Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - Nodechain, Inc. | ex993.htm |

| EX-99.2 - EXHIBIT 99.2 - Nodechain, Inc. | ex992.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K/A

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Act of 1934

September 23, 2014

(Date of Report)

| Vapetek Inc. | ||

| (Exact Name of Registrant as Specified in its Charter) | ||

Delaware |

000-54994 |

46-3021464 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

7611 Slater Avenue, Unit H, Huntington Beach, CA 92647

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

(714) 916 9321

(ISSUER TELEPHONE NUMBER)

None

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | Soliciting Material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| 1 |

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This report contains forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Description of Business” and “Management's Discussion and Analysis of Financial Condition and Results of Operations”. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described in the section captioned “Risk Factors” below. In some cases, you can identify forward-looking statements by terms such as “anticipates”, “believes”, “could”, “estimates”, “expects”, “intends”, “may”, “plans”, “potential”, “predicts”, “projects”, “should”, “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements include, among other things, statements relating to:

| · | our anticipated growth strategies and our ability to manage the expansion of our business operations effectively; |

| · | our ability to keep up with rapidly changing technologies and evolving industry standards; |

| · | our ability to source our needs for skilled employees; |

| · | the loss of key members of our senior management; and |

| · | uncertainties with respect to the legal and regulatory environment surrounding our technologies. |

Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference and filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

As used in this current report, the terms the “the Company”, “Vapetek”, “we”, “us” and “our” refer to Vapetek Inc., (formerly ALPINE 2, Inc.), a Delaware company.

Explanatory Statement

This current report on 8-K/A is the second amendment to Form 8-K filed with the Securities and Exchange Commission, by the registrant on September 23, 2014. This amendment is being made in response to the staff’s comments to include additional disclosures and clarification.

| 2 |

Vapetek Inc.

Item 1.01 Entry into a Material Definitive Agreement

West Coast Vape Supply Agreement

On

April 1, 2014, Vapetek Inc. ("Vapetek" or the “Company”) entered

into a product distribution agreement with West Coast Vape Supply Inc. (the “West

Coast Vape Supply Agreement”) under a non-exclusive agreement to supply electronic

cigarettes, vaporizers, e-liquids, and accessories, and other third party products. West

Coast Vape Supply Inc. is a related party and owned 100% by the management of Vapetek Inc. West Coast Vape Supply Inc. made several

loans to the Company during the second quarter, in aggregate, $13,658. Additionally, PennyGrab Inc., a related party owned 100%

by our Chairman, loaned the Company $5,000 in the second quarter. These loans were made under the Loan Agreement (“Loan

Agreement”) and provided capital to purchase inventory and begin our operations.

As previously disclosed via Form 8-K on August 13, 2014, Vapetek entered into a Licensing Agreement (the “PennyGrab Technology Agreement”) with PennyGrab Inc. (“PennyGrab”), a related party entity 100% owned by our Chairman, Alham Benyameen, on August 11, 2014. The Company has developed its website from the PennyGrab Technology Agreement license which has been customized and designed for wholesale and retail sales of its products. The software code is a PHP website script that is 100% customizable and is SEO friendly that improves site search engines rankings. The software code is the “Licensed Technology.”

Pursuant to the Agreement, PennyGrab granted to the Company an exclusive, transferable (including sublicensable) worldwide perpetual license of the Licensed Technology, to make, use, lease, and sell products incorporating the Licensed Technology (the “Licensed Products”). The Company is required to pay to PennyGrab royalty payments equal to $100 (One Hundred Dollars) per year.

The term of the Agreement is ongoing and effective as of August 11, 2014.

Item 2.01 Completion of Disposition or Acquisition of Assets

As described above under Item 1.01, the Company entered into an agreement with West Coast Vape Supply Inc., pursuant to which the Company began operations to supply its products for distribution and sale to fulfill its performance per the agreement.

Upon consummation of the transaction above and in light of our current business operations, sales, and products that we now have available for sale, we have furnished herein Form 10 like information. Is does not however, include each and every item as would otherwise be disclosed if we had acquired or merged with another Company. The information below corresponds to the item numbers of Form 10 under the Exchange Act.

| 3 |

Item 1. Description of Business

(a) Business of Issuer

Vapetek Inc., formerly, ALPINE 2 Inc. was incorporated in the State of Delaware on June 18, 2013 and on July 3, 2013, filed a registration statement on Form 10 to register with the U.S. Securities and Exchange Commission (the "SEC") as a public company. The Form 10 automatically became effective by lapse of time 60 days after it was filed. . On March 6, 2014, we entered into a Share Purchase Agreement with Alham Benyameen and Andy Michael Ibrahim whereby Richard Chiang our Chairman of the Board of Directors, President, CEO, CFO and Secretary elected Mr. Benyameen as our Chairman of the Board of Directors and Mr. Ibrahim as our President, CEO, CFO, Secretary and Member of our Board of Directors. Under the terms of the agreement, Mr. Chiang sold his 7,200,000 shares of ALPINE 2 Inc. to Mr. Benyameen and Mr. Ibrahim for $20,000, and resigned his positions. Upon the closing of our Share Purchase Agreement, we entered into an employment agreement with Mr. Benyameen and Mr. Ibrahim as officers and directors of ALPINE 2 Inc. We issued in advance 20,000,000 shares of our common stock to Mr. Benyameen and 20,000,000 shares of our common stock to Mr. Ibrahim. These shares were valued at par $0.0001 at the time of transfer. Immediately after the closing of the Share Purchase Agreement, we had 50,000,000 shares of common stock outstanding, no shares of preferred stock, no options, and no warrants outstanding. On March, 12, 2014, we filed a certificate of amendment of certificate of incorporation with the State of Delaware and on March 25, 2014, officially amended our name from ALPINE 2 Inc., to Vapetek Inc.

The Company is a smaller reporting company under SEC Rule 405 because it is currently not trading, has a public float of zero and annual revenues of less than $50 million during the most recently completed fiscal year for which audited financial statements are available. As a smaller reporting company, pursuant to Rule 8-01 of Regulation S-X, the Company is only required to produce financial statements as follows: (a) audited balance sheet as of the end of each of the most recent two fiscal years, or as of a date within 135 days if the issuer has existed for a period of less than one fiscal year, (b) audited statements of income, cash flows and changes in stockholders' equity for each of the two fiscal years preceding the date of the most recent audited balance sheet (or such shorter period as the registrant has been in business), and (c) interim reviewed financial statements for the current period if the filing is more than 135 days after the end of your fiscal year. Any and all amendments shall include updated interim or audited financial statements if the financial statements in the prior filing are more than 135 days old.

Vapetek is a technology company engaged in developing, marketing and selling electronic cigarettes (“e-cig”), e-liquids, rechargeable batteries and vapor devices in the emerging growth e-cigarette industry.

The Company’s business product mix currently stands at 25% e-liquids and 75% devices, which consist of e-cig, rechargeable batteries and vapor devices. During our second quarter-ended June 30, 2014, all of our revenues came from 3 products; The Vapetek Liquivape e-Liquid, 1100 mAh Vapetek Batteries and our DA Blaster product.

*All of our current products are third party products created by third party manufacturers branded under our own trademark.

Current Products

| Ø | Devices: The Vhit DABlaster Atomizer. Designed for wax, its portability is its main focus. The DABlaster is 510 threaded and connects directly to most electronic cigarette pens. The DABlaster can be used to heat up dry wax within seconds, insuring satisfying vapor. This product is made from premium stainless steel and pyrex glass tube ,a standard 510 thread and is commercially available. We began sales of our Vhit DABlaster Atomizer product on May 30, 2014. |

| 4 |

| Ø | Devices: Electronic Battery Starter Kit. This product is designed as the Company’s vaporizer starter kit with an adjustable variable voltage that gives the user complete control when vaporizing dry herb or wax. This product is commercially available. We began sales of our Electronic Battery Starter Kit on June 25, 2014. |

| Ø | Vapetek Liquivape e-Liquid: The VapetekLiquivape-liquid is a branded line of flavored cartridges in 15 milligram sizes with several flavors. Key ingredients that we use in e-liquids are all U.S. pharmacopeia (USP) grade and kosher. This product is commercially available. We began sales of our Vapetek Liquivape e-Liquid on May 9, 2014 |

Current Flavor Offerings

| · | Liquivape eJuice Strawbomb Mellon |

| · | Liquivape eJuice Willy's Berry Lemonade |

| · | Liquivape eJuice Orange Julius |

| · | Liquivape eJuice Redhead |

| · | Liquivape eJuice Apple Tropicana |

| · | Liquivape eJuice Grapevape |

| · | Liquivape eJuice Cookie Boy |

| · | Liquivape eJuice SnicSnax |

| · | Liquivape eJuice Java the Hut |

| · | Liquivape eJuice The Red Pack |

| · | Liquivape eJuice The White Pack |

| · | Liquivape eJuice The 100s Pack |

| · | Liquivape eJuice The Turkish Crush |

| · | Liquivape eJuice The Cuban Cigar |

Our Vapetek Liquivape e-Liquid contain low levels of nicotine which are disclosed on our bottles. Our e-Liquids carry 6 milligrams, 12 milligrams and 18 milligrams, but no amounts higher than these . Please review our Risk Factors section particularly on page 24, for information related to the risks of nicotine exposure and toxicity through contact with these liquids.

U.S. pharmacopeia (USP) grade means our e-liquids are meet the product quality and standards set by The United States Pharmacopeial Convention, a non-profit organization that publishes food ingredients and dietary supplements. Food ingredients, flavorings and colorings, are reviewed by the USP and these standards are used by regulatory agencies and manufacturers to help ensure that these products are of appropriate identity, as well as strength, quality, purity and consistency.

| 5 |

On August 26, 2014, the Company began shipping its e-Liquid flavored cartidges to a new customer in Japan, that particular shipment did not contain any nicotine. The Company expects to continue developing international sales of its products, in markets that it considers to be emerging for e-cigarette devices and products.

Future Product Offerings

Our manufacturing partners in China have already developed the following products. We expect to carry these products in the near future. Our manufacturers would be able to deliver these products within 30 days of our paid purchase order. Our cost associated for each product is subject to change.

| Ø | Devices: The eJoint electronic cigarette. A compact two-piece device which allows the cartridge to be disposable for easy use, and an efficient tank system that allows a user to vape, or to "vaporize" liquid inexpensively. The battery, e-liquid cartridge and coil can also be easily replaced. The eJoint electronic cigarette has been developed by a manufacturer in China and we seek to initially purchase 500 units at a cost of $18.00 dollars per unit. We anticipate that our cost for initial shipment will be $9,000. |

| Ø | Devices: EVO Personal Vaporizer. The Vapetek EVO personal vaporizer will feature a display system which makes changing settings easy. As an advanced technology product, the Vapetek EVO will bring digitization to the vapor industry. The EVO Personal Vaporizer has been developed by a manufacturer in China and is commercially available to purchasers. We seek to meet their initial purchase requirements at 1,000 units at a cost of $13.50 dollars per unit. We anticipate that our cost for initial shipment will be $13,500. |

| Ø | Vapet ek Atomizer Jig Tool: We recently paid a 30% deposit of $2,580.00 for the purchase of 2,000 units at $4.00 per unit on October 24, 2014. We expect to purchase 5,000 units on our next order; our cost will be approximately $40,000.00. |

| Ø | Devices: The Vhit DABlaster Mini Atomizer. The DABlaster Mini Atomizer is a smaller version of the Vhit DABlaster Atomizer. As the Vhit DABlaster Atomizer, it focuses on its portability feature. Made from premium machined stainless steel and Pryex glass tube, it is eGO threaded and will connect directly to most electronic cigarette pens. We expect to purchase our first order of 5,000 units and anticipate our cost to be $25,000. |

| Ø | Devices: Aluminum OHM Reader. The Aluminum OHM Reader tests cartomizers and atomizers without having to use a meter. It is used to test the current flow of electronic devices. The Aluminum OHM Reader has been developed by a manufacturer in China and we purchased 200 units on October 17, 2014 and will purchase 1,000 units on our next order, our cost will be $11,000.00 for 1,000 units. |

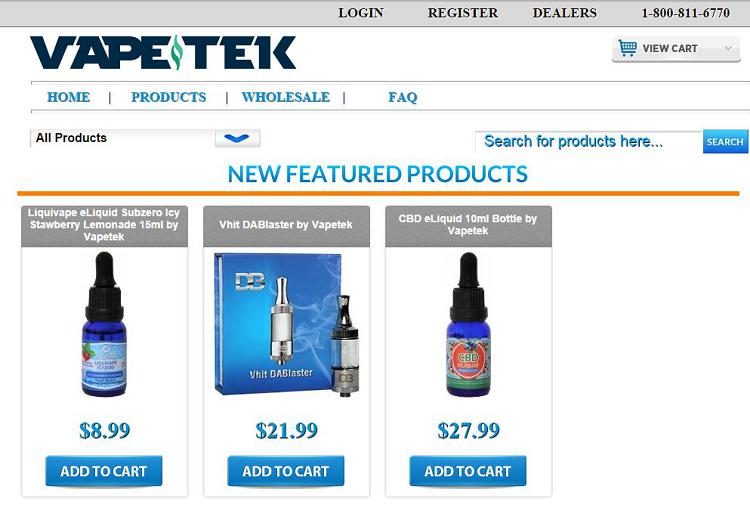

Corporate Website

Vapetek entered into a Licensing Agreement through its PennyGrab Technology Agreement with PennyGrab Inc. The website has been customized and designed for wholesale and retail sales of its products in an effort to become its interface with its customers both domestically and internationally. The Company has featured several of its products for sale to both wholesale and retail customer on its website located on the Internet at www.vapetek.com and seeks to establish a presence online to further develop its brand and network with customers.

| 6 |

The Company’s philosophy behind its website is to attract customers with consumer-friendly search engine optimization (“SEO”) marketing campaigns. These SEOs are intended to draw purchasers of e-cigarette products seeking quality, price and selection to the Company’s website. The Company’s management has experience in maximizing SEO programs and studying algorithms from leading search engines such as Google.com and Yahoo.com.

The Company has positioned itself as a technology company focused on the adoption of electronic vaporizing cigarettes (commonly known as “e-cigarettes”) by the world’s 1.2 Billion smokers. The Company provides high quality e-cigarette devices, electronic refillable and rechargeable atomizers and e-liquids offering a much safer alternative delivery system for nicotine. There are an estimated 300,000,000 people in the United States, with approximately 28% or 84,000,000 of the population classified as active cigarette smokers.

A key proposition of an e-cigarette is that it eliminates odor. One of the top reasons people ‘hate smokers’ is the smell of the burning cigarette. The Smoker smells bad, their clothes smell bad, and their breath smells bad, as well as the health issues associated with second hand smoke Health issues related to smoking cigarettes are well known. The Electronic Cigarettes we are bringing to Market, delivers the nicotine through atomizing cartridges containing nicotine, and water. This allows the Nicotine to be delivered through the lungs with Water Vapor, eliminating most all the health issues related to smoking a traditional cigarette (Tar, over 4000 Carcinogenic Chemicals). The Electronic Cigarette also eliminates the smell and stink and ash associated with the burning of traditional cigarettes.

The FDA has indicated that e-cigarettes and their potential risks have not been fully studied. As a result, consumers currently do not know the potential risks of e-cigarettes when used as intended, how much potentially harmful chemicals are being inhaled during use, or whether there are any benefits associated with these products , furthermore, the FDA has announced on April 24, 2014 that it will extend its authority over additional products such as electronic “e-cigarettes”, cigars, pipe tobacco, nicotine gels, waterpipe (hookah), and dissolvables. Under the proposed rule, makers of these newly deemed tobacco products would, among other requirements:

| 7 |

| · | Register with the FDA and report product ingredient listings; |

| · | Only market new tobacco products after FDA review; |

| · | Only make direct and implied claims of reduced risk if the FDA confirms that scientific evidence supports the claim and that marketing the product will benefit the public health as a whole; |

| · | Not distribute free samples; |

In addition, under the proposed new FDA rule, the following provisions would apply to newly “deemed” tobacco products:

| · | Minimum age and identification restrictions to prevent sales to underage youth, |

| · | Requirements to include health warnings, and |

| · | Prohibition of vending machine sales, unless in a facility that never admits youth. |

Customers, Distribution and Marketing

The Company sells its products from its website on the Internet at www.vapetek.com to both retail and wholesale dealer accounts. The wholesale dealer accounts generally provide a wholesale price to volume purchasers. As of September 23, 2014, the Company had four wholesale dealer accounts, not including its distribution agreement with West Coast Vape Supply Inc.

The Company has reached a distribution agreement with a distributor on April 1, 2014. West Coast Vape Supply Inc., an e-cigarette distributor co-owned by Alham Benyameen and Andy Michael Ibrahim, the Company’s Chairman of the Board of Directors and the Company’s President, CEO, CFO and Secretary, respectively.

International Distributors

The Company intends to begin seeking wider distribution for its products outside the United States

and will review distributors for its international distribution efforts.

On August 18, 2014, the Company began shipping its e-Liquid flavored cartidges to a new customer in Japan. The Company expects to continue developing international sales of its products, in markets that it considers to be emerging for e-cigarette devices and products.

Third Party Products

The Company currently carries third party manufactured products such as the eJoint, EVO, and DABlaster products produced by National Gourmet, Smoke Vapor, Vaporijoye, Youde Technologies, and Shenzhen Seego.

| 8 |

Marketing

The Company relies on attending and presenting at industry trade shows as the main venue for marketing. The Company’s tradeshow booth will provide information about its products, and host product presentations to attendees. On average, the Company attends 2trade shows per quarter with presentations in its booth during these shows. The Company can be accessed through its websites on the Internet at www.vapetek.com. Information contained on or available through our websites is not a part of, and is not incorporated by reference into, this current report.

Manufacturing

We have limited manufacturing capabilities for select products such as our e-liquids, but we depend largely on third party manufacturers for our electronic cigarettes, vaporizers, , and accessories. Our customers associate certain characteristics of our products including the weight, feel, draw, flavor, packaging and other unique attributes of our products to the brands we market, distribute and sell. Any interruption in supply and or consistency of our products may harm our relationships and reputation with customers, and have a materially adverse effect on our business, results of operations and financial condition.

We currently utilize multiple manufacturers in China. We contract with our manufacturers on a purchase

order basis. We do not have any output or requirements with regard to our contract with our manufacturers. Our manufacturers provide

us with finished products, which we hold in inventory for distribution, sale and use. Certain Chinese factories and the products

they export have recently been the source of safety concerns and recalls, which is generally attributed to lax regulatory, quality

control and safety standards. Should Chinese factories continue to draw public criticism from exporting unsafe products, whether

those products relate to our products or not, we may be adversely affected by the stigma associated with Chinese production, which

could have a material adverse effect on our business, results of operations and financial condition.

We use Shenzhen Seego Technology Co., Ltd. who manufactures our VhitDABlaster product.

We use ZhuaiYoude Technology Co., Ltd . who manufactures our Vapetek Atomizer Jig Tool product.

We use Smokvapor Technology Limited who controls the logistics of our Electronic Battery Starter Kits product.

We use Shenzhen Kamry Technology Co., Ltd. who manufactures the eJoint Electronic Cigarette product.

We use Ten One International (H.K.) Limited who manufactures the EVO Personal Vaporizer product.

Our trademark, Vapetek covers vapor batteries, namely, electronic cigarette batteries. We have the right to use this trademark on our products perpetually, to the extent that we pay our patent fees, do not abuse the trademark, do not volunteer to release our rights to the trademark, and are not subject to any litigation where we lose our right to use the trademark.

| 9 |

Although we believe that several alternative sources for our products are available, any failure to obtain the components, chemical constituents and manufacturing services necessary for the production of our products would have a material adverse effect on our business, results of operations and financial condition.

Trademarks

On July 8, 2014, the Company was granted the trademark name registration for, “VAPETEK”, from the United States Patent and Trademark Office with the serial number of 86-086,675. This trademark covers vapor batteries, namely, electronic cigarette batteries. The company originally filed its application on October 9, 2013.

Employees

As of September 23, 2014,Vapetek Inc. employed a total of 2 persons. Alham Benyameen, its Chairman of the Board of Directors and Andy Michael Ibrahim, its President, CEO, CFO, Secretary and Member of the Board of Directors. Vapetek Inc. considers its relationship with its employees to be stable. The Company sees the need for a sales manager, sales associate, outside sales associate, product formulation manager, warehouse manager, warehouse associate and web developer in the immediate future.

Facilities and Logistics

The Company is headquartered in Huntington Beach, CA, and occupies a 1,000 square foot leased facility. Our leased space is shared by our management’s other business ventures, West Coast Vape Supply Inc. is 100% owned by our management and PennyGrab Inc., is 100% owned by our Chairman, Alham Benyameen.

The Company’s executive offices are located in Huntington Beach, CA, at 7611 Slater Avenue, Unit H, Huntington Beach, CA, 92647. The following table lists the location of its current operations. The lease payment for ourfacility is approximately $805, paid monthly. The tenancy operates under a lease agreement with a related party, MeWeWorld, Inc. an entity 100% owned by our Chairman, Alham Benyameen.

| Location | Address | Size |

| Huntington Beach, CA | 7611 Slater Avenue, Unit H, Huntington Beach, CA, 92647 | 1,000 square feet |

Government Regulation

Based on the December 2010 U.S. Court of Appeals for the D.C. Circuit’s decision in Sottera, Inc. v. Food & Drug Administration, 627 F.3d 891 (D.C. Cir. 2010), the United States Food and Drug Administration (the "FDA") is permitted to regulate electronic cigarettes as "tobacco products" under the Family Smoking Prevention and Tobacco Control Act of 2009 (the "Tobacco Control Act").

Under this Court decision, the FDA is not permitted to regulate electronic cigarettes as "drugs" or "devices" or a "combination product" under the Federal Food, Drug and Cosmetic Act unless they are marketed for therapeutic purposes.

Our products contain nicotine and therefore do fall under regulatory oversight of the FDA. We believe it is important for any existing or potential investors to understand recent trends in government regulation relating to nicotine-based electronic cigarettes.

The Tobacco Control Act grants the FDA broad authority over the manufacture, sale, marketing and packaging of tobacco products, although the FDA is prohibited from issuing regulations banning all cigarettes or all smokeless tobacco products, or requiring the reduction of nicotine yields of a tobacco product to zero.

The Tobacco Control Act also requires establishment, within the FDAs new Center for Tobacco Products, of a Tobacco Products Scientific Advisory Committee to provide advice, information and recommendations with respect to the safety, dependence or health issues related to tobacco products.

The Tobacco Control Act imposes significant new restrictions on the advertising and promotion of tobacco products. For example, the law requires the FDA to finalize certain portions of regulations previously adopted by the FDA in 1996 (which were struck down by the Supreme Court in 2000 as beyond the FDA's authority). As written, these regulations would significantly limit the ability of manufacturers, distributors and retailers to advertise and promote tobacco products, by, for example, restricting the use of color, graphics and sound effects in advertising, limiting the use of outdoor advertising, restricting the sale and distribution of non-tobacco items and services, gifts, and sponsorship of events and imposing restrictions on the use for cigarette or smokeless tobacco products of trade or brand names that are used for non-tobacco products. The law also requires the FDA to issue future regulations regarding the promotion and marketing of tobacco products sold or distributed over the internet, by mail order or through other non-face-to-face transactions in order to prevent the sale of tobacco products to minors.

It is likely that the Tobacco Control Act could result in a decrease in tobacco product sales in the United States, including sales of our electronic cigarettes.

While the FDA has not yet mandated electronic cigarettes be regulated as tobacco products, during 2012, the FDA indicated that it intends to regulate electronic cigarettes under the Tobacco Control Act through the issuance of deeming regulations that would include electronic cigarettes under the definition of a "tobacco product" under the Tobacco Control Act subject to the FDA's jurisdiction. The FDA initially announced that it would issue proposed deeming regulations by April 2013 and then extended the deadline to October 31, 2013. As of the date of this prospectus, the FDA has issued new policy as outlined in our following risk factor.

The application of the Tobacco Control Act to electronic cigarettes could impose, among other things, restrictions on the content of nicotine in electronic cigarettes, the advertising, marketing and sale of electronic cigarettes, the use of certain flavorings and the introduction of new products. We cannot predict the scope of such regulations or the impact they may have on our company specifically or the electronic cigarette industry generally, though if enacted, they could have a material adverse effect on our business, results of operations and financial condition.

In this regard, total compliance and related costs are not possible to predict and depend substantially on the future requirements imposed by the FDA under the Tobacco Control Act. Costs, however, could be substantial and could have a material adverse effect on our business, results of operations and financial condition. In addition, failure to comply with the Tobacco Control Act and with FDA regulatory requirements could result in significant financial penalties and could have a material adverse effect on our business, financial condition and results of operations and ability to market and sell our products. At present, we are not able to predict whether the Tobacco Control Act will impact us to a greater degree than competitors in the industry, thus affecting our competitive position.

State and local governments currently legislate and regulate tobacco products, including what is considered a tobacco product, how tobacco taxes are calculated and collected, to whom and by whom tobacco products can be sold and where tobacco products may or may not be smoked. Certain municipalities have enacted local ordinances which preclude the use of electronic cigarettes where traditional tobacco burning cigarettes cannot be used and certain states have proposed legislation that would categorize electronic cigarettes as tobacco products, equivalent to their tobacco burning counterparts. If these bills become laws, electronic cigarettes may lose their appeal as an alternative to cigarettes; which may have the effect of reducing the demand for our products and as a result have a material adverse effect on our business, results of operations and financial condition.

The Tobacco industry expects significant regulatory developments to take place over the next few years, driven principally by the World Health Organization's Framework Convention on Tobacco Control ("FCTC"). The FCTC is the first international public health treaty on tobacco, and its objective is to establish a global agenda for tobacco regulation with the purpose of reducing initiation of tobacco use and encouraging cessation. Regulatory initiatives that have been proposed, introduced or enacted include:

| • | the levying of substantial and increasing tax and duty charges; | ||

| • | restrictions or bans on advertising, marketing and sponsorship; | ||

| • | the display of larger health warnings, graphic health warnings and other labeling requirements; | ||

| • | restrictions on packaging design, including the use of colors and generic packaging; | ||

| • | restrictions or bans on the display of tobacco product packaging at the point of sale, and restrictions or bans on cigarette vending machines; | ||

| • | requirements regarding testing, disclosure and performance standards for tar, nicotine, carbon monoxide and other smoke constituents levels; | ||

| • | requirements regarding testing, disclosure and use of tobacco product ingredients; | ||

| • | increased restrictions on smoking in public and work places and, in some instances, in private places and outdoors; | ||

| • | elimination of duty free allowances for travelers; and | ||

| • | encouraging litigation against tobacco companies. |

If electronic cigarettes are subject to one or more significant regulatory initiates enacted under the FCTC, our business, results of operations and financial condition could be materially and adversely affected.

| 10 |

Industry, Competition, and Future Operations

Industry Overview

Electronic cigarettes, or “e-cigs” having recently been introduced to market, are at an early stage of development, and represent a niche market and are evolving rapidly and are characterized by an increasing number of market entrants. Electronic cigarettes are used as smoking cessation devices as well as for recreational use. The global e-cigarette market CAGR (compound annual growth rate) grew 57% between 2010 and 2012 and is currently north of US $2 billion. While first generation e-cigarettes led initial growth of the new industry, a second and third generation of devices is now growing at a more rapid rate. Known as vapors and tanks or “e-vapor”, this sub-category of e-cigarettes along with first generation e-cigarettes are expected to grow to over $10 billion in sales by 2017, surpassing traditional cigarette sales within the next decade. When first launched, e-cigarettes were sold exclusively online e-commerce channels. Over time, online retailers turned to the brick-and-mortar model to allow consumers to experience the product first hand. At present, about 30% of all sales of e-cigarettes are through convenience stores, 26% online, and 17% through retail vape-shops.

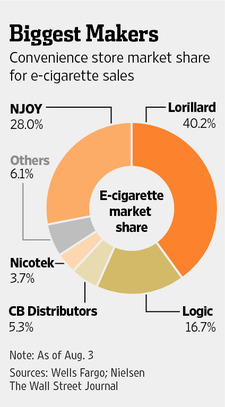

The leading players in this highly fragmented market are Lorillard, the parent company to Blu, a leading e-cigarette company with roughly 40.2% of the domestic e-cigarette market, NJOY, Reynolds American and Altria. There are currently more than 250 different brands in the U.S. that offer e-cigarette products.

Electronic cigarettes were invented by Hon Lik, a Chinese pharmacist, introducing it to the Chinese market in 2004 and expanding sales internationally in 2006. According to the FDA, there are more than 400 manufacturers of e-cigarette devices and components worldwide, the largest of which is Joyetech, a Chinese manufacturer.

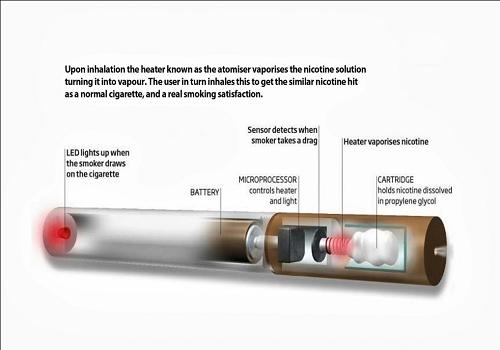

At the core of the device is its atomizer, a technology that heats a nicotine-infused propylene glycol liquid, converting it into a vapor that users inhale through a plastic cartridge mouthpiece. The device is powered by a lithium-ion battery, which is rechargeable through a USB port, an AC wall outlet, a car adapter or a portable charging case.

Competition

The Company operates in an industry that is relatively new and intensely competitive. Additionally, regulation of e-cigarette (“e-cig”) products has yet to be formalized or adopted by a governing entity. Many of the marketed benefits of e-cigs, including reduced health risks, safety, and ability to smoke indoors have yet to be proven and/or adopted at state or county levels. Furthermore, the ability to market these products as a smoking cessation device would trigger the added requirement of FDA approval under FDCA. As a result, the Company’s ability to create sales based on the prospect on private label smoking cessation devices can be significantly delayed, hindering the Company’s ability to meet projected revenues. To that end, companies within the e-cig industry would be forced to compete directly with big tobacco companies which spend significant amounts of capital for advertising.

| 11 |

The leading players in this highly fragmented market are Lorillard, the parent company to Blu, a leading e-cigarette company with roughly 40.2% of the domestic e-cigarette market, NJOY, Reynolds American and Altria. There are currently more than 250 different brands in the U.S. that offer e-cigarette products.

Within our immediate area of concentration, we compete against pure play electronic cigarette companies such as:

| · | NJoy E-Cigarette |

| · | Cigirex |

| · | South Beach Smoke |

| · | Smoke Stick |

| · | Direct E-Cig |

| · | Blu Cig |

| · | Xhale 02 |

| · | Red Puff |

| · | Green Smoke |

| · | Gamucci America |

| · | E-Cig Technologies |

Many of our competitors have longer operating histories, better brand recognition and greater financial resources than we do. In order for us to successfully compete in our industry we will need to:

| · | establish our products’ competitive advantage with customers; |

| · | develop a comprehensive marketing system; and |

| · | increase our financial resources. |

However, there can be no assurance that even if we do these things we will be able to compete effectively with the other companies in our industry.

We believe that we will be able to compete effectively in our industry because of a competitive advantage offered by our products. We believe that the products we are able to offer will provide to be attractive to consumers due to their low cost. We will attempt to inform our potential customers of this competitive advantage through various online marketing techniques and positive word of mouth advertising.

However, as we are a newly-established company, we face the same problems as other new companies starting up in an industry, such as lack of available funds. Our competitors may be substantially larger and better funded than us, and have significantly longer histories of research, operation and development than us. In addition, they may be able to provide more competitive products than we can and generally be able to respond more quickly to new or emerging technologies and changes in legislation and regulations relating to the industry. Additionally, our competitors may devote greater resources to the development, promotion and sale of their products or services than we do. Increased competition could also result in loss of key personnel, reduced margins or loss of market share, any of which could harm our business.

| 12 |

We market our electronic cigarettes as an alternative to traditional tobacco cigarettes. We offer several products such as e-cigarette devices, e-liquid flavor combinations, rechargeable batteries and accessories. Because electronic cigarettes offer a “smoking” experience without the burning of tobacco leaf, electronic cigarettes offer users the ability to satisfy their traditional cigarette cravings without smoke, tar, ash or carbon monoxide. In many cases electronic cigarettes may be used where tobacco-burning cigarettes may not. Electronic cigarettes may be used in some instances where for regulatory or safety reasons tobacco burning cigarettes may not be used. However, we cannot provide any assurances that future regulations may not affect where electronic cigarettes may be used.

According to the U.S. Centers for Disease Control and Prevention, in 2010, an estimated 45.3 million people, or 19.3% of adults, in the United States smoke cigarettes (http://www.cdc.gov/VitalSigns/adultsmoking/index.html). According to the Tobacco Vapor Electronic Cigarette Association, an industry trade group, more than 3.5 million people currently use electronic cigarettes in the United States. In 2011, about 21% of adults who smoke traditional tobacco cigarettes had used electronic cigarettes, up from about 10% in 2010, according to the U.S. Centers for Disease Control and Prevention (http://www.cdc.gov/media/releases/2013/p0228_electronic_cigarettes.html).

RISK FACTORS

The following risk factors and other information included in this Report on Form 8-K should be carefully considered. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we presently deem less significant may also impair our business operations. If any of the events or circumstances described in the following risk factors actually occurs, our business, operating results and financial condition could be materially adversely affected.

Risks Related to Our Business and Industry

| 13 |

We have a limited operating history.

We have a limited operating history and do not have a meaningful historical record of sales and revenues nor an established business track record. While we believe that we have the opportunity to be successful in the electronic cigarette industry, but there can be no assurance that we will be successful in accomplishing our business initiatives, or that we will be able to achieve any significant levels of revenues or net income, from the sale of our products.

There is doubt about our ability to continue as a going concern due to insufficient cash resources to meet our business objectives.

Our continuation as a going concern is dependent on our ability to generate sufficient cash flows from operations to meet our obligations, which we have not been able to accomplish to date, and/or obtain additional financing from equity financings, debt financings, or from other sources. The extent of our future capital requirements will depend on many factors, including results of operations and the growth rate of our business.

Although we intend to raise capital to finance our operations, there can be no assurance that additional financing will be available to us when needed or, if available, that it can be obtained on commercially reasonable terms. If we are not able to obtain additional financing on a timely basis, we may not be able to grow our operations as planned, may not be able to meet our other obligations as they become due and may even need to cease our operations.

If we are successfully able to raise capital, the issuance of additional equity securities by us could result in a significant dilution in the equity interests of our current stockholders and if capital is raised through debt facilities, such facilities will increase our liabilities and future cash commitments, and may also impose restrictive covenants relating to the operation of our business.

We presently do not have any arrangements for additional financing. However, we continue to evaluate various financing strategies to support our current operations and fund our future growth.

We may not be able to compete successfully against current and future competitors.

We compete in a highly competitive market that includes other e-cigarette marketing companies, as well as traditional tobacco companies. In this highly fragmented market, we have focused on building brand awareness early through viral adoption and word of mouth. In the future, we expect to employ additional marketing strategies while continuing to develop our supply chain and fulfillment capabilities. There can be no assurances that our strategy will be meaningful or successful.

We could face intense competition, which could result in lower revenues and higher research and development expenditures and could adversely affect our results of operations.

Unless we keep pace with changing technologies, we could lose existing customers and fail to win new customers. In order to compete effectively in the electronic cigarette market, we must continually design, develop and market new and enhanced technologies. Our future success will depend, in part, upon our ability to address the changing and sophisticated needs of the marketplace.

| 14 |

The market for our technology and products is still developing and if the industry adopts test criteria that are different from our internal test criteria our competitive position would be negatively affected. Additionally, governments could institute laws which negatively affect our competitive position. Our plan to pursue sales in international markets may be limited by risks related to conditions in such markets.

Various Parts of our company’s business plan are dependent on business relationships with various parties.

We expect to rely in part upon third party manufacturers, and distribution partners to sell our products, and we may be adversely affected if those parties do not actively promote our products. Further, if our products are not timely delivered or do not perform as promised, we could experience increased costs, lower margins, liquidated damage payment obligations and reputational harm.

We must attract and maintain key personnel or our business will fail.

We must attract and retain key personnel in order to successfully operate our business. We will have to compete with other companies both within and outside the tobacco/ Electronic Cigarette industry to recruit and retain competent employees. If we cannot maintain qualified employees to meet the needs of our anticipated growth, our business and financial condition could be materially adversely effected.

Our business and operating results could be harmed if we fail to manage our growth or change.

Our business may experience periods of rapid change and/or growth that could place significant demands on our personnel and financial resources. To manage possible growth and change, we must continue to try to locate skilled professionals and adequate funds in a timely manner.

We hold no patents on any of our products, and if we are not able to adequately protect our intellectual property in the future, then we may not be able to compete effectively and we may not be profitable.

We hold no patents on any of our products and rely on trade secret protection and regulatory protection of our technologies and product candidates as well as successfully defending third-party challenges to such technologies and candidates. Upon development of new technologies, we intend to file patents on certain products in the future, and we will seek to protect our technologies and product candidates from use by third parties only to the extent that valid and enforceable patents, trade secrets or regulatory protection cover them and we have exclusive rights to use them. The ability of our licensors, collaborators and suppliers to maintain their patent rights against third-party challenges to their validity, scope or enforceability will also play an important role in determining our future. There can be no assurances that we will ever successfully file or receive any patents in the future.

The copyright and patent positions of technology related companies can be highly uncertain and involve complex legal and factual questions that include unresolved principles and issues. No consistent policy regarding the breadth of claims allowed regarding such companies’ patents has emerged to date in the United States, and the patent situation outside the United States is even more uncertain. Changes in either the patent laws or in interpretations of patent laws in the United States or other countries may diminish the value of our intellectual property. Accordingly, we cannot predict with any certainty the range of claims that may be allowed or enforced concerning our patents.

We currently rely on trade secrets to protect our technologies, however, trade secrets are difficult to protect. While we seek to protect confidential information, in part, through confidentiality agreements with our consultants and other advisors, they may unintentionally or willfully disclose our information to competitors. Enforcing a claim against a third party related to the illegal acquisition and use of trade secrets can be expensive and time consuming, and the outcome is often unpredictable. If we are not able to maintain patent or trade secret protection on our technologies and product candidates, then we may not be able to exclude competitors from developing or marketing competing products, and we may not be able to operate profitability.

We may face difficulty or may prove unsuccessful in developing our own products or technologies. We may also place a substantial financial burden on our Company in researching out and developing our own technologies and products.

In the future we intend to release our own products and or technologies that we developed. We may however be unsuccessful in creating any new products or technologies under our own trademark Vapetek. There is uncertainty that we will arrive at a product or technology that is not already patented, and or viable for sale and or profitable. Additionally, the cost in attempting to develop new products or technologies under our own trademark could be quite costly. At this time we have not investigated the costs of carrying out the development our own products or technologies. There is a risk that if we do attempt to research and or develop our own products or technologies it could be quite costly and not result in any new products that we are able to make a profit from.

We face a significant risk relying on third party products from third party manufacturers to makeup our product lines.

Currently, we rely on third party manufacturers to provide us the products which are sold under our own trademark, Vapetek. Should any of our third party manufacturers who provide us these products, which include Shenzhen Seego Technology Co., Ltd., ZhuaiYoude Technology Co., Ltd., Smokvapor Technology Limited, Shenzhen Kamry Technology Co., Ltd. or Ten One International (H.K.) Limited,, experience financially distress, lack of funds, bankruptcy, or litigation, we may not be able to purchase products from them to resell under our own trademark Vapetek, as these products might no longer be available for purchase. This could cause our own operations to suffer as we would have to find a new source of inventory. This could harm our profitability and even possibly cause us to cease operations temporarily, or permanently if we are unable to find an alternative source to carry similar products.

| 15 |

If we are the subject of an intellectual property infringement claim, the cost of participating in any litigation could cause us to go out of business.

There has been, and we believe that there will continue to be, significant litigation and demands for licenses in our industry regarding patent and other intellectual property rights. Although we anticipate having a valid defense to any allegation that our current products, production methods and other activities infringe the valid and enforceable intellectual property rights of any third parties, we cannot be certain that a third party will not challenge our position in the future. Other parties may own patent rights that we might infringe with our products or other activities, and our competitors or other patent holders may assert that our products and the methods we employ are covered by their patents. These parties could bring claims against us that would cause us to incur substantial litigation expenses and, if successful, may require us to pay substantial damages. Some of our potential competitors may be better able to sustain the costs of complex patent litigation, and depending on the circumstances, we could be forced to stop or delay our research, development, manufacturing or sales activities. Any of these costs could cause us to go out of business.

We could lose our competitive advantages if we are not able to protect any proprietary technology and intellectual property rights against infringement, and any related litigation could be time-consuming and costly.

Our success and ability to compete depends to a significant degree on our proprietary technology incorporated into our products. If any of our competitor’s copies or otherwise gains access to our proprietary technology or develops similar technologies independently, we would not be able to compete as effectively. We also consider our trademarks invaluable to our ability to continue to develop and maintain the goodwill and recognition associated with our brand. We have registered the trademark VAPETEK for electronic cigarette batteries in the United States. This and any other measures that we may take to protect our intellectual property rights, which presently are based upon a combination of copyright, trade secret and trademark laws, may not be adequate to prevent their unauthorized use. Further, the laws of foreign countries may provide inadequate protection of such intellectual property rights. We may need to bring legal claims to enforce or protect such intellectual property rights. Any litigation, whether successful or unsuccessful, could result in substantial costs and diversions of resources. In addition, notwithstanding any rights we have secured in our intellectual property, other persons may bring claims against us that we have infringed on their intellectual property rights, including claims based upon the content we license from third parties or claims that our intellectual property right interests are not valid. Any claims against us, with or without merit, could be time consuming and costly to defend or litigate, divert our attention and resources, result in the loss of goodwill associated with our service marks or require us to make changes to our website or other of our technologies.

If we fail to effectively manage our growth our future business results could be harmed and our managerial and operational resources may be strained.

As we proceed with the expansion of our retail and manufacturing activities, we expect to experience significant and rapid growth in the scope and complexity of our business. We will need to add staff to market our services, manage operations, handle sales and marketing efforts and perform finance and accounting functions. We will be required to hire a broad range of additional personnel in order to successfully advance our operations. This growth is likely to place a strain on our management and operational resources. The failure to develop and implement effective systems, or to hire and retain sufficient personnel for the performance of all of the functions necessary to effectively service and manage our potential business, or the failure to manage growth effectively, could have a materially adverse effect on our business and financial condition.

| 16 |

Our products and may become obsolete and unmarketable if we are unable to respond adequately to rapidly changing technology and customer demands.

Our industry is characterized by rapid changes in technology and customer demands. As a result, our products and services may quickly become obsolete and unmarketable. Our future success will depend on our ability to adapt to technological advances, anticipate customer demands, develop new products and enhance our current products on a timely and cost-effective basis. Further, our products must remain competitive with those of other companies with substantially greater resources. We may experience technical or other difficulties that could delay or prevent the development, introduction or marketing of new products or enhanced versions of existing products. Also, we may not be able to adapt new or enhanced services to emerging industry standards, and our new products may not be favorably received.

The use of electronic cigarettes may pose health risks as great as, or greater than, regular tobacco products.

According to the FDA, electronic cigarettes may contain ingredients that are known to be toxic to humans and may contain other ingredients that may not be safe. Additionally, electronic cigarettes may be attractive to young people and may lead them to try other tobacco products, including conventional cigarettes that are known to cause disease. Because clinical studies about the safety and efficacy of electronic cigarettes have not been submitted to the FDA, consumers currently have no way of knowing whether electronic cigarettes are safe before their intended use; what types or concentrations of potentially harmful chemicals are found in these products; or how much nicotine is being inhaled. In February 2012, it was reported in Florida that an electronic cigarette exploded in a smoker’s mouth causing serious injury. Although there does not appear to be similar incidences elsewhere nor are there specific details concerning the Florida incident, there is a risk that an electronic cigarette can cause bodily injury and the publicity from such instances of injury could dramatically slow the growth of the market for electronic cigarettes.

The price of our products has been arbitrarily determined based on a percentage markup, and it is possible that these prices may not be ideal for the current market, particularly in countries outside the United States, and this could lead to the company making fewer sales than anticipated which would adversely affect our business.

We determine the price of our products based on a percentage markup, the percentage is 10% - 100% depending on what the product is. If it's eliquid then the markup is typically 20% and can be up to 100%, if it's hardware then the markup is typically 10% to West Coast Vape Supply. The same markup applies to all of our customers within the USA however, it may vary for customers outside the USA. We currently only charge customers who are outside of the USA a different price due to the competition and logistics of the company in question on a case by case basis. Currently, that markup is between 60-100% from the purchase price to foreign countries. Thus far we have only had international relations with a customer in Japan. It is possible that these arbitrarily determined prices may not be ideal for the marketplace in which are items are sold, particularly in countries where the price of our products must increase in order to continue making the same amount of profit, and in such instances it is possible that customers may opt to purchase the products of competitors instead of our own. These varying prices could result in a loss of business and adversely affect our financial forecast for the future operations of our Company.

| 17 |

Over the next few years government regulations could change and have a substantial, and most likely negative, influence on the sale of Tobacco products throughout the United States. It is possible that our business, results of operations and financial condition could be adversely affected by these changes.

While the FDA has not yet mandated electronic cigarettes be regulated as tobacco products, during 2012, the FDA indicated that it intends to regulate electronic cigarettes under the Tobacco Control Act through the issuance of regulations that would include electronic cigarettes under the definition of a "tobacco product" under the Tobacco Control Act subject to the FDA's jurisdiction.

The application of the Tobacco Control Act to electronic cigarettes could impose, among other things, restrictions on the content of nicotine in electronic cigarettes, the advertising, marketing and sale of electronic cigarettes, the use of certain flavorings and the introduction of new products. We cannot predict the scope of such regulations or the impact they may have on our company specifically or the electronic cigarette industry generally, though if enacted, they could have a material adverse effect on our business, results of operations and financial condition.

The Tobacco industry expects significant regulatory developments to take place over the next few years, driven principally by the World Health Organization's Framework Convention on Tobacco Control ("FCTC"). The FCTC is the first international public health treaty on tobacco, and its objective is to establish a global agenda for tobacco regulation with the purpose of reducing initiation of tobacco use and encouraging cessation. If electronic cigarettes are subject to one or more significant regulatory initiates enacted under the FCTC, our business, results of operations and financial condition could be materially and adversely affected.

New FDA proposed rules released on April 24, 2014

On April 24, 2014, the FDA announced by press release that it will extend its authority under the implementation of the Family Smoking Prevention and Tobacco Control Act signed by the President in 2009.This action extends the agency’s tobacco authority over additional products such as electronic or “e-cigarettes”, cigars, pipe tobacco, nicotine gels, waterpipe (hookah), and dissolvables. Under the proposed rule, makers of these newly deemed tobacco products would, among other requirements:

| · | Register with the FDA and report product ingredient listings; |

| · | Only market new tobacco products after FDA review; |

| · | Only make direct and implied claims of reduced risk if the FDA confirms that scientific evidence supports the claim and that marketing the product will benefit the public health as a whole; |

| · | Not distribute free samples; |

In addition, under the proposed new FDA rule, the following provisions would apply to newly “deemed” tobacco products:

| · | Minimum age and identification restrictions to prevent sales to underage youth, |

| · | Requirements to include health warnings, and |

| · | Prohibition of vending machine sales, unless in a facility that never admits youth. |

| 18 |

New products face intense media attention and public pressure.

Our product is new to the marketplace and since its introduction certain members of the media, politicians, government regulators and advocate groups, including independent doctors have called for an outright ban of all electronic cigarettes, pending regulatory review and a demonstration of safety. A ban of this type would likely have the effect of terminating our United States’ sales and marketing efforts of certain products which we may currently market or have plans to market in the future. Such a ban would also likely cause public confusion as to which products are the subject of the ban and which are not and would have a material adverse effect on our business, financial condition and performance.

The market for our products is uncertain and is still evolving.

Electronic cigarettes, having recently been introduced to market, are at an early stage of development and are evolving rapidly and are characterized by an increasing number of market entrants. Our future revenues and any future profits are substantially dependent upon the widespread acceptance and use of electronic cigarettes. Rapid growth in the use of and interest in, electronic cigarettes is a recent phenomenon, and may not continue on a lasting basis. The demand and market acceptance for these products is subject to a high level of uncertainty.

| 19 |

We market a single class of products, which may be subject to certain government regulations, whose approval we may or may not be able to achieve.

Electronic cigarettes are new to the marketplace and may be subject to regulation as a drug, a medical device, a drug and medical device and or as a tobacco product. Most electronic cigarettes are sold as a means of delivering nicotine to the body. The FDA is the regulatory agency which oversees drugs, medical devices and tobacco; however at present it is unclear which, if any regulatory process is required to market, and sell electronic cigarettes. To date the FDA has not established a definitive policy regulating “electronic cigarettes” but is reviewing cases on a case by case basis. We intend to use reasonable efforts to file for the appropriate approvals to allow us to sell our product in the United States, however we have no indication that at present we will be able to afford to pursue regulatory approval and that if we are able to pursue said approval we have no assurances that the outcome of said approval process will result in our products being approved by the FDA. Moreover, if the FDA establishes a regulatory process that we are unable or unwilling to comply with our business, results of operations, financial condition and prospects would be adversely affected.

The anticipated costs of complying with future FDA regulations will be dependent on the rules issued by the FDA. Since our products are manufactured by third parties, we anticipate that they will bear the initial investment of approval and will pass those costs to us through price increases. If we need seek FDA approval, then based on several factors including either pre-market approval or 510K application, we estimate an application could take between 6 to 24 months with a cost of $100,000 to $2 million. If the device is deemed a drug and a device, we anticipate that the time and costs to comply with FDA regulations would be prohibitive to the future operations of our company and may have a material adverse effect on our business, results of operations and financial condition. In addition, failure to comply with

| 20 |

FDA regulatory requirements could result in significant financial penalties and could have a material adverse effect on our business, financial condition and results of operations and ability to market and sell our products.

Our products contain low levels of nicotine which is considered to be a highly addictive substance.

| · | Certain of our products contain nicotine, a chemical found in cigarettes and other tobacco products which is considered to be highly addictive. Our Vapetek Liquivape e-Liquid contain low levels of nicotine which are disclosed on our bottles. Our e-Liquids carry 6 milligrams, 12 milligrams and 18 milligrams, but no amounts higher than these . The risks of nicotine exposure and toxicity through contact with the e-Liquids are the following: |

| · | General Nicotine Exposure: Nicotine is a major factor in dependence forming properties of tabacco smoking and is known to cause a myriad of health problems, such as cancer. |

| · | Eye Contact: Will cause slight temporary eye irritation and discomfort. |

| · | Skin Contact: Depending on the concentration of nicotine exposure, lower levels will cause irritation of the skin and flakiness. However, heavy concentration of nicotine on skin contact can cause intoxication or even death. |

The Family Smoking Prevention and Tobacco Control Act, empowers the FDA to regulate the amount of nicotine found in tobacco products, but may not require the reduction of nicotine yields of a tobacco product to zero. Any FDA regulation may require us to reformulate, recall and or discontinue certain of the products we may sell from time to time, which may have a material adverse effect on our ability to market our products and have a material adverse effect on our business, financial condition, results of operations, cash flows and/or future prospects.

Our business may be affected if we are taxed like other tobacco products or if we are required to collect and remit sales tax on certain of our internet sales.

Presently our products are not taxed like cigarettes or other tobacco products, all of which have faced significant increases in the amount of taxes collected on the sale of their products. Should state and federal governments and or taxing authorities impose taxes similar to those levied against cigarettes and tobacco products on our products, it may have a material adverse effect on the demand for our products. Moreover we may be unable to establish the systems and processes needed to track and submit the taxes we collect through internet sales, which would limit our ability to market our products through our websites which would have a material adverse effect on our revenues, operation and financial condition.

States such as New York, Hawaii, Rhode Island, Georgia and North Carolina have begun collecting taxes on Internet sales where companies have used independent contractors in those states to solicit sales from residents of those states. The requirement to collect, track and remit taxes based on independent affiliate sales may require us to increase our prices, which may affect demand for our products or conversely reduce our net profit margin; either of which would have a material adverse effect on our revenues, financial condition and operating results.

Our success is dependent upon our marketing efforts.

We have limited marketing experience in marketing electronic cigarettes and limited financial, personnel and other resources to undertake extensive marketing activities. If we are unable to generate significant

| 21 |

market awareness for our products and our brands our operations may not generate sufficient revenues for us to execute our business plan, generate revenues and achieve profitable operations.

We rely, in part, on the efforts of our independent sales distributors and outside broker/dealer network to augment our internal sales efforts and distribute our product to wholesalers and or retailers to generate revenues. No single distributor currently accounts for a material percentage of our revenues and we believe that should any of these relationships terminate we would be able to find suitable replacements, however any change in distributors or our ability to timely replace any given distributor would have a material adverse effect on our business, prospects, financial condition and results of operations.

The lack of public company experience of our management team may put us at a competitive disadvantage.

As a company with a class of securities registered under the Exchange Act, we are subject to reporting and other legal, accounting, corporate governance, and regulatory requirements imposed by the Exchange Act and rules and regulations promulgated under the Exchange Act. Our Chairman and CEO lacks public company experience which could impair our ability to comply with these legal, accounting, and regulatory requirements. Such responsibilities include complying with Federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement and effect programs and policies in an effective and timely manner that adequately responds to such increased legal and regulatory compliance and reporting requirements. Our failure to do so could lead to the imposition of fines and penalties and further result in the deterioration of our business.

Regulations, including those contained in and issued under the Sarbanes-Oxley Act of 2002 (“SOX”) and the Dodd–Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank”), increase the cost of doing business and may make it difficult for us to retain or attract qualified officers and directors, which could adversely affect the management of our business and our ability to obtain or retain listing of our Common Stock.

We are a public company. The current regulatory climate for public companies, even small and emerging growth companies such as ours, may make it difficult or prohibitively expensive to attract and retain qualified officers, directors and members of board committees required to provide for our effective management in compliance with the rules and regulations which govern publicly-held companies, including, but not limited to, certifications from executive officers and requirements for financial experts on boards of directors. The perceived increased personal risk associated with these recent changes may deter qualified individuals from accepting these roles. For example, the enactment of the Sarbanes-Oxley Act of 2002 has resulted in the issuance of a series of new rules and regulations and the strengthening of existing rules and regulations by the SEC. Further, recent and proposed regulations under Dodd-Frank heighten the requirements for board or committee membership, particularly with respect to an individual’s independence from the corporation and level of experience in finance and accounting matters. We may have difficulty attracting and retaining directors with the requisite qualifications. If we are unable to attract and retain qualified officers and directors, the management of our business could be adversely affected.

Our internal controls over financial reporting may not be effective, and our independent auditors may not be able to certify as to their effectiveness, which could have a significant and adverse effect on our business.

| 22 |

We are subject to various SEC reporting and other regulatory requirements. We have incurred and will continue to incur expenses and, to a lesser extent, diversion of our management’s time in our efforts to comply with SOX Section 404 regarding internal controls over financial reporting. Our management’s evaluation over our internal controls over financial reporting may determine that material weaknesses in our internal control exist. If, in the future, management identifies material weaknesses, or our external auditors are unable to attest that our management’s report is fairly stated or to express an opinion on the effectiveness of our internal controls, this could result in a loss of investor confidence in our financial reports, have an adverse effect on our stock price, and subject us to sanctions or investigation by regulatory authorities.

Limitations on director and officer liability and our indemnification of our officers and directors may discourage stockholders from bringing suit against a director.

Our Certificate of Incorporation and By-Laws provide, with certain exceptions as permitted by Delaware corporation law, that a director or officer shall not be personally liable to us or our stockholders for breach of fiduciary duty as a director, except for acts or omissions which involve intentional misconduct, fraud or knowing violation of law, or unlawful payments of dividends. These provisions may discourage stockholders from bringing suit against a director for breach of fiduciary duty and may reduce the likelihood of derivative litigation brought by stockholders on our behalf against a director. In addition, our Certificate of Incorporation and By-Laws provide for mandatory indemnification of directors and officers to the fullest extent permitted by governing state law.

We may incur a variety of costs to engage in future acquisitions of companies, products or technologies, to grow our business, to expand into new markets, or to provide new services. As such, the anticipated benefits of those acquisitions may never be realized.

It is management’s intention to acquire other businesses to grow our customer base, to expand into new markets, and to provide new product lines. We may make acquisitions of, or significant investments in, complementary companies, products or technologies, although no additional material acquisitions or investments are currently pending. Acquisitions may be accompanied by risks such as:

| - | difficulties in assimilating the operations and employees of acquired companies; |

| - | diversion of our management’s attention from ongoing business concerns; |

| - | our potential inability to maximize our financial and strategic position through the successful incorporation of acquired technology and rights into our products and services; |

| - | additional expense associated with amortization of acquired assets; |

| - | additional expense associated with understanding and development of acquired business; |

| - | maintenance and implementation of uniform standards, controls, procedures and policies; and |

| - | impairment of existing relationships with employees, suppliers and customers as a result of the integration of new management employees. |

Our failure to manage growth effectively could harm our ability to attract and retain key personnel and adversely impact our operating results.

There can be no assurance that we will be able to manage our expansion through acquisitions effectively. Our current and planned personnel, systems, procedures and controls may not be adequate to support and effectively manage our future operations. We may not be able to hire, train, retain, motivate and manage required personnel, which may limit our growth, damage our reputation and negatively affect our financial performance and harm our business.

| 23 |

The forecasts of market growth included in this Form 8-K may prove to be inaccurate, and even if the market in which we compete achieve the forecasted growth, we cannot assure you our business will grow at similar rates, if at all.

Growth forecasts are subject to significant uncertainty and are based on assumptions and estimates, which may not prove to be accurate. Forecasts relating to the expected growth in the biometrics market, including the forecasts or projections referenced in this Form 8-K, may prove to be inaccurate. Even if these markets experience the forecasted growth, we may not grow our business at similar rates, or at all. Our growth is subject to many factors, including our success in implementing our business strategy, which is subject to many risks and uncertainties. Accordingly, the forecasts of market growth included in this prospectus should not be taken as indicative of our future growth.

We might require additional capital to support business growth, and this capital might not be available on acceptable terms, if at all.