Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Discover Financial Services | d833980d8k.htm |

David Nelms, Chairman & CEO

Mark Graf, EVP & CFO

December 10, 2014

2014 Goldman Sachs U.S. Financial Services Conference

©2014 DISCOVER FINANCIAL SERVICES

Exhibit 99.1 |

2

Notice

The following slides are part of a presentation by Discover Financial Services (the "Company")

and are intended to be viewed as part of that presentation. No representation is made that the

information in these slides is complete. The presentation contains forward-looking statements. You are cautioned not to place undue

reliance on forward-looking statements, which speak only as of the date on which they are

made, which reflect management’s estimates, projections, expectations or beliefs at that

time, and which are subject to risks and uncertainties that may cause actual results to differ

materially. For a discussion of certain risks and uncertainties that may affect the future results of

the Company, please see "Special Note Regarding Forward-Looking Statements,"

"Risk Factors," "Business – Competition," "Business – Supervision

and Regulation" and "Management’s Discussion and Analysis of Financial Condition and

Results of Operations" in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2013 and "Management’s Discussion and Analysis of Financial

Condition and Results of Operations" in the Company's Quarterly Reports on Form 10-Q for the

quarters ended March 31, 2014, June 30, 2014 and September 30, 2014, which are available on the

Company’s website and the SEC’s website. The Company does not undertake to update or

revise forward-looking statements as more information becomes available.

of

We own or have rights to use the trademarks, trade names and service marks that we

use in conjunction with the operation our

business,

including,

but

not

limited

to:

Discover

®

,

PULSE

®

,

Cashback

Bonus

®

,

Discover

Cashback

Checking

SM

,

Discover

it

®

,

Discover

®

Network

and

Diners

Club

International

®

.

All

other

trademarks,

trade

names

and

service

marks

included in this presentation are the property of their respective owners.

|

3

Executive summary

•

Positioning to be the leading direct bank and payments partner

•

Achieving higher returns through direct banking strategy

•

Driving better card loan growth with disciplined credit risk

•

Additional topics of interest:

–

Enhancing cardmember security

–

Extending funding duration to partially mitigate the impact of rising rates

–

Dedicating significant resources to regulatory and compliance initiatives

|

4

Company Overview -

Positioning to be leading direct bank and payments partner

•

$4.8Bn personal loans

-

$2.8Bn in originations

-

1.9% net charge-off rate

•

$8.5Bn private student loans

-

$1.2Bn in originations

-

1.1% net charge-off rate (excl.

PCI loans)

•

$29Bn direct-to-consumer deposits

-

43% of funding

-

62% of accounts have a loan

product relationship with DFS

-

>100k Cashback Checking

accounts

Discover Consumer

Lending & Banking

Note(s)

Balances as of 9/30/14; net charge-off rates as of 3Q14; originations and

volumes based on the trailing four quarters ending 3Q14; direct-to-consumer deposits includes affinity deposits

•

$54Bn in card receivables

•

Leading cash rewards program

•

1 in 4 U.S. households

Discover Card

•

$319Bn volume (incl. proprietary cards)

•

30MM+ acceptance locations globally

•

$140MM+ in merchant funded rewards

annually

Payments |

5

Company Overview -

Driving faster loan growth, better efficiencies and returns

2009-2013 Average

Efficiency Ratio

(1)

(2)

Note(s)

1.

Defined as total operating expense divided by revenue net of interest expense

2.

Bank holding companies participating in the 2014 Comprehensive Capital Analysis and

Review (CCAR); excludes Ally Financial and Santander Holdings USA due to limited

information; excludes Discover

3.

2009

adjusted

to

exclude

$1.4

billion

($0.9

billion

after

taxes)

Visa

and

MasterCard

settlement

2009-2013 Average

Return on Equity

(3)

(2)

Source

SNL, regulatory reports; Discover

2009-2013 CAGR

Total Loan Growth (%)

(2)

6%

3%

Discover

Large Banks

37%

66%

Discover

Large Banks

19%

5%

Discover

Large Banks |

6

“Highest in Customer

Satisfaction with Credit Card

Company Overview –

Recognized industry leader

#1 or tied for #1

18 years in a row

Note(s)

1.

Discover

received

the

highest

numerical

score

among

credit

card

issuers

in

a

tie

in

the

proprietary

J.D.

Power

2014

Credit

Card

Satisfaction

Study

SM

. Study

based

on

responses

from

19,913

consumers

measuring

11

card

issuers

and

measures

opinions of consumers about the issuer of their primary credit card. Proprietary

study results are based on experiences and perceptions of consumers surveyed in September 2013-May 2014. Your experiences may vary. Visit jdpower.com

According to

Computerworld.com

in 2014

Companies

-

Tied

in

2014”

(1) |

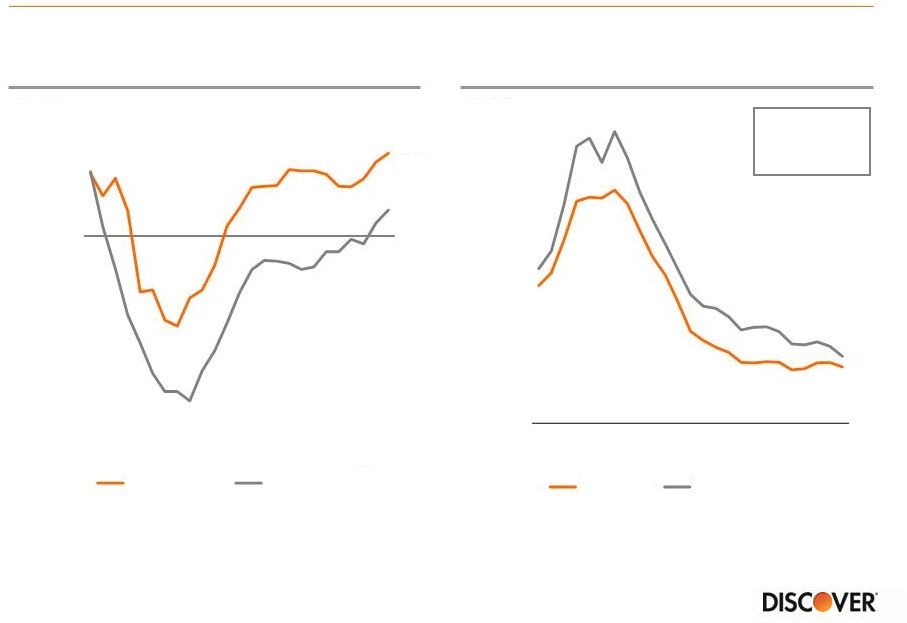

Card

– Driving better loan growth and credit performance

Card Loans (%YOY)

(1)

Source

SEC filings, calendar year data, internal estimates

Card Net Charge-off Rate (%)

(2)

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

3Q08

3Q09

3Q10

3Q11

3Q12

3Q13

3Q14

Discover

Peer Group

October

2014

2.1%

-15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

3Q08

3Q09

3Q10

3Q11

3Q12

3Q13

3Q14

Discover

Peer Group

6.6%

2.1%

1.

Includes weighted average card receivables growth for American Express (U.S. Card), Bank of America

(U.S. Card), Capital One (U.S. Card excl. HSBC for 2Q12-1Q13 and installment loans), Citi

(Citi-branded Cards N.A.), Wells Fargo (Consumer Credit Card Portfolio), and JPMorgan Chase (Card Services)

2.

Weighted average rate; includes U.S. card net charge-off rates for Citi (Citi-branded Cards

N.A.), JPMorgan Chase (Card Services), Capital One (U.S. Card), American Express (U.S. Card)

and Bank of America (U.S. Card)

Note(s)

7 |

Card

- Provisioning will be driven by loan growth

% of Card Portfolio on

Book for <3 Years

2010-2013

Card Vintage Gross Loss Rate

(1)

Note(s)

1.

2010 to 2013 blended vintage 6-month moving average gross principal

charge-off rate (excludes recoveries) 8

0

6

12

18

24

30

36

42

48

10%

11%

12%

13%

14%

15%

16%

17%

18%

Jan-12

Jan-13

Jan-14 |

Card

– Making cash rewards easier

•

Redemption experience is as important to a customer as earn rate

•

Removed redemption threshold to use rewards and eliminated forfeiture

(1)

–

Resulted in one-time charge of approximately $178MM in 4Q14 and

manageable ongoing impact of <5 bps expected annually

–

Delivering on brand promise: “We treat you like you’d treat

you” •

Continue to target features and benefits that increase loyalty and attract new

customers

Note(s)

1.

Removed redemption thresholds for statement credits, charitable contributions, and

electronic deposits in bank accounts and forfeiture of rewards due to delinquency, inactivity

or account closure

9 |

Investor Topics -

Continued focus on payments security

•

Merchant breaches dramatically increased industry focus on payments security

•

Discover is preparing for migration to EMV chip and choice (PIN or SIG) for

point-of-sale and tokenization for card not present transactions in

2015 •

EMV card issuance and network costs expected to be an incremental $35MM+

for 2015 but should result in some expense savings longer-term

•

Discover’s multilayered approach designed to address security across all

payment channels

10 |

Investor Topics -

NIM –

less funding cost tailwind and extending duration

Cost of Funds

(1)

Average Months to

Liability Repricing

(2)

Note(s)

1.

Rate on total interest-bearing liabilities

2.

Excludes all indeterminate maturity deposits (savings and money market) and

preferred stock; includes derivatives and hedging activities 11

Source

Internal estimates

1.0%

1.2%

1.4%

1.6%

1.8%

2.0%

2.2%

2.4%

2.6%

3Q11

1Q12

3Q12

1Q13

3Q13

1Q14

3Q14

4Q12

4Q14E

16

25 |

12

Investor Topics -

NIM -

Discover direct deposit betas will be less than “1”

DFS vs. Traditional Bank

Illustrative

Betas

(1)

•

Similar to “traditional”

bank, strong

synergy between right and left

hand side of balance sheet

–

62% of current accounts have a loan

product relationship with DFS

–

78% of new accounts have a loan

product relationship with DFS

•

Different from “traditional”

bank…

–

Checking deposits are still relatively

small (<1% of DFS funding)

–

Funding stack relies on ABS, direct

deposits and brokered deposits

Note(s)

1.

Defined as the ratio of expected change in deposit pricing relative to Federal

Reserve increases in short term interest rates 0.0

0.5

1.0

Traditional

Bank Deposit

Pricing

Discover

Direct Deposit

Pricing

Brokered CD

Pricing |

Investor Topics -

AML & BSA Update

•

FDIC issued consent order on 6/13/14 which requires

–

Improvements in Anti-Money Laundering and Bank Secrecy Act

compliance (AML & BSA) program

–

“Look Back Review”

for all transactions back to 6/30/12

–

Additional staff, training and internal controls

•

Made progress adding staff, new technology and enhanced program in 2014

–

Expect continued time and effort will be required to meet regulatory

expectations

–

Limitations on certain expansionary transactions during remediation

13

•

Federal Reserve intends to issue a supervisory action requiring

enhancements to enterprise-wide AML & BSA program

|

14

Summary –

YTD performance against 2014 business priorities

•

Grow Discover card loan share while maintaining leading credit

performance

•

Expand direct consumer banking products

–

Mortgages

•

Grow global network volume and acceptance

–

Third party payments

•

Optimize funding, cost structure and capital position

•

Enhance operating model, including risk management and leadership

development |