Attached files

| file | filename |

|---|---|

| EX-5.1 - EXHIBIT 5.1 OPINION OF WEIL GOHSTAL & MANGES LLP - New Remy Corp | exhibit51opinionofweilamen.htm |

| EX-23.1 - EXHIBIT 23.1 CONSENT OF ERNST & YOUNG LLP, INDEPENDENT PUBLIC ACCOUNTING FIRM - New Remy Corp | exhibit231eyconsentonforms.htm |

Subject to completion, as filed with the Securities and Exchange Commission on November 25, 2014.

Registration No. 333- 199291

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

AMENDMENT No. 2 to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

___________________________

New Remy Corp.

(Exact name of registrant as specified in its charter)

Delaware (State or Other Jurisdiction of Incorporation or Organization) | 3714 (Primary Standard Industrial Classification Code Number) | 47-2022310 (I.R.S. Employer Identification No.) | ||

601 Riverside Avenue Jacksonville, Florida 32204 (904) 854-8100 (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) ____________________________ | ||||

Michael L. Gravelle Executive Vice President, General Counsel and Corporate Secretary New Remy Corp. 601 Riverside Avenue Jacksonville, Florida 32204 Tel. (904) 854-8100 (Name, address, including zip code, and telephone number, including area code, of agent for service) ____________________________ | ||||

Copies to: | ||||

Michael J. Aiello Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, NY 10154 (212) 310-8000 | John J. Pittas Remy International, Inc. 600 Corporation Drive Pendleton, IN 46064 (765) 778-6499 | Robert S. Rachofsky Willkie Farr & Gallagher LLP 787 Seventh Avenue New York, NY 10019 (212) 728-8000 | ||

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective and the satisfaction of all other conditions to the completion of the transactions described in the enclosed document have been satisfied or waived.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨

Non-accelerated filer x (Do not check if a smaller reporting company) Smaller reporting company ¨

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated November 25, 2014

PRELIMINARY PROSPECTUS

92,934,470 shares

New Remy Corp.

Common Stock

(par value $0.0001 per share)

This prospectus is being furnished in connection with the planned distribution by Fidelity National Financial, Inc. (“FNF”) on a pro rata basis to the holders of its Fidelity National Financial Ventures (“FNFV”) Group common stock of all of the outstanding shares of its wholly-owned subsidiary New Remy Corp. (“New Remy”), which will hold all of the shares in Remy International, Inc. (“Old Remy”) beneficially owned by FNF and all of the outstanding units in Fidelity National Technology Imaging, LLC (“Imaging”). We refer to such distribution as the “spin-off”. We expect that, immediately following the spin-off, New Remy and Old Remy will each merge with wholly-owned subsidiaries of New Remy Holdco Corp. (“New Holdco”), with New Remy and Old Remy surviving such mergers as wholly-owned subsidiaries of New Holdco. We refer to such mergers as the “New Remy merger” and the “Old Remy merger” respectively and together as the “mergers”. Promptly following the mergers, New Holdco will change its name to “Remy International, Inc.”

Each share of FNFV Group common stock outstanding as of 5:00 p.m., New York City time, on the record date for the spin-off (the “record date”), which has not yet been determined and FNF will publicly announce prior to the completion of the spin-off and the mergers, entitle its holder to receive one share of New Remy common stock. The distribution of shares will be made to a third party exchange agent in book-entry form for the benefit of the holders of FNFV Group common stock. Immediately following the spin-off, as consideration for the New Remy merger, each share of New Remy common stock will be converted into the right to receive a number of shares of New Holdco common stock determined by a formula based on the number of shares of New Remy common stock outstanding at the effective time of the New Remy merger. Based on the number of shares of FNFV Group common stock outstanding as of November 24, 2014, we expect the exchange ratio to be approximately 0.17879 shares of New Holdco common stock for each share of New Remy common stock. As a result, holders of FNFV Group common stock will hold approximately 51.5% of the common stock of New Holdco outstanding immediately following the mergers.

New Holdco has applied to have its common stock listed on the NASDAQ Global Select Market (“NASDAQ”) under the symbol “REMY”, which is Old Remy’s current trading symbol.

We expect that the spin-off should be tax-free to holders of FNFV Group common stock for U.S. federal income tax purposes.

FNF does not require, and is not seeking, the approval of the holders of FNF or the FNFV Group common stock in connection with the spin-off or the mergers. Old Remy is seeking the approval of its stockholders for the Old Remy merger and approval by Old Remy stockholders is required for the mergers to take place.

No action will be required of you to receive shares of common stock of New Remy in the spin-off or the shares of New Holdco common stock issued in exchange therefor immediately following the spin-off, which means that:

• | you will not be required to pay for the New Remy common stock that you receive in the spin-off or the New Holdco common stock that you receive in the mergers; and |

• | you do not need to surrender or exchange any of your FNF or FNFV Group shares in order to receive the New Remy common shares, or take any other action in connection with the spin-off. |

In reviewing this prospectus, you should carefully consider the matters described under “Risk Factors” beginning on page 10 of this prospectus for a discussion of certain factors that should be considered by recipients of the New Remy common stock.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined that this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities.

The date of this prospectus is [____________], 2014.

TABLE OF CONTENTS

Page | |

Introduction | |

Questions and Answers About the Transactions | |

Summary | |

Summary Historical Combined Financial Data | |

Risk Factors | |

Cautionary Statement Concerning Forward-Looking Statements | |

The Transactions | |

The Merger Agreement | |

The Reorganization Agreement | |

Additional Agreements | |

Selected Historical Combined Financial Data | |

Unaudited Pro Forma Condensed Combined Financial Information | |

Comparative Historical and Pro Forma Per Share Data | |

Per Share Market Price and Dividend Information | |

Management's Discussion and Analysis of Financial Condition and Results of Operations | |

Business of New Holdco | |

Management of New Holdco Following the Transactions | |

Compensation of Executive Officers | |

Beneficial Ownership of New Holdco Common Stock | |

Description of the Capital Stock of New Remy Corp | |

Description of the Capital Stock of New Holdco | |

Material U.S. Federal Income Tax Consequences of the Transactions | |

Legal Matters | |

Experts | |

Where You Can Find More Information | |

Index to Financial Statements | |

This prospectus is being furnished solely to provide information to holders of FNFV Group common stock who will receive shares of our common stock in the spin-off. It is not and is not to be construed as an inducement or encouragement to buy or sell any securities of FNF, FNFV, Old Remy or New Holdco. This prospectus describes our business, which will be the business of New Holdco following the mergers and, with the exception of the addition of the Imaging business, the business of Old Remy prior to the transactions, our relationships with FNF, Old Remy and New Holdco and other information to assist you in evaluating the benefits and risks of holding or disposing of the shares that you will receive in the transactions. You should be aware of certain risks relating to the spin-off, the mergers, the New Holdco business and ownership of New Holdco common stock, which are described under “Risk Factors”.

You should not assume that the information contained in this prospectus is accurate as of any date other than the date set forth on the cover. Changes to the information contained in this prospectus may occur after that date, and we undertake no obligation to update the information.

INTRODUCTION |

On September 8, 2014, Old Remy and FNF, the beneficial owner of approximately 51.1% of the common stock of Old Remy, announced a transaction involving the distribution of Old Remy shares owned by FNF and the outstanding units of Imaging to the holders of its FNFV Group common stock (a separate class of FNF stock that tracks selected assets of FNF) and the acquisition by a new holding company of Old Remy and Imaging. This transaction involves the following steps:

• | FNF will contribute all of its shares in Old Remy, together with all of the outstanding units of Imaging, to New Remy (the “contribution”); |

• | shares of New Remy will be distributed as a dividend to holders of the FNFV Group common stock (the “spin-off” and, together with the contribution, the “restructuring”); and |

• | Old Remy and New Remy will merge with, and continue their existence as, wholly-owned subsidiaries of New Holdco, a newly-formed holding company established in connection with the transactions (collectively, the “mergers”). |

We refer to the restructuring and the mergers collectively as the transactions. The terms of the restructuring and mergers are set forth in the merger agreement and reorganization agreement, respectively, which are each described in this prospectus.

In the spin-off, each share of FNFV Group common stock as of the record date for the spin-off will entitle its holder to one share of New Remy common stock. Each share of New Remy common stock outstanding will immediately thereafter be converted into the right to receive in the mergers a number of shares of New Holdco common stock determined by a formula based on the number of shares of New Remy common stock outstanding at the effective time of the New Remy merger. Based on the number of shares of FNFV Group common stock outstanding as of November 24, 2014, we expect the exchange ratio to be approximately 0.17879 shares of New Holdco common stock for each share of New Remy common stock. As a result, holders of FNFV Group common stock will hold approximately 51.5% of the common stock of New Holdco outstanding immediately following the mergers.

Because the shares of New Remy will immediately be converted into shares of New Holdco, this prospectus describes the business, management, compensation and capital stock of New Holdco.

If you have any questions regarding the spin-off, you can contact FNF prior to the spin-off and New Holdco following the spin-off, each at the contact information listed below.

Fidelity National Financial, Inc.

601 Riverside Drive

Jacksonville, Florida 32204

Telephone: (904) 854-8100

Attention: Corporate Secretary

Remy International, Inc.

600 Corporation Drive

Pendleton, Indiana 46064

Telephone: (765) 778-6602

Attention: Corporate Secretary

i

QUESTIONS AND ANSWERS ABOUT THE TRANSACTIONS

Set forth below are commonly asked questions about the spin-off, the mergers and the transactions contemplated thereby. You should read the sections entitled “The Transactions” and “The Transaction Agreements” of this prospectus for a more detailed description of the matters described below.

Q. | What are the transactions described in this document? |

A. | Old Remy and FNF, the beneficial owner of approximately 51.1% of the outstanding common stock of Old Remy, have entered into a transaction involving the distribution of Old Remy shares held by FNF to the holders of its FNFV Group common stock (a separate class of FNF stock that tracks selected assets of FNF), together with a small company, Fidelity National Technology Imaging, LLC, which we refer to as Imaging. This transaction involves the following steps: |

• | FNF will contribute all of its shares in Old Remy, together with all of the outstanding units of Imaging, to a newly formed corporation, New Remy Corp., which we refer to as New Remy (the “contribution”); |

• | shares of New Remy will be distributed as a dividend to holders of the FNFV Group common stock (the “spin-off” and, together with the contribution, the “restructuring”); and |

• | Old Remy and New Remy will merge with, and continue their existence as, wholly-owned subsidiaries of New Remy Holdco Corp., which we refer to as New Holdco, a newly-formed holding company established in connection with the transactions (collectively, the “mergers”). |

We refer to the restructuring and mergers collectively as the transactions. The terms of the restructuring and mergers are set forth in the merger agreement and reorganization agreement, respectively, which are each described in this prospectus.

Q: What is New Remy?

A: | New Remy is a wholly-owned subsidiary of FNF, newly formed for the purpose of effecting the transactions. Prior to the contribution, New Remy will have no assets. Following the contribution, New Remy will own all of the Old Remy common stock beneficially owned by FNF and all of the outstanding units of Imaging. |

Q: What will I receive in the transactions?

A: | Each share of FNFV Group common stock as of the record date for the spin-off will entitle its holder to receive one share of New Remy common stock. As of November 24, 2014, there were 92,934,470 shares of FNFV Group common stock outstanding. Each share of New Remy common stock outstanding will immediately thereafter be converted into the right to receive a number of shares of New Holdco based on the New Remy exchange ratio. Therefore, based on the number of outstanding shares of FNFV Group common stock as of November 24, 2014, it is currently estimated that New Remy stockholders will be entitled to receive approximately 0.17879 shares of New Holdco common stock for each share of New Remy common stock that they own. If there are fewer shares of FNFV Group common stock outstanding on the record date for the Spin-off, the New Remy exchange ratio will be higher. The New Remy exchange ratio is obtained by dividing the sum of (i) 16,342,508 (which is equal to the number of outstanding shares of Old Remy beneficially owned by FNF) and (ii) 272,851 (the number of shares of New Holdco to be issued in respect of the contribution of the Imaging business), by the number of shares of New Remy common stock outstanding as of the effective time of the New Remy merger, rounded to the nearest five decimal places and subject to adjustment for payment of cash in lieu of fractional shares. See “The Transaction Agreements - The Merger Agreement-New Remy Exchange Ratio” for details on the calculation. |

As a result of the mergers, Old Remy stockholders (other than New Remy) will be entitled to receive one share of New Holdco common stock for each share of Old Remy common stock that they own. See “The Transaction Agreements - The Merger Agreement-Old Remy Exchange Ratio”.

ii

Q: What are the reasons for the transactions?

A: FNF’s principal purposes and reasons for the transactions are:

• | the transactions should enable holders of FNFV Group common stock to receive shares of New Holdco in a manner that is generally tax-free to them; |

• | the transactions will significantly increase the float and trading liquidity in Old Remy’s common stock; |

• | the FNF board believes that a completely independent Old Remy with a fully-distributed common stock will better enable Old Remy to pursue its strategic plans and create additional long-term value for Old Remy stockholders; |

• | the transactions should eliminate the overhang and potential price disruptions in Old Remy’s common stock which could arise as a result of a controlling stockholder selling stock over a period of time; |

• | the transactions will eliminate potential limitations arising from a controlling stockholder’s right to veto proposals by Old Remy to issue common stock for purposes of funding strategic acquisitions or management compensation plans, if stockholder approval thereof would be required under NASDAQ rules; and |

• | the transactions should attract new stockholders and research analysts to Old Remy. |

Q: Who will control New Holdco after the transactions?

A: | Although FNF holds a controlling interest in the shares of Old Remy today, immediately following the transactions FNF will no longer hold a controlling interest in the shares of Old Remy, and it is not expected that any person or group will hold a controlling interest in New Holdco. |

Q: What stockholder approvals are needed?

A: | No vote of FNF or FNFV stockholders of any class is required, or is being sought, in connection with the transactions. New Remy stockholders are not being requested to vote on the transactions, which will have already been approved by FNF as the sole stockholder of New Remy prior to the spin-off. |

However, the mergers cannot be completed unless the merger agreement is adopted by the affirmative vote of holders of a majority of the outstanding shares of Old Remy common stock. Pursuant to the merger agreement, FNF has agreed to cause all shares of Old Remy common stock beneficially owned by it, currently representing approximately 51.1% of the outstanding shares of Old Remy common stock, to be voted in favor of the adoption of the merger agreement. As a result, approval of the adoption of the merger agreement and the transactions contemplated thereby is assured.

Q: What should FNFV Group stockholders do now?

A: | FNFV Group stockholders should carefully read this prospectus, which contains important information on the spin-off, the merger, New Remy and New Holdco. FNFV Group stockholders are not required to take any action to approve the spin-off, the mergers or any of the transactions contemplated thereby. No action will be required of you to receive shares of common stock of New Remy in the spin-off or the shares of New Holdco common stock issued in exchange therefor in the mergers. You will not be required to pay for the New Remy common stock that you receive in the spin-off, or the New Holdco common stock issued on the conversion thereof in the mergers, and you do not need to surrender or exchange any shares of your FNF or FNFV Group common stock in order to receive the New Remy common stock or New Holdco common stock, or take any other action in connection with the spin-off or mergers. |

Q: Has FNF set a record date for the distribution of New Remy shares in the spin-off?

A: | No. FNF will publicly announce the record date when it has been determined. This announcement will be made prior to completion of the spin-off and the mergers. |

iii

Q: When will the transactions occur?

A: The transactions are expected to close in December 2014 or in the first quarter of 2015.

Q: What will happen to the listing of shares of FNFV Group common stock?

A: Nothing. FNFV Group common stock will continue to be traded on the New York Stock Exchange under the symbol “FNFV”.

Q: Will the spin-off affect the trading price of my shares of FNFV Group common stock?

A: | Yes. We expect the trading price of FNFV Group common stock immediately following the spin-off to be lower than immediately prior to the spin-off because the trading price will no longer reflect the value of Old Remy or Imaging, which are being spun-off through the distribution of New Remy shares. Furthermore, until the market has fully analyzed the value of the FNFV Group common stock without Old Remy or Imaging, the price of FNFV Group common stock may fluctuate. |

Q: | What if I want to sell my shares of FNFV Group common stock or my shares of New Holdco common stock? |

A: | You should consult with your financial advisors, such as your stockbroker, bank or tax advisor. None of FNF, New Holdco or New Remy makes any recommendations on the purchase, retention or sale of FNFV Group common stock or the New Holdco common stock to be distributed immediately following the transactions. |

If you decide to sell any shares before the spin-off, you should make sure your stockbroker, bank or other nominee understands whether you want to sell your FNFV Group common stock or the New Holdco common stock you will receive immediately following the transactions. If you own FNFV Group common stock as of 5:00 p.m., New York City time, on the record date, which has not yet been determined, and sell those shares up to and including the distribution date, you will still receive the New Remy common stock, and the New Holdco common stock issued upon conversion thereof in the mergers, that you would be entitled to receive in respect of the FNFV Group common stock you owned as of 5:00 p.m., New York City time on the record date.

Q: How will FNF distribute our shares of New Remy common stock?

A: | The distribution of New Remy common stock will be made to a third party exchange agent in book-entry form for the benefit of the holders of FNFV Group common stock. Immediately following the spin-off, as consideration for the New Remy merger, each share of New Remy common stock will be converted into the right to receive a number of shares of New Holdco common stock determined by a formula based on the number of shares of New Remy common stock outstanding at the effective time of the New Remy merger. At the effective time of the New Remy merger, New Remy will instruct the exchange agent to make book-entry credits for the shares of New Holdco common stock that you are entitled to receive. Since shares of New Holdco common stock will be in uncertificated book-entry form, you will receive share ownership statements in place of physical share certificates. See “The Transactions-Exchange of Old Remy and New Remy Shares”. |

Q: What are the U.S. federal income tax consequences to me of the spin-off?

A: | The spin-off is conditioned upon the receipt by FNF of the opinion of Deloitte Tax LLP (“Deloitte”), tax advisor to FNF, to the effect that the contribution and the spin-off should qualify as a tax-free reorganization under Sections 368(a) and 355 of the Code and a distribution to which Sections 355 and 361 of the Code applies. Accordingly, FNF and holders of FNFV Group common stock generally should recognize no gain or loss with respect to the spin-off. The opinion will be based upon various factual representations and assumptions, as well as certain undertakings made by FNF, New Remy, and Old Remy. Any inaccuracy in the representations or assumptions upon which such tax opinion is based, or failure by FNF, New Remy, or Old Remy to comply with any undertakings made in connection with such tax opinion, could alter the conclusions reached in such opinion. Opinions with respect to these matters are not binding on the IRS or the courts. As a result, the conclusions expressed in these opinions could be challenged by the IRS and a court could sustain such a challenge. You should note that FNF does not intend to seek a ruling from the IRS as to the U.S. federal income tax treatment of the spin-off. |

iv

If, notwithstanding the receipt of an opinion of Deloitte, if the spin-off were determined to be a taxable transaction, each holder of FNFV Group common stock who receives shares of New Remy common stock in the spin-off would generally be treated as receiving a taxable distribution in an amount equal to the total fair market value of such shares of New Remy common stock. In general, the distribution would be taxable as a dividend to the extent of FNF’s current and accumulated earnings and profits. Any amount of the distribution in excess of FNF's earnings and profits would be treated first as a non-taxable return of capital to the extent of the holder's tax basis in its shares of FNFV Group common stock, with any remaining amount taxed as gain from the sale or exchange of the FNFV Group common stock. FNF would generally recognize taxable gain equal to the excess of the fair market value of the shares of New Remy common stock distributed by FNF in the spin-off over FNF’s tax basis in such stock.

For further information concerning the U.S. federal income tax consequences of the spin-off, see “Material U.S. Federal Income Tax Consequences of the Transactions--the Spin-Off.”

Q: How will New Holdco’s common stock trade?

A: | There is currently no public market for New Holdco common stock. We have applied to list New Holdco common stock on the NASDAQ Global Select Market under the symbol “REMY”. |

Q: Who is the exchange agent for the New Remy shares?

A: | American Stock Transfer & Trust Company, Old Remy’s transfer agent, will be the exchange agent for the New Remy shares. |

Q: Whom should I call with other questions?

A: | If you have any questions regarding the transactions, you can contact FNF prior to the spin-off and New Holdco following the spin-off, each at the contact information listed below. |

Fidelity National Financial, Inc.

601 Riverside Drive

Jacksonville, Florida 32204

Telephone: (904) 854-8100

Attention: Corporate Secretary

Remy International, Inc.

600 Corporation Drive

Pendleton, Indiana 46064

Telephone: (765) 778-6602

Attention: Corporate Secretary

v

SUMMARY

This summary highlights selected information from this document and may not contain all of the information that is important to you. To understand the restructuring, the mergers and other transactions more fully and for a more complete description of the legal terms of the transactions, you should read carefully this entire document.

Except as otherwise indicated or the context otherwise requires, the information included in this prospectus assumes the completion of the spin-off and the mergers.

The Companies

Remy International, Inc.

Remy International, Inc.

600 Corporation Drive

Pendleton, Indiana 46064

Telephone: (765) 778-6499

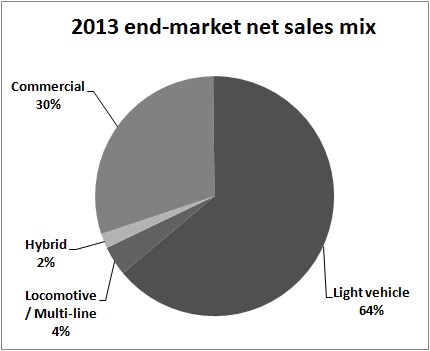

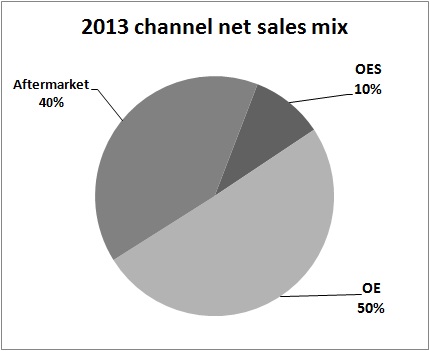

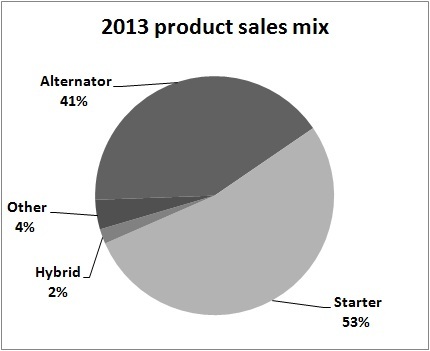

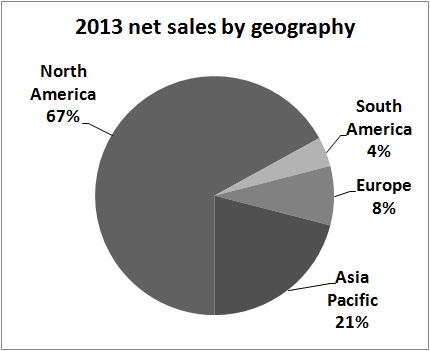

Remy International, Inc., which we refer to as Old Remy, is a leading global vehicular parts designer, manufacturer, remanufacturer, marketer and distributor of aftermarket and original equipment electrical components for automobiles, light trucks, heavy-duty trucks and other vehicles. It conducts substantially all of its operations through subsidiaries. Old Remy sells its products worldwide primarily under the “Delco Remy”, “Remy”, “World Wide Automotive”, and “USA Industries” brand names and its customers' widely recognized private label brand names. Old Remy's products include new and remanufactured, light-duty and heavy-duty starters and alternators for both original equipment and aftermarket applications, hybrid power technology, and multi-line products, such as constant velocity (“CV”) axles, disc brake calipers, and steering gears. These products are principally sold or distributed to original equipment manufacturers (“OEMs”) for both original equipment manufacture and aftermarket operations, as well as to warehouse distributors and retail automotive parts chains. Old Remy sells its products principally in North America, Europe, Latin America and Asia-Pacific.

Old Remy is one of the largest producers in the world of remanufactured starters and alternators for the aftermarket. Old Remy was incorporated in the State of Delaware in 1993 and on December 13, 2012 it completed its initial public offering and became a publicly traded company under the ticker symbol “REMY”.

Fidelity National Financial, Inc.

Fidelity National Financial, Inc.

601 Riverside Avenue

Jacksonville, Florida 32204

Telephone: (904) 854-8100

Fidelity National Financial, Inc., which we refer to as FNF, is a leading provider of title insurance, technology and transaction services to the real estate and mortgage industries. FNF is organized into two groups, FNF Core Operations and Fidelity National Financial Ventures (“FNFV”). FNF is the nation’s largest title insurance company through its title insurance underwriters - Fidelity National Title, Chicago Title, Commonwealth Land Title and Alamo Title - that collectively issue more title insurance policies than any other title company in the United States. FNF also provides industry-leading mortgage technology solutions and transaction services, including MSP®, the leading residential mortgage servicing technology platform in the U.S., through its majority-owned subsidiaries, Black Knight Financial Services, LLC and ServiceLink Holdings, LLC. In addition, it owns majority and minority equity investment stakes in a number of entities, including Old Remy, Imaging, American Blue Ribbon Holdings, LLC, J. Alexander’s, LLC, Ceridian HCM, Inc., Comdata Inc. and Digital Insurance, Inc. On June 30, 2014, following a restructuring, FNF issued a tracking stock to FNF stockholders on a pro rata basis (the “FNFV Group common stock”) to track and reflect the performance of the portfolio company investments.

1

Fidelity National Technology Imaging, LLC

Fidelity National Technology Imaging, LLC

601 Riverside Avenue

Jacksonville, Florida 32204

Telephone: (904) 854-8100

Fidelity National Technology Imaging, LLC, which we refer to as Imaging, is an indirect wholly-owned subsidiary of FNF, and is a provider of document conversion, indexing and redaction services supporting government and private industries. Imaging is headquartered in San Jose, CA.

New Remy Holdco Corp.

New Remy Holdco Corp.

601 Riverside Avenue

Jacksonville, Florida 32204

Telephone: (904) 854-8100

New Remy Holdco Corp., which we refer to as New Holdco, is a newly-formed corporation that was organized in the State of Delaware on August 27, 2014 for the purpose of holding shares of Old Remy and New Remy following the mergers and serving as the new public company parent of Old Remy. Following the transactions, New Holdco will be renamed “Remy International, Inc.” and its common stock will be listed on NASDAQ under the ticker symbol “REMY”.

New Remy Corp.

New Remy Corp.

601 Riverside Avenue

Jacksonville, Florida 32204

Telephone: (904) 854-8100

New Remy Corp., which we refer to as New Remy, is a wholly-owned subsidiary of FNF. New Remy was organized in the State of Delaware on August 27, 2014 for the purpose of holding shares of Old Remy and Imaging and effecting the transactions.

New Remy Merger Sub, Inc. and Old Remy Merger Sub, Inc.

New Remy Merger Sub, Inc. and Old Remy Merger Sub, Inc., which we refer to as Merger Sub One and Merger Sub Two respectively, are newly-formed corporations that were organized in the State of Delaware on August 27, 2014 for the purpose of effecting the transactions.

The Transactions (see page 29)

The Restructuring (see page 29)

Pursuant to the reorganization agreement, FNF will engage in a series of corporate transactions (the “restructuring”), including the following:

• | FNF will cause its subsidiaries to effect a series of distributions such that, following such distributions, FNF will directly own all of the outstanding Imaging units and the Old Remy shares currently owned by it; |

• | FNF will contribute to New Remy (i) all of the Old Remy shares owned by FNF and (ii) all of the Imaging units, in exchange for 100% of the shares of New Remy common stock (the “contribution”); and |

• | immediately prior to the consummation of the mergers, FNF will cause all of the shares of New Remy to be distributed pro rata to the holders of the FNFV Group common stock (the “spin-off”). |

The Contribution. FNF currently indirectly owns Old Remy common stock representing approximately 51.1% of the outstanding shares of Old Remy, as well as all of the outstanding units in Imaging. In order to effect the spin-off of these interests to FNFV Group stockholders, FNF will cause these interests to be contributed to New Remy prior to

2

the spin-off in exchange for all of the shares of New Remy common stock. As a result, following the contribution, New Remy will own all of the shares of Old Remy common stock beneficially owned by FNF and the Imaging business.

The Spin-Off. Immediately prior to the mergers, FNF will distribute all of the shares of New Remy common stock held by FNF on a pro rata basis to all of the holders of FNFV Group common stock. Each share of FNFV Group common stock outstanding on the record date for the spin-off will entitle its holder to receive one share of New Remy common stock. FNF has not yet set the record date for the spin-off. FNF will publicly announce the record date when it has been determined, which will be prior to completion of the spin-off and the mergers. The distribution of shares will be made to a third party exchange agent in book-entry form for the benefit of the holders of the FNFV Group common stock. After giving effect to the restructuring, New Remy, which will be 100% owned by holders of the FNFV Group common stock, will own all of the Old Remy common stock beneficially owned by FNF prior to the restructuring and all of the outstanding units in Imaging. Immediately thereafter, each share of New Remy common stock will be converted into a right to receive a number of shares of New Holdco common stock. See “-The Mergers” below.

The Mergers (see page 30)

Upon satisfaction or waiver of each of the conditions to the merger agreement and immediately after the spin-off, Merger Sub One will merge with and into New Remy (the “New Remy merger”). In the New Remy merger, each outstanding share of New Remy common stock (other than shares owned by New Remy) will be exchanged for a number of shares of New Holdco common stock equal to the quotient of (i) the sum of (A) 16,342,508 (the number of shares of Old Remy common stock currently beneficially owned by FNF) and (B) 272,851 (the number of shares of New Holdco to be issued in respect of the contribution of Imaging), divided by (ii) the number of outstanding New Remy shares as of the effective time of the New Remy merger, rounded to the nearest five decimal places and subject to adjustment for the payment of cash in lieu of fractional shares.

Upon satisfaction or waiver of each of the conditions to the merger agreement and immediately following the New Remy merger, Merger Sub Two will merge with and into Old Remy (the “Old Remy merger”, and together with the New Remy merger, the “mergers”). In the Old Remy merger, each outstanding share of Old Remy common stock (other than shares owned by Old Remy and New Remy) will be exchanged for one share of New Holdco common stock.

Conditions to Completion of the Transactions (see page 42)

Consummation of the mergers is subject to the satisfaction of certain conditions, including, among others:

• | consummation of the restructuring, including the spin-off, in accordance with the reorganization agreement; |

• | the obtaining of the requisite approval by the Old Remy stockholders; |

• | the receipt of required regulatory approvals and third party consents; |

• | the SEC declaring effective the registration statement of New Remy on Form S-1, of which this prospectus forms a part, in connection with the spin-off and the registration statement of New Holdco on Form S-4; |

• | the shares of New Holdco common stock deliverable to certain stockholders of New Remy and Old Remy having been approved for listing on NASDAQ; |

• | each party’s compliance in all material respects with its obligations under the merger agreement; |

• | no event or circumstance shall have occurred that has or would reasonably have a “material adverse effect” on New Remy or Old Remy; and |

• | receipt of a tax opinion from Willkie Farr & Gallagher LLP to the effect that the mergers will be treated for federal income tax purpose as a tax-free exchange described in section 351 of the Code and a tax opinion from Deloitte Tax LLP to the effect that the New Remy Merger will qualify as a tax-free reorganization under Section 368 of the Code. |

3

Termination (see page 44)

The merger agreement may be terminated:

• | by mutual consent of the parties; |

• | by any of the parties if the merger has not been completed by March 7, 2015, subject to certain extension rights; |

• | by any of the parties if the merger is enjoined; |

• | by any of the parties if the Old Remy stockholder approval is not obtained; |

• | by Old Remy, on the one hand, and New Remy, on the other hand, upon an incurable material breach of the merger agreement by the other party or parties; or |

• | by New Remy if the Old Remy board withdraws or modifies its recommendation of the mergers to the Old Remy stockholders. |

FNF’s Reasons for the Transactions (see page 30)

In the course of reaching its decision to approve and declare advisable the merger agreement, the reorganization agreement and the transactions contemplated thereby, the FNF board of directors considered a number of factors in its deliberations. Those factors are described in “The Transactions--FNF’s Reasons for the Transactions”.

Accounting Treatment (see page 33)

FNF originally acquired approximately 47% of the common stock of Old Remy upon Old Remy’s emergence from bankruptcy in 2007. In the third quarter of 2012, FNF acquired additional shares of Old Remy, bringing its total ownership to approximately 51.1%, and began to consolidate Old Remy in its financial statements. At the time FNF began to consolidate Old Remy, FNF applied purchase accounting to record the then-fair value of the assets and liabilities of Old Remy, and recorded the amount that the fair value of Old Remy exceeded the fair value of the identified assets and liabilities at that date as goodwill. As FNF owned less than 80% of Old Remy, however, Old Remy did not apply push-down accounting in accordance with U.S. generally accepted accounting principles (“US GAAP”) for business combinations. Therefore, FNF reports different income statement and balance sheet amounts for Old Remy than Old Remy itself does in its stand-alone financial statements for periods after August 14, 2012. Among other things, FNF’s reported earnings from continuing operations for Old Remy for such periods are lower than Old Remy’s reported amounts, primarily because of increased amortization expense for intangibles recorded at fair value in FNF’s purchase accounting.

Under US GAAP accounting rules on the treatment of transactions occurring within controlled groups, FNF’s basis of accounting for Old Remy is the basis on which New Holdco will present Old Remy in its financial statements following the transactions. This basis of accounting is reflected in the audited annual and unaudited interim combined financial statements of Remy International, Inc. and Fidelity National Technology Imaging, LLC included in this prospectus commencing on page F-1. After the transactions, these financial statements (which are referred to herein as the “Annual Audited Financial Statements” and the “Interim Unaudited Financial Statements,” respectively) will be the historical financial statements of the predecessor of New Holdco for periods prior to the mergers. For periods after the closing of the transactions, items relating to stockholders’ equity will be adjusted for shares issued in the mergers. Accordingly, readers of this prospectus should not place undue weight on the audited and unaudited financial statements and other financial information of Old Remy as prepared on its historical basis of accounting which are included or incorporated by reference in this prospectus for periods following August 14, 2012. It should be noted, however, that this change in the basis of accounting for Old Remy does not change the amount of cash generated by its operations, and the US GAAP cash flow from operations reported by New Holdco for Old Remy following the mergers will be the same as Old Remy would have reported.

4

Certain Material U.S. Federal Income Tax Consequences of the Transactions (see page 135)

The Spin-off

The spin-off is conditioned upon the receipt by FNF of the opinion of Deloitte, tax advisor to FNF, to the effect that the contribution and the spin-off should qualify as a tax-free reorganization under Sections 368(a) and 355 of the Code and a distribution to which Sections 355 and 361 of the Code applies. Accordingly, FNF and holders of FNFV Group common stock generally should recognize no gain or loss with respect to the spin-off. The opinion will be based upon various factual representations and assumptions, as well as certain undertakings made by FNF, New Remy, and Old Remy. Any inaccuracy in the representations or assumptions upon which such tax opinion is based, or failure by FNF, New Remy, or Old Remy to comply with any undertakings made in connection with such tax opinion, could alter the conclusions reached in such opinion. Opinions with respect to these matters are not binding on the IRS or the courts. As a result, the conclusions expressed in these opinions could be challenged by the IRS and a court could sustain such a challenge. You should note that FNF does not intend to seek a ruling from the IRS as to the U.S. federal income tax treatment of the spin-off.

If, notwithstanding the receipt of an opinion of Deloitte, the spin-off was determined to be a taxable transaction, each holder of FNFV Group common stock who receives shares of New Remy common stock in the spin-off would generally be treated as receiving a taxable distribution in an amount equal to the total fair market value of such shares of New Remy common stock. In general, the distribution would be taxable as a dividend to the extent of FNF’s current and accumulated earnings and profits. Any amount of the distribution in excess of FNF's earnings and profits would be treated first as a non-taxable return of capital to the extent of the holder's tax basis in its shares of FNFV Group common stock, with any remaining amount taxed as gain from the sale or exchange of the FNFV Group common stock. FNF would generally recognize taxable gain equal to the excess of the fair market value of the shares of New Remy common stock distributed by FNF in the spin-off over FNF’s tax basis in such stock.

For further information concerning the U.S. federal income tax consequences of the spin-off, see “Material U.S. Federal Income Tax Consequences of the Transactions--The Spin-Off.”

The Mergers

A U.S. holder who exchanges Old Remy common stock or New Remy common stock for New Holdco common stock will not recognize any gain or loss, for United States federal income tax purposes, upon the exchange, except for gain or loss with respect to cash received in lieu of New Holdco fractional shares. Such holder will have a tax basis in the New Holdco common stock received equal to the tax basis of the Old Remy common stock or New Remy common stock surrendered therefor, reduced by any tax basis allocable to the fractional share interests in New Holdco stock for which cash is received, provided either that the Old Remy common stock or New Remy common stock exchanged does not have a tax basis that exceeds its fair market value or, if it does, that a certain election to reduce the tax basis of the New Holdco common stock received to its fair market value is not made. The holding period for the New Holdco common stock received will include the holding period for the Old Remy common stock or New Remy common stock surrendered therefor.

Board of Directors and Management of New Holdco (see page 99)

The directors of New Holdco following the mergers will consist of the following six members: John H. Weber and George P. Scanlon, each of whom shall have a term expiring in 2015, Lawrence F. Hagenbuch and J. Norman Stout, each of whom shall have a term expiring in 2016, and Douglas K. Ammerman and John J. Pittas, each of whom shall have a term expiring in 2017. With the exception of Mr. Pittas, who is the Chief Executive Officer of Old Remy, all of the directors of New Holdco were directors of Old Remy immediately prior to the mergers. See “Management of New Holdco Following the Transactions--Board of Directors”.

The executive officers of Old Remy immediately prior to the effective time of the Old Remy merger will be the initial executive officers of New Holdco, with the exception of Michael L. Gravelle, who prior to the Old Remy merger served as Senior Vice President, General Counsel and Corporate Secretary to Old Remy. Mr. Gravelle will cease to act in his capacity as Senior Vice President and General Counsel of Old Remy following the mergers but will continue as Corporate Secretary on a transitional basis. See “Management of New Holdco Following the Transactions--Management”.

5

Name Change; Listing (see page 34)

Shares of New Holdco will be traded on the NASDAQ Global Select Market under the trading symbol “REMY”. Immediately following the completion of the transactions, the name of New Holdco will be changed to “Remy International, Inc.”

Interests of Certain Persons in the Old Remy Merger (see page 31)

You should be aware that some of the directors and officers of Old Remy have interests in the Old Remy merger that may be in addition to or differ from those of Old Remy’s stockholders, including, but not limited to:

• | except as discussed above, the continued employment of Old Remy’s executive officers as New Holdco’s executive officers and the continued service of Old Remy’s directors as directors of New Holdco; |

• | the indemnification of officers and directors of Old Remy by New Holdco for their services as such up to the time of the consummation of the mergers; |

• | the fact that certain directors and officers of Old Remy are also directors and current or former officers of FNF, which currently beneficially owns approximately 51.1% of the outstanding common stock of Old Remy; and |

• | the treatment of certain of the Old Remy equity awards held by certain directors of Old Remy in the mergers (including the acceleration and survival of such equity awards). |

6

SUMMARY HISTORICAL COMBINED FINANCIAL DATA

The following table consists of the results of operations and financial position of Remy International, Inc. ("Old Remy"), for all periods prior to August 14, 2012, which is the date that FNF obtained control of Old Remy. Financial information presented prior to August 14, 2012 is defined as being of the "Predecessor." The results of operations and financial position of Old Remy on FNF's basis of accounting combined with the results of operations and financial position of Imaging, are presented for periods subsequent to August 14, 2012. Financial information presented subsequent to August 14, 2012 is defined as being of the "Successor." Collectively, these entities constitute the predecessor to New Remy and New Holdco. We have not presented historical information for New Remy or New Holdco because these entities have not had any corporate activity since their formation other than the issuance of shares of common stock in connection with their initial capitalization. This information should be read in conjunction with the Annual Audited Financial Statements and the related notes thereto and the Interim Unaudited Financial Statements and the related notes thereto and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus. The information as of December 31, 2013 and 2012 and for the years ended December 31, 2013, 2012 and 2011 has been derived from the Annual Audited Financial Statements included in this prospectus. The information as of December 31, 2011, 2010 and 2009 and for the years ended December 31, 2010 and 2009 has been derived from Old Remy’s audited consolidated financial statements not included or incorporated by reference in this prospectus.

The summary unaudited combined financial information as of and for each of the nine month periods ended September 30, 2014 and 2013 are derived from the Interim Unaudited Financial Statements included in this prospectus. Such financial statements include all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of the results of the unaudited periods. You should not rely on these interim results as being indicative of the results New Holdco may expect for the full year or any other interim period.

The following information is divided into information for the Successor and Predecessor periods. As used in the table below:

• | The “Successor” represents the combined financial position as of September 30, 2014, December 31, 2013 and 2012, and the combined results of operations for the nine months ended September 30, 2014 and 2013, the year ended December 31, 2013, and the period from August 15, 2012 through December 31, 2012, of Old Remy and Imaging. These periods reflect the application of purchase accounting to the assets and liabilities of Old Remy as of August 14, 2012, as described further in Note 2 to the Annual Audited Financial Statements, relating to FNF’s acquisition of a controlling interest in Old Remy. |

• | The Predecessor represents the consolidated financial position and results of operations of Old Remy as previously reported for all periods prior to August 14, 2012. This presentation is on Old Remy’s historical basis of accounting without the application of purchase accounting related to FNF’s acquisition of a controlling interest in Old Remy. |

Historical results are not necessarily indicative of the results to be obtained in the future.

7

Successor | Predecessor | |||||||||||||||||||||||||

Nine months ended September 30, | Year ended December 31, | Period August 15 to December 31, | Period January 1 to August 14, | Years ended December 31, | ||||||||||||||||||||||

(in thousands, except per share data) | 2014 | 2013 | 2013 | 2012 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||||

Combined and Consolidated Statements of Operations Data: | ||||||||||||||||||||||||||

Net sales | $ | 900,896 | $ | 842,960 | $ | 1,140,183 | $ | 416,317 | $ | 723,278 | $ | 1,194,953 | $ | 1,103,799 | $ | 910,745 | ||||||||||

Cost of goods sold | 780,954 | 711,048 | 954,402 | 348,176 | 574,639 | 925,052 | 866,761 | 720,723 | ||||||||||||||||||

Gross profit | 119,942 | 131,912 | 185,781 | 68,141 | 148,639 | 269,901 | 237,038 | 190,022 | ||||||||||||||||||

Selling, general and administrative expenses | 103,854 | 103,002 | 135,237 | 45,655 | 84,284 | 139,685 | 127,405 | 101,827 | ||||||||||||||||||

Intangible asset impairment charges | — | — | — | — | — | 5,600 | — | 4,000 | ||||||||||||||||||

Restructuring and other charges | 2,605 | 4,263 | 4,066 | 1,699 | 6,013 | 3,572 | 3,963 | 7,583 | ||||||||||||||||||

Operating income | 13,483 | 24,647 | 46,478 | 20,787 | 58,342 | 121,044 | 105,670 | 76,612 | ||||||||||||||||||

Interest expense-net | 15,041 | 14,698 | 18,978 | 9,529 | 17,473 | 30,900 | 46,739 | 49,534 | ||||||||||||||||||

Loss on extinguishment of debt and refinancing fees | — | 2,737 | 2,737 | — | — | — | 19,403 | — | ||||||||||||||||||

Income (loss) before income taxes | (1,558 | ) | 7,212 | 24,763 | 11,258 | 40,869 | 90,144 | 39,528 | 27,078 | |||||||||||||||||

Income tax expense (benefit) | 4,064 | 2,959 | 8,959 | 2,854 | (72,982 | ) | 14,813 | 18,337 | 13,018 | |||||||||||||||||

Net income (loss) | (5,622 | ) | 4,253 | 15,804 | 8,404 | 113,851 | 75,331 | 21,191 | 14,060 | |||||||||||||||||

Less: Net income attributable to noncontrolling interest | — | 659 | 659 | 1,112 | 1,662 | 3,445 | 4,273 | 3,272 | ||||||||||||||||||

Net income (loss) attributable to combined entities | $ | (5,622 | ) | $ | 3,594 | $ | 15,145 | $ | 7,292 | 112,189 | 71,886 | 16,918 | 10,788 | |||||||||||||

Preferred stock dividends | — | (2,114 | ) | (30,571 | ) | (25,581 | ) | |||||||||||||||||||

Loss on extinguishment of preferred stock | — | (7,572 | ) | — | — | |||||||||||||||||||||

Net income (loss) attributable to common stockholders | $ | 112,189 | $ | 62,200 | $ | (13,653 | ) | $ | (14,793 | ) | ||||||||||||||||

Basic earnings (loss) per share: (1) | ||||||||||||||||||||||||||

Earnings (loss) per share | $ | 3.67 | $ | 2.14 | $ | (1.33 | ) | $ | (1.46 | ) | ||||||||||||||||

Weighted average shares outstanding | 30,589 | 29,096 | 10,278 | 10,130 | ||||||||||||||||||||||

Diluted earnings (loss) per share: (1) | ||||||||||||||||||||||||||

Earnings (loss) per share | $ | 3.63 | $ | 2.10 | $ | (1.33 | ) | $ | (1.46 | ) | ||||||||||||||||

Weighted average shares outstanding | 30,939 | 29,674 | 10,278 | 10,130 | ||||||||||||||||||||||

Dividends declared per common share | $ | 0.20 | $ | — | $ | — | $ | — | ||||||||||||||||||

(1) No per share activity is included for the Successor period because the transactions have not occurred and New Remy and New Holdco have not issued any shares of stock other than in connection with their initial capitalization. For pro forma per share information, see "Unaudited Pro Forma Condensed Combined Financial Information".

8

Successor | Predecessor | ||||||||||||||||||||

As of September 30, | As of December 31, | As of December 31, | |||||||||||||||||||

(in thousands) | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||

Combined and Consolidated Balance Sheet Data: | |||||||||||||||||||||

Cash and cash equivalents | $ | 62,328 | $ | 114,884 | $ | 111,733 | $ | 91,684 | $ | 37,514 | $ | 30,171 | |||||||||

Working capital | 223,889 | 252,658 | 231,783 | 139,567 | 81,762 | 72,723 | |||||||||||||||

Total assets | 1,348,489 | 1,317,846 | 1,321,994 | 1,029,519 | 969,156 | 927,255 | |||||||||||||||

Long-term debt, net of current maturities | 313,168 | 295,401 | 286,912 | 286,680 | 317,769 | 337,905 | |||||||||||||||

Accrued pension benefits, net of current portion | 16,823 | 19,103 | 31,762 | 31,060 | 21,002 | 17,816 | |||||||||||||||

Total equity | 602,968 | 615,588 | 617,858 | 317,344 | 77,473 | 82,988 | |||||||||||||||

9

RISK FACTORS

You should consider carefully the following risks or investment considerations related to the transactions, in addition to the other information in this prospectus. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business. If any of the following risks actually occur, our business could be adversely affected.

Risks Relating to the Transactions

Officers and directors of Old Remy have certain interests in the Old Remy merger that are different from, or in addition to, the interests of Old Remy stockholders. These interests may be perceived to have affected their decision to support or approve the Old Remy merger.

Old Remy officers and directors have certain interests in the mergers that are different from, or in addition to, interests of stockholders of Old Remy. These interests include, but are not limited to:

• | the continued employment of substantially all of Old Remy’s executive officers as New Holdco’s executive officers and the continued service of certain of Old Remy’s directors as directors of New Holdco; |

• | the indemnification of officers and directors of Old Remy by New Holdco for their services as such up to the time of the consummation of the mergers; |

• | the fact that certain directors and officers of Old Remy are also directors and current or former officers of FNF, which currently beneficially owns approximately 51.1% of the outstanding common stock of Old Remy; and |

• | the treatment of certain of the Old Remy equity awards held by certain directors of Old Remy in the mergers (including the acceleration and survival of such equity awards). |

See “The Transactions--Interests of Certain Persons in the Transactions.”

As a result of the accounting treatment for the mergers, New Holdco’s reported GAAP net earnings after the mergers will be significantly lower than Old Remy’s would have been, which could impact the market price of New Holdco common stock.

Under GAAP, New Holdco’s basis of accounting will be the same as that presented in the Annual Audited Financial Statements. This basis of accounting differs from that historically used by Old Remy, because under GAAP FNF was required to record the assets and liabilities of Old Remy at fair value as of August 14, 2012, the date that FNF acquired a majority of Old Remy’s common stock. These adjustments have no effect on the amount of cash generated by the operations of Old Remy, and the amount of cash flow from operations reported by New Holdco from the operations of Old Remy will be the same as Old Remy would have reported. However, the negative impact of such adjustments on New Holdco’s GAAP net earnings after the mergers could have an adverse effect on the market price of New Holdco’s common stock.

If holders of FNFV Group common stock who receive New Holdco common stock in the transactions sell that stock immediately, it could cause a decline in the market price of New Holdco common stock.

All of the shares of New Holdco common stock to be issued in the transactions will be registered with the SEC under the registration statement of which this prospectus is a part, and therefore will be immediately available for resale in the public market, except with respect to shares issued in the transactions to certain affiliates (as that term is defined in Rule 405 of the Securities Act). The number of holders of New Holdco common stock immediately after the mergers will be substantially larger than the current number of holders of Old Remy common stock. Holders of FNFV Group common stock who are not directors, officers or affiliates of FNF may elect to sell the New Holdco shares they receive immediately after the transactions. Directors, officers and other affiliates of FNF may immediately resell the New Holdco shares they receive under Rule 144 of the Securities Act under certain conditions, one of which limits the amount of shares to the greater of 1% of the outstanding shares or the average weekly volume of trading of New Holdco stock for the four weeks prior to their proposed sale. As a result of future sales of such common stock, or the perception that these sales could occur, the market price of New Holdco common stock may decline and could decline

10

significantly before or at the time the transactions are completed, or immediately thereafter. If this occurs, or if other holders of New Holdco common stock sell significant amounts of New Holdco common stock immediately after the transactions are completed, it is likely that these sales would cause a decline in the market price of New Holdco common stock.

The spin-off could result in significant tax liability to FNF and to holders of FNFV Group common stock, and under certain circumstances New Holdco may have a significant indemnity obligation to FNF, which is not limited in amount or subject to any cap, if the spin-off is treated as a taxable transaction.

The spin-off is conditioned upon the receipt by FNF of the opinion of Deloitte, tax advisor to FNF, to the effect that the contribution and the spin-off should qualify as a tax-free reorganization under Sections 368(a) and 355 of the Code and a distribution to which Sections 355 and 361 of the Code applies. The opinion will be based upon various factual representations and assumptions, as well as certain undertakings made by FNF, New Remy, and Old Remy. Any inaccuracy in the representations or assumptions upon which such tax opinion is based, or failure by FNF, New Remy, or Old Remy to comply with any undertakings made in connection with such tax opinion, could alter the conclusions reached in such opinion. Opinions with respect to these matters are not binding on the IRS or the courts. As a result, the conclusions expressed in these opinions could be challenged by the IRS and a court could sustain such a challenge.

Even if the spin-off otherwise qualifies for tax-free treatment under Sections 355, 361 and 368 of the Code, the spin-off would result in a significant U.S. federal income tax liability to FNF (but not to holders of FNFV Group common stock) under Section 355(e) of the Code if one or more persons acquire a 50% or greater interest (measured by vote or value) in the stock of New Remy (including indirectly through acquisitions of New Holdco common stock) as part of a plan or series of related transactions that includes the spin-off. Current law generally creates a presumption that any acquisitions of the stock of New Remy within two years before or after the spin-off are part of a plan that includes the spin-off, although the parties may be able to rebut that presumption. The process for determining whether an acquisition is part of a plan under these rules is complex, inherently factual and subject to interpretation of the facts and circumstances of a particular case. New Remy does not expect that the mergers, by themselves, will cause Section 355(e) to apply to the spin-off. Further, it will be a condition to FNF’s obligations to consummate the spin-off that FNF receive an opinion of Deloitte implicitly concluding that the mergers should not cause Section 355(e) to apply to the spin-off. This opinion will be based on certain representations and assumptions, and, as discussed above, will not be binding on the IRS or the courts. Further, notwithstanding such opinion, New Remy or New Holdco might inadvertently cause or permit a prohibited change in the ownership of New Remy or New Holdco to occur, thereby triggering a tax liability to FNF. If the spin-off is determined to be taxable to FNF, FNF would recognize gain equal to the excess of the fair market value of the New Remy common stock held by it immediately before the spin-off over FNF's tax basis therein. Open market purchases of New Holdco common stock by third parties without any negotiation with New Holdco will generally not cause Section 355(e) of the Code to apply to the spin-off.

If it is subsequently determined, for whatever reason, that the spin-off does not qualify for tax-free treatment, holders of FNFV Group common stock immediately prior to the spin-off and/or FNF could incur significant tax liabilities. Under the tax matters agreement, New Holdco will be obligated to indemnify FNF and its subsidiaries for any losses and taxes resulting from the failure of the spin-off to be a tax-free transaction described under Sections 355, 361 and 368 of the Code to the extent that such failure results from (i) any action by New Holdco or its subsidiaries within their respective control, or the failure to take any action; or (ii) any event or series of events as a result of which any person or persons would (directly or indirectly) acquire or have the right to acquire from New Holdco or New Remy and/or one or more direct or indirect holders of outstanding shares of New Holdco equity interests or New Remy equity interests that would, when combined with any other changes in the ownership of New Remy or New Holdco, cause the spin-off to be a taxable event to FNF as a result of the application of Section 355(e) of the Code.

New Holdco may decide to forgo certain transactions in order to avoid the risk of incurring significant tax related liabilities.

In the tax matters agreement, New Holdco will covenant that following the mergers it will not take any action, or fail to take any action, which action or failure to act is inconsistent with the spin-off qualifying for tax-free treatment under Sections 355, 361 and 368 of the Code. Further, the tax matters agreement will require that New Holdco generally indemnify FNF and its subsidiaries for any taxes or losses incurred by FNF resulting from an action or inaction on the part of New Holdco and/or its subsidiaries or resulting from Section 355(e) of the Code applying to the spin-off because of certain acquisitions of equity interests in New Holdco or New Remy. As a result, New Holdco might determine to forgo certain transactions that might have otherwise been advantageous in order to preserve the tax-free treatment

11

of the spin-off. Open market purchases of New Holdco common stock by third parties without any negotiation with New Holdco will generally not cause Section 355(e) of the Code to apply to the spin-off.

In particular, New Holdco might determine to continue to operate certain of its business operations for the foreseeable future even if a liquidation or sale of such business might have otherwise been advantageous. Moreover, in light of the mergers as well as certain other transactions that might be treated as part of a plan that includes the spin-off for Section 355(e) purposes (as discussed above), New Holdco might determine to forgo certain transactions, including share repurchases, stock issuances, asset dispositions or other strategic transactions for some period of time following the mergers.

Risks Relating to New Holdco’s Business after the Mergers

The following risks will apply to the business of New Holdco upon completion of the mergers.

General economic conditions may have an adverse effect on our business, financial condition and results of operations.

The recent global financial crisis has impacted our business and our customers' businesses in the United States and globally. During 2009, the United States experienced its lowest light vehicle production rate in over 25 years, and commercial vehicle production declined by 38%. Since 2009, U.S. vehicle production has improved, but is still less than the average for the period during 2000 to 2007. The light and commercial vehicle industries in Europe and Asia faced similar trends. Continued weakness or deteriorating conditions in the U.S. or global economy that result in reduction of vehicle production and sales by our customers may harm our business, financial condition and results of operations. Additionally, in a down-cycle economic environment, we may experience increased competitive pricing pressure and customer turnover.

Deteriorating economic conditions impact driving habits of both consumers and commercial operators, leading to a reduction in miles driven. If total miles driven decreases, demand for our aftermarket products could decline due to a reduction in the need for replacement parts.

Difficult economic conditions may cause changes to the business models, products, financial condition, consumer financing and rebate programs of the OEMs. This could reduce the number of vehicles produced and purchased, which would, in turn, reduce the demand for both our OEM and aftermarket products. Our contracts do not require our customers to purchase any minimum volume of our products.

Recent economic conditions have generally increased the availability of capital and decreased the cost of financing. If we, our customers or our suppliers experience a material tightening in the availability of credit, it could adversely affect us. Among other possible effects, we may have to pay suppliers in advance or on short credit terms, which would harm our liquidity or lead to production interruptions.

Risks specific to the light and commercial vehicle industries will affect our business.

Our operations, and, in particular, our original equipment, or OE, business, are inherently cyclical and depend on many industry-specific factors such as:

• | credit availability and interest rates; |

• | fuel prices and availability; |

• | consumer confidence, spending and preference; |

• | costs related to environmental hazards; |

• | governmental incentives; and |

• | political volatility. |

Our business may also be adversely affected by regulatory requirements, trade agreements, our customers' labor relations issues, reduced demand for our customers' product programs that we currently support, the receipt of sales

12

orders for new or redesigned products that replace our current product programs and other factors. The current political environment has led, and may lead in the future, to further federal, state and local government budget cuts. Old Remy has in the past received governmental grants that benefit our industry. A significant adverse change in any of these factors may reduce automotive production and sales by our customers, which would materially harm our business, financial condition and results of operations.

Inventory levels and our OE customers' production levels also affect our OE sales. We cannot predict when our customers either increase or reduce inventory levels. This may result in variability in our sales and financial condition. Uncertainty regarding inventory levels may be exacerbated by our customers or governments initiating or terminating consumer financing programs.

Longer useful product life of parts may reduce aftermarket demand for some of our products.

In 2012 and 2013, roughly half of Old Remy’s net sales were to aftermarket customers. The average useful life of automotive parts has been steadily increasing in recent years due to improved quality and innovations in products and technologies. The longer product lives allow vehicle owners to replace parts of their vehicles less often. Additional increases in the average useful life of automotive parts are likely to reduce the demand for our aftermarket products, which could materially harm our business, financial condition and results of operations.

We may incur material losses and costs as a result of product liability and warranty claims, litigation and other disputes and claims.

We are exposed to warranty and product liability claims if our products fail to perform as expected. Old Remy has in the past been, and we may in the future be, required to participate in a recall of those products. If public safety concerns are raised, we may have to participate in a recall even if our products are ultimately found not to be defective. Vehicle manufacturers have experienced increasing recall campaigns in recent years. Our customers and other OEMs are increasingly looking to us and other suppliers for contribution when faced with recalls and product liability claims. If our customers demand higher warranty-related cost recoveries, or if our products fail to perform as expected, our business, financial condition and results of operations could materially suffer.

We may also be exposed to product liability claims, warranty claims and damage to our reputation if our products (including the parts of our products produced by third-party suppliers) actually or allegedly fail to perform as expected or the use of our products results, or is alleged to result, in bodily injury or property damage. Recalls may also cause us to lose additional business from our customers. Material product defect issues may subject us to recalls of those products and restrictions on bidding on new customer programs. Old Remy has in the past incurred, and we could in the future incur, material warranty or product liability losses and costs to defend these claims.

Old Remy is also involved in various legal proceedings. See Note 21 of notes to the Annual Audited Financial Statements included elsewhere in this prospectus. There can be no assurance as to the ultimate outcome of any of these legal proceedings, and future legal proceedings may materially harm our business, financial condition and results of operations.

Changes in the cost and availability of raw materials and supplied components could harm our financial performance.

We purchase raw materials and component parts from outside sources. The availability and prices of raw materials and component parts may change due to, among other things, new laws or regulations, increased demand from the automotive sector and the broader economy, suppliers' allocations to other purchasers, interruptions in production by suppliers, changes in exchange rates and worldwide price levels. In recent years, market conditions have caused significant increases in the price of some raw materials and component parts and, in some cases, reductions in short-term availability. We are especially susceptible to changes in the price and availability of copper, aluminum, steel and certain rare earth magnets. The price of these materials has fluctuated significantly in recent years. An increase in the price of these materials, or a reduction in their supply, could harm our business.

Raw material price inflation and availability have placed significant operational and financial burdens on automotive suppliers at all levels, and are expected to continue for the foreseeable future. Our need to maintain a continuing supply of raw materials and components makes it difficult to resist price increases and surcharges imposed by our suppliers. Further, it is difficult to pass cost increases through to our customers, and, if passed through, recovery is typically delayed. Because the recognition of the cost/benefit and the price recovery/reduction do not occur in the same

13

period, the impact of a change in commodity cost is not necessarily offset by the change in sales price in the same period. Accordingly, a change in the supply of, or price for, raw materials and components could materially harm our business, financial condition and results of operations.

Disruptions in our or our customers' supply chain may harm our business.

We depend on a limited number of suppliers for certain key components and materials. In order to reduce costs, our industry has been rationalizing and consolidating its supply base. Suppliers may delay deliveries to us due to failures caused by production issues, and they may also deliver non-conforming products. Recently, several of Old Remy’s suppliers have ceased operations.

If one of our suppliers experiences a supply shortage or disruption, we may be unable to procure the components from another source to produce the affected products. The lack of a subcomponent necessary to manufacture one of our products could force us to cease production. Shortages and disruptions could be caused by many problems, such as closures of one of our suppliers' plants or critical manufacturing lines due to strikes, mechanical breakdowns, electrical outages, fires, explosions or political upheaval, or logistical complications due to weather, natural disasters, mechanical failures or delayed customs processing. Also, we and our suppliers deliver products on a just-in-time basis, which is designed to maintain low inventory levels but increases the risk of supply disruptions.

Products delivered by our suppliers may fail to meet quality standards. Potential quality issues could force us to halt deliveries while we revalidate the affected products. When deliveries are not timely, we have to absorb the cost of identifying and solving the problem, as well as expeditiously producing replacement components or products. We may also incur costs associated with “catching up,” such as overtime and premium freight. Our customers may halt or delay their production for the same reason if one of their suppliers fails to deliver necessary components. This may cause our customers to suspend their orders or instruct us to suspend delivery of our products, which may harm our business, financial condition and results of operations. In turn, if we cause a customer to halt production, the customer may seek to recoup its losses and expenses from us, which could be significant or include consequential losses.

Shortages of and volatility in the price of oil may materially harm our business, financial condition and results of operations.