Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CITIZENS FINANCIAL GROUP INC/RI | d834330d8k.htm |

Goldman Sachs

US Financial Services Conference 2014 December 9, 2014

Bruce Van Saun, Chairman and Chief Executive Officer

Exhibit 99.1 |

Forward-looking statements and Non-GAAP financial measures

Forward-Looking Statements

This document contains forward-looking statements within the Private Securities Litigation

Reform Act of 1995. Any statement that does not describe historical or current facts is a forward-looking statement. Statements regarding

potential

future

share

repurchases

and

future

dividends

are

forward-looking

statements.

These

statements

often

include

the

words

“believes,”

“expects,”

“anticipates,”

“estimates,”

“intends,”

“plans,”

“goals,”

“targets,”

“initiatives,”

“potentially,”

“probably,”

“projects,”

“outlook”

or

similar

expressions

or

future

conditional

verbs

such

as

“may,”

“will,”

“should,”

“would,”

and

“could.”

Forward-looking

statements

are

based

upon

the

current

beliefs

and

expectations

of

management

and

on

information

currently

available

to

management.

Our

statements

speak

as

of

the

date

hereof,

and

we

do

not

assume

any

obligation

to update these statements or to update the reasons why actual results could differ from those

contained in such statements in light of new information or future events. We caution you, therefore, against relying on any of these

forward-looking statements. They are neither statements of historical fact nor guarantees

or assurances of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, important

factors that could cause actual results to differ materially from those in the

forward-looking statements include the following, without limitation: negative

economic conditions that adversely affect the general economy, housing prices, the job market, consumer confidence and spending habits which may affect, among other things, the level of nonperforming assets,

charge-offs and provision expense;

the rate

of

growth

in

the

economy

and

employment

levels,

as

well

as

general

business

and

economic

conditions;

our ability to implement our strategic plan, including the cost savings and efficiency

components, and achieve our indicative performance targets; our ability to remedy

regulatory deficiencies and meet supervisory requirements and expectations; liabilities

resulting from litigation and regulatory investigations; our capital and liquidity

requirements (including under regulatory capital standards, such as the Basel III capital standards) and our ability to generate capital internally or raise capital on favorable terms;

the effect of the current low interest rate environment or changes in interest rates on our net

interest income, net interest margin and our mortgage originations, mortgage servicing rights and mortgages held for sale;

changes in interest rates and market liquidity, as well as the magnitude of such changes, which

may reduce interest margins, impact funding sources and affect the ability to originate and distribute financial products in the

primary and secondary markets;

the effect of changes in the level of checking or savings account deposits on our funding costs

and net interest margin; financial services reform and other current, pending or future

legislation or regulation that could have a negative effect on our revenue and businesses, including the Dodd-Frank Act and other legislation and regulation relating to

bank products and services;

a failure

in

or

breach

of

our

operational

or

security

systems

or

infrastructure,

or

those

of

our

third

party

vendors

or

other

service

providers,

including

as

a

result

of

cyber

attacks;

management’s ability to identify and manage these and other risks; and

any failure by us to successfully replicate or replace certain functions, systems and

infrastructure provided by RBS. In

addition

to

the

above

factors,

we

also

caution

that

the

amount

and

timing

of

any

future

common

stock

dividends

will

depend

on

our

financial

condition,

earnings,

cash

needs,

regulatory

constraints,

capital

requirements

(including

requirements of our subsidiaries), and any other factors that our Board of Directors deems

relevant in making such a determination. Therefore, there can be no assurance that we will pay any dividends to holders of our common stock,

or as to the amount of any such dividends. In addition, the timing and manner of the sale of

RBS's remaining ownership of our common stock remains uncertain, and we have no control over the manner in which RBS may seek to divest

such remaining shares. Any such sale would impact the price of our shares of common

stock. More

information

about

factors

that

could

cause

actual

results

to

differ

materially

from

those

described

in

the

forward-looking

statements

can

be

found

under

“Risk

Factors”

in

our

Registration

Statement

on

Form

S-1

filed

with the

United States Securities and Exchange Commission and declared effective on September 23,

2014. Non-GAAP Financial Measures

This

document

contains

non-GAAP

financial

measures,

"noninterest

income”,

“net

interest

income”,

“total

revenue”,

“

noninterest

expense”,

“net

income

(loss)”,

“income

tax

expense

(benefit)”,

“service

charges

and

fees”,

“card

fees”,

“trust & investment services fees”, and “securities gains, other income, and

estimated Chicago Divestiture fees”. In addition, we present computations for “return on average tangible common equity”, “return on average total tangible

assets”

and

“efficiency

ratio”

as

part

of

our

non-GAAP

measures.

These

non-GAAP

measures

exclude

discontinued

operations,

goodwill

impairment,

restructuring

charges

and

special

items,

which

are

usually

included,

where

applicable, in

the

financial

results

presented

in

accordance

with

GAAP.

Special

items

include

regulatory

expenses,

expenses

relating

to

our

initial

public

offering,

and

other

expenses

or

income.

All

references

to

“Adjusted”

results

are

non-GAAP

financial

measures.

These

measures

exclude

restructuring

charges

and

special

items.

We believe these non-GAAP measures provide useful information to investors because these

are among the measures used by our management team to evaluate our operating performance and make day-to-day operating decisions. In

addition, we believe discontinued operations, goodwill impairment, restructuring charges and

special items in any period do not reflect the operational performance of the business in that period and, accordingly, it is useful to consider

these line items with and without discontinued operations, goodwill impairment, restructuring

charges and special items. We believe this presentation also increases comparability of period-to-period results.

Other

companies

may

use

similarly

titled

non-GAAP

financial

measures

that

are

calculated

differently

from

the

way

we

calculate

such

measures.

Accordingly,

our

non-GAAP

financial

measures

may

not

be

comparable

to

similar

measures

used

by

other

companies.

We

caution

investors

not

to

place

undue

reliance

on

such

non-GAAP

measures,

but

instead

to

consider

them

with

the

most

directly

comparable

GAAP

measure.

Non-GAAP

financial

measures

have

limitations

as

analytical tools, and should not be considered in isolation, or as a substitute for our results

as reported under GAAP. A reconciliation of non-GAAP measures to the most comparable financial measure prepared in accordance with GAAP is

included in the Appendix hereto.

1 |

2

Dimension

Rank

(2)

Assets -

$131.3 billion

#13

Loans -

$91.0 billion

#13

Deposits -

$93.5 billion

#14

Branches -

1,225

#11

ATM network -

3,208

#7

Lead/joint lead

bookrunner

#5

(3)

Deposits -

$93.5 billion

Top 5 rank:

9/10 markets

(1)

HELOC -

$16.1 billion

Top 5 rank:

9/9 markets

(4)

Auto -

$12.1 billion

Top 5 rank:

6/9 markets

(5)

Mortgage –

$11.3 billion

Top 5 rank:

2/9 markets

(6)

Middle-market lending

#5

(7)

1)

As of 6/30/2014, excludes non-retail branches and banks with limited retail

operations. 2)

As of 9/30/2014, unless otherwise noted; excludes non-retail depository institutions,

includes U.S. subsidiaries of foreign banks. 3)

Thomson Reuters LPC, 3Q14 data based on number of deals for Overall Middle Market (defined as

Borrower Revenues < $500MM and Deal Size < $500MM). 4)

According to Equifax; origination volume as of 1Q14, excludes Illinois.

5)

According to Autocount; origination volume as of 2Q14, excludes Illinois.

6)

According to Equifax; origination volume as of 4Q13, excludes Illinois.

7)

Based on market penetration, according to Greenwich Associates 2Q14 rolling four-quarter

data; survey may include clients & competitors in Illinois. Leading deposit market

share of 9.1% in top 10 MSAs –

#2 deposit market share in New England

Relatively diverse economies/affluent demographics

Serve 5 million+ individuals, institutions and

companies

As of 10/8/2014, 70.5% of CFG owned by The Royal

Bank of Scotland (RBS) -

intends to fully exit by the

end of 2016

Solid franchise with leading positions in attractive markets

Source: SNL Financial, unless otherwise noted.

Significant scale in core markets

(1)

>10%

5–10%

<5%

State Deposit Market Share

Buffalo, NY: #4

Providence, RI: #1

Albany, NY: #2

Pittsburgh, PA: #2

Cleveland, OH: #4

Manchester,

NH: #1

Boston, MA:

#2

Rochester, NY: #4

Philadelphia, PA: #5

13

th

largest

U.S.

retail

bank

by

assets |

Corporate

banking Commercial real estate

Franchise finance

Asset finance

PE/sponsor finance

Healthcare/technology/not

for profit verticals

Capital markets

Treasury solutions

Commercial deposit services

Retail deposit services

Mobile/online banking

Credit/debit card

Wealth management

Home equity loans/lines

Mortgage

Auto

Education finance

Business banking

Consumer

Commercial

Targeting

50/50

Mix

Robust product offerings and balanced business mix

Deep client

relationships

+

Drive cross-sell and

wallet share

Extensive

product set

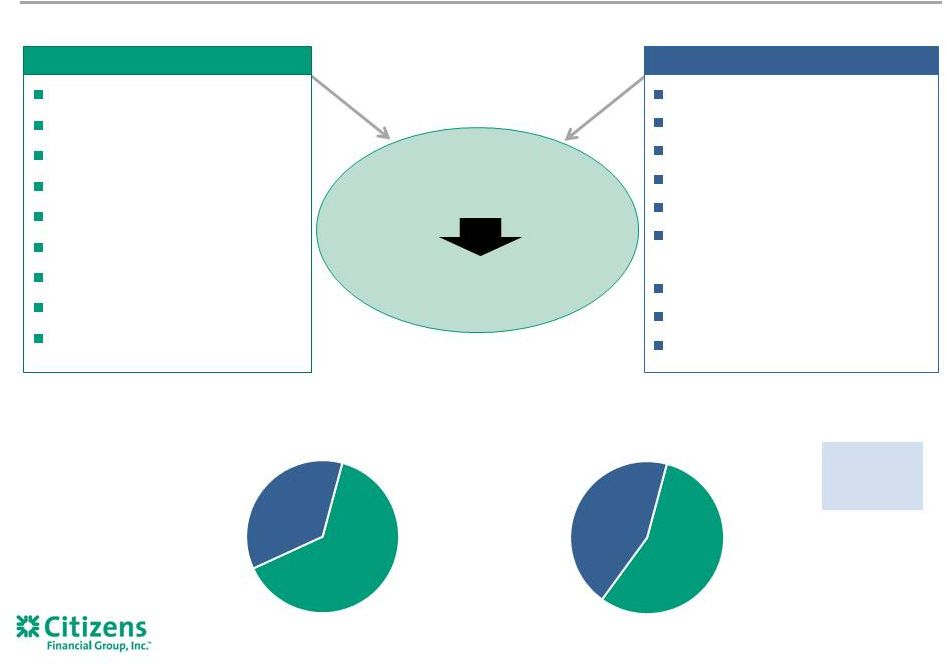

Period-end loans and leases

(1)

$87 billion 3Q14

$74 billion 2009

3

64%

36%

Commercial

Consumer

56%

44%

Commercial

Consumer

1) Reflects loans and leases and loans and leases held for sale in

our operating segments (Consumer and Commercial Banking). Excludes loans held in Other,

principally Non-core loans. |

Well

capitalized

with

a

Tier

1

common

equity

ratio

of

12.6%

(1)

;

pro

forma

common

equity

Tier

1

ratio of 12.2%

(1)

on a fully phased-in Basel III basis

Solid asset quality performance with net charge-offs of 37 bps YTD 3Q14; core net

charge-offs of 30 bps YTD 3Q14

Strong

deposit

franchise

with

$81.9

billion

of

core

deposits

(2)

,

or

88%

of

total

period-end

deposits,

and a total deposit cost of 18 bps

Internal plan in place to address Fed’s CCAR standards

Strong, clean balance sheet funded with low-cost deposits

4

1)

3Q14 data. Pro forma for 14.3 million shares repurchased for $334 million on October 8,

2014. 2)

Core deposits defined as deposits, excluding term deposits.

3)

Peer banks include BB&T (BBT), Comerica (CMA), Fifth Third (FITB), KeyCorp (KEY), M&T

(MTB), PNC (PNC), Regions (RF), SunTrust (STI), and US Bancorp (USB). 4)

Non-core peer charge-offs reflects data from quarterly filings where non-core

data disclosed (PNC, BBT, KEY). 3Q14 period-end

Tier 1 common equity ratio

3Q14 average

cost of deposits

YTD 3Q14 net charge-offs/

average loans and leases

(3)

(3)

(1)

0.30%

0.32%

(4)

(3)

0.37%

0.34%

CFG

Peer

Average

0.18%

0.15%

CFG

Peer

12.6%

10.5%

CFG

Peer

Average

Core

Non-Core

Source: SNL financial, Company filings

Average |

Customers

Serve our

customers well

Colleagues

Offer fulfilling jobs

Regulators

Comply with

letter and

spirit of rules

and

regulations

Investors

Deliver

strong value

proposition

and

attractive

returns

Communities & Society

Support sustainable prosperity

Aspire to be a top-performing regional bank, delivering well for all stakeholders

Customer-centric culture

5 |

6

Return on average tangible

common equity (“ROTCE”)

(2)

End 2016

Targets

4.2%

4.9%

6.9%

Adjusted ROTCE

(2)(3)

4.5%

5.1%

5.9%

Return on average total tangible

assets

(2)

0.4%

0.6%

0.7%

1.0%+

Adjusted efficiency ratio

(2)(3)

66%

69%

69%

~60%

Tier 1 common equity ratio

13.3%

13.5%

12.9%

~11%

10%+

Key Indicators

2011

2013

(1)

YTD 2014

Embarked on a plan to improve financial results

1)

2013 excludes $4.4 billion pre-tax ($4.1 billion after-tax) goodwill impairment

charge. See appendix pages 29-31 for a reconciliation of non-GAAP items.

2)

See appendix pages 29-31 for a reconciliation of non-GAAP items.

3)

Excludes restructuring charges and special items.

6

Future target

12%+

Goal is to deliver a 10%+ run-rate ROTCE by end of 2016

10%+ |

7

Offer our customers a differentiated customer experience through the quality of our

colleagues, products and services

–

Foster a culture around customer-centricity, commitment to excellence, leadership,

teamwork and integrity

Build a great brand that invokes trust from our customers and reinforces our value

proposition –

Consumer: Simple. Clear. Personal.

–

Commercial: Thought Leadership

Strive to deliver attractive risk-adjusted returns by making good

capital and resource allocation decisions, being good stewards of our resources, and

rigorously evaluating our execution Operate with a strong balance sheet with

regards to capital, liquidity and funding, and with a well- defined and prudent risk

appetite Maintain a balanced business mix between commercial banking and consumer

banking Position

the

bank

as

a

‘community

leader’

that

makes

a

positive

impact

on

the

communities

and

local economies we serve

Our vision and strategy

Our objective is to be a top-performing bank that delivers well for our stakeholders

Our vision is to deliver the best possible banking experience

7

Our strategy to achieve this is to: |

8

Position Consumer Banking to deliver improved capabilities and profitability

Reenergize household growth and deepen relationships through cross-sell

Scale up growth in consumer asset businesses

Move towards smaller branch formats with fewer but more productive bankers and

enhanced on-line and mobile functionality

Continue our momentum in Commercial Banking

Equip our bankers to drive thought leadership and differentiate our customer experience

Deepen customer relationships with a focus on capital markets and treasury solutions

Grow

our

balance

sheet

to

build

scale

while

maintaining

a

strong

capital

position

Focus on growing a cost-effective, sustainable deposit base in support of

business loan growth

Tightly

manage

expense

base

while

funding

technology,

colleague,

and

regulatory

needs

and

maintaining sufficient investment in our infrastructure

Embed

risk

management

throughout

the

organization

and

build

strong

relationships

with regulators

Develop

a

high-performing,

customer-centric

organization

and

culture

Live our values every day

Empowerment with accountability

Our strategy results in six priorities

1

2

3

4

5

6

8 |

Year over year

progress on strategic priorities 9

Improved

Consumer Bank

Continued

Commercial

Momentum

Balance Sheet

Growth /

Capital Mix

Normalization

Added 33 origination officers since 3Q13

Extended franchise finance capabilities into new food concepts

and convenience store segments

Acquiring select energy-sector assets and talent from RBS

Balance

sheet

growth

of

$11.3

billion

since

3Q13

Reinvigorating deposit growth; already LCR compliant

Executed $1.0 billion of capital actions in 2014

Leveraging

Capabilities in Auto

and Education

Finance

Introduced new One Deposit Product; investing in advertising

and marketing

Net checking account growth of over 80,000 YTD 3Q14

Expanding Sales

Force

Reenergizing

Household Growth

On track to add over 60 mortgage officers and reach a total of

~450 wealth managers by YE 2014

Business banking 3Q14 loan originations up 23% over PY

Auto originations/flow purchases up 112% from 3Q13 with

average FICO score of 750 in 3Q14

Student loan originations up 61% from 3Q13

including $38 million in

3Q14 new refinance product originations Growing

MidCorporate/

Specialty Verticals &

Franchise Finance

Strengthening Fee

Income Capabilities

Moved to #5 middle-market book runner ranking

Intensified treasury services focus with new products and

leadership

Improved Alignment

with Peers

1

2

3

Priorities

Proof Points

Initiatives |

Priorities

Progress on strategic priorities

10

Enhanced

Efficiency &

Infrastructure

Embed Robust

Risk /

Regulatory

Framework

High-

Performing,

Customer-

Centric Culture

Established enterprise-wide capital planning & management

program with significant augmentation in resources

Strengthening our operating model and risk management

framework to address supervisory feedback

Ahead

of

schedule

on

separation

from

RBS

–

completed

largest

traditional

bank

IPO

–

solid

first

quarter

as

a

public

company

Maintaining

strong

customer-centric

culture

–

JD

Power

score

of

770

(1)

in Consumer, and in Commercial overall lead client

satisfaction

now

89%

(2)

Enhanced leadership, recruiting, and talent management

Continued commitment to volunteerism/financial contributions

Optimizing

Footprint/Branch

Delivery Model

Efficiency initiatives on track to achieve 25% of 2016 $200 million

targeted cost saves by YE 2014

Since 3Q13 -

upgraded or enhanced branch teller platform, ATM

network, call center system, auto loan platform, online and mobile

banking offerings, treasury services platform

Completed

Chicago

Divestiture

-

helping

to

fund

continued

investment in our businesses

Consolidated 36 branches since 3Q13; universal banker branch

penetration rate of 47% vs. 37% in 3Q13

Enhancing CCAR

and Regulatory

Framework

Driving Risk

Awareness and

Accountability

Enhancing our culture to embrace well-defined and prudent

approach to managing credit, operational and reputational risk

Repositioning

Organization for

Success

1)

J.D. Power and Associates score for New England; score based on a split year basis (i.e. ,

2014 score is based on measurement from half of 2013). 2)

Satisfaction based on Greenwich Associates Market Tracking Program (Citizens

–footprints, $25-$500 million, 3Q14 rolling four-quarter data).

4

5

6

Proof Points

Initiatives

Achieving Cost

Saves to Fund

Investments |

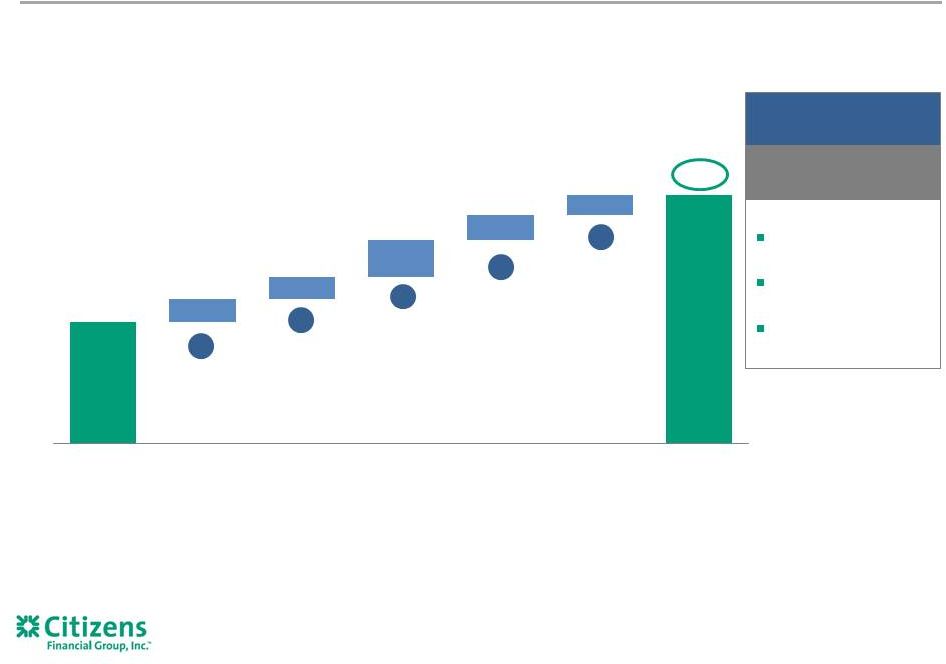

11

+188

bps

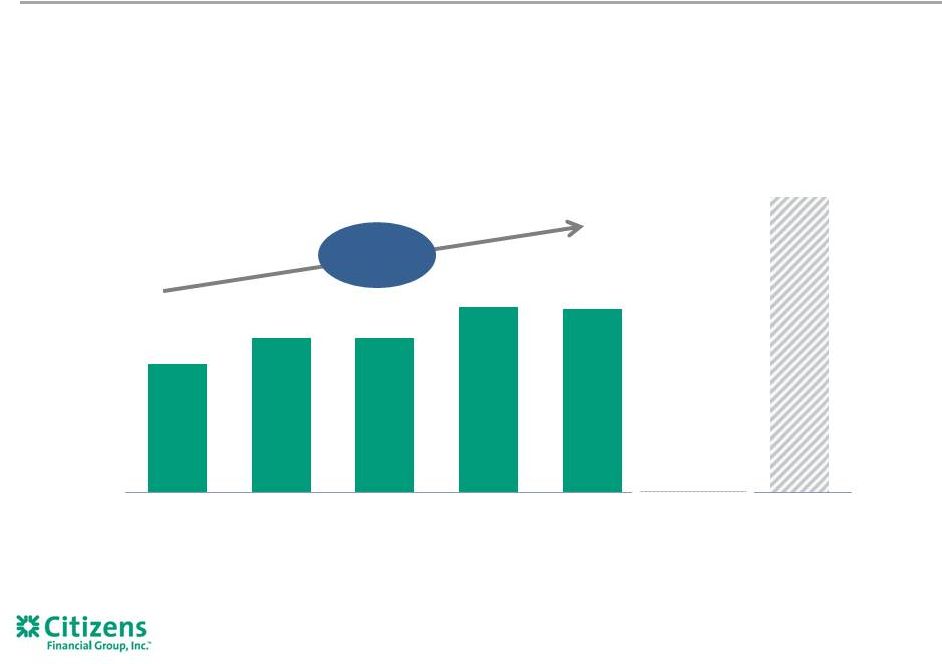

ROTCE is trending in line with plan

Adjusted ROTCE

(1)

4.34%

5.24%

5.24%

6.28%

6.22%

Target

10% +

3Q13

4Q13

1Q14

2Q14

3Q14

End 2016

1) Excluding restructuring charges and special items. See appendix

pages 29-31 for a reconciliation of non-GAAP items. |

Asset-sensitive position relative to peers

12

Delivering loan growth

(1)

1)

Peer banks include BB&T, Comerica, Fifth Third, KeyCorp, M&T, PNC, Regions, SunTrust,

and US Bancorp. Note: peer estimate based on public disclosures; 200 2)

Quarterly results in each period prior to 3Q14 have been adjusted to exclude $13 million in

Net interest income associated with the estimated Chicago Divestiture impact.

Growing

the

balance

sheet

again

–

well

positioned

for

rising

rates

NII growing with NIM broadly stable

Net interest income

$s in billions

Average earning assets

$s in millions

excluding estimated

Chicago Divestiture impact

(2)

(2)

(2)

(2)

6.3%

3.7%

CFG

Peer Median

$757

$766

$795

$820

bps gradual impact inferred for certain peers based on available information. Data as of

September 30, 2014. Net interest income

Net interest income,

$105.9

$109.0

$112.5

$116.0

$117.2

3Q13

4Q13

1Q14

2Q14

3Q14

$770

$779

$808

$833

$820

3Q13

4Q13

1Q14

2Q14

3Q14 |

Adjusted

noninterest income relatively stable, with recent underlying growth (1)

1)

2)

13

Adjusted noninterest income

$s in millions

$310

$301

$310

$301

$283

5% CAGR

since 3Q13 in

capital markets

fees, trust and

investment

services fees,

and mortgage

banking fees

(1)

$383

$379

$358

$352

$341

3Q13

4Q13

1Q14

2Q14

3Q14

Service

charges

and

fees,

excluding

Chicago

Divestiture

fees

(2)

Card

fees,

excluding

Chicago

Divestiture

fees

(2)

Foreign exchange and trade finance fees

Capital markets fees

Mortgage banking fees

Trust

and

investment

services

fees,

excluding

Chicago

Divestiture

fees

(2)

Securities

gains,

other

income,

and

estimated

Chicago

Divestiture

fees

(2)

Quarterly results in each period prior to 3Q14 have been adjusted to exclude $6 million in

service charges and fees, $3 million in card fees, $2 million in trust and investment

services fees and $1 million of Other fee income associated with the estimated Chicago Divestiture impact. These amounts have been included in

Securities gains , other Income, and estimated Chicago Divestiture fees category which also

includes bank-owned life insurance income. 2Q14 noninterest income of $352 million excludes $288 million Chicago Divestiture gain on

sale. See appendix pages 29-31 for a reconciliation of non-GAAP items.

|

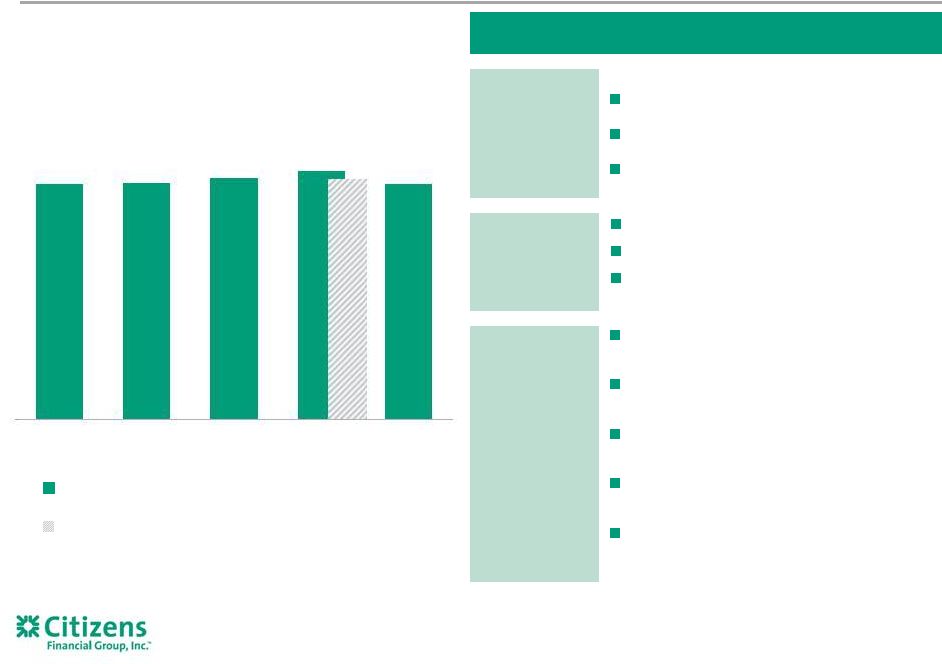

Discipline on

expenses is funding investments to drive growth 1)

Non-GAAP item. Adjusted results exclude the effect of net restructuring charges and

special items associated with Chicago Divestiture, efficiency and effectiveness

programs and separation from RBS. See important information on use of Non-GAAP items on

pages 29-31. Excludes restructuring charges and special items of: salaries and

benefits of $43 million in 2Q14 and $5 million in 4Q13; outside services of $19 million in 3Q14 and $41 million in 2Q14; occupancy of $2 million in 3Q14,

$9 million in 2Q14, and $11 million in 4Q13; equipment of $3 million in 2Q14 and $7 million

in 4Q13; and other expense of $19 million in 2Q14 and $3 million in 4Q13. 2)

Excludes estimated impact of Chicago Divestiture.

14

$s in millions

Adjusted noninterest expense

(1)

(1)

(1)

(1)

$200 million targeted cost savings by end 2016

(2)

Salaries and

employee

benefits

~$120

million

Other

~$60 million

Occupancy

~$20 million

Expand technology outsourcing model by

consolidating vendors/increasing scope

Consolidate and migrate IT application

portfolio to single sourcing partner

Strengthen competitive sourcing on

consulting engagements

Streamline internal travel and enhance

A/V facilities

Enhance loss collection by improving

segmentation of customers

Further optimize branch network

Exit surplus office space

Redevelop underutilized owned-branch

real estate

Align employee benefits to market

Organizational redesign

Reduction in FTEs

Noninterest expense

Noninterest expense, excluding estimated

Impact of Chicago Divestiture

$788

$792

$810

$833

$789

3Q13

4Q13

1Q14

2Q14

3Q14

$812

(2) |

3Q14 net

charge-offs of 0.38% of average loans and leases with core portfolio charge-offs of

0.31%

Allowance coverage of NPLs of 111%, up from 72% in 3Q13

NPLs to total loans and leases down 79 bps to 1.19% from 1.98% in 3Q13

Provision for credit losses, charge-offs, NPLs

Allowance for loan and lease losses

1) Allowance for loan and lease losses to nonperforming loans and leases.

(1)

for credit

losses

15

Credit quality continues to improve

$s in millions

$s in millions

$1,219

$1,221

$1,259

$1,210

$1,201

72%

86%

92%

101%

111%

3Q13

4Q13

1Q14

2Q14

3Q14

Allowance for loan and lease losses

NPL coverage ratio

$131

$115

$87

$68

$88

$145

$132

$121

$49

$77

$1.7B

$1.4B

$1.4B

$1.2B

$1.1B

3Q13

4Q13

1Q14

2Q14

3Q14

Net charge-offs

Provision

NPLs |

Adjusting capital

structure towards peers 1)

Data as of 3Q14

2)

Pro forma for 14.3 million shares repurchased for $334 million on October 8, 2014.

Progress against capital plan:

–

$333 million capital exchange transaction

on 8/1/14

–

$334 million sub-debt issuance and 14.3

million share repurchase on 10/8/14

3Q14 Tier 1 common equity ratio of 12.9%,

down 34 basis points from 2Q14

–

Targeting ~11% Basel III CET1 Ratio by end

of 2016

16

Tier 1 common equity ratio

(1)

(2)

9.6%

9.6%

9.7%

9.8%

10.5%

10.5%

10.7%

11.1%

11.3%

11.8%

12.6%

SunTrust

Fifth Third

U.S. Bancorp

M&T

Peer Average

BB&T

Comerica

PNC

KeyCorp

Regions

Citizens

Source: SNL Financial |

Building blocks

are in place to drive enhanced performance 13

th

largest

U.S.

retail

bank

holding

company

with

attractive

demographics

in core markets

Attractive business mix with growing and profitable commercial business

complementing strong consumer business

Client-centric model focused on deepening customer relationships

Attractive,

client-centric

franchise with

scale

Intense focus on strategic priorities driving attractive growth with improving

asset mix and returns

Committed to driving enhanced efficiency and effectiveness

Prudently optimizing capital structure and risk profile to help drive improved

risk-adjusted returns

Peer-leading capital ratios

Stable, low-cost deposit base

Solid asset quality through credit cycles

Strong, clean

balance sheet

supports

growth plans

Expected path

to double-digit

ROTCE

17 |

18

Q&A |

|

Appendix

|

Expected path to

improving ROTCE 21

4Q16 ROTCE targeted to be in excess of 10%

Not shown in the above are the following offsetting items: runoff of legacy non-core

business and runoff of legacy-fixed rate swaps, which are offset by normalization

of credit provision and securities gains 0.8 –

1.0%

0.7 –

0.8%

0.9 –

1.0%

1.3 –

1.6%

0.8 –

1.0%

10%+

5%

A

B

C

D

E

Potential upside from

further normalization

Momentum carries

forward beyond 2016

Full Impact of:

1)

Subject to regulatory approval.

2)

Potential upside from further normalization assumes Fed Funds rate of 3%.

3)

Excludes $4.4 billion pre-tax ($4.1 billion after-tax) goodwill impairment

charge. See appendix pages 29-31 for a reconciliation of non-GAAP items.

(3)

2013

Earning asset

growth & NII

expansion

Fee income

growth

Yield curve

benefit

Cost saving

actions

Planned capital

actions

4Q16

Targeted

Capital

normalization

(1)

Rate normalization

(2)

(+100 to +150 bps)

Non-core runoff

(+15 to +20 bps) |

Progress on ROTCE

improvement plan 22

Commercial loans up 7% annualized from year end 2013, driven by growth in

mid-corporate, franchise finance, technology, and business capital

Retail loans up 8% annualized from year end 2013, driven by growth in auto and mortgage

3Q14 NII up 7% annualized from 4Q13, driven by 10% annualized increase in average

interest earning assets

Yield Curve

Benefit

Fee Income

Growth

Earning Asset

Growth & NII

Expansion

1

2

3

Cost Saving

Actions

Planned Capital

Actions

4

5

Underlying momentum in service charges/fees masked by impact of posting order changes and

Chicago Divestiture

Mortgage banking relatively weaker despite improving origination

trends

Gaining traction in capital markets, foreign exchange and trade finance

6.3% modeled benefit to NII assuming 200 basis point gradual ramp in rates at September 30

Estimate

~85% of interest rate sensitivity is concentrated at the short end of the curve

Expense initiatives are tracking to all implementation dates

Expect to have 25% of 2016 $200 million targeted program goal in

run rate by end 2014

2014 capital realignment plan completed as of October 8

with 14.3 million share repurchase

Capital mix now 78% CET1/22% capital securities vs. goal of 70%/30%

Highlights

Adjusted ROTCE up 188 basis points since 3Q13

(1)

1)

Non-GAAP item. Adjusted results exclude the effect of net restructuring charges and

special items associated with Chicago Divestiture, efficiency and effectiveness

programs and separation from RBS. See pages 29-31 for a reconciliation of Non-GAAP items.

th

th |

Delivered solid

3Q14 adjusted financials (1)

1)

Non-GAAP item. Adjusted results exclude the effect of net restructuring charges and

special items associated with Chicago Divestiture, efficiency and effectiveness

programs and separation from RBS. See pages 29-31 for a reconciliation of Non-GAAP items.

2)

Includes held for sale.

3)

Return on average tangible common equity.

4)

Return on average total tangible assets.

5)

Full-time equivalent employees.

Linked quarter:

Adjusted net income down $3 million largely

driven by effect of unusually low 2Q14

provision expense

Adjusted pre-provision profit up 6%

Adjusted revenue down $24 million driven

by an estimated $25 million related to

Chicago Divestiture

Adjusted NII stable excluding the impact

of the Chicago Divestiture

Adjusted noninterest income down $11

million driven by effect of Chicago

Divestiture and 2Q14 loan sale gain

Adjusted noninterest expense down $44

million, driven by an estimated $21 million

from the Chicago Divestiture as well as

lower regulatory costs and incentives

expense

Adjusted efficiency ratio improved 221 bps

Prior Year Quarter:

Adjusted net income up $58 million reflecting

positive operating leverage and a $68 million

reduction in provision expense

Highlights

23

3Q14 change from

$s in millions

3Q14

2Q14

3Q13

2Q14

3Q13

$

%

$

%

Net interest income

820

$

833

$

770

$

(13)

$

(2) %

50

$

6 %

Adjusted noninterest income

1

341

352

383

(11)

(3) %

(42)

(11) %

Adjusted total revenue

1

1,161

1,185

1,153

(24)

(2) %

8

1 %

Adjusted noninterest expense

1

789

833

788

(44)

(5) %

1

—

%

Adjusted pre-provision profit

1

372

352

365

20

6 %

7

2 %

Provision for credit losses

77

49

145

28

57 %

(68)

(47) %

Adjusted pretax income

1

295

303

220

(8)

(3) %

75

34 %

Adjusted income tax expense

1

93

98

76

(5)

(5) %

17

22 %

Adjusted net income

1

202

$

205

$

144

$

(3)

$

(1) %

58

$

40 %

$s in billions

Average interest earning assets

117

$

116

$

106

$

1

$

1 %

11

$

11 %

Average deposits

2

92

92

93

(0)

(1) %

(1)

(2) %

Key metrics

Net interest margin

2.77

%

2.87

%

2.88

%

(10)

bps

(11)

bps

Loan-to-deposit ratio (period-end)

2

97.32

%

97.20

%

91.34

%

12

bps

598

bps

Adjusted ROTCE

1,3

6.22

%

6.28

%

4.34

%

(6)

bps

188

bps

Adjusted ROTA

1,4

0.66

%

0.68

%

0.52

%

(2)

bps

14

bps

Adjusted efficiency ratio

1

68

%

70

%

68

%

(221)

bps

(47)

bps

FTEs

5

17,852

18,049

18,961

(197)

(1) %

(1,109)

(6) %

Per common share

Adjusted diluted EPS

1

0.36

$

0.37

$

0.26

$

(0.01)

$

(3) %

0.10

$

38 %

Tangible book value

23.04

$

23.39

$

22.97

$

(0.35)

$

(1) %

0.07

$

—

%

Average diluted shares outstanding

(in millions)

560.2

560.0

560.0

0.2

—

%

0.2

—

%

–

– |

24

Bruce Van Saun

Chairman and

Chief Executive Officer

30 Years in Banking

Strong and experienced leadership team

Brad Conner

Vice Chairman-

Consumer

Banking

26 Years

Robert Matthews

Vice Chairman-

Commercial Banking

26 Years

John Fawcett

Chief Financial

Officer

26 Years

Robert Nelson

Chief Compliance

Officer

27 Years

David Bowerman

Vice Chairman-

Business Services

26 Years

Nancy Shanik

Group EVP-

Chief Risk Officer

36 Years

Michael Cleary

Group EVP-

Consumer

Distribution

14 Years

Stephen Gannon

Chief Legal Officer

36 Years

Brian O’Connell

Regional Director-

Technology Services

27 Years

Beth Johnson

Corporate

Strategy

15 Years

Susan LaMonica

Director of HR

21 Years

24

Executive committee with an average of over 24 years of banking experience

|

Board

Member Title and Company

Year Joined

Committees

Bruce Van Saun

Chairman and Chief Executive Officer

Citizens Financial Group, Inc. and Head of RBS Americas

2013

Chairman of the Board

Chair of Executive Committee

Arthur F. Ryan

Former Chairman, Chief Executive Officer & President

Prudential Financial Inc.

2009

Lead Director

Chair of Compensation and Human Resources Committee

Member of Nominating and Corporate Governance Committee;

Executive Committee

Mark Casady

Chairman & Chief Executive Officer

LPL Financial Holdings Inc.

2014

Member of Risk Committee

Anthony Di Iorio

Former Chief Financial Officer

Deutsche Bank A.G.

2014

Member of Audit Committee; Nominating and Corporate

Governance Committee

Robert Gillespie

Director, The Royal Bank of Scotland Group plc

2014

Member of Executive Committee

William P. Hankowsky

Chairman, President & Chief Executive Officer

Liberty Property Trust

2006

Member of Audit Committee; Compensation and Human

Resources Committee

Howard W. Hanna III

Chairman & Chief Executive Officer

Howard Hanna Real Estate Services

2009

Member of Audit Committee; Nominating and Corporate

Governance Committee

Leo I. Higdon

Former Vice Chairman Solomon

Brothers

Past President of Connecticut College

2014

Member Audit Committee; Compensation and Human Resources

Committee

Charles J. (“Bud”) Koch

Former Chairman, President & Chief Executive Officer

Charter One Bank

2004

Chair of Risk Committee

Member of Audit Committee

Robert D. Matthews, Jr.

Vice Chairman, Commercial Banking

Citizens Financial Group, Inc.

2009

Shivan S. Subramaniam

Chairman & Chief Executive Officer

FM Global

2005

Chair of Nominating and Corporate Governance Committee

Member of Risk Committee; Executive Committee

Wendy A. Watson

Former Executive Vice President, Global Services

State Street Bank & Trust Company

2010

Chair of Audit Committee

Member of Risk Committee; Compensation and Human Resources

Committee

Marita Zuraitis

Director, President & CEO

The Horace Mann Companies

2011

Member of Risk Committee

Well respected and accomplished Board of Directors

25 |

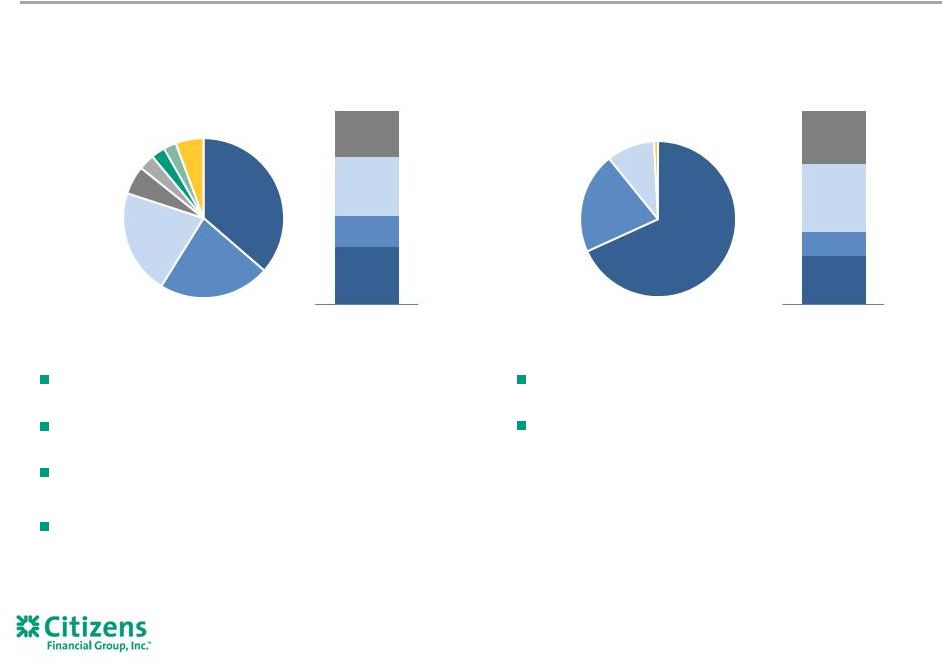

Diversified and

granular loan mix $52.2 billion

3Q14

Consumer

Banking

segment

portfolio

(1)

1)

Includes loans and leases (other than loans held for sale) from our Other portfolio allocated

by product class according to our risk management system. 2)

Includes owner-occupied commercial real estate.

$38.5 billion

3Q14

Commercial

Banking

segment

portfolio

(1)

Other

Mid-

Atlantic

Midwest

New England

30%

16%

(2)

Home Equity –

average FICO of 763 and average loan-to-

value of 66% on the Core portfolio

Mortgage –

average FICO of 762 and 65% average loan-to-

value on the Core portfolio

Auto Finance –

finance for purchase only, no leasing

–

6,687 dealers across 43 states; average FICO of 752

Student Lending –

94% of Trufit loans co-signed with average

portfolio FICO of 774

Within Citizens footprint focused on Middle Market,

Government Banking, Not-for-Profit and Professional

National mandate for Asset Finance, Business Capital,

Commercial Real Estate, Franchise Finance, Healthcare,

Technology and MidCorporate

26

Home

equity

Indirect auto

Residential

mortgage

Business banking

Education finance

Credit cards

Other

30%

24%

Non-core

Leases

C&I

CRE

Other

Mid-

Atlantic

Midwest

New England

25%

13%

35%

27%

Non-core

36%

22%

21%

6%

3%

3%

3%

6%

3Q14

68%

21%

10%

1%

3Q14 |

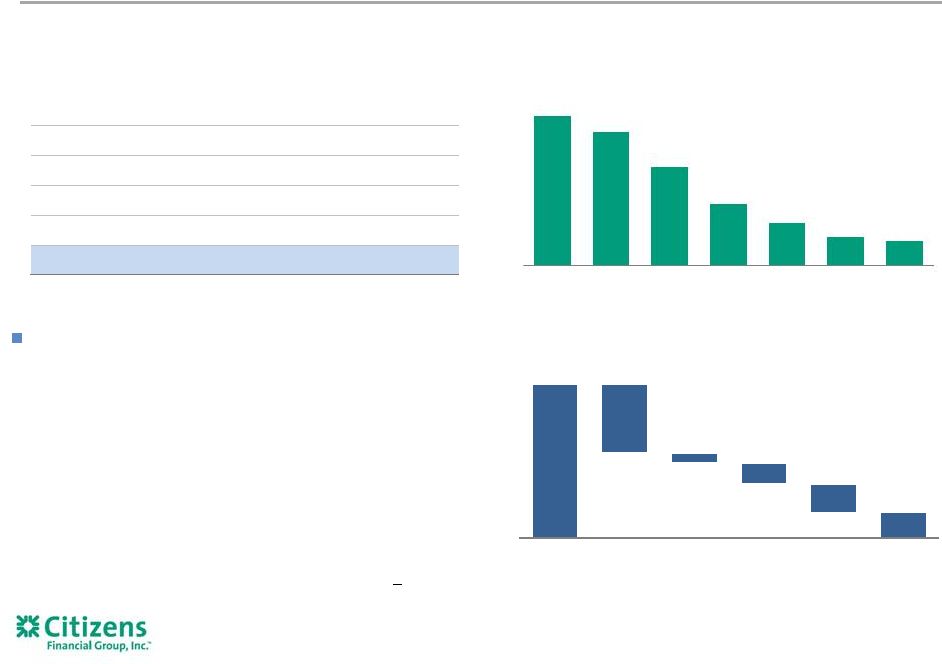

Non-core

portfolio significantly reduced Serviced by others home equity portfolio

(1)

$1.9

Other consumer real estate

0.6

Student lending

0.4

Commercial real estate

0.3

Commercial loans

0.1

Non-Core

$3.3

$20.5 billion of assets identified as Non-Core in June 2009

–

Balance has declined 43% from start of 2013

–

~4% of total loan and lease portfolio

–

57% related to out-of-footprint home equity Serviced By

Others (“SBO”) portfolio

–

69% home equity loans and 31% HELOC

–

SBO portfolio accounted for 2% of total loans as of

3Q14, but contributed over 14% of YTD charge-offs

–

Over

60%

of

SBO

loans

have

a

FICO

score

>

700

Non-core end of period assets

$s in billions as of 3Q14

Non-core end of period assets

$s in billions

Drivers of non-core asset reduction

$s in billions

Note: Data above was sourced from CFG’s risk systems and may not reconcile with other

disclosures due to differences in accounting methodology or the way the information is

captured. 1)

Portion of portfolio now serviced by Citizens.

$20.5

$3.3

$9.3

$1.3

$2.8

$3.8

Jun-09

Pay downs

Sales

Transfers to

Core

Net

Charge-offs

3Q14

27

$20.5

$18.3

$13.5

$8.4

$5.7

$3.8

$3.3

Jun-09

2009

2010

2011

2012

2013

3Q14 |

Loan-to-value

FICO

Lien position

Lien position

FICO

Loan-to-value

<649

650-699

700-749

750-799

800+

<70%

90-100%

600-649

650-699

700-749

750-799

800+

<600

100%+

80-89%

71-79%

<70%

2nd

1st

2nd

1st

71-79%

80-89%

3Q14 home equity originations of $1.1 billion

HELOC originations had a weighted-average

FICO score of 788, and a weighted-average

CLTV of 64%

Between October 2014 –

December 2017 $5.0

billion of the HELOC portfolio is at risk for

payment shock

83% of the payment shock population has a

FICO score greater than 740 or an LTV of

80% or lower

3Q14 YTD performance is strong, 95%

current or refinanced/paid off, 4% past due

and 1% charged off

3Q14 $15.5 billion HELOC

3Q14 $3.9 billion HELOAN

Core home equity portfolio

(1)

28

1)

Excludes serviced by other portfolio.

Highlights

100%+

90-100% |

Non-GAAP

financial measures 29

This document contains non-GAAP financial measures. The table below presents

reconciliations of certain non-GAAP measures to the most directly comparable measures.

These Non-GAAP measures exclude discontinued operations, goodwill impairment,

restructuring charges and/or special items, which are usually included, where applicable, in

the financial results presented in accordance with GAAP. Special items include regulatory

expenses, and expenses relating to our initial public offering and other expenses or

income. All references to “Adjusted” results are Non-GAAP financial measures.

These measures exclude restructuring charges and special items.

The non-GAAP measures set forth below include “noninterest income”, “net

interest income”, “total revenue”, “noninterest expense”, “net income (loss)”, “income tax expense

(benefit)”, “service charges and fees”, “card fees”, “trust

& investment services fees”, and “securities gains, other income, and estimated Chicago Divestiture fees”. In addition,

we present computations for “return on average tangible common equity”, “return

on average total tangible assets” and “efficiency ratio” as part of our non-GAAP measures.

We believe these non-GAAP measures provide useful information to investors because these

are among the measures used by our management team to evaluate our operating

performance and make day-to-day operating decisions. In addition, we believe goodwill impairment, restructuring charges and special items in any period do not

reflect the operational performance of the business in that period and, accordingly, it is

useful to consider these line items with and without goodwill impairment, restructuring

charges and special items. We believe this presentation also increases comparability of period-to-period results.

We also consider pro forma capital ratios defined by banking regulators but not effective at

each period end to be non-GAAP financial measures. Since analysts and banking

regulators may assess our capital adequacy using these pro forma ratios, we believe they are

useful to provide investors the ability to assess our capital adequacy on the same

basis.

Other companies may use similarly titled non-GAAP financial measures that are calculated

differently from the way we calculate such measures. Accordingly, our non-GAAP

financial measures may not be comparable to similar measures used by other companies. We

caution investors not to place undue reliance on such non-GAAP measures, but

instead to consider them with the most directly comparable GAAP measure. Non-GAAP

financial measures have limitations as analytical tools, and should not be considered in

isolation, or as a substitute for our results as reported under GAAP. |

30

Non-GAAP reconciliation table

$s in millions, except per share data

2011

2013

YTD 2014

Noninterest income, excluding special items:

Noninterest income (GAAP)

A

$1,711

$1,632

$1,339

Less: Special items

-

-

288

Noninterest income, excluding special items (non-GAAP)

B

$1,711

$1,632

$1,051

Total revenue, excluding special items:

Total revenue (GAAP)

C

$5,031

$4,690

$3,800

Less: Special items

-

-

288

Total revenue, excluding special items (non-GAAP)

D

$5,031

$4,690

$3,512

Noninterest expense, excluding restructuring charges and special items:

Noninterest expense (GAAP)

E

$3,371

$7,679

$2,568

Less: Restructuring charges and special expense items

HH

65

4,461

136

Noninterest expense, excluding restructuring charges and special items (non-GAAP)

F

$3,306

$3,218

$2,432

Noninterest expense, excluding goodwill impairment

Noninterest expense (GAAP)

E

$3,371

$7,679

$2,568

Less: Goodwill impairment (GAAP)

-

4,435

-

Noninterest expense, excluding goodwill impairment (non-GAAP)

N

$3,371

$3,244

$2,568

Net income (loss), excluding goodwill impairment

Net income (loss) (GAAP)

G

$506

($3,426)

$668

Add: Goodwill impairment, net of income tax benefit (GAAP)

-

4,080

-

Net income (loss), excluding goodwill impairment (non-GAAP)

M

$506

$654

$668

Net income (loss), excluding restructuring charges and special items:

Net income (loss) (GAAP)

G

$506

($3,426)

$668

Add: Restructuring charges and special items, net of income tax expense (benefit)

42

4,097

(95)

Net income (loss), excluding restructuring charges and special items (non-GAAP)

H

$548

$671

$573

Return on average tangible common equity excluding goodwill impairment; return on average

tangible common equity excluding goodwill impairment, restructuring charges and special

items: Average common equity (GAAP)

I

$23,137

$21,834

$19,463

Less: Average goodwill (GAAP)

11,311

9,063

6,876

Less: Average other intangibles (GAAP)

15

9

7

Add: Average deferred tax liabilities related to goodwill (GAAP)

295

459

368

Average tangible common equity (non-GAAP)

J

$12,106

$13,221

$12,948

Return on average tangible common equity (non-GAAP)

G/J

4.2%

-25.9%

6.9%

Return on average tangible common equity excluding goodwill impairment (non-GAAP)

M/J

4.2%

4.9%

6.9%

Return on average tangible common equity, excluding goodwill impairment, restructuring charges

and special items (non-GAAP)

H/J

4.5%

5.1%

5.9%

Return on average total tangible assets excluding goodwill impairment

Average total assets (GAAP)

K

$128,344

$120,866

$126,598

Less: Average goodwill (GAAP)

11,311

9,063

6,876

Less: Average other intangibles (GAAP)

15

9

7

Add: Average deferred tax liabilities related to goodwill (GAAP)

295

459

368

Average tangible assets (non-GAAP)

L

$117,313

$112,253

$120,083

Return on average total tangible assets excluding goodwill impairment (non-GAAP)

M/L

0.4%

0.6%

0.7%

Efficiency ratio excluding goodwill impairment; efficiency ratio excluding goodwill impairment,

restructuring charges and special items:

Net interest income (GAAP)

$3,320

$3,058

$2,461

Add: Noninterest income (GAAP)

1,711

1,632

1,339

Total revenue (GAAP)

P

$5,031

$4,690

$3,800

Efficiency ratio

E/P

67%

164%

68%

Efficiency ratio, excluding goodwill impairment, restructuring charges and special items

(non-GAAP) F/D

66%

69%

69% |

31

Non-GAAP reconciliation table

$s in millions, except per share data

3Q13

4Q13

1Q14

2Q14

3Q14

Net interest income, excluding estimated Chicago Divestiture impact:

Net interest income (GAAP)

$770

$779

$808

$833

$820

Less: estimated Chicago Divestiture Impact

13

13

13

13

—

Net interest income, excluding estimated Chicago Divestiture impact (non-GAAP)

$757

$766

$795

$820

$820

Noninterest income, excluding special items:

Noninterest income (GAAP)

A

$383

$640

$341

Less: Special items - Chicago gain

—

288

—

Noninterest income, excluding special items (non-GAAP)

B

$383

$352

$341

Service charges and fees, excluding estimated Chicago Divestiture fees:

Service charges and fees

$163

$152

$139

$147

$144

Less: estimated Chicago Divestiture fees

6

6

6

6

—

Service charges and fees, excluding estimated Chicago Divestiture fees (non-GAAP)

$157

$146

$133

$141

$144

Card fees, excluding estimated Chicago Divestiture fees:

Card fees

$63

$58

$56

$61

$58

Less: estimated Chicago Divestiture fees

3

3

3

3

—

Card fees, excluding estimated Chicago Divestiture fees (non-GAAP)

$60

$55

$53

$58

$58

Trust and investment services fees, excluding estimated Chicago Divestiture fees:

Trust and investment services fees

$39

$40

$39

$42

$39

Less: estimated Chicago Divestiture fees

2

2

2

2

—

Trust and investment services fees, excluding estimated Chicago Divestiture fees

(non-GAAP) $37

$38

$37

$40

$39

Other income, securities gains and estimated Chicago Divestiture fees:

Other income

$37

$42

$39

$40

$29

Add: securities gains

25

25

25

—

2

Add: estimated Chicago Divestiture fees

11

11

11

11

—

Other income, securities gains and estimated Chicago Divestiture fees (non-GAAP)

$73

$78

$75

$51

$31

Total revenue, excluding special items:

Total revenue (GAAP)

C

$1,153

$1,473

$1,161

Less: Special items - Chicago gain

—

288

—

Total revenue, excluding special items (non-GAAP)

D

$1,153

$1,185

$1,161

Noninterest expense, excluding restructuring charges and special items:

Noninterest expense (GAAP)

E

$788

$818

$948

$810

Less: Restructuring charges and special expense items

HH

—

26

115

21

Noninterest expense, excluding restructuring charges and special items (non-GAAP)

F

$788

$792

$833

$789

Net income (loss), excluding restructuring charges and special items:

Net income (loss) (GAAP)

G

$144

$313

$189

Add: Restructuring charges and special items, net of income tax expense (benefit)

—

(108)

13

Net income (loss), excluding restructuring charges and special items (non-GAAP)

H

$144

$205

$202

Return on average tangible common equity and return on average tangible common equity, excluding

restructuring charges and special items: Average common equity (GAAP)

I

$19,627

$19,364

$19,370

$19,607

$19,411

Less: Average goodwill (GAAP)

6,876

6,876

6,876

6,876

6,876

Less: Average other intangibles (GAAP)

9

8

7

7

6

Add: Average deferred tax liabilities related to goodwill (GAAP)

325

342

351

369

384

Average tangible common equity (non-GAAP)

J

$13,067

$12,822

$12,838

$13,093

$12,913

Return on average tangible common equity, excluding restructuring charges and special items

(non-GAAP) H/J

4.34%

5.24%

5.24%

6.28%

6.22%

Net interest income (GAAP)

$770

$833

$820

Add: Noninterest income (GAAP)

383

640

341

Total revenue (GAAP)

C

$1,153

$1,473

$1,161

Efficiency ratio, excluding restructuring charges and special items (non-GAAP)

F/D

68%

70%

68%

Total revenue, excluding restructuring charges and special items (non-GAAP)

D

$1,153

$1,185

$1,161

Less: Noninterest expense, excluding restructuring charges and special items

(non-GAAP) F

788

833

789

Pre-provision profit, excluding restructuring charges and special items (non-GAAP)

CC

$365

$352

$372

Income before income tax expense (benefit), excluding restructuring charges and special items

Income before income tax expense (benefit) (GAAP)

DD

$220

$476

$274

Less: Income before income tax expense (benefit) related to restructuring charges and special

items (GAAP) —

173

(21)

Income before income tax expense (benefit), excluding restructuring charges and special items

(non-GAAP) EE

$220

$303

$295

Income tax expense (benefit), excluding restructuring charges and special items:

Income tax expense (benefit) (GAAP)

FF

$76

$163

$85

Less: Income tax (benefit) related to restructuring charges and special items (GAAP)

—

65

(8)

Income tax expense (benefit), excluding restructuring charges and special items

(non-GAAP) GG

$76

$98

$93

Earnings per shares - diluted, excluding restructuring charges and special items

Average common shares outstanding - diluted (GAAP)

JJ

559,998,324

559,998,324

560,243,747

Earnings per shares - diluted, excluding restructuring charges and special items

(non-GAAP) H/JJ

$0.26

$0.37

$0.36

Return on average total tangible assets excluding restructuring charges and special items:

Average total assets (GAAP)

KK

$117,386

$127,148

$128,691 |

32 |