Attached files

| file | filename |

|---|---|

| 8-K - SYNERGETICS USA, INC. 8-K 12-11-2014 - SYNERGETICS USA INC | form8k.htm |

Exhibit 99.1

Annual Shareholders’ Meeting Presentation December 11, 2014

Certain statements made in this presentation are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. This presentation may include statements concerning management’s expectations of future financial results, potential business, potential acquisitions, government agency approvals, additional indications and therapeutic applications for medical devices, as well as their outcomes, clinical efficacy and potential markets and similar statements, all of which are forward looking. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from predicted results. For a discussion of such risks and uncertainties, please refer to the information set forth under “Risk Factors” included in Synergetics USA, Inc.’s Annual Report on Form 10-K for the year ended July 31, 2014, and information contained in subsequent filings with the Securities and Exchange Commission. These forward looking statements are made based upon our current expectations and we undertake no duty to update information provided in this presentation. Safe Harbor Statement 2

Program Topic Presenting Annual Stockholder Meeting Business Meeting Bob Dick Stockholder Assembly Strategy UpdateRecent DevelopmentsOphthalmologyNeuro /OEM Dave Hable MarketingBase Business UpdateNew Products Launched Jason Stroisch OperationsEnterprise Wide Continuous Improvement InitiativeKing of Prussia Integration John Copeland Finance Pam Boone Q & A Session Bob Blankemeyer, Bob Dick & Dave Hable 3

Business Meeting 4

Shareholders’ Business Meeting Declaration of QuorumElection of DirectorAdvisory (Non Binding) Approval of Compensation of the Company’s Named Executive OfficersRatification of the Appointment of UHY LLP as Independent Registered Public Accounting FirmReport of Inspectors of Election 5

Strategy Update 6

Overall Strategy Drive Accelerating Growth in our Ophthalmology BusinessDeliver Improved Profitability through our Enterprise-Wide Continuous Improvement InitiativeManage our Neurosurgery and OEM Businesses for Stable Growth and Strong Cash FlowDemonstrate Consistent, Solid Financial PerformanceContinued Growth through Strategic Acquisitions 7

Recent Developments 8

Recent DevelopmentsOphthalmology Announced acquisition of Sterimedix – UK Manufacturer/Distributor of ophthalmology cannulas, needles and other disposable productsLaunched 2nd generation VersaVIT vitrectomy machineMaturing product/challenging environment has pressured revenue growth in base ophthalmic businessInternal focus on improving operational excellence and enterprise-wide lean initiativesM.I.S.S. Ophthalmics LTD acquisitionKing of Prussia plant closure“Biggest Loser” exerciseScrap reduction 9

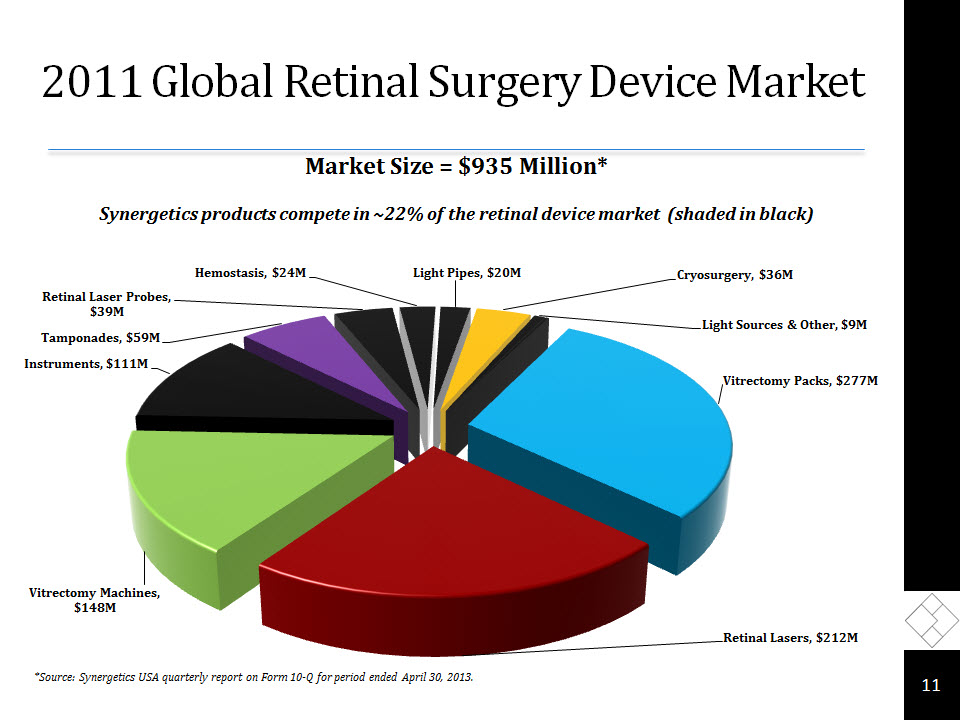

Ophthalmic Surgical Market 10 *Source: Synergetics USA quarterly report on Form 10-Q for period ended April 30, 2013.

2011 Global Retinal Surgery Device Market 11 *Source: Synergetics USA quarterly report on Form 10-Q for period ended April 30, 2013. Market Size = $935 Million*Synergetics products compete in ~22% of the retinal device market (shaded in black)

2014 Global Retinal Surgery Device Market 12 Estimated Market Size = $1.22 Billion*Implied Annual Growth = ~7%Synergetics products compete in ~69% of the retinal device market (shaded in black) *Source: Synergetics USA quarterly report on Form 10-Q for period ended April 30, 2013. Market Scope data estimates that the vitreoretinal market will grow approximately 7 percent to $1.2 billion in 2014, as compared to 2013.

Ophthalmic Products Core VersaPACK™ Directional Laser Probes DDMS-Diamond Duster Membrane Scraper Endoilluminator Awh Chandelier Photon II New 13 Directional Laser Probe VersaVIT 2.0™

VersaVIT™ vs. the Competition VersaVIT™ vs. ACCURUS® (25lbs vs. 90lbs) CONSTELLATION® Vision System CONSTELLATION® Vision System and ACCURUS® are registered trademarks of Alcon® Laboratories, a division of Novartis 14

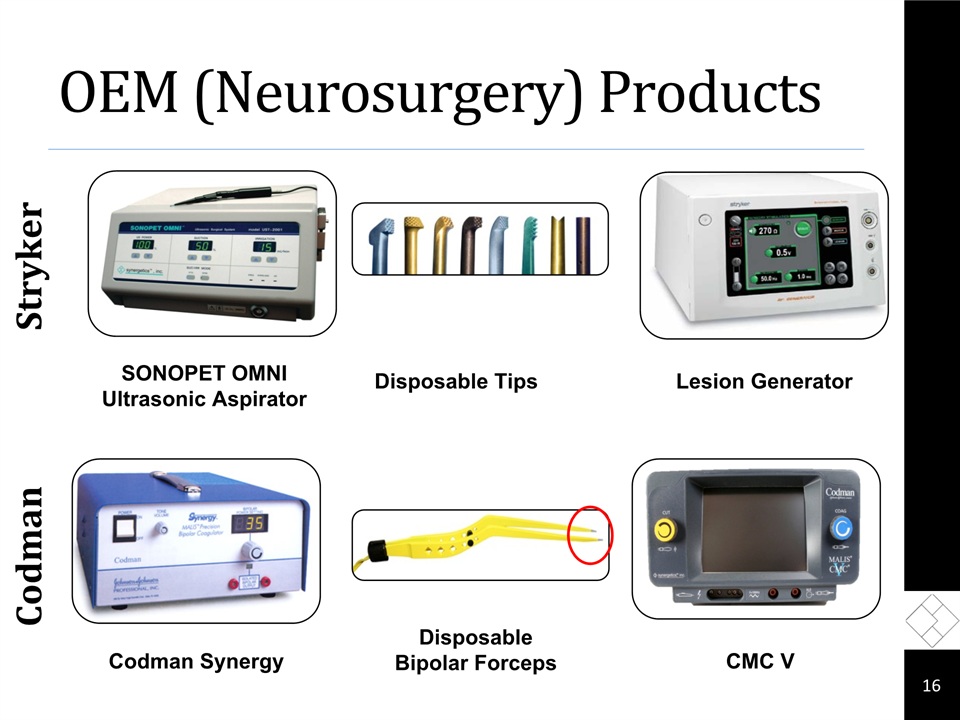

Recent Developments OEM (Neurosurgery) OEM partnerships remain strong - growth in FY 2014A majority of the business is consumablesLaunched “slim” and irrigating bi-polar forceps in SeptemberKing of Prussia plant will close completely this month 15

OEM (Neurosurgery) Products 16 Codman Stryker Lesion Generator SONOPET OMNI Ultrasonic Aspirator Disposable Tips Codman Synergy Disposable Bipolar Forceps CMC V

PRODUCTS 17

Anterior Products I/A Hand Pieces Injection Cannulas 18

Posterior Products Injection Cannulas Flute Handle Cannulas Heavy Liquid Infusion Handles Scleral Markers Infusion Lines Corneal Fixation/Incision Templates 19

Aesthetic Products Dermal Filler Cannula Fat Transfer Cannula Sharp Needle Cannula 20

Marketing 21

Base Business Update Several of our base business product platforms have been challenged over the past few yearsLaser ProbesMore and more low cost providers are entering the marketAlcon utilizing new vitrectomy machine with built-in laser to gain businessIridex has new agreement with low cost provider DORC has copied our patented Directional Laser Probe and is offering at aggressively low prices overseasLight pipe business Competition has caught up on technology for light sourcesNew stronger light sources built into new generation vitrectomy machine platformsSeveral other products in our product offering have become commoditized in the retinal space. This includes:Soft tip cannulasIris retractorsEven our popular DDMS is now offered by 4 different companies 22

Base Business Update (continued) How are we dealing with this erosion?Developed key new products launched in FY14 or to be launched in FY15 Tracking lost business on monthly business and going back to accounts to find solution to gain back business Utilizing VersaVIT™ platform as vessel for locking down accountsShifting business focus toward vitrectomy machines and packs 23

Key new products launched during last 12 monthsOphthalmology VersaVIT 2.0™ and Corresponding Packs & AccessoriesDirectional II Laser ProbeFlexible Tapered Illuminated Laser ProbeROP Instrument LineNeurosurgerySlim Bipolar ForcepsIrrigating Bipolar Forceps New Products Launched Over Last 12 months 24

Surgeon Feedback ProsEfficiency of machine and cutter combinationLight outputDuty cycle controlSimplicity (not a Constellation)“Beauty in its simplicity”Straight forward KEY RecommendationsSilicone oil injectionsRefluxStiffer light pipesImproved system feedbackVial removal potential issue with nursing staff (more of a nuisance) 25

Surgical Staff Feedback ProsEase of use Compact foot printSimplified setup processImproved pack configurations RecommendationsMayo tray Sterile barriers 26

Sales Force Feedback Excited by direct feedback from respected surgeons in their territoriesExcited about improved technologyEnergized by and active with 2.0 demosAddition of error codes has improved field diagnosticsNeed 27ga system urgentlyAdditional DEMO units in field to have multiple longer term DEMOs 27

Operations 28

Enterprise Wide Continuous Improvement Initiative GoalCreate a culture of continuous improvement through all functional operational areas by driving out waste in processesResultsImproved Service LevelsOverall fill rate increase from 92% in FY13 to 95% in FY14Reduced Costs Scrap ReductionReduced from 5.8% in FY13 to 3.3% in FY14 resulting in $400,000+ savingsLabor Content ReductionCross-functional Continuous Improvement (The Biggest Loser) activities generated over $700,000 in labor savingsFuture State (FY2015)Continue pursuing our Biggest Loser improvement opportunitiesIntroduce formal Project Management methodologies and tools to our more complex Continuous Improvement activitiesProject charterTime tables (Gantt chart)Formal project reviews 29

King of Prussia Integration GoalCreate a capital equipment center of excellence in our O’Fallon location and realize reduced operating costsKOP OperationDesign and manufacture of electrosurgical generators for Bipolar coagulation and lesion generationSupply Codman and Stryker24 Employees 14,000 sq. ft. leased spaceProject UpdateProject is on track for Scheduled December 2014 closeFully transitioned Stryker product line to O’Fallon and ceased production in KOPBegan production of Codman products in O’Fallon in NovemberFinal builds for Codman products in KOP will be completed late December 2014All capital equipment is now manufactured in one consolidated location 30

Finance 31

Sales (dollars in thousands) 32

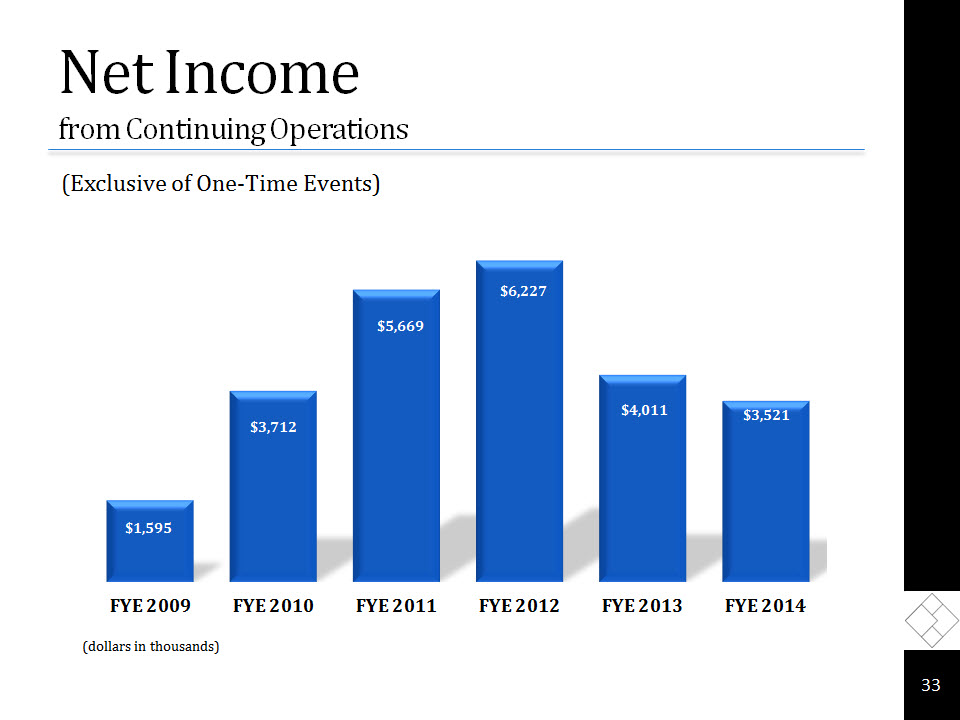

Net Income from Continuing Operations (Exclusive of One-Time Events) (dollars in thousands) 33

EBITDA from Operations (dollars in thousands) (dollars in thousands) (Exclusive of One-Time Events) 34

Use of Non-GAAP Financial Measures This presentation contains certain non-GAAP financial information that management believes is useful to investors in evaluating the Company’s performance. More information about these non-GAAP financial measures is included in a Current Report on Form 8-K that the Company filed with the Securities and Exchange Commission immediately prior to this presentation. This Current Report on Form 8-K is available on the Company’s website at www.synergeticsusa.com by clicking on Financial Information: SEC Filings under the Investor Relations tab. 35

Major Financial Events Alcon Settlement – April 23, 2010:In April 2010, we entered into a Settlement and License Agreement.Alcon paid the Company $32.0 million in settlement and license proceeds. The net proceeds were $21.4 million, after contingency payments to the attorneys.In 3Q 2010, we recognized a gain of $2.4 million from the settlement.In 1Q 2012, we made a $5.8 million tax payment on the net settlement amount which made our cash flow from operations negative during this time period.In 2Q 2012, Alcon canceled the project, orders and forecasts covering the two products to have been supplied under the Supply Agreement.The remaining portion of the proceeds has been accounted for as an up-front licensing fee and is being deferred over the life of the patents.Currently, we are recognizing $1,288,000 of this deferred revenue annually. 36 Continued

Major Financial Events (continued) Neurosurgery Distribution Changes are going very well since they were implemented in FY 2010:Codman – Exclusive distribution of disposable bipolar forceps. In the last full year of direct forceps sales (2009), we sold approximately $3.1 million. For FY 2014, we sold approximately $8.2 million of forceps to Codman.Stryker – Exclusive distribution of ultrasonic aspirator tips and accessories. In the last full year of direct ultrasonic aspirator tips and accessories (2009), we sold approximately $4.2 million. For FY 2014, we sold approximately $8.7 million of ultrasonic aspirators tips and accessories to Stryker. 37 Continued

Major Financial Events (continued) Inventory Write-Offs:In the 3Q of FY 2012, we recorded $367,000, primarily for obsolete inventory.In the 2Q of FY 2013, we recorded $2.1 million, primarily for excess inventory.There were no inventory write-offs during fiscal 20143In June 2012, we received regulatory approval for our VersaVIT™ vitrectomy system.In June 2014, we announced the launch of the next generation vitrectomy system, VersaVIT 2.0TM. 38

Acquisitions In July 2013, we acquired our long-standing UK distributor, M.I.S.S. Ophthalmics LTD.In May 2014, we acquired a private OEM company.In December 2014, we acquired Sterimedix LTD. 39

Q & A Session 40

3845 Corporate Centre DriveO’Fallon, MO 63368(636) 939-5100www.synergeticsusa.com