Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Avaya Holdings Corp. | d784146dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on December 5, 2014

Registration No. 333-174801

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 7

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AVAYA HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 3661 | 26-1119726 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

4655 Great America Parkway

Santa Clara, California 95054

(908) 953-6000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Amy Fliegelman Olli

Senior Vice President and General Counsel

Avaya Holdings Corp.

4655 Great America Parkway

Santa Clara, California 95054

(908) 953-6000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Julie H. Jones, Esq. Thomas Holden, Esq. Ropes & Gray LLP |

Daniel J. Zubkoff, Esq. Douglas S. Horowitz, Esq. Cahill Gordon & Reindel LLP 80 Pine Street New York, NY 10005 Telephone (212) 701-3000 Fax (212) 269-5420 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued December 5, 2014

Shares

COMMON STOCK

Avaya Holdings Corp. is offering shares of its common stock. This is the initial public offering of shares of our common stock and no public market currently exists for our shares. We expect the initial public offering price of our common stock to be between $ and $ per share.

After the completion of this offering, funds affiliated with our Sponsors (as defined herein) will continue to own a majority of the voting power of our outstanding common stock. As a result, we expect to be a “controlled company” within the meaning of the corporate governance standards of the New York Stock Exchange. See “Principal Stockholders.”

We have applied to list our common stock on the New York Stock Exchange under the symbol “AVYA.”

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 18.

PRICE $ A SHARE

| Public Offering Price |

Underwriting |

Proceeds to Avaya | ||||

| Per Share |

$ | $ | $ | |||

| Total |

$ | $ | $ |

We have granted the underwriters the right to purchase up to an additional shares of common stock for a period of 30 days.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on , 2014.

| MORGAN STANLEY | GOLDMAN, SACHS & CO. | J.P. MORGAN |

| CITI | DEUTSCHE BANK SECURITIES | |

| BofA MERRILL LYNCH | BARCLAYS UBS INVESTMENT BANK | CREDIT SUISSE | ||

, 2014

Table of Contents

Table of Contents

Table of Contents

Table of Contents

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we file with the Securities and Exchange Commission, or the SEC. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

Until , (25 days after the commencement of this offering), all dealers that buy, sell or trade shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

For investors outside the United States: we have not and the underwriters have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

When we use the terms “we,” “us,” “our,” “Avaya” or the “Company,” we mean Avaya Holdings Corp., a Delaware corporation, and its consolidated subsidiaries, including Avaya Inc., our principal U.S. operating subsidiary, taken as a whole, unless the context otherwise indicates.

Avaya Aura®, AvayaLive, Avaya Scopia® and other trademarks or service marks of Avaya are the property of Avaya Holdings Corp. and/or its affiliates. This prospectus also contains additional tradenames, trademarks or service marks belonging to us and to other companies. We do not intend our use or display of other parties’ trademarks, tradenames or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the “Risk Factors” section of this prospectus and our Consolidated Financial Statements and related notes appearing at the end of this prospectus, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from the results discussed in the forward-looking statements as a result of certain factors, including those set forth in “Risk Factors” and “Special Note Regarding Forward-Looking Statements.”

Our Company

Avaya is a leading provider of contact center, unified communications and networking products and services designed to help enterprise and midmarket businesses increase workforce productivity, customer engagement, and customer lifetime value, with the ultimate objective of higher revenue and profitability for our customers. Through September 30, 2014, we had over 300,000 customers, including over 95% of the Fortune 500, with installations in over one million customer locations worldwide.

Our products and services portfolio spans software, hardware, professional and support services, and cloud services. These fall under three reporting segments:

| • | Global Communications Solutions, or GCS, encompass all of our real-time collaboration, contact center and unified communications software and hardware. Unified communications integrates real-time communication services including telephony, e-mail, instant messaging and video. Examples in GCS include audio conferencing systems; mobile video software, software that runs contact center operations such as call routing; software that enables mobile access to the company network for employees; and hardware such as phones, gateways, and servers. This reporting segment also includes a development platform, which allows our customers and third parties to adapt our technology by creating custom applications, workflows, and environments for their unique needs and allows them to integrate Avaya’s capabilities into their existing infrastructure. GCS also includes cloud-supporting software and hardware products, which make it possible to use our contact center and unified communications products via the cloud. |

| • | Avaya Networking includes our advanced fabric networking technology which offers a virtualized network designed to be simple to deploy, agile and resilient. This reporting segment also includes products such as Ethernet switches and routers; wireless networking; and access control products that enforce role- and policy- based access to the network. Our fabric networking technology is flexible and extensible to legacy network systems, which gives customers the option to upgrade to new contact center and unified communications technology while maintaining their existing infrastructure, if desired. |

| • | Avaya Global Services, or AGS, includes professional and support services designed to help our customers maximize the benefits of using our products and technology. Our services include support for implementation, deployment, monitoring, troubleshooting, optimization, and more. This reporting segment also includes our cloud and managed services, which enable customers to take advantage of our technology in a private, hybrid, or public cloud environment. The majority of our revenue in this reporting segment is recurring in nature, based on multi-year services contracts. |

With our products and services, packaged as solutions, we can address the needs of a diverse range of customers, including large multinational enterprises, small and medium-sized businesses, and government organizations. Our customers operate in a broad range of industries, including financial services, manufacturing, retail, transportation, energy, media and communications, healthcare, education and government. We employ a

1

Table of Contents

flexible go-to-market strategy with direct or indirect presence in over 160 countries. As of September 30, 2014, we had approximately 10,800 channel partners and for fiscal 2014, our product revenue from indirect sales through our channel partners represented approximately 75% of our total product revenue.

For fiscal 2014 and 2013, we generated revenue of $4,371 million and $4,578 million, respectively. For fiscal 2014, our total revenue was evenly split between product revenue and services revenue. For fiscal 2013, product revenue represented 51% of our total revenue and services revenue represented 49%. Revenue generated in the United States for fiscal 2014 and 2013 represented 52% and 53% of our total revenue, respectively. For fiscal 2014 and 2013 we had operating income from continuing operations of $197 million and $144 million, respectively. For fiscal 2014 and 2013, we had Adjusted EBITDA of $898 million and $922 million, respectively. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations: EBITDA and Adjusted EBITDA” for a definition and explanation of Adjusted EBITDA and a reconciliation of net loss to Adjusted EBITDA.

Industry Background

As enterprise and midmarket businesses increasingly seek to improve customer experience and team engagement through the quality and efficiency of contact center and unified communications, they are confronted with several industry trends presenting emerging and varied challenges. We believe the most forceful among these trends are:

| • | the increasing mobility of the workforce; |

| • | shifting priorities of C-level business decision makers, including an increased preference for software-defined networking (SDN, or network virtualization), cloud delivery of applications, and management of multiple and varied devices, all of which must be handled with the security the business demands; |

| • | increasing demand for IT purchases under operating expense models over capital expense models; and |

| • | the rise of omni-channel customer service involving multiple modes of communications. |

We believe that the total available market for customer and team engagement solutions includes spending on unified communications, contact center applications and networking infrastructure equipment, as well as spending on one-time and recurring professional, managed/cloud, and support services to implement, maintain and manage these tools. We believe that in 2015, the portion of these markets that Avaya serves will have grown to approximately $60 billion of vendor spending, with approximately $36 billion of that amount coming from enterprises having 5,000 or more employees. In aggregate, we see unified communications accounting for $16 billion, contact center accounting for $4 billion, data networking infrastructure accounting for $18 billion and support, managed/cloud and professional recurring services accounting for the remaining $22 billion. These markets are impacted positively by the need for enterprises to increase productivity and upgrade their unified communications strategy to a more integrated approach, accounting for mobility, varied devices, and multiple communications channels. In response to this need, industry analysts expect that from 2014 through 2017 aggregate spending on unified communications, contact center, data networking and support, managed/cloud and professional services will grow.

Furthermore, the midmarket, which we define as companies with fewer than 5,000 employees, is a growing opportunity for Avaya’s products and services. We believe our communications market opportunity for the portion of the midmarket segment which Avaya serves is approximately $24 billion. Not only do we believe this segment is growing, but we believe it is underserved and willing to invest in IT enhancements. Avaya has a set of offerings that are specifically designed to address the needs of midmarket businesses, built around our Avaya IP Office, software and hardware designed to simplify processes and streamline information exchange within companies. It lets midmarket companies deliver a collaboration experience that integrates voice, video, and mobile device communications, at price points affordable to midmarket businesses.

2

Table of Contents

Our Solutions

We aim to be the leader in our industry in addressing the resulting customer needs and priorities in light of industry trends and emerging challenges. We have invested in open, mobile enterprise communication and collaboration platforms and are well poised to serve a broad range of needs, from servicing old phone systems to deploying leading edge call center technology via the cloud. While we remain committed to our legacy capabilities and the customers who rely on them, in the past several years we have also responded to the emerging landscape by evolving our market and product approach in three important ways.

| • | We have invested in research and development and new technologies to develop and provide more comprehensive contact center, unified communications, and networking products and services, continuing our focus on the enterprise while expanding the value we can provide to midmarket customers. |

| • | We have evolved our product design philosophy, anticipating demand for products that are cloud- and mobile- enabled. We also design our products to be flexible, extensible, secure and reliable. This allows our customers to transition from old communications and collaboration technology to newer technology in a way that is manageable and cost-effective. |

| • | We have increased our focus on packaging our products and services into “solutions” including Customer Engagement Solutions, Team Engagement Solutions and Networking Solutions. |

Avaya’s solutions are combinations of our products and services designed to help our customers address their customer and team engagement needs, before, during and after any transition they may make to a mobile- and cloud-enabled communications environment. We believe our unified communications, contact center, and networking technology can increase productivity and profitability for businesses of all sizes.

Customer Engagement Solutions

Our Customer Engagement Solutions are designed to facilitate long-lasting and successful relationships between companies and their customers. The objective is to increase customer lifetime value, revenue, and profitability for our customers – even as they evolve to integrate more communications channels and mobile devices into their customer service strategies. These solutions are predominately made up of our contact center products and services, and supported by our networking technology and development environment. Some of the benefits of Avaya Customer Engagement Solutions include:

| • | Improved customer experience: As businesses increasingly compete on customer experience, we offer products and services designed to incorporate multiple channels of communication, improve customer satisfaction and retention; increase referrals and customer acquisition; and increase cross-sell and upsell opportunities. For example, our intelligent routing and multi-modal integration software can help an enterprise or midmarket business deliver a seamless ongoing conversation with a customer, even if that conversation includes interactions by phone, chat, email, and social media. Our products and services are designed to drive consistency and increased satisfaction across touch points and enable better measurement of customer experience data for dispersion to other business units. |

| • | Contact center efficiency: We believe the contact center is at the heart of a successful customer engagement solution because it is a primary channel of communication between the customer and businesses, even as modes of contact expand to include social media, chat, and mobile apps. Our products and services are designed to help our customers achieve contact center efficiency through automation, by reducing operational costs and staffing impacts, eliminating resource constraints caused by repetitive requests and manual processes, and ensuring service level agreements as well as compliance requirements. For example, we might deploy our contact center platform with intelligent call routing and contact flow analytics software to help a customer better manage volume fluctuations and better match contact center resources to customer needs in real-time. |

3

Table of Contents

| • | Revenue growth: Our solutions are designed to help our customers increase revenue through stronger and longer lasting customer relationships. We believe our solutions address this challenge by reducing complexity within the contact center and facilitating better sell-through, sell-in and sell-up performance. For example, we might deploy our Avaya Customer Experience Portal with software for proactive consumer outreach, to help a customer increase the efficiency and effectiveness of increasing repeat purchases and order sizes, while allowing the customer’s end-consumer to use his or her preferred communications channel for the interaction. |

Team Engagement Solutions

Avaya Team Engagement Solutions are designed to offer businesses the simplicity of a single solution to address workforce communication and collaboration needs, including via mobile devices. These solutions are made up predominately of our real-time collaboration and unified communications products and services, and supported by our networking technology and development environment. Some of the benefits of Avaya Team Engagement Solutions include:

| • | Communications modernization: Avaya helps modernize communications ecosystems by centralizing, consolidating and virtualizing underlying technology infrastructures and making applications available via the cloud. This model is designed to account for mobile device usage, reduce total cost of ownership, or TCO, for the entire collaboration environment and allow firms to transition from a capital expenditure to operating expenditure model. For example, an Avaya private cloud solution can be implemented to integrate virtualized voice, email, video, messaging, chat and conferencing capabilities. This enables cloud access to communications tools for desk-based and remote workers and improves security, delivering TCO efficiencies and rapid payback. |

| • | Worker productivity: Our conferencing, messaging, and other unified communications products and services are designed to help our customers integrate products that equally support desk-workers, teleworkers, and frequent business travelers, thereby increasing the mobility and productivity of their workforce. Our customers are increasingly demanding that individual workers be able to communicate across device types, channels and geographic locations knowing that their devices, data and connections are reliable and secure. For example, our customers using the Avaya Session Border Control can securely extend the corporate unified communications capabilities to a remote user on a mobile device and to desk phones in their remote and home offices. |

| • | Team productivity: Our unified communications products and services are designed to help our customers improve team productivity by diminishing the complexity of team collaboration channels, enabling off-the-shelf and customizable application integration, providing omni-channel conferencing across audio, web, and video for room, desktop, and mobile platforms. It also provides the opportunity to simplify and expand by moving conferencing services into the cloud. For example, the Avaya Scopia platform can enable employees or remote workers to collaborate using high-definition, secure video conferencing accessed through on-premise conference rooms, desktop systems, and mobile devices. |

Networking Solutions

Our advanced fabric networking technology, based on open industry standards, is designed to deliver a virtualized network that is simple to deploy, agile to operate, and resilient. Many conventional networking technologies have complex architectures, layering protocols over protocols, making the network architecture fragile and significantly impeding the roll-out of real-time applications. Avaya’s Fabric Connect, our fabric networking technology, is designed to deliver the agility businesses need to focus on integrating customer and team engagement solutions into their existing IT infrastructures. Unified access and network virtualization capabilities form the foundation of Avaya Networking Solutions. Benefits include:

| • | Unified access: Our unified access solution is designed to securely extend both fixed and mobile “bring-your-own-device (BYOD)” policies and enable proactive provisioning, quality monitoring, and active application awareness and control. |

4

Table of Contents

| • | Network virtualization: Our network virtualization solutions are designed to optimize the physical network, decrease network complexity, eliminate complex protocols, and integrate security features for the safe segmentation of data. All of this is intended to accelerate application and user deployment. |

Our Competitive Strengths

We believe the following competitive strengths position us well to capitalize on the opportunities created by the market trends affecting our industry.

Leading position across our key end markets

We are a leader in business collaboration and communications, with leading market share in worldwide telephony systems1, contact center infrastructure2, voice maintenance services3 and enterprise messaging4, and a position in the Leader’s quadrant in each of Gartner’s Magic Quadrants for Corporate Telephony, Unified Communications and Contact Center Infrastructure5. Additionally, we believe we are a leading provider of cloud and managed services, which in fiscal 2014 grew revenues 19 percent over fiscal 2013 and has continued to be one of the fastest growing areas of our business. We also believe that our market leadership and our incumbent position within our customer base better enables us to cross-sell to existing customers and win new customers.

Open standards technology that supports multi-vendor environments

Our open standards-based technology is designed to accommodate customers with multi-vendor environments seeking to leverage existing investments. Providing enterprises with strong integration capabilities allows them to take advantage of new collaboration and contact center technology as it is introduced. It does not limit customers to a single vendor or add to the backlog of integration work. We also continue to invest in our developer ecosystem, Avaya DevConnect, which has grown to include over 24,000 members as of September 30, 2014. We believe Avaya DevConnect, together with our Agile Communication Environment, or ACE, toolkits, application programming interfaces, or APIs, and integration environments allow businesses to derive unique value from our architecture.

Leading service capabilities tied to a large recurring revenue stream

Avaya Global Services, or AGS, is a leading provider of recurring support services relating to business collaboration and communications products. Our worldwide services-delivery infrastructure and capabilities help

| 1 | Dell’Oro Group, Enterprise Telephony Report, 4Q13, March, 2014 |

| 2 | Gartner Inc. Market Share, Contact Center: Worldwide, 2013, Drew Kraus, 2014. Gartner ranks Avaya the leader in Contact Center Agent End-User Revenue by Manufacturer, Worldwide in 2013. |

| 3 | IntelliCom Analytics, Services Market Dashboard, Q4 2013 Global Lifecycle Services Market Workbook, June 2014. |

| 4 | T3i Group, InfoTrack for converged Applications, Messaging Systems Shipments, Revenue &Market Share Details, Full Year 2013, June 2014. |

| 5 | Gartner Magic Quadrants-Gartner Magic Quadrant for Corporate Telephony, Sorell Slaymaker, et al, October, 2014. |

- Gartner Magic Quadrant for Unified Communications, Bern Elliot et al, August 2014.

- Gartner Magic Quadrant for Contact Center Infrastructure, Drew Kraus, et al, May 2014.

Gartner, Inc. (Gartner) does not endorse any vendor, product or service depicted in our research publications, and does not advise technology users to select only those vendors with the highest ratings. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

The Gartner Report(s) described herein, (the Gartner Report(s)) represent(s) data, research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. (Gartner), and are not representations of fact. Each Gartner Report speaks as of its original publication date (and not as of the date of this prospectus) and the opinions expressed in the Gartner Report(s) are subject to change without notice.

5

Table of Contents

customers address critical business collaboration and communications needs from initial planning and design through implementation, maintenance and day-to-day operation, monitoring and troubleshooting. We believe AGS is uniquely positioned as a result of close collaboration between our R&D and service planning teams in advance of new products being released. Customers can use “Ava”, our virtual agent, to get immediate answers online. They can also connect with one of our experts via web chat, web talk, or web video. Avaya Global Services can also directly access our research and development teams when necessary to quickly resolve customer issues. These capabilities allow Avaya to provide quality service for Avaya products.

In addition, AGS delivers cloud and managed services with a focus on customer performance and growth. These services can range from managing software releases to operating customer communication systems to helping customers migrate to next-generation business collaboration and communications environments. We believe that our deep understanding of application management supporting unified communications, contact center, video and networking uniquely position us to best manage and operate cloud-based communications systems for our customers.

Our service delivery is most often provided to customers through recurring contracts. In fiscal 2014, we generated 50% of our revenues from services with over 80% of service revenues from recurring contracts. Recurring contracts for support services typically have terms that range from one to five years, and contracts for cloud and managed services typically have terms that range from one to seven years. In fiscal 2014, the U.S. accounted for approximately 64% of our support revenue, with contract renewal rates of more than 83%. We believe our services relationships have provided us with a large recurring revenue base and significant visibility into our customers’ future collaboration needs.

Lower total cost of ownership (TCO)

Many vendors try to address customer demands by layering on more architectures and protocols. In the process, they frequently sacrifice simplicity, flexibility and total cost of ownership. In contrast, our products and services are specifically designed to address these needs - typically with less hardware - without sacrificing performance. We believe our product performance, deployment methods, and networking technology contribute to a lower total cost of ownership for customer and team engagement solutions.

Large, diverse and global customer installed base

Our products and services address the needs of a diverse range of customers from large multinational enterprises to small and medium-sized businesses in various industries, including financial services, manufacturing, retail, transportation, energy, media and communications, health care, education and government. Through September 30, 2014, we had over 300,000 customers, including over 95% of the Fortune 500 with installations in over one million customer locations worldwide. We believe our large and diverse customer base provides us with recurring revenue and the opportunity to further expand within our customer base.

Our Growth Strategy

We believe we are well-positioned worldwide and have a multi-faceted strategy to be a leading provider in delivering engagement and networking solutions.

Expand our cloud offerings and capabilities

In our experience, technology and business leaders are increasingly turning to cloud-based technologies and business models that allow enterprises to cut costs, increase productivity, simplify IT environments, and shift when possible to usage-based operating expense models.

6

Table of Contents

Avaya’s technologies that make up our Customer Engagement, Team Engagement, and Networking solutions are designed to be available both on-premise and as a cloud-based service to meet these demands.

Increase mobility offerings to customers

As global workforces change and demand mobile engagement solutions, we intend to meet these demands. For example, the Avaya Aura Platform is designed to support mobility, providing dynamic access to applications and services based on need, not location.

Invest in open standards and product differentiation and innovation

As potential customers look to migrate to our products and services, our open architecture can integrate with competitor systems and provide a path for gradual transition while still achieving cost savings and improved functionality. Our Fabric Networking technology is fundamental to this approach. Fabric networking represents a strong growth area for Avaya, as fabric networking deployments gain momentum.

During fiscal 2014, we delivered a total of 114 new product releases, which is more than 10% above the level from fiscal 2013. We also expect to continue to make investments in product innovation and research and development across the portfolio to create enhancements and breakthroughs. We believe this will encourage customers to upgrade their products more frequently. We also plan to continue to embrace the cloud computing and mobility opportunities, and to seek new ways to leverage the Virtual Desktop Integration, or VDI, trend to securely deliver business collaboration to users.

Increase our midmarket offerings, capabilities, and market share

We believe our communications market opportunity for the portion of the midmarket segment which Avaya serves is approximately $24 billion. We define the midmarket as firms with fewer than 5,000 employees. Not only do we believe this segment is growing, but we believe midmarket businesses are underserved and willing to invest in IT enhancements. With the most recent version of our IP Office product, version 9.0, we developed our first complete offering specifically tailored to the needs of midmarket businesses. We believe this offering increases the value we can provide to midmarket businesses and creates an opportunity for market share gain. During fiscal 2014, we made over 300 new strategic hires to key front line sales, specialist, and support roles to increase reach and accelerate our growth, particularly in the midmarket. We intend to continue to invest in our midmarket offerings and go-to-market resources to increase market share and meet the growing demands of this segment.

Increase sales to existing customers and pursue new customers

We believe that we have a significant opportunity to increase our sales to our existing customers by offering new solutions from our diverse product portfolio, including cloud, mobility, and networking solutions. This ability is supported by our market leadership, global scale and extensive customer interaction, including at the C-suite, and creates a strong platform from which to drive and shape the evolution of enterprise communications toward greater business collaboration. Our track record with our customers gives us the credibility that we believe provides us with a competitive advantage in helping them cope with this evolution.

Invest in sales and distribution capabilities

Our flexible go-to-market strategy, which consists of both a direct sales force and approximately 10,800 channel partners (as of September 30, 2014), allows us to reach customers across industries and around the globe while allowing them to interact with Avaya in a way that fits their organization. We intend to continue investing in our channel partners and sales force to optimize their market focus, enter new geographies and provide our channel partners with training, marketing programs, and technical support through our Avaya Connect program.

7

Table of Contents

We also leverage our sales and distribution channels to accelerate customer adoption and generate an increasing percentage of our revenue from our new high-value software products, data networking, video collaboration, midmarket offerings, and user experience-centric applications.

Expand margins and profitability

We have maintained our focus on profitability levels and implemented a number of cost savings initiatives. These initiatives, along with decreases in the amortization of acquired technology intangible assets, have contributed to improvements in our gross margin. Our gross margin has improved from 43.5% in fiscal 2010 to 57.2% in fiscal 2014. This improvement in gross margin along with other cost savings is also reflected in Adjusted EBITDA, a key metric management uses to evaluate the Company’s performance. Adjusted EBITDA as a percentage of revenues improved from 15.6% in fiscal 2010 to 20.5% in fiscal 2014. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations: EBITDA and Adjusted EBITDA” for a definition and explanation of Adjusted EBITDA and a reconciliation of loss from continuing operations to Adjusted EBITDA.

We expect to pursue additional cost reduction opportunities which are likely to be more targeted and may include increased automation of our processes, headcount attrition, actions to address unproductive assets, real estate consolidation, sales back office and front line skill transformations, and balancing our professional services structure. Having delivered substantial cost structure reductions over the past several years, we believe the opportunities for additional savings and execution of our growth strategy can result in further margin and profitability expansion.

Risks Associated with Our Company

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. These risks include, but are not limited to, the following:

| • | Our revenues are dependent on general economic conditions and the willingness of enterprises to invest in technology. The impact of economic conditions on the willingness of enterprises to make capital investments, particularly in business collaboration technology and related services can significantly affect our operating results and we believe that enterprises continue to be cautious about sustained economic growth. |

| • | The market opportunity for business collaboration products and services may not develop in the ways that we anticipate. The demand for our products and services can change quickly and in ways that we may not anticipate because the market in which we operate is characterized by rapid, and sometimes disruptive, technological developments, evolving industry standards, frequent new product introductions and enhancements, changes in customer requirements and a limited ability to accurately forecast future customer demand. |

| • | We are dependent on our intellectual property. As a leader in technology and innovation in business collaboration and communications, we are dependent on the maintenance of our current intellectual property rights and the establishment of new intellectual property rights. If we are not able to protect our intellectual property rights or if those rights are invalidated or circumvented, our business may be adversely affected. |

| • | Our degree of leverage could adversely affect our ability to raise additional capital to fund our operations and limit our ability to react to changes in the economy or our industry. Our degree of leverage could have important consequences, including making it more difficult for us to make payments on our indebtedness and increasing our vulnerability to general economic and industry conditions. |

8

Table of Contents

| • | We face formidable competition from providers of unified communications, contact center and networking products and services; as these markets evolve, we expect competition to intensify. In addition to the competition we face from traditional enterprise voice communications products and providers of technology related to business collaboration and contact center products and services, we expect competition to intensify and expand to include companies that do not currently compete directly against us. |

| • | The Sponsors have significant influence over corporate transactions. Following the completion of this offering, funds affiliated with TPG Global LLC, or, together with its affiliates, TPG, and Silver Lake Partners, or Silver Lake, which are collectively referred to as our Sponsors, will have the ability to control the outcome of matters submitted for stockholder approval and may have interests that differ from those of our other stockholders. |

| • | We expect to be a “controlled company” within the meaning of the rules of the New York Stock Exchange. After completion of this offering, the Sponsors will continue to control a majority of the voting power of our outstanding common stock. As a result, we will qualify for, and intend to rely on, exemptions from certain corporate governance requirements. |

Company Information and Corporate Structure

Our principal executive offices are located at 4655 Great America Parkway, Santa Clara, CA 95054. Our telephone number is (908) 953-6000. Our website address is www.avaya.com. Information contained in, and that can be accessed through, our website is not incorporated into and does not form a part of this prospectus.

Avaya Holdings Corp., formerly known as Sierra Holdings Corp., was incorporated under the laws of the State of Delaware on June 1, 2007 by affiliates of the Sponsors. The Sponsors, through a subsidiary holding company, acquired Avaya Inc., our principal U.S. operating subsidiary, and each of its subsidiaries in a merger transaction that was completed on October 26, 2007, which we refer to in this prospectus as the Merger. Despite the fact that Avaya Inc.’s obligation to file periodic and current reports with the SEC ended on October 1, 2010, it voluntarily files such reports with the SEC to comply with the terms of the indenture governing its senior secured notes. Avaya Holdings Corp. is a holding company with no stand-alone operations and has no material assets other than its ownership interest in Avaya Inc. and its subsidiaries. All of Avaya Holdings Corp.’s operations are conducted through its various subsidiaries, which are organized and operated according to the laws of their jurisdiction of incorporation, and consolidated by Avaya Holdings Corp.

As of September 30, 2014, our total outstanding indebtedness was $6,044 million (excluding capital lease obligations and $21 million of debt discount due upon settlement of our indebtedness), of which $5,035 million was attributable to financing associated with the Merger and $1,009 million was attributable to financing associated with the acquisition of the enterprise business solutions business of Nortel Networks Corporation in 2009. For a complete discussion of our financing see Note 10, “Financing Arrangements,” to our audited Consolidated Financial Statements included elsewhere in this prospectus.

9

Table of Contents

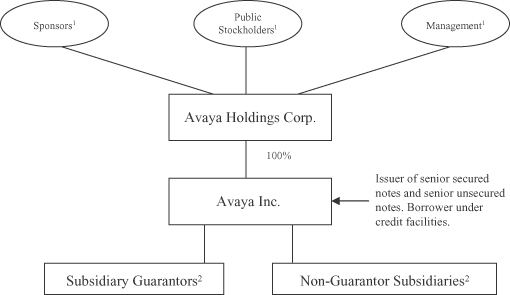

The following chart shows our organizational structure immediately following the consummation of this offering:

| (1) | Sponsors, public stockholders, and management, represents %, % and % of the total voting power in our company, respectively. |

| (2) | Substantially all of our domestic 100% owned subsidiaries as of September 30, 2014 guarantee our notes and our credit facilities. Other subsidiaries, including non-U.S. subsidiaries, do not guarantee our notes or our credit facilities. See “Description of Certain Outstanding Indebtedness” for more information. |

10

Table of Contents

THE OFFERING

| Common stock we are offering |

Shares | |

| Common stock to be outstanding after this offering |

Shares | |

| Option to purchase additional shares offered to underwriters |

Shares | |

| Use of proceeds |

We intend to use the net proceeds received by us in connection with this offering to pay certain amounts in connection with the termination of our management services agreement with affiliates of our Sponsors. | |

| We intend to use the remainder of the net proceeds, for working capital and other general corporate purposes, including repayment of a portion of our long-term indebtedness, the potential redemption of some or all of our Series A Preferred Stock and supporting our strategic growth opportunities in the future. | ||

| See “Use of Proceeds.” | ||

| Risk factors |

You should carefully read the “Risk Factors” section of this prospectus beginning on page 18 for a discussion of factors to consider carefully before deciding whether to purchase shares of our common stock. | |

| Proposed NYSE symbol |

“AVYA” | |

| Principal Stockholders |

Upon completion of this offering, the Sponsors will continue to beneficially own a controlling interest in us. As a result, we intend to avail ourselves of the “controlled company” exemption under the rules of the NYSE. | |

| In connection with this offering, in the event we decide to redeem some or all of our outstanding Series A Preferred Stock, the Sponsors will receive a total of up to $ million from the redemption of our outstanding Series A Preferred Stock held by them. In addition, we expect to pay management companies affiliated with the Sponsors a total of $ million in connection with the termination of our management services agreement with them pursuant to its terms. | ||

As of September 30, 2014, we had 489,459,943 shares of common stock outstanding. This excludes the following numbers of shares of our common stock issuable in connection with the exercise of warrants outstanding as of September 30, 2014, the conversion of our Series B Convertible Preferred Stock and equity awards under our Amended and Restated 2007 Equity Incentive Plan, or the 2007 Plan:

| • | 100,000,000 shares of common stock issuable upon the exercise of warrants held by affiliates of our Sponsors, which warrants are subject to the lock-up agreements described under “Underwriters” and |

11

Table of Contents

| exercisable at any time prior to December 18, 2019 at an exercise price of $3.25 per share (see “Description of Capital Stock—Warrants”); |

| • | 24,460,642 shares of common stock issuable upon the exercise of warrants held by affiliates of our Sponsors, which warrants are subject to the lock-up agreements described under “Underwriters” and exercisable at any time prior to May 29, 2022 at an exercise price of $4.00 per share (see “Description of Capital Stock—Warrants”); |

| • | shares of common stock issuable upon conversion of the Series B Convertible Preferred Stock held by affiliates of our Sponsors, and convertible at any time as such Series B Convertible Preferred Stock is outstanding at a conversion price equal to the lesser of (1) $4.00 per share (subject to certain anti-dilution provisions) or (2) the offering price per share in this offering, which shares if converted are subject to the lock-up agreements described under “Underwriters” (see “Description of Capital Stock—Preferred Stock—Series B Convertible Preferred Stock”); |

| • | 26,055,786 shares of common stock issuable upon the exercise of options with exercise prices ranging from $2.25 to $5.00 per share and a weighted average exercise price of $2.95 per share; |

| • | 16,172,848 shares of common stock issuable upon the vesting and distribution of restricted stock units, or RSUs; and |

| • | 4,530,864 additional shares of common stock as of September 30, 2014 reserved for future grants under the 2007 Plan. |

This also excludes additional shares of common stock reserved for future equity incentive plans to be effective upon the completion of this offering.

Unless otherwise indicated, all information in this prospectus:

| • | assumes the adoption of our amended and restated certificate of incorporation and our amended and restated bylaws to be effective upon the closing of this offering; |

| • | assumes no exercise by the underwriters of their option to purchase up to additional shares of our common stock in this offering; and |

| • | reflects, for all prior periods, a for reverse stock split of our common stock to be effected prior to the consummation of this offering. |

12

Table of Contents

SUMMARY HISTORICAL FINANCIAL DATA

Avaya Holdings Corp., was formed by affiliates of two private equity firms, Silver Lake Partners (“Silver Lake”) and TPG Capital (“TPG”) (collectively, the “Sponsors”). Avaya Holdings Corp., through a subsidiary holding corporation, acquired Avaya Inc. in a transaction that was completed on October 26, 2007 (the “Merger”) with Avaya Inc. continuing as the surviving entity and a wholly owned subsidiary of Avaya Holdings Corp. Avaya Holdings Corp. is a holding company and has no material assets or stand-alone operations other than the ownership in Avaya Inc. and its subsidiaries. See discussion in Note 1, “Description of Business,” to our audited Consolidated Financial Statements included elsewhere in this prospectus for further details.

The summary historical consolidated financial data set forth below as of September 30, 2014 and 2013 and for the years ended September 30, 2014, 2013 and 2012 have been derived from our audited Consolidated Financial Statements and related notes included elsewhere in this prospectus. The summary historical consolidated financial data set forth below as of September 30, 2012 and as of and for the years ended September 30, 2011 and 2010 has been derived from Consolidated Financial Statements that are not included in this prospectus.

The following summary should be read together with our Consolidated Financial Statements and the related notes appearing elsewhere in this prospectus and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this prospectus.

13

Table of Contents

| Fiscal years ended September 30, |

||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| (in millions, except per share amounts) | ||||||||||||||||||||

| STATEMENTS OF OPERATIONS DATA: |

||||||||||||||||||||

| REVENUE |

||||||||||||||||||||

| Products |

$ | 2,196 | $ | 2,337 | $ | 2,672 | $ | 2,976 | $ | 2,602 | ||||||||||

| Services |

2,175 | 2,241 | 2,347 | 2,398 | 2,300 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 4,371 | 4,578 | 5,019 | 5,374 | 4,902 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| COSTS |

||||||||||||||||||||

| Products: |

||||||||||||||||||||

| Costs (exclusive of amortization of acquired technology intangible assets) |

854 | 963 | 1,145 | 1,314 | 1,243 | |||||||||||||||

| Amortization of acquired technology intangible assets |

56 | 63 | 192 | 257 | 291 | |||||||||||||||

| Services |

962 | 1,022 | 1,134 | 1,214 | 1,237 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 1,872 | 2,048 | 2,471 | 2,785 | 2,771 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| GROSS PROFIT |

2,499 | 2,530 | 2,548 | 2,589 | 2,131 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| OPERATING EXPENSES |

||||||||||||||||||||

| Selling, general and administrative |

1,531 | 1,512 | 1,617 | 1,833 | 1,709 | |||||||||||||||

| Research and development |

379 | 445 | 464 | 461 | 407 | |||||||||||||||

| Amortization of acquired intangible assets |

227 | 228 | 227 | 227 | 219 | |||||||||||||||

| Restructuring and impairment charges, net |

165 | 200 | 147 | 189 | 187 | |||||||||||||||

| Acquisition-related costs |

— | 1 | 4 | 5 | 20 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 2,302 | 2,386 | 2,459 | 2,715 | 2,542 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| OPERATING INCOME (LOSS) |

197 | 144 | 89 | (126 | ) | (411 | ) | |||||||||||||

| Interest expense |

(459 | ) | (467 | ) | (432 | ) | (460 | ) | (487 | ) | ||||||||||

| Loss on extinguishment of debt |

(5 | ) | (6 | ) | — | (246 | ) | — | ||||||||||||

| Other income (expense), net |

3 | (25 | ) | (29 | ) | 5 | 15 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| LOSS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES |

(264 | ) | (354 | ) | (372 | ) | (827 | ) | (883 | ) | ||||||||||

| (Provision for) benefit from income taxes |

(51 | ) | 35 | 4 | (54 | ) | (4 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| LOSS FROM CONTINUING OPERATIONS |

(315 | ) | (319 | ) | (368 | ) | (881 | ) | (887 | ) | ||||||||||

| Income (loss) from discontinued operations, net of income taxes |

62 | (57 | ) | 14 | 18 | 16 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET LOSS |

(253 | ) | (376 | ) | (354 | ) | (863 | ) | (871 | ) | ||||||||||

| Less: net income attributable to noncontrolling interests |

— | — | — | — | 3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET LOSS ATTRIBUTABLE TO AVAYA HOLDINGS CORP. |

(253 | ) | (376 | ) | (354 | ) | (863 | ) | (874 | ) | ||||||||||

| Less: Accretion of issuance costs and accrued dividends on Series A and Series B preferred stock |

(45 | ) | (43 | ) | (71 | ) | (7 | ) | (62 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| NET LOSS ATTRIBUTABLE TO AVAYA HOLDINGS CORP. COMMON STOCKHOLDERS |

$ | (298 | ) | $ | (419 | ) | $ | (425 | ) | $ | (870 | ) | $ | (936 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic and diluted earnings per share attributable to common stockholders: |

||||||||||||||||||||

| Loss from continuing operations per share - basic and diluted |

$ | (0.73 | ) | $ | (0.74 | ) | $ | (0.90 | ) | $ | (1.82 | ) | $ | (1.95 | ) | |||||

| Income (loss) from discontinued operations per share - basic and diluted |

0.13 | (0.12 | ) | 0.03 | 0.04 | 0.03 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss per share - basic and diluted |

$ | (0.60 | ) | $ | (0.86 | ) | $ | (0.87 | ) | $ | (1.78 | ) | $ | (1.92 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted average shares outstanding - basic and diluted |

495.4 | 489.8 | 489.6 | 489.0 | 488.6 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

14

Table of Contents

| Fiscal years

ended September 30, |

||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| (in millions) | ||||||||||||||||||||

| BALANCE SHEET DATA (at end of period): |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 322 | $ | 289 | $ | 338 | $ | 415 | $ | 594 | ||||||||||

| Intangible assets, net |

1,224 | 1,497 | 1,787 | 2,142 | 2,617 | |||||||||||||||

| Goodwill |

4,047 | 4,048 | 4,055 | 3,946 | 3,942 | |||||||||||||||

| Total assets |

7,234 | 7,649 | 8,184 | 8,561 | 9,276 | |||||||||||||||

| Total debt (excluding capital lease obligations) |

6,023 | 6,086 | 6,121 | 6,157 | 5,928 | |||||||||||||||

| Equity awards on redeemable shares |

21 | 5 | — | — | — | |||||||||||||||

| Preferred stock, Series B |

300 | 263 | 227 | — | — | |||||||||||||||

| Preferred stock, Series A |

159 | 151 | 144 | 137 | 130 | |||||||||||||||

| Total Avaya Holdings Corp. stockholders’ deficiency |

(3,621 | ) | (3,138 | ) | (2,843 | ) | (2,500 | ) | (1,543 | ) | ||||||||||

| STATEMENT OF CASH FLOWS DATA: |

||||||||||||||||||||

| Net cash provided by (used in) continuing operations: |

||||||||||||||||||||

| Operating activities |

$ | 35 | $ | 131 | $ | 16 | $ | (335 | ) | $ | 12 | |||||||||

| Investing activities |

(33 | ) | (113 | ) | (283 | ) | (101 | ) | (864 | ) | ||||||||||

| Financing activities |

(60 | ) | (79 | ) | 155 | 228 | 853 | |||||||||||||

| OTHER FINANCIAL DATA: |

||||||||||||||||||||

| EBITDA |

$ | 627 | $ | 566 | $ | 622 | $ | 282 | $ | 291 | ||||||||||

| Adjusted EBITDA(1) |

898 | 922 | 946 | 940 | 766 | |||||||||||||||

| Capital expenditures |

134 | 110 | 92 | 83 | 79 | |||||||||||||||

| Capitalized software development costs |

1 | 14 | 35 | 42 | 43 | |||||||||||||||

| (1) | Adjusted EBITDA is calculated in accordance with Avaya Inc.’s debt agreements entered into in connection with the Merger. |

EBITDA is defined as net income (loss) before income taxes, interest expense, interest income and depreciation and amortization and excludes the results of discontinued operations. EBITDA provides us with a measure of operating performance that excludes items that are outside the control of management, which can differ significantly from company to company depending on capital structure, the tax jurisdictions in which companies operate and capital investments. Under Avaya Inc.’s debt agreements, its ability to draw on its revolving credit facilities or engage in activities such as incurring additional indebtedness, making investments and paying dividends is tied in part to ratios based on Adjusted EBITDA. As defined in Avaya Inc.’s debt agreements, Adjusted EBITDA is a non-GAAP measure of EBITDA further adjusted to exclude certain charges and other adjustments permitted in calculating covenant compliance under Avaya Inc.’s debt agreements. We believe that including supplementary information concerning Adjusted EBITDA is appropriate to provide additional information to investors to demonstrate compliance with Avaya Inc.’s debt agreements and because it serves as a basis for determining management compensation. In addition, we believe Adjusted EBITDA provides more comparability between our historical results and results that reflect purchase accounting and our new capital structure. Accordingly, Adjusted EBITDA measures our financial performance based on operational factors that management can impact in the short-term, namely the Company’s pricing strategies, volume, costs and expenses of the organization.

EBITDA and Adjusted EBITDA have limitations as analytical tools. Adjusted EBITDA does not represent net income (loss) or cash flow from operations as those terms are defined by GAAP and does not necessarily indicate whether cash flows will be sufficient to fund cash needs. While Adjusted EBITDA and similar measures are frequently used as measures of operations and the ability to meet debt service requirements, these terms are not necessarily comparable to other similarly titled captions of other companies due to the potential inconsistencies in the method of calculation. Adjusted EBITDA does not reflect the impact of earnings or charges resulting from matters that we consider not to be indicative of our ongoing operations. In particular, the

15

Table of Contents

definition of Adjusted EBITDA in Avaya Inc.’s debt agreements allows us to add back certain non-cash charges that are deducted in calculating net income (loss). Avaya Inc.’s debt agreements also allows us to add back restructuring charges, certain fees payable to our private equity investors or their affiliates and other specific cash costs and expenses as defined in the agreements and that portion of our pension costs, other post-employment benefit costs, and non-retirement post-employment benefit costs representing the amortization of prior service costs and actuarial gain or loss associated with these employment benefits. However, these are expenses that may recur, may vary and are difficult to predict. Further, Avaya Inc.’s debt agreements require that Adjusted EBITDA be calculated for the most recent four fiscal quarters. As a result, the measure can be disproportionately affected by a particularly strong or weak quarter. Further, it may not be comparable to the measure for any subsequent four-quarter period or any complete fiscal year.

The unaudited reconciliation of loss from continuing operations, which is a GAAP measure, to EBITDA and Adjusted EBITDA is presented below:

| Fiscal years ended September 30, |

||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| (in millions) | ||||||||||||||||||||

| Loss from continuing operations |

$ | (315 | ) | $ | (319 | ) | $ | (368 | ) | $ | (881 | ) | $ | (887 | ) | |||||

| Interest expense |

459 | 467 | 432 | 460 | 487 | |||||||||||||||

| Interest income |

(2 | ) | (2 | ) | (3 | ) | (5 | ) | (5 | ) | ||||||||||

| Provision for (benefit from) income taxes |

51 | (35 | ) | (4 | ) | 54 | 4 | |||||||||||||

| Depreciation and amortization |

434 | 455 | 565 | 654 | 692 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

627 | 566 | 622 | 282 | 291 | |||||||||||||||

| Impact of purchase accounting adjustments(a) |

— | 1 | 3 | — | 5 | |||||||||||||||

| Restructuring charges, net |

165 | 200 | 142 | 189 | 171 | |||||||||||||||

| Sponsors’ fees(b) |

7 | 7 | 7 | 7 | 7 | |||||||||||||||

| Acquisition-related costs(c) |

— | 1 | 4 | 5 | 20 | |||||||||||||||

| Integration-related costs(d) |

7 | 15 | 19 | 132 | 208 | |||||||||||||||

| Divestiture-related costs |

2 | — | — | — | — | |||||||||||||||

| Debt registration fees . |

— | — | — | — | 1 | |||||||||||||||

| Loss on extinguishment of debt(e) |

5 | 6 | — | 246 | — | |||||||||||||||

| Third-party fees expensed in connection with debt modification(f) |

2 | 18 | — | 9 | — | |||||||||||||||

| Strategic initiative costs(g) |

— | — | — | — | 6 | |||||||||||||||

| Non-cash share-based compensation |

25 | 11 | 8 | 12 | 19 | |||||||||||||||

| Write-down of held for sale assets to net realizable value |

— | — | 5 | 1 | — | |||||||||||||||

| (Gain) loss on investments and sale of long-lived assets, net |

— | (1 | ) | 3 | 1 | (4 | ) | |||||||||||||

| Gain on sale of TBU business |

(14 | ) | — | — | — | — | ||||||||||||||

| Change in certain tax indemnifications |

4 | — | — | — | — | |||||||||||||||

| Impairment of long-lived assets |

— | 1 | 6 | — | 16 | |||||||||||||||

| Reversal of contingent liability related to acquisition . |

— | — | (1 | ) | — | — | ||||||||||||||

| Change in fair value of Preferred Series B embedded derivative(h) |

22 | 11 | 6 | — | — | |||||||||||||||

| Venezuela hyperinflationary and devaluation charges |

2 | 1 | — | — | — | |||||||||||||||

| Securities registration fees(i) |

— | 1 | 3 | — | — | |||||||||||||||

| Net income of unrestricted subsidiaries, net of dividends received |

— | — | — | — | (6 | ) | ||||||||||||||

| Resolution of certain legal matters(j) |

8 | 10 | — | — | — | |||||||||||||||

| (Gain) loss on foreign currency transactions |

(18 | ) | (5 | ) | 21 | (12 | ) | 1 | ||||||||||||

| Pension/OPEB/nonretirement postemployment benefits and long-term disability costs(k) |

51 | 79 | 98 | 68 | 31 | |||||||||||||||

| Other |

3 | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 898 | $ | 922 | $ | 946 | $ | 940 | $ | 766 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | Represents adjustments to eliminate the impact of certain purchase accounting adjustments recorded as a result of the acquisitions of NES, Radvision and Konftel AB, or Konftel, and the Merger, including the recognition of the |

16

Table of Contents

| amortization of business partner commissions, which were eliminated in purchase accounting, the recognition of revenue and costs that were deferred in prior periods and eliminated in purchase accounting and the elimination of the impact of estimated fair value adjustments for certain assets and liabilities, such as inventory. |

| (b) | Sponsors’ monitoring fees represent monitoring fees payable to affiliates of the Sponsors and their designees pursuant to a management services agreement entered into at the time of the Merger. See “Certain Relationships and Related Party Transactions.” |

| (c) | Acquisition-related costs include legal and other costs related to the acquisition of NES, Radvision and other acquisitions. |

| (d) | Integration-related costs primarily represent third-party consulting fees and other administrative costs associated with consolidating and coordinating the operations of Avaya with NES, Radvision and other acquisitions. These costs were incurred in connection with, among other things, the on-boarding of NES and Radvision personnel, developing compatible IT systems and internal processes and developing and implementing a strategic operating plan to help enable a smooth transition with minimal disruption to NES customers. Integration-related costs also include fees paid to certain Nortel-controlled entities for logistics and other support functions being performed on a temporary basis pursuant to a transition services agreement. |

| (e) | Loss on extinguishment of debt represents losses recognized in connection with certain debt refinancing transactions entered into during fiscal 2014, 2013 and 2011. The losses are based on the difference between the reacquisition price and the carrying value of the debt. See Note 10, “Financing Arrangements,” to our audited Consolidated Financial Statements located elsewhere in this prospectus. |

| (f) | The third-party fees expensed in connection with debt modification represents fees paid to third-parties in connection with certain debt refinancing transactions entered into during fiscal 2014, 2013 and 2011. See Note 10, “Financing Arrangements,” to our audited Consolidated Financial Statements located elsewhere in this prospectus. |

| (g) | Strategic initiative costs represent consulting fees in connection with management’s cost-savings actions, which commenced subsequent to the Merger. |

| (h) | Represents the loss (gain) on changes in the fair value of certain embedded derivative features of the Company’s Series B Convertible Preferred Stock. Under GAAP, these embedded derivative features must be recognized at fair value at each balance sheet date with the changes in the fair value recognized in operations. See Note 16, “Capital Stock,” to our audited Consolidated Financial Statements located elsewhere in this prospectus. |

| (i) | Represents third party fees incurred in connection with the Company’s registration statement. |

| (j) | Charges recognized in connection with the resolution of certain commercial and intellectual property legal disputes that, individually and in the aggregate, were not material to Avaya’s financial position. |

| (k) | Represents that portion of our pension costs, other post-employment benefit costs, non-retirement post-employment benefit costs representing the amortization of prior service costs and net actuarial gains/losses associated with these employment benefits. In fiscal 2013, the amount includes $9 million of net curtailment gains associated with the U.S. pension and postemployment plans. In fiscal 2012 and 2011, the amounts include a curtailment charge of $5 million associated with workforce reductions in Germany and the U.S. and $7 million associated with workforce reductions in Germany, respectively. |

17

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as the other information in this prospectus, before deciding to invest in our common stock. The occurrence of any of the following risks could harm our business, financial condition, results of operations or prospects. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business

Our products and services may fail to keep pace with rapidly changing technology and evolving industry standards.

The market in which we operate is characterized by rapid, and sometimes disruptive, technological developments, evolving industry standards, frequent new product introductions and enhancements and changes in customer requirements. In addition, both traditional and new competitors are investing heavily in this market and competing for customers. As next-generation business collaboration technology continues to evolve, we must keep pace in order to maintain or expand our market leading position. We recently introduced a significant number of new product offerings and are increasingly focused on new, high value software products, as a revenue driver. If we are not able to successfully develop and bring these new products to market in a timely manner, achieve market acceptance of our products and services or identify new market opportunities for our products and services, our business and results of operations may be materially and adversely affected.

The market opportunity for business collaboration products and services may not develop in the ways that we anticipate.

The demand for our products and services can change quickly and in ways that we may not anticipate because the market in which we operate is characterized by rapid, and sometimes disruptive, technological developments, evolving industry standards, frequent new product introductions and enhancements, changes in customer requirements and a limited ability to accurately forecast future customer orders. Our operating results may be adversely affected if the market opportunity for our products and services does not develop in the ways that we anticipate or if other technologies become more accepted or standard in our industry or disrupt our technology platforms.

We face formidable competition from providers of unified communications, contact center and networking products and related services; as these markets evolve, we expect competition to intensify and expand to include companies that do not currently compete directly against us.

Our unified communications products and services compete with companies such as Cisco Systems, Inc., or Cisco, Microsoft Corporation, or Microsoft, NEC Corporation, or NEC, Unify GmbH & Co. Kg, or Unify, Alcatel-Lucent and Huawei Technologies Co., Ltd, or Huawei, in the enterprise segment; with companies such as ShoreTel, Inc., or ShoreTel, and Mitel Networks Corp., or Mitel, in the midmarket; and with companies such as Cisco, Broadsoft Inc., or Broadsoft, Microsoft, 8x8, Inc., or 8x8, RingCentral, Inc. or RingCentral and ShoreTel in cloud products and services. Our video products and services compete with companies such as Cisco, Polycom Inc., Huawei and LifeSize (now a division of Logitech International S.A.).

Our contact center products and services compete with companies such as Genesys Telecommunications Laboratories, Inc., or Genesys, Cisco, Huawei and Mitel in the enterprise segment and with companies such as Cisco, Genesys and Interactive Intelligence, Inc. or Interactive Intelligence, in the midmarket and cloud products and services.

Our networking products and services compete with companies such as Cisco, Hewlett-Packard Company, or HP, Huawei, Dell Inc., or Dell and Juniper Networks, Inc., or Juniper, primarily with respect to L2/L3 ethernet switching.

18

Table of Contents

We face competition in certain geographies with companies that have a particular strength and focus in these regions, such as Huawei in China, Intelbras in Latin America and Panasonic in Asia.

While we believe our global, in-house end-to-end services organization provides us with a competitive advantage, it faces competition from companies like those above offering services, either directly or indirectly through their channel partners, with respect to their own product offerings, as well as many value-added resellers, consulting and systems integration firms and network service providers.

In addition, because the business collaboration market continues to evolve and technology continues to develop rapidly, we may face competition in the future from companies that do not currently compete against us, but whose current business activities may bring them into competition with us in the future. In particular, this may be the case as business, information technology and communications applications deployed on converged networks become more integrated to support business collaboration. We may face increased competition from current leaders in information technology infrastructure, information technology, consumer products, personal and business applications and the software that connects the network infrastructure to those applications. With respect to services, we may also face competition from companies that seek to sell remotely hosted services or software as a service directly to the end customer. Competition from these potential market entrants may take many forms, including offering products and applications similar to those we offer as part of another offering. In addition, these technologies continue to move from a proprietary environment to an open standards-based environment.

Several of our existing competitors have, and many of our future competitors may have, greater financial, personnel, technical, research and development and other resources, more well-established brands or reputations and broader customer bases than we do and, as a result, these competitors may be in a stronger position to respond quickly to potential acquisitions and other market opportunities, new or emerging technologies and changes in customer requirements. Some of these competitors may have customer bases that are more geographically balanced than ours and, therefore, may be less affected by an economic downturn in a particular region. Other competitors may have deeper expertise in a particular stand-alone technology that develops more quickly than we anticipate. Competitors with greater resources also may be able to offer lower prices, additional products or services or other incentives that we cannot match or do not offer. Industry consolidations may also create competitors with broader and more geographic coverage and the ability to reach enterprises through communications service providers. Existing customers of data networking companies that compete against us may be inclined to purchase enterprise communications products and services from their current data networking or software vendors rather than from us. Also, as communications and data networks converge, we may face competition from systems integrators that traditionally have been focused on data network integration.

We cannot predict which competitors may enter our markets in the future, what form such competition may take or whether we will be able to respond effectively to the entry of new competitors into competition with us or the rapid evolution in technology and product development that has characterized our businesses. In addition, in order to effectively compete with any new market entrant, we may need to make additional investments in our business, use more capital resources than our business currently requires or reduce prices, any of which may materially and adversely affect our profitability.

Our revenues are dependent on general economic conditions and the willingness of enterprises to invest in technology.