Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Mark One)

[ X ] Annual Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

For the Fiscal Year Ended April 30, 2014

[ ] Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from _______________ to _______________

Commission File Number: 000-54851

|

CANYON GOLD CORP.

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

Nevada

|

Not Applicable

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

4730 South Fort Apache Road, Suite 300, Las Vegas, Nevada 89147

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (888) 788-0986

101 Convention Center Dr, Suite. 700 Las Vegas, Nevada 89109

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [ X ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [ X ]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ X ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

|

Large accelerated filer

|

[ ] |

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[X]

|

|

(Do not check if a smaller reporting company)

|

|||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [ X ]

The aggregate market value of the voting stock held by non-affiliates of the registrant based on the closing sales price, or the average bid and asked price on such stock, as of October 31, 2013, the last business day of the registrant’s most recently completed second quarter, was $11,398,000. Shares of the registrant’s common stock held by each executive officer and director and by each entity or person that, to the registrant’s knowledge, owned 10% or more of registrant’s outstanding common stock as of October 31, 2013 have been excluded in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of the registrant’s common stock outstanding as of November 25, 2014 was 20,798,976

DOCUMENTS INCORPORATED BY REFERENCE

A description of "Documents Incorporated by Reference" is contained in Part IV, Item 15.

|

CANYON GOLD CORP.

|

||

|

TABLE OF CONTENTS

|

||

|

Page

|

||

|

PART I

|

||

|

Item 1.

|

Business

|

3

|

|

Item 1A.

|

Risk Factors

|

20

|

|

Item 1B.

|

Unresolved Staff Comments

|

20

|

|

Item 2.

|

Properties

|

20

|

|

Item 3.

|

Legal Proceedings

|

20

|

|

Item 4.

|

Mine Safety Disclosures

|

20

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

20

|

|

Item 6.

|

Selected Financial Data

|

21

|

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

22

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

27

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

27

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and 26Financial Disclosure

|

27

|

|

Item 9A.

|

Controls and Procedures

|

27

|

|

Item 9B

|

Other Information

|

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

28

|

|

Item 11.

|

Executive Compensation

|

31

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

32 |

|

Item 13.

|

Certain Relationships and Related Transactions and Director Independence

|

32

|

|

Item 14.

|

Principal Accounting Fees and Services

|

34

|

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules.

|

36

|

|

Signatures

|

37

|

|

|

As used in this report, unless otherwise indicated, “we”, “us”, “our”, “Canyon Gold” and the “company” refer to Canyon Gold Corp.

|

||

2

EXPLANATORY NOTE

This Amendment No. 1 to the Form 10-K for Canyon Gold Corp. amends the Form 10-K for the year ended April 30, 2014, originally filed with the SEC on July 29, 2014. This Amended Form 10-K is being filed solely to revise certain portions of “Item 1, Business”, in response to comments issued by the SEC, and to update “Item 10, Directors, Executive Officers and Corporate Governance”. No other material changes or additions are being made hereby except to update the report as necessary.

PART I

Item 1. Business

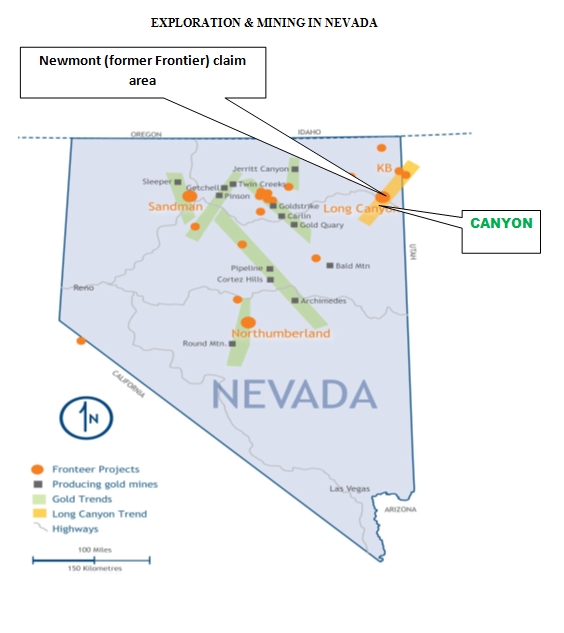

Canyon Gold Corp. presently holds mining claims and leases located in the State of Nevada. According to SEC Industry Guide No. 7, we are classified or considered an exploration stage mineral company defined as a company engaged in the search for mineral deposits or reserves of precious and base metal targets, which are not in either the development or production stage.

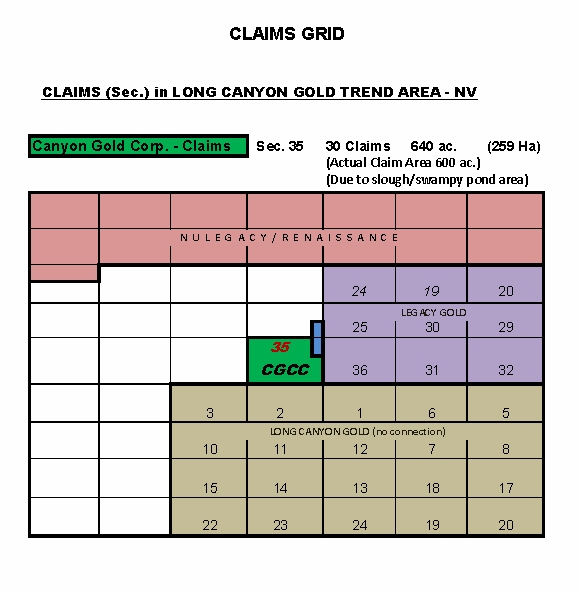

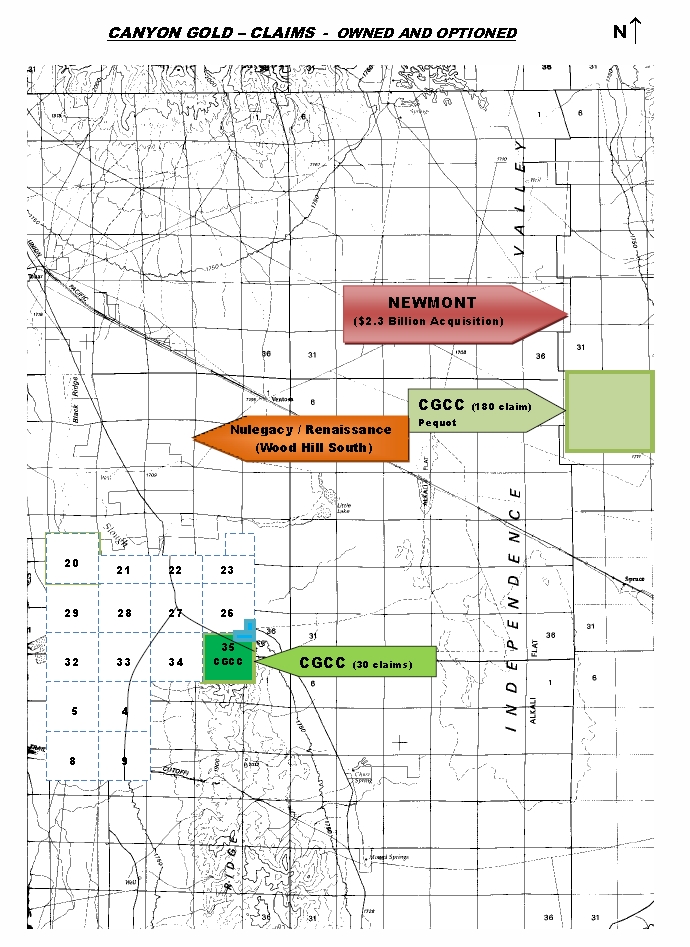

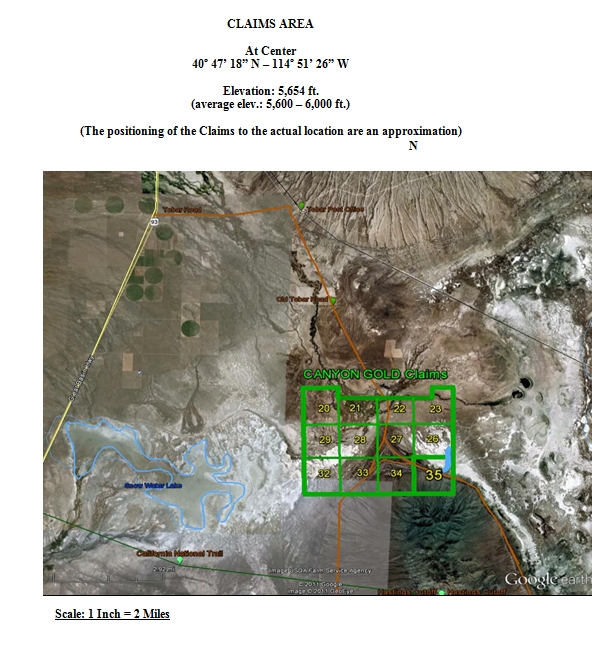

In July 2011, we acquired 100% of the outstanding capital stock of Long Canyon Gold Resources Corp. of North Vancouver BC, Canada, formerly Ferguson Holdings Ltd. (“Long Canyon”), whereby Long Canyon became our wholly owned subsidiary. As a result of the acquisition, Canyon Gold and Long Canyon owned and controlled a 100% interest in approximately 640 acres of mineral lease properties and/or 30 BLM mineral lease claims, situated in the west section of the new Long Canyon Gold Trend area of east central Nevada. Each of the 30 claims in Section 35 is a Federal BLM unpatented lode claims, 20 acres in size and includes placer rights in Nevada. The actual area of the 30 claims is 600 acres and the balance of approximately 40 acres in Section 35 consists of a slough and swampy pond area. The claims were initially listed as CG #1 through CG#30.

In exchange for the acquisition of Long Canyon, we issued to the stockholders of Long Canyon 27,998,699 shares of our common stock and 500,000 Series B preferred shares, which are convertible into a total of 5.0 million of our common shares. The Series B preferred shares were assigned to DRLLC as consideration for the 30 BLM mineral lease claims previously acquired by Long Canyon from DRLLC. On July 22, 2011, we issued to EMAC, 600,000 Series A preferred shares, convertible into 6.0 million shares of common stock. The Series A preferred shares satisfied certain payables to EMAC in connection with Long Canyon’s acquisition of mineral claims and certain related party payables. The payables refer to certain executive and administrative services provided to Canyon Gold and Long Canyon. Also, at the time of the Long Canyon acquisition, Long Canyon and Canyon Gold agreed that the 600,000 Series A preferred shares would be transferred to EMAC in consideration for a payable to EMAC. The preferred shares are only convertible into common stock starting 12 months after the first day that our common stock is traded on the on the OTC-Bulletin Board, now the OTCQB.

We have engaged Development Resources LLC of American Fork, Utah (“DRLLC”) to conduct preliminary studies of our claims. We intend to conduct exploration activities on the properties in phases. We plan to explore for gold, silver and other minerals on the property covering an area of approximately 6,890 acres, which includes the acres subject to an option. There can be no assurance that a commercially viable mineral deposit exists on our property. Extensive exploration will be required before we can make a final evaluation as to the economic and legal feasibility of any potential deposit.

Our principal executive office is located at 4730 South Fort Apache Road, Suite 300, Las Vegas, Nevada 89147, telephone (1-800) 520-9485. Additional office space is subleased from EMAC at 641 West 3rd Street, North Vancouver BC, Canada. The office of DRLLC that is responsible for management of exploration program is located at 125 East Main Street # 307, American Fork, Utah 84003.

Corporate Name Changes and Stock Split

The company was originally incorporated in the State of Delaware on May 27, 1998 as Mayne International, Inc. Our corporate name was changed to Black Dragon Entertainment, Inc. on September 5, 2000, then to Vita Biotech Corporation on July 31, 2002, and to August Energy Corp. on May 27, 2004. We changed our corporate name to the current Canyon Gold Corp. on March 21, 2011.

On February 12, 2014, a majority of our stockholders holding 82.95% of the company’s voting stock approved a one share for twenty shares reverse stock split, which became effective on April 4, 2014. All references to the number of shares of common stock herein will be on a post-split basis, unless otherwise noted.

Recent Events

On April 7, 2014, Canyon Gold entered into an agreement with EMAC Handels AG, to acquire control of a 100% interest in 180 mineral lease claims, situated in six sections in the west section of the new Long Canyon Gold Trend of the Pequop Mountains area of Elko County, Nevada. The company anticipates the preparation of a NI 43.101 Technical Report in the near future. Contingent upon the results of that report and as necessary funding becomes available, we expect to commence an exploration program on the property for possible gold and silver mineralization deposits. The company became delinquent in its assessment payments as of September 3, 2014, but has engaged DRLLC to perform the necessary re-staking of the claims and to make the requisite filings and payments to reinstate the claims, of which there can be no assurance.

The acquisition of the claims was facilitated through our wholly owned subsidiary, Long Canyon. Consideration for the claims was the issuance to EMAC of 12,000,000 shares of Canyon Gold’s authorized, but previously unissued common stock (post-split) valued at $0.04 per share. EMAC will retain a 3% Net Smelter Royalty on the claims.

3

Pursuant to the agreement, Canyon Gold will take all necessary actions to register the claims and to maintain the claims in good standing. Canyon Gold will also use its best efforts to perform an initial exploration program during 2014. Canyon Gold will be responsible for all costs and expenses associated with maintaining and exploring the claims. We intend to contract the services of Development Resources LLC located in American Fork, Utah, to provide the necessary exploration services on the property. The transaction closed on April 7, 2014.

On May 21, 2014, Canyon Gold entered into an agreement to acquire 100% of the issued and outstanding capital shares of Marshall Thomsen Ltd., a development stage company that intends to produce and distribute medicinal marijuana in Canada. Marshall Thomsen had previously applied to Health Canada for a Commercial Production License as a commercial grower of cannabis. The agreement provided for a closing on or before July 31, 2014, which was extended to August 31, 2014. However, the agreement did not close on August 31 and the company and Marshall Thomsen came to a mutual understanding to terminate the agreement on that date without any further obligations.

The initial agreement provided that the company was to issue to the sole shareholder of Marshall Thomsen 1,000,000 shares of Canyon Gold Series “B” preferred convertible non-voting stock. Each Series “B” preferred share is convertible into 10 shares of Canyon Gold voting common stock. The preferred shares would not be convertible until 12 months following Marshall Thomsen receiving the Commercial Production License. Marshall Thomsen would also been able to earn up to a total of 1,000,000 Series “A” preferred convertible voting shares upon approval and receipt of the Commercial Production License and completion of at least $12,000,000 in new funding. Marshall Thomsen would have been able to earn up to an additional 7,000,000 Series “A” shares by attaining certain future gross sales levels. Each Series “A” share has the voting power of 100 common share votes per share and is convertible into 10 common voting shares. Pursuant to the agreement, Canyon Gold was to use its best efforts to assist Marshall Thomsen with funding the planned operations up to a maximum of $12.0 million. The company would have managed all product, production and marketing from seed to sale.

As a result of the mutual termination of the agreement, neither party will have any future or ongoing obligations under the agreement. There were no early termination penalties incurred by either party due to the termination.

Our Strategy

We have assembled a portfolio of exploration and potential exploitation projects in the Long Canyon Gold Trend of the State of Nevada. Our goal is to secure sufficient capital to conduct the business of exploration and mineral project development. We continue to examine viable mineral leases that could potentially enhance our portfolio.

Current Business

On May 15, 2011, Long Canyon entered into an option agreement with EMAC Handels AG (“EMAC”) of Pfaeffikon, Switzerland. EMAC owns and controls a 100% interest in 275 mineral lease claims situated on approximately 6,250 acres of mineral lease properties adjoining the 640 acres owned by Long Canyon. EMAC initially acquired these claims from DRLLC. The option agreement allows Long Canyon to earn a 100% interest in the 6,250 acres for the exercise price of $350,000 and 425,000 shares of Canyon Gold Series B preferred stock. The agreement also provided to EMAC a 2% Net Smelter Royalty on the 275 claims subject to the option agreement. Long Canyon, as our wholly owned subsidiary, retains all rights under the option agreement, but has no obligations regarding the optioned claims until the option is exercised. On May 31, 2014 pursuant to an extension of the option agreement, the exercise period of the option agreement was extended to December 31, 2014.

Canyon Gold and Emac Handels AG were unable to make the large required payment due September 1, 2014 to maintain the 275 claims adjacent to section 35, nor the 180 claims at Pequop Mountain and thus the interest in these sections were not renewed and do not appear on the claims map.

4

All of our properties including the claims subject to the option are located in the west section of the new Long Canyon Gold Trend area of Nevada. These properties are located next to other exploration projects owned by other mining companies in the Long Canyon Gold Trend. All of the claims are located in Section 35, T 34N R63E, Mount Diablo Base & Meridian (Meridian MDB&M). We intend to explore the claims for gold and silver mineralization deposits.

The property rights to each claim are acquired by first staking the ground with a legal marker wooden post with identification of the location, date of staking location and owners name attached to each post. The locator or owner then has a period of time to then file the Mining Claim Notices with the County Recorders office and, in this case, in Elko County, Nevada. A fee is paid for this filing and a County Stamp with the date of such recording is put on each Claim Location Notice. The locator or owner then has up to 90 days from the location date on the Claim Notice to file and pay an additional fee to the BLM in Reno, Nevada to record the ownership of each claim with the BLM. The locator or owner is then officially listed with both the County and the BLM as having the mineral claim control to the claims and holds complete ownership interest in the surface rights and subsurface rights to all minerals on the claims up to the new required notice to hold date, which is the following next September 1 date from the date of the location on the Claim Notice. It is officially recognized that the locator or owner has such rights on the ground that each claim is located on from the date the posts are put in the ground on the claim with the attached document as well until the proper recording dates required by the County and the BLM.

It should be noted that the company did not make requisite assessment payments on the 30 claims by the September 1, 2014 due date (final payment due September 3) that necessitated re-staking the claims and making new filing and payments to retain the claims. The company’s consultants (DRLLC) re-staked the claims on September 5, 2014 and registered the claims with the Elko County Recorders office and must make requisite filings and pay the applicable fees with the BLM within 90 days from the re-staking date. Management is taking the necessary actions and believes that all filings and filing fees will be made within the allotted time period.

The claims were initially listed as CG#1 through CG#30. However, due to the re-staking and re-filing of the claims, they will not be registered with the BLM until we file the necessary documents and pay the requisite fees. We have registered the 35 claims with the Elko County Recorders office. Following the re-staking, the claims are under the control of the company, provided we make the requisite filings and payment to the BLM within the 90 day period of the re-staking date, at which time the claims will be legally registered. In the event we do not meet the 90 day deadline, we would once again have to re-stake the claims. In that event we have the risk of losing the claims, particularly if another party were to come in and re-stake the claims ahead of us.

In January 2012, DRLLC prepared the preliminary geological report on our properties. Alex Burton of Burton Consulting Inc., was the consulting geologist for DRLLC and conducted additional fieldwork from May 19 to May 29, 2012 as part of the requirements for dissemination of his final geology report. Mr. Burton, an exploration geologist and geochemist, has become a member of our advisory board. Titles to the first 30 claims (approximately 640 acres), owned and controlled by us, and the 275 claims subject to the option agreement, have been recorded in the name of DRLLC. DRLLC initially held title to the 305 claims and, pursuant to the agreements with Long Canyon and DRLLC and the option agreement between Long Canyon and EMAC, titles to the claims are to be transferred and registered in the name of Canyon Gold Corp. The title to the first 30 claims has been transferred to Canyon Gold. As per the terms of the option agreement and extension, title to the remaining 275 claims will be transferred to Canyon Gold within 30 days of the option being exercised. Upon exercise of the option agreement, of which there can be no assurance, we would own and control approximately 6,890 acres and 305 claims.

Our agreement with DRLLC obligated Long Canyon to pay to DRLLC $30,000 to complete full staking and acquisition of mineral lease claims. DRLLC would then assign to Long Canyon a 100% interest in the claims, subject to DRLLC holding a 3% Net Smelter Royalty on the claims. Long Canyon is further obligated to pay all BLM and State of Nevada registration fees and to perform initial exploration work on the claims. Also, DRLLC will retain a first right of refusal to buy back the claims in the event Long Canyon / Canyon Gold intends to sell the claims.

We are conducting exploration activities on the properties in phases. As we proceed, we will record and transfer to the company all title to the property upon which we are conducting exploration activities, which titles are presently being registered in the name of EMAC. We intend to explore for gold, silver and other minerals on the property covering an area of approximately 6,890 acres. There is no assurance that a commercially viable mineral deposit exists on our property. Extensive exploration will be required before we can make a final evaluation as to the economic and legal feasibility of any potential deposit.

The 180 claims acquired from EMAC Handels AG in April 2014 are in proximity to the Pequop Mountain discovery in the Long Canyon Trend area of Elko County, Nevada. The claims are located at Range 65E Township 34N and 35N, in Mount Diablo Base & Meridian (Meridian MDB&M). We plan to explore these claims for possible gold deposits similar to the original discovery now owned by New Mont Mining adjacent to the 180 claims. We intend to commission a NI 43.101 Technical Report by a qualified geologist in the near future and as adequate funds permit. Subject to the results of that report, we plan to move aggressively to fully explore the claims with preliminary geologic expectations of a Carlin Type gold deposit similar to the Newmont Pequot discovery.

5

Exploration Properties

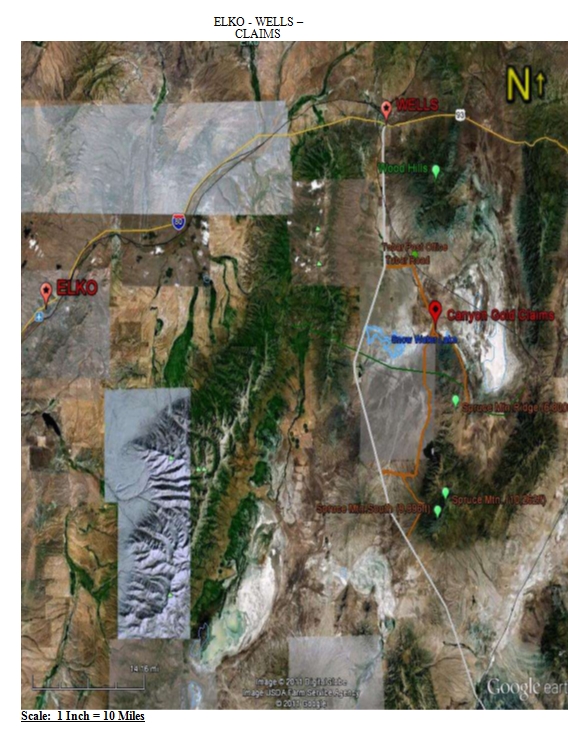

Our mineral lease properties are located in the Long Canyon Gold Trend in the Spruce Mountain Mining District, Nevada. The area is generally characterized by an average elevation of approximately 5,600 feet and is made up of gentle rising hills and ridges to about 6,000 feet to the west and 5,800 feet to the east. The ridges and elevation increase to the south to an elevation of 6,800 feet at Ventosa Peak. The highest elevation in the district is Spruce Mountain at an elevation of just over 10,000 feet, located approximately 16 miles due south of our claims. The trees on these properties are small Spruce, Pine and scrub brush, not densely covered with many open areas on the higher ridges and side slopes with open areas in the small valleys at lower elevations.

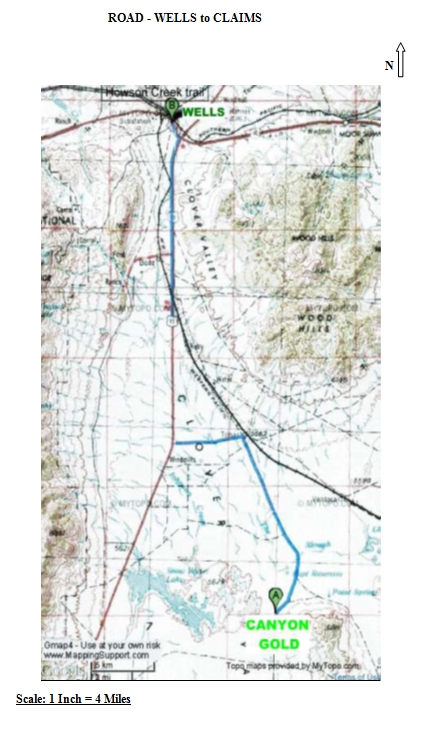

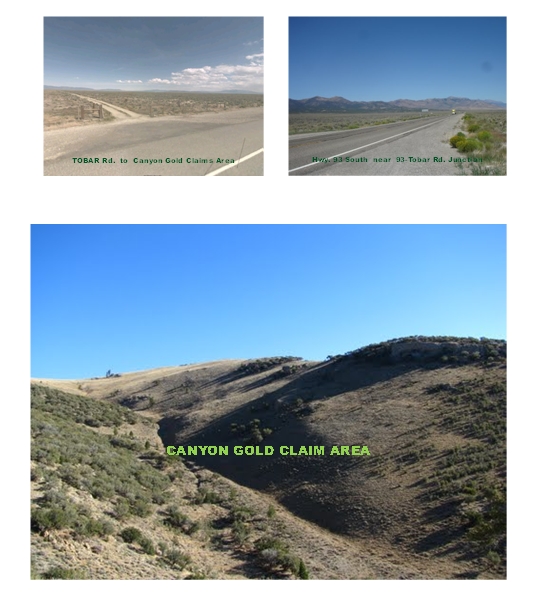

All of our claims are located in one block in a semi-remote area with no infrastructure in place. The only access to the properties is by historic gravel or dirt roads and trails. There is no current access to water or power, although we do not foresee a need during the first phases of exploration. Typically, all contract personnel carry their own water and have portable generators for their operations, including phase two drill programs. Drilling operators supply tanker trucks for their water needs.

In the event an ore body is discovered as a result of our exploration programs, significant additional funding would be necessary to proceed. In order to satisfy this need, we anticipate seeking a strategic partnership or joint venture with a much larger mining company in order to fund additional heavy exploration drilling, feasibility studies and establishing mining operations. A feasibility study would detail the costs to provide all infrastructure including, but not limited to, pumping water from underground sources or building lakes to hold such water needs, building electrical lines to the area for needed power or using stand-alone large generator systems to provide necessary power. It is our intent to remain an exploration company and to seek a partner to further develop and operate our properties. Presently, there can be no assurance that we will discover minerals in a commercially viable amount or that we would be able to secure a strategic partner to provide necessary funding to become operational.

Regulatory Requirements

In order to maintain the company’s claims and/or leases, we must make annual payments to the Bureau Land Management (“BLM”) and State of Nevada, due in September of each year. Payment to the BLM is $145 per claim and the State of Nevada is $70 per claim. We currently own the 30 BLM mineral leases for which we are obligated to make annual payments and, commencing in September 2014, we will be responsible for annual payments on the 180 claims acquired in April 2014. The annual payments for the 275 claims under option with EMAC are the responsibility of EMAC. Upon exercise of the option, Canyon Gold will be responsible for these payments.

We did not make the requisite assessment payments on the 30 BLM claims by the September 1, 2014 due date, but we did re-stake the claims on September 5, 2014 and registered the claims with the Elko County Recorders office. We intend to make new filings and payments to the BLM within the applicable 90 day period to retain the claims. The annual payments for the Pequop Mountain claims and the 275 claims optioned from EMAC were also not paid by the September 1 due date. We have engaged DRLLC to perform the necessary re-staking of the Pequop Mountain claims and to make the requisite filings and payments to reinstate the claims, although the re-staking has not yet been accomplished. We currently have not made arrangements for renewing the EMAC optioned claims and could possibly lose those claims.

Phase one of our exploration program, completing a preliminary geological report on our four sections of BLM mineral lease claims, required no permits or bonding, provided there was no surface land disturbance of more than one-third acre. Phase two, provided preliminary geological reports are favorable, will proceed with a drill program to confirm mineralization on these target areas from the surface to depth. If initial core samples show evidence of gold mineralization, a geological, grid maps will be produced to lay out an extensive drill program to define a potential mineable ore body. Phase two will require an “Access and Land Use Permit” from the BLM and State of Nevada. Generally, this will require about 30 days for the filing process and cost approximately $12,000 for a bond to assure the reclamation of the subject areas. We anticipate processing paperwork for the permit and securing the requisite bond will be completed during the third quarter of calendar 2014. This will enable us to obtain the necessary permits to begin phase two during the fourth quarter of calendar 2014.

Royalties

Presently, we are committed to pay a 3% Net Smelter Royalty (“NSR”) to DRLLC on all of our 305 claims pursuant to the agreement between DRLLC and Long Canyon. We are also obligated to pay EMAC a 2% NSR on the 275 claims subject to the option agreement with EMAC.

6

Maps of Properties

The following are maps and pictures of the company’s properties.

7

8

9

10

As of November 21, 2014

11

12

13

14

History

Spruce Mountain Mining District

Our properties lie at the north end of the Spruce Mountain district, in southern Elko County, approximately 19 miles south of Wells, Nevada. The properties are located near Highway 93 on the old Tobar Road, which provides easy access to the area. The Spruce Mountain district covers the north flank and summit of Spruce Mountain and part of the Spruce Mountain Ridge to the north. Spruce Mountain and Spruce Mountain Ridge form a somewhat isolated spur between the Pequop Mountains on the east and Clover Valley on the west.

Spruce Mountain has seen mining activity since 1869. During the early years, small communities such as Sprucemont, Spruce, Hickneytown, Monarch, Black Forest, Latham, Jasper, Steptoe, Johnson, and Killie were founded and then declined. These mining camps stretched for six miles, from the western to the eastern slopes of Spruce Mountain. In 1869, W.B. Latham discovered the Latham mine, later renamed the Killie. The lead-silver ore was sufficiently valuable that a small rush of prospectors came to the area. Within months, three new mines, the Black Forest, the Juniper, and the Fourth of July, began production.

Three separate mining districts, the Latham, Johnson and Steptoe districts, were initially created in the Spruce Mountain area. On September 26, 1871, the three districts were consolidated, and the Spruce Mountain Mining District was created.

From 1869 to the 1930's, lead, silver, copper and zinc were produced from several underground mines in the Spruce Mountain district. The Standard and Old Paramount mines are on the RenGold Spruce Mountain property. Several other historical underground workings are located to the east of the property.

No production has taken place on Spruce Mountain since 1961. Some exploration occurred through the 1980s, but none were considered worthy of extensive mining. Between 1958 and 1982, several companies conducted exploration for porphyry molybdenum deposits throughout the district. In 1984 and 1985, Santa Fe Mining Inc. remapped the western portion of the district, took rock and soil samples, conducted a VLF survey and drilled 33 RC holes, 30 of these on the Spruce Mountain property. Several of these holes intersected gold mineralization in the northern part of the Spruce Mountain property (the North Target) leading to recent in the district for gold potential.

In 1996 and 1997, Battle Mountain Gold Corp explored primarily to the east of the Spruce Mountain property. Between 1997 and 2009, Teck Resources, Inc. and Nevada Pacific Gold (US) Inc. explored the property. In 2009 AuEx took rock samples, staked the SM claims and quitclaimed the claims to Renaissance in 2010.

Geology

The oldest rocks exposed in the Spruce Mountain district consist of limestone of the Ordovician Pogonip Formation, which crops out on the summit and west slope of Spruce Mountain. It is overlain by, or is in fault contact with limestone, dolomite, shale, and quartzite of the Silurian through Permian ages. The sedimentary rocks are tilted gently to moderately eastward, displaced along the Spruce Mountain thrust fault, and are cut by steep north-northwest and east-trending normal faults.

The sedimentary rocks have been intruded by a granite porphyry dike that cuts across the north side of Spruce Mountain in a northeasterly direction. This porphyry, where seen near the Killie mine and east of the Black Forest mine, is bleached and kaolinized, and contains sericite, euhedral quartz phenocrysts, and some fine-grained sulfides. Many of the mines and prospects in the district are found along the trend of this porphyry dike. Three or more small or irregular stocks of granite porphyry and diorite are intruded along and near the crest of the ridge.

Limestone adjacent to some of the intrusive contacts is metamorphosed to skarn consisting of quartz, calcite, garnet, fluorite, actinolite, diopside, and other pyroxenes. The largest metamorphic zone is on the west side of the range. Between the contact zone and the main dike, there are two prominent knoblike outcrops of iron-oxide stained quartz-cemented breccias pipe. On the east side of the range, the northeastward continuation of the zone of intrusive is marked by outcrops of jasperoid.

15

Two kinds of metalliferous ore bodies have been mined in the Spruce Mountain district; (i) bedded replacement deposits of lead, silver, copper, and (ii) zinc in limestone and skarn, and fissure-filling stock work deposits of lead and silver with minor gold along normal faults in limestone, skarn, quartz breccias, and granite porphyry. Replacement deposits in limestone and skarn occur near the center of the district. Ore shoots were commonly a few feet thick, and as much as 100 feet long. Mineralization extended up to 100 feet away from the fissures into the limestone host rock. Bedded replacement deposits yielded most of the early production from the district.

The deepest ore shoot in the district was mined to the 520-foot level in the Monarch mine. To the northeast, at the Humbug mine and nearby prospects, outcrops of gossan and jasperoid occur in siliceous breccias along shear zones in limestone.

Most orebodies in the district were mined primarily for lead and silver, with increasing amounts of zinc recovered in the later years of production. Orebodies in which copper predominates generally occur adjacent to the intrusive bodies. Proportions of lead, silver, gold, copper, and zinc vary widely among the different orebodies.

Recent Activity

Our properties are in immediate proximity on the north to a 35 square mile area owned by Renaissance Gold, in joint venture with NuLegacy Gold. The two companies have collected soil samples and exposed rock chip samples that may indicate anomalous gold.

In February 2011, Newmont Gold acquired properties in the Spruce Mountain area and has extended its gold exploration activities. Frontier Gold and AuEx Ventures are joint venturing in exploration drilling to define a possible gold ore body in the area. AuEx Ventures has also entered into a joint venture drilling project with Agnico-Eagle USA in an area adjoining our properties to the west. The Renaissance Gold Group has formed a joint venture with NuLegacy Gold to conduct exploration activities in close proximity to our properties. Just to the south of our properties is another Renaissance Gold project called the Spruce Mountain Prospect.

Plan of Operations

The company recently completed a significant acquisition that is reflected in the accompanying financial statements.

With the completion of phase one of our exploration program and receipt of the final geology report and its recommendations to continue with Phase Two of the company’s exploration program, we will need an estimated $1,057,200 in funds for drilling and engineering studies to determine whether the mineral deposit is commercially viable. If we are unable to raise additional funds for this work, we would be unable to proceed, even if a mineral deposit is discovered. The following planned phases presume that we are successful in re-registering our BLM claims.

Phase Two – Summer/Fall 2014 – Summer 2015

Premised on and supported by the findings set forth in the final geology report, phase two will proceed with continued exploration and a drill program to confirm mineralization on the target areas from the surface to depth. Typically, exploration results that will warrant phase two work include:

|

●

|

Analysis of surface geochemical sample results with values that are suggestive of a mineral deposit, when considered in the context of the geologic setting of the property;

|

|

●

|

Analysis of geophysical anomalies that are suggestive of a mineral deposit considered in the context of the geologic setting of the property; and

|

|

●

|

Interpretation of geological results that is indicative of a favorable setting for a mineral deposit.

|

These results are usually interpreted in conjunction with current metal-market conditions, management’s corporate goals and the potential for phase two plans to facilitate the discovery process. The first phase of our two-phase exploration program on our property was completed in July 2012 and the final geology report delivered in September 2012. The final report indicates a plan for further exploration, including an initial drilling program, with recommendations and budgets.

16

Alex Burton, exploration geologist and geochemist and a member of our advisory board, is responsible for the final geology report. Based on the conclusions set forth in the report and the preliminary exploration results obtained in phase one, management is confident that our properties are sufficiently positioned geologically to proceed with phase two.

All core drill samples will be sent to the ALS Chemex Labs for assay results. In the event these first drill core sample assays show substantial gold mineralization, a geological grid map will be produced to lay out an extensive “in-fill” drill program to define a potential mineable ore body. Once an ore body is defined by these drill program, a feasibility report will be produced to prepare and perform an application to all Nevada regulatory agencies for mining operation permits.

Our ability to complete the two-phase exploration will be dependent on our available funds and the ability to raise additional necessary funds as required. Phase two will require renting certain heavy-duty equipment to open new trails into the target area and perform some open trenching to gather deeper samples. The following is our estimate of the cost to successfully complete the first two phases. Our estimates for phase two are based on the findings set forth in the final geology report and are divided into two stages.

Phase Two – Estimated Exploration Costs as per the final geology report:

|

Stage “A”

|

||||||

|

●

|

Geochemistry

|

|||||

|

Hand held Auger Pediment and Upper slope soil sampling

|

||||||

|

Combined with surface cobble sampling

|

||||||

|

20 line of 6000m length at 50m spacings includes $30 analysis

|

$

|

80,000

|

||||

|

Blasting and Channel sampling outcrops on upper slopes and pediment

|

80,000

|

|||||

|

Valley Flats ATV mounted auger sampling includes $30 assay

|

80,000

|

|||||

|

Water Well drill (RC type)

|

||||||

|

30 holes to 60 feet at $25/foot

|

45,000

|

|||||

|

●

|

Collection and assay costs $70 per sample 30 holes X 10 samples

|

21,000

|

||||

|

●

|

Geophysical surveys

|

170,000

|

||||

|

●

|

Engineering

|

45,000

|

||||

|

●

|

Contingency (20%)

|

104,200

|

||||

|

Total Estimated budget, Stage A

|

$

|

625,200

|

||||

It is possible that inflation may affect the exploration costs, as analytical, geophysical, and drilling costs have seen increases.

17

|

Stage “B”

|

||||

|

Stage B exploration is sequential after assay results have been evaluated. A new report is not required. Further exploration will require the drilling of a series of about a dozen Reverse Circulation drill holes to depths ranging from 4 00 feet to 1000 feet. This is usually followed by a series holes drilled with a diamond drill to firm up the grades obtained in the RC (Reverse Circulation) drilling so that greater validity can be assigned to the ore grades for reserve and resource calculations.

|

||||

|

Reverse circulation of 12 holes to 400 feet with engineering plus assays is $75 per foot with 20% contingency will total (Stage B) ……

|

$

|

432,000

|

||

|

Total cost for PHASE TWO, Stage A and B …

|

1,057,200

|

|||

|

TOTAL - Phase One and Phase Two

|

1,165,123

|

|||

|

● Exercise of options ($350,000) and general expenses ($50,000)

|

400,000

|

|||

|

TOTAL FUNDING REQUIREMENTS

|

$

|

1,565,123

|

||

Note: Please be advised of the following terms used in the table above:

IP/resistivity: During phase two, we may use a program called Induced Polarization (IP), which can be used to further define deeper mineralization zones on the properties. This is performed by placing metal electrodes at interval spacing on a laid out grid according to the suitable format for the mineralized zone and the property location. Electrical impulses are then passed through these electrodes, sending back a recorded signal that can define a certain measured decay of mineralization below the surface, thus defining potential higher-grade areas for further testing programs such as drilling.

Exposed mineralized zones: We anticipate phase one will define possible mineralized zones on the properties, which will further define potential drill targets.

Final geology report: The final geology report, provided by a qualified, licensed geologist, written to the requirements of the NI43.101 Technical Report, will describe in detail all of the exploration data, testing results and all other operations performed on the properties as well as a definitive further exploration program with suggested costs to enter into and perform the next phase of the expected exploration.

Our exploration expenditures for phase one have been $107,923 and we anticipate an additional $1,057,200 to complete phase two. Each phase of our proposed exploration will be assessed to determine whether the results warrant further work. If exploration results on the initial phases do not warrant drilling or further exploration, we will suspend operations on the property. We will then seek additional exploration properties and additional funding with which to conduct the work. In the event that we are unable to obtain additional financing or additional properties, we may not be able to continue active business operations.

Historically, we have incurred operating losses and will not be able to exist indefinitely without securing additional operating funds. In the view of our independent auditors, we require additional funds to maintain our operations and these conditions raise substantial doubt about our ability to continue as a going concern.

We will not be conducting any product research or development over the next 12 months. We do not expect to purchase any plant or significant equipment over the next 12 months. We do not have employees and do not expect add employees over the next 12 months. Our current management team will satisfy our requirements for the foreseeable future.

Competition

The exploration for and exploitation of mineral reserves is highly competitive with many local, national and international companies in the marketplace. We must compete against several established companies in the industry that are better financed and/or who have closer working relationships with productive mining companies. We will most likely seek a strategic relationship with a more established and larger mining company to provide assistance in developing our property into production, if exploration results so warrant. We have not entered into any agreements with any third parties to produce any minerals from our property, nor have we identified any potential partners in that regards, nor is there any assurance we will be able to secure such agreements. If we are unable to identify and/or partner with any third parties to assist us in attaining production grade minerals, we will likely be unsuccessful in producing any such minerals.

18

Government Regulation

Because we are engaged in the mineral exploration activities, we are exposed to many governmental and environmental risks associated with our business. We are currently in the initial exploration stages and management has not determined whether significant site reclamation costs will be required.

Environmental and other government regulations at the federal, state and local level may include:

|

●

|

surface impact;

|

|

●

|

water acquisition and treatment;

|

|

●

|

site access;

|

|

●

|

reclamation;

|

|

●

|

wildlife preservation;

|

|

●

|

licenses and permits; and

|

|

●

|

maintaining the environment.

|

Regulatory compliance in the mining industry is complex and the failure to meet and satisfy various requirements can result in fines, civil or criminal penalties or other limitations.

In the event we are able to secure funding necessary to implement a bona fide exploration program, we will be subject to regulation by numerous governmental authorities. In order to maintain our claims, we must make annual payments to the BLM and the State of Nevada. If we proceed to phase two drilling, we must secure an Access and Land Use Permit. Subsequently, operating and environmental permits will be required from applicable regulatory bodies using technical applications filed by us. The failure or delay in obtaining regulatory approvals or licenses will adversely affect our ability to explore our property and otherwise carry out our business plan.

Any exploration or production on United States Federal land will have to comply with the Federal Land Management Planning Act, which has the effect generally of protecting the environment. Any exploration or production on private property, whether owned or leased, will have to comply with the Endangered Species Act and the Clean Water Act. The costs of complying with environmental concerns under any of these acts vary on a case-by-case basis. In many instances the cost can be prohibitive to development. Environmental costs associated with a particular project must be factored into the overall cost evaluation of whether to proceed with the project.

There are no costs to us at the present time except for annual fee payments related to the claims and reclamation bonding requirements of the Bureau of Land Management in connection with compliance with environmental laws. However, because we anticipate engaging in natural resource projects, these costs could occur at any time and the potential liability extensive.

Trademarks and Copyrights

We do not own any patents, trademarks or copyrights.

Employees

We presently do not have any employees and do not anticipate adding employees until our business operations and financial resources so warrant. We consider our current management to be sufficient to satisfy our requirements for the foreseeable future. Our exploration program is contracted to Development Resources LLC. and is payable in both cash and stock.

Facilities

We presently rent office facilities in Las Vegas, Nevada that serve as our principal executive offices. The facilities are rented on a month-to-month basis on terms of $497 per month.

19

Employee Stock Plan

We have not adopted any kind of stock or stock option plan for employees at this time.

Industry Segments

No information is presented regarding industry segments. We are presently a development stage company that has been seeking potential business opportunities. Reference is made to the statements of income included in this Form 10-K for a report of our operating history for the past two fiscal years.

Item 1A. Risk Factors.

This item is not required for a smaller reporting company.

Item 1B. Unresolved Staff Comments.

This item is not required for a smaller reporting company.

Item 2. Description of Property.

We do not presently own any property except for the Claims discussed in Item 1 above.

Item 3. Legal Proceedings.

There are no material pending legal proceedings to which the company or any subsidiary is a party, or to which any property is subject and, to the best of our knowledge, no such action against us is contemplated or threatened.

Item 4. Mine Safety Disclosures.

This item is not applicable.

PART II

Item 5 .Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock was accepted for quotation on the OTCQB on September 5, 2012 under the symbol “CGCC”. Previously, the shares were quoted on the OTC Pink Market, although there was not an active trading market. Set forth in the table below are the quarterly high and low prices of our common stock as obtained from the OTCQB for the past two fiscal years ended April 30, 2014.

|

High

|

Low

|

|||||||

|

Fiscal year ended April 30, 2014

|

||||||||

|

First Quarter

|

$ | 0.55 | $ | 0.25 | ||||

|

Second Quarter

|

$ | 0.28 | $ | 0.10 | ||||

|

Third Quarter

|

$ | 0.29 | $ | 0.081 | ||||

|

Fourth Quarter (1)

|

$ | 0.75 | $ | 0.40 | ||||

|

Fiscal year ended April 30, 2013

|

||||||||

|

First Quarter

|

$ | 0.55 | $ | 0.55 | ||||

|

Second Quarter

|

$ | -- | $ | -- | ||||

|

Third Quarter

|

$ | 0.75 | $ | 0.45 | ||||

|

Fourth Quarter

|

$ | 0.51 | $ | 0.44 | ||||

(1) The above quotes for the fourth quarter of fiscal year ended April 30, 2014 reflect and have been adjusted for the reverse stock split on a one share for twenty shares basis, which became effective on April 4, 2014. All other quotes are on a pre-split basis.

As of November 24, 2014 there were approximately 102 stockholders of record of our common stock, which does not take into account those shareholders whose certificates are held in the name of broker-dealers or other nominee accounts.

20

Secondary trading of our shares may be subject to certain state imposed restrictions. Except for the OTCB, we have no immediate plans, proposals, arrangements or understandings with any person concerning the development of a trading market in any of our securities. The ability of individual stockholders to trade their shares in a particular state may be subject to various rules and regulations of that state. A number of states require that an issuer's securities be registered in their state or appropriately exempted from registration before the securities are permitted to trade in that state. Presently, we have no plans to register our securities in any particular state.

Penny Stock Rule

It is unlikely that our securities will be listed on any national or regional exchange or The Nasdaq Stock Market in the foreseeable future. Therefore our shares most likely will be subject to the provisions of Section 15(g) and Rule 15g-9 of the Exchange Act, commonly referred to as the "penny stock" rule. Section 15(g) sets forth certain requirements for broker-dealer transactions in penny stocks and Rule 15g-9(d)(1) incorporates the definition of penny stock as that used in Rule 3a51-1 of the Exchange Act.

The SEC generally defines a penny stock to be any equity security that has a market price less than $5.00 per share, subject to certain exceptions. Rule 3a51-1 provides that any equity security is considered to be a penny stock unless that security is:

|

●

|

registered and traded on a national securities exchange meeting specified criteria set by the SEC;

|

|

●

|

authorized for quotation on The Nasdaq Stock Market;

|

|

●

|

issued by a registered investment company;

|

|

●

|

excluded from the definition on the basis of price (at least $5.00 per share) or the issuer's net tangible assets; or

|

|

●

|

exempted from the definition by the SEC.

|

A broker-dealer who sells penny stocks to a person other than an established customer or accredited investor is subject to additional sales practice requirements. An accredited investor is generally defined as a person with assets in excess of $1,000,000 or annual income exceeding $200,000, or $300,000 together with their spouse.

For transactions covered by these rules, a broker-dealer must make a special suitability determination for the purchase of such securities and must receive the purchaser's written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the rules require the delivery, prior to the first transaction, of a risk disclosure document relating to the penny stock market. A broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, a monthly statement must be sent to the client disclosing recent price information for the penny stocks held in the account and information on the limited market in penny stocks. Consequently, these rules may restrict the ability of broker-dealers to trade and/or maintain a market in our common stock and may affect the ability of stockholders to sell their shares.

These requirements may be considered cumbersome by broker-dealers and could impact the willingness of a particular broker-dealer to make a market in our shares, or they could affect the value at which our shares trade. Classification of the shares as penny stocks increases the risk of an investment in our shares.

Rule 144

All of our outstanding common shares were issued in private transactions and considered restricted securities, except for those shares included in our August 2012 registration statement. Rule 144 is the common means for stockholders to resell restricted securities and for affiliates, to sell their securities, either restricted on non-restricted (control) shares. Rule 144 was amended, effective February 15, 2008.

21

Under the amended Rule 144, an affiliate of a company filing reports under the Exchange Act who has held their shares for more than six months, may sell in any three-month period an amount of shares that does not exceed the greater of:

|

●

|

the average weekly trading volume in the common stock, as reported through the automated quotation system of a registered securities association, during the four calendar weeks preceding such sale, or

|

|

●

|

1% of the shares then outstanding.

|

Sales by affiliates under Rule 144 are also subject to certain requirements as to the manner of sale, filing appropriate notice and the availability of current public information about the issuer.

A non-affiliate stockholder of a reporting company who has held their shares for more than six months, may make unlimited resales under Rule 144, provided only that the issuer has available current public information about itself. After a one-year holding period, a non-affiliate may make unlimited sales with no other requirements or limitations.

An important exception to the above described availability of the amended Rule 144 is that Rule 144 is not available for either a reporting or non-reporting shell company, unless the company:

|

●

|

has ceased to be a shell company;

|

|

●

|

is subject to the Exchange Act reporting obligations;

|

|

●

|

has filed all required Exchange Act reports during the preceding twelve months; and

|

|

●

|

at least one year has elapsed from the time the company filed with the SEC current Form 10 type information reflecting its status as an entity that is not a shell company.

|

Because Canyon Gold was previously classified as a “shell” company, stockholders holding restricted shares of common stock would not be able to rely on Rule 144 until one year after we ceased to be a shell company and filed with the SEC adequate information that we are no longer a shell company. The information included in our registration statement dated November 10, 2011 is considered adequate information and, accordingly, our stockholders, both affiliates and non-affiliates, became eligible to use Rule 144 after one year from the initial filing of the registration statement.

We cannot predict the effect any future sales under Rule 144 may have on the market price of our common stock, if a market for our shares develops, but such sales may have a substantial depressing effect on such market price.

Dividends Policy

We have never declared cash dividends on our common stock, nor do we anticipate paying any dividends on our common stock in the foreseeable future.

Item 6. Selected Financial Data.

This item is not required for a smaller reporting company.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following information should be read in conjunction with the financial statements and notes thereto appearing elsewhere in this Form 10-K.

Financial statements included herewith were prepared in consideration of the reverse acquisition between Canyon Gold and Long Canyon and are prepared on a consolidated basis. The consolidated financial statements include the operating results of Long Canyon and those of Canyon Gold from the date of the acquisition, July 20, 2011, through April 30, 2014. Share amounts and per share data are depicted on a post-split basis.

22

Forward Looking and Cautionary Statements

This report contains forward-looking statements relating to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “will” “should," “expect," "intend," "plan," anticipate," "believe," "estimate," "predict," "potential," "continue," or similar terms, variations of such terms or the negative of such terms. These statements are only predictions and involve known and unknown risks, uncertainties and other factors. Although forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment, actual results could differ materially from those anticipated in such statements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Going Concern

Our consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States applicable to a going concern. At April 30, 2014, the company has no revenues to date, has accumulated losses of $1,303,074 since inception on June 19, 2008 and had a working capital deficit of $1,170,974, and expects to incur further losses in the development of its business, all of which cast substantial doubt about the company’s ability to continue as a going concern. Management plans to continue to provide for the capital needs during the year ending April 30, 2015 by issuing debt and equity securities and by the continued support of its related parties. The consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or amounts and classification of liabilities that might be necessary should the company be unable to continue in existence. There is no assurance that funding will be available to continue the company’s business operations.

Results of Operations

For the fiscal year ended April 30, 2014 compared to the fiscal year ended April 30, 2013.

We currently have no sources of operating revenues and, accordingly, no revenues were recorded for either year ended April 30, 2014 or 2013.

Total operating expenses decreased from $493,950 in the year ended April 30, 2013 to $323,744 for the year ended April 30, 2014. The decrease in the 2014 fiscal year was due primarily to the decrease in directors’ fees from $155,000 in 2013 to $30,000 for the 2014 fiscal year, due to lower director compensation and fewer new directors. Additionally, general and administrative expenses decreased from $131,021 in fiscal 2013 to $125,272 in fiscal year 2014, and professional fees decreased from $92,688 in 2013 to $79,472, primarily attributed to decreased legal, audit, accounting costs. Also, our exploration costs decreased from $73,261 in fiscal 2013 to $14,000 in 2014, attributed to reduced exploration due to a lack of capital. The above decreases were partially offset by the increase in management and administrative fees from $42,000 in 2013 to $75,000 in 2014, attributed primarily to an increase in monthly administration fees from $3,500 to $5,000, effective May 1, 2013.

Other expenses increased in fiscal 2014 to $40,997 compared to $28,996 in 2013. This was due to interest expense increasing from $28,996 in fiscal 2013 to $46,138 in 2014 due to incurring additional debt. A substantial portion of our interest expense is incurred to related parties. We also recorded a loss on derivative liability of $20,859 in 2014, but also realized a gain on settlement of debt of $26,000 in 2014.

Our net loss for fiscal 2014 was $364,741 compared to a loss of $522,946 in fiscal 2013, primarily due to the decrease in operating expenses.

We have no firm commitments for capital expenditures other than to complete the acquisition of the optioned properties and to explore our properties as funds permit. In the process of carrying out our business plan, we may determine that we cannot raise sufficient capital to support our business on acceptable terms, or at all.

23

Liquidity and Capital Resources

At April 30, 2014, we had total current assets of $4,406 (cash of $396) and total current liabilities of $1,175,380, resulting in a working capital deficiency of $1,170,974. A significant portion of our current liabilities is comprised of amounts due related parties: accrued interest payable – related parties of $50,613; convertible notes payable – related parties of $156,000; notes payable – related parties of $79,656; and payables – related parties of $399,905. We anticipate that in the short-term operating funds will continue to be provided by related parties.

As of April 30, 2014, we had convertible notes payable – related parties totaling $156,000 bearing interest at 4% per annum. As subsequently amended, the notes may be converted into common stock of the company at a price of $0.10 per share. We have calculated imputed interest on these notes at an annual rate of 9%.

All convertible notes payable – related parties are convertible 30 days from the first day the company’s common shares are qualified for trading on the OTC Bulletin Board, which occurred in November 2012. As of April 30, 2014, neither of these convertible notes had been converted and therefore all are in default.

As of April 30, 2014, we had other short-term notes payable – related parties totaling $79,656. These notes bear interest at an annual rate of 6% and are currently past due.

Accrued interest payable – related parties was $50,613 at April 30, 2014.

As of April 30, 2014, we had a convertible note payable to a non-related party in the amount of $100,000, bearing no interest. We have calculated imputed interest on this note at an annual rate of 9%. The note is only convertible into common stock of the company at a price of $0.125 per share.

As of April 30, 2014, we had a convertible note payable to a non-related party in the amount of $25,010, bearing no interest. We have calculated imputed interest on this note at an annual rate of 6%. The note is convertible into 250,000 shares of common stock at a price of $0.10 per share.

The $100,000 and $25,010 convertible notes payable are convertible 30 days from the first day the company’s common shares are qualified for trading on the OTC Bulletin Board, which occurred in November 2012. As of April 30, 2014, neither of these convertible notes had been converted and therefore are in default.

During the year ended April 30, 2014, we received proceeds of $36,000 from a convertible note payable to a non-related party, which balance was outstanding as of April 30, 2014. The note bears no interest and is convertible into common stock of the company at a price of $0.05 per share on or before July 31, 2014.

During the year ended April 30, 2014, we transferred $141,150 from payables – related parties to a convertible note payable to a non-related party, which balance was outstanding as of April 30, 2014. The note bears no interest and is convertible into common stock of the company at a price of $0.10 per share 90 days from demand.

During the year ended April 30, 2014, we received proceeds of $9,000 from a short-term note payable to a non-related party, which balance was outstanding as of April 30, 2014. The note bears interest at an annual rate of 6%.

On February 13, 2014, the company entered into a convertible promissory note with an institutional investor for $42,500, which bears interest at an annual rate of 8% and matures on November 18, 2014. The investor has the right, after the first 180 days of the note, to convert the note and accrued interest in whole or in part into shares of the company’s common stock at a price per share equal to 58% (representing a discount rate of 42%) of the average of the lowest three trading prices for the company’s common stock during the ten trading day period ending one trading day prior to the date of the conversion notice. At any time for the period beginning on the date of the note and ending on the date which is 30 days following the date of the note, the company may prepay the note upon payment of an amount equal to the outstanding principal multiplied by 120%, together with accrued and unpaid interest. The amount of the prepayment increases every subsequent 30 days to 125%, 130%, 135%, 140% and 145% of the outstanding principal together with accrued and unpaid interest. After the expiration of 180 days following the date of the note, the company will have no right of prepayment.

24

We have determined the conversion feature of the convertible promissory note with the institutional investor is a derivative and have estimated its value as a derivative liability of $63,359 at April 30, 2014.

As discussed in the notes to our consolidated financial statements, there is currently a limited market value for our common stock. Accordingly, no beneficial conversion feature or derivative liabilities, except for the conversion feature of the convertible promissory note with the institutional investor, are determinable or have been recognized related to our convertible notes payable. These convertible features will be evaluated in subsequent periods for fair value determination.

During the year ended April 30, 2014, we used net cash in operating activities of $135,107, as a result of our net loss of $364,741, partially offset by the increase in accounts payable of $48,800, imputed interest on convertible notes payable of $23,040, and increases in accounts payable – related parties of $144,107.

During the year ended April 30, 2013, we used net cash in operating activities of $107,097, as a result of our net loss of $522,946, partially offset by imputed interest on convertible notes payable of $27,098, decrease in prepaid expenses of $32,961, and increases in accounts payable of $53,050, accrued interest payable of $888, accrued interest payable – related parties of $1,010 and payables – related parties of $300,842.

During the year ended April 30, 2014, net cash provided by financing activities was $135,000, comprised of proceeds from notes payable – related parties of $47,500 and proceeds from convertible note payable of $87,500. We did not have any cash provided by or used in investing activities during either fiscal 2014 or 2013.

During the year ended April 30, 2013, net cash provided by financing activities was $57,166, comprised of proceeds from notes payable – related parties of $32,156 and proceeds from convertible notes payable of $25,010.

We have not realized any revenues since inception and paid expenses and costs with proceeds from the issuance of securities as well as by loans from directors and other stockholders.

We believe a related party will provide sufficient funds to carry on general operations for the next three months. We expect that we will need to raise additional funds, most likely from the sale of securities or from stockholder loans, to be able to execute phase two of our exploration program. We may not be successful in our efforts to obtain equity financing to carry out our business plan and there is doubt regarding our ability to complete our planned exploration program.

As of April 30, 2014, we did not have sufficient cash to fund our operations for the next twelve months.

Inflation

In the opinion of management, inflation has not and will not have a material effect on our operations until such time as we successfully complete an acquisition or merger. At that time, management will evaluate the possible effects of inflation related to our business and operations following a successful acquisition or merger.

Net Operating Loss

We have accumulated a net operating loss carryforward of approximately $1,079,100 as of April 30, 2014. This loss carry forward may be offset against future taxable income through the year 2035. The use of these losses to reduce future income taxes will depend on the generation of sufficient taxable income prior to the expiration of the net operating loss carryforwards. In the event of certain changes in control, there will be an annual limitation on the amount of net operating loss carryforwards that can be used. No tax benefit has been reported in the financial statements for the years ended April 30, 2014 and 2013 because it has been fully offset by a valuation reserve. The use of future tax benefit is undeterminable because we presently have no operations.

Due to the change in ownership provisions of U.S. federal and Canada and British Columbia income tax laws, operating loss carryforwards are potentially subject to annual limitations. As a result of the change in ownership of Canyon Gold Corp., $1,502,000 of net operating loss carryforwards have been deemed to have been forfeited. The net operating loss balance above reflects the forfeiture of this carryforward.

25

Critical Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Basic and Diluted Loss per Common Share

Basic loss per share is calculated by dividing the company’s net loss applicable to common shareholders by the weighted average number of common shares during the period. Diluted earnings per share is calculated by dividing the company’s net loss available to common shareholders by the diluted weighted average number of shares outstanding during the year. The diluted weighted average number of shares outstanding is the basic weighted number of shares adjusted for any potentially dilutive debt or equity. There are no such common stock equivalents outstanding for the fiscal years ended April 30, 2014 and 2013.

Dividends

The company has not adopted any policy regarding payment of dividends. No dividends have been paid during any of the periods shown.

Comprehensive Income

The company has no component of other comprehensive income. Accordingly, net income equals comprehensive loss for the fiscal years ended April 30, 2014 and 2013.

Cash and Cash Equivalents

For purposes of the statement of cash flows, the company considers all highly liquid instruments purchased with a maturity of three months or less to be cash equivalents to the extent the funds are not being held for investment purposes.

Income Taxes

The company provides for income taxes under ASC 740, Accounting for Income Taxes. ASC 740 requires the use of an asset and liability approach in accounting for income taxes. Deferred tax assets and liabilities are recorded based on the differences between the financial statement and tax bases of assets and liabilities and the tax rates in effect when these differences are expected to reverse. The company’s predecessor operated as entity exempt from Federal and State income taxes.

ASC 740 requires the reduction of deferred tax assets by a valuation allowance if, based on the weight of available evidence, it is more likely than not that some or all of the deferred tax assets will not be realized.

Impairment of Long-Lived Assets

The company continually monitors events and changes in circumstances that could indicate carrying amounts of long-lived assets may not be recoverable. When such events or changes in circumstances are present, the company assesses the recoverability of long-lived assets by determining whether the carrying value of such assets will be recovered through undiscounted expected future cash flows. If the total of the future cash flows is less than the carrying amount of those assets, the company recognizes an impairment loss based on the excess of the carrying amount over the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or the fair value less costs to sell.

26

Accounting Basis

Our consolidated financial statements are prepared using the accrual method of accounting and accounting principles generally accepted in the United States of America. The company has adopted an April 30 fiscal year end.

Revenue Recognition

Revenues from the sale of products will be recorded when the product is shipped, title and risk of loss have transferred to the purchaser, payment terms are fixed or determinable and payment is reasonably assured. Revenues from service contracts will be recognized when performance of the service is complete or over the term of the contract.

Recent Accounting Pronouncements

There were no new accounting pronouncements issued during the year ended April 30, 2014 and through the date these consolidated financial statements were available to be issued that the company believes are applicable to or would have a material impact on the consolidated financial statements of the company.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

This item is not required for a smaller reporting company.

Item 8. Financial Statements and Supplementary Data.

Financial statements for the fiscal years ended April 30, 2014 and 2013 have been examined to the extent indicated in their reports by HJ & Associates, LLC, independent certified public accountants and have been prepared in accordance with accounting principles generally accepted in the United States of America and pursuant to regulations promulgated by the SEC. The aforementioned financial statements are included herein under Item 15.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

This item is not applicable.

Item 9A. Controls and Procedures.

Evaluation of Disclosures and Procedures

Our chief executive officer and chief financial officer have evaluated the effectiveness of “disclosure controls and procedures,” as defined in the Securities Exchange Act of 1934, Rules 13a-15(e) and 15-d-15(e), as of April 30, 2014. Based upon that evaluation, it was concluded that as of April 30, 2014, our disclosure controls and procedures were not effective to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is:

(i) recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms; and

(ii) accumulated and communicated to management, including our chief executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure.

Management’s Annual Report on Internal Control Over Financial Reporting

27

Management is responsible for establishing and maintaining adequate internal control over financial reporting. Our control system is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U.S. generally accepted accounting principles. Our internal control over financial reporting includes those policies and procedures that:

|

●

|

pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and disposition of our assets;

|

|

●

|

provide reasonable assurance that the transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles and that receipts and expenditures are being made only with proper authorizations of management and directors; and

|

|

●

|

provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of company assets that could have a material effect on the financial statements.

|

Because of inherent limitations, internal control over financial reporting may not prevent or detect all misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.