Attached files

| file | filename |

|---|---|

| 8-K/A - FORM 8-K/A - HomeStreet, Inc. | form8-kainvestorpresentati.htm |

THIRD QUARTER 2014 - REVISED NASDAQ:HMST

Important Disclosures Forward-Looking Statements This presentation includes forward-looking statements, as that term is defined for purposes of applicable securities laws, about our industry, our future financial performance and business activity. These statements are, in essence, attempts to anticipate or forecast future events, and thus subject to many risks and uncertainties. These forward-looking statements are based on our management's current expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts, as well as a number of assumptions concerning future events. Forward-looking statements in this release include, among other matters, statements regarding our business plans and strategies (including our expansion strategies) and the expected effects of those initiatives, general economic trends, particularly those that affect mortgage origination and refinance activity, and growth scenarios and performance targets. Readers should note, however, that all statements in this presentation other than assertions of historical fact are forward-looking in nature. These statements are subject to risks, uncertainties, assumptions and other important factors set forth in our SEC filings, including but not limited to our most recent Annual Report on Form 10-K for the fiscal year ended December 31, 2013, our most recent Quarterly Report on Form 10-Q; and our Quarterly Report on Form 10-Q for the third quarter of 2014, which we intend to file with the SEC on or before November 10, 2014. Many of these factors are beyond our control. Such factors could cause actual results to differ materially from the results discussed or implied in the forward-looking statements. These risks include statements predicated on our ability to complete our proposed merger with Simplicity Bancorp, Inc., realize the expected value of that transaction and the combined entity resulting from that transaction, integrate our recent and pending acquisitions and to continue to expand our banking operations geographically and across market sectors, grow our franchise and capitalize on market opportunities; our ability to manage these efforts cost-effectively and to attain the desired operational and financial outcomes; our ability to manage the losses inherent in our loan portfolio; our ability to make accurate estimates of the value of our non-cash assets and liabilities; our ability to maintain electronic and physical security of customer data; our ability to respond to an increasingly restrictive and complex regulatory environment; and our ability to attract and retain key personnel. Actual results may fall materially short of our expectations and projections, and we may change our plans or take additional actions that differ in material ways from our current intentions. Accordingly, we can give no assurance of future performance, and you should not rely unduly on forward-looking statements. All forward-looking statements are based on information available to the Company as of the date hereof, and we do not undertake to update or revise any forward-looking statements, for any reason. Additional Information About the Merger and Where to Find it The merger of Simplicity Bancorp, Inc. (“Simplicity”) with and into HomeStreet (the “merger”) will require the approval of Simplicity’s stockholders, and the issuance of shares comprising the merger consideration will require the approval of HomeStreet’s shareholders. This presentation is not a recommendation in favor of a vote on the transaction or on the issuance of shares in the transaction, nor is it a solicitation of proxies in connection with any such vote. HomeStreet and Simplicity will file a joint proxy statement and other relevant documents with the SEC in connection with the merger. The parties also will apply for registration of the HomeStreet shares to be issued in the transaction following a fairness hearing to be convened by the Commissioner of the California Department of Business Oversight. Details about the fairness hearing, including a formal notice of the hearing, will be published and made available to Simplicity stockholders in accordance with Section 25142 of the California Corporations Code. SHAREHOLDERS OF SIMPLICITY AND HOMESTREET ARE ADVISED TO READ THE JOINT PROXY STATEMENT WHEN IT BECOMES AVAILABLE, AS WELL AS THE FAIRNESS HEARING NOTICE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC AND THE CALIFORNIA DEPARTMENT OF BUSINESS OVERSIGHT, IN ADDITION TO ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The joint proxy statement, fairness hearing notice, and other relevant materials (when they become available), and any other documents filed with or furnished to the SEC by HomeStreet or Simplicity, may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders may obtain free copies of these documents by contacting the Corporate Secretary of HomeStreet at 800-654-1075 or the Corporate Secretary of Simplicity at 800-524-2274. HomeStreet and Simplicity and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Simplicity and HomeStreet shareholders in connection with the proposed merger. Information concerning such participants’ ownership of Simplicity and HomeStreet common shares will be set forth in the joint proxy statement relating to the merger when it becomes available. This communication does not constitute an offer to sell, or a solicitation of an offer to buy, any securities. Basis of Presentation of Financial Data Unless noted otherwise in this presentation, all reported financial data is being presented as of the period ending September 30, 2014. Non-GAAP Financial Measures Information on any non-GAAP financial measures referenced in this presentation, including a reconciliation of those measures to GAAP measures, may also be found in our SEC filings and in the earnings release available on our web site. 2

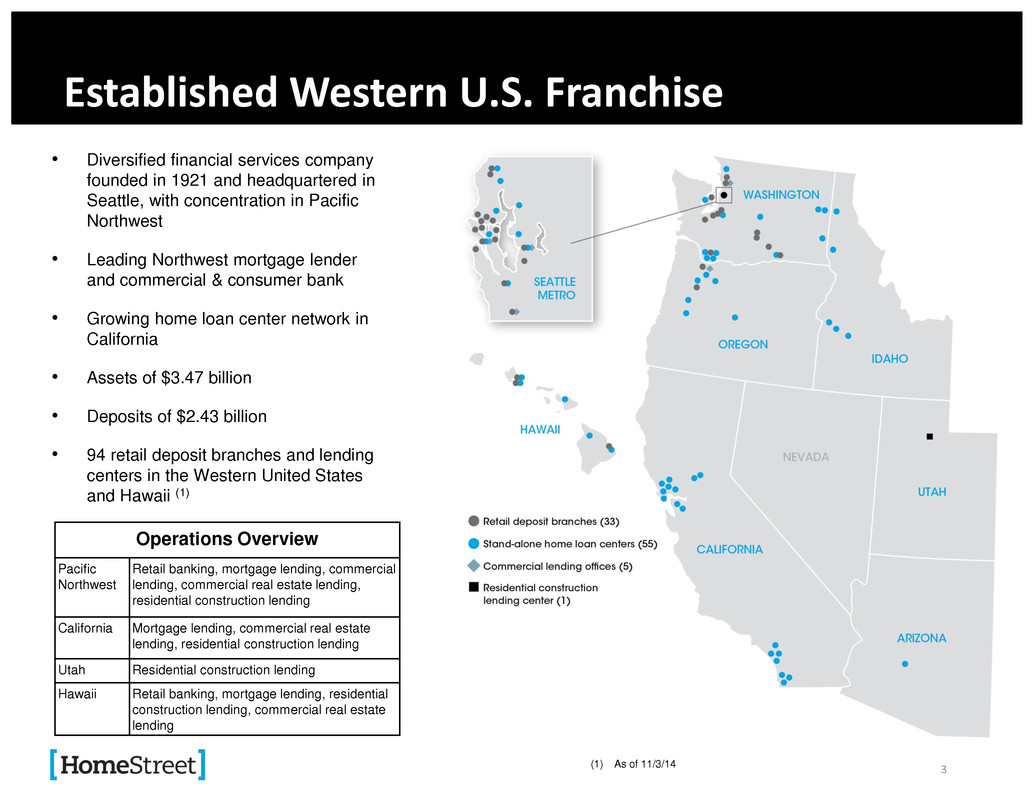

3 Established Western U.S. Franchise • Diversified financial services company founded in 1921 and headquartered in Seattle, with concentration in Pacific Northwest • Leading Northwest mortgage lender and commercial & consumer bank • Growing home loan center network in California • Assets of $3.47 billion • Deposits of $2.43 billion • 94 retail deposit branches and lending centers in the Western United States and Hawaii (1) (1) As of 11/3/14 Operations Overview Pacific Northwest Retail banking, mortgage lending, commercial lending, commercial real estate lending, residential construction lending California Mortgage lending, commercial real estate lending, residential construction lending Utah Residential construction lending Hawaii Retail banking, mortgage lending, residential construction lending, commercial real estate lending

Strategy Build Single Family Mortgage origination market share • Organic growth opportunities Grow portfolio lending – Commercial Lending, Commercial Real Estate and Construction Increase density of retail deposit branch network • Growth via acquisition of smaller institutions in-market and in new markets • Continue opportunistic expansion (market share and footprint) of Single Family mortgage banking activities • Target major markets in Western U.S. • Grow earning assets while containing operating expenses to improve operating efficiencies • Long-term target efficiency ratio in the mid-to-low 60% range • Target long-term 15%+ ROE, subject to achievement of targeted segment contributions • Future initiation of regular dividend upon stabilization of earnings Expand Commercial & Consumer Banking Ongoing expense management Optimize use of capital To grow and diversify earnings by expanding our Commercial & Consumer Banking business and continue to build Mortgage Banking market share in new and existing markets 4

5 Recent Developments Results of Operations • Third quarter net income of $5.0 million or $0.33 diluted EPS Strategic Growth Activity • Announced plans to acquire Simplicity Bancorp and Simplicity Bank in Southern California – target closing date of Q1 2015 (see Simplicity Acquisition section of this presentation) • Significant progress toward diversifying earnings Strong growth of average interest-earning assets – over 8% in the quarter. Best quarter yet for new loan commitments in LHFI portfolio – increase of 19% from 6/30/14 Core deposit growth of 2.8% in Q3, including 15% growth in noninterest-bearing transaction & savings accounts • Increased network to 94 branches and lending centers Added net of five lending centers (Washington, California, Hawaii) Opened two new retail deposit branches in Seattle Opened first home loan center in Arizona in November California ended quarter at 18 home loan centers, with production volume making up 21% of total closed loans • Net headcount increase of 20 Decrease of 5 Operations, Lending, Customer Service and Support headcount in the Commercial & Consumer Banking Segment Increase of 2 Corporate Support & Administration headcount Increase of 16 Mortgage Banking Production headcount Increase of 7 Mortgage Banking Fulfillment & Operations headcount

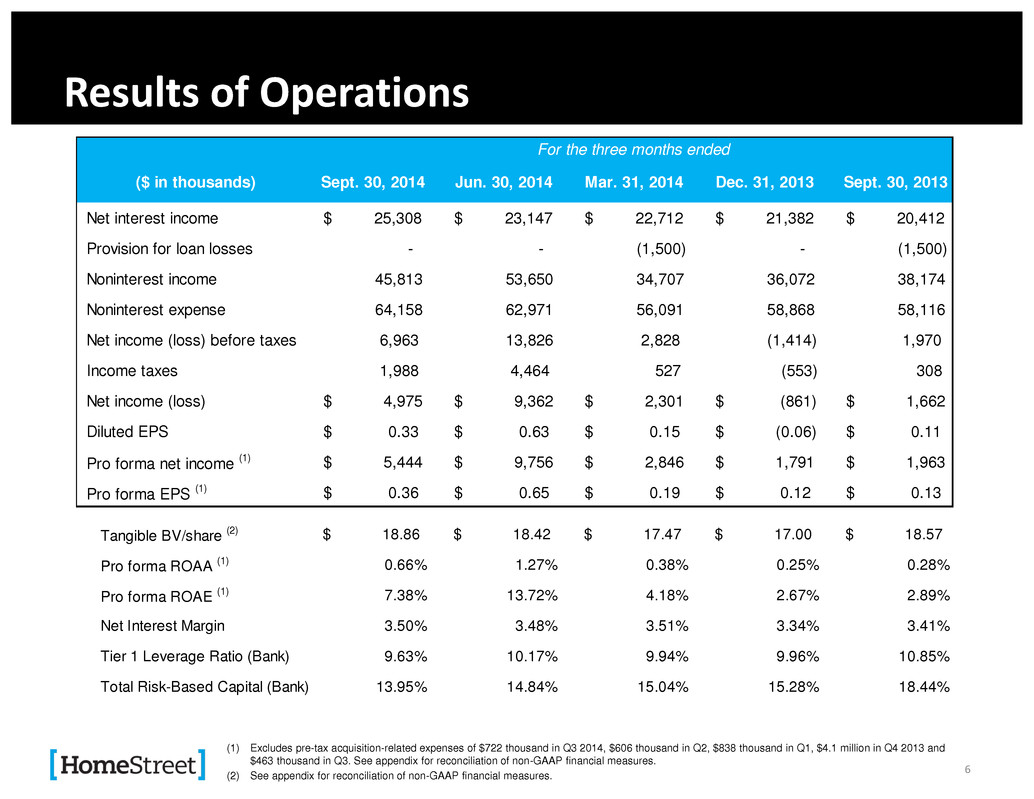

Results of Operations For the three months ended (1) Excludes pre-tax acquisition-related expenses of $722 thousand in Q3 2014, $606 thousand in Q2, $838 thousand in Q1, $4.1 million in Q4 2013 and $463 thousand in Q3. See appendix for reconciliation of non-GAAP financial measures. (2) See appendix for reconciliation of non-GAAP financial measures. For the nine months ended ($ in thousands) Sept. 30, 2014 Jun. 30, 2014 Mar. 31, 2014 Dec. 31, 2013 Sept. 30, 2013 Net interest income $ 25,308 $ 23,147 $ 22,712 $ 21,382 $ 20,412 Provision for loan losses - - (1,500) - (1,500) Noninterest income 45,813 53,650 34,707 36,072 38,174 Noninterest expense 64,158 62,971 56,091 58,868 58,116 Net income (loss) before taxes 6,963 13,826 2,828 (1,414) 1,970 Income taxes 1,988 4,464 527 (553) 308 Net income (loss) $ 4,975 $ 9,362 $ 2,301 $ (861) $ 1,662 Diluted EPS $ 0.33 $ 0.63 $ 0.15 $ (0.06) $ 0.11 Pro forma net income (1) $ 5,444 $ 9,756 $ 2,846 $ 1,791 $ 1,963 Pro forma EPS (1) $ 0.36 $ 0.65 $ 0.19 $ 0.12 $ 0.13 Tangible BV/share (2) $ 18.86 $ 18.42 $ 17.47 $ 17.00 $ 18.57 Pro forma ROAA (1) 0.66% 1.27% 0.38% 0.25% 0.28% Pro forma ROAE (1) 7.38% 13.72% 4.18% 2.67% 2.89% Net Interest Margin 3.50% 3.48% 3.51% 3.34% 3.41% Tier 1 Leverage Ratio (Bank) 9.63% 10.17% 9.94% 9.96% 10.85% Total Risk-Based Capital (Bank) 13.95% 14.84% 15.04% 15.28% 18.44% For the three months ended 6

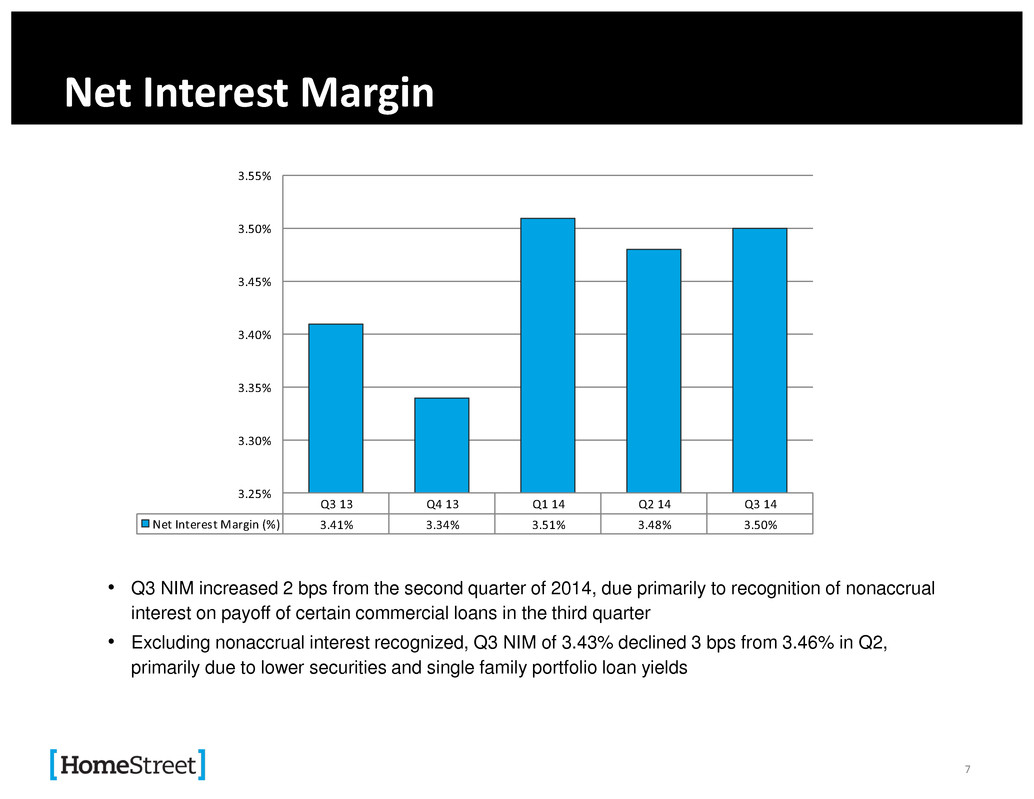

Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Net Interest Margin (%) 3.41% 3.34% 3.51% 3.48% 3.50% 3.25% 3.30% 3.35% 3.40% 3.45% 3.50% 3.55% Net Interest Margin • Q3 NIM increased 2 bps from the second quarter of 2014, due primarily to recognition of nonaccrual interest on payoff of certain commercial loans in the third quarter • Excluding nonaccrual interest recognized, Q3 NIM of 3.43% declined 3 bps from 3.46% in Q2, primarily due to lower securities and single family portfolio loan yields 7

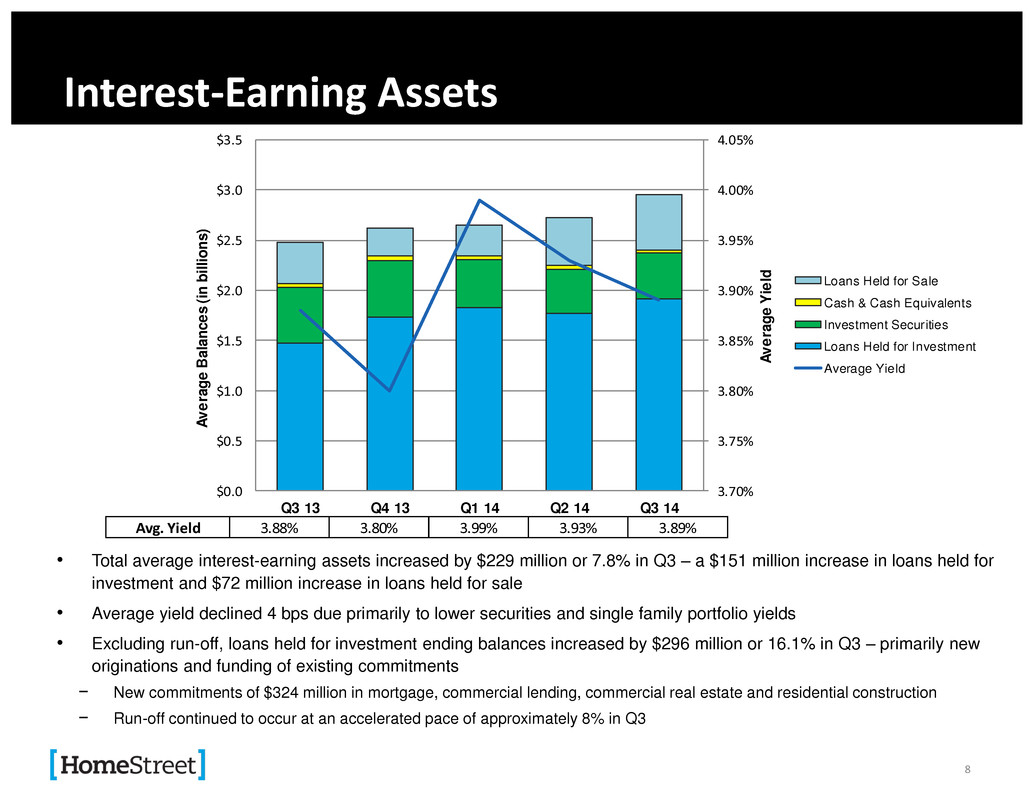

Avg. Yield 3.70% 3.75% 3.80% 3.85% 3.90% 3.95% 4.00% 4.05% $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Av era ge Yi eld Av era ge Ba lan ce s ( in bil lio ns ) Loans Held for Sale Cash & Cash Equivalents Investment Securities Loans Held for Investment Average Yield Interest-Earning Assets • Total average interest-earning assets increased by $229 million or 7.8% in Q3 – a $151 million increase in loans held for investment and $72 million increase in loans held for sale • Average yield declined 4 bps due primarily to lower securities and single family portfolio yields • Excluding run-off, loans held for investment ending balances increased by $296 million or 16.1% in Q3 – primarily new originations and funding of existing commitments − New commitments of $324 million in mortgage, commercial lending, commercial real estate and residential construction − Run-off continued to occur at an accelerated pace of approximately 8% in Q3 Avg. Yield 3.88% 3.80% 3.99% 3.93% 3.89% 8

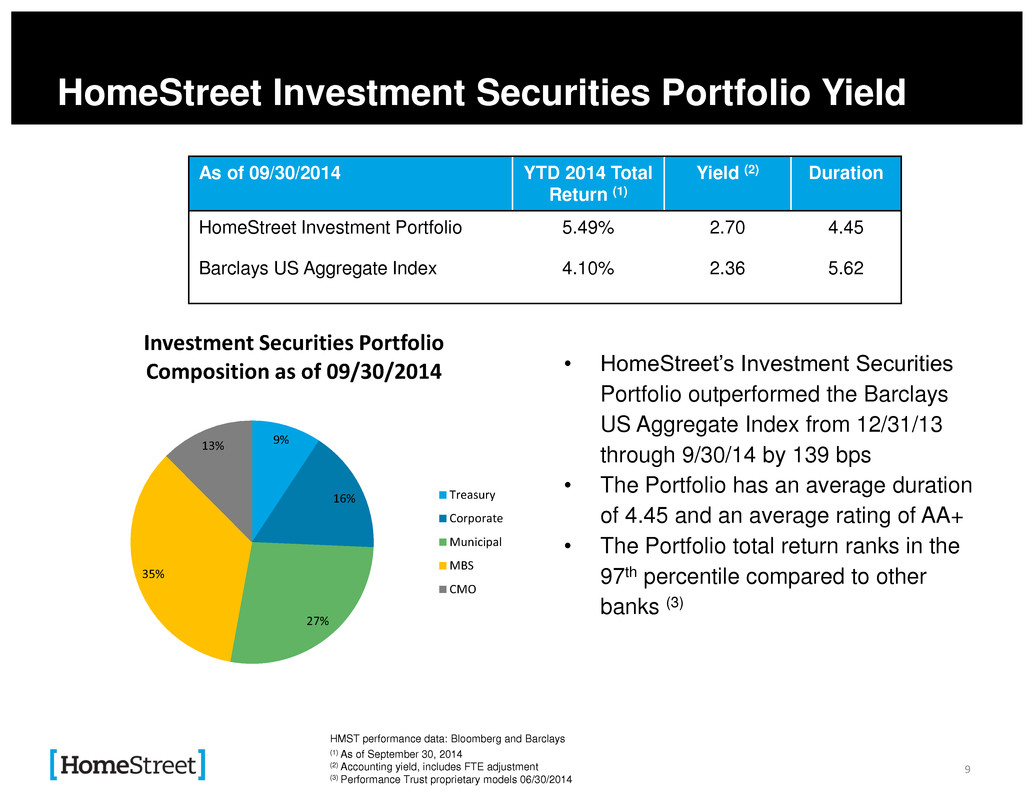

HomeStreet Investment Securities Portfolio Yield As of 09/30/2014 YTD 2014 Total Return (1) Yield (2) Duration HomeStreet Investment Portfolio 5.49% 2.70 4.45 Barclays US Aggregate Index 4.10% 2.36 5.62 HMST performance data: Bloomberg and Barclays (1) As of September 30, 2014 (2) Accounting yield, includes FTE adjustment (3) Performance Trust proprietary models 06/30/2014 • HomeStreet’s Investment Securities Portfolio outperformed the Barclays US Aggregate Index from 12/31/13 through 9/30/14 by 139 bps • The Portfolio has an average duration of 4.45 and an average rating of AA+ • The Portfolio total return ranks in the 97th percentile compared to other banks (3) 9 9% 16% 27% 35% 13% Investment Securities Portfolio Composition as of 09/30/2014 Treasury Corporate Municipal MBS CMO

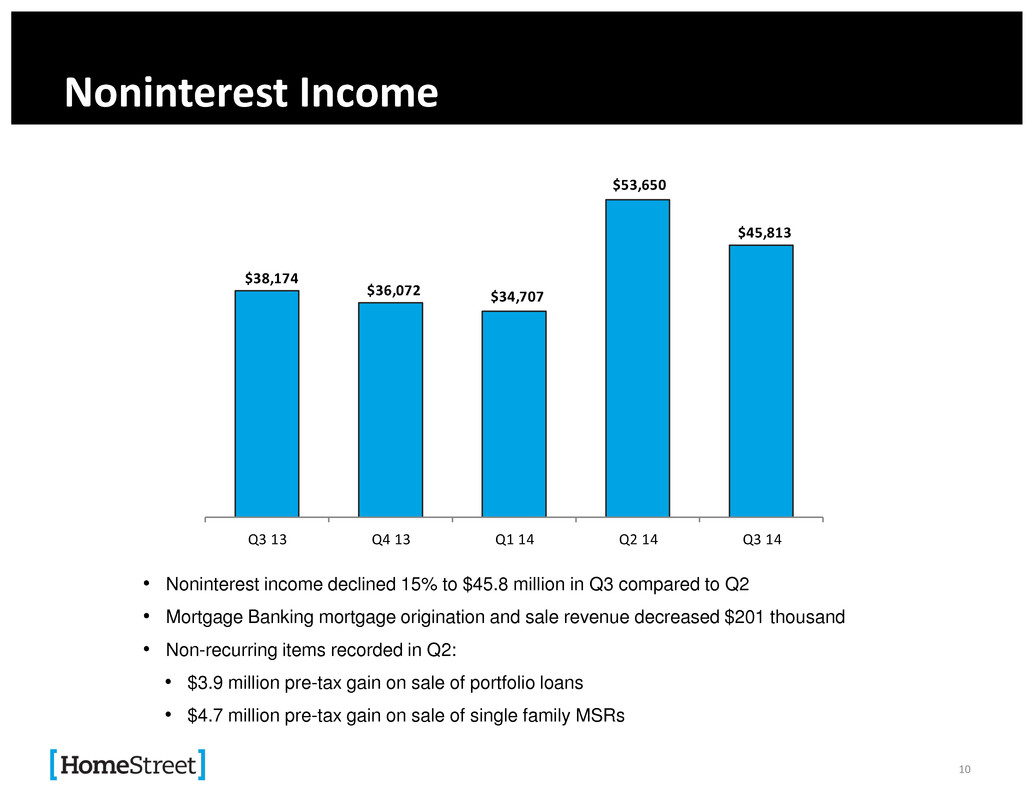

Noninterest Income • Noninterest income declined 15% to $45.8 million in Q3 compared to Q2 • Mortgage Banking mortgage origination and sale revenue decreased $201 thousand • Non-recurring items recorded in Q2: • $3.9 million pre-tax gain on sale of portfolio loans • $4.7 million pre-tax gain on sale of single family MSRs $38,174 $36,072 $34,707 $53,650 $45,813 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 10

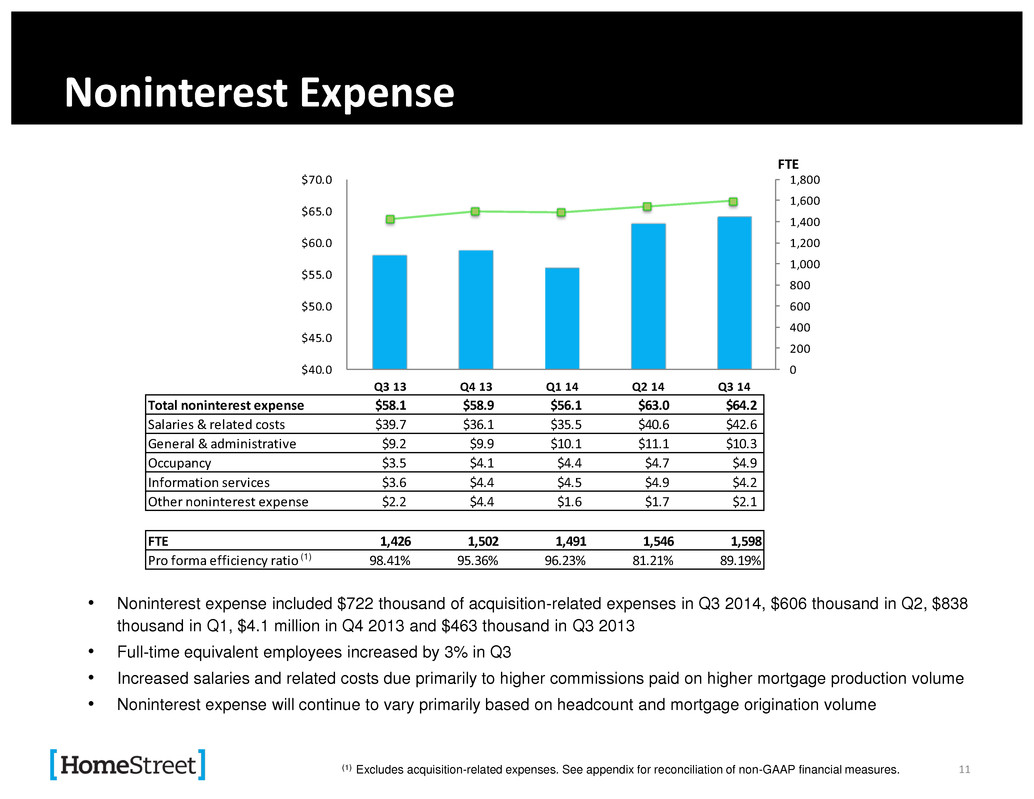

0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 $40.0 $45.0 $50.0 $55.0 $60.0 $65.0 $70.0 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 FTE Total noninterest expense $58.1 $58.9 $56.1 $63.0 $64.2 Salaries & related costs $39.7 $36.1 $35.5 $40.6 $42.6 General & administrative $9.2 $9.9 $10.1 $11.1 $10.3 Occupancy $3.5 $4.1 $4.4 $4.7 $4.9 Information services $3.6 $4.4 $4.5 $4.9 $4.2 Other noninterest expense $2.2 $4.4 $1.6 $1.7 $2.1 FTE 1,426 1,502 1,491 1,546 1,598 Pro forma efficiency ratio 98.41% 95.36% 96.23% 81.21% 89.19% Noninterest Expense • Noninterest expense included $722 thousand of acquisition-related expenses in Q3 2014, $606 thousand in Q2, $838 thousand in Q1, $4.1 million in Q4 2013 and $463 thousand in Q3 2013 • Full-time equivalent employees increased by 3% in Q3 • Increased salaries and related costs due primarily to higher commissions paid on higher mortgage production volume • Noninterest expense will continue to vary primarily based on headcount and mortgage origination volume (1) Excludes acquisition-related expenses. See appendix for reconciliation of non-GAAP financial measures. (1) 11

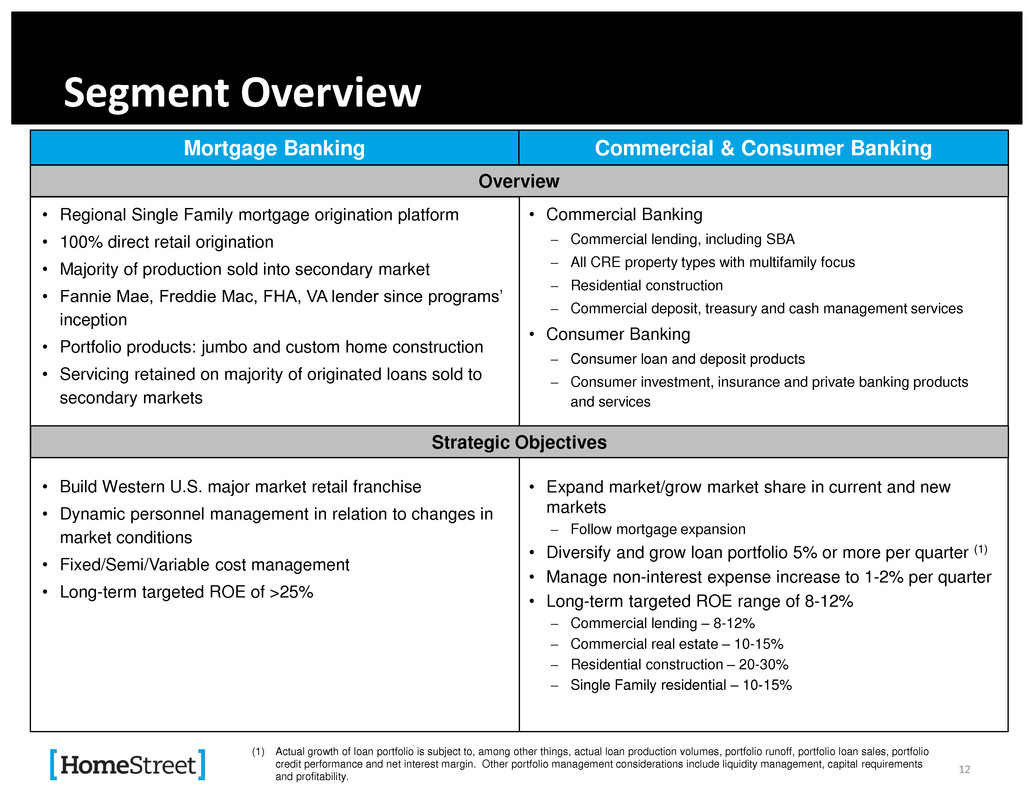

Segment Overview Mortgage Banking • Regional Single Family mortgage origination platform • 100% direct retail origination • Majority of production sold into secondary market • Fannie Mae, Freddie Mac, FHA, VA lender since programs’ inception • Portfolio products: jumbo and custom home construction • Servicing retained on majority of originated loans sold to secondary markets • Build Western U.S. major market retail franchise • Dynamic personnel management in relation to changes in market conditions • Fixed/Semi/Variable cost management • Long-term targeted ROE of >25% Commercial & Consumer Banking Overview • Commercial Banking Commercial lending, including SBA All CRE property types with multifamily focus Residential construction Commercial deposit, treasury and cash management services • Consumer Banking Consumer loan and deposit products Consumer investment, insurance and private banking products and services • Expand market/grow market share in current and new markets Follow mortgage expansion • Diversify and grow loan portfolio 5% or more per quarter (1) • Manage non-interest expense increase to 1-2% per quarter • Long-term targeted ROE range of 8-12% Commercial lending – 8-12% Commercial real estate – 10-15% Residential construction – 20-30% Single Family residential – 10-15% Strategic Objectives (1) Actual growth of loan portfolio is subject to, among other things, actual loan production volumes, portfolio runoff, portfolio loan sales, portfolio credit performance and net interest margin. Other portfolio management considerations include liquidity management, capital requirements and profitability. 12

Commercial & Consumer Banking 13

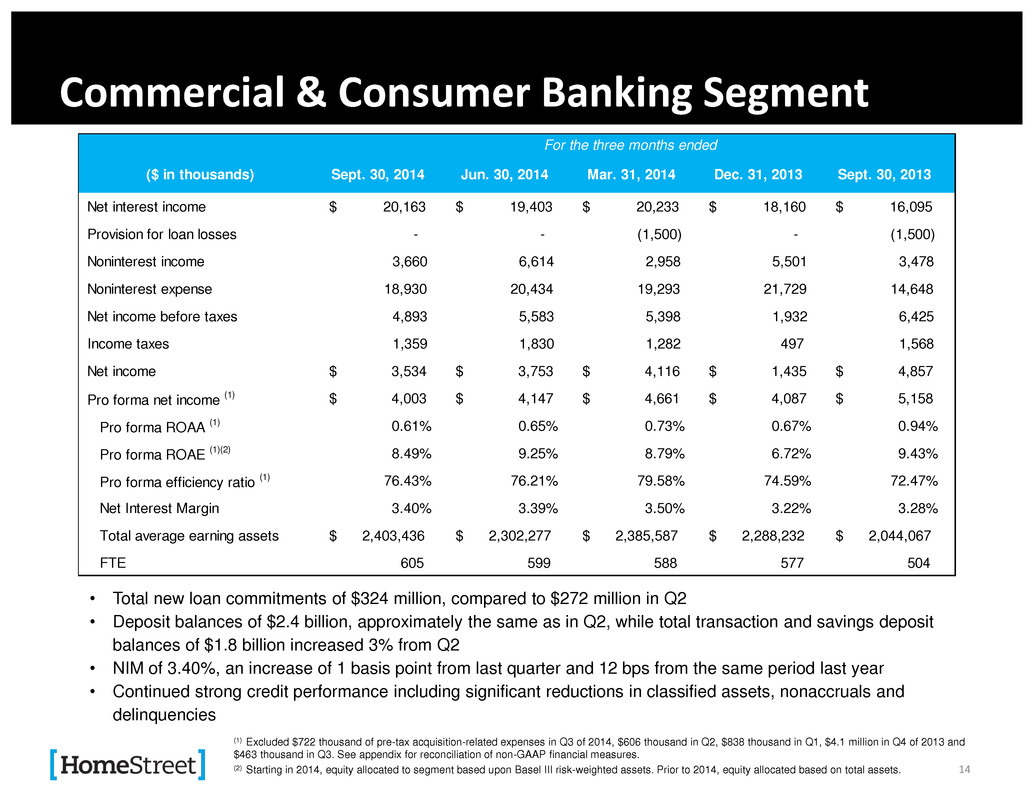

Commercial & Consumer Banking Segment • Total new loan commitments of $324 million, compared to $272 million in Q2 • Deposit balances of $2.4 billion, approximately the same as in Q2, while total transaction and savings deposit balances of $1.8 billion increased 3% from Q2 • NIM of 3.40%, an increase of 1 basis point from last quarter and 12 bps from the same period last year • Continued strong credit performance including significant reductions in classified assets, nonaccruals and delinquencies (1) Excluded $722 thousand of pre-tax acquisition-related expenses in Q3 of 2014, $606 thousand in Q2, $838 thousand in Q1, $4.1 million in Q4 of 2013 and $463 thousand in Q3. See appendix for reconciliation of non-GAAP financial measures. (2) Starting in 2014, equity allocated to segment based upon Basel III risk-weighted assets. Prior to 2014, equity allocated based on total assets. ($ in thousands) Sept. 30, 2014 Jun. 30, 2014 Mar. 31, 2014 Dec. 31, 2013 Sept. 30, 2013 Net interest income $ 20,163 $ 19,403 $ 20,233 $ 18,160 $ 16,095 Provision for loan losses - - (1,500) - (1,500) Noninterest income 3,660 6,614 2,958 5,501 3,478 Noninterest expense 18,930 20,434 19,293 21,729 14,648 Net income before taxes 4,893 5,583 5,398 1,932 6,425 Income taxes 1,359 1,830 1,282 497 1,568 Net income $ 3,534 $ 3,753 $ 4,116 $ 1,435 $ 4,857 Pro forma net income (1) $ 4,003 $ 4,147 $ 4,661 $ 4,087 $ 5,158 Pro forma ROAA (1) 0.61% 0.65% 0.73% 0.67% 0.94% Pro forma ROAE (1)(2) 8.49% 9.25% 8.79% 6.72% 9.43% Pro forma efficiency ratio (1) 76.43% 76.21% 79.58% 74.59% 72.47% Net Interest Margin 3.40% 3.39% 3.50% 3.22% 3.28% Total average earning assets $ 2,403,436 $ 2,302,277 $ 2,385,587 $ 2,288,232 $ 2,044,067 FTE 605 599 588 577 504 For the three months ended 14

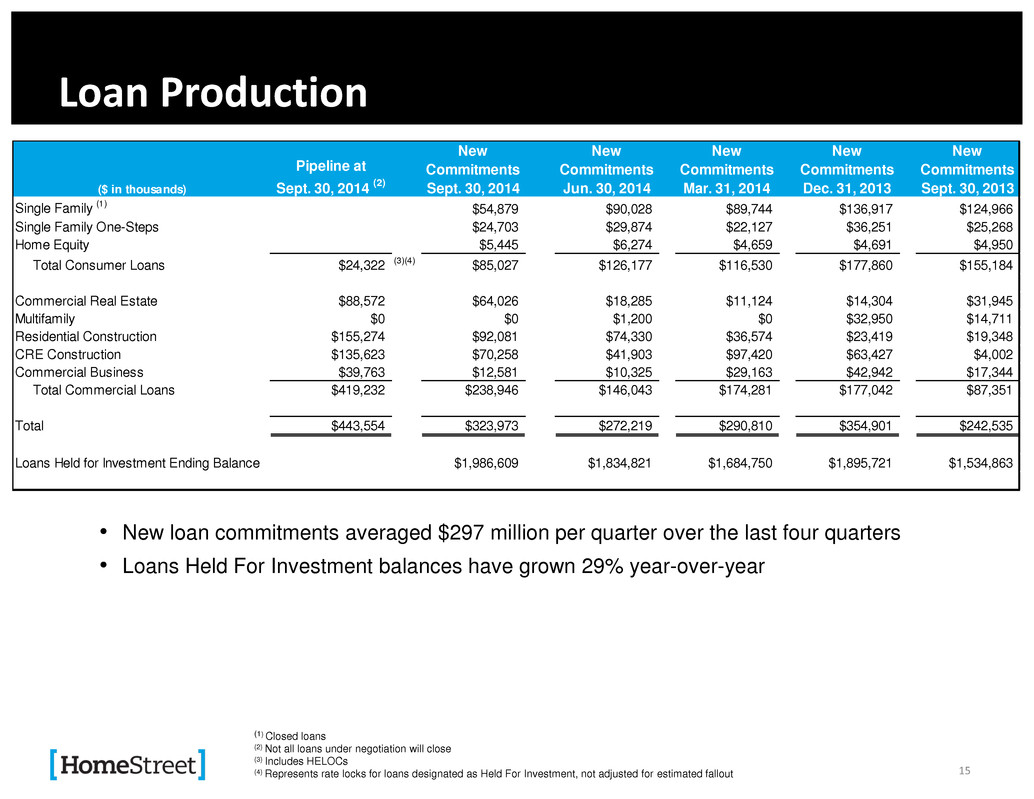

Loan Production 15 (1) Closed loans (2) Not all loans under negotiation will close (3) Includes HELOCs (4) Represents rate locks for loans designated as Held For Investment, not adjusted for estimated fallout • New loan commitments averaged $297 million per quarter over the last four quarters • Loans Held For Investment balances have grown 29% year-over-year ($ in thousands) Pipeline at Sept. 30, 2014 (2) New Commitments Sept. 30, 2014 New Commitments Jun. 30, 2014 New Commitments Mar. 31, 2014 New Commitments Dec. 31, 2013 New Commitments Sept. 30, 2013 Single Family (1) $54,879 $90,028 $89,744 $136,917 $124,966 Single Family One-Steps $24,703 $29,874 $22,127 $36,251 $25,268 Home Equity $5,445 $6,274 $4,659 $4,691 $4,950 Total Consumer Loans $24,322 (3)(4) $85,027 $126,177 $116,530 $177,860 $155,184 Commercial Real Estate $88,572 $64,026 $18,285 $11,124 $14,304 $31,945 Multifamily $0 $0 $1,200 $0 $32,950 $14,711 Residential Construction $155,274 $92,081 $74,330 $36,574 $23,419 $19,348 CRE Construction $135,623 $70,258 $41,903 $97,420 $63,427 $4,002 Commercial Business $39,763 $12,581 $10,325 $29,163 $42,942 $17,344 Total Commercial Loans $419,232 $238,946 $146,043 $174,281 $177,042 $87,351 Total $443,554 $323,973 $272,219 $290,810 $354,901 $242,535 Loans Held for Investment Ending Balance $1,986,609 $1,834,821 $1,684,750 $1,895,721 $1,534,863

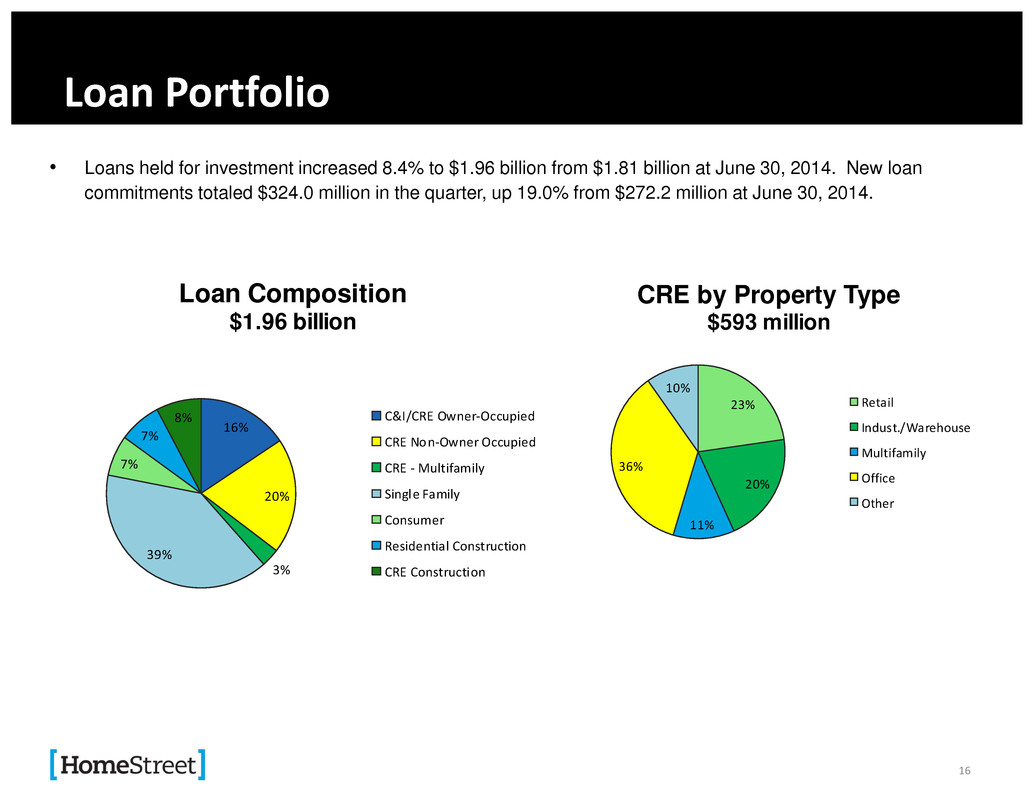

Loan Portfolio 16 • Loans held for investment increased 8.4% to $1.96 billion from $1.81 billion at June 30, 2014. New loan commitments totaled $324.0 million in the quarter, up 19.0% from $272.2 million at June 30, 2014. 16% 20% 3% 39% 7% 7% 8% Loan Composition $1.96 billion C&I/CRE Owner-Occupied CRE Non-Owner Occupied CRE - Multifamily Single Family Consumer Residential Construction CRE Construction 23% 20% 11% 36% 10% CRE by Property Type $593 million Retail Indust./Warehouse Multifamily Office Other

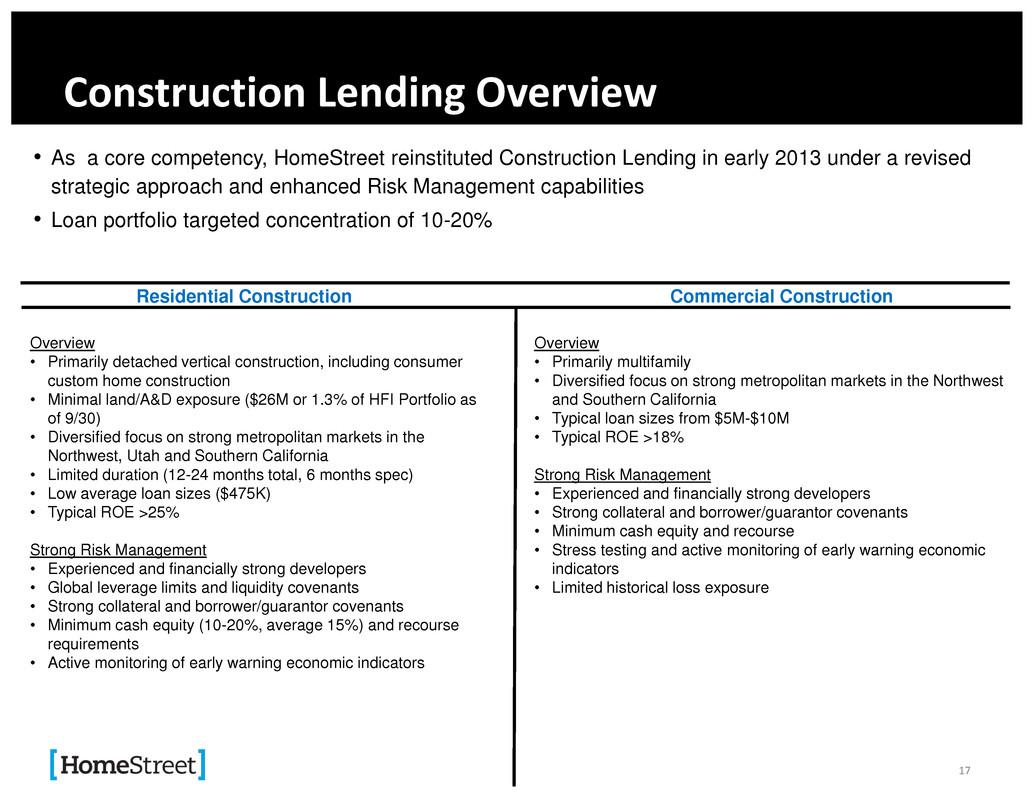

Construction Lending Overview 17 • As a core competency, HomeStreet reinstituted Construction Lending in early 2013 under a revised strategic approach and enhanced Risk Management capabilities • Loan portfolio targeted concentration of 10-20% Residential Construction Commercial Construction Overview • Primarily detached vertical construction, including consumer custom home construction • Minimal land/A&D exposure ($26M or 1.3% of HFI Portfolio as of 9/30) • Diversified focus on strong metropolitan markets in the Northwest, Utah and Southern California • Limited duration (12-24 months total, 6 months spec) • Low average loan sizes ($475K) • Typical ROE >25% Strong Risk Management • Experienced and financially strong developers • Global leverage limits and liquidity covenants • Strong collateral and borrower/guarantor covenants • Minimum cash equity (10-20%, average 15%) and recourse requirements • Active monitoring of early warning economic indicators Overview • Primarily multifamily • Diversified focus on strong metropolitan markets in the Northwest and Southern California • Typical loan sizes from $5M-$10M • Typical ROE >18% Strong Risk Management • Experienced and financially strong developers • Strong collateral and borrower/guarantor covenants • Minimum cash equity and recourse • Stress testing and active monitoring of early warning economic indicators • Limited historical loss exposure

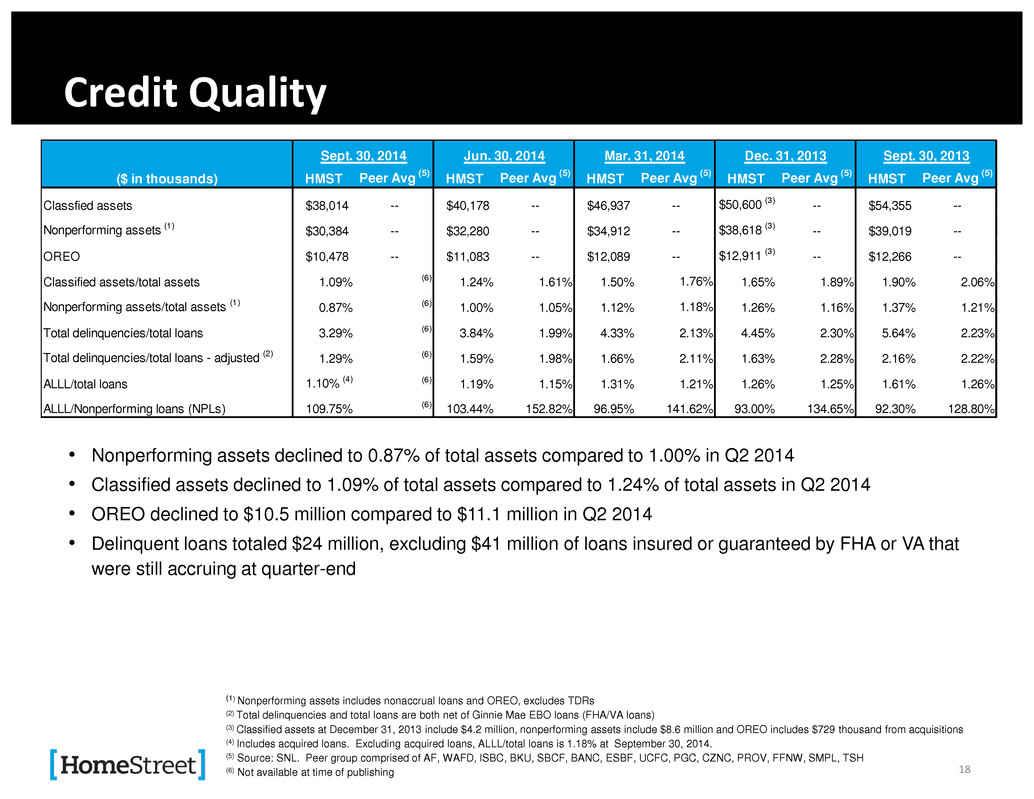

Credit Quality 18 ($ in thousands) HMST Peer Avg (5) HMST Peer Avg (5) HMST Peer Avg (5) HMST Peer Avg (5) HMST Peer Avg (5) Classfied assets $38,014 -- $40,178 -- $46,937 -- $50,600 (3) -- $54,355 -- Nonperforming assets (1) $30,384 -- $32,280 -- $34,912 -- $38,618 (3) -- $39,019 -- OREO $10,478 -- $11,083 -- $12,089 -- $12,911 (3) -- $12,266 -- Classified assets/total assets 1.09% (6) 1.24% 1.61% 1.50% 1.76% 1.65% 1.89% 1.90% 2.06% Nonperforming assets/total assets (1) 0.87% (6) 1.00% 1.05% 1.12% 1.18% 1.26% 1.16% 1.37% 1.21% Total delinquencies/total loans 3.29% (6) 3.84% 1.99% 4.33% 2.13% 4.45% 2.30% 5.64% 2.23% Total delinquencies/total loans - adjusted (2) 1.29% (6) 1.59% 1.98% 1.66% 2.11% 1.63% 2.28% 2.16% 2.22% ALLL/total loans 1.10% (4) (6) 1.19% 1.15% 1.31% 1.21% 1.26% 1.25% 1.61% 1.26% ALLL/Nonperforming loans (NPLs) 109.75% (6) 103.44% 152.82% 96.95% 141.62% 93.00% 134.65% 92.30% 128.80% Sept. 30, 2014 Jun. 30, 2014 Mar. 31, 2014 Dec. 31, 2013 Sept. 30, 2013 • Nonperforming assets declined to 0.87% of total assets compared to 1.00% in Q2 2014 • Classified assets declined to 1.09% of total assets compared to 1.24% of total assets in Q2 2014 • OREO declined to $10.5 million compared to $11.1 million in Q2 2014 • Delinquent loans totaled $24 million, excluding $41 million of loans insured or guaranteed by FHA or VA that were still accruing at quarter-end (1) Nonperforming assets includes nonaccrual loans and OREO, excludes TDRs (2) Total delinquencies and total loans are both net of Ginnie Mae EBO loans (FHA/VA loans) (3) Classified assets at December 31, 2013 include $4.2 million, nonperforming assets include $8.6 million and OREO includes $729 thousand from acquisitions (4) Includes acquired loans. Excluding acquired loans, ALLL/total loans is 1.18% at September 30, 2014. (5) Source: SNL. Peer group comprised of AF, WAFD, ISBC, BKU, SBCF, BANC, ESBF, UCFC, PGC, CZNC, PROV, FFNW, SMPL, TSH (6) Not available at time of publishing

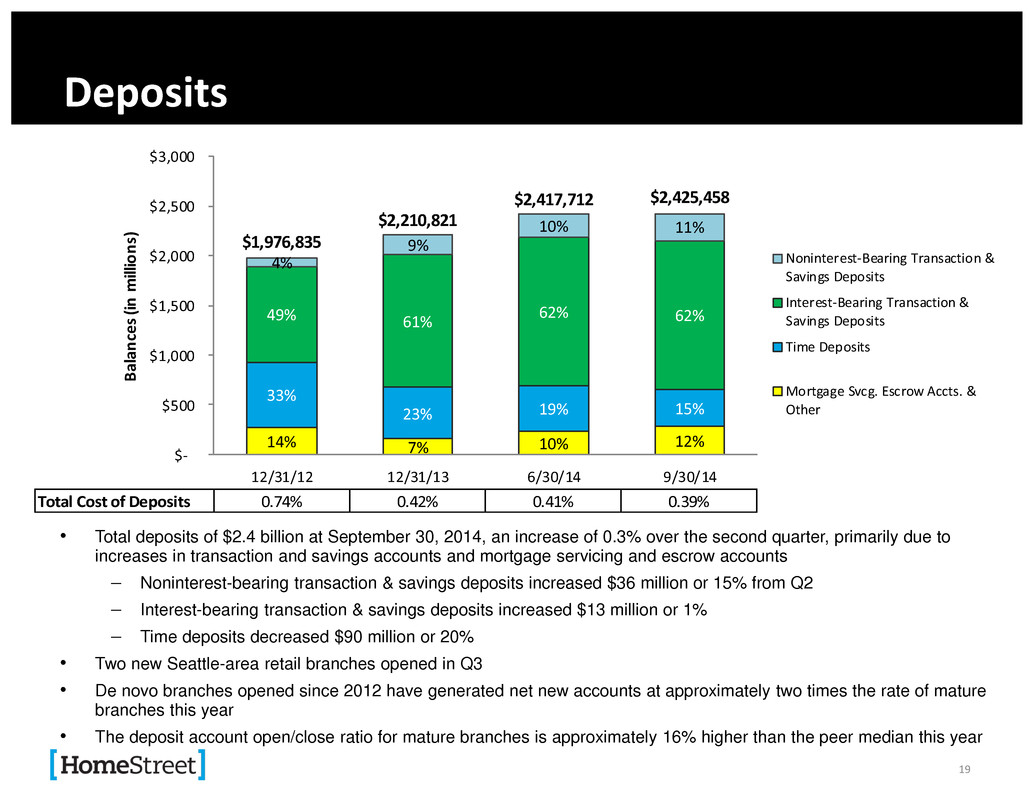

Deposits • Total deposits of $2.4 billion at September 30, 2014, an increase of 0.3% over the second quarter, primarily due to increases in transaction and savings accounts and mortgage servicing and escrow accounts Noninterest-bearing transaction & savings deposits increased $36 million or 15% from Q2 Interest-bearing transaction & savings deposits increased $13 million or 1% Time deposits decreased $90 million or 20% • Two new Seattle-area retail branches opened in Q3 • De novo branches opened since 2012 have generated net new accounts at approximately two times the rate of mature branches this year • The deposit account open/close ratio for mature branches is approximately 16% higher than the peer median this year 19 Total Cost of Deposits 14% 7% 10% 12% 33% 23% 19% 15% 49% 61% 62% 62% 4% 9% 10% 11% $1,976,835 $2,210,821 $2,417,712 $2,425,458 $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 12/31/12 12/31/13 6/30/14 9/30/14 Bala nce s (in mil lion s) Noninterest-Bearing Transaction & Savings Deposits Interest-Bearing Transaction & Savings Deposits Time Deposits Mortgage Svcg. Escrow Accts. & Other Total Cost of Deposits 0.74% 0.42% 0.41% 0.39%

Mortgage Banking 20

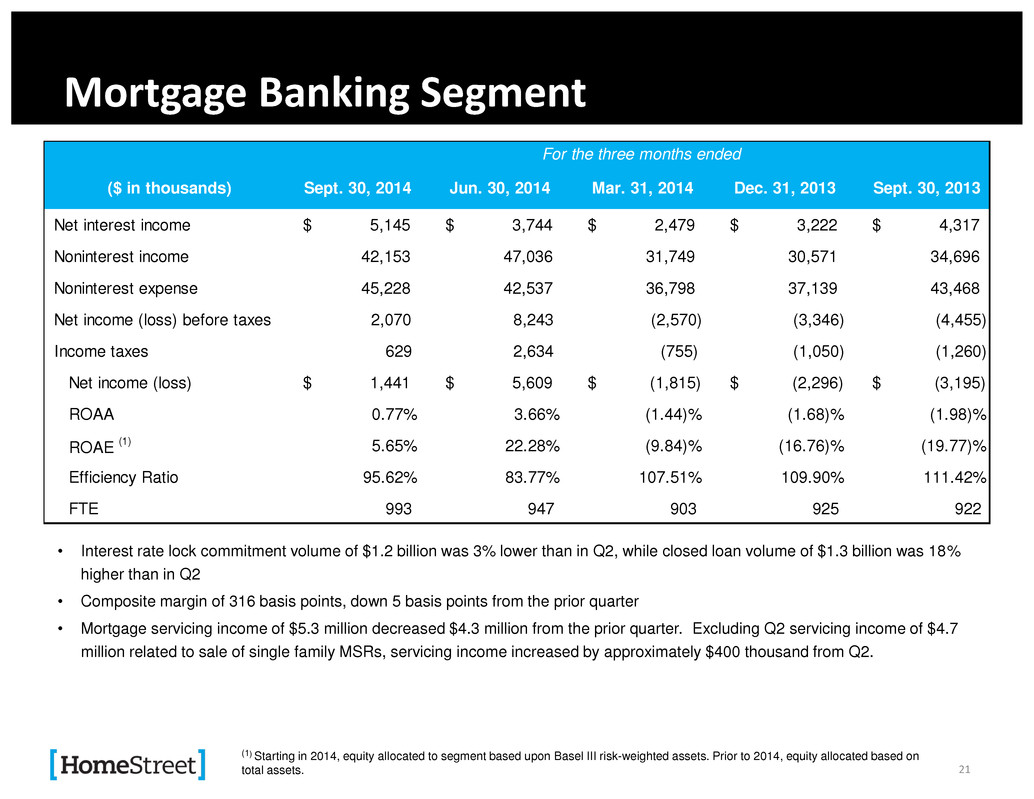

($ in thousands) Sept. 30, 2014 Jun. 30, 2014 Mar. 31, 2014 Dec. 31, 2013 Sept. 30, 2013 Net interest income $ 5,145 $ 3,744 $ 2,479 $ 3,222 $ 4,317 Noninterest income 42,153 47,036 31,749 30,571 34,696 Noninterest expense 45,228 42,537 36,798 37,139 43,468 Net income (loss) before taxes 2,070 8,243 (2,570) (3,346) (4,455) Income taxes 629 2,634 (755) (1,050) (1,260) Net income (loss) $ 1,441 $ 5,609 $ (1,815) $ (2,296) $ (3,195) ROAA 0.77% 3.66% (1.44)% (1.68)% (1.98)% ROAE (1) 5.65% 22.28% (9.84)% (16.76)% (19.77)% Efficiency Ratio 95.62% 83.77% 107.51% 109.90% 111.42% FTE 993 947 903 925 922 For the three months ended Mortgage Banking Segment • Interest rate lock commitment volume of $1.2 billion was 3% lower than in Q2, while closed loan volume of $1.3 billion was 18% higher than in Q2 • Composite margin of 316 basis points, down 5 basis points from the prior quarter • Mortgage servicing income of $5.3 million decreased $4.3 million from the prior quarter. Excluding Q2 servicing income of $4.7 million related to sale of single family MSRs, servicing income increased by approximately $400 thousand from Q2. (1) Starting in 2014, equity allocated to segment based upon Basel III risk-weighted assets. Prior to 2014, equity allocated based on total assets. 21

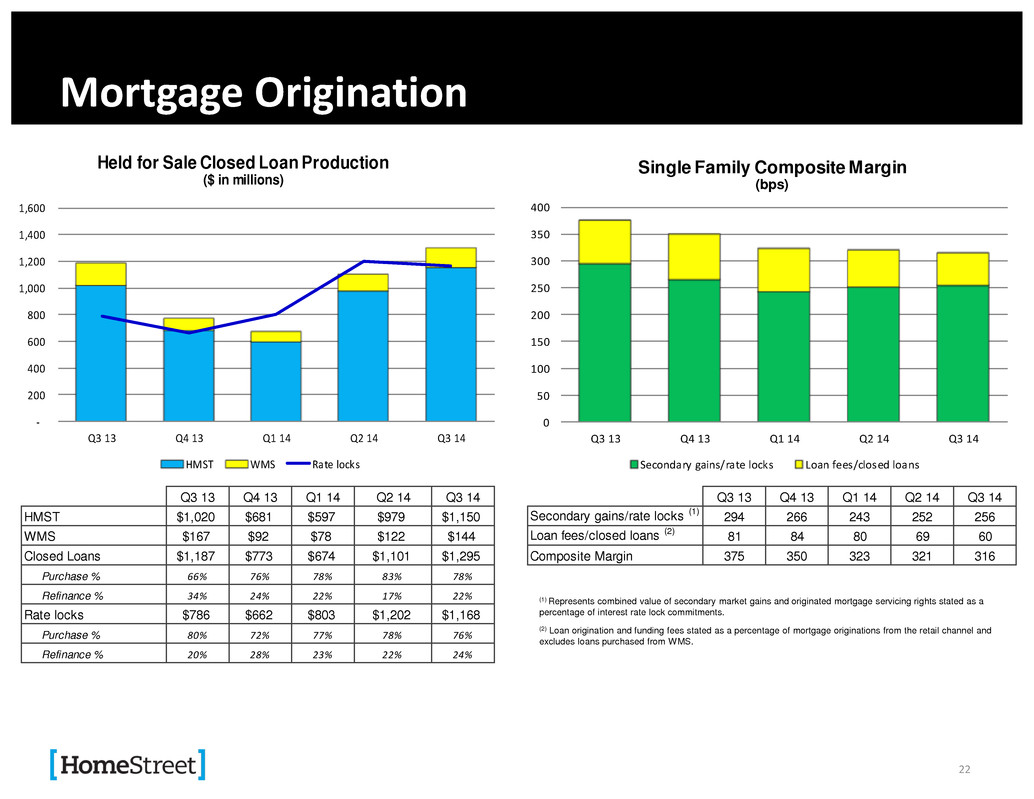

Mortgage Origination (1) Represents combined value of secondary market gains and originated mortgage servicing rights stated as a percentage of interest rate lock commitments. (2) Loan origination and funding fees stated as a percentage of mortgage originations from the retail channel and excludes loans purchased from WMS. 22 - 200 400 600 800 1,000 1,200 1,400 1,600 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Held for Sale Closed Loan Production ($ in millions) HMST WMS Rate locks Bps Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 HMST $1,020 $681 $597 $979 $1,150 WMS $167 $92 $78 $122 $144 Closed Loans $1,187 $773 $674 $1,101 $1,295 Purchase % 66% 76% 78% 83% 78% Refinance % 34% 24% 22% 17% 22% Rate locks $786 $662 $803 $1,202 $1,168 Purchase % 80% 72% 77% 78% 76% Refinance % 20% 28% 23% 22% 24% 0 50 100 150 200 250 300 350 400 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Single Family C mposite Margin (bps) econdary gains/rate locks Loan fees/closed loans Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Secondary gains/rate locks (1) 294 266 243 252 256 Loan fees/closed loans (2) 81 84 80 69 60 Composite Margin 375 350 323 321 316

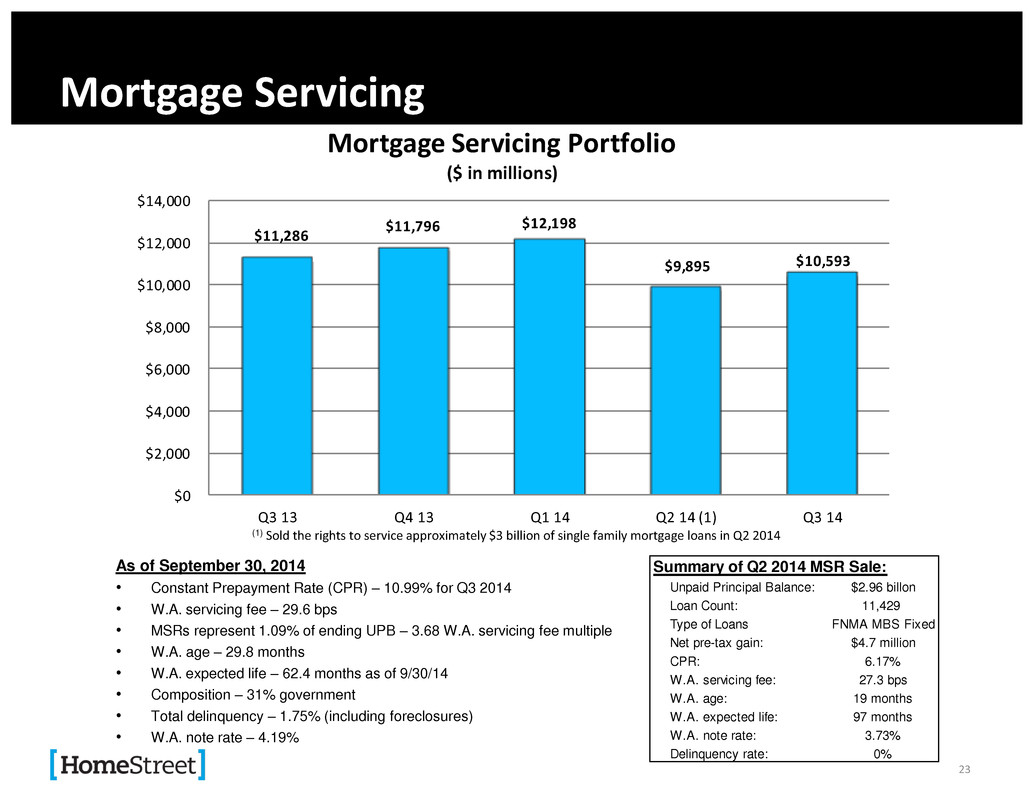

Mortgage Servicing As of September 30, 2014 • Constant Prepayment Rate (CPR) – 10.99% for Q3 2014 • W.A. servicing fee – 29.6 bps • MSRs represent 1.09% of ending UPB – 3.68 W.A. servicing fee multiple • W.A. age – 29.8 months • W.A. expected life – 62.4 months as of 9/30/14 • Composition – 31% government • Total delinquency – 1.75% (including foreclosures) • W.A. note rate – 4.19% 23 (1) Sold the rights to service approximately $3 billion of single family mortgage loans in Q2 2014 $11,286 $11,796 $12,198 $9,895 $10,593 $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 Q3 13 Q4 13 Q1 14 Q2 14 (1) Q3 14 Mortgage Servicing Portfolio ($ in millions) Summary of Q2 2014 MSR Sale: Unpaid Principal Balance: $2.96 billon Loan Count: 11,429 Type of Loans FNMA MBS Fixed Net pre-tax gain: $4.7 million CPR: 6.17% W.A. servicing fee: 27.3 bps W.A. age: 19 months W.A. expected life: 97 months W.A. note rate: 3.73% Delinquency rate: 0%

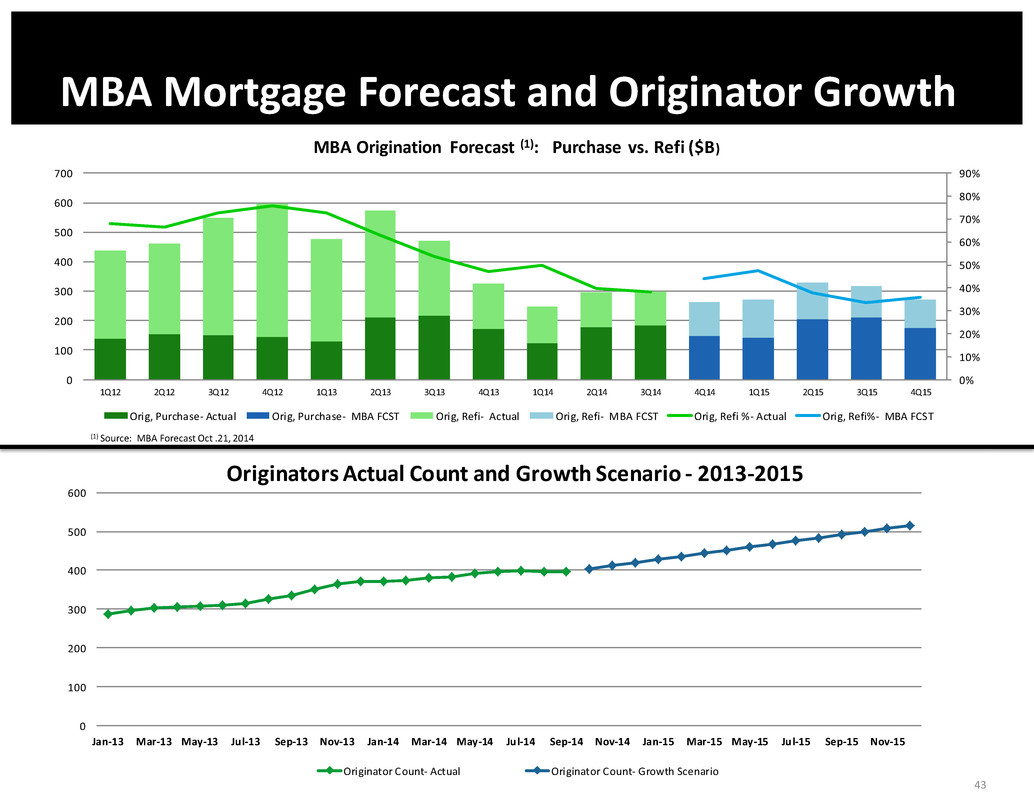

Mortgage Market & Competitive Landscape Mortgage Market • MBA estimates third quarter mortgage origination nationally to increase 1% over second quarter. By contrast, HomeStreet’s originations were significantly higher, increasing 18% over the prior quarter. • The MBA recently revised its 2015 forecast upward, with total originations projected to be 7% higher than 2014. Purchase mortgages are expected to increase 15% in 2015, while refinances are expected to drop 3% next year. • Recently, interest rates have declined and our refinancing loan originations have increased. October interest rate lock activity, which is projected to come in 30% above September, will be the highest for HomeStreet since April of 2013. This recent improvement will improve our October results, and if these rates continue through the fourth quarter, our fourth quarter expectations will improve. Competitive Landscape • Purchases comprised 62% of originations nationally and 60% in the Pacific Northwest in the third quarter. HomeStreet continues to perform above the national and regional averages, with purchases accounting for 78% of our closed loans and 77% of our interest rate lock commitments in the quarter. • Inventory continues to be a significant constraining issue on the housing recovery. U.S. housing starts are continuing to recover but are still well short of the long-run average. • The Pacific Northwest is expected to continue to grow more quickly than the rest of the country, consistent with the past six months. The Puget Sound and Portland/Vancouver markets are forecasted to be above the long-range average for housing starts in 2015. 24

Origination Growth Strategy • Grow market share in many of our existing and new regions. The California region accounted for 24% of retail channel’s closed loans volume in the third quarter, up from 20% in the second quarter. • Opening first home loan production office in Phoenix, Arizona in November and expect to open several more offices in Arizona before year-end. • Our strategy of continuing to grow our retail mortgage banking franchise and mitigating the effects of a constrained market through this growth helped us increase our closed loan production 18% in the third quarter, versus the national industry’s increase of 1%. • Through the third quarter, national mortgage volume declined 44% from the prior year while HomeStreet’s held for sale loan volume decreased only 17% as a result of our growth strategy. • While the mortgage industry continues to produce substantially lower than historical loan volumes, our mortgage banking segment has returned to profitability and is on its way to re-levering our system and returning to expected levels of profitability. • Continued hiring of high quality loan producers will result in loan volume not declining in the fourth quarter as it normally would given historic seasonality in purchase mortgage volume. • Average loan amount increased 7% to $286,500 in September compared to December of last year. This growth in average loan size is attributable to a number of factors including the growth in jumbo non-conforming loans as a percent of our total, our growing franchise and market share in California and overall home price appreciation in all markets we serve. • Over the last year, HomeStreet became a rated originator and servicer of non-conforming jumbo mortgage loans to enable us to sell our loans to securitization aggregators. 25

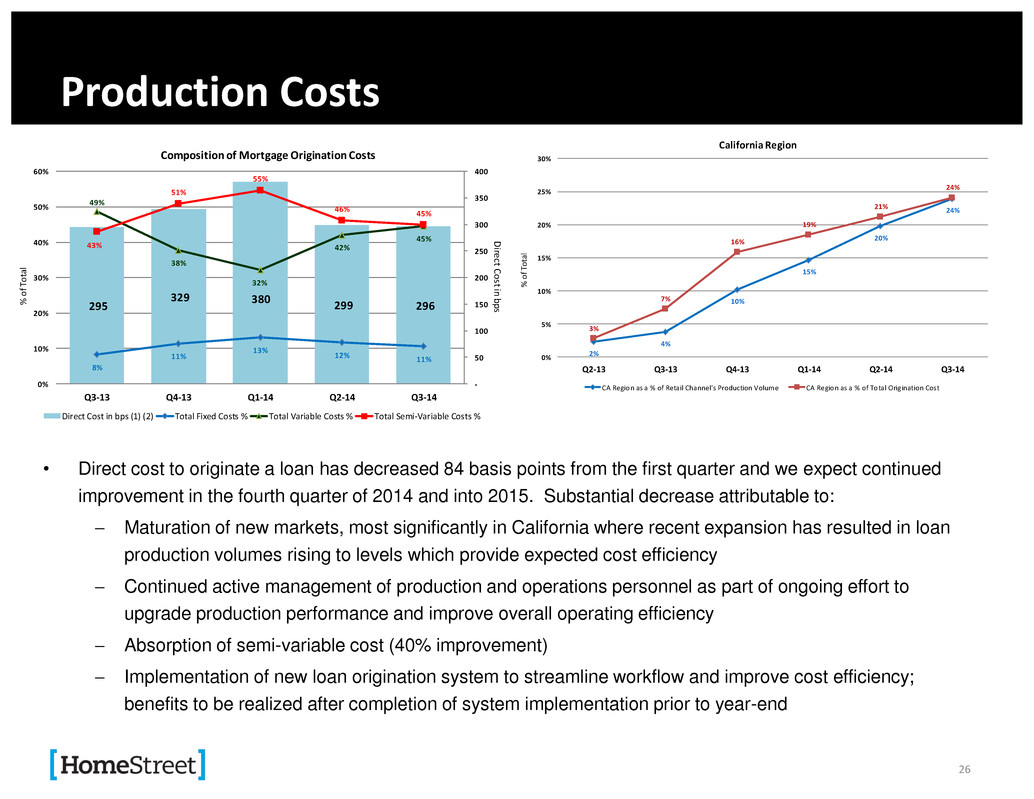

Production Costs • Direct cost to originate a loan has decreased 84 basis points from the first quarter and we expect continued improvement in the fourth quarter of 2014 and into 2015. Substantial decrease attributable to: Maturation of new markets, most significantly in California where recent expansion has resulted in loan production volumes rising to levels which provide expected cost efficiency Continued active management of production and operations personnel as part of ongoing effort to upgrade production performance and improve overall operating efficiency Absorption of semi-variable cost (40% improvement) Implementation of new loan origination system to streamline workflow and improve cost efficiency; benefits to be realized after completion of system implementation prior to year-end 26 295 329 380 299 296 8% 11% 13% 12% 11% 49% 38% 32% 42% 45% 43% 51% 55% 46% 45% - 50 100 150 200 250 300 350 400 0% 10% 20% 30% 40% 50% 60% Q3-13 Q4-13 Q1-14 Q2-14 Q3-14 Direct Cost in bps% of To tal Composition of Mortgage Origination Costs Direct Cost in bps (1) (2) Total Fixed Costs % Total Variable Costs % Total Semi-Variable Costs % 2% 4% 10% 15% 20% 24% 3% 7% 16% 19% 21% 24% 0% 5% 10% 15% 20% 25% 30% Q2-13 Q3-13 Q4-13 Q1-14 Q2-14 Q3-14 % o f To tal California Region CA Region as a % of Retail Channel's Production Volume CA Region as a % of Total Origination Cost

Franchise Value • Established and growing financial institution concentrated in the Pacific Northwest with growing presence in California • Leading regional Single Family mortgage lender • Focus on business diversification: growth of Commercial & Consumer Banking to mitigate cyclicality of Mortgage Banking earnings • High historical returns on equity due to high noninterest income • Attractive valuation transition opportunity as company diversifies http://ir.homestreet.com ir@homestreet.com 27

Simplicity Acquisition 28

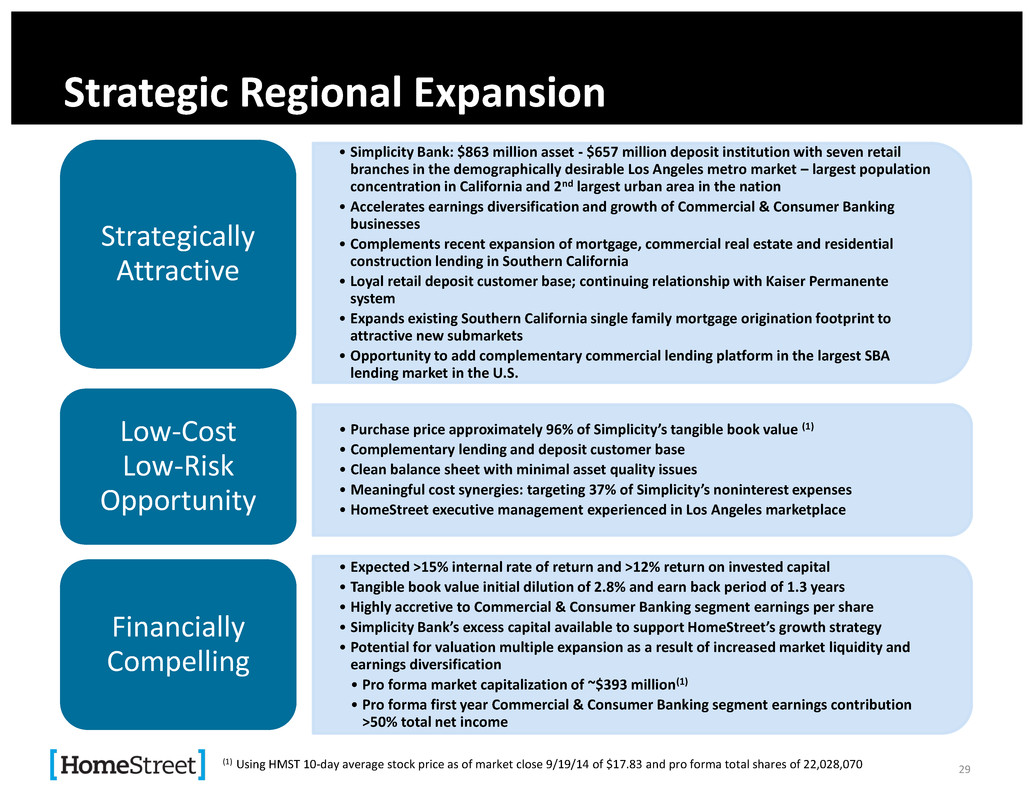

Strategic Regional Expansion • Simplicity Bank: $863 million asset - $657 million deposit institution with seven retail branches in the demographically desirable Los Angeles metro market – largest population concentration in California and 2nd largest urban area in the nation • Accelerates earnings diversification and growth of Commercial & Consumer Banking businesses • Complements recent expansion of mortgage, commercial real estate and residential construction lending in Southern California • Loyal retail deposit customer base; continuing relationship with Kaiser Permanente system • Expands existing Southern California single family mortgage origination footprint to attractive new submarkets • Opportunity to add complementary commercial lending platform in the largest SBA lending market in the U.S. Strategically Attractive • Purchase price approximately 96% of Simplicity’s tangible book value (1) • Complementary lending and deposit customer base • Clean balance sheet with minimal asset quality issues •Meaningful cost synergies: targeting 37% of Simplicity’s noninterest expenses • HomeStreet executive management experienced in Los Angeles marketplace Low-Cost Low-Risk Opportunity • Expected >15% internal rate of return and >12% return on invested capital • Tangible book value initial dilution of 2.8% and earn back period of 1.3 years • Highly accretive to Commercial & Consumer Banking segment earnings per share • Simplicity Bank’s excess capital available to support HomeStreet’s growth strategy • Potential for valuation multiple expansion as a result of increased market liquidity and earnings diversification • Pro forma market capitalization of ~$393 million(1) • Pro forma first year Commercial & Consumer Banking segment earnings contribution >50% total net income Financially Compelling (1) Using HMST 10-day average stock price as of market close 9/19/14 of $17.83 and pro forma total shares of 22,028,070 29

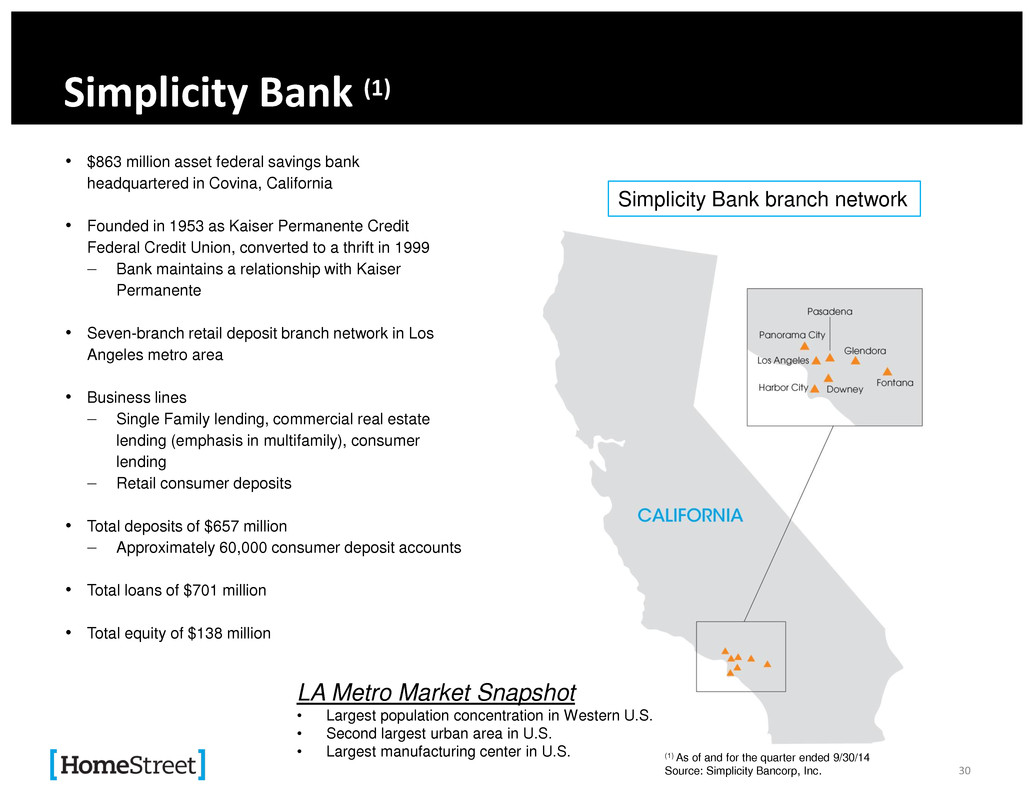

Simplicity Bank (1) • $863 million asset federal savings bank headquartered in Covina, California • Founded in 1953 as Kaiser Permanente Credit Federal Credit Union, converted to a thrift in 1999 Bank maintains a relationship with Kaiser Permanente • Seven-branch retail deposit branch network in Los Angeles metro area • Business lines Single Family lending, commercial real estate lending (emphasis in multifamily), consumer lending Retail consumer deposits • Total deposits of $657 million Approximately 60,000 consumer deposit accounts • Total loans of $701 million • Total equity of $138 million Simplicity Bank branch network LA Metro Market Snapshot • Largest population concentration in Western U.S. • Second largest urban area in U.S. • Largest manufacturing center in U.S. (1) As of and for the quarter ended 9/30/14 Source: Simplicity Bancorp, Inc. 30

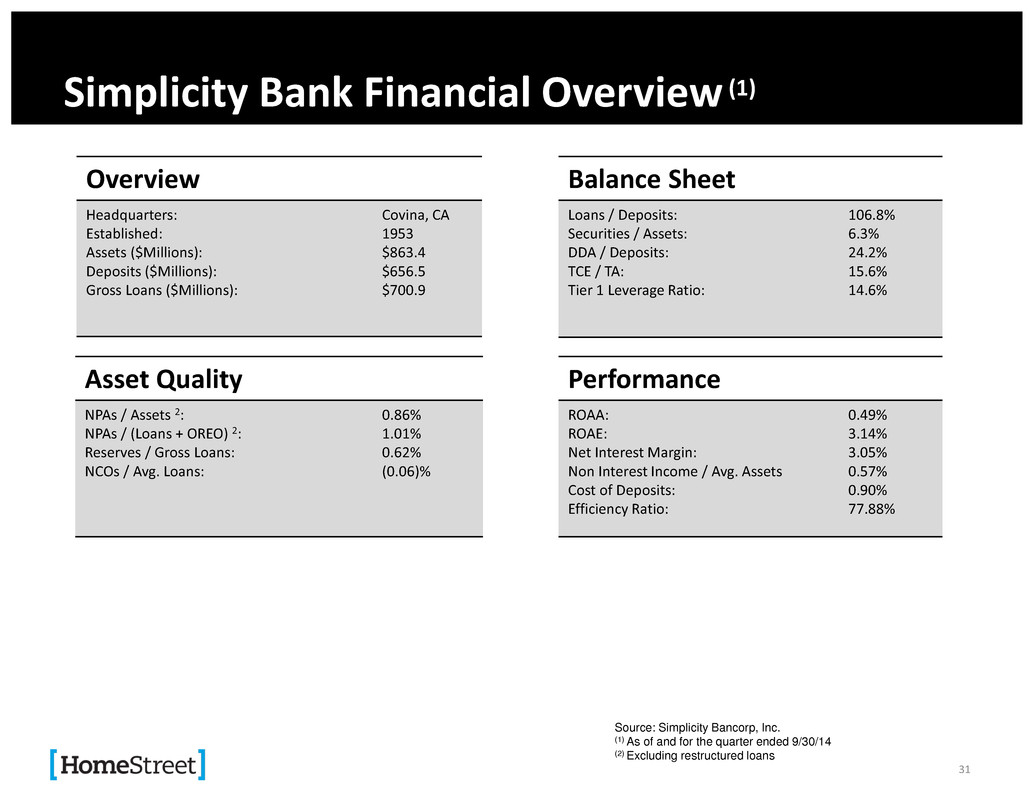

Simplicity Bank Financial Overview (1) Overview Headquarters: Established: Assets ($Millions): Deposits ($Millions): Gross Loans ($Millions): Covina, CA 1953 $863.4 $656.5 $700.9 Asset Quality NPAs / Assets 2: NPAs / (Loans + OREO) 2: Reserves / Gross Loans: NCOs / Avg. Loans: 0.86% 1.01% 0.62% (0.06)% Balance Sheet Loans / Deposits: Securities / Assets: DDA / Deposits: TCE / TA: Tier 1 Leverage Ratio: 106.8% 6.3% 24.2% 15.6% 14.6% Performance ROAA: ROAE: Net Interest Margin: Non Interest Income / Avg. Assets Cost of Deposits: Efficiency Ratio: 0.49% 3.14% 3.05% 0.57% 0.90% 77.88% Source: Simplicity Bancorp, Inc. (1) As of and for the quarter ended 9/30/14 (2) Excluding restructured loans 31

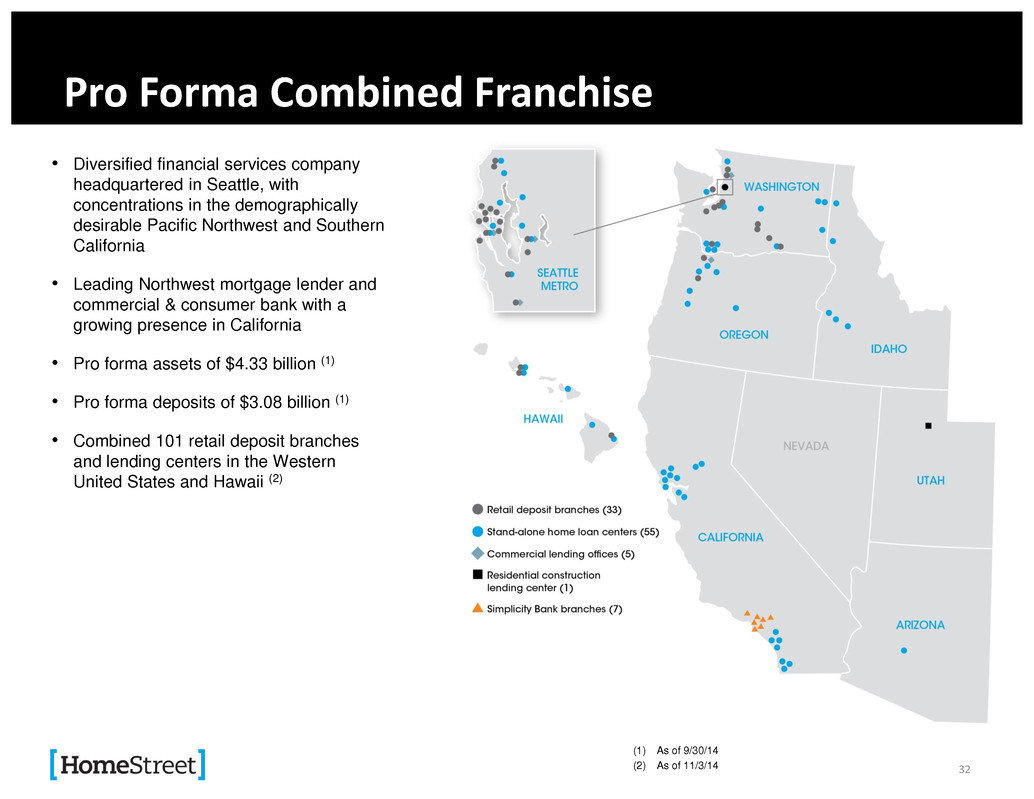

Pro Forma Combined Franchise • Diversified financial services company headquartered in Seattle, with concentrations in the demographically desirable Pacific Northwest and Southern California • Leading Northwest mortgage lender and commercial & consumer bank with a growing presence in California • Pro forma assets of $4.33 billion (1) • Pro forma deposits of $3.08 billion (1) • Combined 101 retail deposit branches and lending centers in the Western United States and Hawaii (2) (1) As of 9/30/14 (2) As of 11/3/14 32

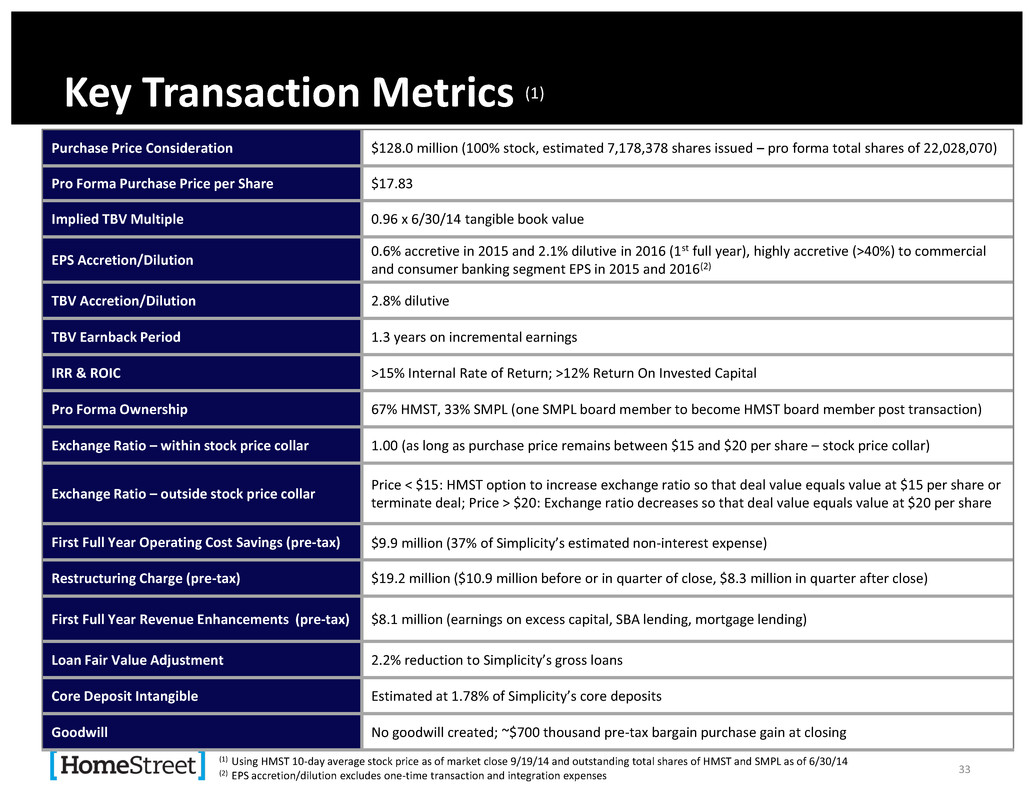

(1) Using HMST 10-day average stock price as of market close 9/19/14 and outstanding total shares of HMST and SMPL as of 6/30/14 (2) EPS accretion/dilution excludes one-time transaction and integration expenses Key Transaction Metrics (1) Purchase Price Consideration $128.0 million (100% stock, estimated 7,178,378 shares issued – pro forma total shares of 22,028,070) Pro Forma Purchase Price per Share $17.83 Implied TBV Multiple 0.96 x 6/30/14 tangible book value EPS Accretion/Dilution 0.6% accretive in 2015 and 2.1% dilutive in 2016 (1st full year), highly accretive (>40%) to commercial and consumer banking segment EPS in 2015 and 2016(2) TBV Accretion/Dilution 2.8% dilutive TBV Earnback Period 1.3 years on incremental earnings IRR & ROIC >15% Internal Rate of Return; >12% Return On Invested Capital Pro Forma Ownership 67% HMST, 33% SMPL (one SMPL board member to become HMST board member post transaction) Exchange Ratio – within stock price collar 1.00 (as long as purchase price remains between $15 and $20 per share – stock price collar) Exchange Ratio – outside stock price collar Price < $15: HMST option to increase exchange ratio so that deal value equals value at $15 per share or terminate deal; Price > $20: Exchange ratio decreases so that deal value equals value at $20 per share First Full Year Operating Cost Savings (pre-tax) $9.9 million (37% of Simplicity’s estimated non-interest expense) Restructuring Charge (pre-tax) $19.2 million ($10.9 million before or in quarter of close, $8.3 million in quarter after close) First Full Year Revenue Enhancements (pre-tax) $8.1 million (earnings on excess capital, SBA lending, mortgage lending) Loan Fair Value Adjustment 2.2% reduction to Simplicity’s gross loans Core Deposit Intangible Estimated at 1.78% of Simplicity’s core deposits Goodwill No goodwill created; ~$700 thousand pre-tax bargain purchase gain at closing 33

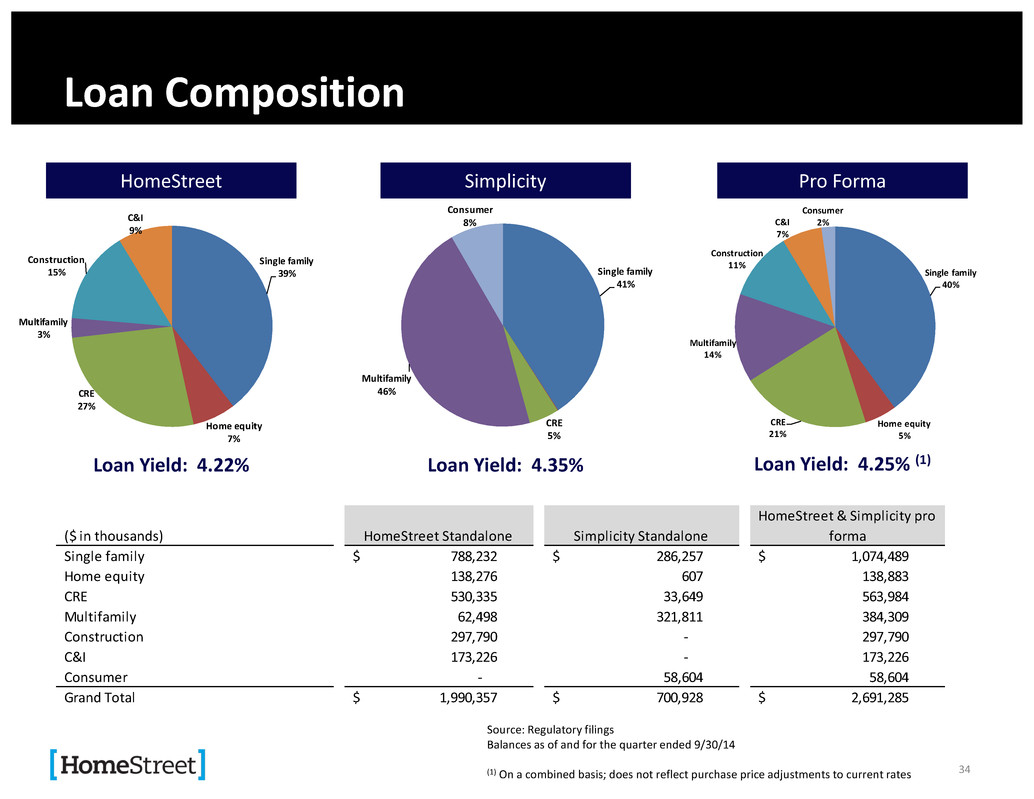

Single family 40% Home equity 5% CRE 21% Multifamily 14% Construction 11% C&I 7% Consumer 2% Single family 41% CRE 5% Multifamily 46% Consumer 8% Single family 39% Home equity 7% CRE 27% Multifamily 3% Construction 15% C&I 9% Loan Composition HomeStreet Loan Yield: 4.22% Simplicity Loan Yield: 4.35% Pro Forma Loan Yield: 4.25% (1) Source: Regulatory filings Balances as of and for the quarter ended 9/30/14 (1) On a combined basis; does not reflect purchase price adjustments to current rates ($ in thousands) Single family 788,232$ 286,257$ 1,074,489$ Home equity 138,276 607 138,883 CRE 530,335 33,649 563,984 Multifamily 62,498 321,811 384,309 Construction 297,790 - 297,790 C&I 173,226 - 173,226 Consumer - 58,604 58,604 Grand Total 1,990,357$ 700,928$ 2,691,285$ HomeStreet Standalone Simplicity Standalone HomeStreet & Simplicity pro forma 34

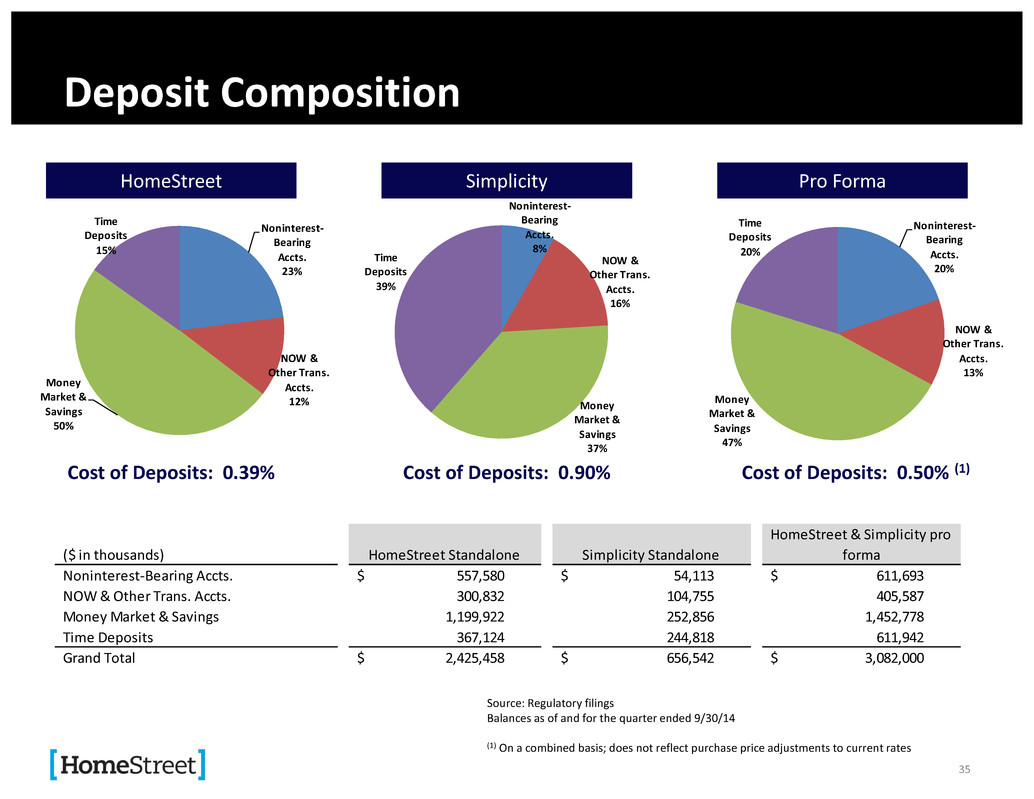

Source: Regulatory filings Balances as of and for the quarter ended 9/30/14 (1) On a combined basis; does not reflect purchase price adjustments to current rates Noninterest- Bearing Accts. 8% NOW & Other Trans. Accts. 16% Money Market & Savings 37% Time Deposits 39% Noninterest- Bearing Accts. 20% NOW & Other Trans. Accts. 13% Money Market & Savings 47% Time Deposits 20% Noninterest- Bearing Accts. 23% NOW & Other Trans. Accts. 12% Money Market & Savings 50% Time Deposits 15% Deposit Composition HomeStreet Simplicity Pro Forma Cost of Deposits: 0.39% Cost of Deposits: 0.90% Cost of Deposits: 0.50% (1) ($ in thousands) Noninterest-Bearing Accts. 557,580$ 54,113$ 611,693$ OW & Other Trans. Accts. 300,832 104,755 405,587 Money Market & Savings 1,199,922 252,856 1,452,778 Time Deposits 367,124 244,818 611,942 Grand Total 2,425,458$ 656,542$ 3,082,000$ HomeStreet Standalone Simplicity Standalone HomeStreet & Simplicity pro forma 35

. Appendix 36

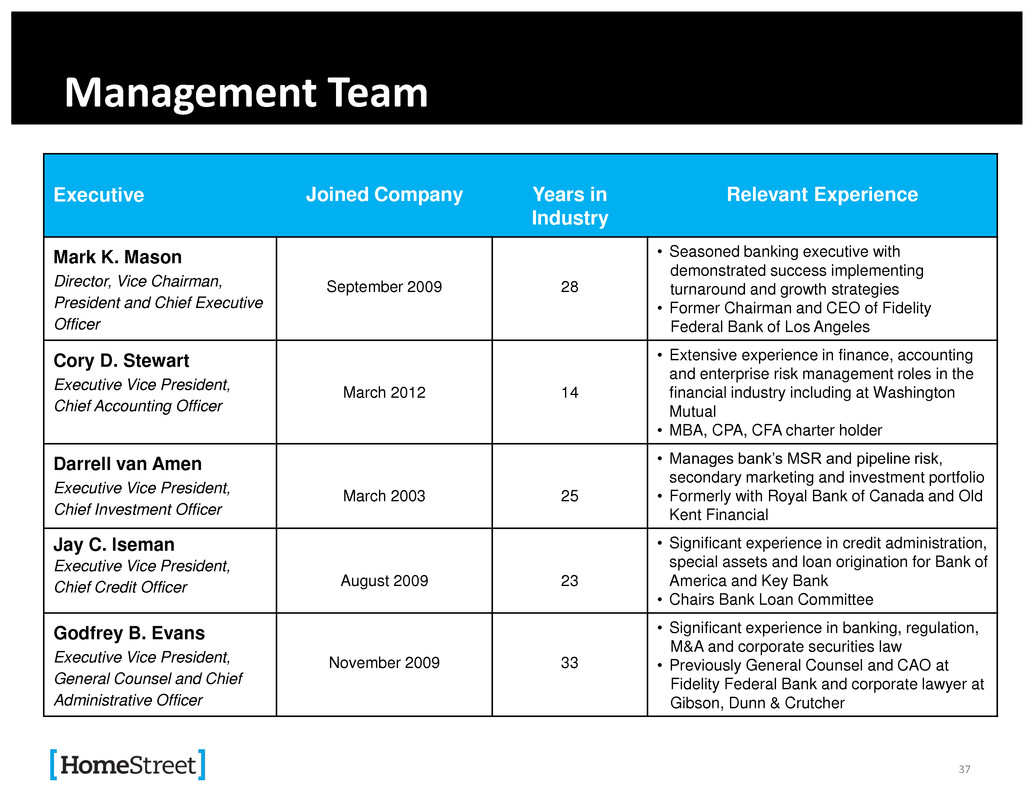

Management Team Executive Joined Company Years in Industry Relevant Experience Mark K. Mason Director, Vice Chairman, President and Chief Executive Officer September 2009 28 • Seasoned banking executive with demonstrated success implementing turnaround and growth strategies • Former Chairman and CEO of Fidelity Federal Bank of Los Angeles Cory D. Stewart Executive Vice President, Chief Accounting Officer March 2012 14 • Extensive experience in finance, accounting and enterprise risk management roles in the financial industry including at Washington Mutual • MBA, CPA, CFA charter holder Darrell van Amen Executive Vice President, Chief Investment Officer March 2003 25 • Manages bank’s MSR and pipeline risk, secondary marketing and investment portfolio • Formerly with Royal Bank of Canada and Old Kent Financial Jay C. Iseman Executive Vice President, Chief Credit Officer August 2009 23 • Significant experience in credit administration, special assets and loan origination for Bank of America and Key Bank • Chairs Bank Loan Committee Godfrey B. Evans Executive Vice President, General Counsel and Chief Administrative Officer November 2009 33 • Significant experience in banking, regulation, M&A and corporate securities law • Previously General Counsel and CAO at Fidelity Federal Bank and corporate lawyer at Gibson, Dunn & Crutcher 37

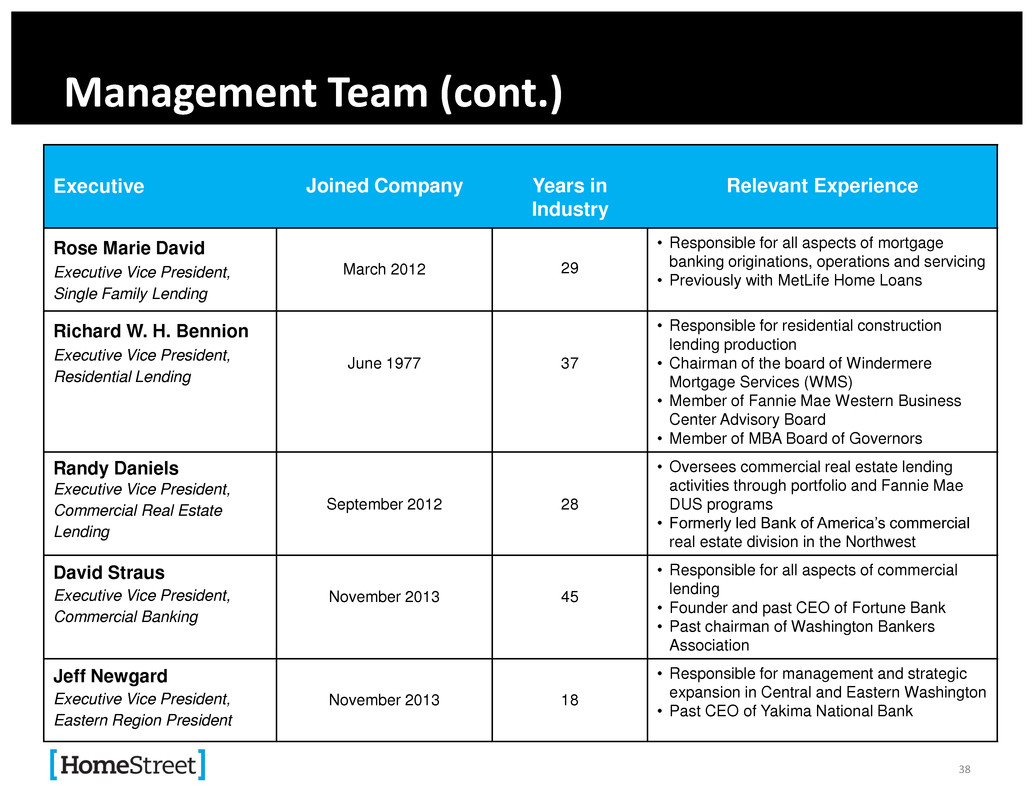

Management Team (cont.) Executive Joined Company Years in Industry Relevant Experience Rose Marie David Executive Vice President, Single Family Lending March 2012 29 • Responsible for all aspects of mortgage banking originations, operations and servicing • Previously with MetLife Home Loans Richard W. H. Bennion Executive Vice President, Residential Lending June 1977 37 • Responsible for residential construction lending production • Chairman of the board of Windermere Mortgage Services (WMS) • Member of Fannie Mae Western Business Center Advisory Board • Member of MBA Board of Governors Randy Daniels Executive Vice President, Commercial Real Estate Lending September 2012 28 • Oversees commercial real estate lending activities through portfolio and Fannie Mae DUS programs • Formerly led Bank of America’s commercial real estate division in the Northwest David Straus Executive Vice President, Commercial Banking November 2013 45 • Responsible for all aspects of commercial lending • Founder and past CEO of Fortune Bank • Past chairman of Washington Bankers Association Jeff Newgard Executive Vice President, Eastern Region President November 2013 18 • Responsible for management and strategic expansion in Central and Eastern Washington • Past CEO of Yakima National Bank 38

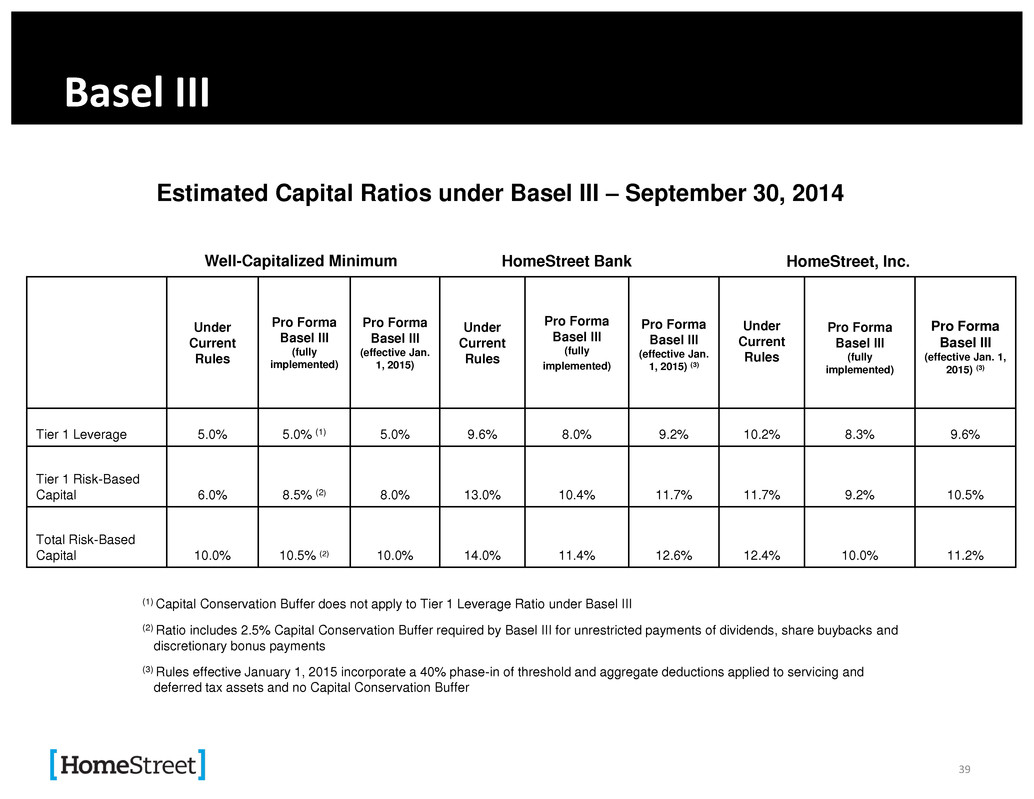

Basel III Estimated Capital Ratios under Basel III – September 30, 2014 Under Current Rules Pro Forma Basel III (fully implemented) Pro Forma Basel III (effective Jan. 1, 2015) Under Current Rules Pro Forma Basel III (fully implemented) Pro Forma Basel III (effective Jan. 1, 2015) (3) Under Current Rules Pro Forma Basel III (fully implemented) Pro Forma Basel III (effective Jan. 1, 2015) (3) Tier 1 Leverage 5.0% 5.0% (1) 5.0% 9.6% 8.0% 9.2% 10.2% 8.3% 9.6% Tier 1 Risk-Based Capital 6.0% 8.5% (2) 8.0% 13.0% 10.4% 11.7% 11.7% 9.2% 10.5% Total Risk-Based Capital 10.0% 10.5% (2) 10.0% 14.0% 11.4% 12.6% 12.4% 10.0% 11.2% HomeStreet Bank HomeStreet, Inc. (1) Capital Conservation Buffer does not apply to Tier 1 Leverage Ratio under Basel III (2) Ratio includes 2.5% Capital Conservation Buffer required by Basel III for unrestricted payments of dividends, share buybacks and discretionary bonus payments (3) Rules effective January 1, 2015 incorporate a 40% phase-in of threshold and aggregate deductions applied to servicing and deferred tax assets and no Capital Conservation Buffer Well-Capitalized Minimum 39

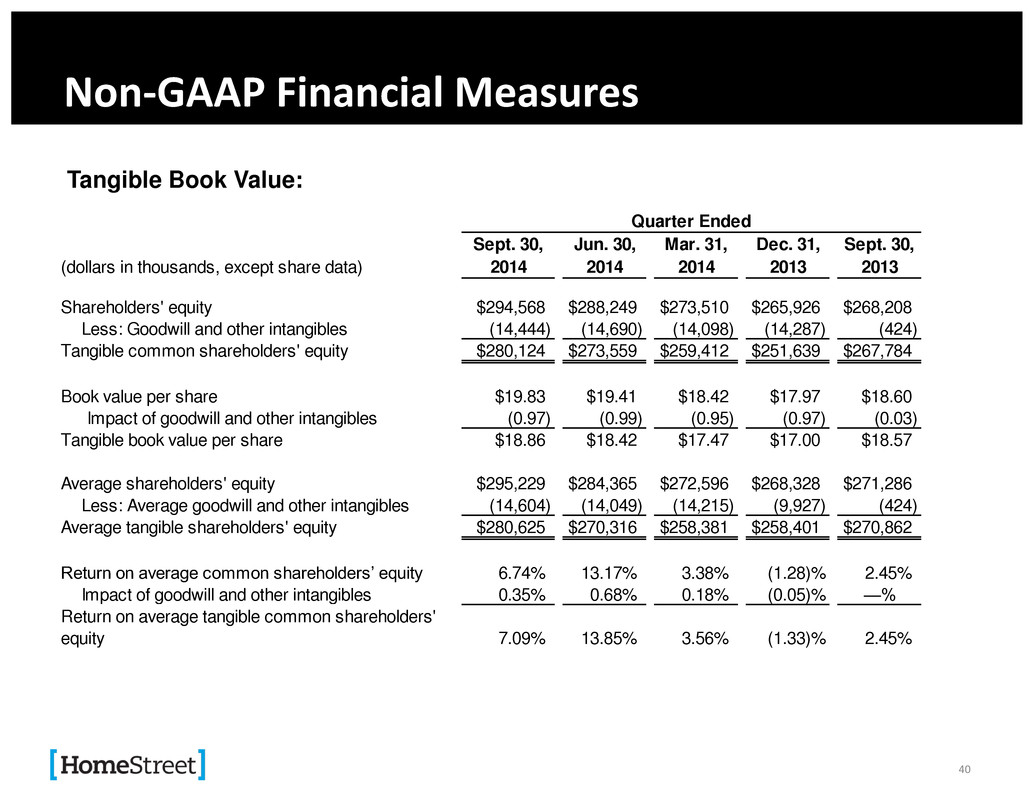

Non-GAAP Financial Measures Tangible Book Value: Sept. 30, Jun. 30, Mar. 31, Dec. 31, Sept. 30, (dollars in thousands, except share data) 2014 2014 2014 2013 2013 Shareholders' equity $294,568 $288,249 $273,510 $265,926 $268,208 Less: Goodwill and other intangibles (14,444) (14,690) (14,098) (14,287) (424) Tangible common shareholders' equity $280,124 $273,559 $259,412 $251,639 $267,784 Book value per share $19.83 $19.41 $18.42 $17.97 $18.60 Impact of goodwill and other intangibles (0.97) (0.99) (0.95) (0.97) (0.03) Tangible book value per share $18.86 $18.42 $17.47 $17.00 $18.57 Average shareholders' equity $295,229 $284,365 $272,596 $268,328 $271,286 Less: Average goodwill and other intangibles (14,604) (14,049) (14,215) (9,927) (424) Average tangible shareholders' equity $280,625 $270,316 $258,381 $258,401 $270,862 Return on average common shareholders’ equity 6.74% 13.17% 3.38% (1.28)% 2.45% Impact of goodwill and other intangibles 0.35% 0.68% 0.18% (0.05)% —% Return on average tangible common shareholders' equity 7.09% 13.85% 3.56% (1.33)% 2.45% Quarter Ended 40

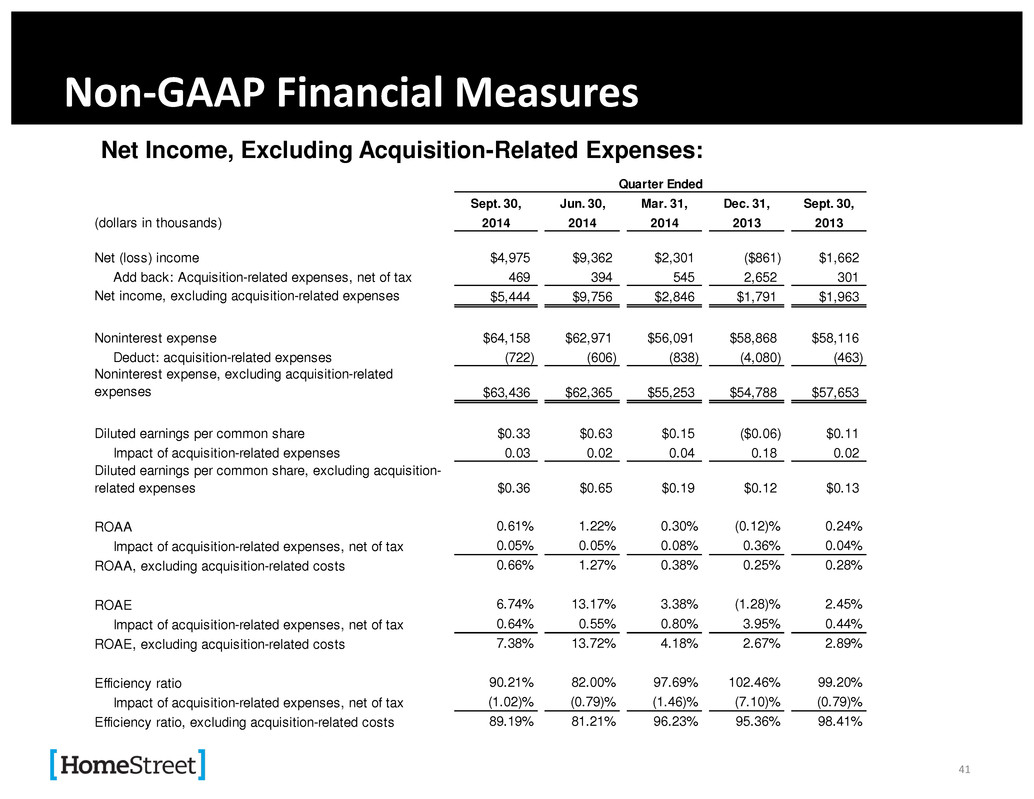

Non-GAAP Financial Measures Net Income, Excluding Acquisition-Related Expenses: Sept. 30, Jun. 30, Mar. 31, Dec. 31, Sept. 30, (dollars in thousands) 2014 2014 2014 2013 2013 Net (loss) income $4,975 $9,362 $2,301 ($861) $1,662 Add back: Acquisition-related expenses, net of tax 469 394 545 2,652 301 Net income, excluding acquisition-related expenses $5,444 $9,756 $2,846 $1,791 $1,963 Noninterest expense $64,158 $62,971 $56,091 $58,868 $58,116 Deduct: acquisition-related expenses (722) (606) (838) (4,080) (463) Noninterest expense, excluding acquisition-related expenses $63,436 $62,365 $55,253 $54,788 $57,653 Diluted earnings per common share $0.33 $0.63 $0.15 ($0.06) $0.11 Impact of acquisition-related expenses 0.03 0.02 0.04 0.18 0.02 Diluted earnings per common share, excluding acquisition- related expenses $0.36 $0.65 $0.19 $0.12 $0.13 ROAA 0.61% 1.22% 0.30% (0.12)% 0.24% Impact of acquisition-related expenses, net of tax 0.05% 0.05% 0.08% 0.36% 0.04% ROAA, excluding acquisition-related costs 0.66% 1.27% 0.38% 0.25% 0.28% ROAE 6.74% 13.17% 3.38% (1.28)% 2.45% Impact of acquisition-related expenses, net of tax 0.64% 0.55% 0.80% 3.95% 0.44% ROAE, excluding acquisition-related costs 7.38% 13.72% 4.18% 2.67% 2.89% Efficiency ratio 90.21% 82.00% 97.69% 102.46% 99.20% Impact of acquisition-related expenses, net of tax (1.02)% (0.79)% (1.46)% (7.10)% (0.79)% Efficiency ratio, excluding acquisition-related costs 89.19% 81.21% 96.23% 95.36% 98.41% Quarter Ended 41

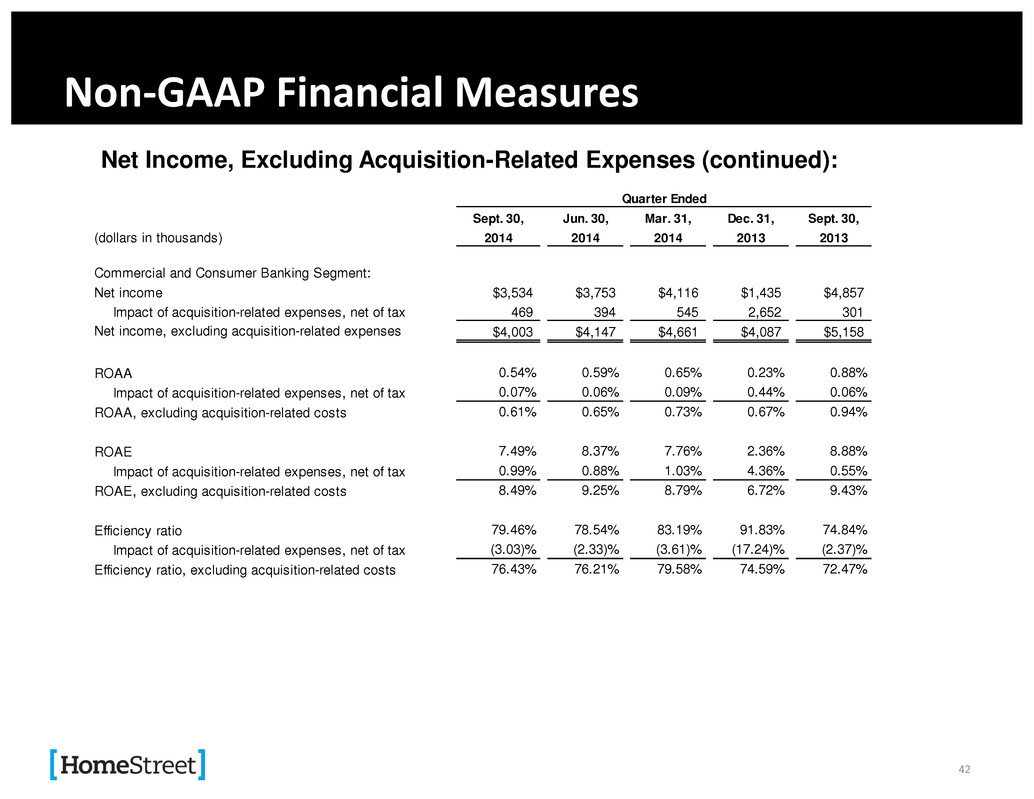

Non-GAAP Financial Measures Net Income, Excluding Acquisition-Related Expenses (continued): Sept. 30, Jun. 30, Mar. 31, Dec. 31, Sept. 30, (dollars in thousands) 2014 2014 2014 2013 2013 Commercial and Consumer Banking Segment: Net income $3,534 $3,753 $4,116 $1,435 $4,857 Impact of acquisition-related expenses, net of tax 469 394 545 2,652 301 Net income, excluding acquisition-related expenses $4,003 $4,147 $4,661 $4,087 $5,158 ROAA 0.54% 0.59% 0.65% 0.23% 0.88% Impact of acquisition-related expenses, net of tax 0.07% 0.06% 0.09% 0.44% 0.06% ROAA, excluding acquisition-related costs 0.61% 0.65% 0.73% 0.67% 0.94% ROAE 7.49% 8.37% 7.76% 2.36% 8.88% Impact of acquisition-related expenses, net of tax 0.99% 0.88% 1.03% 4.36% 0.55% ROAE, excluding acquisition-related costs 8.49% 9.25% 8.79% 6.72% 9.43% Efficiency ratio 79.46% 78.54% 83.19% 91.83% 74.84% Impact of acquisition-related expenses, net of tax (3.03)% (2.33)% (3.61)% (17.24)% (2.37)% Efficiency ratio, excluding acquisition-related costs 76.43% 76.21% 79.58% 74.59% 72.47% Quarter Ended 42

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 0 100 200 300 400 500 600 700 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 MBA Origination Forecast (1): Purchase vs. Refi ($B) Orig, Purchase- Actual Orig, Purchase- MBA FCST Orig, Refi- Actual Orig, Refi- MBA FCST Orig, Refi %- Actual Orig, Refi%- MBA FCST (1) Source: MBA Forecast Oct .21, 2014 MBA Mortgage Forecast and Originator Growth 43 Nelson 0 100 200 300 400 500 600 Jan-13 Mar-13 May-13 Jul-13 Sep-13 Nov-13 Jan-14 Mar-14 May-14 Jul-14 Sep-14 Nov-14 Jan-15 Mar-15 May-15 Jul-15 Sep-15 Nov-15 Originators Actual Count and Growth Scenario - 2013-2015 Originator Count- Actual Originator Count- Growth Scenario 43