Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

|

R

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended December 31, 2013

OR

|

£

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Transition Period from ______ to ______

Commission File No. 000-22905

GOLDEN PHOENIX MINERALS, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Nevada

|

41-1878178

|

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

|

|

125 East Main Street, Suite 602

American Fork, Utah

|

84003

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code (801) 418-9378

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o

(Do not check if a smaller reporting company)

|

Smaller reporting company þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). £ Yes R No

The aggregate market value of common stock held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter, June 28, 2013, was $2,310,090.

The number of shares of registrant’s common stock outstanding as of April 11, 2014 was 443,273,907.

DOCUMENTS INCORPORATED BY REFERENCE:

None

EXPLANATORY NOTE

This Form 10-K/A is being filed as an amendment (“Amendment No. 1”) to the Annual Report on Form 10-K filed by Golden Phoenix Minerals, Inc. (the “Company”) with the Securities and Exchange Commission (the “SEC”) on April 14, 2014 (the “Original Filing”). The amendment is being filed to amend the disclosures provided in the Original Filing for our mineral properties included in ITEM 1, BUSINESS, and ITEM 2, PROPERTIES. We are including currently dated certifications by our Principal Executive Officer and Principal Accounting and Financial Officer as Exhibits 31.1 and 31.2 under Section 302 of the Sarbanes-Oxley Act of 2002, as required by Rule 12b-15 under the Securities Act of 1934, as amended. We are not including updated certifications under Section 906 of the Sarbanes-Oxley Act of 2002, as there are no financial statements included in the Amendment No. 1.

Except as described above, no other sections of the Original Filing have been amended. This Amendment No. 1 is presented as of April 14, 2014, the filing date of the Original Filing, and has not been updated to reflect other events occurring after the date of the Original Filing, or to modify or update those disclosures affected by subsequent events. More current information is contained in our other filings with the SEC.

GOLDEN PHOENIX MINERALS, INC.

TABLE OF CONTENTS

|

PART I

|

|

ITEM 1.

|

BUSINESS

|

1

|

|

|

ITEM 2.

|

PROPERTIES

|

5

|

|

PART IV

|

|

ITEM 15.

|

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

|

13

|

|

|

SIGNATURES

|

14

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” as such term is defined by the Securities and Exchange Commission in its rules, regulations and releases, which represent our expectations or beliefs, including but not limited to, statements concerning our operations, economic performance, financial condition, growth and acquisition strategies, investments, and future operational plans. Forward-looking statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “hope,” “intend,” “could,” “might,” “plan,” “predict” or “project” or the negative of these words or other variations on these words or comparable terminology.

Such forward-looking statements include statements regarding, among other things, (1) our estimates of mineral reserves and mineralized material, (2) our projected sales and profitability, (3) our growth strategies, (4) anticipated trends in our industry, (5) our future financing plans, (6) our anticipated needs for working capital, (7) our lack of operational experience, (8) our plans with respect to properties and programs, (9) our beliefs and expectations regarding litigation, (9) our position with respect to disputes, and (10) the benefits related to ownership of our common stock. These statements constitute forward-looking statements within the meaning of the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” as well as in this filing generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Item 1A. Risk Factors” below and other risks and matters described in this filing and in our other SEC filings. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur as projected. We do not undertake any obligation to update any forward-looking statements.

PART I

ITEM 1. BUSINESS

As used in this Annual Report on Form 10-K, unless otherwise indicated, the terms “we,” “us,” “our,” and “the Company” refer to Golden Phoenix Minerals, Inc., a Nevada corporation.

Going Concern Qualification and Financial Status

The Report of Independent Registered Accounting Firm on our 2013 audited consolidated financial statements addresses an uncertainty, indicating that our operating losses and lack of working capital raise substantial doubt about our ability to continue as a going concern. We have a history of operating losses since our inception in 1997, and have an accumulated deficit of $62,663,722 and a total stockholders’ deficit of $3,913,037 at December 31, 2013. We currently have no operating revenues, and will require additional capital to fund our operations and to pursue mineral property opportunities with our existing properties and other prospects.

We have entered into options and agreements for the acquisition and development of our mineral properties that will require us to raise significant additional capital to complete the acquisitions and to fund the required exploration, evaluation and development costs and expenditures. There can be no assurance that we will be successful in raising the required capital or that any of these mineral properties will ultimately attain a successful level of operations. None of our mineral properties currently have reserves.

Because of the negative impact of disputes and litigation on our fund raising efforts, including the foreclosure and sale of our interest in the Mineral Ridge LLC and the rescission of our joint venture in Panama, and other negative market factors, we have been unable to raise the capital necessary to continue our mineral property exploration and evaluation activities and fund our operations. During 2013, we obtained only limited convertible debt financing to partially fund certain general and administrative expenses. As a result, we significantly scaled back our mineral property acquisition and exploration plans and reduced the level of our operations.

1

On February 18, 2014, we received an initial payment of $260,000 and fully executed documents dated February 6, 2014 related to the sale of our 10% interest in the Santa Rosa Gold Mine, Panama for an aggregate purchase price of US $2,600,000. Pursuant to the agreements, the balance of the purchase price of $2,340,000 is to be paid in April 2014, within 45 business days of the closing of the sale.

There can be no assurance that we will receive the balance of the purchase price from the sale of our interest in the Santa Rosa Gold Mine, or alternatively, that we will be successful in our efforts to obtain additional financing. If we are unable to raise sufficient capital to meet our current obligations, we may be forced to further reduce or terminate operations and file for reorganization or liquidation under the bankruptcy laws. These factors and our negative working capital position together raise doubt about our ability to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Corporate History; Recent Events

We are a mineral exploration and development company, formed in Minnesota on June 2, 1997 and reincorporated in the State of Nevada in May 2008.

Our business includes acquiring mineral properties with potential production and future growth through exploration discoveries. Pending requisite funding, our current growth strategy is focused on the expansion of our operations through the development of mineral properties into joint ventures or royalty mining projects. Our current efforts are focused on our properties in Nevada.

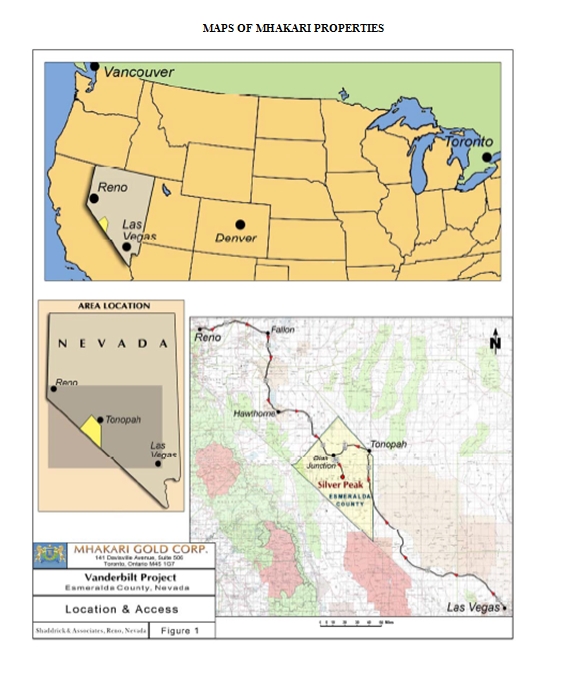

As more fully described in the Notes to Consolidated Financial Statements and elsewhere in this annual report, we have entered into an agreement to acquire an 80% interest in the “Mhakari Properties”, which includes the Vanderbilt Silver and Gold Project, the Coyote Fault Gold and Silver Project, and Galena Flat Gold Project, all located adjacent or near the producing Mineral Ridge gold mine near Silver Peak, Nevada. In addition, we entered into an agreement to acquire the rights to the “North Springs” properties consisting of 16 unpatented lode mining claims in three claim blocks on BLM lands in Esmeralda County, Nevada, also located near the Mineral Ridge gold mine.

Because of lack of funds and scaling back our operations, we allowed the remainder of our mineral property claims interests to lapse in 2013, and we have abandoned the projects to focus on our Nevada properties, which in the opinion of management have the best potential for success.

As funding permits, we intend to continue to strategically acquire, explore and develop mineral properties. We plan to provide joint venture opportunities for mining companies to conduct exploration or development on mineral properties we own or control. We, together with any future joint venture partners, intend to explore and develop selected properties to a stage of proven and probable reserves, at which time we would then decide whether to sell our interest in a property or take the property into production alone or with our future partner(s). By joint venturing our properties, we may be able to reduce our costs for further work on those properties, while continuing to maintain and acquire interests in a portfolio of gold and base strategic metals properties in various stages of mineral exploration and development. We expect that this corporate strategy will minimize the financial risk that we would incur by assuming all the exploration costs associated with developing any one property, while maximizing the potential for success and growth.

Some of our more significant recent events, including events subsequent to December 31, 2013, are summarized as follows:

Sale of Interest in the Santa Rosa Mine, Panama

On February 18, 2014, we received an initial payment of $260,000 and fully executed documents dated February 6, 2014, including a Share Purchase Agreement and Trust Agreement (“Sale Agreements”), with Silver Global, S.A. (“Silver Global”) and two foreign corporations (collectively, the foreign corporations are referred to herein as “Buyers”) related to the sale of the Company’s ten percent (10%) interest in the Santa Rosa Gold Mine, Panama for an aggregate purchase price of $2,600,000.

The Company and Silver Global initially entered into an Acquisition Agreement and joint venture in September 2011 (the “Acquisition Agreement”), forming a Panamanian corporation (Golden Phoenix Panama, S.A., subsequently renamed Vera Gold Corporation, S.A. “Vera Gold”), for the purpose of developing and operating mining concessions pertaining to the Santa Rosa Gold Mine located in the Province of Veraguas, Panama. Details regarding the Acquisition Agreement were previously disclosed in the Company’s Current Report on Form 8-K, as filed with the U.S. Securities and Exchange Commission on September 22, 2011 (the “Prior Report-Acquisition”). The information contained in the Prior Report-Acquisition is incorporated herein in its entirety.

2

The Company and Silver Global subsequently entered into a Rescission and Release Agreement, dated July 23, 2012, as subsequently amended (the “Rescission Agreement”), pursuant to which the parties agreed to rescind the Acquisition Agreement, and Silver Global would purchase the Company’s then fifteen percent (15%) interest in Vera Gold in tranches according to a specified payment schedule. The Rescission Agreement subsequently terminated according to its own terms due to discontinuation of the scheduled payments, and the Company retained a ten percent (10%) interest in Vera Gold. Further details regarding the Rescission Agreement were previously disclosed in the Company’s Form 8-K, as filed with the U.S. Securities and Exchange Commission on August 8, 2012 (the “Prior Report-Rescission”). The information contained in the Prior Report-Rescission is incorporated herein in its entirety.

Pursuant to the Sale Agreements, as consented to by Silver Global, the Buyers shall purchase the Company’s ten percent (10%) interest in Vera Gold for a purchase price of $2,600,000 (“Purchase Price”), with an initial payment of $260,000 and the balance of the Purchase Price to be paid is to be paid in April 2014, within 45 business days of the closing of the sale. The Company’s shares representing its 10% interest shall be held in trust, and delivery of such shares is made contingent upon delivery of the Purchase Price in full.

Amended and Restated Option Agreement for Mhakari Properties, Nevada

On February 26, 2013, we entered into an Amended and Restated Option Agreement with Mhakari Gold (Nevada) Inc. (“Mhakari”) with respect to the Mhakari Properties, which terminated all rights and obligations under prior agreements and restated the parties’ agreement with respect to each of the Mhakari Properties.

Mhakari granted us an option to acquire up to an undivided 80% interest in the Mhakari Properties for the following consideration to be paid by us to Mhakari:

Cash payments: $25,500, payable $20,000 upon execution of the agreement and $5,500 within 60 days thereafter; $20,000 payable on the 3 month anniversary of the agreement; $15,000 on the 6 month and 9 month anniversary of the agreement; and $50,000 on the 15 month anniversary of the agreement.

Equity payments: 8,000,000 shares of our common stock upon the execution of the agreement; an additional 7,000,000 shares of our common stock on the 4 month anniversary of the agreement; and an additional 5,000,000 shares on the 12 month anniversary of the agreement.

Work commitment: $500,000 in exploration and development expenditures on the Mhakari Properties within 18 months of the date of the agreement; an additional $500,000 in exploration and development expenditures between 18 months and 30 months from the date of the agreement; with no less than $2,000,000 in exploration and development expenditures in the aggregate within 48 months from the date of the agreement. Inclusive in this work commitment, we are to earmark no less than $10,000 per contract year for 4 years to enhancing safety on the Mhakari Properties.

Upon satisfying the consideration payable under the agreement, we shall receive an 80% undivided interest in the Mhakari Properties and the parties shall enter into a joint venture to further develop the Mhakari Properties, with us retaining an 80% interest in the joint venture. In the event that we fail to satisfy the entire purchase price by completing all cash, equity and work commitment payments within the required time frames, the agreement will be deemed to have been terminated and all payments made to date will be forfeited to Mhakari with no interest earned by us in the Mhakari Properties.

As of the date of filing this report, we had met the equity payments obligation but were in arrears by $45,500 on the cash payments obligation. We are currently in discussions with Mhakari, and anticipate making further cash payments and beginning our work commitment in the near future as funding permits.

3

North Springs Properties, Esmeralda County, Nevada

Under the terms of an Exploration and Mining Lease with Options to Purchase Agreement effective June 17, 2013 (the “North Springs Agreement”), we acquired the rights to 16 unpatented lode mining claims on BLM lands in Esmeralda County, Nevada, located near the operating Mineral Ridge gold project (the “North Springs Properties”). As required by the North Springs Agreement, we made advance royalty payments of $5,000 cash in June 2013 and issued 1,000,000 shares of our common stock in July 2013. We are further obligated to make the following payments under the terms of the North Springs Agreement:

|

Date

|

Cash Payment

|

Common

Share Payment

|

|||

|

First Anniversary of Effective Date

|

$ | 10,000 |

1,000,000 shares

|

||

|

Second Anniversary of Effective Date

|

$ | 15,000 |

1,000,000 shares

|

||

|

Third Anniversary of Effective Date

|

$ | 20,000 |

1,000,000 shares

|

||

|

Fourth Anniversary of Effective Date

|

$ | 25,000 |

1,000,000 shares

|

||

|

Fifth Anniversary of Effective Date

|

$ | 30,000 | |||

|

Six through Tenth Anniversary of Effective Date

|

$ | 50,000 | |||

|

Eleventh through Fifteenth Anniversary of Effective Date

|

$ | 75,000 | |||

|

Sixteenth and Each Subsequent Anniversary of Effective Date

|

$ | 100,000 | |||

Subject to prior termination, the term of the North Springs Agreement shall be for a period of twenty years commencing on the effective date. The Company is obligated to pay a production royalty equal to three percent of the Net Smelter Returns (“NSR”) from the production or sale of minerals from the North Springs Properties and meet defined minimum annual work commitments ranging from $10,000 in the first year to $100,000 beginning in the fifth year and thereafter

Sale of Ashdown NSR

On January 31, 2014, we sold for $45,000 our net smelter royalty return (“NSR”) interest relating to the operations conducted by or on behalf of the Ashdown Project, LLC ( the “Ashdown Project”) on certain mining properties. We acquired the NSR pursuant to the sale of our ownership interest in the Ashdown Project in May 2009 and a subsequent Termination, Settlement and Release Agreement entered into in August 2011. We received a deposit of $31,000 in December 2013, with the $14,000 remaining payment due prior to March 31, 2014. As of the date of this filing, we had not collected the remaining payment. The operations of the Ashdown Project are currently idle.

Management Changes

The day-to-day operations of the Company continue to be managed by our Interim Governing Board (“IGB”) formed in June 2012 to develop legal strategy and establish the next steps for developing our mining projects. The IGB utilizes the collective strengths of our Board of Directors and management team and is currently comprised of three members, Donald Gunn, John Di Girolamo, and Jeffrey Dahl. Donald Gunn serves as Chair of the IGB, which has temporarily absorbed the position of Chief Executive Officer.

On January 15, 2013, our Board of Directors appointed Dennis P. Gauger as our Chief Financial Officer and Corporate Secretary. Mr. Gauger replaced J. Roland Vetter who resigned as our Chief Financial Officer in December 2012 and as a member of our Board of Directors in January 2013. Mr. Gauger was subsequently appointed to our Board of Directors.

Robert Martin announced his resignation from our Board of Directors, effective March 4, 2013. The Board has elected Donald Gunn to replace Mr. Martin as Chairman.

On August 26, 2013, Hans J. Rasmussen resigned as a member of the Board of Directors, effective September 1, 2013.

4

Our corporate directors and officers have prior management experience with large and small mining companies. We believe that we have created the basis for a competitive mineral exploration, development and operational company through assembling a group of individuals with experience in target generation, ore discovery, resource evaluation, mine development and mine operations.

We expect to retain up to a 30% interest in each project, and we anticipate our cash flow will be leveraged to the price of gold or the underlying strategic metal. Ultimately, we intend to convert some of our interests into royalty agreements.

Government Regulations and Permits

In connection with exploration, mining and milling activities, we are subject to extensive federal, state and local laws and regulations, domestic and international, governing the protection of the environment, including laws and regulations relating to protection of air and water quality, hazardous waste management and mine reclamation as well as the protection of endangered or threatened species.

We are required to comply with numerous environmental laws and regulations imposed by federal and state authorities within the United States. At the federal level, legislation such as the Clean Water Act, the Clean Air Act, the Resource Conservation and Recovery Act, the Comprehensive Environmental Response Compensation Liability Act and the National Environmental Policy Act impose effluent and waste standards, performance standards, air quality and emissions standards and other design or operational requirements for various components of mining and mineral processing, including molybdenum, gold and silver mining and processing.

At present, we do not employ any individuals at our mining properties; we utilize the services of consultants and independent contractors, which are regulated by the Mine Safety and Health Administration (MSHA), a federal agency within the United States.

Our planned exploration activities at the Mhakari and North Springs properties do not require permits or bonding, but will be necessary for proposed future work programs.

If we or the operators of the properties in which we have an interest cannot obtain or maintain the necessary permits, or if there is a delay in receiving such permits, our timetable and business plan for development and mining of these properties could be adversely affected. See “Item 1A. Risk Factors” for more information.

Competition And Mineral Prices

The mining industry has historically been intensely competitive and the increasing price of gold since 2002 has led a number of companies to begin once again to aggressively acquire claims and properties.

Employees

As of the date of this filing, we currently have no full-time employees. We have contracts with various independent contractors and consultants to fulfill our personnel needs, including management, accounting, investor relations, exploration, development, permitting, and other administrative functions, and may staff further with employees as funding permits and as we bring new projects on line.

Corporate Office

Currently, our principal executive office consists of shared space on a month-to-month basis located at 125 East Main Street, Suite 602, American Fork, Utah 84003.

ITEM 2. PROPERTIES

Mining Properties And Projects

Our business includes acquiring mineral properties with potential production and future growth through exploration discoveries. Pending requisite funding, our current growth strategy is focused on the expansion of our operations through the development of mineral properties into joint ventures or royalty mining projects. Our current efforts are focused on our properties in Nevada. These properties are early exploration stage and we have not developed any future exploration plans due to the lack of funding.

5

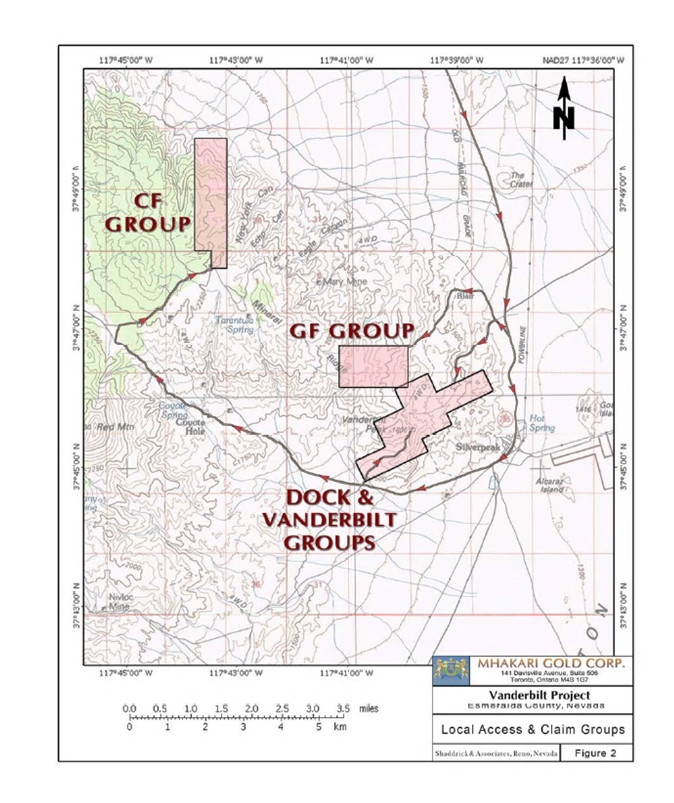

We have entered into an agreement to acquire an 80% interest in the “Mhakari Properties”, which include the Vanderbilt Silver and Gold Project, the Coyote Fault Gold and Silver Project, and Galena Flat Gold Project, and claims that are an extension to the Coyote Fault property, all located adjacent to the producing Mineral Ridge property near Silver Peak, Nevada In addition, we entered into an agreement to acquire the rights to the “North Springs” properties consisting of 16 unpatented lode mining claims in three claim blocks on BLM lands in Esmeralda County, Nevada, also located near the Mineral Ridge property .

Mhakari Legal Agreement

On February 26, 2013, we entered into an Amended and Restated Option Agreement with Mhakari Gold (Nevada) Inc. (“Mhakari”) with respect to the Mhakari Properties, which terminated all rights and obligations under prior agreements and restated the parties’ agreement with respect to each of the Mhakari Properties.

Mhakari granted us an option to acquire up to an undivided 80% interest in the Mhakari Properties, which consist of three separate unpatented mining claims blocks, for the following consideration to be paid by us to Mhakari:

Cash payments: $25,500, payable $20,000 upon execution of the agreement and $5,500 within 60 days thereafter; $20,000 payable on the 3 month anniversary of the agreement; $15,000 on the 6 month and 9 month anniversary of the agreement; and $50,000 on the 15 month anniversary of the agreement.

Equity payments: 8,000,000 shares of our common stock upon the execution of the agreement; an additional 7,000,000 shares of our common stock on the 4 month anniversary of the agreement; and an additional 5,000,000 shares on the 12 month anniversary of the agreement.

Work commitment: $500,000 in exploration and development expenditures on the Mhakari Properties within 18 months of the date of the agreement; an additional $500,000 in exploration and development expenditures between 18 months and 30 months from the date of the agreement; with no less than $2,000,000 in exploration and development expenditures in the aggregate within 48 months from the date of the agreement. Inclusive in this work commitment, we are to earmark no less than $10,000 per contract year for 4 years to enhancing safety on the Mhakari Properties.

As of the date of filing this report, we had met the equity payments obligation but were in arrears by $45,500 on the cash payments obligation. We are currently in discussions with Mhakari, and anticipate making further cash payments and beginning our work commitment in the near future as funding permits. Upon satisfying the consideration payable under the agreement, we shall receive an 80% undivided interest in the Mhakari Properties and the parties shall enter into a joint venture to further develop the Mhakari Properties, with us retaining an 80% interest in the joint venture. In the event that we fail to satisfy the entire purchase price by completing all cash, equity and work commitment payments within the required time frames, the agreement will be deemed to have been terminated and all payments made to date will be forfeited to Mhakari with no interest earned by us in the Mhakari Properties.

North Springs Legal Agreement

Under the terms of an Exploration and Mining Lease with Options to Purchase Agreement effective June 17, 2013 (the “North Springs Agreement”), we acquired the rights to 16 unpatented lode mining claims, which consists of three separate unpatented lode mining claims, on BLM lands in Esmeralda County, Nevada, located near the operating Mineral Ridge gold project (the “North Springs Properties”). As required by the North Springs Agreement, we made advance royalty payments of $5,000 cash in June 2013 and issued 1,000,000 shares of our common stock in July 2013. We are further obligated to make the following payments under the terms of the North Springs Agreement:

6

|

Date

|

Cash Payment

|

Common

Share Payment

|

|||

|

First Anniversary of Effective Date

|

$ | 10,000 |

1,000,000 shares

|

||

|

Second Anniversary of Effective Date

|

$ | 15,000 |

1,000,000 shares

|

||

|

Third Anniversary of Effective Date

|

$ | 20,000 |

1,000,000 shares

|

||

|

Fourth Anniversary of Effective Date

|

$ | 25,000 |

1,000,000 shares

|

||

|

Fifth Anniversary of Effective Date

|

$ | 30,000 | |||

|

Six through Tenth Anniversary of Effective Date

|

$ | 50,000 | |||

|

Eleventh through Fifteenth Anniversary of Effective Date

|

$ | 75,000 | |||

|

Sixteenth and Each Subsequent Anniversary of Effective Date

|

$ | 100,000 | |||

Subject to prior termination, the term of the North Springs Agreement shall be for a period of twenty years commencing on the effective date. The Company is obligated to pay a production royalty equal to three percent of the Net Smelter Returns (“NSR”) from the production or sale of minerals from the North Springs Properties and meet defined minimum annual work commitments ranging from $10,000 in the first year to $100,000 beginning in the fifth year and thereafter

Because of lack of funds and scaling back our operations, we allowed the remainder of our mineral property claims interests to lapse in 2013, and we have abandoned the projects to focus on our Nevada properties, which in the opinion of management have the best potential for success.

Mhakari Properties

The Mhakari properties are all in early stage exploration and do not contain any reserves. Of the three properties held under the Mhakari Option Agreement, the Vanderbilt and Coyote Fault properties have received all the past work, which consisted of sampling and mapping. Because the three properties are exploration in nature, there is no infrastructure established. If the Company is successful with establishing mineable reserves, then power and water would have to be established from the nearby town of Silver Peak.

Total costs incurred on the Mhakari Properties through December 31, 2013 were $1,290,353. Current lack of funding has precluded us from developing any future plans for exploration activities; therefore, we are currently unable to estimate future exploration costs. Absent an exploration plan, we anticipate that future costs for the Mhakari properties will consist of annual minimum claim maintenance costs estimated at approximately $26,000 per year.

Vanderbilt

The Vanderbilt property is located within 4 miles of the town of Silver Peak, Nevada and highway 265 via Coyote Road. It is comprised of 44 claims, plus 3 patented claims for a total of 900 acres and is located on the southern flank of Mineral Ridge within the Silver Peak Range. The Vanderbilt property is within the middle of the Walker Lane tectonic belt with the Sierra uplift to the west and the Basin and Range to the east. The claim name designations include the 5 Van, 39 Dock unpatented lode mining claims and the patented claims called the Vanderbilt Extension, Pocotillo and Vanderbilt. Access is achieved by four wheel drive trucks over steep rocky roads. The Company controls the subsurface mineral rights, but the surface is controlled by the Bureau of Land Management (BLM). There are currently no formal permits with the BLM, but access and work is allowed on a casual basis.

The underlying rocks found at Vanderbilt are part of the Mineral Ridge Metamorphic Core Complex (MRMCC) and include granite, Wyman Formation slates and phyllites, and Reed Formation marble. Gold and silver mineralization is found in flat lying fault zones in the Wyman associated with quartz veins and stockworks.

The Vanderbilt property was first developed around 1860 by prospectors looking for gold. They developed a number of small tunnels and shafts where the quartz veins contained high values of gold and silver. This material was transported to Silver Peak and milled where access to water was possible. There are no hazardous materials on the property, and the old mine workings have been fenced for public safety. The Company has not to this date conducted any road building or other surface disturbance. Future drilling work will require an approved BLM Notice of Exploration (NOI) and a posted reclamation bond before such work is conducted.

7

Phase I geologic mapping and outcrop sampling (above ground) was completed in October 2010, resulting in average grades of 2.1 g/t gold and 58.6 g/t silver. A Phase II exploration program (below ground) in the old mine workings was commenced during the first quarter of 2011 to help identify drill targets. The average assay value of the channel samples collected from the old mine tunnels was 9.04 g/t gold and 140 g/t silver, utilizing a 1.0 g/t cutoff value. These sample assay results were obtained from ALS Global Laboratories using fire assay/atomic absorption assay techniques. ALS is an international analytical laboratory used by numerous mining companies globally. An exploratory drill program is expected to begin as funding is obtained and the Company receives permits from the BLM.

Coyote Fault/Coyote Fault Extension

The Coyote Fault/Coyote Fault Extension claim block is within nine miles of Silver Peak, Nevada and Hwy 265 via Coyote Road. This property is considered to be an early stage exploration project. The property consists of 110 contiguous unpatented mining claims having a total of 2,200 acres. The claim block is represented with claims labeled CF 1 to CF 37 and SP 1 to SP71. The property is on the northern flank of Mineral Ridge and is along the eastern edge of the Silver Peak Range. Access is achieved by four-wheel drive truck over graded roads followed by steep rocky roads

The underlying rocks found at Coyote Fault are part of the Mineral Ridge Metamorphic Core Complex (MRMCC) and include granite, Wyman Formation slates and phyllites, and Reed Formation marble. Gold and silver mineralization is found in flat lying fault and shear zones in the Wyman associated with quartz veins and stockworks.

Phase I geologic mapping and outcrop sampling (above ground) was completed on the Coyote Fault claim group in December 2010, which identified a new potential gold exploration target. These sample results were obtained from ALS Global Laboratories using fire assay/atomic absorption assay techniques.

Currently, the Company has not conducted any surface work such as road building and no exploration plans have been developed at this time.

Galena Flat

The Galena Flat claims are found about 4 miles from Silver Peak, Nevada and can be accessed by dirt road from the historic town site of Blair off of State Highway 265. The project is in early stage exploration and consists of 24 unpatented lode mining claims for a total of 480 acres. The claim block is identified with claim names GF 1 to GF 24. Access is achieved by four wheel drive trucks over steep rocky roads

The underlying rocks found at Galena Flat are part of the Mineral Ridge Metamorphic Core Complex (MRMCC) and include granite, Wyman Formation slates and phyllites, and Reed Formation marble. Gold and silver mineralization is found in flat lying fault zones in the Wyman associated with quartz veins and stockworks.

Very little exploration work has been conducted on the Galena Flat Project. No sampling or mapping or any surface work such as road building has been conducted and no exploration plans have been developed at this time.

8

9

10

North Springs Properties

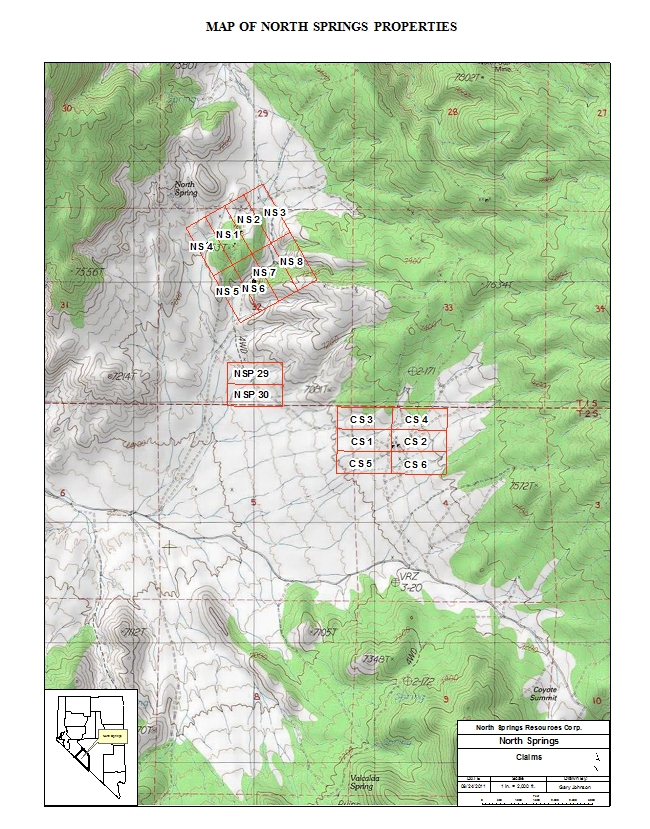

The North Springs Properties are located along the western margin of the Mineral Ridge Mining District, approximately 8 miles west of the town of Silver Peak and 3 miles west of the Mineral Ridge open pit and underground mines. This property consists of 16 unpatented lode mining claims in three separate blocks totaling 320 acres.

The North Springs Properties, Mhakari Properties and the Mineral Ridge gold mine deposits are situated along a regional northwest trending, large anticline known as the Mineral Ridge Metamorphic Core Complex. This geologic complex hosts extensive high-grade gold and stacked, low angle, shear zones, which has been open pit mined in several deposits at the Mineral Ridge mine. The North Springs Properties occupies similar geological environment to the Mineral Ridge deposits.

The North Springs Properties consist of three separate claim blocks and are identified as NS 1 through NS 8 (Roadrunner or North Springs prospect), NSP 29 and 30 (North Springs Pediment prospect) and CS 1 through CS 6 (Coyote Summit prospect) for a total of 16 claims or 320 acres. The claims are located on BLM administered lands. Access is from Silver Peak about 10 miles west along the Coyote dirt road by four wheel drive truck. Each claim block is easily reached by following good secondary dirt roads to each area.

The three North Springs claim blocks are all underlain by granite and a minor veneer of Wyman phyllite. Considerable rock chip sampling has been conducted to determine if anomalous gold and silver values exist on the properties. Only one of the three properties has returned chip samples with gold values that are of interest. This area, called North Springs, contains anomalous gold mineralization over an area approximately 75 feet wide by 300 feet long. Inspection of the some of the exposed shafts and cuttings from a rotary hole suggests the mineralized zone is too small to host a gold deposit that could be mined at a profit. The other two blocks contain very low values of gold and do not contain a gold target.

There is no infrastructure available in the area. Water would need to be hauled in from Silver Peak to conduct an exploration drilling program. Certain hazards exist including open shafts and adits in all three claim blocks. The Company has previously not completed any surface disturbance such as road building on any one of the claim blocks.

There are no plans at this time to conduct exploration activities. The properties will be maintained until a decision on what to do with them is made.

Total costs incurred on the North Springs Properties through December 31, 2013 were $13,812. Should we elect to continue to hold and conduct exploration activities on the properties, our costs will include the advance royalty cash and share payments required in year two and thereafter as described above under North Springs Legal Agreement. In addition we estimate our annual obligation for minimum claim maintenance costs will approximate $3,000.

Other Related Disclosures

Any physical work conducted on any of the Company’s properties requires a Bureau of Land Management permit and reclamation bond. For less than 5 acres of proposed disturbance, a Notice of Intent Permit is required. A reclamation bond amount is calculated, and money is provided to an account that the BLM controls before work can begin. Depending upon the surface disturbance provided, the amount of bond money may range from $5,000 to $30,000. For work over 5 acres of disturbance, an Exploration Plan of Operations is required and would add a considerable amount of field study including cultural resource studies, biological studies and other concerns that are important for the public. Because the amount of work proposed for a POO is considerable, the bond amount may range from $20,000 to $100,000 depending on the size of the exploration program.

Any mining company engaged in exploration, development or mining activities face considerable risk due to the large number of state and federal regulation that require compliance. These regulations include surface degradation, air quality, water quality, chemical controls, mercury controls, and others. The Company would need to address socio-economic impacts of a large operation and understand those impacts. Any one of these issues may delay a project until specific compliance measures are addressed.

11

12

PART IV

ITEM 15. EXHIBITS AND FINANCIAL STATEMENTS SCHEDULES

The following Exhibits are filed or incorporated herein by reference as part of this Annual Report.

|

Exhibit No.

|

Description

|

|

31.1

|

Certification of Principal Executive Officer Pursuant to Section 302.*

|

|

31.2

|

Certification of Chief Financial Officer Pursuant to Section 302.*

|

*Filed herewith.

13

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

GOLDEN PHOENIX MINERALS, INC.

|

||

|

Date: November 26, 2014

|

By:

|

/s/ Donald B. Gunn

|

|

Name: Donald B. Gunn

|

||

|

Title: President and Chair of Interim Governing Board

|

||

|

(Principal Executive Officer)

|

||

|

Date: November 26, 2014

|

By:

|

/s/ Dennis P. Gauger

|

|

Name: Dennis P. Gauger

|

||

|

Title: Chief Financial Officer

|

||

|

(Principal Accounting and Financial Officer)

|

||

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

SIGNATURE

|

TITLE

|

DATE

|

|

|

/s/ Donald B. Gunn

|

|||

|

Donald B. Gunn

|

President, Chair of Interim Governing Board and Director

|

November 26, 2014

|

|

|

/s/ Dennis P. Gauger

|

|||

|

Dennis P. Gauger

|

Chief Financial Officer and Director

|

November 26, 2014

|

|

|

/s/John Di Girolamo

|

|||

|

John Di Girolamo

|

Director

|

November 26, 2014

|

|

|

/s/ Jeffrey Dahl

|

|||

|

Jeffrey Dahl

|

Director

|

November 26, 2014

|

14