Attached files

| file | filename |

|---|---|

| EX-10.2 - EXHIBIT 10.2 - Dealertrack Technologies, Inc | v396943_ex10-2.htm |

| EX-99.1 - EXHIBIT 99.1 - Dealertrack Technologies, Inc | v396943_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - Dealertrack Technologies, Inc | v396943_ex2-1.htm |

| EX-10.3 - EXHIBIT 10.3 - Dealertrack Technologies, Inc | v396943_ex10-3.htm |

| EX-10.1 - EXHIBIT 10.1 - Dealertrack Technologies, Inc | v396943_ex10-1.htm |

| 8-K - FORM 8-K - Dealertrack Technologies, Inc | v396943_8k.htm |

EXHIBIT 99.2

Acquisition of incadea Catalyzes Global Expansion December 18, 2014 Investor Presentation Copyright © 2014 Dealertrack Technologies. All rights reserved. 1

Safe Harbor Forward - Looking Statements Statements in this presentation regarding the expected performance of Dealertrack Technologies, Inc . , the expected benefits of the transaction with i ncadea, the expected timing of the transaction, the long - term outlook for its business, and all other statements in this presentation other than the recitation of historical facts are forward - looking statements (as defined in the Private Securities Litigation Reform Act of 1995 ) . These statements involve a number of risks, uncertainties and other factors that could cause actual results, performance or achievements of Dealertrack Technologies to be materially different from any future results, performance or achievements expressed or implied by these forward - looking statements . Factors that might cause such a difference include : the possibility that expected benefits of the acquisition of incadea may not materialize as expected, that the conditions to the offer are not satisfied, that the acquisition may not be timely completed , if at all, that Dealertrack and its subsidiaries may not be able to successfully integrate the operations of incadea , realize synergies from the acquisition, or ensure the continued performance or growth of Incadea , economic trends that affect the automotive retail industry or the indirect automotive financing industry including the number of new and used cars sold ; reductions in auto dealerships ; increased competitive pressure from other industry participants, including CDK Global, Reynolds & Reynolds, Open Dealer Exchange, RouteOne, CUDL, Finance Express and AppOne ; the impact of some vendors of software products for automotive dealers making it more difficult for Dealertrack Technologies’ customers to use Dealertrack Technologies’ solutions and services ; security breaches, interruptions, failures and/or other errors involving Dealertrack Technologies’ systems or networks ; the failure or inability to execute any element of Dealertrack Technologies’ business strategy, including selling additional products and services to existing and new customers ; Dealertrack Technologies’ success in implementing an ERP system ; the volatility of Dealertrack Technologies’ stock price ; new regulations or changes to existing regulations ; the integration of recent acquisitions and the expected benefits, as well as the integration and expected benefits of any future acquisitions that Dealertrack Technologies may pursue ; Dealertrack Technologies’ success in expanding its customer base and product and service offerings, the impact of recent economic trends, and difficulties and increased costs associated with raising additional capital ; the impairment of intangible assets, such as trademarks and goodwill ; and other risks listed in Dealertrack Technologies’ reports filed with the Securities and Exchange Commission (SEC), including its most recent Annual Report on Form 10 - K . These filings can be found on Dealertrack Technologies’ website at www . Dealertrack . com and the SEC’s website at www . sec . gov . Forward - looking statements included herein speak only as of December 18 , 2014 and Dealertrack Technologies disclaims any obligation to revise or update such statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events or circumstances, except as required by law . 2

Dealertrack Technologies to Acquire incadea plc Chairman & CEO – Mark O’Neil 3

Taking Our Vision Global Deliver the market leading suite of integrated technologies capable of transforming automotive retailing… globally 1999 Elevated the role of digital in car buying. 2001 Revolutionized automotive credit. 2007 Offered end - to - end tools to drive efficiency. 2014 Provided clients with the tools to transform automotive retail. 2015 Global expansion. 4

Transaction Summary ▪ Under the terms of the Offer, incadea’s shareholders will receive 190 pence in cash for each issued and to be issued share ▪ The consideration for the Offer represents an aggregate equity value of approximately £ 122 million or US$ 190 million Purchase Price Financial Impact ▪ Offer and related transaction fees will be financed from Dealertrack’s available cash resources and borrowings under existing credit facilities, which have already been deposited into escrow ― Initial Net Debt / LTM EBITDA leverage ratio expected to be between 3.8x to 4.0x ▪ Impact of transaction on Dealertrack’s 2015 results will be disclosed during Q4 2014 earnings call in late February 2015 ▪ i ncadea’s publicly disclosed results and forecasts are presented under IFRS accounting standards and are not a representation of U.S. GAAP ▪ Cash offer for incadea plc (“incadea”), listed on the AIM market of the London Stock Exchange, subject to the UK Takeover Code ▪ Unanimous recommendation from the Board of incadea ▪ Irrevocable undertakings received from incadea’s major shareholders, who together control approximately 56% of incadea’s shares in issue ▪ Expected to close during the first quarter of 2015 ▪ incadea management team, led by Patrick Katenkamp, is expected to continue in their roles as an important part of Dealertrack’s international organization The Transaction 5

i ncadea Overview Business Overview Customer Overview Product Portfolio ▪ DMS, CRM, and Business Intelligence software and services ▪ Single platform built on proven Microsoft technology ▪ Robust new product development pipeline ▪ Available in more than 20 languages and fully localized to specific needs of individual markets ▪ Active customers in more than 85 countries ― Significant presence in Europe, Asia - Pacific and Latin America ▪ Long - term, deeply - established relationships with major global OEMs ▪ Serves more than 75,000 end - users across 3,400+ dealerships (1) ▪ Long - term contracts provide significant forward visibility ▪ Leading provider of DMS software and services to global automotive retail and wholesale market ▪ Founded in 2000 ▪ Headquartered in Munich, Germany ▪ IPO on the AIM market of the London Stock Exchange in May 2012 ▪ More than 500 global employees (1) 6 Note: incadea financials presented are under IFRS and not U.S. GAAP. 1. As of June 30, 2014.

$7 $10 $4 $21 DRIVER (pre- DDC) DDC IRENE Other Pro Forma DRIVER Increasing Market Opportunity International DMS Opportunity (1) ($ in billions) 2001 - 2013 2014 2015 2016+ Total North American Digital Advertising North American Product Offerings 7 ~ New Market Opportunity Potential incremental value from international penetration of existing DT products (2) (1) Source: Wall Street Research. (2) Potential incremental value will be evaluated in more detail to determine an estimate of the scale of the opportunity.

Transaction Rationale ▪ Positions Dealertrack as a global provider of retail automotive software and solutions ▪ Instant leadership position in the largest and fastest growing automotive markets around the world Global Footprint Global Addressable Market OEM Relationships Financial Profile Combined Growth Opportunities ▪ E xpands our global addressable market by approximately $4 billion for DMS only ▪ Increases our global installed dealer base ▪ Strengthens and broadens our existing relationships with global OEMs, dealers and other players in the automotive retail ecosystem ▪ Dilutive to Dealertrack’s 2015 revenue growth rate ▪ Accretive to Dealertrack’s revenue growth rate from 2016 to 2018 ▪ Large recent exclusive OEM wins provide long - term growth and visibility ▪ Experienced international management team with a successful track record of growth ▪ Expanded business into strategic key markets through several key OEM relationships and acquisitions Management ▪ Accelerate incadea’s standalone growth prospects by leveraging Dealertrack’s relationships and resources ▪ Potential opportunity to cross - sell and up - sell Dealertrack’s product solutions 8

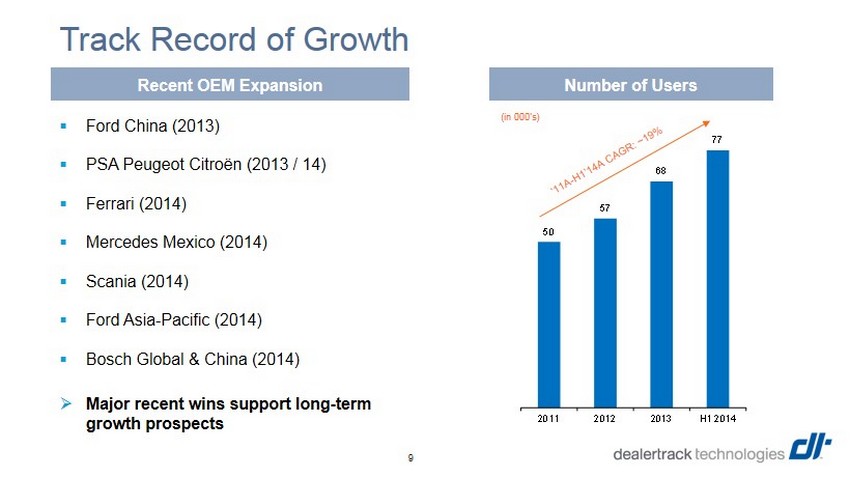

50 57 68 77 2011 2012 2013 H1 2014 Track Record of Growth ▪ Ford China (2013) ▪ PSA Peugeot Citroën ( 2013 / 14 ) ▪ Ferrari (2014) ▪ Mercedes Mexico (2014 ) ▪ Scania (2014) ▪ Ford Asia - Pacific (2014) ▪ Bosch Global & China (2014 ) Recent OEM Expansion Number of Users » Major recent wins support long - term growth prospects 9 (in 000’s)

Select OEM Wins Major contract with Ford worth more than $35 million over the next five years to cover the whole of the Asia Pacific region, covering approximately 1,000 franchised dealers with 15,000 users. incadea.myengine is implemented across Toyota’s Caucasus dealerships to cover Azerbaijan, Armenia, Tajikistan and Uzbekistan and increase its existing presence in Georgia M ulti - year agreement with Bosch China worth $20 million and expected to commence towards the end of 2015. This is the first deal won as part of the global framework agreement, announced in July 2014 Mercedes - Benz Mexico selected incadea.myengine, naming incadea an official certified DMS for Mercedes - Benz Mexico 10

i ncadea’s Growth Strategy Lines Up With Dealertrack’s ▪ Continued OEM expansion supported by recent wins ▪ Well - positioned in fastest growing automotive markets around the world ▪ Multiple sales opportunities with existing OEM’s (DMS, BI and CRM) ▪ Potential future opportunity to cross - sell Dealertrack’s solutions ▪ Cloud - based solutions ▪ Mobile tools ▪ Natural expansion opportunities inside the dealership and across the aftermarket value chain Grow Install Base Greater Share of Wallet New Products and Services Adjacent Segments 11

Incadea Financial Overview EVP, Chief Financial & Administrative Officer - Eric Jacobs 12

Financial Reporting Considerations ■ i ncadea’s LTM revenue based on June 30, 2014 results was approximately $54.8 million ( € 44.2 million) ■ Historical results have been reported under IFRS reporting standards, not U.S. GAAP ■ Prior company disclosed or analyst estimates for incadea’s 2015 outlook do not reflect Dealertrack management’s U.S. GAAP expectations ■ Expected impact on Dealertrack’s 2015 results will be disclosed during Q4 2014 earnings release in late February 2015 ■ Transaction is expected to close during first quarter, therefore incadea’s results will only impact a portion of the first quarter of 2015 13

Financial Reporting Considerations (cont’d) ■ incadea’s current pricing model is typically an upfront license fee followed by recurring annual maintenance and support fees ■ Majority of revenue is from on premise software solutions (emerging markets are adopting cloud solutions) ■ Dealertrack anticipates including maintenance and support fees within subscription revenue segment due to the recurring nature of the revenue stream ■ Dealertrack expects significant revenue recognition adjustments and a reduction of capitalized costs under U.S. GAAP ■ Expect no acquisitions of significance in the near - term ■ Renew our focus in 2015 on deleveraging our business 14

Conclusion Chairman & CEO – Mark O’Neil 15

Highlights ▪ Exciting and highly complementary acquisition ▪ International expansion from a DMS solution available in more than 85 countries (directly or through VARs) ▪ Reinforces and enhances OEM relationships globally ▪ Scalable global technology platform enabling significant upsell and cross - sell ▪ Expands addressable market opportunity and positions the combined company for continued future growth ▪ Adds to management strength in terms of international experience and industry knowledge ▪ Offer has secured the recommendation of the Board of incadea ▪ Received irrevocable undertakings representing approximately 56 % of the shares of incadea ▪ Offer expected to close in the first quarter of 2015 16

Appendix 17

Well Positioned to Benefit from Underlying Industry Dynamics ▪ Large and growing addressable market ▪ Significant opportunity to increase penetration within existing accounts ▪ New OEMs are emerging, particularly in China where incadea has a leadership position Strong, Diversified OEM Relationships Geographic Diversity Integrated Technology Platform ▪ Leadership position in Europe and the BRICs with a growing presence in the MINTs ▪ Established markets – focused on optimizing revenue, customer retention and profitability ▪ Emerging markets – focused on rolling out new dealer networks ▪ Strong relationships with VAR partners in certain geographies ▪ Global OEMs’ need for seamless global solutions ▪ Large, sticky installed user base with substantial upside potential ▪ Well positioned for ongoing OEM transition towards cloud and big data (BI) 2013A Sales per Geography Europe 58% APAC 33% LatAm 5% Russia 3% Rest of World 1% 18

Global Presence Germany Austria Greece Russia Portugal Spain China India Taiwan New Zealand Malaysia Hong Kong Colombia (Coming in 2015) Cyprus Dubai (Coming in 2015) Japan Mexico Latin America 1,400+ users 5 % of sales Russia 2,900+ users 3 % of sales Asia Pacific 23,400+ users 33% of sales Rest of the World 3,400+ users 1 % of sales Europe 45,800+ users 58% of sales ▪ Global capabilities with local market knowledge ▪ Long - term strategic consultative approach with OEM clients ▪ Continual investment in highly scalable technology ▪ i ncadea has long - term relationships with VAR partners in certain geographies 19

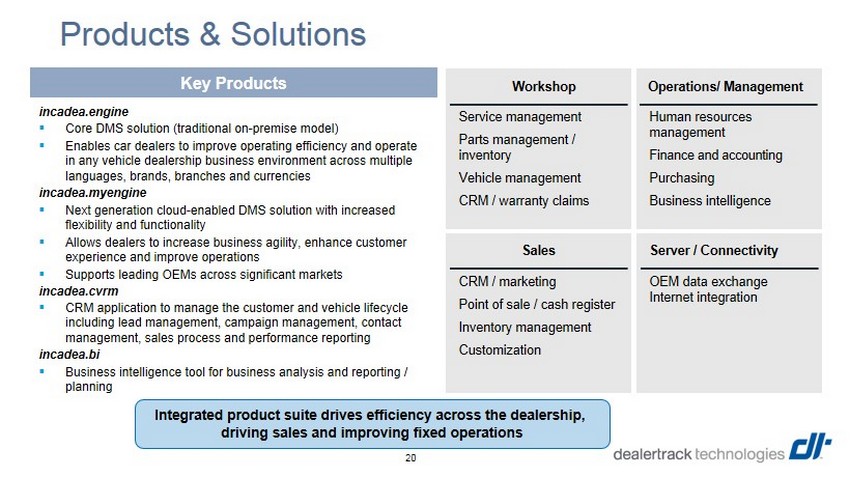

Products & Solutions Service management Parts management / inventory Vehicle management CRM / warranty claims Human resources management Finance and accounting Purchasing Business intelligence CRM / marketing Point of sale / cash register Inventory management Customization OEM data exchange Internet integration Workshop Operations/ Management Sales Server / Connectivity Key Products incadea.engine ▪ Core DMS solution (traditional on - premise model) ▪ Enables car dealers to improve operating efficiency and operate in any vehicle dealership business environment across multiple languages, brands, branches and currencies incadea.myengine ▪ Next generation cloud - enabled DMS solution with increased flexibility and functionality ▪ Allows dealers to increase business agility, enhance customer experience and improve operations ▪ Supports leading OEMs across significant markets incadea.cvrm ▪ CRM application to manage the customer and vehicle lifecycle including lead management, campaign management, contact management, sales process and performance reporting incadea.bi ▪ Business intelligence tool for business analysis and reporting / planning Integrated product suite drives efficiency across the dealership, driving sales and improving fixed operations 20

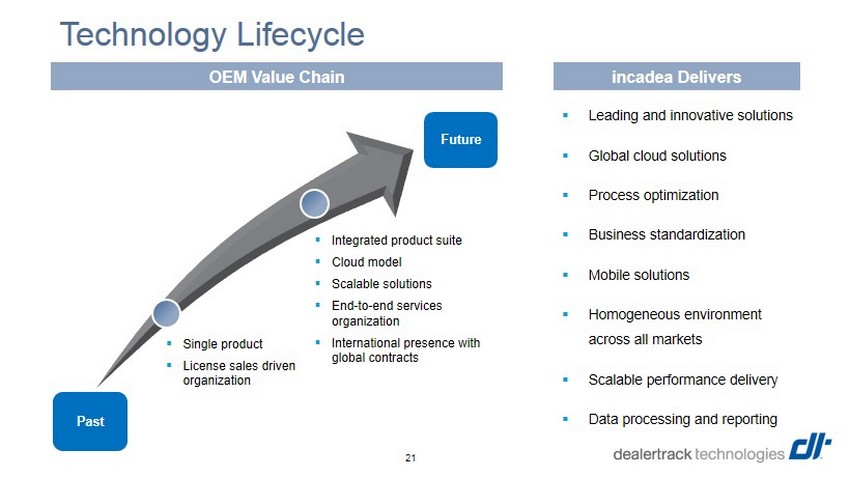

Technology Lifecycle OEM Value Chain incadea Delivers ▪ Leading and innovative solutions ▪ Global cloud solutions ▪ Process optimization ▪ Business standardization ▪ Mobile solutions ▪ Homogeneous environment across all markets ▪ Scalable performance delivery ▪ Data processing and reporting ▪ Integrated product suite ▪ Cloud model ▪ Scalable solutions ▪ End - to - end services organization ▪ International presence with global contracts ▪ Single product ▪ License sales driven organization Past Future 21

Why OEMs Choose incadea DMS Vendor Industry Positioning ▪ Provides OEM customers with a full “turn key” international solution in more than 85 markets ▪ Supports many of its OEM clients in their most important / fastest growing markets (e.g. BRIC) ▪ Seamless global technology platform provides further process efficiencies to OEM s ▪ Reputation is built on long standing and strong customer relationships ▪ Capability to support OEMs in a highly fragmented industry Local Multi - Market International Global Low Medium High International Coverage Strategic Relevance for OEM s 22 Preferred Vendor on last 3 RFPs Source: Dealertrack’s internal research.

Historical Financial Summary – IFRS presentation Revenue Geographic Revenue Mix ( € in millions) 2009 2013 55% 6% 28% 6% 6% Europe Russia Asia Pacific LatAm RoW 23 54% 6% 28% 6% 6% € 19.6 € 29.3 € 36.0 € 44.2 € 0.0 € 10.0 € 20.0 € 30.0 € 40.0 € 50.0 2011 2012 2013 LTM 6/30/2014 90% 6% 4%