Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Well Power, Inc. | Financial_Report.xls |

| EX-23.1 - EX23_1 - Well Power, Inc. | ex23_1.htm |

| EX-23.3 - EX23_3 - Well Power, Inc. | ex23_3.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WELL POWER, INC.

(Exact name of registrant in its charter)

| Nevada | 61-1728810 | |

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

11111 Katy Freeway

Suite #9 110

Houston, TX 77079, (713) 973-5738

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

N/A

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of communications to:

Gregg E. Jaclin, Esq.

Szaferman, Lakind, Blumstein & Blader, P.C.

101 Grovers Mill Road, Second Floor

Lawrenceville, NJ 08648

Tel. No.: (609) 275-0400

Fax No.: (609) 275-4511

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [x]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of large accelerated filer, accelerated filer and smaller reporting company in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] | Smaller reporting company | [x] |

| (Do not check if a smaller reporting company) | |||

Calculation of Registration Fee

| Title of Each Class of Securities to be Registered | Amount to be Registered (1) | Proposed Maximum Offering Price Per Share (2) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||||

| Common stock, par value $0.001 per share, issuable pursuant to certain equity purchase agreement | 14,370,000 (3) | $ | 0.053 | $ | 761,610.00 | $ | 88.50 | |||||||||

| Total | 14,370,000 | $ | 761,610.00 | $ | 88.50 | |||||||||||

| (1) | We are registering 14,370,000 shares of our common stock that we will put to Premier Venture Partners, LLC pursuant to that certain equity purchase agreement (the “Equity Purchase Agreement”). The Equity Purchase Agreement was entered into on August 26, 2014. In the event of stock splits, stock dividends or similar transactions involving the common stock, the number of common shares registered shall, unless otherwise expressly provided, automatically be deemed to cover the additional securities to be offered or issued pursuant to Rule 416 promulgated under the Securities Act of 1933, as amended (the “Securities Act”). In the event that the adjustment provisions of the Equity Purchase Agreement require the registrant to issue more shares than are being registered in this registration statement, for reasons other than those stated in Rule 416 of the Securities Act, the registrant will file a new registration statement to register those additional shares. | |

| (2) | The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(o) of the Securities Act on the basis of the closing price of the common stock of the registrant as reported on the OTCQB on November 21, 2014. | |

| (3) | Including an aggregate of 3,955,070 shares of our common stock issued upon the execution of the Equity Purchase Agreement (“Initial Commitment Shares”) |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the commission, acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission (the “SEC”) is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| 2 |

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED December ____, 2014 |

14,370,000 Shares of Common stock

WELL POWER, INC.

This prospectus relates to the resale of up to 14,370,000 shares of common stock of Well Power, Inc. (“we” or the “Company”), par value $0.001 per share (the “Common Stock”), issuable to Premier Venture Partners, LLC (“Premier Venture”) pursuant to that the Equity Purchase Agreement. The Equity Purchase Agreement permits us to “put” up to $10,000,000 in shares of our Common Stock to Premier over a period of up to thirty-six (36) months commencing from the effectiveness of the registration statement, or until the termination of the Equity Purchase Agreement in accordance with the terms and provisions thereof (the “Open Period”). We will not receive any proceeds from the resale of these shares of Common Stock. However, we will receive proceeds from the sale of securities pursuant to our exercise of the put right offered by Premier Venture. Premier Venture is deemed an underwriter for our common stock.

The selling stockholders may offer all or part of the shares for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. The Company is paying all of the registration expenses incurred in connection with the registration of the shares except for underwriting discounts, selling commissions, brokerage fees and related expenses.

Our common stock is quoted on the OTCQB under the ticker symbol WPWR. On November 21, 2014, the closing price of our common stock was $0.053 per share.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 7 to read about factors you should consider before investing in shares of our common stock.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| 3 |

The Date of This Prospectus Is: _____, 2014

| 4 |

This summary highlights selected information contained elsewhere in this Prospectus. This summary does not contain all the information that you should consider before investing in the common stock of Well Power, Inc. (referred to herein as the “Company,” “we,” “our,” and “us”). You should carefully read the entire Prospectus, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the accompanying financial statements and notes before making an investment decision.

Business Overview

Well Power, Inc. was incorporated on March 26, 2007 under the name of “Vortec Electronics, Inc.” On December 10, 2013, we filed Articles of Merger with the Secretary of State of Nevada in order to effectuate a merger with our wholly-owned subsidiary, Well Power, Inc. (the “Merger”) whose shareholder approval was not required pursuant to Section 92A.180 of the Nevada Revised Statutes. As part of the merger, our board of directors (“the Board”) authorized a change in our name to “Well Power, Inc.” and our Articles of Incorporation were amended to reflect this name change accordingly. Our ticker symbol subsequently changed from “VOELD” to “WPWR” to resemble our new name.

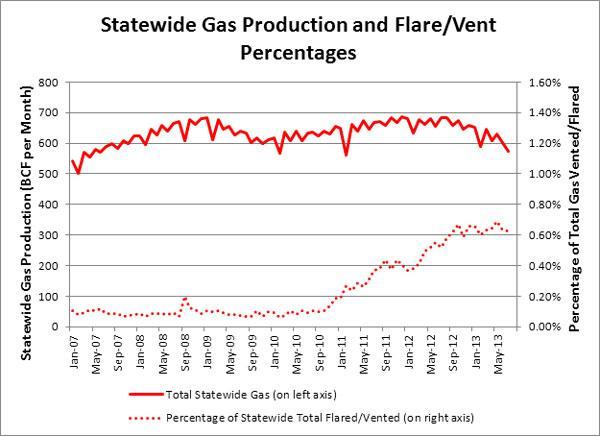

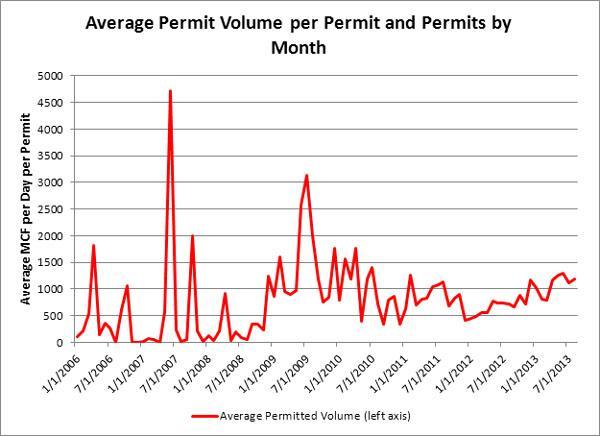

Since the Merger, we have acquired an exclusive license from ME Resource Corporation (“MEC”), a Canadian publicly listed company for which a director and the Chief Technology Officer is related to our President Dan Patience. MEC is creating mobile and scalable Wellhead Micro-Refinery Units (“MRUs”) deployable close to the wellhead to process raw natural gas into liquid fuels and clean power. As a result of the license with MEC, we are now in the business of distributing MRUs in the State of Texas and from there into other geographical areas.

The product is still under development, which is ongoing, and the first MRU is expected to occur within a year. Discussions are ongoing to raise capital to begin construction of a commercial unit. There is no assurance that we will be able to raise the capital needed to develop the first MRU. Our expectation is that we will obtain financing, chose a site for the MRU, and begin construction of the unit in the third quarter. As such, we will not be able to realize any revenue from the sale of MRUs until the development has completed and a commercialized product is ready for launch.

Our plan is to assist the development of the MRUs and distribute them in our licensed territory. We hope to provide oil and gas producers and operators in the State of Texas a solution to process otherwise wasted natural gas, including stranded, shut-in, flared and vented gas and produce valued end-products including engineered fuel (diesel, diluents, synthetic crude) and electrical power. The MRU is a novel method and apparatus, for producing chemicals, heat, energy and water from a methane-containing gas. The innovative method and apparatus makes use of heterogeneous catalysis in a single-vessel, beginning with the partial oxidation of methane to produce synthesis gas followed by a Fischer-Tropsch reaction to produce chemicals and other end products with no excess hydrogen.

Under our license agreement, we agreed to pay MEC $400,000 for our exclusive license; the money will go toward the unit cost of an MRU at $800,000 or, alternatively, a revenue sharing arrangement where MEC leases the MRU at 50% unit cost and shares in 50% of the net revenue generated. In either event, this money will be applied to the technical and engineering development of the first demonstration MRU in the territory and may be used to develop catalyst for specific engineered fuels.

The payment to MEC was due in two installments: i) $100,000 within thirty (30) days of January 29, 2014; and ii) balance of $300,000 within ninety (90) days of January 29, 2014. We have made total cash payments of $379,000 subsequent to the quarter ended July 31, 2014.

Equity Purchase Agreement with Premier Venture

On August 26, 2013, we entered into the Equity Purchase Agreement with Premier Venture, a California liability company. Pursuant to the terms of the Equity Purchase Agreement, Premier Venture committed to purchase up to $10,000,000 of our Common Stock during the Open Period. From time to time during the Open Period, we may deliver a drawdown notice to Premier Venture which states the dollar amount that we intend to sell to Premier Venture on a date specified in the put notice (the “Put Notice”). The maximum investment amount per notice shall not exceed the lesser of (i) 200% of the average daily trading volume of Company’s common stock on the five trading days prior to the day the Put Notice is received by Premier Venture and (ii) 110% of any previous put amount during the maximum thirty-six (36) month period (or for the first Put Notice, 2,000,000 shares). The total purchase price to be paid, in connection to the Put Notice, by Premier Venture shall be calculated at a thirty percent (30%) discount to the lowest individual daily volume weighted average price of the Common Stock during such trading day (“VWAP”) of during the five (5) consecutive trading days immediately after the applicable Put notice date, notwithstanding certain provisions pursuant to the Equity Purchase Agreement, less six hundred dollars ($600.00). We have more shares reserved than are covered in this registration statement. In consideration for the execution and delivery of the Equity Purchase Agreement by Premier Venture, we issued Premier Venture 3,955,070 shares of Company’s Common Stock (the “Initial Commitment Shares”), at a purchase price equal to 30% discount to the lowest total share price based on the daily VWAPs of the Common Stock on the three (3) trading days immediately preceding the execution date the Equity Purchase Agreement.

| 5 |

In connection with the Equity Purchase Agreement, we also entered into a registration rights agreement (the “Registration Rights Agreement”) with Premier Venture, pursuant to which we are obligated to file a registration statement with the SEC. We are obligated to use all commercially reasonable efforts to maintain an effective registration statement until termination of the Equity Purchase Agreement.

The 14,370,000 shares to be registered herein represent 12.85% of the shares issued and outstanding, assuming that the selling stockholder will sell all of the shares offered for sale.

At an assumed purchase price of $0.0371 (representing 70% of the closing price of our Common Stock of $0.053 on November 21, 2014), we will be able to receive up to $533,127 in gross proceeds, assuming the sale of the entire 14,370,000 shares being registered hereunder pursuant to the Equity Purchase Agreement. Accordingly, we would be required to register an additional 255,171,779 shares to obtain the balance of $9,466,873 under the Equity Purchase Agreement. We are currently authorized to issue 4,500,000,000 shares of our common stock. Premier Venture has agreed to refrain from holding an amount of shares which would result in Premier Venture owning more than 4.99% of the then-outstanding shares of our common stock at any one time.

There are substantial risks to investors as a result of the issuance of shares of our Common Stock under the Equity Purchase Agreement. These risks include dilution of stockholders’ percentage ownership, significant decline in our stock price and our inability to draw sufficient funds when needed.

Premier Venture will periodically purchase our Common Stock under the Equity Purchase Agreement and will, in turn, sell such shares to investors in the market at the market price. This may cause our stock price to decline, which will require us to issue increasing numbers of common shares to Premier Venture to raise the same amount of funds, as our stock price declines.

The aggregate investment amount of $10,000,000 was determined based on numerous factors, including the following:

| • | Current financial operating needs |

| • | Financing of workover projects |

| • | Acquisition of assets, business and/or operations |

| • | Acquisition of additional licensing |

| • | Ot1her purposes that the Board in its good faith deem in the best interest of the Company |

Where You Can Find Us

Our mailing address is 11111 Katy Freeway, Suite # 910, Houston, TX 77079, and our telephone number is (713) 973-5738.

| Common stock outstanding before the offering | 111,861,931 shares of Common Stock as of December 1, 2014. |

| Common stock offered by selling stockholder | 14,370,000 shares of Common Stock. |

| Common stock outstanding after the offering | 126,231,931 shares of common stock. |

| Use of proceeds | We will not receive any proceeds from the sale of shares by the selling stockholder. However, we will receive proceeds from the sale of securities pursuant to the Equity Purchase Agreement. The proceeds received under the Equity Purchase Agreement will be used for general corporate and working capital purposes and acquisitions or assets, businesses or operations or for other purposes that the Board, in its good faith deem to be in the best interest of the Company. |

| OTCQB Trading Symbol | WPWR |

| Risk Factors | The Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” on page 7. |

| 6 |

You should carefully consider the risks described below together with all of the other information included in this Prospectus before making an investment decision with regard to our securities. The statements contained in or incorporated into this Prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business

We rely upon key personnel and if they leave us, our business plan and results of operations could be adversely affected.

We rely heavily on our executives Cristian Neagoe and Dan Patience. Their experience and input creates the foundation for our business and they are responsible for the directorship and control over our operations. We currently have a consulting agreement with both executives, but have not put into place a “key man” insurance policy on either of them. Moving forward, should we lose the services of either executive, for any reason, we will incur costs associated with recruiting a replacement and delays in our operations. If we are unable to replace either Mr. Neagoe or Mr. Patience with another suitably trained individual or individuals, we may be forced to scale back or curtail our business plan. As a result of this, investors’ investment in us could become devalued or worthless and we may be forced to abandon or change our business plan.

We may not be able to successfully manage our growth, which could lead to our inability to implement our business plan.

Our growth is expected to place a significant strain on our managerial, operational and financial resources, especially considering that we currently only have three directors and two executive officers. Further, as we enter into additional contracts, we will be required to manage multiple relationships with various consultants, businesses and other third parties. These requirements will be exacerbated in the event of our further growth. There can be no assurance that our systems, procedures and/or controls will be adequate to support our operations or that our management will be able to achieve the rapid execution necessary to successfully implement our business plan. If we are unable to manage our growth effectively, our business, results of operations and financial condition will be adversely affected, which could lead to us being forced to abandon or curtail our business plan and operations.

We have a limited operating history in our current business focus of selling MRUs and, because of this, it may be difficult to evaluate our chances for success.

We were formed in March 2007 as a company specializing in in the business of designing, developing, manufacturing, and selling fully automated frying woks. We only generated limited revenues in connection with such operations, and changed our business focus to distribution of MRUs after our acquisition of the exclusive distribution license from MEC on January 22, 2014. As such, we have a limited history in our current business focus of MRU distribution. We are a relatively new company and, as such, run a risk of not being able to compete in the marketplace because of our relatively short existence. New companies in the competitive environment of the distribution of MRUs or similar products may face significant competition, and as a result, we may be forced to abandon or curtail our business plan. Under such a circumstance, the value of any investment in us may become worthless.

Our Articles of Incorporation, as amended, and Bylaws limit the liability of, and provide indemnification for, our officers and directors.

Our Articles of Incorporation, as amended, generally limit our officers' and directors' personal liability to the Company and its stockholders for breach of fiduciary duty as an officer or director except for breach of the duty of loyalty or acts or omissions not made in good faith or which involve intentional misconduct or a knowing violation of law. Our Articles of Incorporation, as amended, and Bylaws provide indemnification for our officers and directors to the fullest extent authorized by the Nevada General Corporation Law against all expense, liability, and loss, including attorney's fees, judgments, fines excise taxes or penalties and amounts to be paid in settlement reasonably incurred or suffered by an officer or director in connection with any action, suit or proceeding, whether civil or criminal, administrative or investigative (hereinafter a " Proceeding ") to which the officer or director is made a party or is threatened to be made a party, or in which the officer or director is involved by reason of the fact that he is or was an officer or director of the Company, or is or was serving at the request of the Company as an officer or director of another corporation or of a partnership, joint venture, trust or other enterprise whether the basis of the Proceeding is an alleged action in an official capacity as an officer or director, or in any other capacity while serving as an officer or director. Thus, the Company may be prevented from recovering damages for certain alleged errors or omissions by the officers and directors for liabilities incurred in connection with their good faith acts for the Company. Such an indemnification payment might deplete the Company's assets. Stockholders who have questions regarding the fiduciary obligations of the officers and directors of the Company should consult with independent legal counsel. It is the position of the SEC that exculpation from and indemnification for liabilities arising under the Securities Act and the rules and regulations thereunder is against public policy and therefore unenforceable.

Our President’s leave could harm our business relationship with ME Resource Corporation.

Our President Dan Patience is related to a director and the Chief Technology Officer of ME Resource Corporation, from which we have acquired an exclusive license to distribute and sell their MRUs in the State of Texas and potentially other geographical regions in the United States. Going forward, should we lose the service of Mr. Patience, for any reason, our company may not be able to maintain the exclusive licensing rights from ME Resource Corporation and the loss of licensing rights could harm or affect our core business.

| 7 |

Risks Related To Product Liabilities

We may be subject to product liability claims if people or properties are harmed by the MRUs we sell.

We have obtained the exclusive distribution license of MRUs manufactured by MEC. Some of those products may be defectively designed or manufactured. As a result, sales of such products through us could expose us to product liability claims relating to personal injury or property damage and may require product recalls or other actions. Third parties subject to such injury or damage may bring claims or legal proceedings against us as the distributors of such products. We do not currently maintain any third-party liability insurance or product liability insurance in relation to products sold through us. As a result, any material product liability claim or litigation could have a material and adverse effect on our business, financial condition and results of operations. Even unsuccessful claims could result in the expenditure of funds and managerial efforts in defending them and could have a negative impact on our reputation.

Risks Relating To Our Securities

Shareholders may be diluted significantly through our efforts to obtain financing, satisfy obligations, and/or complete acquisitions through the issuance of additional shares of our common stock or other securities.

Wherever possible, our Board will attempt to use non-cash consideration to satisfy the Company’s obligations. The non-cash consideration may consist of restricted shares of our common stock, convertible debt, or other securities.

We have signed an Equity Purchase Agreement with Premier Venture, for up to $10,000,000 through sales of our common stock. The Equity Purchase Agreement grants the investors the ability to buy a substantial number of shares of common stock in a series of private placement transactions at a price that is at a discount to the market price. If common stock is issued in return for additional funds, the price per share could be lower than that paid by our current stockholders. We anticipate continuing to rely on equity sales of our common stock in order to fund our business operations. If we issue additional stock, investors' percentage interests in us will be diluted. The result of this could reduce the value of current investors' stock.

Additionally, moving forward, we may attempt to conduct acquisitions and/or mergers of other entities or assets using our common stock or other securities as payment for such transactions. Our Board has authority, without action or vote of the shareholders, to issue all or part of the authorized but unissued shares of common stock and preferred stock with various preferences and other rights. If such transactions occur, this may result in substantial dilution of the ownership interests of existing shareholders, and dilute the book value of the Company’s common stock.

We do not expect to pay dividends in the foreseeable future.

We do not intend to declare dividends for the foreseeable future, as we anticipate that we will reinvest any future earnings in the development and growth of our business. Therefore, our stockholders will not receive any funds unless they sell their common stock, and stockholders may be unable to sell their shares on favorable terms or at all.

Trading in our common stock on the OTCQB is limited and sporadic and fluctuates, making it difficult for our shareholders to sell their shares or liquidate their investments.

Our common stock is quoted on the OTCQB under the symbol “WPWR”. We anticipate the market for our common stock on the OTCQB to be subject to fluctuations in response to several factors, including, but not limited to:

| • | actual or anticipated variations in our results of operations; |

| • | our ability to generate revenues; |

| • | conditions and trends in the market for oil and natural gas; and |

| • | future acquisitions we may make |

Furthermore, our stock price may be impacted by factors that are unrelated or disproportionate to our operating performance. These market fluctuations, as well as general economic, political and market conditions, such as recessions, interest rates, or government regulations may adversely affect the market price and liquidity of our common stock.

| 8 |

We are subject to penny stock regulations and restrictions and investors may have difficulty selling shares of our common stock.

Our common stock is subject to the provisions of Section 15(g) and Rule 15g-9 of the Securities Exchange Act of 1934 (the “Exchange Act”), commonly referred to as the “penny stock rule.” Section 15(g) sets forth certain requirements for transactions in penny stock, and Rule 15g-9(d) incorporates the definition of “penny stock” that is found in Rule 3a51-1 of the Exchange Act. The SEC generally defines a penny stock to be any equity security that has a market price less than $5.00 per share, subject to certain exceptions. We are subject to the SEC’s penny stock rules.

Since our common stock is deemed to be penny stock, trading in the shares of our common stock is subject to additional sales practice requirements on broker-dealers who sell penny stock to persons other than established customers and accredited investors. “Accredited investors” are persons with assets in excess of $1,000,000 (excluding the value of such person’s primary residence) or annual income exceeding $200,000 or $300,000 together with their spouse. For transactions covered by these rules, broker-dealers must make a special suitability determination for the purchase of such security and must have the purchaser’s written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, unless exempt the rules require the delivery, prior to the first transaction of a risk disclosure document, prepared by the SEC, relating to the penny stock market. A broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements must be sent disclosing recent price information for the penny stocks held in an account and information to the limited market in penny stocks. Consequently, these rules may restrict the ability of broker-dealer to trade and/or maintain a market in our common stock and may affect the ability of our stockholders to sell their shares of common stock.

There can be no assurance that our shares of common stock will qualify for exemption from the Penny Stock Rule. In any event, even if our common stock was exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock if the SEC finds that such a restriction would be in the public interest.

State securities laws may limit secondary trading, which may restrict the state in which and conditions under which you can sell shares.

Secondary trading in our common stock may not be possible in any state until the common stock is qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the common stock in any particular state, the common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity for the common stock could be significantly impacted.

Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our stockholders have limited protections against interested director transactions, conflicts of interest, and similar matters.

The Sarbanes-Oxley Act of 2002, as well as rule changes proposed and enacted by the SEC, the New York and American Stock Exchanges and the Nasdaq Stock Market, as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities that are listed on those exchanges or the Nasdaq Stock Market.

We do not currently have an independent audit or compensation committee. As a result, our Directors have the ability to, among other things; determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our stockholders without protections against interested director transactions, conflicts of interest, if any, and similar matters and any potential investors may be reluctant to provide us with funds necessary to expand our operations.

We intend to comply with all corporate governance measures relating to Director independence as and when required. However, we may find it very difficult or be unable to attract and retain qualified officers, Directors and members of board committees required to provide for our effective management as a result of the Sarbanes-Oxley Act of 2002. The enactment of the Sarbanes-Oxley Act of 2002 has resulted in a series of rules and regulations by the SEC that increase responsibilities and liabilities of Directors and executive officers. The perceived increased personal risk associated with these recent changes may make it more costly or deter qualified individuals from accepting these roles.

Nevada law and our Articles of Incorporation authorize us to issue shares of stock, which shares may cause substantial dilution to our existing shareholders.

We have authorized capital stock consisting of 4,500,000,000 shares of common stock, $0.001 par value per share. As of December 1, 2014, we had 111,861,934 shares of common stock outstanding. As a result, our Board has the ability to issue a large number of additional shares of common stock without shareholder approval, which if issued could cause substantial dilution to our then shareholders. Investors should keep in mind that the Board has the authority to issue additional shares of common stock, which could cause substantial dilution to our existing shareholders. As a result, the issuance of shares of common stock may cause the value of our securities to decrease and/or become worthless.

| 9 |

Premier Venture will pay less than the then-prevailing market price for our common stock.

The common stock to be issued to Premier Venture pursuant to the Equity Purchase Agreement will be purchased at a 30% discount to the VWAP of the five (5) consecutive trading days immediately after the applicable Put notice date. Premier Venture has a financial incentive to sell our common stock immediately upon receiving the shares to realize the profit equal to the difference between the discounted price and the market price. If Premier Venture sells the shares, the price of our common stock could decrease. If our stock price decreases, Premier Venture may have a further incentive to sell the shares of our common stock that it holds. These sales may have a further impact on our stock price.

Investors’ ownership interest may be diluted and the value of our common stock may decline by exercising the put right pursuant to the Equity Purchase Agreement.

Pursuant to the Equity Purchase Agreement, when we deem it necessary, we may raise capital through the private sale of our common stock to Premier Venture at a price equal to a 30% discount to the VWAP of the five (5) consecutive trading days immediately after receiving our notice of sale. Because the put price is lower than the prevailing market price of our common stock, to the extent that the put right is exercised, your ownership interest may be diluted.

We are registering an aggregate of 14,370,000 shares of common stock to be issued under the Equity Purchase Agreement. The sales of such shares could depress the market price of our common stock.

We are registering an aggregate of 14,370,000 shares of common stock under the registration statement of which this prospectus is a part, pursuant to the Equity Purchase Agreement. Notwithstanding Premier Venture’s ownership limitation, the 14,370,000 shares would represent approximately 12.85% of our shares of common stock outstanding immediately after our exercise of the put right under the Equity Purchase Agreement. The sale of these shares into the public market by Premier Venture could depress the market price of our common stock.

We may not have access to the full amount available under the Equity Purchase Agreement.

Our ability to draw down funds and sell shares under the Equity Purchase Agreement requires that this resale registration statement be declared effective and continue to be effective. This registration statement registers the resale of 14,370,000 shares issuable under the Equity Purchase Agreement, and our ability to sell any remaining shares issuable under the Equity Purchase Agreement is subject to our ability to prepare and file one or more additional registration statements registering the resale of these shares. These registration statements may be subject to review and comment by the staff of the SEC, and will require the consent of our independent registered public accounting firm. Therefore, the timing of effectiveness of these registration statements cannot be assured. The effectiveness of these registration statements is a condition precedent to our ability to sell all of the shares of common stock to Premier Venture under the Equity Purchase Agreement. Even if we are successful in causing one or more registration statements registering the resale of some or all of the shares issuable under the Equity Purchase Agreement to be declared effective by the SEC in a timely manner, we may not be able to sell the shares unless certain other conditions are met. For example, we might have to increase the number of our authorized shares in order to issue the shares to Premier Venture. Accordingly, because our ability to draw down any amounts under the Equity Purchase Agreement is subject to a number of conditions, there is no guarantee that we will be able to draw down any portion or all of the proceeds of $10,000,000 under the Equity Purchase Agreement.

Certain restrictions on the extent of puts and the delivery of advance notices may have little, if any, effect on the adverse impact of our issuance of shares in connection with the Equity Purchase Agreement, and as such, Premier Venture may sell a large number of shares, resulting in substantial dilution to the value of shares held by existing shareholders.

Premier Venture has agreed, subject to certain exceptions listed in the Equity Purchase Agreement, to refrain from holding an amount of shares which would result in Premier Venture or its affiliates owning more than 4.99% of the then-outstanding shares of our common stock at any one time. These restrictions, however, do not prevent Premier Venture from selling shares of common stock received in connection with a put, and then receiving additional shares of common stock in connection with a subsequent put. In this way, Premier Venture could sell more than 4.99% of the outstanding common stock in a relatively short time frame while never holding more than 4.99% at one time.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains certain forward-looking statements. When used in this prospectus or in any other presentation, statements which are not historical in nature, including the words “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” “may,” “project,” “plan” or “continue,” and similar expressions are intended to identify forward-looking statements. They also include statements containing a projection of revenues, earnings or losses, capital expenditures, dividends, capital structure or other financial terms.

The forward-looking statements in this prospectus are based upon our management’s beliefs, assumptions and expectations of our future operations and economic performance, taking into account the information currently available to them. These statements are not statements of historical fact. Forward-looking statements involve risks and uncertainties, some of which are not currently known to us that may cause our actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial condition we express or imply in any forward-looking statements. These forward-looking statements are based on our current plans and expectations and are subject to a number of uncertainties and risks that could significantly affect current plans and expectations and our future financial condition and results.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus might not occur. We qualify any and all of our forward-looking statements entirely by these cautionary factors. As a consequence, current plans, anticipated actions and future financial conditions and results may differ from those expressed in any forward-looking statements made by or on our behalf. You are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented herein.

| 10 |

We will not receive any proceeds from the sale of shares by the selling stockholder. However, we will receive proceeds from the sale of securities pursuant to the Equity Purchase Agreement. The proceeds received from any “drawdowns” tendered to Premier Venture under the Equity Purchase Agreement will be used for general corporate and working capital purposes and acquisitions or assets, businesses or operations or for other purposes that the Board, in its good faith deems to be in the best interest of the Company.

“Dilution” as used herein represents the difference between the offering price per share of shares offered hereby and the net tangible book value per share of the Company’s common stock after completion of the offering. Dilution in the offering is primarily due to the losses previously recognized by the Company.

At an assumed purchase price of $0.0371 (equal to 70% of the closing price of our common stock of $0.053 on November 21, 2014), and the issuance of 100% of the shares being registered, we will be required to issue an aggregate of 14,370,000 shares of Common Stock, with net proceeds of $533,127 pursuant to the Equity Purchase Agreement.

The net tangible book value of the Company at July 31, 2014 was $(910,915) or $(0.0081) per share. Net tangible book value represents the amount of total tangible assets less total liabilities. Assuming that 100% of the shares offered hereby were purchased by investors (a fact of which there can be no assurance) as of November 26, 2014, the then outstanding 126,231,943 shares of common stock, which would constitute all of the issued and outstanding equity capital of the Company, would have a net tangible book value of $(377,788) (after deducting commissions and offering expenses) or approximately $(0.0030) per share.

Assuming a 50% decrease in the number of shares to be issued, based upon the purchase price of $0.0371(equal to 70% of the closing price of our common stock of $0.053 on November 21, 2014), we will be required to issue an aggregate of 7,185,000 shares of common stock, with net proceeds of $266,564 pursuant to the Equity Purchase Agreement.

Assuming a 75% decrease in the number of shares to be issued, based upon the purchase price of $0.0371(equal to 70% of the closing price of our common stock of $0.053 on November 21, 2014), we will be required to issue an aggregate of 3,592,570 shares of common stock, with net proceeds of $133,282 pursuant to the Equity Purchase Agreement.

The dilution associated with the offering and each of the above scenarios is as follows:

| 50 | % | 75 | % | |||||||||

| Decrease | Decrease | |||||||||||

| in Shares | in Shares | |||||||||||

| Offering | Issued | Issued | ||||||||||

| Offering price | $ | .0371 | $ | .0371 | $ | .0371 | ||||||

| Net tangible book value before Offering (per share) | $ | (.0081 | ) | $ | (.0081 | ) | $ | (.0081 | ) | |||

| Net tangible book value after Offering (per share) | $ | (.0030 | ) | $ | (.0054 | ) | $ | (.0067 | ) | |||

| Dilution per share to investor | $ | (.0051 | ) | $ | (.0027 | ) | $ | (.0014 | ) | |||

| Dilution percentage to investor | (63 | )% | (33 | )% | (17 | )% |

| 11 |

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Information

Our Common Stock is quoted under the ticker symbol “WPWR” on the OTCQB operated by OTC Markets Group, Inc. Only a limited market exists for our securities. There is no assurance that a regular trading market will develop, or if developed, that it will be sustained. Therefore, a shareholder may be unable to resell his securities in our company.

The following table sets forth the range of high and low bid quotations for our common stock for each of the periods indicated as reported by the OTCQB. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| Fiscal Year Ending April 30, 2015 | ||||||||||

| Quarter Ended | High $ | Low $ | ||||||||

| October 31, 2014 | 0.097 | 0.038 | ||||||||

| July 31, 2014 | 0.279 | 0.08 | ||||||||

| Fiscal Year Ending April 30, 2014 | ||||||||||

| Quarter Ended | High $ | Low $ | ||||||||

| April 30, 2014 | 0.1745 | 0.163 | ||||||||

| January 31, 2014 | 0.24 | 0.24 | ||||||||

| October 31, 2013 | 0.25 | 0.25 | ||||||||

| July 31, 2013 | 0 | 0.25 | ||||||||

| Fiscal Year Ending April 30, 2013* | ||||||||||

| Quarter Ended | High $ | Low $ | ||||||||

| April 30, 2013 | N/A | N/A | ||||||||

| January 31, 2013 | N/A | N/A | ||||||||

| October 31, 2012 | N/A | N/A | ||||||||

| July 31, 2012 | N/A | N/A | ||||||||

*Our Common Stock was first quoted on September 19, 2013.

On November 24, 2014, the last sales price per share of our Common Stock on the OTCQB was $0.053.

Penny Stock

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer’s account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling our securities.

| 12 |

Holders of Our Common Stock

As of December 1, 2014, we had 111,861,934 shares of our Common Stock issued and outstanding, held by seven (7) shareholders of record, with others holding shares in street name.

Description of Securities to be Registered

We have authorized capital stock consisting of 4,500,000,000 shares of Common Stock, par value $0.001 per share.

Common stock

The holders of outstanding shares of common stock are entitled to receive dividends out of assets or funds legally available for the payment of dividends of such times and in such amounts as the board from time to time may determine. Holders of common stock are entitled to one vote for each share held on all matters submitted to a vote of shareholders. There is no cumulative voting of the election of directors then standing for election. The common stock is not entitled to pre-emptive rights and is not subject to conversion or redemption. Upon liquidation, dissolution or winding up of our company, the assets legally available for distribution to stockholders are distributable ratably among the holders of the common stock after payment of liquidation preferences, if any, on any outstanding payment of other claims of creditors. Each outstanding share of common stock is, and all shares of common stock to be outstanding upon completion of this Offering will upon payment therefore be, duly and validly issued, fully paid and non-assessable.

Dividends

There are no restrictions in our Articles of Incorporation or Bylaws that restrict us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

| 1. | we would not be able to pay our debts as they become due in the usual course of business; or | |

| 2. | our total assets would be less than the sum of our total liabilities, plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution. |

We have not declared any dividends. We do not plan to declare any dividends in the foreseeable future.

Warrants, Options and Convertible Securities

Cristian Neagoe, the Company’s Chief Executive Officer, Director and Petroleum Engineer was issued, as part of the 2014 Stock Incentive Plan, stock options to purchase 2,000,000 shares of the Company’s common stock at an exercise price of $0.70 per share, which have a term of two years commencing from the date of Mr. Neagoe’s appointment.

Dan Patience, the Company’s President, Chief Financial Officer, Treasurer, Secretary, Director, and Petroleum Advisor was issued, as part of the 2014 Stock Incentive Plan, stock options to purchase 2,000,000 shares of the Company’s common stock at an exercise price of $0.70 per share, which have a term of two years commencing from the date of Mr. Patience’s appointment.

An accredited investor was granted a common stock warrant at the time of certain private placement for 431,034 shares. The exercise price was $0.90 per share and the warrant expires on March 10, 2016.

An accredited investor was granted a common stock warrant at the time of certain private placement for 3,000,000 shares. The exercise price was $0.90 per share and the warrant expires on March 10, 2016.

An accredited investor was granted a common stock warrant at the time of certain private placement for 5,000,000 shares. The exercise price was $0.90 per share and the warrant expires on March 10, 2016.

The Company has convertible notes with numerous individual and financial institutions that have conversion prices at a discount from 45% to 55% based on different formulas using historical trade prices to arrive at a base market price.

| 13 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of the results of operations and financial condition for the quarter ended July 31, 2014; and the fiscal years ended June 30, 2014 and 2013 should be read in conjunction with our financial statements and the notes to those financial statements that are included elsewhere in this registration statement. Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors. See “Cautionary Statements Regarding Forward-Looking Statements.” We use words such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “could,” and similar expressions to identify forward-looking statements.

Plan of Operations

We have acquired an exclusive license from ME Resource Corporation (“MEC”), a Canadian publicly listed company for which a director and the Chief Technology Officer is related to our President Dan Patience. MEC is creating mobile and scalable Wellhead Micro-Refinery Units (MRUs) deployable close to the wellhead to process raw natural gas into liquid fuels and clean power. As a result of the license with MEC, we are now in the business of distributing MRUs in the State of Texas and from there into other geographical areas.

The product is still under development, which is ongoing, and the first MRU is expected to occur within a year. Discussions are ongoing to raise capital to begin construction of a commercial unit. There is no assurance that we will be able to raise the capital needed to develop the first MRU. Our expectation is that we will obtain financing, chose a site for the MRU, and begin construction of the unit in the third quarter. As such, we will not be able to realize any revenue from the sale of MRUs until the development has completed and a commercialized product is ready for launch.

Our plan is to assist the development of the MRUs and distribute them in our licensed territory. We hope to provide oil and gas producers and operators in the State of Texas a solution to process otherwise wasted natural gas, including stranded, shut-in, flared and vented gas and produce valued end-products including engineered fuel (diesel, diluents, synthetic crude) and electrical power. The MRU is a novel method and apparatus, for producing chemicals, heat, energy and water from a methane-containing gas. The innovative method and apparatus makes use of heterogeneous catalysis in a single-vessel, beginning with the partial oxidation of methane to produce synthesis gas followed by a Fischer-Tropsch reaction to produce chemicals and other end products with no excess hydrogen.

Under our license agreement, we agreed to pay MEC $400,000 for our exclusive license, which money will go toward the unit cost of an MRU at $800,000 or, alternatively, a revenue sharing arrangement where MEC leases the MRU at 50% unit cost and shares in 50% of the net revenue generated. In either event, this money will be applied to the technical and engineering development of the first demonstration MRU in the territory and may be used to develop catalyst for specific engineered fuels.

The payment to MEC was due in two installments: i) $100,000 within thirty (30) days of January 29, 2014; and ii) balance of $300,000 within ninety (90) days of January 29, 2014. We have made total cash payments of $379,000 subsequent to the quarter ended July 31, 2014.

Recent Developments

Equity Purchase Agreement

On August 26, 2013, we entered into the Equity Purchase Agreement with Premier Venture, a California liability company. Pursuant to the terms of the Equity Purchase Agreement, Premier Venture committed to purchase up to $10,000,000 of our Common Stock during the Open Period.

From time to time during the Open Period, we may deliver a drawdown notice to Premier Venture which states the dollar amount that we intend to sell to Premier Venture on a date specified in the Put Notice. The maximum investment amount per notice shall not exceed the lesser of (i) 200% of the average daily trading volume of Company’s common stock on the five trading days prior to the day the Put Notice is received by Premier Venture and (ii) 110% of any previous put amount during the maximum thirty-six (36) month period (or for the first Put Notice, 2,000,000 shares). The total purchase price to be paid, in connection to the Put Notice, by Premier Venture shall be calculated at a thirty percent (30%) discount to the VWAP during the five (5) consecutive trading days immediately after the applicable Put notice date, notwithstanding certain provisions pursuant to the Equity Purchase Agreement, less six hundred dollars ($600.00). We have more shares reserved than are covered in this registration statement. In consideration for the execution and delivery of the Equity Purchase Agreement by Premier Venture, we issued Premier Venture 3,955,070 shares of Company’s Common Stock, at a purchase price equal to 30% discount to the lowest total share price based on the daily VWAPs of the Common Stock on the three (3) trading days immediately preceding the execution date the Equity Purchase Agreement.

In connection with the Equity Purchase Agreement, we also entered into the Registration Rights Agreement with Premier Venture, pursuant to which we are obligated to file a registration statement with the SEC. We are obligated to use all commercially reasonable efforts to maintain an effective registration statement until termination of the Equity Purchase Agreement.

| 14 |

The 14,370,000 shares to be registered herein represent 12.85% of the shares issued and outstanding, assuming that the selling stockholder will sell all of the shares offered for sale.

At an assumed purchase price of $0.0371 (representing 70% of the closing price of our Common Stock of $0.053 on November 21, 2014), we will be able to receive up to $533,127 in gross proceeds, assuming the sale of the entire 14,370,000 shares being registered hereunder pursuant to the Equity Purchase Agreement. Accordingly, we would be required to register an additional 255,171,779 shares to obtain the balance of $9,466,873 under the Equity Purchase Agreement. We are currently authorized to issue 4,500,000,000 shares of our common stock. Premier Venture has agreed to refrain from holding an amount of shares which would result in Premier Venture owning more than 4.99% of the then-outstanding shares of our common stock at any one time.

Convertible Debentures

Between July 23, 2014 and August 21, 2014, we entered into convertible note agreements with Macallan Partners, LLC, Tarpon Bay Partners, LLC and Melvyn Maller that have conversion prices at a discount from 45% to 55% based on different formulas using historical trade prices to arrive at a base market price. We received an aggregate of $255,006 from issuances of notes.

Results of Operations

For the Three Month Period Ended July 31, 2014 and July 31, 2013

We generated no revenue for the three months ended July 31, 2014 and 2013. We do not anticipate earnings revenues until we are able to distribute the MRUs under our license with MEC.

Our operating expenses during the three months ended July 31, 2014 were $208,647, compared with $2,000 for the same period ended July 31, 2013. Our operating expenses during the three months ended July 31, 2014 consisted mainly of consulting fees of $141,096, general and administrative fees of $27,236, and professional fees of $23,129.

We anticipate our operating expenses will increase as we undertake our plan of operations. The increase will be attributable to the continued development of the MRUs, consulting fees to our management, general and administrative expenses and the professional fees associated with our reporting obligations under the Securities Exchange Act of 1934.

We, recorded a net loss of $209,617 for the three months ended July 31, 2014, compared with a net loss of $2,000 for the three months ended July 31, 2013.

Results of Operations for the Years ended April 30, 2014 and 2013

Revenues

We have not generated revenues since our inception. We do not anticipate generating revenues until we have a completed the development of the MRUs and a commercialized product is ready for launch. We are a start-up company and there is no guarantee that we will be able to execute on our business. We have incurred losses since our inception.

Operating Expenses

Operating expenses increased to $2,064,479 for the year ended April 30, 2014 from $19,760 for the year ended April 30, 2013. Our operating expenses for the year ended April 30, 2014 consisted mainly of consulting fees of $1,940,537, professional fees in the amount of $47,363, and general and administrative expenses of $57,197. In comparison, our operating expenses for the year ended April 30, 2013 consisted of professional fees in the amount of $19,760.

We anticipate our operating expenses will increase as we undertake our plan of operations. The increase will be attributable to administrative and operating costs associated with our business plan and the professional fees associated with our reporting obligations under the Securities Exchange Act of 1934.

Net Loss

We incurred a net loss of $2,065,784 for the year ended April 30, 2014, compared to a net loss of $19,760 for the year ended April 30, 2013.

Liquidity and Capital Resources

As of July 31, 2014, we had total current assets of $17,633. We had $928,548 in current liabilities as of July 31, 2014. Thus, we had a working capital deficit of $910,915 as of July 31, 2014.

| 15 |

Cash flows for the years April 30, 2014 and 2013

Operating activities used $151,211 in cash for the year ended April 30, 2014, as compared with $19,459 used for the year ended April 30, 2013. Our negative operating cash flow for April 30, 2014 was mainly a result of payment of professional fees, consulting fee, and other general and administrative expenses.

Investing activities used $100,000 for the purchase of a license for the year ended April 30, 2014, as compared with $0 for the year ended April 30, 2013.

Financing activities for the year ended April 30, 2014 generated $291,043 in cash, as compared with cash flows provided by financing activities of $19,459 for the year ended April 30, 2013. We also received a loan in the amount of $35,000. The loan is unsecured, bears interest at 11% per annum and is payable on September 30, 2014.

Cash flows for the three months ended July 31, 2014 and 2013

Operating activities used $345,598 in cash for three months ended July 31, 2014. Our net loss of $209,617 and $133,382 decrease in accounts payable and accrued liabilities mainly accounted for our negative operating cash flow.

Financing activities during the three months ended July 31, 2014 generated $320,800 in cash, represented by $250,000 in proceeds from the sale of our stock and $70,800 in net advances from related parties.

We sold units consisting of stock and warrants for proceeds of $250,000 during the months ended July 31, 2014.

We have entered into a number of loan agreements in an effort to provide needed financing. From July 25, 2014 to August 27, 2014, those loans and their terms are detailed in our Current Report on Form 8-K that we filed with the SEC on August 27, 2014.

Despite the financing received, we have insufficient cash to operate our business at the current level for the next twelve months and insufficient cash to achieve our business goals. The success of our business plan beyond the next 12 months is contingent upon us obtaining additional financing. We intend to fund operations through debt and/or equity financing arrangements, which may be insufficient to fund our capital expenditures, working capital, or other cash requirements. We do not have any formal commitments or arrangements for the sales of stock or the advancement or loan of funds at this time. There can be no assurance that such additional financing will be available to us on acceptable terms, or at all.

Despite the financing received, we have insufficient cash to operate our business at the current level for the next twelve months and insufficient cash to achieve our business goals. The success of our business plan beyond the next 12 months is contingent upon us obtaining additional financing. We intend to fund operations through debt and/or equity financing arrangements, which may be insufficient to fund our capital expenditures, working capital, or other cash requirements. We do not have any formal commitments or arrangements for the sales of stock or the advancement or loan of funds at this time. There can be no assurance that such additional financing will be available to us on acceptable terms, or at all.

Going Concern

We have incurred losses since inception, have negative working capital, and have not yet received revenues from sales of products or services. These factors create substantial doubt about our ability to continue as a going concern. The financial statements do not include any adjustment that might be necessary if we are unable to continue as a going concern. Our ability to continue as a going concern is dependent on our generating cash from the sale of our common stock and/or obtaining debt financing and attaining future profitable operations. Management’s plans include selling our equity securities and obtaining debt financing to fund our capital requirement and ongoing operations; however, there can be no assurance we will be successful in these efforts.

Critical Accounting Policies

Our financial statements and accompanying notes have been prepared in accordance with United States generally accepted accounting principles applied on a consistent basis. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods.

We regularly evaluate the accounting policies and estimates that we use to prepare our financial statements. In general, management's estimates are based on historical experience, information from third party professionals, and various other assumptions that are believed to be reasonable under the facts and circumstances. Actual results could differ from those estimates made by management.

Stock-Based Compensation

The expense for equity awards vested during the reporting period is based upon the grant date fair value of the award. The expense is recognized over the applicable vesting period of the stock award using the straight-line method.

| 16 |

Recently Issued Accounting Pronouncements

We have implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Contractual Obligations

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Future Financings

We will continue to rely on equity sales of our common shares and debt proceeds in order to continue to fund our business operations. Issuances of additional shares will result in dilution to existing stockholders. There is no assurance that we will achieve any additional sales of the equity securities or arrange for debt or other financing to fund our operations and other activities.

Off Balance Sheet Arrangements

As of July 31, 2014, there were no off balance sheet arrangements.

Corporate History

Well Power, Inc. was incorporated on March 26, 2007 under the name of “Vortec Electronics, Inc.” On December 10, 2013, we filed Articles of Merger with the Secretary of State of Nevada in order to effectuate a merger with our wholly-owned subsidiary, Well Power, Inc. whose shareholder approval was not required pursuant to Section 92A.180 of the Nevada Revised Statutes. As part of the merger, our Board authorized a change in our name to “Well Power, Inc.” and our Articles of Incorporation were amended to reflect this name change accordingly. Our ticker symbol subsequently changed from “VOELD” to “WPWR” to resemble our new name.

Since the Merger, we have acquired an exclusive license from MEC, a Canadian publicly listed company for which a director and the Chief Technology Officer is related to our President Dan Patience. MEC is creating mobile and scalable Wellhead Micro-Refinery Units (MRUs) deployable close to the wellhead to process raw natural gas into liquid fuels and clean power. As a result of the license with MEC, we are now in the business of distributing MRUs in the State of Texas and from there into other geographical areas.

The product is still under development, which is ongoing, and the first MRU is expected to occur within a year. Discussions are ongoing to raise capital to begin construction of a commercial unit. There is no assurance that we will be able to raise the capital needed to develop the first MRU. Our expectation is that we will obtain financing, chose a site for the MRU, and begin construction of the unit in the third quarter. As such, we will not be able to realize any revenue from the sale of MRUs until the development has completed and a commercialized product is ready for launch.

Our plan is to assist the development of the MRUs and distribute them in our licensed territory. We hope to provide oil and gas producers and operators in the State of Texas a solution to process otherwise wasted natural gas, including stranded, shut-in, flared and vented gas and produce valued end-products including engineered fuel (diesel, diluents, synthetic crude) and electrical power. The MRU is a novel method and apparatus, for producing chemicals, heat, energy and water from a methane-containing gas. The innovative method and apparatus makes use of heterogeneous catalysis in a single-vessel, beginning with the partial oxidation of methane to produce synthesis gas followed by a Fischer-Tropsch reaction to produce chemicals and other end products with no excess hydrogen.

Under our license agreement, we agreed to pay MEC $400,000 for our exclusive license, which money will go toward the unit cost of an MRU at $800,000 or, alternatively, a revenue sharing arrangement where MEC leases the MRU at 50% unit cost and shares in 50% of the net revenue generated. In either event, this money will be applied to the technical and engineering development of the first demonstration MRU in the territory and may be used to develop catalyst for specific engineered fuels.

The payment to MEC is due in two installments: i) $100,000 within thirty (30) days of January 29, 2014; and ii) balance of $300,000 within ninety (90) days of January 29, 2014. We have made total payments of $379,000, which results in a balance of $21,000 remaining. We will have to continue to raise money to make the remaining payment amount. Although we are outside of the contract terms, we have a good working relationship with MEC and hope to make the payment in the near future. If we are unable to, we will lose our contract and we would lose this business opportunity.

| 17 |

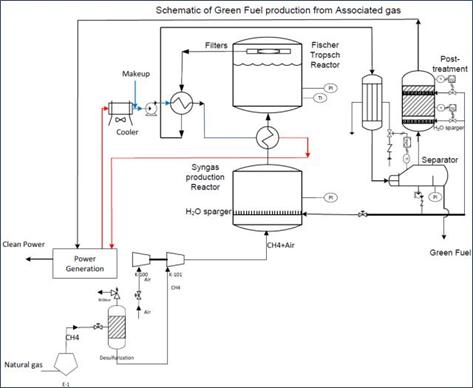

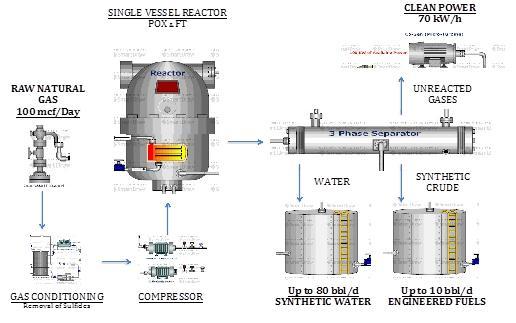

The Technology

An MRU is an assembly of proven commercial technologies with a proprietary micro synthesizing system as the key technology component. With the addition of catalytic reactors and power generation components, various liquid and power outputs can be achieved. Our goal is to provide an economically viable solution to develop wasted gas opportunities in the oil and gas sector into revenue streams with minimal capital expenditure. We hope to be able to provide a novel and economically viable solution to utilize wasted natural gas resources for remote power and fuel generation while reducing greenhouse gas emissions.

MEC and our company, along with those involved in the manufacturing process, are currently working to develop a finished MRU product. The product is still in development, which is ongoing, and a finished MRU is expected to occur within a year. As such, we will not be able to realize any revenue from the sale of MRUs until the development has completed and a commercialized product is ready for launch.

The objective is to produce green fuel from associated natural gas and thereby reduce emissions due to flaring and venting. The methane is first converted to CO and hydrogen (syngas), followed by Fischer-Tropsch in order to produce green fuel. Power is produced from heat generated by endothermic catalytic reactions and combustion of unreacted light hydrocarbons and C02. The final unit will be mobile, modular and economically feasible.

A MRU will convert associated gas into the following valued end products while reducing flared gas.

| 1) | Engineered Fuels: Light Synthetic Crude that can be used for blends or even fuels as high as $200/bbl. Each 100 mcf of natural gas will produce up to 10 barrels/day of Engineered Fuels. | |

| 2) | Power: To provide up to 70 kW of continuous Power for use near the wellhead. | |

| 3) | Flaring Reduction: Each MRU will have the ability to reduce up to 1224 tonnes CO2 per year. | |

| 4) | Usable Water: Each MRU will produce 80 barrels/day of water that could be used for fracking or EOR. | |

| 5) | Natural gas and oil separator |

| · | Natural gas is recovered from petroleum fluids (+ water, +impurities) in the first separator. The condensable are returned to the pipeline. The separator contains a high efficiency mist eliminator to remove carry over water particles. |

| 6) | Gas treatment column |

| · | Sulphurous compounds (H2S, COS, CS2, etc.), acids and other impurities are then removed in a gas treatment column. |

| 7) | Gas compressor |

| · | The conditioned gas is compressed to approximately 20 bar in a gas compressor. |

| 8) | Air Compressor |

| · | Air is also compressed to reaction pressure (of about 20 bar) in a second larger compressor. |

| 9) | Reaction vessel |

| · | The natural gas and air are fed to the bottom of the syngas production vessel. The reaction is exothermic and controlled solely by the partial pressures of the reaction gases. The gases pass through the syngas production fluidized bed where they contact the FT catalyst and react. The temperature is controlled at around 250oC with a set of cooling coils installed in the reactor. The gases pass through the bed and into the freeboard. The gas velocity is sufficiently low so as to minimize the entrainment of catalyst powder to the filters. There is a provision to periodically blow back the filters as the pressure drop increases. The blow back sequence is timed in such a way as not to disrupt production. |

| 10) | The first waste heat boiler |

| · | The gas stream exits the reactor and is further cooled with water coming from air cooler in a waste heat boiler. The gas temperature drop in the waste heat boiler is about 100ºC. The produced steam is fed to steam turbine for power generation. |

| 18 |

| 11) | Condenser |

| · | The exit gas stream from the first waste heat boiler is cooled to 60ºC in the condenser. |

| 12) | Three phase separator |

| · | The mixture is then separated into three phases. The gas phase goes to a post treatment reactor to combust CO and other light hydrocarbons. The dense aqueous phase is either fed back to the reactor to help control the temperature (as well as the reaction kinetics) or it is fed to the post treatment reactor to control the temperature rise. The organic phase (+ some water) is fed to the pipeline or a storage tank, or separated to produce drop in diesel. |

| 13) | Post treatment unit |

| · | The gas phase coming from three phase separator contains light hydrocarbons and CO which are combusted to produce hot gas for steam generation in the second waste heat boiler. |

| 14) | Gas expander |

| · | The hot exit gas from the second waste heat boiler is fed to a gas expander to produce power for the gas compressors. |

| 15) | Steam Turbine |

| · | The steam turbine is used to generate power for gas compression resulting from steam generated in the cooling coils in the fluidized bed reactor and waste heat boilers |

| 16) | Cooler |

| · | The low pressure steam exit from steam turbine goes to a cooler to produce water for cooling coils and waste heat boilers. |

| 19 |

| 20 |

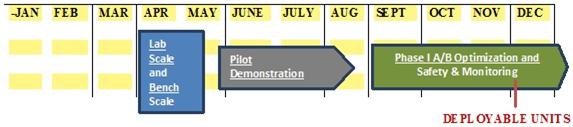

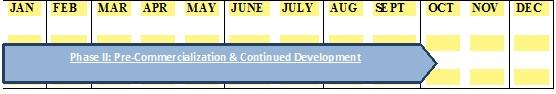

Below is a schematic of the MRU and the beneficial by products it creates.

| 21 |

Product Development and Manufacturing

Under the License Agreement, we will pay MEC $400,000 for its exclusive License, which money will go toward the Unit Cost of an MRU at $800,000 or, alternatively, a revenue sharing arrangement where MEC leases the MRU at 50% Unit Cost and shares in 50% of the net revenue generated. In either event, this money will be applied to the technical and engineering development of the first demonstration MRU in the territory and may be used to develop catalyst for specific engineered fuels.

MEC has contracted to use a production facility in Alberta that will facilitate the mass fabrication of the MRUs.