Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Neurotrope, Inc. | v395225_ex23-1.htm |

| EX-21.1 - EXHIBIT 21.1 - Neurotrope, Inc. | v395225_ex21-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Neurotrope, Inc. | Financial_Report.xls |

As filed with the Securities and Exchange Commission on December 1, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Neurotrope, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 2834 | 46-3522381 |

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

50 Park Place, Suite 1401

Newark, New Jersey 07102

973-242-0005

(Address, including zip code, and telephone number,

including area code, of registrant’s principle executive offices)

Charles S. Ramat

Neurotrope, Inc.

50 Park Place, Suite 1401

Newark, New Jersey 07102

973-242-0005

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Nanette W. Mantell

Edward P. Bromley III

Reed Smith, LLP

136 Main Street, Suite 250

Princeton, NJ 08540

(609) 987-0050

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company þ |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered (1) | Proposed Maximum Offering Price Per Share (2) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||

| Common stock, par value $0.0001 per share | 25,225,000 shares | $ | 0.665 | $ | 16,774,625 | $ | 1,949.21 | |||||||

| (1) | Consists of (a) 1,337,000 outstanding shares of the registrant’s common stock, (b) 21,663,000 shares of the registrant’s common stock issuable upon conversion of 21,663,000 outstanding shares of the registrant’s Series A convertible preferred stock, (c) 1,325,000 shares of common stock issuable upon conversion of 1,325,000 shares of Series A convertible preferred stock issuable upon exercise of Series A convertible preferred stock purchase warrants, and (d) 900,000 shares of common stock issuable upon exercise of common stock purchase warrants. Pursuant to Rule 416 under the Securities Act of 1933, as amended, the securities being registered hereunder include such indeterminate number of additional shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends, or similar transactions. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, based on the average of the high and low prices of the registrant’s common stock as reported by the OTCQB marketplace (the “OTC Market”) on November 21, 2014. The shares offered hereunder may be sold by the selling stockholders from time to time in the open market, through privately negotiated transactions or a combination of these methods, at market prices prevailing at the time of sale or at negotiated prices. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and the selling stockholders are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated December 1, 2014

Neurotrope, Inc.

Prospectus

25,225,000 Shares

Common Stock

This prospectus relates to the sale of up to 25,225,000 shares of our common stock, par value $0.0001 per share, by the selling stockholders of Neurotrope, Inc., a Nevada corporation, listed in this prospectus. Of the shares being offered, (a) 1,337,000 are issued and outstanding as of the date of this prospectus; (b) 21,663,000 of the shares of our common stock are issuable upon conversion of 21,663,000 outstanding shares of our Series A convertible preferred stock, or Series A Stock, (c) 1,325,000 of the shares of our common stock are issuable upon conversion of 1,325,000 shares of Series A Stock that are issuable upon exercise of Series A Stock purchase warrants, and (d) 900,000 of the shares of our common stock are issuable upon exercise of common stock purchase warrants. The shares offered by this prospectus may be sold by the selling stockholders from time to time in the open market, through privately negotiated transactions or a combination of these methods, at market prices prevailing at the time of sale or at negotiated prices.

Our common stock is traded on the OTCQB marketplace (the “OTC Market”) under the symbol “NTRP.” On November 13, 2014, the last reported sale price for our common stock was $0.62 per share.

The distribution of the shares by the selling stockholders is not subject to any underwriting agreement. We will not receive any proceeds from the sale of the shares by the selling stockholders. We will bear all expenses of registration incurred in connection with this offering, but all selling and other expenses incurred by the selling stockholders will be borne by them.

Our business and an investment in our securities involve a high degree of risk. Before making any investment in our securities, you should read and carefully consider the risks described in the “Risk Factors” section beginning on page 10 of this prospectus.

You should rely only on the information contained in this prospectus and any prospectus supplement or amendment. We have not authorized anyone to provide you with different information. This prospectus may only be used where it is legal to sell these securities. The information in this prospectus is only accurate on the date of this prospectus, regardless of the time of any sale of securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is dated , 2014.

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment. We have not authorized any other person to provide you with information that is different from, or adds to, that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The selling stockholders are offering to sell and seeking offers to buy our common stock only in jurisdictions where offers and sales are permitted. You should assume that the information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of any securities in any jurisdiction.

TABLE OF CONTENTS

| 2 |

The following summary highlights information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that should be considered before investing in our common stock. Potential investors should read the entire prospectus carefully, including the more detailed information regarding our business provided below in the “Description of Business” section, the risks of purchasing our common stock discussed under the “Risk Factors” section, and our consolidated financial statements and the accompanying notes to the consolidated financial statements.

Unless the context indicates otherwise, all references in this registration statement to “Neurotrope,” the “Company,” “we,” “us” and “our” refer to Neurotrope, Inc. and its wholly-owned consolidated operating subsidiary, Neurotrope BioScience, Inc. All references in this registration statement to “Neurotrope BioScience” refer solely to Neurotrope BioScience, Inc.

Overview

We are a biopharmaceutical and diagnostics company with product candidates in pre-clinical and clinical development. Neurotrope BioScience began operations in October 2012. We have been principally focused on developing two product platforms, a drug candidate called bryostatin for the treatment of Alzheimer’s disease, or AD, and a diagnostic test for AD, both of which are in the clinical testing stage. We have a technology license and services agreement, or the BRNI License, with the Blanchette Rockefeller Neurosciences Institute, and its affiliate NRV II, LLC, which we collectively refer to herein as BRNI, pursuant to which we have an exclusive non-transferable license to certain patents and technologies required to develop our proposed products. Neurotrope BioScience was formed for the primary purpose of commercializing the technologies initially developed by BRNI for therapeutic or diagnostic applications for AD or other cognitive dysfunctions. These technologies have been under development by BRNI since 1999 and, up until March 2013, have been financed by BRNI through funding from a variety of non-investor sources (which include not-for-profit foundations, the National Institutes of Health (which is part of the U.S. Department of Health and Human Services) and individual philanthropists). From March 2013 forward, development of the licensed technology has been funded principally through collaboration by BRNI with Neurotrope BioScience.

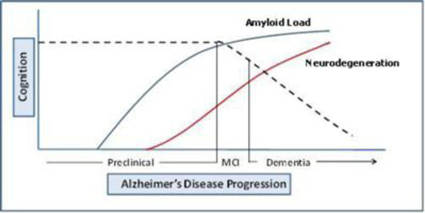

According to the Alzheimer’s Association, an estimated 36 million people worldwide had AD in 2010. The prevalence of AD is independent of race, ethnicity, geography, life style and, to a large extent, genetics. The most common cause of developing AD is old age. In developing countries, where the median age of death is less than 65 years old, AD is rarely recognized or diagnosed. In the U.S. in 2013, 5.2 million people are estimated to have AD, and 96% of these people are older than 65 years of age.

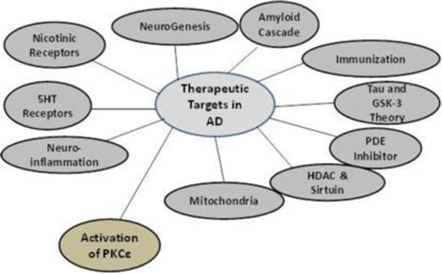

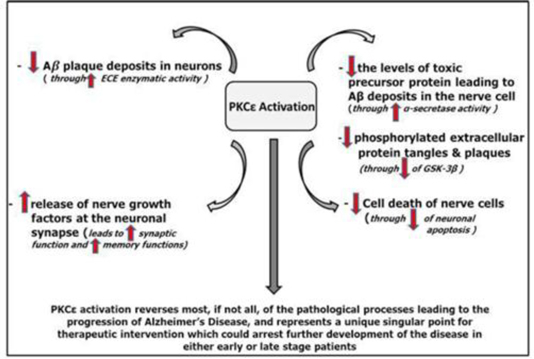

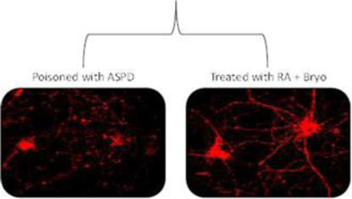

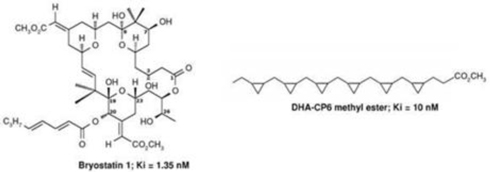

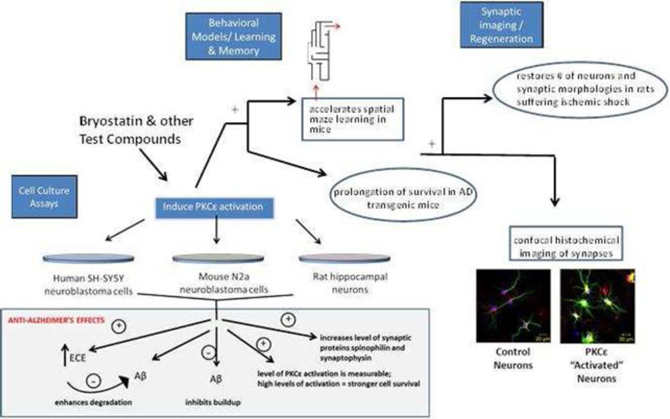

Researchers have explored and continue to explore a wide range of drug mechanisms in hopes of developing drugs to combat AD. We believe that our approach, which involves the activation of an enzyme called protein kinase C epsilon, or PKCε, represents a novel mechanism in potential AD drug therapies.

BRNI is conducting an enhanced access program, formerly known as compassionate use, of Bryostatin-1 in patients with advanced AD. Thus far, three patients with advanced AD have been treated, two of which were treated under an Investigational New Drug Application, IND, cleared by the FDA which is held by BRNI. One of these patients has died, but the death was not drug-related. The study for another one of these patients has concluded and the other patient is still being treated after 6 months on the protocol. On the basis of communication from caregivers and treating physicians, BRNI, with our support, has decided to enroll additional patients in the extended access program. We are providing funding and personnel support under the terms of our agreement with BRNI for a modest expansion of this clinical effort in AD in the 2014 – 2015 timeframe.

On July 29, 2014, we announced the initiation of a Phase 2a clinical trial to evaluate bryostatin for the treatment of patients with AD. We have commenced enrollment and now plan to enroll a total of nine patients in the randomized, double-blind, placebo-controlled, single dose study. We now plan that six patients will be randomized to receive bryostatin by injection and three will receive a matching placebo control. The primary objective of the clinical trial will be to assess the safety and tolerability of a single dose of bryostatin in the treatment of patients with AD. The secondary objectives of the study are the preliminary evaluation of the efficacy of a single dose of bryostatin in the treatment of patients with AD, its pharmacokinetics and pharmacodynamics and the evaluation of any correlation between changes in PKCε with plasma levels of bryostatin and with improvement in cognitive function. Bryostatin modulates the same enzyme target used by the diagnostic test for the detection of AD. We believe bryostatin may restore synaptic structures and functions damaged by AD, leading to improvements in cognition and memory. Beyond AD, we believe that several other neurodegenerative diseases, such as ischemic stroke, traumatic brain injury, Fragile X mental retardation, depression and aging in the brain, may be amenable to treatment with the same approach.

Since licensing the AD diagnostic technology from BRNI, our Board of Directors and management have conducted analyses of the underlying AD diagnostic technology and our other programs and are continuing to conduct market research to evaluate physician acceptability, commercial sales potential and product development costs of an AD diagnostic product.

| 3 |

To the extent resources permit, we intend to pursue development of selected other technology platforms with applications related to the treatment of AD and other neurodegenerative disorders based on our current licensed technology or technology available from third party licensors or collaborators.

Financings to Date

In February 2013, through a private placement, Neurotrope BioScience issued 9,073,300 shares of its Series A convertible preferred stock, or Neurotrope BioScience Series A Stock, at $1.00 per share, resulting in gross proceeds of $9,073,300. In May 2013, Neurotrope BioScience issued an additional 1,313,325 shares of Neurotrope BioScience Series A Stock at $1.00 per share, resulting in gross proceeds of $1,313,325. In August 2013, Neurotrope BioScience issued 11,533,375 of its Series A convertible preferred stock at $1.00 per share, resulting in gross proceeds of $11,533,375. All of the outstanding shares of Neurotrope BioScience Series A Stock were converted on a one-for-one basis into shares of Neurotrope, Inc.’s Series A Stock, or Series A Stock, in connection with the reverse merger transaction in August 2013. In October 2013, we issued 1,080,000 additional shares of our Series A Stock at $1.00 per share, resulting in gross proceeds of $1,080,000, for a total of $23,000,000 of gross proceeds raised between February and October 2013.

Organizational History

We were incorporated as BlueFlash Communications, Inc. in Florida on January 11, 2011. Prior to the Reverse Merger (as defined below) and split-off (as described below), our business was to provide software solutions to deliver geo-location targeted coupon advertising to mobile internet devices.

On August 9, 2013, we reincorporated in the State of Nevada by merging into a newly-formed special-purpose subsidiary, Neurotrope, Inc., which was incorporated on June 13, 2013 and was the surviving corporation in such reincorporation merger, or the Reincorporation Merger. As a result of the Reincorporation Merger, (i) we changed our name to Neurotrope, Inc., (ii) we changed our jurisdiction of incorporation from Florida to Nevada, (iii) we increased our authorized capital stock from 300,000,000 shares of common stock, par value $0.0001 per share, to 300,000,000 shares of common stock, par value $0.0001 per share, and 50,000,000 shares of “blank check” preferred stock, par value $0.0001 per share, (iv) each share of BlueFlash Communications, Inc. common stock outstanding at the time of the reincorporation merger was automatically converted into 2.242 shares of Neurotrope, Inc. common stock, our common stock, with the result being that the 10,200,000 shares of common stock of BlueFlash Communications, Inc. outstanding immediately prior to the reincorporation merger were converted into 22,868,400 shares of common stock of Neurotrope, Inc. outstanding immediately thereafter. All share and per share numbers in this prospectus relating to the common stock of Neurotrope, Inc., prior to the Reincorporation Merger have been adjusted to give effect to this conversion, unless otherwise stated.

In connection with the Reincorporation Merger, we changed our fiscal year from a fiscal year ending on January 31 of each year to one ending on December 31 of each year.

On August 23, 2013, our wholly-owned subsidiary, Neurotrope Acquisition, Inc., or Acquisition Sub, a corporation formed in the State of Nevada on August 15, 2013 merged with and into Neurotrope BioScience, a corporation incorporated in the State of Delaware on October 31, 2012, the Reverse Merger. Neurotrope BioScience was the surviving corporation in the Reverse Merger, and became our wholly-owned subsidiary. All of the outstanding shares of Neurotrope BioScience common stock, or Neurotrope BioScience Common Stock, were converted into shares of our common stock, par value $0.0001 per share, and all of the outstanding shares of Neurotrope BioScience Series A Stock were converted into shares of our Series A Stock, in each case on a one-for-one basis.

In connection with the Reverse Merger and pursuant to a split-off agreement, or Split-Off, we transferred our pre-Reverse Merger business to Marissa Watson, our pre-Reverse Merger majority stockholder, in exchange for the surrender by her and cancellation of 20,178,000 shares of our common stock.

As a result of the Reverse Merger and Split-Off, we discontinued our pre-Reverse Merger business and acquired the business of Neurotrope BioScience. Following the Reverse Merger and Split-off, we have undertaken the business operations of Neurotrope BioScience as a publicly-traded company under the name Neurotrope, Inc., through Neurotrope BioScience, which is now a wholly-owned subsidiary.

In accordance with “reverse merger” accounting treatment, our historical financial statements as of period ends, and for periods ended, prior to the Reverse Merger have been and will be replaced with the historical financial statements of Neurotrope BioScience prior to the Reverse Merger in all applicable filings with the Securities and Exchange Commission, or the SEC.

Capital Needs

With the capital raised to date as described above and a cash and cash equivalent position of approximately $10.1 million as of September 30, 2014, we believe we have funding for approximately the next 12 months based upon our current product development plans. However, as described in this prospectus, we are currently reviewing our strategic plans. We intend to adjust our operating plans, if necessary, by rationalizing non-contractual variable overhead expenses so that we have at least 12 months of cash for operations at the end of the year ending December 31, 2014. In addition, we may choose to further reevaluate our strategic plan in the future. There can be no assurance that our current funding will last even 12 months. We will need to raise additional funds based upon advancing certain product development programs in our current and future pipeline. We will determine when and if to proceed with future fund raising efforts from time-to-time. There can be no assurance financing will be available to us when required on acceptable terms or at all.

| 4 |

About This Offering

This prospectus relates to the public offering, which is not being underwritten, by the selling stockholders listed in this prospectus, of up to 25,225,000 shares of our common stock. Of the shares being offered, (a) 1,337,000 are issued and outstanding as of the date of this prospectus; (b) 21,663,000 of the shares of our common stock are issuable upon conversion of 21,663,000 outstanding shares of our Series A Stock, (c) 1,325,000 of the shares of our common stock are issuable upon conversion of 1,325,000 shares of Series A Stock that are issuable upon exercise of Series A Stock purchase warrants, and (d) 900,000 of the shares of our common stock are issuable upon exercise of common stock purchase warrants. The shares offered by this prospectus may be sold by the selling stockholders from time to time in the open market, through negotiated transactions or otherwise at market prices prevailing at the time of sale or at negotiated prices. We will receive none of the proceeds from the sale of the shares by the selling stockholders. We will bear all expenses of registration incurred in connection with this offering, but all selling and other expenses incurred by the selling stockholders will be borne by them.

Selected Risks Associated with Our Business and Our Common Stock

Our business is subject to numerous risks described in the section entitled “Risk Factors” and elsewhere in this prospectus, which you should review carefully. You should carefully consider these risks before making an investment. Some of these risks include:

| · | Our ongoing viability as a company depends on our ability to successfully develop and commercialize our licensed technologies. |

| · | We have a limited operating history upon which investors can evaluate our future prospects. It is difficult to judge our prospects. |

| · | We are dependent on BRNI to conduct clinical and non-clinical studies of our drug candidates and prospective diagnostic test and to provide services for certain core aspects of our business. Under certain conditions, we may engage other third parties to provide such services in the future. Any interruption or failure by BRNI or any third parties to meet their obligations pursuant to various agreements with us could have a material adverse effect on our business, results of operations and financial condition. The BRNI License limits our ability to make certain decisions without BRNI’s consent. |

| · | We have relied (without independent third-party verification) on the representations and materials provided by BRNI, including scientific, peer-reviewed and non-peer reviewed publications, abstracts, slides, internal documents, verbal communications, patents and related patent filings, with respect to the results of its research related to our proposed products. Some of BRNI’s results have been included in this prospectus. |

| · | If we do not obtain the necessary regulatory approvals in the United States and/or other countries, we will not be able to sell our drug candidates. |

| · | If we are unable to engage a lab accredited under the Clinical Laboratory Improvement Amendments of 1988, or CLIA, to process our prospective diagnostic test at its facilities, the commercialization of our prospective diagnostic test may be unsuccessful. |

| · | If the FDA requires approval or clearance of our prospective diagnostic test, we could incur substantial costs and time delays associated with meeting requirements for pre-market clearance or approval. |

| · | We have not generated any revenues since our inception and we do not expect to generate revenue for the foreseeable future. If we do not generate revenues and achieve profitability, we will likely have to curtail or cease our development plans and operations. |

| · | Our operating losses and lack of revenues raise substantial doubt about our ability to develop and commercialize our product candidates. If we do not successfully develop and commercialize our product candidates, investors could lose their entire investment. |

| · | We will need additional financing to continue our operations. If we are unable to obtain additional financing on acceptable terms, we may have to curtail or cease our development plans and operations under such circumstances. |

| 5 |

| · | If the BRNI License were terminated, we would lose rights to a substantial portion of the intellectual property currently being developed by us. As a result, we may be required to cease operations. |

| · | Our commercial success will depend, in part, on our ability, and the ability of our licensors, to obtain and maintain patent protection. Our licensors’ failure to obtain and maintain patent protection for our products may have a material adverse effect on our business. |

| · | Our licensed patented technologies may infringe on other patents, which may expose us to costly litigation. |

| · | We may not be able to protect our trade secrets and other unpatented proprietary technologies, which could give our competitors an advantage over us. |

| · | We are dependent on Charles S. Ramat, our President and Chief Executive Officer, for the successful execution of our business plan. The loss of Mr. Ramat or other key members of our management team could have a material adverse effect on our business prospects. |

| · | If we are unable to hire additional qualified personnel our business prospects may suffer. |

| · | We may not be able to in-license or acquire new development-stage products or technologies. |

| · | We are dependent upon the National Cancer Institute, or the NCI, to supply bryostatin for our clinical trials. |

| · | We expect to rely on third parties to manufacture our proposed products and, as a result, we may not be able to control our product development. |

| · | We may rely on third parties for marketing and sales and our revenue prospects may depend on their efforts. |

| · | If our products are not accepted by patients, the medical community or health insurance companies, our business prospects will suffer. |

| · | The branded prescription segment of the pharmaceutical industry in which we operate is competitive, and we are particularly subject to the risks of such competition. |

| · | Our business exposes us to potential product liability risks, which could result in significant product liability exposure. |

| · | Although we have clinical trial product liability insurance and comprehensive insurance, a successful liability claim against us could exceed the limits of such coverages and have a material adverse effect on our financial condition. |

| · | Reforms in the health care industry and the uncertainty associated with pharmaceutical pricing, reimbursement and related matters could adversely affect the marketing, pricing and demand for our product candidates, if approved. |

| · | Consolidation in the pharmaceutical industry could materially affect our ability to operate as an independent entity. |

| · | There currently is a limited public market for our common stock. Failure to develop or maintain an active trading market could negatively affect the value of our common stock and make it difficult or impossible for you to sell your shares. |

| · | We cannot assure you that our common stock will become liquid or that it will be listed on a securities exchange. |

| · | Our common stock is subject to the “penny stock” rules of the SEC and the trading market in the securities is limited, which makes transactions in the stock cumbersome and may reduce the value of an investment in our common stock. |

| · | Volatility in the price of our common stock could lead to losses by investors and costly securities litigation. |

| · | We do not anticipate dividends to be paid on our common stock, and investors may lose the entire amount of their investment. |

| · | If securities analysts do not initiate coverage or continue to cover our common stock or publish unfavorable research or reports about our business, this may have a negative impact on the market price of our common stock. |

| · | You may experience dilution of your ownership interests because of the future issuance of additional shares of our common stock. |

| · | The conversion of our issued and outstanding shares of Series A Stock could have the effect of diluting the voting power of common stockholders. |

| 6 |

| · | We may obtain additional capital through the issuance of preferred stock, which may limit your rights as a holder of our common stock. |

| · | Being a public company is expensive and administratively burdensome. |

| · | Any failure to maintain effective internal control over our financial reporting could materially adversely affect us. |

| · | BRNI and its affiliate Neurosciences Research Ventures, Inc. are able to exercise substantial control over our business. |

| · | Northlea Partners LLLP is able to exercise substantial control over our business. |

Corporate Information

Our principal executive offices are located at 50 Park Place, Suite 1401, Newark, New Jersey 07102. Our telephone number is 1-973-242-0005. Our website address is http://www.neurotropebioscience.com. The information on, or that can be accessed through, our website is not part of this prospectus.

Summary Financial Information

| Nine Months | Nine Months | Fiscal Year | ||||||||||

| Ended | Ended | Ended | ||||||||||

| September 30, | September 30, | December 31, | ||||||||||

| 2014 | 2013 | 2013 | ||||||||||

| Statement of Operations Data | ||||||||||||

| Revenues | $ | - | $ | - | $ | - | ||||||

| Total operating expenses | $ | 6,870,607 | $ | 5,796,483 | $ | 7,590,782 | ||||||

| Net loss | $ | (6,859,017 | ) | $ | (5,796,483 | ) | $ | (7,589,404 | ) | |||

| Statement of Cash Flows Data | ||||||||||||

| Cash used in operating activities | $ | (5,097,100 | ) | $ | (4,217,111 | ) | $ | (5,533,441 | ) | |||

| Cash used in investing activities | $ | (48,720 | ) | $ | - | $ | - | |||||

| Cash provided by financing activities | $ | - | $ | 19,773,185 | $ | 20,745,185 | ||||||

| At September 30, | At December 31, | |||||||||||

| 2014 | 2013 | |||||||||||

| Balance Sheet Data | ||||||||||||

| Total current assets | $ | 10,220,536 | $ | 15,298,803 | ||||||||

| Total assets | $ | 10,268,643 | $ | 15,298,803 | ||||||||

| Total current liabilities | $ | 1,281,400 | $ | 408,416 | ||||||||

| Total liabilities | $ | 1,281,400 | $ | 408,416 | ||||||||

| Convertible redeemable preferred stock | $ | 19,639,022 | $ | 19,943,572 | ||||||||

| Total stockholders' deficit | $ | (10,651,779 | ) | $ | (5,053,185 | ) | ||||||

| 7 |

| Common stock currently outstanding | 23,120,866 shares (1) | |

| Series A Stock currently outstanding | 21,663,000 shares (1)(2) | |

| Common stock offered by the Company | None | |

| Common stock offered by the selling stockholders | up to 25,225,000 shares (3) | |

| Use of proceeds | We will not receive any of the proceeds from the sales of our common stock by the selling stockholders. | |

| OTC Market symbol | NTRP | |

| Risk Factors | You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 10 of this prospectus before deciding whether or not to invest in shares of our common stock. |

| (1) | As of November 13, 2014. | |

| (2) | Currently, our Series A Stock is convertible into our common stock at the option of the holder currently on a one-for-one basis. However, each share of our Series A Stock will convert into more than one share of our common stock in the event that we sell certain securities of the Company at a price per share that is less than the conversion price, which is currently set at $1.00 per share. | |

| (3) | Consists of (a) 1,337,000 outstanding shares of our common stock, (b) 21,663,000 shares of our common stock issuable upon conversion of 21,663,000 outstanding shares of our Series A Stock, (c) 1,325,000 shares of our common stock issuable upon conversion of 1,325,000 shares of Series A Stock that are issuable upon exercise of Series A Stock purchase warrants, and (d) 900,000 shares of our common stock issuable upon exercise of common stock purchase warrants. |

| 8 |

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements, including, without limitation, in the section captioned “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere. Any and all statements contained in this prospectus that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this prospectus may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to the development of commercially viable pharmaceuticals, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the SEC, and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or (iii) above.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, our inability to obtain adequate financing, the significant length of time associated with drug development and related insufficient cash flows and resulting illiquidity, our inability to expand our business, significant government regulation of pharmaceuticals and the healthcare industry, lack of product diversification, volatility in the price of our raw materials, existing or increased competition, results of arbitration and litigation, stock volatility and illiquidity, and our failure to implement our business plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this prospectus appears in the section captioned “Risk Factors” and elsewhere in this prospectus. Readers should carefully review this prospectus in its entirety, including but not limited to our financial statements and the notes thereto and the risks described herein. We advise you to carefully review the reports and documents we file from time to time with the SEC, particularly our quarterly reports on Form 10-Q and our current reports on Form 8-K.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this prospectus to reflect any new information or future events or circumstances or otherwise.

| 9 |

An investment in shares of our common stock is highly speculative and involves a high degree of risk. We face a variety of risks that may affect our operations and financial results and many of those risks are driven by factors that we cannot control or predict. Before investing in our common stock you should carefully consider the following risks, together with the financial and other information contained in this prospectus. If any of the following risks actually occurs, our business, prospects, financial condition and results of operations could be materially adversely affected. In that case, the trading price of our common stock would likely decline and you may lose all or a part of your investment. Only those investors who can bear the risk of loss of their entire investment should invest in our common stock.

Risks Related to Our Business and Financial Condition

We will need additional financing to continue our operations. If we are unable to obtain additional financing on acceptable terms, we will need to curtail or cease our development plans and operations.

As of September 30, 2014, we had approximately $10.1 million of available cash and cash equivalents. We expect that our operating expenses over the next several years will increase as we expand our product acquisition, facilities, personnel, infrastructure and research and development activities. Based upon our projected activities, we believe that our current available cash will be sufficient to support our current operating plan for approximately the next 12 months. However, we are currently reviewing our plans and, if our operating plan changes or we incur significant unanticipated expenses, we may require additional capital before this timeframe. Additional funds may be raised through debt financing and/or the issuance of equity securities, there being no assurance that any type of financing on terms acceptable to us will be available or otherwise occur. Debt financing must be repaid regardless of whether we generate revenues or cash flows from operations and may be secured by substantially all of our assets. Any equity financing or debt financing that requires the issuance of warrants or other equity securities to the lender would cause the percentage ownership by our current stockholders to be diluted, which dilution may be substantial. Also, any additional equity securities issued may have rights, preferences or privileges senior to those of existing stockholders. Any equity financing at a price below the then current conversion price of our Series A Stock will result in an adjustment to the conversion ratio, applicable to our Series A Stock, resulting in the issuance of additional shares of our common stock upon the conversion of our Series A Stock, which would further dilute our other stockholders. If such financing is not available when required or is not available on acceptable terms, we may be required to reduce or eliminate certain product candidates and development activities related to bryostatin, the “bryologs” or PUFA (as defined below) analogs (as described in “Description of Business” below) and it may ultimately require us to suspend or cease operations, which could cause investors to lose the entire amount of their investment.

Our ongoing viability as a company depends on our ability to successfully develop and commercialize our licensed technology.

We are principally focused on developing two product platforms, a drug, bryostatin, for the treatment of AD and our diagnostic test for the detection of AD, both of which are still in the clinical testing stage and have not yet been fully developed. Our potential success is highly uncertain since both of our principal product candidates are in development. Bryostatin is also subject to regulatory approval. Our potential success depends upon our ability to complete development and successfully commercialize in a timely manner bryostatin for the treatment of AD and the diagnostic test for AD. We must develop bryostatin, successfully test it for safety and efficacy in the targeted patient population and manufacture the finished dosage form on a commercial scale to meet regulatory standards and receive regulatory approvals. The development and commercialization process is both time-consuming and costly, and involves a high degree of business risk. Bryostatin is still at an early stage in its product development cycle, and any follow-on product candidates are still at the concept stage. In order to make our diagnostic test for AD commercially available, we must make investments to upgrade BRNI’s laboratory facilities or contract with a third-party lab for the processing of the diagnostic test. The results of clinical testing of our product candidates are uncertain and we cannot assure anybody that we will be able to obtain regulatory approvals of our product candidates. If obtained, regulatory approvals may take longer or be more expensive than anticipated. Furthermore, even if regulatory approvals are obtained, our products may not perform as we expect and we may not be able to successfully and profitably produce and market any products. Delays in any part of the process or our inability to obtain regulatory approval of our products could adversely affect our future operating results by restricting (or even prohibiting) the introduction and sale of our products.

| 10 |

If the BRNI License were terminated, we may be required to cease operations.

Our rights to develop, commercialize and sell certain of our proposed products, including bryostatin and our diagnostic test for the detection of AD, are, in part, dependent upon the BRNI License. BRNI has the right to terminate this agreement after 30 days prior notice in certain circumstances, including if we were to materially breach any provisions of the agreement after a 60-day cure period for breaches that are capable of being cured, in the event of certain bankruptcy or insolvency proceedings or in the event of the termination of the Common Stockholders Agreement with respect to the Company. See “Certain Relationships and Related Transactions—Common Stockholders Agreement” for more information about this agreement, the Common Stockholders Agreement. Additionally, the BRNI License provides that the license may not be assigned, including by means of a change of control of the Company, or sublicensed without the consent of BRNI. For additional information regarding the BRNI License, see “Business—Intellectual Property—Technology License and Services Agreement.” If the BRNI License were terminated, we would lose rights to a substantial portion of the intellectual property currently being developed by us and no longer have the rights to develop, commercialize and sell some of our proposed products. As a result, we may be required to cease operations under such circumstance.

We currently rely on BRNI, and may also rely on other independent third-party contract research organizations, to perform clinical and non-clinical studies of our drug candidate and diagnostic test and to perform other research and development services.

The BRNI License requires us to use BRNI to provide research and development services and other scientific assistance and support services, including clinical trials, under certain conditions. The BRNI License limits our ability to make certain decisions, including those relating to our drug candidate and diagnostic test, without BRNI’s consent. See “Business—Intellectual Property—Technology License and Services Agreement.” Under certain conditions, we may, however, also rely on independent third-party contract research organizations, or a CRO, to perform clinical and non-clinical studies of our drug candidate and diagnostic test. Many important aspects of the services that may be performed for us by CROs would be out of our direct control. If there were to be any dispute or disruption in our relationship with such CROs, the development of our drug candidate and diagnostic test may be delayed. Moreover, in our regulatory submissions, we would expect to rely on the quality and validity of the clinical work performed by our CROs. If any of our CROs’ processes, methodologies or results were determined to be invalid or inadequate, our own clinical data and results and related regulatory approvals could be materially adversely impacted.

We have relied on the representations and materials provided by BRNI, including scientific, peer-reviewed and non-peer reviewed publications, abstracts, slides, internal documents, verbal communications, patents and related patent filings, with respect to the results of its research related to our proposed products.

BRNI began the development of the intellectual property that forms the basis for our proposed products in 1999. We have relied on the quality and validity of the research results obtained by BRNI with respect to this intellectual property, and we have conducted limited verification of the raw preclinical and clinical data produced by BRNI. No independent third-party has verified any such data. Some of BRNI’s results have been included in this prospectus. If any of BRNI’s basic processes, methodologies or results were determined to be invalid or inadequate, our own clinical data and results and related regulatory approvals, could be materially adversely impacted.

We have a limited operating history upon which investors can evaluate our future prospects.

Our product candidates are in an early development stage and we are subject to all of the risks inherent in the establishment of a new business enterprise. While development of our product candidates was started in 1999 by BRNI, Neurotrope BioScience was incorporated on October 31, 2012 and on that same date entered into the BRNI License for the continuing development and commercialization of our product candidates, and therefore we have a limited operating history. Our proposed products are currently in the research and development stage and we have not generated any revenues, nor do we expect our products to generate revenues for at least 36 months, if ever. As a result, any investment in our securities must be evaluated in light of the potential problems, delays, uncertainties and complications encountered in connection with a newly established pharmaceutical development business. The risks include, but are not limited to, the possibilities that any or all of our potential products will be found to be unsafe, ineffective or, that the products once developed, although effective, are not economical to market; that our competitors hold proprietary rights that preclude us from marketing such products; that our competitors market a superior or equivalent product; or the failure to receive necessary regulatory clearances for our proposed products. To achieve profitable operations, we must successfully develop, obtain regulatory approval for, introduce and successfully market at a profit product candidates that are currently in the research and development phase, including candidates that are not yet in clinical development. We only have two product candidates in clinical development. Much of the clinical development work and testing for our product candidates remains to be completed. No assurance can be given that our research and development efforts will be successful, that required regulatory approvals will be obtained, that any of our candidates will be safe and effective, that any products, if developed and introduced, will be successfully marketed or achieve market acceptance or that products will be marketed at prices necessary to generate profits. Failure to successfully develop, obtain regulatory approvals for, or introduce and market our products would have material adverse effects on our business prospects, financial condition and results of operations.

| 11 |

If we do not obtain the necessary regulatory approvals in the United States and/or other countries, we will not be able to sell our drug candidates.

We cannot assure you that we will receive the approvals necessary to commercialize bryostatin, or any other potential drug candidates we acquire or attempt to develop in the future. We will need approval from the FDA to commercialize our drug candidates in the U.S. and approvals from similar regulatory authorities in foreign jurisdictions to commercialize our drug candidates in those jurisdictions. In order to obtain FDA approval of bryostatin or any other drug candidate for the treatment of AD, we must submit a New Drug Application, or NDA, to the FDA, demonstrating that the drug candidate is safe, pure and potent, and effective for its intended use. This demonstration requires significant research including completion of clinical trials. Satisfaction of the FDA’s regulatory requirements typically takes many years, depending upon the type, complexity and novelty of the drug candidate and requires substantial resources for research, development and testing. We cannot predict whether our clinical trials will demonstrate the safety and efficacy of our drug candidates or if the results of any clinical trials will be sufficient to advance to the next phase of development or for approval from the FDA. We also cannot predict whether our research and clinical approaches will result in drugs or therapeutics that the FDA considers safe and effective for the proposed indications. The FDA has substantial discretion in the drug approval process. The approval process may be delayed by changes in government regulation, future legislation or administrative action or changes in FDA policy that occur prior to or during our regulatory review. Delays in obtaining regulatory approvals may prevent or delay commercialization of, and our ability to derive revenues from, our drug candidates and diminish any competitive advantages that we may otherwise believe that we hold. Even if we comply with all FDA requests, the FDA may ultimately reject one or more of our applications. We may never obtain regulatory clearance for any of our drug candidates. Failure to obtain FDA approval of our drug candidates will leave us without a saleable product and therefore without any source of revenues. In addition, the FDA may require us to conduct additional clinical testing or to perform post-marketing studies, as a condition to granting marketing approval of a drug product or permit continued marketing, if previously approved. If conditional marketing approval is obtained, the results generated after approval could result in loss of marketing approval, changes in product labeling, and/or new or increased concerns about the side effects or efficacy of a product. The FDA has significant post-market authority, including the explicit authority to require post-market studies and clinical trials, labeling changes based on new safety information and compliance with FDA-approved risk evaluation and mitigation strategies. The FDA’s exercise of its authority has in some cases resulted, and in the future could result, in delays or increased costs during product development, clinical trials and regulatory review, increased costs to comply with additional post-approval regulatory requirements and potential restrictions on sales of approved drugs. In foreign jurisdictions, the regulatory approval processes generally include the same or similar risks as those associated with the FDA approval procedures described above. We cannot assure you that we will receive the approvals necessary to commercialize our drug candidates for sale either within or outside the United States.

If we are unable to engage a CLIA-certified lab to process our diagnostic test at its facilities, the commercialization of our diagnostic test may be unsuccessful.

We have conducted analyses of the underlying AD diagnostic technology and are continuing to conduct market research to evaluate physician acceptability, commercial sales potential and product development costs of an AD diagnostic product. If our Board of Directors determines to continue development of our AD diagnostic product, we plan to offer the test in the United States in a laboratory that has been accredited under CLIA, to perform high complexity testing. We believe that if our diagnostic test is solely available through a single CLIA-certified lab, we may market the diagnostic test as a laboratory developed test, or LDT, and fall within the FDA’s enforcement discretion policy for such tests. Under historic FDA enforcement policies and guidance, LDTs such as this generally did not require FDA premarket clearance or approval before commercialization, and we plan to market our test on that basis. FDA guidance and policy pertaining to diagnostic testing, however, is continuing to evolve and is subject to ongoing review and revision. A significant change in FDA guidance and policy may trigger FDA oversight of any diagnostic test we develop and offer through a single CLIA-certified lab. If we are unable to contract with a CLIA-certified lab for the processing of our diagnostic test, we may not be able to market the test as an LDT, which could result in substantial delays in the commercialization of our diagnostic test. We have supported the progress of BRNI’s facility located in Rockville, Maryland towards becoming a CLIA-accredited facility; however, there is no guarantee that this facility will achieve this certification in the timeframe required for commercial introduction of an AD diagnostic product.

If the FDA requires approval or clearance of our diagnostic test, we could incur substantial costs and time delays associated with meeting requirements for pre-market clearance or approval.

Although the FDA maintains that it has authority to regulate the development and use of LDTs, such as ours, as medical devices, it has not exercised its authority with respect to most LDTs as a matter of enforcement discretion. The FDA does not generally extend its enforcement discretion to reagents or software provided by third parties and used to perform LDTs, and therefore these products must typically comply with FDA medical device regulations, which are wide-ranging and govern, among other things: product design and development, product testing, product labeling, product storage, pre-market clearance or approval, advertising and promotion and product sales and distribution.

| 12 |

We believe that a diagnostic test utilized in a single CLIA-certified laboratory falls within the FDA’s current enforcement discretion policy for diagnostic tests. As a result, we believe that pursuant to the FDA’s current policies and guidance, the FDA, in its discretion, would not require that we obtain regulatory clearances or approvals for this type of AD test. The container we provide for collection and transport of biopsy samples from a pathology laboratory to our clinical reference laboratory may be a medical device subject to FDA regulation but, we believe, would not receive pre-market review by the FDA because under current policy and guidance we expect the FDA to exercise its discretion not to enforce the requirement. We cannot assure you that the FDA or other regulatory agencies would agree with our determination. A determination that we have violated these laws or a public announcement that we are being investigated for possible violations of these laws could adversely affect our business prospects, financial condition and results of operations.

Moreover, FDA guidance and policy pertaining to diagnostic testing is continuing to evolve and is subject to ongoing review and revision. A significant change in any of the laws, regulations or policies may require us to change our business model in order to maintain regulatory compliance. At various times since 2006, the FDA has issued guidance documents or announced draft guidance regarding initiatives that may require varying levels of FDA oversight of our test. For example, in June 2010, the FDA announced a public meeting to discuss the agency’s oversight of LDTs prompted by the increased complexity of LDTs and their increasingly important role in clinical decision-making and disease management, particularly in the context of personalized medicine. The FDA indicated that it was considering a risk-based application of oversight to LDTs and that, following public input and discussion, it might issue separate draft guidance on the regulation of LDTs, which ultimately could require that we seek and obtain either pre-market clearance or approval of LDTs, depending upon the risk-based approach the FDA adopts. On October 3, 2014, the FDA published a proposed risk-based framework for LDTs, which are designed, manufactured, and used within a single laboratory. This draft guidance indicates that the FDA would like to establish an LDT oversight framework, including premarket review for higher-risk LDTs, such as those that have the same intended use as FDA-approved or cleared companion diagnostics currently on the market. The FDA’s notice states that it does not consider devices to be LDTs if they are designed or manufactured completely, or partly, outside of the laboratory that offers and uses them. This includes instances in which an academic institution develops a device, which it then licenses to or signs an exclusivity agreement (to manufacturer and use the device) with a private corporation that owns a CLIA-certified laboratory. It also includes instances in which a laboratory contracts with a specification developer to design a new device and transfer the design to the laboratory for final validation prior to the device being manufactured and used by the laboratory. The FDA’s draft guidance, if and when finalized, may significantly impact the development and commercialization of our products, and may require us to change our business model in order to maintain compliance with these laws. We cannot predict the ultimate timing or form of any FDA guidance or regulation addressing LDTs.

If the FDA significantly changes the regulation of LDTs, it could reduce our projected revenue or increase our projected costs and adversely affect our business, prospects, results of operations or financial condition. We cannot provide any assurance that FDA regulation, including pre-market review, will not be required in the future for our tests, whether through additional guidance issued by the FDA, new enforcement policies adopted by the FDA or new legislation enacted by Congress. We believe it is possible that legislation will be enacted into law or guidance could be issued by the FDA which may result in increased regulatory burdens for us to offer a diagnostic test.

The requirement of pre-market review could negatively affect our business until such review is completed and clearance to market or approval is obtained. The FDA could require that we stop selling our tests pending pre-market clearance or approval. We may be required to proactively achieve compliance with certain FDA regulations and to conform our manufacturing operations to the FDA’s good manufacturing practice regulations for medical devices, known as the Quality System Regulation (“QSR”), as part of our contracts with customers or as part of our collaborations with third parties. In addition, we may voluntarily seek to conform our manufacturing operations to QSR requirements. For clinical diagnostic products that are regulated as medical devices, the FDA enforces the QSR through pre-approved inspections and periodic unannounced inspections of registered manufacturing facilities. If we are subject to QSR requirements, the failure to comply with those requirements or take satisfactory corrective action in response to an adverse QSR inspection could result in enforcement actions, including a public warning letter or an untitled letter, a delay in approving or clearing, or a refusal to approve or clear, our products, a shutdown of manufacturing operations, a product recall, civil or criminal penalties or other sanctions, which could in turn cause our sales and business to suffer.

If the FDA allows our test to remain on the market but there is uncertainty about our tests, if they are labeled investigational by the FDA or if labeling claims the FDA allows us to make are very limited, orders or reimbursement may decline. The regulatory approval process may involve, among other things, successfully completing additional clinical trials and making a 510(k) submission, or filing a pre-market approval application with the FDA. If the FDA requires pre-market review, our tests may not be cleared or approved on a timely basis, if at all. We may also decide voluntarily to pursue FDA pre-market review of our tests if we determine that doing so would be appropriate.

If we were required to conduct additional clinical trials prior to continuing to offer our diagnostic test, those trials could lead to delays or failure to obtain necessary regulatory approval, which could cause significant delays in commercializing the product candidate and harm our ability to generate revenue.

| 13 |

We have not generated any revenues since our inception and we do not expect to generate revenue for the foreseeable future. If we do not generate revenues and achieve profitability, we will likely need to curtail or cease our development plans and operations.

Our ability to generate revenues depends upon many factors, including our ability to complete development of our proposed products, our ability to obtain necessary regulatory approvals for our proposed products and our ability to successfully commercialize market and sell our products. We have not generated any revenues since we began operations on October 31, 2012. We expect to incur significant operating losses over the next several years. If we do not generate revenues, do not achieve profitability and do not have other sources of financing for our business, we will likely need to curtail or cease our development plans and operations, which could cause investors to lose the entire amount of their investment.

Our commercial success will depend, in part, on our ability, and the ability of our licensors, to obtain and maintain patent protection. Our licensors’ failure to obtain and maintain patent protection for our products may have a material adverse effect on our business.

Pursuant to the BRNI License, we have obtained rights to certain patents owned by BRNI or licensed to NRV II, LLC by BRNI as of or subsequent to October 31, 2012. For additional information regarding the BRNI License, see “Business—Intellectual Property—Technology License and Services Agreement.” In the future, we may seek rights from third parties to other patents or patent applications. Our success will depend, in part, on our ability and the ability of our licensors to maintain and/or obtain and enforce patent protection for our proposed products and to preserve our trade secrets, and to operate without infringing upon the proprietary rights of third parties. Patent positions in the field of biotechnology and pharmaceuticals are generally highly uncertain and involve complex legal and scientific questions. We cannot be certain that we or our licensors were the first inventors of inventions covered by our licensed patents or that we or they were the first to file. Accordingly, the patents licensed to us may not be valid or afford us protection against competitors with similar technology. The failure to maintain and/or obtain patent protection on the technologies underlying our proposed products may have material adverse effects on our competitive position and business prospects.

Our licensed patented technologies may infringe on other patents, which may expose us to costly litigation.

It is possible that our licensed patented technologies may infringe on patents or other rights owned by others. We may have to alter our products or processes, pay additional licensing fees, pay to defend an infringement action or challenge the validity of the patents in court or cease activities altogether because of patent rights of third parties, thereby causing additional unexpected costs and delays to us. Patent litigation is costly and time consuming, and we may not have sufficient resources to pay for such litigation. Pursuant to the BRNI License, BRNI has the exclusive right (but not the obligation) to apply for, file, prosecute or maintain patents and patent applications for our licensed technologies. However, in order to maintain our rights to use our licensed technologies, we must reimburse BRNI for all of the attorney’s fees and other costs and expenses related to any of the foregoing. For additional information regarding the BRNI License, see “Business—Intellectual Property—Technology License and Services Agreement.” If the patents licensed to us are determined to infringe a patent owned by a third party and we do not obtain a license under such third-party patents, or if we are found liable for infringement or are not able to have such third-party patents declared invalid, we may be liable for significant money damages, we may encounter significant delays in bringing products to market or we may be precluded from participating in the manufacture, use or sale of products or methods of treatment requiring such licenses.

We may not be able to protect our trade secrets and other unpatented proprietary technologies, which could give our competitors an advantage over us.

In addition to our reliance on patents and pending patents owned by BRNI, we rely upon trade secrets and other unpatented proprietary technologies. We may not be able to adequately protect our rights with regard to such unpatented proprietary technologies or competitors may independently develop substantially equivalent technologies. We seek to protect trade secrets and proprietary knowledge, in part through confidentiality agreements with our employees, consultants, advisors and collaborators. Nevertheless, these agreements may not effectively prevent disclosure of our confidential information and may not provide us with an adequate remedy in the event of unauthorized disclosure of such information and, as a result, our competitors could gain a competitive advantage over us.

We are dependent on Charles S. Ramat, our President and Chief Executive Officer, for the successful execution of our business plan. The loss of Mr. Ramat or other key members of our management team could have a material adverse effect on our business prospects.

We are highly dependent on Charles S. Ramat, our President and Chief Executive Officer. We are dependent on Charles S. Ramat’s and our directors’ networks of contacts and experience to recruit key talent to the Company. We do not have key-man insurance on any of our officers. Loss of the services of Charles S. Ramat or other key members of our management team or our Board of Director’s ability to identify and hire key talent could have a material adverse effect on our business prospects, financial condition and results of operations.

| 14 |

If we are unable to hire additional qualified personnel our business prospects may suffer.

Our success and achievement of our business plans depend upon our ability to recruit, hire, train and retain other highly qualified technical and managerial personnel. Competition for qualified employees among pharmaceutical and biotechnology companies is intense, and the loss of any of such persons, or an inability to attract, retain and motivate any additional highly skilled employees required for the implementation of our business plans and activities could have a materially adverse effect on us. Our inability to attract and retain the necessary technical and managerial personnel and consultants and scientific and/or regulatory consultants and advisors could have a material adverse effect on our business prospects, financial condition and results of operations.

We may not be able to in-license or acquire new development-stage products or technologies.

Our product commercialization strategy relies, to some extent, on our ability to in-license or acquire product formulation techniques, new chemical entities, or related know-how that has proprietary protection. We may also seek to acquire, by license or otherwise, other development stage products that are consistent with our product portfolio objectives and commercialization strategy. The acquisition of products requires the identification of appropriate candidates, negotiation of terms of acquisition, financing for the acquisition and integration of the candidates into our portfolio. Failure to accomplish any of these tasks may diminish our growth rate and adversely alter our competitive position.

We are dependent upon the NCI to supply bryostatin for our clinical trials.

BRNI has entered into a material transfer agreement with the NCI, pursuant to which the NCI has agreed to supply bryostatin required for our pre-clinical research and clinical trials. This agreement does not provide for a sufficient amount of bryostatin to support the completion of our clinical trials that we are required to conduct in order to seek FDA approval of bryostatin for the treatment of AD. Therefore, BRNI or we will have to enter into one or more subsequent agreements with the NCI for the supply of additional amounts of bryostatin. If BRNI or we are unable to secure such additional agreements or if the NCI otherwise discontinues for any reason supplying us with bryostatin, then we would have to either secure another source of bryostatin or discontinue our efforts to develop and commercialize bryostatin for the treatment of AD. We are currently exploring alternative sources of bryostatin and believe it will be feasible to secure future bryostatin supplies from these sources on commercially reasonable terms, although there can be no assurance this will be the case.

We expect to rely on third parties to manufacture our proposed products and, as a result, we may not be able to control our product development or commercialization.

We currently do not have an FDA approved manufacturing facility. We expect to rely on contract manufacturers to produce quantities of products and substances necessary for product commercialization. See also the risk factor above captioned “We are dependent upon the NCI to supply bryostatin for our clinical trials.” Contract manufacturers that we use must adhere to current good manufacturing practice regulations enforced by the FDA through its facilities inspection program. If the facilities of such manufacturers cannot pass a pre-approval plant inspection, the FDA pre-market approval of our products will not be granted. As a result:

| · | there are a limited number of manufacturers that could produce the products for us and we may not be able to identify and enter into acceptable agreements with any manufacturers; |

| · | the products may not be produced at costs or in quantities necessary to make them commercially viable; |

| · | the quality of the products may not be acceptable to us and/or regulatory authorities; |

| · | our manufacturing partners may go out of business or file for bankruptcy; |

| · | our manufacturing partners may decide not to manufacture our products for us; |

| · | our manufacturing partners could fail to manufacture to our specifications; |

| · | there could be delays in the delivery of quantities needed; |

| · | we could be unable to fulfill our commercial needs in the event we obtain regulatory approvals and there is strong market demand; or |

| 15 |

| · | ongoing inspections by the FDA or other regulatory authorities may result in suspensions, seizures, recalls, fines, injunctions, revocations and/or criminal prosecutions. |

If we are unable to engage contract manufacturers or suppliers to manufacture or package our products, or if we are unable to contract for a sufficient supply of required products and substances on acceptable terms, or if we encounter delays or difficulties in our relationships with these manufacturers, or with a regulatory agency, then the submission of products for regulatory approval and subsequent sales of such products would be delayed. Any such delay may have a materially adverse effect on our business prospects, financial condition and results of operations.

We may rely on third parties for marketing and sales and our revenue prospects may depend on their efforts.

We currently have no experience in sales, marketing or distribution. We do not anticipate having the resources in the foreseeable future to allocate to the sales and marketing of our proposed products. As a result if our product development is successful, our future success will likely depend, in part, on our ability to enter into and maintain collaborative relationships with one or more third parties for sales, marketing or distribution, on the collaborator’s strategic interest in the products we have under development and on such collaborator’s ability to successfully market and sell any such products. We intend to pursue collaborative arrangements regarding the sales and marketing of our products as appropriate. However, we may not be able to establish or maintain such collaborative arrangements or, if we are able to do so, they may not have effective sales forces. To the extent that we decide not to, or are unable to, enter into collaborative arrangements with respect to the sales and marketing of our proposed products, significant capital expenditures, management resources and time will be required to establish and develop an in-house marketing and sales force with technical expertise. To the extent that we depend on third parties for marketing and distribution, any revenues received by us will depend upon the efforts of such third parties, which may not be successful.

If our products are not accepted by patients, the medical community or health insurance companies, our business prospects will suffer.

Commercial sales of any products we successfully develop will substantially depend upon the products’ efficacy and on their acceptance by patients, the medical community, providers of comprehensive healthcare insurance, healthcare benefit plan managers, the Centers for Medicare and Medicaid Services, or CMS (which is the U.S. federal agency which administers Medicare, Medicaid and the State Children’s Health Insurance Program), and other organizations. Widespread acceptance of our products will require educating patients, the medical community and third party payors of medical treatments as to the benefits and reliability of the products. Our proposed products may not be accepted, and, even if they are accepted, we are unable to estimate the length of time it would take to gain such acceptance.

The branded prescription segment of the pharmaceutical industry in which we operate is competitive, and we are particularly subject to the risks of such competition.

The branded prescription segment of the pharmaceutical industry in which we operate is competitive, in part, because the products that are sold require extensive sales and marketing resources invested in their commercialization. The increasing cost of prescription pharmaceuticals has caused providers of comprehensive healthcare insurance, healthcare benefit plan managers, CMS, as well as other organizations, collectively known as third party payors, to tightly control and dictate their drug formulary plans to control the costs associated with the use of prescription pharmaceutical products by enrollees in these plans. Our ability to gain formulary access to drug plans supported by these third party payors is substantially dependent on the differentiated patient benefit that our proposed products can provide, compared closely to similar products claiming the same benefits or advantages. We may not be able to differentiate our proposed products from those of our competitors, successfully develop or introduce new products that are less costly or offer better performance than those of our competitors, or offer purchasers of our proposed products payment and other commercial terms as favorable as those offered by our competitors. We expect that some of our proposed products, even if successfully developed and commercialized, will eventually face competition from a significant number of biotechnology or large pharmaceutical companies. Because most of our competitors have substantially greater financial and other resources than we have, we are particularly subject to the risks inherent in competing with them. The effects of this competition could materially adversely affect our business prospects, financial condition and results of operations.