Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Inuvo, Inc. | form8-kxxirdeck12x2014.htm |

Richard Howe • CEO Wally Ruiz • CFO DELIVERING ADS TO DESKTOP & MOBILE NYSE MKT: INUV

Forward Looking Statements Certain statements in this presentation relating to Inuvo®, Inc. ("Inuvo") contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. All forward-looking statements included in this presentation are based on information available to Inuvo as of the date hereof and Inuvo assume no obligation to update any forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including, without limitation, statements made with respect to expectations with respect to the strategy, markets, synergies, costs, efficiencies, and the company's plans, objectives, expectations, and intentions with respect to future operations. All forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements, many of which are generally outside the control of Inuvo and are difficult to predict. Additional key risks are described in the filings made by Inuvo filed with the U.S. Securities and Exchange Commission.

Marketing and Technology Company that brings Internet Consumers to Advertisers • $46M Revenue (TTM), $3.8M AEBITDA (TTM), $1.3M Profit (TTM) • In 2014, revenue has grown 14% sequentially to $13M in Q3 • 49% of revenue is from mobile • Net Income is already $1.5M, triple all of 2013 • AEBITDA is running 11% of revenue compared to 8.4% last year • Proprietary content and technology; serving 2 billion ads, collecting >20M clicks and > 5M unique visitors per month • Long standing advertising partnerships with Yahoo! and Google, amongst others • An accomplished management team and board with > 20% ownership Who is Inuvo?

It’s a Big Market Internet advertising worldwide is expected to be $140 billion in 2014; and growing at a 11% CAGR through 2017 Mobile advertising is expected to be $33 billion in 2014 and grow to be > 50% of all internet advertising by 2017 Search, 42.0% Display, 23.0% Mobile, 18.0% Social, 8.0% Other, 9.0% We have products in all digital advertising sectors

Two Business Segments 46% 54% 1 million users in 26 countries • 50 million unique visitors monthly 2 billion ads served monthly • 20 million clicks monthly OWNED DISTRIBUTION Apps PARTNER DISTRIBUTION Various Verticals

Information in this presentation is considered Confidential and Proprietary to INUVO and should not be disclosed or shared with others without INUVO’s permission. Reaching Consumers THRU A NETWORK OF PARTNER SITES & APPLICATIONS

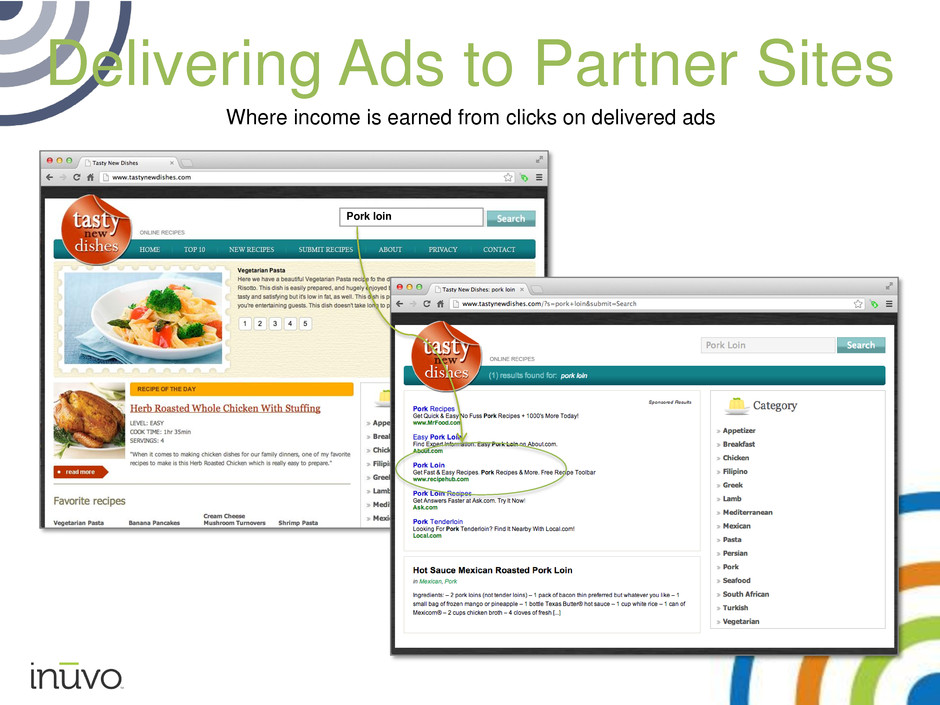

Delivering Ads to Partner Sites Where income is earned from clicks on delivered ads Pork loin

A Native Ad-Service to Partners Where income is earned from clicks on delivered ads

Inuvo Mobile D2S Landing Page A Display Service for Mobile Apps App Partner Mobile Ad Network Partner Where income is earned from clicks on delivered ads

Reaching Consumers THRU A NETWORK OF OWNED SITES & APPLICATIONS

careers.alot.com health.alot.com finance.alot.com travel.alot.com living.alot.com local.alot.com Suite of Mobile-Ready Web Sites That allow for the distribution of content & advertising

A Suite of Mobile-Ready Apps That allow for the distribution of content & advertising Finance Weather Photo Editing News Entertainment Travel Health Local

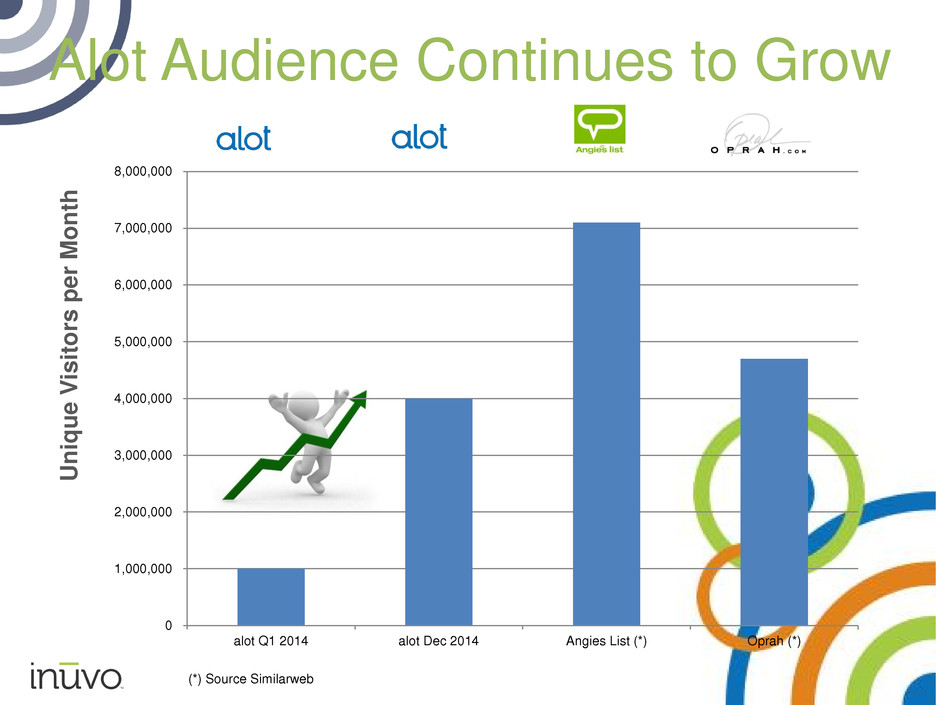

Alot Audience Continues to Grow U n iq u e V isi to rs p e r M o n th 0 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 7,000,000 8,000,000 alot Q1 2014 alot Dec 2014 Angies List (*) Oprah (*) (*) Source Similarweb

We own the end-to-end Ecosystem: • Content • Data–driven Marketing • Advanced Ad Serving Technology Competitive Strength …enhancing revenue and improving margins

Marketing Technology is a Core Competency DRIVING TRAFFIC THRU…

Organic & Social Media Traffic An important component of margin expansion • Shareable but reusable content • Our content is designed for sharing • Focus on headlines and images • Publishing on social channels • 2k+ Health, Finance & Travel followers • 50k fans on Facebook – 10% increase • Pinterest, LinkedIn, Tumblr, Instagram • 40-45 posts per day for Alot

Where are we going? • Capitalize on improving margins for faster growth • Continue development of ad tech through expansion of “Smart” ad units (e.g. programmatic and native advertising) • Accelerate the development of content and ways to access it • Increase number of publishers and available publisher inventory • Improve margins with organic traffic • Maintain low cost overhead and operation • Acquisitions that leverage our core competencies or expand our product offerings

Competitive Valuations (*) TTM Net Mkt Cap/ Mkt Cap Sales Profit Sales ABTL Autobytel, Inc. $98.7 $100.9 $38.4 1.0 BCOR Bluecora, Inc. $542.1 $640.0 $31.4 0.8 CNVR Conversant, Inc. $2,220.0 $598.1 $85.9 3.7 CRTO Criteo SA $2,290.0 $798.1 $24.8 2.9 DMD Demand Media, Inc. $119.9 $365.9 ($251.9) 0.3 DRIV Digital River Inc. $491.9 $375.3 ($9.0) 1.3 FUEL Rocket Fuel Inc. $576.5 $354.7 ($46.0) 1.6 LOCM Local Corporation $29.3 $93.6 ($7.1) 0.3 MCHX Marchex, Inc $166.3 $189.0 ($19.5) 0.9 MM Millennial Media Inc. $167.1 $306.4 ($141.2) 0.5 RUBI The Rubicon Project Inc. $535.4 $111.6 ($14.0) 4.8 TZOO Travelzoo Inc. $192.7 $148.1 $18.3 1.3 Average $619.1 $340.1 ($24.1) 1.8 INUV Inuvo, Inc. $28.7 $45.5 $1.2 0.6

• Fast growth - • Focused on achieving $100 million annual revenue within next 3 years • 14% sequential quarterly growth; Q3 revenue $13 million • Net Income is already triple all of 2013, $1.5 million • Strong cash flow and lower debt ($1 million net of cash at Sept 2014) significantly improves access to capital • Leverage created by contract structure and high component of fixed cost • Competitive advantage; proprietary content and technology; marketing prowess • High mobile content, a head of the industry curve 49% • High insider ownership > 20%; approximately 24 million common, no preferred or convertibles ; average daily volume 170,000 shares • Attractive valuation @ .6 * Sales Why Inuvo Should Be Part of Your Portfolio

Keeping Up With Inuvo Go to http://www.inuvo.com/investor-email to sign up today. Or call Wally Ruiz, CFO at 501-205-8397