Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Dime Community Bancshares, Inc. /NY/ | a14-26169_18k.htm |

| EX-99.1 - EX-99.1 - Dime Community Bancshares, Inc. /NY/ | a14-26169_1ex99d1.htm |

|

|

Forward Looking Statements This presentation may contain forward-looking statements regarding Bridge Bancorp, Inc. These statements constitute forward-looking information within the definition of the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from any forward-looking statements expressed in this presentation, since forward-looking information involves significant known and unknown risks, uncertainties and other factors. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, among others, the following: failure to satisfy the conditions to closing for the proposed merger in a timely manner or at all; failure of either party’s stockholders to approve the proposed transaction; failure to obtain the necessary governmental approvals for the proposed merger or adverse regulatory conditions in connection with such approvals; disruption to the parties’ businesses as a result of the announcement and pendency of the transaction; difficulties related to the integration of the businesses following the merger; competitive pressures among depository and other financial institutions; changes in the interest rate environment; and changes in general economic conditions, either nationally or regionally. For a discussion of additional factors that might cause such differences, please refer to Bridge Bancorp, Inc.’s public filings with the Securities and Exchange Commission. These are available online at http://www.sec.gov. Bridge Bancorp, Inc. does not undertake to update any forward-looking statements made in this presentation to reflect new information, future events or otherwise. Bridge Bancorp, Inc. will be filing a registration statement on Form S-4 containing a proxy statement/prospectus and other documents regarding the proposed transaction with the SEC. Community National Bank stockholders and investors are urged to read the proxy statement/prospectus when it becomes available, because it will contain important information about Bridge Bancorp, Inc. and Community National Bank and the proposed transaction. When available, copies of the proxy statement/prospectus will be mailed to Community National Bank stockholders. Copies of the proxy statement/prospectus also may be obtained free of charge at the SEC’s web site at http://www.sec.gov, or by directing a request to Bridge Bancorp, Inc., Attention: Corporate Secretary, 2200 Montauk Highway, P.O Box 3005, Bridgehampton, NY 11932, or on its website at www.bridgenb.com, or to Community National Bank, Attention: Corporate Secretary, 400 Broadhollow Road, Suite 305, Melville NY 11747, or on its website at www.cnbny.com. Copies of other documents filed by Bridge Bancorp, Inc. with the SEC may also be obtained free of charge at the SEC’s website or by directing a request to Bridge Bancorp, Inc. at the address provided above. Bridge Bancorp, Inc. and Community National Bank and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Bridge Bancorp, Inc. and Community National Bank in connection with the proposed transaction. Information about the directors and executive officers of Bridge Bancorp, Inc. is set forth in the proxy statement, dated April 2, 2014, for the Bridge Bancorp, Inc. 2014 annual meeting of stockholders, as filed with the SEC on Schedule 14A. Information about the directors and executive officers of Community National Bank and additional information about the interests of directors and executive officers of Bridge Bancorp, Inc. and other persons who may be deemed participants in the transaction may be obtained by reading the joint proxy statement/prospectus included in the Form S-4 when it becomes available. This presentation does not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities. 2 |

|

|

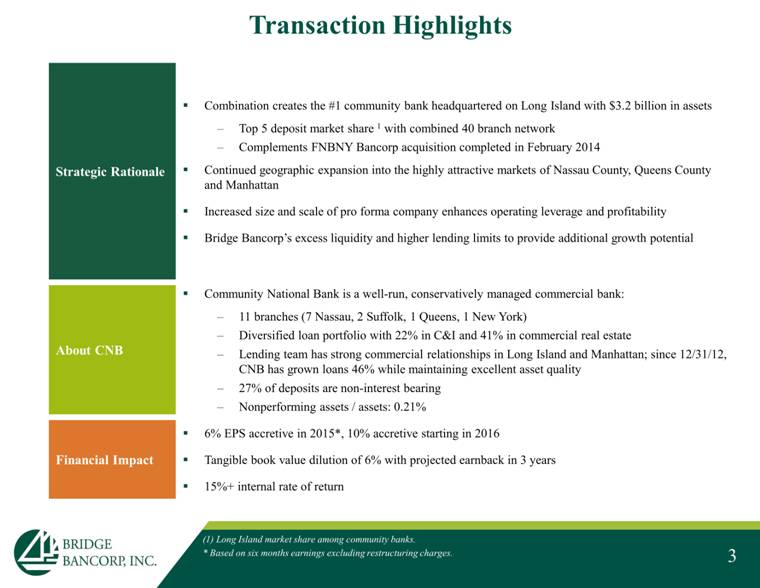

3 Transaction Highlights Strategic Rationale Combination creates the #1 community bank headquartered on Long Island with $3.2 billion in assets Top 5 deposit market share 1 with combined 40 branch network Complements FNBNY Bancorp acquisition completed in February 2014 Continued geographic expansion into the highly attractive markets of Nassau County, Queens County and Manhattan Increased size and scale of pro forma company enhances operating leverage and profitability Bridge Bancorp’s excess liquidity and higher lending limits to provide additional growth potential About CNB Community National Bank is a well-run, conservatively managed commercial bank: 11 branches (7 Nassau, 2 Suffolk, 1 Queens, 1 New York) Diversified loan portfolio with 22% in C&I and 41% in commercial real estate Lending team has strong commercial relationships in Long Island and Manhattan; since 12/31/12, CNB has grown loans 46% while maintaining excellent asset quality 27% of deposits are non-interest bearing Nonperforming assets / assets: 0.21% Financial Impact 6% EPS accretive in 2015*, 10% accretive starting in 2016 Tangible book value dilution of 6% with projected earnback in 3 years 15%+ internal rate of return (1) Long Island market share among community banks. * Based on six months earnings excluding restructuring charges. |

|

|

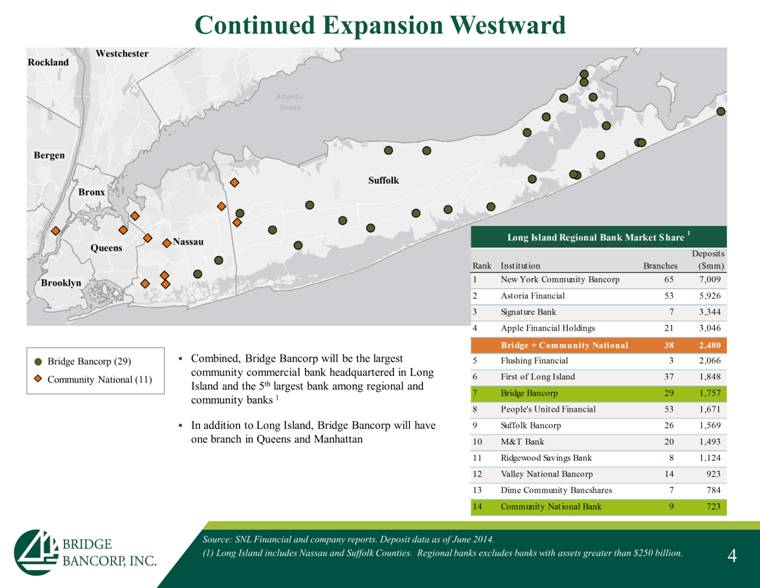

4 Continued Expansion Westward Source: SNL Financial and company reports. Deposit data as of June 2014. (1) Long Island includes Nassau and Suffolk Counties. Regional banks excludes banks with assets greater than $250 billion. Bridge Bancorp (29) Community National (11) Combined, Bridge Bancorp will be the largest community commercial bank headquartered in Long Island and the 5th largest bank among regional and community banks 1 In addition to Long Island, Bridge Bancorp will have one branch in Queens and Manhattan Suffolk Nassau Queens Brooklyn Bronx Bergen Rockland Westchester |

|

|

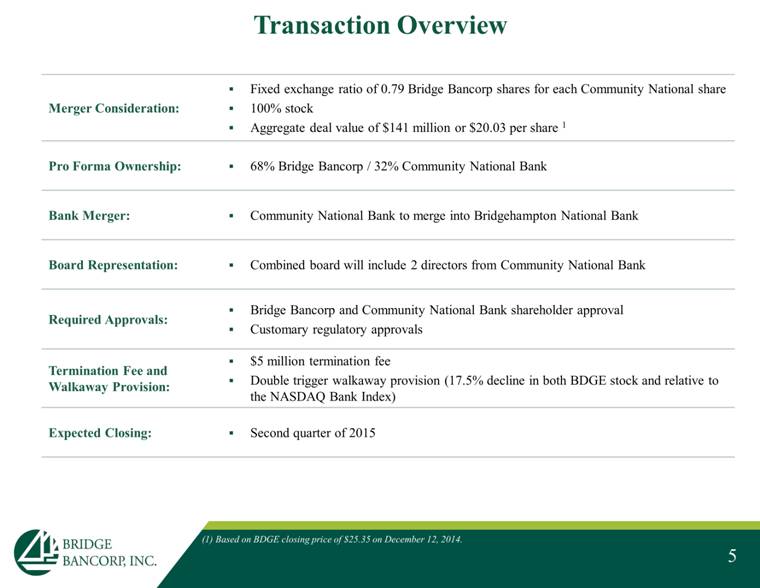

5 Transaction Overview (1) Based on BDGE closing price of $25.35 on December 12, 2014. Merger Consideration: Fixed exchange ratio of 0.79 Bridge Bancorp shares for each Community National share 100% stock Aggregate deal value of $141 million or $20.03 per share 1 Pro Forma Ownership: 68% Bridge Bancorp / 32% Community National Bank Bank Merger: Community National Bank to merge into Bridgehampton National Bank Board Representation: Combined board will include 2 directors from Community National Bank Required Approvals: Bridge Bancorp and Community National Bank shareholder approval Customary regulatory approvals Termination Fee and Walkaway Provision: $5 million termination fee Double trigger walkaway provision (17.5% decline in both BDGE stock and relative to the NASDAQ Bank Index) Expected Closing: Second quarter of 2015 |

|

|

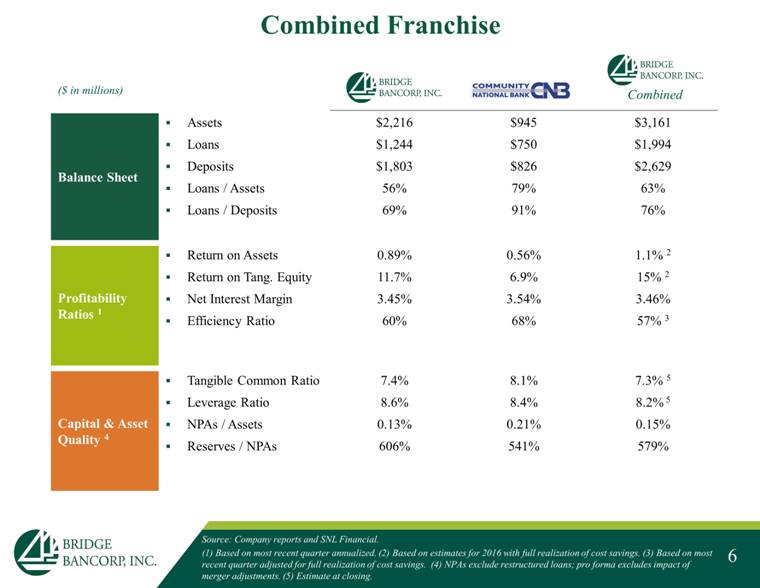

($ in millions) Balance Sheet Assets Loans Deposits Loans / Assets Loans / Deposits $2,216 $1,244 $1,803 56% 69% $945 $750 $826 79% 91% $3,161 $1,994 $2,629 63% 76% Profitability Ratios 1 Return on Assets Return on Tang. Equity Net Interest Margin Efficiency Ratio 0.89% 11.7% 3.45% 60% 0.56% 6.9% 3.54% 68% 1.1% 2 15% 2 3.46% 57% 3 Capital & Asset Quality 4 Tangible Common Ratio Leverage Ratio NPAs / Assets Reserves / NPAs 7.4% 8.6% 0.13% 606% 8.1% 8.4% 0.21% 541% 7.3% 5 8.2% 5 0.15% 579% Combined Franchise Combined Source: Company reports and SNL Financial. (1) Based on most recent quarter annualized. (2) Based on estimates for 2016 with full realization of cost savings. (3) Based on most recent quarter adjusted for full realization of cost savings. (4) NPAs exclude restructured loans; pro forma excludes impact of merger adjustments. (5) Estimate at closing. 6 |

|

|

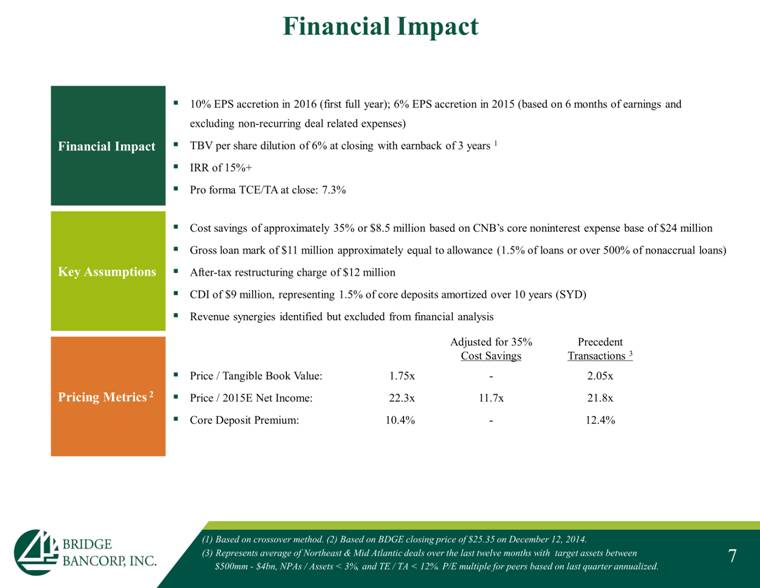

7 Financial Impact (1) Based on crossover method. (2) Based on BDGE closing price of $25.35 on December 12, 2014. (3) Represents average of Northeast & Mid Atlantic deals over the last twelve months with target assets between $500mm - $4bn, NPAs / Assets < 3%, and TE / TA < 12%. P/E multiple for peers based on last quarter annualized. Financial Impact 10% EPS accretion in 2016 (first full year); 6% EPS accretion in 2015 (based on 6 months of earnings and excluding non-recurring deal related expenses) TBV per share dilution of 6% at closing with earnback of 3 years 1 IRR of 15%+ Pro forma TCE/TA at close: 7.3% Key Assumptions Cost savings of approximately 35% or $8.5 million based on CNB’s core noninterest expense base of $24 million Gross loan mark of $11 million approximately equal to allowance (1.5% of loans or over 500% of nonaccrual loans) After-tax restructuring charge of $12 million CDI of $9 million, representing 1.5% of core deposits amortized over 10 years (SYD) Revenue synergies identified but excluded from financial analysis Pricing Metrics 2 Adjusted for 35% Precedent Cost Savings Transactions 3 Price / Tangible Book Value: 1.75x - 2.05x Price / 2015E Net Income: 22.3x 11.7x 21.8x Core Deposit Premium: 10.4% - 12.4% |

|

|

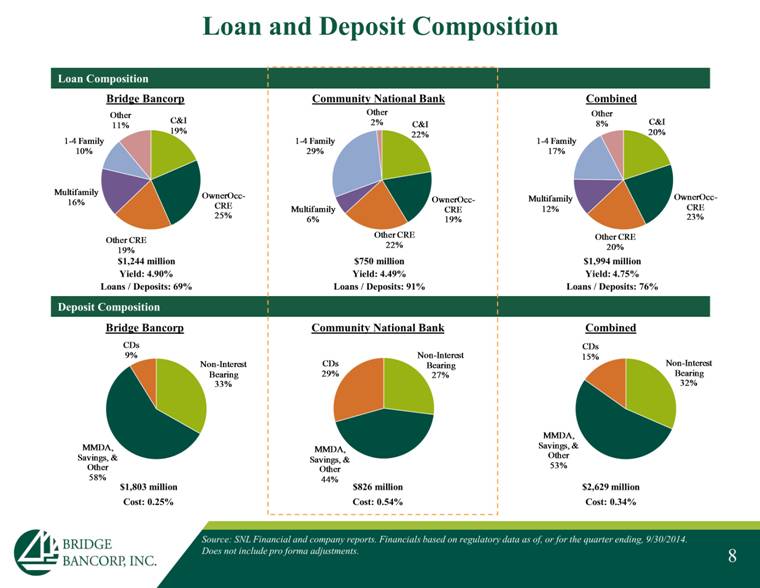

8 Loan and Deposit Composition Source: SNL Financial and company reports. Financials based on regulatory data as of, or for the quarter ending, 9/30/2014. Does not include pro forma adjustments. Loan Composition Deposit Composition $1,244 million $750 million $1,994 million Yield: 4.90% Yield: 4.49% Yield: 4.75% Loans / Deposits: 69% Loans / Deposits: 91% Loans / Deposits: 76% Bridge Bancorp Community National Bank Combined Bridge Bancorp Community National Bank Combined $1,803 million $826 million $2,629 million Cost: 0.25% Cost: 0.54% Cost: 0.34% |

|

|

9 Summary Creates the largest community commercial bank on Long Island and accelerates growth westward into Nassau County, Queens County, and Manhattan Increased size and scale will translate into operating leverage and enhanced financial returns Highly attractive pro forma loan and deposit mix positions Bridge Bancorp to be the dominant commercial bank in the Long Island market Financially attractive transaction with 10% EPS accretion, 6% TBV dilution with 3 year earnback, and IRR greater than 15% Strong internal capital generation to drive future growth |

|

|

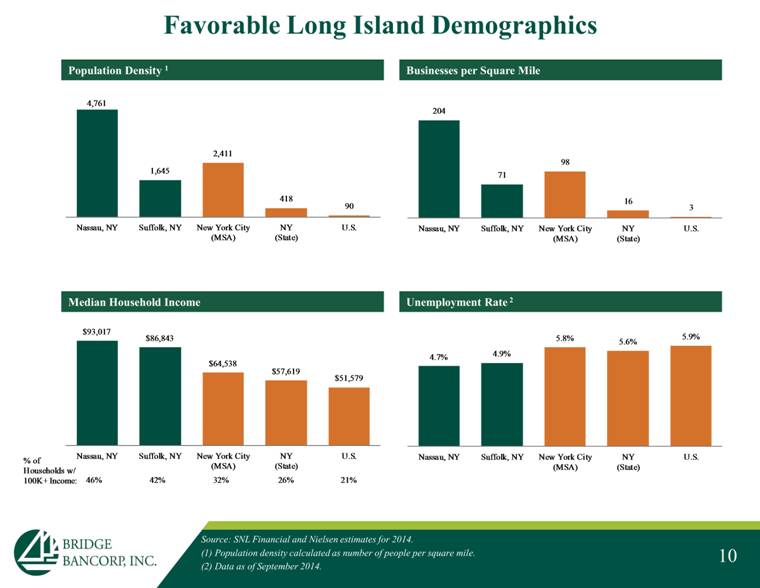

Population Density 1 Businesses per Square Mile 10 Favorable Long Island Demographics Source: SNL Financial and Nielsen estimates for 2014. (1) Population density calculated as number of people per square mile. (2) Data as of September 2014. Median Household Income Unemployment Rate 2 |

|

|

[LOGO] |