing core samples as a secured facility, shipping the core samples to an assayer for analysis, and hiring geologists to conduct further geology on the properties.

(5) This includes costs for obtaining vehicles to be used on the mining claims, for purchasing private property in Meadview, AZ for storing core samples, employee housing, and securing other equipment and tools we acquire.

DETERMINATION OF OFFERING PRICE

There is no established market for our common stock. The Offering Price of the Shares has been determined arbitrarily by the Company and bears no direct relationship to our assets, book value, earnings, or other established criteria for valuing a privately held company. In determining the number of Shares to offer and the Offering Price, we took into consideration our capital structure and the amount of money we would need to implement our business plan. The Offering Price of the Shares should not be considered an indication of the actual or subsequent trading value of our common stock.

Our Director, Lacome, purchased 100,000,000 shares at par value, for a total of $100, as founder’s shares. Our President & CEO, Brown, received stock in exchange for director/officer’s services. The price and/or value paid by both directors had no bearing on determining our offering price.

DILUTION

Dilution represents the difference between the offering price and the net tangible book value per share immediately after completion of this offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of our arbitrary determination of the offering price of the shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of the shares held by our existing stockholders. We intend to sell 100,000,000 shares of our common stock at a price of $0.25 per share. The following table sets forth the number of shares of common stock purchased from us, the total consideration paid and the price per share. The table assumes all 100,000,000 shares of common stock will be sold.

|

|

|

Shares Issued |

|

|

Total Consideration |

|

|

|

| |||||||||||

|

|

|

Number of Shares |

|

|

Percent |

|

|

Amount |

|

|

Percent |

|

|

Price Per Share |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Existing Shareholder |

|

|

127,300,000 |

|

|

|

56 |

% |

|

$ |

2,400 |

|

|

|

0.01 |

% |

|

$ |

0.001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchasers of Shares |

|

|

100,000,000 |

|

|

|

44 |

% |

|

$ |

25,000,000 |

|

|

|

99.09 |

% |

|

$ |

0.25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

227,300,000 |

|

|

|

100 |

% |

|

$ |

25,002,400 |

|

|

|

100 |

% |

|

|

|

|

The following table sets forth the difference between the offering price of the shares of our common stock being offered by us, the net tangible book value per share, and the net tangible book value per share after giving effect to the offering by us, assuming that 100%, 75%, and 50% of the offered shares are sold. Net tangible book value per share represents the amount of total tangible assets less total liabilities divided by the number of shares outstanding as of September 30, 2014. Totals may vary due to rounding.

|

If 100% of the Shares are Sold |

If 75% of the Shares are Sold |

If 50% of the Shares are Sold |

If 25% of the Shares are Sold | |

|

|

|

|

|

|

|

Offering price per share |

$0.25 |

$0.25 |

$0.25 |

$0.25 |

|

Book value per share before offering |

$0.00026 |

$0.00026 |

$0.00026 |

$0.00026 |

|

Book value per share after offering |

$0. 11013 |

$0.09285 |

$0.07069 |

$0.04126 |

|

Increase in net tangible book value per share attributable to cash payments made by new investors |

$0.10987 |

$0.09259 |

$0.07043 |

$0.04100 |

|

Per share dilution to new Investors |

$0.13987 |

$0.15715 |

$0.17931 |

$0.20874 |

|

Percentage Dilution to new investors |

56% |

63% |

72% |

84% |

BUSINESS DESCRIPTION

The Company

Seirra Madre mining is an exploration stage company. We have no subsidiaries. The Company has not been the subject of any bankruptcy, receivership or similar proceedings or any reclassification, merger or consolidation proceedings. We have not generated revenue from mining operations. We are engaged in the business of acquisition and exploration of mineral properties. The Company has a 20% ownership interest in 200 lode mining claims located in Mohave County, Arizona. The other 80% mineral owners are either AJA Mining, LLC, or Gold Basin Exploration, LLC, whom we have a JV with. Throughout the prospectus we may refer to the claims as the “Copper Blowout Ridge,” “Arizona Mine,” “Blowout Ridge,” “Gold Hill,” “our claims” or “the claims.”

We have an option to purchase, within two years, the remaining 80% ownership interest in the 200 lode claims. The terms of the purchase are included with the JV agreement we signed with AJA & Gold Basin. We will keep our 20% ownership interest as long as we continue to pay our portion of the annual BLM fees. There is a 2% NSR that AJA & Gold Basin will retain during this period, and even after we elect to exercise our option to purchase the remaining 80% ownership interest. We are presently in the exploration stage at the Property.

Mineral property exploration is typically conducted in phases. The exploration activities have so far been taking surface samples. Our next phase would be to conduct core drilling, which we lack the funding to do. Once we have completed each phase of exploration and analyzed the results, we will make a decision as to whether we will proceed with each successive phase. Our Board will make decisions on whether to proceed or not, based on our drilling results. Our goal in exploration of the Property is to ascertain whether it possesses economic quantities of mineralization. We cannot assure you that any economical mineral deposits exist on the Property until appropriate exploration work is completed. Even if we complete our proposed exploration program on the Property and we are successful in identifying a mineral deposit, we will have to spend substantial funds on further drilling and engineering studies before we will know if we have a commercially viable mineral deposit.

2% NSR

If we ever go into operation on the mining claims, we will pay a 2% NSR to AJA Mining & Gold Basin Mining. Payments will be made quarterly, no later than 20 business days following the end of each calendar quarter. Quarterly royalty payments will be provisional and subject to adjustment at the end of Lessee's accounting year. If no written objection is made by Lessor to the correctness of a royalty payment or its accompanying statement within two years from the date of such payment, such statement shall be conclusively deemed to be correct and such royalty payment sufficient and complete, and no exception or claim for adjustment shall thereafter be permitted.

The term "NSR" means the dollar amount actually received by Lessee from the sale of minerals from the Property less costs of shipping, insurance and transportation. All payments and royalties payable hereunder may be made by Lessee’s check, and delivery thereof shall be deemed completed on the mailing thereof to Lessor.

Option to Purchase

Sierra has the option to purchase the remaining 80% ownership interest in all 200 claims from AJA & Gold Basin Mining under any of the following options 1) $30,000,000 cash, to be made within 30 days of triggering the option, 2) $15 million cash, plus $20 million worth of Sierra class B common stock, based on the preceding six month average closing price for Sierra’s stock, 3) paying AJA $250,000 per month, starting 12/15/15, for a period of up to 24 months. At any time during the 24 month period Sierra may purchase the claims for $30,000,000. The monthly payments do not offset the purchase price. b) The buyout option terminates after 24 months, starting January 1st, 2015 if Sierra elects not to purchase the claims.

JV Operators

Our JV Operators for copper blowout are Keith Jay, Thomas Arkoosh, and John Arkoosh. The JV agreement includes a clause that we register part of the shares issued to AJA and Gold Basin with our S-1. We mutually agreed not to register their shares with this S-1, but may register the LLC member’s shares in the future. The JV Operators, and the LLC’s, under our agreement, are not required to fund any of the exploration activities.

Keith S. Jay - Mr. Jay, age 60, received a B.A. in Biochemistry from the University of Wisconsin-Madison in 1977 and has been involved in the mining industry for over 30 years. Positions included Operations Manager, Mill Superintendent, Project Manager of mining and mineral processing companies, as well a partner in mineral exploration companies in the Southwest, USA. Mr. Jay is also a Certified Environmental Manager in Nevada performing consulting activities for permitting mining exploration and processing activities, interfacing with both Federal BLM and State EPA agencies for environmental compliance and financial guarantees with successful approvals to proceed.

Thomas J. Arkoosh - Mr. Arkoosh, age 50, received a B.A. from the University of Washington and has worked in various positions with mining companies for 20 years. Mr. Arkoosh is a Mine Safety and Health Administration (MSHA) instructor performing mine safety and training to mine workers. Mr. Arkoosh has worked in mineral processing as well as a primary landman for the proper mine claim-staking and property acquisition. Mr. Arkoosh also assisted in claim survey and exploration seismic activities for AJA Mining, LLC & Gold Basin Exploration, LLC.

John T. Arkoosh, Sr. - Mr. Arkoosh, age 66, graduated from the University of Washington (1971) with a B.A. in Finance and University of California (1974) B.S. in Accounting. Mr. Arkoosh worked for British Petroleum (BP) Alaska Exploration, Inc., a 100% subsidiary of British Petroleum, Inc. starting as an accountant and eventually becoming Controller. During his tenure, Mr. Arkoosh has acquired knowledge in accounting, budgeting, and contracts in the area of commodities. Recently, Mr. Arkoosh has co-founded two Limited Liability Companies (LLC) – AJA Mining, and Gold Basin Exploration, LLC, in mineral prospecting.

Surface Samples

In July, 2014, AJA Mining took twenty rock samples from the copper blowout ridge. The samples were taken from twenty outcroppings that were located in a 40 acre area on the copper blowout ridge. The samples were conducted by Skyline Assayers & Laboratories in Tucson, Arizona. The results are included as an exhibit with our S-1. This has been the only sampling that we know of that has been done. In summary, the samples taken showed Cu from 0 to 12.9%, Fe from 0 to 36.9%, and Au from 0 to 4.95 grams/Mt.

The Mineral Claims

The Claims are described as the our mining claims are recorded in Mohave County, Arizona, in the name of AJA Mining, LLC and Gold Basin Exploration, LLC, with a 20% ownership interest to Sierra Madre Mining. The following are the serial numbers of the recorded claims. The claims are in good standing as of the date of this prospectus.

|

NAME |

AMC # |

NAME |

AMC # |

NAME |

AMC # |

NAME |

AMC # |

NAME |

AMC # |

|

TUT-1 |

AMC415013 |

BB-1 |

AMC420119 |

AJA-1 |

AMC413510 |

GBM-1 |

AMC420131 |

GBM-38 |

AMC420168 |

|

TUT-2 |

AMC415014 |

BB-2 |

AMC420120 |

AJA-2 |

AMC413511 |

GBM-2 |

AMC420132 |

GBM-39 |

AMC420169 |

|

TUT-3 |

AMC415015 |

BB-3 |

AMC420121 |

AJA-3 |

AMC413512 |

GBM-3 |

AMC420133 |

GBM-40 |

AMC420170 |

|

TUT-4 |

AMC415016 |

BB-4 |

AMC420122 |

AJA-4 |

AMC413513 |

GBM-4 |

AMC420134 |

GBM-41 |

AMC420171 |

|

TUT-5 |

AMC415017 |

BB-5 |

AMC420123 |

AJA-5 |

AMC413514 |

GBM-5 |

AMC420135 |

GBM-42 |

AMC420172 |

|

TUT-6 |

AMC415018 |

BB-13 |

AMC425251 |

AJA-6 |

AMC413515 |

GBM-6 |

AMC420136 |

GBM-43 |

AMC420173 |

|

TUT-7 |

AMC415019 |

BB-14 |

AMC425252 |

AJA-7 |

AMC413516 |

GBM-7 |

AMC420137 |

GBM-44 |

AMC420174 |

|

TUT-8 |

AMC415020 |

BB-15 |

AMC425253 |

AJA-8 |

AMC413517 |

GBM-8 |

AMC420138 |

GBM-45 |

AMC420175 |

|

TUT-9 |

AMC415597 |

BB-16 |

AMC425254 |

AJA-9 |

AMC413518 |

GBM-9 |

AMC420139 |

GBM-46 |

AMC420176 |

|

TUT-10 |

AMC415598 |

BB-17 |

AMC425255 |

AJA-10 |

AMC413519 |

GBM-10 |

AMC420140 |

GBM-47 |

AMC420177 |

|

TUT-11 |

AMC415599 |

BB-18 |

AMC425256 |

AJA-11 |

AMC413520 |

GBM-11 |

AMC420141 |

GBM-48 |

AMC420178 |

|

TUT-12 |

AMC415600 |

BB-19 |

AMC425257 |

AJA-12 |

AMC413521 |

GBM-12 |

AMC420142 |

GBM-49 |

AMC420179 |

|

TUT-13 |

AMC415601 |

BB-20 |

AMC425258 |

AJA-13 |

AMC413769 |

GBM-13 |

AMC420143 |

GBM-50 |

AMC420180 |

|

TUT-14 |

AMC415602 |

BB-21 |

AMC425259 |

AJA-14 |

AMC414246 |

GBM-14 |

AMC420144 |

GBM-51 |

AMC420181 |

|

TUT-15 |

AMC415603 |

BB-22 |

AMC425260 |

AJA-15 |

AMC414247 |

GBM-15 |

AMC420145 |

GBM-52 |

AMC420182 |

|

TUT-16 |

AMC415604 |

BB-23 |

AMC425261 |

AJA-16 |

AMC414248 |

GBM-16 |

AMC420146 |

GBM-53 |

AMC420183 |

|

TUT-17 |

AMC416173 |

BB-24 |

AMC425262 |

AJA-17 |

AMC414249 |

GBM-17 |

AMC420147 |

GBM-54 |

AMC420184 |

|

TUT-18 |

AMC416174 |

BB-25 |

AMC425263 |

AJA-18 |

AMC414252 |

GBM-18 |

AMC420148 |

GBM-55 |

AMC420185 |

|

TUT-19 |

AMC416175 |

BB-26 |

AMC425264 |

AJA-19 |

AMC414253 |

GBM-19 |

AMC420149 |

GBM-56 |

AMC420186 |

|

TUT-20 |

AMC416176 |

BB-27 |

AMC425265 |

AJA-20 |

AMC414254 |

GBM-20 |

AMC420150 |

GBM-57 |

AMC420187 |

|

TUT-21 |

AMC416177 |

BB-28 |

AMC425266 |

AJA-21 |

AMC414255 |

GBM-21 |

AMC420151 |

GBM-58 |

AMC420188 |

|

TUT-22 |

AMC416178 |

BB-29 |

AMC425267 |

AJA-22 |

AMC414256 |

GBM-22 |

AMC420152 |

GBM-59 |

AMC420189 |

|

TUT-23 |

AMC416179 |

BB-30 |

AMC425268 |

AJA-23 |

AMC414257 |

GBM-23 |

AMC420153 |

GBM-60 |

AMC420190 |

|

TUT-24 |

AMC416180 |

BB-31 |

AMC425269 |

AJA-24 |

AMC414258 |

GBM-24 |

AMC420154 |

GBM-61 |

AMC420191 |

|

TUT-25 |

AMC416181 |

BB-32 |

AMC425270 |

AJA-25 |

AMC414259 |

GBM-25 |

AMC420155 |

GBM-62 |

AMC420192 |

|

TUT-26 |

AMC416182 |

BB-33 |

AMC425271 |

AJA-26 |

AMC414260 |

GBM-26 |

AMC420156 |

GBM-63 |

AMC420193 |

|

TUT-27 |

AMC416183 |

BB-40 |

AMC425272 |

AJA-27 |

AMC414261 |

GBM-27 |

AMC420157 |

TUT-48 |

AMC416665 |

|

TUT-28 |

AMC416184 |

BB-41 |

AMC425273 |

AJA-28 |

AMC414262 |

GBM-28 |

AMC420158 |

TUT-49 |

AMC416666 |

|

TUT-29 |

AMC416646 |

BB-42 |

AMC425274 |

AJA-29 |

AMC414263 |

GBM-29 |

AMC420159 |

TUT-50 |

AMC416667 |

|

TUT-30 |

AMC416647 |

BB-43 |

AMC425275 |

AJA-30 |

AMC414264 |

GBM-30 |

AMC420160 |

TUT-51 |

AMC416668 |

|

TUT-31 |

AMC416648 |

BB-44 |

AMC425276 |

AJA-31 |

AMC414265 |

GBM-31 |

AMC420161 |

TUT-52 |

AMC416669 |

|

TUT-32 |

AMC416649 |

BB-45 |

AMC425277 |

AJA-32 |

AMC414266 |

GBM-32 |

AMC420162 |

TUT-53 |

AMC416670 |

|

TUT-33 |

AMC416650 |

BB-46 |

AMC425278 |

AJA-33 |

AMC414267 |

GBM-33 |

AMC420163 |

TUT-54 |

AMC416671 |

|

TUT-34 |

AMC416651 |

BB-47 |

AMC425279 |

TUT-57 |

AMC416674 |

GBM-34 |

AMC420164 |

TUT-55 |

AMC416672 |

|

TUT-35 |

AMC416652 |

TUT-43 |

AMC416660 |

TUT-58 |

AMC416675 |

GBM-35 |

AMC420165 |

TUT-56 |

AMC416673 |

|

TUT-36 |

AMC416653 |

TUT-44 |

AMC416661 |

TUT-59 |

AMC416676 |

GBM-36 |

AMC420166 |

TUT-65 |

AMC416682 |

|

TUT-37 |

AMC416654 |

TUT-45 |

AMC416662 |

TUT-60 |

AMC416677 |

GBM-37 |

AMC420167 |

TUT-66 |

AMC416683 |

|

TUT-38 |

AMC416655 |

TUT-46 |

AMC416663 |

TUT-61 |

AMC416678 |

TUT-67 |

AMC416684 | ||

|

TUT-39 |