Attached files

| file | filename |

|---|---|

| EX-23 - CONSENT LETTER - Pantop Corp | ex231-120214pan.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1 Amendment No. 2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PANTOP CORPORATION

(Exact name of Registrant as specified in its charter)

| Nevada | 3679 | N/A |

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Suite

3906, Far East Finance Centre, Admiralty, Hong Kong |

||

| (address of principal executive offices) | ||

| Registrant's telephone number, including area code: |

+852 5325 5932 | |

Registrant's

fax number, |

+852 2149 7094 | |

| Copies of all communications to: | ||

Grenfell Capital Limited Suite 705, Siu On Centre, 188 Lockhart Road, Wanchai, Hong Kong (Name

and address |

|

|

| Telephone: | +852 8120 7213 | |

| Fax: | +1 323 843 1095 | |

| Email: | corp@grenfellcapital.com | |

Approximate date of commencement of proposed sale to the public: |

As soon as practicable after the effective date of this Registration Statement. | |

If any of the securities being registered on the Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box | X |

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |__|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |__|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |__|

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. |__|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer |__| Accelerated filer |__| Non-accelerated filer |__| Smaller reporting company | X |

1

CALCULATION OF REGISTRATION FEE

TITLE

OF EACH CLASS |

AMOUNT

|

PROPOSED

MAXIMUM |

PROPOSED

MAXIMUM |

AMOUNT

OF |

| Common Stock | 5,000,000 | $0.02 | $100,000.00 | $12.88 |

| (1) | This price was arbitrarily determined by Pantop Corporation. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

2

PROSPECTUS

PANTOP CORPORATION

5,000,000

SHARES OF COMMON STOCK

INITIAL PUBLIC OFFERING

___________________

SUBJECT TO COMPLETION, Dated [ ]

This prospectus relates to our offering of 5,000,000 new shares of our common stock at an offering price of $0.02 per share. The offering will commence promptly after the date of this prospectus and close no later than 120 days after the date of this prospectus. However, we may extend the offering for up to 90 days following the 120 day offering period. We will pay all expenses incurred in this offering. The shares are being offered by us on a "best efforts" basis and there can be no assurance that all or any of the shares offered will be subscribed. If less than the maximum proceeds are available to us, our development and prospects could be adversely affected. There is no minimum offering required for this offering to close. All funds received as a result of this offering will be immediately available to us for our general business purposes. The Maximum Offering amount is 5,000,000 shares ($100,000).

The offering is a self-underwritten offering; there will be no underwriter involved in the sale of these securities. We intend to offer the securities through our Officer and Director, who will not be paid any commission for such sales. The Company sole Officer and Director intends to market the shares and identify potential investors through use her personal contacts and network to promote the shares to her friends, family members, business partners and associates.

Offering Price |

Underwriting

Discounts and Commissions |

Proceeds to Company | |

| Per Share | $0.02 | None | $0.02 |

Total (maximum offering) |

$100,000 | None | $100,000 |

Our common stock is presently not traded on any market or securities exchange. The sales price to the public is fixed at $0.02 per share.

We are an emerging growth company as that term is used in the Jumpstart Our Business Startups Act of 2012 (the"JOBS Act") and are subject to reduced public company reporting requirements. Details please refer to Page 5 description of emerging growth company definition and points related to emerging growth company in Risk Factor section.

The purchase of the securities offered through this prospectus involves a high degree of risk. See section entitled "Risk Factors" starting on page 7.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The Date of This Prospectus is: [ ]

3

Table of Contents

| Page | |

| Summary | 5 |

| The Offering | 6 |

| Risk Factors | 7 |

| Forward-Looking Statements | 13 |

| Use of Proceeds | 13 |

| Determination of Offering Price | 14 |

| Dilution | 15 |

| Plan of Distribution, Terms of the Offering | 16 |

| Description of Securities | 19 |

| Interest of Named Experts and Counsel | 20 |

| Description of Business | 21 |

| Description of Property | 25 |

| Legal Proceedings | 25 |

| Market for Common Equity and Related Stockholder Matters | 25 |

| Financial Statements | 27 |

| Management Discussion and Analysis of Financial Condition and Results of Operations | 28 |

| Changes in and Disagreements with Accountants | 30 |

| Directors and Executive Officers | 30 |

| Executive Compensation | 31 |

| Security Ownership of Certain Beneficial Owners and Management | 33 |

| Disclosure of Commission Position on Indemnification for Securities Act Liabilities | 33 |

| Certain Relationships and Related Transactions | 34 |

| Available Information | 34 |

| Dealer Prospectus Delivery Obligation | 34 |

| Other Expenses of Issuance and Distribution | 35 |

| Indemnification of Directors and Officers | 35 |

| Recent Sales of Unregistered Securities | 36 |

| Table of Exhibits | 36 |

| Undertakings | 37 |

| Signatures | 38 |

4

Summary

PANTOP CORPORATION

The Company

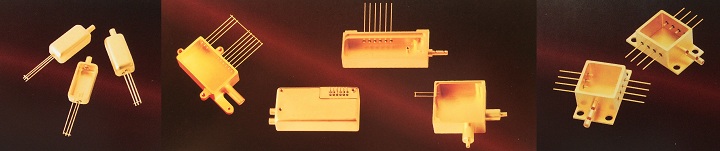

We were incorporated as Pantop Corporation on May 6, 2014 in the State of Nevada for the purpose of designing and selling of Hermetically Sealed Microelectronic Packages, using both Glass-To-Metal-Seal and High Temperature Cofired Ceramic (HTCC) technology. Within the main business unit Hermetic Sealed Microelectronic Package, Pantop Corporation intends to develop a complete customer interface, engineering and production capability to address opportunities for its product lines across Optical Communication, Telecommunication, and Industrial markets. We are a development stage company and have not generated any revenues to date. Our business will likely fail unless we achieve sales revenue sufficient to fund ongoing operations by the mid-point of the third quarter of the fiscal year that began on June 30, 2014.

We are not a "blank check" company and have no plans to engage in a merger or acquisition with any other company or other entity. We have no plans to acquire any other business and we have no intention of using investor funds or any other resources for that purpose. We plan to conduct the business disclosed herein and intend to use the proceeds from this offering in furtherance of our Hermetically Sealed Microelectronic Packages business as disclosed in more detail under the heading labeled "Use of Proceeds."

As of September 30, 2014, we had $7,116 in current assets and $6,919 in current liabilities. Accordingly, we had working capital of $197 as of September 30, 2014. Our current working capital is not sufficient to enable us to implement our business plan as set forth in this prospectus. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. For these and other reasons, our independent auditors have raised substantial doubt about our ability to continue as a going concern. Accordingly, we will require additional financing, including the equity funding sought in this prospectus.

We are offering for sale to investors a maximum of 5,000,000 shares of our common stock at an offering price of $0.02 per share (the "Offering"). Our business plan is to use the proceeds of this offering for engineer consultancy cost and the order of certain materials, outsourcing manufacturing to downstream factories, and marketing through website, local exhibitions and by other means. The shares are being offered by us on a "best efforts" basis and there can be no assurance that all or any of the shares offered will be subscribed. If less than the maximum proceeds are available to us, our development and prospects could be adversely affected. There is no minimum offering required for this offering to close. The proceeds of this offering will be immediately available to us for our general business purposes. The Maximum Offering amount is 5,000,000 shares ($100,000).

Our principal office address is Suite 3906, Far East Finance Centre, 16 Harcourt Road, Admiralty, Hong Kong. Our phone number is +852 5325 5932 and the to-be-developed website is www.pantopcorp.com. And our fiscal year end is June 30.

Implications of Being an Emerging Growth Company

We qualify as an emerging growth company as that term is used in the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| 1. | A requirement to have only two years of audited financial statements and only two years of related MD&A; |

| 2. | Exemption from the auditor attestation requirement in the assessment of the emerging growth company’s internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002; |

| 3. | Reduced disclosure about the emerging growth company’s executive compensation arrangements; and |

| 4. | No non-binding advisory votes on executive compensation or golden parachute arrangements. |

We have already taken advantage of these reduced reporting burdens in this prospectus, which are also available to us as a smaller reporting company as defined under Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the "Exchange Act").

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the "Securities Act") for complying with new or revised accounting standards. We have elected to use the extended transition period provided above and therefore our financial statements may not be comparable to companies that comply with public company effective dates. We could remain an emerging growth company for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a "large accelerated filer" as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

For more details regarding this exemption, see "Financial Statements from Page F1 to F16."

5

The Offering

| Securities Being Offered | Up to 5,000,000 shares of our common stock. |

| Offering Price | The offering price of the common stock is $0.02 per share. There is no public market for our common stock. We cannot give any assurance that the shares offered will have a market value, or that they can be resold at the offered price if and when an active secondary market might develop, or that a public market for our securities may be sustained even if developed. The absence of a public market for our stock will make it difficult to sell your shares in our stock.

Upon the effectiveness of the registration statement of which this prospectus is a part, we intend to apply through FINRA to the over-the-counter bulletin board, through a market maker that is a licensed broker dealer, to allow the trading of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934. |

| Minimum Number of Shares To Be Sold in This Offering | N/A |

| Maximum Number of Shares To Be Sold in This Offering | 5,000,000 |

| Securities Issued and to be Issued | 12,000,000 shares of our common stock are issued and outstanding as of the date of this prospectus. Our sole Officer and Director, Ms. Lijuan Hao, owns an aggregate of 83.33% of the common shares of our company and therefore have substantial control; Grenfell Capital Limited owns 16.67% of the common shares before new issuance. Upon the completion of this offering, our sole Director and Officer and Grenfell Capital Limited will own an aggregate of approximately 58.82% and 11.76%, respectively, of the issued and outstanding shares of our common stock if the maximum number of shares is sold. |

| Number of Shares Outstanding After The Offering If All The Shares Are Sold | 17,000,000 |

| Use of Proceeds | If we are successful at selling all the shares we are offering, our proceeds from this offering will be approximately $100,000. We intend to use these proceeds to execute our business plan as set out in Use of Proceeds section on pages 13-14 of this Prospectus. |

| Offering Period | The shares are being offered for a period up to 120 days after the date of this Prospectus, unless extended by us for an additional 90 days. |

The following selected financial data should be read in conjunction with our financial statements and the related notes to those statements included in "Financial Statements" and with " Management’s Discussion and Analysis of Financial Condition And Results Of Operations" appearing elsewhere in this Prospectus.

| Summary Financial Information for the year ended June 30, 2014 |

| September 30, | June 30, | ||||

| 2014 | 2014 | ||||

| $ | $ | ||||

| Balance Sheet Data | |||||

| Cash and cash equivalents | 3,901 | 3,901 | |||

| Deposit | 2,500 | 2,500 | |||

| Prepayments | 715 | 1,165 | |||

| Total Current Assets | 7,116 | 7,566 | |||

| Total Current Liabilities | (6,919) | (5,059) | |||

| Total Stockholder’s Equity | 197 | 2,507 |

| Three Months Ended September 30, | Period from May 6, 2014 (inception) to June 30, | ||||

| 2014 | 2014 | ||||

| $ | $ | ||||

| Statement of Operations | |||||

| Revenue | - | - | |||

| Net Profit (Loss) for Reporting Period | (2,310) | (9,493) |

6

Risk Factors

You should consider each of the following risk factors and any other information set forth herein, including our financial statements and related notes, in evaluating our business and prospects. The risks and uncertainties described below are not the only ones that impact on our operations and business. Additional risks and uncertainties not presently known to us, or that we currently consider immaterial, may also impair our business or operations. If any of the following risks actually occur, our business and financial results or prospects could be harmed. In that case, the value of the Common Stock could decline.

Risks Related To Our Financial Condition and Business

If we do not obtain additional financing, including the financing sought in this offering, our business will fail.

We have not yet commenced active operations and have not generated any revenue to date. Our business plan calls for expenses related to the acquisition of certain materials and equipment, engineering consultancy and marketing throughout local industrial exhibitions and electronic fairs, probably professional manufacturing procedure consultation, and other start-up costs. Our the most ideal cash requirements over the next coming twelve months are expected to be approximately $100,000, major expense consisting of approximately for $10,500 on professional fee for this Offering, consisting of approximately $49,000 for order material for outsourcing manufacturing, $14,000 for marketing, $24,000 for Engineering consultation specialized in manufacturing procedure management and control, and the rest for administrative and web development expenses. As of September 30, 2014, we had cash on hand in the amount of $3,901 and working capital in the amount of $197. Accordingly, our business will likely fail if we are unable to successfully complete this Offering at or near the maximum offering amount. In addition, if we are unable to achieve sales revenue sufficient to fund ongoing operations by the mid-point of the third quarter of our fiscal year beginning June 30, 2014, we will be required to seek additional financing. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. Obtaining additional financing beyond the initial equity financing sought through this offering will be subject to a number of factors, including our ability to show strong early revenues and sustained sales growth. These factors may make the most desirable timing, amount, and terms or conditions of additional financing unavailable to us.

Because we have limited experience marketing our services, designing customized products and working with the machinery manufacturing downstream factories, we may find it difficult to smooth the entire working system, generate significant revenue and we face a high risk of business failure.

Our management has very little experience marketing our services and designing customized products for clients. We have not commenced operations in the past few months, let alone taken our first customer order, and have not yet completed any project. Our experience in marketing our products to date has consisted of informal contacts with potential purchasers and we lack a proven track record of supplying high quality products on which to rely on marketing to potential customers. Because of our very limited experience in marketing our services and monitoring downstream collaborative machinery manufacturing factories in manufacturing our self-designed products, we can provide no assurance that we will be able to successfully deliver the order, generate significant sales or net profits. We have not earned any revenues as of the date of this prospectus, and we face a high risk of business failure.

We have not found a suitable and capable machinery manufacturing factories to be our downstream factories yet. We may find it difficult to manufacture products even though we successfully complete designing the engineering samples for the customers, which will seriously affect our ability to generate revenue, negatively affect our reputation, and eventually we may face a high risk of business failure.

Due to our limited financial resources, our management has not started searching for the suitable and capable machinery factories to be our manufacturers. Evaluating and searching for a qualified downstream producer is time and energy consuming, to find a qualified manufacturer is essential to the success of our business. Even if the downstream producer can be found in a very short time, smooth operation between our Company and the factory will depend on knowledge and technical transfer to make the product. Furthermore, there is a possibility that the downstream factories cannot produce our designed products to our specification and standard.

Because our sole Director and Officer has no prior experience as a Chief Executive or as the head of a public company, we may be hindered in our ability to efficiently and competitively execute our business strategy and achieve profitability.

Our sole Director and Officer, Ms. Hao, lacks any prior experience as a company Chief Executive. In addition, Ms. Hao does not have any business experience beyond her past position as a head of Equipment & Mechanical Lubrication Department of Shenzhen Seg-HITACHI Display Devices Co. Ltd. Our competitors will likely have substantially more experienced management as well as greater revenue and resources. We believe competition in the market for our services will be based primarily on product designing innovation, price, and timely completion and high quality hermetically sealed microelectronic packages. Due to more experienced management and greater overall resources, our competitors will have a significant advantage over us and we may struggle to grow our sales effectively and achieve long term profitability. In addition, Ms. Hao has no experience managing a publicly reporting company. Accordingly, Ms. Hao will be less effective than more experienced managers in efficiently managing our ongoing regulatory compliance obligations and in dealing with such matters as public relations, investor relations, and corporate governance.

7

Because we do not have a corps of experienced personnel, our ability to expand our operations and to grow revenues over time may be limited.

We have no full time employees and will rely upon individuals working as independent consultants on an as-needed basis to assist with the manufacturing and quality control process for our orders. Our competitors may have rosters of experienced full time personnel which will enable them to expand more rapidly, handle a larger volume of business, and thereby continue to maintain their larger market shares. Accordingly, our ability to significantly expand our operations and to engage in the design and manufacturing of multiple orders at one time may be hindered during the immediate future and our prospects for growth of our revenue base may be limited.

Because our auditor has issued a going concern opinion regarding our company, there is an increased risk associated with an investment in our company.

We have earned no revenue since our inception, which makes it difficult to evaluate whether we will operate profitably. We have not attained profitable operations and are dependent upon obtaining financing or generating revenue from operations to continue operations for the immediate future. As of September 30, 2014, we had cash in the amount of $3,901. Our future is dependent upon our ability to obtain financing or upon future profitable operations. We are currently seeking equity financing through this offering. We reserve the right to seek additional funds through private placements of our common stock and/or through debt financing. Our ability to raise additional financing is unknown. We do not have any formal commitments or arrangements for the advancement or loan of funds. For these reasons, our auditors stated in their report that they have substantial doubt we will be able to continue as a going concern. As a result, there is an increased risk that you could lose the entire amount of your investment in our company.

Because our offering will be conducted on a best efforts basis, there can be no assurance that we can raise the money we need.

The shares are being offered by us on a "best efforts" basis without benefit of a private placement agent. We can provide no assurance that this Offering will be completely sold out. If less than the maximum proceeds are available, our business plans and prospects for the current fiscal year could be adversely affected.

Because our president has only agreed to provide her services on a part-time basis, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

Ms. Hao, our sole Officer and Director and the designer and primary developer of our products, devotes 10 to 15 hours per week to our business affairs. Currently, we do not have any full or part-time employees and rely upon outside consultants to assist with the performance of our projects on an as-needed basis. If the demands of our business require the full business time of Ms. Hao, it is possible that she may not be able to devote sufficient time to the management of our business, as and when needed. If our management is unable to devote a sufficient amount of time to manage our operations, our business will fail.

Because our President and sole Director and Officer, Ms. Lijuan Hao, will own approximately 58.82% of our outstanding common stock, if the maximum number of shares is sold, investors may find that corporate decisions influenced by Ms. Lijuan Hao are inconsistent with the best interests of other stockholders.

Ms. Lijuan Hao is our sole Director and Officer. She will own approximately 58.82% of the outstanding shares of our common stock, if the maximum number of shares is sold. Accordingly, she will have an overwhelming influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sales of all or substantially all of our assets, and also the power to prevent or cause a change in control. While we have no current plans with regard with regard to any merger, consolidation or sale of substantially all of our assets, the interests of Ms. Lijuan Hao may still differ from the interests of the other stockholders.

The direction Ms. Hao takes in the Company may also differ from the interests of the other stockholders. She has sole power to decide every aspect of our business, including fundamental decisions like raising money, which could dilute your ownership in our Company, spending investment funds and any future revenue, pursing business direction, deciding on what contracts to sign and other important matters These decisions may differ radically from the choices you would make as an investor in our Company.

Because we will incur additional costs as the result of becoming a public company, our cash needs will increase and our ability to achieve net profitability may be delayed.

Upon effectiveness of our Registration Statement for the Offering, we will become a publicly reporting company and will be required to stay current in our filings with the SEC, including, but not limited to, quarterly and annual reports, current reports on materials events, and other filings that may be required from time to time. We believe that, as a public company, our ongoing filings with the SEC will benefit shareholders in the form of greater transparency regarding our business activities and results of operations. In becoming a public company, however, we will incur additional costs in the form of audit and accounting fees and legal fees for the professional services necessary to assist us in remaining current in our reporting obligations. We expect that, during our next coming up twelve months of operations following the effectiveness of our Registration Statement, we will occur additional costs for professional fees in the approximate amount of $10,500. These additional costs will increase our cash needs and may hinder or delay our ability to achieve net profitability even after we have begun to generate revenues from sales of our products.

8

Risks Related To the Industry and Market

If the target market can not be recovered soon, our business will fail.

Our target markets are the telecommunication and the industrial markets. For the telecommunication markets, it has recently experienced an exceptional crisis with a slight recovery in 2008 but still hampered by the effects of the global economic crisis of 2009. Nevertheless, the upward trend is expected to intensify over the coming years to fill the demand for more traffic transmission. For the industrial sector, this ne of our most important target market is the telecommunication, which contains a large sector of anti-collision radar ("intelligent" speed regulators). This global market has experienced an exceptional crisis in both its expansion and duration, which are currently in a down-market shift. It has slightly recovered in the recent two years, however, there is no hint of recovery sign of this market. Therefore, both the telecommunication and the industrial sector may not recover and this it may detrimentally affect the Company's to success in the business and our business may fail.

PRC laws and regulations governing our businesses and the validity of certain of our contractual arrangements are uncertain. If we are found to be in violation, we could be subject to sanctions. In addition, changes in such PRC laws and regulations may materially and adversely affect our business.

There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations including, but not limited to, the laws and regulations governing our business, or the enforcement and performance of cooperative arrangements with certain of our Chinese downstream manufacturers. We are considered foreign persons under PRC law. As a result, we are subject to PRC law limitations on manufacturing and trading. These laws and regulations are relatively new and may be subject to change, and their official interpretation and enforcement may involve substantial uncertainty. The effectiveness of newly enacted laws, regulations or amendments may be delayed, resulting in detrimental reliance by foreign investors. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively.

The PRC government has broad discretion in dealing with violations of laws and regulations, including levying fines, revoking business and other licenses and requiring actions necessary for compliance. In particular, licenses and permits issued or granted to us by relevant governmental bodies may be revoked at a later time by higher regulatory bodies. We cannot predict the effect of the interpretation of existing or new PRC laws or regulations on our businesses. We cannot assure you that our current operating structure would not be found in violation of any current or future PRC laws or regulations. As a result, we may be subject to sanctions, including fines, and could be required to restructure our operations or cease to provide certain services. Any of these or similar actions could significantly disrupt our business operations or restrict us from conducting a substantial portion of our business operations, which could materially and adversely affect our business, financial condition and results of operations.

Adverse changes in economic and political policies of the PRC government could have a material adverse effect on the overall economic growth of China, which could adversely affect our business.

As our hermetically sealed microelectronic packages products offered through the internet expands, we expect an increasing portion of our business operations would likely be conducted in China, including receiving orders from China since this product’s mass production hasn’t been taken off due to the technology barriers, most likely our collaborative downstream manufacturers will be picked in mainland China, and China telecommunication market has been booming in the resent years. Accordingly, our results of operations, financial condition and prospects are subject to a significant degree to economic, political and legal developments in China. China's economy differs from the economies of most developed countries in many respects, including the amount of government involvement, level of development, growth rate, controlling of foreign exchange and allocation of resources. While China's economy has experienced significant growth in the past 20 years, growth has been uneven across different regions and among various economic sectors of China. The PRC government has implemented various measures to encourage economic development and guide the allocation of resources. Some of these measures benefit the overall PRC economy, but may also have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by governmental control over capital investments or changes in tax regulations that are applicable to us. Since early 2004, the PRC government has implemented certain measures to control the pace of economic growth. Such measures may cause a decrease in the level of economic activity in China, which in turn could adversely affect our results of operations and financial condition.

Uncertainties with respect to the PRC legal system could adversely affect us.

Our future collaborative downstream manufacturers will be picked in mainland China, which means we will conduct an increasing portion our business through affiliated entities based in China. Our operations in China are governed by PRC laws and regulations. These new downstream cooperative manufacturers are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to wholly foreign-owned enterprises. The PRC legal system is based on written statutes. Prior court decisions may be cited for reference but have limited precedent value. Since 1979, PRC legislation and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, China has not developed a fully integrated legal system and recently-enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. In particular, because these laws and regulations are relatively new, and because of the limited published decisions and their non-binding nature, the interpretation and enforcement of these laws and regulations involve uncertainties. In addition, the PRC legal system is based in part on governmental policies and internal rules (some of which are not published on a timely basis or at all) that may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until after the occurrence of the violation. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

9

Risks Related To Legal Uncertainty

If we are the subject of future product defect or liability suits, our business will likely fail.

In the course of our planned development, we may become subject to legal actions based on a claim that our planned hermetically sealed microelectronic packages products are defective in workmanship or have caused personal or other injuries. We currently do not maintain liability insurance and we may not be able to obtain such coverage in the future or such coverage may not be adequate to cover all potential claims. Moreover, even if we are able to maintain sufficient insurance coverage in the future, any successful claim could significantly harm our business, financial condition and results of operations.

If we are not granted trademark and copyright protection for our designs, we may have difficulty safeguarding our designs, potentially resulting in our competitors utilizing them, thereby impairing our ability to achieve profitable operations.

Our success will depend, in part, on our ability to obtain and enforce intellectual property rights over our name and original designs in China. To date, we have sought no intellectual property rights protection. No assurance can be given that any intellectual property rights owned by us will not be challenged, invalidated or circumvented, that any rights granted will provide competitive advantages to us. Intellectual property litigation is expensive and time-consuming, and can be used by well-funded adversaries as a strategy for depleting the resources of a small company such as us. There is no assurance that we will have sufficient resources to successfully prosecute our interests in any litigation that may be brought. The failure to adequately protect our intellectual property could result in our competitors utilizing our core technology/process, and impairing our ability to achieve profitable operations.

Risks Related To This Offering

If a market for our common stock does not develop, shareholders may be unable to sell their shares.

Prior to this offering, there has been no public market for our securities and there can be no assurance that an active trading market for the securities offered herein will develop after this offering, or, if developed, be sustained. We anticipate that, upon completion of this offering, the common stock will be eligible for quotation on the OTC Bulletin Board. If for any reason, however, our securities are not eligible for initial or continued quotation on the OTC Bulletin Board or a public trading market does not develop, purchasers of the common stock may have difficulty selling their securities should they desire to do so and purchasers of our common stock may lose their entire investment if they are unable to sell our securities.

Because regulatory sales practice requirements may limit a stockholder’s ability to buy and sell our stock, investors may not be able to sell their stock should they desire to do so.

In addition to the "penny stock" rules described below, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity in our common stock. As a result, fewer broker-dealers may be willing to make a market in our common stock, reducing a stockholder's ability to resell shares of our common stock.

Because state securities laws may limit secondary trading, investors may be restricted as to the states in which they can sell the shares offered by this prospectus.

If you purchase shares of our common stock sold in this offering, you may not be able to resell the shares in any state unless and until the shares of our common stock are qualified for secondary trading under the applicable securities laws of such state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in such state. There can be no assurance that we will be successful in registering or qualifying our common stock for secondary trading, or identifying an available exemption for secondary trading in our common stock in every state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, our common stock in any particular state, the shares of common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the market for the common stock will be limited which could drive down the market price of our common stock and reduce the liquidity of the shares of our common stock and a stockholder's ability to resell shares of our common stock at all or at current market prices, which could increase a stockholder's risk of losing some or all of his investment.

Because we do not expect to pay dividends for the foreseeable future, investors seeking cash dividends should not purchase our common stock.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future. Our payment of any future dividends will be at the discretion of our Board of Directors after taking into account various factors, including but not limited to our financial condition, operating results, cash needs, growth plans and the terms of any credit agreements that we may be a party to at the time. Accordingly, investors must rely on sales of their own common stock after price appreciation, which may never occur, as the only way to realize their investment. Investors seeking cash dividends should not purchase our common stock.

10

Because we will be subject to the "Penny Stock" rules, the level of trading activity in our stock may be reduced.

Broker-dealer practices in connection with transactions in "penny stocks" are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges or quoted on NASDAQ). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, broker-dealers who sell these securities to persons other than established customers and "accredited investors" must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules, and investors in our common stock may find it difficult to sell their shares.

If our shares are quoted on the over-the-counter bulletin board, we will be required to remain current in our filings with the SEC and our securities will not be eligible for quotation if we are not current in our filings with the SEC.

In the event that our shares are quoted on the over-the-counter bulletin board, we will be required to remain current in our filings with the SEC in order for shares of our common stock to be eligible for quotation on the over-the-counter bulletin board. In the event that we become delinquent in our required filings with the SEC, quotation of our common stock will be terminated following a 30 day grace period if we do not make our required filing during that time. If our shares are not eligible for quotation on the over-the-counter bulletin board, investors in our common stock may find it difficult to sell their shares.

Because purchasers in this offering will experience immediate and substantial dilution in the net tangible book value of the common stock, you may experience difficulty recovering the value of your investment.

Purchasers of our securities in this offering will experience immediate and substantial dilution in the net tangible book value of their common stock from the initial public offering price. Dilution in net tangible book value per share represents the difference between the amount per share paid by purchasers of shares of our common stock in this offering and the pro forma net tangible book value per share of our common stock immediately following this offering. The dilution experienced by investors in this offering will result in a net tangible book value per share that is less than the offering price of $0.02 per share. Such dilution may depress the value of the company’s common stock and make it more difficult to recover the value of your investment in a timely manner should you chose sell your shares.

If we undertake future offerings of our common stock, purchasers in this offering will experience dilution of their ownership percentage.

Generally, existing shareholders will experience dilution of their ownership percentage in the company if and when additional shares of common stock are offered and sold. In the future, we may be required to seek additional equity funding in the form of private or public offerings of our common stock. In the event that we undertake subsequent offerings of common stock, your ownership percentage, voting power as a common shareholder, and earnings per share, if any, will be proportionately diluted. This may, in turn, result in a substantial decrease in the per share value of your common stock.

11

We are an "emerging growth company," and any decision on our part to comply only with certain reduced disclosure requirements applicable to "emerging growth companies" could make our common stock less attractive to investors.

We are an "emerging growth company," as defined in the JOBS Act, and, for as long as we continue to be an "emerging growth company," we expect and fully intend to take advantage of exemptions from various reporting requirements applicable to other public companies but not to "emerging growth companies," including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We could be an "emerging growth company" for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a "large accelerated filer" as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three years period.

In addition, Section 107 of the JOBS Act also provides that an "emerging growth company" can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an "emerging growth company" can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to opt in to the extended transition period for complying with the revised accounting standards. We have elected to rely on these exemptions and reduced disclosure requirements applicable to "emerging growth companies" and expect to continue to do so.

The JOBS ACT allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies.

Since, we have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act, this election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

Reporting requirements under the exchange act and compliance with the SARBANES-OXLEY ACT OF 2002, including establishing and maintaining acceptable internal controls over financial reporting, are costly and may increase substantially.

The rules and regulations of the SEC require a public company to prepare and file periodic reports under the Exchange Act, which will require that the Company engage legal, accounting, auditing and other professional services. The engagement of such services is costly. Additionally, the Sarbanes-Oxley Act of 2002 (the "Sarbanes-Oxley Act") requires, among other things, that we design, implement and maintain adequate internal controls and procedures over financial reporting. The costs of complying with the Sarbanes-Oxley Act and the limited technically qualified personnel we have may make it difficult for us to design, implement and maintain adequate internal controls over financial reporting. In the event that we fail to maintain an effective system of internal controls or discover material weaknesses in our internal controls, we may not be able to produce reliable financial reports or report fraud, which may harm our overall financial condition and result in loss of investor confidence and a decline in our share price.

As a public company, we will be subject to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act, the Dodd-Frank Act of 2010 and other applicable securities rules and regulations. Despite recent reforms made possible by the JOBS Act, compliance with these rules and regulations will nonetheless increase our legal and financial compliance costs, make some activities more difficult, time-consuming or costly and increase demand on our systems and resources, particularly after we are no longer an "emerging growth company." The Exchange Act requires, among other things, that we file annual, quarterly, and current reports with respect to our business and operating results.

We are working with our legal, independent accounting and financial advisors to identify those areas in which changes should be made to our financial and management control systems to manage our growth and our obligations as a public company. These areas include corporate governance, corporate control, disclosure controls and procedures and financial reporting and accounting systems. We have made, and will continue to make, changes in these and other areas. However, we anticipate that the expenses that will be required in order to adequately prepare for being a public company could be material. We estimate that the aggregate cost of increased legal services; accounting and audit functions; personnel, such as a chief financial officer familiar with the obligations of public company reporting; consultants to design and implement internal controls; and financial printing alone will be a few hundred thousand dollars per year and could be several hundred thousand dollars per year. In addition, if and when we retain independent directors and/or additional members of senior management, we may incur additional expenses related to director compensation and/or premiums for directors’ and officers’ liability insurance, the costs of which we cannot estimate at this time. We may also incur additional expenses associated with investor relations and similar functions, the cost of which we also cannot estimate at this time. However, these additional expenses individually, or in the aggregate, may also be material.

In addition, being a public company could make it more difficult or more costly for us to obtain certain types of insurance, including directors’ and officers’ liability insurance, and we may be forced to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. The impact of these events could also make it more difficult for us to attract and retain qualified persons to serve on our board of directors, our board committees or as executive officers.

The increased costs associated with operating as a public company may decrease our net income or increase our net loss, and may cause us to reduce costs in other areas of our business or increase the prices of our products or services to offset the effect of such increased costs. Additionally, if these requirements divert our management’s attention from other business concerns, they could have a material adverse effect on our business, financial condition and results of operations.

12

Forward-Looking Statements

We have made statements in this Prospectus, including under "Prospectus Summary," "Risk Factors," "Management’s Discussion and Analysis of Financial Condition and Results of Operations," "Description of Business" and elsewhere that constitute forward-looking statements. Forward-looking statements involve risks and uncertainties, such as statements about our plans, objectives, expectations, assumptions or future events. In some cases, you can identify forward-looking statements by terminology such as "anticipate," "estimate," "plan," "project," "potential," "predict," "continuing," "ongoing," "expect,", "we believe," "we intend," "we prepare", "may," "should," "will," "could" and similar expressions denoting uncertainty or an action that may, will or is expected to occur in the future. These statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from any future results, performances or achievements expressed or implied by the forward-looking statements.

Examples of forward-looking statements include:

| • | the timing of the development of future products; |

| • | projections of costs, revenue, earnings, capital structure and other financial items; |

| • | statements of our plans and objectives; |

| • | statements regarding the capabilities of our business operations; |

| • | statements of expected future economic performance; |

| • | statements regarding competition in our market; and |

| • | assumptions underlying statements regarding us or our business. |

The ultimate correctness of these forward-looking statements depends upon a number of known and unknown risks and events. We discuss our known material risks under the heading "Risk Factors" above. Many factors could cause our actual results to differ materially from the forward-looking statements. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

The forward-looking statements speak only as of the date on which they are made, and, except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

You should also assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

Use of Proceeds

The net proceeds to us from the sale of up to 5,000,000 shares of common stock offered at a public offering price of $0.02 per share will vary depending upon the total number of shares sold. We are conducting this Offering on a best-effort basis. There is no minimum amount of shares we are required to sell nor is a minimum amount of money we are required to raise from this Offering. If we well all of the shares offered, we will receive $100,000 in gross proceeds, but there can be no assurance that all or any of the shares will be sold.

The following table summarizes in the next page, in order of priority the anticipated application of the proceeds we will receive from this offering if 25%, 50%, 75% and 100% number of shares is sold in this offering by the Company:

Business development expenses consist primarily of office expenses, marketing expenses, and acquisition of certain materials. And the compensation for personnel like engineering consultation and professional fee take a huge portion of our use of proceed. We plan to use the proceeds from this offering to introduce our designed of hermetic sealed microelectronic package products to the target mainly Telecommunications and Industrial markets. Following the raising of the necessary funds from this prospectus, we anticipate to commence marketing our services and products, select the downstream factories, and manufacturing our first engineering sample order from first customer in the next 12 month. We are unable to predict whether there will be any direct financial impact from the planned business development and there can be no assurance our product development plans will achieve any of the benefits we anticipate.

13

| If

25% of Shares are sold |

If

50% of Shares are sold |

If

75% of Shares are sold |

If

100% of Shares are sold | |

| Gross Proceeds from this Offering | $25,000 | $50,000 | $75,000 | $100,000 |

| Planned Expenditures: | ||||

| Offering Expenses | ||||

| -Legal and Accounting | $7,000 | $7,000 | $7,000 | $7,000 |

| -SEC Filing Fees | $3,000 | $3,000 | $3,000 | $3,000 |

| -Postage/Printing | $500 | $500 | $500 | $500 |

| Sub-total | $10,500 | $10,500 | $10,500 | $10,500 |

| Less: | ||||

| Business Development | ||||

| -Domain Name Fee | $10 | $10 | $10 | $10 |

| -Web Development | $500 | $800 | $900 | $1,000 |

| -Marketing | $4,936 | $9,000 | $11,250 | $14,000 |

| -Material | $3,500 | $16,800 | $27,000 | $49,000 |

| Sub-total | $8,946 | $26,610 | $39,160 | $64,010 |

| Less: | ||||

| Admin. Expenses | ||||

| -Registered Agent Fee - Nevada | $129 | $129 | $129 | $129 |

| -Annual List Fee | $325 | $325 | $325 | $325 |

| -Telephone/Printing/Mail/Office/Misc | $100 | $300 | $600 | $800 |

| -Engineer Consultation | $5,000 | $12,000 | $24,000 | $24,000 |

| -Others | $0 | $136 | $286 | $236 |

| Sub-total | $5,554 | $12,890 | $25,340 | $25,490 |

| Grand Expenditures | $25,000 | $50,000 | $75,000 | $100,000 |

| Investors must be aware that the above figures represent only estimated costs. | ||||

We believe our anticipated funds from this Offering and the cash we currently have, will provide us with sufficient funds to meet our cash requirements for our business operations for at least twelve months following the date of this registration statement provided that we are able to successfully complete this Offering at or near the maximum offering amount. Moreover, none of the offering proceeds we receive will be used to make loans to Directors.

Our description represents our best estimate of the allocation of the proceeds of this offering based upon our start-up stage. Our estimates may prove to be inaccurate. We based this estimate on various assumptions, including our anticipated sales, marketing expenditures, and consultancy fee of professional engineers to monitor the quality control and assurance, etc. If any of these factors changes, we may find it necessary to reallocate a portion of the proceeds within the above described categories. If our plans change or our assumptions prove to be inaccurate, we may need to seek additional financing sooner than currently anticipated or to curtail our operations.

Determination of Offering Price

The $0.02 per share offering price of our common stock was arbitrarily chosen by management. There is no relationship between this price and our assets, earnings, book value or any other objective criteria of value.

14

Dilution

Purchasers of our securities in this offering will experience immediate and substantial dilution in the net tangible book value of their common stock from the initial public offering price.

The price of the current offering is fixed at $0.02 per share. This price is significantly greater than the price paid by the Company’s sole Director and Officer for common equity since the Company’s inception on May 6, 2014. The Company’s sole Officer and Director paid $0.001 per share, a difference of $0.199 per share lower than the sale price in this offering.

The historical net tangible book value as of June 30, 2014 was $2,507 or $0.00021 per share. The following assumes the sale of 100% of the shares of common stock in this offering. After giving effect to the sale of 5,000,000 shares at an offering price of $0.02 per share of common stock, the new investors’ capital contributions reach to the maximum amount as $100,000, as 89.29% of the capital. Thus, the percentage of ownership after offerings reaches as high as 29.41%. Other figures as illustrated in the following table:

| If 100% shares are sold: | ||

| Public offering price per share of common stock | $ | 0.02000 |

| Net tangible book value per share prior to offering | $ | 0.00021 |

| Increase per share attributable to new investors | $ | 0.00638 |

| Net tangible book value per share after offering | $ | 0.00659 |

| Dilution per share to new investors | $ | 0.01341 |

The following assumes the sale of 75% of the shares of common stock in this offering. After giving effect to the sale of 3,750,000 shares at an offering price of $0.02 per share of common stock, the new investors’ capital contributions reach to the amount as $75,000, as 86.21% of the capital. Thus, the percentage of ownership after offerings reaches as much as 23.81%. Other figures as illustrated in the following table:

| If 75% shares are sold: | ||

| Public offering price per share of common stock | $ | 0.02000 |

| Net tangible book value per share prior to offering | $ | 0.00021 |

| Increase per share attributable to new investors | $ | 0.00531 |

| Net tangible book value per share after offering | $ | 0.00552 |

| Dilution per share to new investors | $ | 0.01448 |

The following assumes the sale of 50% of the shares of common stock in this offering. After giving effect to the sale of 2,500,000 shares at an offering price of $0.02 per share of common stock, the new investors’ capital contributions reach to the amount as $50,000, as 80.65% of the capital. Thus, the percentage of ownership after offerings reaches 17.24%. Other figures as illustrated in the following table:

| If 50% shares are sold: | ||

| Public offering price per share of common stock | $ | 0.02000 |

| Net tangible book value per share prior to offering | $ | 0.00021 |

| Increase per share attributable to new investors | $ | 0.00407 |

| Net tangible book value per share after offering | $ | 0.00428 |

| Dilution per share to new investors | $ | 0.01572 |

The following assumes the sale of 25% of the shares of common stock in this offering. After giving effect to the sale of 1,250,000 shares at an offering price of $0.02 per share of common stock, the new investors’ capital contributions reach to the amount as $25,000, as 67.57% of the capital. Thus, the percentage of ownership after offerings reaches as 9.43%. Other figures as illustrated in the following table:

| If 25% shares are sold: | ||

| Public offering price per share of common stock | $ | 0.02000 |

| Net tangible book value per share prior to offering | $ | 0.00021 |

| Increase per share attributable to new investors | $ | 0.00258 |

| Net tangible book value per share after offering | $ | 0.00279 |

| Dilution per share to new investors | $ | 0.01721 |

15

Plan of Distribution, Terms of the Offering

There Is No Current Market for Our Shares of Common Stock

There is currently no market for our shares. We cannot give you any assurance that the shares you purchase will ever have a market or that if a market for our shares ever develops, that you will be able to sell your shares. In addition, even if a public market for our shares develops, there is no assurance that a secondary public market will be sustained.

The shares you purchase are not traded or listed on any exchange. After the effective date of the registration statement of which this prospectus forms a part, we intend to have a market maker file an application with the Financial Industry Regulatory Authority to have our common stock quoted on the OTC Bulletin Board. We currently have no market maker who is willing to list quotations for our stock. Further, even assuming we do locate such a market maker, it could take several months before the market maker’s listing application for our shares is approved.

The OTC Bulletin Board is maintained by the Financial Industry Regulatory Authority. The securities traded on the Bulletin Board are not listed or traded on the floor of an organized national or regional stock exchange. Instead, these securities transactions are conducted through a telephone and computer network connecting dealers in stocks. Over-the-counter stocks are traditionally smaller companies that do not meet the financial and other listing requirements of a regional or national stock exchange.

Even if our shares are quoted on the OTC Bulletin Board, a purchaser of our shares may not be able to resell the shares. Broker-dealers may be discouraged from effecting transactions in our shares because they will be considered penny stocks and will be subject to the penny stock rules. Rules 15g-1 through 15g-9 promulgated under the Securities Exchange Act of 1934, as amended, impose sales practice and disclosure requirements on FINRA brokers-dealers who make a market in a "penny stock." A penny stock generally includes any non-NASDAQ equity security that has a market price of less than $5.00 per share. Under the penny stock regulations, a broker-dealer selling penny stock to anyone other than an established customer or "accredited investor" (generally, an individual with net worth in excess of $1,000,000 or an annual income exceeding $200,000, or $300,000 together with his or her spouse) must make a special suitability determination for the purchaser and must receive the purchaser's written consent to the transaction prior to sale, unless the broker-dealer or the transactions is otherwise exempt. In addition, the penny stock regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to the broker-dealer and the registered representative and current quotations for the securities. Finally, a broker-dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer's account and information with respect to the limited market in penny stocks.

The additional sales practice and disclosure requirements imposed upon brokers-dealers may discourage broker-dealers from effecting transactions in our shares, which could severely limit the market liquidity of the shares and impede the sale of our shares in the secondary market, assuming one develops.

16

The Offering will be sold by our sole Director and Director

We are offering up to a total of 5,000,000 shares of common stock. The offering price is $0.02 per share. The offering will be for a period of 120 days from the effective date and may be extended for an additional 90 days if we choose to do so. In our sole discretion, we have the right to terminate the offering at any time, even before we have sold the 5,000,000 shares. There are no specific events which might trigger our decision to terminate the offering.

The shares are being offered by us on a "best efforts" basis and there can be no assurance that all or any of the shares offered will be subscribed. If less than the maximum proceeds are available to us, our development and prospects could be adversely affected. There is no minimum offering required for this offering to close. All funds received as a result of this offering will be immediately available to us for our general business purposes.

We cannot assure you that all or any of the shares offered under this prospectus will be sold. No one has committed to purchase any of the shares offered. Therefore, we may sell only a nominal amount of shares, in which case our ability to execute our business plan might be negatively impacted. We reserve the right to withdraw or cancel this offering and to accept or reject any subscription in whole or in part, for any reason or for no reason. Subscriptions will be accepted or rejected promptly. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. Certificates for shares purchased will be issued and distributed by our transfer agent promptly after a subscription is accepted and "good funds" are received in our account.

If it turns out that we have not raised enough money to effectuate our business plan, we will try to raise additional funds from a second public offering, a private placement or loans. At the present time, we have not made any plans to raise additional money and there is no assurance that we would be able to raise additional money in the future. If we need additional money and are not successful, we will have to suspend or cease operations.

We will sell the shares in this offering through our sole Director and Officer. The sole Director engaged in the sale of the securities will receive no commission from the sale of the shares nor will she register as broker-dealers pursuant to Section 15 of the Securities Exchange Act of 1934 in reliance upon Rule 3(a) 4-1. Rule 3(a) 4-1 sets forth those conditions under which a person associated with an issuer may participate in the offering of the issuer's securities and not be deemed to be a broker-dealer. Our Officer and Director satisfies the requirements of Rule 3(a) 4-1 in that:

| 1. | They are not subject to a statutory disqualification, as that term is defined in Section 3(a)(39) of the Act, at the time of his or her participation; and |

| 2. | They are not compensated in connection with their participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; and |

| 3. | They are not, at the time of their participation, an associated person of a broker- dealer; and |

| 4. | They meet the conditions of Paragraph (a)(4)(ii) of Rule 3(a)4-1 of the Exchange Act, in that they (A) primarily perform, or are intended primarily to perform at the end of the offering, substantial duties for or on behalf of the issuer otherwise than in connection with transactions in securities; and (B) are not brokers or dealers, or an associated person of a broker or dealer, within the preceding twelve (12) months; and (C) do not participate in selling and offering of securities for any issuer more than once every twelve (12) months other than in reliance on Paragraphs (a)(4)(i) or (a)(4)(iii). |

17

As long as we satisfy all of these conditions, we are comfortable that we will be able to satisfy the requirements of Rule 3(a)4-1 of the Exchange Act.

As our sole Director and Officer will sell the shares being offered pursuant to this offering, Regulation M prohibits the Company and its officer and director from certain types of trading activities during the time of distribution of our securities. Specifically, Regulation M prohibits our sole Director and Officer from bidding for or purchasing any common stock or attempting to induce any other person to purchase any common stock, until the distribution of our securities pursuant to this offering has ended.

We have no intention of inviting broker-dealer participation in this offering.

Offering Period and Expiration Date

This offering will commence on the effective date of this prospectus, as determined by the Securities and Exchange Commission and continue for a period of 120 days. We may extend the offering for an additional 90 days unless the offering is completed or otherwise terminated by us. Funds received from investors will be counted towards the minimum subscription amount only if the form of payment, such as a check, clears the banking system and represents immediately available funds held by us prior to the termination of the 120-day subscription period, or prior to the termination of the extended subscription period if extended by our Board of Directors.

Procedures for Subscribing

If you decide to subscribe for any shares in this offering, you can either deliver cash, a check or certified funds for acceptance or rejection. All checks for subscriptions must be made payable to "Pantop Corporation".

Right to Reject Subscriptions

We maintain the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected within 48 hours of our having received them.

18

Description of Securities

Our authorized capital stock consists of 75,000,000 shares of common stock, with a par value of $0.001 per share. As of September 30, 2014, there were 12,000,000 shares of our common stock issued and outstanding. Our shares are currently held by two (2) stockholders of record. So far, we have not issued any shares of preferred stock.

Common Stock

Our common stock is entitled to one vote per share on all matters submitted to a vote of the stockholders, including the election of directors. Except as otherwise required by law or provided in any resolution adopted by our Board of Directors with respect to any series of preferred stock, the holders of our common stock will possess all voting power. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all shares of our common stock that are present in person or represented by proxy, subject to any voting rights granted to holders of any preferred stock. Holders of our common stock representing fifty percent (50%) of our capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our Articles of Incorporation. Our Articles of Incorporation do not provide for cumulative voting in the election of directors.

Subject to any preferential rights of any outstanding series of preferred stock created by our Board of Directors from time to time, the holders of shares of our common stock will be entitled to such cash dividends as may be declared from time to time by our Board of Directors from funds available therefore.

Subject to any preferential rights of any outstanding series of preferred stock created from time to time by our Board of Directors, upon liquidation, dissolution or winding up, the holders of shares of our common stock will be entitled to receive pro rata all assets available for distribution to such holders.

In the event of any merger or consolidation with or into another company in connection with which shares of our common stock are converted into or exchangeable for shares of stock, other securities or property (including cash), all holders of our common stock will be entitled to receive the same kind and amount of shares of stock and other securities and property (including cash). Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Preferred Stock

There are currently no Preferred Shares authorized and the Company has no plans to authorize or create a class of preferred shares.

19

Dividend Policy

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Nevada Anti-Takeover Laws