Attached files

| file | filename |

|---|---|

| EX-23.7 - EX-23.7 - TerraForm Power NY Holdings, Inc. | d827022dex237.htm |

| EX-23.1 - EX-23.1 - TerraForm Power NY Holdings, Inc. | d827022dex231.htm |

| EX-23.6 - EX-23.6 - TerraForm Power NY Holdings, Inc. | d827022dex236.htm |

| EX-23.4 - EX-23.4 - TerraForm Power NY Holdings, Inc. | d827022dex234.htm |

| EX-23.5 - EX-23.5 - TerraForm Power NY Holdings, Inc. | d827022dex235.htm |

| EX-23.2 - EX-23.2 - TerraForm Power NY Holdings, Inc. | d827022dex232.htm |

| EX-23.3 - EX-23.3 - TerraForm Power NY Holdings, Inc. | d827022dex233.htm |

| EX-23.8 - EX-23.8 - TerraForm Power NY Holdings, Inc. | d827022dex238.htm |

| EX-23.9 - EX-23.9 - TerraForm Power NY Holdings, Inc. | d827022dex239.htm |

Table of Contents

As filed with the Securities and Exchange Commission on December 9, 2014

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TerraForm Power, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 4911 | 46-4780940 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

12500 Baltimore Avenue

Beltsville, Maryland 20705

(443) 909-7200

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Sebastian Deschler, Esq.

Senior Vice President, General Counsel and Secretary

TerraForm Power, Inc.

12500 Baltimore Avenue

Beltsville, Maryland 20705

(443) 909-7200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| Andrea L. Nicolas Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, New York 10036 (212) 735-3000 |

Kirk A. Davenport II Latham & Watkins LLP 885 Third Avenue New York, New York 10022 (212) 906-1200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate |

Amount of Registration Fee(2) | ||

| Class A Common Stock, $0.01 par value per share |

$350,000,000 | $40,670 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(o) of the Securities Act of 1933, as amended. |

| (2) | Includes the offering price of any additional shares of Class A Common Stock that the underwriters have the option to purchase. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated December 9, 2014

Shares

TerraForm Power, Inc.

Class A Common Stock

We are selling shares of our Class A common stock.

Our Class A common stock trades on the NASDAQ Global Select Market under the symbol “TERP.” The last reported trading price of shares of our Class A common stock on December 5, 2014 was $30.99.

We are an “emerging growth company” as the term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements.

See “Risk Factors” beginning on page 31 to read about factors you should consider before buying shares of our Class A common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share |

Total | |||||||

| Price to the public |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

The underwriters have the option to purchase up to an additional shares from TerraForm Power, Inc. at the price to the public less the underwriting discount for a period of 30 days after the date of this prospectus.

The underwriters expect to deliver the shares against payment in New York, New York on , .

| Barclays | Goldman, Sachs & Co. | Morgan Stanley |

| BofA Merrill Lynch | Citigroup | Macquarie Capital |

Prospectus Dated , .

Table of Contents

| Page | ||||

| 1 | ||||

| 31 | ||||

| 78 | ||||

| 80 | ||||

| 81 | ||||

| 82 | ||||

| 83 | ||||

| 87 | ||||

| 102 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

104 | |||

| 131 | ||||

| 140 | ||||

| 176 | ||||

| 182 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

188 | |||

| 191 | ||||

| 215 | ||||

| 220 | ||||

| 228 | ||||

| UNITED STATES FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS |

231 | |||

| 236 | ||||

We have not and the underwriters have not authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We are offering to sell, and seeking offers to buy, shares of our Class A common stock only in jurisdictions where such offers and sales are permitted. The information in this prospectus or any free writing prospectus is accurate only as of its date, regardless of its time of delivery or the time of any sale of shares of our Class A common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Trademarks and Trade Names

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of SunEdison, Inc. and third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks and trade names.

Industry and Market Data

This prospectus includes industry data and forecasts that we obtained from industry publications and surveys, public filings and internal company sources. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources

i

Table of Contents

believed to be reliable, but there can be no assurance as to the accuracy or completeness of the included information. Statements as to our market position and market estimates are based on independent industry publications, government publications, third party forecasts, management’s estimates and assumptions about our markets and our internal research. While we are not aware of any misstatements regarding the market, industry or similar data presented herein, such data involve risks and uncertainties and are subject to change based on various factors, including those discussed under the headings “Risk Factors” and “Cautionary Statement Concerning Forward-Looking Statements” in this prospectus.

As used in this prospectus, all references to watts (e.g., Megawatts, Gigawatts, MW, GW, etc.) refer to measurements of direct current, or “DC,” with respect to solar generation assets, and measurements of alternating current, or “AC,” with respect to wind generation assets.

Certain Defined Terms

Unless the context provides otherwise, references herein to:

| • | “COD” refers to commercial operations date; |

| • | “IPO” refers to our initial public offering in July 2014; |

| • | “PPAs” refers to our long-term power purchase agreements and energy hedge contracts; |

| • | “SunEdison” and “Sponsor” refer to SunEdison, Inc. together with, where applicable, its consolidated subsidiaries; |

| • | “Support Agreement” refers to the project support agreement entered into with our Sponsor in connection with our IPO; |

| • | “Terra LLC” refers to TerraForm Power, LLC; |

| • | “Terra Operating LLC” refers to TerraForm Power Operating, LLC, a wholly owned subsidiary of Terra LLC; and |

| • | “we,” “our,” “us,” “our company” and “TerraForm Power” refer to TerraForm Power, Inc., together with, where applicable, its consolidated subsidiaries. |

See “Summary—Organizational Structure” for more information regarding our ownership structure.

ii

Table of Contents

The following summary highlights information contained elsewhere in this prospectus. It does not contain all the information you need to consider in making your investment decision. Before making an investment decision, you should read this entire prospectus carefully and should consider, among other things, the matters set forth under “Risk Factors,” “Selected Historical Combined Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our and our predecessor’s financial statements and related notes thereto appearing elsewhere in this prospectus.

About TerraForm Power, Inc.

We are a dividend growth-oriented company formed to own and operate contracted clean power generation assets acquired from SunEdison and third parties. Our business objective is to acquire high-quality contracted cash flows, primarily from owning solar and wind generation assets serving utility, commercial and residential customers. Over time, we intend to acquire other clean power generation assets, including natural gas and hydro-electricity facilities, as well as hybrid energy solutions that enable us to provide contracted power on a 24/7 basis. We believe the renewable power generation segment is growing more rapidly than other power generation segments due in part to the emergence in various energy markets of “grid parity,” which is the point at which renewable energy sources can generate electricity at a cost equal to or lower than prevailing electricity prices. We expect retail electricity prices to continue to rise due to the increasing cost of producing electricity from fossil fuels caused by required investments in generation plants and transmission and distribution infrastructure and increasing regulatory costs, among other factors.

Our current portfolio consists of solar projects located in the United States, Canada, the United Kingdom and Chile with an aggregate nameplate capacity of 887.1 MW. As of our IPO, our portfolio consisted of projects with an aggregate nameplate capacity of 807.7 MW. Since then, we acquired several Call Right Projects from our Sponsor with a total capacity of 54.6 MW and also completed the Hudson Energy Acquisition (as defined herein), in which we acquired 25.5 MW of operating solar power assets. In addition, we expect to complete the Capital Dynamics Acquisition (as defined herein) in December 2014, which will add a further 77.6 MW of operating solar power assets to our portfolio. In November 2014, we agreed to acquire 521.1 MW of operating power assets, including 500.0 MW of wind power assets and 21.1 MW of solar power assets, in the First Wind Acquisition (as defined herein) for a total consideration of $862.0 million. If the Capital Dynamics Acquisition and the First Wind Acquisition are consummated, our portfolio will include both solar and wind projects and will increase to a total nameplate capacity of 1,485.8 MW.

In addition to growing our current portfolio, our pipeline of call right projects has increased since the IPO. As of November 30, 2014, the Call Right Projects that are specifically identified pursuant to the Support Agreement have a total nameplate capacity of 1.7 GW. Additionally, in connection with the First Wind Acquisition, we entered into an Intercompany Agreement with our Sponsor, or the “Intercompany Agreement,” under which we will be granted additional call rights with respect to certain projects in the First Wind pipeline, which are expected to represent an additional 1.6 GW of wind and solar generation assets. If the First Wind Acquisition is consummated, the total nameplate capacity of the projects to which we have call rights under both the Intercompany Agreement and the Support Agreement will be over 3.3 GW. We anticipate the First Wind Acquisition will close in the first quarter of 2015. See “—Recent Developments—Acquisition Transactions.”

We intend to further expand and diversify our current project portfolio by acquiring utility-scale, distributed and residential assets located in the United States, Canada, the United Kingdom, Chile and

1

Table of Contents

certain other jurisdictions, each of which we expect will have a long-term PPA with a creditworthy counterparty. Substantially all of the projects we will acquire in the Capital Dynamics Acquisition and First Wind Acquisition have a long-term PPA with a creditworthy counterparty, and the weighted average (based on MW) remaining life of our PPAs if both acquisitions are consummated would be approximately 16 years.

Further growth in our project portfolio will be driven by our relationship with our Sponsor, including access to its project pipeline, and by our access to third party developers and owners of clean generation assets in our core markets. As of September 30, 2014, our Sponsor had a 4.5 GW pipeline of development stage solar projects. An additional 1.6 GW pipeline of solar and wind development projects will be acquired by our Sponsor if the First Wind Acquisition is consummated. In addition, our Sponsor is a leading operator of solar power plants with approximately 3.0 GW of total nameplate capacity under management. Our Sponsor has provided us with a dedicated management team that has significant experience in clean power generation. We believe we are well-positioned for substantial growth due to the high quality, diversification and scale of our project portfolio, the PPAs we have with creditworthy counterparties, our dedicated management team and our Sponsor’s project origination and asset management capabilities.

We entered into the Support Agreement with our Sponsor in connection with our IPO, which requires our Sponsor to offer us additional qualifying projects from its development pipeline by the end of 2016 that are projected to generate an aggregate of at least $175.0 million of cash available for distribution, or “CAFD,” during the first 12 months following the qualifying projects’ respective COD, or “Projected FTM CAFD.” We refer to these projects as the “Call Right Projects.” Specifically, the Support Agreement requires our Sponsor to offer us:

| • | from the completion of our IPO through the end of 2015, projects that are projected to generate an aggregate of at least $75.0 million of cash available for distribution during the first 12 months following their respective COD; and |

| • | during calendar year 2016, projects that are projected to generate an aggregate of at least $100.0 million of cash available for distribution during the first 12 months following their respective COD. |

If the amount of Projected FTM CAFD of the projects we acquire under the Support Agreement through the end of 2015 is less than $75.0 million, or the amount of Projected FTM CAFD of the projects we acquire under the Support Agreement during 2016 is less than $100.0 million, our Sponsor has agreed that it will continue to offer us sufficient Call Right Projects until the total aggregate Projected FTM CAFD commitment has been satisfied. Since our IPO, our Sponsor has updated the list of Call Right Projects, with projects representing a further 1.7 GW of total nameplate capacity identified as Call Right Projects as of November 30, 2014. We believe the currently identified Call Right Projects, along with the 54.6 MW of Call Right Projects we have acquired from our Sponsor since our IPO, will be sufficient to satisfy a majority of the Projected FTM CAFD commitment for 2015 and between 45% and 70% of the Projected FTM CAFD commitment for 2016 (depending on the amount of debt financing we use for such projects).

In addition, the Support Agreement grants us a right of first offer with respect to any solar projects (other than Call Right Projects) located in the United States, Canada, the United Kingdom, Chile and certain other jurisdictions that our Sponsor decides to sell or otherwise transfer during the six-year period following the completion of our IPO. We refer to these projects as the “ROFO Projects.” The Support Agreement does not identify the ROFO Projects since our Sponsor will not be obligated to sell any project that would constitute a ROFO Project. As a result, we do not know when, if ever, any

2

Table of Contents

ROFO Projects or other assets will be offered to us. In addition, in the event that our Sponsor elects to sell such assets, it will not be required to accept any offer we make to acquire any ROFO Project and, following the completion of good faith negotiations with us, our Sponsor may choose to sell such assets to a third party or not to sell the assets at all.

In addition to the Call Right Projects under the Support Agreement, pursuant to the Intercompany Agreement we will have additional call rights with respect to certain projects in the First Wind pipeline, which are expected to represent an additional 1.6 GW of wind and solar generation assets from 2015 to 2017, subject to the consummation of the First Wind Acquisition. These additional call right projects will not count towards our Sponsor’s Projected FTM CAFD commitment under the Support Agreement.

3

Table of Contents

Our Portfolio and the Call Right Projects

The following table provides an overview of the assets that comprise our portfolio as of November 30, 2014:

| Offtake Agreements |

||||||||||||||||||||||

| Project Names |

Location | COD(1) | Nameplate Capacity (MW)(2) |

# of Sites |

Project Origin(3) |

Counterparty |

Counterparty Credit Rating(4) |

Remaining Duration of PPA (Years)(5) |

||||||||||||||

| Distributed Generation: |

||||||||||||||||||||||

| U.S. Projects 2014 |

U.S. | Q2 2014-Q4 2014 |

45.4 | 41 | C | Various utilities, municipalities and commercial entities | A+, A1 | 20 | ||||||||||||||

| Hudson Energy |

U.S. | 2011-2013 | 25.5 | 101 | A | Various commercial, residential and governmental entities | A+, A1 | 15 | ||||||||||||||

| Summit Solar Projects |

U.S. | 2007-2014 | 19.6 | 50 | A | Various commercial and governmental entities | A, A2 | 14 | ||||||||||||||

| Canada | 2011-2013 | 3.8 | 7 | A | Ontario Power Authority | A-, Aa1 | 18 | |||||||||||||||

| Enfinity |

U.S. | 2011-2013 | 15.7 | 16 | A | Various commercial, residential and governmental entities | A, A2 | 18 | ||||||||||||||

| U.S. Projects 2009-2013 |

U.S. | 2009-2013 | 15.2 | 73 | C | Various commercial and governmental entities | BBB+, Baa1 | 16 | ||||||||||||||

| California Public Institutions |

U.S. | Q4 2013-Q3 2014 |

13.5 | 5 | C | State of California Department of Corrections and Rehabilitation | A+, A3 | 19 | ||||||||||||||

| MA Operating |

U.S. | Q3 2013-Q4 2013 |

12.2 | 4 | A | Various municipalities | A+, A1 | 20 | ||||||||||||||

| SunE Solar Fund X |

U.S. | 2010-2011 | 8.8 | 12 | C | Various utilities, municipalities and commercial entities | AA, Aa2 | 17 | ||||||||||||||

| LPT II Fund |

U.S. | Q4 2014-Q2 2015 |

4.6 | 9 | S | Various commercial and governmental entities | A, A2 | 19 | ||||||||||||||

|

|

|

|

|

|||||||||||||||||||

| Subtotal |

164.3 | 318 | ||||||||||||||||||||

4

Table of Contents

| Offtake Agreements |

||||||||||||||||||||||

| Project Names |

Location | COD(1) | Nameplate Capacity (MW)(2) |

# of Sites |

Project Origin(3) |

Counterparty |

Counterparty Credit Rating(4) |

Remaining Duration of PPA (Years)(5) |

||||||||||||||

| Utility: |

||||||||||||||||||||||

| Mt. Signal |

U.S. | Q1 2014 | 265.9 | 1 | A | San Diego Gas & Electric | A, A1 | 24 | ||||||||||||||

| Regulus Solar |

U.S. | Q4 2014 | 81.6 | 1 | C | Southern California Edison | BBB+, A2 | 20 | ||||||||||||||

| North Carolina Portfolio |

U.S. | Q4 2014 - Q1 2015 |

26.0 | 4 | C | Duke Energy Progress | BBB+, A1 | 15 | ||||||||||||||

| Atwell Island |

U.S. | Q1 2013 | 23.5 | 1 | A | Pacific Gas & Electric Company | BBB, A3 | 23 | ||||||||||||||

| Nellis |

U.S. | Q4 2007 | 14.1 | 1 | A | U.S. Government (PPA); Nevada Power Company (RECs)(6) | AA+, Aaa, BBB+, Baa2 |

13 | ||||||||||||||

| Alamosa |

U.S. | Q4 2007 | 8.2 | 1 | C | Xcel Energy | A-, A3 | 13 | ||||||||||||||

| CalRENEW-1 |

U.S. | Q2 2010 | 6.3 | 1 | A | Pacific Gas & Electric Company | BBB, A3 | 16 | ||||||||||||||

| Marsh Hill |

Canada | Q2 2015 | 18.7 | 1 | A | Ontario Power Authority | A-, Aa1 | 20 | ||||||||||||||

| SunE Perpetual Lindsay |

Canada | Q4 2014 | 15.5 | 1 | C | Ontario Power Authority | A-, Aa1 | 20 | ||||||||||||||

| Stonehenge |

U.K. | Q2 2014 | 41.1 | 3 | A | Statkraft AS | A-, Baa1 | 15 | ||||||||||||||

| Crundale |

U.K. | Q4 2014 | 37.8 | 1 | S | Statkraft AS | A-, Baa1 | 15 | ||||||||||||||

| Stonehenge Operating |

U.K. | Q1 2013 - Q2 2013 |

23.6 | 3 | A | Total Gas & Power Limited | NR, NR | 14 | ||||||||||||||

| Says Court |

U.K. | Q2 2014 | 19.8 | 1 | C | Statkraft AS | A-, Baa1 | 15 | ||||||||||||||

| Crucis Farm |

U.K. | Q3 2014 | 16.1 | 1 | C | Statkraft AS | A-, Baa1 | 15 | ||||||||||||||

| Fairwinds |

U.K. | Q4 2014 | 12.2 | 1 | S | Statkraft AS | A-, Baa1 | 15 | ||||||||||||||

| Norrington |

U.K. | Q2 2014 | 11.2 | 1 | A | Statkraft AS | A-, Baa1 | 15 | ||||||||||||||

| CAP(7) |

Chile | Q1 2014 | 101.2 | 1 | C | Compañia Minera del Pacifico (CMP) | BBB-, NR | 19 | ||||||||||||||

|

|

|

|

|

|||||||||||||||||||

| Subtotal |

722.8 | 24 | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||

| Total Portfolio |

887.1 | 342 | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||

| (1) | Represents actual or anticipated COD, as applicable, unless otherwise indicated. |

| (2) | Nameplate capacity for solar projects represents the maximum generating capacity at standard test conditions of a facility multiplied by our percentage ownership of that facility (disregarding any equity interests held by any tax equity investor or lessor under any sale-leaseback financing or of any non-controlling interests in a partnership). Generating capacity may vary based on a variety of factors discussed elsewhere in this prospectus. |

5

Table of Contents

| (3) | Projects which were contributed by our Sponsor prior to our IPO, or “Contributed Projects,” are reflected in the Predecessor’s combined consolidated historical financial statements, and are identified with a “C” above. Projects which were acquired either contemporaneously with the completion of our IPO or in the period since our IPO are identified with an “A” above. Projects which have been sold to us by our Sponsor in the period since our IPO are identified with an “S” above. |

| (4) | For our distributed generation projects with one counterparty and for our utility-scale projects the counterparty credit rating reflects the counterparty’s or guarantor’s issuer credit ratings issued by Standard & Poor’s Ratings Services, or “S&P,” and Moody’s Investors Service Inc., or “Moody’s.” For distributed generation projects with more than one counterparty the counterparty credit rating represents a weighted average (based on nameplate capacity) credit rating of the project’s counterparties that are rated by S&P, Moody’s or both. The percentage of counterparties that are rated by S&P, Moody’s or both (based on nameplate capacity) of each of our distributed generation projects is as follows: |

| • | U.S. Projects 2014: 82% |

| • | Hudson Energy: 54% |

| • | Summit Solar Projects (U.S.): 21% |

| • | Summit Solar Projects (Canada): 100% |

| • | Enfinity: 85% |

| • | U.S. Projects 2009-2013: 35% |

| • | California Public Institutions: 100% |

| • | MA Operating: 100% |

| • | SunE Solar Fund X: 89% |

| • | LPT II Fund: 68% |

| (5) | Calculated as of September 30, 2014. For distributed generation projects, the number represents a weighted average (based on nameplate capacity) remaining duration. For Nellis, the number represents the remaining duration of the renewable energy credit, or “REC,” contract. |

| (6) | The REC contract for the Nellis project, which represents over 90% of the expected revenues, has remaining duration of approximately 13 years. The PPA of the Nellis project has an indefinite term subject to one-year reauthorizations. |

| (7) | The PPA counterparty has the right, under certain circumstances, to purchase up to 40% of the project equity from us pursuant to a predetermined purchase price formula. See “Business—Our Portfolio—Current Portfolio—Utility Projects—CAP.” |

The projects in our portfolio, as well as the Call Right Projects discussed below, were selected because they are located in the geographic locations we intend to initially target. All of the projects in our portfolio have, and all of the Call Right Projects have, or will have, long-term PPAs with creditworthy counterparties that we believe will provide sustainable and predictable cash flows to fund the regular quarterly cash dividends that we intend to continue to pay to holders of our Class A common stock. The Call Right Projects generally are not expected to reach COD until the first quarter of 2015 or later.

The Support Agreement has established an aggregate cash purchase price that, when taken together with applicable project-level debt, equals $846.5 million (subject to such adjustments as the parties may mutually agree) for the Call Right Projects set forth in the table below under the heading “Priced Call Right Projects.” This aggregate price was determined by good faith negotiations between us and our Sponsor.

6

Table of Contents

We will have the right to acquire additional Call Right Projects set forth in the table below under the heading “Unpriced Call Right Projects” at prices that will be determined in the future. The price for each Unpriced Call Right Project will be the fair market value of such project. The Support Agreement provides that we will work with our Sponsor to mutually agree on the fair market value, but if we are unable to, we and our Sponsor will engage a third-party advisor to determine the fair market value, after which we have the right (but not the obligation) to acquire such Call Right Project. Until the price for a Call Right Asset is mutually agreed to by us and our Sponsor, in the event our Sponsor receives a bona fide offer for a Call Right Project from a third party, we will have the right to match any price offered by such third party and acquire such Call Right Project on the terms our Sponsor could obtain from the third party. After the price for a Call Right Asset has been agreed upon and until the total aggregate Projected FTM CAFD commitment has been satisfied, our Sponsor may not market, offer or sell that Call Right Asset to any third party without our consent. The Support Agreement further provides that our Sponsor is required to offer us additional qualifying Call Right Projects from its pipeline on a quarterly basis until we have acquired projects under the Support Agreement that have the specified minimum amount of Projected FTM CAFD for each of the periods covered by the Support Agreement. We cannot assure you that we will be offered these Call Right Projects on terms that are favorable to us. See “Certain Relationships and Related Party Transactions—Project Support Agreement” for additional information.

The following table provides an overview of the Call Right Projects that are identified pursuant to the Support Agreement as of November 30, 2014:

| Project Names(1) |

Country | Estimated Acquisition Date(2) |

Nameplate Capacity (MW)(3) |

# of Sites | ||||||||

| Priced Call Right Projects |

||||||||||||

| Ontario 2015 projects |

Canada | Q1 2015 - Q4 2015 | 8.5 | 30 | ||||||||

| U.K. projects #1-11 |

U.K. | Q1 2015 - Q2 2015 | 150.8 | 11 | ||||||||

| Chile project #1(4) |

Chile | Q1 2015 | 41.7 | 1 | ||||||||

| U.S. DG 2H2014 & 2015 projects |

U.S. | Q4 2014 - Q4 2015 | 83.7 | 59 | ||||||||

| Chile project #2 |

Chile | Q1 2016 | 94.0 | 1 | ||||||||

|

|

|

|

|

|||||||||

| Total Priced Call Right Projects |

378.6 | 102 | ||||||||||

| Unpriced Call Right Projects |

||||||||||||

| U.S. DG 2H2014 & 2015 projects |

U.S. | Q4 2014 - Q4 2015 | 58.4 | 69 | ||||||||

| U.S. AP North Lake I |

U.S. | Q2 2015 | 24.1 | 1 | ||||||||

| U.S. Bluebird |

U.S. | Q2 2015 | 7.8 | 1 | ||||||||

| U.S. River Mountains Solar |

U.S. | Q4 2015 | 18.0 | 1 | ||||||||

| U.S. Kingfisher |

U.S. | Q4 2015 | 6.5 | 1 | ||||||||

| U.S. Commanche |

U.S. | Q2 2016 | 156.0 | 1 | ||||||||

| U.S. Island project #1 |

U.S. | Q2 2016 | 65.0 | 1 | ||||||||

| U.S. Southwest project #1 |

U.S. | Q3 2016 | 100.0 | 1 | ||||||||

| Tenaska Imperial Solar Energy Center West(5) |

U.S. | Q4 2016 | 72.5 | 1 | ||||||||

| U.S. Utah project #1 |

U.S. | Q3 2016 | 163.0 | 2 | ||||||||

| U.S. California project #1 |

U.S. | Q3 2016 | 54.2 | 1 | ||||||||

| U.S. California project #2 |

U.S. | Q4 2016 | 44.8 | 1 | ||||||||

| U.S. DG 2016 projects |

U.S. | Q1 2016 - Q4 2016 | 54.1 | 12 | ||||||||

| U.S. California projects #3-4 |

U.S. | 2016-2019 | 513.0 | 2 | ||||||||

|

|

|

|

|

|||||||||

| Total Unpriced Call Right Projects |

1,337.5 | 95 | ||||||||||

| Total 2015 Projects |

399.5 | 174 | ||||||||||

| Total 2016 Projects |

1,316.7 | 23 | ||||||||||

|

|

|

|

|

|||||||||

| Total Call Right Projects |

1,716.1 | 197 | ||||||||||

7

Table of Contents

| (1) | The overview above does not include the First Wind projects to which we will be granted call rights pursuant to the Intercompany Agreement if the First Wind Acquisition is consummated. See “—Acquisition Portfolios.” Our Sponsor may remove a project from the Call Right Project list effective upon notice to us if, in its reasonable discretion, a project is unlikely to be successfully completed. In that case, the Sponsor will be required to replace such project with one or more additional reasonably equivalent projects that have a similar economic profile. |

| (2) | Represents date of anticipated acquisition. |

| (3) | Nameplate capacity for solar projects represents the maximum generating capacity at standard test conditions of a facility multiplied by our expected percentage ownership of such facility (disregarding equity interests of any tax equity investor or lessor under any sale-leaseback financing or any non-controlling interests in a partnership). Generating capacity may vary based on a variety of factors discussed elsewhere in this prospectus. |

| (4) | Represents an expected 60% interest in a 69.5 MW project. |

| (5) | Our Sponsor acquired an indirect 19.8% interest in the Tenaska Imperial Solar Energy Center West project in July 2014 and has entered into an agreement to acquire an additional 19.8% interest in such project from Silver Ridge Power, LLC, or “Silver Ridge,” upon the project achieving COD. This acquisition is in addition to the acquisition of the Mt. Signal project from Silver Ridge. The 72.5 MW nameplate capacity included in the table above reflects a 39.6% interest in the 183.1 MW Tenaska Imperial Solar Energy Center West project. We expect the project to achieve COD in the second half of 2016. Our Sponsor’s acquisitions of the interest in the Tenaska Imperial Solar Energy Center West project are subject to certain regulatory approvals, including Federal Energy Regulatory Commission, or “FERC,” approval and third-party consents, as well as customary closing conditions. |

Acquisition Portfolios

The following table provides an overview of the projects that will become part of our portfolio upon consummation of the Capital Dynamics Acquisition, which we refer to as the CD DG Portfolio. We may not be able to complete the Capital Dynamics Acquisition on a timely basis or at all, and this offering is not conditioned upon the completion of the Capital Dynamics Acquisition. See “—Recent Developments—Capital Dynamics Acquisition.”

| Project Name |

Location | COD | Nameplate Capacity (MW)(1) |

# of Sites |

Offtake Agreements |

|||||||||||||||||||||

| Counterparty |

Counterparty Credit Rating(2) |

Remaining Duration of PPA (Years)(3) |

||||||||||||||||||||||||

| CD DG Portfolio |

U.S. | 2011-2014 | 77.6 | 39 | Various utilities and commercial and governmental entities |

A-, A3 | 19 | |||||||||||||||||||

| (1) | Nameplate capacity for solar projects represents the maximum generating capacity at standard test conditions of a facility multiplied by our percentage ownership of that facility (disregarding any equity interests held by any tax equity investor or lessor under any sale-leaseback financing or of any non-controlling interests in a partnership). Generating capacity may vary based on a variety of factors discussed elsewhere in this prospectus. |

| (2) | The counterparty credit rating represents a weighted average (based on nameplate capacity) credit rating of the project’s counterparties that are rated by S&P, Moody’s or both. The percentage of counterparties that are rated by S&P, Moody’s or both (based on nameplate capacity) of this distributed generation project is 99%. |

| (3) | Calculated as of September 30, 2014. For distributed generation projects, the number represents a weighted average (based on nameplate capacity) remaining duration. |

8

Table of Contents

The following table provides an overview of the projects that will become part of our portfolio upon consummation of the First Wind Acquisition. We may not be able to complete the First Wind Acquisition on a timely basis or at all, and this offering is not conditioned upon the completion of the First Wind Acquisition. See “—Recent Developments—First Wind Acquisition.”

| Offtake Agreements |

||||||||||||||||||||||||||||

| Project Names |

Location | COD(1) | Nameplate Capacity (MW)(2) |

# of Sites |

Project Origin(3) |

Counterparty |

Counterparty Credit Rating |

Remaining Duration of PPA (Years)(4) |

||||||||||||||||||||

| Wind: |

||||||||||||||||||||||||||||

| Cohocton |

U.S. | 2009 | 125.0 | 1 | A | Citigroup Energy | A-, Baa2 | 6 | ||||||||||||||||||||

| Rollins |

U.S. | 2011 | 60.0 | 1 | A | Central Maine Power; Bangor Hydro Electric | BBB+, A3; NR, NR |

17, 17 | ||||||||||||||||||||

| Stetson I |

U.S. | 2009 | 57.0 | 1 | A | Exelon Generation Company | BBB, Baa2 | 5 | ||||||||||||||||||||

| Mars Hill |

U.S. | 2007 | 42.0 | 1 | A | New Brunswick Power(5) | A+, Aa2 | <1 | ||||||||||||||||||||

| Sheffield |

U.S. | 2011 | 40.0 | 1 | A | City of Burlington; Vermont Electric Cooperative; Washington Electric Cooperative | NR, NR; NR, NR; NR, NR |

7, 17, 17 | ||||||||||||||||||||

| Bull Hill |

U.S. | 2012 | 34.5 | 1 | A | NSTAR | A-, Baa1 | 13 | ||||||||||||||||||||

| Kaheawa Wind Power I |

U.S. | 2006 | 30.0 | 1 | A | Maui Electric Company | BBB-, NR | 12 | ||||||||||||||||||||

| Kahuku |

U.S. | 2011 | 30.0 | 1 | A | Hawaiian Electric Company | BBB-, Baa1 | 16 | ||||||||||||||||||||

| Stetson II |

U.S. | 2010 | 25.5 | 1 | A | Exelon Generation Company; Harvard University | BBB, Baa2; NR, NR |

5, 11 | ||||||||||||||||||||

| Kaheawa Wind Power II |

U.S. | 2012 | 21.0 | 1 | A | Maui Electric Company | BBB-, NR | 18 | ||||||||||||||||||||

| Steel Winds I |

U.S. | 2007 | 20.0 | 1 | A | Morgan Stanley Capital Group | A-, Baa2 | 5 | ||||||||||||||||||||

| Steel Winds II |

U.S. | 2012 | 15.0 | 1 | A | Morgan Stanley Capital Group | A-, Baa2 | 5 | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| Subtotal |

500.0 | 12 | ||||||||||||||||||||||||||

| Solar: |

||||||||||||||||||||||||||||

| MA Solar |

U.S. | 2014 | 21.1 | 4 | A | Various municipalities and universities | A+, A1(6) | 24 | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| Subtotal |

21.1 | 4 | ||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| Total First Wind Portfolio |

521.1 | 16 | ||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| (1) | Represents actual or anticipated COD, as applicable, unless otherwise indicated. |

| (2) | Nameplate capacity for solar projects represents the maximum generating capacity at standard test conditions of a facility multiplied by our percentage ownership of that facility (disregarding any equity interests held by any tax equity investor or lessor under any sale-leaseback financing or any noncontrolling interests in a partnership). Nameplate capacity for wind facilities represents the manufacturer’s maximum nameplate generating capacity of each turbine multiplied by the number of turbines at a facility multiplied by our anticipated percentage ownership of that facility (disregarding any equity interests held by any tax equity investor or lessor under any sale-leaseback financing or of any non-controlling interests in a partnership). Generating capacity may vary based on a variety of factors discussed elsewhere in this prospectus. |

| (3) | Projects which will be acquired in connection with the First Wind Acquisition are identified with an “A” above. |

| (4) | Calculated as of September 30, 2014. For distributed generation projects, the number represents a weighted average (based on nameplate capacity) of remaining duration. |

| (5) | First Wind is currently in the process of negotiating an extension to the PPA with New Brunswick Power. |

| (6) | The counterparty credit rating represents a weighted average (based on nameplate capacity) credit rating of the project’s counterparties that are rated by S&P, Moody’s or both. The percentage of counterparties that are rated by S&P, Moody’s or both (based on nameplate capacity) of the MA Solar project is 39%. |

9

Table of Contents

The following table provides an overview as of November 30, 2014 of the projects in the First Wind pipeline to which we expect to be granted additional call rights pursuant to the Intercompany Agreement:

| Project Names |

Country | Estimated Acquisition Date(1) |

Nameplate Capacity (MW)(2) |

# of Sites |

||||||||||||

| Solar Projects |

||||||||||||||||

| Mililani Solar I |

U.S. | Q4 2015 | 26.0 | 1 | ||||||||||||

| Seven Sisters |

U.S. | Q4 2015 | 22.6 | 7 | ||||||||||||

| Kawailoa Solar |

U.S. | Q4 2016 | 65.0 | 1 | ||||||||||||

| Waiawa |

U.S. | Q4 2016 | 61.1 | 1 | ||||||||||||

| Mililani Solar II |

U.S. | Q4 2016 | 19.5 | 1 | ||||||||||||

| Four Brothers |

U.S. | Q4 2016 | 400.0 | 4 | ||||||||||||

|

|

|

|

|

|||||||||||||

| Total Intercompany Solar Projects |

594.2 | 15 | ||||||||||||||

| Wind Projects |

||||||||||||||||

| South Plains |

U.S. | Q4 2015 | 200.0 | 1 | ||||||||||||

| Oakfield |

U.S. | Q4 2015 | 147.6 | 1 | ||||||||||||

| South Plains II |

U.S. | Q4 2015 | 150.0 | 1 | ||||||||||||

| Bingham |

U.S. | Q4 2016 | 184.8 | 1 | ||||||||||||

| Hancock |

U.S. | Q4 2016 | 51.0 | 1 | ||||||||||||

| Weaver |

U.S. | 2017 | 73.6 | 1 | ||||||||||||

| Rattlesnake |

U.S. | 2017 | 62.0 | 1 | ||||||||||||

| Route 66 II |

U.S. | 2017 | 100.0 | 1 | ||||||||||||

| Bowers |

U.S. | 2017 | 48.0 | 1 | ||||||||||||

|

|

|

|

|

|||||||||||||

| Total Intercompany Wind Projects |

1,017.0 | 9 | ||||||||||||||

| Total 2015 Projects |

546.2 | 11 | ||||||||||||||

| Total 2016 Projects |

781.4 | 9 | ||||||||||||||

| Total 2017 Projects |

283.6 | 4 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Total Intercompany Projects |

1,611.2 | 24 | ||||||||||||||

The following table shows the total projects to which we expect to have call rights under both the Intercompany Agreement and the Support Agreement, if the First Wind Acquisition is consummated:

| Nameplate Capacity (MW)(2) |

# of Sites |

|||||||||||

| Total 2015 Projects |

945.7 | 185 | ||||||||||

| Total 2016 Projects |

2,098.0 | 32 | ||||||||||

| Total 2017 Projects |

283.6 | 4 | ||||||||||

|

|

|

|

|

|||||||||

| Total |

3,327.3 | 221 | ||||||||||

| (1) | Represents date of anticipated acquisition. The acquisition date is subject to change, including to preserve the project’s eligibility for federal governmental incentives including Investment Tax Credits or Production Tax Credits. |

| (2) | Nameplate capacity for solar projects represents the maximum generating capacity at standard test conditions of a facility multiplied by our percentage ownership of that facility (disregarding any equity interests held by any tax equity investor or lessor under any sale-leaseback financing or any non-controlling interests in a partnership). Nameplate capacity for wind facilities represents the manufacturer’s maximum nameplate generating capacity of each turbine multiplied by the number |

10

Table of Contents

| of turbines at a facility multiplied by our anticipated percentage ownership of that facility (disregarding any equity interests held by any tax equity investor or lessor under any sale-leaseback financing or any noncontrolling interests in a partnership). Generating capacity may vary based on a variety of factors discussed elsewhere in this prospectus. |

Our Business Strategy

Our primary business strategy is to increase the cash dividends we pay to the holders of our Class A common stock over time. Our plan for executing this strategy includes the following:

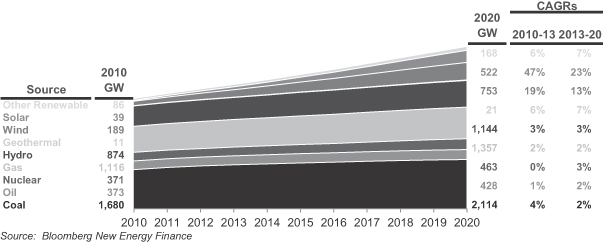

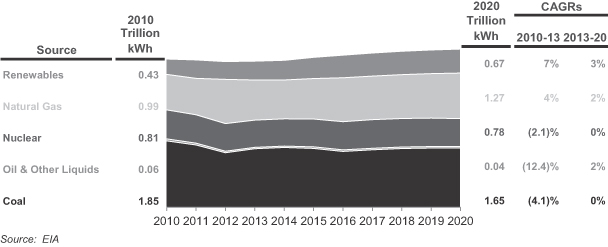

Focus on long-term contracted clean power generation assets. Our portfolio has, and we expect any projects that we acquire from our Sponsor or others will have, long-term PPAs with creditworthy counterparties. We intend to focus on owning and operating long-term contracted clean power generation assets with proven technologies, low operating risks and stable cash flows consistent with our portfolio. We believe industry trends will support significant growth opportunities for long-term contracted power in the clean power generation segment as various markets around the world reach grid parity.

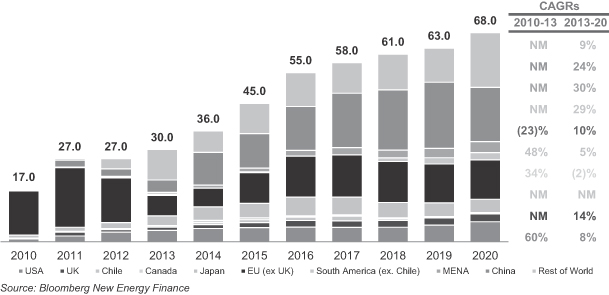

Grow our business through acquisitions of contracted operating assets. We intend to acquire additional contracted clean power generation assets from our Sponsor and unaffiliated third parties to increase our cash available for distribution. The Support Agreement provides us with (i) the option to acquire the identified Call Right Projects, which currently represent an aggregate nameplate capacity of approximately 1.7 GW, and additional projects from our Sponsor’s development pipeline that will be designated as Call Right Projects under the Support Agreement to satisfy the aggregate Projected FTM CAFD commitment of $175.0 million and (ii) a right of first offer on the ROFO Projects. If the First Wind Acquisition is consummated, we will also be granted call rights with respect to projects in the First Wind pipeline expected to represent an additional 1.6 GW of wind and solar generation assets from 2015 to 2017. In addition, we expect to have significant opportunities to acquire other clean power generation assets from third-party developers, independent power producers and financial investors. We believe our knowledge of the market, third-party relationships, operating expertise and access to capital will provide us with a competitive advantage in acquiring new assets.

Attractive asset classes. Our current focus is on the solar and wind energy segments because we believe they are currently the fastest growing segments of the clean power generation industry and offer attractive opportunities to own assets and deploy long-term capital due to the predictability of their cash flows. In particular, we believe the solar and wind segments are attractive because there is no associated fuel cost risk and the relevant technologies have become highly reliable. We also believe the declining levelized costs of energy for solar and wind projects will enable these asset classes to continue to add additional MW of completed projects to our portfolio and enable us to gain market share. Solar and wind projects also have an expected life which can exceed 30 years. In addition, the solar and wind energy generation projects in or to be added to our portfolio generally operate under long-term PPAs with terms of up to 30 years.

Focus on core markets with favorable investment attributes. We intend to focus on growing our portfolio through investments in markets with (i) creditworthy PPA counterparties, (ii) high clean energy demand growth rates, (iii) low political risk, stable market structures and well-established legal systems, (iv) grid parity or the potential to reach grid parity in the near term and (v) favorable government policies to encourage renewable energy projects. We believe there will be ample opportunities to acquire high-quality contracted power generation assets in markets with these attributes. While our current focus is on solar and wind generation assets in the United States, Canada, the United Kingdom and Chile, we will selectively consider acquisitions of contracted clean generation sources in other countries.

11

Table of Contents

Maintain sound financial practices. We intend to maintain our commitment to disciplined financial analysis and a balanced capital structure. Our financial practices include (i) a risk and credit policy focused on transacting with creditworthy counterparties, (ii) a financing policy focused on achieving an optimal capital structure through various capital formation alternatives to minimize interest rate and refinancing risks, and (iii) a dividend policy that is based on distributing the cash available for distribution generated by our project portfolio (after deducting appropriate reserves for our working capital needs and the prudent conduct of our business). Our initial dividend was established based on our targeted payout ratio of approximately 85% of projected cash available for distribution. See “Cash Dividend Policy.”

Our Competitive Strengths

We believe our key competitive strengths include:

Scale and diversity. Our portfolio provides us with significant diversification in terms of market segment, counterparty and geography. Our operating projects, in the aggregate, represent 887.1 MW of nameplate capacity, which consist of 722.8 MW of nameplate capacity from utility projects and 164.3 MW of nameplate capacity of commercial, industrial, government and residential customers. If the Capital Dynamics Acquisition and the First Wind Acquisition are consummated, our portfolio will include both solar and wind projects and will increase to an aggregate of 1,485.8 MW of nameplate capacity, consisting of 1,222.8 MW of nameplate capacity from utility projects and 263.0 MW of nameplate capacity of commercial, industrial, government and residential customers. Of the projects in our portfolio, no single project accounts for more than 20% of our total MW nameplate capacity assuming the Capital Dynamics Acquisition and First Wind Acquisition are consummated. Our diversification reduces our operating risk profile and our reliance on any single market or segment. We believe our scale and geographic diversity improve our business development opportunities through enhanced industry relationships, reputation and understanding of regional power market dynamics. Over time, as we acquire additional projects from our Sponsor and third parties, we expect to become further diversified.

Stable, high-quality cash flows. Our portfolio of projects, together with the Call Right Projects, the projects to which we expect to have call rights under the Intercompany Agreement and third-party projects that we acquire, provide us with a stable, predictable cash flow profile. We sell the electricity generated by our projects under long-term PPAs with creditworthy counterparties. The weighted average (based on MW) remaining life of our PPAs would be approximately 16 years, as of September 30, 2014, if the Capital Dynamics Acquisition and the First Wind Acquisition are consummated. The weighted average credit rating (based on nameplate capacity) of the counterparties to the PPAs for the projects in our portfolio would be A-/A3, which includes only those counterparties that are rated by S&P, Moody’s or both (representing approximately 90% of the total MW of our portfolio) if the Capital Dynamics Acquisition and the First Wind Acquisition are consummated. Based on our portfolio of projects, we do not expect to pay significant federal income taxes for at least the next several years.

Newly constructed solar portfolio. We benefit from a portfolio of relatively newly constructed solar assets, with most of the projects in our portfolio having achieved COD within the past three years. The projects in our portfolio and the Call Right Projects utilize proven and reliable technologies provided by leading equipment manufacturers and, as a result, we expect to achieve high generation availability and predictable maintenance capital expenditures.

12

Table of Contents

Relationship with SunEdison. We believe our relationship with our Sponsor provides us with significant benefits, including the following:

| • | Strong asset development and acquisition track record. Over the last five calendar years, our Sponsor has constructed or acquired solar power generation assets with an aggregate nameplate capacity of 1.4 GW and, as of September 30, 2014, was constructing additional solar power generation assets expected to have an aggregate nameplate capacity of approximately 610 MW. Our Sponsor has been one of the top five developers and installers of solar energy facilities in the world in each of the past four years based on megawatts installed. In addition, our Sponsor had a 4.5 GW pipeline of development stage solar projects as of September 30, 2014. Our Sponsor’s operating history demonstrates its organic project development capabilities and its ability to work with third-party developers and asset owners in our target markets. We believe our Sponsor’s relationships, knowledge and employees will facilitate our ability to acquire operating projects from our Sponsor and unaffiliated third parties in our target markets. |

| • | Project financing experience. We believe our Sponsor has demonstrated a successful track record of sourcing long duration capital to fund project acquisitions, development and construction. Since 2005, our Sponsor has raised approximately $5 billion in long-term, non-recourse project and tax equity financing for hundreds of projects. We expect that we will realize significant benefits from our Sponsor’s financing and structuring expertise as well as its relationships with financial institutions and other providers of capital. |

| • | Management and operations expertise. We will have access to the significant resources of our Sponsor to support the growth strategy of our business. As of September 30, 2014, our Sponsor had over 3.0 GW of projects under management across 20 countries. In addition, our Sponsor maintains four renewable energy operation centers to service assets under management. Our Sponsor’s operational and management experience helps ensure that our facilities will be monitored and maintained to maximize their cash generation. If the First Wind Acquisition is consummated, we will also benefit from First Wind’s operational and management expertise as the First Wind team joins our Sponsor. To date, First Wind has constructed or acquired wind power generation assets with an aggregate nameplate capacity of 1.0 GW and, as of November 30, 2014, was constructing additional wind power generation assets expected to have an aggregate nameplate capacity of approximately 500 MW. |

Dedicated management team. Under the Management Services Agreement, our Sponsor has provided us with a dedicated team of professionals to serve as our executive officers and other key officers. Our officers have considerable experience in developing, acquiring and operating clean power generation assets, with an average of over nine years of experience in the sector. For example, our President and Chief Executive Officer served as the President of SunEdison’s solar energy business from November 2009 to March 2013. Our management team also has access to the other significant management resources of our Sponsor to support the operational, financial, legal and regulatory aspects of our business.

Recent Developments

Acquisition Transactions

Hudson Energy Acquisition

On September 18, 2014, we entered into an agreement whereby we agreed to acquire from Hudson Energy Solar Corporation 25.5 MW of operating solar power assets (the “Hudson Energy Acquisition”) and SunEdison purchased 4.5 MW of developmental pipeline. In connection with the

13

Table of Contents

Hudson Energy Acquisition, we also entered into a right-of-first-offer agreement with Just Energy Group to acquire certain new operating solar power assets located in New Jersey, New York, Massachusetts and Pennsylvania. The total consideration for the Hudson Energy Acquisition was approximately $35 million and was funded with cash-on-hand. The Hudson Energy Acquisition closed on November 4, 2014.

Crundale and Fairwinds Acquisitions

On November 4, 2014, we completed the acquisition of two Call Right Projects, Fairwinds and Crundale, from our Sponsor. The two utility scale power projects, with a total nameplate capacity of 50.0 MW, are located in the United Kingdom and reached COD in October 2014. The purchase price was approximately $32.2 million in cash, and in addition we assumed approximately $63.7 million of project-level debt of the project companies. We expect to repay all of the outstanding project-level debt in the second quarter of 2015.

Capital Dynamics Acquisition

On October 29, 2014, we entered into a securities purchase agreement whereby we agreed to acquire 77.6 MW of operating solar power assets located in California, Massachusetts, New Jersey, New York and Pennsylvania (the “Capital Dynamics Acquisition”) from Capital Dynamics U.S. Solar Energy Fund, L.P. and its affiliates. The purchase price for the Capital Dynamics Acquisition is expected to be approximately $250 million and will be funded through borrowings under our increased Term Loan (as defined herein). See “Description of Certain Indebtedness.”

The Capital Dynamics Acquisition is subject to customary closing conditions. We expect the Capital Dynamics Acquisition to close during the fourth quarter of 2014, but we may not be able to complete the Capital Dynamics Acquisition on a timely basis or at all. This offering is not conditioned upon the completion of the Capital Dynamics Acquisition.

First Wind Acquisition

On November 17, 2014, we entered into a purchase and sale agreement (the “First Wind Acquisition Agreement”), pursuant to which we agreed to acquire from First Wind Holdings, LLC (together with its subsidiaries, “First Wind”) 521.1 MW of operating power assets, including 500.0 MW of wind power assets and 21.1 MW of solar power assets (the “First Wind Acquisition”) located in Maine, New York, Hawaii, Vermont and Massachusetts. We will acquire the First Wind Assets for total consideration of $862.0 million, which includes the equity purchase price, the refinancing of certain existing indebtedness, certain swap and debt breakage fees and the purchase of a partner’s ownership stake in certain assets held by First Wind through a joint venture. In addition, pursuant to the First Wind Acquisition Agreement, SunEdison will purchase First Wind’s development platform, pipeline and projects in development, including over 1.6 GW of wind and solar generation assets to which we will be granted call rights pursuant to the Intercompany Agreement, as described below.

In addition to entering into the First Wind Acquisition Agreement, we and SunEdison entered into an Intercompany Agreement. The Intercompany Agreement sets forth the agreement among the parties with respect to, among other things, (i) contributions between, and allocations among, the parties and their respective affiliates of certain costs, expenses, indemnity payments and purchase price adjustments under the First Wind Acquisition Agreement and certain excess capital expenditures and operation and maintenance costs for operating projects following the closing of the First Wind Acquisition, (ii) the grant by SunEdison to us of certain additional call rights, and (iii) the modification of certain terms of the Interest Payment Agreement (as defined herein).

14

Table of Contents

In connection with the First Wind Acquisition, SunEdison also intends to arrange up to $1.5 billion in debt and equity financing to fund the construction of projects with respect to which we will have call rights, including certain development projects to be acquired from First Wind.

The First Wind Acquisition is subject to customary closing conditions, including the receipt of regulatory approval by the Federal Energy Regulatory Commission and other public utility commissions and the Federal Trade Commission under the Hart-Scott-Rodino Act. We expect the First Wind Acquisition to close during the first quarter of 2015.

We may not be able to complete the First Wind Acquisition on a timely basis or at all. This offering is not conditioned upon the completion of the First Wind Acquisition, and, to the extent the First Wind Acquisition is not completed, we will use the net proceeds from this offering for general corporate purposes and to fund other acquisition opportunities that may become available to us. See “Risk Factors—Risks Related to the First Wind Acquisition.”

Acquisition Private Placement

On November 26, 2014, we completed the sale of a total of 11,666,667 shares of our Class A common stock in a private placement (the “Acquisition Private Placement”) to certain eligible investors (the “Acquisition Private Placement Purchasers”) for an aggregate purchase price of $350.0 million. We intend to use the net proceeds from the Acquisition Private Placement to fund a portion of the consideration payable by us in the First Wind Acquisition.

In connection with the Acquisition Private Placement, we entered into a registration rights agreement with the Acquisition Private Placement Purchasers, pursuant to which we have filed a registration statement with the SEC covering the resale of the purchased shares.

Acquisition Financing

We intend to fund the consideration payable by us in the First Wind Acquisition through a combination of the net proceeds from this offering, the net proceeds from the issuance of newly issued senior unsecured notes and cash on hand (including cash from the Acquisition Private Placement).

The consolidated combined pro forma financial information included in this prospectus reflects an assumed issuance of $800.0 million of senior notes and the use of the net proceeds therefrom to pay a portion of the purchase price payable by us in the First Wind Acquisition and to repay certain existing debt. To the extent we obtain financing in excess of the amount needed to fund the First Wind Acquisition, we will use the excess proceeds from this offering for working capital and general corporate purposes. We may not be able to obtain any such debt financing on acceptable terms or at all.

Relationship with our Sponsor

We believe our relationship with our Sponsor provides us with the opportunity to benefit from our Sponsor’s expertise in solar technology, project development, finance, management and operation. Our Sponsor is a solar industry leader based on its history of innovation in developing, financing and operating solar energy projects and its strong market share relative to other U.S. and global installers and integrators. As of September 30, 2014, our Sponsor had a development pipeline of approximately 4.5 GW and solar power generation assets under management of approximately 3.0 GW, comprised of approximately 1,200 solar generation facilities across 20 countries. These projects were managed by a

15

Table of Contents

dedicated team using four renewable energy operation centers globally. As of September 30, 2014, our Sponsor had approximately 2,400 employees. Our Sponsor owns 100.0% of Terra LLC’s outstanding Class B units and holds all of the IDRs (as defined herein).

If the First Wind Acquisition is consummated, our Sponsor will become a wind industry leader, with a development pipeline of approximately 1.0 GW of wind generation assets and approximately 1.0 GW of wind generation assets under management, and we will benefit from our Sponsor’s expertise in wind technology.

On September 29, 2014, our Sponsor announced that it confidentially submitted a draft registration statement to the SEC relating to the proposed initial public offering of the common stock of a yieldco vehicle focused on contracted clean power generation assets in emerging markets, primarily in Asia (excluding Japan) and Africa. If this initial public offering is completed, our Sponsor would have obligations to present opportunities in these or other emerging markets to the other yieldco vehicle, or may otherwise determine that certain opportunities are more appropriate for the other yieldco vehicle than they are for us. Because our primary target markets do not include the expected primary target markets of the other yieldco vehicle, we do not expect any significant competition for project opportunities with the other yieldco vehicle. Our Sponsor’s development pipeline of approximately 4.5 GW as of September 30, 2014 represents its total development pipeline, including projects under development in emerging markets that would be offered to the other yieldco vehicle.

While our relationship with our Sponsor and its subsidiaries is a significant strength, it is also a source of potential conflicts. As a result of their employment by, and economic interest in, our Sponsor, our officers may be conflicted when advising our board of directors or Corporate Governance and Conflicts Committee or otherwise participating in the negotiation or approval of such transactions.

Notwithstanding the significance of the services to be rendered by our Sponsor or its designated affiliates on our behalf or of the assets which we may elect to acquire from our Sponsor, our Sponsor will not owe fiduciary duties to us or our stockholders and will have significant discretion in allocating acquisition opportunities (except with respect to the Call Right Projects and ROFO Projects) to us or to itself or third parties and will not be prohibited from acquiring operating assets of the kind that we seek to acquire.

For a discussion of certain agreements we have with our Sponsor, see “Certain Relationships and Related Party Transactions.” For a discussion of the risks related to our relationship with our Sponsor, see “Risk Factors—Risks Related to our Relationship with our Sponsor.”

16

Table of Contents

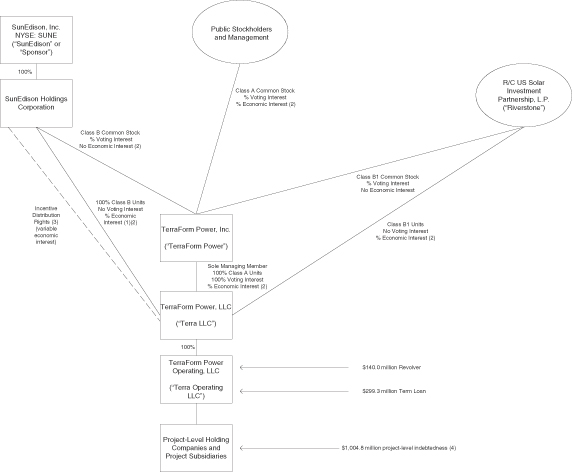

Organizational Structure

The following diagram depicts certain relevant aspects of our ownership structure and principal indebtedness, as of December 5, 2014, after giving effect to this offering:

| (1) | Our Sponsor’s economic interest is subject to certain limitations on distributions to holders of Class B units during the Subordination Period (as defined herein) and the Distribution Forbearance Period (as defined herein). See “Certain Relationships and Related Party Transactions—Amended and Restated Operating Agreement of Terra LLC— Distributions.” In the future, our Sponsor may receive Class B1 units and Class B1 common stock in connection with a reset of the IDR target distribution levels or sales of projects to Terra LLC. |

| (2) | The economic interest of holders of Class A units, Class B units and Class B1 units, and, in turn, holders of shares of Class A common stock, is subject to the right of holders of the IDRs to receive a portion of distributions after certain distribution thresholds are met. See “Certain Relationships and Related Party Transactions—Amended and Restated Operating Agreement of Terra LLC—Distributions.” |

| (3) | Incentive distribution rights, or “IDRs,” represent a variable interest in distributions by Terra LLC and therefore cannot be expressed as a fixed percentage interest. All of our IDRs are currently issued to SunEdison Holdings Corporation, which is a wholly owned subsidiary of our Sponsor. In |

17

Table of Contents

| connection with a reset of the target distribution levels, holders of IDRs will be entitled to receive newly-issued Class B1 units of Terra LLC and shares of our Class B1 common stock. Please read “Certain Relationships and Related Party Transactions—Amended and Restated Operating Agreement of Terra LLC—Distributions” for further description of the IDRs and “Description of Capital Stock—Class B1 Common Stock” for further description of the Class B1 common stock. |

| (4) | For additional information regarding our project-level indebtedness, see “Description of Certain Indebtedness—Project-Level Financing Arrangements.” |

Our Initial Public Offering and Related Transactions

On July 23, 2014, we closed our initial public offering, or “IPO,” of 20,065,000 shares of our Class A common stock at a price to the public of $25.00 per share, or the “IPO Price.” In addition, the underwriters exercised in full their option to purchase an additional 3,009,750 shares of Class A common stock at the IPO price. Concurrently with our IPO, we sold an aggregate of 2,600,000 shares of our Class A common stock at the IPO Price to Altai Capital Master Fund, Ltd., or “ACMF” and Everstream Opportunities Fund I, LLC, or “Everstream Opportunities” (the “IPO Private Placements”). In addition, on July 23, 2014, as consideration for the acquisition of the Mt. Signal project from Silver Ridge at an aggregate purchase price of $292.0 million, Terra LLC issued to Silver Ridge 5,840,000 Class B units (and we issued a corresponding number of shares of Class B common stock) and 5,840,000 Class B1 units (and we issued a corresponding number of shares of Class B1 common stock). Silver Ridge distributed the Class B shares and units to SunEdison and the Class B1 shares and units to R/C US Solar Investment Partnership, L.P., or “Riverstone”, the owners of Silver Ridge.

We received $533.5 million of net proceeds from our IPO (including the net proceeds from the underwriters exercise in full of their option to purchase additional shares of Class A common stock in our IPO), after deducting underwriting discounts, commissions and offering expenses. We also received $65.0 million of net proceeds from the IPO Private Placements.

Certain Risk Factors

We are subject to a number of risks, including risks that may prevent us from achieving our business objectives or may materially and adversely affect our business, financial condition, results of operations, cash flows and prospects. You should carefully consider these risks, including the risks discussed in the section entitled “Risk Factors,” before investing in our Class A common stock.

Risks related to the First Wind Acquisition include, among others:

| • | completion of the First Wind Acquisition is subject to conditions and if these conditions are not satisfied or waived, the First Wind Acquisition will not be completed; |

| • | integrating the assets we intend to acquire in the First Wind Acquisition may be more difficult, costly or time consuming than expected and the anticipated benefits of the First Wind Acquisition may not be realized; and |

| • | in connection with the First Wind Acquisition, we expect to incur significant additional indebtedness and may also assume certain of First Wind’s outstanding indebtedness, which could adversely affect us, including by decreasing our business flexibility, and will increase our interest expense. |

Risks related to our business include, among others:

| • | counterparties to our PPAs may not fulfill their obligations, which could result in a material adverse impact on our business, financial condition, results of operations and cash flows; |

18

Table of Contents

| • | a portion of the revenues under the PPAs for the U.K. projects in our portfolio are subject to price adjustments after a period of time; if the market price of electricity decreases and we are otherwise unable to negotiate more favorable pricing terms, our business, financial condition, results of operations and cash flows may be materially and adversely affected; |

| • | certain of the PPAs for power generation projects in our portfolio and that we may acquire in the future contain or will contain provisions that allow the offtake purchaser to terminate or buyout a portion of the project upon the occurrence of certain events; if such provisions are exercised and we are unable to enter into a PPA on similar terms, in the case of PPA termination, or find suitable replacement projects to invest in, in the case of a buyout, our cash available for distribution could materially decline; and |

| • | the growth of our business depends on locating and acquiring interests in additional, attractive clean energy projects from our Sponsor and unaffiliated third parties at favorable prices. |

Risks related to our relationship with our Sponsor include, among others:

| • | our Sponsor is our controlling stockholder and exercises substantial influence over TerraForm Power, and we are highly dependent on our Sponsor; |

| • | we may not be able to consummate future acquisitions from our Sponsor; |

| • | our organizational and ownership structure may create significant conflicts of interest that may be resolved in a manner that is not in our best interests or the best interests of holders of our Class A common stock and that may have a material adverse effect on our business, financial condition, results of operations and cash flows; |

| • | the holder or holders of our IDRs may elect to cause Terra LLC to issue Class B1 units in connection with a resetting of target distribution levels which could result in lower distributions to holders of our Class A common stock; and |

| • | as a result of our Sponsor holding all of our Class B common stock (each share of which entitles our Sponsor to 10 votes on matters presented to our stockholders generally), our Sponsor controls a majority of the vote on all matters submitted to a vote of our stockholders for the foreseeable future. |

Risks related to an investment in the Class A common stock offered in this offering include, among others:

| • | we may not be able to continue paying comparable or growing cash dividends to holders of our Class A common stock in the future; |

| • | we are a holding company and our only material asset is our interest in Terra LLC, and we are accordingly dependent upon distributions from Terra LLC and its subsidiaries to pay dividends and taxes and other expenses; and |

| • | we are an “emerging growth company” and have elected, and may elect in future SEC filings, to comply with reduced public company reporting requirements, which could make our Class A common stock less attractive to investors. |

Corporate Information

Our principal executive offices are located at 12500 Baltimore Avenue, Beltsville, Maryland 20705. Our telephone number is (443) 909-7200. Our internet site is www.terraform.com. Information contained on our internet site is not incorporated by reference into the prospectus and does not constitute part of this prospectus.

19

Table of Contents

JOBS Act

As a company with less than $1.0 billion in revenue during our last fiscal year, we currently qualify as an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, or the “JOBS Act.” Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. Thus, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

An emerging growth company may also take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the “Sarbanes-Oxley Act;” |

| • | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| • | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act, which such fifth anniversary will occur in 2019. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.0 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

We have elected to take advantage of certain of the reduced disclosure obligations regarding financial statements and executive compensation in this prospectus and may elect to take advantage of other reduced burdens in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.