Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LOCAL Corp | d827232d8k.htm |

Exhibit 99.1 |

2

Corporate

Overview

–

Q4

2014

Certain matters being discussed by Local Corporation’s management today include

forward looking statements which are made pursuant to the Safe Harbor provisions

of section 21-E of the Securities Exchange Act of 1934. Investors are cautioned that

statements which are not strictly historical statements, including statements

concerning future expected financial performance, management objectives and

plans for future operations, our relationships with strategic or other partners, the

release of new

products or services or enhancements to existing products or

services, our expectations regarding potential acquisitions and the future

performance of past acquisitions including our ability to realize expected synergies,

trends in the market for our current or planned products or services, and market

acceptance of our products or services, constitute forward looking statements. The

forward looking statements include, but are not limited to, any statements containing the words

“expect”, “anticipate”, “estimates”, “believes”, “should”, “could”

“may”, “possibly”, and similar expressions and the negatives thereof. These

forward looking statements involve a number of risks and uncertainties that could cause

actual results to differ materially from the forward looking statements. Those risks

and uncertainties are detailed in the company’s filings from time to time with the

Securities and Exchange Commission. The information contained in the forward

looking statements is provided as of the date of such oral statements and the

company disclaims any obligation to update such statements.

Adjusted EBITDA is defined as net income (loss) excluding: provision for income

taxes; interest and other income (expense), net; depreciation; amortization; stock-

based compensation charges; gain or loss on derivatives’ revaluation; net income

(loss) from discontinued operations; LEC receivables reserve; finance-related

charges; accrued lease liability/asset; severance charges; and an expense related

to a settlement accrual.

Adjusted EBITDA, as defined above, is not a measurement under GAAP. Adjusted

EBITDA is reconciled to net loss and loss per share, which we believe are the most

comparable GAAP measures, at the end of this presentation. Management believes

that Adjusted EBITDA provides useful information to investors about the company’s

performance because it eliminates the effects of period-to-period changes in

income from interest on the company’s cash and marketable securities, expense

from the company’s financing transactions and the costs associated with income

tax expense, capital investments, stock-based compensation expense, warrant

revaluation charges, and non-recurring charges which are not directly attributable to

the underlying performance of the company’s business operations. Management

uses Adjusted EBITDA in evaluating the overall performance of the company’s

business operations. A

limitation of non-GAAP Adjusted EBITDA is that it excludes items that often have a

material effect on the company’s net income and earnings per common share calculated in

accordance with GAAP. Therefore, management compensates for this limitation by using Adjusted

EBITDA in conjunction with GAAP net loss and loss per share measures. The company believes

that Adjusted EBITDA provides investors with an additional tool for evaluating the

company’s core performance, which management uses in its own evaluation of overall

performance, and as a base-line for assessing the future earnings potential of the

company. While the GAAP results are more complete, the company prefers to allow investors to

have this supplemental metric since, with reconciliation to GAAP (as noted above), it may

provide greater insight into the company’s financial results. The non-GAAP

measures should be viewed as a supplement to, and not as a substitute for, or

superior to, GAAP net income or earnings per share.

|

3

Our strategy

Corporate

Overview

–

Q4

2014

Reach

3B impressions

per month

Audience

226M consumers

Intent

Locally-focused

consumer search

Technology

Patented content &

localization engine

To aggregate and curate the most relevant

local content

for consumers and present it wherever and

however the consumer searches

for information while providing significant reach and value to our

advertisers and partners. |

•

Local Audience Network

•

Hosted Mobile Search

•

O&O Properties

•

Network

4

•

Mobile is the fastest growing

segment

of

search

&

mobile

local

ad revenues are projected to grow

>3X in 5 yr. to $15.7B in 2018*

•

Global

programmatic

digital

display ad spending is expected to

increase from $21B in 2014 to

$55B by 2018**

•

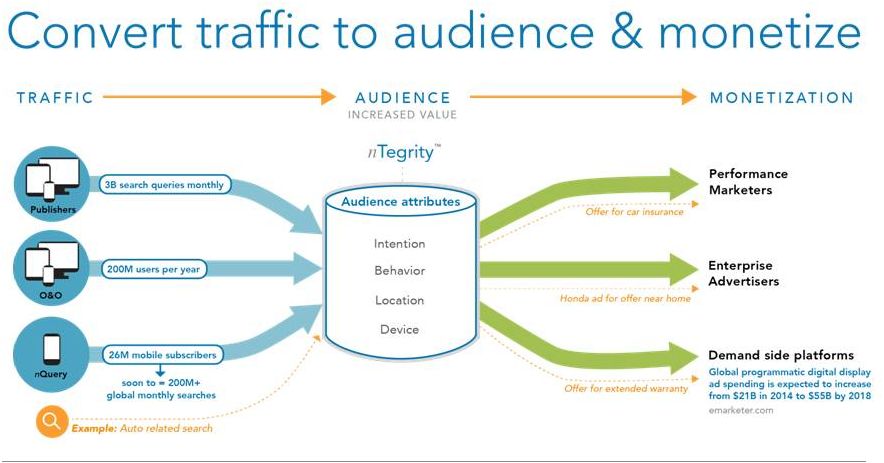

nQuery

™

–

hosted

local

search

opens up new enterprise

channels and markets

•

nTegrity

™

–

will

detect,

analyze

and

decide

the

best

delivery

of

content and ads

•

IP

–

Licensing

and

strategic

opportunities

•

Reduced debt by $4.5M

million during Q3

•

Took cost savings actions

during Q4 with expected

$2.6M

in annual savings

•

7 consecutive quarters

of positive adjusted EBITDA

growth

*BIA/Kelsey 2014

** emarketer.com

Corporate

Overview

–

Q4

2014

Market

opportunity is

growing

Diversified

revenue

streams

Innovation yields

competitive

advantages

Improving

financial

outlook |

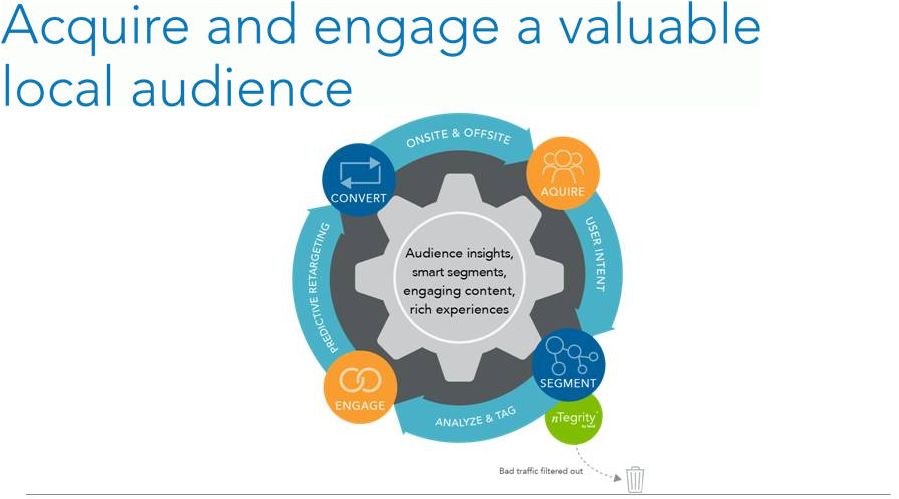

5

Given nPression Score

Visibility •

Authenticity •

Validity

226M high intent, local consumers annually

•

Desktop

•

Mobile

•

Apps

•

Carriers

•

WiFi

TM

Corporate

Overview

–

Q4

2014

•

Display

•

Video

•

Mobile

•

Search

•

Local.com

•

nQuery

•

nPress

•

Publisher Partner network |

6

An advanced technology that filters and scores

traffic based on a multitude of data, and in the

future will detect, analyze and decide the most

successful delivery of content and ads

Quality traffic based on:

nTegrity

Corporate

Overview

–

Q4

2014

Paid Search feed

served to qualified

audience |

7

Corporate

Overview

–

Q4

2014 |

8

Corporate

Overview

–

Q4

2014

1

2

3

Putting advertisers in front of a premium, high-intent local audience

Reaching valuable mobile consumers through search in North and

South America.

Quickly connect with the most receptive consumers though our

programmatic solution

Single

platform

to

reach

consumers

across

Local.com,

nPress, nQuery,

and publisher partner network

Integrate

organic

content

and

search

ads

into

our

mobile

search

platform

Providing

valuable

insights

through

our

local

audience

network |

9

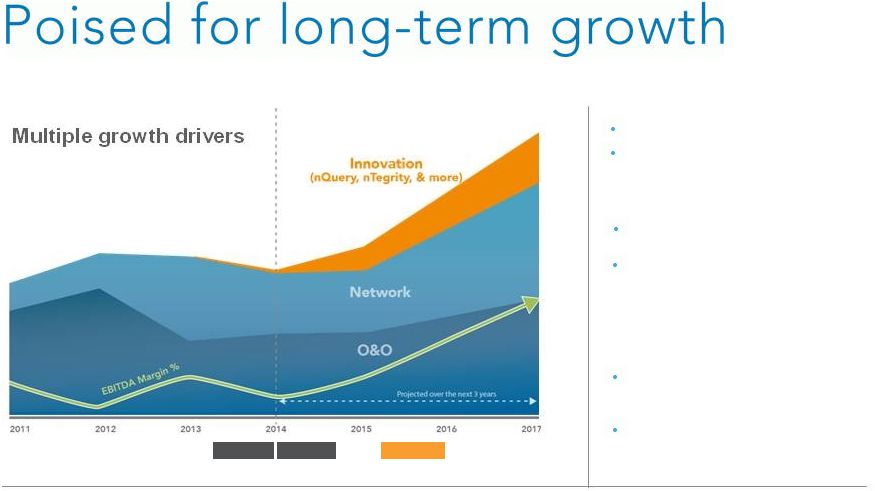

*Estimate

Note: See reconciliation of Adjusted EBITDA to GAAP net income at presentation

end Stabilize

Execute

GROW

Focusing on key initiatives

Expect expanding EBITDA

margin*

Scaling business

*Based on forecast from 2014 to 2017

Corporate

Overview

–

Q4

2014

Monetizing local audience and

growing mobile search

Realigned organization

Driving growth without significant

incremental cost

Leveraging existing technology

platform, core development team and

corporate infrastructure

Expect $2.6M in annual cost savings

and improved Adjusted EBITDA

profitability

Increasing revenue on more profitable

business lines |

Local Labs serves as a

digital technology lab and

incubator focused on

innovating the digital

ecosystem that converges

around the digital

consumer.

Local Labs

Business Model Target

10

Corporate

Overview

–

Q4

2014 |

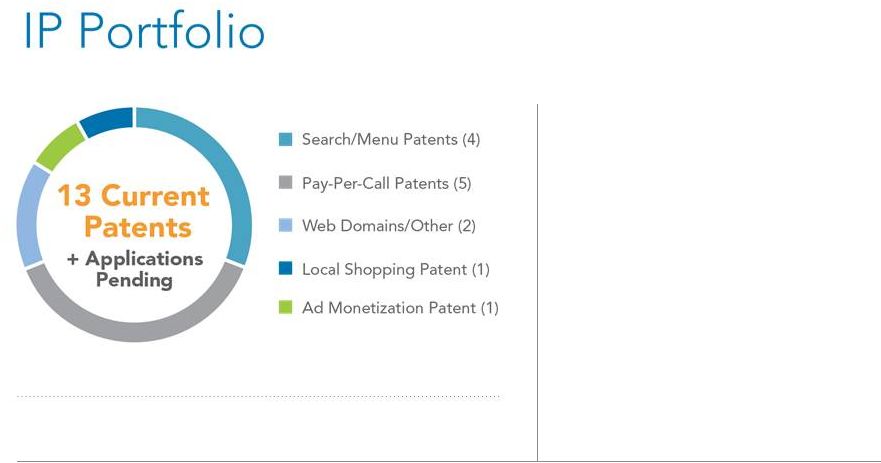

11

The patent descriptions herein do not constitute the legal opinion or advice of the

patent owner or their counsel. The reader is encouraged to seek the advice

of their own counsel regarding the scope

of any domestic or foreign patents.

Settlement reached

In September, the lawsuit against Fry's

Electronics regarding the infringement of Local's

U.S. patent 7062453, (‘453’) patent, which covers

messaging systems for dynamic networked

commerce architecture, was settled to the mutual

satisfaction of the parties and Fry's Electronics

agreed to license the patent.

Continuing our efforts

to enforce our intellectual property rights.

We believe we have the opportunity

for

strong monetization of our

proven patents.

Corporate

Overview

–

Q4

2014 |

|

13

Fred Thiel

Chairman of the Board & Chief Executive Officer

John M. Payne

Director

David M. Hughes

Director

Norman K. Farra, Jr.

Lead Director

Corporate

Overview

–

Q4

2014

Director since January 2013, chairman since May 2014

25+ years leading technology, data communications, Internet, Big

Data, digital media and software companies

Formerly CEO at GameSpy Industries and Lantronix (LTRX) and

executive at Triton Pacific Capital Partners, TechStarter Ventures

and Graham Partners

•

Director since August 2005

•

20+ years of strategic leadership experience and investment

banking

•

Aegis Capital, Corp., R.F. Lafferty & Co. Inc., Cresta Capital

Strategies, LLC, GunnAllen Financial Inc.

Director since June 2014

15+ years of executive leadership experience with specialties in

global digital marketing, SEO and SEM

CEO of The Search Agency, a global digital marketing company

United Online, Inc., Boston Consulting Group, Mercer Management

Consulting

Serving on boards of Spark Networks (NYSE: LOV), YPOLA & The

Huron University College Foundation USA

Director since August 2005 and lead independent director from

December 2005 to October 2011

30+ years of strategic leadership experience

Adjunct professor of marketing and strategy for the Executive MBA

Program at Pepperdine University, since 1998 and the University of

San Diego, since 2010

Serving currently as director of Lantronix, Inc. and was previously

director of ADC Telecommunication, Inc. and Primal Solutions, Inc.

John E. Rehfeld

Director

Director since June 2014

30+ years of experience leading public and private companies

specializing

in

early

stage

software

and

technology

companies

as

well

as significant IP licensing strategies

CEO of SimpleAir, Inc., an inventor-owned technology licensing

company with mobile interests and intellectual property assets

Stamps.com (NASDAQ: STMP), Day Software (SWX: DAYN), CEO of

10+ digital technology and enterprise security companies

Serving as MD Outset Ventures and as an advisory board member for

Digital Offering LLC. |

14

Q3 Highlights

Financials

Innovation

Corporate

Overview

–

Q4

2014

Total revenue of $18.1M,

O&O revenue up 31% y-o-y

Adjusted EBITDA $407K

Cash from operating activities of $3.0M

Reduced debt by $4.5M

RKV of $201, up from $180 in Q313

$4.3M in total cash and $4.3M in debt

as of Sept. 30

th

Announced annual cost savings actions of

approximately $2.6M

Updated 2014 guidance:

Revenue

$87M

-

$90M

Adjusted

EBITDA

$2.0M

-

$2.4M

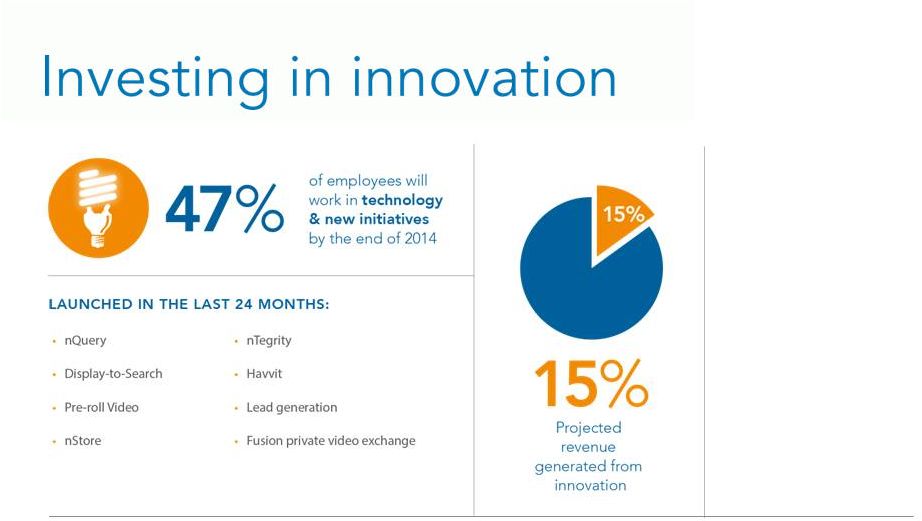

Expanding reach with the expected

launch of nQuery

TM

solution with a top

five global carrier

Launched our advanced traffic quality

solution nTegrity

TM

Building and monetizing our Local

audience with proprietary traffic quality

tools

Note: Since we cannot predict the valuation of the warrant liability and the conversion

option liability, we cannot reasonably project our GAAP net income (loss). We,

therefore, cannot provide GAAP guidance, but we do report GAAP results. An explanation of the Company’s use of Non-GAAP measures is set forth on Slide 12 |

Fred

Thiel Chairman & CEO

fred@local.com

Local

Corporation

|

7555

Irvine

Center

Drive

|

Irvine

CA

92618

|

949.784.0800

|

www.localcorporation.com

Ken Cragun

CFO

kcragun@local.com

15

Corporate

Overview

–

Q4

2014 |

16

Corporate

Overview

–

Q4

2014 |

17

•

Rich, relevant local content

•

500M annual searches

•

Growing mobile segments in local jobs,

coupons and apartment rentals

•

Most popular segments

>

Home services

>

Medical

>

Legal

>

Restaurant

Corporate

Overview

–

Q4

2014

•

Advertiser partner CTR >40% |

18

Corporate

Overview

–

Q4

2014

>

Chinese

>

Portuguese

>

Spanish

>

English

Several languages:

Biz Dev conversations open

with several global carriers

& MVNOs

Launching top 5 mobile

carrier in South America

~200M+ searches per

month

10M US smartphone

searches per month

26M mobile

subscribers activated |

19

•

Rich, relevant local content

•

100% organic audience

•

Traffic across all 50 states

•

50% mobile traffic and growing

•

Categories & performance similar

to Local.com

Featured partners include:

+ hundreds more

Corporate

Overview

–

Q4

2014 |

•

Hundreds of

publisher partner

sites

•

25M search queries

per day*

•

Traffic scored

through

nTegrity

TM

to

ensure it is a valid

impression

20

*As of November 2014

Corporate

Overview

–

Q4

2014 |

21

Corporate

Overview

–

Q4

2014 |

22

*Estimate

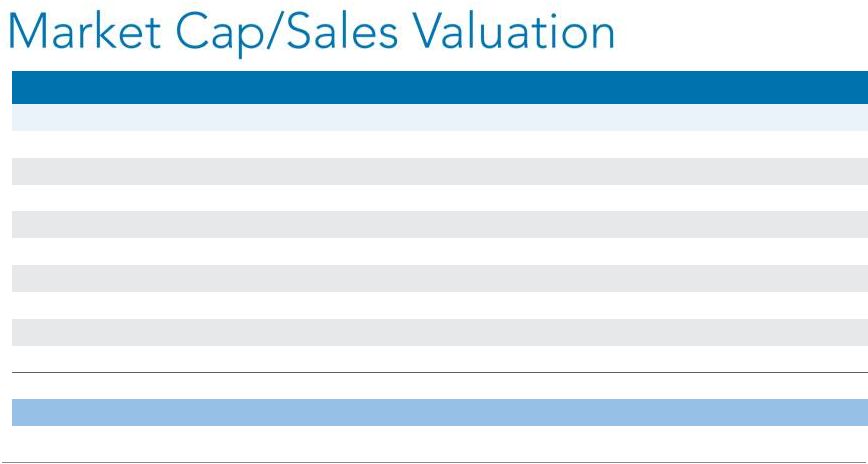

Company

Symbol

Price

Market Cap

(in millions)

2014E Sales

(in millions)

Market Cap/Sales

Blucora, Inc.

BCOR

$ 14.23

$ 570.7

$ 575.0

1.0

The Rubicon Project, Inc.

RUBI

$ 13.04

$ 451.4

$ 123.0

3.7

Angie's List, Inc.

ANGI

$ 5.96

$ 338.8

$ 314.0

1.1

Marchex, Inc.

MCHX

$ 3.58

$ 151.8

$ 177.0

0.9

Autobytel Inc.

ABTL

$ 10.74

$ 99.3

$ 106.0

0.9

Yelp, Inc.

YELP

$ 58.00

$ 4,183.0

$ 376.0

11.1

Travelzoo Inc.

TZOO

$ 12.72

$ 186.7

$ 145.0

1.3

XOXO Group Inc.

XOXO

$ 13.98

$ 354.6

$ 141.0

2.5

Demand Media

DMD

$ 5.68

$ 106.9

$ 168.0

0.6

Rocket Fuel Inc.

FUEL

$ 17.78

$ 726.3

$ 416.0

1.7

Average

2.5

Local Corporation

LOCM

$ 1.40

$ 32.0

$ 88.5

0.4

Corporate

Overview

–

Q4

2014 |

23

Corporate

Overview

–

Q4

2014

This document includes the non-GAAP financial measure of “Adjusted EBITDA” which

we define as net income (loss) excluding: provision for income taxes; interest and

other income (expense), net; depreciation; amortization; stock based compensation

charges; gain or loss on derivatives’ revaluation, net income (loss) from discontinued

operations; gain on sale of Rovion; impairment charges; LEC receivables reserve;

finance related charges; accrued lease liability/asset; and severance charges.

Adjusted EBITDA, as defined above, is not a measurement under GAAP. Adjusted

EBITDA is reconciled to net income (loss) which we believe is the most comparable

GAAP measure. A reconciliation of net income (loss) to Adjusted EBITDA is set forth

within this presentation.

Management believes that Adjusted EBITDA provides useful information to investors

about the company’s performance because it eliminates the effects of period-to-period

changes in income from interest on the company’s cash and marketable securities,

expense from the company’s financing transactions and the costs associated with

income tax expense, capital investments, stock-based compensation expense, LEC

receivables reserve, warrant revaluation charges; finance related charges; accrued

lease liability; and severance charges which are not directly attributable to the

underlying performance of the company’s business operations. Management uses

Adjusted EBITDA in evaluating the overall performance of the company’s business

operations.

A limitation of non-GAAP Adjusted EBITDA is that it excludes items that often have

a material effect on the company’s net income and earnings per common share

calculated in accordance with GAAP. Therefore, management compensates for this

limitation by using Adjusted EBITDA in conjunction with net income (loss) and net

income (loss) per share measures. The company believes that Adjusted EBITDA

provides investors with an additional tool for evaluating the company’s core

performance, which management uses in its own evaluation of overall performance,

and as a base-line for assessing the future earnings potential of the company.

While the GAAP results are more complete, the company prefers to allow investors

to have this supplemental metric since, with reconciliation to GAAP; it may provide

greater insight into the company’s financial results. The non-GAAP measures

should be viewed as a supplement to, and not as a substitute for, or superior to,

GAAP net income (loss) or earnings (loss) per share.

|

24

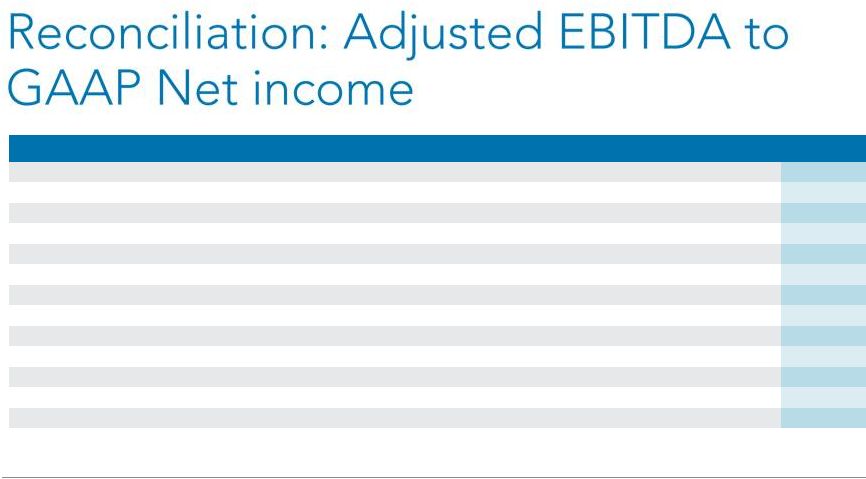

Description

FY-09

FY-10

FY-11

FY-12

FY-13

FY-14*

Adjusted EBITDA

$3,041

$13,775

$3,247

$777

$4,533

$2,200

Less interest and other income (expense), net

(27)

(275)

(413)

(425)

(2,321)

(2,100)

Less provision for income taxes

(158)

(102)

(178)

(111)

(139)

(100)

Less amortization of intangibles

(2,524)

(5,734)

(4,864)

(3,611)

(912)

(700)

Less depreciation

(734)

(1,418)

(3,182)

(3,658)

(3,896)

(4,000)

Less stock-based compensation

(2,364)

(2,911)

(3,442)

(2,533)

(1,619)

(800)

Less LEC receivable reserve

-

-

-

(1,407)

(1,721)

-

Less net loss from discontinued operations

-

-

(6,899)

(14,250)

(3,740)

-

Plus gain on sale of Rovion

-

-

-

1,458

-

-

Plus revaluation of warrants

(2,981)

887

2,633

202

1,100

-

Less Geo-Tag settlement

-

-

-

-

(550)

-

Less non-recurring charges

(520)

-

(1,461)

(684)

(1,108)

(1,800)

GAAP Net income (loss)

$(6,267)

$4,222

$(14,559)

$(24,242)

$(10,373)

$(7,300)

Note: Since we cannot predict the valuation of the warrant liability and the

conversion option liability, we cannot reasonably project our GAAP net income (loss).

*Midline of current guidance

Corporate

Overview

–

Q4

2014

We, therefore, cannot provide GAAP guidance, but we do report GAAP results. An

explanation of the Company’s use of Non-GAAP measures is set forth on Slide 12 |

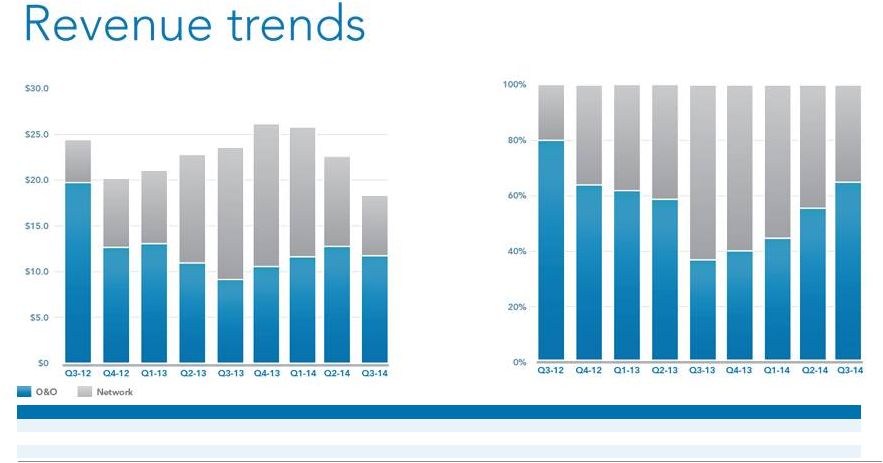

25

$ in Millions

Q3-12

Q4-12

Q1-13

Q2-13

Q3-13

Q4-13

Q1-14

Q2-14

Q3-14

Network

$ 5.0

$ 7.6

$ 8.3

$ 11.6

$ 14.5

$ 16.1

$ 14.8

$ 9.9

$ 6.4

O&O

$ 19.4

$ 12.9

$ 13.2

$ 11.1

$ 8.9

$ 10.7

$ 11.4

$ 12.6

$ 11.7

Consolidated Revenue

$ 24.4

$ 20.6

$ 21.5

$ 22.7

$ 23.5

$ 26.8

$ 26.2

$ 22.5

$ 18.1

Corporate

Overview

–

Q4

2014

% of Total Revenue by Business Unit

Quarterly Revenues by Business Unit

20%

80%

37%

63%

39%

61%

51%

49%

$5.0

$19.4

$7.6

$12.9

$8.3

$13.2

$11.6

$11.1

$14.5

$8.9

62%

38%

60%

40%

$16.1

$10.7

$24.4

$20.6

$21.5

$22.7

$23.5

$26.8

$14.8

$11.4

$26.2

56%

44%

$22.5

$9.9

$12.6

44%

56%

$18.1

$6.4

$11.7

36%

64% |