Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DAWSON OPERATING CO | d832925d8k.htm |

December 2014

Investor Presentation

Exhibit 99.1 |

Statements in

this presentation that relate to forecasts, estimates or other expectations regarding future

events, including without limitation, statements regarding the pending transaction,

technological advancements and the companies’

financial position, business strategy and plans and objectives of

management for future operations, may be deemed to be forward-looking statements within

the meaning of Section

27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. When

used in this presentation, words such as “anticipate,”

“believe,”

“estimate,”

“expect,”

“intend,”

and similar

expressions are intended to identify forward-looking statements. Such forward-looking

statements are based on the beliefs of management as well as assumptions made by and

information currently available to management. Actual results could differ materially

from those contemplated by the forward-looking statements as a result of certain

factors, including but not limited to the possibility that the transaction does not

close when expected or at all because required shareholder or other approvals and other

conditions to closing are not received or satisfied on a timely basis or at all; the risk that

the benefits from the transaction may not be fully realized or may take longer to

realize than expected; the ability to promptly and effectively integrate the businesses

of Dawson and TGC; the reaction of the companies’ customers, employees and

counterparties to the transaction; diversion of management time on

transaction-related issues; the volatility of oil and natural gas prices; dependence upon

energy industry spending; disruptions in the global economy; industry competition;

reduced utilization; delays, reductions or cancellations of service contracts; high

fixed costs of operations and high capital requirements; external factors affecting our

crews such as weather interruptions and inability to obtain land access rights of way;

the type of contracts we enter into; crew productivity; limited number of customers; credit

risk related to the companies’

customers; the availability of capital resources and operational disruptions. A discussion of

these and other factors, including risks and uncertainties with respect to Dawson is

set forth in Dawson’s Form 10-K for the fiscal year ended September 30, 2013,

and with respect to TGC, is set forth in TGC’s Form

10-K for the fiscal year ended December 31, 2013. Dawson and TGC disclaim any intention or

obligation to revise any forward-looking statements, whether as a result of new

information, future events or otherwise. Nasdaq: DWSN

2 |

Important

Information For Investors and Shareholders This presentation does not constitute an

offer to sell or the solicitation of an offer to buy any securities or a solicitation of any

vote or approval. The transactions contemplated by the merger agreement, including, with the

respect to Dawson, the proposed merger and, with respect to TGC, the proposed issuance

of TGC common stock in the merger and an amendment to TGC’s certificate of

formation, will, as applicable, be submitted to the shareholders of Dawson and TGC for their consideration.

On November 6, 2014, TGC filed with the Securities and Exchange Commission (SEC) a

registration statement on Form S-4 that included a joint proxy statement of Dawson

and TGC that also constitutes a prospectus of TGC. After the registration statement has

been declared effective and subject to the terms of the merger agreement, Dawson and TGC will mail the joint proxy

statement/prospectus to their respective shareholders. Dawson and TGC also plan to file other

documents with the SEC regarding the proposed transaction. INVESTORS AND SECURITY

HOLDERS OF DAWSON AND TGC ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND

OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR

ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

THE PROPOSED TRANSACTION. Investors and shareholders may currently obtain free copies of the

joint proxy statement/prospectus filed on November 6, 2014 and will be able to obtain

free copies of any amendments to the joint proxy statement/prospectus and other

documents containing important information about Dawson and TGC, once such documents

are

filed

with

the

SEC,

through

the

website

maintained

by

the

SEC

at

www.sec.gov.

Dawson

and

TGC

make

available

free

of

charge

at

www.dawson3d.com

and

www.tgcseismic.com,

respectively

(in

the

"Investor

Relations"

section),

copies

of

materials

they file with, or furnish to, the SEC, or investors and shareholders may contact Dawson at

(432) 684-3000 or TGC at (972) 881- 1099

or

c/o

Dennard-Lascar

Associates

at

(713)

529-6600

to

receive

copies

of

documents

that

each

company

files

with

or

furnishes to the SEC.

Participants in the Merger Solicitation

Dawson, TGC, and certain of their respective directors and officers may be deemed to be

participants in the solicitation of proxies from the shareholders of Dawson and TGC in

connection with the proposed transactions. Information about the directors and officers

of Dawson is set forth in its proxy statement for its 2014 annual meeting of shareholders, which was filed

with the SEC on December 18, 2013, as well as subsequent periodic reports filed with the SEC.

Information about the directors and officers of TGC is set forth in the joint proxy

statement/prospectus. These documents can be obtained free of charge from the sources

indicated above. Other information regarding the participants in the proxy solicitation and a description of their

direct and indirect interests, by security holdings or otherwise, will be contained in the

joint proxy statement/prospectus and other relevant materials to be filed with the SEC

when they become available. Nasdaq: DWSN

3 |

|

In business 62

years (founded 1952) Acquire and process seismic data

for the accounts of our clients

A leading provider of U.S. onshore

seismic data acquisition services

(2-D and 3-D)

Canadian-based operations

10 crews operating 178,500 channels

Diversified mix of oil and liquids-rich projects

Primarily turnkey contracts

Nasdaq: DWSN

5

Denver

Midland

Houston

Pittsburgh

Oklahoma City

Calgary |

62-year

history enables Dawson Geophysical to navigate the cyclical nature of the

business Investments in technology and equipment upgrades generate

improved efficiencies

Robust equipment base drives opportunities for growth and leads

to improved contract terms

Geographic diversity fosters opportunities in multiple basins

Expertise in proprietary seismic solutions

Fiscally conservative management team

Nasdaq: DWSN

6 |

Demand for

Dawson Geophysical services remains steady despite project readiness issues

Company deployed eight to twelve data acquisition crews in fiscal 2014

Order book sufficient to sustain deployment of nine to ten data

acquisition crews into calendar year 2015

Balance sheet strength remains strong with approximately $73,777,000

of working capital and approximately $11,685,000 of debt

Declared quarterly dividend of $0.08 per share in December 2014

2015 Capex anticipated to be at maintenance levels

Announced early termination of HSR waiting period and filing of joint

proxy statements/prospectus of Dawson Geophysical and TGC Industries

Nasdaq: DWSN

7 |

E&P

company emphasis on exploration & developmental activities Seismic

sector

entering

a

new

phase

of

growth

with

an

increasing

portfolio

of

both exploration and developmental services

Continued emphasis on oil and liquids-rich projects with increasing

growth opportunities in the natural gas

Oil drives demand and creates opportunities for growth

Permian,

Delaware,

Mississippi

Lime

activity

creates

new

avenues

of

growth

Demand for high-resolution images

Increased channel count

Enhances subsurface resolution

Complex geological structures

Helps reduce dry-hole risk and optimize production

Advancements in technology

Increased utilization of cableless recording equipment

Nasdaq: DWSN

8 |

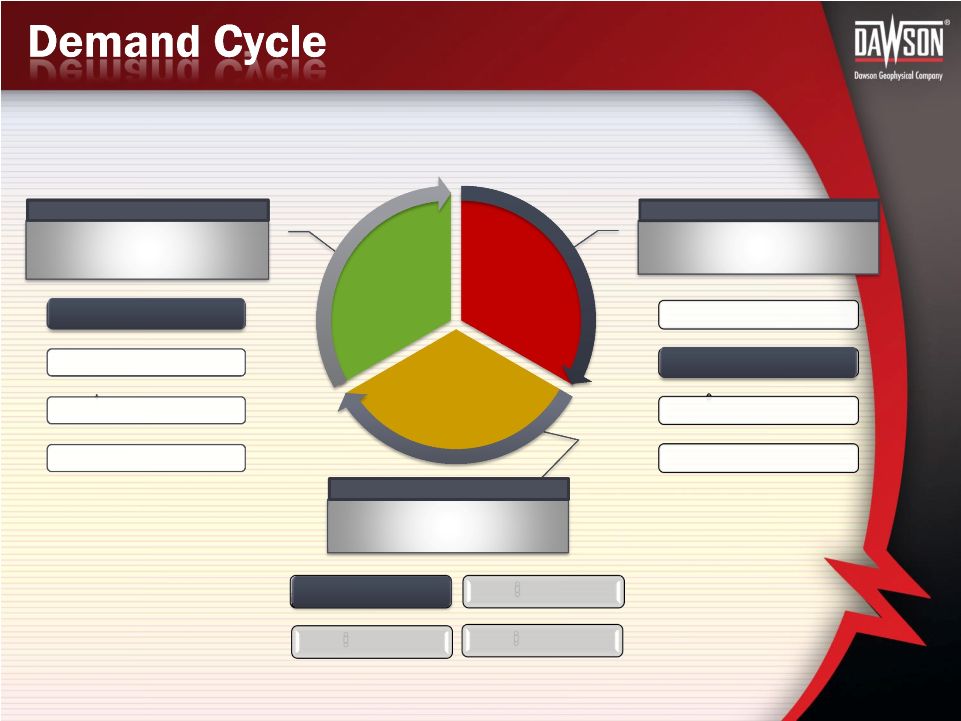

Nasdaq: DWSN

9

Seismic data acquisition and processing is needed at all

stages of the exploration and production process

Map It

Lease It

Drill It

CONVENTIONAL

PROSPECTING

Objective

Shoot It

IDENTIFY GEO-HAZARD

Objective

Lease It

Map It

Drill It

Map It

Drill It

Repeat

MAXIMIZE PRODUCTION

Objective

Shoot It

Shoot It

Exploration

Evaluation

Exploitation |

Data

Acquisition Design

Permit

Survey

Field Operations

Maintenance

Support Functions

Data Processing

Midland, Houston,

Oklahoma City

In-field Services

Nasdaq: DWSN

10 |

Nasdaq: DWSN

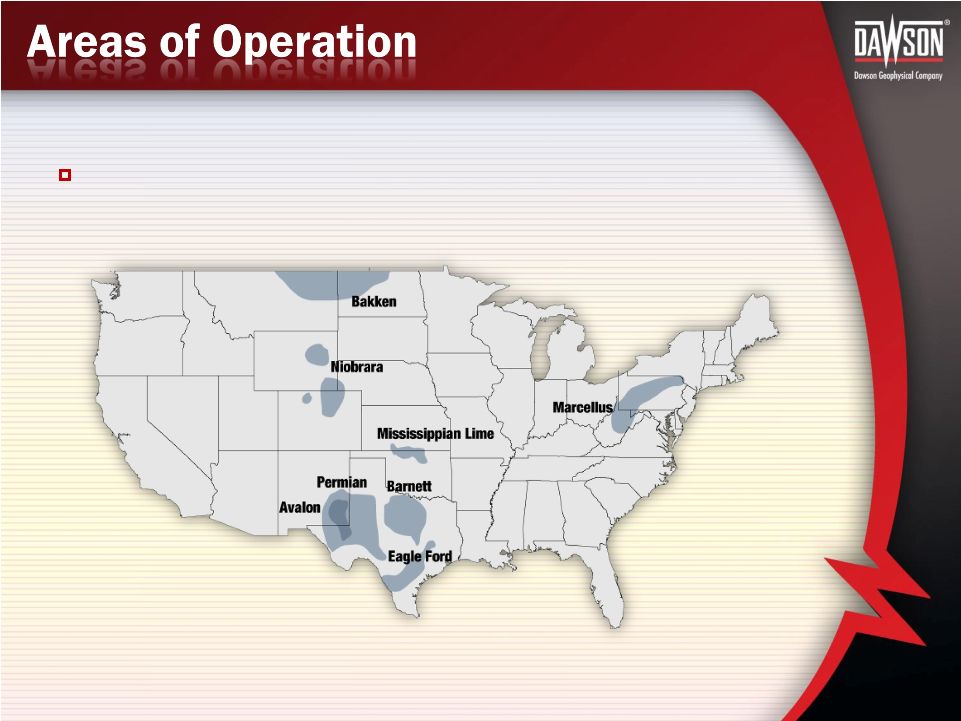

11

10 Data Acquisition Crews Currently Spread Across Every

Major Basin in the Continental United States |

Nasdaq: DWSN

12

150,000

155,000

160,000

165,000

170,000

175,000

180,000

185,000

2011

2012

2013

2014

145

150

155

160

165

170

175

2011

2012

2013

2014

Channel Count Growth

Energy Source Units

Operating 10 Crews

3 ARAM ARIES Systems

6 GSR Systems

2,500 channels Wireless System RT2000

56,000 channels of GSR multi-channel

boxes with 3-C geophones

48,000 single-channel GSR Units

9,000 three-component Geospace GSX3

Units

Recording Channels

178,500

Vibrator Energy Source Units

149 energy source units

8 Envirovibe units

Data Processing Services

Houston

Oklahoma City

Midland |

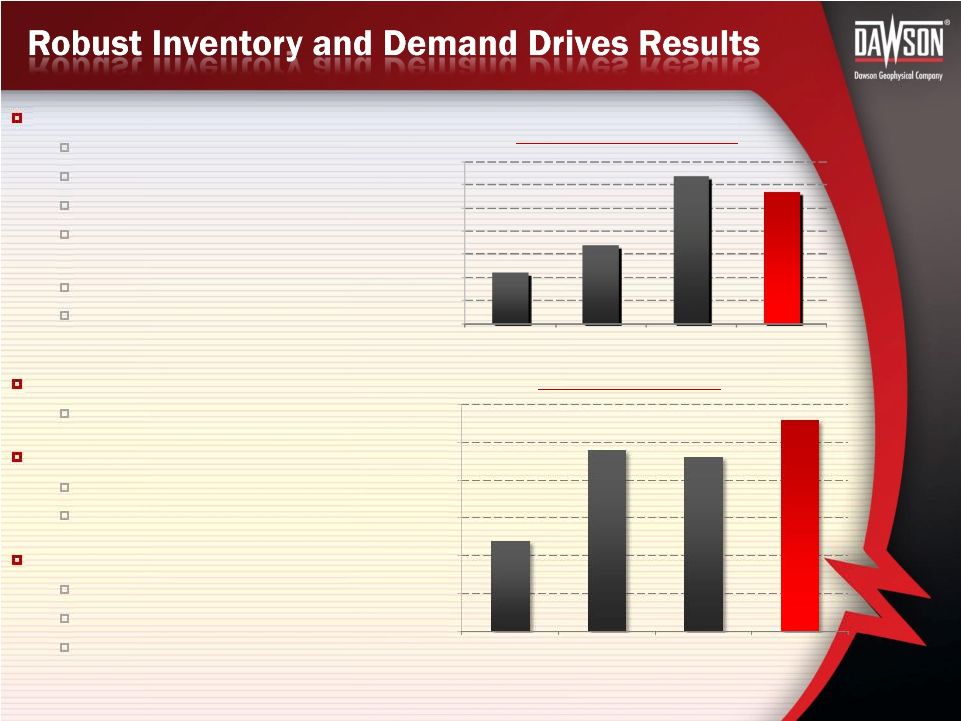

Reported revenues of $261,683,000 compared to $305,299,000 for the

prior fiscal year EBITDA* for fiscal 2014 was $22,730,000 compared to

$57,262,000 in fiscal 2013

Capital expenditures for fiscal 2014 were $34,073,000 compared

to $50,069,000 in fiscal 2013

Balance sheet remains strong with $49,753,000 of cash and

short-term investments, $73,777,000 of working capital and

$11,685,000 of debt at September 30, 2014

On November 10, 2014 the Company's Board of Directors

approved the payment on December 8, 2014 of an $0.08 per

share quarterly cash dividend

*For a definition of EBITDA and a reconciliation of EBITDA to our net income (loss), see

Appendix A on Slides 24 and 25. Nasdaq: DWSN

13 |

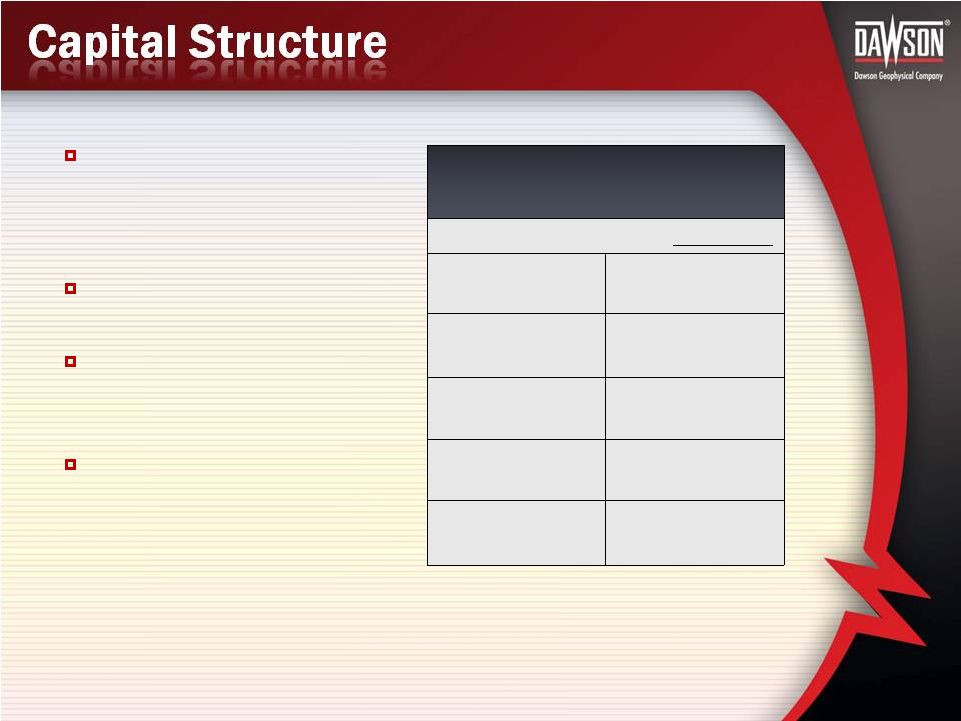

History of

conservative financial management

in a cyclical industry

Low debt

Well-positioned to respond

to future client demand

$20 million undrawn

revolving line of credit

available

Nasdaq: DWSN

Balance Sheet Data

($ in thousands)

At 09/30/14

Working Capital

$73,777

Net Property, Plant

and Equipment

$164,494

Total Assets

$262,639

Debt

$11,685

Stockholders’

Equity

$199,530

14 |

|

Combined

Company to Retain the Dawson Geophysical Name and Trading Symbol: DWSN

Current Dawson and TGC Shareholders will own approximately

66% and 34% of the combined company respectively

Continue Dawson and Eagle Canada as operating entities

Structured as a stock-for-stock transaction that qualifies as a

“reorganization”

for tax purposes

Closing is anticipated during the first calendar quarter of 2015

Requires 2/3 shareholder approval from both TGC and Dawson

shareholders

Board

of

Directors

–

5

previous

Dawson

Board

members

and

3

previous TGC Board members

Nasdaq: DWSN

16 |

Structured as a

stock-for-stock transaction Dawson will merge into a wholly-owned subsidiary

of TGC and Dawson shareholders will receive shares of TGC common stock

TGC will effect a 1-for-3 reverse stock split, which will reduce the number

of outstanding TGC common shares from approximately 22 million to 7.3

million shares for transactional and charter purposes

Dawson shareholders will receive 1.76 shares of TGC split-effected stock for

every one share of Dawson stock

TGC will issue approximately 14.2 million of split-effected shares in

exchange for the approximately 8.1 million shares of Dawson stock

outstanding

Nasdaq: DWSN

17 |

Expanded

geographical presence Positioned to better serve clients through regional

deployments Strengthened balance sheet

Enhances operational and financial flexibility

Enables

company

to

respond

more

quickly

to

client

needs

&

market

conditions

Compatible equipment bases

Increases operational efficiencies and logistics

Improves utilization rates and lowers costs

Improved processes drives efficiencies

Leads to lower expenses and increased revenue

Reduce dependence on third party providers

Expanded client base and order book

Relieves pressure on utilization rates

Nasdaq: DWSN

18 |

Nasdaq: DWSN

19

Executive Management Team

Dawson to Designate Four Additional Board Members

TGC to Designate Two Additional Board Members

Stephen C. Jumper –

Chairman of the Board, President and Chief Executive Officer

Wayne Whitener –

Vice-Chairman and Officer

Craig W. Cooper –

Retired Geophysicist

Gary M. Hoover, Ph.D –

Retired Geophysicist

Ted R. North –

Certified Public Account

Mark A. Vander Ploeg –

Retired Investment Banker

William J. Barrett –

President of W.J. Barrett Associates, Inc.

Allen T. McInnes, Ph.D –

Emeritus Dean, Texas Tech University |

Experienced

management team and companies with more than 100 years combined existence

Expanded equipment base and improved logistics designed to

increase utilization and lower costs

Combined client base and order book to relieve pressure on

utilization rates

Increased level of internal support services designed to reduce

outsourcing

Expanded channel count to shorten cycle times and provide

higher resolution images

Nasdaq: DWSN

20 |

Full-service provider of data acquisition and data processing

services

First-Class Health, Safety & Environmental program

Continued commitment to superior land survey and

permitting services, improved IT support, expanded repair

capabilities, trucking services, data processing, research and

development and dynamite energy source drilling services

Top

rated

platform

of

shared

resources

--

people,

equipment

and

services

--

that

flows

through

to

our

clients,

shareholders

and employees

Nasdaq: DWSN

21

Staying the Course |

Current Stock

Price: $15.57 (November 20, 2014)

52-Week Range: $15.25 -

$34.90

Market Cap: $123.63 Million

3-Month Avg. Daily Volume: 70,471

Shares Outstanding: 7.96 Million

Institutional Ownership: 80%

Fiscal Year-end: September 30

Publicly-traded since 1981

Nasdaq: DWSN

22 |

A leading U.S. land

seismic data acquisition

company from coast-to-coast. |

Nasdaq: DWSN

24

Use of EBITDA (Non-GAAP measure)

depreciation

and

amortization

expense.

Our

management

uses

EBITDA

as

a

supplemental

financial

measure to assess:

the

term

EBITDA

is

not

defined

under

generally

accepted

accounting

principles

(“GAAP”),

and

EBITDA

is

not a measure of operating income, operating performance or liquidity presented in accordance

with GAAP. When assessing our operating performance or liquidity, investors and others

should not consider this

data

in

isolation

or

as

a

substitute

for

net

income

(loss),

cash

flow

from

operating

activities

or

other

cash

flow

data

calculated

in

accordance

with

GAAP.

In

addition,

our

EBITDA

may

not

be

comparable

to

EBITDA

or

similarly

titled

measures

utilized

by

other

companies

since

such

other

companies

may

not

calculate EBITDA in the same manner as us. Further, the results presented by EBITDA cannot be

achieved without incurring the costs that the measure excludes: interest, taxes,

depreciation and amortization.

the financial performance of our assets without regard to financing methods, capital

structures, taxes or historical cost basis;

our

liquidity

and

operating

performance

over

time

in

relation

to other

companies

that

own

similar

assets

and

that

we

believe

calculate

EBITDA

in

a

similar

manner;

and

the ability of our assets to generate cash sufficient for us to pay potential interest costs.

We also understand that such data are used by investors to assess our performance.

However, We define EBITDA as net income (loss) plus interest expense, interest income,

income taxes, •

•

• |

Nasdaq: DWSN

25

Twelve

Months

Ended

September

30,

2014

2013

(in thousands)

Net income (loss)

$

(12,620)

10,480

Depreciation

40,168

37,095

Interest expense (income), net

462

597

Income tax (benefit) expense

(5,280)

9,090

EBITDA

$

22,730

$

57,262

$ |

26

NASDAQ:

DWSN

Nasdaq: DWSN |