Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Mahwah Bergen Retail Group, Inc. | v396388_8k.htm |

Annual Meeting of Stockholders December 11, 2014

David Jaffe President & CEO

Lece Lohr EVP, CMO

Linda Heasley President and CEO Changing the Conversation

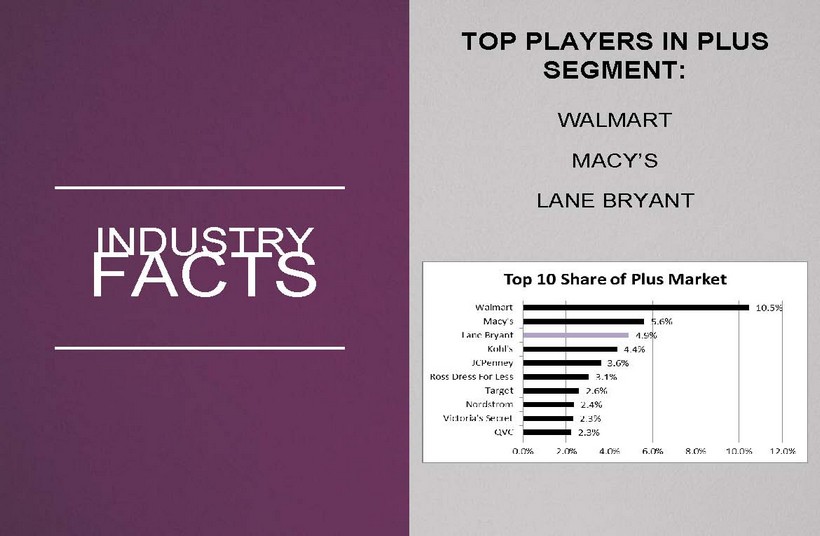

$19 BILLION SEGMENT FY 2014 GROWTH: TOTAL WOMEN’S APPAREL +1% TOTAL PLUS SEGMENT: +2% PLUS SEGMENT AGES 24+: 0% LANE BRYANT: +3% FACTS INDUSTRY

GROWTH FY 2014: PLUS - SIZE ECOMMERCE: +13% LANE BRYANT: +21% FACTS INDUSTRY

TOP PLAYERS IN PLUS SEGMENT: WALMART MACY’S LANE BRYANT FACTS INDUSTRY

OUR LONG STANDING HISTORY MAKES US THE AUTHORITY WITHIN THE CATEGORY, BUT WE NEED TO ACT QUICKLY TO SIEZE THE MOMENT FROM 2 TO 10 YEARS OF EXPERIENCE OVER 100 YEARS OF EXPERIENCE…JUST ABOUT AND FOR HER

CHANGING THE CONVERSATION

A complete lifestyle brand…

DESIGNER COLLABORATIONS

2014 RESULTS: Progress to LY, but short of plan • Sales +$30M to last year but $20M short of plan • Gross margin +190 bps to LY • Expenses - $6M to plan GOAL: 10% Operating Income • Avg store grows from $1.1M to $1.3M • Store productivity improves to $240/sf • Margin improves through promotion efficiency and sourcing leverage • Expenses leverage 200 bps FINANCIAL RESULTS

• “Blue Chip” integration projects • New customer acquisition • Speed and vertical sourcing • Optimal real estate positioning • Maximizing what’s working – Cacique – Knits & Activewear – E - Commerce • Productivity improvement and cost leverage that supports 10% operating income “DOUBLING DOWN”

George Goldfarb | PRESIDENT

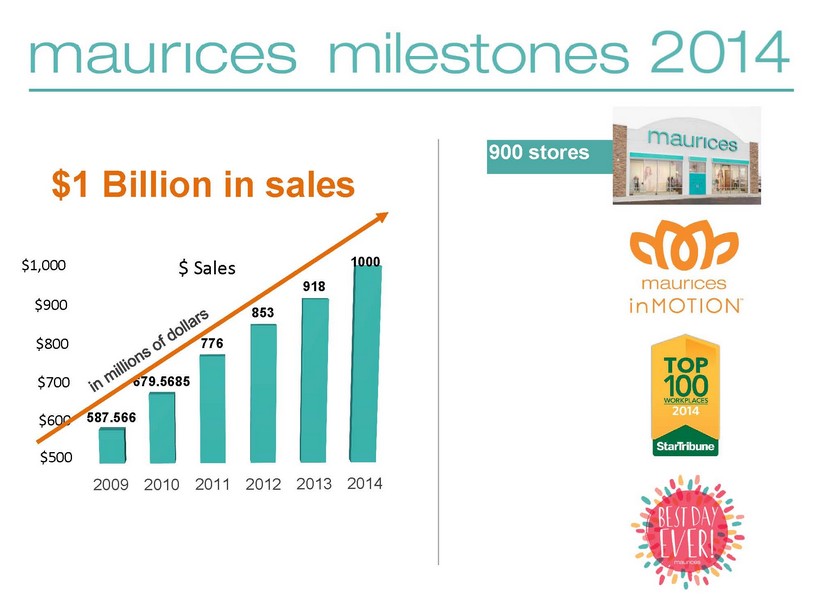

$500 $600 $700 $800 $900 $1,000 2009 2010 2011 2012 2013 2014 587.566 679.5685 776 853 918 1000 $ Sales $1 Billion in sales 900 stores

talent & culture

BooFest celebration

AGS summit

George Goldfarb | PRESIDENT

Ben Moore SVP, Store Development

Priorities DELIVER BRAND RIGHT ASSORTMENT • Grow sales by delivering brand right assortments. Align look, fit, quality and value with SMART girl preferences EXPAND DESIGN/SOURCING • Increase merchandise differentiation thru internal design / drive IMU increases thru direct sourcing LAUNCH DRESSbar • Attract new customers to our brand. Leverage dresses to drive trial MOVE TO CUSTOMER CENTRICITY • Increase engagement / retention thru alignment with current and future needs of SMART girl ACCELERATE E - COMMERCE GROWTH • Drive trial for overall Brand and expand customer engagement across all channels OPTIMIZE REAL ESTATE PORTFOLIO • Drive store productivity by optimizing existing fleet and new prototype roll - out

Real Estate 9 Box FY 2013 3 (<$150k) 60 77 64 191 158 80 107 42 12 1 2 2 ($150 - $300k) 1 (>$300k) REAL ESTATE QUALITY A B C

Profitable / High ROIC New Store Openings • Opened 50 new stores / relocations in FY14 • $10.8mm capital investment ($19.4 less $8.7 tenant allowance) • $8.7mm Year 1 EBITDA Improve Underperformers • Apollo stats • Close low profit locations in C real estate Lock in High Performers • Golden goose stats Increased Portfolio Productivity • Store contribution increased by 254bps for FY14 vs. FY13, or +17% Drive Productivity: FY14

Real Estate 9 Box FY 2013 3 (<$150k) A B C 60 77 64 191 158 80 107 42 12 1 2 2 ($150 - $300k) 1 (>$300k) REAL ESTATE QUALITY

Real Estate 9 Box FY 2014 A B C 42 70 79 167 204 95 54 54 3 2 ($150 - $300k) 1 (>$300k) 3 (<$150k) REAL ESTATE QUALITY

• Reposition / Grow the Fleet – FY15 - FY17: 99 new stores only in “A” or “B” real estate – FY15 - FY17: 43 relocations – Continue to drive performance of ‘underperformers’ – Close most remaining ‘C - 3’ locations (54 at FY14 / 15 in FY17 pending relocation) • Rationalize Markets – Identify over - penetrated markets with opportunity to reduce store count / increase profitability • Smaller Footprint – Reduce average store size (now 7,500). Currently testing smaller space configurations • New Prototype – Implement new design oriented around brand distinctions (first opening 8/15) Drive Productivity: Increase Average Store Sales Strategy

Joan Munnelly SVP, Chief Merchandising Officer

John Sullivan Executive Vice President & COO

Shared Services Group Update The journey to create world - class Shared Services for our brands.....

Shared Services Group Update Investments in distribution services are completed… SSG Etna Greencastle

Newly designed web - sites Customer service capability Ship from store Customer Loyalty program Shared Services Group Update Our Strategic focus….Omni Channel Capabilities

Robb Giammatteo SVP, FP&A and Investor Relations

Safe Harbor Statement Forward - Looking Statements Certain statements made within this press release may constitute “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward - looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially. The Company does not undertake to publicly update or review its forward - looking statements even if experience or future changes make it clear that our projected results expressed or implied will not be achieved. Detailed information concerning a number of factors that could cause actual results to differ materially from the information contained herein is readily available in the Company’s most recent Annual Report on Form 10 - K.

Fiscal 2014 – Financial Highlights* * All figures shown reflect adjusted reporting basis; reconciliation to GAAP figures available on Form 8K, filed with the Securities and Exchange Commission on September 22, 2014 ** FY13 gross margin excludes the impact of approximately $20M of purchase price accounting adjustments, as discussed on Form 10K, filed with the Securities and Exchange Commission on September 23, 2014. **

Looking Ahead… Challenging macro environment Control the controllables Capital allocation / free cash flow Maintain / build balance sheet strength Leverage the platform model

Sue Ross Executive Vice President, HR Maurices

What We Stand For Empowering Women And Children To Be Their Best Education Self - Esteem Wellness Social Support

Monetary Donations Volunteer In Kind Expertise Forms of Giving

FY 2014 Objectives Roll out the Ascena Cares programs across the enterprise Roll out the first annual Roslyn S. Jaffe Awards Develop and execute a governance structure Develop and implement standardized reporting

Brand Work

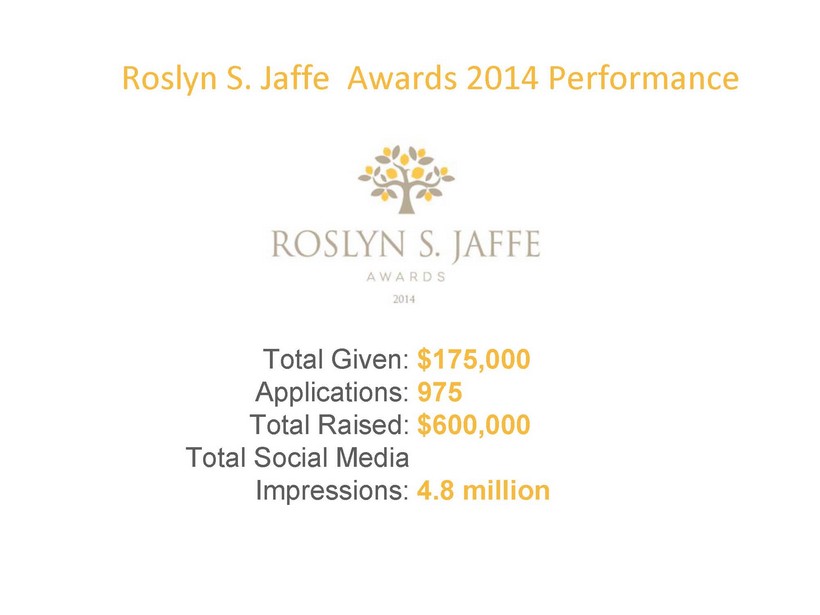

Roslyn S. Jaffe Awards 2014 Performance Total Given: Applications: Total Raised: Total Social Media Impressions: $175,000 975 $600,000 4.8 million

FY 2015 Goals • Provide support to the 2014 winners throughout the year. • Double the number of applications. • Consider additional winners. • Reduce administrative expenses by leveraging the foundational work completed in 2014. • Increase PR impressions.

David Jaffe President & CEO

Q A &

Annual Meeting of Stockholders December 11, 2014