Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SUNTRUST BANKS INC | a8kbodygs120914.htm |

Goldman Sachs Financial Services Conference William H. Rogers, Jr., Chairman and Chief Executive Officer, SunTrust Banks, Inc. December 9, 2014

2 The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2013 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. This presentation includes non-GAAP financial measures to describe SunTrust’s performance. The reconciliations of those measures to GAAP measures are provided within or in the appendix of this presentation. In this presentation, the Company presents net interest income and net interest margin on a fully taxable-equivalent (“FTE”) basis, and ratios on an annualized basis. The FTE basis adjusts for the tax-favored status of income from certain loans and investments. The Company believes this measure to be the preferred industry measurement of net interest income and provides relevant comparison between taxable and non-taxable amounts. This presentation contains forward-looking statements. Statements regarding future efficiency improvement are forward looking statements. Also, any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” “initiatives,” “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could"; such statements are based upon the current beliefs and expectations of management and on information currently available to management. Such statements speak as of the date hereof, and we do not assume any obligation to update the statements made herein or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. Forward-looking statements are subject to significant risks and uncertainties. Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward- looking statements. Factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in Part I, “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2013 and in other periodic reports that we file with the SEC. Those factors include: as one of the largest lenders in the Southeast and Mid-Atlantic U.S. and a provider of financial products and services to consumers and businesses across the U.S., our financial results have been, and may continue to be, materially affected by general economic conditions, particularly unemployment levels and home prices in the U.S., and a deterioration of economic conditions or of the financial markets may materially adversely affect our lending and other businesses and our financial results and condition; legislation and regulation, including the Dodd-Frank Act, as well as future legislation and/or regulation, could require us to change certain of our business practices, reduce our revenue, impose additional costs on us, or otherwise adversely affect our business operations and/or competitive position; we are subject to capital adequacy and liquidity guidelines and, if we fail to meet these guidelines, our financial condition would be adversely affected; loss of customer deposits and market illiquidity could increase our funding costs; we rely on the mortgage secondary market and GSEs for some of our liquidity; our framework for managing risks may not be effective in mitigating risk and loss to us; we are subject to credit risk; our ALLL may not be adequate to cover our eventual losses; we may have more credit risk and higher credit losses to the extent that our loans are concentrated by loan type, industry segment, borrower type, or location of the borrower or collateral; we will realize future losses if the proceeds we receive upon liquidation of NPAs are less than the carrying value of such assets; a downgrade in the U.S. government's sovereign credit rating, or in the credit ratings of instruments issued, insured or guaranteed by related institutions, agencies or instrumentalities, could result in risks to us and general economic conditions that we are not able to predict; weakness in the real estate market, including the secondary residential mortgage loan markets, has adversely affected us and may continue to adversely affect us; we are subject to certain risks related to originating and selling mortgages, and may be required to repurchase mortgage loans or indemnify mortgage loan purchasers as a result of breaches of representations and warranties, borrower fraud, or certain breaches of our servicing agreements, and this could harm our liquidity, results of operations, and financial condition; we face certain risks as a servicer of loans, and may be terminated as a servicer or master servicer, be required to repurchase a mortgage loan or reimburse investors for credit losses on a mortgage loan, or incur costs, liabilities, fines and other sanctions if we fail to satisfy our servicing obligations, including our obligations with respect to mortgage loan foreclosure actions; financial difficulties or credit downgrades of mortgage and bond insurers may adversely affect our servicing and investment portfolios; we are subject to risks related to delays in the foreclosure process; we face risks related to recent mortgage settlements; we may continue to suffer increased losses in our loan portfolio despite enhancement of our underwriting policies and practices; our mortgage production and servicing revenue can be volatile; changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital and liquidity; changes in interest rates could also reduce the value of our MSRs and mortgages held for sale, reducing our earnings; the fiscal and monetary policies of the federal government and its agencies could have a material adverse effect on our earnings; clients could pursue alternatives to bank deposits, causing us to lose a relatively inexpensive source of funding; consumers may decide not to use banks to complete their financial transactions, which could affect net income; we have businesses other than banking which subject us to a variety of risks; hurricanes and other disasters may adversely affect loan portfolios and operations and increase the cost of doing business; negative public opinion could damage our reputation and adversely impact business and revenues; we rely on other companies to provide key components of our business infrastructure; a failure in or breach of our operational or security systems or infrastructure, or those of our third party vendors and other service providers, including as a result of cyber attacks, could disrupt our businesses, result in the disclosure or misuse of confidential or proprietary information, damage our reputation, increase our costs and cause losses; the soundness of other financial institutions could adversely affect us; we depend on the accuracy and completeness of information about clients and counterparties; competition in the financial services industry is intense and could result in losing business or margin declines; maintaining or increasing market share depends on market acceptance and regulatory approval of new products and services; we might not pay dividends on our common stock; our ability to receive dividends from our subsidiaries could affect our liquidity and ability to pay dividends; disruptions in our ability to access global capital markets may adversely affect our capital resources and liquidity; any reduction in our credit rating could increase the cost of our funding from the capital markets; we have in the past and may in the future pursue acquisitions, which could affect costs and from which we may not be able to realize anticipated benefits; we are subject to certain litigation, and our expenses related to this litigation may adversely affect our results; we may incur fines, penalties and other negative consequences from regulatory violations, possibly even inadvertent or unintentional violations; we depend on the expertise of key personnel, and if these individuals leave or change their roles without effective replacements, operations may suffer; we may not be able to hire or retain additional qualified personnel and recruiting and compensation costs may increase as a result of turnover, both of which may increase costs and reduce profitability and may adversely impact our ability to implement our business strategies; our accounting policies and processes are critical to how we report our financial condition and results of operations, and require management to make estimates about matters that are uncertain; changes in our accounting policies or in accounting standards could materially affect how we report our financial results and condition; our stock price can be volatile; our disclosure controls and procedures may not prevent or detect all errors or acts of fraud; our financial instruments carried at fair value expose us to certain market risks; our revenues derived from our investment securities may be volatile and subject to a variety of risks; and we may enter into transactions with off-balance sheet affiliates or our subsidiaries. Important Cautionary Statement

3 Investment Thesis Improving Returns & Efficiency Investing in Growth Opportunities Strong & Diverse Franchise Higher Capital Return to Shareholders

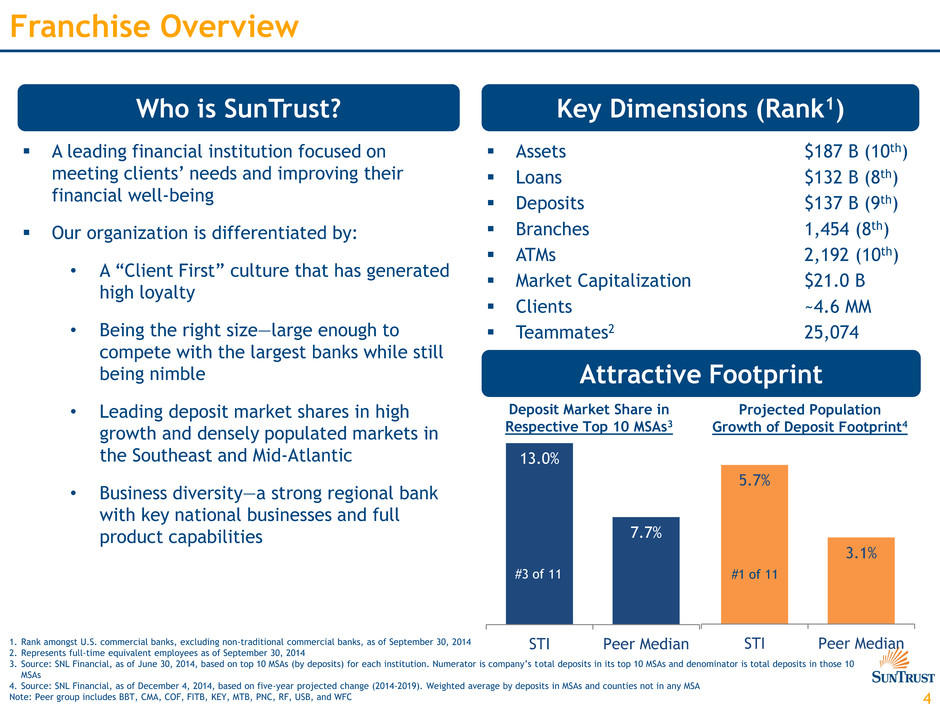

4 5.7% 3.1% STI Peer Median 13.0% 7.7% STI Peer Median Franchise Overview Who is SunTrust? Key Dimensions (Rank1) A leading financial institution focused on meeting clients’ needs and improving their financial well-being Our organization is differentiated by: • A “Client First” culture that has generated high loyalty • Being the right size—large enough to compete with the largest banks while still being nimble • Leading deposit market shares in high growth and densely populated markets in the Southeast and Mid-Atlantic • Business diversity—a strong regional bank with key national businesses and full product capabilities 1. Rank amongst U.S. commercial banks, excluding non-traditional commercial banks, as of September 30, 2014 2. Represents full-time equivalent employees as of September 30, 2014 3. Source: SNL Financial, as of June 30, 2014, based on top 10 MSAs (by deposits) for each institution. Numerator is company’s total deposits in its top 10 MSAs and denominator is total deposits in those 10 MSAs 4. Source: SNL Financial, as of December 4, 2014, based on five-year projected change (2014-2019). Weighted average by deposits in MSAs and counties not in any MSA Note: Peer group includes BBT, CMA, COF, FITB, KEY, MTB, PNC, RF, USB, and WFC Assets $187 B (10th) Loans $132 B (8th) Deposits $137 B (9th) Branches 1,454 (8th) ATMs 2,192 (10th) Market Capitalization $21.0 B Clients ~4.6 MM Teammates2 25,074 Attractive Footprint Deposit Market Share in Respective Top 10 MSAs3 Projected Population Growth of Deposit Footprint4 #3 of 11 #1 of 11

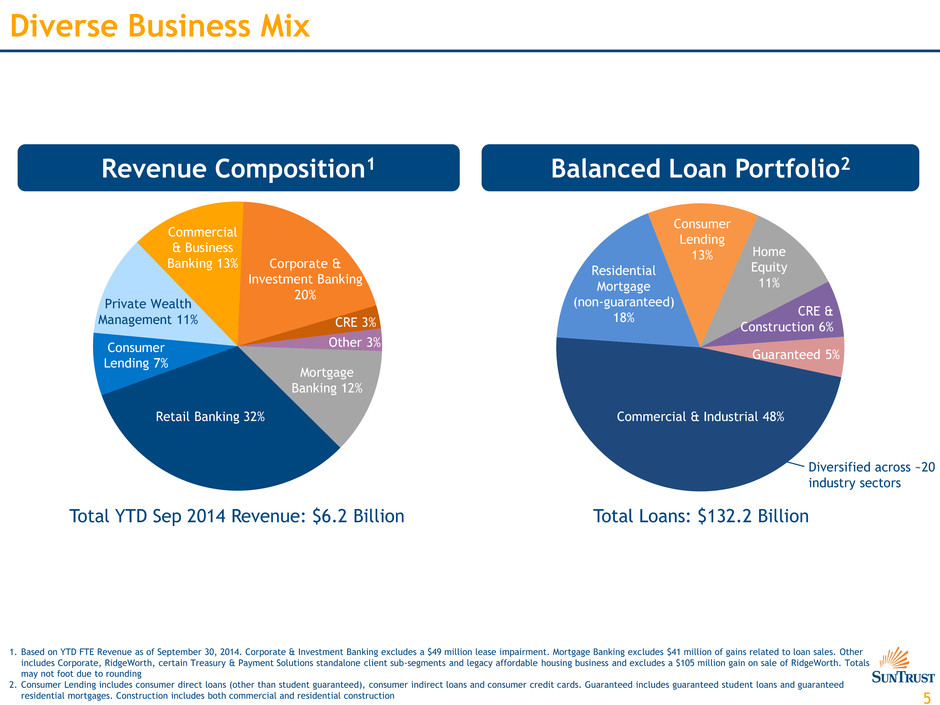

5 Diverse Business Mix 1. Based on YTD FTE Revenue as of September 30, 2014. Corporate & Investment Banking excludes a $49 million lease impairment. Mortgage Banking excludes $41 million of gains related to loan sales. Other includes Corporate, RidgeWorth, certain Treasury & Payment Solutions standalone client sub-segments and legacy affordable housing business and excludes a $105 million gain on sale of RidgeWorth. Totals may not foot due to rounding 2. Consumer Lending includes consumer direct loans (other than student guaranteed), consumer indirect loans and consumer credit cards. Guaranteed includes guaranteed student loans and guaranteed residential mortgages. Construction includes both commercial and residential construction Commercial & Industrial 48% Residential Mortgage (non-guaranteed) 18% Consumer Lending 13% Home Equity 11% Guaranteed 5% Revenue Composition1 Balanced Loan Portfolio2 CRE & Construction 6% Total Loans: $132.2 Billion Total YTD Sep 2014 Revenue: $6.2 Billion Commercial & Business Banking 13% Private Wealth Management 11% Consumer Lending 7% Corporate & Investment Banking 20% Mortgage Banking 12% CRE 3% Other 3% Retail Banking 32% Diversified across ~20 industry sectors

6 Business Segment Overview Wholesale Banking Consumer Banking and Private Wealth Management Mortgage Banking 50% % of YTD Sep 2014 Adjusted Revenue1,2 Strategic Focus Revenue Growth Enhance Profitability Business Scope / Recognition 1. Corporate Other (not shown) makes up 2% of YTD Sep 2014 adjusted revenue 2. YTD Sep 2014 reported revenue for Wholesale Banking and Mortgage Banking was $2.2 billion and $0.8 billion, respectively. Wholesale Banking adjusted revenue excludes a $49 million lease impairment. Mortgage Banking adjusted revenue excludes $41 million of gains related to loan sales. Total revenue excludes the $105 million pre-tax gain associated with the RidgeWorth sale 3. Reported efficiency ratios were 70% and 54% for Consumer Banking and Private Wealth Management and Wholesale Banking, respectively. The Wholesale Banking adjusted tangible efficiency ratio excludes a $36 million legacy affordable housing impairment charge in 1Q 14, a $49 million lease impairment in 3Q 14, and an $8 million affordable housing recovery in 3Q 14. The impacts from excluding the amortization and associated funding cost of intangible assets, alongside the aforementioned items, were -2% and -4% for Consumer Banking and Private Wealth Management and Wholesale Banking, respectively. Reported efficiency ratio for Mortgage Banking was 93%. The adjusted efficiency ratio excludes $179 million of operating losses related to specific legacy mortgage matters in 2Q 14 4. Source: SNL Financial. National rank amongst all U.S. commercial banks, excluding non-traditional banks, as of September 30, 2014. In-footprint rank includes all banks with deposits in FL, GA, VA, TN, MD, NC, DC, SC, AL, WV, AR, and MS (as of June 30, 2014) 5. Source: Javelin Strategy & Research 2014 Digital Banking Experience Leaders 6. Source: SNL Financial. Data represents 2013 originations Each segment has distinct strategies to drive higher growth and enhance profitability YTD Sep 2014 Adjusted Tangible Efficiency Ratio3 Geographic Presence 36% 12% 68% 50% 74% Primarily Regional (Southeast & Mid-Atlantic) CIB & CRE: National Commercial and Business Banking: Primarily Regional (Southeast & Mid-Atlantic) Retail Channel: Primarily Regional (Southeast & Mid-Atlantic) Correspondent Channel: National •#3 deposit market share in footprint4 •#9 deposit market share nationally4 •Online banking recognition5 ‐First place – Digital Experience Leader in Online Banking ‐Top 5 scores in Mobile Banking, Digital Adoption, and Digital Strategy •SunTrust Robinson Humphrey: Leading, full-service middle market investment bank •11 Greenwich Excellence Awards in Business Banking •Commercial Real Estate: Full- service financial provider to CRE developers and investors •#4 mortgage originator in footprint6 •#10 mortgage originator nationally6 •Ranked in the Top 10 for both Servicing and Origination in J.D. Power Client Satisfaction results

7 Investment Thesis Improving Returns & Efficiency Investing in Growth Opportunities Strong & Diverse Franchise Higher Capital Return to Shareholders

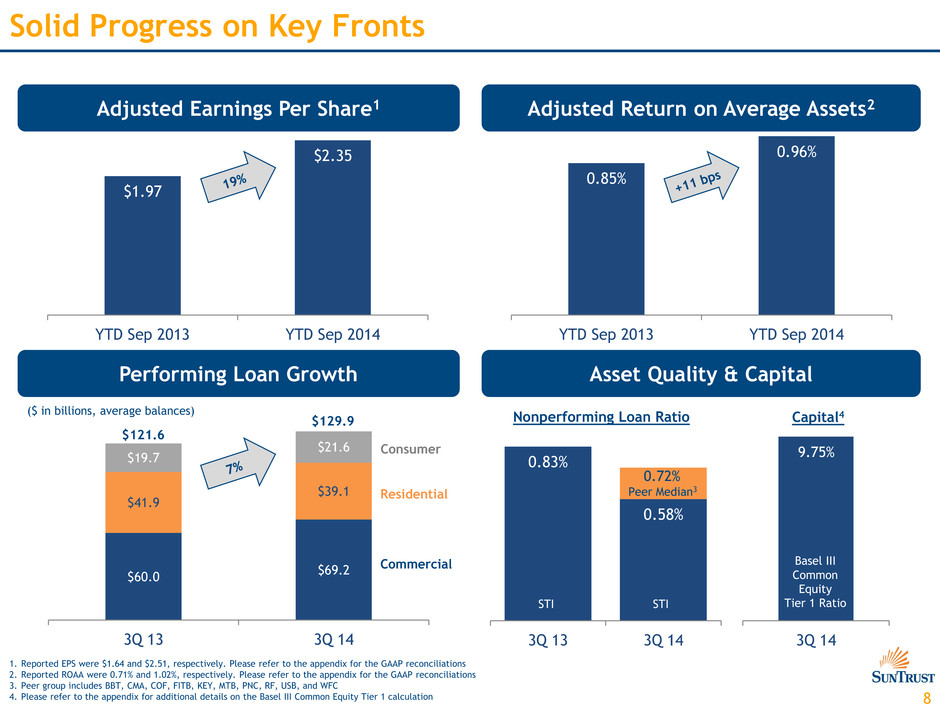

8 0.83% 0.58% 3Q 13 3Q 143Q 14 $60.0 $69.2 $41.9 $39.1 $19.7 $21.6 3Q 13 3Q 14 Solid Progress on Key Fronts Adjusted Earnings Per Share1 Asset Quality & Capital Adjusted Return on Average Assets2 Performing Loan Growth $121.6 $129.9 ($ in billions, average balances) 1. Reported EPS were $1.64 and $2.51, respectively. Please refer to the appendix for the GAAP reconciliations 2. Reported ROAA were 0.71% and 1.02%, respectively. Please refer to the appendix for the GAAP reconciliations 3. Peer group includes BBT, CMA, COF, FITB, KEY, MTB, PNC, RF, USB, and WFC 4. Please refer to the appendix for additional details on the Basel III Common Equity Tier 1 calculation Nonperforming Loan Ratio Capital4 Basel III Common Equity Tier 1 Ratio Consumer Residential Commercial 0.72% STI Peer Median3 STI 9.75% $1.97 $2.35 YTD Sep 2013 YTD Sep 2014 0.85% 0.96% YTD Sep 2013 YTD Sep 2014

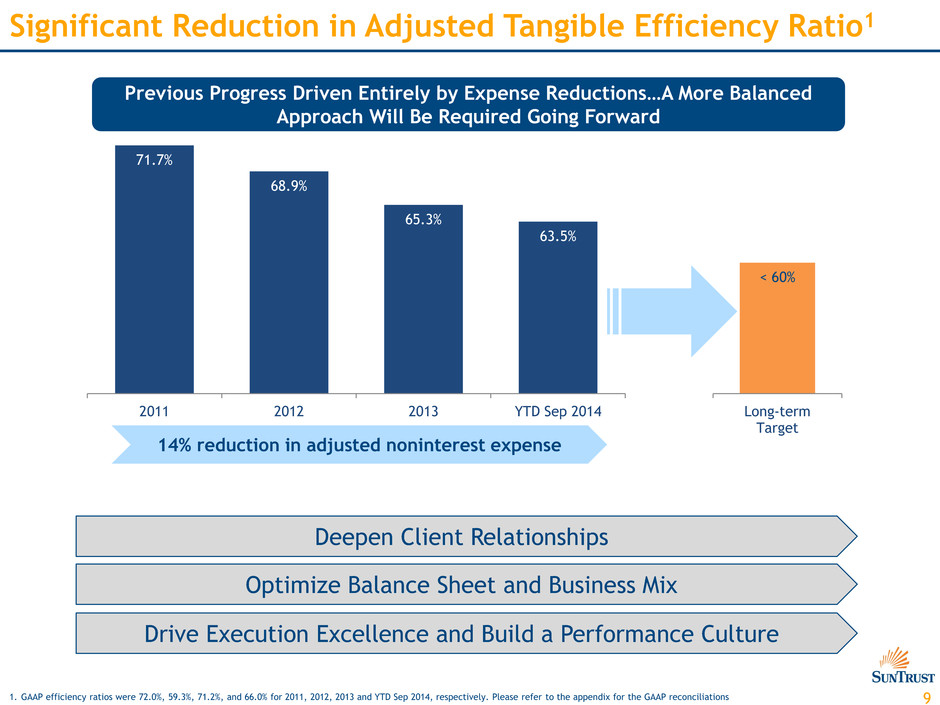

9 14% reduction in adjusted noninterest expense Significant Reduction in Adjusted Tangible Efficiency Ratio1 1. GAAP efficiency ratios were 72.0%, 59.3%, 71.2%, and 66.0% for 2011, 2012, 2013 and YTD Sep 2014, respectively. Please refer to the appendix for the GAAP reconciliations Deepen Client Relationships Optimize Balance Sheet and Business Mix Drive Execution Excellence and Build a Performance Culture Previous Progress Driven Entirely by Expense Reductions…A More Balanced Approach Will Be Required Going Forward Long-term Target < 60% 71.7% 68.9% 65.3% 63.5% 2011 2012 2013 YTD Sep 2014

10 Investment Thesis Improving Returns & Efficiency Investing in Growth Opportunities Strong & Diverse Franchise Higher Capital Return to Shareholders

11 $907 2008 2013 YTD Sep 2014 Opportunity 6% 11% STI Peer Median $39.3 $43.1 3Q 13 3Q 14 $4,615 $6,386 3Q 13 3Q 14 Wholesale Banking Areas of Focus 1. Includes investor-owned commercial real estate, commercial construction and land development, and multifamily loans. Source: Y-9C Bank Holding Company data 2. Peer group includes BBT, CMA, COF, FITB, KEY, MTB, PNC, RF, USB, and WFC 3. Represents growth in expenses associated with investments in technology, marketing, training, and consulting Grow CRE ($ in millions, average balances) Continue CIB Momentum Drive Higher Productivity in Commercial Banking Invest in Treasury & Payment Solutions ($ in millions) Revenue $1,502 Tangible Efficiency Ratio 56.1% ~50% 2012 2013 2014 CRE1 as % of Total Loans ($ in billions, average balances) 2 Forecast Investments in Technology3 Wholesale Banking Deposits Driven by higher revenue / FTE Loans

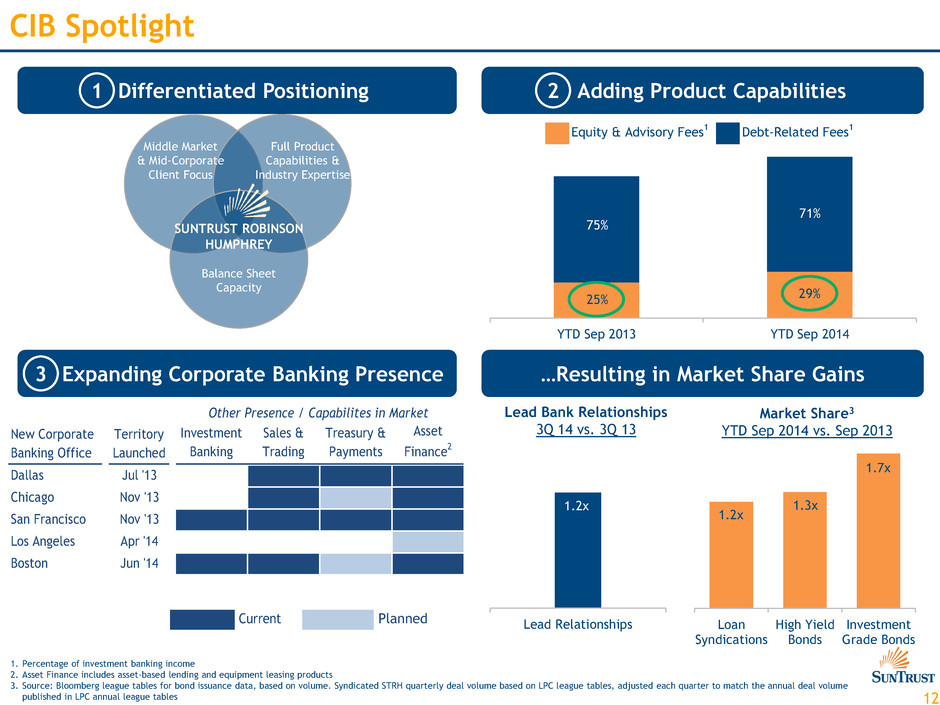

12 Loan Syndications High Yield Bonds Investment Grade Bonds Differentiated Positioning Middle Market & Mid-Corporate Client Focus Full Product Capabilities & Industry Expertise Balance Sheet Capacity …Resulting in Market Share Gains CIB Spotlight 1. Percentage of investment banking income 2. Asset Finance includes asset-based lending and equipment leasing products 3. Source: Bloomberg league tables for bond issuance data, based on volume. Syndicated STRH quarterly deal volume based on LPC league tables, adjusted each quarter to match the annual deal volume published in LPC annual league tables Expanding Corporate Banking Presence Market Share3 YTD Sep 2014 vs. Sep 2013 1.7x 1.3x 1.2x Lead Bank Relationships 3Q 14 vs. 3Q 13 Lead Relationships 1.2x Adding Product Capabilities SUNTRUST ROBINSON HUMPHREY Current 1 2 3 Planned YTD Sep 2013 YTD Sep 2014 Equity & Advisory Fees 1 Debt-Related Fees 1 25% 29% 75% 71% Investment Banking Sales & Trading Treasury & Payments Asset Finance 2 Dallas Jul '13 Chicago Nov '13 San Francisco Nov '13 Los Angeles Apr '14 Boston Jun '14 New Corporate Banking Offic T rritory Launched Other Presence / Capabilites in Market

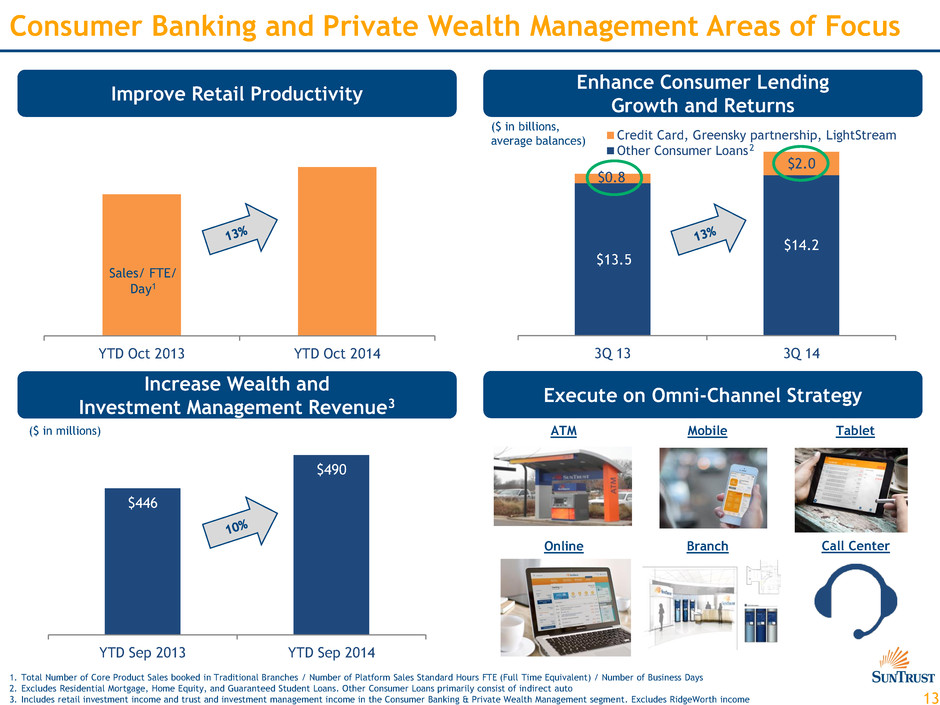

13 $13.5 $14.2 $0.8 $2.0 3Q 13 3Q 14 Credit Card, Greensky partnership, LightStream Other Consumer Loans YTD Oct 2013 YTD Oct 2014 Consumer Banking and Private Wealth Management Areas of Focus Execute on Omni-Channel Strategy Improve Retail Productivity Enhance Consumer Lending Growth and Returns ATM Branch Call Center Mobile Tablet Online 1. Total Number of Core Product Sales booked in Traditional Branches / Number of Platform Sales Standard Hours FTE (Full Time Equivalent) / Number of Business Days 2. Excludes Residential Mortgage, Home Equity, and Guaranteed Student Loans. Other Consumer Loans primarily consist of indirect auto 3. Includes retail investment income and trust and investment management income in the Consumer Banking & Private Wealth Management segment. Excludes RidgeWorth income ($ in billions, average balances) 2 Sales/ FTE/ Day1 Increase Wealth and Investment Management Revenue3 ($ in millions) $446 $490 YTD Sep 2013 YTD Sep 2014

14 8.0 10.6 11.7 0.6 3.6 4.5 2012 2013 YTD Sep 2014 Annualized ATM Deposits Mobile/Tablet Deposits 2012 2013 2014 69% 73% 77% 80% 31% 27% 23% 20% 2011 2012 2013 3Q 14 Self-Service Full-Service Omni-Channel & Digital Spotlight Investments in Digital Resulting In… A More Robust Client Experience Higher Mobile/ATM Deposit Transactions Increased Self-Service Utilization3 1. Source: Javelin Strategy & Research 2014 Digital Banking Experience Leaders (July 2014) 2. Source: Third party financial industry research firm examining financial planning solutions 3. Self-service transactions include mobile, tablet, online, ATM, and EIVR (Enhanced Interactive Voice Response). Full-service transactions include branch and SunTrust Online live agent (in millions) Forecast 1 2 3 12% reduction in branch count Digital Banking Awards1 • #1 Online Banking • Top 5 – Mobile Banking, Digital Adoption, Digital Strategy SummitView • “Best-in-class” rating2 among financial planning solutions • Featured in Barron’s (2014) (Example SummitView dashboard)

15 125% 74% 2H 13 Quarterly Average YTD Sep 2014 Opportunity $105 $109 $115 2Q 14 3Q 14 3Q 14 Pro Forma $176.1 4.7% 3.0% 3Q 13 3Q 14 $0.5 $0.3 3Q 13 3Q 14 Mortgage Banking Areas of Focus ($ in billions) Residential Mortgage NPLs (non- guaranteed) Loss Rate = ~3 bps 1. Total losses include net charge-offs and repurchase losses for loans originated from 1Q 09 through 3Q 14 2. 2H 13 reported revenue (FTE), noninterest expense, and efficiency ratio were $344 million, $895 million, and 260%, respectively. Adjusted figures exclude $291 million of specific operating losses related to the settlement of certain legal matters and $96 million in collection services related to the mortgage servicing advances allowance increase in 3Q 13). Also excluded are $63 million of mortgage repurchase settlements with Fannie Mae and Freddie Mac in 3Q 13. YTD Sep 2014 reported revenue (FTE), noninterest expense, and efficiency ratio were $772 million, $717 million, and 93%. Adjusted figures exclude $179 million of operating losses related to specific legacy mortgage matters in 2Q 14 and $41 million of gains related to loan sales in 3Q 14 3. Pro forma for $6 billion of servicing acquisitions that had closed by September 30, 2014 but had not yet been transferred Delinquent Servicing UPB / Total Servicing UPB ($ in billions, period-end balances) $0.05 Servicing for Others UPB ($ in billions) Continue Resolution of Legacy Mortgage Originate High Quality Mortgages Further Progress on Efficiency Grow Servicing Portfolio Total Originations 1Q 09 – 3Q 14 Cumulative Losses 1Q 09 – 3Q 14 Vintages1 3 Adjusted Noninterest Expense2 Adjusted Efficiency Ratio2 60 – 70% ($ in millions) $254 $179 2H 13 Quarterly Average YTD Sep 2014 Quarterly Average

16 Investment Thesis Improving Returns & Efficiency Investing in Growth Opportunities Strong & Diverse Franchise Higher Capital Return to Shareholders

Appendix

18 Income Statement ($ in millions, except per share data) YTD 2013 Reported Earnings Impact from Significant 2013 Items YTD 2013 Adjusted Earnings YTD 2014 Reported Earnings Impact from Significant 2014 Items YTD 2014 Adjusted Earnings NET INTEREST INCOME $3,640 $3,640 $3,629 $3,629 Provision for Credit Losses 453 453 268 268 NET INTEREST INCOME AFTER PROVISION FOR CREDIT LOSSES 3,187 3,187 3,361 3,361 NONINTEREST INCOME Service charges on deposit accounts 492 492 483 483 Trust and investment management income 387 387 339 339 Retail investment services 198 198 224 224 Other charges and fees 277 277 274 274 Investment banking income 260 260 296 296 Trading Income 124 124 141 141 Card fees 231 231 239 239 Mortgage production related income / (loss) 282 (63) 345 140 140 Mortgage servicing related income 50 50 143 143 Other noninterest income 98 98 260 105 155 Net securities gains 2 2 (11) (11) Total noninterest income 2,401 (63) 2,464 2,528 105 2,423 NONINTEREST EXPENSE Employee compensation and benefits 2,178 2,178 2,293 2,293 Net occupancy expense 261 261 254 254 Outside processing and software 555 555 535 535 Equipment expense 136 136 127 127 Marketing and customer development 95 95 91 91 Amortization/impairment of intangible assets/goodwill 18 18 14 14 Operating losses 461 323 138 268 179 89 FDIC premium/regulatory exams 140 140 109 109 Other noninterest expense 626 96 530 443 443 Total noninterest expense 4,470 419 4,051 4,134 179 3,955 INCOME BEFORE PROVISION FOR INCOME TAXES 1,118 (482) 1,600 1,755 (74) 1,829 Provision/(benefit) for income taxes 184 (303) 487 364 (155) 519 NET INCOME INCLUDING INCOME ATTRIBUTABLE TO NONCONTROLLING INTEREST 934 (179) 1,113 1,391 81 1,310 Net income attributable to noncontrolling interest 16 16 11 11 NET INCOME 918 (179) 1,097 1,380 81 1,298 NET INCOME AVAILABLE TO COMMON SHAREHOLDERS 884 (179) 1,064 1,343 81 1,262 EPS - DILUTED $1.64 ($0.33) $1.97 $2.51 $0.16 $2.35 RETURN ON AVERAGE ASSETS 0.71% -0.14% 0.85% 1.02% 0.06% 0.96% Reconciliation of YTD Sep 2013 and YTD Sep 2014 EPS & ROAA 1. Reflects the pre-tax impact of mortgage repurchase settlements with Fannie Mae and Freddie Mac 2. Reflects the pre-tax impact from the settlement of certain legal matters 3. In accordance with recently issued GAAP, amortization of affordable housing investments of $48 million was reclassified and is now presented in provision for income taxes for 2013. Previously, the amortization was presented in other noninterest expense. 4. Reflects the pre-tax impact from the mortgage servicing advances allowance increase 5. Reflects the benefit for income taxes impact related to footnotes 1,2,4 ($191) and the other tax items ($113) referred to in the October 10, 2013 8-K 6. Reflects the pre-tax gain associated with the RidgeWorth sale. 7. Reflects the pre-tax impact from the settlement of certain legacy mortgage-related matters. 8. Reflects the benefit for income taxes impact related to footnotes 6 – 7 and the income tax benefit related to the completion of a tax authority exam 1 2 4 5 3 3 6 7 8

19 Reconciliation of Basel III Common Equity Tier 1 Ratio1 ($ in billions) September 30, 2014 Tier 1 Common Equity – Basel I $15.4 Adjustments from Basel I to Basel III 2 - Common Equity Tier 1 – Basel III 3 $15.4 Risk-Weighted Assets - Basel I $160.0 Adjustments from Basel I to Basel III 4 (2.0) Risk-Weighted Assets - Basel III 3 $158.0 Basel I - Tier 1 Common Equity Ratio 9.63% Basel III - Common Equity Tier 1 Ratio 3 9.75% 1. The Tier 1 common ratio is a financial measure that is used by regulators, bank management, and investors to assess the capital position of financial services companies. The Common Equity Tier 1 ratio as calculated for Basel III is considered non-GAAP, and as such we have presented a reconciliation to the Tier 1 common ratio under Basel I that is currently used by regulators. 2. Relates to the treatment of mortgage servicing assets essentially offset by certain disallowed DTAs 3. The Basel III calculations of CET 1, RWA, and the CET 1 ratio are based upon our current interpretation of the final Basel III rules published by the Federal Reserve during October 2013, on a fully phased in basis 4. The largest differences between our RWA as calculated under Basel I compared to Basel III relate to the risk-weightings for derivatives, unfunded commitments, letters of credit, certain commercial loans, and mortgage servicing assets

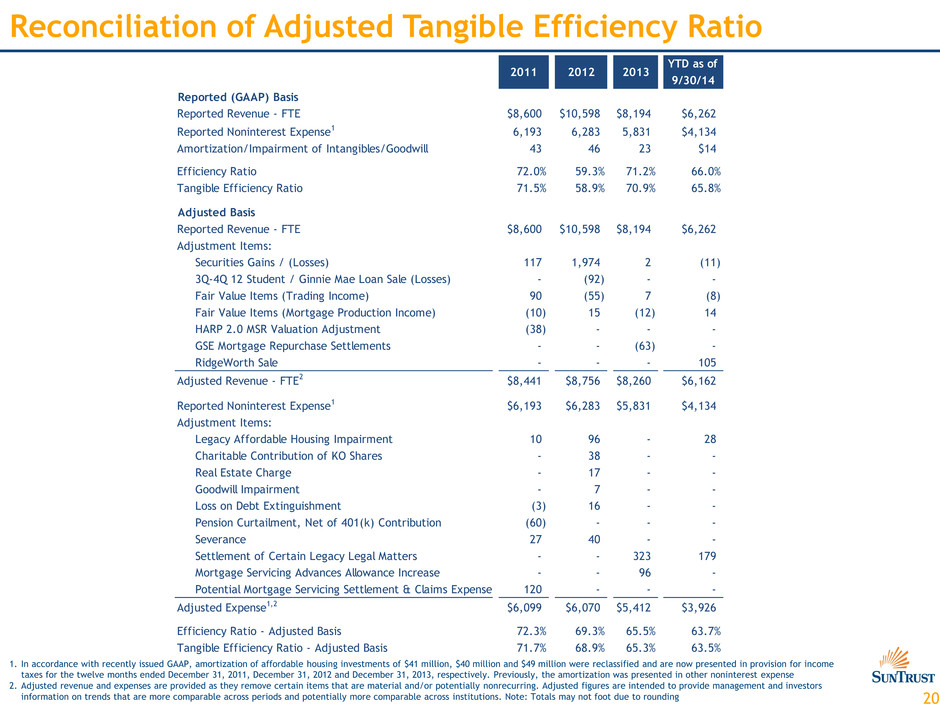

20 Reconciliation of Adjusted Tangible Efficiency Ratio 1. In accordance with recently issued GAAP, amortization of affordable housing investments of $41 million, $40 million and $49 million were reclassified and are now presented in provision for income taxes for the twelve months ended December 31, 2011, December 31, 2012 and December 31, 2013, respectively. Previously, the amortization was presented in other noninterest expense 2. Adjusted revenue and expenses are provided as they remove certain items that are material and/or potentially nonrecurring. Adjusted figures are intended to provide management and investors information on trends that are more comparable across periods and potentially more comparable across institutions. Note: Totals may not foot due to rounding 2011 2012 2013 YTD as of 9/30/14 Reported (GAAP) Basis Reported Revenue - FTE $8,600 $10,598 $8,194 $6,262 Reported Noninterest Expense1 6,193 6,283 5,831 $4,134 Amortization/Impairment of Intangibles/Goodwill 43 46 23 $14 Efficiency Ratio 72.0% 59.3% 71.2% 66.0% Tangible Efficiency Ratio 71.5% 58.9% 70.9% 65.8% Adjusted Basis Reported Revenue - FTE $8,600 $10,598 $8,194 $6,262 Adjustment Items: Securities Gains / (Losses) 117 1,974 2 (11) 3Q-4Q 12 Student / Ginnie Mae Loan Sale (Losses) - (92) - - Fair Value Items (Trading Income) 90 (55) 7 (8) Fair Value Items (Mortgage Production Income) (10) 15 (12) 14 HARP 2.0 MSR Valuation Adjustment (38) - - - GSE Mortgage Repurchase Settlements - - (63) - RidgeWorth Sale - - - 105 Adjusted Revenue - FTE2 $8,441 $8,756 $8,260 $6,162 Reported Noninterest Expense1 $6,193 $6,283 $5,831 $4,134 Adjustment Items: Legacy Affordable Housing Impairment 10 96 - 28 Charitable Contribution of KO Shares - 38 - - Real Estate Charge - 17 - - Goodwill Impairment - 7 - - Loss on Debt Extinguishment (3) 16 - - Pension Curtailment, Net of 401(k) Contribution (60) - - - Severance 27 40 - - Settlement of Certain Legacy Legal Matters - - 323 179 Mortgage Servicing Advances Allowance Increase - - 96 - Potential Mortgage Servicing Settlement & Claims Expense 120 - - - Adjusted Expense1,2 $6,099 $6,070 $5,412 $3,926 Efficiency Ratio - Adjusted Basis 72.3% 69.3% 65.5% 63.7% Tangible Efficiency Ratio - Adjusted Basis 71.7% 68.9% 65.3% 63.5%