Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - HAWKER ENERGY, INC. | Financial_Report.xls |

| EX-21 - EXHIBIT 21 - HAWKER ENERGY, INC. | ex21.htm |

| EX-32 - EXHIBIT 32 - HAWKER ENERGY, INC. | ex32.htm |

| EX-31 - EXHIBIT 31 - HAWKER ENERGY, INC. | ex31.htm |

| EX-10.6 - EXHIBIT 10.6 - HAWKER ENERGY, INC. | ex10_6.htm |

| EX-10.8 - EXHIBIT 10.8 - HAWKER ENERGY, INC. | ex10_8.htm |

| EX-23.1 - EXHIBIT 23.1 - HAWKER ENERGY, INC. | ex23_1.htm |

| EX-23.2 - EXHIBIT 23.2 - HAWKER ENERGY, INC. | ex23_2.htm |

| EX-10.5 - EXHIBIT 10.5 - HAWKER ENERGY, INC. | ex10_5.htm |

| EX-10.20 - EXHIBIT 10.20 - HAWKER ENERGY, INC. | ex10_20.htm |

| EX-10.12 - EXHIBIT 10.12 - HAWKER ENERGY, INC. | ex10_12.htm |

| 10-K - FOR THE FISCAL YEAR ENDED AUGUST 31, 2014 - HAWKER ENERGY, INC. | h111814010k.htm |

Exhibit 99.1

RESERVE AND ECONOMIC EVALUATION

OIL PROPERTY

D.E.E.P. PROPERTY, MIDWAY – SUNSET FIELD

CALIFORNIA, USA

Prepared for

HAWKER ENERGY INC.

September 1, 2014

October 31, 2014

Hawker Energy Inc.

102, 326 South Pacific Coast Highway

Redondo Beach, CA

USA 90277

Attention: Mr. Darren Katic

Dear Sir:

|

Re:

|

Reserve and Economic Evaluation – Hawker Energy Inc.

|

|

D.E.E.P. Property, Midway-Sunset Field, California, USA – September 1, 2014

|

In accordance with your authorization we have prepared a reserve and economic evaluation of an oil property located in California, USA, for Hawker Energy Inc. (the "Company") for an effective date of September 1, 2014.

This evaluation has been carried out in accordance with the guidelines of Regulation S-X, Rule 4 -10 (a) of the Securities Exchange Act, with respect to the classification of Reserves. The report has been prepared and/or supervised by a "Qualified Reserves Evaluator" as demonstrated on the accompanying Certificate of Qualification of the author(s).

The SCOPE OF REPORT contains the authorization and purpose of the report and describes the methodology and economic parameters used in the preparation of this report.

The SUMMARY OF RESERVES AND ECONOMICS includes values at the property level and the consolidated cash flows for each accumulating reserve category, and contains the results of the economic forecasts using pricing guidelines as defined in Regulation S-X 210.4-10 22 (v), and expressed in United States dollars, as applicable for SEC filing. The net present values presented in this report do not necessarily represent the fair market value of the reserves evaluated in this report.

The DISCUSSION contains a description of the interests and burdens, reserves and geology, production forecasts, product prices, capital and operating costs and a map of each major property. The economic results and cash flow forecasts (before income tax) are also presented on an entity and property summary level.

A REPRESENTATION LETTER from the Company, confirming that to the best of their knowledge all the information they provided for our use in the preparation of this report was complete and accurate as of the effective date, is enclosed following the Glossary.

Because the reserves data are based on judgments regarding future events, actual results will vary and the variations may be significant. We have no responsibility to update our report for events and circumstances which may have occurred since the preparation date of this report.

Prior to public disclosure of any information contained in this report, or our name as author, our written consent must be obtained, as to the information being disclosed and the manner in which it is presented. This report may not be reproduced, distributed or made available for use by any other party without our written consent and may not be reproduced for distribution at any time without the complete context of the report, unless otherwise reviewed and approved by us.

We consent to the submission of this report, in its entirety, to securities regulatory agencies and stock exchanges, by the Company.

It has been a pleasure to prepare this report and the opportunity to have been of service is appreciated.

Yours very truly,

Chapman Petroleum Engineering Ltd.

[Original Signed By:]

C.W. Chapman

C.W. Chapman, P.Eng.,

President

[Original Signed By:]

M. Stromar

M. Stromar, M.Sc., P.Eng.,

Associate

|

PERMIT TO PRACTICE

CHAPMAN PETROLEUM ENGINEERING LTD.

|

|||

|

Signature

|

[Original Signed By:]

C.W. Chapman

|

||

|

Date

|

October 31, 2014

|

||

|

PERMIT NUMBER: P 4201

The Association of Professional Engineers

and Geoscientists of Alberta |

|||

CERTIFICATE OF QUALIFICATION

I, C. W. CHAPMAN, P. Eng., Professional Engineer of the City of Calgary, Alberta, Canada, officing at Suite 445, 708 – 11th Avenue S.W., hereby certify:

|

1.

|

THAT I am a registered Professional Engineer in the Province of Alberta and a member of the Australasian Institute of Mining and Metallurgy.

|

|

2.

|

THAT I graduated from the University of Alberta with a Bachelor of Science degree in Mechanical Engineering in 1971.

|

|

3.

|

THAT I have been employed in the petroleum industry since graduation by various companies and have been directly involved in reservoir engineering, petrophysics, operations, and evaluations during that time.

|

|

4.

|

THAT I have in excess of 25 years in the conduct of evaluation and engineering studies relating to oil & gas fields in Canada and around the world.

|

|

5.

|

THAT I participated directly in the evaluation of these assets and properties and preparation of this report for Hawker Energy Inc., dated October 31, 2014 and the parameters and conditions employed in this evaluation were examined by me and adopted as representative and appropriate in establishing the value of these oil and gas properties according to the information available to date.

|

|

6.

|

THAT I have not, nor do I expect to receive, any direct or indirect interest in the properties or securities of Hawker Energy Inc. its participants or any affiliate thereof.

|

|

7.

|

THAT I have not examined all of the documents pertaining to the ownership and agreements referred to in this report, or the chain of Title for the oil and gas properties discussed.

|

|

8.

|

A personal field examination of these properties was considered to be unnecessary because the data available from the Company's records and public sources was satisfactory for our purposes.

|

[Original Signed By:]

C.W. Chapman

C.W. Chapman, P.Eng.

President

|

PERMIT TO PRACTICE

CHAPMAN PETROLEUM ENGINEERING LTD.

|

|||

|

Signature

|

[Original Signed By:]

C.W. Chapman

|

||

|

Date

|

October 31, 2014

|

||

|

PERMIT NUMBER: P 4201

The Association of Professional Engineers

and Geoscientists of Alberta |

|||

CERTIFICATE OF QUALIFICATION

|

|

I, HAROLD J. RYAN, P. Geol., Professional Geologist of the City of Calgary, Alberta, Canada, officing at Suite 445, 708 – 11th Avenue S.W., hereby certify:

|

|

1.

|

THAT I am a registered Professional Geologist in the Province of Alberta, a Fellow of the Geological Association of Canada and a Fellow of the Geological Society of London.

|

|

2.

|

THAT I graduated from the University of Calgary with a Bachelor of Science degree in Geology in 1983.

|

|

3.

|

THAT I have been employed in the petroleum industry since graduation by various companies and have been directly involved in petroleum geology, petrophysics, operations, and evaluations during that time.

|

|

4.

|

THAT I have in excess of 15 years of experience in the conduct of evaluation and geological studies relating to oil and gas fields in Canada and internationally.

|

|

5.

|

THAT I participated directly in the evaluation of these assets and properties and preparation of this report for Hawker Energy Inc., dated October 31, 2014 and the parameters and conditions employed in this evaluation were examined by me and adopted as representative and appropriate in establishing the value of these oil and gas properties according to the information available to date.

|

|

6.

|

THAT I have not, nor do I expect to receive, any direct or indirect interest in the properties or securities of Hawker Energy Inc., its participants or any affiliate thereof.

|

|

7.

|

THAT I have not examined all of the documents pertaining to the ownership and agreements referred to in this report, or the chain of Title for the oil and gas properties discussed.

|

|

8.

|

A personal field examination of these properties was considered to be unnecessary because the data available from the Company’s records and public sources was satisfactory for our purposes.

|

[Original Signed By:]

Harold J. Ryan

Harold J. Ryan, P.Geol.

Manager Geoscience

CERTIFICATE OF QUALIFICATION

I, MIRO STROMAR, M. Sc., P. Eng., Professional Engineer of the City of Calgary, Alberta, Canada, officing at Suite 445, 708 – 11th Avenue S.W., hereby certify:

|

1.

|

THAT I am a registered Professional Engineer in the Province of Alberta.

|

|

2.

|

THAT I graduated from the University of Zagreb with a Masters of Science degree in Chemical Engineering in 1974.

|

|

3.

|

THAT I have been employed in the petroleum industry since graduation by various companies and have been directly involved in reservoir engineering, petrophysics, operations, and evaluations during that time.

|

|

4.

|

THAT I have in excess of 20 years in the conduct of evaluation and engineering studies relating to oil & gas fields in Canada and around the world.

|

|

5.

|

THAT I participated directly in the evaluation of these assets and properties and preparation of this report for Hawker Energy Inc., dated October 31, 2014 and the parameters and conditions employed in this evaluation were examined by me and adopted as representative and appropriate in establishing the value of these oil and gas properties according to the information available to date.

|

|

6.

|

THAT I have not, nor do I expect to receive, any direct or indirect interest in the properties or securities of Hawker Energy Inc., its participants or any affiliate thereof.

|

|

7.

|

THAT I have not examined all of the documents pertaining to the ownership and agreements referred to in this report, or the chain of Title for the oil and gas properties discussed.

|

|

8.

|

A personal field examination of these properties was considered to be unnecessary because the data available from the Company's records and public sources was satisfactory for our purposes.

|

[Original Signed By:]

M. Stromar

M. Stromar, M.Sc., P.Eng.,

Associate

RESERVE AND ECONOMIC EVALUATION

OIL PROPERTY

D.E.E.P. PROPERTY, MIDWAY – SUNSET FIELD

CALIFORNIA, USA

Prepared for

HAWKER ENERGY INC.

September 1, 2014

TABLE OF CONTENTS

Scope of Report

Authorization

Purpose

Reserve Definitions

Barrels of Oil Equivalent

Sources of Information

Product Prices

Product Sales Arrangements

Capital Expenditures and Operating Costs

Income Tax Parameters

Abandonment and Restoration

Economics

Constant Price Parameters

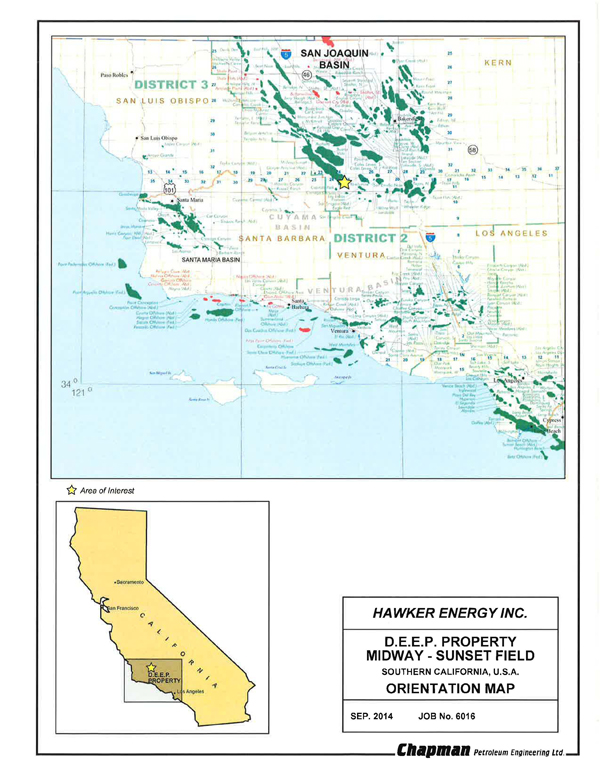

Orientation Map

Product Price Forecast

Discussion

CALIFORNIA, USA

D.E.E.P. Property, Midway – Sunset Field

Glossary

Company Representation Letter

SCOPE OF REPORT

Authorization

This evaluation has been authorized by Mr. Darren Katic, on behalf of Hawker Energy Inc. The engineering analysis has been performed during the month of September 2014.

Purpose

The purpose of this report was to prepare a third party independent appraisal of the oil reserves owned by Hawker Energy Inc. for the Company's financial planning.

The values in this report do not include the value of the Company's undeveloped land holdings nor the tangible value of their interest in associated plant and well site facilities they may own. The cash flow forecasts account for well and/or facility abandonment and reclamation costs and the offsetting salvage value of the tangible equipment after abandonment.

Reserve Definitions

Proved and probable reserves as classified in the report have been based on Rule 4-10(a) of Regulation S-X of the Securities Exchange Act:

Classification of Reserves

Proved Oil and Gas Reserves.

Proved oil and gas reserves are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible—from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will commence the project within a reasonable time.

|

(i)

|

The area of the reservoir considered as proved includes:

|

|

|

(A)

|

The area identified by drilling and limited by fluid contacts, if any, and

|

|

|

(B)

|

Adjacent undrilled portions of the reservoir that can, with reasonable certainty, be judged to be continuous with it and to contain economically producible oil or gas on the basis of available geoscience and engineering data.

|

|

|

(ii)

|

In the absence of data on fluid contacts, proved quantities in a reservoir are limited by the lowest known hydrocarbons (LKH) as seen in a well penetration unless geoscience, engineering, or performance data and reliable technology establishes a lower contact with reasonable certainty.

|

|

|

(iii)

|

Where direct observation from well penetrations has defined a highest known oil (HKO) elevation and the potential exists for an associated gas cap, proved oil reserves may be assigned in the structurally higher portions of the reservoir only if geoscience, engineering, or performance data and reliable technology establish the higher contact with reasonable certainty.

|

|

|

(iv)

|

Reserves which can be produced economically through application of improved recovery techniques (including, but not limited to, fluid injection) are included in the proved classification when:

|

|

|

(A)

|

Successful testing by a pilot project in an area of the reservoir with properties no more favorable than in the reservoir as a whole, the operation of an installed program in the reservoir or an analogous reservoir, or other evidence using reliable technology establishes the reasonable certainty of the engineering analysis on which the project or program was based; and

|

|

|

(B)

|

The project has been approved for development by all necessary parties and entities, including governmental entities.

|

|

|

(v)

|

Existing economic conditions include prices and costs at which economic producibility from a reservoir is to be determined. The price shall be the average price during the 12-month period prior to the ending date of the period covered by the report, determined as an unweighted arithmetic average of the first-day-of-the-month price for each month within such period, unless prices are defined by contractual arrangements, excluding escalations based upon future conditions.

|

Probable Reserves

Probable reserves are those additional reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered.

|

|

(i)

|

When deterministic methods are used, it is as likely as not that actual remaining quantities recovered will exceed the sum of estimated proved plus probable reserves. When probabilistic methods are used, there should be at least a 50% probability that the actual quantities recovered will equal or exceed the proved plus probable reserves estimates.

|

|

|

(ii)

|

Probable reserves may be assigned to areas of a reservoir adjacent to proved reserves where data control or interpretations of available data are less certain, even if the interpreted reservoir continuity of structure or productivity does not meet the reasonable certainty criterion. Probable reserves may be assigned to areas that are structurally higher than the proved area if these areas are in communication with the proved reservoir.

|

|

|

(iii)

|

Probable reserves estimates also include potential incremental quantities associated with a greater percentage recovery of the hydrocarbons in place than assumed for proved reserves.

|

Possible Reserves

Possible reserves are those additional reserves that are less certain to be recovered than probable reserves.

|

|

(i)

|

When deterministic methods are used, the total quantities ultimately recovered from a project have a low probability of exceeding proved plus probable plus possible reserves. When probabilistic methods are used, there should be at least a 10% probability that the total quantities ultimately recovered will equal or exceed the proved plus probable plus possible reserves estimates.

|

|

|

(ii)

|

Possible reserves may be assigned to areas of a reservoir adjacent to probable reserves where data control and interpretations of available data are progressively less certain. Frequently, this will be in areas where geoscience and engineering data are unable to define clearly the area and vertical limits of commercial production from the reservoir by a defined project.

|

|

|

(iii)

|

Possible reserves also include incremental quantities associated with a greater percentage recovery of the hydrocarbons in place than the recovery quantities assumed for probable reserves.

|

|

|

(iv)

|

The proved plus probable and proved plus probable plus possible reserves estimates must be based on reasonable alternative technical and commercial interpretations within the reservoir or subject project that are clearly documented, including comparisons to results in successful similar projects.

|

|

|

(v)

|

Possible reserves may be assigned where geoscience and engineering data identify directly adjacent portions of a reservoir within the same accumulation that may be separated from proved areas by faults with displacement less than formation thickness or other geological discontinuities and that have not been penetrated by a wellbore, and the registrant believes that such adjacent portions are in communication with the known (proved) reservoir. Possible reserves may be assigned to areas that are structurally higher or lower than the proved area if these areas are in communication with the proved reservoir.

|

|

|

(vi)

|

Pursuant to paragraph (a)(22)(iii) of this section, where direct observation has defined a highest known oil (HKO) elevation and the potential exists for an associated gas cap, proved oil reserves should be assigned in the structurally higher portions of the reservoir above the HKO only if the higher contact can be established with reasonable certainty through reliable technology. Portions of the reservoir that do not meet this reasonable certainty criterion may be assigned as probable and possible oil or gas based on reservoir fluid properties and pressure gradient interpretations.

|

Barrel of Oil Equivalent

If at any time in this report reference is made to “Barrels of Oil Equivalent” (BOE), the conversion used is 6 Mscf : 1 STB (6 Mcf : 1 bbl).

BOEs may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf : 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent value equivalency at the well head.

Sources of Information

Source of the data used in the preparation of this report are as follows:

|

|

i)

|

Ownership and Burdens have been derived from the Company's land records and other information from the Company as required for clarification

|

|

|

ii)

|

Production data is acquired from public data sources, except for very recent data or certain wells which are provided directly by the Company

|

|

|

iii)

|

Well data is accessed from the Company's well files and from public data sources

|

|

|

iv)

|

Operating Costs are based on actual revenue and expense statements provided by the Company for established properties or from discussions with the Company and our experience in the area for new properties

|

|

|

v)

|

Price differentials are derived from revenue statements, compared to actual posted prices for the appropriate benchmark price over a period of several months

|

|

|

vi)

|

Timing of Development Plans and Capital estimates are normally determined by discussions with the Company together with our experience and judgement

|

Product Prices

The price used for each area in this report, in accordance with SEC regulation S-X rule 4-10, was the average price during the 12-month period prior to the ending date of the period covered by the report, determined as an unweighted arithmetic average of the first-day-of-the-month price for each month, within such period, unless prices are defined by contractual arrangements, excluding escalations based on future conditions.

Adjustments for crude quality, gas heating value and NGL trucking and fractionation have still been applied to the average prices to reflect actual prices being received. In addition, no escalation has been applied to either the capital expenditures or operating costs.

The average price shown in the cash flows may differ from year to year due to variations in the proportionate production volumes from each property relative to the total.

For the purpose of US Security Exchange Commission filing, the results of the Constant Prices and Cost case for proved and probable reserves are expressed in United States dollars are presented in the Summary of Reserves and Economics (SEC).

Product Sales Arrangements

The Company does not have any "hedge" contracts in place at this time.

Capital Expenditures and Operating Costs

Operating costs and capital expenditures have been based on historical experience and analogy where necessary and have not been escalated.

Income Tax Parameters

Net cash flows after consideration of corporate income tax have not been included in this report.

Abandonment and Restoration

Abandonment and restoration costs, net of salvage, have been included in the cash flows for the final event of any particular well. The abandonment cost does not impact the economic limit and is included in the final year of production automatically by ERGO. For marginal wells nearing the end of their economic life, these costs may result in a negative net present value.

In this report, we have account for these costs for only the wells which are being included and have not included other shut-in or suspended wells in the Company's inventory or their facilities and pipelines.

Economics

The results of the before tax economic analysis, which are presented for each entity and property summary, are in a condensed form presented on one page for simplicity in analyzing the cash flows, however, if for any reason more extensive breakdown of the cash flow is required, a separate schedule can be provided showing the full derivation and breakdown of any or all of the columns on the summary page.

The economic presentation shows the gross property and company gross and net (before and after royalty) production of oil gas and each NGL product along with the product prices adjusted for oil quality and heating value of gas. Oil prices also include the deduction for trucking costs where applicable for royalty deductions.

The second level includes the revenues, royalties, operating costs, processing income, abandonment costs, capital and cash flow of the property. Operating costs are presented for the gross property and the company share, split between variable and fixed costs, and the effective cost per BOE.

Net revenues are presented annually and as a net back in $/BOE @ 6 Mscf/STB. Revenue from custom processing of oil or gas is presented separately.

The third level of data presents the cumulative cash flow values (present worth) for various discount rates. Also, the net cash flow breakdown is presented. The project profitability criteria are summarized on the bottom right of the page. These data are not relevant in the case of corporate evaluations but are useful in assessing individual capital projects.

Constant Price Parameters

The Constant Price values utilized in this report are the latest prices being received posted prices for oil by the Company.

Adjustments for crude quality, gas heating value and NGL trucking and fractionation have still been applied to the average prices to reflect actual prices being received. In addition, no escalation has been applied to either the capital expenditures or operating costs.

In the Constant Price cash flows the magnitude of the gross and net reserves will not change except where production forecasts have been truncated or extended due to economic limits being reached earlier or later in the life of the properties than in the forecast price case, and due to the impact of royalties which are price related.

The average price shown in the cash flows may differ from year to year due to variations in the proportionate production volumes from each property relative to the total.

D.E.E.P. PROPERTY, MIDWAY – SUNSET FIELD

CALIFORNIA, USA

INDEX

Discussion

Ownership

Geology

Reserves

Production

Product Prices

Capital Expenditures

Operating Costs

Economics

Attachments

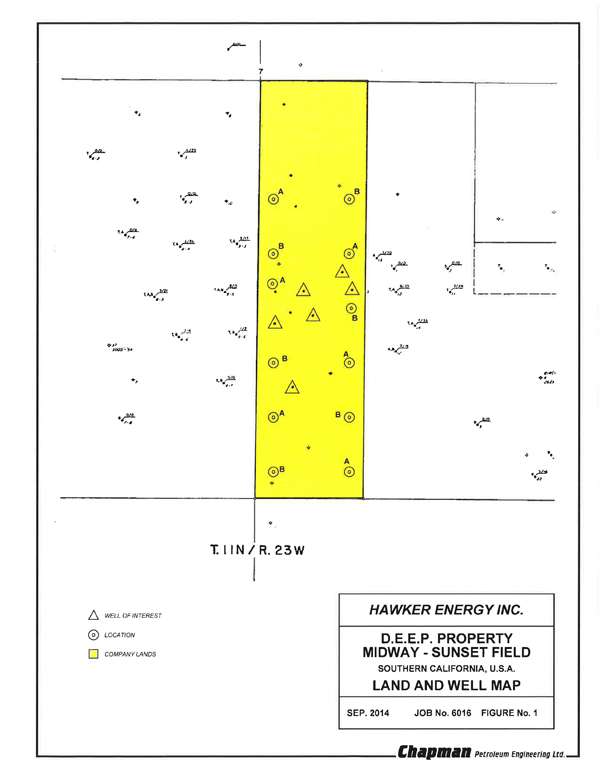

Figure 1: Land and Well Map

Table 1: Schedule of Lands, Interests and Royalty Burdens

Figure 2: Geological Maps and Figures

|

|

a)

|

Table of Formations

|

|

|

b)

|

Isopach Total Net Monarch Oil Sand

|

|

|

c)

|

Isopach of Top Oil Sand

|

Table 2: Summary of Reserves

Summary of Reserves and Reservoir Parameters

Proved Developed Non-Producing

|

|

a)

|

D.E.E.P. Lease – Monarch SS

|

Figure 3: Production History Graphs

|

|

a)

|

Proved Developed Producing

|

|

|

b)

|

Proved plus Probable

|

Table 3: Summary of Anticipated Capital Expenditures

|

|

a)

|

Development

|

|

|

b)

|

Abandonment and Restoration

|

Table 4: Summary of Company Reserves and Economics

Consolidated Cash Flows

|

|

a)

|

6 Wells, Monarch SS and Top Oil – Proved Developed Producing

|

|

|

b)

|

D.E.E.P. Lease, California – Total Proved

|

|

|

c)

|

D.E.E.P. Lease, California – Total Proved Plus Probable

|

Individual Cash Flows

Proved Undeveloped

|

|

d)

|

12 Wells, Monarch SS

|

Proved Plus Probable Developed Producing

|

|

e)

|

6 Wells, Monarch SS and Top Oil

|

Proved Plus Probable Undeveloped

|

|

f)

|

12 Wells, Monarch SS

|

Figure 4: Production History and Forecast – Company Share

D.E.E.P. PROPERTY, MIDWAY – SUNSET FIELD

CALIFORNIA, USA

INDEX

Ownership

The Company owns a 100 percent working interest in 40 acres of land containing three producing and three shut in heavy oil wells, as shown on the map, Figure 1. Production is subject to a 20.9 percent freehold royalty.

A detailed description of the lands, interests and royalty burdens is presented in Table 1.

Geology

The San Joaquin Basin is a deep asymmetric synclinal downwarp that underlies the Central Valley of California. The basin is a prolific oil-producing area that originated in the Late Mesozoic. The Midway-Sunset Oil Field is located along the southwestern flank of the basin, as shown on the orientation map illustrated in Figure 1. It is the largest field in the southern portion of San Joaquin Basin and has produced over 2 billion barrels of oil.

There are two productive zones on the Company property. The Monarch Sand is a submarine fan sandstone of Miocene Age encapsulated within the Belridge Diatomite Member of the Monterey Formation. The Top Oil Sand is the basal unit of the San Joaquin Formation of Pliocene Age. Both these units are shown on the Table of Formations chart illustrated in Figure 2a.

The Monarch Sand is found at an average depth of 1600 feet on the Company property. It is a silty fine to very fine grained sandstone containing heavy oil within a stratigraphic-structural trap. A map of total net oil sand is illustrated in Figure 2b. The thickness is up to over 55 feet within an upper “A” and lower “B” sandstone unit.

An additional potential of this property is the Top Oil Sand is found at an average depth of 1400 feet on the Company property and is a fine to very fine grained sand with silt and shale inclusions, heavy oil is stratigraphically trapped within this unit which can be up to over 35 feet in thickness on the Company land, as shown on the isopach map illustrated in Figure 2c.

Reserves

Total gross remaining proved developed producing heavy oil reserves of 4.1 MSTB have been estimated for the Monarch and Top Oil zones in three producing wells based on decline analysis of their production performance.

Total proved undeveloped heavy oil reserves of 335 MSTB have been estimated for the same zones in twelve future locations in anticipation of steam assisted recovery based on geological mapping and reservoir parameters derived from log analysis, and analogy to successful steam scheme recoveries in immediate vicinity of the lands.

Incremental probable producing reserves of 2.2 MSTB have been assigned to the five producing wells in anticipation of a better performance than in the proved case.

Incremental probable undeveloped reserves of 167 MSTB have been assigned to the same twelve locations in anticipation of a better recovery than in the proved case.

A summary of reserves is presented in Table 2, and the reserves and reservoir parameters are presented in table 2a.

Production

Production from the area currently averages 4.2 STB/d and is expected to gradually decline to economic limits.

The non-producing probable reserves are expected to commence production in 2015 on a steam cycling scheme, i.e. super heated steam injection into two diagonally opposed wells (A locations) for a month, then producing them while injecting steam into B locations. This would be an alternating scheme on one month cycles, so at any given time, six wells would be producing. The wells are expected to commence production at initial rates of 8 STB/d per well, peak at 15 STB/d per well in 2016, then commence a gradual decline.

In the proved plus probable scenario, all those rates are expected to be 50 percent higher.

A production history graph is shown on Figure 3a for the proved case and Figure 3b for the proved plus probable case.

Product Prices

An average 2014 price of $92.02/STB of heavy oil has been utilized based on production and revenue statements provided by the Company. The Company receives a price that is $7.96 less relative to the SEC price of $99.98.

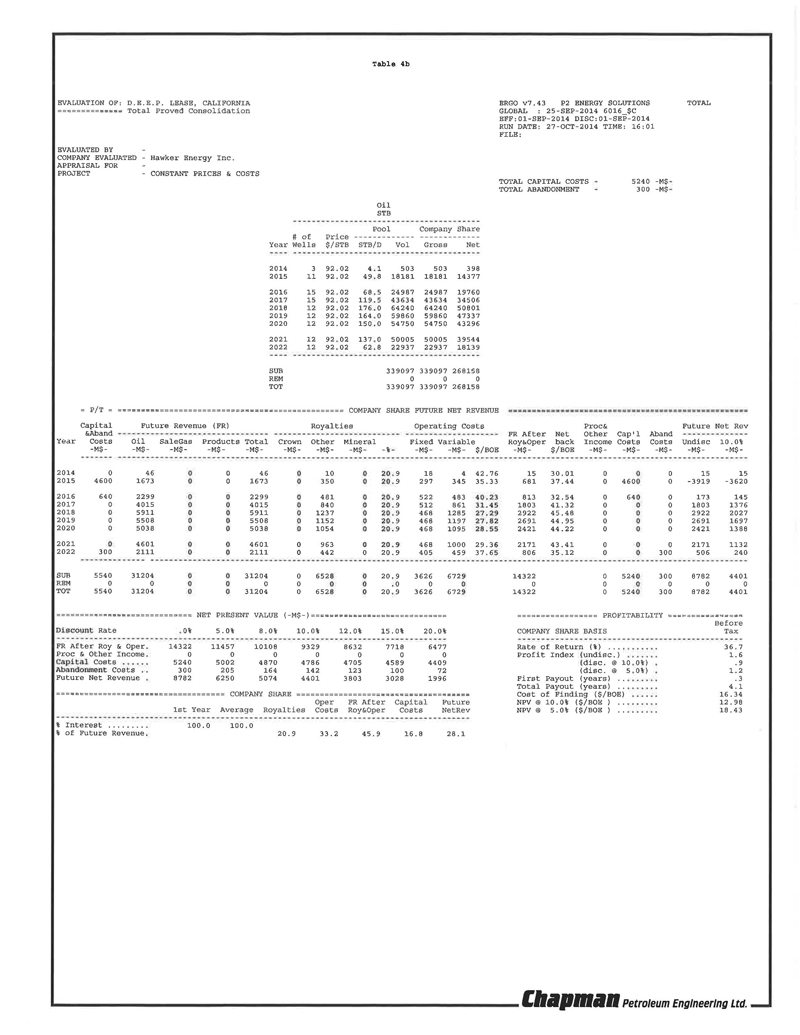

Capital Expenditures

Total development expenditures of $5,240,000 have been anticipated for this project as detailed in Table 3a.

Total abandonment and restoration liabilities of $300,000 have been anticipated for this project as detailed in Table 3b.

Operating Costs

Operating costs of $1,500 per producing well per month as well as $7.00 per STB and $3,000 per future wells per month plus $20.00/STB, which includes the cost of steam generation, have been estimated based on production and revenue statements provided by the Company, and our experience and judgement for the steam generation aspects.

Economics

An economic summary is presented in Table 4, and the results of our economic analysis are presented in Table 4a through 4f.

The Company’s total historical production together with our proved producing and proved plus probable forecast is presented on Figure 4.

|

Table 2

|

|||||||||||||||||||||||

|

Summary of Reserves

|

|||||||||||||||||||||||

|

September 1, 2014

|

|||||||||||||||||||||||

|

D.E.E.P Lease, Kern Co., California

|

|||||||||||||||||||||||

|

Current or

|

||||||||||||||||||||||||

|

Initial

|

API

|

Ultimate

|

Cumulative

|

Remaining

|

||||||||||||||||||||

|

Rate

|

Gravity

|

ROIP

|

Production

|

ROIP

|

||||||||||||||||||||

|

Description

|

STB/d

|

(Deg)

|

(MSTB)

|

(MSTB)

|

(MSTB)

|

Reference

|

||||||||||||||||||

|

Heavy Oil

|

||||||||||||||||||||||||

|

Proved Developed Producing

|

||||||||||||||||||||||||

|

Six Wells

|

Monarch and Top Oil

|

4.2 | 15 | 126.3 | 122.2 | 4.1 |

Figure 3a

|

|||||||||||||||||

|

Total Proved Developed Producing

|

4.2 | 126.3 | 122.2 | 4.1 | ||||||||||||||||||||

|

Proved Undeveloped

|

||||||||||||||||||||||||

|

Thermal Project - Development

|

Monarh SS

|

15 | 335.0 | 0.0 | 335.0 |

Table 2a

|

||||||||||||||||||

|

Total Proved Undeveloped

|

335.0 | 0.0 | 335.0 | |||||||||||||||||||||

|

Total Proved

|

461.3 | 122.2 | 339.1 | |||||||||||||||||||||

|

Probable

|

||||||||||||||||||||||||

|

Six Wells

|

Monarch and Top Oil

|

(incr.)

|

15 | 2.2 | 0.0 | 2.2 |

Figure 3b

|

|||||||||||||||||

|

Thermal Project - Development

|

Monarh SS

|

(incr.)

|

15 | 167.0 | 0.0 | 167.0 |

Table 2a

|

|||||||||||||||||

|

Total Probable

|

169.2 | 0.0 | 169.2 | |||||||||||||||||||||

|

Total Proved Plus Probable

|

630.5 | 122.2 | 508.3 | |||||||||||||||||||||

|

Table 3a

|

||||||||||

|

Summary of Anticipated Capital Expenditures

|

||||||||||

|

Development

|

||||||||||

|

September 1, 2014

|

||||||||||

|

HAWKER ENERGY INC.

|

||||||||||

|

D.E.E.P Lease, Kern Co., California

|

|

Capital

|

Gross

|

Net

|

||||||||||||||

|

Interest

|

Capital

|

Capital

|

||||||||||||||

|

Description

|

Date

|

Operation

|

%

|

$M | $M | |||||||||||

|

Proved Undeveloped

|

||||||||||||||||

|

Drill twelwe wells

|

2015

|

Drill twelwe wells

|

100.0000 | 4,600 | 4,600 | |||||||||||

|

Upgrade facilities

|

2016

|

Expand facilities

|

100.0000 | 640 | 640 | |||||||||||

|

Total Proved Undeveloped

|

5,240 | 5,240 | ||||||||||||||

|

Total Proved

|

5,240 | 5,240 | ||||||||||||||

Note: The above capital values are expressed in terms of current dollar values without escalation.

|

Table 3b

|

|||||||||||

|

Summary of Anticipated Capital Expenditures

|

|||||||||||

|

Abandonment and Restoration

|

|||||||||||

|

September 1, 2014

|

|||||||||||

|

HAWKER ENERGY INC.

|

|||||||||||

|

D.E.E.P Lease, Kern Co., California

|

|||||||||||

|

Working

|

Gross

|

Net

|

|||||||||||||||

|

Interest

|

Capital

|

Capital

|

|||||||||||||||

|

Well location

|

Operation

|

Year

|

%

|

$M | $M | ||||||||||||

|

Abandon wells and future locations

|

Abandon 17 wells

|

100.0000 | 300.0 | 300.0 | |||||||||||||

|

Total

|

300.0 | 300.0 | |||||||||||||||

Note: The above capital values are expressed in terms of current dollar values without escalation.

|

Table 4

|

Contant Prices & Costs | |

|

Summary of Company Reserves and Economics

|

||

|

Before Income Tax

|

||

|

September 1, 2014

|

||

|

Hawker Energy Inc.

|

||

|

D.E.E.P. LEASE, CALIFORNIA

|

|

N e t T o A p p r a i s e d I n t e r e s t

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Reserves

|

Cumulative Cash Flow (BIT) - M$

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Light and Medium Oil

|

Heavy Oil

|

Sales Gas

|

NGL

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

MSTB

|

MSTB

|

MMscf

|

Mbbls

|

Discounted at:

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

Description

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

Undisc.

|

5%/year

|

10%/year

|

15%/year

|

20%/year

|

|||||||||||||||||||||||||||||||||||||||||

|

Proved Developed Producing

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Total

|

Monarch SS and Top Oil

|

0 | 0 | 4 | 3 | 0 | 0 | 0 | 0 | 100 | 93 | 88 | 83 | 79 | ||||||||||||||||||||||||||||||||||||||||

|

Total Proved Developed Producing

|

0 | 0 | 4 | 3 | 0 | 0 | 0 | 0 | 100 | 93 | 88 | 83 | 79 | |||||||||||||||||||||||||||||||||||||||||

|

Proved Undeveloped

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

12 Wells

|

Monarch SS

|

0 | 0 | 335 | 265 | 0 | 0 | 0 | 0 | 8,682 | 6,157 | 4,313 | 2,945 | 1,917 | ||||||||||||||||||||||||||||||||||||||||

|

Total Proved Undeveloped

|

0 | 0 | 335 | 265 | 0 | 0 | 0 | 0 | 8,682 | 6,157 | 4,313 | 2,945 | 1,917 | |||||||||||||||||||||||||||||||||||||||||

|

Total Proved

|

0 | 0 | 339 | 268 | 0 | 0 | 0 | 0 | 8,782 | 6,250 | 4,401 | 3,028 | 1,996 | |||||||||||||||||||||||||||||||||||||||||

|

Probable

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Probable Developed Producing

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Total

|

Monarch SS and Top Oil

|

Incr.

|

0 | 0 | 2 | 2 | 0 | 0 | 0 | 0 | 54 | 45 | 39 | 34 | 29 | |||||||||||||||||||||||||||||||||||||||

|

Total Probable Developed Producing

|

0 | 0 | 2 | 2 | 0 | 0 | 0 | 0 | 54 | 45 | 39 | 34 | 29 | |||||||||||||||||||||||||||||||||||||||||

|

Probable Undeveloped

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

12 Wells

|

Monarch SS

|

Incr.

|

0 | 0 | 167 | 132 | 0 | 0 | 0 | 0 | 8,766 | 7,041 | 5,755 | 4,777 | 4,022 | |||||||||||||||||||||||||||||||||||||||

|

Total Probable Undeveloped

|

0 | 0 | 167 | 132 | 0 | 0 | 0 | 0 | 8,766 | 7,041 | 5,755 | 4,777 | 4,022 | |||||||||||||||||||||||||||||||||||||||||

|

Total Probable

|

0 | 0 | 170 | 134 | 0 | 0 | 0 | 0 | 8,820 | 7,086 | 5,794 | 4,811 | 4,051 | |||||||||||||||||||||||||||||||||||||||||

|

Total Proved Plus Probable

|

0 | 0 | 509 | 402 | 0 | 0 | 0 | 0 | 17,602 | 13,337 | 10,195 | 7,839 | 6,047 | |||||||||||||||||||||||||||||||||||||||||

M$ means thousands of United States dollars

Gross reserves are the total of the Lease's working and/or royalty interest share before deduction of royalties owned by others.

Net reserves are the total of the Lease's working and/or royalty interest share after deducting the amounts attributable to royalties owned by others.

Columns may not add precisely due to accumulative rounding of values throughout the report.

|

Table 5

|

|

CHAPMAN PETROLEUM ENGINEERING LTD.

|

|

CRUDE OIL

|

|

HISTORICAL, CONSTANT, CURRENT AND FUTURE PRICES

|

|

September 1, 2014

|

|

AB Synthetic

|

Western Canada

|

Exchange

|

||||

|

WTI [1]

|

Brent Spot (ICE)[2]

|

Crude Price [3]

|

Select [4]

|

Rate

|

||

|

Date

|

$US/STB

|

$US/STB

|

$CDN/STB

|

$CDN/STB

|

$US/$CDN

|

|

|

HISTORICAL PRICES

|

||||||

|

2004

|

41.48

|

38.03

|

52.89

|

37.52

|

0.77

|

|

|

2005

|

56.62

|

55.28

|

69.16

|

43.25

|

0.83

|

|

|

2006

|

65.91

|

66.09

|

72.88

|

50.40

|

0.88

|

|

|

2007

|

72.35

|

72.74

|

75.57

|

53.17

|

0.94

|

|

|

2008

|

99.70

|

98.33

|

102.98

|

83.88

|

0.94

|

|

|

2009

|

61.64

|

62.52

|

76.77

|

53.04

|

0.88

|

|

|

2010

|

79.42

|

80.22

|

80.56

|

66.58

|

0.97

|

|

|

2011

|

95.03

|

109.67

|

102.45

|

77.43

|

1.01

|

|

|

2012

|

94.16

|

108.75

|

92.56

|

71.70

|

1.00

|

|

|

2013

|

97.93

|

108.68

|

100.17

|

75.76

|

0.97

|

|

|

2014

|

8 mos

|

100.57

|

107.95

|

109.08

|

87.72

|

0.91

|

|

CONSTANT PRICES (The average of the first-day-of-the-month price for the preceding 12 months-SEC)

|

||||||

|

|

99.98

|

108.68

|

104.72

|

81.78

|

0.93

|

|

|

FORECAST PRICES

|

||||||

|

2014

|

4 mos

|

100.00

|

110.00

|

110.11

|

83.68

|

0.90

|

|

2015

|

96.00

|

106.00

|

105.67

|

80.31

|

0.90

|

|

|

2016

|

94.00

|

101.50

|

103.44

|

78.62

|

0.90

|

|

|

2017

|

95.00

|

100.00

|

104.56

|

79.46

|

0.90

|

|

|

2018

|

97.00

|

102.00

|

106.78

|

81.15

|

0.90

|

|

|

2019

|

98.00

|

103.00

|

107.89

|

82.00

|

0.90

|

|

|

2020

|

100.00

|

105.00

|

110.11

|

83.68

|

0.90

|

|

|

2021

|

100.00

|

105.00

|

110.11

|

83.68

|

0.90

|

|

|

2022

|

102.00

|

107.00

|

112.33

|

85.37

|

0.90

|

|

|

2023

|

104.04

|

109.04

|

114.60

|

87.10

|

0.90

|

|

|

2024

|

106.12

|

111.12

|

116.91

|

88.85

|

0.90

|

|

|

2025

|

108.24

|

113.24

|

119.27

|

90.65

|

0.90

|

|

|

2026

|

110.41

|

115.41

|

121.68

|

92.47

|

0.90

|

|

|

2027

|

112.62

|

117.62

|

124.13

|

94.34

|

0.90

|

|

|

2028

|

114.87

|

119.87

|

126.63

|

96.24

|

0.90

|

|

|

2029

|

117.17

|

122.17

|

129.18

|

98.18

|

0.90

|

|

|

Constant thereafter

|

||||||

|

Notes:

|

[1]

|

West Texas Intermediate quality (D2/S2) crude (40API)landed in Cushing, Oklahoma.

|

||||

|

[2]

|

The Brent Spot price is estimated based on historic data.

|

|||||

|

[3]

|

Equivalent price for Light Sweet Crude (D2/S2) & Synthetic Crude (34API)landed in Edmonton.

|

|||||

|

[4]

|

Western Canada Select (20.5API), spot price for B.C., Alberta, Saskatchewan, and Manitoba.

|

|||||

GLOSSARY OF TERMS

(Abbreviations & Definitions)

General

|

BIT

|

-

|

Before Income Tax

|

|

AIT

|

-

|

After Income Tax

|

|

M$

|

-

|

Thousands of Dollars

|

|

Effective Date

|

-

|

The date for which the Present Value of the future cash flows and reserve categories are established

|

|

$US

|

-

|

United States Dollars

|

|

WTI

|

-

|

West Texas Intermediate – the common reference for crude oil used for oil price comparisons

|

|

ARTC

|

-

|

Alberta Royalty Tax Credit

|

|

GRP

|

-

|

Gas Reference Price

|

Interests and Royalties

|

BPO

|

-

|

Before Payout

|

|

APO

|

-

|

After Payout

|

|

APPO

|

-

|

After Project Payout

|

|

Payout

|

-

|

The point at which a participant’s original capital investment is recovered from its net revenue

|

|

GORR

|

-

|

Gross Overriding Royalty – percentage of revenue on gross revenue earned (can be an interest or a burden)

|

|

NC

|

-

|

New Crown – crown royalty on petroleum and natural gas discovered after April 30, 1974

|

|

SS 1/150 (5%-15%) Oil

|

-

|

Sliding Scale Royalty – a varying gross overriding royalty based on monthly production. Percentage is calculated as 1-150th of monthly production with a minimum percentage of 5% and a maximum of 15%

|

|

FH

|

-

|

Freehold Royalty

|

|

P&NG

|

-

|

Petroleum and Natural Gas

|

|

Twp

|

-

|

Township

|

|

Rge

|

-

|

Range

|

|

Sec

|

-

|

Section

|

Technical Data

|

psia

|

-

|

Pounds per square inch absolute

|

|

MSTB

|

-

|

Thousands of Stock Tank Barrels of oil (oil volume at 60 F and 14.65 psia)

|

|

MMscf

|

-

|

Millions of standard cubic feet of gas (gas volume at 60 F and 14.65 psia)

|

|

Bbls

|

-

|

Barrels

|

|

Mbbls

|

-

|

Thousands of barrels

|

|

MMBTU

|

-

|

Millions of British Thermal Units – heating value of natural gas

|

|

STB/d

|

-

|

Stock Tank Barrels of oil per day – oil production rate

|

|

Mscf/d

|

-

|

Thousands of standard cubic feet of gas per day – gas production rate

|

|

GOR (scf/STB)

|

-

|

Gas-Oil Ratio (standard cubic feet of solution gas per stock tank barrel of oil)

|

|

mKB

|

-

|

Metres Kelly Bushing – depth of well in relation to the Kelly Bushing which is located on the floor of the drilling rig. The Kelly Bushing is the usual reference for all depth measurements during drilling operations.

|

|

EOR

|

-

|

Enhanced Oil Recovery

|

|

GJ

|

-

|

Gigajoules

|

|

Marketable or Sales

Natural Gas

|

-

|

Natural gas that meets specifications for its sale, whether it occurs naturally or results from the processing of raw natural gas. Field and plant fuel and losses to the point of the sale must be excluded from the marketable quantity. The heating value of marketable natural gas may vary considerably, depending on its composition; therefore, quantities are usually expressed not only in volumes but also in terms of energy content. Reserves are always reported as marketable quantities.

|

|

NGLs

|

-

|

Natural Gas Liquids – Those hydrocarbon components that can be recovered from natural gas as liquids, including but not limited to ethane, propane, butanes, pentanes plus, condensate, and small quantities of non-hydrocarbons.

|

|

Raw Gas

|

-

|

Natural gas as it is produced from the reservoir prior to processing. It is gaseous at the conditions under which its Volume is measured or estimated and may include varying amounts of heavier hydrocarbons (that may liquefy at atmospheric conditions) and water vapour; may also contain sulphur and other non-hydrocarbon compounds. Raw natural gas is generally not suitable for end use.

|

|

EUR

|

-

|

Estimated Ultimate Recovery

|

11/3, 2014

Chapman Petroleum Engineering Ltd.

445, 708 - 11 Avenue SW

Calgary, AB

T2R 0E4

Dear Sir:

| Re: | Company Representation Letter |

Regarding the evaluation of our Company's oil and gas reserves and independent appraisal of the economic value of these reserves for the year ended August 31, 2014, (the effective date), we herein confirm to the best of our knowledge and belief as of the effective date of the reserves evaluation, and as applicable, as of today, the following representations and information made available to you during the conduct of the evaluation:

|

|

1.

|

We, Hawker Energy Inc., (the Client) have made available to you, Chapman Petroleum Engineering Ltd. (the Evaluator) certain records, information, and data relating to the evaluated properties that we confirm is, with the exception of immaterial items, complete and accurate as of the effective date of the reserves evaluation, including the following:

|

|

|

·

|

Accounting, financial, tax and contractual data

|

|

|

·

|

Asset ownership and related encumbrance information;

|

|

|

·

|

Details concerning product marketing, transportation and processing arrangements;

|

|

|

·

|

All technical information including geological, engineering and production and test data;

|

|

|

·

|

Estimates of future abandonment and reclamation costs.

|

|

|

2.

|

We confirm that all financial and accounting information provided to you is, to the best of our knowledge, both on an individual entity basis and in total, entirely consistent with that reported by our Company for public disclosure and audit purposes.

|

|

|

3.

|

We confirm that our Company has satisfactory title to all of the assets, whether tangible, intangible, or otherwise, for which accurate and current ownership information has been provided.

|

|

|

4.

|

With respect to all information provided to you regarding product marketing, transportation, and processing arrangements, we confirm that we have disclosed to you all anticipated changes, terminations, and additions to these arrangements that could reasonably be expected to have a material effect on the evaluation of our Company's reserves and future net revenues.

|

|

|

5.

|

With the possible exception of items of an immaterial nature, we confirm the following as of the effective date of the evaluation:

|

|

|

·

|

For all operated properties that you have evaluated, no changes have occurred or are reasonably expected to occur to the operating conditions or methods that have been used by our Company over the past twelve (12) months, except as disclosed to you. In the case of non-operated properties, we have advised you of any such changes of which we have been made aware.

|

|

|

·

|

All regulatory, permits, and licenses required to allow continuity of future operations and production from the evaluated properties are in place and, except as disclosed to you, there are no directives, orders, penalties, or regulatory rulings in effect or expected to come into effect relating to the evaluated properties.

|

|

|

·

|

Except as disclosed to you, the producing trend and status of each evaluated well or entity in effect throughout the three-month period preceding the effective date of the evaluation are consistent with those that existed for the same well or entity immediately prior to this three-month period.

|

|

|

·

|

Except as disclosed to you, we have no plans or intentions related to the ownership, development or operation of the evaluated properties that could reasonably be expected to materially affect the production levels or recovery of reserves from the evaluated properties.

|

|

|

·

|

If material changes of an adverse nature occur in the Company's operating performance subsequent to the effective date and prior to the report date, we will inform you of such material changes prior to requesting your approval for any public disclosure of reserves information.

|

|

|

6.

|

We hereby confirm that our Company is in material compliance with all Environmental Laws and does not have any Environmental Claims pending.

|

Between the effective date of the report and the date of this letter, nothing has come to our attention that has materially affected or could affect our reserves and economic value of these reserves that has not been disclosed to you.

Yours very truly,

/s/ Darren Katic

President and Chief Executive Officer & Chief Financial Officer