Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Churchill Downs Inc | a8-k120214investorrelations.htm |

December 2, 2014 CDI Acquisition of Big Fish Games

Forward-Looking Statements This document contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The Private Securities Litigation Reform Act of 1995 (the “Act”) provides certain “safe harbor” provisions for forward-looking statements. All forward-looking statements are made pursuant to the Act. The reader is cautioned that such forward-looking statements are based on information available at the time and/or management’s good faith belief with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Forward-looking statements speak only as of the date the statement was made. We assume no obligation to update forward-looking information to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information. Forward-looking statements are typically identified by the use of terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “predict,” “project,” “hope,” “should,” “will,” and similar words, although some forward-looking statements are expressed differently. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Important factors that could cause actual results to differ materially from expectations include: the effect of global economic conditions, including any disruptions in the credit markets; a decrease in consumers’ discretionary income; the effect (including possible increases in the cost of doing business) resulting from future war and terrorist activities or political uncertainties; the overall economic environment; the impact of increasing insurance costs; the impact of interest rate fluctuations; the effect of any change in our accounting policies or practices; the financial performance of our racing operations; the impact of gaming competition (including lotteries, online gaming and riverboat, cruise ship and land- based casinos) and other sports and entertainment options in the markets in which we operate; our ability to maintain racing and gaming licenses to conduct our businesses; the impact of live racing day competition with other Kentucky, Illinois, Louisiana and Ohio racetracks within those respective markets; the impact of higher purses and other incentives in states that compete with our racetracks; costs associated with our efforts in support of alternative gaming initiatives; 2

Forward-Looking Statements (cont’d) costs associated with customer relationship management initiatives; a substantial change in law or regulations affecting pari-mutuel and gaming activities; a substantial change in allocation of live racing days; changes in Kentucky, Illinois, Louisiana or Ohio law or regulations that impact revenues or costs of racing operations in those states; the presence of wagering and gaming operations at other states’ racetracks and casinos near our operations; our continued ability to effectively compete for the country’s horses and trainers necessary to achieve full field horse races; our continued ability to grow our share of the interstate simulcast market and obtain the consents of horsemen’s groups to interstate simulcasting; our ability to enter into agreements with other industry constituents for the purchase and sale of racing content for wagering purposes; our ability to execute our acquisition strategy and to complete or successfully operate planned expansion projects; our ability to successfully complete any divestiture transaction; market reaction to our expansion projects; the inability of our totalisator company, United Tote, to maintain its processes accurately, keep its technology current or maintain its significant customers; our accountability for environmental contamination; the ability of our online business to prevent security breaches within its online technologies; the loss of key personnel; the impact of natural and other disasters on our operations and our ability to obtain insurance recoveries in respect of such losses (including losses related to business interruption); our ability to integrate any businesses we acquire into our existing operations, including our ability to maintain revenues at historic levels and achieve anticipated cost savings; the impact of wagering laws, including changes in laws or enforcement of those laws by regulatory agencies; the outcome of pending or threatened litigation; changes in our relationships with horsemen's groups and their memberships; our ability to reach agreement with horsemen's groups on future purse and other agreements (including, without limiting, agreements on sharing of revenues from gaming and advance deposit wagering); the effect of claims of third parties to intellectual property rights; and the volatility of our stock price. 3

CDI announced that it intends to acquire Big Fish Games boxshadowdwn Founded in 2002 by Stanford business school grad Paul Thelen, Big Fish is one of the world’s largest producers and distributors of casual games, delivering entertainment to millions of people worldwide boxshadowdwn Through its mobile and online distribution platforms, Big Fish has distributed more than 2.5 billion games from a growing library of unique mobile and PC games to customers in 150 countries boxshadowdwn Big Fish Games has emerged as a #4 top-grossing mobile (both iOS and Android) publisher worldwide with a portfolio that includes the #1 mobile social casino on iOS and #2 on Google Play1 Midnight Castle Big Fish Casino Gummy Drop! Fairway Solitaire boxshadowdwn 3,950+ games (3,500+ PC games; 450+ mobile games) boxshadowdwn ~560 total employees in Seattle, WA (HQ); Oakland, CA and Luxembourg boxshadowdwn ~1.15 million quarterly average paying users By the Numbers Big Fish at a glance 4 Source: Big Fish Games, Inc., quarterly avg. paying users based on Q3 2014 consolidated 1 According to App Annie as of October 2014

5 Consideration square6 Upfront consideration: $485 million, on a debt-free, cash-free basis • ~$392 million in cash and ~$15 million in CHDN stock at closing; ~$79 million paid over three years • Represents ~8.5x multiple on 3Q 2014 LTM Adjusted EBITDA of $57.3 million • Adjusted EBITDA includes an adjustment for change in deferred revenue square6 Earn-out consideration: maximum of $350 million based on 2015 Adjusted EBITDA performance • Equal to 2015 Adjusted EBITDA less base value of $51.2 million multiplied by 9x • For purposes of earn-out calculation, 2015 Adjusted EBITDA is reduced by subtracting expected costs associated with the change in deferred revenue • Paid in 1Q 2016 except for founder portion which is paid evenly over three years square6 Founder bonus payment of $50 million if Big Fish achieves $1 billion in bookings during 2016 (compares to 3Q 2014 LTM bookings of $312 million) paid in four equal annual installments Management Retention square6 Key management shareholders required to execute non-competition and non-solicitation agreements with a term ending two years from the date they are no longer employed by CDI square6 Big Fish employees will be eligible for equity compensation programs based on performance & retention Financing square6 $200 million new term loan A; remainder financed with existing revolving credit facility square6 Pro-forma Total Funded Debt / Adjusted EBITDA of 3.2x at closing Segment Reporting square6 Big Fish results will be reported in a new, standalone segment Expected Closing square6 By year end 2014 CDI will pay $485 million upfront and up to $350 million in an earn-out Transaction structure

6 Positions Churchill Downs at the forefront of the mobile and online games industry, particularly social casino genre, which is experiencing strong organic global growth based on positive industry fundamentals and the acceptance of new forms of gaming on mobile devices Strong cultural fit; management teams share emphasis on innovation, technology, customer-centric approach and value creation Provides diversification with powerful organic growth and external opportunities via bolt-on acquisitions Strategically improves the competitive position of Churchill Downs as the mobile and online gaming landscape evolves 1 2 3 4 The transaction continues CDI’s growth strategy Extends Churchill Downs’ presence as a leading digital entertainment provider CDI Recent Acquisition History 2007-2010: Twinspires.com (ADW) square4 America Tab square4 Bloodstock Research & Information Systems square4 Youbet.com 2010-2014: Casinos square4 Harlow’s Resort & Casino square4 Riverwalk Hotel Casino square4 Oxford Casino square4 Miami Valley Gaming (JV) square4 Saratoga Harness Racing Inc. (JV) 2014: Mobile Social Games square4 Big Fish Games

7 The mobile and online gaming industry is growing rapidly boxshadowdwn Large market in early growth stage with no clear, sustainable leaders established boxshadowdwn Global mobile and online gaming revenue growth expected to continue square4 Social Casino is one of the largest genres of mobile and online games at ~$3 billion worldwide in 2014 Source: SuperData Research $ 5.4 $ 17.4 2012 2013 2014 2015 2016 2017 2018 2019 Global Mobile/Online Gaming Market Size (US$ in billions) Source: Transparency Market Research

8 Growth in mobile devices is driving games industry growth Big Fish Games has emerged as a #4 top-grossing mobile publisher Sources: Digi-Capital Global Games Investment Review 3Q 2014 Summary, available at http://www.digi-capital.com/reports Kleiner Perkins Caufield Byers, Internet Trends 2014 – Code Conference available at http://www.kpcb.com/internet-trends Screenshots of Apple App Store on iPhone and iPad store taken on 11/7/2014 Screenshot of Google Play taken 12/1/2014 Apple App Store (iPhone) Google Play Store Apple App Store (iPad)

9 <$1 $1 $4 $9 $26 $55 $84 $117 $154 $175 $177 $163 $149 $2 $18 $61 $115 $163 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 LTM Big Fish Games - Annual Bookings Since Founding Mobile PC $156 $193 $238 $278 $312 ($ millions) CAGRs Total Mobile PC 2011 – LTM (9/30/2014) 17% 108% (5)% 2005 – LTM 48% Inception – LTM 66% Achieved long-term growth in the games industry with superior leadership in both content and distribution Source: Big Fish Games, Inc. 1 LTM as of Sept. 30, 2014 Big Fish’s successful transition to mobile devices is driving bookings growth boxshadowdwn Greater than 50% of LTM bookings are mobile boxshadowdwn Big Fish is a top 10 grossing mobile publisher on iOS 1

10 Big Fish is a highly differentiated game platform Big Fish compares favorably to other public company games providers -

11 Free-to-Play Casino Premium Paid Free-to-Play Non-Casino Top Games Big Fish Casino Dark Parables Gummy Drop! Description square6 Casino-style games such as blackjack, poker, slots, craps and roulette square6 PC and Mobile games that customers pay upfront to purchase square6 All non-casino game types including casual free-to- play games Monetization square6 Through in-game micro-transactions square6 Customers pay upfront square6 Through in-game micro- transactions Characteristics square6 Evergreen content with limited “hit” risk square6 Rapid revenue and EBITDA growth; freemium powered margins – low cost and scalable square6 Synergistic with Twinspires and regional casinos square6 Steady cash flow stream built on monthly subscribers, but declining as market moves to F2P square6 Huge installed base allows low cost to acquire customers on new games square6 Represents ~9% of LTM bookings ($27 mil.); currently losing money square6 Optionality upside with strong new game development pipeline Big Fish is diversified

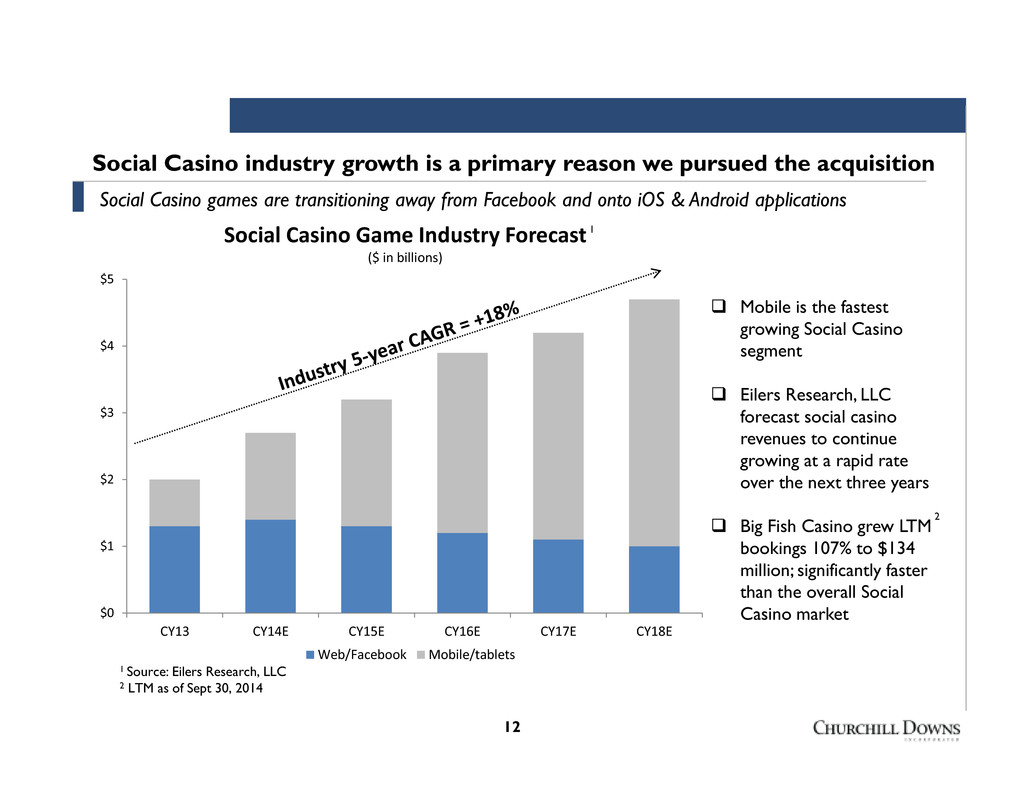

12 $0 $1 $2 $3 $4 $5 CY13 CY14E CY15E CY16E CY17E CY18E Social Casino Game Industry Forecast ($ in billions) Web/Facebook Mobile/tablets 1 Source: Eilers Research, LLC 2 LTM as of Sept 30, 2014 boxshadowdwn Mobile is the fastest growing Social Casino segment boxshadowdwn Eilers Research, LLC forecast social casino revenues to continue growing at a rapid rate over the next three years boxshadowdwn Big Fish Casino grew LTM bookings 107% to $134 million; significantly faster than the overall Social Casino market Social Casino industry growth is a primary reason we pursued the acquisition Social Casino games are transitioning away from Facebook and onto iOS & Android applications 1 2

20.7% 14.0% 8.8% 8.6% 8.1% 39.8% Mobile & Tablet Segment Share Caesa rs Intera ctive Big F ish Cas ino DoubleDown/IGT GS N + Bash Gaming Zynga (S ocia l Cas ino Only) Other 13 Big Fish Casino share gains driven by strength of mobile offering Social casino customers have better monetization and retention rates than other social games boxshadowdwn Big Fish Casino was the top revenue generating casino app on iOS in 2013 and YTD 2014 boxshadowdwn Big Fish Casino is ranked 4th among social casino game publishers with 8.3% market share boxshadowdwn Big Fish Casino has the 2nd largest mobile share among social casino game publishers Top 5 Social Casino Game Publishers – 3Q141 ($ in millions) Sources: AppMtr, Distimo, AppAnnie, MetricsMonk, Eilers Research LLC 20.6 % 10.7 % 8.8 % 8.3 %6.9 % 44.7 % Total SegmentShare 1 Market share by revenue. No publisher outside the top 5 has more than 5% market share.

14 Big Fish Casino is a platform, not a single game boxshadowdwn Big Fish Casino offers a variety of products – Unique slot games (38 currently on the “floor”) – Card games like Blackjack & Texas Hold’em – Casino games like Roulette & Craps boxshadowdwn Big Fish Casino is the only platform that offers synchronous social features for slots (chatting, gifting, friending) – Does not rely on Facebook for the social aspect – Friends play slot games and table games together – Live daily slot tournaments drive player interest & retention – VIP program and leader board engages customer loyalty and connection to the site boxshadowdwn The “social first” approach generates vast in-game friend connections, resulting in high switching costs, engaged players and very strong life-time values boxshadowdwn Big Fish delivers a steady flow of new products they own and develop thru an in-house studio – A new slot product is launched approximately every three weeks

15 Bookings per month by install cohort (all platforms) Social Casino customer retention patterns are very long Cohorts are becoming larger with awareness and TV advertising

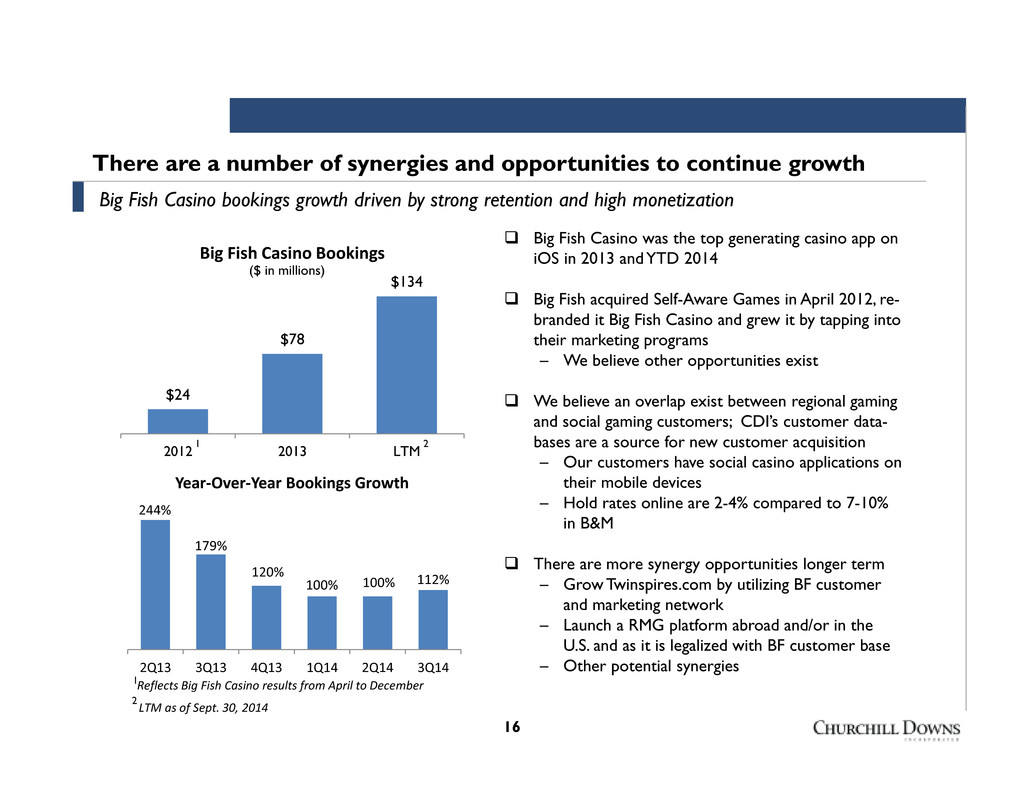

$24 $78 $134 2012 2013 LTM Big Fish Casino Bookings 16 244% 179% 120% 100% 100% 112% 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 Year-Over-Year Bookings Growth boxshadowdwn Big Fish Casino was the top generating casino app on iOS in 2013 and YTD 2014 boxshadowdwn Big Fish acquired Self-Aware Games in April 2012, re- branded it Big Fish Casino and grew it by tapping into their marketing programs – We believe other opportunities exist boxshadowdwn We believe an overlap exist between regional gaming and social gaming customers; CDI’s customer data- bases are a source for new customer acquisition – Our customers have social casino applications on their mobile devices – Hold rates online are 2-4% compared to 7-10% in B&M boxshadowdwn There are more synergy opportunities longer term – Grow Twinspires.com by utilizing BF customer and marketing network – Launch a RMG platform abroad and/or in the U.S. and as it is legalized with BF customer base – Other potential synergies Reflects Big Fish Casino results from April to December LTM as of Sept. 30, 2014 There are a number of synergies and opportunities to continue growth Big Fish Casino bookings growth driven by strong retention and high monetization 1 2 1 2 ($ in millions)

17 Big Fish has a diversified game portfolio with limited revenue concentration boxshadowdwn Social Casino 46%, Other Genres 54% boxshadowdwn U.S. 65%, Rest of World 35% boxshadowdwn F2P Games 54%, Paid Games 46% boxshadowdwn Mobile Games 54%, PC Games 46% boxshadowdwn Largest contributor to Non-Casino F2P games is 29.2% of bookings3 boxshadowdwn Top 5 Premium Paid PC Games contributed 4.1% of YTD2 Premium Paid PC revenue boxshadowdwn Top 5 Premium Paid Mobile Games contributed 7.1% of YTD2 Premium Paid Mobile revenue Game Type & Geographic Diversity1 Non-Casino Game Concentration Revenue by Game Type1 45.6% 45.9% 8.5% Premium Paid Free-to-Play Casino Free-to-Play Non-Casino Top F2P Non-Casino Games3 1 YTD through September 2014 2 YTD through August 2014 3 Bookings for Q3 2014 29.2% 20.9% 9.4% 7.9% 5.4% 4.8% 4.5% 2.3% 1.7% 1.2% 12.7% Fairway Solitaire Midnight Castle Fairway Blast! Cascade Gummy Drop! Awakening Kingdoms Dark Manor Found Farm Up Cooking Academy All Other Source: Big Fish Games, Inc.

18 Big Fish has powerful worldwide game development and distribution capabilities A portfolio approach to game development square6 Five internal studios with distinct production strategies square6 Launch more than 100 new titles annually square6 Large, high quality, lower cost, exclusive worldwide developer network Rigorous, data- driven culture square6 Data-driven framework produces high performing games and mitigates downside risk square6 Disciplined new game introduction process with numerous tollgates utilizes a soft launch system to manage over-investment square6 Focused on the spread between cost to acquire a paying user and the lifetime profit of a player Marketing expertise square6 Broad customer access via proprietary marketing channels square6 Cross-promotion within the Big Fish network square6 Expertise in app store optimization (ASO) and search engine optimization (SEO) square6 Paid online and television advertising expertise allows high-performing games to achieve large scale Organic expansion opportunities square6 Strong pipeline of new non-Casino F2P games square6 Brand licenses for new casino games square6 3rd party licensing and publishing deals using Big Fish’s cost-effective customer acquisition framework Acquisition opportunities square6 Big Fish’s broad marketing reach, growing customer base and brand strengthen its opportunities to generate more game installs, making acquisitions attractive and accretive

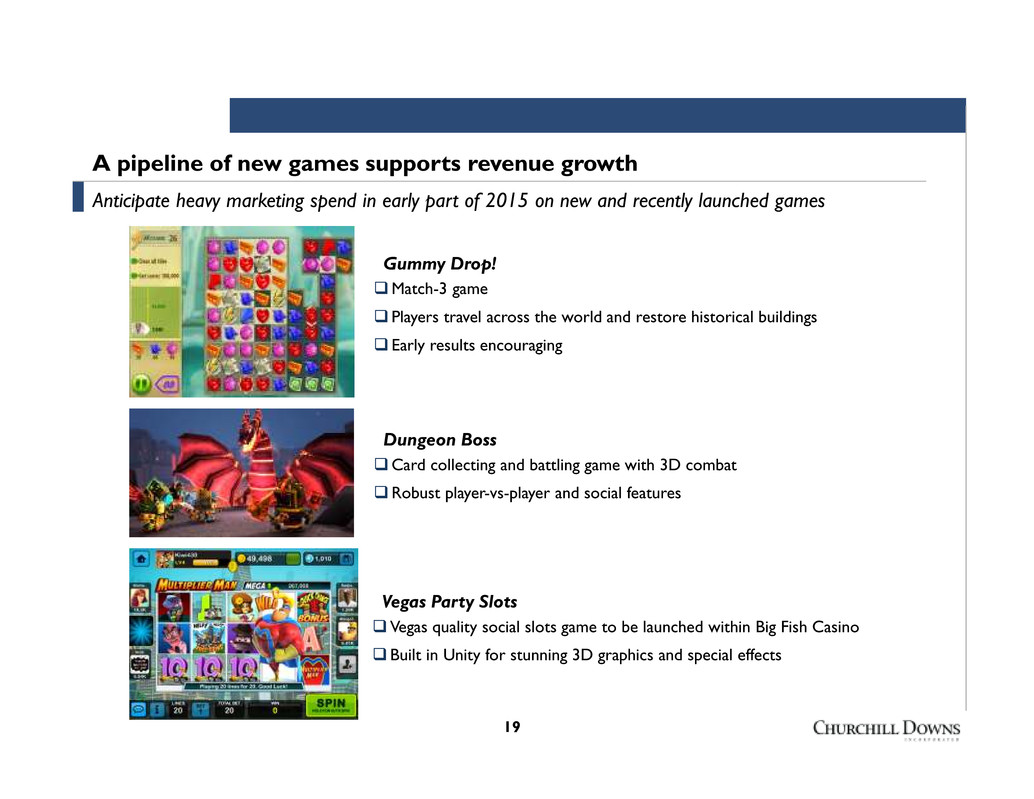

19 A pipeline of new games supports revenue growth Anticipate heavy marketing spend in early part of 2015 on new and recently launched games Gummy Drop! boxshadowdwnMatch-3 game boxshadowdwn Players travel across the world and restore historical buildings boxshadowdwn Early results encouraging Vegas Party Slots boxshadowdwnVegas quality social slots game to be launched within Big Fish Casino boxshadowdwnBuilt in Unity for stunning 3D graphics and special effects Dungeon Boss boxshadowdwnCard collecting and battling game with 3D combat boxshadowdwnRobust player-vs-player and social features

20 Big Fish is an attractive acquisition and growth opportunity for CDI checkbld Games industry is a large and rapidly growing worldwide business driven by mobile device growth checkbld Big Fish has strong worldwide game development and distribution capabilities checkbld A seasoned, exceptional team will continue under founder Paul Thelen checkbld CDI has extensive relevant online experience with Twinspires.com checkbld Deal is attractively valued checkbld Deal is significantly accretive to free cash flow beginning in year 1 and to EPS in year 2 checkbld Deal is comfortably financed; CDI remains conservatively leveraged

Appendix 21

22 Reconciliation of Adjusted EBITDA to net income BIG FISH GAMES, INC. SUPPLEMENTAL INFORMATION (Unaudited) (in thousands) Twelve months ending, September 30, 2014 Reconciliation of Adjusted EBITDA to net income: Net income $24,922 Income tax provision 11,906 Interest (expense) income, net 9 Depreciation & Amortization 7,572 Share based compensation expense 7,953 Change in deferred revenue 3,701 Other charges 1,235 Total Adjusted EBITDA $57,299

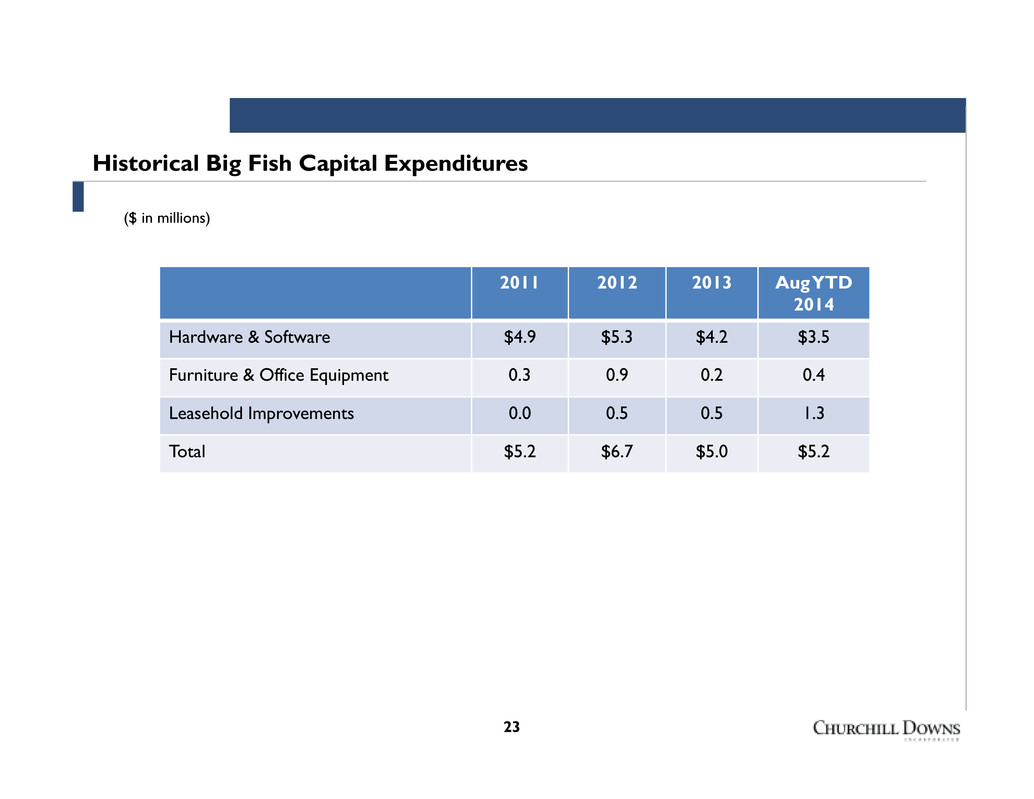

23 Historical Big Fish Capital Expenditures 2011 2012 2013 Aug YTD 2014 Hardware & Software $4.9 $5.3 $4.2 $3.5 Furniture & Office Equipment 0.3 0.9 0.2 0.4 Leasehold Improvements 0.0 0.5 0.5 1.3 Total $5.2 $6.7 $5.0 $5.2 ($ in millions)