Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FARMER BROTHERS CO | form8-k2014annualmeeting.htm |

| EX-99.2 - EXHIBIT - FARMER BROTHERS CO | ex992amendedandrestatednom.htm |

| EX-10.1 - EXHIBIT - FARMER BROTHERS CO | ex101amendedandrestated200.htm |

Exhibit 99.1

Farmer Bros. Co.

Edited Transcript of Remarks From the

2014 Annual Stockholders’ Meeting Held on December 4, 2014

Presented by

• | Michael H. Keown; Farmer Bros. Co.; President, CEO |

• | Mark J. Nelson; Farmer Bros. Co.; Treasurer, CFO |

PRESENTATION

Mark Nelson - Farmer Bros. Co. – Treasurer, CFO

While the Inspector of Election is tabulating votes, I would now like to turn the meeting over to our President and CEO, Mike Keown.

Mike Keown - Farmer Bros. Co. - President, CEO

Good morning, everybody. Thank you. It’s great to be here. I welcome you to the 2014 Annual Stockholders Meeting. This is my third stockholders meeting, and it is nice to see some familiar faces. For those I haven’t had the chance to meet yet, my name is Mike Keown, and I’m the President and CEO.

Let me take a step back, if I could, and talk about what we are trying to accomplish in the next 30 to 45 minutes.

I see three objectives and they are the same three objectives we set out every year. First, we want to give you some insight into the financial issues and accomplishments of the Company and how the business is performing. That is always objective one.

1

Objective two is to give you a deeper dive into something of a strategic nature that is important to us as an organization. So, as an example, over the past couple of years, we’ve put the spotlight on the work that Jonathan Waite did in unifying the green coffee program across the Company. On another note, we talked about sustainability. We have also discussed how we manage performance and set objectives to build the human capital of the Company. For that today, I’ve asked Mark Nelson to share with you a bit of the work that he has done to build the financial team of the Company in terms of how we see costs, how we do internal audits, how we see our systems and processes work, etc. He’ll be reviewing that later in the presentation.

And then, of course, the third objective is to answer any questions that you may have. Those are the three objectives.

Here’s the agenda. I’m going to start with key message points—the summary points. Then, we are going to introduce the senior team to you. There are a few new faces and a few more “experienced” faces as well. We’ll talk about the business, what we do and how we do it; and of our accomplishments. Along the way, I will also share a few of the key areas where we’ve stubbed our toe because we want to be very transparent about where we’ve come up a little short, what we’ve learned, and how we plan to do better in the future.

Then, we’ll spend the balance of the meeting talking about the future in terms of where we are financially, and where we see ourselves going in terms of key strategic initiatives.

2

Before I begin, I want to give you an eye chart here regarding forward looking statements.

I’ll just summarize it by saying, in the spirit of some of the Safe Harbor provisions and regulatory issues, you will hear comments today of a forward-looking nature. Those comments represent my perspectives and Mark’s perspectives. We think they’re grounded well in facts regarding the business, but at the same time, they only reflect those perspectives and should be taken with a note of caution.

For those who are analysts in the room, you know we don’t give guidance. So please don’t take any comments of that nature as providing guidance.

If you have any questions on this, this presentation will be on the website and we can certainly give you both this summary and additional summary, if you would like.

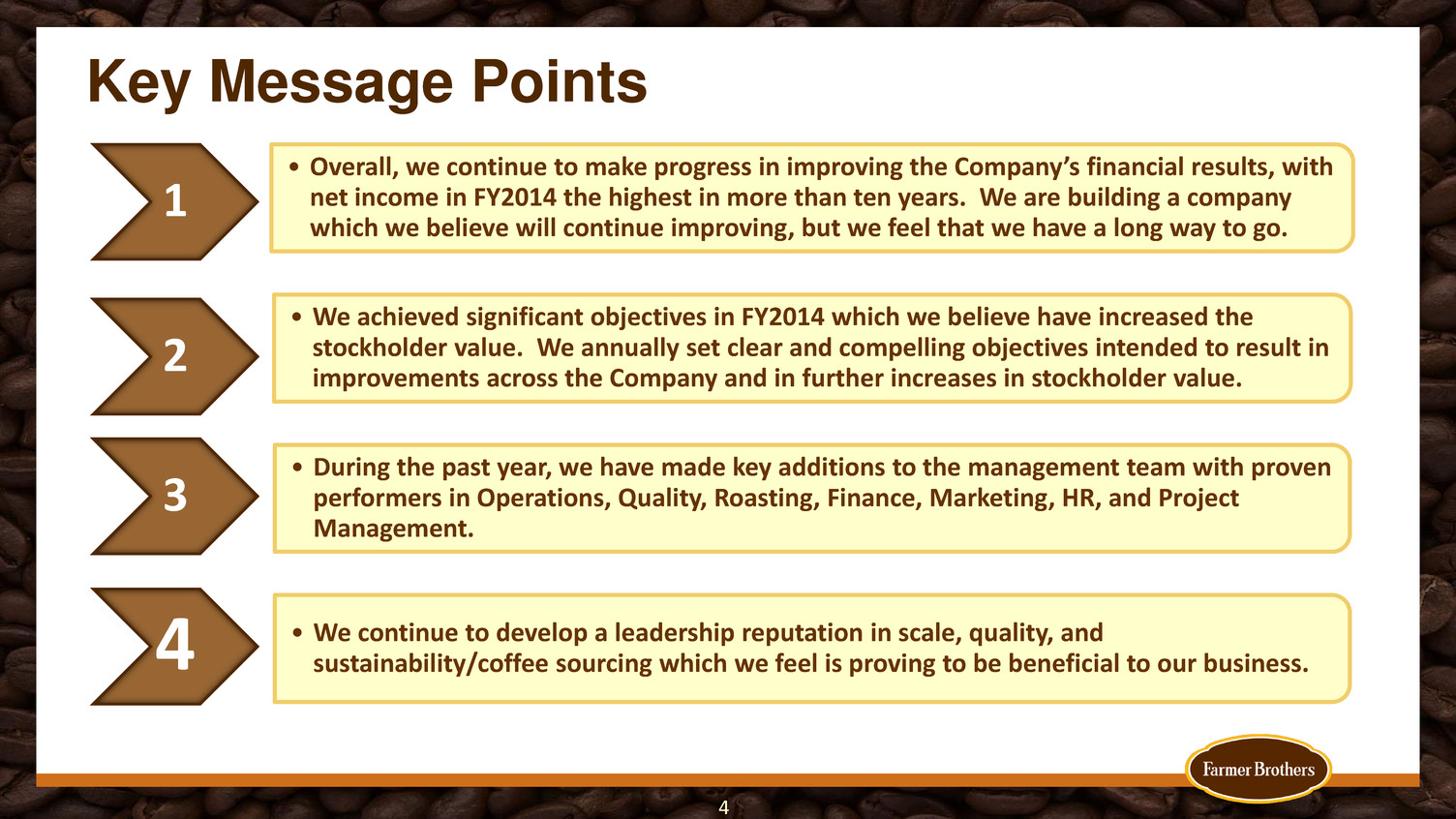

In terms of the key message points, a few highlights here...

Number one, the turnaround continues. In the last year, we returned to profitability for the first time in about a decade. We are proud of that. But we’re not satisfied with it. I can assure you that the

3

Board’s expectations, as well as our own expectations, are to continue advancing the Company from a financial standpoint. And we’re making progress.

Secondly, when I look at the Company’s performance, we set cascading objectives (that are approved by the Board) that start with me and go on down through the organization. If I had to scorecard it, I’d say we performed pretty well in general. We’re achieving our objectives. We have a lot of opportunity to improve, but, at the same time, we are winning far more than we are losing.

Third, we’ve made some very nice additions to the management team, both in terms of internal promotions and some new faces I’ll take you through in a moment. At the same time, we are staying very focused on being a streamlined organization while working to improve efficiency. We are continuing to make progress while we bring on new resources to help us achieve our strategic objectives.

Lastly, one area that I’m very excited about is how we are doing in areas like coffee sourcing and sustainability and so forth. I hope you have a chance to go online and look at our sustainability report. Under Sarah Beaubien’s leadership, but really driven by the entire Company, we’re making great progress in improving our environmental performance, which is important, both from a planet standpoint and company standpoint. I think this is enormously important because it attracts like-minded customers and helps control and reduce costs.

So, with that, let me talk a little bit about the senior team. I’ll ask each one to stand up. You’ve already seen Mark and me up at the podium. We have a newcomer to the team, Barry Fischetto. Barry, please stand up. This is his day three. Welcome, Barry! Barry’s got a very rich background that’s grounded in blue chips, consumer packaged goods related to food. He has also done some entrepreneurial stints, so we believe that he has the right experience to guide our supply chain in the future.

At the same time, I want to take a moment to publicly acknowledge Jose Ramirez. He served in an interim capacity and did a fantastic job. So please help me welcome and thank Jose. Thank you. He came into a very dynamic circumstance, some would say challenging. And he’s done a fantastic job shoring things up as Barry comes on board. So thank you, Jose!

4

Going from three days to considerably more time at the Company, Tom Mortensen. Where’s Tom? Please stand. Tom, as many of you know, is the elder statesman of the senior team in many ways. He’s our rudder because of his rich background in the Farmer Brothers culture. And, obviously, he has done a lot for the organization over an extended period of time.

Next, Scott Siers, please stand up. He runs our national account business. Scott, as you’ve heard before, comes to us from Pepsi and McLane and he has done a very nice job growing that business.

A newcomer — Gerard Bastiaanse — Please, stand up Gerard. Gerard runs our marketing organization. And while he has considerable skills in marketing in the aggregate, he also has some rich commodity experience globally working with Dole from sourcing to packaging, driving those products through different channels and so forth.

Tom Mattei —You have met Tom, our internal legal counsel. In addition, Tom heads our real estate and our risk management functions. Tom is also probably the most efficient part of our team with a staff of three, maybe four, very soon. They find a way to get things done very frugally.

Pat Quiggle couldn’t be here. He runs our Human Resources organization.

Pieter Theron—Pieter, could you stand up? Pieter will be working very closely with a number of the leaders in several key areas. Pieter’s background is from Proctor & Gamble where he worked in finance, the supply chain, M&A, as well as technology, and took that background into PWC. He was doing some consulting work for us and came in one day and said, “I don’t want to be a consultant anymore,” in simple terms. We are thrilled to have him.

And last, but not the least by any means, Nanette Richardson who’s heading up our e-commerce initiative and several other initiatives, and was integral to the recent acquisition of Gourmet Cup in Florida which we announced recently.

That’s the senior team. I hope you get a chance to meet them. Also — are Rob Coleman and Brian Csehi here from the DSD group? We’ll talk later about some of the great work they’re doing. So, come on, let’s give a round of applause for them. Thanks, guys!

5

Then we’ll move on. For those who are new—we’re over $0.5 billion in net sales. The pie chart shows you the key categories. For those who can’t see it well from the back, it’s primarily coffee, both roast and ground and liquid, and tea are the areas we major in. But we’ve got a considerable business in spice and some other items as well.

For those who don’t know, we’re just slightly over 100 years old. Our primary business model is DSD, or direct store delivery. That’s where the individual trucks show up at a food service operator such as a restaurant or casino, service the equipment, sell coffee and other foodservice products. We also have a fast-growing national account business. But our bread and butter over most of the 100 years is our DSD business. And we think the national scope of that differentiates us from our competition.

In terms of our financial results, Mark will go into this in greater detail.

What you see here on the blue bar is our net sales. The green line is net income. In our fiscal year 2011, we lost approximately $52 million. Many of you lived through that era, and I’ve appreciated your perspective on what that time period was like. We’ve tried to learn from it. And then you can see we made progress to a considerably smaller loss; moved towards break-even; and then last year, we broke through and became profitable for the first time in about a decade!

6

Underlying this financial performance, there are a couple of key drivers. First is volume growth. Our volume is up roughly 47% in the last two years. It’s up about 14% in the last year. To give you some perspective, food service coffee is up 45%, so we’re growing well in excess of that. The food service industry is still a very challenging industry experiencing growth of 1% to 2%. So we’re proud of these results, but we think there’s considerable upside moving forward.

The second driver is some terrific work from the DSD group to grind down some poor practices. Under Tom Mortensen’s leadership with Rob and Bryan, we’ve improved our machine management. We have also improved inventory and we have improved scrap—we’ve improved a whole host of things that have underlined this progress.

And then the last area that has helped is the continued focus on cost management.

Next, I want to just take a few moments and discuss some of the accomplishments over the last year or so because I think you will be proud of them. First and foremost, as many of you know, we continue the path of integration. You might recall in my first meeting I said we need to bring together what was “Coffee Bean International” and “Sara Lee DSD coffee” into the HQ structure in Torrance. We did that. The next step was aligning Green Coffee and National Account Sales in a whole host of other areas.

The next wave happened in technology this spring where we implemented J.D. Edwards across the entire organization. You might remember we had multiple ERP processes and tools. And under Mark Nelson and Bob Ing, we pressed the start button and it worked! It was tremendous and really gives us a tool to better see and understand our costs. Now, we’ve got to take the tool and maximize it.

I talked about our roast and ground volume. We expanded with several key customers. We added some others. And we’ve got to continue to drive that.

Third, we’re continuing to learn how to work together across the organization to attract new business and better solidify ourselves with key customers. Although we can’t take you all upstairs

7

to where the awards are, we’re really proud that we were noted by customers like McDonald's, Target, Sheetz and Einstein Noah for our work in sustainability, for innovation, for customer excellence, for shipment excellence, for high quality and so forth. It’s a reflection on the entire management team and the people below them who are working together, I think, better. Though we need to do even better in the future.

We’ve already hit on sustainability so I won’t go there. Mark will talk about hedging. So I’ll leave that in the spirit of time.

I want to spend a minute as we talk about lowering costs and improving the supply chain, to highlight some of the quality improvements we’ve made as well over the year. We’ve brought in people to help us drive to new standards of quality and freshness. We’ve attracted master roasters from some of the most cutting edge coffee companies like Intelligentsia and others. And we’re thrilled about that because moving forward we think it ensures that the Farmer Brothers’ legacy of great coffee will continue.

Is David Pohl in the room? David has really been critical to bringing in talent as Jonathan Waite has as well.

So what does this mean for you? This is the stock price over the last two-and-a-half years or so as the management team came in. We started just a little bit south of $7. And you can see turnarounds aren’t linear. There have been some ups and downs along the way. But we believe the combination of setting good objectives, executing against them, making sure that we’re hitting our targets, both in terms of financials, but key measures as well as building the organization is going to be the key to the growth in shareholder value that we’ve experienced. But also what we expect in the future.

So before I hand it over to Mark, a little glimpse of the future. There are two or three areas that the management team is spending a lot of time on. The first is ensuring we’re moving to a low cost producer without compromising customer service, quality and all those types of things.

8

So what does that mean? To compete in the long run, we need to ensure we’re handling every aspect of cost better, whether that’s planning, forecasting, sourcing, ensuring we have the right tools and equipment in the plants and in the field, ensuring we have the right technology in our trucks on our DSD routes to form a foundation to allow us to compete vigorously in the long run.

Next — and Scott’s heard this many times — we need to attract more national customer business. The two go hand in hand. Having a good low-cost platform allows us to bid aggressively to win this business. And we’ve grown it pretty considerably. But we have a very small share of large restaurants, convenience stores and grocery stores. So there’s plenty of upside in the future.

The third area is refining our direct store delivery model. What does that mean? I get a question — I’m sure I’ll get it later —- DSD is a fundamentally high-cost model. And the question usually is —does it work? The answer is yes and no. By that I mean I can show you markets where we are performing extremely well. And how do we know that? The financials are strong. Customers — and we do customer surveys now — tell us we’re providing great value. Usually you see a well-constructed team in an area or a market and then you look at other markets and it’s not so good. And we need to find ways to ensure that we’re providing value that customers will pay for.

I feel good that we’re winning more than we’re losing. But we need to continue to rethink that model. And if it’s not working, find a way to make it work. Because, fundamentally, it can work. But we’re not firing on all cylinders yet.

Hopefully, you’ve got a sense now of how the Company’s performing—some of the things that are working and some of the areas that we’re focused on moving forward.

I will take questions, and Mark will take questions, in just a moment. But before we do that, Mark Nelson will come up and give you a deeper dive into our financial capabilities and also our financial results. Thank you!

Mark Nelson: Thank you, Mike.

9

Mike alluded to the changes and the development of the accounting function and some of the capabilities within the accounting and financial reporting. What’s very important to investors is the reliability, the accuracy, the robustness of an internal control structure and network. And so I’ve spent, what seems like many more than 18 months - but it’s only been 18 months on - have been a number of things, including a deep dive into the financials.

When I first arrived, we found that we had to restate our previously issued financial statements and we went through that process. We came out the other side, I think, with a much deeper understanding of the accounting issues that affect this Company. In the process, we brought on a new auditor — a new audit firm. So we are very excited to have a fresh set of eyes through Deloitte take a look at our accounting, our practices, the way we assemble our financial statements. And I think they’ve done a great job.

Through the internalization of a resource that had been supporting us externally — Melanie Markwell — I think she’s in the room with us here — was hired as Director of Internal Audit. She came on board through an external consulting group that we used for many years. She’s helped to reshape the internal audit team, provide direction and really helped to tighten our controls on our processes so we’re in compliance with Sarbanes Oxley and we have good accounting practices in place.

10

We worked to help rebuild the finance team with some key internal promotions. So I think — is Brent Hollingsworth in the room? He is Vice President and Assistant Treasurer. We brought on Rene Peth as Vice President and Corporate Controller. And I’m not sure if there’s anybody else in the room that has been promoted from within. But we’ve added a number of folks to really build the team from the accounting perspective with internal and new external resources.

Our hedging program has involved a focus on and an understanding of what we do and why we hedge. We hedge a lot of coffee for our customers, for our national customers who are on a cost-plus basis and then we also hedge for our own DSD volume. That’s more of a market priced model.

What’s different from, say, 2011, where we saw a very rapid spike in coffee prices and we were unprepared because we simply weren’t hedged out far enough, to just recently in the spring of this year where we saw another very rapid increase in coffee prices and we were hedged, which provided us ample time to react to the change in the commodity. Coffee is our biggest input for our material costs. And, as a result, its volatility can cause volatility in our earnings when the price of coffee goes up. We don’t like it when we start to lose money.

So the hedging program that we’re adhering to is quite prescribed and it’s been effective. As you can see in our fiscal third quarter of last year when we experienced that very rapid price increase.

Along the way, the Board appointed a new Chair of the Audit Committee, Chris Mottern, who we introduced earlier. He has provided a lot of guidance for us to get through these changes and to ensure good governance and good adherence to accounting principles. So Chris has been a lot of help and provided a lot of insight in driving these changes.

And we’ve also worked to enhance our Investor Relations to make sure that we are providing information to the market consistent with securities laws and regulations, and providing good communication to our stockholders. So that’s been part of the changes.

A lot going on in finance and accounting and it’s been a long and rewarding 18 months. It’s been exciting.

11

I’ll just quickly touch on some of the financials. As you see in this chart, in 2007, the acquisition of Coffee Bean International brought with it the Portland roasting facility. And then the acquisition of the Sara Lee DSD coffee business in 2009 brought many of our east coast sites, as well as the Houston manufacturing facility. This set the baseline for the current business as we know it. Since then, we’ve grown from roughly $450 million in fiscal 2010 upwards to $528 million in the most recent fiscal year, which is a 4% compounded annual growth rate in net sales. But behind that is a much more rapid growth in the volume of coffee, as Mike mentioned. Just since 2012, it’s been about a 45% growth in the volume of coffee that we’ve manufactured.

So it’s pretty impressive. And what this leads to, as you can see on the next slide is profitability; that this growth in net sales, which you see in the top left quadrant, the continued

focus is on maintaining our operating expenses and trying to manage costs, which we’ve done quite well, has translated into is an improvement in operating income and also improvement in net income.

So that’s the recipe — to grow sales and maintain or control costs. This translates into improved profitability. And there’s so much more that goes on behind that, but that’s the headline financials that you see as a result.

12

One other measure that we look at is a measure of cash flow. We call it Adjusted EBITDA. It is Adjusted EBITDA because you basically start at net income and then you add back non-cash related items like depreciation, share based compensation, both for our ESOP and our incentive programs, some non-cash goodwill impairment back a couple of years ago and pension withdrawal expense. But when you look at the performance - not just the growth in net income, but the growth in our cash generation—this allows us to look at areas for investment. Look at investing in things like our announced and yet-to-be closed acquisition of Gourmet Cup. Look at things like revitalizing the brewer program, investing in new equipment for our customers and looking at other opportunities.

So cash is what the end game is— to generate cash flow and to allow us to invest in the infrastructure and the growth opportunities for the business.

One thing I will also say is the only piece of guidance we’ve really given is a target Adjusted EBITDA margin number. And we were pleased with the fiscal 2014 8.7% Adjusted EBITDA as a percent of net sales. We believe that - and we’ve stated that a 10% Adjusted EBITDA margin is our goal. I can’t characterize exactly how quickly we want to get there. It’s as quick as we can. But that’s really what we believe is a good goal to focus on, is the generation of cash within this business and driving this business to a 10% Adjusted EBITDA margin.

The balance sheet has also improved considerably as a result of the generation of cash and the improvement in the financials.

Most notably, you can see at the end of fiscal 2014, we had just about $100,000 borrowed on our credit facility. So from many quarters of being drawn, we were able to pay down that credit facility. And, as well, continue to generate cash. Between cash and short term investments, roughly, $35 million. And also maintain focus on the other assets.

So this is a much improved balance sheet. This is another area of attraction for investors. They like our balance sheet. It’s a very strong and clean balance sheet.

13

And then, just a final chart.

Very quickly I’ll talk about the first quarter. We saw growth in revenue over the prior year period. We characterize that growth as about a 5% revenue growth over the first quarter of fiscal 2014. There was underlying stronger volume growth behind that. We had about a 7% growth in the volume of our coffee produced in the quarter. And it still represents the growth that we’ve seen and the trajectory.

We continued to maintain a focus on controlling operating expenses. As a result, you can see the net income and the operating profit were very good, too.

Our fiscal first quarter is a prelude to our second quarter, which is traditionally our strongest seasonal quarter. So we were very pleased with the results. There have been many recent first quarters where we’ve lost money. But we improved our profitability here in the first quarter.

And so that concludes the prepared presentation. We can now transition into the question-and-answer section. And, at this time, the meeting will be open to any new business.

14

15