Attached files

| file | filename |

|---|---|

| 8-K - 8-K - USD Partners LP | d841268d8k.htm |

December 2014

Partnership Overview

Exhibit 99.1 |

Cautionary Statements

2

This presentation may contain forward-looking statements within the meaning of U.S. federal

securities laws. These statements can be identified by the use of forward-looking

terminology including “may,” “believe,” “will,” “expect,” “anticipate,” “estimate,”

“continue,” or other similar words. These statements discuss future expectations, contain

projections of results of operations or of financial condition, or state other

“forward-looking” information. These forward-looking statements involve risks and uncertainties.

When considering these forward-looking statements, you should keep in mind the risk factors and

other cautionary statements in this presentation. The risks noted throughout this presentation

could cause our actual results to differ materially from those contained in any

forward-looking statement.

A forward-looking statement may include a statement of the assumptions or bases underlying the

forward-looking statement. USD Partners LP (“USDP” or the

“Partnership”) believes that it has chosen these assumptions or bases in good faith and that

they are reasonable. You are cautioned not to place undue reliance on any forward-looking

statements. Except as required by law, USDP undertakes no obligation to revise or update

any forward-looking statement. You should also understand that it is not possible to

predict or identify all such factors and should not consider the following list to be a complete statement of all potential

risks and uncertainties:

Changes in general economic conditions; competitive conditions in our industry; actions taken by our

customers and competitors; the supply of, and demand for, crude oil and biofuel rail

terminalling services; our ability to successfully implement our business plan; our ability to

complete growth projects on time and on budget; the price and availability of debt and equity financing;

operating hazards and other risks incidental to handling crude oil and biofuels; natural disasters,

weather-related delays, casualty losses and other matters beyond our control; interest

rates; labor relations; large customer defaults; change in availability and cost of capital;

changes in tax status; the effect of existing and future laws and government regulations; changes in insurance

markets impacting cost and the level and types of coverage available; disruptions due to equipment

interruption or failure at our facilities or third-party facilities on which our business

is dependent; the effects of future litigation; and the factors discussed in the “Risk

Factors” section of the Partnership’s final prospectus in connection with its initial public offering, filed with the Securities and

Exchange Commission on October 10, 2014 (File No. 333-198500) (the “IPO

Prospectus”). |

1.

Overview of USD Group LLC (“USDG”)

4

2.

Overview of USD Partners LP (“USDP”)

13

3.

Financial Overview

20

Appendix

25

Table of Contents

3 |

1.

Overview of USD Group LLC (“USDG”) 4 |

A

pioneer

of

the

hydrocarbon-by-rail

concept,

USDG

has

always

focused

on

providing

sustainable

industry

solutions

USDG has a proven history building and operating unit train-capable terminals

with an aggregate capacity of over 725,000 bpd and has safely and efficiently

handled over 155 million barrels of liquid hydrocarbons Since 2010, USDG has

monetized approximately $700 million of assets to high quality third party MLPs

A Proven Developer and Industry Innovator

5

Terminal Start Dates

Deer Park Terminal, TX

Loading / Storage

Facility

West Colton

Terminal, CA

Ethanol Terminal

Baltimore

Terminal, MD

Ethanol Terminal

St. James Terminal, LA

Crude / Condensate

Terminal

Hardisty

Terminal, Canada

Crude Oil Terminal

Van Hook

Terminal, ND

Crude Oil Terminal

Eagle Ford

Terminal, TX

Crude Oil Terminal

Dallas / Ft. Worth

Terminal, TX

Ethanol Terminal

Niobrara

Terminal, CO

Crude Oil Terminal

Bayport Terminal, TX

Railcar Storage and

Staging Terminal

Lomita

Terminal, CA

Ethanol Terminal

Linden

Terminal, NJ

Ethanol Terminal

2000

2007

2008

2014

2011

2012

2010

2004

2006

Initial Terminal Assets of USDP

Assets Sold to

in December 2012 for ~$500 million¹

Assets Sold to

in January 2010 for ~$195 million

Assets Sold to

in April 2006 for ~$48 million

Legend:

San Antonio

Terminal, TX

Ethanol Terminal

1. Bakersfield Terminal not shown in timeline due to early stage of development, but was included in

sale to Plains All American.

|

Independent, Third Party Provider of Logistics Solutions

Focused on industry solutions / macro solutions

Aligned with our customers

Proven Operator with Extensive Track Record

Among the first companies to successfully develop hydrocarbon-by-rail

terminals Longstanding relationships with companies in both railroad and

energy industries Financial Flexibility

Significant

“dry

powder”

to

pursue

third

party

acquisitions

and

/

or

organic

growth

projects

Strategic partnership with Energy Capital Partners (“ECP”) provides

increased liquidity, financial flexibility and access to additional

resources Strong Safety Record

Loaded

or

handled

over

155

million

barrels

of

liquid

hydrocarbons

with

no

reportable

spills

1

Key Competitive Advantages

1. As defined by the U.S. Department of Transportation Pipeline and Hazardous

Materials Safety Administration. 6

Nationally recognized by National Safety Council, Burlington Northern Santa Fe

Railway and Canadian Pacific Railway for outstanding safety record

–

All

USDG

facilities

meet

or

exceed

all

current

government

safety

regulations

–

Deep understanding of capital intensive and highly engineered projects

|

Industry Dynamics

U.S. and Canadian crude oil production has increased

significantly in recent years

Increased crude oil production will lead to

logistics infrastructure opportunities across multiple

products, including:

Compelling Industry Dynamics

7

Crude Oil Flows to U.S. Refining Centers

North America Rail Network

North America Crude Oil Pipeline Network

Source: Canadian Association of Petroleum Producers, U.S. Energy Information Administration,

Association of American Railroads.

Infrastructure and logistic services opportunities will arise,

including additional rail terminals, storage, blending, diluent

recovery, trucking and gathering systems

–

Refined petroleum products

–

Natural gas liquids (“NGLs”)

–

Frac sand

–

Biofuels |

USDG

believes there are substantial opportunities in the U.S. and Canada for both origination and destination

terminals for crude oil, refined products and NGLs

Current

regional

imbalances

have

created

multiple

unit

train

per

day

crude-by-rail

terminal

opportunities

Significant Rail-Related Energy Opportunities

8

Western Canada Origination

~1.8 MMBpd expected increase

in oil sands production over

the next 10 years

East Coast Destination

Substantial refining

capacity plus potential

ability to export overseas

West Coast Destination

Substantial refining

capacity plus potential

ability to export overseas

Gulf Coast Destination

1.5 MMBpd of heavy crude imports

from Mexico and Venezuela could

potentially be displaced with crude

oil from Canada

Source: Canadian Association of Petroleum Producers, U.S. Energy Information Administration,

Association of American Railroads.

Note: Heavy crude oil imports from Mexico and Venezuela per the EIA. Average monthly data from January

2014 to December 5, 2014 shown.

|

Rail

enables a number of advantages for both producers / shippers and refiners

Sustainable Advantages of Rail

9

Rail is a Long-Term, Sustainable Energy Infrastructure Solution

North American Rail Carloads of Petroleum and Petroleum Products

Have Doubled

Since Early 2011

Ability to offer tailored

takeaway capacity

–

Accessible for small

and mid-sized

producers and early

stage production areas

Increased ability to

expand capacity

Source: Association of American Railroads (U.S. Monthly Rail Traffic Data for

Petroleum and Petroleum Products Carloads). Cost

Speed

Scalability

Market Optionality

Shorter development

time

~1 year vs.

multiple years for

pipeline

Faster deployment

of infrastructure

–

Significant rail

infrastructure

already in-place

–

Fewer right-of-way,

permitting and

regulatory issues

or constraints

Option to reach

markets with best

netbacks and margins

on shorter notice

–

Ability to choose

destination once train

is loaded

–

Faster physical

delivery of product

9 days from Western

Canada to the Gulf

Coast vs. 30 –

45 days

via pipeline

Preserves ability to

export crude oil

Less capital required

Reduced shipper

commitments

3 –

7

years vs. 10+ years for

pipelines

Reduced financial

commitments

Lower

fixed costs / minimal “no

flow”

financial risk

Reduced cost of

feedstock

Access to

domestic feedstock vs.

higher priced imports |

Hardisty Crude Oil Hub: The Cushing of Canada

10

Hardisty Crude Oil Storage Hub

USD’s Hardisty

Rail Terminal

Changes in Crude Oil Flows

Gibson has Over 5 MMbbls of Storage at the Hardisty Hub

with an Additional 2 MMbbls of Storage Under Construction

Source: Gibson Energy Inc., U.S. Energy Information Administration.

|

Hardisty Phase II

Selected Growth Opportunities

11

Expand the Hardisty Rail Terminal to accommodate one additional 120-railcar

unit train per day Targeting bitumen from Western Canada

Endeavor to seek multi-year, take-or-pay agreements with new or

existing customers Targeting

2017 to commence operations, barring any unanticipated financing, permitting,

construction or other hurdles

–

Seeking multi-year, take-or-pay agreements with new or existing

customers –

Targeting

late

2015

/

early

2016

to

commence

operations,

barring

any

unanticipated

financing,

permitting,

construction or other hurdles

–

Expect similar operating cash flow profile to Hardisty I with additional cost and

design efficiencies Hardisty Phase III

Expand the Hardisty Rail Terminal to accommodate two additional 120-railcar

unit trains per day Targeting heavy crude from Western Canada

Currently in process of contracting, designing, engineering and permitting Hardisty

Phase II |

On

September

22

nd

,

USDG

announced

the

successful

closing

of

a

partnership

with

Energy

Capital

Partners,

an

energy infrastructure-focused private equity firm with over $13 billion in

capital commitments As part of this transaction, ECP purchased a meaningful

equity interest in USDG, who utilized the resulting proceeds to realign its

shareholder base, fund several existing growth projects and strengthen its balance sheet to allow for

additional flexibility to pursue its goal of providing rail-related energy

infrastructure solutions Energy Capital Partners (“ECP”)

Overview 12

Renewable Generation

Environmental Infrastructure

Energy Services

ECP has extensive midstream and MLP experience. For example, funds affiliated with

ECP have invested a significant

amount

of

capital

in

Summit

Midstream

Partners,

LLC,

Summit

Midstream

Partners,

LP’s

majority

owner

and its general partner.

–

ECP

has

indicated

an

intention

to

invest

over

$1.0

billion

of

additional

equity

capital

in

USDG,

subject

to

market

and

other

conditions

Fossil Generation

Midstream Oil and Gas |

2.

Overview of USD Partners LP (“USDP”) 13

|

Hardisty Phases

II & III

USDP: Partnership Structure & Overview

14

USD Group LLC

(USDG)

USD Partners GP LLC

(GP & IDRs)

Public Unitholders

Hardisty Rail

Terminal (Phase I)

San Antonio

Rail Terminal

West Colton

Rail Terminal

Railcar

Fleet Services

100%

Ownership

Interest

100% Ownership Interest

Assets Remaining at USDG

2.0% GP

Interest & IDRs

USD Partners LP

(the Partnership)

NYSE: USDP

Other

Strategic Projects

Energy Capital

Partners

USD Holdings LLC

& Management

Goldman Sachs

54.1% LP Interest

(Common Units and

Subordinated Units)

43.9%

LP

Interest

2

Ethanol (Destination)

20,000 Bpd design

capacity

100% fee-based

1. 172,629 bpd = 2 trains loaded per day * 120 railcars per train * approximately

720 barrels per railcar. 2. Includes 250,000 Class A Units (~1% of total

units) beneficially owned by certain management team members subject to certain vesting and other conversion requirements.

3,799 railcar fleet

100% take-or-pay

Ethanol (Destination)

13,000 Bpd design

capacity

100% fee-based

Crude Oil (Origination)

172,629 Bpd design

capacity

100% take-or-pay contracts

1 |

USDG has an extensive history as a proven developer of hydrocarbon-by-rail

facilities ECP involvement at the USDG level strengthens our Sponsor’s

financial position, providing a source of potential capital for third party

acquisitions and development projects

USDP: Investment Highlights

15

Relationship with

Our Sponsor

Strategically Located Assets

Stable and Predictable

Cash Flows

Multiple Growth Levers

Located near critical supply and demand centers

Hardisty Rail Terminal is the only crude-by-rail terminal with unit train

capabilities located in the Hardisty hub, one of the major crude oil supply

centers in North America San Antonio and West Colton rail terminals are the

closest ethanol terminals to key gasoline blending terminals in their areas

of operation 100% of our terminal revenue is fee-based and ~83% is from

investment grade counterparties or their subsidiaries

Substantially all rail terminalling capacity at our Hardisty Rail Terminal is

contracted under multi-year, take-or-pay agreements with

inflation-based rate escalators and automatic renewal provisions

Pursue drop downs from our Sponsor

Pursue organic growth initiatives that complement, optimize or improve the

profitability of our assets

Pursue acquisitions of energy-related rail terminals and high quality,

complementary midstream

infrastructure

from

third

parties

(with

or

without

our

Sponsor)

Financial Flexibility

Conservative

leverage

(1.1x

net

debt

to

NTM

Adjusted

EBITDA)

and

$58.9

million

of

cash on the balance sheet¹

Access to debt and equity capital markets provides significant financial

flexibility to effectively execute growth strategy

1. Based on USDP balance sheet as of 10/31/2014 and the Partnership’s estimated Adjusted EBITDA

for the 12 month period ending September 30, 2015 included in the IPO Prospectus.

Adjusted EBITDA is a non-GAAP financial measure. For a discussion of

EBITDA and the most comparable measures calculated in accordance with GAAP, see the Appendix.

|

Strategically Located Assets: Hardisty Rail Terminal

16

Overview of the Hardisty Rail Terminal

Origination terminal that commenced operations on June 30, 2014

Only unit train capable crude-by-rail terminal located at the Hardisty hub,

the primary location for storing and originating crude oil from

Alberta’s Crude Oil Basin Receives inbound deliveries via direct

pipeline connection to the Gibson Energy Inc. (“Gibson”) Hardisty storage terminal

Connected

to

CP

Railroad’s

North

Main

Line,

which

offers

connectivity

to

all

key

refining

markets

in

North

America

Ability to load up to two 120-railcar unit trains per day

Hardisty Rail Terminal

Located within Close Proximity to the Hardisty Hub

Hardisty Hub

Source: Gibson Energy Inc. (Hardisty hub operational storage capacity

figures). –

Fixed loading rack with 30 railcar loading positions

–

Unit train staging area

–

Loop tracks capable of holding 5 unit trains simultaneously

–

Gibson has over 5 MMbbls of storage at the Hardisty hub, with an additional 2

MMbbls of storage under construction –

Provides

access

to

most

major

pipeline

systems

in

the

Hardisty

complex |

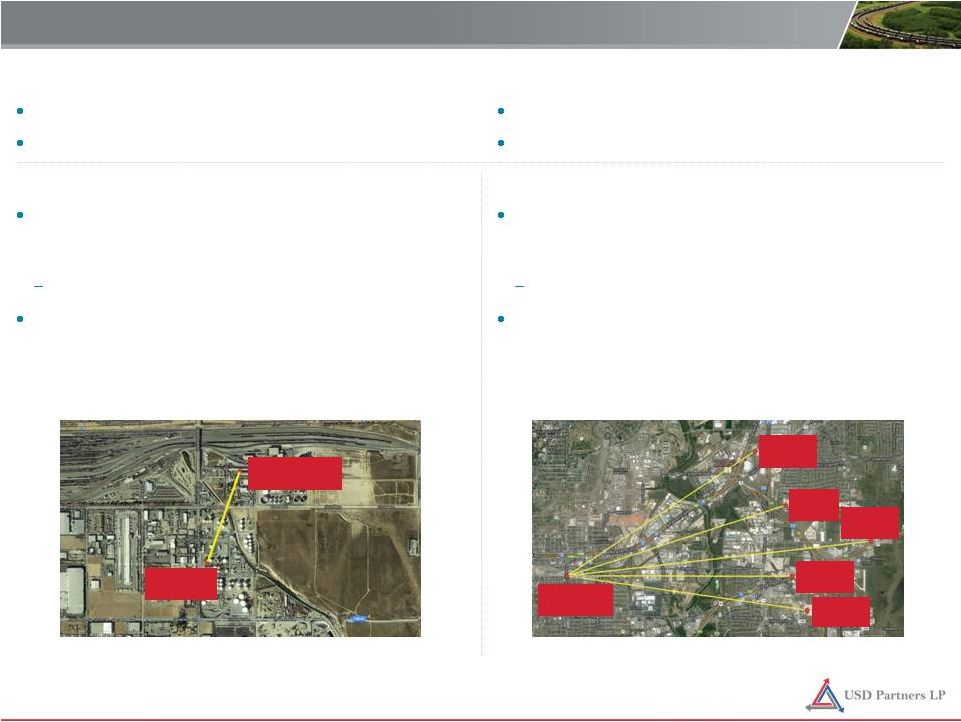

West Colton

Rail Terminal

Blending

Facilities

Strategically Located Assets: Ethanol Destination Terminals

17

Infrastructure Needs Addressed by Our Ethanol Destination Terminals

Fragmented production

Pipelines disadvantaged and trucks uneconomical

Significant regional imbalances

Regulatory pressures regarding gasoline blending

Overview of the West Colton Rail Terminal

Unit train-capable destination terminal that transloads

ethanol received by rail from regional and other producers at

a max rate of 13,000 Bpd

Located within one mile of the gasoline blending

terminals

that

supply

the

greater

San

Bernardino

and

Riverside County-Inland Empire region of Southern

California and the only rail terminal within a 10-mile radius of

the gasoline blending terminals

Overview of the San Antonio Rail Terminal

Unit train-capable destination terminal that transloads

ethanol received by rail from Midwestern producers at a max

rate of 20,000 Bpd

Located within five miles of San Antonio’s gasoline

blending terminals

and the only ethanol rail terminal within

a 20-mile radius of the gasoline blending terminals

San Antonio

Rail Terminal

Blending

Facilities

Blending

Facilities

Blending

Facilities

Blending

Facilities

Blending

Facilities

20 railcar offloading positions and 3 truck loading positions

20 railcar offloading positions and 3 truck loading positions

|

USDP’s ability to provide railcars gives customers additional incentives to

commit to USDP’s terminals, as end customers can find it difficult to

procure railcars themselves without the economies of scale and relationships

with railcar providers

USDP has entered into master fleet services agreements with a number of its rail

terminal customers for the use of its leased railcars on a fee-based,

take-or-pay basis for periods ranging from 5 to 9 years A Strategic

Asset: Our Railcar Fleet 18

Total Railcars (as of 09/30/14)

Currently Available for Service

In Production or on Order

Coiled and Insulated

General Purpose

Constructed in 2013 and 2014

3,799

2,919

2,108

66%

800

1,691

As of September 30, 2014, the weighted-average remaining contract life of

railcars dedicated to Hardisty rail terminal was 6.7 years; the

weighted-average contract life of the entire fleet was 5.3 years |

USDG is committed to safe, efficient and reliable operations that comply with

environmental and safety regulations

All USDG facilities meet or exceed all government safety regulations and are in

compliance with all recently enacted orders regarding the movement of

crude-by-rail USDG has been nationally recognized by the National

Safety Council, Burlington Northern Santa Fe Railway, and

Canadian

Pacific

Railways,

among

others,

for

its

outstanding

safety

record

Since inception, USDG has loaded and / or handled over 155 MMbbls of liquid

hydrocarbons with no reportable spills as defined by the U.S. Department of

Transportation (DOT) Pipeline and Hazardous Materials Safety Administration

(PHMSA) Strong Safety Record

19

Organization

Time Period

Recognition

National Safety Council

2006–2014

(Nine Consecutive Years)

Superior Safety

Performance Award

Canadian Pacific Railways

2013

Safe Shipper Award

Burlington Northern

Santa Fe Railway

2011–2012

(Two Consecutive Years)

Stewardship Award |

3.

Financial Overview 20 |

Stable and Predictable Cash Flows: Fee-Based Contracts

21

Estimated Adjusted EBITDA by Contract Type

Terminalling Customers

Note: Adjusted EBITDA is a non-GAAP measure. Charts represent breakout of

the Partnership’s estimated Adjusted EBITDA for the twelve month period ending September 30, 2015 included in

the IPO Prospectus.

Take-or-Pay

94%

Other Fee-Based

6%

6 out of 8 are subsidiaries of investment grade customers

No single customer represents more than 18% of estimated Adjusted EBITDA

J. Aron &

Company

Estimated Adjusted EBITDA by Asset

Hardisty Crude

Terminal

85%

USD

Rail

9%

Ethanol Terminals

6%

Our

fee-based

contracts

provide

stable

and

predictable

cash

flows

with

94%

from

take-or-pay |

Financial Flexibility

Financial Flexibility: Positioned to Pursue Growth

22

Debt and Liquidity

1.

Calculated based on Total Debt and Net Debt divided by the Partnership’s

estimated Adjusted EBITDA for the twelve month period ending September 30, 2015 included in the IPO

Prospectus.

($ in millions)

As of 10/31/2014

Cash and Cash Equivalents

$58.9

Revolving Credit Facility Capacity

200.0

Less: Funded Borrowings

0.0

Available Liquidity

$258.9

Borrowings on Revolver

$0.0

Term Loan

100.1

Total Debt

$100.1

Net Debt

41.2

Total Debt / Estimated NTM Adjusted EBITDA¹

2.6x

Net Debt / Estimated NTM Adjusted EBITDA¹

1.1x

In connection with the IPO, USDP entered into a $300 million senior secured credit

agreement consisting of a $100 million term loan (drawn in Canadian dollars)

and a $200 million revolving credit facility (undrawn) Revolving credit

facility capacity will expand to $300 million as the term loan is repaid

Revolving credit facility capacity can be further increased by $100 million

As

of

10/31/2014,

the

Partnership

had

$58.9

million

of

cash

on

the

balance

sheet

to

fund

potential

future

growth

initiatives

and

for

general partnership purposes |

Strategic Flexibility: Multiple Growth Levers

23

Pursue Drop Down Acquisitions from USDG

USDG has a strong track record of developing high-quality assets that align

with USDP’s vision and strategy Two

identified

potential

drop

downs

from

USDG:

Hardisty

Phase

II

and

Hardisty

Phase

III

–

USDG

is

in

the

process

of

designing,

engineering,

permitting

and

is

currently

negotiating

contracts

with

third parties with respect to Hardisty Phase II

Pursue

Third

Party

Acquisitions

with

Stable

and

Predictable

Cash

Flows

USDP intends to acquire energy-related rail terminals and high-quality,

complementary midstream infrastructure assets from third parties

–

Acquisitions will be pursued jointly with, or independently from, USDG

Pursue Organic Growth Initiatives

USDP will analyze and pursue operational efficiencies that complement, optimize or

improve the profitability of its assets

–

Currently in the process of seeking permits to construct a pipeline directly from

the West Colton Rail Terminal to Kinder Morgan, Inc.’s gasoline

blending terminals, which may result in additional cash flow and

long-term volume commitments

Expect to Achieve Mid-Teens Distribution Growth CAGR over the Next 5 Years

|

Investment Highlights

24

Strategically Located Assets

Stable and Predictable Cash Flows

Financial Flexibility

Multiple Growth Levers

Relationship with USDG / ECP |

Appendix

25 |

Total Quarterly

Distribution Per Unit Target Amount

Marginal % Interest in Distributions

Unitholders

General Partner

Minimum Quarterly Distribution

$0.287500

98%

2%

First Target Distribution

> $0.287500

$0.330625

98%

2%

Second Target Distribution

> $0.330625

$0.359375

85%

15%

Third Target Distribution

> $0.359375

$0.431250

75%

25%

Thereafter

> $0.431250

50%

50%

Additional Unit Information

26

Subordinated LP Units

Number of Units / % of Total

10,463,545 subordinated units / 49.0% of total units outstanding

Subordination Period

Subordinated units will convert in 5 separate equal tranches beginning no earlier

than January 1, 2015 assuming distributions equal or exceed the MDQ for the

prior 4 quarter period, there are no arrearages owed on common units, and

the adjusted operating surplus generated during the prior 4 quarter period

equals or exceeds the MDQ on all common, Class A, subordinated and GP units on a

fully diluted basis

A tranche of subordinated units will not convert more than once per year

Class A Units

Number of Units / % of Total

250,000 Class A units / 1.2% of total units outstanding

Summary Terms

Maximum number of common units into which Class A units could convert is

406,250 Vest in 4 equal annual installments beginning no earlier than

January 1, 2015 Upon

vesting,

units

are

convertible

into

common

units

based

on

a

factor

that

will

be

tied

to

the

level

of

distribution growth for the applicable year

–

If USDP does not grow its distributions per unit, then Class A units will be

forfeited –

Conversion factor will not exceed 1.25x for the first tranche, 1.5x for the

second, 1.75x for the third and 2.0x for the final tranche

|

Increased oil sands production creates need for sustainable

takeaway solution

A faster, scalable solution to growing production

Sustainability

of

Rail:

Western

Canada

Producer

Perspective

27

Expected Growth in Western Canadian Oil Sands Production

Typical Time to Market: Hardisty to U.S. Gulf Coast

7% CAGR Through 2020

5% CAGR Through 2030

~9 days

~30–45 days

Source: Canadian Association of Petroleum Producers (2014 Canadian Crude Oil

Production Forecast). 0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

Actual

Projected

0

5

10

15

20

25

30

35

40

Rail

Pipeline

–

Ability to choose destination once train is loaded, maximizing

netbacks and margins

–

Rail solution preserves quality of heavy barrel and ability to

export from Gulf Coast

–

Only a portion of rail transportation costs require

long-term commitments (railroads are typically contracted

on a spot basis)

–

Pipeline customers bear greater risks of changes in

regional differentials

–

Lower “no-flow”

financial risk

–

Utilizes existing infrastructure and rights-of-way

–

~1 year development time vs. multiple years for pipeline

–

Faster physical delivery to attractive end markets

–

Accessible to small and mid-sized producers and early stage

production areas

Offers increased flexibility and market optionality

Reduced shipper commitments / risk

~4x Longer

Market Exposure

7% CAGR Through 2020

5% CAGR Through 2030 |

Provides access to cheaper domestic crude feedstock

to displace more expensive heavy imports

Sustainability of Rail: U.S. Gulf Coast Refiner Perspective

28

Volumes of Imported Heavy Crude into the U.S.

Landed Cost of Imported Refinery Crude Inputs

Refinery Crude Oil Input Quality

Source: U.S. Energy Information Administration.

Note: “Landed Cost”

= The dollar per barrel price of crude oil at the port of discharge. Includes

charges associated with the purchase, transportation, and insuring of a cargo from the purchase

point to the port of discharge. Does not include charges incurred at the discharge

port (e.g., import tariffs or fees, wharfage charges, and demurrage).

1.

Notated

2014YTD

figures

represent

a

simple

average

of

monthly

weighted

averages

through

September

(latest

available

as

of

December

18,

2014).

Imported

heavy

crude

volumes

include

data through December 5, 2014.

Lower

API

~1.5 million bpd of

Displacement Opportunity

15

20

25

30

35

East Coast

(PADD1)

Midwest

(PADD2)

Gulf Coast

(PADD3)

TX Gulf

Coast

Rockies

(PADD4)

West Coast

(PADD5)

2012

2013

2014YTD¹

1,000

1,200

1,400

1,600

1,800

2,000

2,200

2,400

2,600

2,800

2010

2011

2012

2013

2014

Canada

Venezuela + Mexico

$84

$84

$87

$102

$99

$94

$102

$99

$94

$-

$20

$40

$60

$80

$100

$120

2012

2013

2014YTD¹

Canada

Mexico

Venezula

–

Opportunity for blending to optimize feedstock

–

Maximizes margins (reducing costs associated

with diluents)

–

Improves product distribution

Preserves the quality of a heavy barrel

–

~$87/bbl average landed cost from Canada vs.

~$94/bbl from Mexico and Venezuela¹

–

Strong demand for heavy crude oil (lower API) in

U.S. Gulf Coast |

Non-GAAP Measures

29

We define Adjusted EBITDA as net income before the following items: depreciation and amortization,

interest and other income, interest and other expense, gains and losses on derivative

contracts, foreign currency transaction gains and losses, unrecovered reimbursable freight

costs, income and withholding taxes, non-cash compensation expense related to our equity

compensation programs, discontinued operations and adjustments related to deferred revenue associated

with minimum volume commitments. Adjusted EBITDA is used as both a supplemental financial performance

measure by management and by external users of our financial statements, such as investors and

commercial banks. Our management and external users use Adjusted EBITDA in a number of ways to assess our combined

financial and operating performance, and we believe this measure is helpful to management and

external users in identifying trends in our performance. Adjusted EBITDA helps management

identify controllable expenses and make decisions designed to help us meet our current

financial goals and optimize our financial performance, while neutralizing the impact of capital

structure on results. Accordingly, we believe this metric measures our financial performance based on

operational factors that management can impact in the short-term, namely our cost structure

and expenses. We believe that the presentation of Adjusted EBITDA provides information useful to investors in

assessing our financial condition and results of operations. The GAAP measures most directly

comparable to Adjusted EBITDA are net income attributable to us and cash flow from operating

activities. Adjusted EBITDA should not be considered an alternative to Net income attributable,

Cash flow from operating activities or any other measure of financial performance or liquidity

presented in accordance with GAAP. Adjusted EBITDA excludes some, but not all, items that affect Net

income, and these measures may vary among other companies. As a result, Adjusted EBITDA may not

be comparable to similarly titled measures of other companies.

For a reconciliation of our estimated Adjusted EBITDA for the twelve months ending September 30, 2015

to our estimated net income for the twelve months ending September 30, 2015, please see page 75

of the IPO Prospectus. |