Attached files

| file | filename |

|---|---|

| 8-K/A - FORM 8-K/A - Kior Inc | d824230d8ka.htm |

Exhibit 17.1

Hoevelaken, August 31st 2014

LETTER OF RESIGNATION

| From: | Paul O’Connor | |

| To: | The board of directors of KiOR Inc. | |

Dear fellow directors

As you know the KiOR technology to convert waste biomass into fuels and chemicals via catalytic pyrolysis (or cracking) originated from a Dutch company called BIOeCON, which invented and explored this concept in 2006 and 2007. I am one of the principal inventors of this technology. Other key inventors are Prof’s Avelino Corma, Jacob Moulijn, Dr. Dennis Stamires, Dr. Igor Babich and Sjoerd Daamen B.Sc. all working and cooperating with BIOeCON since early 2006.

At the end of 2007 BIOeCON and Khosla Ventures (KV) formed KiOR Inc., whereby BIOeCON contributed the technological ideas and the IP, and KV the funding. In 2008 at my suggestion KiOR hired Fred Cannon as their CEO. Fred Cannon had been my boss earlier at Akzo Nobel and Albemarle and I valued Fred for his excellent people skills. During the Akzo years I worked very close with Fred, whereby I lead the technology development together with 2 other colleagues (One of them Dr. Hans Heinerman, who also worked for KiOR in 2008-2009). Fred was always able to get the financial support from the Akzo Nobel board for the funding so we could execute our innovative projects, which greatly enhanced the profitability and value of the Akzo Nobel Catalyst group.

During the first two years of KiOR 2008-2009, I worked as CTO with Fred in building up the organization, proving the concept in a modified FCC pilot plant and leading the research into improved catalysts. Already then we had some technical disagreements about the road forward and managerial issues about the experience and quality of the people being hired. Unfortunately Fred broke off the links to the BIOeCON origin of the technology and so KiOR lost some very valuable experience and insights from the strong European experts connected with BIOeCON. My two-year contract, as CTO was not renewed in October 2009. I did stay on the board of KiOR, until May of 2011. During this period on the board my access to technical information was restricted and limited as the MT and Khosla Ventures were uneasy about my known other activities in the area of biomass conversion in cooperation with PETROBRAS. This cooperation by the way is outside of the KiOR scope as was agreed with Khosla Ventures during the formation of KiOR.

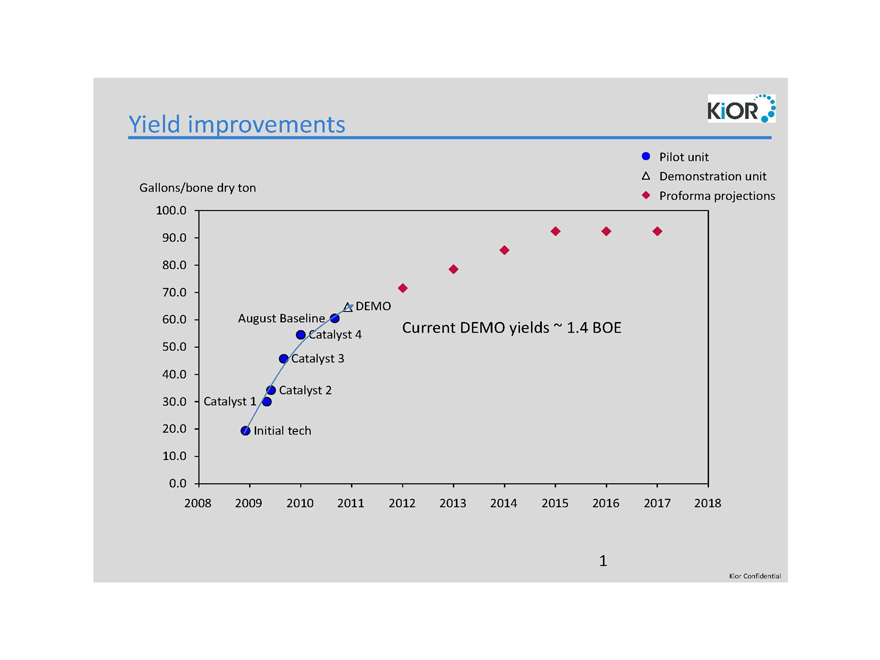

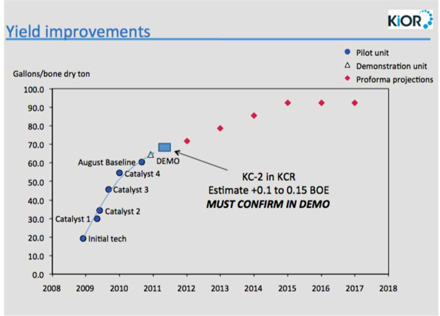

Initially I was not too concerned about the further development of KiOR technology as one of the few figures presented to the board of directors in February of 2011 (See Attachment A) indicated some good progress in increasing the yields in gallons per ton. At the end of 2011 however, I received some additional data (See attachment B) and I was shocked to see that the yields were lower than reported in February (and then projected in the S-1) and that hardly any progress had been made since the end of 2009. I immediately informed KiOR’s CEO, Fred Cannon and Samir Kaul (Director for Khosla Venture, as BIOeCON’s partner and main shareholder of KiOR) about my concerns regarding the limited improvements achieved. After several e-mail and phone discussions with Fred Cannon and Samir Kaul, I received the opportunity to visit KiOR for a

1

technology review. Unfortunately the review was very restricted and limited. Still with the limited data made available to me during my review I could conclude that part of the problem of the lower yields, was the lower than expected oil recovery from the oil-water separation. My main conclusions were:

QUOTE

| • | The present overall yield of saleable liquid products, roughly estimated from the information received falls short of the targets set for 2012 (= 67 gallons per ton bone dry wood, GPBD) and has not improved significantly over the last two years. |

| • | It is possible to reach the target of 67 GPBD and possibly even also the long term target of 90 GPBD, but this will require a drastically different approach, than presently being pursued by R&D. |

UNQUOTE

The full report and relevant correspondence is included as Attachment C.

At the last board meeting where I was present (April/May 2012) the R&D director after a Technology Update, under questioning by myself admitted that we should not expect to reach the 67 GPBD at Columbus, but possibly at the next commercial plant including further reactor modifications. I estimated that based on the R&D data given to me at that time, that the real yields for Columbus would be closer to 30-40 GPBD. Unfortunately none of my recommendations was followed up.

It is obvious for all of us today that KiOR is going through some difficult times, and may even not survive as a company. The reason for this, in my opinion, is not because of the failure of the technology itself, but because of several wrong choices made during the development and commercialization of the technology. Over the years there have been several warning signals (internal & external), one of which as I mentioned in the foregoing has been my own technology audit report in March/April of 2011. Notwithstanding these warnings KiOR’s MT continued on their set course. In mean time everyone else hoped for the best.

After the mechanical completion of the Columbus plant it took quite a long time, before the plant actually started producing products. Of course I was concerned and in preparation of the Annual shareholders meeting in May 2013, I sent a letter to Fred Cannon asking some important questions (Attachment D). At the annual meeting I had a separate meeting with Fred and Samir Kaul. Fred’s response was that I was too negative: “We (= KiOR) have made tremendous progress in the last 18 months in R&D”

The real proof-of-the-pudding however would be a successful start-up and operation of Columbus in 2013. Unfortunately this did not work out the way, which everyone had hoped for and several problems were encountered leading to production rates of about only 10% of the actual design case. The first impression was that this was related to “normal” start-up issues. After an audit requested by the KiOR board and Khosla Ventures in November of 2013 it became clear however that the product yields were in fact much lower than projected (±30 in stead of 70 gallons/ton), while the on-stream times were also way too low (less than 50%).

2

Around that time the KiOR board (via Will Roach and Samir Kaul) approached me to help KiOR as a technical expert in reviewing the situation at KiOR and in January of 2014 I signed an NDA and started reviewing the data from Columbus and R&D. My observation was that the low yields and on-stream times at Columbus were reasonably in line with the results and experience in the DEMO plant in Houston. This means that the main problems at Columbus are already discernable in the DEMO operations and are therefore structural and not “just” operational issues. My belief then and still now is, that these problems can be solved, but that this will require a different approach in catalyst selection and operation strategy. I have stressed to the board that in my opinion a clear change (Plan B/Re-set) in technology strategy as well as leadership style (gOpenness & Transparency) is essential to solve the issues. I reported this to Will Roach and the board in early February.

Near the end of March you as KiOR board asked me to join the board and to assist as a technical advisor, while I would be empowered to lead a taskforce of KiOR’s R&D and technology to address and solve the existing issues in KiOR’s technology.

I started forming this taskforce in April, with apparent approval of the MT, after making some difficult compromises with the MT, as the MT still had very different views on how to improve the technology. These different views resulted in strong differences of opinions with regards to the priorities to be given, the organization, people decisions etc. I persisted with my task and returned to Houston after a short stay in Europe in May. I was then requested by the board to postpone my visits to KiOR, because of my critical attitude towards the MT (sic). This meant that my efforts to lead the taskforce and make the necessary changes at KiOR stopped: In my opinion KiOR hereby lost some crucial months and also some good people. I tried to meet with the MT to reestablish a mode of working together, but the MT did not respond.

In the mean time KiOR has started a marketing process (via Guggenheim) to explore investment and/or sale opportunities for the company. This is a good initiative, as it may help to salvage this interesting and promising technology. However, it is also my conviction that in order to maximize the value and “survivability” of KiOR, KiOR should use the time and funds still available, to focus on the alternative approaches that I have proposed, which I believe will be able to prove on the DEMO scale that the yields and on-stream times of KiOR technology can be substantially improved.

Unfortunately the MT is still not receptive to this and has distributed, what I believe are poorly substantiated projections for Guggenheim to pitch KiOR to potential investors and/or buyers. These projections do not include the crucial learning’s from the DEMO and Columbus. Keep in mind that the MT also convinced the board at the time to build and start-up Columbus based on projections, which have not been substantiated in the DEMO, while we now know that the DEMO predicted reasonably well the poor yields and on-stream times at Columbus. As already communicated to you earlier I cannot support this approach.

Concluding:

I am of the opinion that KiOR’s MT professionally has not performed in evolving the KiOR technology to a commercial success; furthermore the MT in my opinion has not provided the board of directors of KiOR with the adequate, right and relevant information to do their job. I therefore am of the opinion that the MT needs to resign and to be replaced in order to improve the chances of success of KiOR and/or any other potential new ventures based on KiOR technology in the future.

3

In the mean time, as I do not have the opportunity to help KiOR as originally intended, I have resigned from the board as of August 31st 2014. Although I am no longer on the board, I remain a strong supporter of KiOR technology and the company and hope you as board will wisely decide on the future of KiOR.

Very best regards

/s/ Paul O’Connor

31 Aug 2014

Paul O’Connor

Attachments

4

APPENDIX A

KiOR

R&D Update

John Hacskaylo

February 2011

Yield improvements

Pilot

unit

Demonstration unit

Proforma projections

Gallons/bone dry ton

100.0

90.0

80.0

70.0

60.0

50.0

40.0

30.0

20.0

10.0

0.0

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

DEMO

August Baseline

Catalyst 4

Catalyst 3

Catalyst 2

Catalyst 1

Initial tech

Current DEMO yields ~ 14 BOE

1

Kior Confidential

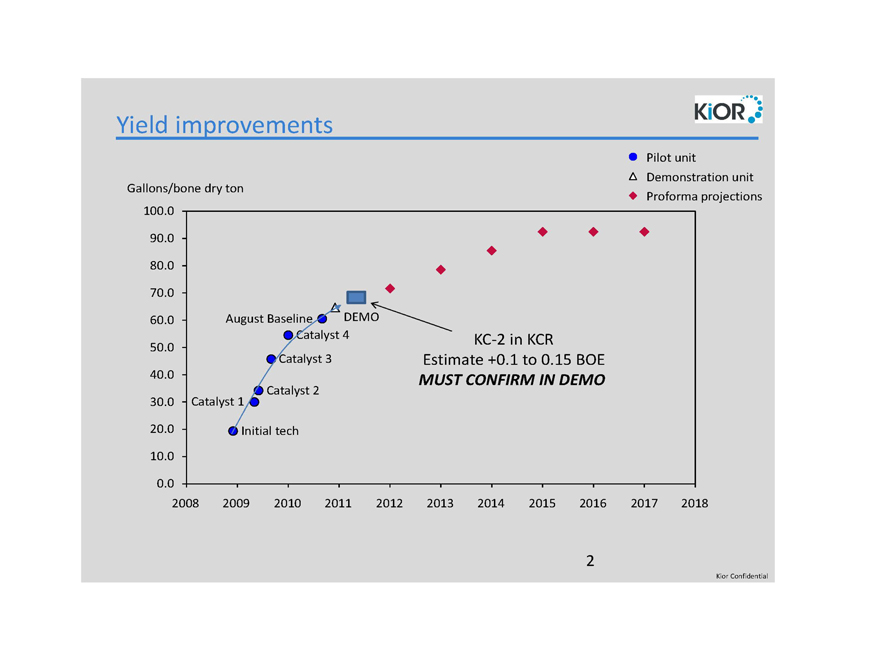

KiOR

Yield improvements

Gallons/bone dry ton

Pilot unit

Demonstration unit

Proforma projections

100.0

90.0

80.0

70.0

60.0

50.0

40.0

30.0

20.0

10.0

0.0

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

August Baseline

DEMO

Catalyst 4

Catalyst 3

Catalyst 2

Catalyst 1

Initial tech

KC-2 in KCR

Estimate +0.1 to 0.15 BOE

MUST CONFIRM IN DEMO

2

Kior Confidential

APPENDIX B

KiOR

Technology Update

Board of Directors Meeting

December 15, 2011

KiOR

Topics

KC-2 Scale-up

Yield Improvement

Key Metrics

Hydrotreating

Emission Testing

Engine Testing

KC-2 Scale-Up

KiOR

We selected 3 vendors as potential scale-up partners for KC-2

- Intercat, WR

Grace and SudChemie

Results to date:

- Intercat has supplied 5 samples for

testing in pilot plant

Several samples have acceptable performance

- WR Grace

has supplied 3 samples

Testing /further development on-going

- Sud Chemie has

not been able to supply acceptable materials

Path Forward:

- Intercat 5 ton

sample on site and DEMO testing to commence week of December 12-28

- Estimate Grace 5 ton DEMO sample to arrive late January, testing to commence upon arrival

- We expect to use both suppliers to produce catalyst for Columbus unit

-

Work continues to optimize formulations to improve performance

KiOR

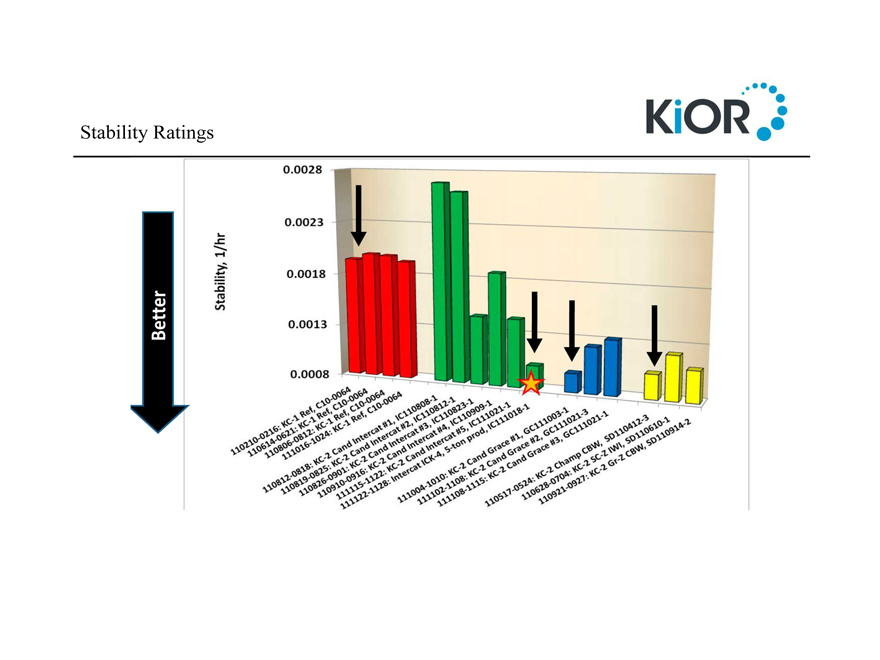

Stability Ratings

Stability, 1/hr

0.0028

0.0023

0.0018

0.0013

0.0008

Better

110210-0216: KC-1 Ref, C10-0064

110614-0621: KC-1 Ref, C10-0064

110806-0812: KC-1 Ref, C10-0064

111016-1024: KC-1 Ref, C10-0064

110812-0818: KC-2 Cand Intercat #1, IC110808-1

110819-0825: KC-2 Cand Intercat #2, IC110812-1

110826-0901: KC-2 Cand Intercat #3, IC110823-1

110910-0916: KC-2 Cand Intercat #4, IC110909-1

111115-1122: KC-2 Cand

Intercat #5, IC11021-1

111122-1128: Intercat ICK-4, 5-ton prod, IC111018-1

111004-1010: KC-2 Cand Grace #1, GC111003-1

111102-1108: KC-2 Cand Grace #2,

GC111021-3

111108-1115: KC-2 Cand Grace # 3, GC111021-1

110517-0524: KC-2

Champ CBW, SD110412-3

110628-0704: KC-2 SC-Z IWI, SD110610-1

110921-0927:

KC-2 Gr-Z CBW, SD110914-2

KiOR

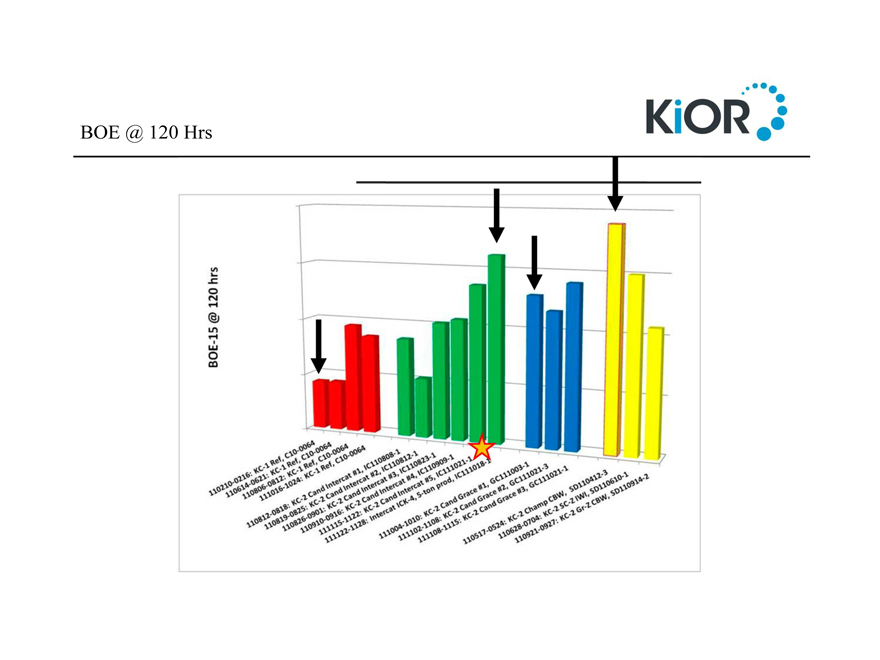

BOE @ 120 Hrs

BOE-15 @ 120 hrs

110210-0216: KC-1 Ref, C10-0064

110614-0621: KC-1 Ref, C10-0064

110806-0812: KC-1 Ref, C10-0064

111016-1024: KC-1 Ref, C10 0064

110812-0818: KC-2 Cand Intercat #1, IC110808-1

110819-0825: KC-2 Cand Intercat #2, IC110812-1

110826-0901: KC-2 Cand Intercat #3, IC110823-1

110910-0916: KC-2 Cand Intercat #4, IC110909-1

111115-1122: KC-2 Cand

Intercat #5, IC111021-1

111122-1128: Intercat ICK-4, 5-ton prod, IC111018-1

111004-1010: KC-2 Cand Grace #1, GC111003-1

111102-1108: KC-2 Cand Grace #2,

GC111021-3

111108-1115: KC-2 Cand Grace #3, GC111021-1

110517-0524: KC-2

Champ CBW, SD110412-3

110628-0704: KC-2 SC-Z IWI, SD110610-1

110921-0927:

KC-2 Gr-Z CBW, SD110914-2

KiOR

Recent Yield

Optimization Work

Working hypothesis is that:

- We may have both a residence

time and temperature effect

- We need to evolve the reactor design to capture full benefits

Additional experiments planned to more clearly define operating window:

- KCR

- PRU (lab batch reactors)

Definitive work must be done in DEMO unit

KiOR

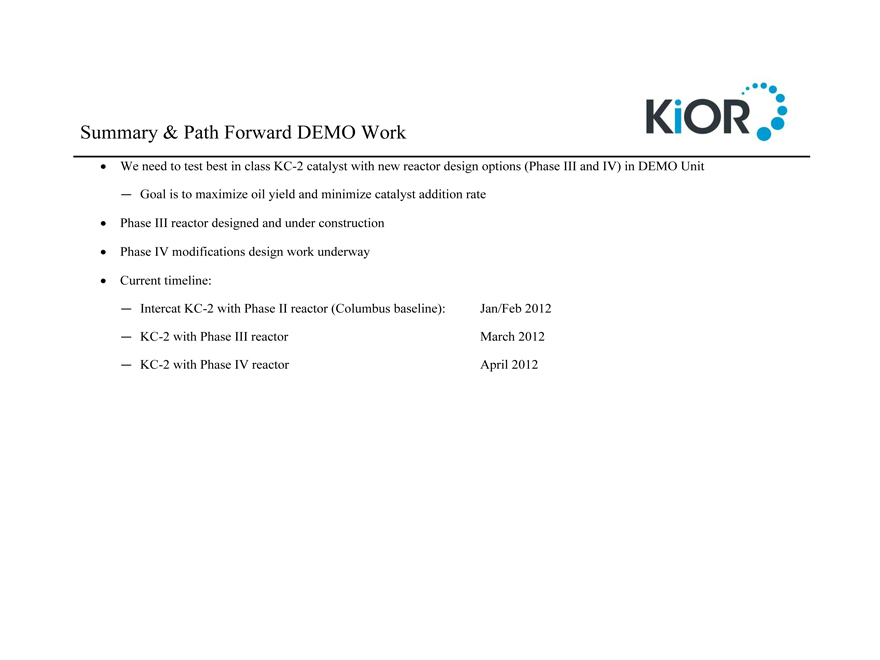

Summary & Path

Forward DEMO Work

We need to test best in class KC-2 catalyst with new reactor design options (Phase III and IV) in DEMO Unit

- Goal is to maximize oil yield and minimize catalyst addition rate

Phase III reactor designed

and under construction

Phase IV modifications design work underway

Current

timeline:

- Intercat KC-2 with Phase II reactor (Columbus baseline): Jan/Feb 2012

- KC-2 with Phase III reactor March 2012

- KC-2 with Phase IV reactor April 2012

KiOR

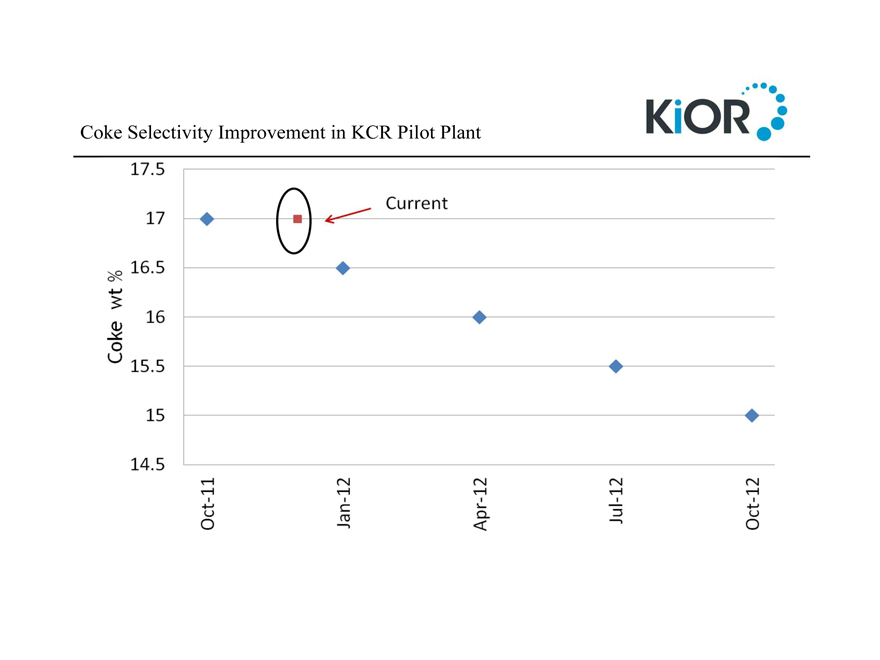

Coke Selectivity

Improvement in KCR Pilot Plant

17.5

17 Current

16.5

16

15.5

15

14.5

Coke wt %

Oct-11

Jan-12

Apr-12

Jul-12

Oct-12

KiOR

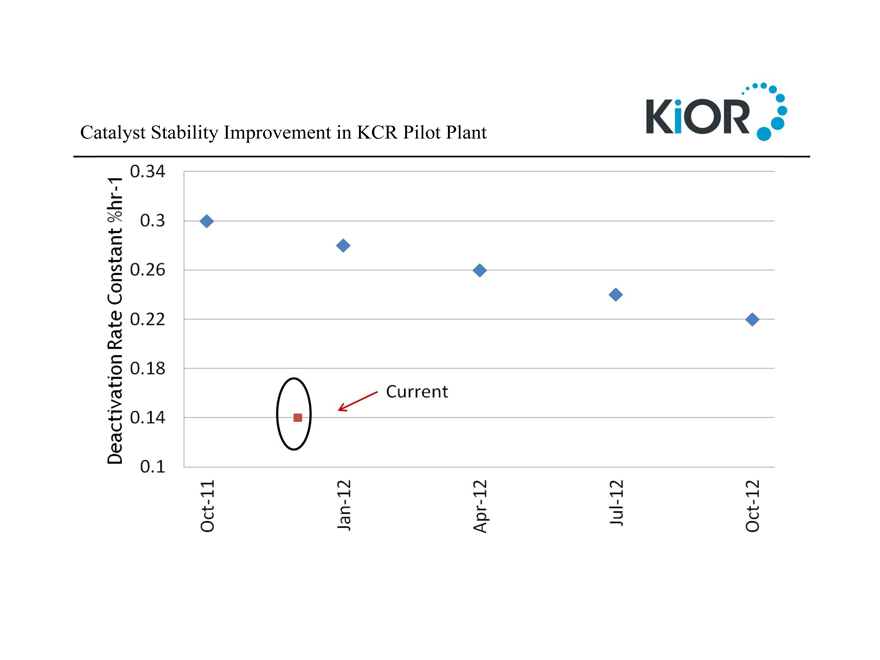

Catalyst Stability

Improvement in KCR Pilot Plant

0.34

0.3

0.26

0.22

0.18

0.14 Current

0.1

Deactivation Rate Constant %hr-1

Oct-11

Jan-12

Apr-12

Jul-12

Oct-12

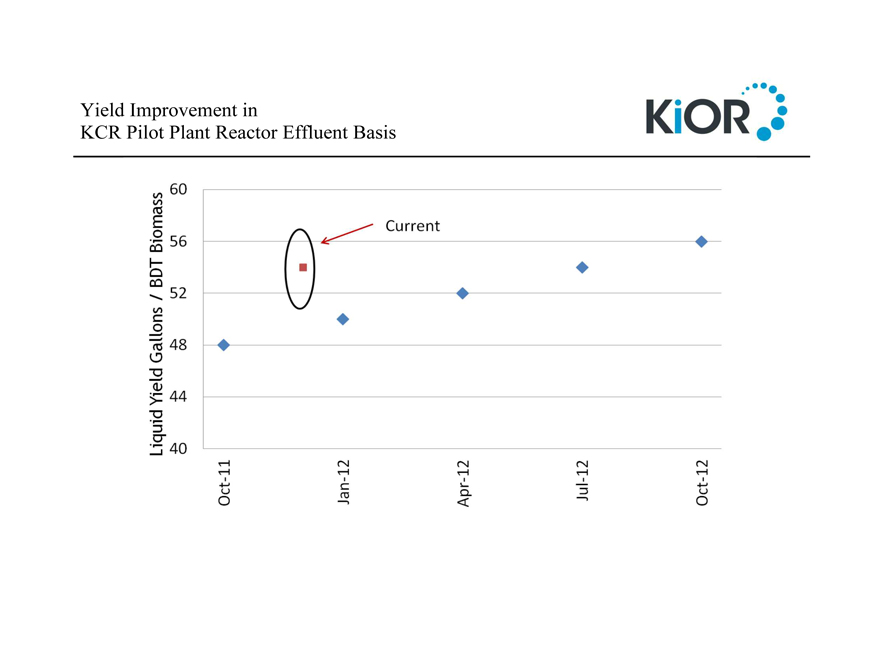

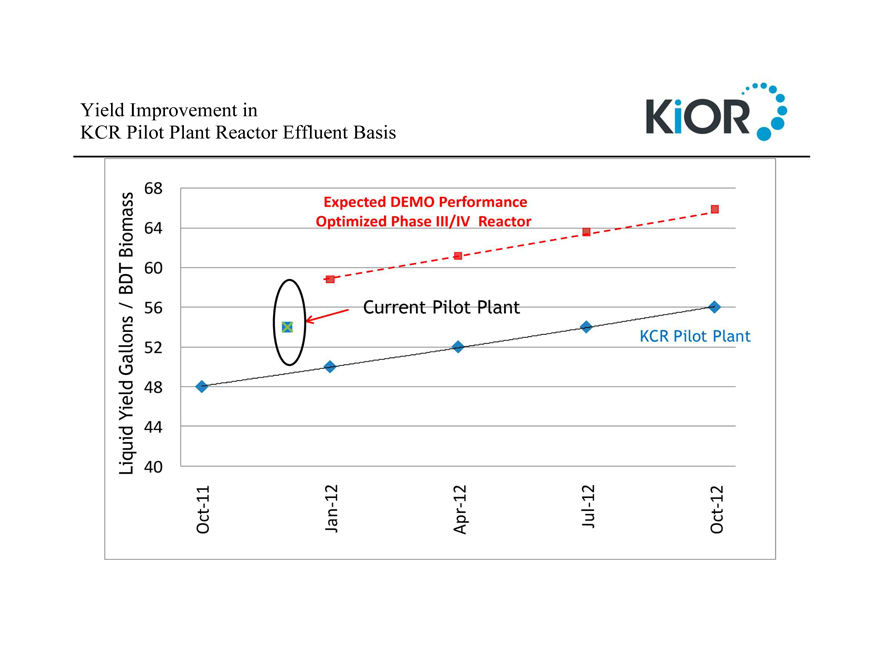

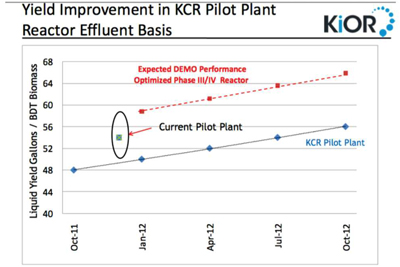

Yield Improvement in

Yield Improvement in

KCR Pilot Plant Reactor Effluent Basis

KiOR

Liquid Yield Gallons / BDT Biomass

Current

60 56 52 48 44 40

Oct-11 Jan-12 Apr-12 Jul-12 Oct-12

Yield Improvement in

Yield Improvement in

KCR Pilot Plant Reactor Effluent Basis

Liquid Yield Gallons / BDT Biomass

Expected DEMO Performance

Optimized Phase III/IV Reactor

Current Pilot Plant

KCR Pilot Plant

68 64 60 56 52 48 44 40

Oct-11 Jan-12 Apr-12 Jul-12 Oct-12

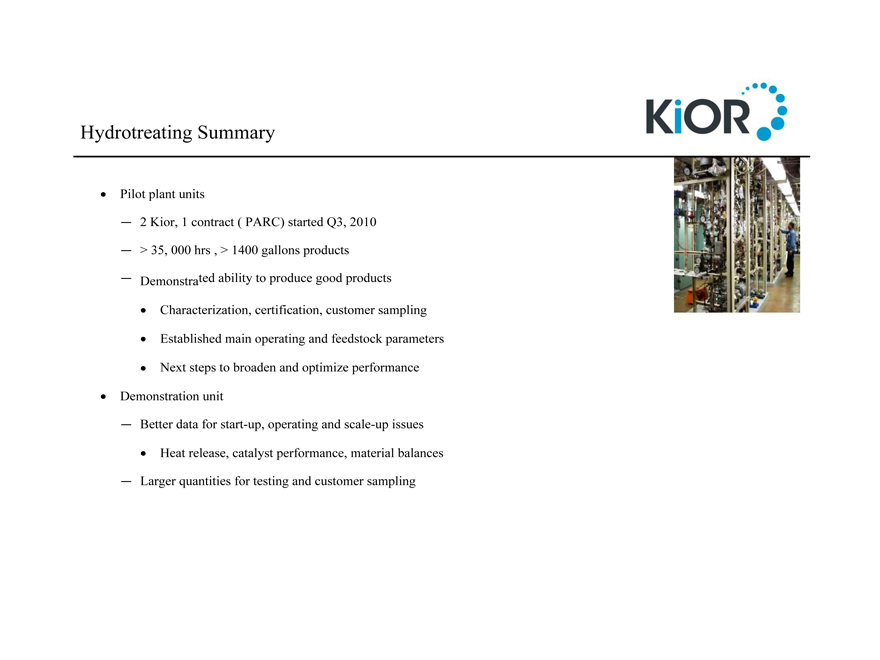

Hydrotreating Summary

Hydrotreating Summary

KiOR

Pilot plant units

2 Kior, 1 contract ( PARC) started Q3, 2010

> 35, 000 hrs , > 1400 gallons products

Demonstrated ability to produce good products

Characterization, certification, customer sampling

Established main operating

and feedstock parameters

Next steps to broaden and optimize performance

Demonstration unit

Better data for start-up, operating and scale-up issues

Heat release, catalyst performance, material balances

Larger quantities for

testing and customer sampling

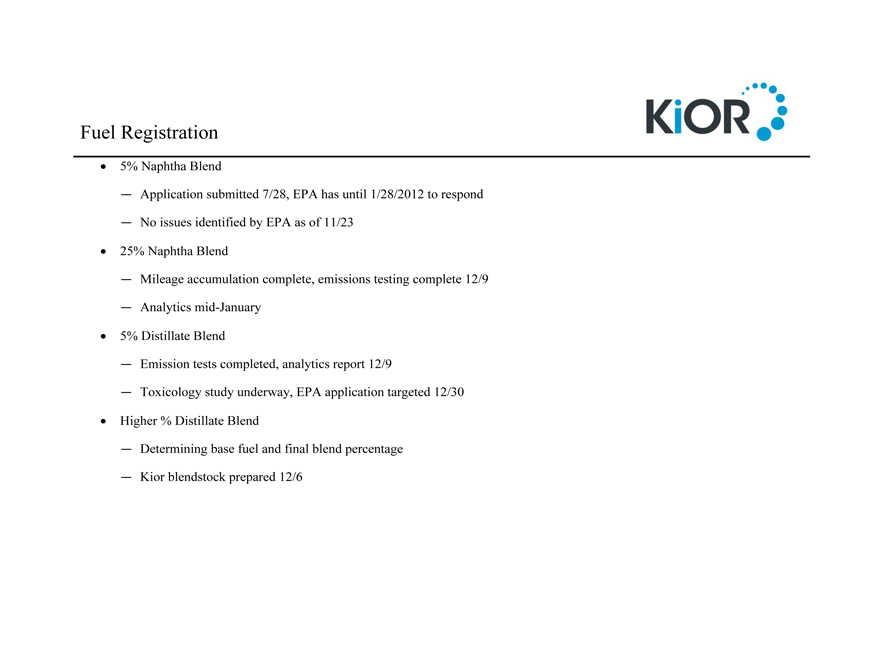

Fuel Registration

Fuel Registration

KiOR

5% Naphtha Blend

Application submitted 7/28, EPA has until 1/28/2012 to

respond

No issues identified by EPA as of 11/23

25% Naphtha Blend

Mileage accumulation complete, emissions testing complete 12/9

Analytics mid-January

5% Distillate Blend

Emission tests completed, analytics report 12/9

Toxicology study underway, EPA application targeted 12/30

Higher % Distillate

Blend

Determining base fuel and final blend percentage

Kior blendstock

prepared 12/6

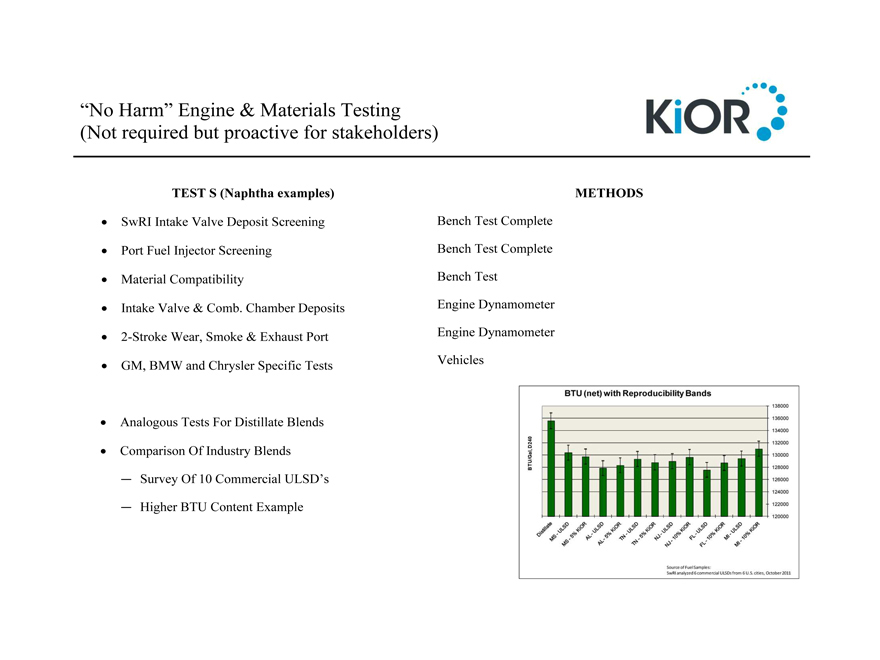

“No Harm” Engine & Materials Testing

“No Harm” Engine & Materials Testing

(Not required but proactive for stakeholders)

KiOR

TEST S (Naphtha examples) METHODS

SwRI Intake Valve Deposit Screening

Port Fuel Injector Screening

Material Compatibility

Intake Valve & Comb. Chamber Deposits

2-Stroke Wear, Smoke & Exhaust Port Bench Test Complete Bench Test Complete Bench Test Engine Dynamometer Engine Dynamometer

GM, BMW and Chrysler Specific Tests Vehicles

Analogous Tests For Distillate Blends

Comparison Of Industry Blends

Survey Of 10 Commercial ULSD’s

Higher BTU Content Example

BTU (net) with Reproducibility Bands

BTU/Gal, D240

138000

136000

134000

132000

130000

128000

126000

124000

122000

120000

Distillate

MS - ULSD

MS - 5% KiOR

AL - ULSD

AL - 5% KiOR

TN - ULSD

TN - 5% KiOR

NJ - ULSD

NJ - 10% KiOR

FL - ULSD

FL - 10% KiOR

MI - ULSD

MI - 10% KiOR

Source of Fuel Samples:

SwRI analyzed 6 commercial ULSDs from 6 U.S. cities, October 2011

APPENDIX C1

CONFIDENTIAL

KiOR Technology Assessment - March 2012

By Paul O’Connor, March 22nd 2012.

Background

On March 8th at the invitation of Fred Cannon (CEO) I visited KiOR to discuss my concerns about the in my mind the limited improvements in the overall process yields obtained over the last 2 years.

My concerns were based on the scarce and conflicting information on product yields I received during the board of director meetings (BOD) in the period of 2009 up to 2011 [See Appendix 1]. These concerns are further amplified given the fierce, rapidly evolving and well-funded competitive technologies in this space. One example is the JV between Ensyn and UOP.

The following assessment is based on limited additional information I received during the meeting and presentations at KiOR on March 8th, and is constrained by the following limitations:

| 1) | I requested, but did not receive the “raw” actual pilot plant and demo plant yields to be able to check the validity of the data presented to me. |

| 2) | I asked, but was not given the opportunity for private one-to-one interviews with key technical personnel, who actually perform the work. |

| 3) | I did not receive answers to several critical questions asked during and after my visit to KiOR [See Appendix 2] |

| 4) | I asked, but was not allowed assistance from the in-house expert consultant, Prof Vasalos, to analyze and validate yield performance. |

| 5) | I was not given access to detailed information regarding the properties, handling, and the suitability of the raw bio-oil to be hydro-treated for upgrading. |

Observations

Notwithstanding the foregoing it is still possible for me to make the following observations:

| 1) | The KiOR management team has made excellent progress in building the organization and scaling up the BCC process from the Pilot to the Demo phase and now also the commercial phase (Columbus plant) in a record time of less than 5 years, considered impossible in the process industry. |

| 2) | The KiOR management and technical personnel feel confident that they can start up the Columbus plant in 2012 and produce good quality saleable products (Gasoline, Diesel, Low S Heavy Fuel Oil). |

| 3) | As can be expected, the major effort of R&D has been and still is in the scaling-up of the process and the catalyst and hence only limited effort has been spent on searching for the next breakthroughs. In fact the catalyst and reactor concepts presently being developed were already conceived in 2009. |

| 4) | The way in which product yields are being reported (e.g. to the BOD) by R&D management is incomplete and misleading and does not correspond with the actual goal of improving overall yield of saleable liquid products. |

| 5) | The present overall yield of saleable liquid products, estimated from the information received [See Table 1] falls short of the targets set for 2012 (= 67 gallons per ton bone dry wood, GPBD) and has not improved considerably over the last two years. |

| 6) | In my opinion it is still possible to reach the target of 67 GPBD and possibly even also the long term target of 90 GPBD, but this will require a drastically different approach, than presently being pursued by R&D [See recommendations] |

Table 1:

Estimates of overall saleable liquid product yield 2009-2012

| Date | Reactor Effluent | Oil Recovered | HT Vol Gain | Overall GPBD | ||||

| June 2009 | ||||||||

| KCR* | ~30-40* | ~5 | ~35-45 | |||||

| February 2011 | ||||||||

| KCR | ~65? | ~65 (100%)** | ~0 | ~65 | ||||

| Demo | ~65? | ~65 (100%)** | ~0 | ~65 | ||||

| December 2011 | ||||||||

| KCR | ~54 | ~40 (74%) | ~5 | ~45 | ||||

| Demo | ~58 | ~44 (75%) | ~5 | ~49 | ||||

| March 2012 | ||||||||

| KCR | ~45-55 | ~35 (70%) | ~5 | ~40 | ||||

| Demo** | ~55-65** | ~45 (75%) | ~5 | ~50 | ||||

| Columbus 4Q2012? | ||||||||

| Best Case | ~65** | ~60 (92%)** | ~10 | ~70 | ||||

| Worst Case | ~50 | ~35 (70%) | 0 | ~35 | ||||

Notes:

| *) | Based on ~20% actual liquid oil yield at ~10% Oxygen yielding ~1% BOE =42 GPBD |

| **) | Remains unconfirmed, limited data; question [Appendix 2] if this is real data or “just” a model extrapolation estimate? |

Recommendations

To achieve these very challenging goals, KiOR needs two separate and individual teams as follows:

Team 1: Technology Optimization KiOR-1G

Implementation and optimization of the present demo-phase ideas/concepts being an improved KC-2 catalyst and an improved 3/4G reactor, technical plant support, in combination with significant improvements in the oil recovery (amongst others in the water-oil separation) in order to ensure overall yield in 60-70 GPBD bracket by late 2012 or early 2013. This includes further hydro-treating technology development and interfacing/screening catalysts supplied by the different vendors for use in the commercial plants.

Team 2: Technology Breakthrough KiOR-2G, next-Gen

Develop the next generation catalysts and/or reactor design necessary to move the overall yield up to the 90-100 GPBD bracket. Includes development of new more effective, less costly, catalysts as well as development of new concepts in the production of bio-crude and its upgrading to fuels.

It is of essence that the two teams are separately managed, with separate resources and facilities, and that the teams will report separately and directly to the CEO and BOD.

Team 1 will in a certain sense be a continuation of the present R&D activities, albeit significant improvements still need to be achieved in unifying the team and in communications with all other departments

Team 2 will be a completely new effort and should involve a very creative Discovery Team (DT) with dedicated resources, staffed with scientists and engineers with experience in the “field” and managed by an established, well respected expert

My estimate would be that of the present 60 FTE’s R&D about 90% will be in Team 1 and about 10% in Team 2 not including new hires with the above mentioned expertise

Furthermore to assist, advise and monitor the two teams, my recommendation is to form a Technical Advisory Board (TAB) consisting of world recognized specialists. Monthly separate progress meetings of the TAB with both teams will be required. The TAB will report directly to the CEO and BOD.

Appendix 1 R&D Presentations

1) BOD February 2011 by John Hacskaylo

2) BOD December 2011 by John Hacskaylo

Appendix 2 Follow up questions

Further to my visit and our telephone conversation on Monday, I would like additional information/data to continue with my analysis and assessment to the BoD:

1) Actual performance data from the Demo Plant.

Reactor effluent oil yields (BOE or GPBD) and oxygen content (%) as a function of time since demo start up, including % oil in water and % of light gases. (No info on reactor or catalyst necessary).

2) Best estimate you have today on % oil recovery to calculate the “Overall product yield” from the reactor effluent yield (without including the amount of oil in the water and also without including the light gases)

At present I am guessing about ~ 70%?

3) Provide detailed information on assumptions and calculations of the $ 1.80 / gallon product cost for a 1500 ton/day plant @ 67? GPBD yield

4) List of abandoned patents (~28) of which I am a co-inventor

APPENDIX C2

From: Paul O’Connor <paul.oconnor@bio-e-con.com>

Subject: Follow up questions - KiOR Review

Date: March 15, 2012 6:46:45 AM PDT

To: Fred Cannon <fred.cannon@kior.com>

Dear Fred

Further to my visit and our telephone conversation monday, I would like some additional information/data to round of my feedback to the board:

1) Actual performance data from the Demo Plant.

Reactor effluent oil yields (BOE or GPBD) and oxygen content (%) as a function of time since demo start up (No info on reactor or catalyst necessary).

2) Best estimate you have today on % oil recovery to calculate the “Overall product yield” from the reactor effluent yield.

At present I am guessing about ~ 70%?

3) Your assumptions and calculation of the $ 1.80 / gallon product cost for a 1500 ton/day plant @ 67? GPBD yield

4) List of abandoned patents (~28) of which I am a co-inventor

I will contact Samir to see how he wants to discuss this at the board.

I agree with you that an Oral presentation is the best.

Best regards

Paul

Paul O’Connor

BIOeCON

Hogebrinkerweg 15e

3871KM Hoevelaken, The Netherlands

Office: +31 33 254 0473

Cell: +31 64 173 4842

paul.oconnor@bio-e-con.com

www.bio-e-con.com

APPENDIX C3

STRICTLY CONFIDENTIAL

KiOR Technology R&D: Assessment & Recommendations

By Paul O’Connor - April 21st 2012

As one of the few directors of KiOR with a technical background I feel I have a special responsibility to critically review the progress being made at KiOR in the fields of Technology and Research & Development.

Overall the information we have been receiving in the area of Technology and R&D as directors of the board has been very limited and very superficial.

In December last I expressed concerns about the limited improvements made in R&D related to the overall process yields. My concerns were based on scarce and conflicting data received during the board meeting in December. At the invitation of Fred Cannon (CEO) I visited KiOR early March to discuss these concerns, while after the BOD meeting of March 23rd the R&D Manager gave a very limited R&D overview to the directors present, which confirmed my opinion that the metrics presently being used to monitor R&D progress are inadequate.

The following assessment is based on limited information received during the meeting and presentations at KiOR on March 8th, and the presentation of the R&D Manager on March 23rd and is constrained by the following limitations:

| 1) | I did not receive the “raw” actual BCC and BCC HT oil hydro-treater pilot plant and demo plant yields. |

| 2) | I was not given the opportunity for private one-to-one interviews with key technical personnel. |

| 3) | I did not receive answers to several critical follow-up questions asked during and after my visit. |

| 4) | I was not allowed assistance from an expert consultant, to analyze and validate the BCC and BCC HT process performance in depth. |

| 5) | I was not given any information on the bio-oil/water separation. |

| 6) | I was not given access to detailed information regarding the properties, handling, and the suitability of the raw BCC bio-oil to be hydro-treated for upgrading into saleable products. |

Therefore this review and assessment is very preliminary and should definitely not be considered as a full in depth technology audit.

Notwithstanding these limitations is still possible for me to report some key observations and recommendations.

Observations

| 1) | KiOR management team has made excellent progress in building the organization and scaling up the BCC process from the Pilot to the Demo phase and now also to the commercial phase (Columbus plant) in a record time of less than 5 years, considered impossible in the process industry. |

| 2) | KiOR management feels confident that they can start up the Columbus plant in 2012 and produce good quality saleable products (Gasoline, Diesel, Low S Heavy Fuel Oil). |

| 3) | As can be expected, the major effort of R&D has been and still is in the scaling-up of the process and the catalyst and hence only limited effort has been spent on searching for the next breakthroughs. In fact the catalyst and reactor concepts presently being developed were already conceived in 2009. |

| 4) | The way in which overall product yields are being reported by R&D management is incomplete, inadequate and misleading and does not correspond with the actual business goal of improving the overall yield of saleable liquid products. |

| 5) | The present overall yield of saleable liquid products, roughly estimated from the information received falls short of the targets set for 2012 (= 67 gallons per ton bone dry wood, GPBD) and has not improved significantly over the last two years. |

| 6) | It is possible to reach the target of 67 GPBD and possibly even also the long term target of 90 GPBD, but this will require a drastically different approach, than presently being pursued by R&D. |

Recommendations

To the CEO

| 1. | Appoint a strong and knowledgeable CTO to effectively lead the important development efforts still required by R&D and Technology. |

| 2. | Review and adapt the performance metrics being used by R&D to correspond with the actual business goal of improving the overall yield of saleable liquid products |

| 3. | Replace the existing R&D Director. His lack of relevant knowledge is exemplified by his poor reporting of inadequate and even misleading metrics. He has demonstrated not to have the right competences and skills to ensure R&D progress over the last 1-2 years. |

| 4. | Establish a separate Discovery Team with dedicated resources, staffed with scientists and engineers with experience in the field and managed by an established, well respected expert reporting directly to the CEO and/or CTO. |

To the Board of Directors (BOD)

| 1. | Appoint a knowledgeable independent team reporting to the BOD to perform a true in-depth technology review, without the limitations that constrained my present assessment. |

| 2. | Establish a Board Technology Committee (similar to the existing Audit committee) to review the technological progress on a regular basis. |

| 3. | Establish a Technical Advisory Board (TAB) consisting of world recognized experts and specialists to advise and assist the CEO, CTO and Board Technology Committee with its tasks (e.g. technology auditing) |

Table 1:

Estimates of overall saleable liquid product yield 2009-2012

| 1) Date | 2) Reactor Effluent | 3) Oil Recovered | 4) HT Vol Gain | 5) Overall GPBD | ||||

| 6) June 2009 | 7) | 8) | 9) | 10) | ||||

| 11) KCR* | 12) | 13) ~30-40* | 14) -5 | 15) ~35-45 | ||||

| 16) | 17) | 18) | 19) | 20) | ||||

| 21) February 2011 | 22) | 23) | 24) | 25) | ||||

| 26) KCR | 27) ~65? | 28) ~65 (100%)** | 29) ~0 | 30) ~65 | ||||

| 31) Demo | 32) ~65? | 33) ~65 (100%)** | 34) ~0 | 35) ~65 | ||||

| 36) | 37) | 38) | 39) | 40) | ||||

| 41) December 2011 | 42) | 43) | 44) | 45) | ||||

| 46) KCR | 47) ~54 | 48) ~40 (74%) | 49) ~5 | 50) ~45 | ||||

| 51) Demo | 52) ~58 | 53) ~44 (75%) | 54) ~5 | 55) ~49 | ||||

| 56) | 57) | 58) | 59) | 60) | ||||

| 61) March 2012 | 62) | 63) | 64) | 65) | ||||

| 66) KCR | 67) ~45-55 | 68) ~35 (70%) | 69) ~5 | 70) ~40 | ||||

| 71) Demo** | 72) ~55-65** | 73) ~45 (75%) | 74) ~5 | 75) ~50 | ||||

| 76) | 77) | 78) | 79) | 80) | ||||

| 81) Columbus 4Q2012? | 82) | 83) | 84) | 85) | ||||

| 86) Best Case | 87) ~ 65** | 88) ~60 (92%)** | 89) ~10 | 90) ~70 | ||||

| 91) Worst Case | 92) ~ 50 | 93) ~35 (70%) | 94) 0 | 95) ~35 | ||||

| 96) Notes: |

| *) | Based on ~20% actual liquid oil yield at ~10% Oxygen yielding ~1% BOE = 42 GPBD |

| **) | Remains unconfirmed, limited data; question if this is real data or “just” a model extrapolation estimate? |

APPENDIX D1

| MEMO: | Towards a prosperous future for KiOR | |

| By Paul O’Connor - April 30th 2012 | ||

I would like to repeat myself by starting to congratulate Fred Cannon and the KiOR team, in particular Ed Smith for the timely and on budget completion of the first cellulosic biomass conversion plant in Columbus.

During my time at Akzo Nobel Fred and Ed delivered similar achievements in construction and commissioning of chemical plants, amongst other in Houston with the completion of the “CRUSADE” (Cost Reduction USA Damn Exciting) project, which saved Akzo’s FCC catalyst business in the USA. So once again: Congratulations!

Up to the completion of Columbus KiOR has been on time and budget with the delivery of her milestones, however unfortunately since then the success ratio has not been so dramatic, resulting in the following delays and shifts in performance targets:

A. The Columbus plant is not yet on-stream, and the suggestion is that it may take up to nine-months before the plant is completely on-stream and ramped up to its capacity at 85% utilization and product yields ( = x? GPDB).

B. The product yields are not at the 72 Gallons per bone dry wood as estimated at the IPO, and in fact the suggestion is that the 72 GPBD will only be reached in the larger (and modified?) Natchez plant.

C. The catalyst being used at Columbus is based on large quantities of an expensive zeolite (apparently public knowledge!) and the rumor is that no substantial costs reductions are to be expected.

E. Based on A, B and C the overall economics and cash flow of KiOR will be substantially less positive than estimated at the IPO etc. While KiOR management is holding the info on A, B and C confidential, the overall financial result is and will become more clearly visible.

D. Because of A, financing of Natchez plant has been delayed and so also start-up of Natchez has been shifted at least one quarter from 4Q 2014 to 1Q 2015.

The result of the foregoing has been a dramatic drop in the KiOR share value, hurting the interests of all it’s shareholders.

While I still fully believe in the benefits and the potentials of further development of KiOR’s technology, I am very concerned about the way the technology is being implemented. My strong impression is that KiOR’s management although very competent and successful in the construction and commissioning phase, lacks the people with experience, vision and leadership to move forward with necessary improvements of the technology (yield improvement and catalyst cost reduction) and operations (capacity, ramp-up and time on stream). This is hurting KiOR now and could in worst case even turn a potential success into a failure if no appropriate corrective action is taken.

This concern of mine is not new, and I have expressed it already for a while, also during my tenure as director on the KiOR board and an official memo to the board and management: “KiOR Technology R&D: Assessment & Recommendations” of April 21st 2012, one year ago. As far as I know these recommendations have not been followed up, while they remain at least just as relevant today as they were a year ago.

While I already for some time, no longer have any official function at KiOR and I do not have any non-public information of KiOR, I am regularly being approached by shareholders from BIOeCON heritage, but also by other institutional investors and the press, asking me critical questions, amongst others why I am not actively helping the KiOR team to solve their problems?

Keep in mind that the success or failure of KiOR is for me not only a financial issue, but also as main inventor one of honor. Although KiOR never properly acknowledges the origin and heritage of the technology: BIOeCON and myself as primary inventor, most informed outsiders are smart enough to figure that out.

I cannot just stand back and watch; As I see it now, the only thing I can really do is to ask critical questions at the annual shareholder meeting on the 30th of May next in Houston with the hope to get the ball moving in the direction of the corrective actions needed to speed up the transition towards a profitable and prosperous business.

I understand that US securities laws requires that any answers must be released to the public via press release, so I am sending the questions for KiOR management and/or board of directors before the quarterly report of May 9th, so that management and/or the board of directors has the option to include answers in the press release(s) of May 9th and/or in a second press release before or on the 30th of May.

Attached the questions, which I intend to raise at the shareholders meeting.

Separate to that, I would like the opportunity to present and discuss my thoughts on how to tackle the issues raised by these questions with CEO Fred Cannon and Samir Kaul as key representative of Khosla Ventures (the controlling shareholder) in the board of directors.

QUESTIONS for KiOR management at the shareholders meeting:

1)

KiOR has disclosed that the expected yield of 72 GPBD, mentioned at the IPO will be achieved in the Natchez plant. How sure is KiOR about that? What are the overall product yields achieved at present in the R&D pilot plant(s) the demo plant and at Columbus? and how and when does KiOR expect to reach the more ambitious target of 90 GPBD?

2)

Two of KiOR’s previous operations managers (Coates ad Lyle) have stepped down, leaving KiOR without a COO or VP Operations. The delay in starting up and getting Columbus on stream could be related to this lack of operational leadership. Does KiOR have sufficient high-level staff with sufficient operational hands-on experience in the FCC and HPC processes to start up and run Columbus and a second plant in Natchez.

3)

Does KiOR have a Scientific and/or Technological Advisory Board in place? How does KiOR ensure an independent technical audit of their R&D and Operations to ensure quality and progress in development?

4)

When does KiOR expect to have the financing of the Natchez plant finalized?