Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TREVENA INC | a2222386z8-k.htm |

Exhibit 99.1

BUSINESS

Overview

We are a clinical stage biopharmaceutical company that discovers, develops and intends to commercialize therapeutics that use a novel approach to target G protein coupled receptors, or GPCRs. Using our proprietary product platform, we have identified and advanced three differentiated product candidates into the clinic as follows:

· TRV130: We recently announced top-line data from our Phase 2a/b clinical trial of TRV130 in postoperative pain. At doses of 2 mg and 3 mg of TRV130 administered every three hours, the trial achieved its primary endpoint of statistically greater pain reduction than placebo for 48 hours, which we believe demonstrates proof of concept for TRV130. The 3 mg dose of TRV130 also showed statistically superior analgesic efficacy over the 48-hour trial period compared to 4 mg of morphine administered every four hours. Additionally, in the first three hours of dosing, when pain was most severe, the 1 mg, 2 mg and 3 mg doses of TRV130 demonstrated superior analgesic efficacy in the trial compared to placebo, and the 2 mg and 3 mg doses of TRV130 demonstrated superior analgesic efficacy compared to 4 mg of morphine. There were no serious adverse events reported in the trial, which we believe suggests that these levels of pain relief can be achieved safely. Over the 48-hour trial period, the tolerability of TRV130 at doses of 2 mg and 3 mg administered every three hours was similar to that of 4 mg of morphine administered every four hours. Based on these data, we plan to move into Phase 3 preparations, which we expect to occur in parallel with a second Phase 2 trial for TRV130 that we plan to commence in December 2014. We also anticipate that we will initiate a Phase 3 clinical trial for TRV130 in the first quarter of 2016. These data complement the data generated in our Phase 1b trial, in which TRV130 showed superior efficacy with an improved tolerability profile following a single dose of TRV130 relative to a 10 mg dose of morphine in a human evoked-pain model. We hold a U.S. patent covering the composition of matter and methods of use for TRV130. We have retained all worldwide development and commercialization rights to TRV130, and plan to commercialize it in acute care markets such as hospitals and ambulatory surgery centers if it receives regulatory approval.

· TRV734: We have completed a first Phase 1 single ascending dose clinical trial for TRV734, an oral follow-on to TRV130 for the treatment of moderate to severe acute and chronic pain. We have completed enrollment in a second Phase 1 multiple ascending dose clinical trial and expect to report data from this trial early in the first quarter of 2015. We have retained all worldwide development and commercialization rights to TRV734.

· TRV027: We have completed a Phase 2a clinical trial and in early 2014 we initiated a Phase 2b clinical trial of TRV027 for acute heart failure, or AHF. Enrollment in this trial is ongoing, with over 250 patients recruited out of planned enrollment of approximately 500 patients. More than 65 sites in 12 countries are now open and recruiting, and we expect patient enrollment will conclude in the third quarter of 2015. We expect to report top-line data from this trial in the fourth quarter of 2015. Actavis plc, or Actavis, has the exclusive option to license TRV027 from us. We plan for TRV027 to be commercialized in the acute care hospital market if it receives regulatory approval.

We also have identified a new product candidate, TRV250, from our preclinical δ-opioid receptor program focused on central nervous system, or CNS, indications and plan to advance TRV250 to preclinical studies in 2015 that would support our submission of an investigational new drug application, or IND, to the U.S. Food and Drug Administration, or FDA.

Our Pipeline

Our Platform

GPCRs are a large family of cell surface receptors that trigger two signaling pathways, G protein and β-arrestin, and are implicated in cellular function and disease processes. More than 30% of all currently marketed therapeutics target GPCRs. Currently available therapeutics that target GPCRs, or GPCR ligands, are typically not signal specific, and therefore either inhibit both the G protein and β-arrestin pathways (an antagonist ligand) or activate both pathways (an agonist ligand). This lack of signal specificity often results in a suboptimal therapeutic profile for these drugs because in many cases one of the pathways is associated with a beneficial therapeutic effect and the other is associated with limiting that benefit or with an undesirable side effect (see Figure 1). We use our proprietary Advanced Biased Ligand Explorer, or ABLE, product platform to identify “biased” ligands, which are compounds that activate one of the two signaling pathways of the GPCR while inhibiting the other (see Figure 2). This signaling specificity is the basis for our drug discovery and development approach, which is to identify selective GPCR biased ligands and develop them into differentiated clinical products. While some GPCRs trigger other signaling pathways in addition to G protein and β-arrestin, most GPCRs trigger those two pathways.

Our ABLE product platform is a collection of proprietary biological information, in vitro assays, know-how and expertise that we use to identify unique GPCR-targeted biased ligands with attractive pharmaceutical properties. In vitro assays are laboratory tests performed outside of a living organism. Our in vitro assays use cells that have the receptor of interest on the cell surface, where G protein and β-arrestin signaling from that receptor can be measured to determine if a particular ligand is biased, and if so whether it is a G protein or β- arrestin biased ligand. Our assays can also measure different cellular responses resulting from signaling through β-arrestin and can thereby help us to associate pharmacological responses with molecular signaling. Most components of our ABLE product platform are maintained as trade secrets, but the output of the product platform is reflected in the product candidates that we have advanced into clinical testing and the research we have published in numerous peer- reviewed journals. We believe that our ABLE product platform provides us with an important competitive advantage in identifying further opportunities for efficient and high-impact biased ligand drug discovery, development and commercialization.

We were founded in late 2007 to discover and develop product candidates based on biased ligands, a concept discovered by our scientific founder, Dr. Robert Lefkowitz, who was awarded the 2012 Nobel Prize in Chemistry in part for his elucidation of the multiple pathways that a GPCR engages. We believe that we are the first company to progress a GPCR biased ligand into clinical trials. The

members of our executive management team have held senior positions at leading pharmaceutical and biotechnology companies and possess substantial experience across the spectrum of drug discovery, development and commercialization.

Figure 1: Mechanism of current GPCR-targeted drugs

Figure 2: Mechanism of our biased ligands—the next generation of GPCR-targeted drugs

Our Strategy

Our goal is to build a leading biopharmaceutical company leveraging our expertise in biased ligands to develop and commercialize innovative, best- in-class drugs targeting established GPCRs. Key elements of our business strategy to achieve this goal are to:

Rapidly advance clinical development of our three lead product candidates to commercialization.

We plan to develop and commercialize TRV130 for the treatment of moderate to severe acute postoperative pain and other indications where intravenous, or IV, therapy is preferred. Specific uses could include the treatment of pain related to surgery as well as nonsurgical settings like severe burn or end-of-life care facilities. The efficacy of drugs targeting the µ-opioid receptor is well-established. We have announced top-line data from our Phase 2a/b trial of TRV130 in postoperative pain in which we observed statistically significant analgesic efficacy compared to placebo and evidence for beneficial

differentiation from a benchmark dose of morphine. We also plan to initiate a second Phase 2 clinical trial for TRV130 in December 2014 in a soft tissue surgery model to further inform Phase 3 development and to further evaluate the potential for an improved therapeutic profile compared to morphine.

We plan to develop TRV734 for oral use in moderate to severe acute and chronic pain. We intend to seek a collaborator with experience in developing and commercializing controlled-substance therapeutics in acute and chronic care pain markets while retaining rights to commercialize TRV734 in hospital surgical settings in the United States. We completed our first Phase 1 clinical trial, in which we observed bioavailability and CNS activity of TRV734 after oral dosing, and we have completed enrollment in a second Phase 1 trial to support Phase 2 development. We expect to report data for the second trial early in the first quarter of 2015.

We plan to complete our Phase 2b clinical trial for TRV027 for the treatment of AHF by the end of 2015. If this trial is successful and Actavis exercises its option, Actavis will be responsible for all costs associated with further development and commercialization of TRV027. If the option is exercised, we will be entitled to an upfront option exercise fee and certain contingent milestone payments and royalties, which we intend to use to further develop and potentially commercialize our proprietary portfolio.

Establish commercialization and marketing capabilities in the United States, initially in acute care markets, for any of our product candidates that are approved or that we anticipate may be approved.

If any of our products beyond TRV027 receive or are anticipated to receive regulatory approval, we intend to build a focused sales force and establish marketing capabilities to commercialize those products to specialists in the United States, initially in acute care settings such as hospitals and ambulatory surgery centers.

We intend to retain full commercialization rights in the United States for TRV130. After the availability of Phase 2 clinical data for TRV130, we may seek collaborators for commercializing TRV130 outside the United States to offset risk and preserve capital.

For TRV734, we intend to seek a collaborator with experience in developing and commercializing controlled-substance therapeutics in acute and chronic care pain markets, thereby leveraging their expertise while retaining rights to commercialize TRV734 in hospital surgical settings and other settings where we may commercialize TRV130 in the United States.

If Actavis exercises its option to license TRV027, Actavis will be responsible for commercialization of TRV027 worldwide. We have the option to negotiate with Actavis for co-promotion rights in the United States, although Actavis has no obligation to grant us any co-promotion rights. We expect that TRV027, if approved, would be used primarily in the acute care setting, thereby providing an opportunity to leverage the commercial infrastructure we plan to implement to market our other product candidates, if any of them are approved.

Expand our CNS product portfolio by advancing TRV250, our δ -opioid receptor product candidate.

We aim to develop TRV250, which we believe will be the first selective δ-opioid receptor-targeted therapeutic for the treatment of CNS disorders. Based on the initial profile of TRV250, we anticipate focusing our initial development efforts on treatment-refractory migraine headaches. According to Decision Resources, a healthcare consulting company, the acute episodic migraine market encompassed approximately 12 million drug-treated patients in 2013 in the United States, representing approximately $2.2 billion of sales. We estimate that approximately 20% to 30% of these patients either do not respond to or cannot tolerate the market-leading triptan drug class and an additional 30% would benefit from improved efficacy compared to these drugs.

We believe TRV250 also may have utility in other CNS areas such as depression, Parkinson’s disease or neuropathic pain. We intend to conduct preclinical work beginning in 2015 designed to support the filing of an IND for TRV250. We also intend to seek a collaborator for TRV250 with CNS development and worldwide commercialization expertise, while potentially retaining commercialization rights in the United States.

Leverage our ABLE product platform to continue to discover and develop a pipeline of innovative biased ligand therapeutics and expand our product platform’s impact through external collaborations.

We have used our ABLE product platform to identify four potential therapeutics targeting GPCRs and have also identified additional high-value GPCR targets. As part of our longer term strategy, we plan to initiate internal drug discovery efforts in indications characterized by significant unmet medical need. We also intend to selectively collaborate on discovery and development programs to leverage the potential of our ABLE product platform.

CNS Portfolio

TRV130

TRV130 is a small molecule G protein biased ligand at the µ-opioid receptor, which we are developing as a first-line treatment for patients experiencing moderate to severe acute pain where IV administration is preferred. TRV130 activates the µ-opioid receptor G protein pathway, which in preclinical studies was associated with analgesia, and inhibits the β-arrestin pathway at the same receptor, which in preclinical studies was associated with limiting opioid analgesia and with promoting opioid-induced respiratory depression and constipation. Given its pharmacokinetic, tolerability and efficacy profile in our Phase 1 and Phase 2a/b trials, we believe that both the inpatient and outpatient settings could be appropriate for TRV130 use. The current focus of our clinical trials is on surgical patients. We believe offering superior analgesia or reducing the adverse side effects typically associated with the activation of the µ-opioid receptor will position TRV130, if approved, to more effectively treat moderate to severe acute pain than currently available µ-opioid therapies. We have an issued U.S. patent that covers TRV130, compositions comprising TRV130 and methods of using TRV130 and this patent is expected to expire no earlier than 2032.

Disease

According to data from IMS Health, in 2013 there were approximately 47 million hospital inpatient stays and outpatient visits during which reimbursement claims for injectable opioids were made, 20 million of which involved a surgical procedure. In terms of the total potential market opportunity, the World Health Organization estimates that over 230 million major surgical procedures are performed each year worldwide. According to Life Science Intelligence, a market research firm, over 30 million inpatient surgical procedures and 42 million outpatient or ambulatory surgical procedures were performed in the United States in 2013. According to the European Commission, about 30 million hospital inpatient surgeries are performed collectively in France, Germany, the United Kingdom, Italy and Spain each year. Accordingly, we believe that there is a large potential commercial opportunity for TRV130 in the treatment of surgical pain, if approved.

Treatment options for moderate to severe, acute postoperative pain

The typical treatment paradigm in developed markets for management of moderate to severe, acute postoperative pain is to initiate injectable or IV pain medication in the preoperative or immediate postoperative period to provide rapid and effective pain relief. As soon as it is safe and practical, a transition is typically made to oral pain medication, allowing patients to take medication home with them.

Opioid analgesics like morphine, fentanyl and hydromorphone are mainstays of pain treatment in the immediate postoperative period. Despite the development and adoption of guidelines for the management of postoperative pain and the extensive use of current treatments, significant unmet need remains. In a 2012 survey of 300 surgical patients in the United States, over 80% of patients reported postoperative pain after the first analgesic medication had been administered, and 40% of this pain was reported to be moderate or severe. The effectiveness of currently available μ-opioid agonists is limited in part because their doses are limited by severe side effects such as respiratory depression, nausea and vomiting, constipation and postoperative ileus, or POI, which is a condition that most commonly occurs after surgery involving interruption of movement of the intestines in which the bowel enters spasm and stops passing food and waste.

A recent survey we conducted in a sample of 72 U.S. surgeons and anesthesiologists suggests that the most important attribute driving physicians’ choice of an IV opioid is analgesic efficacy. In the same survey, respondents stated that injectable non-opioid analgesics are currently used to supplement IV opioids for post-surgical pain management in about 60% of hospital inpatient cases. These drugs, such as IV non-steroidal anti- inflammatory drugs, or NSAIDs, IV acetaminophen or local anesthetics such as bupivacaine, have their own potential side effects in the cardiovascular and gastrointestinal, or GI, systems as well as the liver. We estimate that recently introduced branded versions of these drugs can add $50 to $300 per patient per day to the cost of managing patients with moderate to severe postoperative pain in the United States.

None of these non-opioid analgesic approaches has displaced the use of opioid analgesics as the cornerstone of IV therapy for acute moderate to severe pain. However, the level of analgesic efficacy achievable with opioid medicines is limited as a result of dose-limiting side effects. Opioid-related side effects, including respiratory depression, nausea and vomiting, and constipation, can limit opioid dosing and may contribute to inadequate pain relief reported by patients and physicians with currently prescribed opioids:

· Morphine, fentanyl and hydromorphone are all associated with reduced respiratory rate and reduced tidal volume, which is the amount of air inhaled or exhaled in a single breath. Although serious complications or deaths from opioid-induced respiratory depression are rare, with our estimate being about 80,000 cases per year in U.S. hospitals, fear of respiratory depression represents a major barrier to the effective use of opioids in the management of postoperative pain because physicians are cautious about increasing dose. We believe this contributes to the limited effectiveness of pain relief with current IV opioids.

· In several published surveys, patients faced with surgery list the avoidance of postoperative nausea and vomiting, or PONV, as a leading concern. PONV occurs in approximately one third of surgical patients following treatment with IV opioids. We believe that there are over 5 million cases of opioid- induced PONV annually in U.S. hospitals for inpatients alone. The constipating effects of opioid drugs are also problematic and costly for surgical patients, who are typically not considered ready for discharge until they have had a meal or a bowel movement. POI is a condition in which the bowel enters spasm and stops passing food and waste, which most commonly occurs after surgery involving interruption of movement of the intestines. POI is exacerbated by anesthetics and opioid analgesics, and occurs in at least 10% of patients following invasive abdominal procedures. We believe that opioid-induced PONV, opioid-induced constipation, and POI together add approximately $5 billion to the cost of hospital inpatient post-surgical recovery in the United States annually.

Key differentiating attributes of TRV130

We believe that TRV130 may offer several potential advantages over existing opioid treatments for postoperative pain, any of which may contribute to higher levels of pain relief for TRV130 compared to these drugs. These potential advantages are as follows:

· Efficacy

· Highly effective. Based on top-line data from our Phase 2a/b clinical trial of TRV130 for treatment of postoperative pain following bunionectomy, a 3mg dose of TRV130 administered every three hours showed statistically superior analgesic efficacy over the 48-hour trial period compared to 4 mg of morphine administered every four hours Additionally, 2mg and 3mg doses of TRV130 demonstrated statistically superior analgesic efficacy compared to 4 mg of morphine in the first three hours of dosing, when pain was most severe. There were no serious adverse events reported in the trial, which we believe suggests that these levels of pain relief can be achieved safely. Over the 48-hour trial period, the tolerability of TRV130 at doses of 2 mg and 3 mg administered every three hours was similar to that of 4 mg of morphine administered every four hours. At the highest dose tested, TRV130 was associated with a mean change from baseline pain score of approximately seven (severe pain) to approximately one (mild pain) by the first data collection point five minutes after dosing. By contrast, a standard dose of morphine was associated with a change from the same baseline to a score of approximately five (moderate pain). These data are complementary to data from our Phase 1b trial in healthy subjects using an evoked-pain model, in which 3 mg of TRV130 showed superior analgesia compared to a 10 mg dose of morphine and produced less respiratory depression, less severe nausea and less frequent vomiting compared to morphine. If future pivotal trials of TRV130 continue to provide evidence of an improved therapeutic profile with respect to key safety and tolerability concerns, we believe that TRV130, if approved, may represent an improvement over unbiased µ-opioid agonists, which are the current standard of care.

· Fast acting. In preclinical studies, TRV130 delivered maximal efficacy at only five minutes after dosing. In our Phase 1 clinical trial, we also observed full pharmacodynamic response in the form of pupil constriction in humans at ten minutes after dosing. Pupil constriction is a well-established biomarker for the analgesic efficacy of opioid drugs. We also observed full analgesic effect in the Phase 1b evoked-pain model at the first practical data collection point of 10 minutes after dosing, and in our Phase 2a/b postoperative pain trial we observed maximum analgesia five to 15 minutes after dosing. If our pivotal clinical trials confirm this rapid time to peak effect, we believe the market potential of TRV130, if approved, could be broadened into the peri-operative pain market where fentanyl is commonly used today.

· Drug safety and tolerability

· Reduced respiratory depression risk. In a Phase 1b clinical trial in healthy subjects using an evoked-pain model, TRV130 showed less respiratory depression compared to a10 mg dose of morphine and delivered superior analgesia. In a preclinical proof of concept study, TRV130 showed less respiratory depression at equivalent analgesic doses compared to morphine.

· Reduced PONV. In our Phase 1b clinical trial in healthy subjects using an evoked-pain model, subjects treated with TRV130 showed less severe nausea and less frequent vomiting at a dose eliciting greater analgesia compared to a high dose of morphine. This was consistent with our Phase 1 data in which TRV130 showed no nausea or vomiting at doses eliciting equivalent or greater pupil constriction compared to high doses of morphine or fentanyl that would be expected to result in a 20% to 30% incidence of nausea and vomiting. A reduction in PONV, if supported by future clinical trials, would be a meaningful advantage for physicians, patients and payors.

· Reduced POI and constipation. If we are able to demonstrate its safety and efficacy in clinical trials, in the absence of negative GI side effects, we believe TRV130, if approved, would be an attractive treatment option for patients. In preclinical studies, TRV130 caused

significantly less constipation compared to morphine at doses delivering equivalent analgesia. If these potential benefits translate to the clinical setting, and TRV130 is approved, we believe it could offer the possibility of meaningful cost savings to hospitals.

Clinical experience

We have had an active IND for TRV130 for moderate to severe acute pain with the FDA since January 2012. Since then, we have completed our Phase 2 a/b clinical trial of TRV130 in postoperative pain in 333 patients, four other clinical trials in 121 healthy subjects and one part of a two-part multiple- ascending dose trial in healthy volunteers, the second part of which is ongoing. These trials include:

Phase 2a/b trial of TRV130 in acute postoperative pain following bunionectomy.

The aim of our Phase 2a/b clinical trial was to evaluate TRV130’s efficacy and tolerability in the management of postoperative pain using morphine as a benchmark. The trial was a multicenter, randomized, double-blind, placebo- and active-controlled, multiple dose, adaptive trial in 333 women and men undergoing a primary unilateral first-metatarsal bunionectomy surgery at four sites in the United States. Patients were randomized after surgery to receive TRV130, morphine or placebo to manage their pain. Pain intensity was measured using validated numeric rating scales ranging from ten (most severe pain) to zero (no pain) at multiple time points up to 48 hours. Based on these scales, analgesic efficacy was assessed with a time-weighted average change in pain score over 48 hours—a well established measure of changes in the intensity of pain over time and an FDA-recommended endpoint for pain studies. The trial was conducted in two parts, with the goal of providing information on efficacy and dose- and interval-ranging and furthering the differentiation of TRV130 compared to morphine. In the first part, a pilot phase, patients were randomized to receive one of four doses of TRV130 (1 mg, 2 mg, 3 mg or 4 mg), morphine or placebo, all given at four hour intervals. In the second part of the trial, an adaptive phase, eight cohorts of approximately 25 patients each were randomized successively to one of two adaptive doses of TRV130 given every three hours, morphine given every four hours, and placebo given every three or four hours hours in a double-blind, double-dummy fashion. In this adaptive phase, doses of 0.5 mg, 1 mg, 2 mg and 3 mg of TRV130 were evaluated. Rescue medication consisting of acetaminophen or ketorolac was used in all groups. In total, 141 patients were treated in the pilot phase and 192 patients were treated in the adaptive phase. The second part of the trial was originally planned to include ten cohorts of 25 patients each, but after progressing through the pilot phase and eight of the ten planned cohorts in the second phase, we elected to close enrollment in the trial following a pre- specified interim analysis because the trial had met its objectives.

We recently announced top-line data from this trial. At doses of 2 mg and 3 mg of TRV130 administered every three hours, the trial achieved its primary endpoint of statistically greater pain reduction than placebo for 48 hours, which we believe demonstrates proof of concept for TRV130. Over the 48-hour trial period, the 3mg dose of TRV130 administered every three hours also showed statistically superior analgesic efficacy compared to the 4mg dose of morphine administered every four hours. Additionally, in the first three hours of dosing, when pain was most severe, the 1 mg, 2 mg and 3 mg doses of TRV130 demonstrated superior analgesic efficacy in the trial compared to placebo, and the 2 mg and 3 mg doses of TRV130 demonstrated superior analgesic efficacy compared to the 4 mg dose of morphine.

There were no serious adverse events reported in the trial. Both the 2mg and 3 mg doses of TRV130 showed overall tolerability over the 48-hour trial period similar to the 4 mg dose of morphine administered every four hours. Adverse events attributable to TRV130 were largely opioid-related, with the most frequently reported events being dizziness, headache, somnolence, nausea, vomiting, flushing and itching. Adverse effects were generally dose-related.

These top-line results of the adaptive phase of the trial are summarized in more detail below:

· Primary endpoint—TRV130 compared to placebo over 48 hours. Over 48 hours, doses of 2 mg and 3 mg of TRV130 administered at three hour intervals achieved statistically more reduction in pain intensity compared to placebo administered at three or four hour intervals. The 2 mg dose of TRV130 reduced the time-weighted average pain score by 1.4 points more than placebo and the 3 mg dose of TRV130 reduced the time-weighted average pain score by 2.4 points more than placebo . These results were statistically significant, with one-sided p-values of 0.0024 and less than 0.0001, respectively, for the 2 mg and 3 mg doses of TRV130. P-value is a conventional statistical method for measuring the statistical significance of clinical results. A p-value of 0.05 or less represents statistical significance, meaning that there is a 1-in-20 or less likelihood that the observed results occurred by chance. The mean baseline pain rating was approximately seven out of ten, a pain level considered severe.

· TRV130 compared to morphine over 48 hours. Over 48 hours, 3 mg of TRV130 administered at three hour intervals achieved statistically more reduction in pain intensity compared to 4 mg of morphine administered at four hour intervals, reducing the time-weighted average pain score compared to placebo by 1.0 point more than morphine. This result was statistically significant, with a one-sided p-value of 0.014.

Figure 3 summarizes these results from the adaptive phase of the trial, comparing the least squares mean time-weighted average pain intensity difference over the 48-hour trial period for the four doses of TRV130 and morphine, each compared to placebo.

Figure 3: Pain relief from TRV130 and morphine compared to placebo over 48 hours

· TRV130 compared to placebo and morphine over three hours. When study pain was most severe, during the first three hours after the initial dose, TRV130 at 1 mg, 2 mg and 3 mg showed statistically more reduction in pain intensity compared to placebo, reducing the time-weighted average pain score by 1.0 point, 2.4 points and 3.0 points, respectively, more than placebo and with one-sided p-values of 0.021, less than 0.0001 and less than 0.0001, respectively. Likewise, TRV130 at 2 mg and 3 mg showed statistically more reduction in pain intensity compared to 4 mg of morphine, reducing the time-weighted average pain score by 1.2 points and 1.8 points, respectively, more than morphine, with one-sided p-values of 0.0029 and less than 0.0001, respectively. The 3 mg dose of TRV130 achieved a reduction in least squares mean pain intensity of approximately six points, with notable efficacy at five minutes, the first pain intensity assessment after dosing.

Figure 4 summarizes these results from the adaptive phase of the trial, comparing the mean pain score from one to ten at various measurement points over the first three hours after the initial dose of placebo, 4 mg of morphine or one of the four doses of TRV130.

Figure 4: Pain intensity for TRV130, morphine and placebo over first three study hours

· Patient-reported peak pain relief after first dose. Consistent with these findings, more patients reported statistically greater peak pain relief during the first three-hour dosing period for 2 mg and 3 mg doses TRV130 compared to 4 mg of morphine, with p-values of 0.005 and less than 0.0001, respectively. Of patients receiving 1 mg, 2 mg or 3 mg of TRV130, 13%, 31% and 52%, respectively, reported complete peak pain relief during this period compared to 0% and 8% of patients receiving placebo and 4 mg morphine, respectively.

Figure 5 summarizes these results from the adaptive phase of the trial, indicating the percentage of responding patients taking placebo, morphine or one of the four doses of TRV130 reporting various levels of peak pain relief, from no or little relief to complete relief, during the first three-hour dosing period.

Figure 5: Level of peak pain relief from TRV130, morphine and placebo over first three study hours

The efficacy demonstrated by TRV130 in the first three hours was reproduced upon repeat dosing, leading to sustained differences from placebo at both the 2 mg and 3 mg doses (Figure 6). During the final 24 hours of the trial, pain intensity decreased in patients receiving placebo, which we believe reduced the amount of efficacy that could be measured for TRV130.

Figure 6: Pain intensity for TRV130, morphine and placebo over 48 hours

As noted above, there were no serious adverse events reported in the trial. Adverse events were generally dose-related. Adverse events attributable to TRV130 were largely opioid-related, with the

most frequently reported events, representing a greater than 10% incidence in any group, being dizziness, headache, somnolence, nausea, vomiting, flushing and itching, as reflected below in Figure 7.

Figure 7: Spontaneously reported opioid-related adverse events

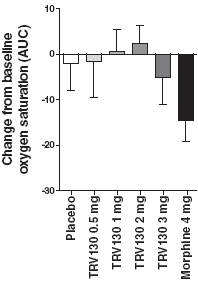

In addition, all four doses of TRV130 showed trends of less respiratory depression than morphine, as measured by oxygen saturation, after three hours following the first dose (hours 0-3) and after 24 hours following the first dose, the last time of oxygen saturation measurement (hours 0-24), as shown in Figure 8.

Figure 8: Change from baseline in oxygen desaturation levels from 0-3 and 0-24 hours

|

hours 0-3 |

|

hours 0-24 |

|

|

|

|

|

|

|

|

Phase 1b proof of concept exploratory trial in healthy subjects using an evoked-pain model

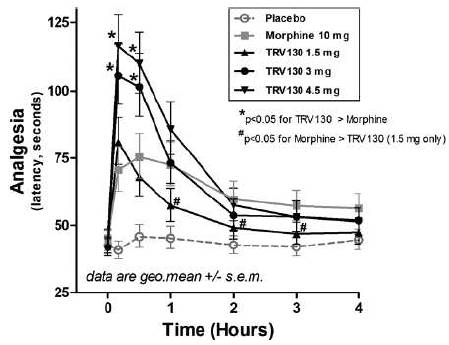

The aims of this trial were to characterize the analgesic efficacy and safety and tolerability of a single dose of TRV130 as compared to a single 10 mg dose of morphine. We employed a double-blind, five-period crossover design with 30 healthy male subjects each randomized to receive a 2-minute infusion of three dose levels of TRV130 (1.5 mg, 3.0 mg and 4.5 mg), 10 mg of morphine, and placebo in random order. We used an evoked-pain model, the cold pain test, to evaluate the analgesic effects of TRV130. The cold pain test is an established model to evaluate opioid effectiveness. We measured time to hand removal, or latency, from a temperature-controlled cold water bath. We used visual analog scale measurements of nausea and measured respiratory depression through ventilatory response to hypercapnia, another well-known experimental model.

At both the 3.0 mg and 4.5 mg doses, TRV130 showed superior efficacy as compared to a 10 mg morphine dose that was statistically significant with a p-value of less than 0.05 at the ten and 30 minute time points after dosing. The durability of the analgesic effect was similar to morphine as shown in Figure 9. In addition, the time to peak effect was more rapid than morphine.

Overall, TRV130 was well tolerated in the trial. Subjects receiving TRV130 showed less severe nausea and less frequent vomiting at the 1.5 mg and 3.0 mg doses as compared to a 10 mg dose of morphine. TRV130 also showed less respiratory depression compared to morphine, measured as minute volume, or MV, area under the curve over 4 hours as shown in Figure 10. MV is a product of respiratory rate and tidal volume, or the amount of air exhaled in a single breath, and thereby captures the body’s ability to expel carbon dioxide. The reduction in respiratory depression was statistically significant as compared to a 10 mg morphine dose with a p-value of less than 0.05 at all TRV130 doses. The 3.0 mg dose of TRV130 therefore demonstrated superior efficacy, less severe nausea, less vomiting and less respiratory depression in this trial as compared to 10 mg morphine, suggesting that TRV130, if approved, may have a better analgesic profile compared to existing unbiased µ-opioid agonists.

Figure 9: Analgesic effect of TRV130 as compared to

morphine in an evoked-pain model

Figure 10: Less respiratory depression with TRV130 as compared to morphine

Three part phase 1 clinical trial in healthy subjects

The primary objectives of this trial were to evaluate the pharmacokinetics and tolerability of TRV130. We also obtained pharmacodynamic data by measuring pupil constriction. At historically efficacious doses, morphine and fentanyl cause approximately 1 to 2 mm of pupil constriction.

Based on the pharmacokinetics data from these trials, we expect TRV130, if approved, could be administered by IV bolus, or continuous infusion, including by way of patient-controlled analgesic device, making it potentially convenient and easy to use for postoperative pain. Specific pharmacokinetic data obtained from these trials is highlighted below:

· TRV130 showed a dose-dependent increase in exposure.

· In vitro data suggest that TRV130 is metabolized by at least two liver enzymes: CYP2D6 and CYP3A4. Approximately 2% to 21% of the population has low levels of CYP2D6 activity. In Part B of the trial, we evaluated TRV130 in a group of these poor metabolizers in order to understand whether dose adjustments will be required in this group. The maximum TRV130 plasma concentration in this group was in the upper range of that observed in non- poor metabolizers, suggesting that the poor metabolizers should exhibit similar tolerability to non-poor metabolizers. There was a reduction in clearance by approximately 50% in the poor metabolizers suggesting that a lower frequency of dosing may be required to offer effective pain relief.

· Reducing infusion time when administering TRV130 as a bolus in Part C of the trial did not significantly alter the exposure, suggesting that TRV130 could be administered as an intermittent bolus infusion without compromising drug exposure.

Overall, TRV130 was well tolerated. In Part A of the Phase 1 clinical trial, when TRV130 was administered as a one-hour infusion, there was no nausea or vomiting reported at doses up to 4 mg/hr that produced a reduction in pupil diameter of approximately 2.5 mm. When the dose was increased to 7 mg/hr, four subjects receiving TRV130 experienced nausea and four experienced vomiting, thus establishing the non-tolerated dose.

In Part A of this Phase 1 clinical trial in healthy subjects, one subject who received 0.25 mg/hr TRV130 experienced a severe episode of vasovagal syncope during which he fainted and his pulse stopped, which were classified as serious adverse events. He recovered without medical intervention and experienced no known adverse consequences from this event. Certain potential triggers of vasovagal syncope were removed from the trial protocol, and dose escalation proceeded up to 7 mg/hr (28-fold higher than the 0.25 mg/hr dose at which the syncope occurred). No additional vasovagal syncope events were reported in the trial or in any other TRV130 trial.

In Part C of the trial, TRV130 was administered to six subjects with each subject receiving on successive days a 1.5 mg dose with an infusion time of 30 minutes, 15 minutes, five minutes and one minute. TRV130 was well tolerated with pupil constriction of approximately 1 mm. We used these data to design a further intravenous bolus trial as described below to evaluate higher bolus doses.

Phase 1 IV bolus trial

In a follow-up trial with bolus doses of 2.0, 3.0 or 3.5 mg administered over two minutes, TRV130 was well tolerated up to 3.5 mg (the highest dose in the trial). One subject experienced mild nausea when 3.5 mg TRV130 was given. No nausea was reported at the lower doses. When 3.5 mg of TRV130 was administered, pupil diameter decreased by approximately 2 mm from baseline, in line with high-dose morphine or fentanyl.

Phase 1 drug-drug interaction trial

To further explore TRV130’s metabolic profile in the clinic, a single dose of TRV130 was administered to healthy subjects in conjunction with ketoconazole, a CYP3A4 inhibitor. TRV130 was safe and generally well-tolerated in the presence of ketoconazole and there was no clinically meaningful change in TRV130 exposure.

Phase 1 two-part multiple ascending dose trial

The first part of this trial evaluated the maximum tolerated dose and pharmacokinetics of TRV130 when multiple doses were given, and also measured pharmacodynamic effects of TRV130, including pupil constriction and cold pain test analgesia. The results of this part of the trial were consistent with earlier trials, showing reproducible pharmacokinetics and pharmacodynamic effects of TRV130. Safety and tolerability of TRV130 were also consistent with earlier trials, and no unexpected adverse effects were observed. The second part of the trial, which is testing the effects of subjects’ metabolic capacity on potential duration of action of TRV130, is in progress and we expect to release data from this part of the trial by the end of 2014.

Preclinical studies

In preclinical models, TRV130 showed analgesic efficacy comparable to morphine but reached peak effect more quickly than morphine. Time to peak effect occurred within five minutes for TRV130 compared to 30 minutes for morphine. TRV130 had a significantly improved therapeutic index, compared to morphine, of analgesia to respiratory depression, measured as blood carbon dioxide, or pCO2, and analgesia to constipation, measured using two GI motility assays. This was consistent with basic research studies in which morphine given to β-arrestin2 knockout mice showed increased analgesia, less respiratory depression and less constipation than morphine given to wild-type mice.

Clinical development strategy

We believe that the early clinical and preclinical data generated suggest that TRV130 may have superior analgesia with fewer dose-limiting safety and tolerability disadvantages compared to existing opioid analgesics. If confirmed in further trials, we believe that this profile will justify TRV130, if approved, as a preferred opioid analgesic for the intravenous treatment of moderate to severe acute pain.

We are also conducting a Phase 1 clinical trial to explore the safety, tolerability, pharmacokinetics and pharmacodynamics of multiple ascending doses of TRV130 in healthy volunteers. This trial consists of two parts. We have completed the first part of this trial, in which we observed safety, tolerability, pharmacokinetics and pharmacodynamics after repeat-dosing consistent with our expectations from earlier single-dose trials. The second part of the trial, which is testing the effects of subjects’ CYP2D6 metabolic capacity on TRV130 potential duration of action, is ongoing.

Separately, we are conducting an additional Phase 1 trial to evaluate the absorption, metabolism and excretion of TRV130 in healthy subjects. This additional Phase 1 trial is ongoing and we expect it to conclude in the first half of 2015.

We expect to initiate a second Phase 2 clinical trial of TRV130 in December 2014 with the goal of evaluating analgesic efficacy following a soft tissue surgery and exploring TRV130’s safety and tolerability profile compared to morphine. We expect to report top-line data from this trial in mid-2015. This trial will employ as-needed dosing to broaden dosing information beyond the fixed-interval dosing used in the bunionectomy trial. In this trial, TRV130, morphine or placebo will be administered as an initial loading dose followed by delivery of on-demand doses via a patient-controlled analgesia device. Approximately 200 patients who have undergone uncomplicated, elective abdominoplasty surgery will be enrolled in the trial, with approximately 40 receiving placebo, 80 receiving TRV130 and 80 receiving morphine. The primary endpoint of the trial will be the efficacy of TRV130 compared to placebo over 24 hours, which may serve as a registration endpoint in Phase 3 development. In parallel with the Phase 2 abdominoplasty clinical trial, we intend to commence Phase 3 preparations for TRV130, with the goal of initiating our first of two Phase 3 clinical trials in the first quarter of 2016. We expect that the Phase 2 abdominoplasty trial, if the data are promising, along with data from the Phase 2a/b clinical trial of treatment of postoperative pain following bunionectomy, would support Phase 3 development in soft and hard tissue pain, which we believe would be required by the FDA for approval of TRV130 for broad use in moderate to severe pain. In addition, we plan to complete other clinical trials that would support Phase 3 clinical development. Core pivotal studies in the Phase 3 program could closely resemble the Phase 2 trials, with additional trials exploring the therapeutic potential more broadly. This approach may enable an NDA for a broad acute moderate to severe pain label and may also guide commercial positioning.

We plan to initially target TRV130 for the treatment of moderate to severe, acute postoperative pain where IV administration is preferred. If our trials for this indication are successful, we believe there may be additional opportunities to expand the target indications in subsequent trials. Other potential patient populations for the eventual use of TRV130 include perioperative use (including sustained dosing for the most painful surgery types); non-surgical hospitalized patients such as burn victims (including debridement); end-of-life palliative care; emergency service trauma care; renal stones; sickle cell crises and military applications. We may also explore other dosage forms, such as transmucosal or transdermal administration for breakthrough or chronic pain, respectively, in additional separate trials.

Commercialization

We plan to develop and commercialize TRV130 for IV administration ourselves, if approved. We intend to build acute care commercial capabilities, initially in the United States, and to retain full U.S. rights. In the United States, sales of injectable analgesics have increased by more than 70% between

2011 and 2013 to approximately $660 million, according to IMS health. We may seek collaborators for commercializing TRV130 outside the United States after the availability of full Phase 2 data to offset risk and preserve capital.

Manufacturing

We have carried out TRV130 drug substance synthesis, performed by a third party, at a scale up to 2 kg per batch. Phase 3 synthetic process development and regulatory compliance studies are in progress. Currently we manufacture drug substance and drug product, both with third parties, at single sites, but we plan to qualify additional sites in connection with any Phase 3 trials.

Competition

If TRV130 is approved for IV treatment of moderate to severe acute pain, it will compete with widely used, currently marketed opioid analgesics, such as morphine, hydromorphone and fentanyl. The effectiveness of these agents is limited by well-known adverse side effects, such as respiratory depression, nausea and vomiting, constipation and POI. TRV130 may also compete against Ofirmev, marketed by Mallinckrodt plc, and Exparel, marketed by Pacira Pharmaceuticals, Inc., which are reformulations of existing products and are typically used in combination with opioids.

We are aware of a number of products in development that are aimed at improving the treatment of moderate to severe, acute postoperative pain while reducing undesirable side effects. The most advanced product candidates are reformulations of existing opioids, such as a fentanyl ionophoresis patch, in development by The Medicines Company, and sufentanil nanotab, in development by AcelRx. In addition, Cara Therapeutics Inc. is developing an IV and oral peripherally restricted κ-opioid receptor agonist, which will likely be used in combination with opioids.

Intellectual property

Our TRV130 patent portfolio is wholly owned by us. The portfolio includes one issued U.S. Patent, which claims among other things, TRV130, compositions comprising TRV130 and methods of using TRV130. The portfolio also includes one pending U.S. patent application claiming TRV130, other compounds and/or methods of making or using the same. If issued, the pending U.S. application is predicted to expire no earlier than 2032, subject to any disclaimers or extensions. A related Patent Cooperation Treaty, or PCT, application was filed and national patent applications have been filed in South Korea, the European Patent Office, the Eurasian Patent Office, Australia, Brazil, Canada, Israel, India, Japan, China, and New Zealand. Any patents resulting from these national patent applications, if issued, are expected to expire no earlier than 2032, subject to any disclaimers or extensions.

TRV734

TRV734 is a small molecule G protein biased ligand at the µ-opioid receptor, which we are developing as a first-line, orally administered compound for the treatment of moderate to severe acute and chronic pain. Like TRV130, TRV734 takes advantage of a well-established mechanism of pain relief by targeting the µ-opioid receptor, but does so with enhanced selectivity for the G protein signaling pathway, which in preclinical studies was linked to analgesia, as opposed to the β-arrestin signaling pathway, which in preclinical studies was associated with side effects. Subject to successful preclinical and clinical development and regulatory approval, we believe TRV734 may have an improved efficacy and side effect profile as compared to current commonly prescribed oral analgesics, such as oxycodone. We have filed patent applications covering TRV734 and methods of using TRV734.

Data from IMS Health show that opioid drug sales across the United States, Europe and Japan were approximately $11 billion in 2013. Despite widespread use, there are significant limitations to existing therapies with respect to efficacy, constipation, nausea and vomiting and respiratory depression. Dose-limiting side-effects may translate into inadequate pain control. The constipating effects of chronic opioids are particularly problematic because they do not lessen over time, while efficacy does

tend to reduce over time for a particular dose level. Numerous approaches have been attempted to mitigate constipation. Laxatives, peripherally restricted opioid antagonists, such as naloxegol, methylnaltrexone and alvimopan, and multimodal analgesia, such as the opioid/SNRI tapentadol, are only partially effective and can raise problematic new side effects in an attempt to mitigate the adverse effects of opioid analgesics. Based on the very large market and substantial limitations confronting current analgesics, we believe a new opioid with a more precisely targeted mechanism of action and an improved therapeutic profile could provide a significant product opportunity in the acute and chronic pain markets.

Clinical experience

We have had an active IND for TRV734 since January 2014. In 2014, we completed our first Phase 1 trial of TRV734, which tested single ascending doses and the relative bioavailability of oral TRV734 in healthy subjects. In this trial, we observed that TRV734 was pharmacologically active at a range of safe and well-tolerated doses. We believe that the data from this trial suggest that TRV734 provides dose-related exposure, speed of onset, and duration of action suitable for treating moderate to severe acute pain. TRV734 elicited dose-related increases in plasma concentrations, with peak plasma concentrations reached approximately one hour after dosing and a terminal half-life consistent with use for treating acute pain. Pupil constriction indicative of analgesia was observed at doses of 80 mg and higher, and mild-to-moderate adverse effects were reported at the maximum explored dose of 250 mg. We believe this suggests that the analgesic efficacy of TRV734 may be separable from opioid-related adverse effects. No clinically significant changes in vital signs, laboratory values or ECG parameters, and no severe or serious adverse events, were reported.

Preclinical data

TRV734 has shown a similar profile to TRV130 in in vitro and in vivo studies. It is highly selective for the µ-opioid receptor, where, like the most powerful opioid analgesics, it is a strong agonist of G protein coupling. TRV734 is distinct from those analgesics in its very weak recruitment of β-arrestins to the µ-opioid receptor. In our preclinical studies, TRV734 showed analgesic effects in preclinical pain models similar to oxycodone and morphine. In the same studies, TRV734 caused less constipation compared to equivalently analgesic doses of oxycodone and morphine. TRV734 is active after oral administration in mice and rats, has high oral bioavailability and has been well tolerated in non-human primates.

Based on these data and data for TRV130, we believe that TRV734 may offer an improved efficacy profile as compared to current opioid therapies or equivalent efficacy with an improved GI tolerability and respiratory safety profile.

Clinical development strategy

We intend to seek a collaborator with experience in developing and commercializing controlled-substance therapeutics in chronic care pain markets thereby leveraging their expertise while still retaining rights to commercialize TRV734 in acute care settings, including hospitals, in the United States.

We have completed enrollment in a second Phase 1 clinical trial, which is a multiple ascending dose trial evaluating the safety, tolerability, pharmacodynamics and pharmacokinetics of TRV734 given as a single dose and as multiple ascending doses in healthy volunteers. The trial is designed to enable Phase 2 development, and is being conducted in two parts with approximately 70 healthy volunteers randomized to participate in the trial. The first part will assess the safety, tolerability, pharmacodynamics and pharmacokinetics of single 125 mg doses of TRV734 in an open-label, randomized, three-period crossover trial in which subjects are fasted, fed a standard meal or fed a high-fat meal. This portion of the trial is designed to explore how changes in absorption may modify the performance of TRV734 and to identify the best administration paradigm for the second part of the

trial. The second part of the trial will assess the safety, tolerability, pharmacodynamics and pharmacokinetics of multiple ascending doses of TRV734 in a double-blind, double-dummy, randomized, active- and placebo-controlled adaptive trial. Oxycodone immediate release 10 mg is used as a benchmark for a variety of pharmacodynamic measures intended to evaluate the analgesic and adverse effect profile of TRV734. We expect to release top line data for both parts of the trial early in the first quarter of 2015. We plan to continue development of TRV734 by conducting activities to support Phase 2 clinical trials. We also plan to seek a collaboration with a third party to support later-stage development and commercialization efforts.

Manufacturing

We have carried out TRV734 drug substance synthesis, performed by a third party, at a scale up to 2 kg per batch. A formulated tablet is being developed for Phase 2 clinical trials.

Intellectual property

Our TRV734 patent portfolio, which is wholly owned by us, includes one pending U.S. patent application claiming TRV734, other compounds and/or methods of making or using the same. If issued, we expect the pending U.S. application will expire no earlier than 2032, subject to any disclaimers or extensions. A related PCT application was filed and national patent applications have been filed in South Korea, the European Patent Office, the Eurasian Patent Office, Australia, Brazil, Canada, Israel, India, Japan, China, and New Zealand. Any patents resulting from these national patent applications, if issued, are predicted to expire no earlier than 2032, subject to any disclaimers or extensions.

TRV250

In November 2014, we identified a new product candidate, TRV250, a small molecule G protein biased ligand of the δ-opioid receptor. Based on the initial profile of TRV250, we anticipate focusing our initial development efforts on the treatment of treatment-refractory migraine headaches. According to Decision Resources, a healthcare consulting company, the acute episodic migraine market encompassed approximately 12 million drug-treated patients in 2013 in the United States, representing approximately $2.2 billion of sales. We estimate that approximately 20% to 30% of these patients either do not respond to or cannot tolerate the market-leading triptan drug class, and an additional 30% would benefit from improved efficacy compared to these drugs.

We believe our preclinical data support targeting the δ-opioid receptor for the treatment of CNS disorders. Prior approaches to modulate this receptor have been limited by a significant risk of seizure associated with this target. By contrast, TRV250 is a potent δ-opioid receptor ligand that displayed strong efficacy in animal models of migraine and other CNS disorders with reduced seizure liability through selectively activating G protein coupling without engaging β-arrestin. These in vivo data are further supported by data for δ-agonists in β-arrestin knockout mice suggesting that β-arrestin plays a role in seizures. We intend to advance TRV250 into preclinical studies in 2015 designed to support our submission of an IND to the FDA. We also intend to seek a collaborator for TRV250 with CNS development and worldwide commercialization expertise, while potentially retaining commercialization rights in the United States. Phase 1 clinical trials could include electroencephalogram studies to specifically assess seizure liability.

We have two provisional patent applications directed to compounds that modulate the δ-opioid receptor. One of the applications is solely owned by us and the other is co-owned by us and Ligand Pharmaceuticals Incorporated. We have an exclusive worldwide, paid up, royalty-free license to any compound or method of use in the field of pharmaceuticals disclosed in the Ligand co-owned application. We expect that any compound that modulates the δ-opioid receptor we choose to pursue under our development program would be covered by the application solely owned by us. These applications are eligible for worldwide filing and may be used to establish non-provisional applications that, if issued, are predicted to expire no earlier than 2035.

Cardiovascular Program

TRV027

TRV027 is a peptide β-arrestin biased ligand that targets the AT1R, inhibiting G protein signaling and activating β-arrestin signaling. We are developing TRV027 for the treatment of AHF in combination with standard diuretic therapy. In our Phase 2a clinical trial, TRV027 rapidly reduced blood pressure and preserved renal, or kidney, function, while preserving cardiac performance. We currently are enrolling patients in a Phase 2b clinical trial to evaluate the safety and efficacy of TRV027 in AHF. If our clinical development of TRV027 is successful and the product ultimately is approved by regulatory authorities, we believe TRV027 would be used as a first-line in-hospital AHF treatment. We also believe TRV027 could improve AHF symptoms, shorten length of hospital stay and potentially lower readmission rates and mortality rates after hospital discharge. U.S. patents covering the composition of matter and method of use of TRV027 have issued and are expected to expire no earlier than 2031 and 2029, respectively.

Disease

Heart failure is the inability of the heart to supply adequate blood flow, and therefore oxygen, to peripheral tissues and organs. When the heart is failing, mechanisms are triggered by the body to maintain blood pressure and tissue perfusion. One such mechanism is the activation of the renin-angiotensin system, or RAS, of which angiotensin II is a key mediator. Through angiotensin II, RAS increases blood pressure and stimulates the kidneys to retain both sodium and water. These mechanisms maintain cardiac performance in the short term, but in the longer term, the heart must pump against higher pressure, referred to as afterload, and is overstretched when filled, referred to as preload. These effects make the failing heart pump less efficiently and lead to progressive damage to the muscular tissue of the heart.

There are over 20 million people living with heart failure in the United States and Europe, according to the American Heart Association and the European Society of Cardiology. AHF, also sometimes referred to as acute decompensated heart failure, is heart failure requiring hospitalization. AHF patients present with fluid overload and severe dyspnea, a serious shortness of breath sometimes described as “air hunger,” leading to an inability to perform simple functions such as standing and walking short distances. AHF can also lead to organ dysfunction, including in the kidneys and heart. Most patients experiencing an AHF event have a worsening of existing chronic heart failure, although an estimated 25% of AHF hospitalizations represent new diagnoses of heart failure.

According to National Hospital Discharge Survey data, in the United States there were over 5 million hospital discharges in 2010 where heart failure was listed as a component of the diagnosis, over 1 million of which listed heart failure as the primary diagnosis. Based on national hospital discharge statistics from 25 countries in Europe, we estimate that there were a total of 1.6 million hospitalizations with a primary heart failure diagnosis in 2010 in those countries. Despite long hospital stays, up to approximately 50% of AHF patients remain symptomatic on discharge according to data from ADHERE, a national U.S. registry of over 100,000 patients admitted to the hospital with AHF between 2000 and 2005. In addition, the risk of readmission is 25% after 30 days and the one-year mortality rate is approximately 30%. Combined, these poor outcomes result in a substantial burden to the healthcare system. In 2012, the American Heart Association estimated the annual direct medical cost of treating heart failure in the United States to be almost $21 billion.

Current treatment options for AHF

We believe there is a significant unmet medical need for improved treatments for AHF. The current approach to treating patients with AHF involves facilitating the excretion of accumulated fluid with loop diuretics like furosemide; improving hemodynamics by reducing preload and afterload blood

pressure with vasodilators like nitroglycerin; and directly stimulating the heart to contract more forcefully with inotropes like dobutamine. None of these approaches has been robustly shown to improve patient outcomes in AHF, and each therapy has specific adverse effects that limit its clinical utility.

The mainstay of therapy for AHF is loop diuretics, such as furosemide. In AHF patients, fluid removal is important to relieve symptoms and to improve tissue oxygenation. Furosemide facilitates excretion of excess fluid, but aggressive diuresis can lead to renal dysfunction. Worsening renal function in AHF patients is associated with higher mortality and increased risk of hospital readmission. Diuretic therapy has also been shown to precipitate activation of RAS, further exacerbating the vicious cycle of heart failure.

After diuretics, IV vasodilators, such as nitroglycerin, nitroprusside and nesiritide, are the most common medications used for the treatment of AHF. These vasodilators effectively reduce blood pressure, but each is associated with undesirable side effects and other limitations. Hypotension, or low blood pressure, is the most common serious side effect of vasodilating agents. Nitroglycerin raises RAS, and its use is also hampered by rapid development of tolerance, such that the medication becomes less effective the longer that it is used. Nitroprusside is associated with possible cyanide toxicity and cannot be used without intensive monitoring, so its use is limited. Nesiritide is infrequently used, which we believe is due to uncertainties about its efficacy and safety.

In severe cases, and those characterized by very low cardiac output, physicians sometimes resort to the use of inotropes, which work by increasing cardiac contractility by mobilizing calcium but at the expense of increased oxygen consumption and risk of arrhythmia. These agents can improve symptoms in the short term but have been shown to increase mortality. In addition, these drugs are only used in patients who have AHF associated with low ejection fraction. This sub-group of AHF patients represents approximately half of all patients who present for urgent AHF treatment.

There remains an unmet need for better therapeutic approaches to treat AHF that can improve blood circulation through vasodilation, facilitate fluid excretion by the kidneys and enhance cardiac function through a novel mechanism not requiring calcium mobilization. Based on our preclinical studies and our clinical trials conducted to date, we believe TRV027 has the potential to meet this unmet need, and may prove to be more effective than currently available treatment options, reducing hospital readmission rates, mortality rates and length of hospital stay, while improving symptoms more rapidly and more completely.

Key differentiating attributes of TRV027

We believe that TRV027, when used with current standard of care, particularly loop diuretics like furosemide,will have the following potential advantages:

· Efficacy

· Targets RAS, a mechanism that is central to the disease. RAS blockade has been shown to have morbidity and mortality benefits in chronic heart failure. We believe that TRV027, if approved, could be the first therapy to bring modulation of RAS to the acute hospital setting, allowing the physician to improve blood circulation while protecting the heart and kidneys.

· Benefits the three key organ systems affected by AHF. In our preclinical studies and Phase 1b and 2a clinical trials, TRV027 has shown beneficial effects on the blood vessels, heart and kidneys. TRV027 could improve patient symptoms and outcomes by rapidly lowering afterload and preload blood pressure, sustaining cardiac output, and preserving kidney performance as a result of the lower blood pressure.

· Enhances furosemide’s effects on pulmonary capillary wedge pressure. Pulmonary capillary wedge pressure is a pharmacodynamic marker of dyspnea, a main symptom of AHF. Loop diuretics, like furosemide, facilitate excretion of excess fluid and are frequently used to manage AHF patients. Loop diuretics also activate RAS, which may compromise their ability to fully resolve symptoms, and may contribute to the estimated 50% of AHF patients who are still symptomatic at the time of discharge from the hospital. We believe that administering TRV027 in combination with furosemide may improve dyspnea directly by decreasing pressure on the heart and in the lungs and indirectly by allowing furosemide to work more effectively without the negative consequences of RAS activation.

· Drug safety and tolerability

· Favorable drug safety profile. TRV027 is a small peptide that is highly specific for the angiotensin receptor, so we believe that off-target adverse effects would not be expected. In clinical trials to date, TRV027 has been well-tolerated in healthy subjects and in patients with advanced chronic congestive heart failure, in each case at doses up to 20-fold higher than the expected efficacious dose. In preclinical toxicology studies, TRV027 had a favorable profile at doses up to 500 times the expected therapeutic dose.

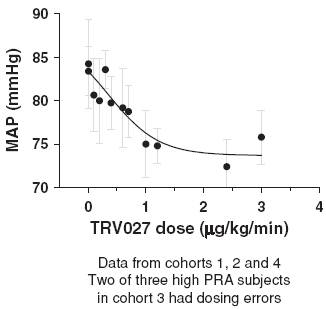

· Self-limiting blood pressure effect. In our Phase 2a clinical trial, there was a dose-dependent decrease in blood pressure up to doses of 1 µg/kg/min. No further reduction in blood pressure was seen at doses up to 3 µg/kg/min. We believe that this characteristic would offer a safety advantage over current vasodilators, which can cause dangerous hypotension.

· Rapidly reversible effects on blood pressure. In our three completed clinical trials, TRV027 had a very short half-life and its effects were rapidly reversible. In the acute care setting, we believe this should allow the physician to alter the dose and avoid prolonged hypotension.

· Action specific to target pathophysiology. In our three completed clinical trials, TRV027 lowered blood pressure only in subjects with elevated measures of RAS activity, the target pathophysiology. This is important for any drug that is used in emergency rooms when the initial diagnosis may be uncertain.

Clinical experience

We have had an active IND, for TRV027 for AHF with the FDA since February 2010. Since then, we have completed three clinical trials of TRV027:

· A Phase 2a clinical trial in medically fragile subjects with advanced stable heart failure, low ejection fraction and a clinical indication for right-heart catheterization. Ejection fraction is a measure of the volume of blood pumped by the heart. Right-heart catheterization is a procedure that allows measurement of intracardiac and intravascular pressures on the side of the heart leading to the lungs. This procedure is not commonly used for the treatment of AHF patients, so this trial enabled us to profile the hemodynamic effects of TRV027 in a comparatively stable chronic heart failure population that could be considered an AHF forerunner population.

· A Phase 1b clinical trial in subjects with moderate heart failure and concomitant renal dysfunction. Selecting a stable population allowed us to directly measure renal plasma flow, or RPF, and glomerular filtration rate, or GFR, two common measures used to evaluate renal safety.

· A Phase 1 clinical trial in healthy subjects to evaluate pharmacokinetics and tolerability prior to moving into chronic stable heart failure subjects.

Phase 2a hemodynamics trial in advanced stable heart failure subjects

The primary objectives of this trial were to characterize the safety and tolerability of TRV027 in subjects with advanced stable heart failure and to measure its effects on blood circulation, also known as hemodynamics. Due to the wide dose-range available following the Phase 1 clinical trial, we elected to employ a step-wise dose titration over five hours with the dose increased to a target dose 10-fold higher than the starting dose. This highest dose was continued for nine hours as a steady state infusion, for a total infusion time of 14 hours, to evaluate the stability of TRV027’s hemodynamic effects. Reversibility of TRV027’s effects was then studied for four hours after the infusion was discontinued. Three dosing regimens were evaluated in 24 subjects: 0.1 µg/kg/min titrated up to 1 µg/kg/min; 0.3 µg/kg/min titrated up to 3 µg/kg/min; and 1 µg/kg/min titrated up to 10 µg/kg/min. In total, 14 different doses were studied across the three different dosing regimens. Nine additional subjects received placebo in a double blind manner. Based on the preclinical and Phase 1 data, we were expecting the hemodynamic effects of TRV027 to depend on elevation of RAS activity. The data were therefore analyzed based on plasma renin activity, or PRA, elevation, with high PRA subjects defined as those with PRA levels greater than 5.82 ng/ml/hr, which is the upper limit of lab normal range. PRA is an enzyme in the RAS cascade and measures RAS activity. Eleven of the 24 treated subjects had high PRA. We believe that these high PRA subjects represent a sicker population more relevant to AHF, and we anticipate that most AHF patients will have high PRA.

In this trial TRV027 produced a dose-related decrease in mean arterial pressure, or MAP, in subjects with elevated PRA, as shown in Figure 11. The reduction in MAP was sustained during the steady state infusion period and reversed during the washout period following the end of the infusion. This reversal of effect was statistically significant compared to both placebo and normal PRA subjects with p-values of less than 0.01 and 0.001, respectively. The decrease in MAP in the high PRA subjects compared to subjects receiving placebo in the maintenance phase was also statistically significant, with a p-value of less than 0.05.

Figure 11: Effect of TRV027 on mean arterial pressure in advanced stable

heart failure subjects with elevated PRA

We also observed evidence of pharmacologic effects on PCWP in the subjects with elevated PRA. PCWP dropped in subjects with high PRA during the titration phase and this was sustained during the

maintenance phase and reversed during the wash-out phase. The interpretation of the results in the titration and maintenance phases was complicated by a baseline drift in PCWP in the placebo group, however, the increase in PCWP when the TRV027 infusion was stopped was clear and statistically significant in high PRA compared to normal PRA subjects, with a p-value of less than 0.01, as shown in Figure 12.

Figure 12: Reversal of effect of TRV027 on pulmonary capillary wedge pressure

in advanced stable heart failure subjects

In this trial, there was no apparent change in cardiac index or heart rate observed in subjects with normal or high PRA following administration of TRV027. Cardiac index is a well accepted measurement of how well the heart is functioning as a pump by directly correlating the volume of blood pumped by the heart with an individual’s body surface area. This contrasts with the response of heart failure subjects to acute administration of the angiotensin receptor blocker, or ARB, losartan, which has been shown to decrease cardiac index in some studies.

TRV027 was well tolerated in this medically fragile population. Despite the substantial reduction in MAP in TRV027-treated high-PRA subjects, there was no apparent increase in heart rate or in levels of cystatin-C or creatinine, which are biomarkers of renal function. This suggests that the blood pressure reduction was accompanied by preservation of kidney function. This result was consistent with our observations in preclinical studies. One subject in the lowest-dose cohort in this trial experienced hypotension necessitating dose reduction and then discontinuation of the TRV027 infusion. No other TRV027-related clinically significant adverse events were reported.

Phase 1b renal safety trial in stable chronic heart failure subjects

The primary objective of this trial was to explore the pharmacokinetics and renal safety of TRV027, co-administered with furosemide, in 17 subjects with a history of heart failure and concomitant renal dysfunction. Two cohorts of six subjects and one cohort of five subjects were enrolled in this two-period crossover trial. All of the subjects had moderate heart failure and concomitant renal dysfunction.

TRV027 was administered using a standard dosing paradigm, with doses of 1.25 mg/hr, 6.25 mg/hr and 31.25 mg/hr (equivalent to 0.35 µg/kg/min, 1.74 µg/kg/min and 8.68 µg/kg/min, respectively, for a 60 kg person), without weight correction. The plasma concentrations obtained were similar to those

obtained when TRV027 was administered on a per-kg basis to subjects with normal kidney function, suggesting that a standard dosing approach with no adjustment for weight or renal impairment is appropriate, which would facilitate use in the emergency room where patients are not routinely weighed.

TRV027 was well tolerated in these renally impaired subjects. There were no TRV027-related clinically significant or serious adverse events reported. Previously published research has shown that oral furosemide administration produces a reduction in GFR that can be inhibited by blocking the effects of elevated angiotensin II. In our trial, however, there was no effect of the single dose of furosemide on GFR or RPF; therefore, it was not possible to show a renal protective effect of TRV027. The trial did, however, show that TRV027 itself preserved GFR and RPF, before and after furosemide administration. In this trial, co-administration of TRV027 did not impair furosemide’s effect on diuresis or urinary sodium excretion.

Taken together, we believe the Phase 2a and Phase 1b clinical trials in stable chronic heart failure subjects provide evidence suggesting that TRV027 may have a beneficial effect on the heart, the blood vessels and kidney function in patients suffering from AHF, consistent with the data we had obtained in preclinical studies.

Phase 1 clinical trial

The Phase 1 clinical trial was a single center, crossover trial evaluating four-hour infusions of TRV027 in 20 healthy subjects at doses ranging from 0.01 to 20 µg/kg/min. The primary objective of the trial was to evaluate the tolerability and pharmacokinetics of TRV027. TRV027 was well tolerated with no serious adverse events or clinically significant adverse events reported even at doses up to 20 times higher than the expected therapeutic dose. There was a linear increase in exposure with dose and TRV027 was rapidly cleared when the infusion was stopped, suggesting that it will potentially be easy to reverse any unexpected hypotensive effects. There was no urinary excretion of TRV027 so we do not expect any dose adjustments to be required for renal insufficiency. We believe this characteristic may make TRV027 easy to use in the emergency room.

Preclinical studies

In a paced dog animal model of heart failure, TRV027 decreased MAP and PCWP. TRV027 also increased renal blood flow and moderately increased cardiac output. In another paced dog model study, TRV027 was studied in combination with furosemide and showed additive effects on reducing PCWP, which would be consistent with beneficial effects on dyspnea in the clinic. In addition, combining the data in normal dogs, paced dogs and paced dogs treated with furosemide, we observed meaningful blood pressure decreases only in animals with elevated RAS, which is consistent with the data seen in the clinical trials and we believe provides further evidence supporting the premise that TRV027 only works in patients with the target pathophysiology. Furthermore, the dose response observed in paced dogs was consistent with that observed in subjects in the Phase 2a clinical trial.