Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ASSOCIATED BANC-CORP | d838341d8k.htm |

OIL

AND GAS LENDING FOURTH QUARTER 2014

ASSOCIATED BANC-CORP

INVESTOR

PRESENTATION

Exhibit 99.1 |

FORWARD-LOOKING STATEMENTS

Important

note

regarding

forward-looking

statements:

1

Statements made in this presentation which are not purely historical are

forward-looking statements, as defined in the Private Securities

Litigation Reform Act of 1995. This includes any statements regarding

management’s plans, objectives, or goals for future operations,

products

or

services,

and

forecasts

of

its

revenues,

earnings,

or

other

measures

of

performance.

Such forward-looking statements may be identified by the use of words such

as “believe”, “expect”, “anticipate”,

“plan”, “estimate”, “should”, “will”, “intend”, “outlook”, or

similar expressions.

Forward-looking statements are based on current management

expectations and, by their nature, are subject to risks and uncertainties. Actual

results may differ materially from those contained in the

forward-looking statements. Factors which may

cause actual results to differ materially from those contained in such

forward-looking statements include those identified in the

Company’s most recent Form 10-K and subsequent SEC filings.

Such factors are incorporated herein by reference. |

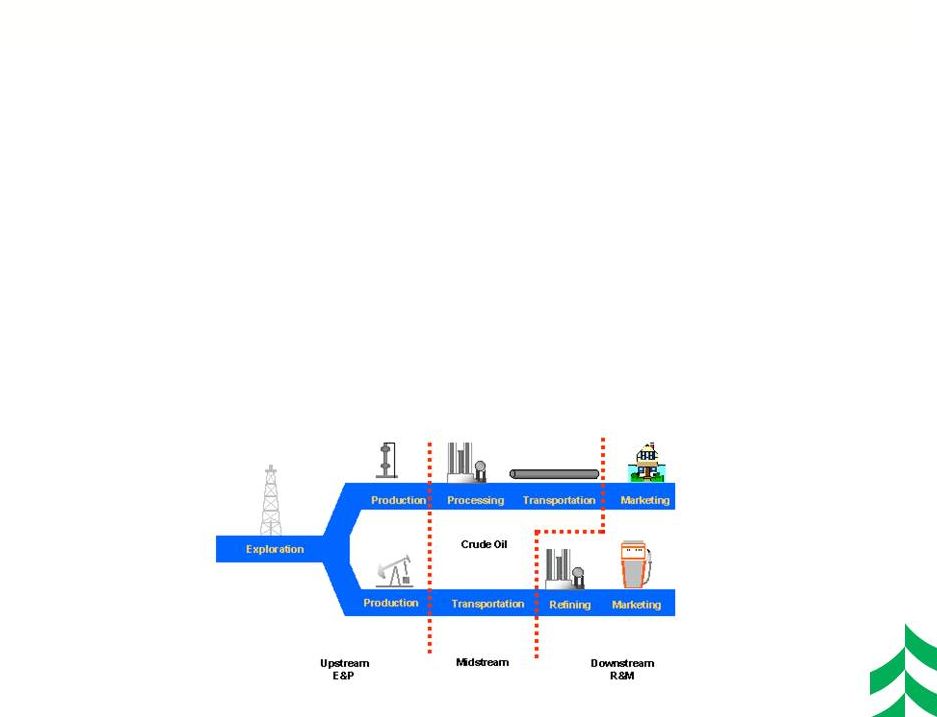

OIL

& GAS VALUE CHAIN •

From beneath the earth’s surface to the end-user:

–

Field Services Sector (Associated Bank is not active in this sector)

•

Supports drilling for oil and gas (offshore and onshore)

–

Upstream Sector (This is Associated Bank’s Oil & Gas

segment’s focus) •

Involved in drilling for oil and natural gas and operating the wells that bring

the oil and natural gas to the surface. Also referred to as the

‘Exploration and production or E&P sector’. –

Midstream Sector (Associated Bank is not active in this sector)

•

Processes, stores, markets, and transports crude oil, natural gas and the various

natural gas liquids like ethane, butane and propane.

–

Downstream Sector (Associated Bank is not active in this sector)

•

Oil refineries and petrochemical plants, and petroleum product distribution via

affiliated retail outlets and natural gas distribution companies.

Responsible for marketing refined products such as gasoline, diesel, and

jet fuel. 2 |

•

United States Oil and Gas production is in a renaissance

–

Continued enhancements in production techniques like horizontal drilling and

hydraulic fracturing have reversed a declining trend in oil and gas

production –

U.S. crude oil production increased from an average of 7.5 million barrels per day

in 2013 to 8.6 million barrels per day in 2014 and is forecast to be 9.4

million barrels per day in 2015 •

This would be the highest daily production since U.S. crude oil production peaked

at 9.6 million barrels per day in 1970 (declined to a low of 5 million

barrels per day in 2008) •

Share of total U.S. liquid fuels consumption met by net imports fell from 60% in

2005 to an average of 33% in 2013 and is expected to decline to 21% in

2015, which would be the lowest level since 1969

•

Benefits to the United States

–

Energy security

–

Thousands of American jobs

–

Millions of dollars in tax revenues

(Source: U.S. Energy Information Administration)

3

CURRENT STATE OF UPSTREAM SECTOR |

PLAYERS IN THE UPSTREAM SECTOR

•

Integrated oil and gas companies

–

Derive revenue from all phases of the energy value chain (e.g., ExxonMobil, BP,

Shell) •

Independent oil and gas companies (Associated Bank’s Oil &

Gas segment’s focus) –

Receive

substantially

all

revenue

from

the

production

of

oil

and

natural

gas.

They

are

public

and

private

companies

that

range

in

size

from

very

small

to

very

large

–

More than 6,000 independent oil & gas producers in the U.S.

–

Responsible for:

•

54% of domestic oil production

•

90% of domestic natural gas production

•

Drilling approximately 95% of wells in the U.S.

–

Direct and indirect impact of oil and natural gas industry to the U.S.

economy: •

$1.2 trillion contribution to U.S. GDP in 2011(8% of U.S. total)

•

9.8 million jobs in 2011 (5.6% of U.S. total)

•

>$30 billion in federal, state, and local taxes

4

(Sources: Independent Producers Association of America, American Petroleum Institute, and

PWC’s July 2013 article “Economic Impacts of the Oil and Natural Gas Industry on the U.S.

Economy in 2011)

|

RESERVE-BASED LENDING

•

Reserve-based lending is a form of Asset-based lending business

•

This is a standard lending model for borrowers engaged in the Upstream sector of

the oil and gas industry

•

Associated Bank’s emphasis is on the small to mid-size independent

segment, both public and private,

collateralized

by

oil

and

gas

reserves

(larger

companies

typically

borrow

on

an

unsecured basis)

•

Typical Borrowing Base Valuation:

–

Based on independent review by Associated Bank petroleum engineers of proven

reserves –

Overall market assessment of commodity prices is made based on industry information

sources and is continuously monitored to estimate future cash flow from

proven reserves –

Cash

flows

from

proven

reserves

are

discounted

to

derive

a

present

value

–

Risk adjustments are made to present value of non producing proven reserves

–

A further significant advance rate haircut is applied to derive a conforming

borrowing base –

Semi-annual

redetermination

of

borrowing

base

and

more

frequent

field

visits

during

periods

of high volatility or risk in O&G markets.

–

If the borrowing base declines below the outstanding balance, there are

restructuring expectations.

Typically, this would mean reducing revolving lines to fully amortize inside a

conforming borrowing base within 3-6 months.

5 |

TYPICAL LOAN STRUCTURE

•

Secured by first priority lien on oil and gas reserves

•

These are syndicated deals with several banks participating in the credit

•

3 to 5 year working capital revolver with availability governed by a borrowing base

subject to semi-annual determinations

•

Proceeds used for acquisitions, development, working capital / letter of credit

issuance, and general corporate purposes

•

Financial covenants typically include cash flow leverage, interest coverage, and/or

current ratio measured quarterly

•

Sources of Repayment:

Primary Source of Repayment (“PSOR”) is cash flow.

Secondary Source of Repayment (“SSOR”) is sale of assets.

6 |

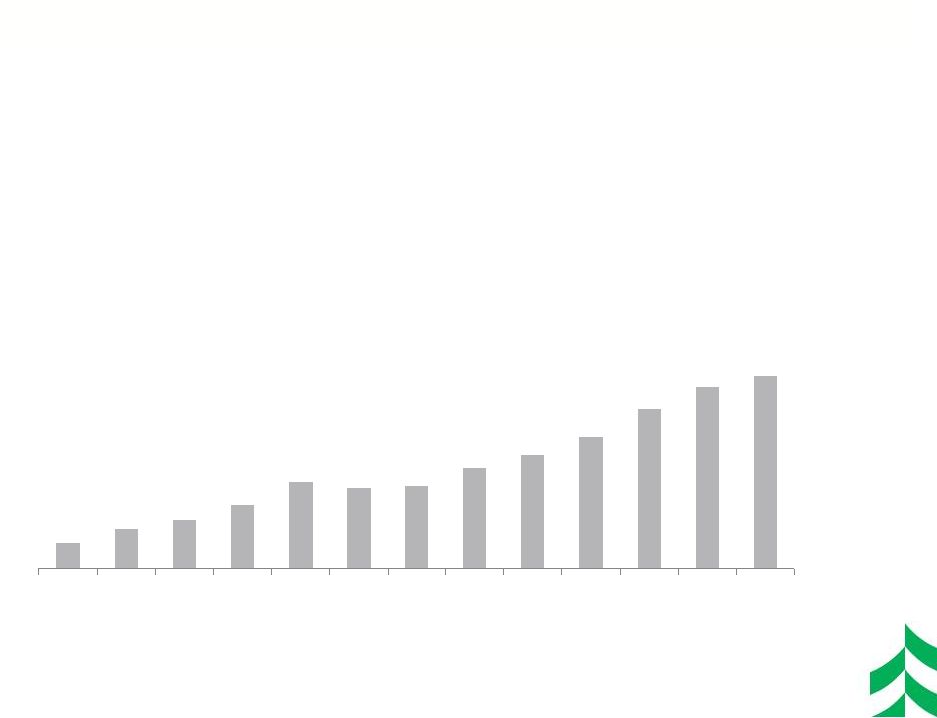

ASSOCIATED’S OIL & GAS PORTFOLIO

•

Established in January 2011 as a de novo lending vertical with zero loans

outstanding and zero clients, the Oil & Gas group has grown steadily to

its current book of approximately forty-seven clients with aggregate

commitments of more than $1 billion ($652MM funded; ~63% utilization).

–

Associated

has

Oil

and

Gas

average

loan

balances

of

$652

million

as

of

9/30/2014

representing approximately 3.8% of the total average loans outstanding ($17.1

Billion). –

In addition, these balances are diversified between Oil and Gas operations.

7

Oil and Gas Average Loan Balances by Quarter ($ in Millions)

$87

$165

$295

$281

$387

$539

$652

Q3

2011

Q4

2011

Q1

2012

Q2

2012

Q3

2012

Q4

2012

Q1

2013

Q2

2013

Q3

2013

Q4

2013

Q1

2014

Q2

2014

Q3

2014 |

RISKS

•

Commodity price risk. Partially mitigated by:

–

Borrowers usually mitigate prices risk by entering into multi-year commodity

hedges with financial counterparties

–

Risk adjustments are made to proven reserves that are not producing

–

Commodity

price

environment

is

continuously

monitored

and

changes

in

commodity

prices

are

considered

in

semi-annual

redeterminations

•

Development risk. Partially mitigated by:

–

Borrowing Base is derived from existing Proven reserves (90% certainty of

recovery) –

Risk adjustments are made to non-proven, developed and producing reserves

–

At

least

70%

of

borrowing

base

is

required

to

be

attributable

to

proven,

developed

and producing reserves

•

Reserve risk. Partially mitigated by:

–

Reserve report is required to be prepared by a qualified independent third party

engineering firm –

Associated Bank employs highly qualified staff petroleum engineers to evaluate the

assumptions utilized by the independent third party firms that prepare the

reserve reports. The engineering report addresses four critical

concerns: 1.

Pricing –

Future O&G prices must be realistic and fully supported

2.

Costs –

Exploration, development, and production costs

3.

Discount Rate –

Include the assumptions made

4.

Timing

–

Engineering

report

should

be

no

more

than

six

months

old,

never

over

a

year.

8 |