Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 11, 2014

INTERNATIONAL GOLD CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-53676

|

N/A

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

|

666 Burrard Street, Suite 600

Vancouver, British Columbia, Canada

|

V6C 3P6

|

|

(Address of principal executive offices)

|

(Zip Code)

|

778-370-1372

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

1

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This current report on Form 8-K (this “Report”) contains forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks and the risks set out below, any of which may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks include, by way of example and not in limitation:

|

·

|

the uncertainty of future revenue and profitability based upon our current financial condition and history of losses;

|

|

·

|

our lack of operating history;

|

|

·

|

risks relating to our liquidity;

|

|

·

|

risks related to the market for our common stock and our ability to dilute our current shareholders’ interest;

|

|

·

|

risks related to our ability to locate and proceed with a new project or business for which we can obtain funding;

|

|

·

|

risks related to our ability to obtain adequate financing on a timely basis and on acceptable terms; and

|

|

·

|

other risks and uncertainties related to our business strategy.

|

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

USE OF CERTAIN DEFINED TERMS

Except as otherwise indicated by the context, references in this Report to “we”, “us” and “our” are to International Gold Corp.

In addition, unless the context otherwise requires and for the purposes of this Report only:

|

|

·

|

“Closing Date” means December 11, 2014;

|

|

|

·

|

“Exchange Act” means the Securities Exchange Act of 1934, as amended;

|

|

|

·

|

“LSG” means Lode Star Gold Inc., a Nevada corporation;

|

|

|

·

|

“NSR” means net smelter returns;

|

2

|

|

·

|

“Option Agreement” means our mineral option agreement with LSG dated October 4, 2014;

|

|

|

·

|

“Property” means those mineral claims owned by LSG and located in the State of Nevada known as the “Goldfield Bonanza Project”;

|

|

|

·

|

“SEC” means the Securities and Exchange Commission;

|

|

|

·

|

“Securities Act” means the Securities Act of 1933, as amended; and

|

|

|

·

|

“US GAAP” means generally accepted accounting principles in the United States.

|

Additional defined terms are included throughout this Report.

All references to currency in this Report are to United States dollars unless otherwise specified.

INTRODUCTION

On December 5, 2014, we entered into a subscription agreement (the “Subscription Agreement”) with LSG pursuant to which we agreed to issue 35,000,000 shares of our common stock to LSG in exchange for a 20% undivided interest in and to the Property (the “Acquisition”). The execution of the Subscription Agreement was one of the closing conditions of the Option Agreement, pursuant to which we acquired the sole and exclusive option to earn up to an 80% undivided interest in and to the Property. In order to earn the additional 60% interest in the Property, we are required to fund all expenditures on the Property and pay LSG an aggregate of $5 million in cash in the form of a NSR royalty, each beginning on the Closing Date.

On the Closing Date, we satisfied all the closing conditions in the Subscription Agreement and issued the 35,000,000 shares of our common stock to LSG, thereby completing the Acquisition.

The Acquisition was accounted for as a reverse acquisition whereby LSG acquired a majority of our issued and outstanding shares, resulting in LSG acquiring control of us. LSG is therefore is considered the acquirer for accounting purposes.

As a result of the Acquisition and on the Closing Date, Robert Baker submitted his resignation as our President and Chief Executive Officer, and Mark Walmesley, our Chief Financial Officer, Treasurer and director, as well as a director of LSG, was appointed to fill the resulting vacancies. Mr. Walmesley is now our President, Chief Executive Officer, Chief Financial Officer, Treasurer and director, and Mr. Baker is our Secretary and director.

Prior to the completion of the Acquisition, we were a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act) since we were not generating revenues, did not own an operating business, did not have any assets other than cash and cash equivalents, and had no specific plan other than to engage in a merger or acquisition transaction with an operating company or business. Since we were a shell company, and in accordance with the requirements of Items 2.01(f) and 5.01(a)(8) of Form 8-K, this Report sets forth information that would be required if we were required to file a general form for registration of securities on Form 10 under the Exchange Act with respect to our common stock (which is the only class of our securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act).

Item 1.01 Entry into a Material Definitive Agreement

On the Closing Date, we acquired a 20% interest in the Property in exchange for the issuance of 35,000,000 shares of our common stock to LSG at a deemed price of $0.02 per share. As a result of the Acquisition, LSG became our controlling stockholder.

3

As a condition of the closing of the Subscription Agreement, we also entered into a settlement agreement with Woodburn Holdings Ltd. and Robert Baker, our former sole officer and director, dated December 5, 2014 (the “Settlement Agreement”).

Option Agreement

The Option Agreement sets out the terms and conditions governing the Acquisition as well as our obligations in respect of the Property. Following the completion of the Acquisition and in order to earn an additional 60% interest in the Property (for a total of 80%), we are required to fund all expenditures on the Property and pay LSG an aggregate of $5 million in cash from the Property’s mineral production proceeds in the form of a NSR royalty. Until such time as we have earned the additional 60% interest, the NSR royalty will be split as to 79.2% to LSG and 19.8% to us since the Property is subject to a pre-existing 1% NSR royalty in favor of a third party.

If we fail to make any cash payments to LSG within one year of the Closing Date, we are required to pay LSG an additional $100,000, and in any subsequent years in which we fail to complete the payment of the entire $5 million described above, we must make quarterly cash payments to LSG of $25,000 until such time as we have earned the additional 60% interest in the Property.

In addition, the Option Agreement provides that we will act as the operator on the Property and that a management committee will be formed comprised of representatives from us and LSG, with voting based on each party’s proportionate Interest, to supervise exploration of the Property and approve work programs and budgets. As the operator, we are also obliged to perform a number of functions, including the following:

|

·

|

consider, develop and submit work programs to the management committee for consideration and approval, and to implement work programs when approved;

|

|

·

|

carry out operations in a prudent and workmanlike manner and in accordance with all applicable laws and regulations, and all agreements, permits and licenses relating to the Property and LSG;

|

|

·

|

pay and discharge all wages and accounts for material and services and all other costs and expenses that may be incurred by the us in connection with our operations on the property;

|

|

·

|

maintain and keep in force and, upon request by LSG provide reasonable documentary verification of, levels of insurance as are reasonable in respect of our activities in connection with the Property;

|

|

·

|

maintain true and correct books, accounts and records of expenditures; and

|

|

·

|

deliver to the management committee quarterly and annual progress reports.

|

Settlement Agreement

The closing of the Subscription Agreement was conditional upon the termination of the consulting agreement between us and Woodburn Holdings Ltd. (“Woodburn”) dated February 21, 2012 and effective as of January 1, 2012 (the “Consulting Agreement”), the complete text of which was included as Exhibit 10.1 to our current report on Form 8-K filed with the SEC on February 21, 2012. Robert Baker, our former sole officer and director, is the controlling shareholder of Woodburn.

Pursuant to the Consulting Agreement, Woodburn agreed to provide the services of Mr. Baker as our Chief Executive Officer, Chief Financial Officer and Secretary for a term of 48 months in exchange for base compensation of $90,000 per annum, to be paid in equal monthly installments of $7,500, in arrears, plus applicable taxes. In addition, we agreed to reimburse Woodburn for its reasonable business and/or entertainment and automobile expenses for the duration of the Consulting Agreement. Effective July 1, 2012, the compensation rate was increased to $108,000 per annum, in equal monthly installments of $9,000, in arrears, plus applicable taxes.

4

The Settlement Agreement terminates the Consulting Agreement with immediate effect and provides for the settlement of any and all claims between us, Woodburn and Mr. Baker that existed as of the date of the Settlement Agreement. In addition, it provides that we will pay Mr. Baker $10,000 in cash on or before 30 days from the Closing Date and a minimum of $2,400 in cash per month until such time as he has received an aggregate of $34,000 in cash compensation from us. As of the date of the Settlement Agreement, we had paid Mr. Baker the sum of $13,750, meaning that we still owed him a total of $20,250.

The foregoing description of the Option Agreement and Settlement Agreement includes a summary of all the material provisions but is qualified in its entirety by reference to the complete text of those agreements included as Exhibits 10.1 and 10.2, respectively, to this Report and incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets

The disclosure in Item 1.01 regarding the Acquisition is incorporated herein by reference in its entirety.

FORM 10 DISCLOSURE

As disclosed elsewhere in this Report, we issued 35,000,000 shares of our common stock to LSG on the Closing Date pursuant to the Subscription Agreement, thereby completing the Acquisition. The Acquisition was accounted for as a reverse acquisition, with LSG considered as the acquirer for accounting purposes. Items 2.01(f) and 5.01(a)(8) of Form 8-K provide that if we were a shell company, other than a business combination related shell company (as those terms are defined in Rule 12b-2 under the Exchange Act) immediately before the Acquisition, then we must disclose the information that would be required if we were filing a general form for registration of securities on Form 10 under the Exchange Act reflecting all classes of our securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon the completion of the Acquisition.

Since we were a shell company immediately before the Acquisition, we are providing the information that we would be required to disclose on Form 10 under the Exchange Act if we were to file such a form.

DESCRIPTION OF BUSINESS

Our History

We were incorporated in the State of Nevada on December 9, 2004 for the purpose of engaging in the acquisition and exploration of mining properties. We maintain our statutory registered agent’s office at 502 North Division Street, Carson City, Nevada 89703-4103 and our business office is located at 666 Burrard Street, Suite 600, Vancouver, British Columbia, Canada V6E 4M8.

From 2004 to 2011, we held the right to conduct mineral exploration activities on a property in British Columbia, Canada. The claim was located on the south end of Polley Lake, approximately 90 kilometers northeast of the city of Williams Lake in the Cariboo Mining Division of British Columbia. No work was performed on the property. In 2011, due to adverse economic conditions and the increasing difficulty of raising funding for small scale mining exploration, we decided not to pursue exploration activities on the claim. The mineral claim interest was expensed and charged to mineral property costs in 2011.

On July 15, 2011, we entered into a definitive securities purchase agreement with respect to the proposed acquisition of rights to certain mining concessions located in the State of Chihuahua, Mexico, covering approximately 15,980 hectares. Pursuant to the terms of the agreement we agreed to issue 25,000,000 shares of common stock and make $150,000 in aggregate cash payments. Of that amount, $75,000 was advanced on June 20, 2011 and the remaining $75,000 was payable on or before closing.

5

In the event the transaction did not close, the advance amount paid was to be treated as a secured demand loan bearing interest at 5% per annum.

The closing of the transaction was subject to a number of conditions, including satisfactory completion of both parties’ due diligence; obtaining all necessary governmental, regulatory and third party consents, waivers and approvals; the appointment of two nominees to our board of directors; and completion of an interim financing with proceeds intended to be used to fund our working capital.

The 25,000,000 shares were not issued and none of the closing conditions described above were completed. We agreed on September 27, 2011 to a mutual release and cancellation of the agreement. The other party acknowledged the $75,000 advanced as a loan from us, bearing interest at 5% per annum and indicated it would use best efforts to repay the loan in a timely manner. The loan is secured by the assets of the other party and we expect to be repaid. However, collectability is uncertain. In 2011 we made a provision for loan loss in the amount of $76,418, for the full amount of the loan plus accrued interest.

On July 15, 2012, we entered into a letter of intent (the “SLC LOI”) with SignalChem Lifesciences Corporation, a private company incorporated in the Province of British Columbia, Canada (“SLC”), with respect to the proposed exchange of all of the issued and outstanding shares of SLC for shares of our common stock. We were unable to conclude negotiations with SLC and agreed with that company on October 1, 2013 to terminate the SLC LOI.

On January 30, 2014, we entered into a letter of intent (the “ECI LOI”) with ECI Canada, Inc., a private company incorporated in the Province of Ontario, Canada (“ECI”), with respect to the proposed exchange of all the issued and outstanding shares of ECI for a minimum of 60% of our outstanding shares following the completion of the transaction. The ECI LOI was subject to a number of conditions, including the negotiation and execution of a definitive agreement, receipt of all required regulatory approvals, and completion of due diligence investigations by both companies. We were unable to negotiate a definitive agreement with ECI by April 15, 2014 and decided against pursuing an agreement during the second quarter of 2014.

On August 29, 2014, we entered into a letter of intent (the “LSG LOI”) with LSG which was superseded by the Option Agreement. A complete text of the LSG LOI was included as Exhibit 10.1 to our current report on Form 8-K filed with the SEC on September 3, 2014.

We have no revenues, have experienced losses since inception and have been issued a going concern opinion by our auditor. Immediately prior to the Acquisition, we also had no properties, were not conducting any exploration work and were not currently in the “exploration stage”.

LSG’s History

LSG was incorporated in the State of Nevada on March 13, 1998 for the purpose of acquiring exploration stage mineral properties. It currently has one shareholder, Lonnie Humphries, who is the spouse of Mark Walmesley, our Chief Financial Officer, Treasurer and director prior to the completion of the Acquisition, and now our President and Chief Executive Officer as well. Mr. Walmesley is also the Director of Operations and a director of LSG.

LSG acquired the leases to the Property in 1997 and became the registered and beneficial owner of the Property on September 19, 2009. Since the earlier of those dates, it has conducted contract exploration work on the Property but has not determined whether it contains mineral reserves that are economically recoverable.

In December 2010, it entered into a binding letter of intent with ICN Resources Ltd., a British Columbia corporation with its common shares listed for trading on the TSX Venture Exchange (“ICN”), to earn up to an 80% interest in the Property. ICN and LSG, together with Esmerelda Gold Inc, a wholly-owned Nevada subsidiary of ICN (“Esmerelda”), entered into a definitive mineral option agreement in respect of this transaction on March 23, 2011 (the “ICN Option Agreement”).

6

On October 17, 2012, Corazon Gold Corp., another British Columbia corporation with its common shares listed for trading on the TSX Venture Exchange (“Corazon”), completed a business combination with ICN whereby it acquired 100% of ICN’s issued and outstanding shares and therefore the rights to the Property through Esmerelda. On August 13, 2013, LSG issued a notice of default to Corazon under the ICN Option Agreement, and that agreement was formally terminated by LSG on September 17, 2013.

LSG is an exploration stage company and has not generated any revenues since its inception. The Property represents its only material asset.

The Acquisition

On the Closing Date, we completed the Acquisition whereby we acquired a 20% interest in the Property in exchange for the issuance of 35,000,000 shares of our common stock to LSG at a deemed price of $0.02 per share. As a result of the Acquisition, LSG became our controlling stockholder. The Acquisition was accounted for as a reverse acquisition, with LSG as the accounting acquirer and our company as the accounting acquiree.

In connection with the Acquisition and on the Closing Date, our former sole officer and director, Robert Baker, resigned as our President and Chief Executive Officer and we appointed Mark Walmesley, our Chief Financial Officer, Treasurer and director, as well as a director of LSG, to fill the resulting vacancies. Mr. Walmesley is now our President, Chief Executive Officer, Chief Financial Officer, Treasurer and director, and Mr. Baker is our Secretary and director.

The Property

Location and Means of Access

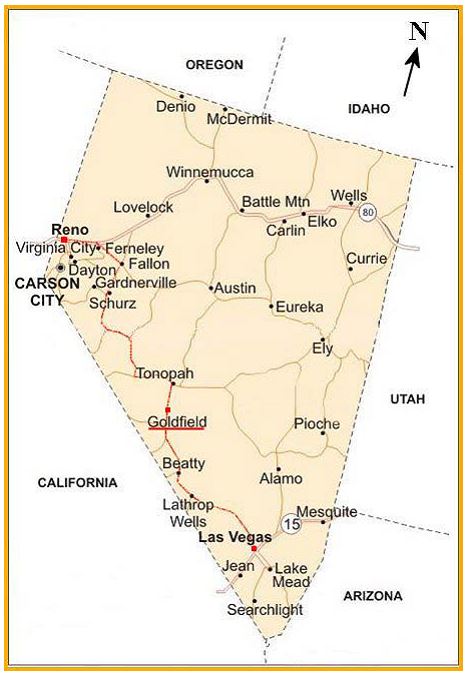

The Property is located in west-central Nevada (Figure 1), in the Goldfield Mining District at Latitude 37° 42’, and Longitude 117° 14’. The claims comprising the Property are located in surveyed sections 35 and 36, Township 2 South, Range 42 East, and in sections 1, 2, 11, and 12, Township 3 South, Range 42 East, in Esmeralda County, Nevada. The Property is accessible by traveling approximately one-half mile northeast of the community of Goldfield, along a county-maintained road that originates at U.S. Highway 95, which runs through “downtown” Goldfield. The town of Goldfield, which is the Esmeralda county seat (population 300), is approximately 200 air miles south of Reno and 180 air miles north of Las Vegas.

Surface access on the Property is excellent and the relief is low, at an elevation of approximately 6000 feet. Vegetation is sparse, consisting largely of sagebrush, rabbitbrush, Joshua trees and grasses.

7

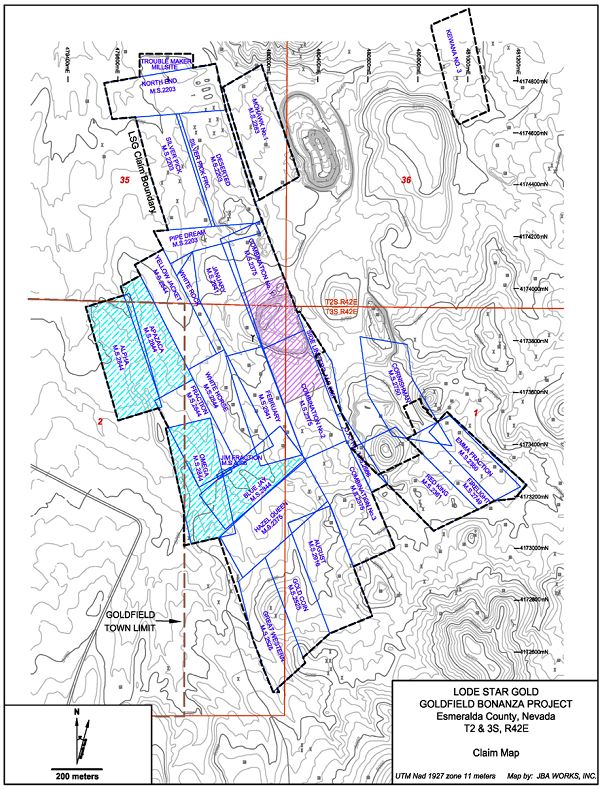

Figure 1: Property Location Map

Description of the Property

The Property consists of 31 patented claims and 1 unpatented millsite claim, covering a total of approximately 460 acres, or 186 hectares. Only the single unpatented claim is administered by the United States Bureau of Land Management (the “BLM”), and annual assessment filings and payments are due on it. The patented claims are owned as private land by LSG, and only annual property taxes must be paid.

The 31 patented claims and one unpatented millsite claim are as follows:

8

Patented Claims

|

Claim Name

|

U.S. Survey No.

|

|

Combination No. 3

|

2375

|

|

August

|

2916

|

|

Great Western

|

2525

|

|

Gold Coin

|

2525

|

|

February

|

2941

|

|

Mohawk No. 1

|

2283

|

|

Side Line Fraction

|

2567

|

|

January

|

2941

|

|

Silver Pick

|

2203

|

|

Silver Pick Fraction

|

2203

|

|

Deserted (1)

|

2203

|

|

Pipe Dream

|

2203

|

|

North End (2)

|

2203

|

|

Hazel Queen

|

2375

|

|

Fraction

|

2844

|

|

White Horse

|

2844

|

|

White Rock

|

2844

|

|

Yellow Jacket

|

2844

|

|

Firelight

|

2749

|

|

Emma Fraction

|

2360

|

|

S.E. 2/3 Red King (more or less)

|

2361

|

|

S.E. 1/2 (Cornishman)

|

2750

|

|

Kewana #3

|

2565

|

|

Blue Jay

|

2375

|

|

Combination No. 1 Claim (3)

|

2375

|

9

|

Combination No 2 Claim (4)

|

2844 (19/24th interest)

|

|

Omega

|

2844 (19/24th interest)

|

|

Apazaca

|

2844 (19/24th interest)

|

|

Alpha

|

2844 (19/24th interest)

|

|

Jim Fraction

|

4096 (19/24th interest)

|

|

O.K. Fraction

|

2560 (¾ of ½ interest)

|

Notes:

|

(1)

|

Excluding the upper 200 feet from surface of the north ½ of such claim (the “Deserted Excluded Zone”). We may, in our sole and unfettered discretion, by written notice to LSG at any time during the term of the Option Agreement, opt to include the Deserted Excluded Zone in the Property.

|

|

(2)

|

Excluding the upper 200 feet from surface of the east ½ of such claim (the “North End Excluded Zone”). We may, in our sole and unfettered discretion, by written notice to LSG at any time during the term of the Agreement, opt to include the North End Excluded Zone in the Property.

|

|

(3)

|

Includes all depths of the north ½ of such claim along with depths beneath 380 feet on the south ½ of such claim.

|

|

(4)

|

Includes all depths of the south ½ of such claim along with depths beneath 380 feet on the south ½ of such claim.

|

Unpatented Claims

|

Claim Name

|

Nevada Mining Claim (NMC) No.

|

|

Troublemaker

|

1034313

|

The claims include any and all contracts, easements, leases and rights-of-way affecting or appurtenant thereto.

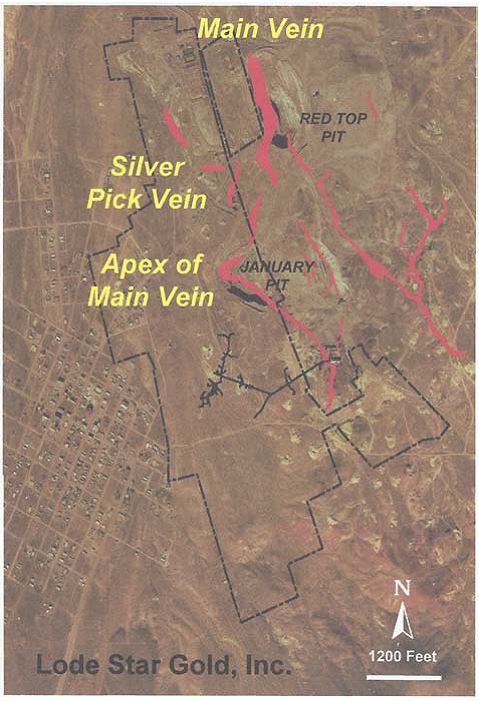

A map of the claims is included in Figure 2.

10

Figure 2: Claim Map

11

Glossary

Ag – silver

Andesite – An igneous, extrusive rock.

Anomaly – Any departure from the norm which may indicate the presence of mineralization in the underlying bedrock.

Assay – A chemical test performed on a sample of ores or minerals to determine the amount of valuable metals contained therein.

Au – Gold

Base metal – Any non-precious metal (e.g., copper, lead, zinc, nickel, etc.).

Breccia – A rock composed of broken fragments of minerals that can either be similar to or different from the composition of the fragments.

Calcereous – mostly or partly composed of calcium carbonate.

Chalcocite – A sulphide mineral of copper and iron; the most important ore mineral of copper.

Claim – A portion of land held either by a prospector or a mining company.

Clastic sediments – Rocks composed predominantly of broken pieces of older weathered or eroded rocks.

Clay – A fine-grained material composed of hydrous aluminum silicates.

Cleavage – The tendency of a mineral to split along crystallographic planes.

Contact – A geological term used to describe the line or plane along which two different rock formations meet.

Crosscut – A horizontal opening driven from a shaft and (or near) right angles to the strike of a vein or other orebody.

Dacite – An igneous, volcanic rock.

Development – Underground work carried out for the purpose of opening up a mineral deposit. It includes shaft sinking, crosscutting, drifting and raising.

Drift – A horizontal underground opening that follows along the length of a vein or rock formation as opposed to a crosscut which crosses the rock formation.

Epithermal – Deposited from warn waters at shallow depth under conditions in the lower ranges of temperature and pressure.

Exploration – Prospecting, sampling, mapping, diamond drilling and other work involved in searching for ore.

Face – The end of a drift, crosscut or stope in which work is taking place.

Fracture – A break in the rock, the opening of which allows mineral-bearing solutions to enter. A "cross-fracture" is a minor break extending at more-or-less right angles to the direction of the principal fractures.

Gangue -- the commercially worthless material that surrounds, or is closely mixed with, a wanted mineral in an ore deposit.

Geochemistry – The study of the chemical properties of rocks.

Geology – The science concerned with the study of the rocks which compose the Earth.

G/t – grams per tonne.

Host rock – The rock surrounding an ore deposit.

Igneous rocks – Rocks formed by the solidification of molten material from far below the earth’s surface.

Intrusive – A body of igneous rock formed by the consolidation of magma intruded into other rocks, in contrast to lavas, which are extruded upon the surface.

Km – kilometers.

Latite – An igneous, volcanic rock.

Lava – A general name for the molten rock ejected by volcanoes.

Lens – Generally used to describe a body of ore that is thick in the middle and tapers towards the ends.

Lode – A mineral deposit in solid rock.

M – meters.

Magma – The molten material deep in the Earth from which rocks are formed.

Metamorphic rocks – Rocks which have undergone a change in texture or composition as the result of heat and/or pressure.

Mineral – A naturally occurring homogeneous substance having definite physical properties and chemical composition and, if formed under favorable conditions, a definite crystal form.

Mineralization – A natural aggregation of one or more minerals, which has not been delineated to the extent that sufficient average grade or dimensions can be reasonably estimated or called a “deposit” or “ore”. Further exploration or development expenditures may or may not be warranted by such an occurrence depending on the circumstances.

Monzonite – An igneous, intrusive rock.

Net smelter return – A share of the net revenues generated from the sale of metal produced by a mine.

Ore – A mixture of ore minerals and gangue from which at least one of the metals can be extracted at a profit.

Orebody – A natural concentration of valuable material that can be extracted and sold at a profit.

Oz – troy ounces precious metal.

Plutonic – Refers to rocks of igneous origin that have come from great depth.

Prophyry – A variety of igneous rock consisting of large-grained crystals.

Pyrite – A yellow iron sulphide mineral, normally of little value. It is sometimes referred to as “fool's gold”.

Quartz – A common rock-forming mineral consisting of silicon and oxygen.

Reclamation – The restoration of a site after mining or exploration activity is completed.

Resource – The calculated amount of material in a mineral deposit, based on limited drill information.

Rhyolite – An igneous rock of silica-rich composition.

Rock – Any natural combination of minerals; part of the earth’s crust.

Royalty – An amount of money paid at regular intervals by the lessee or operator of an exploration or mining property to the owner of the ground. Generally based on a certain amount per tonne or a percentage of the total production or profits. Also, the fee paid for the right to use a patented process.

Sample – A small portion of rock or a mineral deposit taken so that the metal content can be determined by assaying.

Sampling – Selecting a fractional but representative part of a mineral deposit for analysis.

Sandstone – A sedimentary rock consisting of grains of sand cemented together.

Schist – A foliated metamorphic rock the grains of which have a roughly parallel arrangement; generally developed by shearing.

Sedimentary rocks – Secondary rocks formed from material derived from other rocks and laid down under water.

Shaft – A vertical or inclined excavation in rock for the purpose of providing access to an orebody. Usually equipped with a hoist at the top, which lowers and raises a conveyance for handling workers and materials.

Shear or shearing – The deformation of rocks by lateral movement along innumerable parallel planes, generally resulting from pressure and producing such metamorphic structures as cleavage and schistosity.

Shear zone – A zone in which shearing has occurred on a large scale.

Slica – Silicon dioxide. Quartz is a common example.

Stope – An excavation in a mine from which ore is, or has been, extracted.

Strike – The direction, or bearing from true north, of a vein or rock formation measured on a horizontal surface.

Strike length – The longest horizontal dimension of a body or zone.

Sulphide – A compound of sulphur and some other element.

Tuff – Rock composed of fine volcanic ash.

USGS – The United States Geological Survey.

Vein – A fissure, fault or crack in a rock filled by minerals that have travelled upwards from some deep source.

Volcanic rocks – Igneous rocks formed from magma that has flowed out or has been violently ejected from a volcano.

Zone – An area of distinct mineralization.

History

The Goldfield district was discovered late in 1902 and the first production was late in 1903. It was a stereotypical mining boomtown with a population of 25,000 people within a few years. An estimated 4.2 million ounces (130,000 kg) of gold were produced between 1903 and 1960, with more than 90% of that produced before 1919. Some of the ore was incredibly rich.

The Property lies along the western margin of the Main District and covers 460 acres. The first production was of high grades from the Phelan shaft in the northern part in 1910. Other modest production was made from several shafts on the Property. The first significant production was made by Newmont Mining (“Newmont”) in 1949-51 in the Newmont Lode and Red Hills areas, where ICN focused most of its exploration. There is a complex modern exploration history, with the Property being explored by Trafalgar Mines (“Trafalgar”) and Westley Explorations Inc. (“Westley”) from 1983 to 1988. They drilled 37,000 feet of holes and did seismic studies. From 1988 to 1997, Geochem Mines, Inc. (“Geochem”) explored the Property. Its principal contribution was rehabilitating the February Premier shaft. LSG explored the property from 1998 to 2010, and its program included rehabilitation and sampling of old workings, and extensive surface and underground drilling. Drilling totaled 39,300 feet.

In March 2011, ICN carried out an extensive program. It included a biogeochemical study, a CSAMT survey of the entire property, 5800 feet of core drilling in 26 holes and 27,400 feet of reverse circulation drilling for a total of 63 reverse circulation (“RC”) holes.

A more detailed description of the Property’s history follows.

The first mention of mining on the Property regarded production of an unknown quantity of ore grading up to 3.5 oz Au/ton (120 g/t) on the 132 foot level of the Phelan Shaft, located in the northern portion of the claim block. The Phelan ledge was similar in dip and strike to those found in the Mohawk and Combination veins, indicating high grade potential west of the Main District. In 1939, Martin Duffy discovered an ore pillar near the Little Florence Shaft which is adjacent to the southeast border of the Property. This 17’ x 6’ x 40’ block contained about 4700 ounces (146 kg) of gold at an average grade of 15 oz Au/ton (514 g/t). At the time, the claim group held by LSG was called the Margraf claim group, owned in fee by Oscar and Marieanne Margraf.

Newmont worked in both the northern and the southern parts of the Margraf claims (now the LSG claims) from 1947 to 1951. The Seibert Formation was considered to be a poor host and barren of gold, so exploration ceased early in shallow shafts on the Margraf claims. In the 1940’s, USGS data revealed that the Siebert Formation was younger than the mineralizing phase (post-mineral), thus Newmont began exploring for mineralization beneath the Siebert in this under-explored area. They first rehabilitated the Silver Pick shaft and found low grade mineralization beneath Seibert rocks on the 500 foot (152 m) level. In 1947, Newmont rehabilitated and extended a 2500 foot (762 m) crosscut westward from the Florence shaft (near the eastern corner of the Property) on the 300 foot (91 m) level. The objective was to explore the southern continuation of the mineralized Columbia Mountain Fault that had been inferred from magnetometer surveys. Several mineralized veins were encountered, and high grade ore (up to 14 oz Au/ton, or 480 g/t) was found near the projected fault. Approximately 20,000 ounces (622 kg) of gold, 4,123 ounces (128 kg) of silver and 5,200 pounds (2,364 kg) of copper were recovered from what is now called the Newmont Lode. This mining operation ceased early in 1951.

12

Subsequently, Newmont leased a separate vein occurrence in the Red Hills area, a short distance to the east. Production data are not available, but maps of the Red Hills Stope indicate face assays up to 170 oz Au/ton (5.29 kg/tonne).

From 1980 to 1988, Trafalgar (a subsidiary of Transwestern Mining Company) leased the Margraf claim block. A 4-line refraction seismic survey done by Cooksley Geophysics generated several shallow anomalies interpreted as silica-bearing fault zones. Subsequent drilling confirmed this interpretation. Trafalgar drilled 29,450 feet (8979 m) in 132 vertical holes. This program discovered two gold occurrences, the Church vein zone and the January target area with grades up to 0.38 oz Au/ton (13 g/t). Additional holes in the Newmont Lode and Silver Pick areas yielded encouraging gold values. Their drilling indicated the presence of three low grade and not well-defined bodies of mineralization in silicified ledges in the Sheets-Ish, February-Whiterock, and January areas. Trafalgar also sampled all the dumps and tailing on the Margraf claims and moved approximately 200,000 tons (181,400 tonnes) to a stockpile for which sampling yielded an average grade of 0.045 oz Au/ton (1.54 g/tonne). From June 1982 to March 1983 Trafalgar crushed, agglomerated and leached 63,000 tons (57,140 tonnes) of this material and recovered approximately 1700 ounces (52.9 kg) of gold.

Westley leased the Margraf claims from Trafalgar early in 1985 and terminated the lease on January 1, 1986. Refraction seismic surveys were conducted to locate quartz veining and silicified zones. Westley used this information to drill 11 RC holes for a total of 8000 feet (2439 m). While all holes cut interesting alteration only one cut good gold values – a 5-foot (1.52 m) intercept grading 0.46 oz Au/ton (15.9 g/t) – near the projected intersection of the Church and Red Hills Decline zones.

The Margraf property was leased by Geochem in 1988. Their principal contribution to the property was rehabilitating the February-Premier shaft to a depth of 300 feet (91 m) and rehabilitating 1500 feet (457 m) of drift on the 300 foot (91 m) level SW toward the Newmont Lode and Church Shaft. For the first time in 50 years, there was access to the underground workings. They also drilled a 380 foot (116 m) surface RC hole.

R.H. Law & Associates acquired the property from Geochem Mines via a quiet title action in 1997, formed LSG and placed the property in that company. LSG started an exploration program of its own in 1998. The program included re-conditioning of the February-Premier shaft, additional rehabilitation of underground workings, surface and underground geologic mapping, 3,500 feet (167 m) of surface reverse circulation drilling, 23,000 feet (7012 m) of underground core drilling, 10,400 feet (3170 m) of surface core drilling, and a CSAMT geophysical survey test.

The rehabilitation work provided access to the Newmont Lode, the Red Hills area and the Church workings to conduct geologic mapping and sampling. This identified several gold-bearing quartz vein zones. In 1998, a 3500 foot (1067 m) program of seven surface RC holes and 2400 feet (732 m) of underground jack-leg drilling were carried out. The objective was to verify the presence of gold mineralization and extend it along strike and down dip and to better define the vein geometry. The Red Hills and Church zones were the main focus of the work.

Between 2000 and 2008 a total of 23,000 feet (7012 m) of underground core was drilled in 152 holes. These were focused on the Red Hills and Church zones with some holes in the Newmont Lode area.

In 2007, a total of 10,400 feet (3170 m) of surface core drilling was done in 23 holes largely in the Red Hills area. This program yielded very encouraging results with several multi-ounce gold intercepts, as high as 75 oz Au/ton (2.57 kg).

On March 28, 2011, LSG and ICN entered into the ICN Option Agreement, and during 2011, ICN contracted Zonge Geophysics to complete a CSAMT geophysical survey over the entire property. ICN also drilled 5600 feet (1767 m) in 26 core holes, largely in the Church Zone and 63 reverse circulation holes (27,470 feet or 8375 m) throughout the property. Shea Clark Smith also supervised a biogeochemical orientation survey over portions of the property in 2011.

13

Drilling by LSG and ICN in the Church, Red Hills and other areas indicates the presence of a substantial tonnage of well-mineralized material. Recent geologic modeling has more clearly outlined the geometry of this mineralization and suggested potential extensions. Additional drilling will be required to define these well enough that they can be considered reserves.

Geologic Setting

Regional Geology

The Goldfield District is located in the Basin and Range Physiographic Province which stretches from Salt Lake City to Reno, characterized by north and south trending ranges separated by flat sediment-filled structural basins. This appearance is due to large scale extensional tectonics during the Tertiary. Superimposed on the Basin and Range is the Walker Lane Structural Zone, roughly parallel to the California-Nevada state line. This is a series of west-northwest strike-slip faults and north to northeast striking oblique-slip and normal faults. The Walker Lane is host to several precious metal mining districts in addition to Goldfield, such as Tonopah, Divide and Klondyke to the northwest, Bullfrog, Rhyolite and Railroad Springs to the southeast.

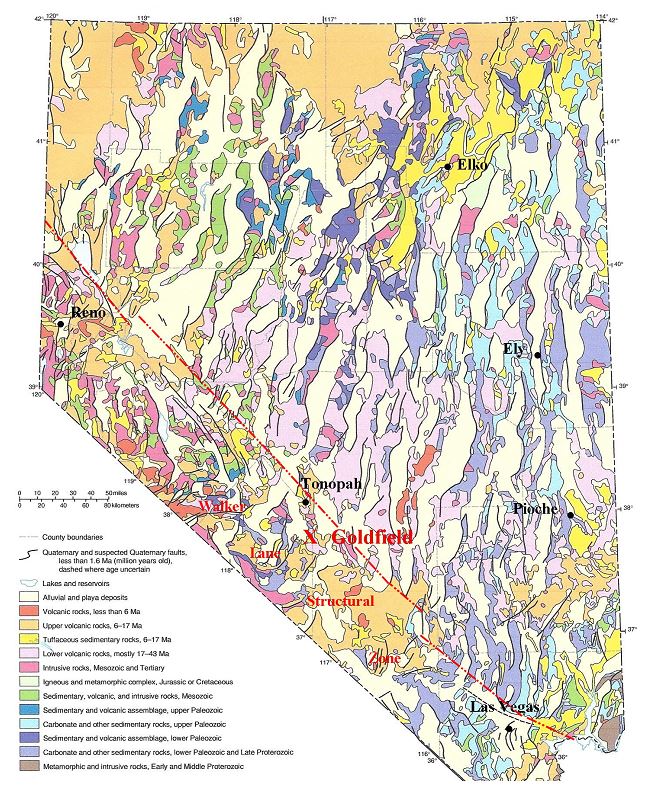

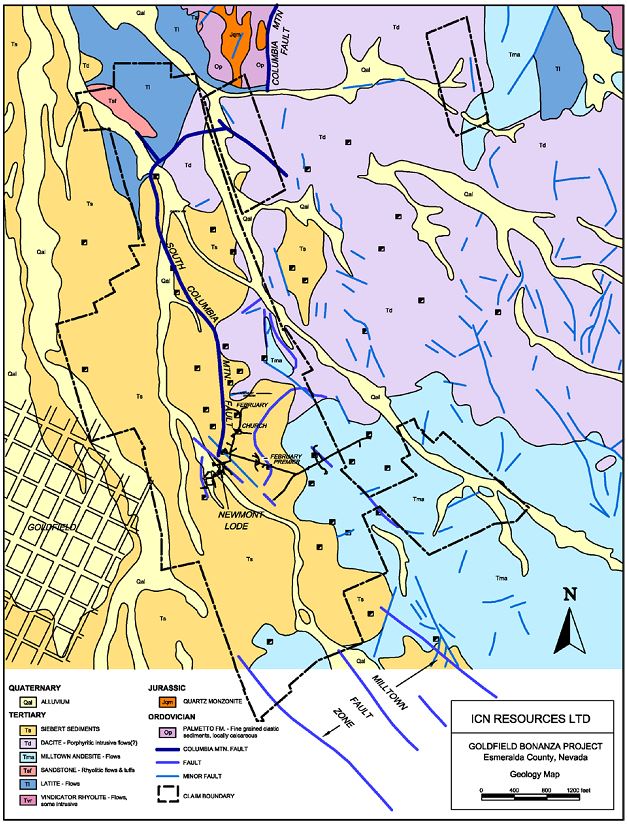

The rocks in the region are Paleozoic marine sedimentary and metamorphic rocks which have been intruded by or are overlain by younger igneous rocks of Mesozoic and Tertiary age (Figure 3). Mineralization in the region is interpreted to be spatially and perhaps genetically related to Tertiary intrusive rocks, dominantly hosted in Oligocene to Miocene volcanic rocks and is primarily epithermal in nature.

14

Figure 3: Generalized Geologic Map of Nevada

15

Goldfield District Geology

The Goldfield mining district is closely related to a complex and long-lived volcanic center defined by a thick series of tuffs domes and flows. It is a 4.4 mile in diameter circular ring-fracture zone outlined by a series of curved faults, eruptive vents, doming and intense alteration. The volcanic rocks of this feature range in age from Oligocene to Miocene. The high-sulfidization, quartz-alunite hydrothermal alteration and widespread gold-enargite mineralization appear to be related to the emplacement of an igneous intrusive complex of Miocene (20-23 MA) age. Intersections of northwest-striking right-lateral strike-slip faults and north to northeast striking normal faults appear to have localized both volcanic activity and gold-enargite mineral deposits. The general sequence of mineralization-related events in the Goldfield District is as follows:

|

|

1.

|

Development of the East Goldfield structural zone and subsequent development of a major northwest striking right lateral shear zone along the south edge of the present location of the Goldfield Main District.

|

|

|

2.

|

Eruption of the early rhyolite and latitic volcanic sequence and possible initial development of a ring fracture system (33-30 MA).

|

|

|

3.

|

Deposition of the sediments included in the Diamondfield Formation and the Sandstorm Rhyolite (28 MA).

|

|

|

4.

|

Resurgence, uplift and eruption of the Milltown Andesite, Main District Rhyodacite, and probably emplacement of a central intrusive complex in the deeper core of the district (23-20 MA).

|

|

|

5.

|

Continued development of the controlling right-lateral strike-slip fault system, including development of a right stepping releasing bend on the Columbia Mountain fault and the development of a zig-zag pattern of fractures and shears in the Main District area (20-21 MA).

|

|

6a.

|

Initiation of the hydrothermal system. This event produced intense silicification, formation of multiple silica ledge zones, and propylitically altered the adjacent rhyodacite, dacite and Milltown andesite wall rocks (20.5 MA).

|

|

6b.

|

Stage 2 structural development, continued intrusions, uplift and hydrothermal fracturing and local brecciation of silica ledge zones and adjacent wall rocks.

|

|

6c.

|

Pre-gold acid leach event.

|

|

6d.

|

Intense argillic alteration of wallrock/ledge contacts.

|

|

6e.

|

Main stage gold deposition.

|

|

6f.

|

Barren, open space filling translucent quartz vein emplacement.

|

|

7.

|

Post-mineral faulting, deposition of post-mineral volcanic and sedimentary units and erosion of the Goldfield volcanic center (20 MA to present).

|

16

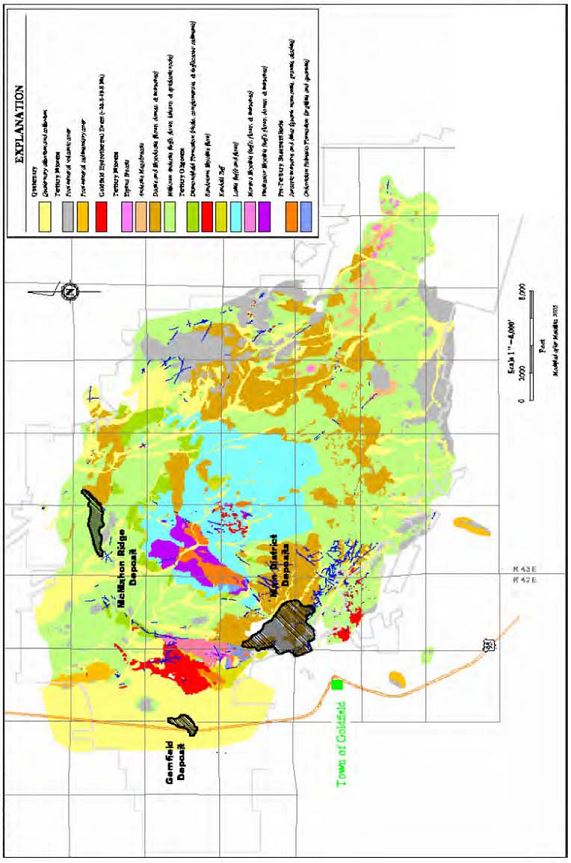

Figure 4: Goldfield District Geology

17

Project Geology

The Property is located along the southwestern margin of the Goldfield ring-fracture zone, an area of very strong alteration and strong fracturing or faulting in north-northwest (NNW) and northeast directions. The largest through-going structure is the NNW trending South Columbia Mountain Fault, thought to be an important control of the localization of gold mineralization.

The oldest geologic unit in the area is the Ordovician Palmetto Formation, which consists largely of fine grained clastic sediments, including local calcareous sediments. It is present only near the northern margin of the Property, along with small Jurassic quartz monzonite intrusive bodies and arealy small amounts of early Tertiary latite flows and rhyolitic sandstones.

The principal host rocks of the property and the Main District are andesitic flows of the Milltown andesite and a large dacite porphyry intrusive body. These are overlain by post-mineral, later Tertiary age, coarse clastic sediments of the Siebert Formation. Elsewhere the Siebert contains interbeds of tuffaceceous rocks, but such tuffs have not been observed in mapping or drilling on the Property.

Figure 5 displays the distribution of the major historic ore bodies of the Goldfield Main District. The Church-Newmont workings southwest of the January Pit were the principal focus of the work of ICN and LSG. The orientation of the mineralization is clearly structurally controlled, at a district scale. There is a strong north-northwest trend and a less strong northeasterly trend. A strike-slip style of fault movement, with the right side down to the right and the left side up to the left would commonly produce such a fracture pattern. This is consistent with the movement along the regional Walker Lane structural zone. Although the structures are more complex at a smaller scale, a very similar fault/fracture pattern can be observed in mine workings.

18

Figure 5: Goldfield Historic Ore Bodies

19

Figure 6: Property Geology Map

20

Deposit Type

The Goldfield District is a classic example of a structurally controlled, volcanic-hosted, epithermal gold deposit of the high-sulfidation, quartz-alunite type. Other examples of this deposit type are Paradise Peak (Nevada), Summitville (Colorado), El Indio (Chile), Rodalquilar (Spain) and Lepanto (Phillipines).

These hydrothermal systems commonly develop in extensional or trans-tensional settings. They commonly occur in zones where high level magmatic intrusives are emplaced below volcanic edifices which are constructed above plutons. These systems are thought to overlie and be genetically related to deeper porphyry copper systems. The most common geologic settings are calderas, and flow-dome complexes, often associated with sub-volcanic intrusive bodies and breccias. Host rocks are typically volcanic flows and pyroclastics, largely of andesite-dacite-rhyodacite composition. Permeable intercalated sedimentary units are often hosts for mineralization (e.g. Diamondfield sediments at Goldfield).

Mineralization typically forms in veins and massive sulfide replacement pods and lenses, stockworks and breccias. Commonly irregular deposit shapes are determined by a combination of host rock permeability and the geometry of ore-controlling structures. The most common minerals within the quartz veins are pyrite, enargite, famatinite, chalcocite, covellite, bornite gold and electrum. Tellurides and silver sulfo-salt minerals are often present as well. There are two common types of ore – massive enargite+pyrite or quartz+alunite+gold.

Mineralization

Most of the production of gold and lesser amounts of silver and base metals has come from high grade bodies located in a relatively small area of about 0.7 square miles or one square kilometer, northeast of the Goldfield town site. Mineralization is generally present in zones of strong silica-alunite alteration surrounded by wider zones of clay alteration set in a large area of propylitic alteration. High grade bodies may be connected by narrow structures or splays defined by alteration, quartz veinlets and low grade mineralization within the larger clay alteration envelope.

The principal host rocks are the dacite, the Milltown Andesite and the Sandstorm Rhyolite. The older rocks of the Palmetto Formation and the Jurassic intrusive rocks may locally host mineralization. The irregular intensely silicified zones which contain the major ore bodies have been locally named “ledges” by the miners. Mineable gold grades within the ledges decrease outward to low grade or barren silicified rocks over distances of often less than a meter. This gradation is seldom obvious, so that ore boundaries are rarely sharp and usually not visually apparent. Higher gold grades are not distributed evenly throughout the ledges and occur as irregular sheets, blobs, pipes and shoots throughout the ledge. Irregular breccia bodies are usually present, associated with late stage silica and clays filling open spaces. Gold mineralization is associated with this late stage event. The ore at Goldfield consists of native gold with bismuth and copper-arsenic-antimony-bearing sulfides and tellurides including bismuthinite, famatinite, enargite and goldfieldite (first identified in Goldfield ores). In the “rich ores” native gold is often visible in high grade bands. For the most part the gold is present as tiny grains in sulfides and tellurides, or as disseminations in quartz. There was very little coarse gold reported in Goldfield ores – it was almost entirely present as flour-sized particles barely visible to the naked eye.

In the Goldfield Main District, historically mined gold ores occurred in northwesterly trending and easterly dipping zones as well as northeasterly trending southeasterly dipping zones. Dips often became more shallow with depth. The mineralized area has a strike length of 5000 feet (1550 m), a maximum width of 4000 feet (1220 m) and extends down dip to over 1700 feet (520 m) below the surface.

Mineralization on the Property

Exploration by ICN, LSG and their predecessors since the 1930’s has become focused in the south-central portion of the Property. Silicified ledges and small bodies of gold mineralization were identified in the northern part, near the Phelan and Sheets-Ish shafts. Other similar zones were found in the January and Whiterock areas in the center, just west of the Combination Pit. However, the most attractive area was that in the February-Church-Newmont-Red Hills area immediately east of Goldfield and southwest of the Combination Pit. This area has become known as the NE Corridor.

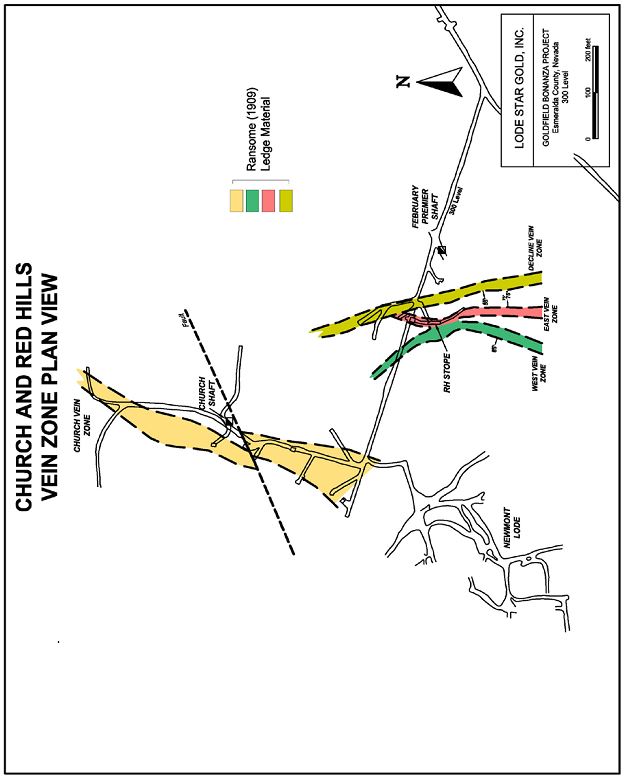

21

In the NE Corridor, gold mineralization appears to be associated on a larger scale with the southern extension of the South Columbia Mountain Fault (trending north-south in this area), and its intersections with more northwesterly trending structures. Newmont mined small very high grade zones (grades up to 14 oz Au per ton, or 480 g/t) in the southwestern part of this area in 1947 to 1951 in both the Newmont Lode and the Red Hills area, from lodes along both structural trends, and some northeast trending structures. Drilling and underground geologic mapping by ICN and LSG in both of these areas, as well as the Church Zone, have demonstrated that these mineralized structural zones are persistent over a strike length of at least 1500 feet (457 m). See Figure 7. There were many intercepts with gold grades greater than 1 oz Ag per ton (34.3 gm/tonne). These zones are interpreted to dip nearly vertically and to have potentially minable widths of several feet or a few meters. In appearance, the mineralized zones were very similar to those mined historically in the Main District.

22

Figure 7: Mineralization in Church, Red Hills and Newmont Zones

Plan of Operations

Over the next 12 months, we plan to complete the first phase of a proposed two phase program involving some preliminary work, as follows:

23

Preliminary Work

The preliminary underground scope of work of approximately $250,000 will complete the hoist retro fitting and rehab work of LSG’s existing underground workings and obtain all necessary regulatory compliance to initiate Phase 1.

Phase 1 – The Church Zone & Stope Zone

The purpose of this phase is to define a mineral resource estimate in compliance with National Instrument 43-101 of the Canadian Securities Administrators. It is our intention to complete work addressing both surface and underground targets in two separate areas: the Church Zone and the Stope Zone. In this Phase, we expect to perform 15,000 feet of combined RC and core surface drilling on the Church Zone at an estimated cost of $500,000, plus 2,250 feet of underground drilling at an anticipated cost of US$225,000, both in order to extend the known high-grade gold zones,

In our opinion the Stope Zone is mine-ready, and therefore, during Phase 1 we anticipate determining how best to execute the extraction of mineralized rock. As part of Phase 1, we may conduct some confirmation drilling in the Red Hills Stope Zone at an anticipated cost of $150,000, although to execute drilling in some areas will require additional access work.

In addition, we plan to begin preparing and filing all necessary permitting applications at an approximate cost of $100,000.

If we are able to complete Phase 1 as planned, we expect to commence Phase 2 which consists of a one year work program for which we have yet to prepare a detailed budget.

Intellectual Property

We do not own any intellectual property and we have not filed for any protection of our trademark.

Employees

As of the Closing Date, we did not have any full time or part time employees. We plan to rely on the efforts of Mark Walmesley and Robert Baker, our officers and directors, as well as a number of independent consultants, to manage our operations. However, we may hire workers on a contract basis from time to time as the need arises.

Government Regulations

We plan to engage in mineral exploration and are accordingly exposed to environmental risks associated with mineral exploration activity. LSG is currently in the exploration stage on the Property and, pursuant to the Option Agreement, we are now the operator thereof.

In general, in Nevada, no government permits are required on mining claims for exploration activities which do not involve the use of powered equipment. Any disturbance of existing land and vegetation by powered means will generally require a permit which will specify that after work is completed land be re-contoured to the original surface and be seeded with native plant species. On unpatented claims with federally-owned surface, a “Notice of Intent” must be filed with the BLM for all activities involving the disturbance of five acres (two hectares) or less of the surface. A Notice of Intent will include details on the company submitting the notice, maps of the proposed disturbance, equipment to be utilized, the general schedule of operations, a calculation of the total disturbance anticipated, and a detailed reclamation plan and budget. A bond will be required to ensure reclamation and the amount will be determined by the calculated acreage being disturbed. The notice does not have an approval process associated with it but the bond calculation does have to be approved with a letter from the BLM before work can proceed. It is not necessary to file a Notice of Intent prior to work on land with privately owned surface.

24

Measurement of land disturbance is cumulative, and once five acres total has been disturbed on one project, a “Plan of Operations” must be filed and approved by the BLM before additional work can take place. This too requires a cash bond along with a reclamation plan.

LSG is not required to file a Notice of Intent for the Property with the BLM; instead, it is required to file one with the Department of Environmental Protection of the State of Nevada (NDEP), since the only portion of the Property that has publicly-owned surface rights is that which overlaps the Goldfield town limits. This form of notice includes the same information as the BLM Notice of Intent except that a detailed reclamation plan, budget and bond are not required. The notice also has a very informal approval process associated with it.

LSG is currently operating under a Notice of Intent filed with the NDEP and dated January 2011. This is an open-ended permit that does not require bonding for reclamation and allows for a total of five acres of disturbance. We do not have any pending Notices of Intent.

To the best of our knowledge, there are no existing environmental liabilities on the Property. A detailed environmental investigation has not been conducted.

RISK FACTORS

An investment in our common stock involves a high degree of risk. Investors should carefully consider the risks described below, together with all of the other information included in this Report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer and they may lose all or part of their investment. See “Cautionary Note Regarding Forward Looking Statements” above for a discussion of forward-looking statements and the significance of such statements in the context of this Report.

Risks Related to Our Business

We have a history of operating losses and there can be no assurance that we can achieve or maintain profitability.

We have a history of operating losses and may not achieve or sustain profitability. We cannot guarantee that we will become profitable. Even if we achieve profitability, given the competitive and evolving nature of the industry in which we operate, we may be unable to sustain or increase profitability and our failure to do so would adversely affect our business, including our ability to raise additional funds.

Because our auditors have issued a going concern opinion, there is substantial uncertainty that we will be able to continue our operations.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue to operate over the next 12 months. Our financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event we cannot continue in existence. As such, if we are unable to obtain new financing to execute our business plan we may be required to cease our operations.

The Property may not contain mineral reserves that are economically recoverable and we cannot accurately predict the effect of certain factors affecting such a determination.

LSG has not determined if the Property contains mineral reserves that are economically recoverable. Exploration for mineral reserves involves a high degree of risk, which even a combination of careful evaluation, experience and knowledge, may not eliminate. Few properties which are explored are ultimately developed into producing properties. Regardless, LSG is currently in the process of re-opening its underground working and plans to complete the first and second phases of its feasibility program, which, pursuant to the Option Agreement, we are required to fund.

25

Estimates of mineral reserves and any potential determination as to whether a mineral deposit will be commercially viable can be affected by such factors as deposit size; grade; unusual or unexpected geological formations and metallurgy; proximity to infrastructure; metal prices which are highly cyclical; environmental factors; unforeseen technical difficulties; work interruptions; and government regulations, including regulations relating to permitting, prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted.

The long term profitability of our operations will be in part directly related to the cost and success of our exploration and development program. Substantial expenditures are required to establish reserves through drilling, to develop processes to extract the ore and, in the case of new properties, to develop the extraction and processing facilities and infrastructure at any site chosen for extraction. Although substantial benefits may be derived from the discovery of a major deposit, we cannot provide any assurance that any such deposit will be commercially viable or that we will be able to obtain the funds required for development on a timely basis.

If the Property is ultimately placed into production, we will encounter hazards and risks that could result in significant legal liability.

In the event that we are ultimately able to commence commercial production on the Property, our operations will be subject to all of the hazards and risks normally encountered in the exploration, development and production of gold, including unusual and unexpected geologic formations, seismic activity, rock bursts, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, the mine and other producing facilities, damage to life or property, environmental damage and possible legal liability. Although we plan to take appropriate precautions to mitigate these hazards and risks by, among other things, obtaining liability insurance in an amount considered to be adequate by management, their nature is such that the liabilities might exceed policy limits, they might not be insurable, or we may not elect to insure against them due to high premium costs or other reasons, which could have a material adverse effect upon our financial condition and results of operations.

We face significant competition in the mineral resource industry that presents an ongoing threat to the success of our business.

The mining industry is intensely competitive in all of its phases, and we will be forced to compete with many companies that possess greater financial resources and technical facilities than we do. Significant competition exists for the limited number of mineral acquisition opportunities available in our sphere of operations. As a result of this competition, our ability to acquire additional attractive mining properties on terms we consider acceptable may be adversely affected.

Fluctuating mineral prices may negatively affect our ability to secure financing or our results of operations.

Our future revenues, if any, will likely be derived from the extraction and sale of base and precious metals. The price of those commodities has fluctuated widely, particularly in recent years, and is affected by numerous factors beyond our control including economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global and regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of base and precious metals, and therefore the economic viability of our business, could negatively affect our ability to secure financing or our results of operations.

26

We are subject to government laws and regulations particular to our operations with which we may be unable to comply.

We may not be able to comply with all current and future government environmental laws and regulations which are applicable to our business. Our operations are subject to all government regulations normally incident to conducting business: occupational safety and health acts, workmen’s compensation statutes, unemployment insurance legislation, income tax and social security laws and regulations, and most importantly, environmental laws and regulations. In addition, we are subject to laws and regulations regarding the development of mineral properties in the State of Nevada. We are also subject to governmental laws and regulations applicable to small public companies and their capital formation efforts.

We are engaged in mineral exploration and are accordingly exposed to environmental risks associated with mineral exploration and mining activity. LSG is currently in the exploration stage and has not determined whether significant site reclamation costs will be required on the Property in the future, which we will likely be responsible for as well. Although we will make every effort to comply with all applicable laws and regulations, we cannot provide any assurance that we will be able to deal with evolving environmental attitudes and regulations, nor can we predict the effect of any future changes to environmental regulations on our proposed business activities. We only plan to record liabilities for site reclamation when reasonably determinable and when such costs can be reliably quantified. Other costs of compliance with environmental regulations may also be burdensome.

Our failure to comply with material regulatory requirements could have an adverse effect on our ability to conduct our business. The expenditure of substantial sums on environmental matters would have a materially negative effect on our ability to implement our business plan and could require us to cease operations.

Our business depends substantially on the continuing efforts of our two officers, and our business may be severely disrupted if we lose their services.

Our future success heavily depends on the continued service of our two officers. Although we plan to increase the size of our Board of Directors, appoint additional officers and engage various consultants as our business grows, if they are unable or unwilling to continue to work for us in their present capacities, we may have to spend a considerable amount of time and resources searching, recruiting and integrating one or more replacements into our operations, which would severely disrupt our business. This may also adversely affect our ability to execute our business strategy.

Our new officer’s limited experience managing a publicly traded company may divert his attention from operations and harm our business.

Mark Walmesley, our President, Chief Executive Officer, Chief Financial Officer, Treasurer and director, has no experience managing a publicly traded company and complying with federal securities laws, including compliance with recently adopted disclosure requirements on a timely basis. He, together with Robert Baker, our current Secretary and director and former sole officer and director, will be required to design and implement appropriate programs and policies in responding to increased legal, regulatory compliance and reporting requirements, and any failure to do so could lead to the imposition of fines and penalties and harm our business.

We may be unable to attract and retain qualified, experienced, highly skilled personnel, which could adversely affect the implementation of our business plan.

Our success depends to a significant degree upon our ability to attract, retain and motivate skilled and qualified personnel. As we become a more mature company in the future, we may find recruiting and retention efforts more challenging. If we do not succeed in attracting, hiring and integrating such personnel, or retaining and motivating existing personnel, we may be unable to grow effectively. The loss of any key employee, including members of our management team, and our inability to attract highly skilled personnel with sufficient experience in our industry could harm our business.

27

Since our officers and directors are located in Canada, investors may be limited in their ability to enforce U.S. civil actions against them for damages to the value of our common stock.

Our officers and directors are residents of Canada. Consequently, U.S. investors may experience difficulty affecting service of process on our officers and directors within the United States or enforcing a civil judgment of a U.S. court in Canada if a Canadian court determines that the U.S. court in which the judgment was obtained did not have jurisdiction in the matter. There is also substantial doubt whether an original action predicated solely upon civil liability may successfully be brought in Canada against our officers and directors. As a result, investors may not be able to recover damages as compensation for a decline in the value of their investment.

We may indemnify our officers and directors against liability to us and our security holders, and such indemnification could increase our operating costs.

Our Bylaws allow us to indemnify our officers and directors against claims associated with carrying out the duties of their offices. Our Bylaws also allow us to reimburse them for the costs of certain legal defenses. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our officers, directors or control persons, we have been advised by the SEC that such indemnification is against public policy and is therefore unenforceable.

Since our officers and directors are aware that they may be indemnified for carrying out the duties of their offices, they may be less motivated to meet the standards required by law to properly carry out such duties, which could increase our operating costs. Further, if any of our officers and directors files a claim against us for indemnification, the associated expenses could also increase our operating costs.

Failure to comply with the Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

As a Nevada corporation, we are subject to the Foreign Corrupt Practices Act, which generally prohibits United States companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Some foreign companies, including some that may compete with us, may not be subject to these prohibitions. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices may occur from time-to-time in the countries in which we conduct our business. However, our employees or other agents may engage in conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

Current global financial and economic conditions could adversely impact our operations and financial condition.

Current global financial and economic conditions, while improving, remain volatile. Many industries, including the mineral resource industry, are impacted by these market conditions. Some of the key impacts of the current financial market turmoil include contraction in credit markets resulting in a widening of credit risk; devaluations and high volatility in global equity, commodity, foreign exchange and precious metal markets; and a lack of market liquidity. Such factors may impact our ability to obtain financing on favourable terms or at all. Additionally, global economic conditions may cause a long term decrease in asset values. If such global volatility and market turmoil continue, our operations and financial condition could be adversely impacted.

28

Risks Related to Ownership of Our Common Stock

Because there is a limited public trading market for our common stock, investors may not be able to resell their shares.

There is currently a limited public trading market for our common stock. Therefore, there is no central place, such as stock exchange or electronic trading system, to resell any shares of our common stock. If investors wish to resell their shares, they will have to locate a buyer and negotiate their own sale. As a result, they may be unable to sell their shares or may be forced to sell them at a loss.

We cannot assure investors that there will be a market in the future for our common stock. The trading of securities on the OTCQB is often sporadic and investors may have difficulty buying and selling our shares or obtaining market quotations for them, which may have a negative effect on the market price of our common stock. Investors may not be able to sell shares at their purchase price or at any price at all.

LSG has voting control over matters submitted to a vote of the stockholders, and it may take actions that conflict with the interests of our other stockholders and holders of our debt securities.

We issued 35,000,000 shares of our common stock to LSG on the Closing Date, and LSG therefore controls approximately75.3% of the votes eligible to be cast by stockholders in the election of directors and generally. As a result, LSG has the power to control all matters requiring the approval of our stockholders, including the election of directors and the approval of mergers and other significant corporate transactions.

The sale of securities by us in any equity or debt financing could result in dilution to our existing stockholders and have a material adverse effect on our earnings.

Any sale of common stock by us in a future private placement offering could result in dilution to the existing stockholders as a direct result of our issuance of additional shares of our capital stock. In addition, our business strategy may include expansion through the acquisition of additional property interests or through business combinations with entities operating in our industry. In order to do so, or to finance the cost of our operations, we may issue additional equity securities that could dilute our stockholders’ stock ownership. We may also pursue debt financing, if and when available, and this could negatively impact our earnings and results of operations.

We are subject to penny stock regulations and restrictions and investors may have difficulty selling shares of our common stock.

Our common stock is subject to the provisions of Section 15(g) and Rule 15g-9 of the Exchange Act, commonly referred to as the “penny stock rules”. Section 15(g) sets forth certain requirements for transactions in penny stock, and Rule 15g-9(d) incorporates the definition of “penny stock” that is found in Rule 3a51-1 of the Exchange Act. The SEC generally defines a penny stock to be any equity security that has a market price less than $5.00 per share, subject to certain exceptions. We are subject to the SEC’s penny stock rules.

Since our common stock is deemed to be penny stock, trading in the shares of our common stock is subject to additional sales practice requirements on broker-dealers who sell penny stock to persons other than established customers and accredited investors. “Accredited investors” are generally persons with assets in excess of $1,000,000 (excluding the value of such person’s primary residence) or annual income exceeding $200,000 or $300,000 together with their spouse. For transactions covered by these rules, broker-dealers must make a special suitability determination for the purchase of such security and must have the purchaser’s written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the rules require the delivery, prior to the first transaction, of a risk disclosure document relating to the penny stock market. A broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements must be sent disclosing recent price information for the penny stocks held in an account and information to the limited market in penny stocks.

29

Consequently, these rules may restrict the ability of broker-dealer to trade and/or maintain a market in our common stock and may affect the ability of our stockholders to sell their shares of common stock.

There can be no assurance that our common stock will qualify for exemption from the penny stock rules. In any event, even if our common stock was exempt from the penny stock rules, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock if the SEC finds that such a restriction would be in the public interest.

We do not expect to pay dividends for the foreseeable future.